#capital loan

Link

Small Business Loan

Small business loan are provided to business owners to meet their entrepreneurial objectives. This type of small business loans can be obtained distributors, wholesalers, manufacturing units, retailers, self-employed professionals, non-professionals and services.

Under small business loan individuals can get loans up to Rs.75 lakh with a maximum flexible tenure of 60 months. Small business loans are offered by various banks, financial institutions, or NBFCs. However, this can be obtained either in the form of secured or unsecured business loans.

Eligibility criteria of small business loan

The age limit of the individual is ranging from 21 to 65 years of age.

A minimum of 3 years of business vintage is required.

CIBIL Score must be 750 or above.

The individual has ownership of business loan property or residence.

Manufacturing units, Artisans, Trader, Retailer, self-employed professionals, Distributor, Wholesalers, Services, skilled workers or semi-skilled workers are eligible for this loan.

Documents required for small business loan

2 passport-sized photographs

Proof of business stability.

Aadhar card and Passport.

Copy of PAN Card.

Bank statements of last 6 months for proof of business vintage.

KYC Documents

Proof of ownership such as business premises, residence.

Recent electricity bill of business premises.

Cheque for processing fee.

Complete documentation of property with ATS, Chain + MAP.

Address proof required whether permanent or rented.

Permanent address proof required and also if rented.

#small business loans#unsecured business loans#personal loans#msme loans#working capital loan#capital loan#professional loan#business loan#financeseva

2 notes

·

View notes

Text

In the fast-paced world of business, having access to sufficient working capital is crucial for maintaining smooth operations, meeting short-term obligations, and driving growth. Whether you need to purchase inventory, manage cash flow, or cover unexpected expenses, a working capital loan can provide the financial support your business needs. The good news is that applying for a working capital loan online has never been easier.

What is a Working Capital Loan?

A working capital loan is a type of financing specifically designed to help businesses manage their day-to-day operational expenses. Unlike loans used for purchasing long-term assets or investments, working capital loans are intended for short-term financial needs. They can be used for various purposes, such as:

Purchasing Inventory: Ensuring you have enough stock to meet customer demand.

Covering Payroll: Making sure your employees are paid on time.

Managing Cash Flow: Bridging the gap between receivables and payables.

Paying Rent and Utilities: Keeping your business premises operational.

Handling Unforeseen Expenses: Addressing unexpected costs that arise.

Why Apply for a Working Capital Loan Online?

Applying for a working capital loan online offers several advantages:

Convenience: You can apply from the comfort of your home or office without needing to visit a bank or financial institution in person.

Speed: Online applications are processed quickly, often within hours or days, ensuring that you get the funds you need promptly.

Easy Comparison: The online platform allows you to compare different lenders and loan options, helping you find the best deal that suits your business needs.

Flexible Terms: Many online lenders offer flexible repayment terms and customized loan amounts, giving you greater control over your finances.

Paperless Process: The entire application process can be completed digitally, reducing paperwork and streamlining the approval process.

Steps to Apply for a Working Capital Loan Online

Applying for a working capital loan online is a straightforward process. Here’s a step-by-step guide to help you get started:

Assess Your Business Needs: Before applying, determine how much working capital your business requires and how you plan to use it. This will help you choose the right loan amount and repayment terms.

Research Lenders: Look for reputable online lenders that offer working capital loans. Compare interest rates, loan terms, and eligibility criteria to find the best option for your business.

Check Eligibility: Most lenders have specific eligibility requirements, such as a minimum annual revenue, time in business, and credit score. Make sure your business meets these criteria before applying.

Prepare Required Documents: Gather the necessary documents, such as your business registration, financial statements, bank statements, and tax returns. Having these ready will speed up the application process.

Fill Out the Application: Visit the lender’s website and complete the online application form. You’ll need to provide details about your business, the loan amount you’re requesting, and how you plan to use the funds.

Submit Your Application: After reviewing your application, submit it along with the required documents. Some lenders may require additional information or verification.

Wait for Approval: Online lenders typically process applications quickly. You may receive a decision within a few hours or days. If approved, the loan amount will be disbursed directly to your business account.

Use Funds Wisely: Once you receive the loan, use the funds for the intended purpose, whether it’s purchasing inventory, covering payroll, or managing cash flow. Make sure to stick to your repayment schedule to maintain a positive relationship with the lender.

Benefits of a Working Capital Loan

Maintaining Business Operations: A working capital loan ensures that your business continues to operate smoothly, even during cash flow challenges.

Flexibility: Use the funds for a variety of short-term needs without restrictions.

Quick Access to Funds: Online lenders offer fast approval and disbursement, providing timely financial support.

Build Credit: Repaying your loan on time can help build your business credit, making it easier to secure future financing.

Conclusion

A working capital loan is a vital financial tool that helps businesses manage their short-term needs and maintain operational stability. By business working capital loans online, you can quickly access the funds you need to keep your business running smoothly. With the convenience, speed, and flexibility offered by online lenders, securing a working capital loan has never been easier. Whether you’re looking to cover payroll, purchase inventory, or manage cash flow, a working capital loan can provide the support your business needs to thrive.

0 notes

Text

Running a business comes with its share of challenges, and one of the most common is managing cash flow. Whether you need funds to cover daily operations, purchase inventory, or pay employees, a working capital loan can be a valuable solution. Apply for working capital loan online is now easier than ever, thanks to advancements in financial technology. This guide will walk you through the process of applying for a working capital loan and highlight the benefits of doing so online.

What is a Working Capital Loan?

A working capital loan is a type of financing that helps businesses cover their short-term operational needs. Unlike loans that are used for long-term investments or large projects, working capital loans are typically used to finance the day-to-day expenses of running a business, such as paying suppliers, managing payroll, and covering rent or utilities. These loans are especially useful for businesses that experience seasonal fluctuations in revenue or need quick access to cash.

Why Apply for a Working Capital Loan Online?

Applying for a working capital loan online offers several advantages over traditional methods:

Convenience:

You can apply for a working capital loan from the comfort of your home or office, at any time that suits you. There's no need to visit a bank branch or fill out lengthy paperwork.

Speed:

Online applications are processed faster than traditional loan applications. Many online lenders can approve loans within hours and disburse funds within a few days, helping you address your business needs quickly.

Ease of Comparison:

Applying online allows you to easily compare different loan options from various lenders. You can review interest rates, terms, and eligibility criteria, ensuring you find the best deal for your business.

Minimal Documentation:

Online applications typically require less documentation than traditional loans. Most lenders will ask for basic information such as your business's financial statements, tax returns, and bank statements.

Steps to Apply for a Working Capital Loan Online

Assess Your Needs:

Before applying, determine how much capital you need and what you will use it for. This will help you choose the right loan amount and terms.

Research Lenders:

Look for reputable online lenders who offer working capital loans. Check their interest rates, loan terms, and eligibility requirements. Customer reviews and ratings can also provide insights into the lender’s reliability.

Check Eligibility Criteria:

Review the eligibility criteria of your chosen lender. Common requirements include a minimum credit score, a certain amount of annual revenue, and a specific length of time in business.

Gather Required Documents:

Prepare the necessary documentation, such as business financials, bank statements, tax returns, and any other information the lender may require.

Complete the Online Application:

Fill out the online application form, providing accurate and complete information about your business and its financial situation. Some lenders may also require a brief description of how you intend to use the loan.

Review and Submit:

Double-check all the information before submitting your application. Once submitted, the lender will review your application and may contact you for further details.

Receive Approval and Funds:

If your application is approved, the lender will send you a loan offer detailing the terms and conditions. Once you accept the offer, the funds will be disbursed to your business account, usually within a few days.

Tips for a Successful Application

Maintain a Good Credit Score: A higher credit score increases your chances of approval and may qualify you for lower interest rates.

Keep Financial Records Up-to-Date: Accurate and organized financial records make the application process smoother and quicker.

Be Transparent: Provide honest and detailed information about your business to avoid delays or rejections.

Conclusion

Applying for a working capital loan online is a convenient, fast, and efficient way to secure the funds your business needs to thrive. By following the steps outlined in this guide, you can streamline the application process and increase your chances of approval. Whether you're looking to cover daily expenses, manage seasonal dips in revenue, or invest in growth opportunities, a working capital loan can provide the financial flexibility your business needs.

#working capital loan#capital loan#business capital loans#apply for working capital loan#working capital loan online

0 notes

Text

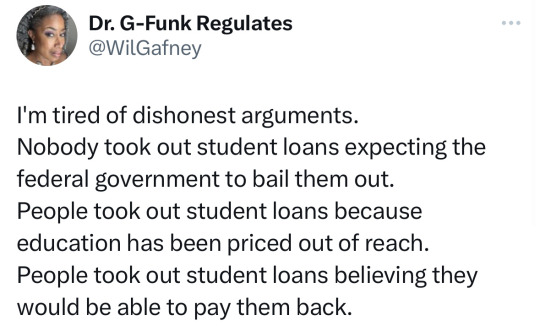

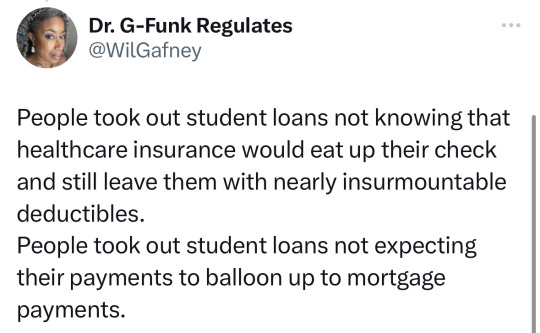

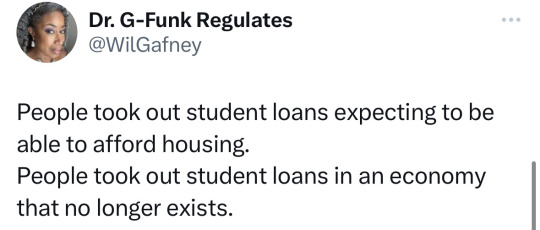

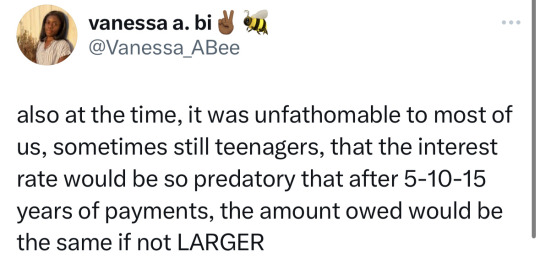

#cancel student debt#student loans#current events#government#education#college#capitalism#eat the rich

33K notes

·

View notes

Text

Merchant Cash Advance Monthly Payment

When we talk of Merchant Cash Advance Monthly Payment, the basic fact that needs to be comprehended is that this is an advance capital that needs to be repaid to the funding network and is quite expensive when compared to other funding options. Another basic rule is that the overall amount of the Merchant Cash Advance would be decided by the lending authority after evaluating the business and its cash requirements.

#Working Capital Loan Medford OR#Working Capital Loan Medford#Working Capital Loan#Capital Loan#Finance#Loan

1 note

·

View note

Text

MYND Fintech: Easy Working Capital Loans

MYND Fintech offers a quick and easy way to secure working capital loans for your business. Our loans are designed to help businesses of all sizes to finance their day-to-day operations and take advantage of growth opportunities. Our loan application process is straightforward and hassle-free, with quick approval times and flexible repayment options. With MYND Fintech, you can get the funds you need to keep your business running smoothly without having to jump through hoops. Whether you're looking to expand your product line, hire new staff, or purchase new equipment, MYND Fintech has got you covered.

Visit Us:- https://myndfin.com/

0 notes

Text

NYT seriously suggesting that you commit suicide to get out of student loan debt.

Someone thought this was a good idea to publish.

#Suicide tw#scotus#news#politics#capitalism#anti capitalism#democrats#republicans#collrge#student loans#federal

1K notes

·

View notes

Photo

*You should recognize bad practices AND not voluntarily support companies through conducting business (i.e. purchasing luxury products).

#Capitalism#Socialism#Politics#Anticapitalism#Antisocialism#Wage#Wage Gap#Eat the Rich#Minimum Wage#Living Wage#Affordable Education#Affordable Healthcare#Free Education#Free Healthcare#Student Loans

2K notes

·

View notes

Text

>sees post complaining about student loan debt crisis

>They better not bring up capitalism

>"you see this all the time in capitalist societies--"

>mfw

186 notes

·

View notes

Text

“We are helping you actually.” -sincerely, your exploiters.

#“We are helping you actually.” -sincerely#your exploiters.#exploitation#exploitative#payday loans#fucking grifters#right wing grifters#opportunists#capitalism#poverty#homeless#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#class war#oppression#repression#anti capitalist#washington capitals#capitalist hell#capitalist dystopia

181 notes

·

View notes

Text

They used to say that the key to success was to go to college, and that anyone who didn't go to college deserves to be paid a poverty wage.

Then, they started saying that anyone who went to college deserves to be trapped in debt forever.

This is all the proof you need that if you follow the rules of a capitalist society, they'll just change the rules.

So stop following the rules. Individualism doesn't work. Making sure someone else is poor instead of you doesn't work. The only solution is for the working class to unite and fight back.

182 notes

·

View notes

Link

Document Required for Business Loan

If you have a lack of cash and you are not able to manage the cash flow. So, you can opt for a business loan to upgrade business equipment and grow the business by the option of business loans. Each bank has specific requirements, criteria, and eligibility factors.

The list of documents is given below. These documents required for business loans are essential documents it may vary from lender to lender. You can visit our website financeseva to check your eligibility for a business loan and you can apply from there.

To apply for a business loan, you need to submit the following documents along with the business loan application:

Identity proof: For individual, company, or firm – submit valid identity proof and PAN (Permanent Account Number) Card.

Address proof: Voter ID Card, Ration Card, Passport or Driving License

Bank Statements: Latest bank statements for at least 6 months

Income Documents: This unsecured business loans would include the latest ITR (Income Tax Return) along with the computation of income, balance sheet, profit & loss account for the past two years. Make sure that the financials are audited by a reputed chartered accountant.

Proof of Continuation: In business continuation proof, you can submit ITR/trade license, sale certificate/establishment

Other mandatory documents: Sole proprietorship declaration, partnership deed, certified true copy of memorandum & articles of association and board resolutions.

These are basic documents that are required for the application for a business loan.

#documents required for business loans#unsecured business loans#startup loan#stand up loan#working capital loan#capital loan#personal loan#business loan#financeseva

2 notes

·

View notes

Text

Running a business comes with its share of challenges, and one of the most common is managing cash flow. Whether you need funds to cover daily operations, purchase inventory, or pay employees, a working capital loan can be a valuable solution. Apply for working capital loan online is now easier than ever, thanks to advancements in financial technology. This guide will walk you through the process of applying for a working capital loan and highlight the benefits of doing so online.

What is a Working Capital Loan?

A working capital loan is a type of financing that helps businesses cover their short-term operational needs. Unlike loans that are used for long-term investments or large projects, working capital loans are typically used to finance the day-to-day expenses of running a business, such as paying suppliers, managing payroll, and covering rent or utilities. These loans are especially useful for businesses that experience seasonal fluctuations in revenue or need quick access to cash.

Why Apply for a Working Capital Loan Online?

Applying for a working capital loan online offers several advantages over traditional methods:

Convenience:

You can apply for a working capital loan from the comfort of your home or office, at any time that suits you. There's no need to visit a bank branch or fill out lengthy paperwork.

Speed:

Online applications are processed faster than traditional loan applications. Many online lenders can approve loans within hours and disburse funds within a few days, helping you address your business needs quickly.

Ease of Comparison:

Applying online allows you to easily compare different loan options from various lenders. You can review interest rates, terms, and eligibility criteria, ensuring you find the best deal for your business.

Minimal Documentation:

Online applications typically require less documentation than traditional loans. Most lenders will ask for basic information such as your business's financial statements, tax returns, and bank statements.

Steps to Apply for a Working Capital Loan Online

Assess Your Needs:

Before applying, determine how much capital you need and what you will use it for. This will help you choose the right loan amount and terms.

Research Lenders:

Look for reputable online lenders who offer working capital loans. Check their interest rates, loan terms, and eligibility requirements. Customer reviews and ratings can also provide insights into the lender’s reliability.

Check Eligibility Criteria:

Review the eligibility criteria of your chosen lender. Common requirements include a minimum credit score, a certain amount of annual revenue, and a specific length of time in business.

Gather Required Documents:

Prepare the necessary documentation, such as business financials, bank statements, tax returns, and any other information the lender may require.

Complete the Online Application:

Fill out the online application form, providing accurate and complete information about your business and its financial situation. Some lenders may also require a brief description of how you intend to use the loan.

Review and Submit:

Double-check all the information before submitting your application. Once submitted, the lender will review your application and may contact you for further details.

Receive Approval and Funds:

If your application is approved, the lender will send you a loan offer detailing the terms and conditions. Once you accept the offer, the funds will be disbursed to your business account, usually within a few days.

Tips for a Successful Application

Maintain a Good Credit Score: A higher credit score increases your chances of approval and may qualify you for lower interest rates.

Keep Financial Records Up-to-Date: Accurate and organized financial records make the application process smoother and quicker.

Be Transparent: Provide honest and detailed information about your business to avoid delays or rejections.

Conclusion

Applying for a working capital loan online is a convenient, fast, and efficient way to secure the funds your business needs to thrive. By following the steps outlined in this guide, you can streamline the application process and increase your chances of approval. Whether you're looking to cover daily expenses, manage seasonal dips in revenue, or invest in growth opportunities, a working capital loan can provide the financial flexibility your business needs.

#working capital loan#capital loan#business capital loans#business working capital loans#apply for working capital loan#working capital loan online

0 notes

Text

Running a business comes with its share of challenges, and one of the most common is managing cash flow. Whether you need funds to cover daily operations, purchase inventory, or pay employees, a working capital loan can be a valuable solution. Apply for working capital loan online is now easier than ever, thanks to advancements in financial technology. This guide will walk you through the process of applying for a working capital loan and highlight the benefits of doing so online.

What is a Working Capital Loan?

A working capital loan is a type of financing that helps businesses cover their short-term operational needs. Unlike loans that are used for long-term investments or large projects, working capital loans are typically used to finance the day-to-day expenses of running a business, such as paying suppliers, managing payroll, and covering rent or utilities. These loans are especially useful for businesses that experience seasonal fluctuations in revenue or need quick access to cash.

Why Apply for a Working Capital Loan Online?

Applying for a working capital loan online offers several advantages over traditional methods:

Convenience:

You can apply for a working capital loan from the comfort of your home or office, at any time that suits you. There's no need to visit a bank branch or fill out lengthy paperwork.

Speed:

Online applications are processed faster than traditional loan applications. Many online lenders can approve loans within hours and disburse funds within a few days, helping you address your business needs quickly.

Ease of Comparison:

Applying online allows you to easily compare different loan options from various lenders. You can review interest rates, terms, and eligibility criteria, ensuring you find the best deal for your business.

Minimal Documentation:

Online applications typically require less documentation than traditional loans. Most lenders will ask for basic information such as your business's financial statements, tax returns, and bank statements.

Steps to Apply for a Working Capital Loan Online

Assess Your Needs:

Before applying, determine how much capital you need and what you will use it for. This will help you choose the right loan amount and terms.

Research Lenders:

Look for reputable online lenders who offer working capital loans. Check their interest rates, loan terms, and eligibility requirements. Customer reviews and ratings can also provide insights into the lender’s reliability.

Check Eligibility Criteria:

Review the eligibility criteria of your chosen lender. Common requirements include a minimum credit score, a certain amount of annual revenue, and a specific length of time in business.

Gather Required Documents:

Prepare the necessary documentation, such as business financials, bank statements, tax returns, and any other information the lender may require.

Complete the Online Application:

Fill out the online application form, providing accurate and complete information about your business and its financial situation. Some lenders may also require a brief description of how you intend to use the loan.

Review and Submit:

Double-check all the information before submitting your application. Once submitted, the lender will review your application and may contact you for further details.

Receive Approval and Funds:

If your application is approved, the lender will send you a loan offer detailing the terms and conditions. Once you accept the offer, the funds will be disbursed to your business account, usually within a few days.

Tips for a Successful Application

Maintain a Good Credit Score: A higher credit score increases your chances of approval and may qualify you for lower interest rates.

Keep Financial Records Up-to-Date: Accurate and organized financial records make the application process smoother and quicker.

Be Transparent: Provide honest and detailed information about your business to avoid delays or rejections.

Conclusion

Applying for a working capital loan online is a convenient, fast, and efficient way to secure the funds your business needs to thrive. By following the steps outlined in this guide, you can streamline the application process and increase your chances of approval. Whether you're looking to cover daily expenses, manage seasonal dips in revenue, or invest in growth opportunities, a working capital loan can provide the financial flexibility your business needs.

#working capital loan#capital loan#business capital loans#business working capital loans#apply for working capital loan

0 notes

Text

Source

Note: the FDIC (insurance paid into by banks, not taxpayers) is covering these loses. Let this be another glaring opportunity showing how deregulation is a dangerous game. If SVB’s collapse leads to broader financial turmoil, a true bailout may be needed.

#politics#us politics#government#capitalism#end capitalism#student debt#cancel student loans#the left#progressive#big banks#current events#news

6K notes

·

View notes

Text

Merchant Cash Advance Monthly Payments

When we talk of Merchant Cash Advance Monthly Payment, the basic fact that needs to be comprehended is that this is an advance capital that needs to be repaid to the funding network and is quite expensive when compared to other funding options. Another basic rule is that the overall amount of the Merchant Cash Advance would be decided by the lending authority after evaluating the business and its cash requirements. Businesses small in scale or even start-ups that are in need of quick funds for either setting up their inventory or creating a cash flow cycle can definitely go in for merchant cash advance payment.

#Working Capital Loan Medford OR#Working Capital Loan Medford#Working Capital Loan#Capital Loan#Finance#Loan

1 note

·

View note