#Upcoming IPOs

Text

Upcoming IPOs in India 2023

The IPO is an Initial Public Offer in which companies offer their privately held shares to the public for the first time, i.e, they sell their shares to the public. Companies that wish to change their company status from Private Limited to Limited must draft a DRHP with SEBI. Here is the list of upcoming IPOs in the year 2023:

S.No

Company

Issue Size (in Rs. Crores)

Sector

1.

Infinion Biopharma

Yet to be updated

Health Care

2.

Go Airlines India Ltd.

3,600

Aviation

3.

Snapdeal Ltd.

1,250 + OFS

E-commerce

4.

Skanray Technologies Ltd.

400

Healthcare technology

5.

One Mobikwik Systems Ltd

1,900

Technology

6.

Ixigo

1,600

Travel & Hospitality

7.

Sterlite Power Transmissions Ltd.

1,250

Industrials

8.

Gemini Edibles and Fats

2,500

Consumer Staples

9.

Bajaj Energy

5,450

Electric utilities

10.

Arohan Financial Services Pvt Ltd.

1,800

Financials

11.

Capillary Technologies India Ltd.

850

Technology

12.

Uma Converter Limited

Yet to be updated

Packaging

13.

Emcure pharmaceuticals

Around 4,500-5,000

Health Care

Here are some factors you should consider before investing in an IPO:

Company’s background: Before investing in any IPO, look for the company’s past background, and understand its business model and how it is operated. Also, look for their financials. It would be a good investment if revenues and profits are increasing consistently.

Valuation: Another factor is to check the company’s valuation. The best way to assess a company's valuation is to compare its price to that of its listed peers. Look for various ratios like price-to-earnings ratio, return on equity, etc.

Future prospects: Now try to understand the reason behind the IPO. And also understand the industry and business in detail to make sure it will sustain itself in the future. Also, the reason behind bringing the IPO can be many, so try to understand whether the money will be used for expansion, paying off loans or anything else.

Conclusion IPOs have rarely seen such strong investor demand as they have in recent years. According to data, the total collection for IPOs has well surpassed the INR 100 lakh crore mark this year. With less than a month until the end of the year, investors may see similar investor participation in upcoming IPOs.

Source - https://justpaste.it/2q3cc

#Upcoming IPOs in India#Upcoming IPOs in India 2023#Upcoming IPOs in India2022#Upcoming IPOs in India 2021#Upcoming IPOs#stocktrading#stock markerting#stock broker in india

2 notes

·

View notes

Text

Check List of All Upcoming IPO Online in India at 5paisa

Get the latest information about news on recent & upcoming IPOs for the year 2022. Know details about all upcoming IPOs and related news at the 5paisa website now!

0 notes

Text

According to persons with knowledge of the situation, the largest online pharmacy PharmEasy has notified its board and investors that it intends to raise around Rs 2,400 crore ($291.5 million) through a rights offering at a 90% discount to its highest stock price in order to pay back a loan from Goldman Sachs. According to documents reviewed by ET, API Holdings, the parent company of the unlisted PharmEasy, would issue fresh shares at a price of Rs 5 per share. In 2021, API raised capital at Rs 50 per share.

youtube

#Emcure Pharmaceuticals share price#Emcure Pharmaceuticals unlisted Shares#Emcure Pharmaceuticals IPO#Emcure Pharmaceuticals Upcoming IPO#Emcure Pharmaceuticals Pre IPO#Youtube

2 notes

·

View notes

Video

youtube

Top Unlisted Stocks to Watch and Consider for August Investments! 📈🔍

Follow Us for such interesting information

2 notes

·

View notes

Text

#Divgi TorqTransfer Systems Limited IPO Details#Divgi TorqTransfer Systems Limited IPO#Upcoming IPO 2023#Mohit Munjal YouTube#Stock Market Latest Updates#Directusinvestments#ipo#finance

2 notes

·

View notes

Text

Exploring the Rise of NCL Buildtek Share Price

Introduction

NCL Buildtek Ltd. has recently witnessed a notable increase in NCL Buildtek Share Price, capturing the attention of investors and market analysts. As a prominent player in the construction and building materials industry, the company's impressive performance and strategic initiatives have contributed significantly to this upward trend. This article delves into the factors driving the rise in NCL Buildtek Share Price and explores the company’s future prospects. NCL Buildtek Ltd. ("NCL Buildtek"), formerly known as NCL Alltek & Seccolor Ltd., is a part of the NCL Group. The company specializes in the manufacturing and sale of spray plasters, paints, skim coats, steel profiles, doors, windows (steel, ABS, and uPVC), and fly ash bricks. The group is organized into four divisions:

Coatings (Wall Putties, Paints, and Textures): The group began manufacturing spray plasters in 1992 using technology from M/s. ICP Sweden, becoming the first in India to produce acrylic-based putties (spray plasters). Today, it is the largest manufacturer of spray plasters in the country. The company also produces emulsion paints, textured paints, white cement-based putty, and other cement-based products like tile adhesives, mortars, and plasters.

Windoors: Since 1988, the group has been manufacturing pre-painted steel doors, windows, partitions, and glazing using technology from M/s. Industrie Secco S.P.A. of Italy, marketed under the brand name Seccolor. The group also fabricates uPVC doors, windows, and ABS doors.

Walls: The production of fly ash bricks began in 2016 at Kavuluru, Krishna District, Andhra Pradesh. A second project in Nellore, Andhra Pradesh, with an installed capacity of 500,000 cubic meters, commenced commercial operations in March 2020.

Services: Providing services to buildings and building materials manufacturing units.

The company operates 11 manufacturing units across various states. As the sole licensee in India for ICP plasters, NCL Buildtek has successfully completed numerous prestigious projects. It was the first company in India to manufacture putty (textured paints) and offers a variety of finishes for interior and exterior applications, including plain, granular, textured, and other designer finishes to suit various architectural and design preferences.

Over time, the company's product portfolio has expanded to include AAC blocks, dry-mix mortars, and tile adhesives. The company is planning to establish a steel door unit in Sangareddy district with an investment of over Rs. 10 crores and an AAC block manufacturing unit in Nellore with an investment of Rs. 80 crores.

Founded by Mr. K. Ramachandra Raju in 1986, NCL Buildtek has three decades of experience in providing innovative and alternative building materials.

Company Overview

From NCL Alltek & Seccolor to NCL Buildtek

NCL Buildtek Ltd., formerly known as NCL Alltek & Seccolor Ltd., is a key entity within the NCL Group. The company specializes in the manufacturing and sale of a wide range of construction and building materials. Its product portfolio includes spray plasters, paints, skim coats, steel profiles, doors, windows (steel, ABS, and uPVC), and fly ash bricks. Over the years, NCL Buildtek has established a strong reputation for quality and innovation in the industry.

Diverse Product Range

The company’s diverse product range caters to various segments of the construction market, ensuring a steady demand for its offerings. Some of the key products include:

Spray Plasters: Known for their ease of application and superior finish.

Paints and Skim Coats: Offering durability and aesthetic appeal for various construction projects.

Steel Profiles, Doors, and Windows: Providing robust and reliable solutions for building structures.

Fly Ash Bricks: An eco-friendly alternative to traditional bricks, promoting sustainable construction practices.

Factors Driving Share Price Growth

Strong Financial Performance

NCL Buildtek’s recent financial results have been a significant driver of its rising share price. The company has reported substantial revenue growth and profitability, reflecting its efficient operations and market demand for its products. Consistent earnings and a healthy balance sheet have boosted investor confidence, contributing to the share price surge.

Strategic Expansion and Innovation

The company’s strategic expansion initiatives have played a crucial role in its success. By entering new markets and expanding its product line, NCL Buildtek has managed to capture a larger market share. Additionally, the company’s focus on innovation, including the development of eco-friendly and technologically advanced products, has set it apart from competitors.

Favorable Market Conditions

The construction and building materials industry has experienced favorable market conditions, with increased infrastructure development and housing projects driving demand. NCL Buildtek has capitalized on this trend, positioning itself as a reliable supplier of high-quality materials. The overall bullish sentiment in the stock market has also contributed to the rise in the company’s share price.

Future Prospects

Continued Growth and Expansion

Looking ahead, NCL Buildtek is well-positioned for continued growth. The company’s strategic plans include further expansion into new geographic regions and the introduction of innovative products to meet evolving market needs. By maintaining its focus on quality and customer satisfaction, NCL Buildtek aims to sustain its upward trajectory.

Potential Challenges

Despite the positive outlook, the company faces potential challenges that could impact its future performance. These include regulatory changes in the construction industry, rising raw material costs, and increased competition. However, NCL Buildtek’s robust business model and adaptive strategies are expected to help mitigate these risks.

Conclusion

The rise in NCL Buildtek’s share price is a testament to the company’s strong performance, strategic vision, and ability to capitalize on favorable market conditions. As it continues to innovate and expand, NCL Buildtek remains a compelling investment opportunity in the construction and building materials sector. Investors and stakeholders will be keenly watching the company’s progress as it navigates the dynamic market landscape.

#NCL Buildtek Share Price#NCL Buildtek IPO#NCL Buildtek Pre IPO#NCL Buildtek Unlisted Shares#NCL Buildtek Upcoming IPO

0 notes

Text

Unlocking Opportunities: The ABCs of IPO Investing

Initial Public Offerings (IPOs) are an exciting opportunity for investors to get in on the ground floor of a company's journey into the public markets. These events mark the transition of a privately-held company to a publicly traded one, offering shares to the public for the first time. While IPOs can be enticing, they also come with their own set of risks and considerations. Let's delve into the world of IPO investing and explore some simple yet effective strategies for navigating this unique market.

Understanding IPOs: An IPO is the process through which a privately-owned company offers its shares to the public for the first time. This allows the company to raise capital to fund its growth initiatives, expand operations, or pay off debts. IPOs typically generate significant buzz and media attention, drawing the interest of both institutional and retail investors.

Key Considerations for IPO Investors: Before diving into an IPO, it's essential to consider several factors to make an informed investment decision:

Company Fundamentals: Evaluate the company's business model, financial performance, growth prospects, and competitive positioning. Look for companies with a strong track record of revenue growth, profitability, and market leadership.

IPO Valuation: Assess the valuation of the IPO relative to the company's earnings, revenue, and industry peers. Be cautious of IPOs that are priced too aggressively, as they may be susceptible to significant price volatility post-listing.

Market Conditions: Consider the prevailing market conditions and investor sentiment. IPOs tend to perform better in bullish market environments, while volatile or uncertain market conditions may dampen investor enthusiasm.

Lock-Up Period: Be aware of any lock-up periods imposed on insiders and pre-IPO shareholders, during which they are prohibited from selling their shares. The expiration of lock-up periods can lead to increased selling pressure on the stock.

Strategies for IPO Investing: Here are some simple yet effective strategies for investing in IPOs:

Do Your Homework: Conduct thorough research on the company's business, industry, management team, and competitive landscape. Read the prospectus (Form S-1) filed with the Securities and Exchange Commission (SEC) for valuable insights into the company's operations and risks.

Diversify Your Portfolio: Spread your investment across multiple IPOs to mitigate risk. Avoid putting all your eggs in one basket and diversify across different sectors and industries.

Be Patient: While IPOs can experience significant price fluctuations in the early days of trading, it's essential to take a long-term perspective. Focus on the company's fundamentals and growth prospects rather than short-term price movements.

Consider Post-IPO Performance: Evaluate the historical performance of IPOs from similar companies in the same industry. Assess how these companies have fared in the months and years following their IPOs to gauge potential investment returns.

Conclusion: IPO investing offers investors the opportunity to participate in the growth story of exciting new companies entering the public markets. By understanding the fundamentals of IPOs, conducting thorough research, and adhering to sound investment principles, investors can position themselves to capitalize on these unique opportunities. However, it's essential to approach IPO investing with caution and to diversify your portfolio to manage risk effectively. With careful consideration and a long-term perspective, IPO investing can be a rewarding strategy for building wealth over time.

0 notes

Text

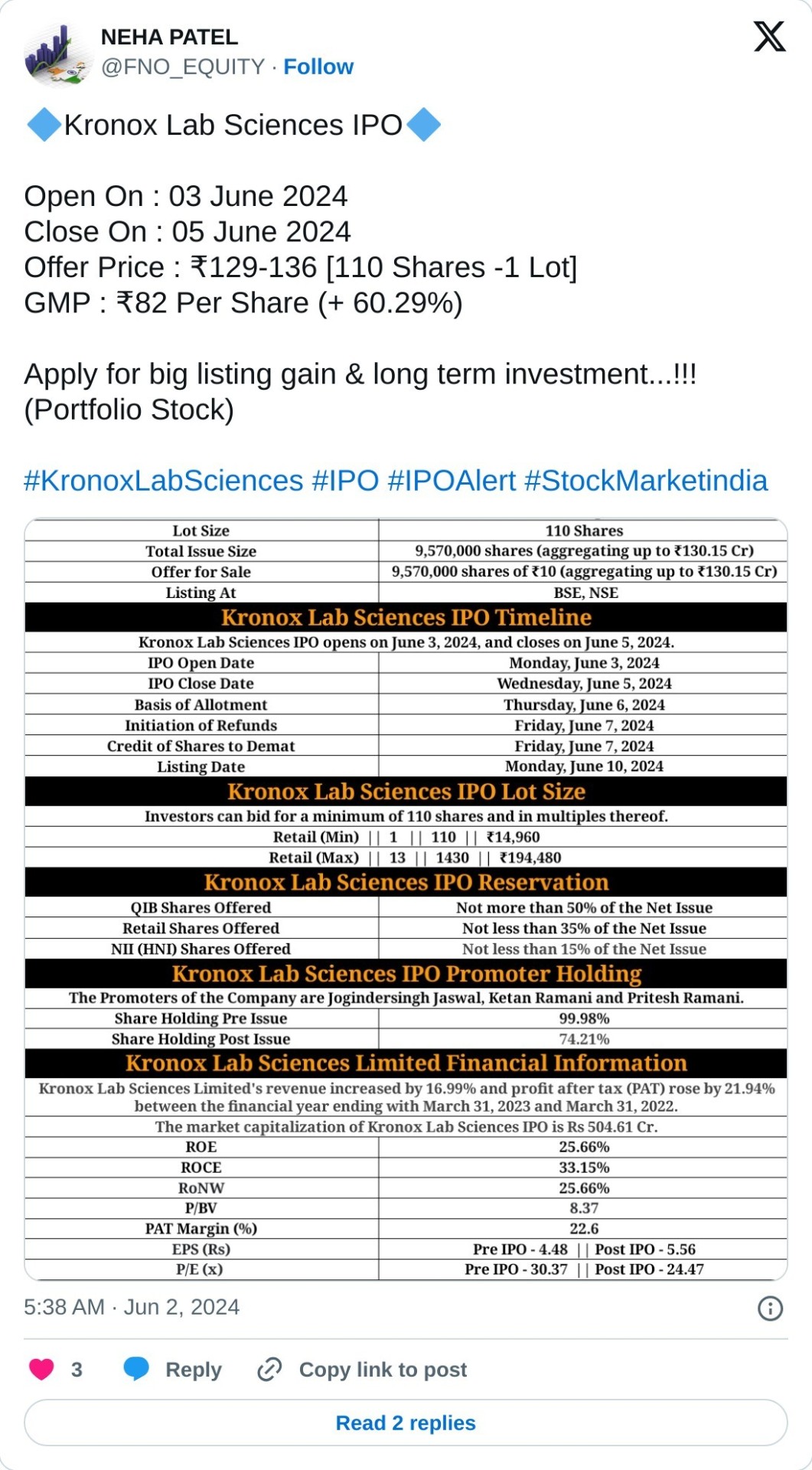

2024 IPO Checklist: A Comprehensive List of Upcoming Public Offerings

The Indian stock market continues to be a hotbed for activity, with several exciting Initial Public Offerings (IPOs) on the horizon in 2024. This comprehensive guide will equip you with the knowledge you need to navigate the upcoming IPO landscape, including details on expected offerings, IPO Grey Market Premium (GMP), and a sneak peek at the upcoming SME IPO list 2024

Upcoming Public Offerings (IPOs):

The remainder of 2024 promises a healthy pipeline of IPOs across various sectors. Here's a glimpse at some of the highly anticipated offerings:

Ebixcash: A leading provider of B2B on-demand services specializing in insurance, travel, and financial technologies.

Indiafirst Life Insurance: A prominent private life insurance company known for its innovative product portfolio and customer-centric approach.

SPC Life Sciences: A fast-growing pharmaceutical company engaged in manufacturing and marketing a diverse range of formulations.

Tata Play: A subsidiary of the Tata Group, offering a comprehensive bouquet of DTH and broadband services.

Lohia Corp: A leading manufacturer of PET packaging solutions with a strong presence in the global market.

Nova Agritech: An agritech company focused on developing and distributing high-quality crop protection products.

What is IPO GMP?

IPO Grey Market Premium (GMP) refers to the unofficial premium investors are willing to pay for shares in an upcoming IPO before they are listed on the stock exchange. It's important to understand that GMP is not an official indicator of the IPO's performance and should be considered speculative. However, it can provide some insight into investor sentiment surrounding a particular offering.

Resources for Tracking Upcoming IPOs and GMP:

Several valuable resources can help you stay updated on upcoming IPOs and track their associated GMP. Here are a few popular options:

Moneycontrol: provides a dedicated IPO section with detailed information on upcoming offerings and historical performance.

Chittorgarh: features a user-friendly IPO calendar with live updates and GMP trends.

The Rise of SME IPOs:

The Indian stock market has witnessed a surge in interest for Small and Medium Enterprises (SME) IPOs. These offerings allow smaller companies to raise capital and expand their operations. Here are some of the advantages of investing in SME IPOs:

High Growth Potential: SME companies often exhibit high growth trajectories, offering the potential for significant capital appreciation.

Diversification: SME IPOs can help diversify your investment portfolio by including companies from various sectors not typically represented in large-cap offerings.

Early Investment Opportunity: Investing in an SME IPO allows you to participate in a company's growth story at an early stage.

A Glimpse into Upcoming SME IPOs (Disclaimer: Listing subject to change):

While the specific SME IPO listings can be dynamic, here are some examples of companies that might be considering an SME IPO in the near future:

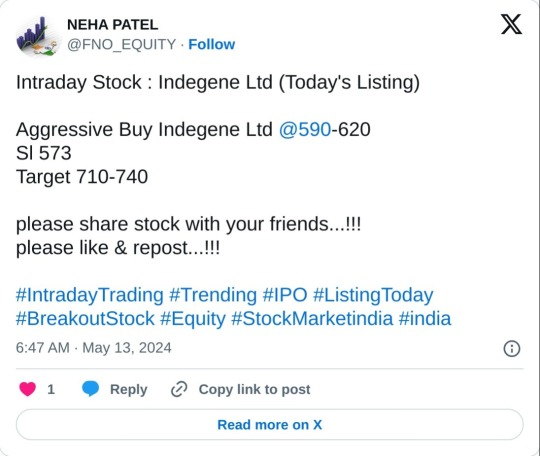

Indegene Ltd: A contract research organization providing drug discovery and development services.

Aadhar Housing Finance: A housing finance company catering to the underserved and affordable housing segments.

TBO Tek: A leading player in the travel technology space.

MobiKwik: A popular digital payments platform offering a wide range of financial services.

Ixigo: A prominent online travel aggregator facilitating hotel bookings, flight reservations, and travel packages.

Important Considerations Before Investing in an IPO:

Before investing in any IPO, including upcoming SME offerings, it's crucial to conduct thorough research. Here are some key factors to consider:

Company Financials: Analyze the company's financial health, profitability, and growth prospects.

Industry Outlook: Evaluate the overall health and growth potential of the industry the company operates in.

Management Team: Assess the experience and capabilities of the company's management team.

IPO Valuation: Compare the IPO price with the company's fundamentals to determine if it's fairly valued.

Remember: IPOs can be a lucrative investment opportunity, but they also carry inherent risks. By conducting thorough research, understanding IPO GMP (while acknowledging its limitations), and carefully considering the factors mentioned above, you can make informed investment decisions in the exciting world of upcoming IPOs and the growing SME IPO market.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Gandhar Oil IPO GMP Today

Fedbank Financial Services IPO GMP Today

Tata Technologies IPO GMP Today

Flair Writing IPO GMP Today

Allied Blenders and Distillers IPO GMP Today

AMIC Forging IPO GMP Today

Net Avenue Tech IPO GMP Today

Marinetrans India IPO GMP Today

Graphisads IPO GMP Today

Sheetal Universal IPO GMP Today

Presstonic Engineering IPO GMP Today

S J Logistics IPO GMP Today

Shree OSFM E-Mobility IPO GMP Today

DCG Wires and Cables IPO GMP Today

Ramdevbaba Solvent IPO GMP Today

WINSOL ENGINEERS IPO GMP Today

Shivam Chemicals IPO GMP Today

Emmforce Autotech IPO GMP Today

Grill Splendour Services IPO GMP Today

Teerth Gopicon IPO GMP Today

Chatha Foods IPO GMP Today

Gabriel Pet Straps IPO GMP Today

Baweja Studios IPO GMP Today

Mayank Cattle Food IPO GMP Today

Docmode Health Technologies IPO GMP Today

Megatherm Induction IPO GMP Today

Siyaram Recycling IPO GMP Today

Accent Microcell IPO GMP Today

SLONE INFOSYSTEMS IPO GMP Today

Greenhitech Ventures IPO GMP Today

0 notes

Text

Vikram Solar journey - Bright Future in Renewable Energy

Vikram Solar IPO specializes in high-efficiency solar photovoltaic (PV) modules, engineering, procurement, and construction (EPC) services, and operations and maintenance (O&M) of solar power plants.

#vikram solar share price#Vikram Solar IPO#vikram solar pre ipo#Vikram Solar Upcoming IPO#Vikram Solar unlisted share

0 notes

Text

#equity#stock market#nseindia#banknifty#bse#nifty#nifty prediction#nifty50#nifty today#niftytrading#debt#inequality#economics#safety#nse#poverty#breakout#memes#youtube#trendingnow#trending#ipo news#finance#investing#economy#budgeting#upcoming ipo#business#i posted this#i post

0 notes

Text

Is Hexaware Technologies Going for IPO?

Hexaware, an IT and business process outsourcing (BPO) services provider, delisted from the NSE and BSE in November 2020 at a price of ₹475 per share. In 2021, US private equity giant Carlyle acquired a 62% stake in Hexaware for $3 billion. Hexaware is now planning to re-enter the public market with an IPO that could raise up to $1 billion (₹8,350 crore) at a valuation of $4-5 billion (₹41,000-50,000 crore). Carlyle has finalized five investment banks as underwriters for the IPO: Kotak Mahindra Capital, Citi, JP Morgan, HSBC, and IIFL Securities. If the IPO goes through, it will be the biggest IPO in the IT services sector after TCS. Currently, shares are available in the pre-IPO market at ₹1,100 per share at a valuation of $4 billion. Investors who have accumulated these shares at ₹450-900 are seeing good returns. I recommend these investors hold on to their shares. For those who haven't invested yet, we suggest doing their due diligence before making an investment decision.

youtube

#hexaware Pre IPO#hexaware IPO#hexaware Unlisted shares#hexaware Unlisted share price#hexaware Share Price#hexaware Upcoming IPO#Youtube

1 note

·

View note

Text

A Beginner's Guide to Investing in IPOs: From Application to Allotment

IPOs can be a thrilling way for beginners to enter the stock market, but they also present challenges and learning curves. From the IPO application to the final allotment, several steps can seem daunting. Successfully investing in new public offerings requires understanding these steps, including IPO allotment.

The first question most new investors have is how to invest in an IPO. The process begins with selecting a reliable broker or trading platform that has access to IPOs. Most brokerage firms offer their clients the facility to apply for IPOs through their platform. It is essential to ensure that your chosen broker is registered with the relevant financial authorities and has a good track record.

Once you have a broker, the next step is to keep an eye on upcoming IPOs. This can be done by monitoring financial news, subscribing to updates from your brokerage, or using financial news platforms. When an appealing IPO is announced, you should carefully review the company's prospectus, which is usually available on the website of the Securities and Exchange Board of India (SEBI) or the company's site. The prospectus provides detailed information about the company’s financials, risks, and reasons for raising funds.

After deciding to participate in an IPO, the application process is the next step. In India, this is typically done through the ASBA (Application Supported by Blocked Amount) facility, where your application money gets blocked in your bank account and is only deducted when you receive the share allotment, thus ensuring safety and transparency in the transaction. You can apply through your bank or directly through your brokerage platform, depending on the facilities provided.

Once the application period ends, the allocation process begins. This allotment process is crucial and can depend on the level of oversubscription. If an IPO is oversubscribed, the shares might be allotted proportionately among all the applicants, or a lottery system might be used in the case of excessive demand. Checking the allotment status is straightforward; it can be done by visiting the registrar’s website of the IPO and entering your application number or PAN card details.

Finally, once the shares are allotted, they will be credited to your demat account, and they can be traded on the stock exchange from the listing date. It's important to have a strategy in place for whether to hold or sell the shares post-listing, which should be based on a careful analysis of the market conditions and the company’s performance outlook.

Beginners can get into the stock market by investing in IPOs. The investor must understand the process, research the market, and monitor it. IPOs can be profitable with the right strategy and analysis. Start small, learn often, and gain confidence as you navigate IPOs.

0 notes

Text

As Bharti Hexacom Limited, the well-known proprietor of the “Airtel” brand, prepares for its highly anticipated initial public offering (IPO) listing on both the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), today is an important day in the fast-paced world of stock markets. The company’s potential for growth and profitability in the telecom industry has raised expectations, and this has attracted a lot of attention from analysts and investors on the IPO.

0 notes