#VAloans

Text

FREE VA Home Loan Pre-Approval. Do you know how much home you can afford? Take the first step by getting pre-approved here for FREE! No SSN Required https://bit.ly/38dW2AR

#applynow#buyahome#buyahouse#homebuyer#realestate#home#homeowner#homeownership#housing#mortgage#fha#fhaloan#va#valoans#realtor#realestateagent#jumboloan#california#colorado#florida#louisiana#michigan#texas#utah#real estate

6 notes

·

View notes

Link

Real Estate Robot Army: IT'S OFFICIAL! I'm a CERTIFIED CE (Continuing Education) Instructor for Real Estate Agents in Texas! Now I gotta figure out what to teach...🤔🤔🤔 #LLTeam #VeteranMortgageAdvisor #YourMortgageInsider #LarryTheMortgageGuy #OpenMortgage #TrophyMortgageGuy Real Estate Agents - I do weekly classes on the VA Loan, First Time Home Buyer Secrets DEEP DIVE, and Social Media Marketing Tips since I am a Social Media Coach and own my own ad agency - find out more here https://www.facebook.com/groups/TLTeamAgents You can also check out all my classes and videos on YouTube here: https://www.youtube.com/channel/UCtwvRuzeaWPuadNKth6cp2Q/featured #RealEstateRobotArmy #RobotsLLC #FUBots #RobotMakers #RobotHustlers #RobotGenerals #RobotVAs https://www.facebook.com/387847640192767/posts/484631610514369

#LarryTheMortgageGuy#RobotsLLC#RealEstateMarketing#SocialMediaMarketing#SocialMedia#Funnels#SalesFunnels#Automation#Technology#LeadGeneration#FollowUp#Marketing#Scripts#Coaching#HomeBuyerSecret#Mortgages#LoanOfficer#Veterans#Veteran#VALoans#FirstTimeHomeBuyer#RealEstate

6 notes

·

View notes

Text

Increased VA loan limits in 2024: How Do They Affect Your Home Buying Power?

VA loans have a history dating back to 80 years, and they continue to help the US purchase their dream home even today. The VA loans are available to military service members and surviving spouses and are backed by the government. The loans can be used for buying your first home or renovating your current residence. These VA home loans are the best option for veterans who are handling issues with bad credit or don’t have accumulated money towards a down payment for a home purchase. If you are someone who has served in the military, take your time to learn the benefits of VA loans to achieve homeownership. In the current article, let us explore more about VA loan limits and how they influence your home buying power.

How does a VA loan work?

VA home loans in Paramus NJ can be used to buy a new home, renovate, or refinance the existing mortgage for different purposes, like fetching low interest rates, longer loan terms, and taking cash out of their home. VA loans are offered by private lenders but backed by the government, where the government will pay a portion of the home loan amount in case of default. The guarantee offered by the government makes them low-risk loans with greater benefits like zero down payment, low interest rates, and lower closing costs compared to other types of loans.

What are VA home loan limits?

The VA loan limit is the amount one can fetch while taking out a VA-backed mortgage. This is the amount that the VA guarantees for home loans without a VA loan downpayment in Paramus NJ . This limit is set by the Federal Housing Finance Agency. Since 2020, qualified borrowers can get full VA loan entitlement, which means veterans can get as much as the lender is willing to offer without a VA loan downpayment in Paramus NJ . However, the absence of a VA loan limit does not imply unlimited borrowing for an individual; various factors like credit score, income, and other related factors can influence it. If you have already used a part of your VA loan entitlement or have defaulted on your previous VA loan, the VA loan limit could be exercised. The best Mortgage lender in Paramus NJ may assess your VA loan application, considering various factors. If you are found eligible for full VA loan entitlement, you can get a loan that exceeds comforting loan limits with a zero down payment. The VA loan limits may apply if you have used a part of it and are planning to hold that property. The VA loan limits in 2024 have jumped up to $766,550, and they may rise to $1,149,825 for one-unit homes in high-cost areas.

When do VA loan limits apply?

VA loan limits may apply when you don’t have full entitlement, and they may also vary depending on the county and downpayment you are making for the loan.

If you have an active VA loan that you are paying back, VA limits may apply.

If you have paid off your VA loan completely but did not restore your entitlement.

If you have cleared the VA loan by refinancing it to another loan type.

If there is a short sale or deed-in-lieu of foreclosure of the home purchased with a VA loan.

If there is a foreclosure on a previous VA loan that is not paid in full.

How do VA loan limits influence your purchasing power?

Loan limits play a key role in VA home loans. These limits are aligned with conforming loan limits and are set by the Federal Housing Finance Agency. This is the amount that is sanctioned to veterans without the down payment. Seeking information on these limits is essential because they can influence the purchasing power of the borrower

Though these loan limits may seem like arbitrary barriers to purchasing a home, they can help veterans manage their home loan EMIs comfortably. Increased VA loan limits in high-cost living areas allow veterans to remain competitive when bidding on homes.

The VA loan limit in your area may determine the need for a VA loan downpayment. If the home value exceeds your VA limit, you may have to pay the difference towards the down payment.

Increased VA loan limits in your county may fetch you best mortgage VA rates as the loans turn less risky.

You may be able to build faster home equity when you take a loan within your limits.

The increased VA limits can make you eligible for a refinance when your home value rises and you are within your loan limits.

Buy expensive homes with a zero-down payment.

0 notes

Text

PCG Mortgages: Simplifying Your Home Purchase

PCG brings you straightforward mortgage solutions to help you purchase your home without hassle. With our transparent fees, expert financial advice, and customer-first approach, securing a home loan has never been easier. Join the thousands who have trusted PCG to make their homeownership dreams a reality.

0 notes

Text

How to Qualify for a VA Loan: Steps and Criteria

A VA loan is an important tool that helps veterans, active-duty military personnel, and some qualified spouses become homeowners. In order to be eligible for a VA loan, one must fulfill certain requirements and adhere to a set of guidelines. This is a thorough guide on how to be eligible for a VA loan.

Determine Eligibility: Verifying your eligibility is the first step towards being approved for a VA loan. In general, eligible individuals include some active-duty service members, Reservists, National Guard members, and some surviving spouses. They may also include veterans who served on active duty and were dismissed under circumstances other than dishonorable. Eligibility requirements are specified by the Department of Veterans Affairs (VA), and these can be verified online or with a lender who has been approved by the VA.

Obtain the Certificate of Eligibility: The VA must issue you with a Certificate of Eligibility (COE) after your eligibility has been determined. Your eligibility to take part in the VA Loan Guaranty program is confirmed by this document. The VA will accept applications for the COE, or your VA-approved lender can help you get one.

Satisfy VA Loan Requirements: VA loans have certain prerequisites, such as a stable work history, a minimum credit score requirement, and enough income to cover monthly expenses. In order to make sure you can afford mortgage payments in addition to other financial commitments, lenders will also evaluate your debt-to-income ratio.

Select a Lender Approved by the VA: Collaborate with a VA-approved lender with processing experience for VA loans. They will help you apply for loans and, in accordance with VA regulations, assist in determining your eligibility.

Provide Required Documentation: Gather required paperwork, including bank records, tax returns, W-2 statements, pay stubs from recent employment, and proof of military service. Verifying your income, job, and financial security requires these documents.

Fulfill Property Requirements: Primary residences are the intended use for VA loans. To guarantee that it is hygienic, safe, and physically sound, the property you plan to buy must adhere to VA's Minimum Property Requirements (MPRs).

Take into Account the VA Funding cost: The majority of borrowers who use VA loans must pay the funding cost. The cost varies based on a number of criteria, including whether this is your first VA loan and how much you put down. This charge aids in defraying the taxpayers' expense of the VA loan program.

Finish the Loan Application Process: Send your lender a VA loan application and all necessary supporting papers. The lender will assess your application, confirm details, and make a determination regarding loan acceptance.

Await Loan Approval and Closing: You will receive a Loan Estimate with specific loan terms after your loan is authorized. The loan will move forward to close, when you will receive ownership of the property, once you have signed the required documentation.

Savor Homeownership: Following closing, you obtain the advantages of a VA loan, such as favorable interest rates, the ability to avoid paying a down payment (in most situations), and the absence of the need for private mortgage insurance (PMI).

To summarize, the process of becoming eligible for a VA loan include verifying your eligibility, fulfilling the loan requirements, collaborating with a VA-approved lender, supplying the required paperwork, and completing the loan application. The goal of this government-sponsored program is to help veterans and their families realize their aspiration of becoming homeowners.

0 notes

Text

Unveiling the Path to Success with VA Mortgage Leads: A Guide by TheLiveLead

Understanding the Essence of VA Mortgage Leads

VA mortgage leads constitute a distinct segment in the lending landscape, catering to veterans and active-duty service members seeking home financing benefits through the Department of Veterans Affairs. These leads embody a unique blend of purpose and privilege, underpinned by the noble objective of serving those who’ve served their nation.

TheLiveLead’s Approach

At TheLiveLead, we recognize the nuanced nature of VA mortgage leads and the imperative to deliver solutions tailored to this niche. Our methodology combines cutting-edge technology with human expertise, ensuring a bespoke approach that resonates with both lenders and potential borrowers.

Unlocking the Potential

Gone are the days of generic lead generation strategies yielding lackluster results. TheLiveLead harnesses the power of data analytics to identify and target qualified VA mortgage leads with precision. Through advanced algorithms and machine learning capabilities, we uncover hidden opportunities and empower lenders to capitalize on them effectively.

Quality Over Quantity

In a sea of leads, discerning quality from quantity is often a daunting task. However, TheLiveLead thrives on this challenge, prioritizing lead quality over mere quantity. Every lead that crosses our threshold undergoes rigorous scrutiny, ensuring alignment with the specific criteria set forth by our lending partners.

Personalization at Its Finest

One size does not fit all, especially in the realm of VA mortgage leads. Recognizing this, TheLiveLead emphasizes personalization as a cornerstone of our approach. By understanding the unique needs and preferences of both lenders and borrowers, we curate tailored solutions that foster meaningful connections and drive conversion rates skyward.

Navigating Compliance with Confidence

In an industry rife with regulatory complexities, compliance is non-negotiable. TheLiveLead stands at the forefront of adherence to regulatory standards, employing robust mechanisms to safeguard the integrity of every lead transaction. Lenders partnering with us can navigate the regulatory landscape with confidence, knowing that their interests are protected at every turn.

The Human Touch

Amidst the digital revolution, TheLiveLead remains anchored in the value of human connection. Beyond algorithms and analytics, our team comprises seasoned professionals dedicated to providing unparalleled support and guidance. Whether it’s answering queries, offering insights, or troubleshooting issues, we’re here every step of the way.

Conclusion

Embark on a journey of unparalleled success in the realm of VA mortgage leads with TheLiveLead as your trusted ally. With our unwavering commitment to excellence, personalized approach, and unwavering adherence to compliance, we pave the way for lenders to thrive in a dynamic and competitive landscape. Join us at TheLiveLead and unlock the limitless potential of VA mortgage leads today.

#VALoans#MortgageLeads#VeteransBenefits#TheLiveLeadSuccess#HomeFinancing#LendingSolutions#LeadGeneration#PersonalizedApproach#ComplianceMatters#VeteransHomeLoans

1 note

·

View note

Text

Honor your service with ReRx Mortgage's VA loans, offering veterans and active military members a path to homeownership with no down payment and favorable terms. Explore how you can own a piece of the American dream at ReRx Mortgage.

0 notes

Text

Rise in Foreclosures Among Veterans: How COVID-19 and Housing Changes Impact VA Loans

#COVID19pandemic #DepartmentofVeteransAffairs #foreclosuresamongveterans #housingmarketchanges #VAloans

#Politics#COVID19pandemic#DepartmentofVeteransAffairs#foreclosuresamongveterans#housingmarketchanges#VAloans

0 notes

Link

#vamortgage #mortgage #homeloan #valoans #valoan #veterans #kentuckymortgage #louisville #louisVILLErealestate

#vamortgage#mortgage#homeloan#valoans#valoan#veterans#kentuckymortgage#louisville#louisVILLErealestate

0 notes

Text

Free Jumbo Loan Pre-Approval! We’re pulling out all the stops for your jumbo clients. Ask about our Jumbo loans up to $3 million with no required mortgage insurance and RSUs accepted as income.

ChangeMyRate.com compares multiple lenders and loan options — all in one place. Take the first step by getting pre-approved here for FREE! No SSN Required https://bit.ly/3K74Ru5

#applynow#buyahome#buyahouse#homebuyer#realestate#home#homeowner#homeownership#housing#mortgage#fha#fhaloan#va#valoans#realtor#realestateagent#jumboloan#real estate

0 notes

Photo

Snappy Flips Wednesday Closing! Congratulations to my Brothers in Real Estate Mr DeShawn Dulan and Mr Wesley Smith (not pictured) on the sale of another investment property! Thinking about purchasing a rehab, rental or investment property? Call me today! 502-931-1139 SoldByChrisRobinson.com #ChrisTheCloser #snappyflips #snappyflip #rentalproperty #flipmyhouse #flippinghouses #rehabhomes #sold #justsold #investments #buysellinvest #louisvillerealestate #louisvillerealtor #listingagent #buyeragent #fhaloans #valoans #conventionalloans #realestatebae #investmentproperty #rentalproperty #realestateagent #realtor #realestateinvesting #investors #realtorlife #supportlocalbusiness #IgnitePropertyGroup #SemoninRealtors #realtorsofinstagram https://www.instagram.com/p/Cp0Z-FKAQyN/?igshid=NGJjMDIxMWI=

#christhecloser#snappyflips#snappyflip#rentalproperty#flipmyhouse#flippinghouses#rehabhomes#sold#justsold#investments#buysellinvest#louisvillerealestate#louisvillerealtor#listingagent#buyeragent#fhaloans#valoans#conventionalloans#realestatebae#investmentproperty#realestateagent#realtor#realestateinvesting#investors#realtorlife#supportlocalbusiness#ignitepropertygroup#semoninrealtors#realtorsofinstagram

0 notes

Text

Why finding the right VA lender is important, and how to find one?

Purchasing a home is a lifetime investment for many. This is not a task people get indulged in quite often. For many, it is one home for a lifetime or maybe two. VA loans are special loans offered to veterans USA with some special benefits. While you are searching for a VA home lender, it is very important that the lender you choose aligns better with your housing needs. VA loans are special category loans, and not every mortgage lender can handle them effectively. Reaching a VA loan-approved lender can make a lot of difference in your experience of fetching a home loan.

VA loans.

VA home mortgage is a loan backed by the U.S. Department of Veterans Affairs (VA) and is offered to Veterans, service members and surviving spouses. The benefits of the loans make them the most sought-after special category loans. The loans are offered by private mortgage lenders, banks and credit unions. They are offered with zero downpayment. Low interest rates and flexible credit guidelines. Choosing the VA-approved lenders makes your lending process smooth and easier and also makes an informed choice.

How to choose the Right VA approved lender?

Get referrals.

Getting referrals from friends and family is a solid strategy for finding the right VA lender for your home loan. Their referrals must be backed by a positive experience. If your close circle lacks this experience, you can relay rely on real estate agents for a valuable source of information. Also, you can tap online social media communities or reach veteran organisations for referrals.

Look for expertise lenders.

Many Mortgage lenders are offering VA loans, you should look for their expertise and experience as they can make your home loan processing journey smoother than ever. Check for their credentials, license and number of mortgages issued annually.

Accreditations and Credentials.

Check for the Accreditations and Credentials of the lender to know their professionalism and commitment to industry standards. This information shows lenders are legally operating VA loans and their dedication to current knowledge in processing VA loans. Do check their certifications specific to VA loans to know their expertise in processing special loans.

Length of licensure.

checking the number of years in operation is another key criteria to know their endurance in the industry and their knowledge gained over some time. A lender with good experience can demonstrate their expertise in processing special VA loans efficiently. Checking the length u of their license gives you a confirmation of their long standing in the industry which in turn echoes the history of customer satisfaction and consistent delivery.

Number of loans issued per year.

The number of VA loans issued by lender gives you information about their familiarity with processing VA loans. Get the data on their approval rates, shedding light on lender’s efficiency and likehood of getting your loan processed smoothly. Look for specialized professional assistance to process VA loans. Their ability to process multiple types of loans shows that they have the resources and expertise to process your loan proficiently.

Compare offers from multiple lenders.

compare loan quotations from different VA-approved lenders to know how they measure up to each other in costs, loan terms, loan rates, closing costs, monthly payments and additional costs. Compare the options from at least three VA-approved lenders to steer towards the best VA mortgage lender. Also, check if the loan agreement is in line with your financial goals.

Evaluate lender reviews.

Get insights into customer reviews to gain more knowledge about borrowers’ experiences. It y gives information about customer’s overall satisfaction about the lender. The reviews online can be misleading at times, so you need to learn to evaluate them. Look for consistent feedback, check for the source and know the response from the lender to validate details. Get a balanced view for an accurate depiction.

Trust your First Impression.

Go with the lender if your lender talks to them in a friendly way and is quite prompt in getting back to you. You can trust the lender if they can answer all your questions and give you more knowledge on loans.

0 notes

Text

Can you go to jail for not paying Progressive Leasing?

While failure to pay Progressive Leasing is not a criminal offense, it is possible that you could end up in jail if you fail to respond to legal action taken by the company. If a court orders you to pay the outstanding balance and you still refuse to pay, you could be held in contempt of court and face imprisonment as a result.

But if you still do not pay then you may have to go to jail. Because in the legal action taken by them, you will have to appear in the court. If you do not pay the fine that the court has imposed on you along with the rest of the payment, then you will have to go to jail and then you will have to get bail.

Thanks.

1 note

·

View note

Photo

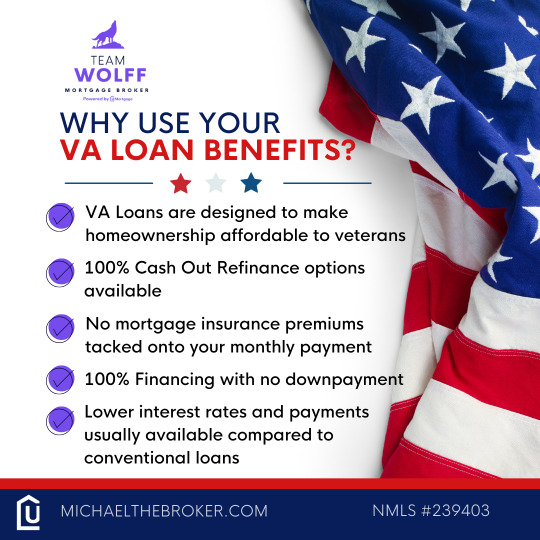

The Department of Veterans Affairs has developed a special type of home loan product exclusively for veterans and active servicemembers which doesn't require a down payment and comes with many other benefits. Some veterans are unaware of their VA loan benefits. If you’re a veteran and still haven’t explored all the benefits of this powerful mortgage loan type. Don’t let this happen to you, Let's talk! 😉 Michael Wolff U Mortgage-Branch Manager NMLS #239403 NC SC CA FL TN SD AK 323.646.8367 . . . . .

#michaelthebroker#realestate#mortgagepro#fortbragg#camplejeune#ncrealestate#raleighnc#military#homebuyingtips#realestateadvice#valoan#veterans#firsttimehomebuyers#valoans#vahomeloan#homeloan#mortgagebroker#ncrealtors#valoanspecialist

0 notes

Text

VA Mortgage Leads

Understanding the Landscape:

Before delving into the intricacies of VA mortgage leads, it’s crucial to grasp the landscape they operate in. VA loans, backed by the U.S. Department of Veterans Affairs, cater to veterans, active-duty service members, and eligible surviving spouses, offering them favorable terms and benefits. However, reaching out to this demographic requires a specialized approach due to their unique needs and preferences.

Enter TheLiveLead:

At TheLiveLead, we recognize the importance of targeted lead generation, especially in the VA mortgage sector. Our innovative approach combines cutting-edge technology with industry expertise to deliver unparalleled results for mortgage professionals. With a keen focus on VA mortgage leads, we ensure that our clients have access to a steady stream of qualified prospects, enabling them to maximize their business potential.

TheLiveLead Advantage:

Precision Targeting: Leveraging advanced data analytics and AI-driven algorithms, we identify and target individuals who are most likely to benefit from VA loans. By analyzing various factors such as military service history, credit profiles, and demographic information, we ensure that our leads are highly relevant and conversion-ready.

Customized Campaigns: We understand that one size does not fit all when it comes to lead generation. That’s why we offer personalized campaign strategies tailored to the unique requirements of our clients. Whether it’s reaching out to recently discharged veterans or engaging with active-duty personnel, our campaigns are designed to resonate with the target audience effectively.

Real-Time Lead Delivery: Time is of the essence in the competitive mortgage industry. With our real-time lead delivery system, clients receive fresh leads as soon as they become available, allowing them to capitalize on opportunities swiftly. This seamless integration ensures that our clients stay ahead of the curve and maintain a competitive edge in the market.

Quality Assurance: Quality is non-negotiable at TheLiveLead. Every lead that passes through our system undergoes rigorous screening and verification processes to ensure authenticity and accuracy. This commitment to quality translates into higher conversion rates and a more efficient sales process for our clients.

Continuous Optimization: The mortgage landscape is dynamic, and what works today may not yield the same results tomorrow. That’s why we continuously monitor and optimize our lead generation strategies to adapt to changing market conditions. By staying ahead of trends and leveraging the latest technologies, we empower our clients to stay ahead of the competition.

Unlocking Growth Potential:

With TheLiveLead as your strategic partner, the possibilities for growth in the VA mortgage sector are endless. Whether you’re a seasoned professional looking to expand your client base or a newcomer seeking to establish your presence, our comprehensive lead generation solutions can propel your business to new heights.

In Conclusion:

VA mortgage leads represent a lucrative opportunity for mortgage professionals, provided they have the right tools and strategies in place. With TheLiveLead, you not only gain access to a reliable source of high-quality leads but also benefit from a partner committed to your success. Together, let’s unlock the full potential of VA mortgage leads and chart a course towards sustained growth and prosperity.

#VALoans#MortgageLeads#Veterans#TheLiveLeadSuccess#RealEstate#LeadGeneration#FinancialFreedom#HomeLoans#MilitaryBenefits#VAHomeLoan#SuccessInSelling#EmpowerYourBusiness#TargetedMarketing#GrowYourPipeline#WinningWithTheLiveLead

1 note

·

View note

Text

FINANCING OPTIONS: WHAT LOAN IS BEST FOR ME?

Figuring out what needs to be done to purchase a home can be intimidating. The main thing that worries people is the state of their credit and if they will qualify for a home loan. There are so many different loan options to choose from, and honestly -- the only way to know what’s best for you is to speak to a mortgage professional. However, it doesn’t hurt to research what’s out there to have an idea of what you may be discussing when the time comes.

Conventional Loans

A conventional loan is a private loan that does not involve the government. Lending institutions offering conventional loans set their own standards and, as a result, offer more variety and flexibility with their mortgage plans. It can be more difficult to qualify for a conventional mortgage than it would be to qualify for a government funded loan.

For the most part, a conventional loan will require a 20% down payment. When this isn’t true, though, the lending institution will require the borrower to pay PMI (Private Mortgage Insurance). PMI protects the lender in case the home is lost in foreclosure when the borrower pays less than a 20% down payment. [PMI can be dropped when equity reaches 20% at the borrower’s request.]

FHA Loans

An FHA loan is a loan that is insured by the Federal Housing Administration. FHA loans are more attractive to borrowers since they require a lower down payment than conventional loans and they allow the seller to assume some of the closing costs (seller concession). They also allow money being placed toward the down payment and/or closing costs to be given as a gift to the buyer.

FHA mortgages require the borrower to pay a MIP or Mortgage Insurance Premium. It is similar to PMI in that it also protects the lender in case the borrower defaults on the loan. Unlike PMI, though, you cannot drop MIP once a certain amount of equity is reached. The only way to get out of paying MIP is to refinance or pay the loan off.

VA Loans

Some veterans and qualified personnel may be eligible for a VA-Guaranteed loan. These are loans offered by lenders where the Department of Veterans Affairs guarantees the top 25% of the loan, so no down payment is required. Although this is the case, depending on the market climate, it still may be smart to offer a down payment to keep your competitive edge. In order to qualify for a VA loan, the veteran must have a discharge that is “other than dishonorable” in addition to the required length of service during wartime or peacetime.

------------------------------------------------------------------------------------------------------

In no way does this break down every loan option, but it does provide an idea of what you may be looking for depending on your circumstance or financial situation. Feel free to reach out to me if you have sany questions about any of the options mentioned above, or anything else Real Estate related!

Check out this free resource for those of you looking for more information on this subject -- Click for Your Home Loan Toolkit: A Step-by-Step Guide (created by the Consumer Financial Protection Bureau.

https://files.consumerfinance.gov/f/201503_cfpb_your-home-loan-toolkit-web.pdf

0 notes