#Vector Control Market Size

Explore tagged Tumblr posts

Text

The vector control market is expected to reach USD 29.80 billion by 2029, growing at a compound annual growth rate (CAGR) of 6.5% from its estimated value of USD 21.72 billion in 2024.

#Vector Control Market#Vector Control#Vector Control Market Size#Vector Control Market Share#Vector Control Market Growth#Vector Control Market Trends#Vector Control Market Forecast#Vector Control Market Analysis#Vector Control Market Report#Vector Control Market Scope#Vector Control Market Overview#Vector Control Market Outlook#Vector Control Market Drivers#Vector Control Industry#Vector Control Companies

0 notes

Text

Vector Control Market Applications in Agriculture and Urban Pest Management

Vector Control Market Growth Strategic Market Overview and Growth Projections

The global vector control market size was valued at USD 22.4 billion in 2022 and is projected to reach USD 34.3 billion by 2031, registering a CAGR of 5.5% during the forecast period (2023-2031).

The latest Global Vector Control Market by straits research provides an in-depth analysis of the Vector Control Market, including its future growth potential and key factors influencing its trajectory. This comprehensive report explores crucial elements driving market expansion, current challenges, competitive landscapes, and emerging opportunities. It delves into significant trends, competitive strategies, and the role of key industry players shaping the global Vector Control Market. Additionally, it provides insight into the regulatory environment, market dynamics, and regional performance, offering a holistic view of the global market’s landscape through 2032.

Competitive Landscape

Some of the prominent key players operating in the Vector Control Market are

Bayer

Syngenta

BASF

Bell Laboratories

FMC Corporation

Rentokil Initial

Ecolab

Terminix International

Rollins

Anticimex Group

Arrow Exterminators

Ensystex

Impex Europa

Liphatech

PelGar International

Get Free Request Sample Report @ https://straitsresearch.com/report/vector-control-market/request-sample

The Vector Control Market Research report delivers comprehensive annual revenue forecasts alongside detailed analysis of sales growth within the market. These projections, developed by seasoned analysts, are grounded in a deep exploration of the latest industry trends. The forecasts offer valuable insights for investors, highlighting key growth opportunities and industry potential. Additionally, the report provides a concise dashboard overview of leading organizations, showcasing their effective marketing strategies, market share, and the most recent advancements in both historical and current market landscapes.Global Vector Control Market: Segmentation

The Vector Control Market segmentation divides the market into multiple sub-segments based on product type, application, and geographical region. This segmentation approach enables more precise regional and country-level forecasts, providing deeper insights into market dynamics and potential growth opportunities within each segment.

By Vector

Insects

Rodents

Others

By Method

Chemical

Biological

Microbials

Predators

Botanicals

Mechanical/Physical

By End-Use

Non-Residential

Residential

Stay ahead of the competition with our in-depth analysis of the market trends!

Buy Now @ https://straitsresearch.com/buy-now/vector-control-market

Market Highlights:

A company's revenue and the applications market are used by market analysts, data analysts, and others in connected industries to assess product values and regional markets.

But not limited to: reports from corporations, international Organization, and governments; market surveys; relevant industry news.

Examining historical market patterns, making predictions for the year 2022, as well as looking forward to 2032, using CAGRs (compound annual growth rates)

Historical and anticipated data on demand, application, pricing, and market share by country are all included in the study, which focuses on major markets such the United States, Europe, and China.

Apart from that, it sheds light on the primary market forces at work as well as the obstacles, opportunities, and threats that suppliers face. In addition, the worldwide market's leading players are profiled, together with their respective market shares.

Goals of the Study

What is the overall size and scope of the Vector Control Market market?

What are the key trends currently influencing the market landscape?

Who are the primary competitors operating within the Vector Control Market market?

What are the potential growth opportunities for companies in this market?

What are the major challenges or obstacles the market is currently facing?

What demographic segments are primarily targeted in the Vector Control Market market?

What are the prevailing consumer preferences and behaviors within this market?

What are the key market segments, and how do they contribute to the overall market share?

What are the future growth projections for the Vector Control Market market over the next several years?

How do regulatory and legal frameworks influence the market?

Straits Research is dedicated to providing businesses with the highest quality market research services. With a team of experienced researchers and analysts, we strive to deliver insightful and actionable data that helps our clients make informed decisions about their industry and market. Our customized approach allows us to tailor our research to each client's specific needs and goals, ensuring that they receive the most relevant and valuable insights.

Contact Us

Email: [email protected]

Tel: UK: +44 203 695 0070, USA: +1 646 905 0080

#Vector Control Market Market#Vector Control Market Market Share#Vector Control Market Market Size#Vector Control Market Market Research#Vector Control Market Industry#What is Vector Control Market?

0 notes

Text

Ms. Rosa is one of the t big executives of the Conglomerate and is often seen as one the more important board members next to Venture, Vector, Violette, and Sage.

She controls the fashion industry and more the cultural trends that come in and out of the Conglomerate, peddling cosmetics, fashion, and a different take on leisure and entertainment.

Often coming off as polite and "kind" she is just better at hiding her fangs behind a nurturing persona.

She is often seen as kind and nurturing to others, often being polite and listening to others and always makes small talk when interacted with.

Truth is she is very cunning and often edges people to pursue their passions, hobbies, and dreams for her own gains, sponsoring would-be designers to work on her clothing lines.

She has her hand wrapped about the cultural heartbeat of the Conglomerate and people often adore and put her on a pedestal as the goal in terms of looks and fashion.

Ms. Rosa invented all the cosmetics among the different factions and peddles them as a necessity to "look how you want" not "who they tell you to be"

She takes advantage of those that are eager to be recognized or want to have their vision seen in the world, especially those who have talent that she can take advantage of

In the Conglomerate, having Ms. Rosa wear your fashion designs or acknowledge your fashion in her publications and social media is consider a super huge honor

She keeps a gaggle of apprentices and tailors around her at all times to take notes on things she feels might make a good fashion trend.

Ms. Rosa holds big prize contests for units, humans, and skibidis of all walks of life to submit their fashion designs to be judged and the winners picked by herself and a panel of judges. These competitions are fierce, but the prizes are very nice.

Every season has a "collection" and "color" that sets what the theme is for that time that most people in the Conglomerate try to match to remain in fashion.

Keeping up with Ms. Rosa is seen as being a high member of the technocracy and a means to rise up in rank. She is the standard more or less.

She was never Alliance, but acts sympathetic to those in the Alliance, seeing them as "mindless drones" that just know how to take orders, fight, and have no joy left. She pities them as "being unable to hold onto anything beautiful,"

Ms. Rosa has a stranglehold on the romantic novels and floods the market in the Alliance under pretense of it being innocent reading material, but it has given a marked rise in units getting wistful for those connections

She has her own shows where she does everything from fashion tips to make cute trendy clothes, to home decoration and making a "positive work space energy", to cooking for humans and skibidi, and even to building meaningful romantic relationships

She has highlights of married couples in very expensive and beautiful weddings, often creating those sense of wistful dreaming in units to have something as cool as that. Especially as Rosa talks about it like it is possible for everyone

She hosts a hugely popular talk show called "Every Rosa has her Charm" talking to other members of the Conglomerate, from humans, to technos, to skibidis, and talking over how the world will look after the war. It is extremely popular among all factions with huge ratings every time it appears. Also it showcases the latest cosmetics, popular books you need to read, new domestic cookware, and always reminds the audience it is available in all sizes!

She herself is single, although will be on the arm of Mr. Venture most times, keeping close to the de facto head of the Conglomerate.

Mr. Sage simps for her SO HARD and wants her to notice him....

Vector and Ms. Rosa get along well given they work together to help get materials to make her lines of home goods and fashion and he in turns sells it

She makes a tidy profit as the Conglomerate is infatuated with her every word, humans adore her, skibidis appreciate her kindness, and the Alliance sees her as an escape. She is here for all of you, to make your lives wonderful and full of life, not just war.

#skibidi toilet oc#skibidi toilet#OC Faction the Conglomerate#Ms. Rosa OC#The fashion mafia mistress

11 notes

·

View notes

Text

𝑻𝒉𝒆 𝑪𝒍𝒆𝒎𝒆𝒏𝒕𝒊𝒏𝒆 𝒑𝒕. 𝟐: 𝒅𝒆𝒔𝒊𝒈𝒏 𝒂𝒏𝒅 𝒔𝒚𝒔𝒕𝒆𝒎𝒔

𝒔𝒄𝒊-𝒇𝒊 𝒅𝒓

𝒔𝒉𝒊𝒑 𝒄𝒍𝒂𝒔𝒔 𝒂𝒏𝒅 𝒄𝒐𝒏𝒇𝒊𝒈𝒖𝒓𝒂𝒕𝒊𝒐𝒏

Class: Modified mid-class freighter (original designation untraceable)

Dimensions: Compact and fast—built more for speed and evasion than cargo bulk

Original Use: Unknown. Judging by the design mix, she may have once been a light cargo hauler, but at this point, almost nothing about her is stock.

𝒉𝒖𝒍𝒍 𝒂𝒏𝒅 𝒂𝒓𝒎𝒐𝒓

Plating: Mismatched but reinforced. Some hull panels are standard titanium composite, others are salvaged from military vessels. I once found a piece stamped with a defense contractor logo. Soren played dumb.

Damage Markers: Scars from asteroid grazes, plasma burns, and at least one railgun strike that tore through the starboard side before being patched with a piece of what appears to be an old satellite dish.

Stealth Coating: A stolen stealth coating on one side (only one side), giving her a bizarre half-gloss appearance when flying in certain light.

𝒑𝒓𝒐𝒑𝒖𝒍𝒔𝒊𝒐𝒏 𝒂𝒏𝒅 𝒎𝒂𝒏𝒆𝒖𝒗𝒆𝒓𝒂𝒃𝒊𝒍𝒊𝒕𝒚

Here’s where things get... illegal.

Engine Type: Tri-core fusion drive (overclocked illegally)

Thrusters: Multi-angle vectoring thrusters scavenged from a racing skiff

Hyperspace Drive: Installed after-market. Very not standard. Definitely not licensed. Burns through fuel like sin, but gets the job done.

Maneuverability: Shockingly agile for her size. She’s not built to win dogfights—she’s built to not get hit.

Speed: Capable of outpacing most patrol cruisers and nearly anything in her class. Soren once escaped a blockade by flipping her vertical, killing main thrust, and gliding between two gunships with only manual microthrusters. Clemmy didn’t love that. But she did it.

Max Velocity: Classified (by Soren) as “if she shakes apart, you pushed her too far.”

Signature Trick: Emergency micro-bursts for fast stops or rapid angular shifts—great for dodging, terrible for unsecured passengers.

𝒐𝒇𝒇𝒆𝒏𝒔𝒊𝒗𝒆 𝒔𝒚𝒔𝒕𝒆𝒎𝒔

While not technically a warship, Clemmy has teeth—and Soren is not shy about using them.

Primary Weapons:

Retractable twin plasma cannons mounted under the nose (illegally modified for rapid cycling)

Hidden turret along the dorsal fin with full 360° tracking (camouflaged beneath sensor shielding)

Secondary Systems:

Ion net disruptor (used for disabling ships mid-chase)

Forward grappling harpoon (officially for salvage… unofficially for “creative boarding solutions”)

Mod Notes: All weapons have been internally rewired for faster charge times and energy efficiency. Soren insists it’s “completely safe.” The ship disagrees. The floor near the control relay is still scorched.

𝒅𝒆𝒇𝒆𝒏𝒔𝒊𝒗𝒆 𝒔𝒚𝒔𝒕𝒆𝒎𝒔

Shielding: Layered energy-dispersal field adapted from outdated military specs. It’s finicky, but when tuned right, it can absorb an entire volley without so much as a flicker.

Hull Reinforcement: Polyceramic inner shell under the patchwork hull. Not factory standard. Probably military surplus. Possibly stolen.

Cloaking:

Partial stealth mode: One side only. Meant for short bursts, ambushes, or dodging sensor sweeps. Jax once described it as “trying to hide behind your own arm.”

Signature Dampeners: Basic-grade dampeners, good enough to fool low-level scans or confuse weapons locks for a few seconds.

Countermeasures:

Chaff and flare deployment for missile evasion

ECM scrambler array that definitely violates at least five galactic communication laws

Reinforcement Field: Short-range gravitic pulse projector, used to knock boarding parties off balance or repel magnetic tethers.

𝒏𝒂𝒗𝒊𝒈𝒂𝒕𝒊𝒐𝒏 𝒂𝒏𝒅 𝒑𝒊𝒍𝒐𝒕𝒊𝒏𝒈

Primary Navigation System: Jury-rigged hybrid between an outdated freighter nav-core and a racing AI module. The interface is messy, but the calculations are blindingly fast—when they don’t crash mid-jump.

Manual Controls: Everything important is mapped to tactile controls. Soren doesn’t trust full automation. If the nav AI glitches mid-dive, he wants to feel the override.

Autopilot: Exists. Technically. Mostly used as a glorified parking brake or when Soren needs to sleep for 20 minutes in a safe orbit.

Charting Software: Half-legal, half-pirated. Capable of plotting hyperspace routes through narrow, high-risk corridors that most ships avoid.

Backup Systems: A wall-mounted hardcopy star chart in the cockpit. Just in case. Zia thinks this is hilarious. Soren calls it “responsible.”

𝒅𝒐𝒄𝒌𝒊𝒏𝒈 𝒄𝒂𝒑𝒂𝒄𝒊𝒕𝒚 𝒂𝒏𝒅 𝒂𝒄𝒄𝒆𝒔𝒔

Docking Clamps: Can attach to standard civilian ports, refueling stations, and most illicit trade hubs. May need to be “persuaded” into alignment.

Shuttle Bay: None. She’s too compact for internal hangars. Instead, she has one reinforced top-hatch cradle rigged for small detachable pods—used rarely, and only when absolutely necessary.

Airlocks:

Main Port: Standard-sized, sealed, and usually a bit stubborn when opening.

Secondary Hatch: Hidden behind a supply wall in the engine bay. Used for stealth entries and exits.

𝒓𝒆𝒑𝒂𝒊𝒓 𝒂𝒏𝒅 𝒎𝒂𝒊𝒏𝒕𝒆𝒏𝒂𝒏𝒄𝒆 𝒏𝒆𝒆𝒅𝒔

Routine Repairs: Constant. Something is always groaning, leaking, sparking, or “just about to give out but not yet.”

Spare Parts: Stored in crates scattered across the ship—engine parts in the pantry, coolant lines under the bench seat, wiring spools in my hydroponics pod (which I do not appreciate).

Self-Diagnostics: Unreliable. The system either reports “everything is fine” (it’s not), or starts shrieking about seven simultaneous reactor leaks (there are none). Soren usually ignores it and just listens to the hum of the engine to diagnose problems.

Repairs in Flight: Doable. Often necessary. Soren has made mid-warp hull welds while dangling from a tether. Zia once had to climb into the bulkhead to manually restart a fried fuse bank after a flare surge.

Critical Weakness: The fuel converter. If anything’s going to go first, it’s that. It’s been patched, rewired, and coaxed with offerings—but one day, it’s going to die loudly.

𝒔𝒚𝒔𝒕𝒆𝒎 𝒊𝒏𝒕𝒆𝒈𝒓𝒂𝒕𝒊𝒐𝒏

Power Grid: Custom-wired. Inconsistent. If too many systems are running at once (say, stealth mode, shields, and weapons), things start flickering. Choosing what gets power is sometimes a strategic decision—or a desperate one.

AI Integration: No full AI. Just a scattered handful of voice-assist systems, diagnostic subroutines, and a navigation core that occasionally asks Soren if he’s “sure about that” when he plots something stupid.

Voice Recognition: Primarily responds to Soren’s voice, but Zia has jury-rigged access to certain commands—especially life support, lighting, and doors.

𝒅𝒐𝒄𝒌𝒊𝒏𝒈/𝒃𝒐𝒂𝒓𝒅𝒊𝒏𝒈 𝒇𝒆𝒂𝒕𝒖𝒓𝒆𝒔

Hard-dock only. No fancy mag-coupling or remote landers.

Zero-G Transfer Capability: Yes, with magnetic grip points and a manually sealed transition tunnel.

Boarding Defense: Reinforcement field, sealed bulkheads, and at least three blasters stashed near the doors “just in case.”

𝒔𝒚𝒔𝒕𝒆𝒎 𝒏𝒐𝒕𝒆𝒔

Most systems are custom-built, hotwired, or frankensteined together. Only Soren knows how everything works—and even he sometimes has to hit things to make them run.

Diagnostics require manual calibration. The ship’s internal sensors are either hyper-sensitive or utterly dead.

Flight path records? Wiped. Regularly. On principle.

𝒊𝒏 𝒔𝒉𝒐𝒓𝒕:

Clementine might look like a rustbucket. But she’s got the firepower of a private gunship, the speed of a racer, and the evasive instincts of a hunted animal. She doesn’t win fights with brute force—she wins them by being faster, smarter, and just illegal enough to stay one step ahead of the galaxy’s worst.

𝒆𝒙𝒕𝒓𝒂

Ok, I'm gonna be honest here, my friend who's really into sci-fi had to help me write most of this, because as I've said before, I know like nothing about it. So all the fancy technical stuff in here was all him.

@aprilshiftz @lalalian

#reality shifting#shiftblr#desired reality#shifters#scripting#original dr rambles#reality shifter#dr scrapbook#original dr scrapbook

6 notes

·

View notes

Text

NTC SMD Thermistor Market: Emerging Opportunities, Growth Drivers, and Forecast to 2025-2032

MARKET INSIGHTS

The global NTC SMD Thermistor market size was valued at US$ 1.34 billion in 2024 and is projected to reach US$ 2.16 billion by 2032, at a CAGR of 7.0% during the forecast period 2025-2032.

NTC SMD thermistors are miniature surface-mount devices that exhibit a negative temperature coefficient, meaning their resistance decreases as temperature rises. These compact components are widely used for temperature sensing, compensation, and protection in electronic circuits. Key product types include chip thermistors in bulk packaging and tape-and-reel formats, catering to various automated assembly processes.

The market growth is driven by increasing demand from consumer electronics, automotive electronics, and industrial automation sectors. Advancements in miniaturization and high-precision temperature measurement capabilities are expanding application areas. Leading manufacturers like TDK, Murata, and Vishay dominate the competitive landscape, collectively holding over 45% market share. Recent industry developments include the launch of ultra-thin 0402 package NTC thermistors by Mitsubishi Materials in Q1 2024, targeting space-constrained IoT applications.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Applications in Consumer Electronics to Propel NTC SMD Thermistor Demand

The proliferation of smart devices and IoT applications is driving significant demand for NTC SMD thermistors, which provide precise temperature sensing capabilities in compact form factors. With smartphones incorporating up to 5-8 thermal sensors per device for battery management and performance optimization, component miniaturization trends directly benefit surface-mount thermistor adoption. The global smartphone market is projected to ship over 1.4 billion units annually, creating sustained demand for reliable temperature monitoring solutions. Furthermore, emerging wearable technologies require ever-smaller yet more accurate thermal protection components, with the wearable device market expected to grow at 14% CAGR through 2030.

Automotive Electrification Creating New Growth Opportunities

The automotive industry’s shift toward electrification represents a major growth vector for NTC SMD thermistors. Modern electric vehicles utilize approximately 300-400% more temperature sensors than conventional vehicles, with critical applications in battery management systems, power electronics, and motor controls. As global EV production is forecast to exceed 40 million units by 2030, thermistor manufacturers are developing specialized automotive-grade components with extended temperature ranges and improved vibration resistance. The recent introduction of AEC-Q200 qualified thermistors by leading suppliers demonstrates the industry’s response to this expanding application space.

Advancements in Medical Technology Driving Precision Requirements

Healthcare applications present substantial opportunities for high-accuracy NTC SMD thermistors. Portable medical devices and diagnostic equipment increasingly require miniature temperature sensors with ±0.1°C accuracy for critical patient monitoring and treatment applications. The global medical electronics market, valued at over $8 billion, continues to grow at 7% annually, creating demand for reliable thermal management solutions. Recent product developments include sterilizable thermistors for surgical equipment and ultra-miniature sensors for minimally invasive diagnostic tools.

MARKET RESTRAINTS

Raw Material Price Volatility Impacting Manufacturing Costs

The NTC SMD thermistor market faces significant margin pressures from fluctuating raw material costs. Critical materials including nickel, manganese, and cobalt have experienced price swings exceeding 50% in recent years, directly affecting production economics. Manufacturers must balance material substitutions against performance requirements, as alternative formulations often compromise key characteristics like thermal response time or stability. This challenge is particularly acute for cost-sensitive consumer electronics applications where component pricing remains under constant downward pressure.

Thermal Accuracy Challenges in Extreme Environments

While NTC thermistors offer excellent sensitivity, their performance limitations in extreme temperature ranges constrain certain industrial applications. Automotive underhood environments, for instance, require reliable operation from -40°C to +150°C, pushing the boundaries of conventional thermistor materials. Advanced packaging solutions and proprietary formulations help mitigate these issues but at significantly higher manufacturing costs. These technical limitations create opportunities for alternative sensing technologies in demanding applications.

MARKET CHALLENGES

Intense Price Competition from Alternative Technologies

The NTC SMD thermistor market faces growing competition from emerging sensing technologies. Silicon-based temperature ICs offer digital outputs and easier integration for certain applications, while RTDs provide superior stability in industrial environments. Although thermistors maintain cost advantages in many scenarios, continuous price erosion in the semiconductor industry makes alternative solutions increasingly attractive. This competitive pressure requires thermistor manufacturers to continually enhance performance characteristics while maintaining cost competitiveness.

Supply Chain Vulnerabilities in Critical Materials

Geopolitical factors and supply chain disruptions have exposed vulnerabilities in the thermistor manufacturing ecosystem. Certain rare earth oxides essential for high-performance formulations face concentrated production in limited geographic regions, creating potential bottlenecks. The industry is responding through strategic inventory management and dual-sourcing initiatives, but these measures add to operational complexity and cost structures. Recent trade policies and export controls have further complicated material procurement strategies for global manufacturers.

MARKET OPPORTUNITIES

5G Infrastructure Development Creating New Application Spaces

The global rollout of 5G networks presents substantial opportunities for NTC SMD thermistor adoption. Next-generation base stations and networking equipment require precise thermal management of power amplifiers and processors, with each unit potentially incorporating dozens of temperature sensors. The projected installation of over 7 million 5G base stations by 2025 creates significant demand for reliable, compact thermal monitoring solutions capable of withstanding harsh outdoor environments.

Energy Storage Systems Driving Specialty Component Demand

Grid-scale energy storage and residential battery systems represent a growing market for specialized thermistor solutions. These applications require sensors capable of precise temperature monitoring across large battery arrays while maintaining long-term reliability. The global energy storage market is projected to grow at 30% annually, with thermal management being critical for both safety and performance optimization. Custom thermistor configurations tailored for battery monitoring present opportunities for differentiation among component suppliers.

Industrial IoT Expansion Fueling Sensor Integration

The Industrial Internet of Things (IIoT) transformation is driving increased adoption of condition monitoring solutions across manufacturing facilities. Predictive maintenance systems often incorporate multiple temperature sensors to monitor equipment health, creating demand for robust, long-life NTC thermistors. With over 35 billion IIoT devices expected to be deployed by 2025, this application space offers significant growth potential for sensor manufacturers able to meet industrial reliability requirements.

NTC SMD THERMISTOR MARKET TRENDS

Miniaturization and High-Performance Demands Drive Adoption of NTC SMD Thermistors

The global NTC SMD thermistor market is experiencing significant growth due to the increasing demand for miniaturized and high-performance electronic components. Surface-mount device (SMD) thermistors offer compact designs with enhanced accuracy, making them indispensable in modern electronics. These components are widely used in applications such as LED control, temperature compensation, and power transistor stabilization. The market is expected to grow at a compound annual growth rate (CAGR) of % from 2024 to 2032, driven by advancements in semiconductor and sensor technologies. Rising demand for IoT-enabled smart devices and automotive electronics further fuels the adoption of NTC SMD thermistors, as they provide reliable temperature monitoring in constrained spaces.

Other Trends

Automotive Electronics and Electrification

The rapid electrification of vehicles is one of the most prominent trends shaping the NTC SMD thermistor market. With electric vehicles (EVs) and hybrid vehicles gaining traction globally, the need for efficient thermal management systems has surged. NTC thermistors play a crucial role in battery temperature monitoring, charging systems, and power electronics, ensuring safety and optimal performance. The automotive sector accounts for approximately 25% of the total demand for NTC thermistors, with China and the U.S. leading in adoption due to aggressive electrification policies. Additionally, the growing integration of advanced driver-assistance systems (ADAS) demands high-precision temperature sensors, further accelerating market growth.

Expansion of Consumer Electronics and Wearables

The consumer electronics sector continues to be a key driver for NTC SMD thermistors, particularly in smartphones, wearables, and smart home devices. Manufacturers are increasingly incorporating these thermistors for thermal management in high-performance processors, battery packs, and fast-charging circuits. The global wearables market, projected to grow at a CAGR of 14% over the next five years, is expected to boost demand for compact and highly responsive temperature sensors. Furthermore, the proliferation of 5G technology necessitates improved thermal regulation in network infrastructure and mobile devices, reinforcing the need for reliable SMD thermistor solutions. Leading suppliers such as TDK, Murata, and Vishay are investing in R&D to develop next-generation thermistors with enhanced sensitivity and durability.

NTC SMD Thermistor Market

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Manufacturers Focus on Precision and Miniaturization to Capture Market Share

The NTC SMD Thermistor market exhibits a moderately fragmented competitive landscape, with established electronics component manufacturers competing alongside specialized sensor producers. In 2024, the top five companies collectively accounted for approximately 38% of global revenue, indicating room for mid-sized players to expand their footprint through technological differentiation.

TDK Corporation and Vishay Intertechnology currently lead the market through their diversified electronic component portfolios and strong distribution networks across Asia-Pacific and North America. These industry giants leverage their economies of scale to offer competitive pricing while investing heavily in miniaturization technologies for next-generation thermistor applications.

Meanwhile, Murata Manufacturing has been gaining significant traction through its proprietary ceramic semiconductor technology, which enables higher temperature stability in compact SMD packages. The company’s recent collaborations with automotive OEMs have positioned it strongly in the vehicle electrification segment, which represents one of the fastest-growing application areas for NTC thermistors.

Chinese manufacturers like Shenzhen Minchuang Electronics and WEILIAN are making strategic inroads through cost-competitive offerings tailored for consumer electronics and IoT devices. These companies are progressively enhancing their quality certifications and production capabilities to compete in higher-margin industrial segments.

Specialist firms such as Ametherm and Semitec Corporation are carving out niche positions through application-specific thermistor solutions. Their focused R&D investments in precision temperature measurement for medical devices and aerospace applications demonstrate how targeted innovation can succeed alongside large-scale manufacturers.

List of Key NTC SMD Thermistor Manufacturers

TDK Corporation (Japan)

Vishay Intertechnology (U.S.)

Murata Manufacturing (Japan)

WEILIAN (China)

Shenzhen Minchuang Electronics Co., Ltd. (China)

HateSensor (China)

Mitsubishi Materials Corporation (Japan)

Ametherm (U.S.)

Semitec Corporation (Japan)

Suzhou Dingshi Electronic Technology CO., LTD (China)

NTC SMD Thermistor Market

Segment Analysis:

By Type

Bulk Packaging Segment Leads Due to High Adoption in Industrial Applications

The market is segmented based on type into:

Bulk Packaging

Tape and Reel Packaging

By Application

Temperature Measurement and Control Dominates Owing to Increasing Demand in IoT and Smart Devices

The market is segmented based on application into:

LED Control

Temperature Compensation

Power Transistor Stabilization

Temperature Measurement and Control

Others

By End User

Consumer Electronics Segment Shows Strong Growth with Rising Smart Device Penetration

The market is segmented based on end user into:

Consumer Electronics

Automotive

Industrial

Medical

Aerospace and Defense

Regional Analysis: NTC SMD Thermistor Market

North America The North American NTC SMD thermistor market is characterized by strong demand from the electronics and automotive sectors, driven by stringent quality standards and rapid technological adoption. The U.S. accounts for approximately 60% of the regional market revenue, supported by a robust semiconductor ecosystem and increasing investments in IoT and 5G infrastructure. Companies like Vishay and Ametherm dominate the space due to their advanced miniaturization technologies. Bulk packaging remains preferred for industrial applications, while tape and reel packaging sees higher demand in consumer electronics. Regulatory standards from Underwriters Laboratories (UL) and the Restriction of Hazardous Substances (RoHS) directive continue to drive compliance-focused innovation.

Europe Europe exhibits steady growth, with Germany and the U.K. leading adoption due to their mature manufacturing bases. The region emphasizes high-precision NTC thermistors for automotive temperature sensors, particularly in electric vehicle (EV) battery management systems. TDK and Murata hold significant market shares, leveraging partnerships with European automakers. Environmental regulations under REACH and WEEE directives push manufacturers toward lead-free and recyclable materials. However, competition from Asian suppliers and higher production costs pose challenges for local players.

Asia-Pacific As the largest and fastest-growing market, Asia-Pacific is driven by China, Japan, and South Korea, which collectively account for over 70% of global NTC thermistor production. China’s dominance stems from cost-efficient manufacturing and extensive electronics supply chains. Temperature measurement and control applications in consumer devices and industrial automation fuel demand. Japanese firms like Semitec Corporation and Mitsubishi Materials Corporation focus on high-reliability thermistors for automotive and medical devices. India emerges as a growth hotspot due to expanding electronics manufacturing under the “Make in India” initiative, though it remains dependent on imports for advanced components.

South America The region shows moderate but inconsistent demand, primarily from Brazil’s automotive aftermarket and Argentina’s energy sector. Economic instability limits large-scale investments, causing reliance on imported thermistors from China and North America. Local assembly of consumer electronics creates niche opportunities, particularly in Brazil, where tape and reel packaging gains traction for PCB assembly lines. However, currency fluctuations and underdeveloped supply chains hinder market expansion.

Middle East & Africa This region represents an emerging opportunity with growth centered in Israel, Turkey, and the UAE for industrial and telecommunications applications. Demand stems from infrastructure projects requiring temperature-stable electronics, though the market remains price-sensitive. Gulf Cooperation Council (GCC) countries show increasing interest in smart city initiatives, driving pilot adoptions of NTC thermistors. South Africa’s automotive sector offers latent potential, but political uncertainties and low local production capacity slow market penetration.

Report Scope

This market research report provides a comprehensive analysis of the global and regional NTC SMD Thermistor markets, covering the forecast period 2024–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global NTC SMD Thermistor market was valued at USD million in 2024 and is projected to reach USD million by 2032.

Segmentation Analysis: Detailed breakdown by product type (Bulk Packaging, Tape and Reel Packaging), application (LED Control, Temperature Compensation, Power Transistor Stabilization, Temperature Measurement and Control, Others), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The U.S. market size is estimated at USD million in 2024, while China is expected to reach USD million.

Competitive Landscape: Profiles of leading market participants including WEILIAN, TDK, Murata, Vishay, Mitsubishi Materials Corporation, and others, with their product offerings, R&D focus, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies, miniaturization trends, and evolving industry standards in thermistor manufacturing.

Market Drivers & Restraints: Evaluation of factors driving market growth along with challenges in supply chain, raw material availability, and regulatory compliance.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, and investors regarding strategic opportunities in the NTC thermistor ecosystem.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/fieldbus-distributors-market-size-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/consumer-electronics-printed-circuit.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-alloy-current-sensing-resistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modular-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/integrated-optic-chip-for-gyroscope.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/industrial-pulsed-fiber-laser-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/unipolar-transistor-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/zener-barrier-market-industry-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/led-shunt-surge-protection-device.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/type-tested-assembly-tta-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/traffic-automatic-identification.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/one-time-fuse-market-how-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pbga-substrate-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/nfc-tag-chip-market-growth-potential-of.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silver-nanosheets-market-objectives-and.html

0 notes

Text

Torque Vectoring Market : Size, Trends, and Growth Analysis 2032

The Torque Vectoring Market was valued at US$ 10,997.32 million in 2024 and is projected to expand at a CAGR of 10.20% from 2025 to 2032. As the automotive industry pivots toward intelligent, high-performance, and electrified mobility solutions, torque vectoring systems have emerged as a cornerstone of modern drivetrains, significantly improving vehicle handling, safety, and overall driving dynamics.

What Is Torque Vectoring?

Torque vectoring refers to the active distribution of torque to individual wheels or axles of a vehicle, based on road conditions, driver input, and vehicle dynamics. Unlike conventional differentials that passively respond to traction, torque vectoring systems electronically control torque flow, particularly during cornering, acceleration, and slippery conditions.

These systems optimize grip, reduce understeer or oversteer, and allow vehicles to navigate turns more confidently and efficiently. They are found in both all-wheel-drive (AWD) and rear-wheel-drive (RWD) configurations and are becoming increasingly common in electric vehicles (EVs), where electric motors can independently control torque at each wheel.

Key Market Drivers

1. Growing Demand for Enhanced Vehicle Dynamics

Consumers and automakers alike are placing a premium on improved handling, stability, and responsiveness, especially in performance and luxury segments. Torque vectoring systems enable vehicles to adapt to changing road surfaces and dynamic driving conditions in real time, offering an exhilarating yet safe driving experience.

2. Electric Vehicle Integration

In EVs, torque vectoring becomes even more crucial due to the independent motor control available on each axle or wheel. Dual or quad motor EVs, such as those produced by Tesla or Rivian, leverage torque vectoring to maximize traction, range efficiency, and cornering control — all without mechanical differentials.

3. Rise in Safety and Active Vehicle Control Systems

The integration of torque vectoring with advanced driver-assistance systems (ADAS), such as electronic stability control (ESC) and traction control, has strengthened its role in improving road safety. Governments worldwide are encouraging or mandating technologies that minimize crash risks, further boosting market adoption.

4. Performance Optimization in Sports and Luxury Vehicles

Luxury automakers like Audi, BMW, and Porsche were early adopters of torque vectoring, using it to improve drivability, launch control, and cornering precision. The trickle-down of these technologies into mid-range vehicles is expanding the market beyond niche performance models.

5. All-Wheel Drive (AWD) Market Growth

As AWD becomes more common in SUVs and crossovers — the fastest-growing vehicle segments globally — the need for smart torque management systems like torque vectoring increases. These systems optimize power delivery based on terrain, enhancing both off-road capability and on-road comfort.

Types of Torque Vectoring Systems

Active Torque Vectoring: Utilizes electronic controls and actuators to dynamically alter torque distribution in real time. Often integrated with braking and steering systems.

Passive Torque Vectoring: Uses mechanical means such as limited-slip differentials (LSD) or torque-sensing differentials. Less complex and lower cost, but with limited adaptability.

Electric Torque Vectoring (e-Torque): Seen in EVs, where dual or quad electric motors can precisely control torque at individual wheels without any mechanical link.

Key Applications

Passenger Cars: Luxury sedans, coupes, and performance hatchbacks benefit from better road grip, agile handling, and enhanced cornering capability.

SUVs and Crossovers: Use torque vectoring to improve traction on varied terrains and ensure driver confidence in challenging weather conditions.

Electric Vehicles (EVs): Especially relevant in AWD EV platforms, where multiple motors can digitally distribute power with extreme precision.

High-Performance and Sports Cars: Key selling point for dynamic performance and track handling. Improves lap times and enhances stability at high speeds.

Commercial and Utility Vehicles: Still a niche, but growing interest in improving cargo safety and ride stability during dynamic load shifts.

Regional Insights

North America: Leads in adoption due to strong presence of performance vehicle manufacturers and growing EV deployment. The U.S. remains a key market.

Europe: A mature and competitive market where premium and performance brands integrate torque vectoring as a standard or optional feature. Tight safety regulations and technological innovation drive growth.

Asia-Pacific: Rapidly growing market, especially in China and Japan, where EVs and AWD SUVs are expanding. Government incentives for advanced technologies contribute to regional demand.

Latin America and Middle East & Africa: Smaller but emerging markets with gradual adoption as vehicle sophistication and consumer expectations rise.

Competitive Landscape

GKN Automotive Limited

A leader in driveline systems, GKN supplies advanced torque vectoring solutions to global OEMs. Known for its Twinster system that uses clutches instead of differentials for torque control.

BorgWarner Inc.

Offers active torque management systems and is investing heavily in electrified drivetrains, positioning itself strongly for the EV market.

ZF Friedrichshafen AG

Provides a wide array of driveline technologies including torque vectoring systems. Their focus on modular systems suits multiple vehicle classes.

JTEKT Corporation

Through its Koyo brand, JTEKT develops torque vectoring differentials and steering systems, emphasizing performance and fuel efficiency.

American Axle & Manufacturing Holdings, Inc. (AAM)

Well-regarded for its e-AAM driveline technology, which supports hybrid and electric applications with precision torque management.

Dana Incorporated

Provides integrated torque vectoring and electric propulsion systems. Focuses on scalable solutions for both traditional and electrified vehicles.

Market Trends

Software-Defined Vehicle Controls: Increasing reliance on advanced software for torque management, enabling over-the-air (OTA) updates and adaptive behavior based on real-time data.

Electrification of AWD Systems: Mechanical AWD is giving way to electric torque vectoring in EVs, simplifying drivetrains and enhancing control.

Integration with ADAS and Autonomy: Torque vectoring is becoming a foundational technology for autonomous vehicle control and advanced safety systems.

Aftermarket Interest: Enthusiasts and tuners are exploring retrofitting torque vectoring solutions for performance gains in conventional cars.

Browse more Report:

Mass Flow Controller Market

Manufacturing Scale Electrostatic Precipitator Market

Lipid Nanoparticle Raw Materials Market

Kinesiology Therapeutic Tape Market

Intelligent Traffic Signal System Market

0 notes

Text

Non-Viral Drug Delivery Systems Market is driven by Rising Biologic Therapeutics

Non-viral drug delivery systems encompass a diverse array of formulations and devices designed to transport therapeutic agents—such as peptides, proteins, nucleic acids, and small molecule drugs—across biological barriers without using viral vectors. These platforms include lipid nanoparticles, polymeric nanoparticles, liposomes, dendrimers, and micelles, offering advantages like reduced immunogenicity, enhanced stability, and controlled release profiles. The ability to fine-tune carrier size, surface charge, and targeting ligands enables improved bioavailability and targeted delivery to specific tissues or cells, mitigating off-target effects and enhancing treatment efficacy.

Growing concerns over safety risks associated with viral vectors, such as insertional mutagenesis and host immune responses, have spurred interest in non-viral alternatives. Moreover, the surge in biologic therapeutics, including mRNA and siRNA-based treatments, has amplified the need for robust delivery platforms that can protect fragile molecules and ensure efficient cellular uptake. Continuous innovation in material science and nanotechnology has facilitated the design of biocompatible carriers capable of overcoming physiological barriers, boosting market opportunities for pharmaceutical and biotech companies. As personalized medicine gains tractionNon-Viral Drug Delivery Systems Market solutions are poised to play a pivotal role in next-generation therapies.

The non-viral drug delivery systems market is estimated to be valued at USD 9.23 Bn in 2025 and is expected to reach USD 23.10 Bn by 2032, growing at a compound annual growth rate (CAGR) of 14.00% from 2025 to 2032. Key Takeaways Key players operating in the Non-Viral Drug Delivery Systems Market are:

-Arcturus Therapeutics

-Bio-Path Holdings

-CureVac

-Entos Pharmaceuticals

-The RNA Immunotherapies

These market players leverage their expertise in nanoparticle formulation, polymer chemistry, and nucleic acid therapeutics to expand their product portfolios. For instance, Arcturus Therapeutics’ lipid nanoparticle-based mRNA delivery platforms and CureVac’s proprietary mRNA technology highlight the convergence of drug delivery innovation with cutting-edge biologic pipelines. Bio-Path Holdings focuses on synthetic packaging vehicles for oligonucleotide therapies, while Entos Pharmaceuticals advances Fusogenix®, a liposomal system for gene editing. eTheRNA Immunotherapies specializes in RNA-based cancer vaccines, underscoring the critical role of non-viral carriers in oncology. The competitive landscape is shaped by ongoing collaborations, licensing agreements, and strategic acquisitions aimed at enhancing market share and streamlining market entry. Growing demand in the non-viral drug delivery systems market is driven by escalating research investments and robust market growth strategies adopted by pharmaceutical companies. A surge in chronic disease prevalence—ranging from cancer and genetic disorders to cardiovascular and metabolic conditions—has elevated the urgency for targeted, long-acting therapeutics. Market research underscores the importance of overcoming physiological barriers such as the blood-brain barrier and mucosal membranes, spurring development of innovative carriers that can navigate these challenges. Additionally, the advent of RNA-based vaccines during the COVID-19 pandemic validated lipid nanoparticle platforms, accelerating interest in non-viral vectors across multiple therapeutic segments. As healthcare stakeholders prioritize patient safety and cost-effective manufacturing, non-viral technologies offer scalable solutions with lower biosafety requirements than their viral counterparts. Market insights indicate that increased regulatory clarity and supportive policies on advanced therapy medicinal products (ATMPs) will further drive adoption and unlock new market opportunities.

‣ Get More Insights On: Non-Viral Drug Delivery Systems Market

‣ Get this Report in Japanese Language: 非ウイルス性薬物送達システム市場

‣ Get this Report in Korean Language: 비바이러스약물전달시스템시장

0 notes

Text

0 notes

Text

0 notes

Text

Risikomonitor: Your All-in-One Risiko Monitoring System for Effortless IT Security

In today’s fast-paced digital world, cyber threats are constantly evolving—putting businesses at risk regardless of their size or industry. Data breaches, ransomware attacks, and phishing attempts are no longer rare incidents—they’re everyday occurrences. That’s why having a reliable, easy-to-use Risiko monitoring system is no longer optional; it’s essential.

Enter Risikomonitor—the most user-friendly and intelligent IT security monitoring solution on the market. Designed with simplicity and power in mind, Risikomonitor helps businesses identify IT vulnerabilities and mitigate security risks with just one click—no technical expertise required.

What is Risikomonitor?

Risikomonitor is a next-generation vulnerability management platform built for modern businesses that want to take control of their cybersecurity without hiring expensive experts or managing complex software. Whether you're a startup or a growing enterprise, Risikomonitor offers real-time, automated IT vulnerability scanning, domain security monitoring, and data breach prevention that protects your business from the inside out.

It’s more than just a scanning tool—it’s your all-in-one security risk detection and mitigation partner.

Why Risikomonitor Stands Out

1. One-Click Vulnerability Detection With Risikomonitor, you don’t need any IT knowledge to perform a full system check. The platform scans your infrastructure and identifies weaknesses instantly—offering a complete picture of your organization’s security status.

2. No Technical Setup Needed Forget complex integrations or service interruptions. Risikomonitor operates with zero system impact, ensuring you can secure your business without slowing it down.

3. Real-Time Insights and Alerts Stay ahead of hackers with real-time alerts on threats, exposure, and attack vectors. Risikomonitor continuously monitors your IT environment, domains, and digital footprint to detect issues before they turn into costly problems.

4. Dark Web Monitoring Risikomonitor also scans the dark web for leaked data or compromised credentials related to your business. This proactive feature is crucial for early data breach prevention and brand reputation protection.

5. Budget-Conscious Cybersecurity Cybersecurity shouldn’t break the bank. Risikomonitor helps you identify security flaws and offers smart, cost-effective solutions that align with your budget—so you can focus on growth, not damage control.

Holistic Security Risk Mitigation

Risikomonitor doesn’t just find risks—it helps you reduce exposure fast. You get clear, actionable steps to resolve vulnerabilities and a complete security risk mitigation plan tailored to your business. Whether it’s outdated software, misconfigured systems, or weak credentials, Risikomonitor flags the issues and guides you through the fix.

This type of automation makes it the perfect solution for teams without dedicated IT staff.

Start Your Free Trial – No Credit Card Needed

Getting started with Risikomonitor is easy and risk-free. You can explore the full platform with a 15-day free trial—absolutely no credit card required. In just minutes, you’ll see how easy it is to scan your entire IT infrastructure and gain full control over your organization’s cyber health.

A Hacker’s Eye View of Your System

Risikomonitor helps you see your system from a hacker’s viewpoint, exposing the same weaknesses cybercriminals look for. This unique perspective allows you to close security gaps before they’re exploited.

Plus, our IT vulnerability scanning works continuously in the background—providing you with round-the-clock security assurance.

Benefits at a Glance

Identify IT vulnerabilities with 1 click

Instant, automated security risk detection

Easy domain security monitoring

Dark web scans for data breach prevention

Real-time alerts and risk scores

Zero system downtime or disruption

Supports compliance and due diligence

15-day free trial—no credit card required

Built for Business Owners, Not Just IT Teams

Many security tools are built for developers and system admins. Risikomonitor is different. It’s designed for business owners, managers, and non-technical professionals who need reliable cybersecurity insights without diving into complex code or hiring specialists.

Our intuitive dashboard makes it simple to monitor your risk posture, take preventive action, and protect your company—all from one place.

Stay Secure, Stay Ahead

Cybersecurity threats will never go away—but your response can make all the difference. With Risikomonitor, you’re not just reacting to attacks—you’re preventing them.

Thousands of businesses trust Risikomonitor as their go-to Risiko monitoring solution because it delivers clarity, control, and confidence. It’s the easiest way to secure your IT systems, monitor your domains, and protect your reputation.

Ready to Try Risikomonitor?

Don’t wait for a breach to take cybersecurity seriously. Try Risikomonitor today for free and see how simple IT security monitoring can be. No credit card. No commitment. Just powerful protection in one click.

Start your 15-day free trial now Identify your risks today, prevent losses tomorrow

Risikomonitor – Because protecting your business shouldn’t require a PhD in cybersecurity.

0 notes

Text

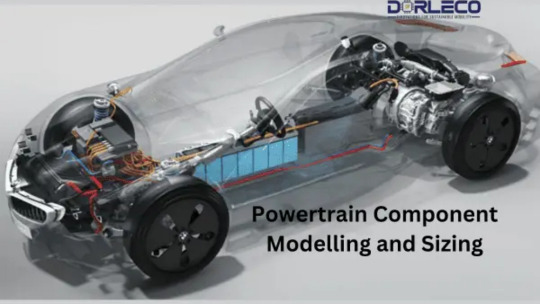

Powertrain Component Modelling and Sizing

Introduction

The dynamic automotive sector is depending more and more on virtual engineering and digital simulations to satisfy strict performance, efficiency, and regulatory requirements. The core of a vehicle’s design is the powertrain, which is the collection of elements that are accountable for generating and distributing power to the wheels. In order to achieve the best possible balance between performance, fuel efficiency, cost, and emissions, powertrain component modelling and size are crucial, regardless of the powertrain’s configuration — internal combustion engine (ICE), hybrid, or entirely electric. The systematic technique, advantages, difficulties, and prospects for powertrain component modelling and sizing in the automotive engineering process are all examined in this blog.

1. Understanding the Powertrain Component

Determining the vehicle’s intended use and performance goals is the first step in any powertrain development cycle. This fundamental stage lays the groundwork for component-level specifications and architectural choices.

Vehicle Type: EV, hybrid, commercial vehicle, sports car, or passenger car.

Performance metrics: include top speed, gradeability, towing capacity, and desired acceleration (0–100 km/h).

Compliance goals include safety regulations, fuel economy requirements, pollution regulations, and sustainability goals.

A thorough comprehension of these factors guarantees that the finished powertrain design complies with regulatory standards and market expectations.

2. Powertrain Architecture Selection

The type of vehicle and its intended use have an impact on the strategic choice of powerplant layout. Among the primary categories are:

Engine Internal Combustion (ICE)

Powertrain Hybrid (PHEV, HEV)

Electric Vehicles with Batteries (BEV)

Electric Vehicles using Fuel Cells (FCEV)

Core elements such the engine, electric motor, battery, gearbox, and control units must interact differently in each architecture. For downstream modelling, it is crucial to map the component interaction and energy flow paths at this point.

3. Modelling at the Component Level

Modelling engines

Modelling for ICE-based systems includes:

Creation of torque-speed curves

Mapping of fuel consumption

Emissions modelling and thermal behaviour

To model operating circumstances, assess combustion efficiency, and investigate transient responses, advanced programs such as GT-Power, AVL Cruise, or MATLAB/Simulink are used.

1.Modelling Transmissions

In this context, the gearbox connects wheel torque and engine power, while modelling helps determine:

Ideal gear ratios

Timing and logic for gear changing

Losses brought caused by inertia and friction

Reactivity and driveability

Single-speed gearboxes are frequently used in electric vehicles; nonetheless, efficiency and thermal considerations are still crucial.

2. Modelling Electric Motors and Batteries

In systems that are electrified:

Electric Motor: Efficiency mapping, torque-speed characteristics, inverter management, and the possibility of regenerative braking are all included in the simulations.

State of charge (SOC), voltage-current profiles, thermal performance, capacity decline, and charging/discharging behaviour are all included in the models of batteries.

Consequently, these components play a vital role in enabling accurate range estimation and supporting effective hybrid control schemes.

3. Control System Modelling

To that end, modern cars use intelligent control algorithms to regulate the flow of torque and energy. Key elements include:

Distribution of power in hybrid automobiles

Energy management systems for batteries (BMS)

Control of traction and stability

Regenerative braking and torque vectoring

Furthermore, control system modelling optimises real-time responses by ensuring smooth interaction between physical components.

4. Component sizing and optimisation

Each component is guaranteed to be neither overdesigned nor underutilised with proper dimensions. Engineers optimise variables like

Engine displacement and output torque

Maximum power and continuous motor rating

C-rate and battery capacity

Gear ratios for transmissions

The proper trade-offs between performance, efficiency, cost, and packing can be achieved with the aid of optimisation technologies (such as genetic algorithms and experiment design).

5. Compatibility and System Integration

The powertrain must function as a cohesive system in addition to its individual performance. Important integration factors consist of:

Thermal control of the battery, inverter, and engine.

Packaging and weight distribution to maintain vehicle dynamics

Features of NVH (Noise, Vibration, Harshness)

Compatibility of mechanical and electrical interfaces

Therefore, ignoring these elements may lead to inefficiencies, reliability issues, or dissatisfied clients.

6. Performance Validation Through Simulation

Subsequently, once components are designed and scaled, system-level simulations are conducted to validate the full powertrain component across real-world scenarios.

Urban driving cycles, such as the FTP-75 and WLTP

Profiles of highway loads

Simulations of hill climbing or towing

Conditions for idle-stop and regenerative braking

Engineers can create control methods and identify bottlenecks early in the process with the help of simulation technologies (such as MATLAB, dSPACE, and IPG Carmaker).

7. Physical Testing and Prototyping

Although simulation offers a theoretical starting point, physical testing is still necessary:

Prototype vehicle builds

Engine test beds and dynamometers for the chassis

Tests of endurance and durability

Prior to mass production, these tests ensure system robustness by validating predictions and identifying unforeseen mechanical, thermal, or ergonomic concerns.

8. Cost Analysis and Compromises

Additionally, a high-performance Powertrain Component needs to be profitable. Cost modelling includes:

Complexity of manufacturing and material selection

Tooling expenses and supplier availability

Implications for warranty and maintenance

In addition, simulations help identify cost-effective solutions without sacrificing critical performance parameters.

9. Iterative Refinement

In practice, the development process is rarely linear; instead, several design iterations are driven by insights gained from simulation, testing, and consumer feedback.

Modifying component specifications

Control logic revision

Power split or thermal load rebalancing

Consequently, this iterative loop ensures that the end product is optimised on all fronts — performance, cost, durability, and regulatory compliance.

10. Records and Adherence

As a result, this iterative loop not only streamlines development but also ensures that the end product is optimised on all fronts — performance, cost, durability, and regulatory compliance.

Logs from simulations and technical reports

Design specifications and the bill of materials

Safety requirements and emissions certifications

Design decision traceability

Proof of due diligence throughout the development process is necessary to comply with international rules (such as those set forth by the EPA, CARB, and UNECE).

Benefits of Powertrain Component Modelling and Sizing:

✔ Performance Enhancement

Fine-tuning for certain objectives, such as high torque, quick acceleration, or fuel economy, is possible through simulation.

✔Enhanced Productivity

Appropriate size improves energy efficiency on both ICE and EV platforms by preventing overdesign and lowering internal losses.

✔ Saving Money

Furthermore, by avoiding needless overspecification, manufacturers can effectively reduce manufacturing and material costs without compromising quality.

✔ Emissions Management

As a result of precise engine mapping and electric system optimisation, CO₂ and NOₓ emissions are significantly reduced.

✔ Predictive Knowledge

Prior to costly tooling and prototyping, simulations identify possible failure areas or inefficiencies.

✔ Personalisation

The architecture and Powertrain Component flexibility made possible by early modelling is advantageous for a variety of vehicle types, including haul trucks and two-wheelers.

✔ Superior Energy Organisation

Reliability and range are directly impacted by efficient battery and power management systems, particularly in EVs and hybrids.

✔ Reduced Market Time

Virtual iterations make faster development cycles possible as opposed to conventional build-and-test loops.

✔ Dependability

Moreover, stress analysis and thermal modelling ensure durability, which in turn lowers warranty claims and enhances brand recognition.

✔ Attention to Regulations

By ensuring early compliance with international safety and emissions standards, manufacturers can significantly reduce the need for costly redesigns later in the development cycle.

Difficulties with Powertrain Component Sizing and Modelling

Despite its strength, this strategy has drawbacks: Model Complexity: It takes knowledge and computing power to accurately simulate multi physics systems. Data Reliability: Reliable input data is necessary for model accuracy, which frequently necessitates rigorous physical testing for calibration. Integration Difficulties: Maintaining balance between electrical, mechanical, and control systems is difficult. Dynamic Operation Limits: Unexpected real-world circumstances are not always taken into account by models. Cost of Software Tools: Smaller businesses cannot afford the sophisticated simulation suites. Rapid Technological Changes: As EVs advance quickly, current models may become outdated. Real-World Parameter Uncertainty: It is challenging to accurately forecast traffic, temperature, and driver behaviour.

Conclusion

At the forefront of contemporary vehicle engineering is the modelling and sizing of powertrain components. In a cutthroat market, they enable automakers and suppliers to create vehicles that are effective, legal, and perform well. Engineers may unlock better ideas while cutting down on time, expense, and environmental effect by combining virtual simulations with actual testing. Modelling techniques will only become more crucial as the sector continues its transition to electrification and autonomous systems. Experts anticipate that future developments in digital twins, AI-driven simulations, and cloud-based co-simulation platforms will further push the limits of accuracy and effectiveness. Powertrain modelling and sizing are essentially strategic enablers of innovation, performance, and sustainability in mobility when used with insight and rigour.

#Dorleco#EVEngineering#PowertrainModelling#AutomotiveInnovation#VCU#CANDisplay#BatteryManagement#SimulationDrivenDesign#ElectricVehicles#MobilitySolutions#FutureOfTransport#EngineeringExcellence#DigitalEngineering

0 notes

Text

Cloud Microservice Market Growth Driven by Demand for Scalable and Agile Application Development Platforms

The Cloud Microservice Market: Accelerating Innovation in a Modular World

The global push toward digital transformation has redefined how businesses design, build, and deploy applications. Among the most impactful trends in recent years is the rapid adoption of cloud microservices a modular approach to application development that offers speed, scalability, and resilience. As enterprises strive to meet the growing demand for agility and performance, the cloud microservice market is experiencing significant momentum, reshaping the software development landscape.

What Are Cloud Microservices?

At its core, a microservice architecture breaks down a monolithic application into smaller, loosely coupled, independently deployable services. Each microservice addresses a specific business capability, such as user authentication, payment processing, or inventory management. By leveraging the cloud, these services can scale independently, be deployed across multiple geographic regions, and integrate seamlessly with various platforms.

Cloud microservices differ from traditional service-oriented architectures (SOA) by emphasizing decentralization, lightweight communication (typically via REST or gRPC), and DevOps-driven automation.

Market Growth and Dynamics

The cloud microservice market is witnessing robust growth. According to recent research, the global market size was valued at over USD 1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) exceeding 20% through 2030. This surge is driven by several interlocking trends:

Cloud-First Strategies: As more organizations migrate workloads to public, private, and hybrid cloud environments, microservices provide a flexible architecture that aligns with distributed infrastructure.

DevOps and CI/CD Adoption: The increasing use of continuous integration and continuous deployment pipelines has made microservices more attractive. They fit naturally into agile development cycles and allow for faster iteration and delivery.

Containerization and Orchestration Tools: Technologies like Docker and Kubernetes have become instrumental in managing and scaling microservices in the cloud. These tools offer consistency across environments and automate deployment, networking, and scaling of services.

Edge Computing and IoT Integration: As edge devices proliferate, there is a growing need for lightweight, scalable services that can run closer to the user. Microservices can be deployed to edge nodes and communicate with centralized cloud services, enhancing performance and reliability.

Key Industry Players

Several technology giants and cloud providers are investing heavily in microservice architectures:

Amazon Web Services (AWS) offers a suite of tools like AWS Lambda, ECS, and App Mesh that support serverless and container-based microservices.

Microsoft Azure provides Azure Kubernetes Service (AKS) and Azure Functions for scalable and event-driven applications.

Google Cloud Platform (GCP) leverages Anthos and Cloud Run to help developers manage hybrid and multicloud microservice deployments.

Beyond the big three, companies like Red Hat, IBM, and VMware are also influencing the microservice ecosystem through open-source platforms and enterprise-grade orchestration tools.

Challenges and Considerations

While the benefits of cloud microservices are significant, the architecture is not without challenges:

Complexity in Management: Managing hundreds or even thousands of microservices requires robust monitoring, logging, and service discovery mechanisms.

Security Concerns: Each service represents a potential attack vector, requiring strong identity, access control, and encryption practices.

Data Consistency: Maintaining consistency and integrity across distributed systems is a persistent concern, particularly in real-time applications.

Organizations must weigh these complexities against their business needs and invest in the right tools and expertise to successfully navigate the microservice journey.

The Road Ahead

As digital experiences become more demanding and users expect seamless, responsive applications, microservices will continue to play a pivotal role in enabling scalable, fault-tolerant systems. Emerging trends such as AI-driven observability, service mesh architecture, and no-code/low-code microservice platforms are poised to further simplify and enhance the development and management process.

In conclusion, the cloud microservice market is not just a technological shift it's a foundational change in how software is conceptualized and delivered. For businesses aiming to stay competitive, embracing microservices in the cloud is no longer optional; it’s a strategic imperative.

0 notes

Text

Europe Cell Therapy Market Opportunity Assessment, Analysis, Size, Share and Key Segments (2019-2027)

The Europe Cell therapy market is expected to reach US$ 3,610.7 million by 2027 from US$ 2,125.7 million in 2019; it is anticipated to grow at a CAGR of 6.9% during 2019–2027.

Market Introduction

Cell therapy is a medical procedure involving the introduction of live, whole cells into a patient's body via injection, implantation, or grafting. The fundamental principle of this technology is to restore function by replacing diseased cells with healthy, working ones. Stem cells are central to these advanced therapies because of their unique ability to develop into the specific cell types required to repair damaged or defective tissues. Moreover, cell therapy is integral to the advancement of regenerative medicine. The anticipated growth of the Cell therapy market during the forecast period is likely to be propelled by the increasing incidence of chronic illnesses, the growing utilization of regenerative medicine approaches, and a rising count of approved cell-based therapies.

Download our Sample PDF Report

@ https://www.businessmarketinsights.com/sample/TIPRE00019052

Market Dynamics

Several factors are poised to stimulate the expansion of the Cell therapy market in the years ahead, including the growing prevalence of chronic diseases, the increasing acceptance of regenerative medicine, and the rising number of approvals for cell-based treatments. Conversely, a potential impediment to market growth during the forecast period is the significant expense associated with cell therapy manufacturing, particularly in emerging economies.

The COVID-19 pandemic posed a major challenge throughout the European region. The market for cell therapy instruments experienced some initial contraction at the onset of the crisis due to factors such as supply chain disruptions and decreased demand resulting from widespread lockdowns across European nations. However, subsequent government support and initiatives led to a substantial surge in the demand for cell therapy.

Market Scope

The European Cell therapy market's scope is defined by therapy type, product, technology, application, end user, and country. Considering therapy types, the allogeneic segment held the largest market share in 2019, primarily attributed to the significant number of approved products available for clinical application. Nevertheless, the autologous segment is also expected to exhibit the highest CAGR within the market throughout the forecast period.

Major Sources and Companies Listed

Several major primary and secondary sources associated with the Europe Cell therapy market report are the World Health Organization (WHO), European Centre for Disease Prevention and Control (ECDC), Alliance for Regenerative Medicine, National Institutes of Health, Anthony Nolan Foundation, among others.

EUROPE CELL THERAPY MARKET SEGMENTATION

Europe Cell Therapy Market: By Therapy Type

Allogeneic

Autologous

Europe Cell Therapy Market: By Product

Consumables

Equipment

Systems and Software

Europe Cell Therapy Market: By Technology

Viral Vector Technology

Genome Editing Technology

Somatic Cell Technology

Cell Immortalization Technology

Cell Plasticity Technology

Three-Dimensional Technology

Europe Cell Therapy Market: By Application

Oncology

Cardiovascular

Orthopedic

Wound Management

Other Applications

Europe Cell Therapy Market: By End User

Research Institutes

Hospitals

Others

Europe Cell Therapy Market: By Country

Germany

France

Italy

UK

Spain

Europe Cell Therapy Market: Company Profiles

Vericel Corporation

MEDIPOST

NuVasive, Inc.

Mesoblast Limited

Smith & Nephew

Bristol-Myers Squibb Company

Cells for Cells

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

#Europe Cell Therapy Market#Europe Cell Therapy Market Opportunity Assessment#Europe Cell Therapy Market Key Segments

0 notes

Text

Application Security Market Drivers: Key Forces Powering Growth Across the Cybersecurity Landscape

The application security market is witnessing significant momentum, fueled by several critical factors reshaping the cybersecurity industry. As businesses grow increasingly reliant on digital infrastructure, the need to safeguard applications—whether web, mobile, or cloud-based—has become paramount. In this fast-changing landscape, various dynamic forces are driving the market’s growth and evolution.

One of the most prominent drivers is the rising frequency and sophistication of cyberattacks. Applications are prime targets for threat actors looking to exploit vulnerabilities for data breaches, ransomware, or unauthorized access. With attackers employing advanced techniques like zero-day exploits and AI-powered intrusions, organizations are under mounting pressure to secure their applications comprehensively. This growing threat landscape has compelled enterprises of all sizes to invest in advanced application security solutions.

Another major force influencing the market is the shift toward cloud computing and hybrid environments. As businesses transition from traditional on-premise systems to cloud-native platforms, the complexity of securing applications increases. Cloud-based applications are exposed to a wider range of security challenges, including data leakage, misconfigured services, and insecure APIs. This transformation is prompting the adoption of application security tools that are compatible with multi-cloud and hybrid infrastructures, ensuring consistent protection across environments.

Regulatory compliance is also a key driver shaping the application security market. Governments and industry bodies worldwide are tightening regulations to protect user data and digital assets. Frameworks such as GDPR, CCPA, and HIPAA require organizations to implement stringent security measures. Failure to comply can result in severe financial and reputational consequences. As a result, businesses are prioritizing application security to align with legal standards and avoid penalties.