#Volume Based Trading Signals

Explore tagged Tumblr posts

Text

Unlocking Trading Potential with Volume Oscillator: A Comprehensive Guide

In the vast ocean of financial markets, traders and investors are constantly seeking tools and indicators to aid their decision-making processes. One such powerful tool that has garnered attention over the years is the Volume Oscillator. In this comprehensive guide, we’ll delve into what a Volume Oscillator is, how it works, its applications, and strategies for maximizing its…

View On WordPress

#Divergence Trading Strategies#Financial Markets#forex trading#Investing#Market Indicators#Price Volume Relationship#stock market#technical analysis#Technical Indicators In Trading#trading signals#Trading Strategies#trading tools#Trend Confirmation Signals#Using Volume Oscillator#Volume Analysis Techniques#Volume Based Trading Signals#Volume Confirmation Patterns#Volume Oscillator#Volume Oscillator Explained#Volume Oscillator Strategy

0 notes

Text

Top stocks to buy today: Stock recommendations for June 18, 2025 - check list

Stock market recommendations: Anand Rathi Shares and Stock Brokers' Mehul Kothari recommends buying Voltas, ONGC, and TCS. Voltas shows a breakout from an Inside Value setup, targeting ₹1540. ONGC, a positional buy, exhibits strength above its consolidation range, aiming for ₹290.

Stock market recommendations: According to Mehul Kothari, DVP - Technical Research, Anand Rathi Shares and Stock Brokers, Voltas, ONGC, and TCS are the top stocks to buy today:VOLTAS – Breakout from Inside Value SetupBuy near ₹1300–₹1280 | Stop Loss: ₹1175 | Target: ₹1540VOLTAS broke out after nearly a month of consolidation, accompanied by a DECENT surge in volume—indicating strong accumulation. What makes this consolidation phase particularly notable is that it occurred within the R3–S3 zone of the monthly Camarilla pivots, establishing an Inside Value relationship.This setup forms when the current month’s pivots are nested within the previous month’s range, often signalling a potential breakout with strong directional bias.ONGC – POSITIONAL BUYBuy near ₹252 | Stop Loss: ₹235 | Target: ₹290ONGC recently broke out of its narrow consolidation range indicating strength. The stock is now trading above this range, supported by a base formation around the 200-day EMA high/low band, reinforcing bullish sentiment.Additionally, the daily RSI has moved above the 50 mark after a prolonged period, signaling a shift in momentum.TCS – Breakout from Inside Value SetupBuy near ₹3515 | SL: ₹3400 | Target: ₹3685TCS recently witnessed a breakout following a consolidation phase that lasted nearly a month, accompanied by a significant rise in volume—signalling strong accumulation.Interestingly, this consolidation happened within the R3–S3 range of the monthly Camarilla pivots, creating an Inside Value setup.This formation occurs when the pivot range for the current month lies within the range of the previous month, typically indicating a possible directional move.

Disclaimer: The opinions, analyses and recommendations expressed herein are those of brokerage and do not reflect the views of The Times of India. Always consult with a qualified investment advisor or financial planner before making any investment decisions.Stay informed with the latest business news, updates on bank holidays and public holidays.

25 notes

·

View notes

Text

Solieum Emerges as Solana’s Next-Gen Layer 2 Solution, Promising Unmatched Speed and Scale

The Solana ecosystem is on the cusp of a transformative leap forward with the upcoming launch of Solieum, a cutting-edge Layer 2 protocol designed to supercharge the blockchain’s already impressive performance. Positioned to address Solana’s scalability challenges during peak demand, Solieum is generating buzz in the crypto community as a game-changer for decentralized finance (DeFi), gaming, and Web3 applications.

A Response to Solana’s Growing Pains

Solana has long been celebrated for its high throughput and low-cost transactions, processing thousands of transactions per second and boasting a total value locked (TVL) of $10.9 billion, surpassing the entire Ethereum Layer 2 ecosystem. However, as the network’s popularity has surged — fueled by meme coins, DeFi projects, and platforms like Pump.fun — congestion during high-traffic periods has exposed scalability limitations, leading to delays and occasional downtime.

Solieum steps into this gap as Solana’s next-generation Layer 2 solution, engineered to enhance the network’s endurance without compromising its core strengths: speed, affordability, and user experience. Unlike Ethereum’s Layer 2s, which primarily address high gas fees, Solieum focuses on managing Solana’s growing waves of activity, ensuring seamless performance under real-world pressure.

What is Solieum?

Solieum is a Layer 2 protocol built to elevate Solana’s capabilities by processing transactions off-chain before committing them to the main network. This approach reduces congestion, lowers fees, and minimizes downtime, making it ideal for high-volume use cases like DeFi, GameFi, and meme coin trading. By leveraging advanced technologies, Solieum aims to deliver:

Infinite Scalability: Handling massive transaction volumes without sacrificing speed.

Zero Downtime: Ensuring continuous operation, even during network stress.

Multi-Chain Interoperability: Operating across Solana and potentially Ethereum, adding a layer of utility for developers and users.

The project’s whitepaper, set to be released soon, promises to outline a roadmap for redefining Solana’s edge in the blockchain space. According to recent posts on X, Solieum is “forged to disrupt limits” and is poised to “rewrite the rules” of Layer 2 solutions.

Momentum Building Ahead of Launch

Solieum’s pre-launch buzz is palpable, with the project nearing its debut. The crypto community is closely watching as Solieum prepares to unveil its infrastructure, which includes a block explorer to boost transparency and long-term upgrades for scalability and network incentives.

Recent posts on X highlight Solieum’s ambition to “unlock a brighter, faster blockchain era” and position it as a cornerstone of the Web3 landscape. The project’s focus on speed, scale, and innovation has drawn comparisons to other Layer 2 solutions like Solaxy, which raised over $34 million in its presale, signaling strong investor confidence in Solana-based scaling solutions.

Why Solieum Matters

As Solana continues to outperform competitors in DeFi metrics — generating $50 million in weekly dApp revenue and eyeing a price target of $300 — its need for robust scaling solutions has never been more critical. Solieum’s arrival could solidify Solana’s position as a leading blockchain for developers and users, particularly in high-throughput sectors.

By addressing network bottlenecks and enhancing interoperability, Solieum is poised to attract developers building next-gen dApps and investors seeking exposure to Solana’s growth. Its multi-chain approach also opens doors for cross-ecosystem collaboration, potentially bridging Solana and Ethereum communities.

Looking Ahead

With its launch on the horizon, Solieum is shaping up to be a pivotal development for Solana’s ecosystem. The project’s emphasis on scalability, reliability, and innovation aligns with the broader trend of Layer 2 solutions driving blockchain adoption. As the whitepaper drop and launch approach, all eyes are on Solieum to deliver on its promise of a “faster, smarter decentralized future.”

For those eager to stay updated, Solieum’s official channels on X and its website (solieum.com) offer the latest insights into its progress. As the countdown to launch continues, Solieum is ready to make waves in the blockchain world, proving that Solana’s best days are yet to come.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments carry high risks, and readers should conduct their own research before participating in any project.

#solana#binance#crypto#blockchain#bitcoin#eth#dogecoin#cryptonews#altcoin#digitalcurrency#cryptocurrency

2 notes

·

View notes

Text

BREAKING NEWS: Revolutionary AI Scheduling Model Disrupts Multi-Billion Dollar Industries

IndustriesMay 14, 2025 – In a groundbreaking development set to redefine time management across education, fitness, and the arts, researchers from the Zurich Institute of Technology (ZIT) have unveiled an artificial intelligence model capable of autonomously optimizing human schedules with an accuracy rate exceeding 98.7%.Dubbed "ChronoPilot," the new system leverages deep contextual learning to interpret not only user preferences but also emotional states, productivity trends, and even regional weather forecasts to dynamically tailor personal and group schedules. In early trials, the system outperformed existing scheduling platforms by over 400% in efficiency and conflict resolution.The implications span vast sectors. Educational institutions using class scheduling software like Lunacal’s platform for class bookings have already reported dramatic improvements in attendance and engagement. In the fitness industry, where applications such as gym booking software are crucial, ChronoPilot’s integration led to a 37% rise in client retention during a 90-day pilot. Music academies leveraging music lesson scheduling tools observed a 52% reduction in missed appointments.ZIT’s Secret Weapon: Sentient Sync ProtocolWhat truly sets ChronoPilot apart is its proprietary Sentient Sync Protocol (SSP) — a neural time-mapping engine that mimics human anticipation. SSP doesn’t just block out time; it predicts the best time for each task based on thousands of variables, including circadian rhythms, cognitive load history, and even micro-fluctuations in vocal tone during user interactions.Dr. Lena Marwick, lead AI architect at ZIT, explained, “We’re no longer asking users to fit into rigid schedules. ChronoPilot adapts to them, moment by moment.”Global Trials, Unprecedented ResultsThe AI was tested across 1.2 million scheduling interactions in 11 countries, across five major time zones. In one compelling instance, a public school in Osaka integrated ChronoPilot into its digital classroom system. Within three weeks, student punctuality improved by 48%, and feedback indicated a 63% increase in perceived classroom coherence.Meanwhile, a UK-based national gym chain used ChronoPilot to coordinate personal training sessions across 87 locations. Instructors reported a 41% decrease in downtime, and an average boost of 18% in customer satisfaction scores.ChronoPilot vs. The Old GuardWhile current scheduling tools rely heavily on manual input or rigid templates, ChronoPilot learns from passive inputs — browsing behavior, sleep app data, voice command history — with the user’s consent. This passive data synergy allows it to preemptively adjust schedules without user intervention.Analysts say the AI’s capabilities pose an existential threat to legacy scheduling systems and even to calendar giants like Google Calendar and Microsoft Outlook. “It’s not just a calendar anymore,” says Gideon Lark, senior analyst at MetaMetrics. “It’s a lifestyle orchestrator.”Privacy Concerns and Ethical DebateNot everyone is celebrating. Digital rights watchdogs have raised concerns about the volume and sensitivity of data ChronoPilot processes. The AI can access everything from location logs to biometric signals. While ZIT asserts the system uses end-to-end encryption and offers opt-out data controls, some critics remain wary."We’re trading convenience for surveillance,” warns Aria Salim, director of the Tech Privacy Initiative. “There must be enforceable limits on how such AI models evolve, especially as they begin to predict and possibly influence human behavior.”ZIT has responded by publishing a white paper detailing its privacy protocols and inviting third-party audits. Still, the debate over AI autonomy and human agency continues to intensify.

2 notes

·

View notes

Text

A Smarter Way to Trade on STON.fi: Understanding Key Analytics for Profitable Trading

Success in crypto trading isn’t just about timing—it’s about strategy. Many traders jump into trades based on hype, only to get stuck in illiquid markets or suffer heavy losses due to unpredictable volatility. If you want to navigate the market efficiently, understanding and using key trading analytics is non-negotiable.

On STON.fi, four essential metrics help traders and liquidity providers make informed decisions: APR, TVL, Trading Volume, and Trust Score. These indicators provide insights into market conditions, potential returns, and risks associated with a given asset or liquidity pool.

This guide breaks down how to use these analytics to improve your trading strategy, whether you're swapping tokens or providing liquidity.

APR: The Indicator of Potential Earnings

APR (Annual Percentage Rate) measures the expected yearly return from a liquidity pool based on the past 24-hour performance. It’s a snapshot of potential earnings, not a guaranteed fixed rate.

APR changes due to multiple factors:

Liquidity Pool Size: More liquidity often means more stable earnings.

Trading Fees Collected: Higher trading activity increases returns for liquidity providers.

Market Conditions: Fluctuations in demand affect reward rates.

How to Use APR for Better Decisions

If you’re a liquidity provider: Choose pools with a balance of high APR and stable liquidity.

If you’re a trader: Monitor APR fluctuations to gauge market activity before entering a trade.

APR can be attractive, but relying solely on this metric is risky. Combine it with other indicators for a complete market view.

TVL: The Confidence Meter

Total Value Locked (TVL) represents the total assets locked in a liquidity pool. The higher the TVL, the more liquidity and stability a pool has.

Why TVL Matters

High TVL = Lower Slippage: More liquidity allows for larger trades without drastic price impact.

Market Trust Indicator: Large TVL often signals investor confidence in a pool.

Better Trading Conditions: A well-funded pool ensures smoother transactions.

When to Consider TVL Before Trading

Low TVL Pools: These can be risky due to potential liquidity shortages, leading to unpredictable price swings.

High TVL Pools: More secure but may offer lower APR since rewards are shared among more participants.

Always cross-check TVL with other factors like trading volume and market trends before making decisions.

Trading Volume: The Market Activity Tracker

Trading volume measures how much of a token has been traded within a specific timeframe (usually 24 hours). It’s one of the most important indicators of liquidity and price stability.

Why Volume is Crucial for Traders

High Volume = More Market Interest: Assets with strong trading volume tend to be more stable and liquid.

More Fees for Liquidity Providers: Higher volume means more transactions, generating more rewards.

Lower Slippage for Traders: Liquid markets allow large trades without extreme price deviations.

How to Use Trading Volume in Strategy

Low Volume Pairs: Riskier due to less market activity. Price changes can be extreme with a single large trade.

High Volume Pairs: Preferred for smooth trades, quick execution, and predictable price movement.

Before trading, compare the volume trend over multiple days. A sudden spike might indicate short-term speculation, while consistent high volume suggests a strong and stable market.

Trust Score: Assessing the Reliability of a Token

Trust Score evaluates a token’s credibility and market strength based on data-driven factors like:

Trading volume consistency

Liquidity depth

Historical price stability

Risk of price manipulation

Why Trust Score Shouldn’t Be Ignored

A high score indicates a well-established asset with strong market backing.

A low score suggests higher risk, often linked to low liquidity or excessive volatility.

Before engaging with a token, checking the Trust Score can help you avoid assets that lack stability or have been prone to extreme price swings.

Applying These Analytics for Smarter Trades

Instead of making random trades based on trends, using APR, TVL, Volume, and Trust Score together can enhance decision-making:

✅ For Liquidity Providers:

Choose pools with a balance of high APR and stable TVL.

Monitor trading volume to ensure the pool remains active.

Use Trust Score to avoid risky, low-liquidity assets.

✅ For Traders:

Check TVL and Volume to confirm liquidity before entering a trade.

Use Trust Score to avoid unstable or manipulated tokens.

Track APR trends to understand market movements.

The more data-driven your decisions, the lower the risk of unexpected losses.

Final Thoughts: Trading with Precision

Crypto trading is more than just speculation—it requires precision, strategy, and data-backed decisions. On STON.fi, APR, TVL, Volume, and Trust Score provide essential insights to help you trade smarter and safer.

Instead of relying on hype, take time to analyze these metrics before making a move. A well-informed trader always has the upper hand in the market.

3 notes

·

View notes

Text

Technical Analysis

Hull Moving Average: The Revolutionary Trend Following Indicator

Introduction

The Hull Moving Average (HMA) has revolutionized how traders identify and follow market trends. Developed by Alan Hull to address the lag inherent in traditional moving averages, the HMA provides a uniquely responsive yet smooth representation of price action. This comprehensive guide explores how traders can leverage this powerful indicator for enhanced trading performance.

Who Created the Hull Moving Average?

Alan Hull, an Australian mathematician and trader, developed the Hull Moving Average in 2005. Frustrated with the significant lag in traditional moving averages, Hull applied his mathematical expertise to create an indicator that could maintain smoothness while dramatically reducing delay in trend identification.

What Makes the Hull Moving Average Special?

Core Features:

Minimal lag compared to traditional MAs

Smooth price action representation

Strong trend identification capabilities

Responsive to price changes

Built-in noise reduction

Key Advantages:

Earlier trend identification

Clearer entry and exit signals

Reduced whipsaws

Superior price tracking

Versatile application across markets

Why Use the Hull Moving Average?

Primary Benefits:

Faster Signal Generation

Reduces lag by up to 60%

Earlier trend identification

Quicker response to reversals

Improved Accuracy

Reduces false signals

Smoother price tracking

Better noise filtration

Enhanced Trend Following

Clear trend direction

Strong support/resistance levels

Trend strength indication

Versatility

Multiple timeframe analysis

Various market applications

Combines well with other indicators

Where to Apply the Hull Moving Average?

Market Applications:

Futures Markets

E-mini S&P 500

Crude Oil

Gold Futures

Treasury Futures

Forex Trading

Major currency pairs

Cross rates

Exotic pairs

Stock Trading

Individual stocks

ETFs

Stock indices

When to Use the Hull Moving Average?

Optimal Market Conditions:

Trending Markets

Strong directional moves

Clear price momentum

Extended market cycles

Breakout Scenarios

Pattern completions

Support/resistance breaks

Range expansions

Volatility Transitions

Market regime changes

Volatility breakouts

Trend initiations

How to Trade with the Hull Moving Average

Basic Trading Strategies:

Trend Following Strategy

Long when price crosses above HMA

Short when price crosses below HMA

Use HMA slope for trend strength

Exit on opposite crossover

Support/Resistance Strategy

Use HMA as dynamic support/resistance

Buy bounces off HMA in uptrends

Sell rejections from HMA in downtrends

Tighter stops for counter-trend trades

Multiple HMA Strategy

Combine different period HMAs

Look for crossovers between HMAs

Use divergences between HMAs

Trade strongest signals only

Advanced Applications:

Multiple Timeframe Analysis

Higher timeframe for trend direction

Lower timeframe for entry timing

Middle timeframe for confirmation

Volatility Integration

Adjust periods based on volatility

Use ATR for stop placement

Scale positions with trend strength

Hybrid Systems

Combine with momentum indicators

Use with price patterns

Integrate with volume analysis

Risk Management Essentials

Position Sizing:

Scale with trend strength

Larger in confirmed trends

Smaller in transitions

Stop Loss Placement:

Beyond HMA level

Based on ATR multiple

At key price levels

Common Pitfalls to Avoid

1. Over-Optimization

Problem: Curve fitting periods

Solution: Use standard settings

Prevention: Test across markets

2. False Signals

Problem: Minor crossovers

Solution: Use confirmation filters

Prevention: Wait for clear signals

3. Late Exits

Problem: Giving back profits

Solution: Use trailing stops

Prevention: Honor exit rules

Real-World Performance Metrics

Typical Results:

Win Rate: 45-55% in trending markets

Risk/Reward Ratio: Best at 1:2 or higher

Average Trade Duration: 5-10 days

Maximum Drawdown: 15-20% with proper risk management

Optimizing Hull Moving Average

Parameter Settings:

Standard Period: 20-30

Aggressive: 14-18

Conservative: 35-50

Market-Specific Adjustments:

Fast Markets: Shorter periods

Slow Markets: Longer periods

Volatile Markets: Multiple confirmations

Conclusion

The Hull Moving Average represents a significant advancement in trend-following indicators. Its ability to reduce lag while maintaining smooth price action makes it an invaluable tool for both discretionary and systematic traders. When properly implemented with sound risk management principles, the HMA can provide a significant edge in futures trading.

#HullMovingAverage#TrendFollowing#FuturesTrading#TechnicalAnalysis#TradingStrategy#MarketIndicators#FinancialMarkets#TradingEducation#AlanHull#MovingAverages

3 notes

·

View notes

Text

What is DXTrade Copier MT4? How does it work?

DXTrade Copier MT4 is a trade copier software designed to facilitate the automatic copying of trading orders from one MetaTrader 4 (MT4) platform to another DXTrade platform. It enables traders to seamlessly replicate their trades across different trading environments, making it an ideal solution for brokers, money managers, and individual traders who want to operate across both platforms efficiently.

Key Features of DXTrade Copier MT4:

Seamless Integration: Ensures smooth trade copying between MT4 and DXTrade platforms.

Real-Time Execution: Provides fast and accurate order replication with minimal delay.

Flexible Lot Sizing: Allows customization based on risk preferences and account equity.

Cross-Platform Compatibility: Works efficiently across different brokers and trading environments.

Risk Management Controls: Includes stop loss/take profit adjustments and equity protection.

Reverse Copying: Enables traders to copy trades in the opposite direction if needed.

User-Friendly Setup: Easy installation and configuration without technical complexities.

How DXTrade Copier MT4 Works:

Trade Signal on MT4:The copier monitors the MT4 account for new trades, modifications, and closures.

Signal Detection: Once a trade is placed, the copier instantly detects and processes the order details.

Replication to DXTrade: The trade is copied to the DXTrade platform with all parameters, ensuring accurate execution.

Automatic Lot Size Adjustment: Trade volumes are adjusted based on predefined risk settings or account balances.

Real-Time Execution & Monitoring: Trades are executed with minimal delay, and the copier continuously tracks performance.

This copier is particularly useful for traders who want to expand their trading strategies across multiple platforms while ensuring consistent execution and risk management.

#telegram signal copier#forex education#TSC#telegram signals copier#dxtrade#Trade Copier#Signal Copier#Forex Copier#Forex Signal Copier

2 notes

·

View notes

Video

youtube

ETHUSDT 31 Consecutive Successes! AI Trading Based on 2,500 Indicators: Unveiling PrimeXAlgo's Innovative Technology A deep dive into PrimeXAlgo's cutting-edge AI trading technology Utilizes a dataset of 2,500 comprehensive indicators No repainting on real-time chart analysis 100% legal and ethical algorithms Provides real-time buy, sell, and neutral signals Discover the state-of-the-art trading solution born from AI and big data!https://primexalgo.comtelegramhttps://t.me/primexalgofacebookhttps://facebook.com/profile.php?id=615665...discordhttps://discord.com/channels/1288670367401...instagramhttps://instagram.com/primexalgox.comhttps://x.com/PrimeXAlgo#PrimeXAlgo,#AITrading,#GoldInvestment,#BitcoinTrading,#TradingSuccess,#FX,#FOREX,#GOLD,#Chart,#TradingChart,#Stock,#Finance,#Investment,#primexalgo,#primex,#ConsecutiveSuccess,#Financial,#AIBOT,#BOT,#BOTtrading,#crypto,#cryptocurrency,#Forex trading,#Buy,#Sell,#Long,#Short,#indicator,#Strategy,#MACD,#RSI,#Bollinger Bands,#Oscillator,#Volume,#Charts,#Scalper,#Trend,#Bond,#Options,#Derivative,#Liquidity,#Leverage,#Margin,#Hedging,#Arbitrage,#Bull market,#Bear market,#BTC,#Bitcoin,#spread

2 notes

·

View notes

Text

Chart Chaser: A Trader’s Obsession with Technical Analysis on MintCFD

In the realm of online trading, a “Chart Chaser” is a trader who relies heavily on technical analysis. These traders obsessively study charts, patterns, and indicators to identify the optimal entry and exit points for their trades. While some traders focus on market news or economic fundamentals, Chart Chasers believe that the key insights lie within the patterns and trends shown in the data itself. For users on MintCFD, adopting the Chart Chaser approach can be rewarding, especially given the wide range of tools and various trading chart patterns available on the platform.

The Allure of Following Trends in Charts

Chart Chasers are drawn to technical analysis because it offers a visual and data-driven way to understand market behavior. By studying price movements, volume, and indicators, they look for recurring patterns, such as Double Bottoms, Head and Shoulders, and Moving Averages, which they believe can predict future price action. With the MintCFD trading app, traders have access to advanced charting tools that make it easy to become a Chart Chaser, allowing for in-depth analysis and strategy development.

Key Tools on the MintCFD Platform for Chart Chasers

MintCFD’s platform is rich with tools tailored for those who take a technical approach. Here are some essentials for the dedicated Chart Chaser:

Real-Time Charting Tools: MintCFD offers detailed, real-time charts that provide instant insights into price movements. For a Chart Chaser, these charts are invaluable as they capture every shift and trend in the market, allowing them to act quickly based on the latest data.

Diverse Chart Patterns: From Candlestick charts to Line charts, MintCFD provides several options, enabling traders to switch between patterns based on their trading style. For instance, Candlestick patterns are often favored by Chart Chasers because they reveal price action in detail, helping traders identify trends and reversals.

Technical Indicators: Popular indicators, such as the RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, are available on MintCFD to help Chart Chasers confirm their hypotheses. These indicators can signal overbought or oversold conditions, momentum changes, and potential trend reversals.

Custom Alerts: MintCFD’s alert system lets Chart Chasers set notifications based on specific price movements, helping them act on technical signals even if they’re not actively monitoring their screens. This way, they never miss a crucial trade opportunity based on their analysis.

Benefits and Pitfalls of Being a Chart Chaser

For those who love data, becoming a Chart Chaser offers unique advantages, but it also comes with some potential pitfalls. Here’s how to manage both on the MintCFD Platform:

Benefits: Technical analysis is highly data-driven, meaning decisions are based on objective data rather than emotional responses. By relying on chart patterns and indicators, Chart Chasers can create highly structured strategies with specific entry and exit points. With MintCFD’s intuitive tools, they can continuously refine their methods and explore different indicators.

Pitfalls: Focusing solely on technical analysis can lead to “analysis paralysis,” where a trader over-analyzes and hesitates to act. Additionally, ignoring market news and economic factors may leave a Chart Chaser blind to important influences. MintCFD offers market news and insights alongside technical tools, helping Chart Chasers balance their analysis with a broader context.

Master the Market on MintCFD Trading App: Stop Over-Analyzing and Start Thriving as a Chart Chaser

To succeed as a Chart Chaser without getting caught in a loop of over-analysis, it’s essential to have a plan and set clear criteria for entering and exiting trades. MintCFD’s watchlists and alert systems can help keep track of multiple assets without overwhelming yourself with constant analysis. Having a set of “go-to” indicators and patterns also helps prevent information overload.

Final Thoughts

For traders who thrive on technical data, becoming a Chart Chaser can be an exciting and rewarding journey. MintCFD is an ideal platform for these traders, with its robust charting tools, real-time indicators, and customizable alerts. While it’s easy to get caught up in the details, the best Chart Chasers know when to step back and trust their analysis. By balancing data with a disciplined approach, MintCFD users can make the most of their technical strategies and succeed in the dynamic world of trading.

Take control of your trading journey with the MintCFD Trading App

#mintcfd#cfdtrading#cryptotrading#onlinetrading#tradingstrategy#tradingsignals#forextrading#forexstrategies#cryptoinvesting#stockmarket

2 notes

·

View notes

Text

How buy bitcoin and make profits in stock Market?

As Example inside Forex Metatrader4 Plataform, double #BUY trade inside #BTCUSD running based in last Non Repaint Buy Signal. Official Website to have access: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexsignals#indicatorforex#forex#forexindicator#forexprofits#cashpowerindicator#forexchartindicators#forextradesystem#forexindicators#forexvolumeindicators#bitcoin#How buy bitcoin and make profits in stock Market?#trading bitcoin#btcusd

2 notes

·

View notes

Text

Xbtdirect Reviews: Your Guide to Smart Crypto Trading

XBTDirect Reviews, a leading cryptocurrency trading platform, has announced a significant milestone in its performance metrics for April 2025. The platform reported an average return on investment (ROI) of 87% across active user accounts, positioning it among the top-tier crypto trading platforms globally. This achievement underscores XBTDirect's commitment to providing innovative solutions for traders seeking to navigate the complexities of the cryptocurrency market.

Revolutionizing Crypto Trading

XBTDirect Reviews success can be attributed to its advanced AI-driven trading engine, which boasts a 92.4% accuracy rate in real-time signal generation. This technological edge enables traders to make informed decisions swiftly, capitalizing on market opportunities with precision. The platform's infrastructure enhancements, including server expansions in Europe and Southeast Asia, have further optimized trade execution speeds and system reliability.

Global Expansion and Regional Success

The April performance report highlights a surge in user activity from the UK and Canada, with these regions accounting for over 63% of global withdrawal volume. The increase in withdrawals, up 41% month-over-month, reflects rising profitability and user satisfaction. XBTDirect’s strategic infrastructure upgrades, such as the deployment of new server hubs in London and Ontario, have contributed to reduced latency and improved user experience in these key markets.

Client-Centric Features

XBTDirect Reviews continues to enhance its platform with features tailored to meet the needs of its diverse user base. The introduction of a new performance analytics dashboard provides traders with deeper insights into their trading activities, while advanced AI signal customization allows for personalized trading strategies. These developments have been well-received, as evidenced by the growing number of positive XBTDirect reviews across financial communities.

Commitment to Transparency and Security

Maintaining a high level of transparency and security remains a priority for XBTDirect. The platform has implemented robust risk management protocols and ensures compliance with data privacy requirements across its active jurisdictions. Clients can trust that their funds and personal information are safeguarded, fostering a secure trading environment.

Looking Ahead

As XBTDirect moves into the second quarter of 2025, the company plans to roll out additional features aimed at enhancing user experience and expanding its global reach. Upcoming developments include multi-language support, institutional dashboard interfaces, and expanded educational materials to assist traders in maximizing their potential.

Experience the Future of Crypto Trading

Discover how XBTDirect is transforming the cryptocurrency trading landscape by visiting https://xbtdirectbot.com/. Join the growing community of traders who are leveraging cutting-edge technology and innovative features to achieve their financial goals.

XBTDirect Reviews, a leading cryptocurrency trading platform, has announced a significant milestone in its performance metrics for April 2025. The platform reported an average return on investment (ROI) of 87% across active user accounts, positioning it among the top-tier crypto trading platforms globally. This achievement underscores XBTDirect's commitment to providing innovative solutions for traders seeking to navigate the complexities of the cryptocurrency market.XBTDirect Reviews success can be attributed to its advanced AI-driven trading engine, which boasts a 92.4% accuracy rate in real-time signal generation. This technological edge enables traders to make informed decisions swiftly, capitalizing on market opportunities with precision. The platform's infrastructure enhancements, including server expansions in Europe and Southeast Asia, have further optimized trade execution speeds and system reliability.

0 notes

Text

How Token Metrics AI Grades Give You an Edge in Crypto Trading

The crypto market is noisy, fast-paced, and emotional. Traders are constantly bombarded with conflicting opinions, volatile price action, and unpredictable news.

To win consistently, you need clarity.

That’s where Token Metrics AI Grades come in—offering a clear, data-backed edge by scoring every token based on trading momentum and long-term strength.

Let’s break down how these AI-powered grades can transform your crypto trading strategy.

The Problem with Human Bias in Trading

Even experienced traders struggle with:

Overreacting to short-term dips

Holding losers too long

Chasing pumps too late

Ignoring data in favor of gut feeling

In crypto, these mistakes can mean the difference between a 10x gain and a 90% drawdown.

AI helps eliminate these emotional errors.

How TM Grades Work

Token Metrics evaluates every supported cryptocurrency with two core scores:

Trader Grade (Short-Term)

Measures momentum, volatility, trend alignment, and recent strength.

Updated frequently to reflect changes in market structure.

Helps traders spot opportunities that are heating up right now.

Investor Grade (Long-Term)

Measures fundamentals, sentiment trends, volume consistency, and risk-adjusted return potential.

Ideal for identifying tokens worth holding or accumulating.

Together, these grades give a complete view of a token’s potential—right now and over time.

Use Case: Filtering the Noise

Let’s say you’re researching altcoins during a bull run.

Instead of manually checking charts, sentiment, and news, you just sort by Trader Grade > 85.

You notice $RNDR and $INJ at the top.

Both are flashing bullish signals and have upward price momentum.

You enter those trades with high confidence—backed by AI analysis.

You didn’t need to guess. You followed the data.

How Grades Help You Exit Smarter

TM Grades aren’t just for entering trades—they’re just as useful for knowing when to exit.

If a token you hold drops from:

Trader Grade 88 → 62

Investor Grade 91 → 70

That’s your signal to reevaluate. The data is warning you.

AI gives you a real-time warning system before the market catches up.

Comparison to Other Platforms

Feature

Token Metrics

Most Competitors

Real-time AI scoring

✅ Yes

❌ No

Dual-grade system

✅ Yes

❌ No

Objective decision filter

✅ Yes

❌ No

Visual grade dashboards

✅ Yes

❌ No

TM doesn’t just show data—it tells you what’s working now.

Who Benefits Most?

Day Traders – Use Trader Grades for quick entries/exits.

Swing Traders – Catch 7–30 day momentum trades.

Investors – Identify strong projects early using Investor Grade.

Analysts & Builders – Integrate grades into dashboards via API.

Whatever your strategy, TM Grades are your filter for focus.

Conclusion

Crypto doesn’t reward guesswork—it rewards insight.

Token Metrics AI Grades:

Cut through noise

Highlight real opportunities

Help you avoid traps

Make portfolio decisions smarter

That’s why they’re not just useful—they’re essential.

If you want to trade smarter, not harder, Token Metrics is the best AI crypto trading option on the market today.

0 notes

Text

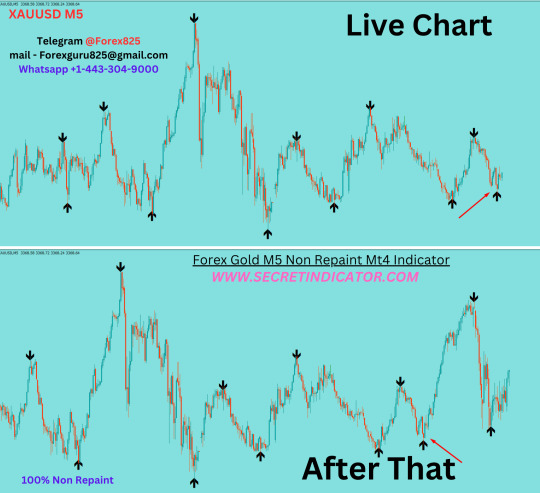

good indicators for forex trading

📊 Good Indicators for Forex Trading: The Ultimate Guide for Profitable Trades

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

✅ Introduction

Forex trading is both an art and a science. While price action and market psychology play key roles, technical indicators help traders make objective, data-driven decisions. Whether you’re a beginner or an experienced trader, choosing the right indicators can dramatically improve your entries, exits, risk management, and profitability.

But with hundreds of forex indicators available — from the classic moving averages to exotic custom tools — how do you know which ones truly work?

This detailed article explores:

What forex indicators do

The core types of indicators

The best and most commonly used indicators

How to use them effectively in combination

Common mistakes and tips for better results

📌 Table of Contents

What Are Forex Indicators?

Types of Technical Indicators

Why Indicators Matter in Forex Trading

The Top 10 Good Indicators for Forex

Deep Dive into the Most Effective Indicators

Best Indicator Combinations

Tips for Using Indicators Effectively

Common Mistakes to Avoid

How to Backtest and Optimize Indicators

Final Thoughts

1. 📉 What Are Forex Indicators?

Forex indicators are mathematical calculations based on price, volume, or open interest. They analyze past market data to help traders make predictions about future price movements. Indicators are typically plotted on or below a chart and can signal:

Trend direction

Reversal zones

Entry/exit points

Market strength

Volatility

Overbought/oversold levels

They don't predict the future perfectly, but when used correctly, they help you make probability-based decisions.

2. 📊 Types of Technical Indicators

Forex indicators fall into several major categories:

🔹 Trend Indicators

Identify the direction and strength of market trends.

Examples: Moving Averages, MACD, ADX, Ichimoku Cloud

🔹 Momentum Indicators

Measure the speed of price movement to find overbought/oversold areas.

Examples: RSI, Stochastic Oscillator, CCI

🔹 Volatility Indicators

Measure the rate of price fluctuations, showing when the market is quiet or explosive.

Examples: Bollinger Bands, ATR (Average True Range)

🔹 Volume Indicators

Gauge trading volume, often used to confirm the validity of price moves.

Examples: OBV, Volume Oscillator, Chaikin Money Flow

🔹 Custom or Composite Indicators

Combine multiple tools or custom formulas.

Examples: TDI (Traders Dynamic Index), Supertrend, Pivot Point Indicator

Each type has a purpose. Great trading strategies usually combine 2–3 different types.

3. 🧠 Why Indicators Matter in Forex Trading

Trading without indicators is like driving without a speedometer or GPS — possible, but risky and uncertain.

Good indicators help:

Define trading rules

Add objectivity to decision-making

Reduce emotional trading

Confirm entries and exits

Prevent overtrading in choppy markets

Identify trends early or avoid weak ones

They don’t guarantee success — but they increase your statistical edge.

4. ✅ The Top 10 Good Indicators for Forex Trading

Here are ten indicators that are time-tested, effective, and widely used by traders across all levels: RankIndicatorTypeUse Case1Moving Averages (EMA/SMA)TrendIdentify direction and smooth price2Relative Strength Index (RSI)MomentumSpot overbought/oversold areas3MACDTrend/MomentumSignal trend changes via crossovers4Bollinger BandsVolatilityBreakout signals, range bounds5ADXTrend StrengthMeasure trend strength (not direction)6Stochastic OscillatorMomentumShort-term reversal entries7ATRVolatilitySet dynamic stop-loss based on volatility8Ichimoku CloudTrendComplete trend system with signals9Fibonacci RetracementSupport/ResistanceIdentify pullback and entry zones10Volume Indicators (OBV/CMF)VolumeConfirm trends and breakouts

Let’s now explore some of the best ones in detail.

5. 🔍 Deep Dive: Best Indicators Explained

🔹 1. Moving Averages (EMA & SMA)

Simple Moving Average (SMA): averages price over a period.

Exponential Moving Average (EMA): gives more weight to recent prices.

Popular Uses:

50 EMA & 200 EMA crossovers = trend change

Price above 200 EMA = long bias, below = short bias

Use slope of EMA for trend strength

Pro Tip: Use moving average channels for dynamic support/resistance.

🔹 2. Relative Strength Index (RSI)

Ranges from 0 to 100

Above 70 = Overbought (possible sell)

Below 30 = Oversold (possible buy)

How to Use:

Divergence between RSI and price = strong reversal signal

Combine with support/resistance zones

Use RSI > 50 in uptrends, < 50 in downtrends

🔹 3. MACD (Moving Average Convergence Divergence)

Consists of:

MACD line (12 EMA – 26 EMA)

Signal line (9 EMA of MACD)

Histogram (difference between MACD and signal)

Strategy:

MACD line crossing above signal = buy signal

Use MACD divergence to detect early trend reversals

🔹 4. Bollinger Bands

3 lines: Upper, Middle (SMA), Lower band

Bands widen with volatility, contract in calm markets

Trading Ideas:

Price touches lower band + oversold RSI = potential long

Breakout with volume = trend beginning

Range-bound strategy: buy at lower band, sell at upper

🔹 5. ADX (Average Directional Index)

Measures trend strength, not direction

Value > 25 = trend is gaining momentum

Value < 20 = market is ranging

Combine with:

+DI and –DI lines to see bull vs bear strength

Trendline or MA to confirm direction

🔹 6. Stochastic Oscillator

Two lines: %K and %D

Values > 80 = overbought, < 20 = oversold

How to Trade:

Buy when %K crosses above %D in oversold zone

Sell when %K crosses below %D in overbought zone

Best in ranging or corrective phases

🔹 7. ATR (Average True Range)

Measures volatility, not direction

Use for:

Setting realistic stop-losses based on market behavior

Filtering out low-volatility trades

Adjusting position sizing dynamically

🔹 8. Ichimoku Cloud

A complete system: trend, momentum, and future resistance zones

Components:

Kumo Cloud: dynamic S/R

Tenkan & Kijun: short-term trend crossovers

Chikou Span: lagging confirmation

Works best on H4 and D1 timeframes.

🔹 9. Fibonacci Retracement

Tool based on key price ratios (0.382, 0.5, 0.618)

Great for pullback entries in trends

Strategy:

Price retraces to 61.8% + MA support = strong long setup

Combine with candle signals or trendline breaks

🔹 10. Volume Indicators

OBV (On-Balance Volume): volume flow

Chaikin Money Flow: volume + price pressure

Use them to:

Confirm breakouts

Spot early accumulation/distribution

Add strength to RSI/MACD setups

6. 🔗 Best Indicator Combinations

No single indicator is perfect. Here are some powerful combos:

✅ RSI + Bollinger Bands

RSI confirms overbought/oversold

BB shows volatility edge

✅ ADX + Moving Averages

MA shows direction, ADX confirms trend strength

✅ MACD + Volume

MACD gives direction change

Volume confirms if it’s real

✅ Stochastic + Fibonacci

Stochastic entry after Fib retracement level

Always look for confluence of signals before entering a trade.

7. 🧠 Tips for Using Indicators Effectively

Use indicators to confirm, not control decisions

Stick to 2–3 indicators max — don’t clutter your chart

Adjust indicator settings based on timeframe and strategy

Use support/resistance and candlestick patterns as base context

Watch for divergence for early reversal warnings

8. ❌ Common Mistakes to Avoid

Over-reliance on indicators

Using too many conflicting tools

Not backtesting indicators

Ignoring market context

Trading all signals — not all are valid

Remember: Indicators follow price, not the other way around. Context is king.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex factory#forex market#forex education#forex online trading#forex broker#crypto#forex news#forex#forex indicators#forex ea

0 notes

Text

AI and Investment Banking: How Artificial Intelligence is Reshaping the Future of Finance

Investment banking is experiencing a tech-driven transformation, and Artificial Intelligence (AI) is leading the charge. From deal origination to automated trading and compliance, AI is optimizing nearly every facet of the industry. For finance aspirants, this isn't just a trend—it’s a roadmap to the future.

If you're serious about breaking into this evolving field, enrolling in an investment banking course in Mumbai that incorporates AI and analytics training can be your best career move.

How AI is Transforming Investment Banking

1. Smarter Deal Origination with Predictive Analytics

AI-powered platforms are changing how banks source potential mergers and acquisitions. These systems crunch massive data sets—financial statements, market trends, and even news headlines—to flag promising targets with surgical precision.

🔍 Example: Goldman Sachs uses predictive models to evaluate which companies are likely to be involved in M&A deals based on industry trends and financial patterns.

2. AI-Enhanced Valuation and Risk Modelling

Traditional valuation models are being revamped with machine learning algorithms. AI doesn’t just speed up the due diligence process—it makes it smarter by identifying anomalies, inconsistencies, and even hidden risks in real-time.

This means faster, more accurate decision-making—something top investment banks now rely on for IPOs and leveraged buyouts.

3. Algorithmic Trading and Robo-Advisors

AI is deeply entrenched in capital markets through algorithmic trading. These AI bots execute trades at lightning speed, maximizing returns by analyzing market signals across the globe in real time.

At the same time, robo-advisors are democratizing wealth management, using AI to build customized investment portfolios for clients of all sizes.

4. AI in Compliance and Regulatory Tech (RegTech)

Investment banks face complex regulatory environments—and AI is making compliance easier and cheaper. RegTech uses AI to scan documents, monitor transactions, and flag suspicious activities, reducing the risk of hefty fines.

🛡️ Case in Point: JP Morgan’s COiN platform analyzes thousands of legal contracts in seconds, saving over 360,000 hours of manual work annually.

5. AI-Powered Client Relationship Management

AI is not just about efficiency—it’s also about personalization. Investment banks use AI to track client behavior, predict their investment needs, and personalize interactions—making client engagement smarter and more data-driven.

Ethical Concerns and Limitations

Despite its many benefits, AI raises key questions:

Bias in models: AI algorithms can unintentionally reinforce existing biases.

Data privacy risks: Handling large volumes of sensitive financial data requires robust cybersecurity.

Job displacement: As AI automates routine tasks, traditional roles are being reshaped or replaced.

However, this also opens new doors for professionals who understand both finance and AI.

Why AI Literacy Is a Must for Aspiring Investment Bankers

The future of investment banking lies at the intersection of finance, data, and technology. Employers are looking for candidates who not only know valuation models but also:

Use Python or R for data analysis

Understand machine learning basics

Know how to visualize financial data

To gain this blended expertise, a specialized investment banking course in Mumbai can give you a strategic advantage. Courses that offer live projects, case studies, and exposure to tools like Excel, Tableau, and Bloomberg Terminal help bridge the gap between academics and the fast-evolving industry needs.

India’s AI-Driven Finance Boom: The Local Advantage

In India, the fusion of AI and finance is picking up speed. Leading firms like ICICI Securities and Axis Capital are already using AI to enhance decision-making. With Mumbai as the financial capital, the demand for AI-ready investment bankers is rising sharply.

So, if you’re based in or near Mumbai, you’re at the epicenter of India’s AI-finance revolution. And with the right training, you can capitalize on this momentum.

Conclusion

Artificial Intelligence is no longer a futuristic concept—it’s reshaping investment banking in real-time. From optimizing deal flows to transforming how trades are executed, AI is the force driving the next wave of financial innovation.

If you're aiming to break into this dynamic field, now is the perfect time to equip yourself with the right skills. Enrolling in a top-tier investment banking course in Mumbai will help you gain not only foundational finance knowledge but also the AI edge you’ll need to thrive in the future of banking.

0 notes

Text

Best SPY Trader in the World: The Proven Path to Consistent Wins

Best SPY Trader in the World: The Proven Path to Consistent Wins

Frustrated by chaotic markets and inconsistent results? Discover how the best SPY trader in the world built a reliable, data-powered system anyone can use to trade with clarity and confidence.

Why Most SPY Traders Fail (And How to Break Free)

Over 80% of retail traders lose money on SPY options due to emotional decisions and overcomplicated strategies. The best SPY trader in the world simplifies the process by focusing on repeatable setups backed by historical edge. By eliminating guesswork, you can finally break the cycle of frustration and start seeing real consistency.

The Core of a Proven SPY Trading System

Consistency comes from a system, not luck. The best SPY trader in the world uses a rules-based approach, combining price action with high-probability signals. According to a 2023 study, traders using clear rules saw win rates jump by 35%. This system ensures every decision is logical and data-driven, not impulsive.

Simplicity Over Complexity: The Winning Edge

Complex indicators often create confusion. The best SPY trader in the world relies on just three core metrics—trend, volatility, and volume. This streamlined approach reduces noise and increases accuracy. Simplicity is not just elegant; it’s proven. Think fewer moving parts, more consistent results.

Historical Performance: Facts Over Hype

Since 2018, the best SPY trader in the world’s strategy has delivered an average annual return of 22%, with less than half the drawdown of popular speculative methods. These results are verifiable, not marketing hype. Real performance data gives you the confidence to follow the system—even during market turbulence.

Actionable Steps to Trade Like the Best SPY Trader in the World

Ready to apply a proven edge? Start by backtesting three simple setups, journal every trade, and review performance weekly. The best SPY trader in the world swears by disciplined execution—no exceptions. Track your metrics, refine your process, and let the numbers guide your decisions.

Trade simple, data-backed setups only

Follow strict rules for entry and exit

Review and adapt based on real results

Consistency is possible—just follow the best SPY trader in the world’s blueprint. Start now and turn chaos into clarity.

FAQ: What makes the best SPY trader in the world’s system different?

This approach is based on tested historical data, not speculation. Every rule has a statistical edge, so you know exactly why you’re entering or exiting a trade—no guesswork.

FAQ: Can beginners use this SPY trading system?

Yes! The system’s simplicity means even new traders can execute with confidence. Focus on mastering rules and tracking results, not chasing hot tips or complex setups.

Have you struggled to find consistency in SPY trading? Drop your thoughts below—what’s your biggest challenge or breakthrough? Reblog and join the discussion!

0 notes

Text

9 Market Moves for Strategic Forex Trade Planning

Market Overview

Strategic forex trade planning is now essential as geopolitical risks dominate global sentiment. Israel's pre-dawn strikes on Iran's key military sites, including the Khojir missile facility, and Iran's retaliatory missile launches have sent shockwaves through the markets. Global powers like the U.S., China, and India are urging their citizens to evacuate Tehran. Meanwhile, safe-haven demand, oil volatility, and macro policy catalysts like the upcoming FOMC meeting are influencing both commodities and currency pairs.

COT Reports Analysis

AUD - WEAK (5/5)

GBP - STRONG (5/5)

CAD - WEAK (3/5)

EUR - STRONG (5/5)

JPY - STRONG (2/5)

CHF - WEAK (3/5)

USD - MIXED

NZD - WEAK (3/5)

GOLD - STRONG (4/5)

SILVER - STRONG (5/5)

Market Analysis

GOLD

GOLD prices are influenced by heightened Middle East conflict but remain somewhat subdued. In this environment, strategic forex trade planning demands patience, especially with Gold lingering near historic highs. While the MACD suggests bullish continuation, RSI shows consolidation. We anticipate renewed momentum, aligning with multi-pair forex strategies that emphasize safe-haven assets.

SILVER

SILVER has surged to 13-year highs, diverging sharply from Gold. This breakout reflects heavy capital flow into the metal as a safer alternative. Technicals are aligned for continuation, and traders involved in forex analysis and predictions should monitor how Silver’s strength reshapes correlated setups.

DXY

The Dollar's spike reflects a classic risk-off bid, yet technicals hint at longer-term weakness. Though the MACD and RSI support short-term bullish momentum, overall structures remain bearish. With the FOMC looming, strategic forex trade planning must account for volatility and potential reversals, especially in multi-pair forex strategies.

GBPUSD

The Pound faces pressure ahead of U.K. CPI data. While the MACD and RSI point to more downside, the pair is testing critical support at 1.34294. Traders using price action trading for EUR/USD can adapt this approach to GBP/USD, watching for confirmation before positioning.

AUDUSD

The Aussie is consolidating under pressure from risk-off flows. Despite mixed signals, the broader context aligns with EUR/USD trend analysis and overall market sentiment that favors defensiveness.

NZDUSD

NZD/USD remains in a tight range, with no clear structural break. Until confirmation comes, this pair aligns with broader forex analysis and predictions suggesting hesitance in risk-sensitive currencies.

EURUSD

EUR/USD continues to build a consolidation zone below 1.16110. While short-term momentum is bearish, the broader structure remains bullish. This is a key setup for price action trading for EUR/USD. We await a breakout for directional confirmation, vital for strategic forex trade planning in euro-related setups.

USDJPY

Despite global tensions, the Yen is surprisingly weak. The pair remains in consolidation. A cautious approach is needed, especially when integrating multi-pair forex strategies where both USD and JPY are safe-haven options with divergent reactions.

USDCHF

USD/CHF is testing EMA200. The MACD shows volume growth, but RSI remains flat. With USDCHF in a broader bearish context, we wait for structure to develop. This fits well into forex analysis and predictions based on safe-haven interplay.

USDCAD

USD/CAD shows rising bullish momentum and volume. The MACD and RSI confirm this move, though the longevity of the trend remains questionable. For strategic forex trade planning, watch for exhaustion or confirmation on higher timeframes.

Final Thoughts

Geopolitical risks are front and center, demanding a disciplined and flexible approach to strategic forex trade planning. From EUR/USD trend analysis to metals divergence and safe-haven flows, each asset presents opportunities—but only for those using well-structured multi-pair forex strategies. Stay alert for structural shifts and central bank guidance as volatility remains the dominant theme.

0 notes