#WeChat Mini Program in Education Market

Explore tagged Tumblr posts

Text

Skywise Digital: Your Trusted WeChat Marketing Agency for Success in China

Navigating the Chinese digital landscape can be a daunting task for international brands. From unfamiliar platforms to unique consumer behavior, achieving brand visibility and engagement in China requires more than just translating content—it demands strategic localization, cultural understanding, and platform-specific expertise.

That’s where Skywise Digital comes in. As a leading WeChat marketing agency with offices in London and Shanghai, we help global brands succeed in China’s fast-evolving and highly competitive digital market. With deep expertise across platforms such as WeChat, Xiaohongshu, Baidu PPC, SEO, and online PR, we empower businesses to connect with Chinese consumers and drive meaningful growth.

Why WeChat Matters in China’s Digital Marketing Ecosystem

WeChat isn’t just an app—it’s China’s digital ecosystem. With over 1.3 billion monthly active users, WeChat is an all-in-one platform for messaging, content sharing, payments, customer service, e-commerce, and more. For global brands looking to build presence in China, having a WeChat strategy is no longer optional—it’s essential.

As a WeChat marketing agency, Skywise Digital helps brands establish and manage their presence on the platform to reach, engage, and convert Chinese consumers effectively. Whether you're launching in China for the first time or looking to scale an existing strategy, our team can tailor a solution to meet your objectives.

What Makes Skywise Digital Different?

Skywise Digital combines the precision of a Western marketing agency with the cultural fluency and technical expertise required to thrive in China. With dual headquarters in London and Shanghai, we bring a unique East-meets-West approach to digital strategy—one that balances brand consistency with local relevancy.

Our bilingual team understands both the expectations of global brands and the preferences of Chinese consumers. From crafting WeChat content that resonates to executing targeted Baidu PPC campaigns, we provide full-service digital solutions that deliver results.

Our WeChat Marketing Services

As a specialized WeChat marketing agency, Skywise Digital offers end-to-end support to help your brand make an impact on China’s most influential platform. Here’s how we can help:

1. WeChat Official Account Setup & Verification

To market on WeChat, your business needs an official account. We handle all the setup and verification processes to ensure your brand is ready to engage with users through a legitimate, verified channel.

2. Content Strategy & Creation

We don’t just translate—we localize. Our content team creates culturally relevant, visually appealing posts designed to educate, inform, and inspire your audience. From industry thought leadership to product launches and promotional content, we plan editorial calendars that support long-term brand building.

3. Follower Growth & Engagement Campaigns

We use organic and paid tactics to grow your WeChat following and improve engagement. This includes influencer collaborations, QR code promotions, giveaways, and mini-program integrations to boost interactivity and lead generation.

4. WeChat Advertising

WeChat offers several advertising options including Moments ads, banner ads, and targeted promotions. We plan and execute highly targeted campaigns based on demographics, interests, and behavior to maximize your return on investment.

5. CRM & Customer Service Integration

We integrate WeChat with customer relationship management (CRM) tools to help you manage leads, respond to inquiries, and nurture prospects. The result is a seamless communication flow that enhances customer satisfaction and loyalty.

6. Analytics & Reporting

We track and analyze every campaign to provide insights into what’s working and where to improve. Our reports help you measure success and adjust your strategy for even better results.

Complementary Digital Services

While WeChat is at the core of your China marketing strategy, we also provide integrated services to build a holistic digital presence:

Xiaohongshu (Little Red Book) Marketing: Ideal for lifestyle, beauty, fashion, and consumer goods brands targeting younger demographics.

Baidu PPC & SEO: Get found on China’s leading search engine with high-performing search campaigns and optimized landing pages.

Online PR & Media Outreach: Build credibility through placements on top Chinese media outlets and influencer platforms.

By combining these services, we ensure your brand visibility extends beyond WeChat and into the wider Chinese internet ecosystem.

Who We Work With

Skywise Digital supports businesses across various industries including:

Consumer goods and retail

Luxury and fashion

Technology and SaaS

Education and training

Healthcare and wellness

Travel and hospitality

Whether you're a startup entering China or an established global enterprise looking to optimize your digital footprint, our customized strategies ensure long-term success.

Why Choose Skywise Digital as Your WeChat Marketing Agency?

Dual-location advantage: With teams in London and Shanghai, we operate across time zones and cultural boundaries to provide seamless service.

Local expertise: We know the rules, platforms, and consumer behavior in China.

Global mindset: We work closely with your global marketing team to ensure brand alignment.

Results-driven: We focus on measurable outcomes—leads, conversions, engagement, and brand lift.

Let’s Start Your China Journey Today

With China’s digital landscape evolving faster than ever, partnering with the right WeChat marketing agency is key to success. At Skywise Digital, we’re here to help you unlock the full potential of the Chinese market.

Skywise Digital is a leading China marketing agency with offices in London and Shanghai, specialising in helping global brands succeed in the competitive Chinese market. From WeChat and Xiaohongshu marketing to Baidu PPC, SEO and online PR, we empower businesses to connect with Chinese consumers and drive growth.

Let’s take your brand to the next level in China. Contact us today to start building your strategy.

0 notes

Text

0 notes

Text

Oriental Selection still has a long way to go

In Yu Minhong's plan, Oriental Selection "will build an excellent agricultural and life industry chain." He mentioned the need to establish a three-dimensional sales platform to serve more Chinese merchants. In addition to HE Tuber Douyin, this three-dimensional sales platform will also consider other platforms and even build its own platform.

But what is the result? At the end of February this year, Oriental Selection also disclosed its first performance report after the name change. In addition to revenue growth, during the six months of the reporting period, Oriental Selection's GMV (gross merchandise transactions) reached 4.8 billion yuan, of which self-operated products contributed Sales revenue of 1.089 billion yuan, and third-party products generated commission service revenue of 677 million yuan. The two incomes accounted for 85% of the total revenue, while the revenue of the traditional education sector was only 295 million yuan, and the proportion shrank to 14%. The revenue and profits disclosed in the report were lower than market expectations.

At the same time, Oriental Screening CEO Sun Dongxu and CFO Yin Qiang successively reduced their holdings by nearly 5 million shares, cashing out at a high level of nearly HK$280 million. This unexpected reduction directly caused Oriental Screening's stock price to plummet 20% that day.

Tianfeng Securities analyzed this in a research report and stated that the decline in GMV was one of the main reasons for the correction in Oriental Selection’s stock price. In addition, the reduction of holdings by Oriental Selection executives was also the reason for the decline in the stock price. "Recently, Oriental Selection's GMV has averaged between 20 million and 30 million yuan per day, which has dropped significantly from the 40 million to 50 million yuan before the Spring Festival. On the one hand, the reason is due to the off-peak consumption season and offline recovery; on the other hand, On the other hand, due to the impact of the epidemic two years ago, the pace of launching new self-operated products after the new year will be slow.”

In terms of goods, in March this year, Oriental Selection was included in the hot search for "the wild white shrimps sold in Ecuador are actually farmed." Last year, there were precedents of high-priced corn incidents and moldy peaches growing hairy incidents. The control of the supply chain Obviously, Eastern Selection requires continuous improvement. As a company that makes a living by selling agricultural products, apart from the anchor halo and conceptual packaging, only "product power" is the key factor that can help it go further.

Looking back at the stock price of Oriental Selection, it has fallen by about half from its high point in January this year. This reminds Oriental Selection to a certain extent: the temporary hype will eventually pass, and we should continue to think about the possibilities and solutions for our own business development. It is an eternal proposition.

At present, "Oriental Selection Beautiful Life" has undoubtedly supported the performance growth of Oriental Selection, but is this phenomenon sustainable? Where is the next "Oriental Selection Beautiful Life"? How to increase profits while improving product capabilities? Dongfang Selection obviously still has a long way to go in the future.

Oriental Selection has actually understood this, so it has gone further and further on the road of "diversification". On the one hand, it has opened two accounts, "Oriental Selection Official Account" and "Oriental Selection Member", on the WeChat video account, and launched the Oriental Selection Selection WeChat mini program; on the other hand, there are also Oriental Selection flagship stores on Tmall and JD.com. In September last year, Oriental Selection also launched an independent e-commerce APP.

As for Dong Yuhui, his work focus is actually much more than just carrying goods on the main account of "Oriental Selection". Since the beginning of this year, Oriental Selection has launched a new live broadcast format of "live broadcast + cultural tourism" through its matrix account "Oriental Selection Views the World". Dong Yuhui has become the resident anchor. In addition to bringing goods, he has found a new working status. Perhaps, it is not that Dongfang Selection "does not rely on Dong Yuhui", but that Dong Yuhui's personal value is no longer limited to a single field.

Source: Guosen Securities

An excessively high influence weight increases the probability of uncontrollable events. On the one hand, judging from the gender and age distribution data of Oriental Selection fans, there are more women among them, and 24 to 40 years old account for 70% of the total number. Many of them are the well-known "mother-in-law" of Dong Yuhui. The main fan group, their "love" for Dong Yuhui can be seen.

On the other hand, in the past few years, the issue of "head-oriented" anchors has been the focus of the industry, and the de-celebrification of head anchors has also become an industry trend. With the development of Oriental Selection, it is only time to gradually "de-celebrify Dong Yuhui" question.

There are also specific actions to follow. Starting from November last year, Dong Yuhui’s live broadcast time was adjusted from 7-10pm to 7-9pm every night. At the same time, Dong Yuhui’s personal cartoon image was previously on the packaging of Oriental Selection’s self-operated brand Sirloin Steak, but the new packaging has removed the image.

A cruel reality is that no live broadcast room can continue to be popular with one style. By creating an artistic conception of "life is not only about the present, but also poetry and the distance", Dong Yuhui captured the idealistic feelings of the public, but a kind of Audiences will inevitably feel tired after listening to the content for a long time. The recent difficulty in maintaining the 100,000 traffic mark in the Oriental Selection live broadcast room is a side proof.

0 notes

Text

Can Meituan defeat magic with magic?

On the highway of local life, Meituan is running all the way with takeaways, restaurants, wine and hotels, etc. When it comes to the turning point of "live broadcast", it runs into Douyin, which has changed its direction from short video and e-commerce.

In the ancient business of catering, a new revolution is taking place.

Wang Xing and Zhang Yiming are the initiators of this change. One of them advocates "long-term patience" and the other claims "vigor can produce miracles." Live broadcast + local life is their new battlefield.

As Wang Xing said many years ago, this HE Tuber is an era of never-ending peace. Some investors once asserted, "We must fight the war at other people's homes. Even if we lose, we will not lose. What we will break are other people's bottles and cans."

The intersection between the two business tycoons is no stranger to the outside world. Although the current situation is not the first time this pair of old acquaintances have crossed paths, it is the most "sparky" one.

According to "LatePost" previous reports, in 2022, Douyin's catering transaction volume has been close to half of Meituan's; in early February 2023, Douyin's local life's transaction volume contributed by the catering business has been higher than that of the hotel, tourism and comprehensive business Sum.

The latest data from QuestMobile shows that the number of overlapping users of Meituan and Douyin exceeds 300 million, accounting for 81.0% of Meituan’s users. As an old rival of Meituan’s food delivery business, Ele.me’s overlapping users account for less than 20% of Meituan’s users.

Douyin's magic to quickly seize the market is "live broadcasting". Although the entry of opponents will help make the pie bigger, who is the winner under the 28-20 rule is crucial. Meituan finally took up arms. Its live broadcast business has grown from two years ago. Start testing the waters and accelerate after building a live broadcast center this year.

And savvy catering businesses are also voting with their feet. Take Wallace, which has nearly 20,000 stores, as an example. During this year’s 618 period, it gained highlights in both Meituan and Douyin. At Meituan’s “618 Group Coupon Festival”, its sales of value-for-money packages exceeded 150 million yuan; while Douyin’s “618 Group Coupon Festival” ranked fifth on the best-selling brand list.

What’s interesting is that Wallace walked into Meituan’s takeout live broadcast room, while the one on Douyin was an in-store live broadcast with online group coupons and offline verification. To a certain extent, the choice of chain merchants also reflects the differences between Meituan and Douyin in local life live broadcasting.

Meituan, standing at the center of the whirlpool, can it use the magic of Douyin to fight back against Douyin this time?

1. How much patience does Meituan have during live streaming?

Meituan Runtong’s first live broadcast product is home delivery (takeaway).

The "Shenshou" live broadcast room is the first official live broadcast room of Meituan to break out of the circle. It focuses on "magic low prices and instant grabs." In fact, its earliest live broadcast attempt was in September 2022, and it did not start daily broadcast until March this year. Meituan’s attempts at live broadcasting date back to earlier, and food delivery is not the vanguard.

In December 2020, Meituan launched the "Meituan Mlive" mini program on WeChat, which was limited to medical beauty and education merchants and has not yet covered the huge takeout merchants. In April 2022, Meituan launched the "Meituan Live Assistant" APP and launched the "Food Live" channel in an attempt to open new sales channels for catering merchants.

In the past two years or so, multiple businesses within Meituan have tried live broadcasting, but they have all stopped. According to "Blue Hole Business", it was not until the first half of this year that Meituan's live broadcast business established an independent team and set up a live broadcast center at the technical level. Each business unit can use this capability.

The popular live broadcast room of Meituan’s food delivery god

A person related to Meituan told "Blue Hole Business": "Shenshou" can be said to be an officially built "model room". In order to set an example for catering merchants, subsequent merchant self-broadcasts will be the main body of Meituan's live broadcast. At the same time, the most popular live broadcast rooms are currently the platform’s traffic and subsidies, and merchants subsidize the cost of goods, which does not involve charging traffic fees for the time being.

Obviously, in the past period of time, Douyin’s local life pressure on Meituan has fallen more on the store rather than the home.

Meituan disclosed in its earnings call that it is currently piloting a new marketing model for its takeout and in-store hotel and travel businesses. For example, live broadcasts, short videos and limited-time sales have been launched to guide user traffic to the products that merchants want to promote and help merchants create popular products. This kind of exploration is defined as shelf + hot style.

Judging from the data in the official live broadcast room of Meituan Waimai, it has given the outside world a signal: Meituan may be able to do live broadcasts.

During Meituan’s two Coupon Festival live broadcasts in April and May, Wallace store sales increased by 4% to 10% month-on-month, and the commodity coupons directly brought more than 100,000 new customers to it.

From the perspective of Meituan’s external caliber, high sales and high conversion are their main promotion of live streaming. According to previously disclosed data, the write-off rate of some single products in Meituan’s takeaway live broadcast room can reach 75%. At the same time, the write-off of one commodity coupon will drive a 1.5-fold increase in order transaction volume. Data from Jiuqian Zhongtai estimates that the write-off rate of Douyin’s takeaway group purchases is only 61%.

From a merchant's perspective, the key factor in choosing to cooperate with Meituan Waimai for live streaming is not only high conversion, but also the ability to fulfill contracts.

As Wang Xing said at the financial report meeting in March this year: "Meituan is very confident in the quality of its riders, operating network and merchants. Some other platforms currently mainly provide scheduled delivery for the next day. This model The impact on us is limited, and consumers’ expectations are also different.”

Douyin, which launched Xindong takeout as early as 2021, has not expanded beyond the three cities of Beijing, Shanghai, and Chengdu until the first half of this year. It currently sells group meals with weak timeliness and high unit price per customer. The unit price per customer is 110 yuan - 130 yuan. The reason is that Douyin does not build its own logistics, but relies on third-party instant delivery platforms such as SF Express and Dada.

There is also no self-built logistics. Why is Douyin e-commerce successful but local life is so difficult?

On the one hand, takeout delivery requires higher timeliness, multiple concurrency, and greater randomness; on the other hand, third-party logistics costs are higher, and it is difficult to improve efficiency through system deployment, and delivery personnel will give priority to orders from their own platforms. CITIC Securities predicts that the average delivery cost of Meituan’s food delivery orders in 2022 will be 7.1 yuan, which is lower than SF Express’s 10.2 yuan in the same city.

According to "Blue Hole Business", starting in July, Douyin Life Service has introduced "group purchase and distribution agents" in five cities: Beijing, Shanghai, Guangzhou, Chengdu, and Changsha to help willing merchants in the service area open group purchase and distribution services, and 33 selected agents have been announced. Just last month, according to a report by "LatePost", Douyin Waimai had given up its GMV target of 100 billion yuan this year.

It is not difficult to see that Douyin still intends to develop the food delivery business, but it has no intention to build its own fulfillment system in the short term.

In addition to the ability to fulfill contracts, another reason that has hindered the development of Douyin's takeout is that compared to in-store dining, takeout does not rely on traffic and is more biased towards search. This is the logic of "people looking for goods", while Douyin still prefers " The flow logic of "finding people for goods". Many merchants started group buying on Douyin and also opened takeout services. But when they found that it was not cost-effective, they closed them down.

"For catering merchants, both home delivery and in-store delivery are necessary products. In the short term, both platforms will be considered. In the future, the focus will still be on one platform for refined operations. If Douyin takeout cannot be implemented, merchants will It will flow back to Meituan." An industry insider said.

Zhang Yiming must fight in the takeout battle, but it is difficult to win by bypassing contract fulfillment. Wang Xing once said in 2019: "The failure of most companies is not that they fail to master difficult movements, but that there is a problem with the basic skills." "If we practice the basic skills solidly, we can win 99% of things."

2. When you go to the store, will Douyin do a miracle?

Completely opposite to Meituan. Douyin's first success in local life is to go to the store.

36Kr reports that Douyin’s local life services will complete approximately 77 billion yuan in GMV in 2022, equivalent to 48% of Meituan’s. According to a recent report by LatePost, the transaction volume of Douyin’s in-store and hotel and travel business before write-off remained at about 40% of Meituan’s. Six months ago, this number was close to 45%.

0 notes

Link

0 notes

Text

Numbers to dream about - 84% of your target market in one place

How to market to Chinese in Australia (and the world!) – Some Tricks to Help You It sounds too good to be true! Well yes and no. If you are targeting the Chinese market in Australia, 84% of them are on WeChat. Extrapolate that to China and WeChat is a super tool that you can’t ignore – used correctly, it may supercharge your sales.

But your competitors won’t ignore it either! So you have to be strategic.

Why WeChat is a Must

The Lowy Institute undertook a survey in 2021 in Australia and ascertained that 84% of Chinese in Australia get their news and information from WeChat marketing. The numbers stack up whether you are selling something to local Chinese in Australia or wanting to get in front of their mainland friends.

Described as the “one app to rule them all” by Harvard Business Review, WeChat impacts every facet of life for most Chinese: work, health, travel, food, entertainment, education, arts, finance/investment, purchasing, pets, government, even politics (if you are in Australia that is).

Many people make purchases directly in WeChat – you need to make it easy for them to find you and buy.People in WeChat circles will check out your brand or service and pay attention to influencer or friend recommendations too. If they can find you! Overall you need to develop a strategy.

Get me on WeChat!

If you are a business, retailer, tourism site, beauty or health service, financial or advisory services provider, real estate business, educator, arts entity, or organisation with interests or market in China (or want one), you should consider WeChat. We’d like to share a few tricks to help you get onto WeChat and to make the most of it.

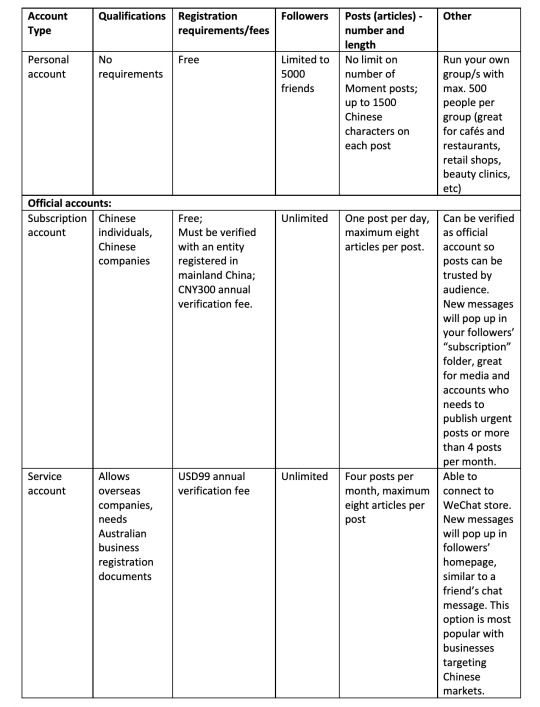

You should immediately set up a personal account so you can delve into the WeChat marketing world (it’s free).

How to market on WeChat

Once you’ve chosen your ideal account type (and seek our help if you’re still not sure), you need to get the word out there! The account will have a QR code (example below) You can scan it and follow – put it on all your marketing materials (especially Chinese facing ones) so your target audience can follow too.

Example: QR code for Chinsight

It is especially important if you are a brand aiming to get into China that you build up awareness at home first. If the local Chinese find and like your offering, they’ll promote and even send the product to China.

Make sure the content is relevant and interesting to your audience and use attractive layouts, readable fonts and appropriate images to capture their eyeballs.

Allocate some budget for promotion and influencers to drive traffic. For example, run some collaborations with other official accounts. Make sure to reach out to all your contacts, stakeholders, clients, etc. and get them to follow and repost content.Beware of censorship; content that is controversial or perceived to be sensitive to China will be deleted.

Make a special offer (especially before and during festivals) and track purchases or queries with a code or coupon). Monitor data and respond to messages and comments.

Don’t leave it too long, the competition is hotting up and if the Chinese are on your radar, WeChat shouldn’t be ignored.

Glossary to help

Post – What is published - each post can contain multiple articles.

Personal account – or personal contact account, similar to your WhatsApp and Messenger accounts.

KOL (Key Opinion Leaders) – Professional accounts with large numbers of followers and specialising in one market.

QR code – we are all familiar with this device now used when we register to dine out – a QR code can also link to a website or WeChat account.

Mini program – sub-applications that include tools to use in daily life where you don’t have to leave the WeChat app, e.g. ordering food deliveries.

Moments – similar to Instagram, individuals can post content to generate the feed for their followers, including text, images, videos, and re-posts of other articles.

WeChat Groups – you can create your WeChat group or join other WeChat groups. If you are running your own business, creating a personal account and setting up some WeChat groups may be the fastest way to know your customers and let them know you!

Tencent – one of the behemoths ruling China’s media. Its products include WeChat, QQ, Tencent Video, QQ music, plus a variety of mobile games, etc.

_______________________________________________________________________

Written by Rebecca Song

All rights reserved 2020 © Kongfuseo Digital Marketing Pty Ltd.

#chinese#chinese market#wechat#wechat marketing#chinese marketing#seo blog#Chin Communications#seo services

0 notes

Photo

As much of the world contends with the serious impact of the coronavirus outbreak, innovation and creative solutions abound. This week, PSFK turns its lens to the ways emerging technology is enabling businesses and services to carry on and communities to come together in new, virtual formats—from clubbing in the cloud and streaming health to neighborhood grocery runs and much more.

We are also excited to present new research into the emerging recommerce operations that retailers are embracing to foster more sustainable business—PSFK Members now have access to the fresh 21-page paper full of inspiring trends and compelling examples here!

Spotlight

At times of crisis like this, we see innovation flourish. In particular, we see the popularization of obscure technologies and the mainstreaming of niche consumer behaviors. Yes, we can point to the jet engine or the radar as well-known examples of this, but did you know that China’s strength in ecommerce rose out of the impact of the SARS epidemic, or that Shopify’s user baseexploded during the financial crisis when people were laid off and wanted to find something to do online?

For this analysis piece, PSFK researchers explored what ideas and technologies that have been manifesting at the ‘edges’ will evolve rapidly as a result of mass confinement, safety worries and inventory shortages? Here’s a run-through of possibilities:

Facial Recognition Roll-Out — Organizations and government bodies ask people to adjust their privacy expectations for access to mass transport, health care and other services. In China, facial recognition programs have been designed to both overcome the wearing of surgical masks and identify people whose foreheads have high temperatures.

Take-Out Becomes Grocery-In — Unsure about the safety of the food prepared in restaurant kitchens (and meeting the delivery person), people order the delivery of the raw ingredients instead to cook at home. For some restaurants in China, delivery has declined 50% while grocery stores have seen a 70% increase.

Informal Group Buying — This sees shoppers getting together to buy in bulk: they communicate over chat platforms and then one of them buys the products. In China, people are doing this to buy their apartment block’s weekly shopping: Residents scan a QR code, join a WeChat group, and post a list of what they have run out of.

Informal Wholesaling — People notice demand for a product and buy up in bulk so they can then retail individual units through ecommerce channels. We witness this with surgical masks on Facebook and Craigslist.

Video Connections — Video conferencing and chat becomes the main way for people, businesses and services to connect. Here are five sub-themes:

Cloud Entertainment — Musicians play live from venues (and theirbedrooms) to at-home crowds watching and sharing on social media. Lots of examples have cropped up in China as festivals and night clubs now entertain through social streams.

Streaming Fitness — Like musicians, physical trainers and gym instructors share routines in a crammed space. We’ve been watching the rise of premium versions of this with the likes of Peloton; now we witness the broadening of access to live fitness instruction over the web. The BBC also writes about a scenario in China where friends tag other friends on social media to do plank challenges.

Show Conferencing — The broadcast of fashion and business events to a professional audience via web conference. Giorgio Armani recently streamed his Milan Fashion Week runway show from inside an empty showroom. Read more on this.

Connected Education — Meeting the right teacher to give the right lesson at the right time via web-conferencing. In China, students are sending videos back as homework assignments.

Live Commerce — Real time web-shows retailing products across platforms. When Chinese brand Forest Cabin realized recently they were two months away from running out of cash, they asked 500 of their staff to work as livestream hosts to sell products online.

Robot Delivery — The autonomous transportation of shopping to peoples’ homes with wheels and with rotors. Ecommerce company Meituan-Dianping is running mini-trucks for groceries on some Chinese streets and in Wuhan, customers use facial recognition tech to access parcels in JD.com’s autonomous carts (without having to touch the vehicle).

Citizen Reporting — The contribution of information to help authorities understand needs. In China and Korea, developers have created hacks for the phone that use government and user-reported data to provide geography-based health reports.

Try & Return — The shipping of products so prospective consumers can check them out. In Korea, Samsung has cancelled its experiential retail program and switched to an at-home testing strategy.

QR Signage — The use of QR to share public information or allow access. Some signage is being hung by drones and at other times the codes check personal credentials to grant entry to a bus or market.

Contactless Delivery Options — Restaurants and other retail businesses use click-and-drop units in third-party areas to avoid human-to-human connection. eCommerce company Meituan-Dianping is offering a “contactless” solutionwhere delivery drivers drop off customer orders at special cabinets.

A lot of these ideas have been circulating for a while now, but PSFK researchers think that this crisis is going to bring then to the mainstream. Sometimes the “way we always did things” needs to change, so we move on to different tools, means and formats—and then once again, we will meet up with each other and still laugh and play, eat and dance.

Stay safe out there.

0 notes

Text

Leveraging Social Platforms For Brand Success

While it is certainly important and meaningful for consumers to know that their brand stands for something beyond the products they sell, we build brands for one reason – to drive business. We’ve said before that the business of China is business, and if you want to find inspiration for what the future might be, look no further than emerging markets, particularly China.

Today, online shopping in China has never been more easy or intuitive. While there’s plenty of excitement happening from e-commerce leaders like Alibaba, at the opposite end, brands are tapping into the power of small, looking at social platforms like WeChat to bring their brands and the customers who buy closer together, and with less friction.

Nearly one-third of Chinese consumers spend about four hours per day using the WeChat app. Not only do they use it to message friends, they use it to pay bills, and it seems more are using it to shop. Jessica Rapp highlights how beauty brand FeelUnique recently setup an e-commerce service on the platform’s Mini Program (a lightweight sub-app), allowing users to seamlessly browse and buy all their cosmetics without ever having to leave the app.

FeelUnique CEO Joël Palix says, “Our Mini Program represents an additional channel to drive consumer acquisition in China. It will leverage our existing WeChat presence—which includes an official account with over 100,000 followers and a WeChat store—by enabling customers to complete a purchase within the WeChat ecosystem.”

Since WeChat’s launching of Mini Programs in 2017, more than half a million have been developed, and more than one-third of users spend between $80-$150 per month, using WeChat Pay. And while the social commerce approach is not unique to China, it seems China is where the approach is most successful. Instagram has been rolling out a feature that allows users to connect to a purchasing page by engaging with a shoppable post, but only five products can be listed at once. Facebook has also been experimenting with e-commerce too, but as a media company, many brands want Facebook to drive traffic to retailers rather than becoming a retailer.

What’s great is the partnership between brands and the WeChat platform, which is investing significant money in creating and offering new ways for shoppers to engage brands within their ecosystem. As Rapp highlights, “L’Oréal harnessed a WeChat Mini Program to create a shoppable livestream event at the Cannes Film Festival. And in the household goods arena, Pinduoduo, a similar platform to Groupon, shot up to the number two e-commerce app in China in December 2017, gaining popularity by allowing users to gather WeChat friends to buy the same product, to get major discounts. And the social commerce craze shows no signs of slowing down.”

The lesson here should be pretty simple. While social commerce might seem to be a new ‘bright shiny object’ the intent is as pure as it gets: Remove barriers between the customer and purchasing. Too often, in order to be on the cutting edge, brands pursue tactics that might be highly visible and noteworthy (like 3D augmented reality mirrors) and attract a lot of press, but might not deliver on the fundamentals.

While there is value in pushing the boundaries of the possible, every brand must be thinking of ways they can make it easier and simpler to connect customers with what they want. Social commerce and its execution in China should be all the evidence brands need to find ways to take what brands are teaching us in one country and apply it in ways that can work globally.

The Blake Project Can Help: Accelerate Brand Growth Through Powerful Emotional Connections

Branding Strategy Insider is a service of The Blake Project: A strategic brand consultancy specializing in Brand Research, Brand Strategy, Brand Licensing and Brand Education

FREE Publications And Resources For Marketers

0 notes

Text

0 notes

Text

Can Meituan defeat magic with magic?

On the highway of local life, Meituan is running all the way with takeaways, restaurants, wine and hotels, etc. When it comes to the turning point of "live broadcast", it runs into Douyin, which has changed its direction from short video and e-commerce.

In the ancient business of catering, a new revolution is taking place.

Wang Xing and Zhang Yiming are the initiators of this change. One of them advocates "long-term patience" and the other claims "vigor can produce miracles." Live broadcast + local life is their new battlefield.

As Wang Xing said many years ago, this HE Tuber is an era of never-ending peace. Some investors once asserted, "We must fight the war at other people's homes. Even if we lose, we will not lose. What we will break are other people's bottles and cans."

The intersection between the two business tycoons is no stranger to the outside world. Although the current situation is not the first time this pair of old acquaintances have crossed paths, it is the most "sparky" one.

According to "LatePost" previous reports, in 2022, Douyin's catering transaction volume has been close to half of Meituan's; in early February 2023, Douyin's local life's transaction volume contributed by the catering business has been higher than that of the hotel, tourism and comprehensive business Sum.

The latest data from QuestMobile shows that the number of overlapping users of Meituan and Douyin exceeds 300 million, accounting for 81.0% of Meituan’s users. As an old rival of Meituan’s food delivery business, Ele.me’s overlapping users account for less than 20% of Meituan’s users.

Douyin's magic to quickly seize the market is "live broadcasting". Although the entry of opponents will help make the pie bigger, who is the winner under the 28-20 rule is crucial. Meituan finally took up arms. Its live broadcast business has grown from two years ago. Start testing the waters and accelerate after building a live broadcast center this year.

And savvy catering businesses are also voting with their feet. Take Wallace, which has nearly 20,000 stores, as an example. During this year’s 618 period, it gained highlights in both Meituan and Douyin. At Meituan’s “618 Group Coupon Festival”, its sales of value-for-money packages exceeded 150 million yuan; while Douyin’s “618 Group Coupon Festival” ranked fifth on the best-selling brand list.

What’s interesting is that Wallace walked into Meituan’s takeout live broadcast room, while the one on Douyin was an in-store live broadcast with online group coupons and offline verification. To a certain extent, the choice of chain merchants also reflects the differences between Meituan and Douyin in local life live broadcasting.

Meituan, standing at the center of the whirlpool, can it use the magic of Douyin to fight back against Douyin this time?

1. How much patience does Meituan have during live streaming?

Meituan Runtong’s first live broadcast product is home delivery (takeaway).

The "Shenshou" live broadcast room is the first official live broadcast room of Meituan to break out of the circle. It focuses on "magic low prices and instant grabs." In fact, its earliest live broadcast attempt was in September 2022, and it did not start daily broadcast until March this year. Meituan’s attempts at live broadcasting date back to earlier, and food delivery is not the vanguard.

In December 2020, Meituan launched the "Meituan Mlive" mini program on WeChat, which was limited to medical beauty and education merchants and has not yet covered the huge takeout merchants. In April 2022, Meituan launched the "Meituan Live Assistant" APP and launched the "Food Live" channel in an attempt to open new sales channels for catering merchants.

In the past two years or so, multiple businesses within Meituan have tried live broadcasting, but they have all stopped. According to "Blue Hole Business", it was not until the first half of this year that Meituan's live broadcast business established an independent team and set up a live broadcast center at the technical level. Each business unit can use this capability.

The popular live broadcast room of Meituan’s food delivery god

A person related to Meituan told "Blue Hole Business": "Shenshou" can be said to be an officially built "model room". In order to set an example for catering merchants, subsequent merchant self-broadcasts will be the main body of Meituan's live broadcast. At the same time, the most popular live broadcast rooms are currently the platform’s traffic and subsidies, and merchants subsidize the cost of goods, which does not involve charging traffic fees for the time being.

Obviously, in the past period of time, Douyin’s local life pressure on Meituan has fallen more on the store rather than the home.

Meituan disclosed in its earnings call that it is currently piloting a new marketing model for its takeout and in-store hotel and travel businesses. For example, live broadcasts, short videos and limited-time sales have been launched to guide user traffic to the products that merchants want to promote and help merchants create popular products. This kind of exploration is defined as shelf + hot style.

Judging from the data in the official live broadcast room of Meituan Waimai, it has given the outside world a signal: Meituan may be able to do live broadcasts.

During Meituan’s two Coupon Festival live broadcasts in April and May, Wallace store sales increased by 4% to 10% month-on-month, and the commodity coupons directly brought more than 100,000 new customers to it.

From the perspective of Meituan’s external caliber, high sales and high conversion are their main promotion of live streaming. According to previously disclosed data, the write-off rate of some single products in Meituan’s takeaway live broadcast room can reach 75%. At the same time, the write-off of one commodity coupon will drive a 1.5-fold increase in order transaction volume. Data from Jiuqian Zhongtai estimates that the write-off rate of Douyin’s takeaway group purchases is only 61%.

From a merchant's perspective, the key factor in choosing to cooperate with Meituan Waimai for live streaming is not only high conversion, but also the ability to fulfill contracts.

As Wang Xing said at the financial report meeting in March this year: "Meituan is very confident in the quality of its riders, operating network and merchants. Some other platforms currently mainly provide scheduled delivery for the next day. This model The impact on us is limited, and consumers’ expectations are also different.”

Douyin, which launched Xindong takeout as early as 2021, has not expanded beyond the three cities of Beijing, Shanghai, and Chengdu until the first half of this year. It currently sells group meals with weak timeliness and high unit price per customer. The unit price per customer is 110 yuan - 130 yuan. The reason is that Douyin does not build its own logistics, but relies on third-party instant delivery platforms such as SF Express and Dada.

There is also no self-built logistics. Why is Douyin e-commerce successful but local life is so difficult?

On the one hand, takeout delivery requires higher timeliness, multiple concurrency, and greater randomness; on the other hand, third-party logistics costs are higher, and it is difficult to improve efficiency through system deployment, and delivery personnel will give priority to orders from their own platforms. CITIC Securities predicts that the average delivery cost of Meituan’s food delivery orders in 2022 will be 7.1 yuan, which is lower than SF Express’s 10.2 yuan in the same city.

According to "Blue Hole Business", starting in July, Douyin Life Service has introduced "group purchase and distribution agents" in five cities: Beijing, Shanghai, Guangzhou, Chengdu, and Changsha to help willing merchants in the service area open group purchase and distribution services, and 33 selected agents have been announced. Just last month, according to a report by "LatePost", Douyin Waimai had given up its GMV target of 100 billion yuan this year.

It is not difficult to see that Douyin still intends to develop the food delivery business, but it has no intention to build its own fulfillment system in the short term.

In addition to the ability to fulfill contracts, another reason that has hindered the development of Douyin's takeout is that compared to in-store dining, takeout does not rely on traffic and is more biased towards search. This is the logic of "people looking for goods", while Douyin still prefers " The flow logic of "finding people for goods". Many merchants started group buying on Douyin and also opened takeout services. But when they found that it was not cost-effective, they closed them down.

"For catering merchants, both home delivery and in-store delivery are necessary products. In the short term, both platforms will be considered. In the future, the focus will still be on one platform for refined operations. If Douyin takeout cannot be implemented, merchants will It will flow back to Meituan." An industry insider said.

Zhang Yiming must fight in the takeout battle, but it is difficult to win by bypassing contract fulfillment. Wang Xing once said in 2019: "The failure of most companies is not that they fail to master difficult movements, but that there is a problem with the basic skills." "If we practice the basic skills solidly, we can win 99% of things."

2. When you go to the store, will Douyin do a miracle?

Completely opposite to Meituan. Douyin's first success in local life is to go to the store.

36Kr reports that Douyin’s local life services will complete approximately 77 billion yuan in GMV in 2022, equivalent to 48% of Meituan’s. According to a recent report by LatePost, the transaction volume of Douyin’s in-store and hotel and travel business before write-off remained at about 40% of Meituan’s. Six months ago, this number was close to 45%.

0 notes

Text

India’s most popular services are becoming super apps

Truecaller, an app that helps users screen strangers and robocallers, will soon allow users in India, its largest market, to borrow up to a few hundred dollars in the nation.

The crediting option will be the fourth feature the nine-year-old app adds to its service in the last two years. So far it has added to the service the ability to text, record phone calls and mobile payment features, some of which are only available to users in India. Of the 140 million daily active users of Truecaller, 100 million live in India.

The story of the ever-growing ambition of Truecaller illustrates an interesting phase in India’s internet market that is seeing a number of companies mold their single-functioning app into multi-functioning so-called super apps.

Inspired by China

This may sound familiar. Truecaller and others are trying to replicate Tencent’s playbook. The Chinese tech giant’s WeChat, an app that began life as a messaging service, has become a one-stop solution for a range of features — gaming, payments, social commerce and publishing platform — in recent years.

WeChat has become such a dominant player in the Chinese internet ecosystem that it is effectively serving as an operating system and getting away with it. The service maintains its own app store that hosts mini apps and lets users tip authors. This has put it at odds with Apple, though the iPhone-maker has little choice but to make peace with it.

For all its dominance in China, WeChat has struggled to gain traction in India and elsewhere. But its model today is prominently on display in other markets. Grab and Go-Jek in Southeast Asian markets are best known for their ride-hailing services, but have begun to offer a range of other features, including food delivery, entertainment, digital payments, financial services and healthcare.

The proliferation of low-cost smartphones and mobile data in India, thanks in part to Google and Facebook, has helped tens of millions of Indians come online in recent years, with mobile the dominant platform. The number of internet users has already exceeded 500 million in India, up from some 350 million in mid-2015. According to some estimates, India may have north of 625 million users by year-end.

This has fueled the global image of India, which is both the fastest growing internet and smartphone market. Naturally, local apps in India, and those from international firms that operate here, are beginning to replicate WeChat’s model.

Founder and chief executive officer (CEO) of Paytm Vijay Shekhar Sharma speaks during the launch of Paytm payments Bank at a function in New Delhi on November 28, 2017 (AFP PHOTO / SAJJAD HUSSAIN)

Leading that pack is Paytm, the popular homegrown mobile wallet service that’s valued at $18 billion and has been heavily backed by Alibaba, the e-commerce giant that rivals Tencent and crucially missed the mobile messaging wave in China.

Commanding attention

In recent years, the Paytm app has taken a leaf from China with additions that include the ability to text merchants; book movie, flight and train tickets; and buy shoes, books and just about anything from its e-commerce arm Paytm Mall . It also has added a number of mini games to the app. The company said earlier this month that more than 30 million users are engaging with its games.

Why bother with diversifying your app’s offering? Well, for Vijay Shekhar Sharma, founder and CEO of Paytm, the question is why shouldn’t you? If your app serves a certain number of transactions (or engagements) in a day, you have a good shot at disrupting many businesses that generate fewer transactions, he told TechCrunch in an interview.

At the end of the day, companies want to garner as much attention of a user as they can, said Jayanth Kolla, founder and partner of research and advisory firm Convergence Catalyst.

“This is similar to how cable networks such as Fox and Star have built various channels with a wide range of programming to create enough hooks for users to stick around,” Kolla said.

“The agenda for these apps is to hold people’s attention and monopolize a user’s activities on their mobile devices,” he added, explaining that higher engagement in an app translates to higher revenue from advertising.

Paytm’s Sharma agrees. “Payment is the mote. You can offer a range of things including content, entertainment, lifestyle, commerce and financial services around it,” he told TechCrunch. “Now that’s a business model… payment itself can’t make you money.”

Big companies follow suit

Other businesses have taken note. Flipkart -owned payment app PhonePe, which claims to have 150 million active users, today hosts a number of mini apps. Some of those include services for ride-hailing service Ola, hotel booking service Oyo and travel booking service MakeMyTrip.

Paytm (the first two images from left) and PhonePe offer a range of services that are integrated into their payments apps

What works for PhonePe is that its core business — payments — has amassed enough users, Himanshu Gupta, former associate director of marketing and growth for WeChat in India, told TechCrunch. He added that unlike e-commerce giant Snapdeal, which attempted to offer similar offerings back in the day, PhonePe has tighter integration with other services, and is built using modern architecture that gives users almost native app experiences inside mini apps.

When you talk about strategy for Flipkart, the homegrown e-commerce giant acquired by Walmart last year for a cool $16 billion, chances are arch rival Amazon is also hatching similar plans, and that’s indeed the case for super apps.

In India, Amazon offers its customers a range of payment features such as the ability to pay phone bills and cable subscription through its Amazon Pay service. The company last year acquired Indian startup Tapzo, an app that offers integration with popular services such as Uber, Ola, Swiggy and Zomato, to boost Pay’s business in the nation.

Another U.S. giant, Microsoft, is also aboard the super train. The Redmond-based company has added a slew of new features to SMS Organizer, an app born out of its Microsoft Garage initiative in India. What began as a texting app that can screen spam messages and help users keep track of important SMSs recently partnered with education board CBSE in India to deliver exam results of 10th and 12th grade students.

This year, the SMS Organizer app added an option to track live train schedules through a partnership with Indian Railways, and there’s support for speech-to-text. It also offers personalized discount coupons from a range of companies, giving users an incentive to check the app more often.

Like in other markets, Google and Facebook hold a dominant position in India. More than 95% of smartphones sold in India run the Android operating system. There is no viable local — or otherwise — alternative to Search, Gmail and YouTube, which counts India as its fastest growing market. But Google hasn’t necessarily made any push to significantly expand the scope of any of its offerings in India.

India is the biggest market for WhatsApp, and Facebook’s marquee app too has more than 250 million users in the nation. WhatsApp launched a pilot payments program in India in early 2018, but is yet to get clearance from the government for a nationwide rollout. (It isn’t happening for at least another two months, a person familiar with the matter said.) In the meanwhile, Facebook appears to be hatching a WeChatization of Messenger, albeit that app is not so big in India.

Ride-hailing service Ola too, like Grab and Go-Jek, plans to add financial services such as credit to the platform this year, a source familiar with the company’s plans told TechCrunch.

“We have an abundance of data about our users. We know how much money they spend on rides, how often they frequent the city and how often they order from restaurants. It makes perfect sense to give them these valued-added features,” the person said. Ola has already branched out of transport after it acquired food delivery startup Foodpanda in late 2017, but it hasn’t yet made major waves in financial services despite giving its Ola Money service its own dedicated app.

The company positioned Ola Money as a super app, expanded its features through acquisition and tie ups with other players and offered discounts and cashbacks. But it remains behind Paytm, PhonePe and Google Pay, all of which are also offering discounts to customers.

Integrated entertainment

Super apps indeed come in all shapes and sizes, beyond core services like payment and transportation — the strategy is showing up in apps and services that entertain India’s internet population.

MX Player, a video playback app with more than 175 million users in India that was acquired by Times Internet for some $140 million last year, has big ambitions. Last year, it introduced a video streaming service to bolster its app to grow beyond merely being a repository. It has already commissioned the production of several original shows.

In recent months, it has also integrated Gaana, the largest local music streaming app that is also owned by Times Internet. Now its parent company, which rivals Google and Facebook on some fronts, is planning to add mini games to MX Player, a person familiar with the matter said, to give it additional reach and appeal.

Some of these apps, especially those that have amassed tens of millions of users, have a real shot at diversifying their offerings, analyst Kolla said. There is a bar of entry, though. A huge user base that engages with a product on a daily basis is a must for any company if it is to explore chasing the super app status, he added.

Indeed, there are examples of companies that had the vision to see the benefits of super apps but simply couldn’t muster the requisite user base. As mentioned, Snapdeal tried and failed at expanding its app’s offerings. Messaging service Hike, which was valued at more than $1 billion two years ago and includes WeChat parent Tencent among its investors, added games and other features to its app, but ultimately saw poor engagement. Its new strategy is the reverse: to break its app into multiple pieces.

“In 2019, we continue to double down on both social and content but we’re going to do it with an evolved approach. We’re going to do it across multiple apps. That means, in 2019 we’re going to go from building a super app that encompasses everything, to Multiple Apps solving one thing really well. Yes, we’re unbundling Hike,” Kavin Mittal, founder and CEO of Hike, wrote in an update published earlier this year.

And Reliance Jio, of course

For the rest, the race is still on, but there are big horses waiting to enter to add further competition.

Reliance Jio, a subsidiary of conglomerate Reliance Industry that is owned by India’s richest man, Mukesh Ambani, is planning to introduce a super app that will host more than 100 features, according to a person familiar with the matter. Local media first reported the development.

It will be fascinating to see how that works out. Reliance Jio, which almost single-handedly disrupted the telecom industry in India with its low-cost data plans and free voice calls, has amassed tens of millions of users on the bouquet of apps that it offers at no additional cost to Jio subscribers.

Beyond that diverse selection of homespun apps, Reliance has also taken an M&A-based approach to assemble the pieces of its super app strategy.

It bought music streaming service Saavn last year and quickly integrated it with its own music app JioMusic. Last month, it acquired Haptik, a startup that develops “conversational” platforms and virtual assistants, in a deal worth more than $100 million. It already has the user bases required. JioTV, an app that offers access to over 500 TV channels; and JioNews, an app that additionally offers hundreds of magazines and newspapers, routinely appear among the top apps in Google Play Store.

India’s super app revolution is in its early days, but the trend is surely one to keep an eye on as the country moves into its next chapter of internet usage.

from iraidajzsmmwtv https://tcrn.ch/2VYrwmG via IFTTT

0 notes

Link

Truecaller, an app that helps users screen strangers and robocallers, will soon allow users in India, its largest market, to borrow up to a few hundred dollars in the nation.

The crediting option will be the fourth feature the nine-year-old app adds to its service in the last two years. So far it has added to the service the ability to text, record phone calls and mobile payment features, some of which are only available to users in India. Of the 140 million daily active users of Truecaller, 100 million live in India.

The story of the ever-growing ambition of Truecaller illustrates an interesting phase in India’s internet market that is seeing a number of companies mold their single-functioning app into multi-functioning so-called super apps.

Inspired by China

This may sound familiar. Truecaller and others are trying to replicate Tencent’s playbook. The Chinese tech giant’s WeChat, an app that began life as a messaging service, has become a one-stop solution for a range of features — gaming, payments, social commerce and publishing platform — in recent years.

WeChat has become such a dominant player in the Chinese internet ecosystem that it is effectively serving as an operating system and getting away with it. The service maintains its own app store that hosts mini apps and lets users tip authors. This has put it at odds with Apple, though the iPhone-maker has little choice but to make peace with it.

For all its dominance in China, WeChat has struggled to gain traction in India and elsewhere. But its model today is prominently on display in other markets. Grab and Go-Jek in Southeast Asian markets are best known for their ride-hailing services, but have begun to offer a range of other features, including food delivery, entertainment, digital payments, financial services and healthcare.

The proliferation of low-cost smartphones and mobile data in India, thanks in part to Google and Facebook, has helped tens of millions of Indians come online in recent years, with mobile the dominant platform. The number of internet users has already exceeded 500 million in India, up from some 350 million in mid-2015. According to some estimates, India may have north of 625 million users by year-end.

This has fueled the global image of India, which is both the fastest growing internet and smartphone market. Naturally, local apps in India, and those from international firms that operate here, are beginning to replicate WeChat’s model.

Founder and chief executive officer (CEO) of Paytm Vijay Shekhar Sharma speaks during the launch of Paytm payments Bank at a function in New Delhi on November 28, 2017 (AFP PHOTO / SAJJAD HUSSAIN)

Leading that pack is Paytm, the popular homegrown mobile wallet service that’s valued at $18 billion and has been heavily backed by Alibaba, the e-commerce giant that rivals Tencent and crucially missed the mobile messaging wave in China.

Commanding attention

In recent years, the Paytm app has taken a leaf from China with additions that include the ability to text merchants; book movie, flight and train tickets; and buy shoes, books and just about anything from its e-commerce arm Paytm Mall. It also has added a number of mini games to the app. The company said earlier this month that more than 30 million users are engaging with its games.

Why bother with diversifying your app’s offering? Well, for Vijay Shekhar Sharma, founder and CEO of Paytm, the question is why shouldn’t you? If your app serves a certain number of transactions (or engagements) in a day, you have a good shot at disrupting many businesses that generate fewer transactions, he told TechCrunch in an interview.

At the end of the day, companies want to garner as much attention of a user as they can, said Jayanth Kolla, founder and partner of research and advisory firm Convergence Catalyst.

“This is similar to how cable networks such as Fox and Star have built various channels with a wide range of programming to create enough hooks for users to stick around,” Kolla said.

“The agenda for these apps is to hold people’s attention and monopolize a user’s activities on their mobile devices,” he added, explaining that higher engagement in an app translates to higher revenue from advertising.

Paytm’s Sharma agrees. “Payment is the mote. You can offer a range of things including content, entertainment, lifestyle, commerce and financial services around it,” he told TechCrunch. “Now that’s a business model… payment itself can’t make you money.”

Big companies follow suit

Other businesses have taken note. Flipkart-owned payment app PhonePe, which claims to have 150 million active users, today hosts a number of mini apps. Some of those include services for ride-hailing service Ola, hotel booking service Oyo and travel booking service MakeMyTrip.

Paytm (the first two images from left) and PhonePe offer a range of services that are integrated into their payments apps

What works for PhonePe is that its core business — payments — has amassed enough users, Himanshu Gupta, former associate director of marketing and growth for WeChat in India, told TechCrunch. He added that unlike e-commerce giant Snapdeal, which attempted to offer similar offerings back in the day, PhonePe has tighter integration with other services, and is built using modern architecture that gives users almost native app experiences inside mini apps.

When you talk about strategy for Flipkart, the homegrown e-commerce giant acquired by Walmart last year for a cool $16 billion, chances are arch rival Amazon is also hatching similar plans, and that’s indeed the case for super apps.

In India, Amazon offers its customers a range of payment features such as the ability to pay phone bills and cable subscription through its Amazon Pay service. The company last year acquired Indian startup Tapzo, an app that offers integration with popular services such as Uber, Ola, Swiggy and Zomato, to boost Pay’s business in the nation.

Another U.S. giant, Microsoft, is also aboard the super train. The Redmond-based company has added a slew of new features to SMS Organizer, an app born out of its Microsoft Garage initiative in India. What began as a texting app that can screen spam messages and help users keep track of important SMSs recently partnered with education board CBSE in India to deliver exam results of 10th and 12th grade students.

This year, the SMS Organizer app added an option to track live train schedules through a partnership with Indian Railways, and there’s support for speech-to-text. It also offers personalized discount coupons from a range of companies, giving users an incentive to check the app more often.

Like in other markets, Google and Facebook hold a dominant position in India. More than 95% of smartphones sold in India run the Android operating system. There is no viable local — or otherwise — alternative to Search, Gmail and YouTube, which counts India as its fastest growing market. But Google hasn’t necessarily made any push to significantly expand the scope of any of its offerings in India.

India is the biggest market for WhatsApp, and Facebook’s marquee app too has more than 250 million users in the nation. WhatsApp launched a pilot payments program in India in early 2018, but is yet to get clearance from the government for a nationwide rollout. (It isn’t happening for at least another two months, a person familiar with the matter said.) In the meanwhile, Facebook appears to be hatching a WeChatization of Messenger, albeit that app is not so big in India.

Ride-hailing service Ola too, like Grab and Go-Jek, plans to add financial services such as credit to the platform this year, a source familiar with the company’s plans told TechCrunch.

“We have an abundance of data about our users. We know how much money they spend on rides, how often they frequent the city and how often they order from restaurants. It makes perfect sense to give them these valued-added features,” the person said. Ola has already branched out of transport after it acquired food delivery startup Foodpanda in late 2017, but it hasn’t yet made major waves in financial services despite giving its Ola Money service its own dedicated app.

The company positioned Ola Money as a super app, expanded its features through acquisition and tie ups with other players and offered discounts and cashbacks. But it remains behind Paytm, PhonePe and Google Pay, all of which are also offering discounts to customers.

Integrated entertainment

Super apps indeed come in all shapes and sizes, beyond core services like payment and transportation — the strategy is showing up in apps and services that entertain India’s internet population.

MX Player, a video playback app with more than 175 million users in India that was acquired by Times Internet for some $140 million last year, has big ambitions. Last year, it introduced a video streaming service to bolster its app to grow beyond merely being a repository. It has already commissioned the production of several original shows.

In recent months, it has also integrated Gaana, the largest local music streaming app that is also owned by Times Internet. Now its parent company, which rivals Google and Facebook on some fronts, is planning to add mini games to MX Player, a person familiar with the matter said, to give it additional reach and appeal.

Some of these apps, especially those that have amassed tens of millions of users, have a real shot at diversifying their offerings, analyst Kolla said. There is a bar of entry, though. A huge user base that engages with a product on a daily basis is a must for any company if it is to explore chasing the super app status, he added.

Indeed, there are examples of companies that had the vision to see the benefits of super apps but simply couldn’t muster the requisite user base. As mentioned, Snapdeal tried and failed at expanding its app’s offerings. Messaging service Hike, which was valued at more than $1 billion two years ago and includes WeChat parent Tencent among its investors, added games and other features to its app, but ultimately saw poor engagement. Its new strategy is the reverse: to break its app into multiple pieces.

“In 2019, we continue to double down on both social and content but we’re going to do it with an evolved approach. We’re going to do it across multiple apps. That means, in 2019 we’re going to go from building a super app that encompasses everything, to Multiple Apps solving one thing really well. Yes, we’re unbundling Hike,” Kavin Mittal, founder and CEO of Hike, wrote in an update published earlier this year.

And Reliance Jio, of course

For the rest, the race is still on, but there are big horses waiting to enter to add further competition.

Reliance Jio, a subsidiary of conglomerate Reliance Industry that is owned by India’s richest man, Mukesh Ambani, is planning to introduce a super app that will host more than 100 features, according to a person familiar with the matter. Local media first reported the development.

It will be fascinating to see how that works out. Reliance Jio, which almost single-handedly disrupted the telecom industry in India with its low-cost data plans and free voice calls, has amassed tens of millions of users on the bouquet of apps that it offers at no additional cost to Jio subscribers.

Beyond that diverse selection of homespun apps, Reliance has also taken an M&A-based approach to assemble the pieces of its super app strategy.

It bought music streaming service Saavn last year and quickly integrated it with its own music app JioMusic. Last month, it acquired Haptik, a startup that develops “conversational” platforms and virtual assistants, in a deal worth more than $100 million. It already has the user bases required. JioTV, an app that offers access to over 500 TV channels; and JioNews, an app that additionally offers hundreds of magazines and newspapers, routinely appear among the top apps in Google Play Store.

India’s super app revolution is in its early days, but the trend is surely one to keep an eye on as the country moves into its next chapter of internet usage.

from Mobile – TechCrunch https://tcrn.ch/2VYrwmG ORIGINAL CONTENT FROM: https://techcrunch.com/

0 notes

Text

Chatbots Market Global Development Industry Trends and Future Outlook to 2023

Market Highlights:

A Chatbot is an artificial intelligence or a computer program that conducts a conversation via textual or auditory methods. They can easily be described as the talking point of the business world. They have materialized as a point of help for the online consumers to navigate through the often-confusing world of the web, to guide them to select products and services, offer customer support, and even answer frequently asked questions. One of the major driving factor in the market is the increasing use of online messaging. Chatbot improve the customer service experience, reduce the wait time and being internet based they obviously never sleep, thus they provide service 24/7. Market Research Future projects a detailed report on the recent trends, various challenges faced and the segments of the market on which Chatbot is based. It is reported there will be a striking upsurge at 37% of CAGR between 2017 and 2023.

With this said, there are however many factors that stifle the growth of this particular market, mainly lack of expertise and lack of awareness. Prominent causes of this issue are high deployment costs and early adoption of technologies.

Get a Sample Report @ https://www.marketresearchfuture.com/sample_request/2981

Major Key Players

WeChat (China),

IBM (U.S.),

Naunce Communications Inc. (U.S.),

Artificial Solutions (Sweden),

Egain Corporation (U.S.),

Creative Virtual Pvt. Ltd. (U.K.),

NEXT IT Corp. (U.S.),

CX Company (Netherlands),

24/7 Customer Inc. (U.S.),

Codebaby (Idavatars), Inc. (U.S.),

Facebook, Inc. (U.S.),

DigitalGenius (U.K.),

Howdy (U.S.),

Speaktoit Inc. (U.S.),

Talla (U.S.),

Semantic Machines (U.S).

Industry News

As reported in May 2018, WeChat now allows Chinese consumers to file for divorce through their smartphones. According to reports, the tool is a pilot in a mini program for public services in the Guangdong province.

DigitalGenius, has raised $14.75m in a Series A funding round led by Global Founders Capital.

Nuance has acquired Voicebox For Natural Language Tech, as reported by GeekWire. Voicebox is a company that deals with Conversational AI, including Voice Recognition (VR), Natural Language Understanding (NLU), and AI services.

Market insights

The Chatbot Market since 2016 has been at an all-time high with regards to its growth. It’s grown by leaps and bound with regard to financial upsurge in the past few years, and is also estimated to reach approximately USD 6 billion, at CAGR of 37%. There are many factors that cater to this onrush, mainly extensive customer assistance, and proactive customer interaction, large share of the market depending on online messaging, multi lingual skills based Chatbots, and cost saving as Chatbots can cater to many customers at the same time without any delay. Major adoption of cloud-based systems can also be labelled as another reason for the growth.

Market Segmentation

The Chartbot market is divided on the basis of model/type, deployment, industry verticals, usage, end users, and regions.

On the basis of deployment, the market can be divided into cloud and on premise.

On the basis of model/type, the market can be further dissected into software and services.

Industry verticals are further split into media industry, health sector, customer service, education, hospitality and travel, banking, retail, publishing, BFSI, government and many more. Advancements in Artificial Intelligence (AI) have validated a new generation of Chatbots that are being utilized across all sectors.

The Chatbot market is segmented on the basis of usage, which is further divided into social media, mobile platform and others.

On the basis of end user, it is further segmented into large, small and medium enterprises.

Regional Analysis

North America is acknowledged to emerge as the largest region for the Chatbot market. On the other hand, Asia Pacific has been observed to be showing immense growth in the forecast period, making it the fastest growing region. Increased usage of tablets, mobiles, social media and technical advancements in the North American region are the main factors that attribute to it becoming the largest region in this market.

Browse Complete Report @ https://www.marketresearchfuture.com/reports/chatbots-market-2981

Intended Audience

Technology investors

Healthcare-related product manufacturers

Integrated device manufacturers (IDMs)

Original Manufacturers (OEMs)

Smart grid integrators

Surface mount component device distributors and providers

Research/Consultancy firms

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact:

Market Research Future

+1 646 845 9312

Email: [email protected]

0 notes

Text

Leveraging Social Platforms For Brand Success

While it is certainly important and meaningful for consumers to know that their brand stands for something beyond the products they sell, we build brands for one reason – to drive business. We’ve said before that the business of China is business, and if you want to find inspiration for what the future might be, look no further than emerging markets, particularly China.

Today, online shopping in China has never been more easy or intuitive. While there’s plenty of excitement happening from e-commerce leaders like Alibaba, at the opposite end, brands are tapping into the power of small, looking at social platforms like WeChat to bring their brands and the customers who buy closer together, and with less friction.

Nearly one-third of Chinese consumers spend about four hours per day using the WeChat app. Not only do they use it to message friends, they use it to pay bills, and it seems more are using it to shop. Jessica Rapp highlights how beauty brand FeelUnique recently setup an e-commerce service on the platform’s Mini Program (a lightweight sub-app), allowing users to seamlessly browse and buy all their cosmetics without ever having to leave the app.