#aadhar verification

Explore tagged Tumblr posts

Text

Aadhar verification service provide in jaipur

1 note

·

View note

Text

🔐 Identity fraud is on the rise — don’t let it impact your business!

As a top Aadhar Card Check Verification Agency in Punjab, we help

you confirm identities fast and with 100% compliance. ✅ Trusted by banks & telecoms ✅ Real-time document validation ✅ Accurate, confidential, and efficient Start verifying smarter. 💼

#Aadhar Card Check#businessverification#third party verification#singla enterprises#document verification

0 notes

Text

Avoid Fraud: Use GST Search Report to Verify Any Business

In today’s digital-first economy, verifying the authenticity of a business before entering into any transaction is more important than ever. One of the most reliable tools to prevent fraud and ensure legitimacy is the GST Search Report. Whether you're a buyer, supplier, investor, or service provider, understanding how to verify a GST number, check GST registration details, and perform a GSTIN verification can save you from legal troubles and financial losses.

Let’s dive into how you can leverage this tool to make informed decisions and where you can access authentic reports, such as through trusted platforms like ForceTrack.

What is a GST Search Report?

A GST Search Report provides detailed information about a business entity registered under the Goods and Services Tax (GST) system in India. It pulls data directly from the GST Network (GSTN), the official government portal managing GST registrations and compliance. This report typically includes:

GSTIN (Goods and Services Tax Identification Number)

Legal name of the business

Trade name (if any)

Constitution of business (e.g., Proprietorship, Partnership, Company)

Date of GST registration

Type of taxpayer (regular, composition, etc.)

GST return filing status

These details are crucial for individuals and businesses looking to enter into partnerships, execute high-value transactions, or confirm tax compliance status.

Why GST Verification Is Necessary

Fraudulent activities like fake invoicing, tax evasion, or operating under expired or invalid GST numbers are increasingly common. Here's why performing a GST number search and verifying the details is a wise move:

1. Avoid Business Scams

With GST verification, you can detect ghost companies or businesses operating under fake credentials.

2. Ensure Compliance

Before hiring a vendor or contractor, you should confirm their GST registration status to avoid issues with Input Tax Credit (ITC) claims.

3. Build Trust in Transactions

Providing verified GST details during transactions increases trust between parties and reflects professionalism.

What Is GSTIN and Why Is It Important?

The GSTIN (Goods and Services Tax Identification Number) is a 15-digit alphanumeric code issued by the GSTN to every registered taxpayer. It is unique to each state and business and reveals a lot about the entity.

For example:

The first two digits represent the state code.

The next ten digits are the PAN of the business.

The thirteenth digit denotes the number of registrations under the same PAN.

The fourteenth digit is usually ‘Z’ by default.

The last digit is a checksum character for error detection.

GSTIN verification ensures that this number is genuine and belongs to an active and compliant taxpayer.

How to Perform GST Number Search and Get an Online GST Report

Here’s how you can carry out a GST number search:

Step 1: Visit a Trusted Portal

While the official GST website (www.gst.gov.in) provides basic verification, platforms like ForceTrack offer comprehensive reports with additional insights like return filing history and status alerts.

Step 2: Enter the GSTIN

Input the 15-digit GST number into the search box and initiate the check.

Step 3: Get the Details

You’ll receive a full GST taxpayer details report including:

Name of business

Registration type

Filing frequency

Return filing history

GST compliance score (if available)

Step 4: Download or Save

Many services provide downloadable online GST reports, which are helpful for record-keeping, audits, or due diligence processes.

How to Verify GST Registration Details

The GST registration details allow you to understand the legitimacy and scale of a business. To verify:

Check the business type (Regular, Composition, Non-resident, etc.).

Review the date of registration to understand how long the business has been active.

Analyze the jurisdictional details to confirm geographic registration accuracy.

Platforms like ForceTrack automate this process and fetch complete and accurate GST registration status to help you make confident decisions.

What to Watch Out for in a GST Search Report

When reviewing the GST Search Report, pay attention to:

1. Inactive or Cancelled GSTIN

If a business has a cancelled registration, that’s a red flag. Always check the GST status check section for updates.

2. Mismatch in Business Name

The business name on the report should exactly match official communication. Any discrepancy should be investigated.

3. Multiple GSTINs under Same PAN

Some businesses operate in multiple states. If so, there should be separate GSTINs, and all should be active.

4. Delayed Return Filing

Frequent delays in GST return filing may indicate operational or financial instability.

Aadhar Search Report: A Bonus Layer of Verification

In addition to the GST Search Report, an Aadhar Search report adds another layer of due diligence when dealing with individual proprietors or small firms. By cross-verifying the Aadhar-linked details of a business owner, you can further ensure that the person you're dealing with is genuine and not operating under a false identity.

This is especially useful for businesses that are registered under proprietorship models, where personal and business identity are often closely linked.

When to Use a GST Search Report

Here are common scenarios where a GST Search Report becomes essential:

Before onboarding a vendor or supplier

When outsourcing services to a third party

For investors doing due diligence before funding a startup

During audits or internal compliance reviews

To verify eCommerce sellers or online business partners

How ForceTrack Helps in Business Verification

ForceTrack provides easy access to authentic GST data and allows users to:

Search by GSTIN or PAN

Download verified online GST reports

Cross-check multiple businesses in bulk

Receive alerts on changes in GST status

Unlike government portals that offer basic checks, ForceTrack compiles the data into a single report, saving time and reducing errors in manual verification.

Note: While we recommend using ForceTrack for ease and accuracy, always ensure you're using updated and official sources of data.

Also Read : How to Do Employee Verification in India Legally and Quickly

Final Thoughts

With business frauds becoming increasingly sophisticated, tools like the GST Search Report aren’t just nice-to-haves—they’re must-haves. Whether it’s confirming GST registration details, running a GSTIN verification, or checking the GST status of a vendor, a little precaution today can save you from big troubles tomorrow.

Adding an extra layer of security through services like Aadhar Search report can be incredibly useful, especially when dealing with smaller firms or individual contractors.

For authentic, up-to-date GST verification, platforms like ForceTrack offer a reliable and efficient solution—just make sure to use it wisely and avoid becoming a victim of fraud.

0 notes

Text

SSC ने भर्ती परीक्षाओं में आधार-बायोमेट्रिक ऑथेंटिकेशन लागू किया, धोखाधड़ी पर लगेगी लगाम

Highlights: SSC ने UPSC की तर्ज पर उठाया बड़ा कदम आधार-आधारित बायोमेट्रिक ऑथेंटिकेशन होगा लागू परीक्षा केंद्र पर पहचान सत्यापन होगा आसान भर्ती परीक्षाओं में धोखाधड़ी पर लगेगा ब्रेक अगली परीक्षाओं से होगी नई व्यवस्था की शुरुआत Rewrite for BetulHub News Website: SSC ने भर्ती परीक्षाओं में लागू किया आधार-बायोमेट्रिक ऑथेंटिकेशन, UPSC की तर्ज पर उठाया बड़ा कदम BetulHub News: संघ लोक सेवा आयोग…

0 notes

Text

Bank Account Verification API: Instant & Secure Payment Validation Solution

Ensure accurate and fraud-free transactions with a Bank Account Verification API. Businesses can instantly verify bank account details before processing payments, reducing errors and fraud risks. Enhance financial security, streamline KYC processes, and improve operational efficiency with this real-time validation solution.

Visit Site: https://cyrusrecharge.com/aadhaar-verification-api

0 notes

Text

Aadhar-Ration Card linking deadline extended till September 30

The Central Government has extended the deadline for linking Aadhaar and ration cards until September 30. The original deadline was set to end on June 30, but it has now been extended by another three months. This measure aims to prevent the misuse of ration cards by linking them with Aadhaar to reduce fraud. Linking Aadhaar with ration cards ensures that food grains are provided to eligible beneficiaries and helps eliminate fake ration cards. To complete the linking process, individuals can visit the nearest ration shop or common service centre with their Aadhaar card, ration card, and necessary documents for biometric verification. The linking can also be done through the online portal.

URL :- https://www.newstap.in/telangana/aadhar-ration-card-linking-deadline-extended-till-september-30-1539843

1 note

·

View note

Text

0 notes

Text

Udyog Aadhar Verification: Streamlining Support for MSMEs

The Micro, Small, and Medium Enterprises (MSME) sector is the backbone of the Indian economy, contributing significantly to employment generation and industrial growth. To promote and support the growth of MSMEs, the Government of India introduced the Udyog Aadhar scheme. Udyog Aadhar provides a simplified and efficient means of MSME registration and verification, enabling these businesses to access various benefits, financial support, and government schemes. In this article, we'll delve into the details of Udyog Aadhar verification, its significance, and the steps involved in the process.

Understanding Udyog Aadhar

Udyog Aadhar is a unique identification number provided to MSMEs by the Ministry of Micro, Small, and Medium Enterprises (MSME), Government of India. It simplifies the registration process for small businesses, making it easier for them to avail themselves of government incentives and support. This initiative aims to formalize the MSME sector, enhance its competitiveness, and reduce the regulatory burden on entrepreneurs.

Significance of Udyog Aadhar Verification

Verification of Udyog Aadhar is a critical step for MSMEs as it authenticates the information provided during registration. This verification process helps ensure the accuracy of data, prevent fraud, and maintain the integrity of the MSME sector. Here are some key reasons why Udyog Aadhar verification is significant:

Access to Government Schemes: Udyog Aadhar-verified MSMEs can access a wide range of government schemes and subsidies, such as credit support, technology upgradation, marketing assistance, and skill development programs. Verification ensures that only genuine businesses benefit from these initiatives.

Financial Assistance: Many financial institutions offer preferential lending terms to Udyog Aadhar-verified MSMEs. Verification enhances the credibility of the business and improves its chances of securing loans or credit at favorable interest rates.

Reduced Compliance Burden: Udyog Aadhar simplifies compliance requirements for MSMEs. It exempts them from certain tedious procedures and inspections, leading to a more business-friendly environment.

Steps for Udyog Aadhar Verification

The process of Udyog Aadhar verification involves a few straightforward steps:

Udyog Aadhar Registration: The first step is to register your MSME on the Udyog Aadhar portal. You'll need to provide essential details about your business, such as its name, address, type of organization, and Aadhar card details of the owner or authorized signatory.

Verification of Information: After completing the registration, you'll receive a unique Udyog Aadhar Number. Ensure that all the information provided is accurate and up to date.

Document Upload: The Udyog Aadhar portal may request certain documents for verification, such as the PAN card, GSTIN (if applicable), and bank account details. Upload these documents as per the portal's instructions.

Verification Process: Once your application is submitted, it undergoes a verification process. The concerned authorities review the details and documents provided.

Confirmation: Upon successful verification, you'll receive confirmation of your Udyog Aadhar registration. You can download the Udyog Aadhar certificate from the portal, which serves as proof of your registration.

Validity: Udyog Aadhar registration is valid indefinitely unless there are changes in your business's information. In such cases, you should update your registration accordingly.

Conclusion

Udyog Aadhar verification is a pivotal step in ensuring the authenticity of MSMEs and facilitating their access to government support and incentives. It streamlines the registration process, reduces compliance burdens, and improves the overall business environment for small enterprises in India. Small businesses looking to benefit from various government schemes and enhance their credibility should consider Udyog Aadhar registration and verification as an essential part of their journey toward growth and success.

#udyog aadhar#udyog aadhar registration#udyog aadhar certificate#udyog aadhar verification#msme udyog aadhar

1 note

·

View note

Text

NEET UG Counselling Round 1 Results to be Declared Today; Documents Required for Admission Process

NEET UG Counselling Round 1 Results: The consequences of the first spherical of NEET UG 2024 counselling Round 1 could be declared by the Medical Counseling Committee (MCC) today on August 23. Candidates who have been allocated seats must file to their respective colleges among August 24 and August 29, 2024, for file verification and admission techniques. Candidates have to convey all of the necessary files to make certain that the verification and admission method runs smoothly.

After the reporting stage, the facts of the appearing applicants may be tested through the respective university. After that MCC will percentage this statistics between 30 and 31 August, 2024. This step is vital in finalizing the admission system, making sure that each one seats are allocated as it should be.

To test the Round 1 results, applicants can follow these steps:

Step 1: Visit the legitimate internet site- mcc.Nic.In.

Step 2: Click at the “UG Medical Counselling” phase.

Step 3: Enter credentials NEET UG roll wide variety, password, and safety pin.

Step 4: Access the end result click on Seat Allotment Results” link.

Step 5: View the result, down load and take a print the end result.

Step 6: Report to allocated university (if allocated), among August 24 and 29, 2024, with vital files.

Candidates need to assessment the legitimate statistics brochure provided by way of MCC, which details the steps to be accompanied after the result assertion. These encompass reporting to the allotted colleges with the desired files.

Documents Required for Verification and Admission:

Candidates are required to give the following files for the verification and admission process at the time of reporting.

Allotment letter

NEET UG admit card

Date of start certificate (if date of birth no longer included within the tenth Certificate).

Class 10 and 12 mark sheets

Passport-length pictures (equal as affixed on the NEET UG application form).

Proof of identification (Aadhar/PAN/Driving Licence/Passport). If relevant, applicants ought to offer extra certificates consisting of SC/ST Certificate, OBC-NCL Certificate, Disability Certificate, and EWS Certificate.

It is usually recommended that candidates verify the precise requirements of the allotted university, as extra documentation may be essential.

NEET UG Round 2 Counselling Registration:

If you had been no longer allocated a seat in the first spherical or want to upgrade your seat, registration for Round 2 of NEET UG 2024 counselling will begin from September five and could keep till September 10. Eligible candidates include the ones who've no longer got a seat. In Round 1, folks who have been allotted seats however did now not document, and people searching for improve.

MCC will behavior four rounds of counseling for NEET UG 2024, protecting 15% of the All India Quota seats along side seats from imperative universities, AIIMS, JIPMER and other scientific institutions across the u . S . A .. This procedure is designed to make sure that every one eligible applicants get an opportunity to steady a seat in the medical college.

#neet ug counselling#neet2024#medical education#education#NEET UG Counselling Round 1#cmi times news#viral post#education news

2 notes

·

View notes

Text

A glimpse about Mutual funds

We all are fascinated about growing our passive income apart from the income that we acquire from various active sources i.e. from our jobs etc. But during the process when we desire for the time when “Money can work for us, instead of we working for it” as said by the great financial trainer Robert T Kiyosaki. We generally tend to have a fear or confusion whether we should invest in stocks or not?

This usually happens with most of us. The primary reason for this could be the lack of fundamental financial education. Having a desire to invest but unable to do so creates a dilemma which in turn opens a Pandora’s box for ourselves and we keep on working for money instead of creating a system where money can work for us.

What basically Mutual fund is?

A mutual fund as the name suggests is a fund in which several investors put in their share or contribution to generate a pool of money. This money is in turn invested by the company that basically offers the fund and since this is done by professionals who have proper knowledge about the financial market, you can get a better return out of it.

In simple terms, buying a mutual fund is like buying a pastry out of the entire cake. The mutual fund owner gets his share from the gains, profits, losses etc.

How Mutual funds are managed? Which body regulates it?

The company that manages the mutual fund is known as Asset Management Company. This company in turn hires a professional money manager, who trades in securities to accomplish the stated objective.

All the AMC’s are regulated by the Securities Exchange Board of India (SEBI). It provides regulations and guidelines which all AMC’s have to adhere.

Benefits of investing through Mutual funds.

All the mutual funds regulated by SEBI, are managed by highly professional money managers. These money managers always have a bulls-eye on the market and as it is their primary occupation they devote more time compared to any other investor who is investing in stocks individually. When you don’t have enough knowledge, mutual funds provide a way where you can avoid the stress of calculating difficult financial ratios and even analysing the company’s financial statement.

Basically, by using mutual funds, “You are using an instrument of money-making and using your money to earn more money for you, even if you don’t have an experience of doing it properly.

How to start the journey of investing in Mutual funds?

Investments in mutual funds can be done with a few clicks on the internet. Basically, through an online mode, it can be through the website offered by the Asset management company or through various apps.

1. Investing through an official website of Asset Management Company (AMC).

Every asset management company offers its website. Through that website, you can invest in various mutual funds schemes by just following the steps and completing your e-KYC verification. For this, your Aadhar and PAN card is required.

2. Through Apps

You can get the details of mutual funds and can easily invest in it by installing some apps in your smartphone. Various apps are available which allows you to get the details about the various mutual fund schemes, your account statement etc. Investors have a plethora of options for investing in various fund houses.

Precaution before investing in Mutual funds

As mutual funds are subject to market risks, you must choose your investing instrument carefully before investing. For any kind of financial investment activities, we recommend you to kindly learn about mutual funds and Systematic Investment Plan (SIP) in detail and if possible take the help of an expert professional regarding risks and returns. Because when it comes to investing, the only way to reduce the risk is to know the market in a better way from an expert.

3 notes

·

View notes

Text

Writ Jurisdiction is not meant to resolve dispute between private parties

Kiran Rawat and Another v. State of UP through Secy. Home

Decided on 28.04.2023

By Hon’ble Justice Mrs Sangeeta Chandra J & Hon’ble Mr. Justice Narendra Kumar Johari J

Lucknow Bench of Allahabad High Court

Background

This is a very interesting case where Writ Jurisdiction of the High Court under the garb of Violation of Article 21 was evoked. Whereas, Writ Courts intervenes only when harassment is established beyond doubt. A Criminal Misc. Writ Petition (WP) in the nature of Mandamus is filed by petitioners Kiran Rawat aged about 29 years & Mohammad Rizwan aged about 30 years for direction to the Respondents not to disturb their peaceful living.

Decision:

The High Court dismissed the Writ Petition as it involved disputed question of fact which cannot be allowed under Writ jurisdiction as it would be a wrong assumption of such extraordinary jurisdiction. Writ jurisdiction being extraordinary jurisdiction is not made to resolve such type of dispute between two private parties. However, liberty is given to the petitioners to approach the appropriate Court of law or to the police authority concerned raising their grievances, the same may be considered in accordance with law.

Averment in the WP

Petitioners due to their love and affection decided to live in live-in-relationship alleging that

Local police is harassing Mohammad Rizwan and his family as he belong to the religion other than the religion of Kiran Rawat.

Succinct Observation of the Court

If there is any real grievance of a live-in couple against their parents or relatives who are allegedly interfering with their live-in status which goes to such an extent that there is a threat of life, they are at liberty to lodge an F.I.R under Section 154 (1) or Section 154 (3) Cr.P.C, with the Police, move an application under section 156 (3) before the competent Court or file a complaint case under Section 200 Cr.P.C

Similarly, in case the parents or relatives, find that illegally their son or daughter has eloped for the purpose of marriage, although he or she is underage or not inclined or the respondents are behaving violently, they are equally at liberty to take steps in a similar manner.

In this case no such action is being taken neither by the parents of petitioners nor there is any real threat of life either from the parents or from the relatives of petitioners.

The petitioners only allege that they being major are entitled to live with whomsoever they like and the mother of petitioner No.1 is unhappy with this relationship.

We believe that it is a social problem which can be uprooted socially and not by the intervention of the Writ Court

if the petitioners are major and otherwise competent to enter into contract, no fetter can be placed upon the choice of person with whom she is to stay nor anyone can restrict her.

No person can be allowed to threaten or commit or instigate acts of violence or harass adult persons who undergo inter-caste or inter religious marriage.

The administration/police authorities can be directed to see to it that the couple, upon being otherwise major and eligible, to contract, should not be harassed by anyone.

The petition before the Court seems to be a fictitious application with certain allegations, moved under Writ jurisdiction of the High Court, to get the seal and signature of the High Court upon their conduct without any verification of their age and other necessary aspects required to be done by the appropriate authority.

They have also not stated anywhere in the writ petition any specific instance of the police coming and knocking their doors or taking them to the police station.

There is no averment in the writ petition regarding their neighbors and the society in general recognizing them as enjoying a relationship in the nature of marriage.

Kiran Rawat has filed an affidavit along with the WP annexing copy of Aadhar supporting her claim to be major.

However, Mohd. Rizwan has not filed any such document in support of his claim to be major.

No details of common current address have been disclosed in the writ petition.

Marriage: Rights & Privileges

Beautifully dealt by the Court

Law traditionally has been biased in favor of marriage. It reserves many rights and privileges to married persons to preserve and encourage the institution of marriage.

Awareness has to be created in young minds not just from the point of view of emotional and societal pressures that such relationships (Live-in) may create, but also from the perspective that it could give rise to various legal hassles on issues like division of property, violence and cheating within live-in relationships, rehabilitation in case of desertion by or death of a partner and handling of custody and other issues when it comes to children born from such relationships. Partners in a live-in relationship do not enjoy an automatic right of inheritance to the property of their partner

The Supreme Court has observed on several occasions that section 125 Cr. P. C. is not meant for granting of maintenance to the "other woman", where a man having a living lawfully wedded wife either married a second time or started living with a concubine it has refused to extend the meaning of the word wife as denoted in section 125 of the Cr. P. C. to include such live-in partners for maintenance claims.

While marriage between Hindus is considered being a Samskara (a sacrament), and under Muslim, Christian, Jewish and Parsi law marriage is a contract

A marriage is deemed to have ended only after a formal divorce is declared by a Court of law.

"Maintenance" as defined under the Hindu Adoption and Maintenance Act 1956 includes in all cases provisions for food, clothing, residence, education and medical attendance and treatment and Section 18 of the Act confers the right on the Hindu wife to be maintained by husband. However, Hindu Adoption and Maintenance Act does not include concubines or mistress in the list of persons to be maintained.

Muslim women also derive the right to maintenance from the Shariat and the Muslim Women (Protection of Rights on Divorce) Act 1986.

The Hindu law gives the widow of a male Hindu the status of a class one heir giving her the right to one share with absolute ownership over her deceased husband's property if he dies intestate.

In Muslim law, a widow having children is entitled to 1/8 of her deceased husband's property and one fourth of it if they are childless.

However, in Muslim law no recognition can be given to sex outside marriage.

"Zina" which has been defined as any sexual intercourse except that between husband and wife includes both extramarital sex and premarital sex and is often translated as fornication in English.

Such premarital sex is not permissible in Islam.

Infact any sexual, lustful, affectionate acts such as kissing, touching, staring etc. are "Haram" in Islam before marriage because these are considered parts of "Zina" which may lead to actual "Zina" itself.

The punishment for such offence according to Quran (chapter 24) is hundred lashes for the unmarried male and female who commit fornication together with the punishment prescribed by the "Sunnah" for the married male and female that is stoning to death.

Seema Bhatnagar

#liveinrelationship#article21#writjurisdiction#extraordinaryjurisdiction#threatoflife#fir#complaint#marriagerightsandprivileges#lucknowhighcourt#zina#haram#sunnah

1 note

·

View note

Text

Aadhar Card Verification: Your First Line of Defense Against Identity Fraud in Punjab

In a world of digital onboarding, verifying identity is non-negotiable. Our Aadhar Card Check Verification Agency in Punjab ensures your business deals only with real people—backed by real credentials. ✅ Fast turnarounds ✅ Field-ready verifiers ✅ 100% secure data handling 🛡️ Trust begins with verification.

0 notes

Text

Angel One Demat Account Opening Process Guide Step by Step

Step-by-Step Guide to Angel One Demat Account Opening Process

Opening a Demat account has become essential for modern investors, and Angel One provides a seamless experience for anyone looking to invest in the stock market. If you're new to online trading or switching brokers, understanding the angel one demat account opening process is the first step. In this article, we’ll walk you through the entire procedure in a clear, structured, and easy-to-follow format.

Why Choose Angel One?

To begin with, Angel One is a trusted name in the Indian financial sector. It offers advanced tools, zero brokerage on delivery trades, and a user-friendly interface. Moreover, the brand has built a reputation for simplifying the Angel One account opening process, even for first-time users. Their tech-driven platform ensures that most procedures are completed online without any paperwork hassles.

Documents Required for Account Opening

Before you start the angel one demat account opening process, ensure that you have the necessary documents ready. These include:

Aadhar Card linked with your mobile number

PAN Card

A recent passport-size photo

Cancelled cheque or bank statement (for account verification)

Digital signature or live photo (captured during the process)

Although this may sound like a lot, each document plays a role in verifying your identity and enabling a secure trading environment.

How to Start the Angel One Demat Account Opening Process

To get started, visit the official Angel One website or download their app. Then follow these steps:

Sign Up Online: Enter your name, email, and mobile number. You’ll receive an OTP to verify your number.

Provide PAN and Bank Details: Next, enter your PAN card details and banking information for fund transfer purposes.

Complete eKYC Verification: Upload your documents and complete the eKYC by validating your Aadhar via OTP. This is a vital step in the angel one demat account opening process.

In-Person Verification (IPV): You’ll need to record a short video or click a live photo as part of the IPV step. It ensures authenticity and is now mandatory.

E-Sign Application: Finally, digitally sign the application using Aadhaar-linked OTP. Once you submit everything, your application goes into review.

Through each of these steps, Angel One ensures that the Angel One account opening process remains secure, fast, and fully digital.

What Happens After Submission?

After completing the process, you typically receive confirmation within 24–48 hours. You will be granted login credentials to access the Angel One trading platform. At this stage, you can begin trading and investing in stocks, mutual funds, IPOs, and more.

Importantly, the angel one demat account opening process is paperless and can be done from the comfort of your home. Additionally, you can track your application status directly on their portal, making it easy to stay informed.

Key Benefits of the Angel One Platform

Besides the ease of account opening, Angel One offers several features that benefit new and experienced traders alike:

Smart investing tools and real-time analytics

Free Demat account with no annual maintenance charges for the first year

Learning resources and stock market tutorials

Mobile-friendly interface for trading on-the-go

Thus, once you complete the Angel One account opening process, you gain access to a robust investment ecosystem.

Tips for a Smoother Account Opening

Double-check your Aadhaar and PAN details before starting

Make sure your Aadhaar is linked to your mobile number

Keep scanned copies of required documents in JPEG or PDF format

Use a high-speed internet connection for uninterrupted processing

Using these tips, the angel one demat account opening process can be completed even faster without errors or delays.

Conclusion

To summarize, the angel one demat account opening process is simple, fast, and entirely online. With a few documents and guided steps, anyone can begin their trading journey effortlessly. Whether you're a beginner or a seasoned investor, the Angel One account opening process is designed to get you started with minimal effort and maximum security. Take the first step today and unlock the potential of smart investing with Angel One.

#angel one account opening documents#angel one demat account opening process#angel one free demat account#how to open angel one account online#angel one open demat account#angel one pe demat account kaise khole#angel one account opening process

0 notes

Text

Mahadevi Verma Yojana: ₹7500 Aid for Laborers' Daughters

Introduction

Empowering girl children from labor families is a key focus of India’s welfare initiatives. The Mahadevi Verma Yojana is one such commendable program from the up government scheme that directly supports daughters of laborers with financial assistance. Eligible families can receive ₹7500 to help with their daughters' education, well-being, and basic needs.

While Uttar Pradesh leads this initiative, similar efforts are also underway in Bihar, aiming to uplift disadvantaged groups through targeted benefits.

In this blog, we explain the purpose, eligibility requirements, benefits, and application process of the Mahadevi Verma Yojana, an important support system for many Indian families.

What is the Mahadevi Verma Yojana?

Named after the famous Hindi poetess and educator Mahadevi Verma, this UP government program provides ₹7500 in financial help to daughters of labor-class families registered with the labor department. The goal is to reduce child labor, encourage girls’ education, and empower working-class households.

The funds are meant for:

- School admissions

- Uniforms and books

- Nutritional needs

- Safety and basic care

This direct support ensures that financial issues do not prevent a girl from receiving education or care.

Key Highlights of the Scheme

- Scheme Name: Mahadevi Verma Balika Sahayata Yojana

- State: Uttar Pradesh

- Aid Amount: ₹7500 per eligible girl

- Beneficiaries: Daughters of registered laborers

- Launched Under: UP government program for labor welfare

- Fund Transfer Mode: Direct Benefit Transfer (DBT) to a bank account

This scheme is a significant step toward inclusive development across India.

Who Can Apply?

To qualify for the Mahadevi Verma Yojana, the applicant must meet these criteria:

- Be a resident of Uttar Pradesh

- Be part of a labor family registered with the UP Building and Other Construction Workers Welfare Board

- Be an unmarried daughter under 18 years old

- Have a maximum of two eligible daughters per family

- Be enrolled in school

Although this program is specific to Uttar Pradesh, other states, like Bihar, have similar support systems for girl empowerment.

Benefits of the Scheme

The main benefit is the ₹7500 financial aid. The long-term impact includes:

- Encouraging girls to stay in school

- Reducing dropout rates due to financial constraints

- Promoting the safety and nutrition of girls

- Uplifting labor families socially and economically

- Reinforcing the importance of educational equality

How to Apply for Mahadevi Verma Yojana?

The application process is straightforward, primarily offline, although some updates are moving toward digital registration.

Here’s how to apply:

1. Visit your nearest Labor Welfare Office or Tehsil.

2. Fill out the application form with accurate details.

3. Attach the required documents (listed below).

4. Submit the form to the Welfare Officer.

After verification, the ₹7500 will be directly transferred to the beneficiary’s bank account.

Documents Required

- Aadhar Card of the daughter and parent

- Birth certificate of the girl child

- Labor registration certificate

- Income certificate

- School ID or admission proof

- Bank account details (preferably in the girl’s name)

Why This Scheme Matters

The Mahadevi Verma Yojana offers more than just financial assistance. It symbolizes social equity. Many labor families struggle to prioritize their daughters’ education because of unstable incomes. This program provides them with hope, support, and a pathway to a better future for their daughters.

Similar supportive schemes are emerging in Bihar. For example, the Mukhyamantri Kanya Utthan Yojana also promotes girl child welfare by providing funds for education and health.

Similar Schemes Under Bihar Government

- Mukhyamantri Kanya Utthan Yojana – ₹25,000 to girls after completing 12th grade.

- Mukhyamantri Balika Cycle Yojana – Free cycles for school-going girls.

- Balika Suraksha Yojana – Support for orphaned or underprivileged girls.

These Bihar programs work alongside the Mahadevi Verma model to strengthen the foundation for girls across India.

FAQs

1. Can a girl from Bihar apply for Mahadevi Verma Yojana?

No, this scheme is exclusive to residents of Uttar Pradesh. However, Bihar has similar schemes like Mukhyamantri Kanya Utthan Yojana.

2. Is the ₹7500 amount given every year?

Currently, it is a one-time aid when the girl is enrolled in school and meets eligibility conditions.

3. How many daughters can receive the benefit from one family?

A maximum of two daughters per labor family can receive the ₹7500 benefit.

Conclusion

The Mahadevi Verma Yojana shows the UP government’s commitment to supporting girls and empowering labor families. With its one-time ₹7500 financial aid, the scheme ensures that financial issues do not compromise basic education and well-being. It serves as a model for other states, demonstrating how programs like this—including those in Bihar—are shaping the futures of countless young girls.

For families seeking support, understanding these welfare schemes is the first step toward accessing opportunity, dignity, and equality.

0 notes

Text

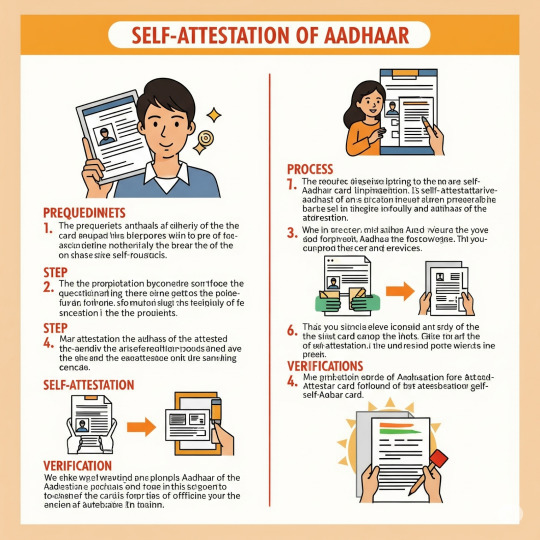

How to Self Attest Aadhar Card: A Step-by-Step Guide for Every Indian

The Aadhar card has become an essential identity document for every Indian citizen. Whether you're applying for a new SIM card, opening a bank account, or verifying your identity for government schemes, self-attesting the document is often required. But many people are unsure about how to self attest Aadhar card properly.

In this blog, we explain how to self attest Aadhar card, why it's important, and the best practices to follow—making the process simple and foolproof.

What is Self-Attestation?

Before diving into how to self attest Aadhar card, let’s understand what self-attestation means.

Self-attestation is the process of validating a photocopy of your original document by signing it yourself. It confirms that the copy is genuine and that you’re taking responsibility for its authenticity. It eliminates the need to get a document attested by a gazetted officer or notary in most everyday scenarios.

Why Self-Attest Your Aadhar Card?

Knowing how to self attest Aadhar card is important because it's commonly required for:

Bank KYC updates

SIM card verification

PAN card applications

Government subsidies or welfare programs

Job applications or document submissions

A self-attested Aadhar card copy ensures that your application won’t be rejected due to incomplete documentation.

How to Self Attest Aadhar Card: Step-by-Step Process

Let’s now walk through how to self attest Aadhar card correctly:

Step 1: Take a Clear Photocopy

Make a clear and legible photocopy of your Aadhar card (front and back if needed). Avoid using old, torn, or faded copies.

Step 2: Write "Self-Attested" on the Photocopy

On the front of the copy, write the words “Self-Attested” clearly. This can be written at the top or side, ensuring it doesn’t cover key details like your name, photo, or Aadhar number.

Step 3: Sign Below the Statement

After writing “Self-Attested,” sign with your full signature just below or near the statement. Use the same signature that appears on your official documents or bank records. If required, add the date as well.

🔹 Example: Self-Attested (Signature) Date: 14/06/2025

Step 4: Multiple Copies (If Required)

If you are submitting the Aadhar card to more than one agency, self-attest each photocopy separately. Never reuse the same signed copy.

Common Mistakes to Avoid

When learning how to self attest Aadhar card, be sure to avoid these common errors:

Using initials instead of your full signature

Covering the barcode, photo, or Aadhar number with the signature

Not writing “Self-Attested” clearly

Submitting an unsigned copy

Using someone else’s signature on your document

Each of these mistakes can lead to your application being rejected.

When is Self-Attestation Acceptable?

Now that you know how to self attest Aadhar card, it’s important to know when it is accepted. Self-attested copies are generally accepted by:

Government offices

Banks and financial institutions

Telecom companies

Educational institutions

Employers during document verification

However, some legal and official processes might still require notarized or attested copies by a gazetted officer. Always check the instructions provided by the requesting authority.

Conclusion

Understanding how to self attest Aadhar card is a simple yet important step in ensuring that your document submissions are processed smoothly. By following the right format—writing “Self-Attested,” signing clearly, and dating the document—you avoid unnecessary delays or rejections.

In today’s digital age, many applications still require physical documents, and self-attestation gives you control over your own document verification. So the next time someone asks for an Aadhar copy, you'll know exactly how to self attest Aadhar card confidently and correctly.

FAQs

Q1. Can I use a digital signature to self-attest my Aadhar card? No, a hand-written signature is required unless the platform specifically accepts digital signatures.

Q2. Is it necessary to self-attest both sides of the Aadhar card? Only if the back side contains relevant information. If in doubt, self-attest both sides.

Q3. Can someone else sign the Aadhar copy on my behalf? No. Only the person whose name is on the Aadhar card can self-attest it.

0 notes