#aapl oracle

Explore tagged Tumblr posts

Text

Why is Binance Popular?

Binance opened its virtual doors in 2017 and has since become one of the most popular crypto exchanges worldwide. While there is no shortage of great exchanges, Binance remains the go-to for investors of all experience levels. Here's why.

Crypto Offering

One reason why people love Binance is because of the wide range of cryptocurrencies available. Binance offers crypto-to-crypto trading in more than 500 cryptocurrencies and virtual tokens. Find prices for well-known coins and countless lesser-known alternatives. You can even check the BNB price, Binance's native token.

Binance also supports many fiat currencies and over 1,500 markets. Thanks to the sheer availability on Binance, it's a great exchange to do all your investing. Instead of hopping between platforms, you can turn to Binance for most of your trading activity.

Impressive Trading Volume

Many traders pay attention to trading volume. A higher trading volume means that investors can buy and sell crypto quickly. It also ensures traders can execute large transactions without worrying about price slippage and other issues.

Binance has one of the largest trading volumes of any exchange in the industry. The latest estimates show the Binance exchange has about $76 billion daily volume.

Affordable Fees

Fees are another concern. Excessive fees can significantly increase trading costs, eating into an investor's gains. While all exchanges have trading fees, Binance has some of the lowest!

Fees can vary, but most are about 0.1 percent of the transaction value. That's impressive on its own. However, traders can lower the fees even more using the native Binance coin. Investors can check the BNB price on the exchange, invest in the coin and use it exclusively for transaction fees to keep their costs as low as possible.

User Experience

Finally, we must recognize the experience of using Binance. The exchange is well-designed, including many features that improve accessibility and navigation. It's a joy to you, cutting through the fluff of other difficult-to-use exchanges to create a smooth and efficient trading experience. Binance is also available in many languages and has a companion app for trading on the go.

Read a similar article about MATIC price here at this page.

0 notes

Text

يتم تنفيذ تجارة الأسهم الأمريكية على السلسلة! Bybit ، Ostium ، Mystonk تطلق وظائف تداول الأسهم | سلسلة أخبار Abmedia

يتوقع الكثير من الناس أن الاتجاه النهائي لصناعة blockchain هو الذهاب إلى السلسلة ، وخاصة الأصول المالية. من خلال التطور المزدهر لـ RWA ، انخفض سوق الرمز المميز لسنوات الخزانة إلى منافسة شرسة ، ويتدافع عمالقة إدارة الأصول لتبني تكنولوجيا blockchain. في الوقت الحاضر ، يتم أيضًا تداول الأسهم والأسهم والبورصة الأجنبية وغيرها من الأصول في عالم Web3. في الآونة الأخيرة ، سواء كانت البورصة المركزية BYBIT ، فإن مشتقات التبادل على السلسلة ، أو Mystonk ، الأسهم ، الصرف الأجنبي ، أعلنوا أنه يمكنهم تداول الأسهم الأمريكية والبورصة الأجنبية على المنصة. سوف تقدم هذه المقالة بإيجاز الآليات الثلاث. (هل نتجه إلى الجيل المفرط السائل؟ التبادلات اللامركزية من السيولة وتفكيك المخاطر) يستخدم Bybit منصة MT5 لتداول العملات الأجنبية والأسهم الأمريكية تبادل Bybit قبل أيام قليلةيعلندعمت وظيفة تداول الفوركس الذهبية سوق الأوراق المالية ، مما يعني أنه يمكن للمستخدمين أيضًا تداول الأسهم الأمريكية على منصة BYBIT. من المفهوم أن وظيفة التداول المالية التقليدية لـ BYBIT هي استخدام منصة صرف MT5 الأجنبية. MT5 عبارة عن منصة تداول أطلقتها شركة Metaquotes لشركة البرمجيات في عام 2010. مقارنةً بالجيل السابق من MT4 ، فإنه يحتوي على المزيد من الوظائف مثل الحد الأقصى لوقف الشراء وحد إيقاف البيع. في الوقت الحالي ، يدعم BYBIT 78 مخزونًا بما في ذلك NVIDIA و TSM و TSLA و NVDA و AAPL و AMAZON و COIN و GOOG و MSFT و NFLX و META و MSTR ، وما إلى ذلك ، مع رسوم معالجة بقيمة 00.04 دولارًا أمريكيًا ، والحد الأدنى من رسوم USD5 لكل ترتيب. حاليًا ، يتم دعم القيمة المخزنة USDT فقط. يرجى الرجوع إلى المسؤول عن الهامش ونظام التسليم لأزواج تداول الصرف الأجنبيإعلان。 يتداول Ostium المنتجات المالية التقليدية على السلسلة يضع Ostium المنتجات المالية التقليدية على السلسلة لمعاملات العقود. من بين المستثمرين الذين يقفون وراءه شريك A16Z السابق ، المدير الفني Coinbase Balaji Srinivasan و Alliance Dao. أثناء المعاملات المالية غير التقليدية ، يمكن تقديم أوامر الحد فقط ، ولا يتم فتح أوامر السوق. عندما يقدم المتداول طلبًا على المنصة ، سيفتح موقعًا بسعر Oracle ، والطرف المقابل للمعامل�� هو تجمع السيولة للسيولة (المخزن المؤقت للسيولة). إذا مرّ البركة العازلة عبر الموضع ، فسيتم الاستيلاء عليها مع LP. (نظام RWA على السلسلة يستخدم Ostium stablecoins لصنع قطرات الهواء في الأصول في العالم الحقيقي المسلح الآمن) يقوم Mystonk بتعيين الأسهم الأمريكية للمعاملات على السلسلة ، والامتثال أمر مشكوك فيه نشأ Mystonk من عملة ميمي التي أعيد نشرها من قبل تويتر الرسمي في ناسداك. في ذلك الوقت ، حطم المطور السوق وتم توليه لاحقًا من قبل مجتمع بروس في الولايات المتحدة (CTO) وتحول إلى تبادل لا مركزي. كانت المنصة قبل أيام قليلةيعلنإطلاق خدمة تداول الأسهم الأمريكية ، من المفهوم أن المنصةمطالبةشريك مع Fidelity لاستضافة 50 مليون دولار من أصول الأسهم. ومع ذلك ، فإن المشاركة المفتوحة لأعمال الأوراق المالية تجعل الامتثال مشكوك فيه. (يقوم مستثمرو التجزئة Sue Nasdaq؟ بروس الصيني في الولايات المتحدة بترويج المجتمع لاتخاذ أكثر من عملات Meme $ ، وتهديدًا بحماية حقوقهم من ناسداك) تغطي هذه الأصول 95 مخزونًا رئيسيًا ، بما في ذلك Apple (AAPL) و Amazon (AMZN) و Alphabet (Googl) و Meta و Microsoft (MSFT) و Netflix (NFLX) و VIDA (NVDA). حاليًا ، توفر منصة Mystonk فقط تداولًا مميزًا في العملات المشفرة وبعض الأسهم الأمريكية ، ولم يتم إطلاق المشتقات بعد. يمكن للمستخدمين شراء الرموز المميزة للأسهم من محافظ التشفير للذاتية باستخدام stablecoins مثل USDC أو USDT. ستقوم Mystonks بتحويل هذه stablecoins إلى دولارات أمريكية وشراء الأسهم المقابلة من خلال الإخلاص. يتم تعيين الأسهم المشتراة 1: 1 إلى الرموز المميزة ERC-20 (مثل AAPL.M) ونعيد على blockchain الأساسية. يمكن للمستخدمين استرداد الرموز المميزة كـ stablecoins في أي وقت ، وسوف يدمر Mystonks الرموز المقابلة وبيع الأسهم المقابلة. تتم مزامنة أسعار الرمز المميز في الوقت الفعلي مع السوق باستخدام chainlink oracle. تحذير المخاطراستثمارات العملة المشفرة محفوفة بالمخاطر للغاية ، وقد تتقلب أسعارها بشكل كبير وقد تفقد كل مديرك. يرجى تقييم المخاطر بحذر.

0 notes

Text

TOP 5 COMPANIES IN TERMS OF MARKET CAPITALIZATION WHICH HAVE ZERO DEBT

TOP 5 COMPANIES IN TERMS OF MARKET CAPITALIZATION WHICH HAVE ZERO DEBT

I can provide you with a general idea of companies that were known for having low or zero debt. Keep in mind that financial situations can change, and it's essential to verify the latest information from reliable financial sources.

Here are examples of companies that were known for having low or zero debt in the past:

Apple Inc. (AAPL): Apple has traditionally maintained a strong balance sheet with a significant cash reserve, and it has been known for having relatively low levels of debt compared to its market capitalization.

Alphabet Inc. (GOOGL): The parent company of Google, Alphabet, has historically had a strong financial position and relatively low debt levels.

Microsoft Corporation (MSFT): Microsoft is known for its solid financial position and has, in the past, kept its debt levels low compared to its market capitalization.

Oracle Corporation (ORCL): Oracle is a technology company that has been known for managing its debt levels prudently.

Facebook, Inc. (Meta Platforms, Inc.) (FB): Facebook, now Meta Platforms, has historically had a strong financial position with low debt compared to its market capitalization.

Please note that the financial health of companies can change, and it's crucial to check the most recent financial reports and updates for accurate and up-to-date information. Additionally, market capitalization and debt levels are just a few factors to consider when evaluating the overall financial health and investment potential of a company.

LTP Calculator Overview:

LTP Calculator is a comprehensive stock market trading tool that focuses on providing real-time data, particularly the last traded price of various stocks. Its functionality extends beyond a conventional calculator, offering insights and analytics crucial for traders navigating the complexities of the stock market.

Also Available on Play store - App

https://play.google.com/store/apps/details?id=com.ltpcalculator.android/

Key Features:

Real-time Last Traded Price:

The core feature of LTP Calculator is its ability to provide users with the latest information on stock prices. This real-time data empowers traders to make timely decisions based on the most recent market movements.

User-Friendly Interface:

Designed with traders in mind, LTP Calculator boasts a user-friendly interface that simplifies complex market data. This accessibility ensures that both novice and experienced traders can leverage the tool effectively.

Analytical Tools:

Beyond basic price information, LTP Calculator incorporates analytical tools that help users assess market trends, volatility, and potential risks. This multifaceted approach enables traders to develop a comprehensive understanding of the stocks they are dealing with.

Customizable Alerts:

Recognizing the importance of staying informed, LTP Calculator allows users to set customizable alerts for specific stocks. This feature ensures that traders receive timely notifications about significant market movements affecting their portfolio.

Vinay Prakash Tiwari - The Visionary Founder:

At the helm of LTP Calculator is Vinay Prakash Tiwari, a renowned figure in the stock market training arena. With a moniker like "Investment Daddy," Tiwari has earned respect for his expertise and commitment to empowering individuals in the financial domain.

Professional Background:

Vinay Prakash Tiwari brings a wealth of experience to the table, having traversed the intricacies of the stock market for several decades. His journey as a stock market trainer has equipped him with insights into the challenges faced by traders, inspiring him to develop tools like LTP Calculator.

Philosophy and Approach:

Tiwari's approach to stock market training revolves around education, empowerment, and simplifying complexities. LTP Calculator reflects this philosophy, offering a tool that aligns with his vision of making stock market information accessible and understandable for all.

Educational Initiatives:

Apart from his contributions as a tool developer, Vinay Prakash Tiwari has actively engaged in educational initiatives. Through online courses, webinars, and seminars, he has shared his knowledge with aspiring traders, reinforcing his commitment to fostering financial literacy.

In conclusion, LTP Calculator stands as a testament to Vinay Prakash Tiwari's dedication to enhancing the trading experience. As the financial landscape continues to evolve, tools like LTP Calculator and visionaries like Tiwari sir play a pivotal role in shaping a more informed and empowered community of traders.

0 notes

Text

2021 digital marketing trends

There is always a huge interest in digital marketing trends and innovation in marketing as we get closer to the new year. And rightly so, since reviewing innovation in digital marketing, technology, and platforms for the year ahead can help marketers identify new opportunities that agile businesses and marketers can tap into... if they're looking in the right place and know the right questions to ask...

Each year, for the last ten years, I have assessed the digital marketing landscape to help give recommendations on the digital marketing trends marketers should focus on in the future.

In this year's guidance on the Smart Insights blog I will cover what I see as the main trends across our RACE customer lifecycle framework which defines 25 key digital marketing activities that can be harnessed by businesses to drive growth through:

Improved reach via digital channels Increasing digital engagement of your audiences Better managing digital marketing to integrate it into marketing activities

Improve your digital marketing plans for growth in the year ahead Our Managing digital marketing research 2020 shows that many businesses don't have a planned approach to take advantage of the latest and evergreen digital marketing techniques. Our RACE digital marketing process gives a simple way to structure a digital marketing plan.

What digital marketing trends should we review? I believe it's important for all businesses to review how they can harness the latest marketing trends so they can apply the latest innovations through the 70:20:10 rule of marketing focus. Google's digital marketing evangelist Avinash Kaushik has explained the benefits of this mindset :

70% of the time we're going to focus on things that we know that are very core to our business. 20% is where we're trying to push the boundaries. You get into the known unknowns. And the last 10% is a true crazy experimental stuff. Trying to figure out how to do uncomfortable things that we're going to fail at more than we will succeed at. But with every success, you build a competitive advantage.

So evaluating innovations can help you push the boundaries, but also improve your digital marketing activities.

Truth-be-told, at a high-level, the trends across digital marketing tactics are similar each year - with a lot of the interest in search, social and email marketing, and new web design and content marketing techniques to engage and convert our audiences. Traditionally, technology innovations are the drivers of trends in digital marketing including changes in:

Digital platforms: Innovations from the FAMGA businesses of Facebook Inc (FB), Apple Inc (AAPL), Microsoft Corp (MSFT), Google (GOOG) and Amazon.com Inc (AMZN) Martech vendors: In particular, the big marketing cloud players with the biggest R&D budgets including Salesforce, Oracle, HubSpot and companies with a larger user base targeting SMEs like Mailchimp Independent standards bodies: Including World Wide Web Consortium, or W3C— of which Tim Berners-Lee is a founder and current leader; Living Standard by Web Hypertext Application Technology Working Group, or WHATWG and the Internet Engineering Task Force, or IETF. Normally the trends are independent of economic factors, but that's not the case this year. Of course, the big difference affecting changes in marketing investment in 2021 is from the havoc that COVID-19 has wrought around the world. Although there have been winners in some sectors where demand has held up or even increased, many have fallen. Regardless of sector, low-cost or no-cost methods of growth are more important than ever. This perhaps explains why our research shows that the AI-based techniques which I will cover throughout this article are relatively unpopular.

Recommendation 1. Organic search: Monitor core updates and EAT During 2020, core updates have had a significant impact on organic visibility for businesses in some sectors as these 4 case studies on the impact of Google’s latest core updates shows.

In their advisory What webmasters should know about Google’s core updates Google explains these like this:

“Each day, Google usually releases one or more changes designed to improve our search results. Most aren’t noticeable but help us incrementally continue to improve. We aim to confirm such updates when we feel there is actionable information that webmasters, content producers, or others might take about them".

The advisory and the more recent case studies often reference the perennial importance of content quality affecting Expertise, Authority and Trust signals. So anyone serious about competing in search should grab a copy of the latest search quality guidelines to benchmark their content.

Recommendation 2. Organic search: Look at opportunities from structured data and the SERPs features. I respect Bill Slawski as a close follower of the latest Google patents and innovations. So, when he pronounces structured data will increase in importance and evolve it's worth listening.

In this article, Bluearray gives the predictions of how structured data will change in future. These predictions are already coming true as in Sept 2020 we saw a first example of structured snippets within SERPs which is evidence of a future trend.

Recommendation 3. Organic search: Voice search remains hyped but will deliver little for most businesses Sorry, I have to mention it since we so often still see the dumb recommendation that Voice search is the number one trend businesses must focus on. If you think back, you may remember the often misquoted 2014 prediction that “voice search will by 50% of all searches by 2020”. Well we're in 2020 and it's still being widely touted and of course, smart speaker use has increased dramatically, but the reality is that voice-based searches on mobile and desktop have a minimal impact on the practical execution of SEO for most businesses.

I agree with the views of Cameo Digital who explain the limited impact of voice search when they comment that regardless of whether the uptake for voice search increases, the game stays virtually the same for SEOs. They explain that Voice Search involves using a spoken command to retrieve the information you want from search engines with two types of voice search, each differing in their type of output. Only the first of these, however, is relevant to SEO:

Type 1: When a user chooses to use spoken voice commands as opposed to typing a query into Google. This is treated as a normal web search, the data of which will be collected in Google Search Console, so SEO as normal. Type 2: When a user chooses to use a spoken voice command in order to receive a spoken answer. This is the case with many smart speakers such as Google Home and Amazon Alexa. These searches are not logged in Google Search Console and have very little relation to SEO. So, businesses can tap into any voice-based changes in search behaviour by focusing on the fundamentals of SEO such as keyword research, on-page optimization best practices, structured data and creating quality content with high Expertise-Authority-Trust to fit evolving search behaviours, including more conversational queries.

I would add that changes in keyword behaviour prompted by rising local voice queries are important to optimize for if you target local buyers.

1 note

·

View note

Text

Debt Disclosures: Finding Them in Calcbench

Our next post on corporate debt is more about practical advice for Calcbench subscribers: a look at the tools you can use within the Calcbench website to find disclosures about corporate debt for the companies you follow.

If you want data from a group of companies, one place to start is our Multi-Company page. First, select the group of companies you want to research. (We have an entire post dedicated to creating a peer group if you need a refresher.) Once that group is set, you can choose from any number of debt-related disclosures we include in our Standardized Metrics field on the left-hand side. Those disclosures include:

Total debt

Short-, long-, and medium-term debt

Floating-rate debt

Debt-to-equity ratio

Interest payable

Interest expense

Just enter the disclosure you want to research, and presto! Those disclosures will populate for every company in your peer group (assuming the company made those disclosures for the period you’re researching).

Researching Single Companies

You can always use the Multi-Company page for a single company’s disclosures, too; just set your peer group to that sole company. But we also have numerous other ways to research debt disclosures one company at a time.

On the Company-in-Detail page, you can research what the company reports on the income statement and the balance sheet. This approach is somewhat hit or miss, because not all companies report interest expenses on the income statement — although all companies do report debt on the balance sheet. You can pull up the disclosures for the company you follow and see what it reports in the primary financial statements.

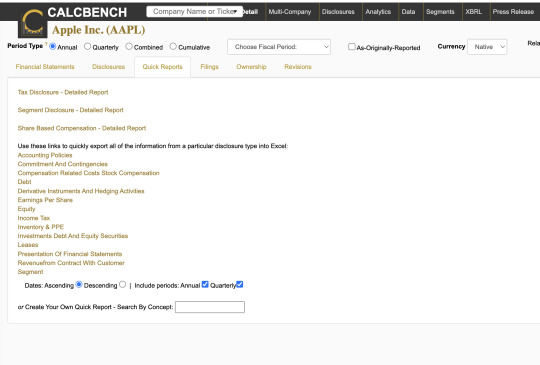

If you want a truly deep dive into the debt data, you can also run a Calcbench “Quick Report,” which will export all the debt data we have on your company into an Excel spreadsheet. To do this, click on the Quick Reports tab and then look for the debt report option. See Figure 1, below.

Be warned, this option gives you a lot of data. We selected Apple ($AAPL) at random, and the resulting spreadsheet listed nearly 900 rows of data across dozens of columns — a separate data cell for each debt instrument Apple reported, for every quarter going back to 2013. Suffice to say that a company as large as Apple has many debt instruments, so yes, the Excel spreadsheet really did need to be that large.

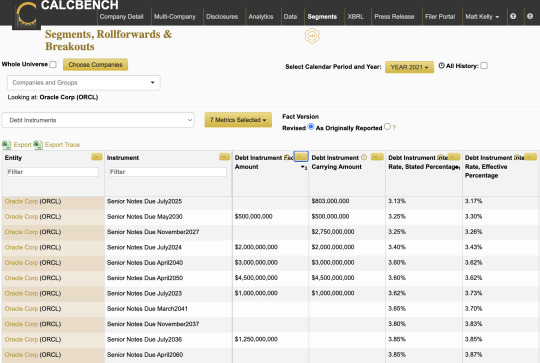

You can also get a global sense of a company’s debt disclosures using our Segments, Rollfowards & Breakouts page. Start by selecting the specific company you want to research. Then select “Debt Instruments” from the pull-down menu of dataset options on the left side of the screen.

Figure 2, below, shows some of the results for Oracle ($ORCL).

Again, a lot of information is packed into these results. We give you a list of notes due, the amount, the stated interest rate, the effective rate, and other snippets of information about the date a debt instrument is due.

For example, we can see in Figure 2 that Oracle has a $1 billion loan coming due in July 2023 (July 23, to be exact) with an effective interest rate of 3.73 percent. Given where interest rates are today, does anyone expect Oracle will be able to refinance that debt at a comparable rate in six months’ time? Anyone at all?

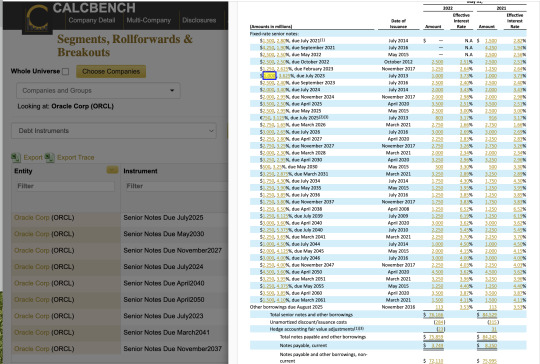

For just about all the disclosures you see from the Segments page, you can also hold your cursor over the item and then use our world-famous Trace feature to trace that number back to its exact disclosure in the financial statements. When we traced that $1 billion debt instrument coming due in July, the resulting chart in Figure 3 quickly appeared.

If you squint at Figure 3, you can see one item high-lighted in yellow. That is the original $1 billion number from the Segments results, traced back to the most recent disclosure Oracle made in its footnotes — along with all the other debt instruments Oracle also reported.

That brings us to our final method to research debt disclosures: by looking in the footnote disclosures directly.

Start with our Interactive Disclosures database. Select the company and specific period you want to research. In the list of Notes to the Financial Statements, look for something along the lines of Notes Payable and Other Borrowings (the headline Oracle used), and you should see the full table of debt disclosures. For example, looking up that disclosure for Oracle would present the same table in Figure 3, just a bit larger and more readable.

Not all companies label their debt disclosures as Notes Payable. Many do, but others might label them as Debt, Debt Instruments, or perhaps some other title. Keep your eyes peeled and your mind open, but the data will be in there somewhere.

0 notes

Text

Investor Tips

One of the finest pieces of financial advice for investors is considering how much risk you're prepared to face. Many first-time investors believe they are more risk tolerant than they are. This causes a panicky response when their riskier assets fall in value. A more deliberate approach to risk and reward guarantees that your investments correspond to your capacity to endure loss. While cash is appealing, it might gradually lose purchasing value due to inflation.

Buffett's investing philosophy is straightforward, and his tactics have produced some of the most remarkable returns for any investor. Berkshire Hathaway gained $3,641,613% from 1964 to 2021, compared to the S& P 500 index's gain of just 3,204,61%. However, Buffett's investments are not based on forecasting the stock market's direction or economy.

Buffett thinks that firms should be well-rounded and favors enterprises with a track record of success. This enables him to pick those with the highest profit margins. He also promotes company openness and seeks organizations to make significant strategic changes that will benefit the bottom line.

Buffett has a track record of investing in technological firms. He purchased IBM as his first technology investment (IBM). He made the investment based on the company's previous performance and future objectives. He sold the shares after just a quarter, although he eventually invested in Oracle and Apple (AAPL). Apple is now one of Berkshire's most considerable assets, accounting for 21% of the company's portfolio.

Goldman Sachs is a multinational investment management organization that offers solutions for investment management across all major asset classes. The company serves individual and institutional clientele. BRIEFINGS, the firm's newsletter, provides news and information on the global economy. In recent years, the company has regularly advised keeping engaged in equities and allocating a more significant portion of an investor's equity portfolio to companies in the United States.

The investing strategy of the company is focused on a focus on sustainability. The corporation intends to lessen its environmental effect by investing in sustainable, renewable energy sources. Aside from portfolio sustainability, the firm's investment strategy highlights the necessity of investing in sustainable firms. The firm's ESG strategies, which engage in equity investments in firms that help the environment, reflect this emphasis on sustainability.

Goldman Sachs gained from the summer 2007 collapse of subprime mortgage bonds. Goldman Sachs traders profited handsomely by shorting these assets. The gains gained during the crisis are attributed to Goldman employees Josh Birnbaum and Michael Swenson. They worked in the structured products group of Goldman Sachs in New York City. They were successful in persuading reluctant risk management leaders to support their plan.

Carl Richards is a well-known investor, education author, and media personality. The diagram below depicts his investment procedure. He discusses the significance of investing with your objectives and priorities in mind and how to keep your money under control. He is a well-known public advocate of fiduciary advice.

Richards' other books include The One-Page Financial Plan and The Behavior Gap. He has a lengthy history of coaching investors for a livelihood and is also a futurist. In a recent interview with Forbes, he discussed the value of human, financial counselors in the era of algorithms.

Phil Town hosts the investing podcast InvestED. It focuses on value investing and money management solutions. InvestED features interviews with Phil Town and his daughter Danielle, who each explain their money-making ideas. Thousands of individuals have begun investing as a result of these discoveries. InvestED may be found on iTunes and Soundcloud.

Phil Town is a motivational speaker and investor with two New York Times best-selling financial books. His counsel has also garnered him several appearances on CNBC. He's been on The Millionaire Insider and episodes of "Your Guide to Wealth and Retiring Rich." He's also frequently contributed to Maria Bartiromo's Closing Bell and MSNBC's "Your Business."

0 notes

Text

Pasar saham melonjak lagi menjelang data CPI. Oracle melonjak dalam keuntungan; Apple, Tesla Mengambil Langkah Besar | investor bisnis harian

Pasar saham melonjak lagi menjelang data CPI. Oracle melonjak dalam keuntungan; Apple, Tesla Mengambil Langkah Besar | investor bisnis harian

Pasar saham memperpanjang kenaikannya pada hari Senin menjelang rilis laporan inflasi utama pada hari Selasa. apel Sementara (AAPL) saham adalah salah satu keuntungan terbesar di Dow Jones Industrial Average Ilmu Gilead (GILD) mengungguli Nasdaq 100, naik lebih dari 4%, setelah perusahaan menyelesaikan kasus paten terkait tiga perawatan untuk HIV. X Apple menunjukkan tindakan teknis yang…

View On WordPress

0 notes

Text

Warren Buffett and Ray Dalio: Is There a Bubble?

gurufocus.com

The price action in equities over the past 12 months has been nothing short of outstanding. Despite the global pandemic and economic turmoil, the S&P 500 and other indexes have rushed to new highs without looking back.

It's not just the indexes, either. Many stocks continue to print new highs. The number of IPOs has soared, and there has been a rush of special purpose acquisition companies (SPAC), which have raised $400 billion from investors to pursue acquisitions over the past year.

This investment environment has all the hallmarks of euphoria. Investors have been happy to throw money at new, unproven companies, hoping they will make money.

GuruFocus has detected 5 Warning Signs with Berkshire Hathaway Inc BRK.A.

BRK.A 30-Year Financial Data

The intrinsic value of BRK.A

Peter Lynch Chart of BRK.A

On the surface, the market looks like a bubble. However, when one digs below the surface, it becomes harder to determine whether or not the whole of the market is in a bubble or just some sections of it. Both Ray Dalio (Trades, Portfolio) and Warren Buffett (Trades, Portfolio) have commented on this in the past year.

Dalio and Buffett's comments

During this week's Robin Hood conference, Dalio, who has spent years studying stock market bubbles and economic cycles, presented his analysis on the current market environment. He explained that while he does see some bubble-type activity in parts of the market, overall, the market is not in a bubble, at least not when compared to the late 90s and 2007.

The founder of Bridgewater went on to explain that he believes around 5% of the stocks in the S&P 500 are in a bubble, which is below the level of stocks that were in bubble territory in 1929, 2000 and 2007.

Based on this analysis, Dalio explained that investors would have to determine for themselves which stocks were in bubble territory and which weren't. "There are a lot of stocks that aren't in a bubble," he claimed.

Buffett expressed a similar opinion at this year's Berkshire Hathaway (BRK.A, Financial) (BRK.B, Financial) annual meeting of shareholders. Responding to a question about "crazy high valuations," the Oracle of Omaha stated:

"Well, we don't think they're crazy. But we don't… at least I… Charlie… I feel that I understand Apple (AAPL, Financial) and its future with consumers around the world, better than I understand some of the others, but I don't regard prices, and that gets back, well, it gets back to something fundamental in investments, I mean, interest rates, basically, are to the value of assets, what gravity is to matter, essentially....I mean, if I could reduce gravity, it's pull by about 80%, I mean, I'd be in the Tokyo Olympics jumping. And essentially, if interest rates were 10%, valuations are much higher. So you've had this incredible change in the valuation of everything that produces money, because the risk-free rate produces, really short enough right now, nothing."

Work required

It seems that these two legendary investors do not believe the whole market is currently overvalued. Sure, it seems they are suggesting some sections of the market are expensive, but on the whole, when one takes interest rates into account, equity valuations do not look expensive. With the Fed being so rewarding to companies with high levels of debt, it has become far more common for investors to consider debt as part of a company's assets, which also serves to move valuations upwards.

One also has to take into account the rates of return some of these companies are earning on capital compared to interest rates. With rates of return in the high-double-digits, compared to interest rates which are sitting around zero, they look incredibly attractive.

As such, we can draw the conclusion from these comments that investors who are still willing to put in the work can find attractive investment opportunities despite the current level of the market. What's more, according to Dalio, the market currently looks expensive but is not overvalued, so S&P 500 investment may see continue to see positive returns as the economy opens up.

0 notes

Link

Can Warren Buffett, the Oracle of Omaha, still see the future? What’s happening: At Berkshire Hathaway’s annual meeting over the weekend, Buffett defended the company’s decision not to release reports on how it’s addressing the risks of climate change. He claimed that Berkshire (BRKA) has a good track record for investing in renewable energy through its utility businesses, and said it would be “asinine” to make all of the group’s numerous companies become more transparent. But pressure is growing. At the meeting, one investor asked him about Berkshire’s decision to own a big stake in oil giant Chevron (CVX) given concerns about the climate crisis. Buffett said he has “no compunction” about owning Chevron, and that he would hate to have all hydrocarbons banned quickly — though he noted that the world is quickly moving away from them. “If we owned the entire business, I would not feel uncomfortable about being in that business,” Buffett said. Step back: The company’s shareholders are siding with the 90-year-old CEO. A proposal asking Berkshire Hathaway to address climate change more directly — as well as a measure calling for more disclosure on diversity and inclusion — failed to pass. Yet it’s not difficult to see which way the winds are blowing. Countries such as the United States and United Kingdom are announcing increasingly ambitious targets for reducing emissions, while hundreds of major corporations have issued net zero commitments and are pouring money into sustainable businesses. The wider investment community is also rushing in, as clients push fund managers to create sustainability-focused portfolios, while spectacular growth for companies like Tesla is stoking enthusiasm among everyday investors. Global assets in sustainable funds hit a record high of nearly $2 trillion in the first three months of 2021, up 18% from the previous quarter, according to new data from Morningstar. Berkshire’s Vice Chairman Greg Abel, who has been tapped as Buffett’s likely successor, said during the meeting that “there’s been a clear commitment to decarbonizing our businesses.” He added that the company will retire all of its coal units by 2050. Still, that may not be enough to convince skeptics that Buffett, who earned the nickname “Oracle of Omaha,” is properly assessing the risks at the play. While Chevron has indicated it could rethink parts of its business model in light of climate fears, it remains a $200 billion fossil fuels empire synonymous with the oil-and-gas industry. As efforts to increase reliance on cleaner energy accelerate, its business will face major headwinds. That could be a threat to Berkshire Hathaway, and Buffett’s reputation, too. Epic v. Apple: Legal fight could remake the digital economy Ever since it launched in 2008, the Apple App Store has been the sole gatekeeper between apps and iPhones and iPads. Other platforms, such as Google’s Android, allow apps to be downloaded through third-party stores. But for any developers who want to be on Apple’s mobile devices, the choice is simple — it’s the App Store or nothing. This gives Apple (AAPL) huge power over the terms it can dictate to app makers, my CNN Business colleague Brian Fung reports. Most notably, any time you buy a digital product or service on many iOS apps, it’s processed on an Apple-run payment system, and Apple collects a 30% fee. Now, a federal judge is slated to decide: Is Apple’s policy just part of a hugely successful business model, or is it a violation of US antitrust law? In a trial starting Monday, the judge will consider whether Apple is justified in requiring many app makers — and by extension, consumers — to use the company’s payments technology. The potentially landmark trial stems from a lawsuit filed by the maker of the hit video game Fortnite. Apple booted Epic from its platform last summer for not complying with its rule. The high-profile case will involve witnesses including Apple CEO Tim Cook and his top lieutenants. Representatives for Facebook (FB) and Microsoft (MSFT) are also expected to testify. Corporate emails and presentations could fuel a fierce courtroom battle over App Store policies, which are increasingly under scrutiny from regulators in Europe, lawmakers in the United States and many others. Remember: Last Friday, European regulators accused Apple of violating EU antitrust law, saying the company’s rules unfairly restrict rival music services. Taken together with the Epic case, it’s clear the company is playing defense. Debate grows over banning political discussions at work Late last month, Basecamp, a project management software company, made an unusual move: It banned political discussions at work. Given the company’s relatively small size, the decision — announced in a sweeping blog post from CEO Jason Fried — might have gone by with little notice, my CNN Business colleague Sara Ashley O’Brien writes. But it swiftly generated a backlash. Roughly 20 of Basecamp’s fewer than 60 employees have posted on Twitter that they are leaving the company, with some explicitly pointing to the new policies. The company is offering severance packages for those who opt to depart given the “new direction.” Not the first: Last fall, cryptocurrency exchange Coinbase made waves when CEO Brian Armstrong said there was no place for engaging in “broader societal issues” or “political causes” outside the company’s core mission. The decision was criticized by some as deeply misguided and lauded by others. Paul Graham, the venture capitalist and cofounder of the elite Silicon Valley accelerator Y Combinator, tweeted at the time: “I predict most successful companies will follow Coinbase’s lead.” But diversity and inclusion experts say such moves aren’t courageous, and instead seem motivated by fear of change. Banning politics at work comes across as an attempt to “bottle the genie on woke politics so people can just get away with what they’ve gotten away with before,” according to Y-Vonne Hutchinson, the founder of inclusion consultancy firm ReadySet. Hutchinson told CNN Business that what the people who are making these decisions are “not realizing — or maybe what they don’t want to realize — is that in an environment where there is literally no separation between your work and your home, and your very existence is political, you can’t really separate the two.” Up next Estee Lauder (EL) reports results before US markets open. XPO Logistics (XPO) follows after the close. Also today: The ISM Manufacturing Index for April posts at 10 a.m. ET. Coming tomorrow: CVS (CVS), Pfizer (PFE), Hyatt Hotels (H), Lyft (LYFT) and Zillow (Z) post earnings. Source link Orbem News #Buffett #Future #investing #Omaha #oracle #Premarketstocks:CanWarrenBuffett #stillseethefuture?-CNN #theOracleofOmaha #Warren

0 notes

Text

Tesla needs a perfect year. That won't be easy

New Post has been published on https://appradab.com/tesla-needs-a-perfect-year-that-wont-be-easy/

Tesla needs a perfect year. That won't be easy

But in order to justify its sky-high stock price, the automaker will need to overcome a growing list of challenges.

What’s happening: A global chip shortage is snarling production, while the business environment in China, a crucial market, remains fraught. Competitors are gaining ground and Tesla faces a safety investigation tied to a fatal crash in Texas.

Shares are down 2% in premarket trading.

Some Wall Street analysts still see a solid case for Tesla’s stock, which is trading at more than 1,100 times its earnings, according to data from Refinitiv.

“While the company is still far from the sort of scale to justify its stock price … production has exploded, and the company expects further expansion with the 2021 completion of its Berlin and Texas factories,” Bespoke Investment Group told clients.

But a closer look at the company’s financial results show that a big reason the company had a strong start to the year is because of its sale of regulatory credits, which brought in $518 million in revenue, and bitcoin holdings.

Tesla invested $1.5 billion in bitcoin last quarter while the cryptocurrency was soaring. Zachary Kirkhorn, the automaker’s “master of coin” (okay, chief financial officer), said the company later sold 10% of its position, resulting in a $101 million profit. That’s nearly a quarter of the $438 million Tesla earned when results are adjusted for stricter accounting standards.

And while there’s no denying that the company’s car sales could continue to boom this year, there are, as ever, a long list of risks.

CEO Elon Musk, whose official title is now “Technoking,” told investors Monday that the chip shortage was “a huge problem” for Tesla, and that it was battling “some of the most difficult supply chain challenges that we’ve ever experienced.”

Musk said the company should be able to stick to its target for better than 50% growth in sales this year, which would take sales over the 750,000 mark.

To reach that target, the company needs to continue to see strong demand in China, the world’s biggest market. But it faces potential issues there from both consumers and Beijing.

Last week, Tesla’s booth at the Shanghai Auto Show was briefly besieged by protesters complaining about problems with its cars. The episode comes after Tesla was summoned by regulators in February to discuss the quality of its Shanghai-made vehicles. The following month, reports surfaced that the country’s military had banned its vehicles from entering its complexes over concerns that cameras onboard could be used for spying.

Chinese authorities aren’t the only ones putting Tesla under the microscope. The company is also working with US safety investigators after two passengers were killed in a crash of a Tesla Model S outside Houston.

These challenges come as Tesla faces increasingly fierce competition from upstart rivals like Rivian, as well as traditional automakers like Volkswagen and General Motors that are ramping up their electric vehicle offerings.

Tesla could still rise above the fray — and Bespoke Investment Group notes that the company’s stock is often divorced from its financial performance anyways. But the path ahead for Tesla and its Technoking looks tricky.

Wall Street’s Archegos losses just topped $10 billion

Losses caused by the collapse of US hedge fund Archegos are piling up, my Appradab Business colleague Charles Riley reports.

The latest: Swiss bank UBS (UBS) revealed on Tuesday that it lost $774 million from last month’s implosion of Archegos Capital Management, a bigger hit than many analysts expected. The announcement came as Japan’s Nomura (NMR) said it would book losses of $2.9 billion from Archegos, a sharp increase from its initial estimate of $2 billion.

Global banks have now disclosed losses of at least $10.4 billion from the failure of Archegos, a New York-based family office that managed the fortune of investor Bill Hwang. Some smaller banks may also have been hit, and the fallout has taken the shine off an otherwise strong earnings season for global banks.

Credit Suisse (CS) has been rocked hardest. The Swiss bank said last week that the collapse will cost it a total of $5.5 billion, and it has announced the departure of its top investment banker and chief risk officer. Other members of the executive board will not receive bonuses for 2020.

Morgan Stanley (MS) suffered a $911 million loss, and Japanese lender Mitsubishi UFJ Securities is expecting to lose roughly $300 million.

Remember: Archegos used borrowed money to build massive positions in stocks including media companies ViacomCBS (VIACA) and Discovery, and was unable to pay back its lenders when share prices dropped. The resulting damage to banks has raised concerns about the dangers of leverage and led to calls for tighter regulation.

Is the $2 trillion company club about to expand?

Apple (AAPL) is the only American firm to reach a $2 trillion market value. But it could soon have a lot more company in that elite club, my Appradab Business colleague Paul R. La Monica reports.

Microsoft is worth just under $2 trillion. Amazon has a market capitalization of $1.7 trillion, and Google owner Alphabet is worth about $1.5 trillion.

Tech stocks have come roaring back in recent weeks, helping to push these Nasdaq stalwarts near record highs.

In fact, tech’s Magnificent Seven — Facebook, Amazon, Apple, Netflix, Alphabet, Microsoft and Tesla— are now collectively worth about $9.3 trillion. That’s a quarter of the S&P 500’s total market value of $37.5 trillion.

“The earnings expectations for the S&P 500 are through the roof for this year as investors expect this great recovery, and tech is a big part of that,” said Daniel Morgan, senior portfolio manager with Synovus Trust Company. “These companies are just so dominant.”

Morgan noted that while some of the tech leaders of the 1990s, such as IBM, Oracle and Cisco, eventually began to post slower earnings and sales growth, that doesn’t appear to be happening with the current industry leaders.

“They are high-growth companies but also defensive because they could still do well if the reopening of the economy doesn’t go smoothly after Covid,” said Chris Gaffney, president of world markets at TIAA Bank. “Some consumer behavior changes during the pandemic may be permanent.”

Up next

3M (MMM), Eli Lilly (LLY), Invesco, GE (GE), Hasbro (HAS), JetBlue (JBLU), Raytheon (RTN) and UPS (UPS) report results before US markets open. Google owner Alphabet (GOOGL), Capital One (COF), FireEye (FEYE), Microsoft (MSFT), Mondelez (MDLZ), Pinterest (PINS), Starbucks (SBUX) and Visa (V) follow after the close.

Also today: US consumer confidence data for April posts at 10 a.m. ET.

Coming tomorrow: Investors will comb through the Federal Reserve’s latest policy announcement for any signs of concern about inflation.

0 notes

Text

3 La mejor regla de Buffett para la inversión en acciones

3 La mejor regla de Buffett para la inversión en acciones

La reunión anual de 2018 de Berkshire Hathaway, presidida por el presidente Warren Buffett, puso un enfoque renovado en los secretos del inversionista maestro para elegir acciones exitosas, desde Apple Inc. (AAPL) a Coca-Cola Inc. (KO) a Delta Airlines Inc. (DAL) – en previsión de los próximos movimientos de Oracle de Omale. Se presenta el último análisis en profundidad del enfoque de Buffett en…

View On WordPress

0 notes

Text

Researching the New Senate Tax Bill

As anyone who watches Washington politics already knows, on Sunday afternoon the Senate passed its massive economic reform bill known as the Inflation Reduction Act. Two elements in that legislation caught Calcbench’s eye: a new minimum corporate tax of 15 percent; and 1 percent excise tax on share repurchase programs.

Can Calcbench users get an early start on considering the implications for Corporate America? You bet!

Let’s start with share repurchase programs. Calcbench has published numerous reports over the years about how much money corporations have spent buying back shares. Most recently, we did an analysis of all public companies (regardless of size), and found that they collectively spent $6.52 trillion from 2012 through 2021 on share buybacks.

Tech companies such as Apple ($AAPL), Google ($GOOG), Microsoft ($MSFT), and Oracle ($ORCL) led the way; but share repurchase programs reached a large swath of corporations great and small.

In 2021, the S&P 500 spent a collective $841.6 billion on share buybacks. Leading the way were Apple ($85.5 billion), Microsoft ($60.7 billion), Google ($50.3 billion), and Facebook ($44.8 billion).

In theory, that 1 percent excise tax would imply an additional tax cost of, well, 1 percent of whatever amount a company is spending on share repurchases. That would have been $8.4 billion for the S&P 500 based on 2021 numbers. (Before anyone gets carried away, though, let’s remember that the House still has to pass this bill too, and the president sign it into law.)

We don’t yet know what 2022 repurchase spending might be, especially since rising interest rates makes borrowing to repurchase shares a less attractive idea than it was in the 2010s. Still, Calcbench has extensive data on share repurchase programs if you want to start modeling some scenarios.

Minimum Tax Plans

The Inflation Reduction Act also contains a corporate minimum tax of 15 percent on the domestic profits of large companies. This is also known as the minimum book tax, since the 15 percent tax would be based on GAAP net income reported to shareholders in the annual 10-K. The tax would apply to companies reporting $1 billion or more in annual net income.

We jumped onto our Multi-Company page and found 303 companies within the S&P 500 that reported $1 billion or more in net income for 2021. Apple led the way with $94.7 billion, down to Campbell Soup ($CPB), which squeaked onto the list with $1.002 billion.

Total net income among this group was $1.752 trillion. A 15 percent minimum tax against that amount would be $262.9 billion.

As the Senate bill stands now, the 15 percent book tax would not automatically be the amount a company has to pay. Companies would also need to calculate their potential income tax using the traditional method of applying the current corporate tax rate (21 percent) plus various deductions and credits. Then a company would need to pay whichever amount is greater— either that traditionally calculated number, or the 15 percent minimum tax.

Again, you can skim the Calcbench research archives to see our prior reports on corporate tax payments. Other analysts have also published their own tax research based on our data, and we have some prior posts recapping their findings as well.

You can always do whatever research catches your fancy as well, using the standardized metrics on our Multi-Company page to search for net income, tax payments, or other related terms.

0 notes

Link

Both blue-chip and tech penny stocks are in a flurry right now after news came out about Berkshire Hathaway cut its stake in Apple (AAPL) in favor of taking up a larger position in names like Verizon (VZ) and Chevron (CVX). The Oracle’s “mystery stock pick” had been the center of speculation over the last week as traders awaited the latest round of 13F filings. So what does this mean for tech? In reality, while tech companies like Apple might experience some selling pressure in light of this latest move, it has ultimately brought attention to alternatives in the technology space. You’ve also likely got some attention building on communications stocks too.

Wednesday saw major benchmark tech ETFs like the XLK pull back from Tuesday’s all-time highs giving back the last 3 days of gains. The S&P and Nasdaq both pulled back in concert. One niche that didn’t pullback was financial stocks. Now, I’m not just talking about your popular banking stocks. Due to the rise in attention surrounding cryptocurrency, there were plenty of fintech stocks making a strong push toward new highs...continued reading on PennyStocks.com

#penny stocks#stocks to watch#stocks to buy#penny stocks to watch#best penny stocks#day trading#tech stocks#technology#tech

0 notes

Text

Stock Market Learning - Master Your Skills In Indian Stock Market

It is also partly because I don't need a clearly defined amount of money for my goals, like the example of the person who wants to buy Manchester United. One hundred times the amount I need for financial freedom, or more, would certainly be very helpful, but 10-20x might also get me quite far. If things really play out as the model predicts, those numbers would lead to a much higher SP than $1,185, because even those bear financials are far better than anybody is expecting. Posted KOP earlier in my private forum to watch out for KOP when the trendy boutique was under collections. As long as General Electric stays above the 50 day, I like the stock in the short term. Apple (AAPL) - Apple (AAPL) rallied back above $220 recently. VIX) briefly spiked above 30 for the first time in five weeks. When you have a set goal, you can always create an FD to get assured returns when the time comes.

It's not entirely set in stone yet. Keep an eye on support at $8.80, a close below this level would set up a retest of $8.25. Here you can find a couple of useful high level statistics. Oracle hit a new 52 week high at $27.62 and is now a buy on pullbacks below $26. If one wants to be extra conservative, perhaps one could use an EBIT multiple of 40x, but I personally think 50x is more than reasonable at this point in time, especially now that the market seems to have begun to realise Tesla's long term potential a little bit. Although there is some seasonality, I think multiplying the most recent quarter's EBIT by 4 to get an 'extrapolated EBIT', and applying the 50x EBIT multiple to that number, is the best way to value Tesla. Going back to Tesla, considering how rapidly it is growing and how early it is still is, I think an EBIT multiple of 50x is very reasonable, and quite possibly conservative.

Usually I use an EBIT multiple for this. There's no exact science, but I like to use a combination of my feeling for how the market currently values Tesla, and by looking at EBIT multiples of various other companies. Looking at competitors' EBIT multiples is pretty much useless in the case of TSLA, and looking at historic valuations is also not super useful, because Tesla has only just started posting EBIT profits. Even the ones from the bear case would be received extremely positively, and would certainly send the stock much, much higher than current levels. And one of the fastest ways to increase your earnings is trading in Indian stock markets. Non-defense capital goods shipments, excluding aircraft, rose 3.3% in June from May, accelerating after the prior month’s 1.6% increase and topping expectations by more than one full percentage point. As you all know, the stock market is full of risks, insecurities and volatility.

0 notes

Text

30 Fun Activities To Do Indoors

SanDisk Corp. (SNDK) - SanDisk Corp. 2% on Thursday. SNDK is a buy below $40. Molycorp will have resistance located at $46 on the upside and needs to hold $40 on the downside. 1. Wrong timing - Timing plays an important role in the future value of a trendy boutique because the timing of investing in the market affect the gain or loss of stock value like investing at the time of recession prove beneficial, as a person will own shares at the lowest price. Shares that pay out dividends are a standard investment selection and this will not change any time soon. Star Scientific, Inc. (CIGX) will now have resistance located at $3.50. Star Scientific, Inc. (CIGX) - Star Scientific, Inc. (CIGX) hit $3.43 on Thursday. Star Scientific, Inc. (CIGX) will now have resistance located at $3.16. FAS will have support located at $27 and resistance located at $30. FAS will now have support located at $25 and resistance up at $30 .

GE stock will now have resistance located at $20. Resistance continues to be located at $37 on the upside. USA Technologies Inc. (USAT) - USA Technologies continues to trade around $2.00. USA Technologies Inc. (USAT) - USA Technologies is back above $2.00. 0.63 on Thursday but then pulled back. Evergreen Energy, Inc. (EEE) - Evergreen Energy broke up through $3 on Thursday. Evergreen Energy, Inc. (EEE) - Evergreen Energy failed at $3.00 on Wednesday. LEI is a buy under $3.00. Below is a list of stocks that are worth watching for March 17, 2011. Also, check out some of the biggest stock gainers of the Day, Top 2011 stock Gainers , stocks to Buy 2011, and Day Trading Tips. GE is a buy below $19 for the long term. The Dow Jones hit a high of 9633 today and traded above 9600 several times, but at 2pm est this all changed. Daily Finan. Bull 3X Shs(ETF)(FAS) - FAS traded up to $44.25 on Tuesday as resistance continues to be at the $45 level. Goldman Sachs Group, Inc. (GS) - Shares of Goldman Sachs Group traded flat Thursday. Sirius XM Radio (SIRI) - Sirius XM Radio (SIRI) was flat on Thursday.

Oracle Corp (ORCL) - Oracle Corp (ORCL) was flat on Friday. Oracle Corp (ORCL) - Oracle Corp (ORCL) rebounded 2% on Thursday. Hyperdynamics made a high of $5.64 on Thursday before pulling back. Lucas Energy, Inc. (LEI) broke $3.45 in early trading and ran up an additional 8% before pulling back. Lucas Energy, Inc. (LEI) hit $3.81 in early trading before pulling back. Arena Pharmaceuticals, Inc. (ARNA) - Shares of Arena Pharmaceuticals, Inc. pulled back after a huge run over the past few trading sessions. Watch for another close over $1.85 which would be bullish. Samson Oil & Gas Limited (SSN) - Samson Oil & Gas Limited (SSN) was up over 10% on Wednesday as oil rallied. SSN will now have resistance located at $2.10. Today I will be day trading AAPL and POT as I did yesterday. Level 3 Communications Inc. (LVLT) - Level 3 Communications Inc. bounced off the 50 day moving average on Thursday. Level 3 Communications Inc. (LVLT) - Level 3 Communications Inc. bounced off the 50 day moving average on Friday.

Bank of America Corp ( BAC ) - Bank of America Corporation reported solid earnings Friday but sold off. Accelr8 Technology Corp. (AXK) - Accelr8 Technology Corp. Potash Corp. of Saskatchewan, Inc. (POT) - Potash Corp. Avalon Rare Metals, Inc. (AVL) - Avalon Rare Metals, Inc. (AVL) continues to move with MCP. China MediaExpress Holdings, Inc. (CCME) - China MediaExpress Holdings, Inc. (CCME) continues to be halted. Goldman Sachs Group, Inc. (GS) - Shares of Goldman Sachs Group rallied on Friday. Netflix, Inc. (NFLX) - Netflix, Inc. (NFLX) dropped below $210 on Friday. Hercules Offshore, Inc. (HERO) - Hercules Offshore, Inc. (HERO) dropped about 9% on Wednesday. 37% at one point Wednesday and is worth watching. Yet by market close Wednesday, stocks pared some gains, after the bill with $2 trillion worth of relief for the coronavirus-stricken economy exposed intra-party divisions. Below is a list of stocks that are worth watching for November 16, 2010. Also, check out some of the biggest stock gainers of the Day, Top 2010 stock Gainers , Hot stock Market News, and Day Trading Tips. For the case mentioned above the trader has $100K trading capital and wants to hold at least twenty stocks.

0 notes