#advanced tax-saving methods

Explore tagged Tumblr posts

Text

The Ultimate Guide to Tax-Saving Techniques: A Beginner's Handbook

The Ultimate Guide to Tax-Saving Techniques: A Beginner's Handbook

Master the art of tax-saving with our comprehensive beginner's guide. Explore the best strategies, tips for beginners, advanced methods, deductions, and credits. Tailored techniques for small businesses included. Start saving more today!

Read more >>

#tax-saving-techniques#best tax-saving strategies#tax-saving tips for beginners#advanced tax-saving methods#tax-saving deductions and credits#"tax-saving techniques for small businesses

0 notes

Text

Saturn in the Houses

paid readings | Masterlist

ᡣ𐭩 Please support me by reposting, liking, following me and commenting your placement. Saturn represents resitictions, delays and obsticals however it's precious as it represents dicipline and what comes from struggle results in a beautiful flower of growth.

1st house When Saturn is in the first house, which governs self and identity, people tend to appear solemn, ordered, and occasionally restrained, which does manifest itself through elegance. Early trials may help kids develop strong morals and a sense of responsibility, resulting in high levels of independence. This placement emphasises the importance of developing a strong personal foundation and overcoming early emotions of inadequacy.

2nd house When Saturn is in the second house, which is responsible for personal resources, values, and finances. These natives may experience early limitations or concerns about money and possessions. They need to understand the true value of their possessions, learn how to manage their finances, and save prudently. They can achieve long-term security and a strong sense of self-worth with persistence and sensible management.

3rd house A guarded speaking pattern or difficulties in early schooling may result from having Saturn in the third house, which is in charge of siblings, communication, and the near surroundings. People may feel indebted to their siblings, and short-distance travel may result in delays. The lesson here is to overcome any anxieties of expression or perceived academic limits by developing clear, succinct, and careful communication abilities.

4th house The 4th House, which governs the house, family, and emotional roots, is sometimes associated with a rigorous upbringing or a strong sense of commitment to family concerns. There may be a desire to create a secure family environment, as well as early experiences with emotional restraint. Through hard work, the individual learns to develop a safe, long-lasting personal sanctuary as well as to establish strong emotional boundaries.

5th house The fifth house, where Saturn is located, is in charge of children, romance, creativity, and pleasure. Natives may encounter delays or proceed cautiously in these areas. Their ability to express themselves creatively may be restricted, or they may take parenting very seriously. The challenge is to get over the fear of criticism, embrace real creativity, and find true joy in a methodical but satisfying way.

6th house A strong sense of responsibility, a diligent work ethic, and meticulous attention to detail regarding daily activities, employment, and health are typically indicated by Saturn in the 6th House. These natives may be prone to health issues, difficult working conditions, or a tendency towards perfection. The lesson is to become more efficient, develop productive habits, and prioritise their health by engaging in self-care.

7th house When Saturn is in the 7th House, which governs partnerships and open enemies, it teaches significant lessons about equality, dedication, and accountability. Business or marital partnerships may be delayed or have significant commitments. People learn patience, loyalty, and the need of selecting partners who share their long-term goals in order to form solid, long-lasting relationships.

8th house With its associations with intimacy, change, and shared resources, Saturn in the 8th House usually imparts important lessons about power dynamics, trust, and vulnerability in relationships. Problems with debt, inheritance, or confronting one's flaws may arise. These natives do have a unique relationship to 8th house matters and they may work in fields revolving around matters such as death and taxes - alot of death nurses have 8th house saturns.

9th house Saturn is associated with a sober and methodical approach to information and belief systems since it is located in the 9th House, which is responsible for philosophy, advanced education, and long-distance travel. Individuals may face obstacles to their fundamental convictions or impediments in their further education. The process includes a thorough analysis of their worldview, the development of a thorough and ethical conception of truth, and a resolute search for wisdom.

10th house Aspiration and notable public achievement are strongly supported by Saturn in the 10th House, which is in charge of reputation, career, and public image. Individuals are often disciplined, accountable, and motivated to enhance their standing and reputation. Their perseverance usually results in persistent success, a strong reputation, and a position of substantial influence, even in the face of potential setbacks or disappointments along the route.

11th house When Saturn is in the 11th House, which is in charge of friendships, groups, and aspirations, people may have a more constrained and selective circle of friends or struggle with group dynamics. They are drawn to deep, enduring relationships and frequently feel a sense of duty to their community or humanitarian causes. The lessons to be learnt include creating strong, reliable networks and bringing fresh, important ideas to the community.

12th house Saturn, the 12th House's ruler of the subconscious, secret affairs, and religion, typically foreshadows karmic teachings about selflessness, solitude, or overcoming buried concerns. Natives may feel burdened by invisible commitments or experience periods of loneliness. To acquire mastery, one must confront subconscious tendencies, grow inner strength via spiritual discipline, and find peace by silently helping others and letting go of old responsibilities.

DISCLAIMER: This post is a generalisation and may not resonate. I recommend you get a reading from an astrologer (me). If you want a reading from me check out my sales page.

@astrofaeology private services 2025 all rights reserved

730 notes

·

View notes

Text

Hi everyone, thank you so much for taking part in the Zukka Thirst NSFW weekend! As promised, here is our masterlist of amazing fanworks created for the weekend, and we wanted to put them together here one easy post for clicking!

Before I begin we just want to thank the creators who took part - this was a fun weekend to run and we hope you had fun too, and that you enjoyed sprinkling a little bit of spice into our Zukka hotpot!

We've popped the list under a read-more to save dash space, but under the cut you'll find a compilation of all the great stuff that came (😏) out of the weekend. Each work comes with its own individual warnings and tags on it, so please read before scrolling down - or if in doubt, browse the AO3 collection instead! We've also included links to the promo post(s) for each piece on tumblr if you'd like to reblog directly from the author or artist. And obvious caveat - all these creations are not worksafe!!

And without further ado... the fanworks!

Title: Blowjob Creator: @umossu on tumblr | 1mossplease on AO3 Summary: They blow each other :-) Links: AO3 Preview:

Title: Just Get On Your Knees (Say Pretty Please) Creator: @erisenyo on tumblr | erisenyo on AO3 Summary: Zuko has a crush. Detective Wang Fire is on the case. And Sokka--Sokka might have a few questions, too, once he gets past how fun it is to see Zuko so flustered. Links: AO3 | tumblr promo post Preview:

“Don’t worry, love,” Sokka tosses over his shoulder, smirking as Zuko’s heat licks up his back. “Second place is still good enough to get your dick w—wait. Mine?” Zuko tumbles Sokka onto the bed. “Yours?” “You said mine doesn’t have posters.” Sokka shoves his loose hair out of his face, rolling onto his back just in time for Zuko to straddle him. “Meaning yours. Your—crush? You have a crush?”

Title: A Primer on How to Make Tax Codes, Trade Taffirs, and Asset Management Sexy Creator: Escyn on tumblr | Escyn on AO3 Summary: NSWF art inspired by Erisenyo’s Lessons in Proper Asset Management Links: AO3 Preview:

Title: high-strung Creator: @ranilla-bean on tumblr | ranilla-bean on AO3 Summary: Sokka gives Zuko a maths lesson. Links: AO3 | tumblr promo post Preview:

Sokka’s eyebrow rose. A smirk tugged at the corner of his mouth. What was he up to? Zuko’s breath hitched; his fingers dug into the lotus silk of his robe. He had never quite managed to become immune to Sokka’s charms. A playful brown hand reached into the bag and pulled out— Well, Zuko wasn’t sure what it was.

Title: Piercings Creator: @umossu on tumblr | 1mossplease on AO3 Summary: Zuko gets ALL the piercings. Sokka approves. Links: AO3 Preview:

Title: Enhanced Interrogation Creator: @watertribe-inventor-guy on tumblr | Fishstick_LBT on AO3 Summary: It's dick. The advanced interrogation method is Fire Lord dick. Links: AO3 | tumblr promo post Preview:

Title: Nice Contrast Creator: @aimrwv on tumblr | AIMRWV on AO3 Summary: Suki mentions Sokka’s involvement in an underground movement for sexual liberation within the Fire Nation and Zuko wonders why his closest friend had never bothered telling him about it.

He finds out the "hard" way. Links: AO3 link Preview:

“Sorry that I wasn’t super excited to talk about my less conventional sex-life with a happily married straight man who also just happens to be the Fire Lord and – wait – my employer.” Sokka said, the bite behind his words was clearly for show but Zuko decided to play along. “Employer” He snorted. “Do you really think that I treat anyone else in this palace like I treat you? I can assure you you’re the only one of my employees who is allowed to sit on my private balcony and share carafe after carafe of this nation’s finest wine with me. That’s how I treat friends, Sokka. And also, I think, as the regent monarch, I should know about underground movements in my country.”

Title: Cooling down (and heating right back up again) Creator: Escyn on tumblr | Escyn on AO3 Summary: NSFW art inspired by SyciaraLynx's Married Zukka Banging it Out Series Links: AO3 | tumblr promo post Preview:

Title: Zukka Thirst Weekend Creator: @shesmykindofboi on tumblr | chibicthulhu on AO3 Summary: Drawing for zukka thirst prompt event on tumblr, literally the first nsfw art I’ve ever done. Fun! Links: AO3 | tumblr promo post Preview:

Title: up with the sun Creator: @dickpuncherdraws on tumblr | dickpuncher420 on ao3 Summary: Sokka wakes up feeling frisky. Links: AO3 link | tumblr promo post Preview:

Title: Unfulfilled Needs Creator: @baileynono on tumblr | baileynono on AO3 Summary: Sokka and Zuko come to the realisation that they desperately need to fuck. However, there are only very few moments where the Fire Lord won't be interrupted. Links: AO3 | tumblr promo post Preview:

“So, mighty Fire Lord, how has this evening been treating you?” Zuko scrunches up his face. “I didn’t escape a bunch of nonsense to hear you spout some more.” “Oh, please. You love it even when I talk all fancy to you.” Sokka receives a glare and a squeeze on his shoulders as Zuko very pointedly avoids his face. “Come on, I asked you a question! How has this evening been?”

Title: Doodles that embarrass me Creator: blu3berrydraws on tumblr | Blu3berry on AO3 Summary: this is a dump for spicy sketches that ill never finish or refine all of them are NSFW ! They feature nudity and sexual acts ! Links: AO3 | tumblr promo post Preview:

Title: Jockey Creator: @umossu on tumblr | 1mossplease on AO3 Summary: Zuko gets pounded into the bed Links: AO3 Preview:

Title: Zukka Smut Compilation Creator: @ash-and-starlight on tumblr | Summary: A place where I can gather my nsfw zukka art, starting off with entries for the Zukka Thirst Weekend over on Tumblr

1) Frotting + fem!zukka 2) Hickeys + modern au 3) Spooning 4) Blowjob + t4t zukka 5) Rimming + a scene from ranilla_bean's "in flammam flammas" Links: AO3 | tumblr promo post 1 | tumblr promo post 2 | tumblr promo post 3 Preview:

Title: golden apple of my eye Creator: @glycopyrrolate on tumblr | aiyah on AO3 Summary: Sokka has a fantastic idea. Zuko obliges. Links: AO3 | tumblr promo post Preview:

But what if? Stupid ideas mean stupid decisions. Sokka’s the type of guy to think about stupid shit when he really shouldn’t. It usually comes back to bite him in the ass.

Title: hit the back Creator: @dickpuncherdraws on tumblr | dickpuncher420 on ao3 Summary: Zuko knows how to treat her girl right. Links: AO3 | tumblr promo post Preview:

Title: helping hand Creator: @ranilla-bean on tumblr | ranilla-bean on AO3 Summary: Sokka wears Zuko like a glove puppet. 🤜 Links: AO3 | tumblr promo post Preview:

Back home, they had, well, objects for this. All sorts of lewd things not meant for polite eyes that they could cram out of sight into all sorts of holes. At Kuei’s palace, they did not. But Sokka was looking thoughtful. “Wait… We might not have our toys, but…” He held up a hand and waggled it. “We could improvise?”

Title: Zukka Thirst Event Creator: @arandin-art on tumblr | nekoppi on AO3 Summary: My art participation to the Zukka Thirst Weekend. Links: AO3 | tumblr post Preview:

Title: You are going to carry that weight Creator: Escyn on tumblr | Escyn on AO3 Summary: Smutty mostly art that took on a life of its own. Ft. Sokka as a cowboy, Zuko as a samurai, scruffy middle-aged men looking for a second chance, and a non-insurmountable language barrier. Links: AO3 | tumblr promo post | tumblr promo post 2 Preview:

"When my lover left me for another man, I, ah, killed both him and his new lover. I felt much, how do you say it, lighter? Yes, lighter." The stranger peers at Sokka though his lashes, golden gaze assessing what Sokka can only guess is a look of utter bewilderment on his face. Heartbreak had driven Sokka away from the only home he ever knew, to a foreign land with only his flask and a letter of introduction to a cattle rancher to his name. The letter had lead him here, on a train to the middle of nowhere, the Eurasian plain flying by. The flask had him spilling his guts to this unsuspecting stranger. A stranger who maybe just admitted to murder, whose pretty pink lips demand all of Sokka's attention, he wants them wrapped around his-- "Would doing that also help you?" Sokka sputters, moving the flask away from his lips. Coughing, he feels the low alcohol buzz in his stomach transform into something hot and churning. So many questions, but only one passes his lips. "Dude, what the fuck is wrong with you?"

Title: Zukka Thirsty Weekend Creator: @chiptrillino Summary: Collection of drawings for the characters sokka and zuko, based on the prompt bingo from the zukka thirst event on tumblr. Links: AO3 Preview:

Title: Fuck me Juliet Creator: @umossu on tumblr | 1mossplease on AO3 Summary: Zuko is horny and Sokka is saying something. Then Sokka is horny, and Zuko is saying something. Then they're both talking. Then they're fucking. Links: AO3 Preview:

The moonlight shines only on Sokka's right side: one eye, bluer than the ocean spirit, stares back at him. Zuko forgets to breathe for a moment. When Sokka's fingers slide down his neck, it brings him back to his senses, and Zuko asks, "Can I–" They're kissing.

#zukka thirst mod post#zukka thirst week#zukka#atla zuko#atla sokka#waaahhh it’s been such a fun ride!!#and so many amazing contributions#we rlly couldn’t have hoped for anything better

62 notes

·

View notes

Note

Hello dear Sarah, how are you? You know, I'm anxious, I wanted to know if you know if they will record the Kalafina concert? I'm dying to see that 😭Please tell me if there will be a release, I want to see them. I can't travel to Japan, it's sad to think that maybe I'll never see them live but I haven't lost hope so it would be great if this comeback was released on bluray I would buy it 😭 although I'm scared I won't receive the discs again excuse my weakness for the kalagirls

Hello there!

I'm good, thank you. A bit overwhelmed with everything that's going on right now but it's fine. I just have to focus on the fact that I will be seeing Kalafina in less than 10 days.

I wish I could give you the answer you are seeking but right now, we simply do not have any info on whether or not they are planning to record the concert. Usually, these things don't get announced in advance, we'll have certainty once the first people are at the venue and can confirm that there are lots of cameras around. I'll try to make a quick post if I happen to see anything.

But yeah, a DVD or Blu-ray would honestly be amazing. In theory, it should be no issue at all for Space Craft to release live recordings of Kalafina's music even without YK' involvement (they have done it before with Wakana's covers) but they might have to pay a fair amount of money to YK for a proper home video release. Not sure if they are willing to do that. We'll see. Maybe they will do a broadcast on a streaming platform instead? This method is becoming more and more popular these days, probably because it's a lot cheaper than a physical release.

I sadly cannot really give you any meaningful advice on how to best receive your packages since I have never really had problems with that. Maybe ask fellow Kalafina fans from your country about how they handle overseas purchases like that. Definitely choose a shipping option that offers a solid tracking service and maybe pick a different address than the one you used before (work place etc). Depending on where you live, you should also expect to pay high import taxes and/or custom fees so it's best to save up some money.

20 notes

·

View notes

Text

Last Will and Testament

I, Harvey Langford of ▆▆ ▆▆▆▆▆ Road, ▆▆▆▆▆, ▆▆▆▆▆▆▆▆, ▆▆▆ ▆▆▆, United Kingdom, revoke all former wills and testamentary dispositions made by me and declare this to be my last will and testament.

1. Declaration of Legal Status

I am unmarried and have no children, biological or adopted. I have no dependents under my care at the time of executing this Will.

2. Appointment of Executor

I appoint John Price as the sole Executor of this Will. If John Price is unable or unwilling to act, I appoint John MacTavish to act as alternate Executor. My Executor shall have full authority to manage, administer, and distribute my estate in accordance with the provisions herein.

3. Bequests and Beneficiaries

3.1 Charitable Donations

I direct that the following donations be made from my estate before any other distributions:

£50,000 to the Combat Stress Foundation

£50,000 to the NSPCC

£50,000 to Mind UK

£25,000 to the Royal British Legion

3.2 Residual Estate and Financial Assets

All monetary accounts, savings, and pensions held in my name and the remainder of my estate, after the above bequests and settlement of debts and taxes, shall be divided equally (50/50) between John Price and John MacTavish.

Should either be deceased at the time of my passing, the other shall inherit the full residual estate.

4. Personal Effects

My personal journals, notebooks, photographs, and letters are to be delivered to MacTavish. He may read or destroy them at his discretion.

My military memorabilia, insignia, medals, commendations, field journals, operational records (excluding classified materials under Official Secrets Act) and service uniforms may be donated to the Regimental Museum of the Special Air Service, with the stipulation that none of my medical or psychological records be disclosed publicly, or returned to Task Force 141 for memorial purposes at the discretion of the Executor.

5. Medical and Psychological Records

While my personal medical and psychological records remain protected under relevant confidentiality laws, I authorize their use in anonymized research for the advancement of medical and psychological care for:

Survivors of childhood abuse

Veterans with PTSD

Individuals suffering from mental disorders

Individuals recovering from head or facial trauma

Permission is granted for release to academic, governmental, or NHS-affiliated research institutions only, provided identifying information is omitted unless required.

6. Burial and Memorial Instructions

I leave the method of body disposition to the discretion of my Executor. I express no preference between cremation or burial. If cremated, the ashes may be kept, scattered, or interred according to the Executor’s judgment.

I request, however, that I be remembered with a grave marker bearing the following:

Name: Harvey Langford

Dates: 1977 – [Year of Death]

Unit: 22nd SAS Regiment – Task Force 141

Epitaph:

If you're reading this, you're still here. That's enough. Keep walking.

The grave is to be located in a military cemetery if possible, or a civilian plot with appropriate discretion and dignity. This is so my comrades may visit and remember.

7. Digital Records and Security

All digital assets, encrypted drives, and online accounts are to be deleted and destroyed, excluding any documentation relevant to MOD or Executor's duties.

8. No Bequest to Family

I intentionally make no provision for my biological parents or extended family in Korea or elsewhere, as all claims to kinship or inheritance are hereby rejected. I instruct my Executor to oppose any claim to my estate by any blood relative not named herein.

9. Final Wishes

Four sealed personal letters have been written by me and entrusted to the Executor, addressed respectively to:

John Price

John MacTavish

Simon Riley

Gary Sanderson

These are to be delivered posthumously, by hand or by secure courier. These letters are not codicils and do not amend the legal contents of this Will.

IN WITNESS WHEREOF, I hereby sign this Last Will and Testament, written and executed in accordance with the Wills Act 1837.

Signed: Harvey Langford

Date: 7th July, 2016

Witnessed by:

1.

Name: Simon Riley

Address: ▆▆▆▆▆▆▆▆▆▆▆ Occupation: British Army Officer

Signature: ▆▆▆▆▆▆▆▆▆▆▆

Date: 7th July, 2016

2.

Name: Gary Sanderson

Address: ▆▆▆▆▆▆▆▆▆▆▆

Occupation: British Army NCO

Signature: ▆▆▆▆▆▆▆▆▆▆▆

Date: 7th July, 2016

13 notes

·

View notes

Text

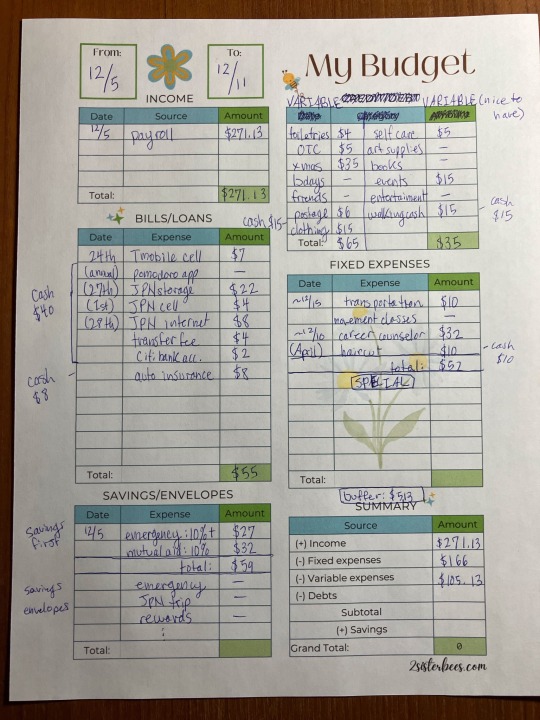

Budget with me, Leftist edition

⚠️I am not a financial advisor. I’m sharing my personal thoughts and methods. Please research for yourself and seek financial advice from a professional if you can ⚠️

Okay, PSA over

I’ve been an on and off budgeting fanatic since I took a personal finance course in high school that rocked my world. I’ve gotten so much out of the personal finance space, but let’s be real, it’s inundated with hyper-individualistic perspectives. I’ve been craving a blend of personal finance and budgeting with leftist ideas, mutual aid, solidarity, community, free resources, and anti-capitalist relearning for a while. I’m trying to expand my media diet and find that community, but in the mean time I want to take a stab at it myself!

So that brings me to a good old fashioned budget with me. My method of budgeting is constantly being reworked, but after ~10 years of trial and error I’m in a pretty happy place with my system. It takes time and bandwidth, but this is what currently works for me. Hopefully at least one person might find some of this useful, and then I will be eternally gratified.

For important context:

I work part time roughly 24 hrs a week and make $22 an hour. I live at home with family, so rent, utilities, groceries etc. are covered by them. This is possible through intergenerational wealth, being an only child, and existing in a loving and functional family (❤️) among other privileges. My income covers my individual personal expenses.

This situation may not be entirely relatable for many people, but I believe the fundamentals of budgeting are widely applicable.

This is what I do:

I start with budgeting for my weekly payday. I work part time so my salary fluctuates, but I can estimate my gross salary in advance based on my hours worked, then deduct the ~15.33% taken out by my employer for taxes and social security to get my net income.

This week my net income is $271.13 (which is lower than average because I worked fewer hours). This will go into the spreadsheet I use so I can track my paychecks.

I have a general guide for my monthly anticipated expenses (aka my budget) that looks like this:

Because I get paid on a weekly basis, I divide each of these estimates by 4 (roughly 4 weeks in a month) to get my weekly budget.

This is what my monthly budget looks like translated to my paycheck this week, which is lower than average:

I use the zero sum budget method. This means every dollar is allocated to a place, so I should have zero dollars leftover by the end.

I also follow the “pay yourself first” school of thought. 10%+ of my net income will go towards my emergency savings, and another 10% will go towards my mutual aid fund. This might seem particularly high for mutual aid (@pocketchangepools on insta, a resource I like, suggests starting at 1% of yearly income), but I feel strongly about redistributing my intergenerational abundance. I also live a very comfortable life with my basic needs met, so 10% is a comfortable amount for me. This will likely vary depending on your financial situation, but budgeting for aid is a great way to ensure you give what you can afford (and your offerings can include time/labor/skills as well!).

I use a mixed system of digital and cash. For digital, I use my checking account and debit card for most bills and regular purchases. I regularly go through my account history on my banking app and write down every incoming or outgoing item in a physical spending tracker notebook.

This helps me pay attention to every individual movement of money in and out of my account so I’m more conscious of what’s going on. I also use these numbers in my spreadsheet tracker:

I use what are called “sinking funds” for most categories. I might allocate $5 a week for self care, for example. I could certainly afford my self care snacks with that $5, but not my self care nail polish. In order to get a bottle of nail polish I might be interested in, I continue to put in $5 a week to let it accumulate, and maybe buy the nail polish when I hit $15 in the sinking fund. If I have $1 leftover from that purchase, it remains in my sinking fund. This way, I can build a fund for each category and spend the money in it on an irregular basis.

Cash gets a different treatment. I take out cash from my checking account every week for things like “walking cash” (money in my wallet I don’t track and spend as I please) or my cash savings envelopes:

In the past I’ve tried putting all of my cash and card purchases into an app while on the go, but I found it takes me out of experiences. Would I rather buy my friend a coffee and enjoy a chat in a coffee shop, or buy a coffee, take out my phone to record how much that coffee cost me, THEN turn back to the conversation we’re having? Some people prefer to track cash spending with things like tracking apps and receipts. I’ve found I am not one of those people! (It’s also worth being wary of tracking apps considering the state of surveillance)

I do still like the feeling of taking cash out of my checking account and filing it away in little envelopes for different savings goals. These cash savings come from any leftover money after my essential and non essential expenses are budgeted for. Currently my priority is a $1000 emergency fund, but I sprinkle cash around other envelopes, too.

And tada! After all that work, I have completed my budgeting for the week.

In conclusion:

This is how I get to know and direct my money flows! I tend to like things complicated, so this system works for me, but the best way to budget is whatever way you find works for you.

I think if knowledge is a step towards empowerment, then getting to know your personal money flows ought to be empowering, too.

16 notes

·

View notes

Text

Marriage Visa in Thailand

The Thailand Marriage Visa is formally designated as a Non-Immigrant O Visa (Category "O") based on marriage to a Thai national. Governed by Immigration Act B.E. 2522 (1979) and Ministerial Regulation No. 35 (B.E. 2562), this visa category permits annual extensions of stay when specific conditions are met.

Key Distinctions:

Initial Visa: 90-day entry (obtainable at embassies abroad or via conversion in Thailand)

Extension Basis: Annual renewal under Clause 2.18 of Immigration Bureau regulations

Not a Work Permit: Separate application required for employment authorization

2. Financial Requirements: Beyond the Basics

A. Capital Deposit Method (Most Common)

THB 400,000 in a Thai personal account

Seasoning Period:

First application: 2 months prior

Subsequent renewals: 3 months prior and continuous maintenance

Account Type Restrictions:

Must be personal savings account (not fixed deposit)

Joint accounts may be accepted at some offices (but risky)

B. Monthly Income Alternative

THB 40,000/month provable income

Verification Methods:

Foreign Income: Embassy letter (US/UK/EU) or 12-month Thai bank transfers

Thai Income: Tax receipts (Por Ngor Dor 91) + company documents

Combined Income: Spouse's income can contribute with marriage proof

Pro Tip: Chiang Mai Immigration notoriously rejects embassy letters without supporting bank transfers - maintain both.

3. Document Preparation: Hidden Requirements

Mandatory Documentation:

Marriage Evidence:

Kor Ror 2 (Thai marriage certificate)

Kor Ror 3 (amendment record, if applicable)

Photos: 5-10 prints showing cohabitation (dated across seasons)

Residence Proof:

Tabien Baan (Blue House Book) or rental contract + owner's documents

Utility Bills: At least 2 different services in both names

Financial Proof:

Bank Book: All pages photocopied (showing seasoning)

Bank Letter: Issued within 24 hours of application

Provincial Variations:

Bangkok (CW): Requires TM30 filing receipt

Phuket: Demands map to residence

Udon Thani: Home visit standard procedure

4. Application Process: Step-by-Step Protocol

A. Initial Visa Acquisition

Option 1: Apply at Thai Embassy Abroad

Savannakhet (Laos) requires least documentation

Penang (Malaysia) demands financial proof upfront

Option 2: Convert from Tourist Visa

Must have 15+ days remaining on current permit

Requires additional TM86 form

B. Annual Extension Process

30-Day Pre-Application:

Verify bank balance seasoning

Schedule appointment (online for Bangkok)

Interview Day:

Couple interrogated separately (common questions: spouse's birthday, wedding date)

Document submission before noon

Under Consideration Period:

30-day stamp issued

Return for final approval stamp

Critical Note: Some offices (e.g., Jomtien) now require biometric fingerprinting.

5. Work Rights & Business Limitations

Employment Authorization:

Work Permit Possible: But employer must handle application

Restrictions:

Cannot work in prohibited occupations (massage, agriculture)

Must meet salary thresholds for nationality

Business Ownership Options:

Thai-Limited Company:

Can own 49% as foreigner

Marriage visa doesn't increase ownership rights

Nominee Structure Warning:

Using spouse as majority owner risks FBA violation

Must prove spouse's independent financial capacity

6. Advanced Strategies & Loopholes

A. The "Income Combination" Tactic

Example: THB 20K pension + THB 20K spouse's income

Requires:

Spouse's tax records

Affidavit of income contribution

B. Multi-Year Planning for PR

Year 3: Can apply for Permanent Residency

Requires THB 30K+/month provable income

Thai language test (basic conversation)

Year 5: Citizenship eligibility begins

C. Avoiding the "Seasoning Trap"

Strategy: Maintain THB 400K year-round

Alternative: Use fixed account with automatic renewal

7. Common Rejection Reasons & Appeals

Top Denial Causes:

Bank Balance Dips:

Even THB 399,999 = automatic rejection

Solution: Maintain THB 410K buffer

Document Discrepancies:

Mismatched addresses

Outdated tabien baan copies

Suspected Sham Marriage:

No children + large age gap = red flag

Counter with: Joint leases, family photos, shared assets

Appeal Process:

30-Day Appeal Window

Requires "new evidence"

Best handled by lawyer

8. Expert Recommendations

For New Applicants:

Start financial seasoning 6 months early

Create document checklist for your specific office

Conduct mock interview with spouse

For Renewals:

Maintain separate visa account

Document 5+ joint activities annually

Pre-apply 45 days early for buffer

For High-Net-Worth Couples:

Consider combining with investment visa

Structure assets to qualify for O-A Long Stay

9. Future Outlook & Policy Trends

Digital Verification: Increasing use of blockchain marriage records

Stricter Scrutiny: More home visits in tourist areas

Financial Thresholds: Likely to increase post-2025

Final Note: Always cross-verify requirements at your local office - immigration practices vary significantly by province. For complex cases (previous overstays, divorce history), retain specialized counsel before application.

#thailand#immigration#thai#thailandvisa#thaivisa#visa#immigrationinthailand#marriagevisa#marriagevisainthailand#thailandmarriagevisa#thaimarriagevisa

2 notes

·

View notes

Text

The night before, in New Hoth...

...the little colony's government had gathered after a citizen of their mother country had gotten murdered on their grounds. By the newly apppointed ambassador of that country, no less.

Now the interesting thing about the Antarctica colonies was that each had gotten founded in the name of a deity. Until those settlements hadn't declared a country they wanted to belong to, they were bound only to whatever laws they made up for themselves.

New Hoth's patron deities were Ea and Maxis, the divine couple that balanced out order and freedom. Everything that kept civilisation going was fine (and tbh these two probably viewed the scene that was about to unfold snacking on the eldritch version of popcorn and taking notes).

Present were:

All of those people had known each other since their university years, where they had been part of Brine Hall, Detroit's chapter of the Aurek-Resh-Resh society.

Gavin, the victim, had never been a college student, let alone ARR member. The others had, however, included him as one. Until today.

Armitage: "I want to make this very clear before we begin: This is a trial against Gavin Reed. And we are here not to determine whether he was guilty or not, but to decide his sentence. Anybody who doesn't agree with that please leave now. - Nobody? Good. Then let's begin."

Finn: "Despite us having treated him no different from a full member, time and again Gavin Reed has violated the principles of ARR. He never cared for sentients' rights or making changes to a flawed society, only about his own advancement in it. Whenever he aided the Underground Railroad, then with the intent to deceive Poe regarding his true colors.

But look at Danny, everyone! He's shaking, barely hearing what we are speaking. If we decide against Gavin today, we also decide against Daniel."

Rose: "I agree. Gavin is, as we all know, hanging on to life by the barest of threads. For Daniel first and for our principles second he needs to live."

Poe: "What are our options?"

Finn: "Your cyborg virus might stabilize Gavin. As might my healing crystal. We only have one try, though, since either method will tax the body."

Poe: "Well, he yelled loudly not to want to get turned into a "machine" when I attacked him, so that leaves the crystal, I guess. I'm more confident in my ability to get Gavin up and running again than I trust in the kyber, though."

Armitage: "Did Gavin leave a patient advance decision?"

Daniel: "Matter of fact, yes! It says he wants the doctors to try "everything in technology and magic" to keep him alive, "just no genie lamp". You know, Gavin is loath of the potentially personality altering side effects of the lamp."

(I mentioned this piece of Gavin lore twice in my chronicles. Daniel throwing the appropriate speech bubble during the court session was chef's kiss!)

Kylo: "Alright. Tech is mentioned first, so Poe should give Gav his kiss. Neckbite. Whatever he does to spread the virus. Problem solved."

Daniel: "But Gav said..."

Armitage: "Irrelevant! Only what's written down counts. We've gathered in Ea's and Maxis' name and Ea in particular would chew New Hoth if we allowed word-of-mouth to influence our ruling today."

Rose: "You must agree, Daniel, it would be poetic justice."

Daniel: "Yes. Yes, you're right, Rose..."

Poe: "Maybe in experiencing for himself what androids have to face, Gavin will turn around."

Finn: "Only he won't experience that. When Gavin returns to Detroit as a cyborg, he'll belong to the ruling class there."

Daniel: "Well, about that... We've always postponed that carib vacation, he wanted to go on."

Kylo: "i don't follow...?"

Poe: "But I do! As a cyborg, Gavin will look indistinguishably from an android. We can safely sell him to a vendor in a caribbean tourist trap or something. Is that what you are suggesting, Daniel?"

Daniel: "Exactly. If you save Gavin's life, I'm willing to agree to spend that life separated from him for however long it will take. That's all I ask. A life for my husband and a small chance for a shared life sometime down the road."

2 notes

·

View notes

Text

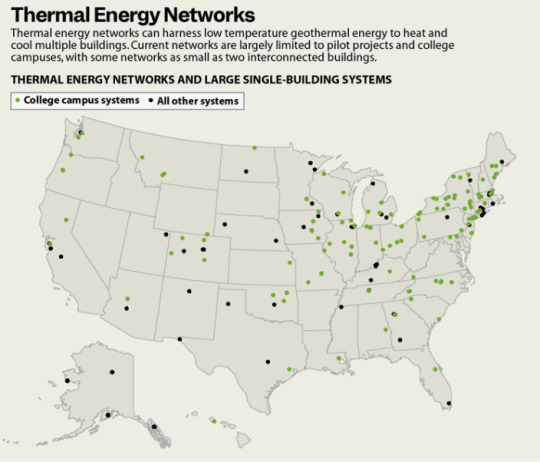

Excerpt from this story from Inside Climate News:

The future is bright for a little known yet highly efficient method of heating and cooling, a new report by the U.S. Department of Energy concludes.

Ground source heat pumps could heat and cool the equivalent of 7 million homes by 2035—up from just over 1 million today, according to the report.

Such widespread use would reduce peak demand on the country’s electric grid by 12 gigawatts in the summer and 40 gigawatts in the winter, according to the report. That’s equivalent to keeping dozens of coal- or gas-fired power plants offline during such periods of high demand.

“There are really large potential grid savings and benefits when these systems get adopted at scale,” Jigar Shah, director of the agency’s Loan Programs Office, said during a Thursday event on the report.

Ground source heat pumps harness low-temperature geothermal energy to heat and cool homes. The devices are similar to the more widely deployed air source heat pumps, which work like air conditioners, using fans and compressors to draw heat out of buildings in the summer. Unlike air conditioners, heat pumps also work in reverse, pulling heat into buildings to warm them in winter.

When outdoor air temperatures spike in the summer or plummet in the winter, air source heat pumps have to work harder, making them less efficient. However, ground source heat pumps typically draw heat from underground wells drilled several hundred feet down, or fields of pipes buried just beneath the surface of the earth, where temperatures are approximately 54 degrees Fahrenheit year round. This makes them a highly efficient source of heating and cooling throughout the year.

“They essentially offer this cost-effective solution for heating and cooling, and the reason that matters is because a significant portion of U.S. energy consumption, of global energy consumption, goes towards space heating and cooling,” said Lauren Boyd, head of the Energy Department’s Geothermal Technologies Office.

The report, released last week, is among the Liftoff Reports the agency has published since 2022 as part of a larger effort under the Biden administration to accelerate the deployment of clean energy technologies to the point where they achieve “liftoff” or widespread commercialization. Prior reports have focused on advanced nuclear, clean hydrogen and offshore wind energy, among others.

High capital costs, including the expense of drilling wells and laying pipes underground, pose a challenge to wider ground source heat pump adoption. While the devices’ high efficiency pays off over time, installation costs for the typical residential system are $19,000 after tax incentives, according to the report.

4 notes

·

View notes

Text

Billing machines have become an essential tool for businesses across various sectors, streamlining the invoicing process and enhancing operational efficiency. This article explores the features, benefits, and types of billing machines, as well as their significance in modern commerce.

What is a Billing Machine?

A billing machine is a device specifically designed to generate invoices and manage transactions efficiently. It automates the billing process, allowing businesses to issue receipts quickly and accurately. Available in various forms such as portable, handheld, and point-of-sale (POS) systems, these machines cater to the needs of small businesses and large enterprises alike.

Key Features of Billing Machines

User-Friendly Interface: Many modern billing machines come with intuitive touchscreen interfaces that simplify the transaction process, making it easy for staff to operate without extensive training.

Fast and Accurate Billing: These machines are designed to process transactions rapidly, significantly reducing customer wait times and enhancing service efficiency.

Customizable Invoices: Users can personalize invoice templates to reflect their branding, including logos and business details, which adds a professional touch to customer interactions.

Comprehensive Reporting: Billing machines often provide detailed sales reports, inventory tracking, and financial records, enabling businesses to monitor performance and make informed decisions.

Tax Compliance: Many billing machines are equipped with features that ensure compliance with tax regulations, making it easier to calculate applicable taxes like GST or VAT.

Multiple Payment Options: They support various payment methods, including cash, credit/debit cards, and digital wallets, providing convenience to customers.

Benefits of Using Billing Machines

Increased Efficiency: Automating the billing process reduces manual errors and speeds up transactions, leading to improved cash flow and customer satisfaction.

Enhanced Security: Billing machines help in maintaining secure records of transactions, reducing the risk of loss or theft associated with cash handling.

Improved Inventory Management: Many billing machines come with inventory management features that allow businesses to track stock levels and set up alerts for low inventory, ensuring timely restocking.

Cost-Effectiveness: While the initial investment in a billing machine may be higher, the long-term savings in time and labor can be substantial, making them a cost-effective solution for businesses.

Types of Billing Machines

POS Systems: These are comprehensive solutions that combine billing, inventory management, and sales tracking, ideal for retail environments and restaurants.

Portable Billing Machines: These compact devices are perfect for businesses that require mobility, such as food trucks or market vendors.

Handheld Billing Machines: Designed for ease of use, these machines are often used in smaller retail settings or for on-the-go transactions.

Touchscreen Billing Machines: Featuring advanced technology, these machines offer a modern interface and are designed for high-volume transaction environments.

Conclusion

Billing machines are vital for modern businesses, providing a range of features that enhance efficiency, accuracy, and customer satisfaction. By automating the billing process, these machines not only save time but also contribute to better financial management and operational transparency. As technology continues to evolve, the capabilities of billing machines will likely expand, further transforming the way businesses handle transactions. Whether for a small shop or a large retail chain, investing in a reliable billing machine can significantly improve business operations.

2 notes

·

View notes

Text

How do you plan an out of state move in 2024?

Planning an out-of-state move can be a complex and stressful process, but with careful planning and organization, you can ensure a smooth transition. Here’s a comprehensive guide to help you begin:

Research Your New Location:

Cost of Living: Begin by comparing the cost of living between your current state and the new one. This includes housing, groceries, utilities, and taxes. Websites like Numbeo can provide detailed comparisons.

Housing: Look into neighborhoods, housing prices, and rental options. Consider factors such as proximity to work, safety, amenities, and school quality if you have children. Online platforms like Zillow and Realtor.com are excellent resources.

Job Market: Investigate job opportunities and the local economy. Sites like Indeed and LinkedIn can help you understand the job market and connect with potential employers.

Lifestyle: Consider the climate, local amenities, schools, and community culture. Explore forums, social media groups, and local news sites to get a feel for the area.

Budgeting:

Moving Costs: Get estimates from moving companies or calculate costs if you plan to move yourself. Include packing materials, transportation, and potential storage fees. Companies like U-Haul provide cost calculators for DIY moves.

Travel Expenses: Budget for gas, flights, hotels, and meals if you’re driving. Websites like GasBuddy can help estimate fuel costs, and travel sites can assist with finding affordable accommodation.

Initial Setup: Plan for deposits, initial rent, utility setup, and any immediate purchases needed upon arrival.

Create a Moving Timeline:

Plan Ahead: Start planning 2–3 months in advance to avoid last-minute stress.

Checklist: Develop a detailed checklist of tasks to be completed each week leading up to the move. This should include everything from hiring movers to packing specific rooms.

Hiring Movers vs. DIY

Consider hiring professional movers by researching and selecting a reputable moving company. Check reviews on sites like Yelp and get multiple quotes to compare prices and services.

DIY Move:

If you decide to move yourself, rent a truck, recruit friends and family, and plan the logistics of driving and unloading. Ensure you have the necessary equipment like dollies and moving blankets.

Declutter and Organize:

Inventory: Take an inventory of your belongings. This helps in estimating moving costs and ensuring nothing gets lost.

Declutter: Sell, donate, or discard items you don’t need. This reduces the volume of items to move and can save money.

Organize: Label boxes clearly by room and content. Use a color-coded system or numbered labels to simplify unpacking.

Update Your Information:

Address Change: Update your address with the postal service, banks, subscription services, and any other relevant parties.

Utilities and Services: Arrange for the disconnection of utilities at your current home and setup at your new home. Ensure you transfer internet, cable, water, and electricity services in time.

Licenses and Registrations: Update your driver’s license, vehicle registration, and voter registration as soon as possible after your move.

Pack Strategically:

Essentials Box: Pack a box of essentials for the first few days, including clothes, toiletries, important documents, and basic kitchen items.

Fragile Items: Pack fragile items with care, using plenty of padding. Clearly label these boxes to ensure they are handled with care.

Room-by-Room: Pack one room at a time and label boxes accordingly. This method makes unpacking more manageable.

Travel Arrangements:

Transport Vehicles: Decide whether to drive your car(s) or have them shipped. Companies like Montway Auto Transport can assist with vehicle shipping.

Pets: Make arrangements for moving pets safely, including carriers, food, and necessary medications.

Accommodation: Book any necessary accommodation if the journey takes more than a day. Plan your route and make reservations in advance.

Settling In:

Unpacking: Start with essential areas like the kitchen and bedrooms to make your new home livable quickly.

Explore: Take time to explore your new neighborhood and meet your neighbors. Familiarize yourself with local grocery stores, pharmacies, and parks.

Emergency Contacts: Find and note down local emergency contacts, such as doctors, vets, and hospitals. Register with local healthcare providers as soon as possible.

Stay Organized:

Keep Records: Maintain a file with all moving-related documents, including contracts, receipts, and inventory lists. This helps in case of disputes or for future reference.

Backup Plans: Have contingency plans in case of delays or unexpected issues. This could include having extra funds for unforeseen expenses or knowing alternative routes.

By following these steps, you can ensure a more organized and less stressful out-of-state move. For personalized assistance with moving in the central Kentucky area, consider reaching out to My 3 Sons Moving and Storage Company.

#moving and storage#out of state moving#moving tips#moving and storage company#state to state moving#out of state relocation#Central Kentucky#United States

5 notes

·

View notes

Text

How do I start a merchant cash advance business?

Starting a merchant cash advance (MCA) business involves several key steps and considerations to ensure that you establish a successful operation. Here’s a guide to help you get started:

. FREE MCA LEADS - https://www.fiverr.com/leads_seo_web .

1. Understand the Industry

Research: Learn about how MCAs work, industry standards, common practices, and the legal framework.

Market Analysis: Identify your potential customer base and their needs. Look into how other MCA businesses operate and succeed.

2. Business Planning

Business Model: Decide on your business model, including how you will fund the advances (e.g., through self-funding, partnering with investors, or using a line of credit).

Risk Assessment: Develop methods to assess the creditworthiness and risk of potential clients since MCAs do not typically require traditional collateral.

Profit Model: Define your factor rates and recovery strategies.

3. Legal and Regulatory Compliance

Licensing: Check if you need specific licenses to operate an MCA business in your area. This can vary widely by region.

Legal Structure: Decide on the legal structure of your business (e.g., LLC, corporation) to manage liability and tax obligations effectively.

Contracts: Work with a lawyer to draft clear and compliant contracts for your clients.

4. Capital Requirements

Funding: Determine how much capital you will need to start your business and keep it operational until it becomes profitable. Consider sources such as personal savings, loans, or investors.

Back-up Plan: Ensure you have a strategy for additional funding if your initial calculations fall short.

5. Technology and Infrastructure

Software: Invest in or develop software that can handle application processing, risk assessment, account management, payment processing, and collections efficiently.

Office Setup: Depending on your business model, decide whether you need a physical office or if you can operate online.

6. Marketing and Sales

Branding: Develop a strong brand identity and online presence.

Marketing Strategy: Utilize online and offline marketing strategies to reach your target audience. Networking with related businesses (like POS system providers or business consultants) can also be beneficial.

Sales Team: Build a knowledgeable sales team skilled in negotiating and explaining complex financial products to potential clients.

7. Launch

Soft Launch: Consider starting with a soft launch to test your processes and adjust based on feedback.

Official Launch: Plan an official launch that can include promotional activities to boost your initial visibility.

8. Ongoing Management

Customer Service: Offer excellent customer service to build trust and retain clients.

Compliance and Collections: Regularly review your compliance with all regulations and manage collections diligently to minimize defaults.

Adaptation and Growth: Stay adaptable and be ready to evolve your business strategies based on market demand and regulatory changes.

9. Networking and Industry Connections

Professional Associations: Join relevant associations to stay updated on industry trends and network with other professionals.

Starting an MCA business requires a substantial commitment of time, capital, and expertise, especially given the financial risk involved. It’s highly recommended to consult with financial experts and legal professionals during the planning and establishment phases.

mca #mcalead #mcaleads #mcaleadswithbankstatements #merchantcashadvance

merchantcash #merchantcashadvanceleads #loan #loanofficer #loans #businessloan

businessloans #businessloansnow #funding #businessfunding #debanked #fundingforbusiness

unsecuredloans

#mcaleads#mca leads#merchantcashadvance#merchantcashadvanceleads#merchant cash advance#cash advance#business loan#funding

2 notes

·

View notes

Text

Decided to start a sort of a challenge run of Unicorn Overlord, cause I really like the game, but I both sort of found the game too easy on my first playthrough, and I was kinda disappointed that the game just vomits story units to you through the whole thing, so after the early game there's little reason to use hireable randos. Which is a real shame, cause making randos in rpgs rules.

So yeah, this run is on True Zenoira mode, so that's permadeath to all troopers in an unit that falls entirely in battle. And im playing with the following additional restrictions:

Only every using hireable mercs. Any story units must be left at the nearest garrison as soon as possible, or otherwise kept away from combat. Technically this run only starts after the first side mission, the one where you get Rolf, cause only then do you get up to D rank and can actually hire anyone at forts.

No grinding missions. I can do the phantom fight stages, but only once. Makes it so I can't ensure an endless amount of resources.

No going back in saves and if I game over then the run is over. Makes it so I actually gotta value every single soldier I have, and if I lose them it's a big hit to the army as a whole. And this makes corne ashes a massively important resource, since they can actually stop me from game overing if my fort gets captured or I run out of time on a mission.

Story wise, this is the anti royalism run. Prince Alain may be the figurehead, but the snot nosed punk wouldn't in a million years actually step on a battlefield to free Fevrith. This is about the common working men of the liberation army getting it done! Let's meet the crew.

Germain. A veteran town militiaman. Thought himself too old to fight back against the empire, but after seeing too much of their opression for too long, he had to take a stand. A lot of the common soldiers in the liberation army rally behind him, much to his irriation.

Florine. A young gal who's lived a good half of her whole life under Zenoiran opression, which has only stoked her want to free her home from it. Very peppy and cheerful, which keeps the moral up when she's around. Kinda thinks of Germain as an uncle of sorts, though no actual relation.

Guy. A tough and stern man who used to work as a bodyguard for a local lord. Looking for revenge for the said lord, after he was murdered by Zenoiran's for opposing their rule. Rumored to have been lovers with the lord in question.

Odo. A woodsman who has lived all his life in farthest ass end of a forest. He had no idea that someone had taken over the world, until just recently when he came over to town for some milk for the first time in ten years.

Nils. Definitely not a Zenoiran spy. No sir.

Armand. A professional soldier who had accepted the new zenoiran rule initially, but his family was torn apart by the new taxes and unjust laws and such, so he picked the side of the liberation.

Sébastien. An extremely cowardly and sulky young knight. He kept getting unwanted advances by a Zenoira aligned noblewoman, and when he kept refusing she had him branded as a criminal. To not have to be on the run for the rest of his life, he now reluctantly fights for the liberation.

First actual mission with our army here was the one against Bruno. Went fairly smoothly, although Germaine, Florine and Guys unit got caught offguard at one point, so I had to use a revival orb. Provoke is good at getting archers out of watchtowers, but do it too far and they'll just run right back as it turns out. The importance of archer support became pretty evident right away. No casualties.

Afterwards hired two more soldiers for a dedicated anti cavalry unit.

Artemisia. A warrior of justice. She won't say anything more about herself.

Maxim. Comes from a long line of spear guard guys, the types that stand around doorways and cross their spears when someone tries to enter without permission. Zenoira does not use the treasured method of sentry-dom, which is why he and his whole family is rising to action against the empire.

Ended it here for now. Very fun so far, glad to be thinking much more about resource management, though im sure it will start to grind my gears the bigger the army and fights get.

I'll keep up updates about this... if this gets any engagement, I guess.

5 notes

·

View notes

Text

CPAs and Small Businesses: Partners for Financial Success

Within the ever-changing landscape of the commercial realm, small firms frequently encounter the challenge of balancing numerous obligations, encompassing the efficient administration of daily activities as well as the pursuit of expansion and long-term viability. Within this intricate and multifaceted environment, a crucial alliance has the potential to provide significant outcomes - the cooperative relationship between Certified Public Accountants (CPAs) and small enterprises. Simplify your financial workflows and boost productivity. Try VNC Global’s Accounting software for CPA firms in Singapore and witness the difference.

This blog article aims to examine the potential for collaboration between Certified Public Accountants (CPAs) and small enterprises, with the objective of achieving financial success.

The Role of CPAs in Small Businesses:

● Financial Expertise:

Certified Public Accountants (CPAs) possess a comprehensive understanding of tax legislation, accounting principles, and financial regulations, making them highly proficient financial professionals. The knowledge and skills possessed by these individuals are of great value to small enterprises that are endeavouring to make well-informed choices regarding their finances. Certified Public Accountants (CPAs) provide the necessary expertise to offer crucial advice in various areas, including the establishment of appropriate accounting systems, tax planning, and financial forecasting.

● Tax Compliance:

Tax compliance can provide a formidable challenge for small business owners due to the constantly evolving nature of tax regulations. Certified Public Accountants (CPAs) possess extensive knowledge and expertise in tax laws and regulations, enabling them to ensure firms' adherence to legal requirements while also optimising their utilisation of tax deductions and credits. This practice not only results in cost savings but also mitigates the risk of future legal complications.

● Financial Planning:

Financial planning is crucial for small businesses in order to ensure long-term stability and success. Certified Public Accountants (CPAs) have the expertise to facilitate the formulation of budgets, conduct comprehensive evaluations of financial statements, and devise effective methods to enhance organisational expansion and profitability. With the assistance of their coaching, organisations have the ability to establish attainable financial objectives and efficiently track their advancement. From tax planning to auditing services, VNC Global - one of the top Accounting CPA firms in Singapore has you covered. Schedule a consultation today to discuss your specific accounting needs.

● Risk Mitigation:

Business activities inherently include financial risks. Certified Public Accountants (CPAs) provide the expertise to assist small businesses in the identification and mitigation of these risks. Certified Public Accountants (CPAs) assume a crucial position in risk management by engaging in various tasks such as cash flow management, evaluating the financial feasibility of expansion strategies, and reviewing investment prospects.

● Business Valuation:

When the decision arises to divest the business or attract potential investors, certified public accountants (CPAs) possess the expertise to deliver precise and reliable business appraisals. This practice guarantees equitable remuneration for small business proprietors' diligent efforts and facilitates the attraction of prospective purchasers or investors.

The Benefits of the CPA-Small Business Partnership:

● Financial Clarity:

One of the foremost benefits associated with collaborating with a Certified Public Accountant (CPA) is the acquisition of enhanced comprehension pertaining to one's financial circumstances. By utilising precise financial information and receiving help from professionals, small business owners are able to make well-informed decisions that contribute to the enhancement of profitability and long-term viability. Unlock cost savings and streamline your operations with professional accounting outsourcing services offered by VNC Global - your trusted partner in Outsourcing for Accounting firm in Singapore.

● Time Savings:

Time savings can be achieved by small business owners through the efficient management of their money, which can otherwise be a burdensome and daunting task. Entrepreneurs can enhance their productivity and alleviate stress by delegating financial responsibilities to a Certified Public Accountant (CPA), allowing them to concentrate on their primary business operations. This strategic approach enables entrepreneurs to save valuable time and streamline their workflow.

● Legal Compliance:

Certified Public Accountants (CPAs) play a crucial role in ensuring that small firms adhere to tax rules and regulations, hence maintaining compliance. This practice mitigates the potential for financial penalties, legal repercussions, or other legal complications, so enabling organisations to function with greater efficiency and assurance.

● Strategic Planning:

Strategic planning involves the utilisation of certified public accountants (CPAs) to assist small firms in formulating comprehensive and enduring financial strategies. This includes the establishment of attainable objectives, the optimisation of tax planning approaches, and the selection of investments that are in line with the organization's overarching vision.

● Financial Health Assessment:

Certified Public Accountants (CPAs) offer periodic evaluations of the financial well-being of firms. The continuous assessment facilitates the early detection of possible difficulties, enabling prompt adjustments and corrections to be made.

Choosing the Best CPA for Your Business:

The selection of an appropriate Certified Public Accountant (CPA) is of utmost importance in establishing a prosperous and mutually beneficial collaboration. When choosing a Certified Public Accountant (CPA) for your small business, it is advisable to take into account the following recommendations:

Qualifications: It is imperative to ascertain that the Certified Public Accountant (CPA) possesses the necessary certification and remains well-informed about current industry knowledge and regulatory requirements.

Experience: Seek out a Certified Public Accountant (CPA) who has a substantial background in collaborating with small enterprises or possesses specialised knowledge within your particular industry.

Compatibility: Compatibility is an essential factor to consider when selecting a Certified Public Accountant (CPA). It is crucial that the chosen CPA comprehends your business objectives and possesses strong communication skills, enabling seamless and efficient interaction between both parties.

Services Offered: The range of services provided includes: It is essential to identify the particular financial services that are needed and ascertain whether the Certified Public Accountant (CPA) possesses the capability to fulfil those requirements.

Fees: The discussion of costs in advance is recommended in order to prevent unexpected financial obligations. Certain certified public accountants (CPAs) employ an hourly billing structure, but others provide fixed fees or monthly retainers as their preferred pricing models.

Final Thoughts:

The collaboration between Certified Public Accountants (CPAs) and small enterprises has been identified as a key factor contributing to achieving financial success. Certified Public Accountants (CPAs) possess specialised knowledge and skills that allow them to provide valuable advice, counsel, and assurance to small business owners. By using their expertise, CPAs empower these entrepreneurs to effectively navigate the intricate financial terrain, instilling them with a sense of confidence and tranquillity.

Through the cultivation of such teamwork, small enterprises can effectively attain their financial objectives and establish a foundation for sustained expansion and profitability. For small business owners seeking to enhance their financial success, it is advisable to engage in collaboration with a proficient Certified Public Accountant (CPA) at the earliest opportunity. Discover the strategic benefits of outsourcing for your accounting firm. If you are looking for an excellent Bookkeeper for Accounting firm in Singapore, partner with VNC Global for a no-obligation outsourcing consultation.

#Accounting software for CPA firms in Singapore#Accounting CPA firms in Singapore#Outsourcing for Accounting firm in Singapore#Bookkeeper for Accounting firm in Singapore#vncglobal

5 notes

·

View notes

Text

Green Building Starts with Insulation Techniques for Sustainable Homes

As climate change accelerates and energy prices continue to rise, the need for sustainable housing is more critical than ever. At the heart of eco-friendly residential design lies a fundamental principle—efficient insulation. Insulation techniques for sustainable homes have evolved significantly, incorporating new materials and methods that reduce energy loss, regulate indoor temperatures, and enhance overall building performance. These strategies are not only beneficial for the planet but also for homeowners seeking comfort, savings, and long-term resilience.

The Role of Insulation in Sustainable Home Design Insulation serves as the barrier between a home and external climate conditions. In sustainable design, this barrier becomes a vital component in reducing the building’s reliance on heating and cooling systems. Proper insulation curbs the need for artificial temperature control, significantly decreasing energy consumption and environmental impact. Sustainable homes prioritize insulation during both construction and retrofitting to ensure long-term efficiency and carbon reduction.

Innovations in Insulation Materials Modern insulation solutions have moved far beyond fiberglass and foam. New-generation materials include cellulose derived from recycled paper, aerogels with remarkable thermal properties, and phase-change materials that adapt to temperature shifts. Natural fibers such as sheep’s wool and hemp are gaining popularity for their sustainability and breathability. These materials not only insulate effectively but also support eco-conscious sourcing and waste reduction.

Smart Installation Methods and Building Integration Sustainability in insulation is not just about the material used, but how it is applied. Continuous insulation across building envelopes eliminates thermal bridges, while spray foam and blown-in cellulose can be tailored to fit irregular spaces. Insulated concrete forms and structural insulated panels combine structural support with thermal performance. Integrating insulation during early design stages ensures a seamless blend with passive solar strategies, ventilation systems, and renewable energy setups.

Reducing Energy Demand through Thermal Efficiency Homes that implement advanced insulation techniques benefit from reduced heating and cooling loads. This not only lowers utility bills but also shrinks the carbon footprint associated with energy production. High thermal resistance or R-value materials trap heat in winter and block it in summer, stabilizing indoor temperatures. Over time, energy savings often outweigh the upfront costs, making insulation one of the most cost-effective sustainability upgrades.

The Impact of Insulation on Indoor Air Quality Insulation also plays an important role in creating healthier indoor environments. Proper sealing minimizes pollutants and allergens from entering the home. Vapor-permeable insulation materials help manage moisture levels, preventing mold and mildew. Sustainable insulation options often exclude harmful chemicals like formaldehyde, ensuring that the pursuit of energy efficiency doesn’t compromise air quality or occupant health.

Regulatory Support and Green Building Standards Governments and certification bodies worldwide are recognizing the importance of effective insulation. Green building standards such as LEED, BREEAM, and Passive House Institute set clear benchmarks for thermal performance. Homeowners and builders adopting advanced insulation techniques can benefit from tax incentives, rebates, and enhanced property value. These standards also push the industry toward innovation and long-term accountability.

Future Trends in Sustainable Home Insulation Looking ahead, the future of insulation lies in smart materials that can adapt to environmental conditions, AI-assisted thermal modeling, and nanotechnology for ultra-thin but highly effective barriers. As building codes grow stricter and consumer awareness increases, demand for durable, high-performance, eco-friendly insulation will continue to rise. Collaboration between architects, engineers, and manufacturers will shape solutions that combine aesthetics with energy optimization.

For More Info https://bi-journal.com/cutting-edge-solutions-for-sustainable-homes-with-advanced-insulation-techniques/

Conclusion Advanced insulation techniques for sustainable homes are a cornerstone of responsible architecture and modern living. They serve as silent enablers of comfort, energy conservation, and climate resilience. By investing in high-performance materials and thoughtful design, homeowners contribute to a greener planet while enhancing their own quality of life. As innovation continues to expand the possibilities of insulation, it becomes clear that sustainability starts from the inside out—with walls that work smarter, not harder.

#Eco Friendly Housing#Energy Efficiency#Smart Homes#BI Journal#BI Journal news#Business Insights articles

0 notes

Text

Advanced Tax Planning Tactics for Growing Businesses

As a business begins to grow, so do its tax obligations—and the need for smarter, more strategic tax planning. What may have worked during the startup phase becomes less effective as revenues increase, employees are added, and operations expand. That’s why growing businesses must go beyond basic deductions and adopt advanced tax planning tactics to reduce liabilities, improve cash flow, and prepare for sustainable growth.

One of the most effective advanced tactics is income deferral, which allows businesses to delay recognizing income until a later tax year. This is particularly useful when your company expects to be in a lower tax bracket in the following year. By timing invoices and controlling when revenue is recognized (especially under the accrual accounting method), businesses can manage taxable income more strategically. Similarly, accelerating deductible expenses before year-end can help reduce current-year taxes.

Another key strategy is entity structure optimization. As your business grows, its original structure may no longer be tax-efficient. Many businesses that begin as sole proprietorships or LLCs later elect to be taxed as S corporations to take advantage of payroll and distribution strategies. S corporation owners can split income between salary and dividends, reducing self-employment tax. This type of structural planning requires careful analysis of income levels, compliance costs, and plans—but it can produce significant long-term savings.

Retirement planning is another overlooked area with powerful tax benefits. Business owners and employees alike can reduce taxable income by contributing to tax-advantaged retirement accounts. Plans like SEP IRAs, SIMPLE IRAs, or solo 401(k)s not only offer deductions today but also support long-term financial well-being. These retirement options can be especially attractive for high-income earners in growing companies seeking to reduce their immediate tax burden.

Research and Development (R&D) tax credits are another valuable tool, especially for businesses investing in innovation, technology, or process improvement. Many small and mid-sized companies mistakenly believe this credit is reserved for large corporations. However, if your business is developing new products, improving software, or streamlining production methods, you may qualify. The R&D credit can offset income tax and, in some cases, payroll tax—providing meaningful relief during growth phases.

Depreciation planning through Section 179 and bonus depreciation allows businesses to write off the cost of equipment, vehicles, and software more rapidly. For growing companies making large capital investments, this tactic can dramatically reduce taxable income. By timing purchases strategically—especially before the fiscal year ends—businesses can maximize immediate deductions while still supporting operational expansion.

As businesses grow in size and complexity, these advanced tactics become essential for tax efficiency. Yet, each strategy carries specific eligibility requirements, limitations, and compliance risks. For this reason, many businesses rely on experts offering small business tax planning services in Fort Worth, TX to guide their decision-making. These professionals bring in-depth knowledge of the tax code, help identify the most suitable strategies for your industry and stage of growth, and ensure proper implementation.

In conclusion, advanced tax planning is not about loopholes or shortcuts—it’s about strategic foresight. By using smart, legal tactics tailored to your business’s unique trajectory, you can reduce your tax burden, reinvest in growth, and set your company up for long-term financial success.

0 notes