#algorithm trading

Explore tagged Tumblr posts

Text

Transform your trading with Invertex Pro! Maximize profits, minimize risks, and trade smarter using advanced algorithmic strategies. Ready for smarter forex trading? Start now!

2 notes

·

View notes

Text

SureShotFX Algo: The Best Algo for MT4 and MT5

SureShotFX Algo is the best algo trading app for Forex that works with MT4 and MT5. It isn’t just about automated trading—it’s your secret trading weapon in the forex market. With its smart algorithms and hands-off approach, it stands with you 24/7 like a trading expert on your team, providing accurate and profitable forex signals.

SSF Algo uses an advanced algorithm combining multiple strategies and advanced indicators to operate seamlessly within the MetaTrader 4 – MT4, MT5 & cTrader platforms. It executes trades based on predefined parameters and market data to generate automated Forex trading signals like a pro.

Whether you’re new to trading or a seasoned pro, this tool offers precision, flexibility, and total control over your investments.

Benefits of Using SureShotFX Algo:

Smart Trading: Harness the power of advanced algorithms for intelligent trade execution and decision-making.

Enhanced Accuracy: The algorithm’s sharp entry strategy increases the likelihood of successful trades.

Effective Risk Management: Adaptive stop-loss modes and flexible lot management help traders manage risks effectively.

Automated Profit Securing: The Auto Close Partial feature ensures that profits are secured at optimal points during a trade.

Proven Performance: Real-time results and performance data are available on Myfxbook, demonstrating the algorithm’s effectiveness with a potential monthly growth of 8-30%.

Total Control and Flexibility: Maintain control over your trading capital and strategy parameters, with the flexibility to customize settings to suit your preferences.

2 notes

·

View notes

Text

Algorithmic trading, powered by advanced mathematical models and automated processes, has reshaped the landscape of financial markets worldwide. When paired with quantitative analysis, which involves extensive data-driven research and statistical methods, these approaches can amplify trading strategies’ effectiveness. This blog explores the synergistic benefits of combining algorithmic trading with quantitative analysis, highlighting strategies, platforms, and real-world applications.

#Quantitative Analysis#Algorithm Trading#algorithmic trading strategies#automated trading strategies

0 notes

Text

#Best Algo Trading Software#Best Algo Trading Software in India#10 Best Algo Trading Software in India#algorithm trading

0 notes

Text

Algorithmic or Alog-based trading is also very popular in the stock market to get better returns compared to traditional human intelligence-based trading. It is not only giving better returns but also doesn't need too much time to take the decision and execute the transaction, every trade happens within a fraction of a second, backed with AI-based algorithms.

0 notes

Text

communist generative ai boosters on this website truly like

#generative ai#yes the cheating through school arguments can skew into personal chastisement instead of criticising the for-profit education system#that's hostile to learning in the first place#and yes the copyright defense is self-defeating and goofy#yes yeeeeeeeeeees i get it but fucking hell now the concept of art is bourgeois lmaao contrarian ass reactionary bullshit#whYYYYYYY are you fighting the alienation war on the side of alienation????#fucking unhinged cold-stream marxism really is just like -- what the fuck are you even fighting for? what even is the point of you?#sorry idk i just think that something that is actively and exponentially heightening capitalist alienation#while calcifying hyper-extractive private infrastructure to capture all energy production as we continue descending into climate chaos#and locking skills that our fucking species has cultivated through centuries of communicative learning behind an algorithmic black box#and doing it on the back of hyperexploitation of labour primarily in the neocolonial world#to try and sort and categorise the human experience into privately owned and traded bits of data capital#explicitly being used to streamline systematic emiseration and further erode human communal connection#OH I DON'T KNOW seems kind of bad!#seems kind of antithetical to and violent against the working class and our class struggle?#seems like everything - including technology - has a class character and isn't just neutral tools we can bend to our benefit#it is literally an exploitation; extraction; and alienation machine - idk maybe that isn't gonna aid the struggle#and flourishing of the full panoply of human experience that - i fucking hope - we're fighting for???#for the fullness of human creative liberation that can only come through the first step of socialist revolution???#that's what i'm fighting for anyway - idk what the fuck some of you are doing#fucking brittle economic marxists genuinely defending a technology that is demonstrably violent to the sources of all value:#the soil and the worker#but sure it'll be fine - abundance babey!#WHEW.

9 notes

·

View notes

Text

Anyone wanna sell me an Alastor trading card? I need something for Amir to sign and nothing is up to snuff

#hazbin#hazbin hotel#alastor#comic con#trading cards#ebay is frustrating so now im here#cant wait to see what this kind of post does to my algorithm

6 notes

·

View notes

Text

5 notes

·

View notes

Text

A determined trader intensely studies fluctuating stock market charts on a laptop screen, surrounded by the glow of modern tech lights. The image captures the precision and focus required in financial trading, highlighting the intersection of data, technology, and decision-making in high-stakes environments

0 notes

Text

youtube

My first highlights video is live today over on my team's channel! Go and check it out if you're interested!!

(English Captions available!)

#vtuber uprising#vtubers of tumblr#vtuberen#I worked on this for like 3 weeks straight so if you want to appease the algorithm gods i could really use a like and subscirbe if you coul#content warning game#content warning#tricksters of the trade

9 notes

·

View notes

Text

UAITrading (Unstoppable AI Trading): AI-Powered Trading for Stocks, Forex, and Crypto

https://uaitrading.ai/ UAITrading For On trading volumes offers, many free trade analysis tools and pending bonuses | Unstoppable AI Trading (Uaitrading) is a platform that integrates advanced artificial intelligence (AI) technologies to enhance trading strategies across various financial markets, including stocks, forex, and cryptocurrencies. By leveraging AI, the platform aims to provide real-time asset monitoring, automated portfolio management, and optimized trade execution, thereby simplifying the investment process for users.

One of the innovative features of Unstoppable AI Trading is its UAI token farming, which offers users opportunities to earn additional income through decentralized finance (DeFi) mechanisms. This approach allows traders to diversify their investment strategies and potentially increase returns by participating in token farming activities.

The platform's AI-driven systems are designed to analyze vast amounts of market data, identify profitable trading opportunities, and execute trades without human intervention. This automation not only enhances efficiency but also reduces the emotional biases that often affect human traders, leading to more consistent and objective trading decisions.

By harnessing the power of AI, Unstoppable AI Trading aims to empower both novice and experienced traders to navigate the complexities of financial markets more effectively, offering tools and strategies that adapt to dynamic market conditions

#Uaitrading#AI Trading#Automated Trading#Forex Trading AI#Crypto Trading Bot#UAI Token#Token Farming#Decentralized Finance (DeFi)#AI Investment Platform#Smart Trading Algorithms#AI Stock Trading#Machine Learning in Trading#AI-Powered Portfolio Management#Algorithmic Trading#Uaitrading AI Trading#Forex AI#Smart Trading#Stock Market#AI Investing#Machine Learning Trading#Trading Bot#Crypto AI#DeFi#UAI#Crypto Investing

2 notes

·

View notes

Text

7 Growth Functions in Data Structures: Behind asymptotic notations

Top coders use these to calculate time complexity and space complexity of algorithms.

https://medium.com/competitive-programming-concepts/7-growth-functions-in-data-structures-behind-asymptotic-notations-0fe44330daef

#software#programming#code#data structures#algorithm#algo trading#datastructures#data#datascience#data analytics

3 notes

·

View notes

Text

DeepSeek AI Can Enhance Algo Trading and Option Trading Strategies.

DeepSeek AI - Algo Trading

DeepSeek AI is a low - cost advanced chatbot. DeepSeek AI can excel in many areas of technology and business, one of these areas is Algo Trading and Option Trading.

Read more..

#Algo Trading#DeepSeek V3#DeepSeek AI#DeepSeek R1#Algorithmic Trading#bigul#ipo price band#algo trading app#algo trading india#algo trading platform#algo trading strategies#algorithm software for trading#bigul algo#finance#free algo trading software#best algo trading app in india#AI#algorithm#algo trading software india#algorithmictradingsoftware#investment#Investment Platform#Investment Platform in India#Best share trading app in India#trading with algo#algorithmic trading software free#best algorithmic trading software#bigul algo trading#best online trading platforms#bigul algo trading review

4 notes

·

View notes

Text

been losing my mind over this vid my sister sent me 💀

#we were trading videos of kids saying 'nigga' in Very Special Episodes of old sitcoms and then the algorithm gave her this vid#the comment section is ace tho everyone is all 'i dont like kids talking like this normally but fuck it she deserved that one' lmfaoo#funnies

3 notes

·

View notes

Text

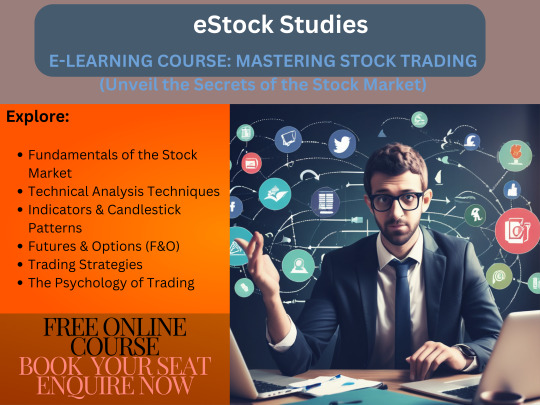

eStock Studies: Online Trading Courses from Basics to Advanced.

eStock Studies: free Online Stock Market Trading Courses from Basic to Advanced, Including Algorithmic Trading Techniques, for Aspiring Trading Experts.

#estock studies#free online stock market trading courses#trading expert#Basic of Stock Market#ALGORITHMIC TRADING TECHNIQUES#trading from basic to advanced#free online Trading Courses#expert trading institute

2 notes

·

View notes

Text

Riding the Digital Wave: Algorithmic Trading in India

Brief Introduction :-

Algorithmic Trading in India has emerged as a transformative force, leveraging advanced algorithms and cutting-edge technology to revolutionize financial markets. It uses intricate mathematical models to execute trades at blazing speed, giving traders speed and accuracy. We investigate available resources, negotiate regulatory frameworks, and look forward to the bright future of algorithmic trading in this ever-changing scene, which is revolutionizing our understanding of and interactions with finance in the Indian market.

History of Algorithmic Trading in India :-

In India, algorithmic trading began in the early 2000s and gained popularity when computerised trading platforms were introduced. An important turning point was the transition from conventional floor trading to screen-based systems, which set the stage for algorithmic trading techniques. Edelweiss Financial Services was a trailblazing organisation in this regard, having adopted algorithmic trading due to its effectiveness and speed, particularly when it came to processing big orders. As technology evolved, financial institutions in India followed suit, with the advent of Direct Market Access (DMA) further quickening the adoption and enabling traders to directly communicate with exchanges. The market has grown increasingly sophisticated over time as a result of Indian companies using artificial intelligence and creating their own proprietary algorithms. Algorithmic trading is currently a major participant in the financial ecosystem in India.The market has grown increasingly sophisticated over time as a result of Indian companies using artificial intelligence and creating their own proprietary algorithms. Algorithmic trading is becoming a major force in India's financial sector, changing the nature of the market and providing new opportunities for both investors and traders.

What is HFT?

High-frequency trading, or HFT for short, is a type of algorithmic trading that uses sophisticated algorithms to execute a large number of orders at speeds never seen before in the financial industry. HFT has emerged as a major force in the Indian financial scene, using cutting-edge technology to take advantage of tiny price differences and inefficiencies in the market. HFT seeks to take advantage of momentary opportunities by analysing data quickly and acting quickly, improving market efficiency and liquidity. Its function is scrutinised, too, and this has sparked debates about how it affects market stability and the necessity of regulatory regimes.

Regulations for Algorithmic Trading in India :-

The Securities and Exchange Board of India oversees algorithmic trading in India (SEBI). The "Algorithmic Trading Framework," a set of recommendations published by SEBI in 2011, was designed to guarantee equitable and transparent market operations. To protect against systemic risks associated with algorithmic trading and to promote market integrity, the laws include requirements for the use of "unique client codes" to track individual trades, risk controls, and order-to-trade ratio limitations.

Skills Required for Algorithmic Trading :-

Econometrics is a tool used in algorithmic trading to model and analyse economic data, offering insights into market movements and possible trading opportunities.

Programming abilities are necessary for developing and putting trading algorithms into practice, which allows for the automation and quick execution of strategies in volatile market environments.

Quantitative analysis: Used to assess market dynamics and financial instruments, enabling traders to spot trends and create data-driven algorithmic trading methods.

Probability and statistics are used to evaluate the chance of market events, which helps with risk management and the development of algorithms that adapt to shifting market conditions.

Proficiency in Financial Markets and Trading: Essential for comprehending market subtleties, allowing traders to create algorithms that conform to current market structures and circumstances.

The ability to reason logically is essential for creating algorithmic trading strategies with clear rules and logic that enable methodical decision-making in the face of changing market conditions.

Conclusion and Future Scope :-

In summary, algorithmic trading has improved market efficiency and opened up new trading opportunities for traders, dramatically changing the Indian financial scene. As the sector continues to be shaped by technological breakthroughs, machine learning, and regulatory frameworks, the future prospects are bright. Algorithmic trading is expected to become increasingly prevalent and play a crucial part in the future of India's financial markets, which are active and growing at a quick pace.

5 notes

·

View notes