#all my problems solved. at least a decade of financial stability

Text

i'm honestly so jealous of whoever did the 50k dollar hazbin hotel amv for that one guy. if every commissioner was like this artists would be living in paradise

#if i was paid 50k dollars to draw that i would weep with joy#all my problems solved. at least a decade of financial stability#300 notes

345 notes

·

View notes

Text

(F/H) =favorite hobby.

I have the weirdest crush on this freaking duck and I don’t know why, so I’m taking out my confusion on this matter by making him yandere. Sorry that this is so long, boring and slow but I’m a sucker for slow burns and just dislike instant love. This went from just from headcannons to a freaking long ass story. I think I’ll make more on how the reader reacts when they find out just how mentally fucked Scrooge became.

Who knows, maybe I’ll write one for good ol’ Flinty. I have a feeling he’d just drop kick any rival he spots without much qualms about it. Meanwhile, Scrooge has a full on psychological derailment.

TW: manipulation, dependent behavior, stalking, and more.

______________

•To be honest, the likelyhood of Scrooge turning into a yandere might be higher than you think. He’s capable of self defense and can fight. He literally hunts treasure for a living. He also has a trillion dollar stockpile sitting around begging to be used for cover ups. His determination is pretty crazy, and he’s seen a lot on his adventures, things that would kind of instill a paranoia over time or an unhealthy me mentality. He can easily hide behind a professional front. Oh, and if he so wanted, he could travel and bury any evidence under a volcano. :)

•Since this is a yandere AU or, I’m gonna go with the idea that this is a what if the show had a TV-14 rating as well, so much darker themes can link and be explored.

•After pretty much a century of adventure, most of which includes violence and fighting through perils, human or not so, Scrooge is desensitized to quite a bit of violence and the dark and greedy side of the world. He’s seen the best of people and also the worst. This plays majorly in anyone who becomes a yandere; how exposed they are to people’s bad side or their own dark tendencies.

•Scrooge himself is not perfect and has demonstrated some traits of greediness, paranoia, and general distrustful behavior which is perfectly reasonable considering his work and the things he exposes himself too during it.

•Even though he loves adventure, there are a lot of bad things that happen on them that he seems to bottle up or keep to himself. Bottling up things causes a negative buildup in anyone, especially Scrooge because he expects that loving his life’s work will repair the same damage it sometimes does to him.

•Most likely, Scrooge developed an affinity with you through your similar drive for adventure. Maybe you worked for him in some way and he saw you defend someone or maybe you outsmarted one of his adversaries on an adventure he decided to bring you on. Regardless, you’ve caught his attention and this is only the beginning.

•A rival love interest’s biggest mistake is mistaking his age for a weakness. One minute he’s complaining about someone being on his lawn, the other they’re buried under it.

•Scrooge would probably connect most if he’s seen that you used to be in his shoes before, or at least a similar situation. Maybe you’re struggling financially but working your ass off to stabilize your income. As someone with the humble origins of a shoeshiner, Scrooge understands perfectly. Despite his incredible stockpile of wealth, he knows what’s it’s like to be at rock bottom.

•At first, you’re probably obviously very suprised with Scrooge’s involvement in your life. He’s from an entirely different world than yours after all, the top of the pyramid. Depending on your origins, you might react quite differently. Currently, you managed to find yourself stuck in a job you hated, working for someone you despised. It was a miserable, repetitive job that brought to your life a void of boredom.

•You craved adrenaline, even if it would get you killed, you finally figured that at least you’d go out with a spark. Putting on a smiling face, you accept a position at McDuck industries thinking that it was going to be another office job. By your luck, (or, later on, unfortunate luck), you managed to score a position that required you to be near Scrooge quite often.

•This gave both of you time to acquaint with eachother and the opportunity for him to see the potential in you as an adventurer instead of just an employee. Scrooge rarely lets people in beyond family, and is quite reserved so he himself questions what he sees in you at first, distrusting you even.

•When you are taken on your first adventure, you nearly boil over with eagerness. There’s a worry at first of the treachery involved but eventually, as you venture on more and more explorations, that fear dulls and you think the adrenaline as far more important than the possible loss of your life.

•Craving adrenaline is the main reason at first as to why you to want to stay around Scrooge. Despite his repeated attempts to brush or push you away, you find yourself excited every time you get to explore and finally get to see a world that you thought you’d never visit.

•Still, Scrooge remains cold and you can’t figure out why beyond the reason that he’s just a pessimistic old capitalist. As much as you want the adrenaline, you kinda can’t help but eventually enjoy his presence as well despite his temper and general grumpiness. Having been alone for over two decades without friends does that to someone. You needed warmth again.

•Maybe you grew attached to all the times you felt you were winning when you snubbed an artifact. Also, after collecting and sneaking a few gold coins into your own pocket, you were finally getting out of debt and on track to actually start your own business involving (F/H). You had the dream that you could travel where you wanted and finally find peace from your own mind and problems.

•Scrooge, despite his own warnings to himself not to persue, can’t help but offer you a job working for him. You made adventuring a million times better and were a great addition to the team, providing your own perspective or plan for the times he and his family would journey out. Oh, and he’d finally get the opportunity to be around you more. It was refreshing to see how optimistic you managed to remain despite your current financial predicament. (Which he contemplated solving.)

•Soon, however, Scrooge began to see that you were not as happy go lucky as you pretended to be, at least not when you weren’t on another treasure hunt. Something appeared to be gnawing at you. Deep down inside, it appeared to plague you and Scrooge began to worry for your well being and as a too curious for his own good duck, he needed to know what was going on. Especially when he had caught you quickly wiping away tears while you began to head home. What could possibly be causing you this pain?

•He had to find out and to his own realization, he had to know now. After all the times you saved and helped him, he wanted to make sure you were at least doing alright in return. He ordered Launchpad to tail you home and Launchpad, oh so very loyal, doesn’t question it much.

•Most yanderes might suffer from the constant delusion that their victims love them back or that they’re in the right but that’s not the case with Scrooge. There are times where he does try to justify himself, but this is mainly due to a fit of rage or to play innocent to you. Most of the time, he knows his actions are wrong and the burning temptation is causing a war. Very early on, he suppresses his curiosity and the growing feelings he has about you. Especially when they begin to boil into something far darker. Although he’s done this to nearly everyone, being cold to you and pushing you away seemed to be his way of trying to ensure your well being instead of his. He was finding it hard not to think about you sometimes.

•Soon enough though, he begins to grow inquisitive about your personal life as you open up to him and define yourself as a person instead of another blur. You were always quite genuine to just sit around and talk to him and despite denying it to himself, Scrooge was lonely, especially after the Spear of Selene. Sometimes you’d joke to him, sometimes you’d think philosophically. Sometimes it was just a mutual, comfortable silence.

•Scrooge might make excuses aloud to you, but doesn’t lie to himself. All the times he’s made you work later or given you an extra dose of paperwork was because he wanted to keep you around and in his line of sight. 12 hours without you was turning into a painful reminder of how isolated he was, even with Beakley around. You were a warmth, a cool, calm warmth.

• “I’ll eventually need to know her address later on in case she’s attacked by one of my adversaries anyways.” Nope, Scrooge wasn’t fooling himself with that sentiment. He knew he was invading your privacy, but he also knew that he was too nosy to care enough.

•The main problem is that although Scrooge knows a lot of what he’s doing isn’t right, he begins to care less and less. (Though this process takes quite a while.) You’re a valuable and positive part of his life, you had stayed when everyone else had abandoned him for his admittedly awful mistakes. He can’t lose another person he treasures. Especially not you. You’re becoming the shiniest yet. Losing you might mean losing himself in some sense.

•Scrooge tries to shake off the guilt but only finds that maybe it’s better to punish himself by feeling it. He’s currently following along your path to wherever your destination currently is.

•Of course, his iconic shiny limousine would be a sore thumb sticking out to both you, the media, and Duckberg in general so he makes sure to either trail far behind or to have another mode of transportation available. Regardless, Scrooge never hires another person to watch you in place.

•Scrooge doesn’t even install cameras. He’d rather experience your life from his own two eyes and not as reported from another bird or screen. He rather liked tracking you himself. It gave him a place to go and at least he’d be able to bask in your duality himself. Sometimes you cried, he found to his own breaking heart. Sometimes you’d smile, (mostly only in his presence, to his delight.)

•Most of all, though, you seem caught in the present of life. Distracted, even. It seems though, that sometimes you’re so distracted that you don’t even notice something is off. Or maybe you yourself are too unable to break the cycle of adrenaline adventure to see it. Maybe you yourself were actively creating excuses, at least at first as to why you sometimes ran into Scrooge McDuck everywhere.

•If there’s something else Scrooge is a master at other than money, it’s with keeping up the detached and reserved persona of a wealthy individual. After all, who would suspect him of such crimes like these? He’s just a selfish, greedy businessman that only cares about his wealth, right? He’d never bother with other birds unless he was shaking hands at a conference table.

•Wrong. As you and him grow to become more like mentor and student, Scrooge begins to insert himself everywhere he possible can in your life, especially after seeing the shitfest that was your social group, what little of it there was. Apparently, you’d finally made a few friends over the years working for him and there was only one out of all of them that Scrooge approved of.

•Two of them, both identical Peacock twins appeared to be fascinated with your link to him and nothing more. It made some sense. After all, who could say they were a close worker to the richest duck in the world? The other one, a tall and lanky chicken, was getting far too handsy with you, and the final, a feline male was nothing but gossip and drama.

•To add to insult, you were a pretty big pushover outside of work which meant that they would drag you to places you didn’t even want to go and pressure you to have drinks you didn’t want to taste. They were in love with the mask you put up, not the complex and amazing face behind it. The one that you were beginning to let Scrooge see.

• Scrooge watches from a distance as your laugh reverberates. The laugh appears to Scrooge as unwavered and solid, mechanical in nature like it was a reoccurring script. Gazing at your face, he could see that your smile was strained, beak scrunched. You just wanted to go home and nothing more.

•The chicken next to you he was sucking a cigarette and the smoke blew in your direction, replacing your laugh with coughing and the others cackled with drunk glee, their solo cups tipping as they did. You blew it off as an accidental push in the wind which, by the way, wasn’t even blowing.

•Out of all of them, Scrooge hated the lanky chicken, who’s name he learned was Gale, the most. You deserved far better than that. Surely you saw through his sleazy act, right? Why were you hanging around such a ratched group of birds? Just how blind were you to their usage of you?

•Almost without even realizing it himself, Scrooge had tailed you the entire way home. After having to torment himself with an hour of seeing you torment yourself, he figured that maybe you’d find something that made you happy other thanyour little flock of “friends.”

•So he was admitting to being a stalker to himself. Did that mean he’d be able to admit it to oblivious ol’ you? Well, no. At least, not for now. Not until you trust him completely. Oh well, he’ll never go further than then that, right? He was watching you, but not engaging in any way. Nothing worse could come out of it..

•Wrong.

•After a while of having you working under him at McDuck Industries, Scrooge began to realize just how much financial control he had over you. Not only did you depend on him cod for paycheck, your landlord worked for someone who worked for him. In other words, the spot of land you were living on was an apartment company that belonged to him. You were living under one of his roofs. All he’d have to do was shift some circumstances and you’d either be homeless or debt free forever. Scrooge of course, plays the benevolent route and lowers it significantly for you. Why antagonize you?

•After having taken that action, Scrooge noticed more and more of a smile on your face as you realized that you didn’t have to depend paycheck to paycheck for food on the table. He had also been aware that you had a side hobby now, involving (F/H.) sometimes you joked you’d start a business and go off parting ways with that hobby. It was source of entertainment to watch you be..Well, you. There was this genuine behavior about you that just drew him in.

•If Scrooge wasn’t adventuring with you or at a meeting also with you, he was still with you. You just didn’t know it yet. Interestingly however, you’d begun to pick up the signs that there was a presence in your life. Whereas you didn’t close the blinds before, you did now. Or maybe that was from all the adventures you’d nearly died on fighting others off. Maybe it was paranoia.

•Eventually, Scrooge managed to break into your apartment under the guise to Launchpad that he’d been invited by you. A ludicrous lie, of course, but Launchpad is gullible to a fault when it comes to Scrooge. He’s loyal like that, and his friendliness to you plays into Scrooge’s emotional manipulation later on.

•As Scrooge sneaks in while you’re still home, he makes his way behind the kitchen counter which seperated your living room. He didn’t expect you to be right there in the living room, but you were, just five feet away from him and the window he snuck in. The window was to your right. He had carefully parted the curtains. Your couch was sitting approximately five feet from the window balcony, facing a corner of the wall with the T.V off.

•Peculiarly, you hadn’t even noticed he’d entered by rigging the door. You were right there, not staring at his direction, but he should have at least appeared in your peripheral. Just what were you doing to be so disconnected to the reality around you? It was worrying.

•Now hidden behind the counter directly to the left of you, he observes your desensitized form. For a moment, Scrooge thought you were a corpse until he peered closer. You were still there, physically. Mentally you looked as if you were in a whole other dimension. In a rather bold move, Scrooge slowly stands up and positions himself in the archway, watching you from his spot.

•You were still, so very still unlike all the times you’d fidget at work or with those “friends.” You still breathed and your hands shook slightly and there was color to your eyes but you yourself didn’t even seem present whatsoever. Your eyes were glazed and far away. It was just your body sitting there in that couch. It was worrisome and yet there was a blissful smile to your face seconds later.

•It was you, daydreaming about something. Something you obviously enjoyed. Scrooge, to his own shame, hoped it involved him. For a few more moments, all you did was sigh like you were meditating. It was haunting how easily you had lost yourself within the confines of your tumbling mind. Somehow, you were blocking out the world beyond, maladaptively.

• Scrooge knew he was taking a huge risk. All you’d have to do to spot him now was swivel your head a few inches or wake up from dreamland. It would take a few inches to ruin what you thought of him.

Just then, to Scrooge’s horror, you had slowly picked yourself off the couch. Your body shuttered as your head snapped up. He knew he was taking a huge risk with this and began to think that maybe it was a terrible idea after all. (Who was he kidding, it was terrible in the first place, he knew what he was doing.)

•He quickly fell back to his crouched position behind the counter, silently and expertly as you turned around and made your way closer and closer. There was a tense moment in which Scrooge contemplated just knocking you down completely and rendering you unconscious. All it would take was a few seconds. Maybe you’d forget or maybe he’d give you the dreamland you seemed so desperate to reach. It would certainly give him peace of mind to know where you are 24/7..All he’d have to do is knock you out and take you to the manor. You’d be secure and have everything you need there…

•Your presence was setting him alight, in the good way and bad way. He loved being near you. But hated the idea of you getting any closer right now, because you getting any closer would ruin your trust in him entirely. A few more steps is all there was between the idol you saw Scrooge as and the monster he was growing to be. You were like a fire. The heat scorched his feathers. Then, when you were away, his thoughts.

•Your steps were louder than they’d ever been. Then, to Scrooge’s unbelievable luck, you turned towards the hallway away from the kitchen. Scrooge knew not to push his luck trying to follow or stay, so despite his clawing urge to figure you out, he hesitantly snuck out with unanswered questions on your concerning mental state.

•It had been a months since that incident and Scrooge was moving onto bigger and bolder actions. Sometimes he’d swipe you away from any conversations you had with your friends by calling you in for a task. Sometimes he’d eat up all your time by keeping you in late, and taking you to places far away that required days of travel.

•Sometimes he’d drive bad influences away by financially ruining their life forever.

You noticed Gale’s downfall quickly, but you didn’t have any idea it was Scrooge who was responsible. Gale lived actually, three complexes from you and oh so suddenly, rent had begun to skyrocket in the particular room he had to himself. This led to him being presented with an eviction notice. You didn’t even have the chance to say goodbye. (Not that you wanted to, though.) deep down you were glad he was gone and Scrooge knew it. Gale had to move far off to find an affordable spot. It was a mercy considering how often Scrooge had dreamed of just throwing him into the ocean tied up for the sharks to find. He was a toxic influence.

•Maybe if someone pushed his button just right, Scrooge would end up killing them, and who would care? There were seven billion fellow people on the planet. Scrooge could just get rid of any threat he wanted and no one would notice or ever suspect it was him. After all, he’s just a grumpy old man with a cane.

•It turns out, Scrooge had picked up on your plans to possibly quit your job. He had never felt his heart sink like it did now. He was fighting off his initial shock as you stood in his office, masking it with a detached face. You hadn’t even confirmed the statement. All you’d said was that maybe you’d found a company within your favorite hobby.

•It was just a small implication. But, Implications could become statements, which could turn into actions, and Scrooge couldn’t let the thought even be a presence in your mind.

•You had stayed with him throughout the years of his loneliest moments, had confessed secrets, had confided in him. You were like his pupil, learning from him and you were like his partner, fighting alongside him. Maybe you were something different altogether.

•...Was it a friend that convinced you? It had to be. Scrooge knew how much you enjoyed galavanting around the world with him. There’s no way you’d just fly off without him.-

“I promise I’ll still occasionally go with you, Scrooge. (A first name basis. This was devolving from anything normal.) I found my passion. We can still adventure together, but I found a path that also makes me happy and doesn’t ya know, get me killed.” You chuckle as if it were nothing. A light joke.

•So you were leaving. You were going to go. Why? You had a great paycheck, (an expensive one that took a lot of money,) you had the opportunity to travel the world. You had the best job you’d ever get. Who else was going to be as good as him? He won’t let you destroy your future by applying for a Mediocre position at some dumptruck company.

•As it turns out, the bird responsible for swaying you was none other than one of the peacocks, her name was Shelby. She and you laughed, and for the first time, your laugh was genuine. Genuine with her and not with Scrooge. You both shared each other’s stories, and she in return had encouraged your little dangerous fantasy of being independent.

•Now of course Scrooge realized how ridiculous this all sounded. He had willingly allowed you to go on perilous adventures with him, but at least then, you were with him. How could he keep an easy eye on you if you just moved off to some rando spot? Plus, he was plenty good as saving you. He was your hero.

•Bad influences needed to go away.

•Scrooge might lie to himself about how much it digs under his feathers, but to see you around other people really dug wrong. He itched every time you decided to take advice from other people, or confide in them instead of him. He was the one you could go to, not them. Your secrets didn’t need to be shared with anyone else but Scrooge. All those rare and precious things that made you yourself didn’t need to be snatched by thieves like Shelby or Gale or whoever else.

•He knew that his criminal actions would scare you. Even with your growing trust and dependence on him, he knew it was too early for you to want to stay with him if you knew what he’s been doing. If he wanted your presence, he’d keep it through lengths you’d find terrifying.

•Scrooge found your biggest flaw was that you always attracted the wrong crowd, and it was primarily because you were always trying to impress others when they really didn’t deserve the magnificent canvas you painted yourself to be. To his even greater detriment, you were beginning to spend your time more and more with Shelby. The canvas you painted was beautiful, as always. But it wasn’t for him, and he found that he was not happy with this new development.

•Don’t you know people take advantage of kindness? It happened to him all the time and still does. It happened to you over and over and yet you kept venturing forth giving out your trust like it was nothing. The world is a sour place if you’re not careful. Cursed kilts, you were already naive about Gale. Who knows how badly future people would hurt you, even if they were well intentioned.

Scrooge could tell that, despite him insisting otherwise, you thought leaning on his shoulder was burdening him. He wanted to make sure you knew it was anything but that. As a matter of fact, he wanted you to lean on his shoulder every moment he possibly could get you to. What was just you occasionally asking for advice on impersonal things becomes entire sessions with Scrooge encouraging you to reveal every personal detail of your life.

•You had revealed that many times, you just wanted independence. A company of your own to possibly build so you could pursue life your own way. Scrooge knew these dangerous thoughts were one of the final roadblocks. Scrooge had to prevent them. Be it through roughening you up financially or discouraging you. Be it from murdering outside influences, too. Who was going to miss the miserable miscreants that plagued your life anyways?

•It is three days before the date you had decided that you would resign. Instead of being merry, you were miserable. The opportunity you had to get the job was burned by them not even calling you for an interview. After your resume, why would they reject you? You had the word of one of the finest businessmen out there to back you up. Scrooge himself promised to put in a good word for you! You were perfectly qualified for the job you were looking for. In your days of being rejected from the position you wanted, you confide in Scrooge. You don’t know it but as he pats your shoulder, he’s thinking of the next way to sabotage your efforts of leaving him.

•Shelby ends up going missing. She was one of your closest friends and the only one who finally treated you well. Your devastation causes a major setback in any ambitious plans as you isolate yourself from anyone else but only the closest person left in your life; Scrooge.

•Currently, you were enveloped in a warm hug, the side of your face leaning in the crook of Scrooge’s neck as he calmed your crying form down, patting your back and promising you his presence would remain forever. You wept at Shelby’s funeral, so did her twin sister and their parents, who, upon seeing Scrooge, had nearly fainted in shock.

•Despite your tumultuous relationship with Shelby, she had actually begun to redeem much of her previously antagonistic actions towards you. She was in a rough place when you had developed a connection with her. So you wept in your boss’s, or rather, your best confidantes arms. You wept.

Scrooge, however, did not.

#yandere#obsession#yandere ducktales#scrooge mcduck#headcanons#yandere x reader#reader insert#platonic or romantic#ducktales#cartoon#yandere Scrooge McDuck#minors do not interact#murder#this is weird I know#dt 2017#ducktales 2017

188 notes

·

View notes

Text

Fic: The Head That Wears The Crown

AU-gust Day Nine: Royalty AU

Fandom: Stargate Universe

Pairing: Nicholas Rush x Gloria Rush

Rated: G

Summary: After almost twenty years of avoiding Gloria’s heritage, a single phone call turns her and Nick’s world upside down, and they are forced to confront the fact that she is, in fact, a princess.

===

The Head That Wears The Crown

Nick knew that something was up from the moment that Gloria picked up her phone where it was innocently buzzing along the kitchen table. Having looked at the caller ID and gone as white as a ghost, her spoon dropped back down into her cereal bowl, sending milk and muesli across the table.

“Oh God.”

Nick grabbed a couple of sheets of kitchen paper to clean up. “Who is it?”

“My mother.”

Well, that was certainly a turn up for the books, and it certainly explained why Gloria had reacted the way she had. She hadn’t spoken to her mother for almost twenty years. She hadn’t spoken to anyone in her family for almost twenty years. Gloria’s family were never mentioned, the ultimate taboo between them.

“You’d probably better take it,” Nick observed. “She wouldn’t be calling you unless it was important.”

Gloria gave a slow nod, the phone continuing to vibrate in her hand as she made no move to answer it.

“Yes, I probably should.” The phone continued to buzz urgently, and Nick held out a hand.

“Do you want me to take it?”

“No, I don’t think that would help.” Gloria took a deep breath and answered just before it cut out to voicemail. “Good morning, Mother.”

Nick couldn’t hear what Gloria’s mother was saying, but since Gloria managed to go even whiter than she already was, it must have been something dramatic. When she got up from the table and vanished into the living room, closing the door firmly behind her, Nick knew that it was very, very serious. He sat back down at the table, his own breakfast completely forgotten in the knowledge that, likely as not, his entire life was about to get turned upside down.

When Nicholas Rush had first met Gloria Andrews, they’d both been studying at Oxford and had happened upon each other quite by chance at one of the rare social events that Nick had attended. A friendship had begun and turned into a relationship, and the relationship had turned into love and a proposal of marriage.

The proposal had opened a rather large can of worms, because for the previous two years of dating and sleeping together and eventually living together, Gloria had omitted to mention one very important fact, namely that she was heir to the throne of a small principality.

Nick hadn’t believed her at first, because surely if she was royalty then she’d be flanked by several bodyguards all the time and wouldn’t be hanging around in student bars in Oxford, and she certainly wouldn’t be doing something as mundane as playing the violin for a living. And surely she wouldn’t have a surname as commonplace as Andrews.

True, she had never shown any inclination for him to meet her family and he had no idea where she’d lived before going into halls of residence and then living with him. She’d always been rather vague about where she spent her holidays, and it had always been clear that she was in no way short of funds.

But the princess of a nation that he’d only vaguely heard of?

Unfortunately, or fortunately, depending on how one looked at it, Gloria was telling the truth, and Nick found out that for the last two years he had been falling in love with Princess Gloria Catherine Anna di Marco, daughter of Prince André di Marco from whom she’d adopted her civilian surname.

Being the heir to the throne of a nation, however small that nation may have been, Gloria really wasn’t expected to marry a penniless Scottish astrophysicist, and upon the revelation of her true heritage, Nick had been fully expecting their relationship to come to an end.

He had not been expecting Gloria to go home to her father, argue with him about her life choices until he disinherited her, and then come back and marry him and live a happy and contented life as a music teacher, completely uncaring for the grandiose existence she had left behind.

Now, nearly twenty years later, that grandiose existence had suddenly made an appearance once more, reminding both of them that their lives were not as simple as they had hoped to keep them.

Nick sighed. There had been so many times over the last two decades when he had doubted his worth, knowing that he didn’t deserve someone like Gloria despite all the times she had reassured him that he was the only thing she wanted. She had given up so much to be with him and she had never once used that maliciously against him. She had never once wished for her royal life back or lamented how different things would have been if they had not stuck together. Nick knew that it was unfair to put all of the upheaval that they were about to face on Gloria. She had done her best to avoid it, and she would feel the stress of it just as much as he would.

At length – time had lost all sense of meaning – Gloria returned to the kitchen and sat back down, staring at her phone for a long time before she spoke. When she did, she didn’t meet Nick’s eyes.

“I have to go home,” she said. Her voice was measured but brittle, as if she was only keeping herself together through sheer force of will. “Actually, we both do.” She looked up at him then, and Nick could see that she’d been crying. “My father is dying, and he wants to see me. And you.”

Considering that Nick had never met any of Gloria’s family, much less her father, who was the ruler of a country, he thought that he was justified in feeling some trepidation at the prospect, and he felt guilty as he started mentally running through a thousand and one reasons why he would have to stay here.

He knew that he couldn’t. Even if none of Gloria’s family wanted anything to do with him, which was the stance they’d made clear when she’d first mentioned him to them, he needed to go with Gloria to support her whilst all this was going on. He’d lost his mother when he’d been too young to remember and his relationship with his father was strained at best, but he knew that he wouldn’t want to go through the loss alone.

“Right.”

For a long time, that was the only thing he could say. There were a hundred questions running through his head, most of them along the lines of does this mean you’ll have to run the country now and most of those followed by where does that leave us?

“I suppose I’d better start cancelling my lessons,” Gloria said. It was so practical and mundane that Nick couldn’t help but give a bark of laughter, alarming Gloria.

“I’m sorry. I think I’m still in shock.”

“Yeah.” Gloria sighed, and suddenly she looked very far away at the other end of the table. “Yeah, you and me both.”

X

Objectively, Nick knew that royal families generally had money to burn, but having lived on the breadline for most of his life and only gaining proper financial stability when he got academic tenure, the extent of wealth was difficult for him to comprehend – and he had wrapped his head around some of the most incomprehensible theoretical physics known to man.

Since getting off the plane, he and Gloria hadn’t had to lift a finger. There had been official people to meet them at every step of the way and a car waiting to whisk them away to the official family residence, and then another one waiting to take them to the hospital. Considering all he’d had to do was follow people along corridors and sit in the back of very luxurious cars, Nick was exhausted. All he wanted was to get back to his office and grade a few choice idiotic papers to take his mind off it all.

“Oh, Gloria!”

As they entered the private wing of the hospital where Prince André was receiving treatment, Gloria was bowled over by someone whom Nick recognised from photographs as her mother – twenty years older, of course, but still definitely the same woman. Even though Gloria was far more comfortable with invasions of personal space than Nick was, it was clear that she was rather taken aback by this sudden display of affection from someone she’d had no contact with for so many years. Eventually she relaxed into the hug and let her mother lead her down the corridor towards her father’s room.

Nick hung back, sitting down on one of the plush seats in the waiting area. He caught Gloria’s glance over her shoulder, almost a plea for deliverance, and he wondered what he should do. What could he do? He was the very definition of a fish out of water here, and Gloria herself wasn’t doing much better. People kept coming and asking if they could get him anything; it was the most surreal experience he’d ever had. Some kind soul sourced him some coffee and the caffeine helped him to focus a little, even if all he was focussing on was pretending to be somewhere else entirely.

It felt like an age before Gloria returned, sinking into the chair next to him.

“Gloria?” She looked blank, like she was miles away. “Gloria? Glo?”

She shook herself out of the stupor and turned to him.

“Hi. Sorry, I’m still trying to work out whether that just happened or if this is all just some weird dream.”

“What happened?”

Gloria shook her head. “I don’t want to talk about it. Not here, at least. God, I want to go home. Proper home, I mean. Our home. Oxford. Not here.” She pressed her hands over her face, leaning heavily on her knees. “I thought I’d left all this behind,” she mumbled behind her fingers. “I was happy to have left it all behind. This can’t be happening.”

No more was said on the subject until they got back to the house, and even then, Gloria spent a long time just wandering through rooms that had once been familiar. Nick trailed after her, unsure of what she needed. This wasn’t a problem that he could just apply maths to in order to solve.

“This was my bedroom when I was a kid.” She’d stopped in the doorway of a room that was at least the footprint of Nick’s entire childhood home and garden. Everything was covered in dust sheets, no sign of personalisation anywhere. Just as Gloria had made a clean break with her previous life, it seemed that her previous life had made a clean break with her as well.

“He wants to reinstate me,” she said suddenly, apropos of nothing. “He wants me to take the throne when he dies.”

Although Nick had suspected that this would be the case from the moment he’d known the situation, it was still something to hear it from Gloria herself and have it confirmed.

“Is this a situation where you can say no, or do you not really have a choice?”

Gloria shrugged. “I have no idea. The lawyer’s coming tomorrow to sort it all out, I guess I’ll find out then.”

“What happens if you don’t take it?”

“There’s a cousin in New Zealand. It’ll go to him.” Gloria sighed. “I’m so sorry, Nicholas. I don’t know who I was fooling when I thought that I could leave all this behind and it would never trouble us again. I’m an only child and my father’s not going to live forever, of course it would come back to bite me sooner rather than later. There was no way I could run from it forever. I’d just hoped that it would be over, done. He’s always been so stubborn. I thought that his first decision would be final. I never thought that he was one for deathbed regrets and trying to make amends. I suppose none of us know what we’re going to regret at the end until we get there ourselves. I’m so sorry.” She wiped away a fresh fall of tears on the back of her hand. “I’m so sorry, Nick. I know you didn’t sign up for all this.”

Nick didn’t reply. He didn’t know what to say, either to comfort Gloria or to try and make sense of his own position in the entire affair. He just put his arms around her, letting her lean in against him, holding her as she cried. He tried to reason that nothing was set in stone yet, that Gloria still had the choice to refuse the crown and everything could go back to the way it was before, that soon enough it would all be the cousin in New Zealand’s problem.

Deep down, though, he knew that it was not going to be as simple as that.

He didn’t think either of them slept that night, both of them caught up in their own thoughts. Nick stared at the ceiling, thinking about everything that he had to lose if Gloria were to take the throne and move their lives over here. The university, his professorship, his positions on all of the research committees he worked on. His office, his tenure, his students… Well, maybe he wouldn’t miss those as much.

Ultimately, though, he knew that the only thing he would really miss if he were to lose it was Gloria. He had started from scratch enough times and he had built himself up from the bare bones before. He could do it again. He could do his research anywhere. But if Gloria wanted to be here, then here was where he would be as well.

“Glo?” He reached across the bed to find her hand, squeezing tightly.

She rolled over, burrowing into his side. “Nick?”

“Whatever happens, whatever you decide, I’m right here with you. I love you. No matter what.”

She kissed him, fumbling and clumsy in the dark, and Nick felt wet on her cheeks.

“Thank you, Nick.”

#SGU#Stargate Universe#Nicholas Rush#Gloria Rush#Nick/Gloria#Royalty AU#AU-gust#Worry does AU-gust#Fic: The Head That Wears The Crown

14 notes

·

View notes

Text

Libra Is Nothing More than a Nice Idea

What kind of money will we use in the future?

The answer might seem obvious: dollars, euros, yen, and other government-issued fiat currencies.

Most of us have never known anything else. Yet these currencies aren’t natural phenomena.

People created them. People can also abandon them for something else, just as they abandoned older currencies.

There are good reasons to think we could once again see some fiat currencies disappear. If so, what “something else” will be money in the future?

I can hear the chorus now: Fiat currencies come and go, but gold is forever. And now there is a drumbeat for cryptocurrencies.

Five years ago, I said that I expected to see a commodity-backed cryptocurrency to eventually emerge and potentially become the currency of the future.

Facebook’s recently announced Libra project may eventually be one. But at this point, it’s really just an idea, and I am not convinced it is ready for primetime.

Trust Issues

Libra is Facebook’s idea, but the company—obviously aware it has public trust issues—has assembled a consortium to manage the project.

This “Libra Association” currently has 28 members. They are mostly payment processors, tech and telecom providers, venture capital managers, and a few nonprofits. Facebook itself is represented by a newly formed subsidiary, Calibra.

Unlike Bitcoin, Libra won’t be “mined” by solving math problems. It will be fully backed by financial assets, which the association says will consist of cash in various currencies, government bonds, and similar short-term debt.

All will go into a “Libra Reserve” as users contribute money, and each Libra unit will be a share of that account. Its value will fluctuate against conventional currencies, but not by much (or so they hope).

How do you know the reserve assets are really there? This requires a lot of trust, something Facebook hasn’t exactly earned from the public it supposedly serves. But MasterCard or Visa? Since most of us have at least one of their cards, we seem to trust them.

Another problem is that Facebook uses your data in unexpected ways most of us would never consent to if it specifically asked us, which it doesn’t. Not to mention the large, profitable firm’s seeming inability to securely store our data.

With this in mind, Mark Zuckerberg is making some gestures toward segregating Libra customer information from the Facebook social network. I’m not sure it will be enough to satisfy the public, not to mention politicians and regulators around the globe.

Know Your Customer

Libra faces another challenge that may be even greater. Much of the “unbanked” economy likes being in the shadows.

People use cash and cryptocurrencies as part of tax evasion, fraud, crime, or terrorist plots. Facebook says it doesn’t want to facilitate such activity. But how to stop it?

Regulators have forced the banking industry to adopt robust “know your customer” practices. You must identify yourself to open an account. Banks report any suspicious activity to the authorities. It is a pain for legitimate businesses and investors, but a necessary one.

US and European regulators may not demand that level of scrutiny from Libra, but they will certainly impose some requirements. There is no way they will let it turn into anything like Bitcoin.

Facebook has millions of fake accounts engaged in all sorts of less-than-honest activities. That’s core to its business model, actually; more eyeballs mean more revenue. The firm is beginning to police the audience more rigorously, but its sincerity is questionable at best.

So the Libra project’s DNA, so to speak, tells it to a) collect lots of data b) not worry too much about its accuracy, and then c) use the data to make money. That is inconsistent with the way Libra will have to operate, if it is to do so legally, as Facebook and its partners say is their intent.

Security Issues

But say Libra implements whatever safeguards the various governments demand. That still leaves it holding a lot of sensitive, private information about people’s assets, spending habits, travel, and more.

Can we a) trust Libra to keep the data out of Facebook’s clutches, and b) trust Libra, Facebook, and whoever else is involved to protect it from cyberthieves?

Just look at all the data breaches that have occurred at large, supposedly sophisticated banks and other institutions that spent billions protecting their systems. Is Libra going to invest that kind of money on security? If so, where will it come from?

Where’s the Money?

Libra itself intends to make revenue from the “float” on its assets. In theory, you will give your dollars or euros to Libra and they will convert it into a basket of currencies, banking assets, and so forth.

The organization will live off the interest, paying you nothing while (you hope) not using your information to its own benefit.

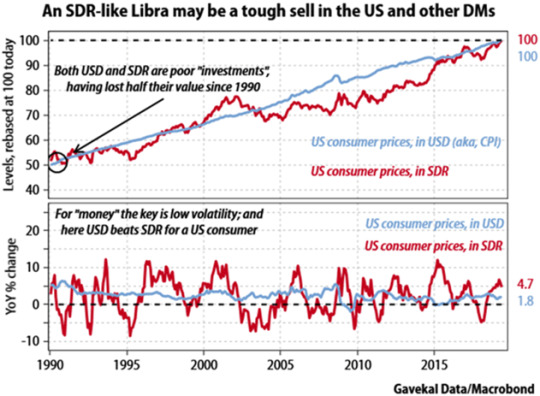

Let’s go back to that stable coin concept. A basket of currencies is not very stable. Fortunately for me, my friends at Gavekal took the trouble to measure the stability of both the dollar and the IMF’s Special Drawing Rights (SDR).

They found that for at least US dollar holders, the dollar would’ve been more stable. It even works out that way for holders of the Indian rupee and other currencies. (Of course, if you live in a country like Venezuela, Libra may be a godsend for you, if you can figure out how to get some.)

Source: Gavekal Research

So, if Libra isn’t going to pay me any interest and it’s not really a great store of value, what’s my motivation to “invest?”

Tough Road Ahead

So, Libra has a tough row to hoe. We’ll see how it goes. But the point remains: Fiat currencies aren’t working so well, either. What would work better?

I continue to think a properly designed, well-regulated commodity-backed cryptocurrency is the best option. But it can only work if governments allow it. They don’t need to ban alternative currencies; governments have many ways to render them impractical.

For instance, in the US, the IRS considers Bitcoin an “investment.” Any change in its value between the time you acquire it and the time you spend it is a capital gain or loss.

Tracking that for every cup of coffee you buy would be a chore. Libra will likely face this same problem.

And speaking of taxes, the IRS accepts only dollars. You must have enough of them to pay your taxes.

Similarly, the government pays its millions of workers and contractors in dollars. Ditto Social Security and other benefits. An enormous part of the economy won’t use any Libra-like alternative money. This will further limit its growth.

Those barriers will fall eventually, but it won’t be tomorrow. I think we will see a lot of experimentation in the next decade. New money is coming. We just don’t know what it will be.

Throwing Down the Gauntlet

All that being said, I wouldn’t bet against Libra actually making it. While I’m a tad skeptical of our privacy in Facebook’s hands, hundreds of millions if not billions of Millennials won’t even think about it.

And if you are one of the major banks that has been working on a blockchain cryptocurrency? Many are doing so.

Facebook’s just sounded the starting gun. And they are doing the banks the courtesy of running the regulatory gauntlet first. Will that give Facebook a first-mover advantage? Hard to say.

Remember MySpace? Not all first movers are created equal.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could be triggered in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

2 notes

·

View notes

Text

New top story from Time: ‘Our Work Is Not Finished.’ Nancy Pelosi Is Trying to Save America’s Economy—Again

Nancy Pelosi was getting impatient. It was mid-March, and the House Speaker and her staff were working around the clock to draft urgent legislation to address the coronavirus pandemic. But the White House was dragging its feet: she hadn’t heard back from Treasury Secretary Steven Mnuchin, her negotiating partner, in more than 12 hours.

Pelosi told Mnuchin the delay was unacceptable, and he got the message. The next morning, he boasted to Pelosi that his staff had been up until 4 a.m. putting the finishing touches on the Families First Coronavirus Response Act, providing funding for free testing, paid leave and expanded food stamps.

“I’m not impressed,” Pelosi replied. “We do it all the time.”

As the pandemic takes tens of thousands of lives and tens of millions of jobs, a Congress known for dysfunction has kicked into gear. Four massive bills with a price tag of nearly $3 trillion have sought to aid the sick, shore up the health care system, and ease the burden on workers and businesses. It’s the biggest federal outlay in history, dwarfing the response to the 2008 financial crisis, and as Speaker, Pelosi is naturally at the center of it. Before the ink was dry on the latest $484 billion small-business rescue package, she was on the phone trying to make the next deal to aid state and local governments whose budgets have been ravaged by the crisis. As Representative Karen Bass, a California Democrat, told Politico recently, “Quiet as it’s kept, she’s the one leading the country right now.”

Precisely because it required a frozen government to act, the pandemic has put Pelosi’s legislative talents on urgent display. It’s a fitting capstone to her historic three-decade career. Many congressional scholars consider Pelosi the most adept lawmaker of the past half-century, measuring her record of society-shaping legislation against the backdrop of the most partisan and gridlocked Congress in decades. While Republicans accuse her of obstruction, and some on the left accuse her of giving away the store, Pelosi believes she’s maximized her leverage at a time when inaction is not an option.

The legislative prowess Pelosi has exhibited during the crisis was honed in years of negotiations, often with the fate of the economy hanging in the balance. As Speaker from 2007 to 2011, she was instrumental in the U.S. response to the 2008 financial crisis and subsequent recession. As minority leader from 2011 to 2017, she forged deals in the high-stakes budget battles between President Obama and congressional Republicans.

For my new biography, Pelosi, I spent more than two years researching the Speaker’s life and career. I conducted more than 100 interviews with critics and supporters, activists and operatives, current and former staff, and dozens of current and former members of Congress from across the political spectrum. It’s the first biography the Speaker has cooperated with, offering extensive access to Pelosi and her inner circle. I found her to be someone everybody has an opinion about but few really know. Republicans have spent tens of millions of dollars over the past decade caricaturing her as a “San Francisco liberal,” while Democrats who once fought for her ouster have embraced her as a Resistance queen.

The woman who ripped up Trump’s State of the Union speech and led the most partisan impeachment in history is a loyal Democrat, but deep down she’s a dealmaker–an old-school legislator whose primary focus is getting things done through negotiation and compromise. Pelosi’s lodestar is securing the votes to deliver results. “Who would have thought Congress could pass four major pieces of legislation in the span of a month with overwhelming bipartisan support?” says former Representative Donna Edwards of Maryland, a onetime Pelosi lieutenant. “You can see it both in her command of the substance and also her command of the process. She’s not a politician; she’s a lawmaker.”

Since Pelosi arrived in Congress in 1987, America has embraced and endured massive change. But no one has ever dealt with anything quite like this–a double-barreled public-health and economic crisis of unprecedented proportions. In what’s likely the twilight of Pelosi’s historic career, a lot is riding on her ability to deliver the votes once again.

Sarah Silbiger—Bloomberg/Getty Images Pelosi, addressing the media on March 27, has been at the center of a rare burst of bipartisan legislation

This is not the first time Nancy Pelosi has been called on to help a Republican President save the U.S. economy from collapse. On Sept. 18, 2008, Treasury Secretary Hank Paulson called Pelosi with panic in his voice. “A very serious situation is developing,” he said. The investment bank Lehman Brothers had declared the largest bankruptcy filing in U.S. history. The Federal Reserve and the Administration had done all they could, Paulson said. They needed help from Congress–fast.

The Troubled Asset Relief Program (TARP) would allow the Fed to buy up banks’ “toxic assets,” stabilizing their debt loads so they wouldn’t go broke. The plan would cost hundreds of billions of dollars. It was odious to both parties: Republicans hated the idea of government meddling so drastically in the economy (and spending so much taxpayer money to do it), while Democrats were loath to clean up the mess they blamed President George W. Bush for causing.

Over a week of intense negotiations, Congress and the Administration hammered out a bill. Pelosi and her GOP counterpart, John Boehner, made a deal: Boehner would come up with 100 Republican votes, and the Democrats would make up the rest–at least 118. Pelosi did her part: 140 of the 235 Democrats voted yes. But on the Republican side, just 65 of 198 were in favor, and the bill went down. The Dow’s 778-point fall was the biggest one-day loss in history at the time, wiping out $1.2 trillion in wealth.

A week later, Pelosi brought a new bill to the floor, a compromise worked out in the Senate. It passed, 263-71, with 172 Democrats and 91 Republicans in favor. She had played a pivotal role in saving the U.S. economy from catastrophe–and bailed Bush out, for the good of the country, at enormous political risk.

After Barack Obama won the election a few weeks later, the economy was still reeling, shedding hundreds of thousands of jobs every month. Obama wanted the House to put together a stimulus bill he could sign on his very first day in office. The price tag would be huge. The White House sought about $800 billion in stimulus–bigger than TARP. As a share of GDP, it would be the largest public investment in U.S. history.

Obama tried to reach out to the GOP, even though Pelosi warned he was being naive. Charlie Dent, a moderate from Pennsylvania, was among the Republicans invited to watch the Super Bowl at the White House, where his wife chatted with Michelle and his kids played with Sasha and Malia Obama. In the end, Dent voted against the bill–and blamed Pelosi. “I believe the President was absolutely sincere in looking for a bipartisan outcome,” he told Newsweek. “But the White House lost control of the process when the bill was outsourced to Pelosi.”

Every single House Republican voted against the stimulus, as did 11 Democrats. But it still passed by a healthy margin. The key to Obama’s triumph had been not his ability to reach across the aisle, but Pelosi’s skill at holding her caucus together.

Over the ensuing two years, Pelosi helped Obama pass the Affordable Care Act, providing universal access to health insurance–something Democrats had been trying and failing to achieve for the better part of a century. In the 2010 midterms, Republicans cast her as the villain, spending $70 million on ads that tied Democratic candidates to her. The chairman of the Republican National Committee embarked on a 117-city “Fire Pelosi” bus tour. It worked: in November, the GOP won 63 seats and the majority.

Pelosi stayed on as minority leader as Obama and the new Speaker, Boehner, tried to figure out a way to strike a grand bargain to balance the country’s books and restore Americans’ trust in government. When Pelosi found out about the talks, she was publicly critical of Obama’s willingness to cut entitlements such as Social Security and Medicare, totemic achievements of past Democratic administrations that had rescued millions from penury and sickness. Privately, she assured Obama that if he needed her, she would be there. But who, she wanted to know, was counting votes? Republicans, she suspected, were just going through the motions, waiting to blame it on the President when the deal fell apart. Within a couple of weeks, that was exactly what happened.

On the eve of a national default that could have shaken the market and sent the fragile economy spiraling, Congress took over the talks. The solution congressional leaders came up with wasn’t pretty: no entitlement reform, no new taxes, but the formation of a bipartisan “supercommittee” that would have 10 weeks to come up with more than a trillion dollars in cuts and revenue. Failure to do so would trigger automatic across-the-board cuts to the entire federal budget. Pelosi, now at the table, secured important concessions: the trigger would hit defense spending just as hard as domestic spending, and there would be no changes to Social Security, Medicare or Medicaid. Democrats hated the deal–Representative Emanuel Cleaver, a pastor from Kansas City, Mo., called it a “sugar-coated Satan sandwich”–but the bill passed with 95 Democratic votes.

This pattern would define the remainder of the Obama presidency: a cycle of crisis, featuring marginalized Democrats, recalcitrant Republicans, a White House unwilling or unable to strategize around them, and a government that could barely keep the lights on, much less solve any of the nation’s pressing problems. Another recurring feature of this depressing cycle: Pelosi, the congressional leader with the longest track record of reaching across the aisle, was routinely cast aside. When she forced her way into the room, problems generally got solved. But it didn’t seem to occur to the men in charge to invite her in the next time.

Pelosi’s current efforts have a political goal: as the November election nears, she wants to show that Democrats are focused on governing responsibly. It’s why she’s urged the party’s candidates to focus on kitchen-table issues and realistic plans; it’s also why she resisted impeachment for the better part of a year, then pushed for a short and simple process.

“The message has to be one that is not menacing,” she told me in December, when both impeachment and the presidential primary were in full swing. “People love change, but they also are menaced by it.” The liberal platform that resonates in her San Francisco district, she said, may not go over as well in swing states like Michigan that Democrats need to win the Electoral College. She cited single-payer health care as an example: “I think it’s menacing to say to people, in order to get this tomorrow, we’re taking away your private insurance.”

Pelosi’s political future isn’t something she talks about–when I mentioned the idea of the “twilight” of her career, she snapped at me–but in 2018, she accepted a term-limit agreement that would force her to step down in 2022. Privately, as I reveal for the first time in the book, she told confidants at the time that she expected the current term to be her last.

The legacy she leaves will be a complex one. As the first female Speaker, she shattered the “marble ceiling,” but her dreams of a woman President were dashed in 2016 and 2020, and she leaves no obvious female successor. She cites the Affordable Care Act as her greatest achievement, but Republicans have succeeded in undermining it and Democrats argue it doesn’t go far enough. Despite her willingness to deal, Congress is a gridlocked mess with dismally low approval ratings.

When I asked Pelosi what she still wants to accomplish, she pointed to the problem of income inequality and the “existential threat” of climate change. Pelosi’s House passed a cap-and-trade bill in 2009, but it never advanced in the Senate; save for a resolution last year in favor of the Paris Agreement, it remains the only major climate legislation ever to pass a house of Congress.

“Our work is not finished,” she said, “when it comes to improving the lives of the American people.”

Adapted from PELOSI by Molly Ball. Published by Henry Holt and Company May 5th 2020. Copyright © 2020 by Molly Ball. All rights reserved.

via https://cutslicedanddiced.wordpress.com/2018/01/24/how-to-prevent-food-from-going-to-waste

0 notes

Text

12 Jobs That Make a Lot of Money

In highschool, my best friend and I looked through a giant book of jobs and their salaries.

We immediately flipped to the end to find the one that paid the most money.

It was an investment banker.

Without a second thought, we both declared we were going to be investment bankers.

Did we have any clue what an investment bank actually did? Nope! We just wanted the highest pay.

I wish I had known how many options I really had. I could have focused on a path that would have been a better fit right from the beginning.

Turns out, there’s a lot of jobs that pay a lot of money. Whether you’re still in highschool or making a career change, you have a lot of options.

Here are the top 12 jobs that potentially can make a lot of money for you.

Accountant

An accountant will perform financial calculations for individuals, small businesses, and large corporations. Accountants must know how to examine and prepare a variety of financial reporting forms, helping customers or businesses remain in compliance with accounting rules and laws. Accountants may need to work long hours at certain times of the year, such as during tax calculation time.

Requirements: Bachelor’s degree, master’s degree for highest paying jobs;,some licensing and certification

Average annual salary: $70,500

Top annual earners: $500,000 plus

The downside: Some of the work is pretty dull. It’s also rare to reach a seven figure salary compared to other jobs on our list

Business Executive

A business executive could hold a multitude of jobs at a company, including CEO, CFO, or COO. A founder of a business could end up being a CEO, because he or she knows the industry and the business. On the other hand, someone with a formal business degree and business training could move into an executive role to help any business run more efficiently and profitably. With bonuses included, business executives can earn huge annual salaries.

Requirements: Bachelor’s degree, master’s degree for highest paying jobs, on-the-job training

Average annual salary: $104,980

Top annual earners: $5 million plus

The downside: Highly stressful jobs, may require decades or more to reach a lucrative business executive position

Computer System and IT Manager

A computer system manager or IT manager will oversee all computer related systems and processes in a company or organization. This can include things like planning out hardware purchases, installing computing software, managing a network, and performing troubleshooting. IT managers need quite a bit of education, including ongoing education, to stay up to date on new techniques and tech products.

Requirements: Bachelor’s degree or master’s degree, ongoing education

Average annual salary: $142,530

Top annual earners: $500,000 plus

The downside: Can require long working hours, extensive education, and rare to reach a seven figure salary

Engineer

Engineers can design things like aircraft, cars, boats, spacecraft, satellites, large buildings, bridges, computers, and infrastructure. Chemical engineers will work with fuel and drugs to solve problems in the use of these substances. Other types of engineers may try to solve environmental problems or help people perform jobs more efficiently and safely. Engineers rely on math, physics, biology, and chemistry to perform their work.

Requirements: Bachelor’s degree, master’s degree for highest paying jobs, on-the-job training

Average annual salary: $80,170

Top annual earners: $500,000 plus

The downside: Requires a high level of mathematical ability, rare to reach a seven figure salary in this profession versus others on our list

Entertainment Professional

Jobs like actor, musician, TV or radio show host, producer, and writer can all fit in the entertainment industry. For the most successful professionals in these areas, this job can be extremely lucrative. However, a job in the entertainment industry rarely has a lot of stability. You’re often on your own, working from contract to contract. You’ll also have to hire an agent to negotiate contracts and help you find work. It can also be extremely difficult to break into the industry.

Requirements: Mix of schooling and on-the-job training

Average annual salary: $40,000

Top annual earners: $10 million plus

The downside: Highly competitive industries, jobs don’t have much stability, agent fees will eat a percentage of your earnings

Investment Banker

It may not be the most exciting job, and it may not be all that well understood, but an investment banker can make a lot of money each year. In general terms, an investment banker is someone who brokers deals, such as company mergers and acquisitions. Those who broker the largest financial deals receive the largest compensation amounts.

Requirements: Bachelor’s degree, master’s degree for highest paying jobs, FINRA licenses

Average annual salary: $64,120, plus performance bonuses

Top annual earners: $5 million plus

The downside: Regular 80+ hour weeks, a lot of stress because of the heavy reliance on performance bonuses

Lawyer

If your idea of a lawyer is someone who is dramatically arguing cases in a courtroom, as happens on TV, this is only a small part of the work. Most of it is spent in research, document review, filing motions, and editing contracts. Lawyers can work in criminal, tax, patent, corporate, or other types of law, so a lot of specialties exist. Lawyers do have an easier time becoming politicians than other professions, if that appeals to you.

Requirements: Tons of extra education, including a law degree, must pass a state bar examination

Average annual salary: $120,910

Top annual earners: $10 million plus

The downside: Extremely competitive profession that requires several years of advanced schooling

Pharmacist

A pharmacist works in a hospital, a medical facility, or a retail store, dispensing prescription medication for customers. A pharmacist needs quite a bit of training in how different medications work, including understanding side effects and interactions with other medications. Pharmacists require formal education and licensing to be able to legally dispense prescription medication.

Requirements: Doctor of pharmacy degree, licenses in the state in which they work

Average annual salary: $126,120

Top annual earners: $250,000 plus

The downside: Pharmacists have little chance of earning a seven figure salary unless they own a business, requires quite a bit of on-going education

Physician and Surgeon

Doctors in the American medical system have the ability to make huge salaries, but it can take a while to hit that level. A physician or a surgeon needs tons of education and on-the-job training. The learning never ends for doctors. When starting out, doctors can work some long, strange hours. But once they reach a certain level of expertise, this job is rewarding financially.

Requirements: Long years of extra education including a medical degree and a residency, licenses required

Average annual salary: $208,000

Top annual earners: $5 million plus

The downside: Making life and death decisions on a daily basis is stressful especially in a highly competitive industry with long hours

Professional Athlete

This is one job that kids dream about having that actually also makes a lot of money. Unfortunately, it’s probably the job they have the least chance of achieving. People need some natural talent to succeed in almost any job, but pro athletes may rely the most on natural talent. Beyond receiving millions to play the game, the most well-known pro athletes may receive just as much money for endorsements.

Requirements: Being selected after a physical tryout, constant on-the-job training and physical workouts

Average annual salary: $50,650

Top annual earners: $10 million plus

The downside: Extreme physical stress and injuries can take their toll on long term health, professional sports careers don’t last more than a few years for most people

Real Estate Developer

A real estate developer will purchase property and develop it with lucrative commercial and residential projects. These purchases are a bit of a gamble, as a mistake can lead to huge financial losses. You may start as a real estate agent, learning how the markets work, before making your own investments or investing on behalf of others.

Requirements: Knowledge of real estate markets and laws through on-the-job training

Average annual salary: $50,300

Top annual earners: $10 million plus

The downside: High rewards come with high risks, choosing the wrong project or making a judgment error about a particular project’s viability could lead to bankruptcy

Software Developer

A software developer will write software, or code, that controls computers and other personal electronics devices. App developers also can be software developers. In fact, someone who develops a highly popular app could make millions off one app. This is another fast growing profession that will need employees in the future.

Requirements: Bachelor’s degree optional

Average annual salary: $105,590

Top annual earners: $5 million plus

The downside: Long hours, especially stressful when trying to complete a project

Picking the Best High Paying Job

Having a list is one thing, picking the right job is a lot harder.

If I was giving “highschool me” some advice, I’d tell him to find a high paying job that’s the best fit. Some jobs are extremely stressful like an investment banker. Others are more routine like an accountant. There’s dozens of different criteria that make up a true dream job.

The best way to figure out which job is the best fit is to develop friendships with people in that field. If you genuinely enjoy spending time with them, that’s a promising sign.

Also look for entry-level roles in those fields to try them yourself. Most of these jobs can be started later on if you discover that a particular path won’t work out.

12 Jobs That Make a Lot of Money is a post from: I Will Teach You To Be Rich.

12 Jobs That Make a Lot of Money published first on https://justinbetreviews.tumblr.com/

0 notes

Text

12 Jobs That Make a Lot of Money

In highschool, my best friend and I looked through a giant book of jobs and their salaries.

We immediately flipped to the end to find the one that paid the most money.

It was an investment banker.

Without a second thought, we both declared we were going to be investment bankers.

Did we have any clue what an investment bank actually did? Nope! We just wanted the highest pay.

I wish I had known how many options I really had. I could have focused on a path that would have been a better fit right from the beginning.

Turns out, there’s a lot of jobs that pay a lot of money. Whether you’re still in highschool or making a career change, you have a lot of options.

Here are the top 12 jobs that potentially can make a lot of money for you.

Accountant

An accountant will perform financial calculations for individuals, small businesses, and large corporations. Accountants must know how to examine and prepare a variety of financial reporting forms, helping customers or businesses remain in compliance with accounting rules and laws. Accountants may need to work long hours at certain times of the year, such as during tax calculation time.

Requirements: Bachelor’s degree, master’s degree for highest paying jobs;,some licensing and certification

Average annual salary: $70,500

Top annual earners: $500,000 plus

The downside: Some of the work is pretty dull. It’s also rare to reach a seven figure salary compared to other jobs on our list

Business Executive

A business executive could hold a multitude of jobs at a company, including CEO, CFO, or COO. A founder of a business could end up being a CEO, because he or she knows the industry and the business. On the other hand, someone with a formal business degree and business training could move into an executive role to help any business run more efficiently and profitably. With bonuses included, business executives can earn huge annual salaries.

Requirements: Bachelor’s degree, master’s degree for highest paying jobs, on-the-job training

Average annual salary: $104,980

Top annual earners: $5 million plus

The downside: Highly stressful jobs, may require decades or more to reach a lucrative business executive position

Computer System and IT Manager

A computer system manager or IT manager will oversee all computer related systems and processes in a company or organization. This can include things like planning out hardware purchases, installing computing software, managing a network, and performing troubleshooting. IT managers need quite a bit of education, including ongoing education, to stay up to date on new techniques and tech products.

Requirements: Bachelor’s degree or master’s degree, ongoing education

Average annual salary: $142,530

Top annual earners: $500,000 plus

The downside: Can require long working hours, extensive education, and rare to reach a seven figure salary

Engineer

Engineers can design things like aircraft, cars, boats, spacecraft, satellites, large buildings, bridges, computers, and infrastructure. Chemical engineers will work with fuel and drugs to solve problems in the use of these substances. Other types of engineers may try to solve environmental problems or help people perform jobs more efficiently and safely. Engineers rely on math, physics, biology, and chemistry to perform their work.

Requirements: Bachelor’s degree, master’s degree for highest paying jobs, on-the-job training

Average annual salary: $80,170

Top annual earners: $500,000 plus

The downside: Requires a high level of mathematical ability, rare to reach a seven figure salary in this profession versus others on our list

Entertainment Professional

Jobs like actor, musician, TV or radio show host, producer, and writer can all fit in the entertainment industry. For the most successful professionals in these areas, this job can be extremely lucrative. However, a job in the entertainment industry rarely has a lot of stability. You’re often on your own, working from contract to contract. You’ll also have to hire an agent to negotiate contracts and help you find work. It can also be extremely difficult to break into the industry.

Requirements: Mix of schooling and on-the-job training

Average annual salary: $40,000

Top annual earners: $10 million plus

The downside: Highly competitive industries, jobs don’t have much stability, agent fees will eat a percentage of your earnings

Investment Banker

It may not be the most exciting job, and it may not be all that well understood, but an investment banker can make a lot of money each year. In general terms, an investment banker is someone who brokers deals, such as company mergers and acquisitions. Those who broker the largest financial deals receive the largest compensation amounts.

Requirements: Bachelor’s degree, master’s degree for highest paying jobs, FINRA licenses

Average annual salary: $64,120, plus performance bonuses

Top annual earners: $5 million plus

The downside: Regular 80+ hour weeks, a lot of stress because of the heavy reliance on performance bonuses

Lawyer

If your idea of a lawyer is someone who is dramatically arguing cases in a courtroom, as happens on TV, this is only a small part of the work. Most of it is spent in research, document review, filing motions, and editing contracts. Lawyers can work in criminal, tax, patent, corporate, or other types of law, so a lot of specialties exist. Lawyers do have an easier time becoming politicians than other professions, if that appeals to you.

Requirements: Tons of extra education, including a law degree, must pass a state bar examination

Average annual salary: $120,910

Top annual earners: $10 million plus

The downside: Extremely competitive profession that requires several years of advanced schooling

Pharmacist

A pharmacist works in a hospital, a medical facility, or a retail store, dispensing prescription medication for customers. A pharmacist needs quite a bit of training in how different medications work, including understanding side effects and interactions with other medications. Pharmacists require formal education and licensing to be able to legally dispense prescription medication.

Requirements: Doctor of pharmacy degree, licenses in the state in which they work

Average annual salary: $126,120

Top annual earners: $250,000 plus

The downside: Pharmacists have little chance of earning a seven figure salary unless they own a business, requires quite a bit of on-going education

Physician and Surgeon