#ap automation for quickbooks

Explore tagged Tumblr posts

Text

PathQuest AP Seamlessly Integrates with Leading Accounting Systems

Experience seamless two-way integration with PathQuest AP and your accounting software. Automate invoice coding, sync payments, and optimize your workflow effortlessly. Whether it's QuickBooks, Xero, or Sage Intacct, streamline your vendor bill processing for higher efficiency and focus on value-added tasks. For more information visit us at https://pathquest.com/ap-integration/

#accounts payable integration#ap automation for quickbooks#sage intacct ap integration#xero ap automation

0 notes

Text

Streamlining AP Through Outsourcing

Introduction

Thinking about outsourcing your receivables? It’s important to understand how the process works. Here’s a look at how Rightpath’s accounts receivable outsourcing model delivers results.

Step-by-Step Process

Discovery & Onboarding Understanding your current AR process, customers, and technology.

System Integration Connecting to your ERP (Tally, QuickBooks, SAP, etc.) for real-time data sync.

Invoice Management Rightpath takes over invoice dispatch—paper or electronic.

Customer Communication Automated follow-ups via email/phone with escalation support.

Cash Application Payments received are recorded and matched with open invoices.

Dispute Management Resolution of any payment delays or issues.

AR Reporting Customized dashboards for aging, collections, DSO, and forecasting.

Tools and Technologies

Rightpath uses:

AI-based payment prediction tools

Multi-channel communication (WhatsApp, Email, IVR)

Secure portals for clients and customers

Conclusion

Rightpath makes outsourcing easy, secure, and impactful. With our tailored approach, your receivables stay healthy and your finance team stays focused.

For more information visit: - https://rightpathgs.com/

0 notes

Text

PathQuest Solutions

PathQuest is a financial intelligence platform by PABS that simplifies accounting through automation and smart insights. With tools like PathQuest BI for real-time financial reporting, PathQuest AP for end-to-end accounts payable automation, and PathQuest Scale for outsourced accounting support, it helps businesses streamline operations, reduce manual tasks, and gain deeper visibility into financial performance. Ideal for multi-entity businesses and accounting firms, PathQuest integrates seamlessly with platforms like QuickBooks, Xero, and Sage.

#software#finance#account#business#accounting#business intelligence#Accounting Payable#accounting software

1 note

·

View note

Link

Discover how AI-powered Intuit Assist and Nanonets automate invoice processing, PO matching, and accounting workflows in QuickBooks to save you hours. #AI #ML #Automation

0 notes

Text

Automated Accounts Payable Software: Streamline Your Finances

For many accounting firms and businesses, managing accounts payable is a tedious, time-consuming task. Manually tracking invoices, verifying payments, and handling reconciliations not only drains your time but also increases the risk of costly errors. That’s where Automated Accounts Payable Software comes in, transforming how businesses manage their financial workflows.

What is Automated Accounts Payable Software?

Automated accounts payable software is designed to streamline the entire AP process, from receiving invoices to approving payments. It uses intelligent automation to capture, validate, and process invoices, removing the need for manual data entry.

With software like NexBot, invoices are scanned, sorted, and matched with purchase orders automatically. Payments are then scheduled and processed seamlessly, ensuring vendors are paid on time and your records stay up-to-date.

Key Benefits of Automated Accounts Payable Software

✅ Time Savings: Manual data entry is labor-intensive. Automation cuts that time by up to 80%, allowing your team to focus on strategic tasks.

✅ Reduced Errors: Human error is one of the biggest risks in AP. Automation ensures data accuracy and reduces discrepancies.

✅ Faster Approvals: Forget the back-and-forth of paper trails. Digital workflows mean invoices are reviewed and approved in real-time.

✅ Enhanced Security: Sensitive financial data is encrypted and securely stored, reducing the risk of fraud or unauthorized access.

✅ Better Cash Flow Management: With real-time visibility into your accounts, you can forecast cash flow more accurately and avoid late fees.

How NexBot’s Automated Accounts Payable Software Works

At NexBot, our automated AP solution is designed to seamlessly integrate with your existing accounting software like Xero, MYOB, and QuickBooks. Here’s how it works:

1️⃣ Invoice Capture: Our software scans invoices, extracts data, and categorizes it automatically. No more manual entry.

2️⃣ Data Validation: Details like invoice amounts, dates, and vendor information are cross-verified against purchase orders to catch errors early.

3️⃣ Approval Workflow: The software routes invoices to the appropriate team members for approval, streamlining the entire process.

4️⃣ Payment Processing: Once approved, payments are scheduled and executed automatically, ensuring vendors are paid on time.

5️⃣ Reporting & Analytics: Get real-time reports on your payable status, cash flow projections, and payment history — all in one dashboard.

Why Choose NexBot for AP Automation?

Choosing the right software can make all the difference. Here’s why NexBot stands out:

Built by Accountants: We understand the nuances of financial management.

Seamless Integration: Works perfectly with Xero, MYOB, and QuickBooks.

Security First: Industry-grade encryption keeps your data safe.

Customizable Workflows: Adaptable to your firm’s unique needs.

The Future of Accounts Payable is AutomatedThe days of manual invoice processing are behind us. With Automated Accounts Payable Software, your firm can save time, reduce costs, and improve accuracy — all while scaling effortlessly.

#accountants melbourne#tax accountant#bot automation#bookkeeping bot for accountants#xero ai#accounting ai

0 notes

Text

Essential Steps to Future-proof Your Business Finances

Future-proofing your business finances means setting up strong, flexible systems that help you weather economic shifts, scale with confidence, and make smart decisions. Here's a practical, no-fluff guide to the essential steps you need to take:

Essential Steps to Future-Proof Your Business Finances

1. Build a Solid Financial Foundation

Use cloud-based accounting software (e.g., QuickBooks, Xero) to keep real-time books.

Automate daily transactions (bank feeds, invoicing, payroll).

Create monthly financial statements: P&L, cash flow, balance sheet.

Why it matters: You can’t improve what you don’t measure.

2. Create Cash Flow Forecasts (and Update Them)

Forecast income, expenses, and runway for 6–12 months.

Run “what-if” scenarios: What happens if revenue drops 20%? Or if you hire an accountant for business?

Use tools like LivePlan, Finmark, or Jirav for easier modeling.

Why it matters: Cash is king — and forecasting helps you avoid surprise shortages.

3. Build an Emergency Fund

Aim for 3–6 months of operating expenses in reserves.

Keep it liquid, but separate from your main account to avoid casual use.

Why it matters: A buffer keeps you from panicking (or borrowing) in a crisis.

4. Streamline and Automate Financial Tasks

Automate payroll (Gusto), AP/AR (Bill.com, Melio), tax reminders (TaxJar).

Set up recurring invoices and payment reminders.

Outsource bookkeeping or use managed services like Bench or Pilot.

Why it matters: Saves time, reduces error, and keeps your books clean year-round.

5. Engage a Fractional CFO or Financial Advisor

You don’t need a full-time CFO to get strategic help.

Use platforms like Paro, Toptal, or CFOShare to find on-demand financial experts.

Why it matters: Strategic financial advice is crucial during growth, funding, or pivots.

6. Regularly Review KPIs and Business Metrics

Track your burn rate, gross margin, customer acquisition cost (CAC), lifetime value (LTV).

Set benchmarks and review monthly or quarterly.

Why it matters: Helps you make better, faster decisions — and spot issues early.

7. Stay Compliant and Tax-Ready

Use tools like Avalara, Taxfyle, or Collective to stay on top of tax filings.

Keep personal and business finances separate (get that business bank account).

Stay ahead of sales tax nexus and state-specific rules.

Why it matters: Avoid fines and penalties that can eat into your bottom line.

8. Plan for Scalable Growth

Use clean, accurate financials to impress investors or lenders.

Align your financial strategy with your long-term goals: expansion, new markets, hiring.

Build systems that grow with you — not ones you'll outgrow in 6 months.

Why it matters: You’re not just surviving — you’re building to scale.

Final Thought:

Future-proofing is proactive finance — not reactive fixing. Whether you're running lean or scaling fast, the best time to set your business up for long-term resilience is now.

0 notes

Text

Streamlining Financial Management: The Power of Accounts Payable Software

In today’s fast-paced business world, managing finances efficiently is crucial for success. One of the key components of financial management is handling accounts payable (AP), which involves tracking and managing a company’s obligations to pay off short-term debts to suppliers and creditors. With the advent of advanced technology, Accounts Payable Software has emerged as an essential tool for businesses to streamline this process and improve overall efficiency.

What is Accounts Payable Software?

Accounts Payable Software is a digital solution designed to automate and manage the AP process. This software allows businesses to process invoices, manage vendor payments, and track outstanding liabilities with ease. By automating repetitive tasks and reducing manual intervention, companies can significantly enhance accuracy, save time, and minimize errors.

Key Features and Benefits

Automation and Efficiency: AP software automates invoice capture, data entry, and payment approvals, reducing the need for manual handling. This leads to faster processing times and fewer errors, allowing businesses to allocate resources to more strategic tasks.

Improved Accuracy and Compliance: By using sophisticated algorithms and data validation tools, the software ensures accurate data entry and compliance with tax regulations and internal policies. This helps prevent fraudulent activities and maintains audit trails for regulatory purposes.

Enhanced Vendor Relationships: Timely payments and clear communication foster stronger relationships with suppliers. AP software often includes features like payment scheduling and automated reminders, ensuring that payments are made on time and avoiding late fees.

Real-time Reporting and Analytics: With built-in reporting tools, businesses can gain insights into cash flow, outstanding liabilities, and spending patterns. This data-driven approach enables better decision-making and strategic planning.

Integration with Other Systems: Most AP software can seamlessly integrate with accounting systems, enterprise resource planning (ERP) platforms, and banking systems. This integration enhances data accuracy and provides a holistic view of financial operations.

Choosing the Right AP Software

When selecting an accounts payable solution, businesses should consider factors such as scalability, ease of use, security features, and customer support. Popular options in the market include QuickBooks, SAP Concur, Bill.com, and Tipalti. Each platform offers unique features tailored to different business sizes and industries.

The Future of Accounts Payable Software

The future of AP software is being shaped by advancements in artificial intelligence (AI) and machine learning. These technologies are enhancing predictive analytics, fraud detection, and intelligent automation. Additionally, the integration of blockchain technology is improving transparency and security in payment processing.

Conclusion

Incorporating Accounts Payable Software into financial management practices is no longer a luxury but a necessity for businesses aiming to stay competitive. By automating processes, improving accuracy, and providing valuable insights, AP software empowers organizations to manage their finances effectively and build stronger vendor relationships. As technology continues to evolve, businesses that leverage these tools will be better positioned for long-term success.

0 notes

Text

The Best Way to Manage Accounts Payable and Receivable in Sage:

In today’s fast-paced business environment, effective financial management can be the difference between success and failure. One of the most critical aspects of financial management is keeping a close eye on accounts payable (AP) and accounts receivable (AR). Whether you're a small business in the United States or the United Kingdom, efficiently managing these aspects can significantly impact your cash flow and overall financial health.

Sage, a leading provider of accounting software, offers a powerful solution to help businesses streamline their AP and AR processes. But what exactly is the best way to manage accounts payable and receivable in Sage? In this blog post, we’ll explore proven strategies, backed by expert opinions and real-life examples, to help you make the most of Sage’s features.

Why Effective Management of AP and AR Matters

Before diving into the specifics of using Sage, it’s essential to understand why managing accounts payable and receivable is so important.

Accounts Payable refers to the money a company owes to its suppliers for goods or services received. Effective AP management ensures that your business maintains good relationships with suppliers and avoids late payment penalties.

Accounts Receivable, on the other hand, refers to the money owed to the company by customers for goods or services sold. Managing AR effectively ensures you get paid on time, maintaining healthy cash flow.

According to a 2023 QuickBooks survey, 64% of small businesses in the U.S. experience cash flow issues, primarily due to poor management of AP and AR. A similar study in the U.K. by Experian found that late payments cost U.K. businesses up to £23.4 billion annually. Clearly, the stakes are high.

How Sage Can Help: An Overview

Sage provides a robust platform for managing both AP and AR. It’s widely used in the U.S. and the U.K., offering features tailored to comply with the unique financial regulations of both countries.

Here’s how Sage helps businesses:

Automation: Sage automates recurring invoices and payments, reducing manual errors and saving time.

Tracking: You can track outstanding payables and receivables in real time, helping you stay on top of due dates and improve cash flow forecasting.

Integration: Sage integrates with various bank feeds, allowing you to import transactions and reconcile them seamlessly.

Compliance: Sage ensures you remain compliant with local tax laws, whether it’s VAT in the U.K. or sales tax in the U.S.

Best Practices for Managing Accounts Payable in Sage

1. Set Up Vendors Correctly

The first step to managing accounts payable in Sage is setting up your vendors accurately. Ensure all vendor details—such as tax ID, payment terms, and contact information—are correct. In both the U.S. and U.K., compliance with tax regulations (e.g., 1099 forms in the U.S. and VAT submissions in the U.K.) requires accurate vendor data.

2. Use Automation to Your Advantage

Sage offers automation features that allow you to schedule payments based on agreed terms with your suppliers. For example, setting up automatic payments for recurring expenses such as rent or utility bills can help prevent late fees and improve your business’s creditworthiness.

3. Track Discounts for Early Payments

Many vendors offer discounts for early payments. For example, a common term might be “2/10 Net 30,” which means you get a 2% discount if you pay within 10 days, even though the invoice isn’t due for 30 days. Sage allows you to track these opportunities and alert you when early payment discounts are available.

4. Maintain Proper Approvals

An effective accounts payable process requires proper checks and balances. Sage allows you to set up approval workflows, ensuring that no invoice is paid without the necessary authorization. This can be crucial in preventing fraud and ensuring accuracy.

Best Practices for Managing Accounts Receivable in Sage

1. Set Clear Credit Terms

Clear communication with customers is essential to managing accounts receivable effectively. Sage enables you to set and enforce specific payment terms, such as “Net 30” or “Due on Receipt.” By integrating these terms into your invoicing process, you can reduce the likelihood of late payments.

2. Automate Invoicing

Sage's automation capabilities extend to AR as well. You can set up automated invoicing, ensuring that your customers receive bills promptly and consistently. For example, if you're a subscription-based service, Sage can automatically generate and send monthly invoices to your clients, reducing the risk of missed payments.

3. Monitor Aging Receivables

A crucial aspect of AR management is monitoring overdue invoices. Sage provides an aging report that highlights outstanding receivables categorized by the number of days overdue (e.g., 30, 60, or 90 days). This report can help you prioritize which customers to follow up with and ensure timely collections.

4. Offer Multiple Payment Options

To encourage faster payments, offer your customers various payment options, such as credit card, bank transfer, or digital payments through platforms like PayPal. Sage integrates with many payment gateways, allowing you to streamline this process.

Real-Life Example: A U.K. Business Boosts Cash Flow Using Sage

Let’s consider a real-world example. Johnston & Co., a U.K.-based manufacturing firm, was struggling with cash flow due to late payments from clients. After implementing Sage’s AR features, they automated their invoicing process and set up clear credit terms. By utilizing Sage’s aging report, they were able to prioritize debt collection, resulting in a 20% reduction in outstanding receivables within three months.

Expert Opinions on AP and AR Management with Sage

According to Sarah Johnson, a CPA and accounting software expert, “Automation is the key to improving efficiency in managing AP and AR. Sage’s automation features reduce human error and free up time for higher-level strategic tasks.”

Meanwhile, Steve Barclay, an AR consultant based in London, emphasizes the importance of data visibility: “With Sage, businesses can track real-time data on payables and receivables, helping them make informed decisions about cash flow and operational strategies.”

Actionable Takeaways

Managing accounts payable and receivable effectively in Sage boils down to setting up automation, leveraging real-time tracking, and maintaining clear communication with vendors and customers. Here are some actionable tips to get you started:

Automate as much as possible: Set up recurring payments and invoices in Sage to reduce manual work.

Track early payment discounts: Use Sage to keep track of opportunities to save on AP.

Monitor aging reports: Use Sage’s aging reports to follow up on overdue receivables.

Set up approval workflows: Implement approval processes in Sage to maintain accuracy and prevent fraud.

Final Thought: Is Your Business Leveraging Sage to Its Full Potential?

In today’s competitive business landscape, efficient management of accounts payable and receivable is crucial. Are you taking full advantage of Sage's features to optimize these processes? Let us know in the comments below how you’re using Sage, or share any challenges you’ve faced when managing AP and AR.

Dive deeper into how you can optimize your accounts payable and receivable processes and ensure your business thrives in today's competitive environment. Don't miss out on unlocking the full potential of Sage��click here for more information.

0 notes

Text

Accounts Payable: Definition, Usage, and Procedures

When managing cash flow in a business, the first thought might be to focus on accelerating collections from accounts receivable. However, accounts payable (AP) is equally important in effective cash management. Below is a detailed breakdown of accounts payable, its meaning, usage, and how to establish an efficient accounts payable process.

What is Accounts Payable?

Accounts payable refers to the amount a business owes to its suppliers or creditors for goods and services received but not yet paid for. It is recorded as a liability on the balance sheet, indicating short-term debt obligations.

Key Components of Accounts Payable

Trade Payables: Invoices received from suppliers for products or services.

Short-Term Debt: Interest and principal due on loans within a 12-month period.

Credit Card Balances: Outstanding balances on business credit cards due within a year.

Noncurrent Liabilities

Liabilities that extend beyond 12 months, such as long-term loans, are considered noncurrent liabilities.

Impact on Cash Flow

Accounts payable affects cash flow as businesses must manage when to pay their obligations. It’s essential to monitor cash inflows and outflows to maintain a healthy buffer of cash for operational needs.

To manage cash flow effectively, businesses can create a monthly cash flow statement, which includes:

Beginning cash balance

Revenues from customer payments and accounts receivable

Cash outflows such as accounts payable, inventory costs, and salaries

Ending cash balance

Difference Between Accounts Payable and Accounts Receivable

Accounts Payable (AP): The money a business owes to its suppliers.

Accounts Receivable (AR): The money owed to the business by its customers.

Managing AP and AR effectively helps maintain positive relationships with vendors and customers, ensuring a smooth cash flow process.

Responsibilities of the Accounts Payable Department

The AP department oversees vendor payments, invoice approval, and reconciliation. It also manages payments for various business needs, such as subcontractor services, equipment, utilities, and licensing. To perform these tasks efficiently, the department requires skills such as:

General Accounting Knowledge: Understanding debits and credits.

Organizational Skills: Properly managing invoices and payment schedules.

Interpersonal Skills: Building strong vendor relationships.

Many companies use automated solutions, like QuickBooks, to manage their AP processes efficiently.

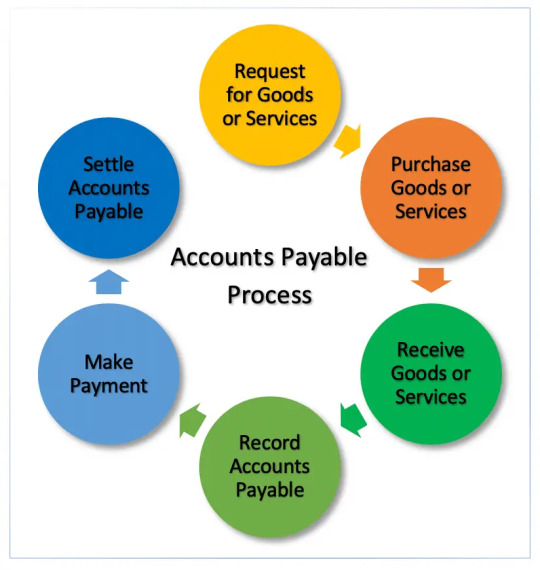

Steps in the Accounts Payable Process

Accrual Accounting: Businesses must record expenses when incurred, regardless of when payment is made. This ensures revenue and expenses align for accurate financial reporting.

Purchase Orders (POs): A PO is required for most significant purchases. For example, a ₹8,35,150 equipment order would require a PO approved by a responsible party, such as the CFO.

Vendor Invoices: Once an order is placed, the vendor sends an invoice. The AP department logs the due date, payment terms, contract information, and invoice number.

Shipment Receipts: A shipment receipt verifies the goods or services received match the order. Once verified, the AP department processes the payment.

Posting to the General Ledger: Journal entries are created to record the transaction in the general ledger. For example, an equipment purchase is recorded as a debit to the asset account and a credit to accounts payable.

Benefits of Automating Accounts Payable

Automating the AP process offers several benefits, including:

Increased Efficiency: Automation reduces the time and errors associated with manual invoice processing.

Improved Accuracy: Accurate data collection minimizes discrepancies.

Enhanced Control: Automation provides real-time visibility into outstanding payments and cash flow.

Cost Savings: Fewer manual interventions lead to reduced operational costs.

Compliance and Security: Automated systems ensure financial data is secure and regulations are followed.

Example of Accounts Payable

On the balance sheet, any item or service purchased but not yet paid for is recorded as accounts payable. For instance:

Leased vehicles

Subcontractor services

Purchased equipment

Production resources

Managing Accounts Payable

To effectively manage AP, it’s essential to monitor specific metrics and implement improvements. Here are some key considerations:

Accounts Payable Turnover Ratio: This metric measures how quickly a business pays off its credit purchases. A higher turnover ratio indicates faster payment of obligations.

Aging Schedule: This schedule divides AP balances based on the time since the invoice was issued. Most invoices should fall within the 0-to-30-day range. Delays in payment can damage vendor relationships.

Streamlining the Accounts Payable Process

To enhance efficiency, businesses should:

Invest in Automation: Automate invoice processing to save time and reduce errors.

Strengthen Vendor Relationships: Build strong relationships to benefit from discounts or flexible payment terms.

Switch to Digital Filing: Reduce paperwork by transitioning to electronic documents.

Best Practices for Accounts Payable

Set a Clear Approval Process: Ensure invoices are approved following a standardized procedure to avoid unauthorized payments.

Use Automation Tools: Implement automated systems like QuickBooks to streamline processes and reduce errors.

Monitor Deadlines: Keep track of payment deadlines to avoid penalties and maintain strong vendor relationships.

Reconcile Accounts Regularly: Reconcile accounts periodically to ensure the accuracy of financial records.

Negotiate Payment Terms: Work with suppliers to negotiate favorable payment terms that align with your cash flow needs.

Train Your Team: Ensure that your team is well-versed in AP procedures to prevent errors and fraud.

Conclusion

Effective accounts payable management is crucial for maintaining positive vendor relationships and a healthy cash flow. By following best practices, investing in automation, and regularly monitoring AP metrics, businesses can streamline their processes and enhance financial performance.

0 notes

Text

Bookkeeping 101: A Guide for Small Businesses

Bookkeeping is the backbone of financial management for any small business. Keeping accurate records of all financial transactions ensures that you can make informed decisions, maintain compliance with tax regulations, and set your business up for success. At Bizee Bookkeeper LLC, we understand the unique challenges small businesses face and are here to help you navigate the essentials of bookkeeping. This guide will walk you through the basics of bookkeeping, so you can manage your finances with confidence.

1. Understanding the Basics of Bookkeeping

Bookkeeping is the process of recording all financial transactions made by your business. These transactions include sales, purchases, income, and payments. The primary goal of bookkeeping is to keep accurate records that can be used to prepare financial statements, file taxes, and analyze the financial health of your business.

There are two main types of bookkeeping systems: single-entry and double-entry. Single-entry bookkeeping is simpler and involves recording each transaction only once, while double-entry bookkeeping records each transaction twice—once as a debit and once as a credit. At Bizee Bookkeeper LLC, we recommend double-entry bookkeeping for small businesses because it provides a more accurate picture of your financial situation.

2. Setting Up Your Bookkeeping System

The first step in effective bookkeeping is setting up a reliable system. You can choose between manual bookkeeping, where records are kept in physical ledgers, or digital bookkeeping, which uses software to record and manage transactions. Digital bookkeeping is often more efficient and reduces the risk of errors.

At Bizee Bookkeeper LLC, we help small businesses set up digital bookkeeping systems tailored to their specific needs. We recommend using software like QuickBooks, Xero, or FreshBooks, which can automate many bookkeeping tasks such as invoicing, expense tracking, and financial reporting.

3. Recording Transactions Accurately

Accurate transaction recording is crucial for effective bookkeeping. Every time your business earns revenue, incurs an expense, or moves money between accounts, it needs to be recorded. Transactions should be categorized properly, such as under "income," "expenses," "assets," or "liabilities."

For example, if you purchase office supplies, this expense should be recorded under the "Office Supplies" category. Proper categorization ensures that your financial reports are accurate and easy to understand.

Bizee Bookkeeper LLC provides services to ensure that all transactions are recorded accurately and consistently, helping you avoid costly errors and ensuring that your financial statements reflect the true state of your business.

4. Managing Accounts Receivable and Payable

Accounts receivable (AR) and accounts payable (AP) are two critical components of bookkeeping. AR refers to the money your business is owed by customers, while AP refers to the money your business owes to suppliers or creditors. Managing these accounts effectively ensures that your cash flow remains healthy.

At Bizee Bookkeeper LLC, we help small businesses set up systems to track and manage AR and AP efficiently. This includes generating and sending invoices promptly, following up on overdue payments, and ensuring that bills are paid on time. Proper management of AR and AP helps you avoid cash flow problems and maintain good relationships with customers and suppliers.

5. Reconciling Your Accounts

Account reconciliation is the process of comparing your business’s financial records with your bank statements to ensure they match. This step is essential for catching errors, identifying fraudulent transactions, and maintaining accurate records.

Reconciliation should be done regularly—at least monthly—to ensure that your books are always up-to-date. Bizee Bookkeeper LLC offers reconciliation services to help small businesses keep their financial records in order. By reconciling your accounts regularly, you can avoid potential discrepancies and ensure that your financial reports are reliable.

6. Understanding Financial Statements

Financial statements are key documents that provide insights into your business's financial performance. The three main financial statements are:

Income Statement (Profit and Loss Statement): This shows your business’s revenue, expenses, and profits over a specific period.

Balance Sheet: This provides a snapshot of your business’s assets, liabilities, and equity at a specific point in time.

Cash Flow Statement: This tracks the flow of cash in and out of your business over a period of time.

At Bizee Bookkeeper LLC, we help small businesses prepare and interpret these financial statements. Understanding these documents allows you to assess your business’s financial health, make informed decisions, and plan for the future.

7. Staying Compliant with Tax Regulations

Tax compliance is a critical aspect of bookkeeping. Keeping accurate records throughout the year ensures that you're prepared when tax season arrives. This includes tracking all income, expenses, and deductions, as well as maintaining proper documentation.

Bizee Bookkeeper LLC offers tax preparation and planning services to help small businesses stay compliant with tax regulations. We ensure that your records are complete and accurate, minimizing the stress and risk of tax season.

8. Planning for the Future

Bookkeeping isn’t just about tracking past transactions—it’s also about planning for the future. By analyzing your financial data, you can set realistic goals, create budgets, and forecast future cash flow. This proactive approach allows you to anticipate challenges, seize opportunities, and ensure the continued growth of your business.

At Bizee Bookkeeper LLC, we work with small businesses to develop long-term financial strategies that support growth and stability. We help you use your bookkeeping data to make informed decisions that drive your business forward.

#accounting services#bookkeeping for small business#bookkeeping solutions#financial planning#financialservices#bookkeeping services#bookkeeping#financial

0 notes

Text

Comprehensive Guide to ERP Software for Retail Industry

Retail ERP vs. Traditional ERP

A erp software for retail industry system is catered to the special processes of multi-channel or omnichannel retailers. On the other hand, a traditional best erp software for retail is outfitted for general business requirements in different industries, e.g. manufacturing or construction. In retail ERP software, the center modules developed are around the workflow of the retail industry.

Some erp software for retail, for example, Brightpearl, can be designed such that they are retail ERPs. When you are looking for a retail version of classic ERP, you are spoilt for choice. Examples of ERP and accounting systems are Acumatica, NetSuite, Microsoft Dynamics 365, SAP Business One, and QuickBooks POS, to name just a few, whose frontend can be integrated with QuickBooks Desktop accounting software.

It pays to buy Quickbooks products and services from a value-added reseller that possess the experience in POS and the level of retail expertise to ensure your QuickBooks retail solution is fine-tuned.

It is possible to fit into a retail and traditional ERPs with an add-on software that serves with purpose specifically for retailers. For Example, AP automation or global mass payments software, for retailers ; Tipalti .Software has enabled companies like Touch of Modern to effectively handle accounts payable and large payment workflows with a small team.

Retail ERP Benefits

The ten good things in a retail ERP are:

Real-time visibility reporting and payment processing

An integrated omnichannel system across the front and back ends

Centralized customer database

eCommerce and physical store integration with an automated POS

Demand forecasting capability

Intelligent procurement, replenishment, and supply chain management

Real-time inventory management

Dynamic pricing capability

Automation in processes for efficient cost savings

Data analytics to support data-driven decision making.

Retail ERP is a real-time, specially customized software system connecting and integrating business processes involved in retail operations. A retail ERP enables retailers to better streamline, automate, and manage front-end and back-office business processes. This is software specially customized for ERP that's designed to help retailers improve their bottom line.

Multichannel commerce involves driving sales through physical retail stores (brick-and-mortar), e-commerce, call centers, and other online sales channels. They may access one or more warehouses and rely on inventory management to fulfill the orders and manage returns.

Automate and Extend Your Retail ERP

Tipalti powers efficiency and enhanced functionality in accounts payable. For businesses, our touchless invoice processing solutions reduce your business expenses.

Best Retail ERP Software Solutions

The erp software for retail business are either specifically designed for the retail sector or part of the traditional ERP systems, add-on third-party integrations poised at elevating the ERP for retail operations.

ERP Systems That Can House Retail-Specific Needs

Some best available ERP systems for retailers include:

Brightpearl

Brightpearl – A review

Brightpearl is an omnichannel retail ERP software solution designed for retailers and wholesalers.

The company bills its software as a Digital Operations Platform that can process thousands of orders daily. Brightpearl is purpose-built retail ERP. It offers eCommerce integrations with BigCommerce, Magento, Shopify, Amazon, eBay, and even Walmart these are erp software for retail shop.

Stated differently, Brightpearl, the retail version of Sage, allows for:

Real-time data

Sales order management

Inventory management and demand planning

Shipping and fulfillment

Warehouse management

Retail accounting

Purchasing and supplier management

Workflow automation

Reporting and business intelligence

Built-in, pre-integrated third-party app solutions for new channels and functional tools

SAP Business One

SAP Business One is ERP software that functions in the cloud for small and mid-sized businesses. By augmenting the following functionality to the ERP software, retailers using SAP Business One get support for:

eCommerce and omnichannel

Back office, online, and in-store operations

Point of sale and payment processing

In-store and inventory management

Analytics and reporting

Acumatica Retail-Commerce Edition

Acumatica

This is Acumatica's retail and eCommerce ERP solution. It is a multi-channel, cloud-based software, and it is best branded as the 'Retail-Commerce Edition' by small and middle-market businesses. Acumatica offers 24/7 customer service as a core feature in ERP.

It has other features such as:

Financial management

CRM

Warehouse management

Sales Order Management

Customer Self-Service Portal

Reporting and data analysis tools

Inventory management

Purchase

0 notes

Text

Is It Time to Outsource AP?

Introduction

As businesses seek efficiency and digital transformation, many are turning to accounts payable outsourcing companies to streamline operations. But not all providers are created equal. Choosing the right partner can make the difference between a smooth transition and a financial headache.

This guide will help you understand what to look for in a provider and why Rightpath ranks among the most trusted AP outsourcing companies.

What Do Accounts Payable Outsourcing Companies Do?

AP outsourcing companies manage your entire invoice-to-payment cycle. This includes:

Invoice receipt and digitization

PO and GRN matching

Approval routing

Exception handling

Vendor payment processing

Reporting and audit preparation

By partnering with such companies, businesses gain access to automation, accuracy, and specialized financial knowledge.

Top Criteria for Choosing the Right AP Outsourcing Company

1. Experience and Reputation

Select a company with a proven track record and positive client testimonials. Rightpath has worked with dozens of SMEs and large enterprises, building a strong reputation for delivering results.

2. Technology Stack

Look for a provider using robust AP automation tools, including:

OCR (Optical Character Recognition)

AI-based workflow engines

ERP integration (SAP, QuickBooks, Oracle, etc.)

Rightpath offers advanced tech integration for seamless workflows.

3. Data Security and Compliance

Ensure your partner complies with GDPR, ISO, SOC 2, or local finance laws. At Rightpath, security is central to every process.

4. Customizability

Every business has unique needs. Avoid one-size-fits-all solutions. Rightpath customizes every workflow, SLA, and report to suit client-specific requirements.

5. Transparency and Communication

Choose a partner that offers real-time dashboards, frequent reporting, and dedicated support. Rightpath gives clients 24/7 visibility into their AP process and access to a dedicated account manager.

Red Flags to Avoid

No real-time reporting or dashboards

Poor integration with your existing ERP

Hidden costs or unclear pricing

Lack of vendor communication protocols

No defined escalation or support structure

Client Testimonial

“Rightpath completely transformed our AP process. We went from chasing invoices to tracking KPIs in real time. Their team is responsive, professional, and results-driven.” — CFO, Logistics Firm

How to Get Started

Book a Consultation – Discuss your current AP process and challenges.

Process Mapping – We analyze your workflow and identify improvement areas.

Pilot Phase – Start with a test batch of invoices for real-time performance.

Full Implementation – Transition your complete AP cycle with minimal disruption.

Ongoing Optimization – Regular reviews and continuous process enhancement.

For more information visit: - https://rightpathgs.com/

0 notes

Text

Accounts Payable Software: Key Features to Look For

Accounts payable (AP) software plays a crucial role in managing and optimizing financial processes within organizations. As businesses grow and transactions increase, the need for efficient AP management becomes more pronounced. Choosing the right accounts payable software can significantly streamline operations, improve accuracy, and enhance financial visibility. In this blog, we'll explore the key features that businesses should look for when selecting AP software, ensuring it not only meets current needs but also supports future growth and scalability.

Introduction to Accounts Payable Software

Accounts payable software automates the processes involved in managing and paying supplier invoices. It replaces manual methods with digital workflows, reducing errors, accelerating processing times, and providing insights into financial obligations. Here are the essential features to consider when evaluating AP software:

Key Features of Accounts Payable Software

1. Invoice Processing Automation

Efficient AP software should automate invoice processing from receipt to payment. This includes:

Invoice Capture: Ability to capture invoices electronically from various sources such as email, scanned documents, and digital submissions.

Data Extraction: Automated extraction of key invoice data (e.g., invoice number, date, amount) using optical character recognition (OCR) or machine learning algorithms.

Workflow Automation: Routing invoices for approval based on predefined rules and workflows, reducing manual intervention and speeding up approval cycles.

2. Integration Capabilities

Look for AP software that integrates seamlessly with your existing ERP (Enterprise Resource Planning) or accounting systems. Integration ensures:

Data Synchronization: Automatic synchronization of invoice and payment data between AP software and other systems, eliminating the need for manual data entry and reducing errors.

Compatibility: Support for popular accounting software such as QuickBooks, Xero, SAP, and Oracle to ensure compatibility across platforms.

3. Electronic Payments

Modern AP software facilitates electronic payments (e.g., ACH transfers, virtual credit cards) to suppliers, offering benefits such as:

Faster Processing: Accelerated payment processing and reduced payment cycle times.

Cost Savings: Lower transaction fees compared to traditional paper checks.

Security: Enhanced security measures to protect sensitive payment information.

4. Document Management and Storage

Effective AP software includes robust document management capabilities:

Centralized Repository: Secure storage of invoices, receipts, and payment records in a centralized digital repository.

Document Retrieval: Quick and easy access to documents for auditing, compliance, and reporting purposes.

Retention Policies: Automated management of document retention policies to ensure compliance with regulatory requirements.

5. Reporting and Analytics

Insightful reporting features provide visibility into AP performance and financial metrics:

Customizable Dashboards: Interactive dashboards with real-time data visualization for monitoring invoice status, payment trends, and financial metrics.

Analytical Tools: Built-in analytics tools to identify cost-saving opportunities, track key performance indicators (KPIs), and forecast cash flow.

6. Compliance and Security

Ensure that AP software adheres to industry regulations (e.g., GDPR, SOX) and includes robust security measures:

Audit Trails: Comprehensive audit trails to track invoice approvals, payments, and user actions for compliance audits.

Data Encryption: Advanced encryption protocols to protect sensitive financial data from unauthorized access and cyber threats.

7. Scalability and Flexibility

Choose AP software that can scale with your business growth and adapt to evolving needs:

Multi-Entity Support: Ability to manage AP processes for multiple entities or subsidiaries from a single platform.

Customization: Flexibility to customize workflows, approval hierarchies, and payment schedules to align with organizational requirements.

8. User Interface and Accessibility

An intuitive user interface enhances user adoption and productivity:

Mobile Accessibility: Access to AP functions via mobile devices for on-the-go approvals and payments.

User Training and Support: Comprehensive training resources and responsive customer support to assist users with software implementation and ongoing use.

youtube

Conclusion

Choosing the right accounts payable software is essential for optimizing financial operations, improving efficiency, and maintaining compliance. By prioritizing features such as invoice processing automation, integration capabilities, electronic payments, document management, reporting tools, compliance, scalability, and user accessibility, businesses can streamline AP processes and achieve greater financial control. Evaluate potential AP software solutions carefully to ensure they align with your organization's current needs and future goals, enabling you to make informed decisions that drive operational excellence and business success.

By incorporating these key features into your search criteria, you can select AP software that not only meets your immediate requirements but also supports long-term growth and efficiency gains.

SITES WE SUPPORT

Modeling Management - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Link

Discover how AI-powered Intuit Assist and Nanonets automate invoice processing, PO matching, and accounting workflows in QuickBooks to save you hours. #AI #ML #Automation

0 notes

Text

(Traditional vs. Retail ERP) Top 2023 Retail ERP Solutions

The unique business requirements and processes of omnichannel or multichannel merchants are handled by a retail ERP system. A standard ERP system, in contrast, is made to accommodate the needs of businesses across all sectors, such as manufacturing or construction. The retailer receives key modules related to the workflow of the retail industry using retail ERP software.

Some ERPs are created specifically as retail ERP. There are more options if you're thinking about a typical ERP system's retail version. Retail industry solutions are provided by ERP systems including QuickBooks POS, NetSuite, Infor, Epicor, Microsoft Dynamics 365, and Acumatica. These systems are all connected with QuickBooks Desktop accounting software.

Retail and traditional ERP systems can be integrated to use third-party AP automation and international mass payments software. For instance, the Tipalti software has allowed Touch of Modern and other stores to develop with less staff by managing the workflow for accounts payable and payments.

0 notes