#ap automation solutions

Explore tagged Tumblr posts

Text

Are you tired of clunky, generic AP automation solutions that never quite fit your business? Discover a smarter way forward with our latest blog post: “Innovative Solutions for AP Automation Customization.”

In this insightful read, you’ll uncover:

Why leading enterprises are ditching cookie-cutter AP tools in favor of tailored automation that truly streamlines processes.

Real-world success stories from industry giants like Unilever and HP, showing how customization delivers measurable results.

Actionable tips and checklists to help you identify your unique needs, avoid costly mistakes, and build flexible workflows that grow with your business.

Whether you’re in finance, IT, or operations, this blog is packed with expert advice and practical strategies to help you transform your AP process—saving time, reducing errors, and boosting compliance.

Don’t settle for less. Read the full blog now and see how customized AP automation can revolutionize your business!

0 notes

Text

Business Process Management Redefined by Rightpath Global Services

In the evolving finance landscape, Rightpath Global Services is redefining efficiency through innovative Accounts Payable Transformation solutions. Traditional AP processes often involve delays, manual errors, and compliance issues. Rightpath GS eliminates these pain points by offering automated workflows, real-time invoice tracking, and streamlined vendor payments, helping businesses gain tighter financial control.

With a strong focus on Business Process Management, Rightpath GS ensures that AP functions are not just outsourced but truly transformed. Their solutions enhance visibility, improve accuracy, and shorten processing cycles, all while aligning with regulatory standards. This approach ensures that organizations don't just digitize payables—but optimize them end-to-end.

The future of AP transformation lies in smart systems, experienced teams, and flexible service models—and that’s exactly what Rightpath GS delivers. For businesses seeking both structure and innovation, Rightpath Global Services is the go-to partner in AP and process excellence.

#AP automation services#finance transformation partner#BPM outsourcing solutions#digital accounts payable#accounts payable innovation

0 notes

Text

How Can Automation of Accounts Payable Benefit a Medical Office?

Discover how automating accounts payable can streamline operations in a medical office. This insightful guide by SAS KPO explains the key benefits of AP automation, including improved accuracy, faster invoice processing, reduced administrative burden, and enhanced financial visibility. Learn how medical practices can save time and costs while ensuring compliance and efficiency. Read more at: https://saskpo.co.uk/how-can-automation-of-accounts-payable-benefit-a-medical-office/

#Accounts Payable Automation work#Benefits of AP Automation#Accounts Payable so challenging#Challenges with Accounts Payable#AP Automation solution

0 notes

Text

The Smart CFO’s Guide to Accounts Payable Outsourcing

As businesses grow, so does the complexity of their financial operations. One of the most time-consuming yet critical functions is managing accounts payable. For growing companies, accounts payable outsourcing has emerged as a strategic solution to streamline processes, reduce operational costs, and enhance accuracy.

Outsourced accounts payable services allow businesses to focus on their core activities while experienced professionals handle invoice processing, vendor management, and payment scheduling. This ensures that all payables are managed efficiently and on time, reducing the risk of late payments and penalties.

Moreover, outsourcing eliminates the need for investing in expensive financial software or expanding internal accounting teams. With scalable solutions, businesses can handle increasing volumes of transactions without compromising on accuracy or speed. AP outsourcing for growing businesses also provides access to the latest automation tools, improving overall efficiency and transparency.

In a competitive environment, agility and cost management are crucial. By leveraging accounts payable outsourcing, companies gain a competitive edge through enhanced financial control and reduced administrative burden. It’s not just a cost-saving measure—it’s a smart move for sustainable growth.

#outsourced accounts payable#benefits of accounts payable outsourcing#AP outsourcing for growing businesses#accounts payable automation#cost-effective AP solutions

0 notes

Text

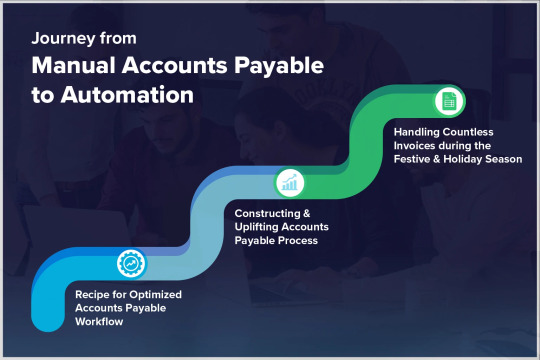

Journey from Manual Accounts Payable to Automation

73% of Accounts Payable Professionals Relying on Manual Process Face Slow Processing & Late Payment – Source

The accounts payable process across industries is still manual, paper-based. As a result, businesses are prone to missing invoices, delay in vendor reconciliation, vendor management, maintaining records, late payments, fraud, duplications, and more.

Let’s have a deeper understanding of how the accounts payable workflow would be when done manually.

It’s a reality. Let’s face it. Accounts Payables continue to be manual, tedious, and mundane for most businesses across diverse industries. However, accounts payable automation is the key to optimizing the complete accounts payable workflow and stay on top of the game.

Transformation from manual to automated accounts payable is no longer a “nice to have” strategic move, rather, it’s a “must have” for all future-focused firms. The Accounts Payable automation market is expected to reach up to USD 2 billion by 2029. Mention not, the need of transformation from manual accounts payable process to automation is different across industries. And guess what?

Here, you have the opportunity to dive deep into accounts payable automation journey of businesses across industries. So, keep scrolling to find out more about some real case studies.

for more information visit us at - https://pathquest.com/knowledge-center/blogs/journey-to-accounts-payable-automation/

#accounts payable automation software#accounting automation#accounts payable automation solutions#automated accounts payable#ap automation software

0 notes

Text

Overcoming Growth Barriers in AP Automation: A Roadmap for Success

In the ever-evolving landscape of financial processes, overcoming growth barriers in Accounts Payable (AP) automation is paramount for sustained success. At Mynd Integrated Solution, we understand the intricacies of AP automation and have crafted a comprehensive roadmap to guide you through the challenges and propel your organization towards unparalleled efficiency and growth.

0 notes

Text

5 Ways Virtual Bookkeeping Services Benefit Small Businesses

Small businesses are increasingly using online bookkeeping services in the digital era to effectively maintain their financial records. Virtual bookkeepers offer affordable solutions that simplify bookkeeping procedures by utilising online platforms and cutting-edge technologies. The importance of virtual bookkeeping services for small businesses is discussed in this article, which also examines their advantages in metropolitan areas including Brisbane, Adelaide, Melbourne, Perth, Sydney, and the Gold Coast.

Increased Productivity with Online Bookkeepers: Virtual bookkeeping services give small businesses access to a group of knowledgeable experts who focus on online bookkeeping. Businesses can optimise their financial operations and free up crucial time to concentrate on their core business operations by utilising their knowledge. Online bookkeepers may effectively manage bookkeeping chores including data input, bank reconciliations, and financial reporting, assuring accuracy and timeliness.

Cost Savings and Scalability: By outsourcing bookkeeping tasks to virtual bookkeeping companies, small businesses can avoid employing, training, and maintaining in-house bookkeepers and save the related high costs. Additionally, virtual bookkeeping services frequently provide adaptable packages that can be scaled up or down in accordance with the changing needs of the business, assuring cost-effectiveness.

Knowledge of Small Business Accounting: Virtual bookkeepers with experience in this area have a thorough awareness of the particular difficulties faced by small businesses. They can offer helpful guidance on tax preparation, cash flow management, and financial decision-making because they are knowledgeable about pertinent rules. Their knowledge assists small firms in being compliant and making wise financial decisions to encourage growth.

Using the Xero Bookkeeping Software: Virtual bookkeepers frequently utilise the well-known cloud-based accounting programme Xero. It is the perfect option for small enterprises thanks to its straightforward UI and powerful functionality. Cities like Brisbane, Melbourne, and Sydney frequently provide Xero integration as part of their virtual bookkeeping services, enabling seamless collaboration and immediate access to financial information. Xero bookkeepers can effectively handle accounts, monitor spending, and create invoices.

Packages for specialised bookkeeping: Virtual bookkeeping services are aware of the particular needs each small business has. They provide customised bookkeeping systems that fit the particular requirements and financial constraints of the company. These packages frequently feature monthly bookkeeping services, transparent pricing, and affordable rates, allowing small businesses to select the best choice.

For small businesses, virtual accounting services have changed the game by providing affordable, effective, and scalable solutions for their bookkeeping needs. Businesses in Brisbane, Adelaide, Melbourne, Perth, Sydney, and the Gold Coast can take use of specialised knowledge, use cutting-edge technologies like Xero, and gain from customised bookkeeping packages by outsourcing bookkeeping tasks to online bookkeepers. Small businesses can simplify their financial procedures and concentrate on their core skills with the help of virtual bookkeeping services, which will help them develop and succeed in the cutthroat business environment of today.

Check our services here:

Peppol e-invoicing- https://www.efficiencyleaders.com.au/peppol-einvoicing/

AP Automation Software - https://www.efficiencyleaders.com.au/ap-automation-software/

Automated Invoice Processing System - https://www.efficiencyleaders.com.au/automated-invoice-processing-system/

Accounts Payable Automation for Small Business - https://www.efficiencyleaders.com.au/accounts-payable-automation-for-small-business/

Accounts Payable Invoice Processing - https://www.efficiencyleaders.com.au/accounts-payable-invoice-processing/

Accounts Payable Automation Solutions - https://www.efficiencyleaders.com.au/accounts-payable-automation-solutions/

Accounts Payable Automation Software - https://www.efficiencyleaders.com.au/accounts-payable-automation-software/

Accounts Payable Automation Process - https://www.efficiencyleaders.com.au/accounts-payable-automation-process/

Automated Invoice Management System - https://www.efficiencyleaders.com.au/automated-invoice-management-system/

Best Accounts Payable Automation Software- https://www.efficiencyleaders.com.au/best-accounts-payable-automation-software/

#Accounts Payable Automation#peppol e-invoicing#ap automation software#automated invoice processing system#Accounts Payable Automation for small business#Accounts Payable Invoice Processing#Accounts Payable Automation Solutions#Accounts Payable Automation Software#Accounts Payable Automation Process#Automated Invoice Management System#and Best Accounts Payable Automation Software

1 note

·

View note

Text

USP team wins Nuclear Olympiad with project to improve access to radiotherapy in Brazil

The Polythermic Neutrons group, from USP’s School of Engineering (Poli), won the nuclear medicine category in the 2024 Brazilian Nuclear Olympiad, organized by the Brazilian Association for the Development of Nuclear Activities (ABDAN). The competition began in April this year and the winners were announced at the beginning of November at the Nuclear Summit 2024 event, with the theme challenge Cancer treatment: how can Brazil advance in the implementation of new technologies?

“We chose to take part in the medical category because it was something new for us and because we didn’t have much contact with this sector during our undergraduate studies,” says Luana Gomes da Silva, one of the members of the group, from the Materials Engineering course. The team also includes students Álvaro Sant’Anna Ferreira Neto, Enzo Yamamoto, João Pedro Oliveira Glóder Prado and Thais Kaori Yazawa, all from the first class of Poli’s Nuclear Engineering course, entrants in 2021.

They developed NPoli, a suite of software for scheduling medical appointments, exams and radiotherapy sessions, which aims to reduce barriers and speed up the stages of treatment in this area of medicine. “Some of the functions offered by the platform are: Smart Radiotherapy Scheduling; Integration with Exam Regulation and Management Systems; Control Panel for Physicians and Healthcare Professionals; and Automated Notifications and Interactivity with Patients,” explains Luana.

Inspired by the main international private solutions, such as Varian’s ARIA and Elekta’s Mosaiq, and the systems used by the SUS (Unified Health System), such as Sisreg and e-SUS APS, NPoli has a simplified interface, making it easy to use for different audiences, and integrates with the health regulation systems already in place in Brazil. The idea was to create a system that would adapt to the decentralized reality of the SUS, serving both large centers and less favored regions. Another difference is that, unlike private solutions, NPoli’s focus is on inclusion and accessibility, facilitating communication with patients. The platform also offers the possibility of managing the use of hospital resources, such as radiotherapy machines, optimizing their use and reducing waiting times.

Continue reading.

#brazil#politics#science#healthcare#good news#brazilian politics#image description in alt#mod nise da silveira

11 notes

·

View notes

Text

Linkty Dumpty

I was supposed to be on vacation, and while I didn’t do any blogging for a month, that didn’t mean that I stopped looking at my distraction rectangle and making a list of things I wanted to write about. Consequentially, the link backlog is massive, so it’s time to declare bankruptcy with another linkdump:

https://pluralistic.net/tag/linkdump/

[Image ID: John Holbo’s ‘trolley problem’ art, a repeating pattern of trolleys, tracks, people on tracks, and people standing at track switches]++

Let’s kick things off with a little graphic whimsy. You’ve doubtless seen the endless Trolley Problem memes, working from the same crude line drawings? Well, philosopher John Holbo got tired of that artwork, and he whomped up a fantastic alternative, which you can get as a poster, duvet, sticker, tee, etc:

https://www.redbubble.com/shop/ap/145078097

The trolley problem has been with us since 1967, but it’s enjoying a renaissance thanks to the insistence of “AI” weirdos that it is very relevant to our AI debate. A few years back, you could impress uninformed people by dropping the Trolley Problem into a discussion:

https://memex.craphound.com/2016/10/25/mercedes-weird-trolley-problem-announcement-continues-dumb-debate-about-self-driving-cars/

Amazingly, the “AI” debate has only gotten more tedious since the middle of the past decade. But every now and again, someone gets a stochastic parrot to do something genuinely delightful, like the Jolly Roger Telephone Company, who sell chatbots that will pretend to be tantalyzingly confused marks in order to tie up telemarketers and waste their time:

https://jollyrogertelephone.com/

Jolly Roger sells different personas: “Whitebeard” is a confused senior who keeps asking the caller’s name, drops nonsequiturs into the conversation, and can’t remember how many credit-cards he has. “Salty Sally” is a single mom with a houseful of screaming, demanding children who keep distracting her every time the con artist is on the verge of getting her to give up compromising data. “Whiskey Jack” is drunk:

https://www.wsj.com/articles/people-hire-phone-bots-to-torture-telemarketers-2dbb8457

The bots take a couple minutes to get the sense of the conversation going. During that initial lag, they have a bunch of stock responses like “there’s a bee on my arm, but keep going,” or grunts like “huh,” and “uh-huh.” The bots can keep telemarketers and scammers on the line for quite a long time. Scambaiting is an old and honorable vocation, and it’s good that it has received a massive productivity gain from automation. This is the AI Dividend I dream of.

The less-fun AI debate is the one over artists’ rights and tech. I am foresquare for the artists here, but I think that the preferred solutions (like creating a new copyright over the right to train a model with your work) will not lead to the hoped-for outcome. As with other copyright expansions — 40 years’ worth of them now — this right will be immediately transferred to the highly concentrated media sector, who will simply amend their standard, non-negotiable contracting terms to require that “training rights” be irrevocably assigned to them as a condition of working.

The real solution isn’t to treat artists as atomic individuals — LLCs with an MFA — who bargain, business-to-business, with corporations. Rather, the solutions are in collective power, like unions. You’ve probably heard about the SAG-AFTRA actors’ strike, in which creative workers are bargaining as a group to demand fair treatment in an age of generative models. SAG-AFTRA president Fran Drescher’s speech announcing the strike made me want to stand up and salute:

https://www.youtube.com/watch?v=J4SAPOX7R5M

The actors’ strike is historic: it marks the first time actors have struck since 2000, and it’s the first time actors and writers have co-struck since 1960. Of course, writers in the Writers Guild of America (West and East) have been picketing since since April, and one of their best spokespeople has been Adam Conover, a WGA board member who serves on the negotiating committee. Conover is best known for his stellar Adam Ruins Everything comedy-explainer TV show, which pioneered a technique for breaking down complex forms of corporate fuckery and making you laugh while he does it. Small wonder that he’s been so effective at conveying the strike issues while he pickets.

Writing for Jacobin, Alex N Press profiles Conover and interviews him about the strike, under the excellent headline, “Adam Pickets Everything.” Conover is characteristically funny, smart, and incisive — do read:

https://jacobin.com/2023/07/adam-conover-wga-strike

Of course, not everyone in Hollywood is striking. In late June, the DGA accepted a studio deal with an anemic 41% vote turnout:

https://www.theverge.com/2023/6/26/23773926/dga-amptp-new-deal-strike

They probably shouldn’t have. In this interview with The American Prospect’s Peter Hong, the brilliant documentary director Amy Ziering breaks down how Netflix and the other streamers have rugged documentarians in a classic enshittification ploy that lured in filmmakers, extracted everything they had, and then discarded the husks:

https://prospect.org/culture/2023-06-21-drowned-in-the-stream/

Now, the streaming cartel stands poised to all but kill off documentary filmmaking. Pressured by Wall Street to drive high returns, they’ve become ultraconservative in their editorial decisions, making programs and films that are as similar as possible to existing successes, that are unchallenging, and that are cheap. We’ve gone directly from a golden age of docs to a dark age.

In a time of monopolies, it’s tempting to form countermonopolies to keep them in check. Yesterday, I wrote about why the FTC and Lina Khan were right to try to block the Microsoft/Activision merger, and I heard from a lot of people saying this merger was the only way to check Sony’s reign of terror over video games:

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

But replacing one monopolist with another isn’t good for anyone (except the monopolists’ shareholders). If we want audiences and workers — and society — to benefit, we have to de-monopolize the sector. Last month, I published a series with EFF about how we should save the news from Big Tech:

https://www.eff.org/deeplinks/2023/04/saving-news-big-tech

After that came out, the EU Observer asked me to write up version of it with direct reference to the EU, where there are a lot of (in my opinion, ill-conceived but well-intentioned) efforts to pry Big Tech’s boot off the news media’s face. I’m really happy with how it came out, and the header graphic is awesome:

https://euobserver.com/opinion/157187

De-monopolizing tech has become my life’s work, both because tech is foundational (tech is how we organize to fight over labor, gender and race equality, and climate justice), and because tech has all of these technical aspects, which open up new avenues for shrinking Big Tech, without waiting decades for traditional antitrust breakups to run their course (we need these too, though!).

I’ve written a book laying out a shovel-ready plan to give tech back to its users through interoperability, explaining how to make new regulations (and reform old ones), what they should say, how to enforce them, and how to detect and stop cheating. It’s called “The Internet Con: How To Seize the Means of Computation” and it’s coming from Verso Books this September:

https://www.versobooks.com/products/3035-the-internet-con

[Image ID: The cover of the Verso Books hardcover of ‘The Internet Con: How to Seize the Means of Computation]

I just got my first copy in the mail yesterday, and it’s a gorgeous little package. The timing was great, because I spent the whole week in the studio at Skyboat Media recording the audiobook — the first audiobook of mine that I’ve narrated. It was a fantastic experience, and I’ll be launching a Kickstarter to presell the DRM-free audio and ebooks as well as hardcovers, in a couple weeks.

Though I like doing these crowdfunders, I do them because I have to. Amazon’s Audible division, the monopolist that controls >90% of the audiobook market, refuses to carry my work because it is DRM-free. When you buy a DRM-free audiobook, that means that you can play it on anyone’s app, not just Amazon’s. Every audiobook you’ve ever bought from Audible will disappear the moment you decide to break up with Amazon, which means that Amazon can absolutely screw authors and audiobook publishers because they’ve taken our customers hostage.

If you are unwise enough to pursue an MBA, you will learn a term of art for this kind of market structure: it’s a “moat,” that is, an element of the market that makes it hard for new firms to enter the market and compete with you. Warren Buffett pioneered the use of this term, and now it’s all but mandatory for anyone launching a business or new product to explain where their moat will come from.

As Dan Davies writes, these “moats” aren’t really moats in the Buffett sense. With Coke and Disney, he says, a “moat” was “the fact that nobody else could make such a great product that everyone wanted.” In other words, “making a good product,” is a great moat:

https://backofmind.substack.com/p/stuck-in-the-moat

But making a good product is a lot of work and not everyone is capable of it. Instead, “moat” now just means some form of lock in. Davies counsels us to replace “moat” with:

our subscription system and proprietary interface mean that our return on capital is protected by a strong Berlin Wall, preventing our customers from getting out to a freer society and forcing them to consume our inferior products for lack of alternative.

I really like this. It pairs well with my 2020 observation that the fight over whether “IP” is a meaningful term can be settled by recognizing that IP has a precise meaning in business: “Any policy that lets me reach beyond the walls of my firm to control the conduct of my competitors, critics and customers”:

https://locusmag.com/2020/09/cory-doctorow-ip/

To see how that works in the real world, check out “The Anti-Ownership Ebook Economy,” a magisterial piece of scholarship from Sarah Lamdan, Jason M. Schultz, Michael Weinberg and Claire Woodcock:

https://www.nyuengelberg.org/outputs/the-anti-ownership-ebook-economy/

Something happened when we shifted to digital formats that created a loss of rights for readers. Pulling back the curtain on the evolution of ebooks offers some clarity to how the shift to digital left ownership behind in the analog world.

The research methodology combines both anonymous and named sources in publishing, bookselling and librarianship, as well as expert legal and economic analysis. This is an eminently readable, extremely smart, and really useful contribution to the scholarship on how “IP” (in the modern sense) has transformed books from something you own to something that you can never own.

The truth is, capitalists hate capitalism. Inevitably, the kind of person who presides over a giant corporation and wields power over millions of lives — workers, suppliers and customers — believes themselves to be uniquely and supremely qualified to be a wise dictator. For this kind of person, competition is “wasteful” and distracts them from the important business of making everyone’s life better by handing down unilateral — but wise and clever — edits. Think of Peter Thiel’s maxim, “competition is for losers.”

That’s why giant companies love to merge with each other, and buy out nascent competitors. By rolling up the power to decide how you and I and everyone else live our lives, these executives ensure that they can help us little people live the best lives possible. The traditional role of antitrust enforcement is to prevent this from happening, countering the delusions of would-be life-tenured autocrats of trade with public accountability and enforcement:

https://marker.medium.com/we-should-not-endure-a-king-dfef34628153

Of course, for 40 years, we’ve had neoliberal, Reaganomics-poisoned antitrust, where monopolies are celebrated as “efficient” and their leaders exalted as geniuses whose commercial empires are evidence of merit, not savagery. That era is, thankfully, coming to an end, and not a moment too soon.

Leading the fight is the aforementioned FTC chair Lina Khan, who is taking huge swings at even bigger mergers. But the EU is no slouch in this department: they’re challenging the Adobe/Figma merger, a $20b transaction that is obviously and solely designed to recapture customers who left Adobe because they didn’t want to struggle under its yoke any longer:

https://gizmodo.com/adobe-figma-acquisition-likely-to-face-eu-investigation-1850555562

For autocrats of trade, this is an intolerable act of disloyalty. We owe them our fealty and subservience, because they are self-evidently better at understanding what we need than we could ever be. This unwarranted self-confidence from the ordinary mediocrities who end up running giant tech companies gets them into a whole lot of hot water.

One keen observer of the mind-palaces that tech leaders trap themselves in is Anil Dash, who describes the conspiratorial, far-right turn of the most powerful men (almost all men!) in Silicon Valley in a piece called “‘VC Qanon’ and the radicalization of the tech tycoons”:

https://www.anildash.com/2023/07/07/vc-qanon/

Dash builds on an editorial he published in Feb, “The tech tycoon martyrdom charade,” which explores the sense of victimhood the most powerful, wealthiest people in the Valley project:

https://www.anildash.com/2023/02/27/tycoon-martyrdom-charade/

These dudes are prisoners of their Great Man myth, and leads them badly astray. And while all of us are prone to lapses in judgment and discernment, Dash makes the case that tech leaders are especially prone to it:

Nobody becomes a billionaire by accident. You have to have wanted that level of power, control and wealth more than you wanted anything else in your life. They all sacrifice family, relationships, stability, community, connection, and belonging in service of keeping score on a scale that actually yields no additional real-world benefits on the path from that first $100 million to the tens of billions.

This makes billionaires “a cohort that is, counterintutively, very easily manipulated.” What’s more, they’re all master manipulators, and they all hang out with each other, which means that when a conspiratorial belief takes root in one billionaire’s brain, it spreads to the rest of them like wildfire.

Then, billionaires “push each other further and further into extreme ideas because their entire careers have been predicated on the idea that they’re genius outliers who can see things others can’t, and that their wealth is a reward for that imagined merit.”

They live in privileged bubbles, which insulates them from disconfirming evidence — ironic, given how many of these bros think they are wise senators in the agora.

There are examples of billionaires’ folly all around us today, of course. Take privacy: the idea that we can — we should — we must — spy on everyone, all the time, in every way, to eke out tiny gains in ad performance is objectively batshit. And yet, wealthy people decreed this should be so, and it was, and made them far richer.

Leaked data from Microsoft’s Xandr ad-targeting database reveals how the commercial surveillance delusion led us to a bizarre and terrible place, as reported on by The Markup:

https://themarkup.org/privacy/2023/06/08/from-heavy-purchasers-of-pregnancy-tests-to-the-depression-prone-we-found-650000-ways-advertisers-label-you

The Markup’s report lets you plumb 650,000 targeting categories, searching by keyword or loading random sets, 20 at a time. Do you want to target gambling addicts, people taking depression meds or Jews? Xandr’s got you covered. What could possibly go wrong?

The Xandr files come from German security researcher Wolfie Christl from Cracked Labs. Christi is a European, and he’s working with the German digital rights group Netzpolitik to get the EU to scrutinize all the ways that Xandr is flouting EU privacy laws.

Billionaires’ big ideas lead us astray in more tangible ways, of course. Writing in The Conversation, John Quiggin asks us to take a hard look at the much ballyhooed (and expensively ballyhooed) “nuclear renaissance”:

https://theconversation.com/dutton-wants-australia-to-join-the-nuclear-renaissance-but-this-dream-has-failed-before-209584

Despite the rhetoric, nukes aren’t cheap, and they aren’t coming back. Georgia’s new nuclear power is behind schedule and over budget, but it’s still better off than South Carolina’s nukes, which were so over budget that they were abandoned in 2017. France’s nuke is a decade behind schedule. Finland’s opened this year — 14 years late. The UK’s Hinkley Point C reactor is massively behind schedule and over budget (and when it’s done, it will be owned by the French government!).

China’s nuclear success story also doesn’t hold up to scrutiny — they’ve brought 50GW of nukes online, sure, but they’re building 95–120GW of solar every year.

Solar is the clear winner here, along with other renewables, which are plummeting in cost (while nukes soar) and are accelerating in deployments (while nukes are plagued with ever-worsening delays).

This is the second nuclear renaissance — the last one, 20 years ago, was a bust, and that was before renewables got cheap, reliable and easy to manufacture and deploy. You’ll hear fairy-tales about how the early 2000s bust was caused by political headwinds, but that’s simply untrue: there were almost no anti-nuke marches then, and governments were scrambling to figure out low-carbon alternatives to fossil fuels (this was before the latest round of fossil fuel sabotage).

The current renaissance is also doomed. Yes, new reactors are smaller and safer and won’t have the problems intrinsic to all megaprojects, but designs like VOYGR have virtually no signed deals. Even if they do get built, their capacity will be dwarfed by renewables — a Gen III nuke will generate 710MW of power. Globally, we add that much solar every single day.

And solar power is cheap. Even after US subsidies, a Gen III reactor would charge A$132/MWh — current prices are as low as A$64-$114/MWh.

Nukes are getting a charm offensive because wealthy people are investing in hype as a way of reaping profits — not as a way of generating safe, cheap, reliable energy.

Here in the latest stage of capitalism, value and profit are fully decoupled. Monopolists are shifting more and more value from suppliers and customers to their shareholders every day. And when the customer is the government, the depravity knows no bounds. In Responsible Statecraft, Connor Echols describes how military contractors like Boeing are able to bill the Pentagon $52,000 for a trash can:

https://responsiblestatecraft.org/2023/06/20/the-pentagons-52000-trash-can/

Military Beltway Bandits are nothing new, of course, but they’ve gotten far more virulent since the Obama era, when Obama’s DoD demanded that the primary contractors merge to a bare handful of giant firms, in the name of “efficiency.” As David Dayen writes in his must-read 2020 book Monopolized, this opened the door to a new kind of predator:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

The Obama defense rollups were quickly followed by another wave of rollups, these ones driven by Private Equity firms who cataloged which subcontractors were “sole suppliers” of components used by the big guys. These companies were all acquired by PE funds, who then lowered the price of their products, selling them below cost.

This maximized the use of those parts in weapons and aircraft sold by primary contractors like Boeing, which created a durable, long-lasting demand for fresh parts for DoD maintenance of its materiel. PE-owned suppliers hits Uncle Sucker with multi-thousand-percent markups for these parts, which have now wormed their way into every corner of the US arsenal.

Yes, this is infuriating as hell, but it’s also so grotesquely wrong that it’s impossible to defend, as we see in this hilarious clip of Rep Katie Porter grilling witnesses on US military waste:

https://www.youtube.com/watch?v=TJhf6l1nB9A

Porter pulls out the best version yet of her infamous white-board and makes her witnesses play defense ripoff Jepoardy!, providing answers to a series of indefensible practices.

It’s sure nice when our government does something for us, isn’t it? We absolutely can have nice things, and we’re about to get them. The Infrastructure Bill contains $42B in subsidies for fiber rollouts across the country, which will be given to states to spend. Ars Technica’s Jon Brodkin breaks down the state-by-state spending:

https://arstechnica.com/tech-policy/2023/06/us-allocates-42b-in-broadband-funding-find-out-how-much-your-state-will-get/

Texas will get $3.31B, California will get $1.86B, and 17 other states will get $1B or more. As the White House announcement put it, “High-speed Internet is no longer a luxury.”

To understand how radical this is, you need to know that for decades, the cable and telco sector has grabbed billions in subsidies for rural and underserved communities, and then either stole the money outright, or wasted it building copper networks that run at a fraction of a percent of fiber speeds.

This is how America — the birthplace of the internet — ended up with some of the world’s slowest, most expensive broadband, even after handing out tens of billions of dollars in subsidies. Those subsidies were gobbled up by greedy, awful phone companies — these ones must be spent wisely, on long-lasting, long-overdue fiber infrastructure.

That’s a good note to end on, but I’ve got an even better one: birds in the Netherlands are tearing apart anti-bird strips and using them to build their nests. Wonderful creatures 1, hostile architecture, 0. Nature is healing:

https://www.theguardian.com/science/2023/jul/11/crows-and-magpies-show-their-metal-by-using-anti-bird-spikes-to-build-nests

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/15/in-the-dumps/#what-vacation

Next Tues, Jul 18, I'm hosting the first Clarion Summer Write-In Series, an hour-long, free drop-in group writing and discussion session. It's in support of the Clarion SF/F writing workshop's fundraiser to offer tuition support to students:

https://mailchi.mp/theclarionfoundation/clarion-write-ins

[Image iD: A dump-truck, dumping out a load of gravel. A caricature of Humpty Dumpty clings to its lip, restrained by a group of straining, Lilliputian men.]

#pluralistic#infrastructure#broadband#linkdumps#fran drescher#labor#strikes#libraries#big tech#sag aftra#writer's strike#commercial surveillance#actor's strike#data brokers#ebooks#moats and walls#drm#licensing#glam#publishing#military privacy#copyfight#platform economics#nukes#adam conover#pentagon#birds#mergers#delightful creatures#hostile architecture

113 notes

·

View notes

Text

The Power of AI and Human Collaboration in Media Content Analysis

In today’s world binge watching has become a way of life not just for Gen-Z but also for many baby boomers. Viewers are watching more content than ever. In particular, Over-The-Top (OTT) and Video-On-Demand (VOD) platforms provide a rich selection of content choices anytime, anywhere, and on any screen. With proliferating content volumes, media companies are facing challenges in preparing and managing their content. This is crucial to provide a high-quality viewing experience and better monetizing content.

Some of the use cases involved are,

Finding opening of credits, Intro start, Intro end, recap start, recap end and other video segments

Choosing the right spots to insert advertisements to ensure logical pause for users

Creating automated personalized trailers by getting interesting themes from videos

Identify audio and video synchronization issues

While these approaches were traditionally handled by large teams of trained human workforces, many AI based approaches have evolved such as Amazon Rekognition’s video segmentation API. AI models are getting better at addressing above mentioned use cases, but they are typically pre-trained on a different type of content and may not be accurate for your content library. So, what if we use AI enabled human in the loop approach to reduce cost and improve accuracy of video segmentation tasks.

In our approach, the AI based APIs can provide weaker labels to detect video segments and send for review to be trained human reviewers for creating picture perfect segments. The approach tremendously improves your media content understanding and helps generate ground truth to fine-tune AI models. Below is workflow of end-2-end solution,

Raw media content is uploaded to Amazon S3 cloud storage. The content may need to be preprocessed or transcoded to make it suitable for streaming platform (e.g convert to .mp4, upsample or downsample)

AWS Elemental MediaConvert transcodes file-based content into live stream assets quickly and reliably. Convert content libraries of any size for broadcast and streaming. Media files are transcoded to .mp4 format

Amazon Rekognition Video provides an API that identifies useful segments of video, such as black frames and end credits.

Objectways has developed a Video segmentation annotator custom workflow with SageMaker Ground Truth labeling service that can ingest labels from Amazon Rekognition. Optionally, you can skip step#3 if you want to create your own labels for training custom ML model or applying directly to your content.

The content may have privacy and digitial rights management requirements and protection. The Objectway’s Video Segmentaton tool also supports Digital Rights Management provider integration to ensure only authorized analyst can look at the content. Moreover, the content analysts operate out of SOC2 TYPE2 compliant facilities where no downloads or screen capture are allowed.

The media analysts at Objectways’ are experts in content understanding and video segmentation labeling for a variety of use cases. Depending on your accuracy requirements, each video can be reviewed or annotated by two independent analysts and segment time codes difference thresholds are used for weeding out human bias (e.g., out of consensus if time code differs by 5 milliseconds). The out of consensus labels can be adjudicated by senior quality analyst to provide higher quality guarantees.

The Objectways Media analyst team provides throughput and quality gurantees and continues to deliver daily throughtput depending on your business needs. The segmented content labels are then saved to Amazon S3 as JSON manifest format and can be directly ingested into your Media streaming platform.

Conclusion

Artificial intelligence (AI) has become ubiquitous in Media and Entertainment to improve content understanding to increase user engagement and also drive ad revenue. The AI enabled Human in the loop approach outlined is best of breed solution to reduce the human cost and provide highest quality. The approach can be also extended to other use cases such as content moderation, ad placement and personalized trailer generation.

Contact [email protected] for more information.

2 notes

·

View notes

Text

The Role of AP Outsourcing in Financial Transformation

Modern businesses are increasingly turning to outsourced finance solutions to gain better control over their spending and streamline operations. Among these, procurement outsourcing is one of the most impactful strategies. By outsourcing procurement, companies can reduce overheads, enhance supplier relationships, and gain access to expert market insights—all while improving efficiency.

The connection between outsourcing and procurement is especially powerful when combined with accounts payable outsourcing. This approach allows companies to automate invoice handling, ensure timely payments, and avoid late fees or duplicate payments. Many accounts payable outsourcing companies also provide real-time tracking tools, compliance support, and advanced analytics, offering full transparency and control.

By integrating procurement and payables into a unified outsourced finance model, businesses can significantly cut costs and improve operational agility. With specialized vendors handling routine finance tasks, internal teams can shift their focus to strategic growth. Whether you're a startup or an enterprise, the benefits of combining outsourcing and procurement are hard to ignore.

#outsourced financial services#AP automation#procurement management#finance process optimization#supplier payment solutions

0 notes

Text

Accounts payable and vendor relationship management

Accounts payable is more than just paying bills—it’s a critical component of an organization’s cash flow, vendor management, and financial controls. As companies grow, managing AP efficiently becomes essential to avoid errors, late payments, and strained vendor relationships. Rightpath Global Services offers end-to-end AP solutions that bring automation, control, and scalability to finance departments.

The AP function typically involves invoice capture, approval, payment, and reconciliation. Manual AP processes often lead to delays, inaccuracies, and missed payment discounts. Rightpath resolves these challenges with automation tools like OCR, electronic invoicing, and RPA-driven approvals that reduce touchpoints and eliminate bottlenecks.

By digitizing AP workflows, businesses gain real-time visibility into their liabilities, improve vendor satisfaction through timely payments, and enhance audit readiness. Dashboards provide insight into key metrics such as invoice backlog, DPO, and discount utilization. This transparency supports better financial planning and working capital management.

Rightpath also ensures that AP processes are aligned with compliance requirements and internal controls. Their AP solutions come with built-in validation checks, approval hierarchies, and audit trails, reducing the risk of fraud or error.

For growing businesses, outsourcing accounts payable can free up internal resources while maintaining accuracy and control. Rightpath customizes AP solutions to fit each client’s size, industry, and existing systems��ensuring minimal disruption during transition.

Ultimately, a streamlined AP function enhances business credibility, supports growth, and creates a solid foundation for financial health. With the right processes and technology in place, accounts payable can shift from a cost center to a strategic advantage.

0 notes

Text

Rightpath GS for Accounts Payable Optimization

Understanding the AP Maze: Where Complexity Begins

Accounts Payable (AP) is one of the most essential functions in finance, yet it’s also one of the most complex. From invoice management and vendor coordination to payment approvals and compliance, the process involves multiple steps, systems, and stakeholders. At Right Path, we understand that even the most established businesses can find AP processes tangled with inefficiencies – especially when dealing with high volumes or scattered workflows. But with the right BPM approach, these complexities can be simplified and transformed into strengths, Right Path P2P Assessment: Identify Opportunities for Improvement”

The Key to Clarity: Streamlining with Process Intelligence

One of the most effective ways to overcome AP complexity is to bring in process intelligence and automation. Traditionally, AP tasks were handled manually, with teams verifying data, chasing approvals, and logging payments across various platforms. This often led to missed deadlines, duplicate payments, and a lack of visibility. Today, we help businesses shift to a streamlined, digitized AP environment – where invoices are automatically captured, matched, validated, and routed through smart workflows. This not only reduces turnaround time but also improves accuracy and accountability across the board.

Automation in Action: Making AP Smarter and Faster

Right Path’s BPM solutions for AP are built to simplify and enhance every stage of the process. Our systems ensure that approvals move faster, exceptions are flagged early, and finance teams can access real-time dashboards that offer complete visibility into payables. This smart automation allows your team to focus on analysis, vendor relationships, and strategic planning, instead of getting stuck in operational bottlenecks.

Your Partner in Process Excellence

At Right Path Global Services Pvt. Ltd., we believe that AP should be more than a back-office function – it should be a value-driving process that supports business agility and growth. As a trusted BPM service provider, we partner with businesses to reimagine and rebuild their AP workflows using best practices, smart technologies, and process expertise. From implementation to continuous improvement, we ensure that your AP function becomes lean, responsive, and aligned with your business goals.

Ready to Transform Your AP Process?

Complexity in Accounts Payable is common—but it doesn’t have to be permanent. With the right partner and a strategic approach, your AP function can become smarter, faster, and a true driver of business value.

That’s why we’re offering a free Procure-to-Pay (P2P) assessment to help you get started. This expert-led review will uncover inefficiencies, highlight areas for improvement, and provide actionable insights to optimize your entire AP workflow.

Explore our website to learn more and claim your free P2P assessment today.

Let our experts help you turn AP complexity into a competitive advantage.

Partner with Right Path Global Services—let’s simplify success, together.

For more information click here: - https://rightpathgs.com/blogs/

0 notes

Text

Optimize Financial Operations with PathQuest Solutions

PathQuest Solutions offers a comprehensive financial management software solution that provides real-time visibility of key performance indicators (KPIs), automates the accounts payable process, and simplifies accounting tasks. With our efficient software, businesses can streamline their financial operations, make data-driven decisions, and enhance overall productivity. Gain insights, reduce manual work, and optimize financial processes with PathQuest Solutions.

Read More at https://www.merchantcircle.com/pathquest-solutions-honolulu-hi

#accounting automation#accounts payable automation software#accounts payable automation solutions#business reporting#business intelligence#ap automation software#accountspayable#business insights#automated accounts payable#accounting

0 notes

Text

Best 5 Accounts Payable Automation Software Tools in 2025

With numerous alternatives available, selecting the best accounts payable automation software can be challenging. So, how can you determine which one is best for you? With hundreds of suppliers fighting for your business, each offering its own set of services and pricing methods, it's hard to know where to begin.

Instead of spending hours comparing options and delving through technical minutiae, you have a handy guide that handles all of the work for you. We examined the top accounts payable automation software products, considering factors such as user interfaces, security, integration, and pricing.

Whether you're a small business searching for a basic solution or a huge corporation in need of strong features, we'll teach you how to select the best system to optimize your AP procedures and keep your cash flow flowing.

Download the sample report of Market Share: https://qksgroup.com/download-sample-form/market-forecast-accounts-payable-automation-2022-2027-worldwide-2204

What is Accounts Payable Automation?

According to QKS Group, an Accounts Payable (AP) application refers to a software solution that enables organizations to automate, manage, and monitor financial transactions owed to vendors. This includes invoice entry, payment processing, and reporting capabilities. By automating the AP processes, organizations can match invoices with Purchase Orders (PO) for executing part or full payments, while effectively managing and reconciling vendors. The use of AP applications helps streamline the entire accounts payable process, eliminating manual tasks, and providing better visibility and control over crucial financial data.

Top Features of Accounts Payable Automation Software

An AP automation solution eliminates manual processes by automating the accounts payable payment process to speed up day-to-day AP processes.

Accounts payable automation software includes:

OCR invoice scanning for data capture

Accounts payable invoice processing software

Automated approvals

Global cross-border payments

Accounts payable document management software

Our accounts payable automation software provides self-service supplier onboarding, tax compliance, fraud prevention, payment discount optimization, electronic document matching, online multi-currency global mass payments, secure payment methods, automatic payment reconciliation, and spend and cash management.

AP automation software streamlines payable operations, reducing human data entry and paper check payments.

Top Accounts Payable Automation Software

AvidXchange

AvidXchange specializes in providing accounts payable automation software and payment resolutions. Primarily, it serves the needs of middle-market enterprises and their suppliers. The firm places a strong focus on innovation, which is evident in the services it provides. The firm maintains an innate culture of entrepreneurship, spurring innovation. Its main goal is to expand, network, and make a lasting contribution to the industry it serves.

Basware

Basware enables finance professionals in multinational businesses to finally automate their complicated, labor-intensive invoice processes while remaining compliant with regulatory changes. Basware's AP automation and invoicing platform helps companies achieve a new level of efficiency – in a matter of months – while reducing errors and risks.

Bill.com

Bill (formerly Bill.com) is a U.S.-based firm offering accounting automation solutions, including accounts payable, receivable, and cost management. Bill is a smart solution that enables you to create and pay invoices, track employee expenses, streamline approvals, and transfer payments, all from one platform. It also integrates seamlessly with various accounting systems, allowing customers to store invoices on a cloud-based platform while ensuring compliance and being audit-ready.

Coupa

Coupa Software is a cloud-based software dedicated to business spend management (BSM). Coupa Software aims to help businesses gain insight and control over their spending, leading to more productive and secure decisions. The company has a global outreach and serves an extensive range of businesses worldwide.

Tipalti

Tipalti provides solutions for accounts payable, procurement, and bulk payments. Tipalti plans to speed up book closure by 25% by simplifying vendor onboarding, invoice processing, global payables, and tax compliance.

Tipalti connects smoothly with NetSuite ERP. It also provides consumers with clear visibility into their expenditures and gathers critical information from vendor documentation. Tipalti, well known for its worldwide partner payments, is chosen by businesses that handle a high number of cross-border payments.

Download the sample report of Market Forecast: https://qksgroup.com/download-sample-form/market-share-accounts-payable-automation-2022-worldwide-2400

Choosing the Right Accounts Payable Automation Software

Implementing accounts payable software can only help your procurement process if you carefully select a solution that offers flexibility, visibility, and security without sacrificing functionality.

Consider software that makes it simple to clear payments but does not settle them for days on the vendor's end. Consider an alternative that your legal or IT staff is reluctant to implement. A QKS Group is a global advisory and consulting firm, offers valuable insights into the account payable automation market. Their Market Intelligence reports, such as " Accounts Payable Automation Market Share, 2023, Worldwide," and "Market Forecast: Accounts Payable Automation, 2024-2028, Worldwide," provide comprehensive data on market trends, competitive landscapes, and growth forecasts. Such reports are indispensable for industry professionals, decision-makers, and stakeholders seeking in-depth knowledge about the AP automation market and multiple software and solutions (as mentioned above) there in the industry. They offer valuable data for strategic planning, investment decisions, and competitive positioning.

Conclusion

Selecting the finest accounts payable software market is an important step toward streamlining your financial processes. Whether you're a small firm or a huge corporation, automating your AP procedures may result in higher productivity, fewer mistakes, stronger supplier relationships, and better cash flow management. Our cloud-based, end-to-end AP automation system simplifies the whole AP process, from invoice capture to payment authorization. We provide the ability to effortlessly interface with your existing systems, such as QuickBooks, NetSuite, and other ERPs.

0 notes

Text

From Manual to Modern: Transform Finance with Outsourcing Solutions

As organizations face tighter margins and rising operational complexity, procurement outsourcing and financial process outsourcing offer a clear solution. By partnering with specialized providers, businesses can offload time-consuming tasks and improve efficiency across the board.

With accounts payable outsourcing, companies can streamline invoice handling, improve approval cycles, and reduce errors. Through payables outsourcing, businesses gain better compliance, reduced fraud risk, and improved vendor satisfaction — all without burdening internal teams.

Accounts receivable outsourcing is equally valuable, helping accelerate collections and reduce outstanding balances. Skilled AR partners use structured workflows and automation to improve cash flow and reduce DSO, ensuring steady revenue streams and fewer write-offs.

Together, these outsourcing strategies empower businesses to cut costs, improve accuracy, and scale quickly. Rather than managing complex financial processes in-house, smart companies are choosing specialized partners to handle AP, AR, and procurement functions with precision and reliability.

0 notes