#atal pension yojana

Text

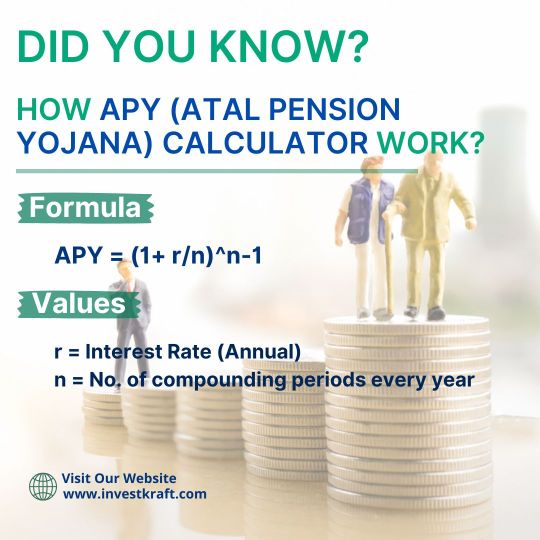

How Accurate Is the Atal Pension Yojana Calculator?

The accuracy of the Atal Pension Yojana (APY) Calculator, particularly on the Investkraft website, is generally reliable. This online tool estimates the pension amount one can receive under the APY scheme based on inputs like age, contribution amount, and the chosen pension plan. While it provides a useful estimate, it's essential to understand that the final pension amount may vary slightly due to factors such as changes in government regulations or economic conditions. However, Investkraft strives to keep its calculator updated to reflect any such changes, ensuring users get as accurate a prediction as possible. Overall, while the APY Calculator offers valuable insights into potential pension benefits, it's advisable to consult with financial experts for a comprehensive retirement planning strategy.

2 notes

·

View notes

Text

हर महीने 5,000 हजार पेंशन, ऐसे मिलेगा लाभ !

Atal Pension Yojana 2024: https://onlinetrendspro.in/atal-pension-yojana-2024-5000-thousand-pension-every-month-this-is-how-you-will-get-benefits/

0 notes

Text

Atal Pension Yojana adds record 12.2 million new members in 2023-24

A record 12.2 million new accounts were opened in the Atal Pension Yojana (APY) during 2023-24 taking the total enrolments to 66.2 million under the government’s social security scheme, according to figures compiled by the Pension Fund Regulatory and Authority (PFRDA).

According to APY data, around 70.44 per cent of the total enrolments in the scheme has been done by public-sector banks, 19.80 per cent by regional rural banks, 6.18 per cent by private sector banks, 0.37 per cent by payment banks, 0.62 per cent by small finance banks and 2.39 per cent by cooperative banks.

Source: bhaskarlive.in

0 notes

Text

Atal Pension Yojana – Scheme Details, Features & Benefits

The central government of India launched its Atal Pension Yojana (APY) in FY2015-16 to consolidate the social security of the working poor. This scheme replaced the previously announced Swavalamban Scheme, as earlier, the beneficiaries used to face complexities while redeeming their benefits

0 notes

Text

#Atal Pension Yojana#Pension Scheme#Financial Security#Unorganized Sector#Retirement Planning#Social Security#Government Scheme#Old Age Pension#Financial Inclusion

0 notes

Text

Atal Pension Yojana Benefits: मजदूरों को हर महीने 5000 रुपए देगी सरकार, आज ही खुलवाएं खाता

Atal Pension Yojana Benefits नई दिल्ली: Atal Pension Yojana Benefits केंद्र एवं राज्य की सरकार देश की जनता को आर्थिक फायदा पहुंचाने के लिए कई तरह की योजनाएं चला रही है। इन योजनाओं में से एक अटल पेंशन योजना है, जिसके तहत लोगों को अंशदान दिया जाता है। वहीं, सरकार ने हाल ही में अटल पेंशन योजना में कुछ बदलाव किए हैं।

इन बदलावों के तहत 1 अक्टूबर से हुए बदलाव के तहत इनकम टैक्स रिटर्न फाइल करने वाला…

View On WordPress

#Atal Pension Yojana#Atal Pension Yojana Benefits#Atal Pension Yojana Benefits: मजदूरों को हर महीने 5000 रुपए देगी सरकार#आज ही खुलवाएं खाता

0 notes

Link

APY योजना के तहत, व्यक्ति 60 वर्ष की आयु तक पहुंचने तक हर महीने एक निश्चित राशि का योगदान कर सकते हैं और फिर किए गए योगदान और जिस उम्र में वे योजना में शामिल हुए, उसके आधार पर हर महीने एक निश्चित पेंशन राशि प्राप्त करते हैं। पेंशन की राशि 1000 रुपये से लेकर 5000 रुपये हो सकती है। केंद्र सरकार भी आपके कुल वार्षिक योगदान का 50% या 1000 रुपये प्रति वर्ष का सह-योगदान करेगी।

0 notes

Text

0 notes

Text

Get Details about Atal Pension Yojana and NREGA Job Card List

The NREGA scheme is an important scheme that helps poor farmers in India. The Yojana (also called as the National Rural Employment Guarantee Act) is a government program that guarantees employment to the farmers.

The Atal Pension Yojana (APY) was launched by the Indian Government in 2011 and it provides pension to people who are aged 60 or above and they have been working for at least 20 years. This scheme was designed to help those who were unable to access social security schemes due to their age or health conditions.

The Job Card List is a list of jobs that are being offered by government agencies, non-profit organizations and private companies for which candidates can apply online through an e-job portal. These jobs can be from any field such as education, health, social work, etc., but there are certain fields where this list includes more than 1000 job opportunities which include all kinds of jobs from construction sector to teaching career paths. It also includes recruitment agencies

The NREGA Job Card List is a list of names that have been selected for the Atal Pension Yojana. This list will be used in the future to select beneficiaries who will get their pensions after they die.

This section is about the NREGA Job Card List. This list of job cards is a must-have for all NREGA workers. The list was prepared by the government and it has been made available to all employers so that they can identify and hire the right workforce in their organisation.

Atal Pension Yojana (APY) is a new scheme launched by the government of India in order to provide financial assistance to people who are unable to get or pay for their pension due to old age or disability. APY will be given as per age group, with an initial amount of Rs 1,000 per month for every member of a family (or any other group). The scheme will also be open to women, children and senior citizens.

The NREGA Job Card list is a list of job cards that are available for the next six months.

The Atal Pension Yojana is a pension scheme that was started by the Atal Pension Yojana Scheme (APY) and the Employees' Provident Fund Organisation (EPFO). The scheme provides a monthly income of up to Rs. 1,500 to all government employees who have been with their respective organizations for at least three years.

The NREGA Job Card List is a useful tool for the poor in India. The list is of unemployed youth who are looking for jobs and are willing to work. However, this list is not updated on a regular basis so it can be a source of frustration to the poor when they have no job prospects.

Atal Pension Yojana (APY)

The Atal Pension Yojana (APY) is a pension scheme that provides pensions to retired people of India. APY was launched on 1st January 2016 with an initial corpus of Rs 1 lakh crore. This pension scheme will provide pensions for those who were born between 1950 and 1969, who will reach retirement age between 65 and 67 years and whose life expectancy at birth is less than 75 years.

APY has been launched by the Union Government as an alternative to providing old-age pensions under the Seventh Pay Commission recommendations which were announced in November 2013 by then Finance Minister P Chidambaram on behalf of Prime Minister Manmohan Singh in Parliament. APY was

The NREGA Job Card List is a list of jobs that every Indian can apply for. It is also referred to as the 'job card'. The aim of the job card is to make it easier for people to find work and make it easier for them to get a job. This article will provide an introduction on how this list came into existence, what are the benefits of using the job card and how it can be implemented in our daily lives.

The Atal Pension Yojana was an initiative launched by the Government of India in 2015. It aims at reducing poverty among Indian households and making them eligible for various social security schemes such as pensions, provident fund, etc. The scheme was launched with an objective of providing a pension or provident fund to every household in India by 2022 (the date when all households would have access to pensions).

1 note

·

View note

Text

Atal Pension Yojana Benefits। অটল পেনশন যোজনা স্কিমের মাধ্যমে বছরে পাবেন ₹60000 হাজার টাকা, কিভাবে আপনিও পাবেন বিশদে জেনে নিন।

0 notes

Text

Atal Pension Yojana के अंतर्गत मिलेंगे 5000 रुपए प्रति माह की पेंशन, जाने कैसे मिलेगा लाभ

Atal Pension Yojana: https://combonews.in/under-atal-pension-yojana-you-will-get-a-pension-of-rs-5000-per-month-know-how-to-get-the-benefit/

0 notes

Text

Atal Pension Yojana Calculator ] : Get Monthly Pension of Rs 5,000 by depositing ₹ 200 every month FREE

Atal Pension Yojana Calculator ] : In old age, people want that they should continue to get assured pension even after retirement! In this, the Central Government's Atal Pension Yojana (Atal Pension Yojana) can help you a lot. You can build a huge pension

Atal Pension Yojana Calculator ] : In old age, people want that they should continue to get assured pension even after retirement! In this, the Central Government’s Atal Pension Yojana (Atal Pension Yojana) can help you a lot. You can build a huge pension fund by depositing small amounts every month. People between 18-40 years can invest in this Atal Pension Yojana (APY Pension Scheme). After…

View On WordPress

0 notes

Text

Best Monthly Pension Scheme for Senior Citizen

Given the ageing population and low-interest rates, the government has implemented several efforts to protect the interests of older citizens. The government has created different schemes for senior citizens under which citizens over 60 can earn a regular income through a pension by investing in such programs.

National Pension System (NPS)

The NPS system in India is an optional defined contribution pension system.

Eligibility for National Pension System

Model for All Citizens

A resident or non-resident Indian citizen is entitled to the following criteria:

The applicant must be between the age 18 and 60 at the time of application to the POP/ POP-SP.

The applicant must acknowledge and follow the Know Your Customer (KYC) guidelines outlined in the Subscriber Registration Form. All documentation needed for KYC compliance must be provided in its entirety.

The Atal Pension Yojana

The Atal Pension Yojana (APY), a pension system for Indian residents, focuses on unorganised sector workers. The APY provides a minimum guaranteed pension of Rs. 1,000/-, Rs. 2,000/-, Rs. 3,000/-, Rs. 4,000/-, or Rs. 5,000/- per month at the age of 60, depending on the subscribers' contributions. Any Indian citizen can participate in the APY scheme.

Below mentioned are the eligibility requirements:

The subscriber needs to be between the age 18 and 40.

They must have a savings account or a post office savings account.

The Employee Provident Fund

Every company registered with the EPFO will grant employees a Provident Fund (PF) account number. The PF number is a numerical code. It denotes the state, regional office, location, and PF member code. The PF trust manages the PF number. When an employee switches jobs, their PF number changes. A Universal Account Number (UAN) is a one-of-a-kind number assigned to PF members. When an employee switches jobs, their PF account number changes. The UAN number, however, remains the same.

New Pension System

The New Pension System in India was implemented in 2004 and has since covered new entrants to the civil service of the central government. An exception is military forces employees, which is not in the purview of the New Pension System. Public service employees who have worked in government departments since 2004 have stayed in the old system.

Employers and employees each contribute 12% of their salaries, which are stored in separate accounts. The new system's minimum retirement age is 60 years, and taxes are based on the EET concept, with a statutory annuitization of 40% of accumulated capital. While the scheme is intended for central government personnel, 26 of the 29 state governments have stated their intention to participate.

Defence Pension

This is a pension fund for the three branches of the armed forces and civilian employees working in Defence installations. The Government of India contributes on their behalf to assist Defence personnel with retirement planning.

Open your account for the National pension system in HDFC; it is available to any Indian citizen and your old days. Our skilled team will undoubtedly aid you in any way possible to make you live your old age independently.

0 notes

Text

How to Integrate PF with Other Financial Planning Tools

SLNPFConsultancy #SLNESIConsultancy #SLNPFESIConsultancy #PFConsultancyHyderabad #BestPFConsultancy

A Provident Fund (PF) is a government-mandated retirement savings scheme designed to help employees accumulate a corpus for their post-retirement years. While contributing to PF is crucial for long-term financial security, it’s equally important to integrate it with other financial planning tools for a holistic approach to wealth management. Combining PF with other investments and financial strategies can maximize returns, minimize risks, and ensure that you achieve your financial goals.

Here’s how you can effectively integrate your PF with other financial planning tools:

Assess Your Retirement Needs

Before integrating PF with other financial tools, it’s essential to understand your retirement needs. Start by calculating the amount you’ll need for a comfortable retirement, taking into account inflation, lifestyle expenses, and medical costs.

Use a Retirement Calculator: This tool can help you determine how much you need to save based on your current age, expected retirement age, and desired post-retirement income.

PF Contribution: Once you have your retirement goal, calculate how much of that goal will be covered by your PF contributions. The Employee Provident Fund (EPF) offers a fixed interest rate, which helps grow your corpus over time. However, relying solely on PF might not be sufficient for a comfortable retirement, making it crucial to combine it with other investment tools.

Link PF with Pension Plans

While PF provides a lump sum at the time of retirement, integrating it with pension plans ensures a regular income stream during retirement.

National Pension System (NPS): NPS is a government-sponsored pension scheme that offers tax benefits and allows you to create a diversified portfolio by investing in equities, corporate bonds, and government securities. The combination of PF and NPS ensures both a lump sum amount and regular income post-retirement.

Atal Pension Yojana (APY): This government-backed scheme provides pension benefits, which can be a useful addition to PF, especially for individuals in the lower-income bracket. It offers a guaranteed pension based on contributions.

By combining PF with NPS or APY, you can create a balanced post-retirement income structure, mitigating the risk of outliving your savings.

Combine PF with Mutual Funds

Mutual funds offer flexibility, diversification, and potentially higher returns compared to traditional savings schemes. While PF is a low-risk, fixed-income tool, adding equity-oriented investments like mutual funds can help accelerate wealth accumulation.

Systematic Investment Plans (SIPs): A SIP in mutual funds allows you to invest a fixed amount regularly, which can grow over time. Since PF predominantly grows through fixed interest rates, SIPs in equity mutual funds can help combat inflation and provide higher returns.

Balanced Funds: These funds invest in both equities and fixed-income securities, providing growth and stability. By investing in balanced funds, you can bridge the gap between the safety of PF and the higher risk-reward of equity markets.

Integrating PF with mutual funds ensures that you have both stability and growth in your financial portfolio.

Leverage Tax-saving Instruments

PF contributions are eligible for tax benefits under Section 80C of the Income Tax Act. However, you can maximize tax benefits by integrating PF with other tax-saving tools.

Public Provident Fund (PPF): PPF is a long-term savings scheme that offers tax-free returns. While both PF and PPF fall under Section 80C, investing in PPF can further boost your retirement corpus, given its safety and tax-free interest.

Equity-Linked Savings Scheme (ELSS): ELSS mutual funds offer tax benefits under Section 80C and have the potential to generate higher returns than PF. While ELSS carries a higher risk due to its equity exposure, its lock-in period of three years is shorter compared to PPF, making it an attractive option for long-term growth.

By diversifying your portfolio with tax-saving tools, you can reduce your tax liability while growing your wealth.

Utilize Health Insurance Plans

Retirement planning is incomplete without factoring in healthcare costs. Medical expenses can significantly drain your retirement savings if not planned for in advance.

Health Insurance Plans: While PF and pension schemes help cover your living expenses, a robust health insurance plan ensures that unexpected medical bills don’t erode your retirement corpus.

Critical Illness Insurance: In addition to regular health insurance, consider purchasing a critical illness plan that provides a lump sum payout upon diagnosis of severe illnesses like cancer or heart disease. This can protect your PF savings from being depleted due to medical emergencies.

Integrating health insurance with your PF contributions provides financial security against unforeseen healthcare costs during your retirement years.

Real Estate and Gold as Diversification Tools

Diversifying your investments is critical for managing risk. Along with PF, real estate and gold can be valuable tools to diversify your financial portfolio.

Real Estate: Investing in real estate offers rental income and long-term appreciation. Post-retirement, rental income can serve as an additional source of cash flow, supplementing the income from PF or pension schemes.

Gold Investments: Gold has historically been a hedge against inflation and market volatility. Including gold in your portfolio, whether through physical gold or digital gold investments, can add stability and act as a store of value.

Real estate and gold provide diversification beyond financial instruments, balancing your overall financial risk.

Create an Emergency Fund

Your PF contributions are primarily for retirement, but it's important to have an emergency fund for unforeseen financial setbacks.

High-yield Savings Account: Keeping your emergency fund in a high-yield savings account or a liquid fund allows easy access while earning moderate returns. This ensures that your PF remains untouched for retirement purposes.

Fixed Deposits (FDs): FDs are another safe option for an emergency fund. While they don’t offer high returns, their safety and liquidity make them reliable for unexpected financial needs.

Having an emergency fund ensures that you don’t have to dip into your PF or long-term investments for immediate expenses.

Conclusion

Integrating PF with other financial planning tools like pension schemes, mutual funds, tax-saving investments, health insurance, and real estate provides a well-rounded approach to financial planning. While PF offers safety and guaranteed returns, these additional tools ensure diversification, tax efficiency, and protection against risks like inflation and medical emergencies. With a holistic financial strategy, you can build a robust retirement corpus and achieve financial security for your golden years.

#sln consultancy#sln pf consultancy#sln esi consultancy#sln pf esi consultancy#Best PF Consultancy in Hyderabad

0 notes