#pension funds

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

63 notes

·

View notes

Text

Canadian pension funds invested $1.6 billion in companies tied to Israeli apartheid

#canada#canadian#pension funds#pensions#pension#$1.6billion#companies#israel#israhell#israeli#apartheid#israeli apartheid#benjamin netanyahu#fuck netanyahu#netanyahu a criminal of war#fears of new front in hamas war as hezbollah chief issues chilling threat to israel and netanyahu says ‘don’t test us’#bibi netanyahu#free palestine#freepalastine🇵🇸#palestine#free gaza#gaza strip#gazaunderattack#gaza genocide#gaza#no pride in genocide#zionist#zionistterror#zionistcensorship#class war

2 notes

·

View notes

Text

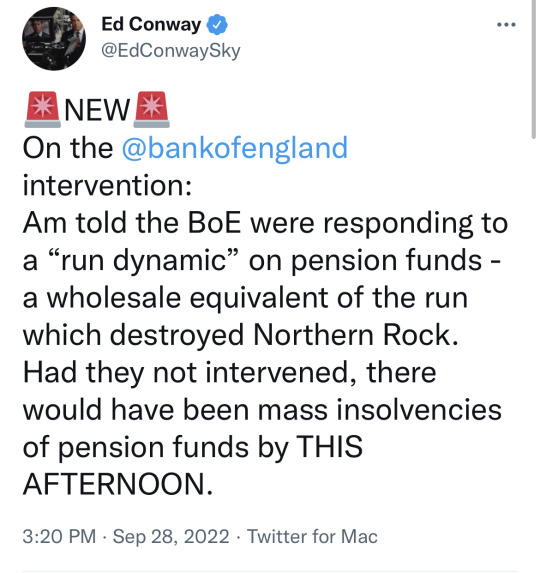

Another fun day in the ongoing macroeconomics course that Liz Truss is putting us through.

17 notes

·

View notes

Text

https://pioneergroup.co.za/

Pioneer House 83 Monty Naicker Road Durban 4001 Pioneer Group Solutions [email protected] 031 301 3205 https://pioneergroup.co.za/ Mon - Fri: 08:00 - 16:30 Sat: 08:00 - 13:00

#finance#financial aid#financial help#pension funds#Other monetary intermediation#Financial service activities#Other financial service activities

2 notes

·

View notes

Link

Excerpt from this New York Times story:

In several Republican-led states, the officials who oversee pension funds for millions of state workers are being told, or may soon be told, to ignore the financial risks associated with a warming world. There’s something distinctly anti-free market about policymakers limiting investment professionals’ choices — and it’s putting the retirement savings of millions at risk.

The Texas comptroller, Glenn Hegar, recently announced that 10 financial firms and 348 funds could be barred from doing business with the state’s pension plans because they appeared to consider environmental risks in their investment decisions regarding the fossil fuel industry. The day before, Gov. Ron DeSantis of Florida announced a similar move. Other states, including Idaho, Louisiana and West Virginia, have either taken or are thinking of taking similar actions, which amount to ideological litmus tests that will likely result in lower returns for pensioners.

These are short-sighted political moves from a party that typically champions the free market, and that is why 12 other state treasurers and New York City’s comptroller recently joined me [the author, the Treasurer of the State of Oregon] to urge that these policies be reversed. The people who will likely suffer are the public servants whose retirement money won’t be managed for a world being disrupted by a rapidly changing climate.

In several Republican-led states, the officials who oversee pension funds for millions of state workers are being told, or may soon be told, to ignore the financial risks associated with a warming world. There’s something distinctly anti-free market about policymakers limiting investment professionals’ choices — and it’s putting the retirement savings of millions at risk.

As Oregon’s state treasurer, I oversee pension funds. These funds are made up of the retirement savings of hundreds of thousands of teachers, police officers, firefighters and other public servants. It is my duty to invest their savings in a way that maximizes returns over the long term so that Oregon can fulfill the promise it made to provide them with a secure retirement. The world is shifting toward clean energy, and we need to take the risks and opportunities of that transition into account as we manage retirement funds for people who will need them 10, 20 or 30 years out.

19 notes

·

View notes

Text

Bank confirms pension funds almost collapsed amid market meltdown | Pensions industry | The Guardian

3 notes

·

View notes

Text

I had no idea we had an pension fund for the Pension Fund (also called the Norwegian Oil Fund) Is it a new pandemic? 🤔🤨

"ONE OF THE MANY FUNDS"???🤨 What other funds are there IN ADDITION TO THIS EXTRA FUND??? Where did the Coucil FIND ALL THESE MONEY TO SAVE? Are these money acquired in "extra legal" ways? And why? Is the Oil Fund in trouble? Will the public be invited to have a look into the accounting or is this too #exemptfrompublic - like so much else that's been going on for the last decades? 🤔🤨 AND LAST, BUT NOT LEAST - IS THIS THE REASON PEOPLE IN NORWAY STARVE OR STRUGGLE TO PAY OUR BILLS?

"Byrådets hovedgrep er å gå løs på et av kommunens mange fond. Det såkalte premieavviksfondet tappes for 700 millioner kroner.

I dette fondet har Oslo kommune fylt på med penger til å betale for økte pensjoner i framtida. Fondet skal brukes dersom det ikke er penger nok i det ordinære pensjonsfondet, som de kommuneansatte betaler inn til."

https://www.theguardian.com/business/2022/nov/12/uk-local-councils-deposit-taxpayer-cash-qatar-bank-lgbt-rights

#pension funds#local politics#uk politics#norwegian politics#i had no idea#knowledge#university memes#norway

1 note

·

View note

Text

The UK Equity Death Spiral: A Drain on the Lifeblood of British Business

Retail investors, too, are exiting the UK equity market, with the Investment Association reporting a withdrawal of £14 billion from UK equity funds in 2023 alone. This marks the eighth consecutive year of outflows. Furthermore, the growing popularity of Exchange Traded Funds (ETFs) exacerbates the situation, as the UK now represents just 3.6% of the World equity market. Any investor wanting to…

View On WordPress

0 notes

Text

The financial stakes for pension funds can bring larger paydays—and prestige—for law firms.

Last year, the attorneys who negotiated a steamfitters’ pension fund’s $1 billion settlement with Dell Technologies Inc. over a 2018 stock conversion were awarded a $266.7 million fee.

The court’s chief judge, Kathaleen St. Jude McCormick, currently is considering whether the lawyers representing the pension fund that pushed Tesla to agree to a $919 million settlement over board compensation deserve a $230 million fee award.

Tesla argues $63.5 million in legal fees would suffice. McCormick has said her decision whether to approve the settlement and attorneys’ fees will depend on how she decides what fees are reasonable for the lawyers in the other case where they successfully challenged Musk’s executive compensation. Those attorneys asked to be paid with over 29 million Tesla shares worth about $6 billion.

Both fee award requests are likely to raise similar legal arguments, McCormick said in a Jan. 31 letter to the parties in the board pay case.

The lawyers who take on these kinds of lawsuits—seeking to hold directors accountable for fiduciary duties—accept a high level of risk, said Paul Regan, a professor at the Widener University Delaware Law School.

Many such lawsuits get dismissed, or the court may only award modest fees. Working with pension funds enhances a law firm’s credibility, he said.

“A client with a stake that’s big enough to say to the court, ‘Look, I’m here for the long haul, I’m highly invested in how this goes, and I have the resources to monitor it as the lead plaintiff,’ probably makes an impact,” Regan said.

0 notes

Text

What is pension plan?

What is pension plan? Retirement is a time for you to focus on yourself after years of working hard to advance your profession and take care of your children. If you were wise with your financial management while you were younger, your post-retirement years can be a joyful and exciting new chapter of life. You can choose a pension plan to make sure you won't have to make lifestyle compromises after retirement.

0 notes

Text

Disability Pension in India

Seeking the best disability pension lawyer in India? Our expert legal counsel provides the support you need to access disability pension benefits effectively.

0 notes

Text

Retirement planning is an essential aspect of financial management that allows individuals to enjoy a comfortable and secure future. In the UK, with a rapidly ageing population and evolving economic landscape, the importance of effective retirement planning cannot be overstated. This article aims to provide valuable insights and strategies to help you navigate the complexities of retirement planning.

#Retirement Planning#Financial Security#Investment Strategies#Savings Plans#Pension Funds#Long-term Financial Goals#Retirement Income#Financial Advisors#Wealth Management#Estate Planning#Tax Efficiency#Wills & Trusts

0 notes

Text

Mutual Funds, Insurance, and Pension Fund.

Mutual funds, insurance, and pensions funds are major financial intermediaries. Mutual funds represent the second-largest pool of private capital in the world after the banking industry. Mutual funds are classified into open-ended, closed-end, and unit investment trusts. The main categories of funds are stock or equity funds, bonds or fixed-income funds, money market funds, and hybrid funds.

The insurance industry is basically classified as life and property insurance. The two main types of life insurance are term and permanent life insurance. There are also other life insurance products such as group life insurance, credit life insurance, annuity and pension plans. Property/casualty insurance is insurance on homes, cars, and businesses. The three fundamental risks faced by insurance companies are underwriting, market, and regulatory risks. Value at risk and expected shortfall are two major metrics used to measure and manage financial risks in insurance. Pension funds are classified into different types: public and private pension plans, occupational and personal pension plans, DC and DB plans, protected and unprotected pension plans, funded versus unfunded pension plans, single- and multiple-employer pension funds. Private pension funds consist of 401(k), 403(b), and individual retirement accounts (IRAs).

Learn more on Mutual Funds, Insurance, and Pension Funds.

#Mutual funds#money market funds#bonds or fixed-income funds#credit life insurance#Private pension funds#and individual retirement accounts (IRAs).#Pension funds#international day of banks#4 december#financial risk management#insurance industry

0 notes

Text

Folks often complain about billionaire corporate profits, some even go so far as to mention Shareholder Profits.

Why do none mention who those shares holders are? For example, the Teachers Pension Fund…

#adam curtis#The Mayfair Set#history#economics#market forces#selling england by the pound#pension funds#elephant in the room

1 note

·

View note

Text

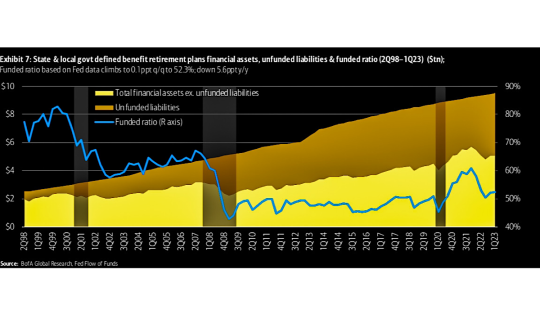

Unfunded defined benefit public pension liabilities stood at roughly $4.4tn in 1Q23, which is a $14.6bn or 0.3% increase q/q.

On a y/y basis, 1Q23’s unfunded amounts are $628.6bn, or 16.5% larger. Funded ratios decreased 5.6ppt y/y to 52.3% on a projected benefit obligation (PBO) basis – well off the post-financial crisis highs reached in 4Q21.

-baml

#discountrate #investments #EconTwitter #Fed #InterestRate

https://twitter.com/mohossain/status/1226287066775945216?s=46&t=GtuOmoaTjOwevz2JidiiDQ

0 notes

Text

The Ultimate Guide to Navigating Switzerland's Wealth Tax

Switzerland is known for its high standard of living and being a hub for financial services, which makes it a popular destination for high net worth individuals. However, Switzerland's wealth tax system can be complicated and confusing for those who are not familiar with it. In this article, we will provide you with the ultimate guide to navigating Switzerland's wealth tax system so that you can be prepared.

What is Wealth Tax?

Wealth tax is a tax levied on the net worth of an individual or entity. Switzerland is one of the few countries that impose wealth tax, which is based on the value of a person's assets, including real estate, investments, bank accounts, and other personal property. The tax rate varies depending on the canton or municipality where the individual resides, but it typically ranges from 0.2% to 1% of net worth.

Who Pays Wealth Tax?

Wealth tax is imposed on all Swiss residents, including individuals, partnerships, and corporations. Non-residents are not subject to Swiss wealth tax unless they own property in Switzerland. For individuals, the tax is assessed on their worldwide assets, while for corporations, the tax is assessed on their assets located in Switzerland.

How is Wealth Tax Calculated?

Wealth tax is calculated by multiplying the net taxable assets by the tax rate applicable in the canton or municipality where the individual resides. The net taxable assets are determined by subtracting any debts or liabilities from the total value of the assets. The tax rate can vary significantly from one canton or municipality to another, so it is essential to be aware of the applicable tax rate.

What Assets are Taxed?

Swiss wealth tax applies to all assets owned by an individual, including real estate, bank accounts, investments, and personal property. However, certain assets are exempt from wealth tax, including:

Pension funds

Life insurance policies

Artwork and collectibles (if held as a hobby rather than for investment purposes)

Assets held in a Swiss-registered charitable foundation

It is essential to note that the exemption of certain assets from wealth tax may vary from canton to canton, so it is crucial to consult with a tax professional to determine which assets are subject to tax.

How to Reduce Wealth Tax?

There are several strategies that individuals can use to reduce their wealth tax liability in Switzerland. These include:

Gifting assets: An individual can reduce their wealth tax liability by gifting assets to their children or other family members. However, it is important to note that there may be gift tax implications associated with this strategy.

Setting up a trust: A trust can be used to transfer assets out of an individual's name and into a trust, reducing their wealth tax liability. However, setting up a trust can be complicated and costly, so it is essential to consult with a tax professional before proceeding.

Investing in tax-exempt assets: Certain investments, such as municipal bonds and Swiss government bonds, are exempt from wealth tax in Switzerland. Investing in these types of assets can help reduce an individual's wealth tax liability.

Moving to a different canton or municipality: Wealth tax rates can vary significantly from one canton or municipality to another. Moving to a canton or municipality with a lower tax rate can help reduce an individual's wealth tax liability.

It is important to note that these strategies may not be suitable for everyone and may have additional tax implications. Therefore, it is essential to consult with a tax professional before proceeding with any of these strategies.

What are the Penalties for Non-Compliance?

Swiss tax authorities take tax compliance very seriously and impose severe penalties for non-compliance. Non-compliance can include failing to file a tax return, understating income, or failing to report assets.

In conclusion, navigating Switzerland's wealth tax can seem daunting at first, but with the right information and guidance, you can ensure that you are prepared to handle it. By understanding the basics of wealth tax, calculating your net worth accurately, and taking advantage of tax deductions and exemptions, you can minimize your tax liability and ensure that you comply with Swiss tax laws.

We hope that this ultimate guide has provided you with valuable insights and tips to help you navigate Switzerland's wealth tax with ease. For more informative articles and news updates on finance and taxation, be sure to check out Online World News at https://onlineworldnews.com/. Stay informed, stay prepared, and stay ahead in today's complex financial landscape.

0 notes