#attendance and payroll software

Text

Attendance management is crucial for any organisation. It helps track the presence of employees so accurate payroll is generated.

0 notes

Text

Boost Your Business with Professional Accounting and Bookkeeping Services

As a business owner, you know that managing your finances is critical to the success of your business. Accurate bookkeeping and accounting can help you track your income and expenses, stay compliant with tax regulations, and make informed decisions about your business's financial future. However, managing your financial records can be a time-consuming and complex process, especially if you lack the necessary skills and resources. That's why it's essential to consider professional accounting and bookkeeping services. In this blog, we will discuss how these services can boost your business and why you should consider them.

Accounting and Bookkeeping Services

Professional accounting and bookkeeping services can help you streamline your financial processes, save time and money, and improve your business's overall financial health. They offer a range of services, including:

Account payable management: Managing your accounts payable can be a daunting task, especially if you have a high volume of invoices to process. Professional accounting and bookkeeping services can help you stay on top of your accounts payable by creating a system that ensures timely payments and reduces the risk of errors and duplicate payments.

Attendance and payroll software: Professional accounting and bookkeeping services can help you automate your attendance and payroll processes by implementing software that simplifies the process. This will help you save time, reduce errors, and ensure compliance with tax regulations.

Business process automation: Professional accounting and bookkeeping services can help you automate your business processes, reducing the risk of errors and improving efficiency. This will help you save time, reduce costs, and improve your business's overall financial health.

Benefits of Accounting and Bookkeeping Services

Now that we've discussed what professional accounting and bookkeeping services entail, let's take a closer look at some of the benefits they offer.

More time to focus on your business: By outsourcing your accounting and bookkeeping tasks, you can free up valuable time to focus on other aspects of your business, such as marketing, sales, and customer service.

Reduced costs: By outsourcing your accounting and bookkeeping tasks, you can save money on overhead costs associated with hiring and training in-house staff. You'll also reduce the risk of errors, which can lead to costly fines and penalties.

Improved accuracy: Professional accounting and bookkeeping services are staffed by experienced professionals who are trained to handle complex financial tasks accurately. By outsourcing these tasks, you can ensure that your financial records are accurate and up-to-date.

Better decision making: Accurate financial records are essential to making informed decisions about your business's financial future. By outsourcing your accounting and bookkeeping tasks, you'll have access to up-to-date financial statements, which can help you identify areas of your business that are performing well and areas that need improvement.

Compliance with tax regulations: Tax regulations are constantly changing, and it can be challenging to keep up with them. Professional accounting and bookkeeping services can help you stay compliant with tax regulations by ensuring that your financial records are accurate and up-to-date.

Full spectrum of offerings by MYND

At MYND Solutions, we provide a range of finance solutions, including accounting and bookkeeping services, to help businesses like yours thrive. Here are some of the ways our services can help you boost your business:

Improve Account Payable Management: Managing your accounts payable can be a time-consuming and complicated task, especially if you have to deal with multiple suppliers and vendors. However, with professional accounting and bookkeeping services, you can streamline your account payable process, ensuring that all payments are made on time and accurately. This will help you build stronger relationships with your suppliers and vendors, and ultimately help you grow your business.

Efficient Attendance and Payroll Software: Managing employee attendance and payroll can also be a complicated task. However, with the right attendance and payroll software, you can simplify the process and ensure that your employees are paid accurately and on time. At MYND Solutions, we offer efficient attendance and payroll software that can help you manage your employee payroll with ease.

Streamline Business Process Automation: Streamlining your business processes can help you save time and resources, which you can use to focus on growing your business. With professional accounting and bookkeeping services, you can automate your business processes, including financial reporting and bookkeeping. This will help you manage your finances more efficiently, giving you the information you need to make informed business decisions.

Accurate Bookkeeping and Accounting Services: Accurate bookkeeping and accounting are crucial to the success of your business. However, these tasks can be time-consuming and complex, especially if you have limited accounting knowledge. Professional accounting and bookkeeping services can help you manage your finances accurately, ensuring that your financial statements are up-to-date and accurate.

Conclusion

Professional accounting and bookkeeping services can be a valuable asset to your business. By outsourcing your accounting and bookkeeping tasks, you can free up valuable time, reduce costs, and ensure compliance with tax regulations. If you're considering outsourcing your accounting and bookkeeping tasks, contact MYND Solutions today. Our experienced professionals are dedicated to helping your business thrive.

#account payable management#account payable management services#accounting and bookkeeping services#attendance and payroll software#bookkeeping and accounting services#business process automation#business process automation software#compliance assessment#compliance audit services#compliance audit software#compliance management software#compliance management tools#compliance monitoring#compliance risk assessment#compliance risk management services#compliance services

1 note

·

View note

Text

Verification of Uploaded Documents

We have robust measures in place to verify the authenticity of uploaded documents such as address proofs and employment contracts. This includes automated verification tools that cross-reference details provided with trusted databases or through verification services. Additionally, designated personnel review documents to ensure compliance with organizational standards and regulatory requirements.

#hrms#hr#humanresources#hrsoftware#hrtech#payroll#humanresource#hrmanagement#payrollsoftware#hris#business#humanresourcemanagement#employee#software#hrsystem#recruitment#humanresourcesmanagement#payrollmanagement#hrd#leadership#payrollservices#shrm#hrconsultant#technology#hrsolutions#attendance#management#hrtips#hrm#hrblog

2 notes

·

View notes

Text

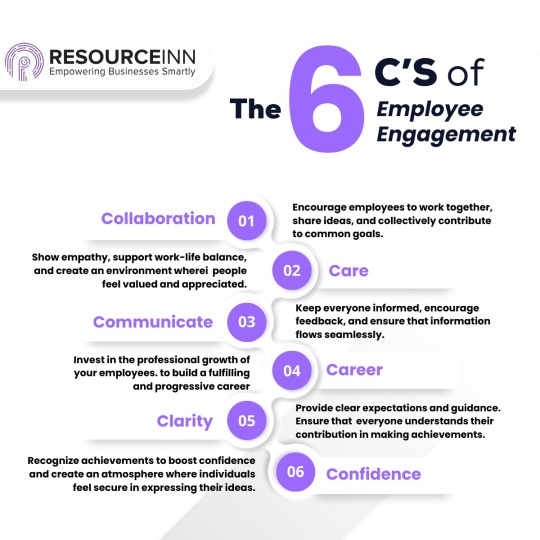

According to 𝐆𝐚𝐥𝐥𝐮𝐩'𝐬 𝐒𝐭𝐚𝐭𝐞 of the Global Workplace, only 23% of employees are actively engaged globally 📉💼

It’s more crucial than ever for organizations to reduce turnover, retain top talent, increase productivity, and build better workplace relationships. 🤝

However, it can be managed with the 𝟔𝐂𝐬 𝐨𝐟 𝐄𝐦𝐩𝐥𝐨𝐲𝐞𝐞 𝐄𝐧𝐠𝐚𝐠𝐞𝐦𝐞𝐧𝐭

1 → Collaboration

2 → Care

3 → Communicate

4 → Career

5 → Clarity

6 → Confidence

From commitment to communication, each C intertwines for workplace brilliance

(You can view more details in the infographics 📊 below)

Which of the 6 Cs of employee engagement do you struggle with the most? Share your experience with us 💬👇

2 notes

·

View notes

Text

HR Software in India

In today’s fast-paced corporate world, HR software has become an essential tool for businesses in India, enabling smooth management of tasks like recruitment, payroll, and employee performance. With the increasing complexity of workforce management, especially in larger enterprises, HR software solutions provide automation, enhance efficiency, and offer a unified platform to streamline operations. These solutions allow HR professionals to focus more on strategic initiatives, ensure compliance with India’s labor laws, and boost employee engagement and productivity simultaneously.

For businesses in India, where compliance with labor laws is crucial and personnel management can be complex, HR software is an essential tool. At OfficeKitHR, we provide comprehensive HR solutions tailored to meet the unique needs of companies across various industries. Our platform optimizes operations and reduces administrative costs by automating key HR tasks such as payroll, recruitment, attendance tracking, and performance management. With a unified system, we enable HR professionals to focus on strategic initiatives that drive business growth.

0 notes

Text

Fee Management Software by Cyber School Manager: Simplify Your Finances

#fee management software#school management mobile app with complete erp#best school time table software#best integrated school management software#school attendance software#school management system#best school erp software#school management software#top student management system#admissions management software#payroll manager software

0 notes

Text

Best HR Software Providers in Bahrain

Enhance your HR and payroll processes with the best HR software in Bahrain. Our HR and payroll software Bahrain offers cloud-based HR management, HR CRM software, and comprehensive solutions for small businesses and SMEs.

#hr management software bahrain#hr & payroll software bahrain#hr payroll software bahrain#best hr software in bahrain#hr and payroll software bahrain#hr and payroll software in bahrain#hr crm software#best hr software for small business#best hr management software#sme hr software#hr management software for small business#hr and payroll software#hr software companies#hr software for small business#hr payroll software#hr attendance software#hr software pricing#best hr software#cloud based hr management software#cloud based hr software#hr application software#hr management software

0 notes

Text

10 HR Technology Products for Secure Recruitment

HR technology is the biggest existing remedy to impromptu activities in the operations of an organization. What gives it a unique touch is the ideal application of HR software systems to existing human resource functions. Numerous core HR features can be actively managed with the support of the right technology tools.

The role and responsibilities of HR technology to build a secure platform for recruitment is well-documented. We will analyze more about HR recruitment and list the top ten HR products and services for recruitment here.

Embracing HR Technology At Its Best

Before delving deeper into the crucial role of smart HR recruitment functions, you should learn about the optimum use cases of HR technology. The concept has redefined how organizational operations are carried out. But it doesn’t end there. Technology innovations are the key to developing an excellent portfolio for any business for branding purposes.

Even in HR marketplaces, suitable application of technology is the distinguishing factor that relates well to the arrival of fresher HRMS professional tools. It directly correlates with the human capital management aspect of companies. This, in turn, contributes to the work-life fit that is desired by most resource personnel in present times.

A collaborative working environment is a must to generate attention for optimum technology allocation in the HR domain. It is only by including and enabling resource member participation that you can develop a mindful HR best practice with efficient technology inputs. Business leaders ardently follow the concept of embracing HR technology to boost their working potential and final output delivery.

Recruitment Function in HRMS Solutions

The recruitment and hiring module in an HRMS service can be conveyed using several pointers that relate to the domain. A few of them are listed below:

The primary option to build a transformative recruitment environment is to appoint technically adept digital tools to perform. These could extend from general automation services to dynamic and resourceful AI-induced systems. Each one serves a unique function that you can leverage for the betterment of the organization.Technology tools alone can’t deliver proper workflow techniques for HR recruitment processes.

You should seek the capable assistance of smart working resource personnel to empower the whole hiring process. Staffing and recruitment should follow a personalized and consistent approach, with the option for suitable upgrades.When you employ technology portals to carry out recruitment functions, responsiveness is important.

Whether it is design, user interaction, intuitive decision-making skills, or social hiring features, responsiveness plays a huge role in managing the system.The core recruitment features in an HR software suite cover cost-efficiency parameters and metrics. It also includes time management as an essential function to control.Database management with personalized tracking features and real-time documentation is a terrific HRMS function under the recruitment category.

It will open up the space to sync with applicant functions ranging from the initial onboarding process to the numerous aspects of the HR recruitment and hiring process.

Recruitment using technology is necessary for ensuring organizations maintain a competitive edge in the marketplace. The recruitment function is relevant even for managing the capability check and skill assessment of human capital resources in the firm. HRMS systems can impart an optimized service to the recruitment function in a firm. Shorter hiring cycles and faster recruitment transactions are experienced in this model.

HR recruitment and selection, plus the screening process, is also made feasibly easy to execute. With the inflow of excellent recruitment tactics in digital mode, the overall branding of the organization will improve. Maximum potential can be derived from the recruitment process irrespective of its tasks in direct, remote, or hybrid modes.

Top 10 HR Technology Products for Hassle-free Recruitment

Without further ado, let’s take a look at the top ten HR technology products available in the market to manage streamlined recruitment for your organization.

Artify360 HR Software

Look no further than Artify360 HR Software if your goal is to employ a sensational HRMS solution with essential recruitment features. It will work feasibly for all industries and organizations in the Middle East region and countries like UAE, Saudi Arabia, Kuwait, Bahrain, Qatar, and Oman.

HR recruitment agencies in Dubai and the top Middle Eastern countries have testified to the success of HR Software Bahrain. More on the Artify360 system is detailed in the final section of this article.

PeopleHum

PeopleHum is an excellent recruitment management system that aims to provide an exclusive platform to enrich the candidate experience. It works well for generating an automated recruitment process and also helps with collaborative hiring models.

Bayzat

Bayzat is a top-notch HR platform that can efficiently carry out all operational activities within an organization. It is majorly known for HR payroll processes but can actively contribute to recruitment features also. Bayzat is based in multiple countries in the Middle East.

GreytHR

In recruitment functions where qualified candidates are urgently needed from a wider talent pool, platforms like GreytHR can sufficiently help. It is useful in evaluating the top-rated HR features for staffing by attracting quality talent from the industry space.

Workday

For employee recruitment and retention in the Middle East, Workday can assist in delivering a dedicated service. It is an excellent talent acquisition software with proven customers all over the world. Challenges within the system are dealt with internally and cause a massive change in the traditional HR processes.

ZenHR

For research-oriented HR software to deal with recruitment features, ZenHR is a good pick. It can help you track the complete hiring process to facilitate optimum staffing methods. You can use the recorded analytics for future hiring references.

MenaItech

MenaItech is a reliable partner that can help you succeed in your organization’s recruitment missions. The full-fledged HR staffing solution works on an end-to-end basis, providing a supportive role for your recruitment aspirations.

Darwinbox

Darwinbox is a globally acknowledged HR software system that enables your company’s Middle East operations to work exceptionally well. It is a new-age HR management solution with the involvement of specific workflow strategies for recruitment and HR staffing roles.

Oracle

Oracle is the most recognizable name on this list. The global software solution is an excellent example of serving multiple tasks in the HR domain. Their recruitment game is spot on and provides significant value addition to the holistic HCM process. They offer the best services to the human capital resource management process.

SAP

SAP also promotes the concept of HCM in large capacities and is a charming addition to the HR recruitment software for the Middle East. An intelligent automated process takes care of the staff sourcing and final hiring streams of the organization’s recruitment principles.

#software#hr management#hrms software#hrms payroll software#attendance management#hiring#payroll#recruitment

0 notes

Text

Arity HRM PRO - All on one Attendance and payroll management software #1

https://youtu.be/ghT9LlfmnJ8

https://www.youtube.com/shorts/eQc0_kzHetc

HRM PRO - 360 degree Attendance Contact us or schedule a demo #hrmssoftware #hrcommunity #attendancesheet #attendancemanagement #attendancesoftware #hashkriotech #innovative #trending #trailer #payroll #accurateinformation #niceview #smartsoftware HR Software Human Resources Management System (HRMS) Employee Management Software Payroll Software Time and Attendance Software Performance Management Software Recruitment Software Onboarding Software HR Analytics Employee Self-Service Portal

https://support.hashkrio.com/

https://hashkrio.com

#hr software#hr management#attendance management#payroll software#recruitment software#onboarding#best hr software#secure storage#technology

0 notes

Text

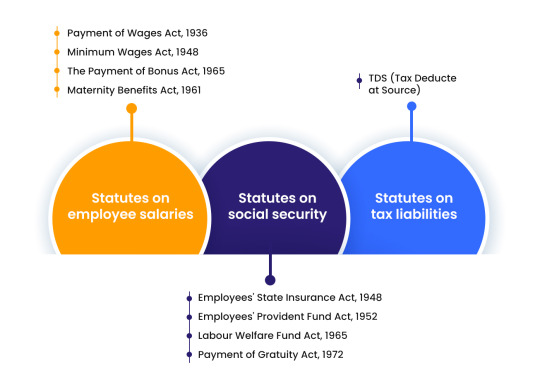

Understanding Taxes: A Simple Guide to Payroll Compliance in India

What is payroll compliance?

Payroll compliance involves adhering to all relevant laws and regulations governing employee compensation. These laws, which can be local, state, or federal, impose a variety of obligations on the employer.

Businesses must constantly abide by the many relevant regulations, regardless of the industry in which they operate. If a problem occurs, it may expose the company to expensive fines and legal action. In many instances, this may also affect the organization's eligibility for tax credits, endangering its financial stability.

Why is payroll compliance important?

Whether big or small, ensuring payroll compliance is of the utmost importance. Here’s why being compliant is important:

Protecting Employees: Compliance ensures employees receive their fair share of wages, including overtime pay and any other benefits like unemployment insurance and social security. This protects their financial well-being and fosters a positive work environment.

Avoiding Penalties and Interest: Non-compliance can lead to hefty fines and interest charges from tax authorities. These penalties can significantly impact your business's bottom line.

Legal Repercussions: Serious violations can lead to legal trouble, including lawsuits from employees or even business closure in extreme cases.

Building Trust with All Stakeholders: Compliance fosters trust not just with the government but also with employees, investors, and business partners. It demonstrates your commitment to ethical and responsible business practices.

Labor laws in India

In 2019, the Ministry of Labor and Employment consolidated 29 central legislative laws into four labor codes. Four main categories—labor wages, industrial relations, social security, occupational safety, health, and working conditions—were used to group these laws.

Statutes on employee salaries and benefits

Payment of Wages Act, 1936

The Payment of Wages Act ensures that workers receive their pay on schedule by establishing penalties for over one-month overdue wages.

As per this regulation, companies with less than 1,000 workers must pay their employees by the seventh of the month. If the company employs more than 1,000 people, their salaries must be paid by the tenth of each month.

This doesn't apply to those whose monthly salary exceeds ₹10,000. Cash or check payments are the preferred salary payment methods under the act. Employee permission is required before any bank transfers can take place. States have different laws and regulations.

Minimum Wages Act, 1948

The Minimum Wages Act is a central legislation established to prevent the exploitation of workers by fixing a minimum wage rate. The minimum wage fluctuates based on location and industry. Factors influencing its determination include living costs, payment frequency (hourly, weekly, or monthly), and job classification

Factors considered before deciding minimum wages include the cost of living, wage period (hourly, weekly, or monthly), and job type.

The Payment of Bonus Act, 1965

The Payment of Bonus Act, of 1965 offers an annual bonus to workers in specific enterprises, such as factories and businesses with 20 or more employees. According to the Act, the establishment's profits and the employee's wage determine the bonus. Employees who have worked for 30 days during the fiscal year and earn ₹21,000 or less per month (basic salary + DA, excluding allowances) are eligible for the bonus payment.

Only basic pay and deferred compensation (DA) are included in salary or earnings; other allowances (such as overtime, HRA, etc.) are not. A minimum of 8.33% and a maximum of 20% should be paid in bonuses. The payment must be made within eight months after the accounting year's end.

Maternity Benefits Act, 1961

The Maternity Benefits Act, of 1961 is put in place to protect women during pregnancy. This act provides them with paid time off work. This act applies to companies with more than ten workers. It's also one of the most crucial legal obligations that organizations must comply with.

To qualify for the benefit, a female employee must have worked for an establishment for a minimum of 80 days in the previous year. The payment during the leave is calculated based on the average daily wage for the period of absence.

This legislation applies to companies that fall under the purview of the relevant applicable legislation, such as factories, mines, plantations, government establishments, stores, and any other establishment that the Central Government designates.

The most recent amendment's maternity benefits include the following:

The latest amendment to maternity benefits extends maternity leave to 26 weeks, up from the previous 12 weeks. You can use maternity leave for a maximum of eight weeks. An additional enabling element regarding women's "work from home" options has been included by the Maternity Benefit Amendment Act. These options can be used after the 26-week leave term has ended. The nature of the work will determine this.

Statutes on Social Security

Employees' State Insurance Act, 1948

ESI assists workers in overcoming unanticipated events, such as maternity leave, medical emergencies, or work-related disabilities. The employee contributes 0.75%, while the employer contributes 3.25% for each pay check. Employers who employ people in non-seasonal factories with more than ten workers must provide ESI. However, this only applies to workers making less than ₹21,000 a month.

Given that ESI applies exclusively to employees earning less than ₹21,000, it's important to verify their earnings at each review cycle. Employees must continue contributing to ESI until the end of the contribution period if their earnings exceed ₹21,000. Contribution periods are six-month cycles, running from April to September and October to March.

Employees' Provident Fund Act, 1952

An employee's largest social welfare contribution is the Employee Provident Fund and Miscellaneous Act. This includes a 12% contribution to the employee's retirement fund from both the employer and the employee in the form of dearness allowance (DA) and basic pay.

Employee take-home pay increases as a result of the tax exemption granted to an employee's contribution to their PF account under Section 80C of the Indian Income Tax Act. Companies that employ 20 people or more are required to abide by the PF legislation.

Labor Welfare Fund Act, 1965

The well-being of workers in certain industries is the primary concern of the Labour Welfare Fund (LWF). It gives laborers access to facilities that will enhance their living standards, social security, and working circumstances.

Specific state authorities are responsible for regulating the statutory contributions of LWF. The state labor welfare board sets the frequency and amount of the contribution, which varies from one state to the next.

Payment of Gratuity Act, 1972

Gratuity is a significant contributor to an employee's well-being. It is the most significant legal requirement for businesses along with EPF. An employee receives a gratuity from their employer as payment for the services they provided while they were employed. If a person has worked for an organization for at least five years, they are eligible to receive a gratuity.

Statutes on tax liabilities

TDS (Tax Deducted at Source)

It was implemented to levy taxes on the income source of each individual. Commission, interest, and salary are just a few of the income streams that are subject to TDS.

Depending on their pay, employees are subject to varying tax rates. According to the most recent union budget releases, Indian employees have a choice between two distinct tax regimes.

Old Tax Regime:

Under the old tax regime, individuals are subject to a structured system of tax slabs, with tax rates varying based on their income levels. This regime allows for deductions and exemptions under various sections of the Income Tax Act, such as Section 80C (investment in specified instruments), Section 80D (health insurance premiums), and others. While the old tax regime offers a multitude of tax-saving opportunities, it may result in higher tax liabilities for certain individuals, especially those in higher income brackets.

New Tax Regime:

On the other hand, the new tax regime provides a streamlined tax structure featuring reduced tax rates but fewer deductions and exemptions. Under this regime, taxpayers can opt for a flat tax rate applicable to their income slab, without availing of deductions under various sections of the Income Tax Act.

The new tax regime aims to simplify the tax filing process and lighten the compliance burden on taxpayers, especially those with moderate incomes. However, individuals choosing the new tax regime may miss out on certain tax-saving benefits provided under the old regime

Choosing Between the Regimes:

The choice between the old and new tax regimes largely depends on individual preferences, financial goals, and tax planning strategies. While the old regime offers greater flexibility in tax planning and the potential for higher tax savings through deductions and exemptions, the new regime provides simplicity and ease of compliance with lower tax rates.

Payroll Compliance Best Practices

Payroll Software: Payroll software calculates deductions for federal, state, and local taxes based on employee location and filing status. It also handles electronic tax filings, saving you time and ensuring timely submissions.

Track important deadlines: Meeting payroll deadlines is crucial to avoid penalties and maintain employee satisfaction. Key deadlines include tax filing dates, employee paydays, and submission deadlines for regulatory forms. Using a reliable calendar or payroll software alerts can help you stay organized and ensure timely submissions.

Verifying employees: Verifying employee information is essential for accurate payroll processing. Ensure that employee data, such as social security numbers, addresses, and tax withholding information, is up-to-date and accurate. Conduct regular audits of employee records to catch and correct any errors promptly.

Time and attendance system: Effective time and attendance systems play a vital role in payroll compliance by accurately tracking employees' work hours. Look for a system that integrates seamlessly with your payroll software to streamline the payroll process and reduce errors. Features to consider include mobile access, biometric authentication, and real-time reporting capabilities.

0 notes

Text

Attendance Management Software for Business: Its Role in Effective Employee Handling

Some of the best IT solution providers help organisations implement attendance management software for proper human resource management. Automation in the space brings transparency and efficiency, which results in the organisation’s success.

0 notes

Text

From Paper to Digital: Transforming Payroll with Innovative Systems Software

Any organisation's payroll management is essential, and it calls for a high level of precision, effectiveness, and security. Payroll management system software has developed greatly in response to the quick development of technology, offering businesses a variety of options to fulfil their demands for payroll processing. In this article, we will delve into the future of payroll system software, exploring the trends, challenges, and opportunities that lie ahead.

Trends in Payroll Processing Software

Increased Adoption of Cloud Technology: One of the most notable trends in payroll system software is the increased adoption of cloud technology. Cloud-based payroll management systems provide organisations with the flexibility to access their payroll data from anywhere at any time. This eliminates the need for in-house servers and hardware, reducing costs and increasing efficiency. Cloud-based payroll systems also provide organisations with automatic software updates, ensuring that they always have access to the latest features and security updates.

Artificial Intelligence and Machine Learning: Artificial intelligence (AI) and machine learning (ML) are rapidly transforming the payroll systems software industry. AI-powered payroll management systems can automate routine tasks such as data entry, payroll calculations, and tax compliance, freeing up HR staff to focus on more strategic tasks. Additionally, machine learning algorithms can analyse payroll data and provide insights that can help organisations optimise their payroll processes and make better business decisions.

Integration with Other HR Systems: Another trend in payroll systems software is the integration of payroll management systems with other HR systems such as time and attendance systems, benefits management systems, and performance management systems. This integration enables organisations to streamline their HR processes and improve the accuracy and efficiency of their payroll processes.

Challenges in Payroll Processing Software

Data Security: Data security is a major challenge for payroll management systems. With the increasing use of cloud-based systems, organisations must ensure that their payroll data is protected against cyber threats such as hacking, theft, and data breaches. To address this challenge, organisations must implement robust security measures, such as encryption, multi-factor authentication, and secure data backups.

Compliance with Labor Laws and Regulations: Compliance with labour laws and regulations is another major challenge for payroll management systems. Organisations must ensure that their payroll processes comply with local, state, and federal laws, including minimum wage laws, overtime laws, and tax laws. This can be a complex and time-consuming process, and organisations must stay up-to-date with changes in the law to avoid potential legal and financial risks.

User Adoption and Training: User adoption and training are also significant challenges in payroll systems software. Organizations must ensure that their HR staff and employees understand how to use the software effectively and efficiently. This requires proper training, documentation, and support to ensure that users are confident and competent in using the software.

Opportunities in Payroll Processing Software

Increased Efficiency and Productivity: The use of Payroll management system software provides organisations with the opportunity to increase their efficiency and productivity. By automating routine tasks and streamlining payroll processes, organisations can save time and reduce the risk of errors, improving overall productivity.

Improved Data Analytics and Insights: Payroll management system software also provides organisations with the opportunity to improve their data analytics and insights. By leveraging the power of AI and ML, organisations can gain valuable insights into their payroll data, including trends, patterns, and anomalies. These insights can be used to make data-driven decisions that can help optimise payroll processes and improve overall business performance.

Enhanced Compliance and Security: The use of payroll systems software also provides organisations with the opportunity to enhance their compliance and security. By automating compliance checks and implementing robust security measures, organisations can reduce the risk of errors and data breaches, ensuring that their payroll processes are secure and in compliance with relevant laws and regulations.

Conclusion

The future of payroll systems software is exciting, with many trends, challenges, and opportunities ahead. From the increased adoption of cloud technology and the integration of AI and ML to the challenges of data security and user adoption, organisations must stay abreast of the latest developments in payroll systems software to remain competitive and effective. By taking advantage of the opportunities presented by this technology, organisations can improve their efficiency, productivity, and compliance, ensuring that their payroll processes are secure and effective for years to come.

#payroll management system#payroll systems software#account payable management#accounting and bookkeeping services#attendance and payroll software#bookkeeping and accounting services#business process automation

0 notes

Text

Accuracy: Attendance machines provide precise records of when employees arrive and leave. This accuracy helps in calculating work hours, overtime, and attendance-related policies.

Efficiency: Automated attendance systems save time compared to manual methods like paper registers or spreadsheets. Employees simply need to scan their fingerprint, card, or use biometric recognition, reducing administrative workload.

Transparency: Having a digital record of attendance promotes transparency. It reduces disputes over attendance discrepancies and ensures fair treatment of employees based on actual attendance data.

Compliance: Many industries have legal requirements regarding employee attendance and work hours. Attendance machines help businesses comply with labor laws and regulations by maintaining accurate records.

Cost Savings: Over time, attendance machines can reduce costs associated with administrative errors, time theft, and inaccuracies in payroll calculations. They contribute to overall operational efficiency.

Security: Biometric attendance systems offer enhanced security by ensuring that only authorized personnel can access sensitive areas or systems, reducing risks associated with unauthorized access.

Analytics: Digital attendance data can be analyzed to identify attendance patterns, trends, and potential issues. This information can be used for workforce management and planning.

Integration: Many attendance machines can integrate with other business systems such as payroll software, HR management systems, and access control systems, streamlining overall business operations.

#hrms#hr#humanresources#hrsoftware#hrtech#payroll#humanresource#hrmanagement#payrollsoftware#hris#business#humanresourcemanagement#employee#software#hrsystem#recruitment#humanresourcesmanagement#payrollmanagement#hrd#leadership#payrollservices#shrm#hrconsultant#technology#hrsolutions#attendance#management#hrtips#hrm#hrblog

0 notes

Text

Top 10 HR Software in India in 2024

Looking for the best HR software in India for your business in 2024? 🤔

Check out this comprehensive guide reviewing the top 10 HRMS solutions like Zimyo, Pocket HRMS, uKnowva, and more. 💻

Get detailed insights on key features, pricing, and customer reviews to help you choose the perfect HR portal for your company's needs. 📈

#hr software#hrms software#hr solutions#hrms systems#human resource management#attendance tracking#hrms payroll software

1 note

·

View note

Text

HR Software in India

Managing employee details can be challenging, especially for large organizations spread across multiple locations. Keeping track of personal information, job contracts, and service records—such as

performance and account documents—requires careful organization to prevent loss or misuse. While HR teams handle these tasks, using a dedicated software solution can greatly simplify the process.

This is where the need of HR management software solutions comes into play inn a business.HR management software solutions have become essential in India, where the market has grown

significantly due to the need for efficient human resource management. These tools streamline processes, enhance data security, and ensure compliance with regulations.

OfficeKit HR is a leading solution in this space, offering modules for employee management, payroll, recruitment, and performance management. Its cloud-based platform emphasizes security and

integration with other business tools, transforming traditional HR practices.

As Indian businesses navigate HR complexities, adopting advanced software solutions like OfficeKit HR is crucial. These tools not only streamline HR operations but also support overall business

objectives through cloud adoption and system integration. Investing in innovative HR solutions is key to staying competitive and effectively managing employee resources. In conclusion, as businesses in India navigate the complexities of managing employee information across various locations, adopting advanced HR software solutions has become essential. These tools not only streamline HR processes but also enhance data security and accessibility, making it easier to manage personal details, job contracts, and service records. The HR software market's growth reflects an increasing demand for efficiency and integration in human resource management. By

embracing trends such as cloud adoption and system integration, companies can better meet their HR needs and support their overall business objectives. As the market continues to evolve, investing

in innovative HR solutions will be key to staying competitive and effectively managing employee resources.

0 notes

Text

Meet Cyber School Manager - advanced school management software for seamless administration and utmost efficiency. Providing effective school administration tools, Cyber School Manager simplifies attendance tracking, grade management, and communication tools to timetable scheduling—all the daily operations for educators and administrators. Managing your school has never been easier with this user-friendly interface and all its extensive features. Enjoy smooth integration, powerful data security, and unmatched support with Cyber School Manager. Transform your school's management today!

#school management software#school management system#admissions management software#fee management software#best school time table software#school management mobile app with complete erp#best school erp software#best integrated school management software#top student management system#school attendance software#payroll manager software

0 notes