#compliance risk assessment

Text

Streamline Communications Monitoring with Cresen Solutions

Effective communication monitoring is vital for maintaining compliance and ensuring the security of your organization’s information. Cresen Solutions offers a cutting-edge Email Monitoring Tool designed to streamline your communication processes, providing real-time insights, automated alerts, and secure data handling. With our tool, you can achieve complete peace of mind, knowing that your communications are monitored efficiently and securely.

Real-Time Insights for Enhanced Monitoring

Our Email Monitoring Tool is equipped with advanced capabilities to deliver real-time insights into your organization's email communications. By continuously analyzing email traffic, our tool provides instant visibility into message content, sender and recipient information, and email metadata. This real-time monitoring allows you to quickly identify and address any potential issues or compliance concerns as they arise, ensuring that you stay ahead of potential risks and maintain control over your communications environment.

Automated Alerts for Proactive Management

Proactive management is essential for effective communication monitoring. Cresen Solutions’ Email Monitoring Tool includes automated alert features that notify you of suspicious activities or potential breaches immediately. These alerts are customizable, allowing you to set specific thresholds and criteria based on your organization's unique needs. By receiving timely notifications, you can take swift action to investigate and resolve issues before they escalate, thereby enhancing your overall risk management strategy.

Secure Data Handling for Complete Peace of Mind

Security is a top priority when it comes to handling sensitive communication data. Our Email Monitoring Tool is designed with robust security features to ensure that all data is managed securely and in compliance with regulatory requirements. We employ encryption protocols and secure storage practices to protect your email data from unauthorized access or breaches. With Cresen Solutions, you can trust that your communications are monitored with the highest level of security, providing you with complete peace of mind.

Seamless Integration with Existing Systems

To maximize the effectiveness of our Email Monitoring Tool, we offer seamless integration with your existing email systems and IT infrastructure. Our tool is designed to work harmoniously with popular email platforms, allowing for a smooth implementation process without disrupting your current operations. Whether you use Microsoft Exchange, Google Workspace, or other email services, Cresen Solutions ensures that our monitoring tool integrates effortlessly, enhancing your communication monitoring capabilities without requiring significant changes to your existing setup.

Comprehensive Support and Expertise

Cresen Solutions is dedicated to providing exceptional support and expertise to our clients. Our team of professionals is available to assist you with the implementation, configuration, and ongoing management of our Email Monitoring Tool. We offer comprehensive training and support to ensure that you and your team are well-equipped to utilize the tool effectively. Our commitment to customer service extends throughout your engagement with us, ensuring that you receive the assistance you need to achieve optimal results.

Conclusion

Streamlining communications monitoring is essential for maintaining compliance and safeguarding your organization's data. Cresen Solutions' Email Monitoring Tool provides real-time insights, automated alerts, and secure data handling to ensure that your email communications are monitored efficiently and securely. With seamless integration capabilities and comprehensive support, our tool enhances your communication monitoring strategy while providing peace of mind. Choose Cresen Solutions to elevate your communications monitoring and protect your organization against potential risks. Contact us today to discover how our Email Monitoring Tool can benefit your business.

Additional info:- https://cresensolutions.com/solutions/communications-monitoring/

Addres: 666 Exton Commons,Exton, PA 19341

Call us: +1 973-943-8935 +1 (973) 975-0326

#Compliance risk assessment#Compliance Analytics#Communications Monitoring#Email monitoring tool#HCPO engagement solutions#Healthcare compliance transparency tool#HCP Contracting#Global compliance transparency reporting#CMS Reporting#EFPIA Reporting#Sanctions and debarment

0 notes

Text

Boost Your Business with Professional Accounting and Bookkeeping Services

As a business owner, you know that managing your finances is critical to the success of your business. Accurate bookkeeping and accounting can help you track your income and expenses, stay compliant with tax regulations, and make informed decisions about your business's financial future. However, managing your financial records can be a time-consuming and complex process, especially if you lack the necessary skills and resources. That's why it's essential to consider professional accounting and bookkeeping services. In this blog, we will discuss how these services can boost your business and why you should consider them.

Accounting and Bookkeeping Services

Professional accounting and bookkeeping services can help you streamline your financial processes, save time and money, and improve your business's overall financial health. They offer a range of services, including:

Account payable management: Managing your accounts payable can be a daunting task, especially if you have a high volume of invoices to process. Professional accounting and bookkeeping services can help you stay on top of your accounts payable by creating a system that ensures timely payments and reduces the risk of errors and duplicate payments.

Attendance and payroll software: Professional accounting and bookkeeping services can help you automate your attendance and payroll processes by implementing software that simplifies the process. This will help you save time, reduce errors, and ensure compliance with tax regulations.

Business process automation: Professional accounting and bookkeeping services can help you automate your business processes, reducing the risk of errors and improving efficiency. This will help you save time, reduce costs, and improve your business's overall financial health.

Benefits of Accounting and Bookkeeping Services

Now that we've discussed what professional accounting and bookkeeping services entail, let's take a closer look at some of the benefits they offer.

More time to focus on your business: By outsourcing your accounting and bookkeeping tasks, you can free up valuable time to focus on other aspects of your business, such as marketing, sales, and customer service.

Reduced costs: By outsourcing your accounting and bookkeeping tasks, you can save money on overhead costs associated with hiring and training in-house staff. You'll also reduce the risk of errors, which can lead to costly fines and penalties.

Improved accuracy: Professional accounting and bookkeeping services are staffed by experienced professionals who are trained to handle complex financial tasks accurately. By outsourcing these tasks, you can ensure that your financial records are accurate and up-to-date.

Better decision making: Accurate financial records are essential to making informed decisions about your business's financial future. By outsourcing your accounting and bookkeeping tasks, you'll have access to up-to-date financial statements, which can help you identify areas of your business that are performing well and areas that need improvement.

Compliance with tax regulations: Tax regulations are constantly changing, and it can be challenging to keep up with them. Professional accounting and bookkeeping services can help you stay compliant with tax regulations by ensuring that your financial records are accurate and up-to-date.

Full spectrum of offerings by MYND

At MYND Solutions, we provide a range of finance solutions, including accounting and bookkeeping services, to help businesses like yours thrive. Here are some of the ways our services can help you boost your business:

Improve Account Payable Management: Managing your accounts payable can be a time-consuming and complicated task, especially if you have to deal with multiple suppliers and vendors. However, with professional accounting and bookkeeping services, you can streamline your account payable process, ensuring that all payments are made on time and accurately. This will help you build stronger relationships with your suppliers and vendors, and ultimately help you grow your business.

Efficient Attendance and Payroll Software: Managing employee attendance and payroll can also be a complicated task. However, with the right attendance and payroll software, you can simplify the process and ensure that your employees are paid accurately and on time. At MYND Solutions, we offer efficient attendance and payroll software that can help you manage your employee payroll with ease.

Streamline Business Process Automation: Streamlining your business processes can help you save time and resources, which you can use to focus on growing your business. With professional accounting and bookkeeping services, you can automate your business processes, including financial reporting and bookkeeping. This will help you manage your finances more efficiently, giving you the information you need to make informed business decisions.

Accurate Bookkeeping and Accounting Services: Accurate bookkeeping and accounting are crucial to the success of your business. However, these tasks can be time-consuming and complex, especially if you have limited accounting knowledge. Professional accounting and bookkeeping services can help you manage your finances accurately, ensuring that your financial statements are up-to-date and accurate.

Conclusion

Professional accounting and bookkeeping services can be a valuable asset to your business. By outsourcing your accounting and bookkeeping tasks, you can free up valuable time, reduce costs, and ensure compliance with tax regulations. If you're considering outsourcing your accounting and bookkeeping tasks, contact MYND Solutions today. Our experienced professionals are dedicated to helping your business thrive.

#account payable management#account payable management services#accounting and bookkeeping services#attendance and payroll software#bookkeeping and accounting services#business process automation#business process automation software#compliance assessment#compliance audit services#compliance audit software#compliance management software#compliance management tools#compliance monitoring#compliance risk assessment#compliance risk management services#compliance services

1 note

·

View note

Text

Best Compliance Services Provider

Find ways to determine your organization's top compliance risks and discover leading practices to consider when building your compliance risk assessment. Helius Work has brought a compliance service for your business security. Our compliance service helps to maintain your organization's standard and avoid risk for vulnerability and uncertainties in business. For compliance services, please reach out to us right away.

0 notes

Link

#sap#grc#risk assessment#risk analysis#risk management#sap services#security#sap evaluation#risk factors#risk#risk compliance

2 notes

·

View notes

Text

Financial Crime Risk Services in 2024 for Cross-Border SMEs

Explore our 2024 guide on navigating financial crime risk services tailored for cross-border SMEs. Learn essential strategies to protect your business and ensure regulatory compliance. Go here https://www.regulatoryrisks.com/blog-details/financial-crime-risk-services-cross-border-smes

#financial crime risk services#financial crime compliance consultant#financial services compliance#financial crime risk assessment

0 notes

Text

Accounting and Audit

Blockchain's transparent and immutable ledger promises a trans formative shift in accounting practices. With blockchain, financial records become easily accessible for auditing purposes, enhancing compliance and operational efficiency.

Borrowing and Lending

Blockchain significantly enhances credit assessments and mitigates the risk of bad loans. By enabling secure sharing of verified customer data among banks, it streamlines processes like syndicated lending, reducing redundancy and accelerating transactions.

Trade Finance

The digitisation of trade finance through blockchain can replace outdated, paper-based systems. This modernisation enables faster, more secure, and transparent global transactions, fundamentally transforming traditional trade finance methods.

Trading and Settlements

Blockchain's decentralised framework is poised to revolutionise trading and settlements. By removing the need for central clearinghouses, blockchain technology facilitates quicker, more accurate transactions with reduced errors.

Fundraising

Blockchain introduces innovative fundraising options, including Initial Coin Offerings (ICOs) and Security Token Offerings (STOs). These methods offer startups new ways to raise capital, expanding beyond traditional banking avenues.

Adopting blockchain across these banking functions can lead to a more efficient, transparent, and technologically advanced financial ecosystem.

#Accounting and Audit#Blockchain's transparent and immutable ledger promises a trans formative shift in accounting practices. With blockchain#financial records become easily accessible for auditing purposes#enhancing compliance and operational efficiency.#Borrowing and Lending#Blockchain significantly enhances credit assessments and mitigates the risk of bad loans. By enabling secure sharing of verified customer d#it streamlines processes like syndicated lending#reducing redundancy and accelerating transactions.#Trade Finance#The digitisation of trade finance through blockchain can replace outdated#paper-based systems. This modernisation enables faster#more secure#and transparent global transactions#fundamentally transforming traditional trade finance methods.#Trading and Settlements#Blockchain's decentralised framework is poised to revolutionise trading and settlements. By removing the need for central clearinghouses#blockchain technology facilitates quicker#more accurate transactions with reduced errors.#Fundraising#Blockchain introduces innovative fundraising options#including Initial Coin Offerings (ICOs) and Security Token Offerings (STOs). These methods offer startups new ways to raise capital#expanding beyond traditional banking avenues.#Adopting blockchain across these banking functions can lead to a more efficient#transparent#and technologically advanced financial ecosystem.#for more details visit : https://smartncode.com/block-chain-development.html#blockchaintechnology#blockchain#blockchaininbanking#blockchainfinance

0 notes

Text

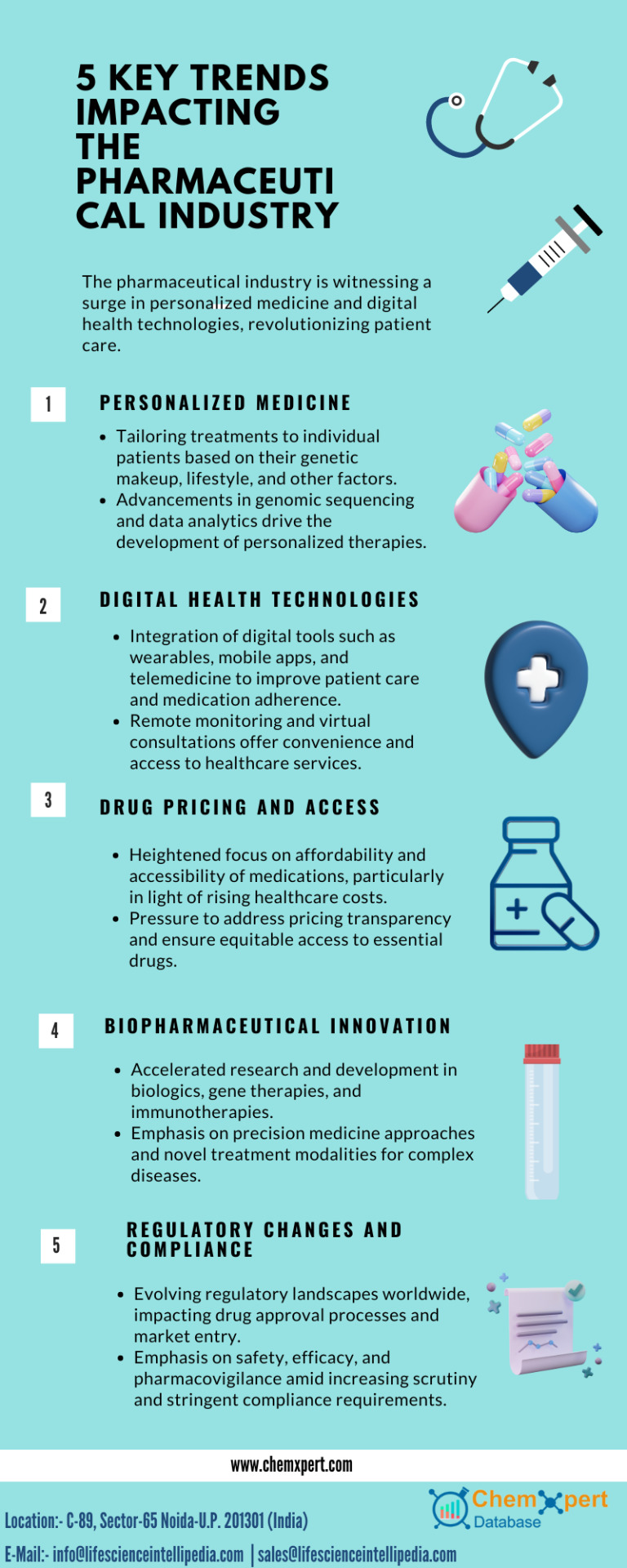

How Pharmaceutical Data Analytics is Revolutionizing Sales

The pharmaceutical industry is undergoing a significant transformation, driven by advancements in technology and data analytics. As one of the most data-intensive sectors, the pharmaceutical industry has long relied on research and development to drive innovation. However, with the advent of data analytics, the landscape of pharmaceutical sales and marketing is changing rapidly. This article explores how pharmaceutical data analytics is revolutionizing sales, highlighting key trends, technologies, and strategies.

#pharmaceutical development#nitrosamine risk assessment#pharmaceutical companies in Netherlands#pharmaceutical compliance#low cost medicine

1 note

·

View note

Text

Enhancing Brand Reputation with MaxLearn’s Microlearning for Compliance Training

In today’s fast-paced business environment, maintaining compliance with regulations and ethical standards is crucial for protecting and enhancing a brand's reputation. Traditional compliance training methods often fall short in engaging employees and ensuring knowledge retention. MaxLearn's microlearning approach offers a dynamic and effective solution for compliance training, helping organizations safeguard their reputation and build a resilient workforce. This article explores how MaxLearn’s microlearning for compliance training can protect and build a brand’s reputation.

The Importance of Compliance Training

Compliance training is essential for ensuring that employees understand and adhere to legal standards, industry regulations, and internal policies. Effective compliance training helps organizations avoid legal penalties, reduce the risk of ethical breaches, and maintain a positive public image. However, traditional compliance training programs often face challenges such as low engagement, poor retention, and high costs.

The Power of Microlearning in Compliance Training

Microlearning involves delivering content in short, focused bursts that are easy for learners to digest and retain. This approach is particularly well-suited for compliance training, offering several advantages:

1. Enhanced Engagement

Traditional compliance training programs can be lengthy and monotonous, leading to disengagement. Microlearning addresses this issue by breaking down complex compliance topics into manageable, interactive modules.

Interactive Content: MaxLearn’s microlearning modules incorporate videos, quizzes, and simulations to make learning more engaging.

Short Duration: Modules typically last between 3 to 10 minutes, making it easier for employees to stay focused and complete the training.

Example: Instead of a two-hour lecture on data privacy, MaxLearn offers a series of five-minute modules covering different aspects of data privacy, each with interactive elements to reinforce learning.

2. Improved Knowledge Retention

Microlearning enhances retention by focusing on one topic at a time and using spaced repetition to reinforce key concepts. This method helps ensure that employees retain and apply what they learn in their daily work.

Spaced Repetition: Key compliance concepts are revisited over time to reinforce learning and improve long-term retention.

Micro-Assessments: Frequent quizzes and assessments help reinforce knowledge and identify areas where additional training is needed.

Example: After introducing a new anti-money laundering policy, MaxLearn’s microlearning platform provides weekly micro-assessments to reinforce the key points and ensure employees remember the information.

3. Flexibility and Accessibility

Microlearning offers flexibility, allowing employees to access training materials at their convenience. This is particularly beneficial for organizations with a diverse workforce, including remote employees and those working in different time zones.

Mobile Accessibility: MaxLearn’s microlearning modules are accessible on mobile devices, enabling employees to learn on the go.

On-Demand Learning: Employees can access training materials whenever they need a refresher or new information.

Example: A compliance officer can complete a microlearning module on conflict of interest policies during a commute, using a mobile device.

4. Cost-Effectiveness and Efficiency

Microlearning can be more cost-effective than traditional training methods, requiring fewer resources and allowing for easy updates to reflect changes in regulations.

Scalable Solutions: MaxLearn’s microlearning platform can be easily scaled to accommodate a growing workforce or new compliance requirements.

Reduced Training Time: Short, focused training sessions minimize the time employees spend away from their primary responsibilities.

Example: When a new regulation is introduced, MaxLearn can quickly update its microlearning modules to reflect the changes, ensuring all employees have access to the latest information without significant downtime.

Implementing MaxLearn’s Microlearning for Compliance Training

1. Identify Key Compliance Topics

Begin by identifying the most critical compliance topics that need to be covered. These topics should align with legal requirements and the organization’s policies and procedures.

Risk Assessment: Conduct a risk assessment to identify areas where compliance training is most needed.

Prioritization: Prioritize topics based on their importance and relevance to the organization’s operations.

Example: For a financial institution, key compliance topics might include anti-money laundering regulations, data protection, and ethical conduct.

2. Design Engaging Microlearning Modules

Design microlearning modules that are concise and focused on a single topic or concept. Each module should be no longer than 5-10 minutes to maintain learner attention and effectiveness.

Clear Objectives: Define clear learning objectives for each module to ensure that the content is targeted and effective.

Engaging Formats: Use a variety of formats, such as videos, infographics, quizzes, and interactive scenarios, to keep learners engaged.

Example: Create a series of short videos on data protection, each focusing on a different aspect, such as data handling procedures, reporting requirements, and best practices.

3. Incorporate Interactive Elements

Interactive elements, such as quizzes, simulations, and case studies, enhance engagement and help learners apply their knowledge in real-world scenarios.

Simulations: Use simulations to mimic real-life situations that employees might encounter, allowing them to practice their responses.

Case Studies: Incorporate case studies that illustrate compliance successes and failures, helping learners understand the practical implications of their actions.

Example: Develop a simulation that places employees in a scenario where they must identify and report suspicious activity, reinforcing anti-money laundering training.

4. Leverage Technology

Utilize learning management systems (LMS) and mobile learning platforms to deliver microlearning content. These technologies can track progress, provide instant feedback, and facilitate continuous learning.

LMS Integration: Integrate microlearning modules into the organization’s LMS to track employee progress and completion rates.

Mobile Learning: Ensure that microlearning content is optimized for mobile devices, allowing employees to learn anytime, anywhere.

Example: Implement an LMS that supports microlearning and mobile access, providing employees with a seamless and flexible learning experience.

5. Measure and Optimize

Regularly evaluate the effectiveness of microlearning modules through assessments, feedback, and performance metrics. Use this data to optimize the training content and delivery methods continuously.

Analytics: Use analytics to monitor learner engagement, completion rates, and knowledge retention.

Feedback Loops: Gather feedback from employees to identify areas for improvement and adjust the content accordingly.

Example: After deploying a series of microlearning modules on data protection, analyze completion rates and quiz scores to identify any gaps in understanding and refine the content.

Conclusion

MaxLearn’s microlearning approach offers a powerful and flexible solution for compliance training, helping organizations protect and build their brand’s reputation. By breaking down complex compliance topics into manageable, engaging segments, microlearning enhances retention, understanding, and engagement. Leveraging technology and interactive elements further boosts the effectiveness of compliance training, ensuring that employees stay informed and compliant with ever-evolving regulations.

Incorporating microlearning into compliance training strategies not only improves training outcomes but also fosters a culture of continuous learning and adaptability. As organizations navigate the complexities of regulatory environments, MaxLearn’s microlearning stands out as a valuable tool for building a resilient and compliant workforce.

#Compliance training#Microlearning#Brand reputation#MaxLearn#Engagement#Knowledge retention#Interactive content#Mobile learning#On-demand learning#Cost-effective training#Risk assessment#Learning objectives#Simulations#Case studies#Learning management systems (LMS)#Spaced repetition#Micro-assessments#Flexibility#Accessibility#Continuous improvement

0 notes

Text

The Crucial Role of Stop Time Distance Meters in Ensuring Machine Safety and Efficiency

Stop time distance meters play a pivotal role in determining a machine’s stop time, thereby contributing significantly to the safety and efficiency of industrial operations. These meters offer accurate and reliable results, making them indispensable tools in various industrial settings.

Value and Importance

Investing in stop time distance meters is of paramount importance for businesses…

View On WordPress

#data collection#machine compliance#Machine efficiency#Mitigating hazards#safety risk assessment#Stop Time Distance Meter

0 notes

Text

Healthcare Compliance Transparency Tool, HCP/O Engagement Solutions

The ever-evolving landscape of healthcare, trust and transparency are paramount for fostering meaningful relationships between healthcare providers HCP contracting, and stakeholders. Recognizing this critical need, Cresen Solutions emerges as a beacon of integrity, offering innovative tools and solutions to enhance compliance and transparency within the healthcare ecosystem.

Cresen Solutions Healthcare Compliance Transparency Tool

At the core of Cresen Solutions’ mission lies a commitment to compliance excellence. Their Healthcare Compliance Transparency Tool serves as a comprehensive platform designed to streamline compliance processes, mitigate risks, and uphold regulatory standards. By integrating advanced technologies such as artificial intelligence and blockchain, this tool ensures the accuracy and integrity of data, thereby instilling confidence in stakeholders regarding the adherence to ethical guidelines and regulations.

Empowering Compliant Interactions with Healthcare Providers (HCPs)

Central to Cresen Solutions’ approach is the empowerment of compliant interactions between healthcare entities and providers. Through their innovative engagement solutions, Cresen facilitates seamless communication and collaboration while maintaining strict adherence to compliance protocols. By leveraging data analytics and real-time monitoring, these solutions enable HCPs to engage with confidence, knowing that their interactions are transparent, ethical, and compliant with industry regulations.

Driving Trust and Transparency

where trust is paramount, Cresen Solutions emerges as a trusted partner, driving transparency across all levels of the healthcare continuum. By providing robust tools and solutions that promote adherence to regulatory standards, Cresen fosters a culture of accountability and integrity within the healthcare industry. Through transparent practices and ethical conduct, Cresen Solutions builds bridges of trust between stakeholders, ultimately enhancing patient outcomes and driving positive healthcare experiences.

Visit here:- https://cresensolutions.com/solutions/engagemate/

Contact us

U.S. Office:666 Exton Commons,Exton, PA 19341

Mobile:+1 973-943-8935 | +1 (973) 975-0326

#HCP/O engagement solutions#Healthcare compliance transparency tool#HCP Contracting#Global compliance transparency reporting#CMS Reporting#EFPIA Reporting#Sanctions and debarment#Compliance risk assessment#Compliance Analytics#Communications Monitoring

0 notes

Text

Now corporate boards have responsibility for cybersecurity, too

New Post has been published on https://thedigitalinsider.com/now-corporate-boards-have-responsibility-for-cybersecurity-too/

Now corporate boards have responsibility for cybersecurity, too

A new ruling from the U.S. Securities and Exchange Commission (SEC), known as the Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure, went into effect last fall. The ruling requires public companies to disclose whether their boards of directors have members with cybersecurity expertise. Specifically, registrants are required to disclose whether the entire board, a specific board member, or a board committee is responsible for the oversight of cyber risks; the processes by which the board is informed about cyber risks, and the frequency of its discussions on this topic; and whether and how the board or specified board committee considers cyber risks as part of its business strategy, risk management, and financial oversight.

“In simplest terms, boards are on the hook for management, governance, and disclosure reporting,” explains Keri Pearlson, executive director of the Cybersecurity at MIT Sloan Research Consortium (CAMS). “While there is a lot of interpretation left to do, this we know for sure.”

Also well understood is the increasing likelihood of hacking events and the exponential cost to companies. Despite recent efforts to beef up cybersecurity by companies and governments worldwide, data breaches continue to increase year over year. Data show a 20 percent increase in data breaches from 2022 to 2023. Given the rapid proliferation of digital work and digitization in general, this should come as no surprise. As noted by the SEC in a fact sheet accompanying the recent rulings, “Cybersecurity risks have increased alongside the digitalization of registrants’ operations, the growth of remote work, the ability of criminals to monetize cybersecurity incidents, the use of digital payments, and the increasing reliance on third-party service providers for information technology services, including cloud computing technology.”

Cyber resilience: respond and recover

Pearlson’s ongoing research includes organizational, strategic, management, and leadership issues in cybersecurity. Her current focus is on the board’s role in cybersecurity. In a January 2023 MIT Sloan Management Review article, “An Action Plan for Cyber Resilience,” Pearlson and her co-authors suggest that board members must assume that cyberattacks are likely and exercise their oversight role to ensure that executives and managers have made the proper preparations to respond and recover.

“After all, if we assume every organization has a likely risk of being breached or attacked, and it’s not possible to be 100 percent protected from every attack, the most rational approach is to make sure the organization can recover with little or no damage to operations, to the financial bottom line, and to the organization’s reputation,” says Pearlson. To properly mitigate cyber risk, company leaders must have rock-solid plans in place to respond and recover quickly so that the company can continue to operate. They need to be cyber resilient.

Pearlson compares cyber resilience to Covid resilience practices. “We did things like stay home, wear masks, and get vaccines to both reduce the chances we got Covid, but also to reduce the consequences of getting sick.”

In other words, the current, protection-oriented approach most companies take to cyber is not enough. Protection only helps us mitigate issues we know about. But cyber criminals are innovative, and we don’t know what we don’t know. They seem to continually find new ways to break into our systems. Pearlson talks about the need to be resilient and how that kind of thinking comes from the top. “While boards have been getting reports on cybersecurity for a long time, these are typically once a year and not focused on the data that boards need to ensure their companies are resilient,” says Pearlson.

In their May 2023 Harvard Business Review article, “Boards Are Having the Wrong Conversations About Cybersecurity,” Pearlson and co-author Lucia Milică comment on the inadequacy of typical cybersecurity presentations during board meetings, which usually cover threats and the actions or technologies the company is implementing to protect against them. “To us, that is the wrong perspective for board oversight. We know we cannot be completely protected, no matter how much money we invest in technologies or programs to stop cyberattacks. While spending resources to protect our assets is critical, limiting discussions to protection sets us up for disaster.”

Instead, the conversation needs to focus on resilience. For example, instead of going into detail in a board meeting on how an organization is set up to respond to an incident, members must focus on what the biggest risk might be and how the organization is prepared to quickly recover from the damage should that situation happen.

Assessing risk using a Balanced Scorecard approach

To that end, Pearlson developed the Board Level Balanced Scorecard for Cyber Resilience (BSCR), designed to help boards and management have more productive discussions and understand the organization’s biggest risks to cyber resilience. Inspired by Kaplan and Norton’s Balanced Scorecard, a well-known tool for measuring organizational performance, Pearlson’s BSCR maps these key risk areas into four quadrants: performance, technology, organizational activities (such as people and compliance requirements), and supply chain. Each quadrant includes three components:

A quantitative progress indicator (red-yellow-green stoplight) based on the organization’s existing framework for cybersecurity controls such as CISA Cybersecurity Performance Goals (CPG), NIST SP 800-53, ISO 27001, CIS Controls or other controls assessments;

The biggest risk factor to organizational resilience according to C-level leaders; and

A qualitative action plan, where C-level leaders share their plan to address this risk.

The scorecard helps orient board reporting and conversation on the focus areas around which the organization should be concerned in the event of a cyberattack — specifically, the technology, the financial side of the business, the organizational side, and the supply chain. While some companies may require other quadrants, the idea is that each of those focus areas should have quantitative measures. By looking at these indicators together in a single framework, leaders can draw conclusions that might otherwise be missed.

“Having controls is nothing new, particularly for publicly traded companies that have a program for measuring and managing their cybersecurity investments,” says Pearlson. “However, there is a qualitative risk that often doesn’t come across in those measurements. While a typical control may measure how many people failed the phishing exercise, which is an important component of cybersecurity, the scorecard encourages businesses to also understand what is at risk and what is being done about it.” You can read more about the scorecard in this recent Harvard Business Review article.

Providing boards the information they need

The vast majority of leaders understand they are in jeopardy of an attack — they just don’t know how to talk about it or what to do about it. While it’s easiest for cyber executives to report on technology metrics or organizational metrics, this information does not help the board with their job of ensuring cyber resilience. “It’s the wrong information, at least initially, for conversations with the board,” says Pearlson.

Throughout Pearlson’s research, cybersecurity leaders, board directors, and other subject matter experts expressed their interest in key information about system assets, proactive capabilities, and how quickly they could recover. Some wanted to better understand what data types their company maintained, where they were maintained, the likelihood of compromise, and the impact that compromise would have on business operations. More than half of the participants wanted to know the financial dollar value involved with breaches or cyberattacks on their organization.

Pearlson’s BSCR helps to put these risks in the context of specific areas or processes that are core to the business and to address nuances, such as: is this an immediate risk or a long-term? Would a compromise in this area have a minimal impact or a huge impact?

“A Balanced Scorecard for Cyber Resilience is the starting place for the discussions about how the business will continue operations when an event occurs,” says Pearlson. “It is not enough to invest only in protection today. We need to focus on business resilience to cyber vulnerabilities and threats. To do that, we need a balanced, qualitative assessment from the operational leaders who know.”

Pearlson teaches in two MIT Sloan Executive Education courses that help individuals and their organizations be more resilient. Designed for non-cyber professionals, Cybersecurity Leadership for Non-Technical Executives helps participants become knowledgeable in the discussion. Cybersecurity Governance for the Board of Directors assists board members, C-suite leaders, and other senior executives in quickly gathering essential language and perspectives for cybersecurity strategy and risk management to better carry out their oversight and leadership responsibilities.

#2022#2023#approach#Article#assessment#assets#beef#board#boards#Business#Business and management#business resilience#c-level#C-suite#cisa#Cloud#cloud computing#Companies#compliance#computing#courses#covid#cyber#cyber criminals#cyber risk#cyberattack#Cyberattacks#cybersecurity#cybersecurity strategy#data

0 notes

Text

Learn Importance of Permit-to-Work systems in industrial safety, covering what they are, why they're necessary, and how they safeguard operations.

0 notes

Text

Financial Crime Risk: A Comprehensive Guide for Cross-Border SMEs

Discover essential insights on financial crime risk services for cross-border SMEs. This comprehensive guide helps you navigate challenges and safeguard your business in 2024. Click on https://medium.com/@regulatoryrisks/financial-crime-risk-a-comprehensive-guide-for-cross-border-smes-2465b28692a6

#financial crime risk services#financial crime compliance consultant#financial services compliance#financial crime risk assessment

0 notes

Text

ICAI's Guidance Note on Audit of Banks (2024 Edition)

The Institute of Chartered Accountants of India (ICAI) stands at the forefront of shaping the accounting profession, providing guidance and standards to ensure excellence and integrity in financial practices. as usual on February 14, 2024, ICAI issued the latest edition of its Guidance Note on Audit of Banks, offering comprehensive insights and directives for auditors navigating the complex…

View On WordPress

#2024 Edition#audit#Audit of Banks#auditing standards#banking sector#business-investments#cybersecurity#emerging risks#Financial Reporting#Guidance Note#icai#icai-dubai-chapter#international standards#jobs#Professional guidance#RBI guidelines#Regulatory Compliance#risk assessment

0 notes

Text

Comprehensive Pharmaceutical Solutions with Chemxpert Database

Chemxpert Database offers robust solutions for pharmaceutical online needs, facilitating cutting-edge pharmaceutical research and seamless connections with third-party medicine manufacturers. Our platform streamlines the drug manufacturing process, ensuring quality and efficiency. Additionally, we provide targeted pharma advertising opportunities to enhance your brand's reach. Trust Chemxpert Database for a comprehensive approach to all your pharmaceutical requirements, from research and manufacturing to marketing.

#pharmaceutical manufacturing process#pharmaceutical development#nitrosamine risk assessment#pharmaceutical companies in Netherlands#pharmaceutical compliance

1 note

·

View note

Text

Enhancing Compliance Training with Microlearning to Foster a Resilient Workforce

Compliance training is a critical component of any organization’s strategy to maintain legal standards and promote ethical behavior. Traditional compliance training programs often struggle with engagement and retention, leading to gaps in understanding and application. Microlearning, which involves delivering content in short, focused bursts, offers a transformative approach to compliance training. By leveraging microlearning, organizations can create a more resilient workforce that is better equipped to adhere to compliance standards. This article explores the benefits and strategies for using microlearning in compliance training.

The Benefits of Microlearning for Compliance Training

1. Increased Engagement

One of the primary challenges of compliance training is keeping employees engaged. Traditional methods can be lengthy and monotonous, leading to low retention rates. Microlearning addresses this issue by breaking down information into bite-sized, easily digestible segments. This approach is more appealing to modern learners who prefer quick and interactive learning experiences.

Interactive Elements: Incorporate quizzes, videos, and interactive scenarios to make learning more engaging.

Mobile-Friendly: Design microlearning modules that are accessible on mobile devices, allowing employees to learn on the go.

Example: Instead of a one-hour lecture on data privacy regulations, create a series of five-minute videos, each focusing on a specific aspect of data privacy, supplemented with interactive quizzes.

2. Improved Retention and Understanding

Microlearning enhances retention by focusing on one topic at a time, allowing learners to absorb and understand information more effectively. The spaced repetition of key concepts helps reinforce learning and ensures that employees retain critical information.

Reinforcement: Use spaced repetition techniques to reinforce key compliance concepts over time.

Micro-Assessments: Implement regular micro-assessments to gauge understanding and retention.

Example: After introducing a new compliance policy, follow up with weekly micro-assessments to reinforce the key points and ensure that employees remember the information.

3. Flexibility and Accessibility

Microlearning offers flexibility, allowing employees to access training materials at their convenience. This is particularly beneficial for organizations with a diverse workforce, including remote employees and those working in different time zones.

On-Demand Learning: Provide on-demand access to microlearning modules, enabling employees to learn at their own pace.

Cross-Platform Accessibility: Ensure that content is accessible across various devices, including smartphones, tablets, and computers.

Example: Create a library of microlearning modules on various compliance topics that employees can access whenever they need a refresher or new information.

4. Cost-Effective and Efficient

Microlearning can be more cost-effective than traditional training methods. It requires fewer resources and can be updated easily to reflect changes in compliance regulations. This efficiency ensures that training remains relevant and up-to-date.

Scalable Solutions: Develop scalable microlearning solutions that can be easily modified and expanded as regulations change.

Reduced Training Time: Minimize the time employees spend away from their primary responsibilities by offering short, focused training sessions.

Example: Develop a compliance training platform that allows quick updates to content, ensuring that all employees have access to the latest information without significant downtime.

Strategies for Implementing Microlearning in Compliance Training

1. Identify Key Compliance Topics

Begin by identifying the most critical compliance topics that need to be covered. These topics should align with legal requirements and the organization’s policies and procedures.

Risk Assessment: Conduct a risk assessment to identify areas where compliance training is most needed.

Prioritization: Prioritize topics based on their importance and relevance to the organization’s operations.

Example: For a financial institution, key compliance topics might include anti-money laundering (AML) regulations, data protection, and ethical conduct.

2. Design Bite-Sized Learning Modules

Design microlearning modules that are concise and focused on a single topic or concept. Each module should be no longer than 5-10 minutes to maintain learner attention and effectiveness.

Clear Objectives: Define clear learning objectives for each module to ensure that the content is targeted and effective.

Engaging Formats: Use a variety of formats, such as videos, infographics, quizzes, and interactive scenarios, to keep learners engaged.

Example: Create a series of short videos on AML regulations, each focusing on a different aspect, such as customer due diligence, reporting requirements, and red flags.

3. Incorporate Interactive Elements

Interactive elements, such as quizzes, simulations, and case studies, enhance engagement and help learners apply their knowledge in real-world scenarios.

Simulations: Use simulations to mimic real-life situations that employees might encounter, allowing them to practice their responses.

Case Studies: Incorporate case studies that illustrate compliance successes and failures, helping learners understand the practical implications of their actions.

Example: Develop a simulation that places employees in a scenario where they must identify and report suspicious activity, reinforcing AML training.

4. Leverage Technology

Utilize learning management systems (LMS) and mobile learning platforms to deliver microlearning content. These technologies can track progress, provide instant feedback, and facilitate continuous learning.

LMS Integration: Integrate microlearning modules into the organization’s LMS to track employee progress and completion rates.

Mobile Learning: Ensure that microlearning content is optimized for mobile devices, allowing employees to learn anytime, anywhere.

Example: Implement an LMS that supports microlearning and mobile access, providing employees with a seamless and flexible learning experience.

5. Measure and Optimize

Regularly evaluate the effectiveness of microlearning modules through assessments, feedback, and performance metrics. Use this data to optimize the training content and delivery methods continuously.

Analytics: Use analytics to monitor learner engagement, completion rates, and knowledge retention.

Feedback Loops: Gather feedback from employees to identify areas for improvement and adjust the content accordingly.

Example: After deploying a series of microlearning modules on data protection, analyze completion rates and quiz scores to identify any gaps in understanding and refine the content.

Conclusion

Microlearning offers a powerful and flexible approach to compliance training, making it easier for organizations to build a resilient and compliant workforce. By breaking down complex compliance topics into manageable, engaging segments, microlearning enhances retention, understanding, and engagement. Leveraging technology and interactive elements further boosts the effectiveness of compliance training, ensuring that employees stay informed and compliant with ever-evolving regulations.

Incorporating microlearning into compliance training strategies not only improves training outcomes but also fosters a culture of continuous learning and adaptability. As organizations navigate the complexities of regulatory environments, microlearning stands out as a valuable tool for building a resilient and compliant workforce.

#Compliance training#Microlearning#Resilient workforce#Engagement#Retention#Interactive learning#Mobile-friendly training#On-demand learning#Spaced repetition#Micro-assessments#Cost-effective training#Scalable solutions#Risk assessment#Learning objectives#Interactive elements#Simulations#Case studies#Learning management systems (LMS)#Mobile learning platforms#Performance metrics

0 notes