#backtest algorithms

Explore tagged Tumblr posts

Text

In recent years, algorithmic trading has gained popularity in India. Traders have switched from manual to algorithmic trading owing to its inherent benefits of powerful analytical tools, user-friendly interfaces, and seamless connectivity to market data.

0 notes

Text

In the fast-paced world of trading, the integration of REST APIs with trading algorithms has become an essential tool for traders looking to enhance their strategies. REST APIs, or Representational State Transfer Application Programming Interfaces, allow seamless communication between different software applications. When integrated with trading algorithms, REST APIs enable traders to automate processes, access real-time data, and execute trades more efficiently.

#integrated with trading algorithms#API trading#trading algorithms#backtest your trading algorithm#trading platform

0 notes

Text

Algorithmic Trading Consulting Services

We can backtest and optimize your trading strategies against historical data.

We can also automate your trading strategies by writing C++/python code to interact directly with the exchange

Do you have an idea for a trading strategy, but want to prove that it will work through backtesting against historical data? Or do you have a successful trading strategy but want to optimize the parameters of the strategy to maximise returns?

Or perhaps you’ve heard about machine learning and would like to find out how you could incorporate it into your trading. Machine learning can be used to trawl through large amounts of data looking for statistically significant signals to use in your trading. It can also be used to determine the optimal way to combine a number of possible signals or ideas into a single algorithm.

We provide cloud-based PhD quant support for traders. We offer trading algorithm development services for equity and FX markets on all major exchanges. We also offer bitcoin and cryptocurrency algorithmic trading services on major exchanges like Binance and Bitmex.

In fact, we offer a wide range of quant (quantitative finance) consulting services including algo trading, derivative pricing and risk modelling. We also offer more general mathematical and algorithmic consulting services.

Find out more about or algo trading and quant consulting services

#algo trading consulting#algorithm consulting#quant consulting#backtesting consulting#algorithmic trading consulting#trading strategy consulting

0 notes

Text

Understanding Forex EA: An Essential Tool for Automated Trading

In the fast-paced world of forex trading, automation has become a powerful tool for traders seeking efficiency and consistency. Forex EA (Expert Advisor) is a widely recognized solution that empowers traders to automate their trading strategies. In this article, we will explore what a Forex EA is, how it works, and why it's essential for modern forex traders.

What is a Forex EA?

A Forex EA is a software application designed to automate forex trading based on predefined rules and algorithms. Installed on trading platforms like MetaTrader 4 or MetaTrader 5, these expert advisors analyze market conditions, execute trades, and manage positions without manual intervention.

Key Features of a Forex EA

Automated Trading Execution: A Forex EA executes trades based on preset parameters, minimizing emotional trading errors.

24/7 Market Monitoring: Unlike human traders, a Forex EA can operate continuously, ensuring no profitable opportunity is missed.

Backtesting Capability: Most Forex EA tools allow backtesting to assess performance based on historical data.

Benefits of Using a Forex EA

Improved Efficiency

By automating trading strategies, a Forex EA can perform transactions faster than manual traders, reducing the chances of missed opportunities.

Emotion-Free Trading

A Forex EA operates strictly according to its programmed rules, eliminating emotional biases that can impair decision-making.

Consistency

With predefined parameters, a Forex EA ensures each trade follows the same logic, reducing inconsistencies caused by human judgment.

Conclusion

For both novice and experienced traders, adopting a Forex EA can enhance trading efficiency, minimize emotional influences, and improve consistency. By integrating this powerful tool into their trading strategy, traders can focus more on refining their tactics while their Forex EA handles the execution.

2 notes

·

View notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

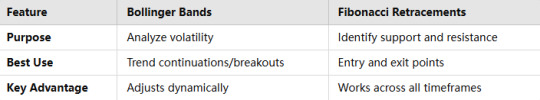

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

Algorithmic trading automates trading using predefined rules and algorithms. Backtesting ensures strategy effectiveness. Continuous monitoring and adjustments optimize performance.

#finance#investing#marketing#poster#stock market#cryptocurrency#cryptomarket#blockchain#altcoin#defi#crypto#investment#fintech#forex#forextrader

6 notes

·

View notes

Text

How Effective is Crypto Algo Trading Bot in the Trading Journey

The cryptocurrency market is well-known for its volatility and quick price changes. Amidst this activity, crypto algo trading bots have appeared as effective tools for guiding the complexity of trading. These automated systems, driven by algorithms and advanced data analysis, offer the potential to improve trading efficiency and profitability. But how effective are they truly in a trader's journey?

Comprehending Crypto Algo Trading Bots

Crypto algo trading bots are computer programs developed to perform trades automatically based on predefined parameters. They work on various strategies, from simple trend-following to complex arbitrage opportunities. These bots can analyze market data at sparky speed, recognizing patterns and executing trades exactly, often exceeding human capabilities.

Key Advantages of Crypto Algo Trading Bots

Emotional detachment: One of the biggest advantages of algo trading is the elimination of human emotions. Fear and desire can often cloud judgment, leading to impulsive decisions. Bots operate in a pure sense, without emotional preferences, ensuring disciplined trading.

Speed and efficiency: Humans have limitations in processing data and responding to market changes. Algo bots can execute trades in milliseconds, capitalizing on quick opportunities that humans might miss.

All time function: The crypto market never sleeps. Algo bots can trade constantly, without the need for rest or breaks, maximizing potential profits.

Backtesting and optimization: Before deploying a bot, traders can backtest its performance on recorded data to assess its significance. This allows for the optimization of trading strategies and risk management parameters.

Diversification: Algo bots can manage numerous trading strategies simultaneously, diversifying risk and increasing the possibility for constant returns.

Impact and Success Stories

Multiple traders have reported significant benefits from using crypto algo trading bots. Some have achieved consistent profitability, outperforming manual trading strategies. These bots have been confirmed particularly effective in high-frequency trading, where speed is essential. Additionally, they can be valuable for arbitrage opportunities, using price differences across different exchanges.

However, it's essential to recognize that not all algo trading bots are created equal. The point of a bot depends on several aspects, including the underlying trading method, the quality of data used, and the bot's ability to adjust to market conditions.

Challenges and Concerns

While the potential advantages of crypto algo trading bots are important, it's crucial to approach them with real expectations. Overfitting to historical data can lead to suboptimal performance in future market conditions.

Moreover, developing and maintaining a good algo trading system requires specialized expertise and continuous monitoring. Traders should carefully evaluate the risks involved and consider their ability and help before launching into algo trading.

Conclusion

Crypto algo trading bots have the prospect of being effective tools in a trader's journey. They offer advantages in terms of speed, efficiency, and emotional detachment. While not a guaranteed path to riches, they can significantly improve trading performance when used wisely.

It's important to approach algo trading with a combination of confidence and notice. Thorough research, backtesting, and ongoing monitoring are essential for increasing the benefits and reducing risks. As with any investment, diversification is key. Combining algo trading with other strategies can help create a well-rounded investment portfolio.

In conclusion, crypto algo trading bots represent an exciting frontier in the world of trading. While challenges exist, the potential rewards are significant for those who approach this technology with knowledge and discipline.

Get a opportunity to grab a FREE DEMO - Crypto Algo Trading Bot Development

2 notes

·

View notes

Text

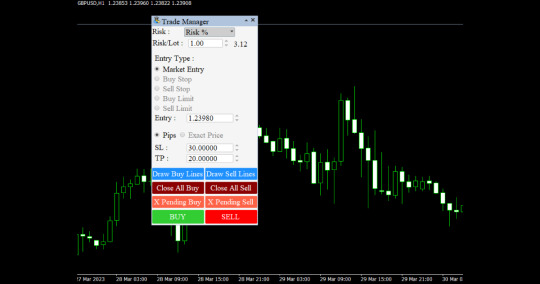

Effortless Efficiency: Automate Your Forex Trades with the Panel

In the dynamic world of forex trading, efficiency is paramount. Traders are constantly seeking ways to streamline their processes, optimize their strategies, and maximize their profits. One powerful tool that has emerged to meet these demands is the Automated Trading Panel. These panels leverage cutting-edge technology to automate trade execution, implement complex strategies, and enhance overall efficiency in forex trading. In this blog post, we'll explore the benefits, features, and potential of Automated Trading Panels in revolutionizing the way traders approach the forex market.

Understanding Automated Trading Panels: Automated Trading Panels are sophisticated software solutions designed to automate various aspects of forex trading, from trade execution to risk management and strategy implementation. These panels utilize advanced algorithms, artificial intelligence, and machine learning techniques to analyze market data, identify trading opportunities, and execute trades on behalf of traders. With their user-friendly interfaces and customizable features, Automated Trading Panels empower traders of all skill levels to automate their trading processes and achieve consistent results in the forex market.

Key Features and Functionality:

Trade Execution Automation: Automated Trading Panels enable traders to automate trade execution, eliminating the need for manual intervention. Traders can set specific parameters for trade entry, exit, and position sizing, allowing the panel to execute trades automatically based on predefined rules and criteria.

Strategy Implementation: Automated Trading Panels support the implementation of complex trading strategies, including trend-following, mean-reversion, and breakout strategies. Traders can customize their strategies by combining technical indicators, price action signals, and market sentiment analysis to suit their trading preferences and objectives.

Risk Management Tools: Automated Trading Panels offer advanced risk management tools to help traders mitigate potential losses and protect their capital. Traders can set stop-loss and take-profit levels, adjust position sizes, and implement trailing stop orders to manage risk effectively.

Backtesting and Optimization: Automated Trading Panels enable traders to backtest and optimize trading strategies using historical market data. By simulating trades under various market conditions, traders can assess the performance of their strategies and make necessary adjustments to improve profitability.

Real-time Market Analysis: Automated Trading Panels provide real-time market analysis and insights, allowing traders to stay informed about key market developments and potential trading opportunities. With access to up-to-date market data and analysis tools, traders can make informed decisions and execute trades with confidence.

Benefits of Using Automated Trading Panels:

Enhanced Efficiency: Automated Trading Panels streamline the trading process by automating repetitive tasks such as trade execution, position management, and risk assessment. By eliminating the need for manual intervention, traders can save significant time and effort. This enhanced efficiency allows traders to focus their attention on analyzing market trends, refining trading strategies, and making informed decisions, rather than getting bogged down by routine tasks.

Improved Accuracy: Automated Trading Panels leverage sophisticated algorithms and artificial intelligence to execute trades with precision and accuracy. Unlike human traders, who may be prone to emotions, biases, and cognitive errors, these panels operate based on predefined rules and criteria. By removing human involvement from the trading process, Automated Trading Panels minimize errors and enhance overall trading performance. Trades are executed consistently and objectively, without the influence of emotions such as fear, greed, or hesitation.

Consistent Performance: With their disciplined approach to trade execution and risk management, Automated Trading Panels help traders achieve consistent and reliable results over time. These panels adhere strictly to predetermined trading rules and strategies, ensuring that trades are executed in a systematic and disciplined manner. By maintaining consistency in trade execution and risk management, traders can avoid impulsive decisions and erratic behavior, thereby improving their chances of long-term success in the forex market.

Accessibility and Convenience: Automated Trading Panels are accessible from any internet-enabled device, allowing traders to monitor and manage their trades on the go. Whether at home, in the office, or on vacation, traders can stay connected to the forex market and take advantage of trading opportunities anytime, anywhere. This level of accessibility and convenience enables traders to stay informed about market developments, adjust their trading strategies, and execute trades promptly, without being tied to a specific location or time zone.

Reduced Stress and Emotional Impact: Trading can be a stressful and emotionally taxing endeavor, particularly during periods of market volatility or when faced with significant losses. Automated Trading Panels help alleviate stress and emotional strain by automating the trading process and removing the need for manual intervention. Traders can trade with confidence, knowing that their trades are being executed according to predefined rules and parameters. By removing the emotional element from trading decisions, Automated Trading Panels help traders maintain a clear and rational mindset, reducing the psychological burden associated with trading and improving overall well-being.

Automated Trading Panels offer numerous benefits to traders, including enhanced efficiency, improved accuracy, consistent performance, accessibility and convenience, and reduced stress and emotional impact. By leveraging advanced technology and automation, traders can streamline their trading processes, optimize their performance, and achieve greater success in the forex market.

Conclusion:

Automated Trading Panel offer a powerful solution for automating forex trades and enhancing trading efficiency. With their advanced features, customizable settings, and user-friendly interfaces, these panels empower traders to execute trades with precision, consistency, and confidence. Whether you're a seasoned trader looking to optimize your trading strategies or a novice trader seeking to streamline your trading process, Automated Trading Panels can help you achieve your trading goals with ease. Embrace the future of forex trading with Automated Trading Panels and experience the benefits of effortless efficiency in your trading journey.

#Trade Panel#Trading Panel#Trading Panel EA#TradePanel MT4#Trade Manager#Forex Trade Manager#Best Trade Manager#Trade Management utility#Trade Management tool#Trading management#forextrading#forexmarket#forex education#forexsignals#forex#black tumblr#technical analysis#4xPip

4 notes

·

View notes

Text

Algo trading | Tradingview algo trading | Algoji

In the dynamic world of financial markets, staying ahead of the curve requires the right tools and strategies. Algo trading, or algorithmic trading, has revolutionized the trading landscape by enabling traders to execute orders with speed and precision that surpasses human capabilities. TradingView, a leading platform for charting and analysis, further enhances the trading experience with its robust features. Combining the power of algo trading with TradingView, Algoji stands out as a premier solution for traders looking to optimize their strategies and achieve consistent success. In this blog, we will delve into the benefits of algo trading and TradingView, and how Algoji can help you master both.

Understanding Algo Trading

Algo trading involves using computer programs to execute trades based on predefined criteria. These algorithms analyze market data, identify trading opportunities, and execute trades at speeds that human traders cannot match. The main advantages of algo trading include:

Speed and Efficiency: Algorithms can execute trades in milliseconds, capturing opportunities that might be missed by manual trading.

Precision: Automated trading reduces human errors, ensuring that trades are executed exactly as intended.

Backtesting: Traders can test their strategies against historical data to refine and optimize their approach before going live.

Emotion-Free Trading: Algorithms follow predefined rules, eliminating emotional biases from trading decisions.

24/7 Trading: Algorithms can operate around the clock, ensuring continuous market engagement.

Why TradingView?

TradingView is renowned for its advanced charting capabilities, user-friendly interface, and a vibrant community of traders. Here’s why TradingView is a favorite among traders:

Comprehensive Charting Tools: TradingView offers a wide range of chart types, indicators, and drawing tools to help traders analyze market trends and make informed decisions.

Real-Time Data: Stay updated with real-time data and alerts, ensuring you never miss a trading opportunity.

Community and Collaboration: Engage with a global community of traders, share ideas, and gain insights from other experts.

Customization and Flexibility: Customize your trading charts and interface to suit your trading style and preferences.

Introducing Algoji: The Perfect Synergy of Algo Trading and TradingView

Algoji seamlessly integrates the power of algo trading with the advanced features of TradingView, providing traders with a comprehensive solution for optimizing their trading strategies. Here’s how Algoji can transform your trading experience:

1. Advanced Algorithm Development

Algoji offers an intuitive platform for developing sophisticated trading algorithms. With a wide range of technical indicators and customization options, you can create strategies tailored to your unique trading style. Whether you are a technical analyst or a quantitative trader, Algoji provides the flexibility and power you need.

2. Real-Time Market Insights

Stay ahead with Algoji’s real-time data and analytics. The platform provides detailed market analysis, helping you make informed decisions based on the latest trends. Real-time insights enable you to adapt quickly to market changes and seize opportunities as they arise.

3. Seamless Execution Automation

Algoji integrates seamlessly with TradingView, allowing you to automate trade execution based on predefined rules. This reduces manual errors, minimizes latency, and improves execution efficiency. Set your strategies to execute trades automatically, ensuring timely and accurate order placement.

4. Robust Risk Management

Protect your capital with Algoji’s advanced risk management features. The platform allows you to set risk controls, implement stop-loss orders, and manage position sizes to optimize risk-adjusted returns. Effective risk management is crucial for long-term trading success, and Algoji provides the tools you need to safeguard your investments.

5. Comprehensive Support

Algoji’s dedicated support team is always ready to assist you. From onboarding to technical guidance, Algoji ensures you have all the resources you need to succeed in algo trading. The platform also offers educational resources and community engagement opportunities to enhance your trading knowledge and skills.

Getting Started with Algoji

Whether you’re new to algo trading or an experienced trader seeking advanced solutions, Algoji makes it easy to get started:

Sign Up: Create an account with Algoji and explore the platform’s features.

Develop Your Strategy: Use Algoji’s advanced tools to develop and backtest your trading strategies.

Automate Your Trades: Integrate your strategies with TradingView and automate the execution process.

Monitor and Optimize: Use real-time analytics to monitor your strategy’s performance and make necessary adjustments for optimal results.

Engage with the Community: Join Algoji’s community of traders, participate in educational events, and stay updated with industry trends to continuously improve your trading knowledge and skills.

Conclusion

In the competitive world of financial trading, having the right tools can make all the difference. Algoji, with its seamless integration of algo trading and TradingView, offers the advanced features, real-time insights, and comprehensive support you need to succeed. Whether you’re a seasoned trader or just starting, Algoji empowers you to harness the power of algorithmic trading and achieve your trading goals.

2 notes

·

View notes

Text

ICFM Share Market Courses Online - Enroll Today

Discover the freedom to learn trading anytime, anywhere with ICFM's (Institute of Career in Financial Market) industry-leading share market courses online. These comprehensive digital programs are meticulously designed to transform beginners into confident traders and help experienced investors refine their strategies. The curriculum covers all critical aspects of modern trading including technical analysis, derivatives trading, algorithmic strategies, and behavioral finance, delivered through an engaging mix of pre-recorded masterclasses and live interactive webinars.

ICFM's online platform stands out with its cutting-edge virtual trading lab that simulates real market conditions, allowing students to practice complex strategies risk-free. Each module is crafted by market veterans with decades of experience, ensuring you learn practical, battle-tested techniques rather than just theoretical concepts. The courses feature progressive learning paths that adapt to your skill level, from understanding basic candlestick patterns to mastering advanced option spreads and portfolio hedging techniques.

What makes ICFM's online offering exceptional is the personalized mentorship program. Every student gets dedicated guidance from professional traders who provide regular feedback on your trading journal and strategy backtesting. The flexible learning management system tracks your progress while allowing you to learn at your optimal pace, with 24/7 access to all resources including video lessons, e-books, and case studies.

Upon completion, you'll receive an ICFM certification that adds significant value to your professional profile in the financial sector. Beyond the certificate, you gain lifetime access to our vibrant trading community, weekly market analysis webinars, and exclusive stock screening tools. Whether you're looking to trade professionally or simply want to grow your personal wealth intelligently, ICFM's online share market courses provide the perfect combination of convenience and quality education. Join thousands of successful traders who launched their journey with India's most trusted online trading education platform.

0 notes

Text

https://www.storeboard.com/sachinjoshi1/images/how-to-customise-algorithmic-trading-software-to-suit-your-trading-style/1136694

Algorithmic trading, or algo-trading, has revolutionised the financial markets. It involves using computer programs to execute trading strategies automatically based on predefined rules and parameters.

#Algorithmic Trading Software#Customise Algorithmic Trading Software#pre-built algorithmic trading#robust backtesting

0 notes

Text

Algorithmic Trading Software in India | Powered by ThinkNextITSolution

Automate strategies, execute trades at lightning speed & conquer NSE/BSE volatility. Our AI-driven platform offers precision, 24/7 backtesting & institutional-grade tools. Discover India’s most reliable algorithmic trading software in india. Start Your Demo!

0 notes

Text

Legendary stock traders: How to Master Consistency in Market Chaos

Legendary stock traders: How to Master Consistency in Market Chaos

Frustrated by endless volatility? Discover how legendary stock traders have mastered simple, proven methods to achieve reliable results—even when markets feel impossible to predict.

The Secret Behind Legendary Stock Traders’ Success

Legendary stock traders aren’t born different—they follow data-driven systems. A 2023 analysis revealed that 80% of profitable traders rely on repeatable strategies, not gut instinct. These traders cut through noise with clear, actionable rules. If you’re tired of overcomplicating things, their disciplined approach is your blueprint for consistency.

Why Simplicity Beats Complexity in Trading

Complex strategies often fail under pressure. Legendary stock traders like Paul Tudor Jones credit their long-term consistency to simple systems. One study showed traders using straightforward entry/exit criteria outperformed “advanced” algorithmic traders by 16%. Focusing on clarity gives you an edge—especially in chaotic markets.

Proven Historical Performance Matters Most

Legendary stock traders always track results. For example, Richard Dennis’s Turtle Traders achieved a 100%+ annual return by sticking to tested rules. Real historical performance beats hype every time. Look for backtested strategies that show steady gains across multiple market cycles for genuine reliability.

Turn Chaos Into Clarity With a Reliable System

Market chaos is inevitable, but legendary stock traders thrive by using systems with clear risk controls. Simple rules—like 2% max loss per trade—help limit mistakes and boost confidence. The right system transforms confusion into clarity, so you act decisively, not emotionally, regardless of volatility.

Take Action: Start Your Consistent Trading Journey

Most traders struggle because they lack a clear, proven system. Legendary stock traders succeed by following simple, data-backed rules. Ready to trade with confidence? Embrace a systematic approach and leave frustration behind as you build consistency, one trade at a time.

Simplicity outperforms complexity in the stock market

Legendary stock traders rely on proven, data-driven systems

Clear rules and risk controls turn chaos into opportunity

Consistency is possible. Legendary stock traders have shown the way—now it’s your turn. Ready to master the markets? Start with a reliable, rules-based system today.

What traits set legendary stock traders apart?

Legendary stock traders excel through discipline, using simple, historically proven systems. They avoid emotional decisions and always track performance, focusing on consistent execution over flashy, high-risk moves.

How can I build my own data-driven trading strategy?

Begin by backtesting simple strategies and setting clear entry/exit rules. Monitor performance over time. Refine your approach based on real results, and never risk more than you can afford per trade.

Have you tried a rules-based system? Share your biggest trading challenge or breakthrough in the comments, and reblog if you found these legendary stock traders’ tips helpful!

0 notes

Text

Enroll in ICFM’s Algo Trading Course and Transform Your Financial Skills with Real-World Automated Trading Experience

Welcome to the Future of Trading: Why Algo Trading Matters Today

In today’s digital age, speed and accuracy define success in the stock market. Manual trading strategies, while still relevant, often fail to match the precision and efficiency of automated systems. That’s where algorithmic trading—commonly known as algo trading—takes center stage. For those looking to dive into this advanced method of trading, enrolling in a specialized algo trading course is essential. And when it comes to quality training in this domain, ICFM – Stock Market Institute offers one of the most comprehensive and practical programs in India.

ICFM’s Algo Trading Course – Learn to Trade with Logic, Speed, and Discipline

ICFM has developed a uniquely structured algo trading course that helps students, finance professionals, and traders understand the mechanics behind automated systems. This course is designed to provide a strong foundation in algorithmic logic, strategy creation, backtesting, and real-time execution. It goes beyond theory and dives deep into the actual workings of automation tools, trading APIs, and risk control mechanisms. The program is tailored to bridge the gap between traditional trading practices and the modern, data-driven approach that dominates today’s financial world.

How ICFM Makes Algo Trading Easy to Understand and Apply

One of the common misconceptions about algorithmic trading is that it’s only for coders or IT professionals. ICFM breaks this myth through its thoughtfully curated algo trading course, where even non-technical learners can understand complex concepts with ease. The course is taught using simple language, practical examples, and live demonstrations. Whether you're a trader aiming to automate your strategy or a student aspiring to enter the fintech world, this course equips you with actionable knowledge to start building and deploying trading algorithms efficiently.

Course Structure Designed for Real-World Market Application

The curriculum of ICFM’s algo trading course has been designed by industry experts with years of experience in algorithmic trading. The course begins with an introduction to the basics of financial markets and gradually moves into advanced topics like Python programming for trading, API integration, strategy development, and algo testing environments. Each module is aligned with real-world trading needs. By the end of the course, learners not only understand the concepts but also develop the skills to implement their own trading algorithms confidently.

Live Market Exposure and Hands-On Practice

Unlike many theory-heavy courses available online, ICFM’s algo trading course emphasizes practical learning. Students work on actual datasets, simulate trades, and test their strategies in real market conditions. This hands-on approach is what sets ICFM apart. It allows learners to troubleshoot in real-time, observe the behavior of different trading models, and fine-tune their strategies for better accuracy and profitability. The live trading lab provides the perfect environment to transition from a theoretical learner to a capable algo trader.

Ideal for Beginners, Professionals, and Financial Enthusiasts

ICFM’s algo trading course has been designed to cater to learners from all backgrounds. Whether you are a student of finance, an MBA graduate, a software developer, or even a self-taught trader, this course can help enhance your understanding of algorithmic trading. For working professionals already in the trading space, the course adds depth and automation to their existing skillset. For new entrants, it builds the entire framework needed to enter the domain with confidence and clarity.

Tools, Technologies, and Industry-Relevant Knowledge

In the rapidly evolving financial sector, keeping up with new tools and technologies is critical. ICFM’s algo trading course introduces learners to a variety of software and platforms commonly used in the industry. From Python and SQL to broker APIs and backtesting libraries, students become familiar with everything needed to execute an automated trading strategy. Additionally, the course keeps learners informed about current regulations, risk management practices, and the ethical use of algorithms in the financial markets.

Expert Faculty and Personalized Mentorship

The success of any educational program lies in its faculty, and ICFM doesn’t compromise here. Every instructor involved in the algo trading course is a seasoned market practitioner with a background in algo development, financial modeling, or quantitative research. Their real-world experience translates into practical teaching that goes far beyond textbook knowledge. ICFM also offers mentorship support throughout the course, where students can clarify doubts, receive career guidance, and get help in building customized trading bots.

Career Prospects After Completing the Algo Trading Course

Completing ICFM’s algo trading course opens the doors to several career opportunities. Graduates can work as algorithmic traders, quant analysts, strategy developers, or even independent automated traders. The fintech industry in India and abroad is witnessing exponential growth, and demand for skilled algo professionals is at an all-time high. ICFM’s certification and real-market training make students job-ready and highly competitive in the global job market.

Why Choose ICFM Over Other Institutes?

There are many online courses available on algorithmic trading, but few match the depth, support, and live exposure offered by ICFM. Their algo trading course is structured for serious learners who want more than just theoretical knowledge. With access to experienced mentors, real-time platforms, and industry-specific training, ICFM helps learners evolve into full-fledged algo traders.

Conclusion: Embrace the Future of Trading with ICFM’s Algo Trading Course

Technology is redefining financial markets, and those who adapt early will lead tomorrow’s trading landscape. By enrolling in the algo trading course offered exclusively by ICFM – Stock Market Institute, you gain the tools, techniques, and confidence to navigate and excel in automated trading. Whether you're planning to start your career or scale your existing skills, this course is your gateway to the future of finance. It’s not just about learning to trade—it’s about learning to trade smarter.

#algo trading course#online algo trading course#learn algorithmic trading#algo trading course with certification#algo trading classes#algo trading course near me#practical algo trading course

1 note

·

View note

Text

The Future of MT4 and MT5: What Traders Should Know

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) have been around for a long time, almost unbeatable as platforms for retail traders and algo traders. But with the financial markets moving so quickly, there are many traders and developers asking, —What's next for MT4 and MT5?

Let's take a look at MT4 and MT5 and their situation and future relevance in trading.

MT4 v. MT5: A Quick History

MT4 has been around since 2005 and is very commonly used for forex and CFDs. It is renowned for its straightforward user experience and for the vast ecosystem of indicators and Expert Advisors (EAs) available.

MT5 was released in 2010 and has better specifications, supports more assets, processes trades faster, has multi-threaded backtesting, and allows an economic calendar.

There is no question that MT5 is technically superior—so why does MT4 continue to command the market, with brokers placing more importance on it than MT5, if they even offer MT5?

Why MT4 Will Continue to Thrive in 2025 Extensive Community Support: Thousands of traders and developers are still using the MT4 codebase and ecosystem.

Lightweight Environment: MT4 has a smaller memory footprint in terms of running resources and can be easily implemented on older PCs or in stable environments.

Supported Orders in MetaConnector | TradingView to MT4/MT5

Broker Supported: There are still many brokers working with MT4 as their most preferred version due to so much interest in the platform. But can this last? Reasons Why MT4 and MT5 Will Remain Relevant 1. Extensive International User Base Millions of traders continue to use MT4 and MT5, especially for forex and CFD trading, and brokers globally still continue to reveal both platforms. 2. Sophisticated Automation Options The growth of copy trading and algorithmic trading means that with MT4 and MT5 there are different solutions available for integrating several options: MetaConnector and TradingView to MT5 Copier allow people to automate, even those new to the industry. 3. Broker and 3rd Party Connectivity Currently, although new platforms continue to arrive on the market, MT4 and MT5 remain intimately embedded in systems amongst brokers and will not be replaced overnight. The Challenges Ahead 1. MetaQuotes Licensing Approach MetaQuotes ceased providing MT4 to new brokers in 2022 and will only be providing MT5 in the future. Over time, this will inevitably diminish the availability of MT4, but not at a rapid rate. 2. Regulatory Pressure Regulators in some areas have recently become more stringent around MetaTrader platforms after many prominent scam brokers have exploited the platforms. This has required it to now be temporarily removed from app stores in those areas. Competing Platforms New web-based platforms are arriving, such as cTrader, TradingView, and broker-specific terminals, offering non-proprietary, intuitive design and social options that dynamically update in real time, which is attracting younger traders. Copy Trading / MT5 Future The growth in copy trading continues and is making the MT5 platform alive again, with the integral tools that firms such as Combiz Services Pvt are offering. Copy Trading & the MT5 Platform: An Exciting Future The thrilling rise of copy trading is reinvigorating the MT5 platform. With incredible capabilities existing between companies like Combiz Services Pvt. Ltd., traders can copy trades across MT4, MT5, and from other platforms like TradingView, all without programming. This is a tremendous value added to the MT5 ecosystem since it allows new and experienced traders a great deal of flexibility with available integrations for tools like Master-Child Auto Copy System Broker API Integrations Real-time Trade Copier Techniques The Outlook Here are a few different views on what we may see in the future: Declining MT4: As MetaQuotes continues to withdraw the license for MT4, we may see it decline slowly, but relevant support is foreseen for years. Dominating MT5: With more features and constant updates, MT5 will undoubtedly become the universal MetaTrader platform, maintained by strict regulations. Leading Custom Integrations: With automation products like MetaConnector and amazing companies like Combiz Services Pvt. Ltd., MT5 will futuristically become the nucleus for all of your next-generation algo and copy trading thinking plans. Conclusion While MT4 has had a historical run, the predominance of the future is MT5. Obviously, traders and brokers are slowly transitioning over to MT5. Everyone is seeing the benefits of having more functionality and compliance. That said, both platforms are extremely valuable—especially when used with smart automation tools. So if you are a trader, simply stay ahead of the game and make sure you are using the best tools (including those offered by Combiz Services Pvt Ltd)!

1 note

·

View note

Text

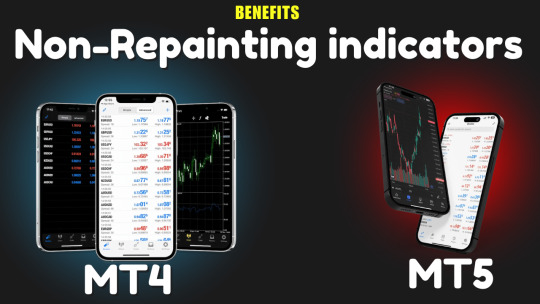

What are the main benefits of using non-repainting indicators in MT4 or MT5.

Using non-repainting indicators in MetaTrader 4 (MT4) or MetaTrader 5 (MT5) offers a range of benefits that can significantly improve a trader’s ability to analyze the markets, manage risk, and execute more accurate trades. In both platforms, indicators play a critical role in shaping trading strategies—whether manual or automated. Repainting indicators, which change their past signals based on new price data, can mislead traders and create a false sense of strategy success during backtesting. Non-repainting indicators, on the other hand, offer consistency, accuracy, and transparency.

In this article, we’ll explore the main benefits of using non-repainting indicators in MT4 or MT5, supported by examples, practical uses, and strategic insights.

1. Reliable Signal Consistency

One of the most important benefits of using non-repainting indicators is signal consistency. Once a signal appears (such as a buy/sell arrow or crossover), it remains fixed. This allows traders to trust that the signals shown during live trading are the same ones that would have appeared in past conditions.

In contrast, repainting indicators often “move” their signals or adjust historical bars, making trades look better than they really were. This creates illusionary accuracy, especially in strategies involving trend reversals or scalping.

✅ Benefit: Real-time signals are trustworthy and can be acted upon with confidence.

2. Accurate Backtesting and Strategy Development

Backtesting is the backbone of developing a reliable trading system. With non-repainting indicators, you can accurately test your strategies over historical data and get realistic results. Since these indicators do not adjust historical outputs, they allow you to assess whether a strategy would have performed well without curve-fitting or hindsight bias.

For example, a non-repainting moving average crossover system will provide the same cross points in both live and historical charts. This ensures that any optimization or manual review of trades is based on genuine data.

✅ Benefit: Eliminates false confidence in strategies and improves the quality of backtests.

youtube

3. Enhanced Risk Management

Accurate signals from non-repainting indicators allow traders to better plan stop-loss and take-profit levels. Since the indicator will not change its past reading, you can confidently place a trade knowing that the signal has been validated by closed price action, not subject to change.

For example, if a non-repainting Relative Strength Index (RSI) shows divergence on the H1 chart, a trader can set risk parameters accordingly without fearing that the divergence will vanish later.

✅ Benefit: Improves placement of protective stops and profit targets, leading to better capital protection.

4. Improved Entry and Exit Timing

Non-repainting indicators often issue signals only after a bar closes, which ensures that the movement is confirmed. While this might slightly delay the entry, it significantly reduces the risk of false breakouts or market noise that can cause premature or incorrect trades.

This is especially useful for intraday and scalping strategies in MT4 or MT5, where timing and accuracy are critical.

✅ Benefit: Reduces whipsaws and fake signals, especially during volatile or choppy market phases.

5. Stronger Trading Psychology and Discipline

Trading psychology is a key element of success. Non-repainting indicators contribute to emotional discipline by giving traders clear, unchanging rules to follow. When an indicator consistently shows valid signals, traders are more likely to stay committed to their plan and avoid second-guessing.

This reduces the emotional rollercoaster caused by indicators that change signals unexpectedly, helping you stick to your system even during losses.

✅ Benefit: Builds confidence in your system, reduces emotional trading, and promotes consistency.

6. Simplicity in Algorithmic Trading (Expert Advisors)

For traders who build or use Expert Advisors (EAs) in MT4/MT5, non-repainting indicators are essential. Algorithms operate on strict logic, and repainting indicators can break this logic by changing conditions mid-execution.

Non-repainting indicators ensure that signals used to trigger trades remain consistent, leading to more stable and predictable EA behavior.

✅ Benefit: Ensures algorithmic systems operate on solid, repeatable conditions for better performance.

7. Transparency in Trading Education and Mentorship

When learning or teaching trading strategies, non-repainting indicators offer a clear advantage. They allow students or mentees to see the actual signals that occurred at specific points in time without confusion.

This transparency makes it easier to study past trades, improve strategies, and understand market behavior without being misled by hindsight-optimized indicators.

✅ Benefit: Enables honest evaluation of setups and better learning outcomes.

8. Supports Multi-Timeframe Analysis

Non-repainting indicators are highly useful in multi-timeframe trading strategies. For example, a trader might use a non-repainting trend indicator on the H4 chart and wait for a confirmation on the M15 chart.

Because the indicator’s signals won’t change after candle closure, the trader can synchronize entries and exits across different timeframes more accurately.

✅ Benefit: Enhances the effectiveness of confluence strategies using higher and lower timeframes.

Final Thoughts

Non-repainting indicators in MT4 or MT5 offer traders a more authentic and dependable trading experience. They provide honest historical signals, eliminate misleading setups, and support the development of professional-grade strategies. While they may sometimes lag compared to repainting tools that try to predict future moves, their accuracy and consistency far outweigh the downside.

In summary, the main benefits of using non-repainting indicators in MT4/MT5 include:

Consistent signals in real time

Honest and accurate backtesting

Better risk management

Improved entries and exits

Emotional and strategic discipline

Reliable inputs for Expert Advisors

Transparency in trading education

Enhanced multi-timeframe strategy building

Whether you're a manual trader or an automated system developer, choosing non-repainting indicators helps ensure that your trading decisions are grounded in reality—not illusion.

#forex ea#best forex broker#forexsignals#forextrading#forexmarket#forexstrategy#forex news#forex indicator#forex trading#Youtube

0 notes