#algorithmic trading consulting

Explore tagged Tumblr posts

Text

Algorithmic Trading Consulting Services

We can backtest and optimize your trading strategies against historical data.

We can also automate your trading strategies by writing C++/python code to interact directly with the exchange

Do you have an idea for a trading strategy, but want to prove that it will work through backtesting against historical data? Or do you have a successful trading strategy but want to optimize the parameters of the strategy to maximise returns?

Or perhaps you’ve heard about machine learning and would like to find out how you could incorporate it into your trading. Machine learning can be used to trawl through large amounts of data looking for statistically significant signals to use in your trading. It can also be used to determine the optimal way to combine a number of possible signals or ideas into a single algorithm.

We provide cloud-based PhD quant support for traders. We offer trading algorithm development services for equity and FX markets on all major exchanges. We also offer bitcoin and cryptocurrency algorithmic trading services on major exchanges like Binance and Bitmex.

In fact, we offer a wide range of quant (quantitative finance) consulting services including algo trading, derivative pricing and risk modelling. We also offer more general mathematical and algorithmic consulting services.

Find out more about or algo trading and quant consulting services

#algo trading consulting#algorithm consulting#quant consulting#backtesting consulting#algorithmic trading consulting#trading strategy consulting

0 notes

Text

The Digital Euro in 2025: How This Game-Changer Will Impact Forex Traders

The European Central Bank’s plan to roll out the Digital Euro in 2025 is set to reshape the forex landscape. As a central bank digital currency (CBDC), it promises greater financial inclusion, enhanced security, and faster transactions. But what does this mean for traders? Will it create new opportunities or add more volatility to the market? PipInfuse, a leading Forex & Investment consultancy, explores how the Digital Euro could impact currency trading, offering expert trading solutions to help you navigate the changes.

What is the Digital Euro and Why Does It Matter?

The Digital Euro is a fully digital form of fiat currency issued by the European Central Bank (ECB). Unlike cryptocurrencies, it is centralised and backed by the EU, ensuring stability. The key objectives behind its launch include:

Reducing dependence on cash

Enhancing payment security

Strengthening the EU’s financial sovereignty

Offering an alternative to private digital payment solutions

For forex traders, this introduction means potential shifts in liquidity, volatility, and trading strategies.

Impact on the Forex Market

1. Liquidity and Volatility Shifts

The Digital Euro is expected to influence EUR trading pairs significantly. If widely adopted, it could increase liquidity in the forex market, making it easier to trade. However, during the initial rollout, uncertainty and speculation may create short-term volatility, presenting both risks and opportunities.

2. Changes in EUR/USD and EUR/GBP Dynamics

With the EU strengthening its monetary control, traders may see the Digital Euro influencing major forex pairs like EUR/USD and EUR/GBP. Any policy shifts by the ECB regarding CBDC interest rates or usage restrictions could impact price action, requiring expert market analysis to make informed trading decisions.

3. Effect on Forex Trading Strategies

Profitable forex strategies will need to adapt to the Digital Euro’s influence. Algorithmic trading models, liquidity forecasting, and AI-based analysis will become even more crucial. PipInfuse provides advanced forex tools and expert solutions tailored for all trader types, helping traders stay ahead of market changes.

4. Regulation and Transparency

The introduction of the Digital Euro could lead to stricter regulatory measures affecting brokers and forex trading platforms. While increased transparency may benefit traders, brokers offering unregulated services might face challenges. Trusted forex partners and copy trading solutions will become even more valuable for those looking to trade securely.

How Traders Can Prepare for the Digital Euro

Stay Updated with Expert Insights: Following reliable sources like PipInfuse ensures traders receive timely forex trading insights and expert market analysis on the Digital Euro’s impact.

Upgrade Trading Tools: As the forex market evolves, using advanced analytics and automation tools will be crucial for staying competitive.

Refine Risk Management: Increased volatility requires disciplined risk management. A well-structured forex trading plan is essential to mitigate potential losses.

Seek Expert Consultation: Understanding the broader economic impact of CBDCs can be complex. Free forex trading plan and expert consultation by PipInfuse can help traders develop strategies tailored to the changing forex landscape.

The Digital Euro marks a major shift in the financial world, with significant implications for forex traders. Whether it leads to increased liquidity, regulatory challenges, or new trading opportunities, being prepared is key. PipInfuse, an expert forex trading and investment consultancy, provides traders with the knowledge, tools, and strategies to navigate these changes confidently. By staying informed and leveraging expert trading solutions, traders can turn this disruption into a profitable opportunity.

Happy Trading

PipInfuse

#Digital Euro#Forex Trading#CBDC#Central Bank Digital Currency#Forex Market#EUR/USD#EUR/GBP#Forex Strategies#Risk Management#Advanced Forex Tools#Expert Trading Solutions#PipInfuse#Forex & Investment Consultancy#Forex Trading Insights#Market Analysis#Trusted Forex Partners#Copy Trading Solutions#Free Forex Trading Plan#Expert Consultation#Forex News#Trading Opportunities#Forex Regulation#Liquidity#Volatility#ECB#Algorithmic Trading#AI in Forex#Forex Brokers#Forex Education

0 notes

Text

The Pipefox! Little keepers of knowledge who love hanging out in libraries and such. And I do mean little, they're like a foot long or so (31+ cm). They can magically speak and read any language, cast any cantrip spell it has seen within the last minute, and turn invisible at will. They're very secretive, only coming out to discuss theories and swap info with people they believe to also be heavily devoted to knowledge. Thing is, this is ALL knowledge they care about, and they switch hyperfocus every few months. They might be learning a trade skill in the spring, then dedicate the winter to learning all the gossip of a workplace and figuring out thier entire social structure from all angles.

If these were on Earth, Matpat would have a pipefox slither out of his chimney and trade FNAF lore stolen from Scott Kaufman's sleeptalk for consultations on the Youtube Algorithm.

46 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

January 18, 2025

Heather Cox Richardson

Jan 19, 2025

Shortly before midnight last night, the Federal Trade Commission (FTC) published its initial findings from a study it undertook last July when it asked eight large companies to turn over information about the data they collect about consumers, product sales, and how the surveillance the companies used affected consumer prices. The FTC focused on the middlemen hired by retailers. Those middlemen use algorithms to tweak and target prices to different markets.

The initial findings of the FTC using data from six of the eight companies show that those prices are not static. Middlemen can target prices to individuals using their location, browsing patterns, shopping history, and even the way they move a mouse over a webpage. They can also use that information to show higher-priced products first in web searches. The FTC found that the intermediaries—the middlemen—worked with at least 250 retailers.

“Initial staff findings show that retailers frequently use people’s personal information to set targeted, tailored prices for goods and services—from a person's location and demographics, down to their mouse movements on a webpage,” said FTC chair Lina Khan. “The FTC should continue to investigate surveillance pricing practices because Americans deserve to know how their private data is being used to set the prices they pay and whether firms are charging different people different prices for the same good or service.”

The FTC has asked for public comment on consumers’ experience with surveillance pricing.

FTC commissioner Andrew N. Ferguson, whom Trump has tapped to chair the commission in his incoming administration, dissented from the report.

Matt Stoller of the nonprofit American Economic Liberties Project, which is working “to address today’s crisis of concentrated economic power,” wrote that “[t]he antitrust enforcers (Lina Khan et al) went full Tony Montana on big business this week before Trump people took over.”

Stoller made a list. The FTC sued John Deere “for generating $6 billion by prohibiting farmers from being able to repair their own equipment,” released a report showing that pharmacy benefit managers had “inflated prices for specialty pharmaceuticals by more than $7 billion,” “sued corporate landlord Greystar, which owns 800,000 apartments, for misleading renters on junk fees,” and “forced health care private equity powerhouse Welsh Carson to stop monopolization of the anesthesia market.”

It sued Pepsi for conspiring to give Walmart exclusive discounts that made prices higher at smaller stores, “[l]eft a roadmap for parties who are worried about consolidation in AI by big tech by revealing a host of interlinked relationships among Google, Amazon and Microsoft and Anthropic and OpenAI,” said gig workers can’t be sued for antitrust violations when they try to organize, and forced game developer Cognosphere to pay a $20 million fine for marketing loot boxes to teens under 16 that hid the real costs and misled the teens.

The Consumer Financial Protection Bureau “sued Capital One for cheating consumers out of $2 billion by misleading consumers over savings accounts,” Stoller continued. It “forced Cash App purveyor Block…to give $120 million in refunds for fostering fraud on its platform and then refusing to offer customer support to affected consumers,” “sued Experian for refusing to give consumers a way to correct errors in credit reports,” ordered Equifax to pay $15 million to a victims’ fund for “failing to properly investigate errors on credit reports,” and ordered “Honda Finance to pay $12.8 million for reporting inaccurate information that smeared the credit reports of Honda and Acura drivers.”

The Antitrust Division of the Department of Justice sued “seven giant corporate landlords for rent-fixing, using the software and consulting firm RealPage,” Stoller went on. It “sued $600 billion private equity titan KKR for systemically misleading the government on more than a dozen acquisitions.”

“Honorary mention goes to [Secretary Pete Buttigieg] at the Department of Transportation for suing Southwest and fining Frontier for ‘chronically delayed flights,’” Stoller concluded. He added more results to the list in his newsletter BIG.

Meanwhile, last night, while the leaders in the cryptocurrency industry were at a ball in honor of President-elect Trump’s inauguration, Trump launched his own cryptocurrency. By morning he appeared to have made more than $25 billion, at least on paper. According to Eric Lipton at the New York Times, “ethics experts assailed [the business] as a blatant effort to cash in on the office he is about to occupy again.”

Adav Noti, executive director of the nonprofit Campaign Legal Center, told Lipton: “It is literally cashing in on the presidency—creating a financial instrument so people can transfer money to the president’s family in connection with his office. It is beyond unprecedented.” Cryptocurrency leaders worried that just as their industry seems on the verge of becoming mainstream, Trump’s obvious cashing-in would hurt its reputation. Venture capitalist Nick Tomaino posted: “Trump owning 80 percent and timing launch hours before inauguration is predatory and many will likely get hurt by it.”

Yesterday the European Commission, which is the executive arm of the European Union, asked X, the social media company owned by Trump-adjacent billionaire Elon Musk, to hand over internal documents about the company’s algorithms that give far-right posts and politicians more visibility than other political groups. The European Union has been investigating X since December 2023 out of concerns about how it deals with the spread of disinformation and illegal content. The European Union’s Digital Services Act regulates online platforms to prevent illegal and harmful activities, as well as the spread of disinformation.

Today in Washington, D.C., the National Mall was filled with thousands of people voicing their opposition to President-elect Trump and his policies. Online speculation has been rampant that Trump moved his inauguration indoors to avoid visual comparisons between today’s protesters and inaugural attendees. Brutally cold weather also descended on President Barack Obama’s 2009 inauguration, but a sea of attendees nonetheless filled the National Mall.

Trump has always understood the importance of visuals and has worked hard to project an image of an invincible leader. Moving the inauguration indoors takes away that image, though, and people who have spent thousands of dollars to travel to the capital to see his inauguration are now unhappy to discover they will be limited to watching his motorcade drive by them. On social media, one user posted: “MAGA doesn’t realize the symbolism of [Trump] moving the inauguration inside: The billionaires, millionaires and oligarchs will be at his side, while his loyal followers are left outside in the cold. Welcome to the next 4+ years.”

Trump is not as good at governing as he is at performance: his approach to crises is to blame Democrats for them. But he is about to take office with majorities in the House of Representatives and the Senate, putting responsibility for governance firmly into his hands.

Right off the bat, he has at least two major problems at hand.

Last night, Commissioner Tyler Harper of the Georgia Department of Agriculture suspended all “poultry exhibitions, shows, swaps, meets, and sales” until further notice after officials found Highly Pathogenic Avian Influenza, or bird flu, in a commercial flock. As birds die from the disease or are culled to prevent its spread, the cost of eggs is rising—just as Trump, who vowed to reduce grocery prices, takes office.

There have been 67 confirmed cases of the bird flu in the U.S. among humans who have caught the disease from birds. Most cases in humans are mild, but public health officials are watching the virus with concern because bird flu variants are unpredictable. On Friday, outgoing Health and Human Services secretary Xavier Becerra announced $590 million in funding to Moderna to help speed up production of a vaccine that covers the bird flu. Juliana Kim of NPR explained that this funding comes on top of $176 million that Health and Human Services awarded to Moderna last July.

The second major problem is financial. On Friday, Secretary of the Treasury Janet Yellen wrote to congressional leaders to warn them that the Treasury would hit the debt ceiling on January 21 and be forced to begin using extraordinary measures in order to pay outstanding obligations and prevent defaulting on the national debt. Those measures mean the Treasury will stop paying into certain federal retirement accounts as required by law, expecting to make up that difference later.

Yellen reminded congressional leaders: “The debt limit does not authorize new spending, but it creates a risk that the federal government might not be able to finance its existing legal obligations that Congresses and Presidents of both parties have made in the past.” She added, “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

Both the avian flu and the limits of the debt ceiling must be managed, and managed quickly, and solutions will require expertise and political skill.

Rather than offering their solutions to these problems, the Trump team leaked that it intended to begin mass deportations on Tuesday morning in Chicago, choosing that city because it has large numbers of immigrants and because Trump’s people have been fighting with Chicago mayor Brandon Johnson, a Democrat. Michelle Hackman, Joe Barrett, and Paul Kiernan of the Wall Street Journal, who broke the story, reported that Trump’s people had prepared to amplify their efforts with the help of right-wing media.

But once the news leaked of the plan and undermined the “shock and awe” the administration wanted, Trump’s “border czar” Tom Homan said the team was reconsidering it.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Consumer Financial Protection Bureau#consumer protection#FTC#Letters From An American#heather cox richardson#shock and awe#immigration raids#debt ceiling#bird flu#protests#March on Washington

30 notes

·

View notes

Text

It's been days but I'm still thinking about how someone basically asked Neil Gaiman for passive permission to use AI for writer's block and he was like "I recommend having a friend instead"

and a lot of people were like "lol yeah but your friend was Pterry" and SURE. POINT.

But the majority of friends I consult when I have writer's block are not prolific beloved authors. And many aren't authors, period.

The story I just sent in to an editor? The friend who got me unstuck is a mechanic by trade, a writer once in a while for fun. He's also known me for half my life, knows what kinds of stories I like to write, and knows what makes an entertaining story for the readership I was writing for (since he's part of it). The whole second half of the story - the good part - came about because of his suggestion. You can read it probably later this year and let me know if he was helpful, but I'm pretty sure you'll agree that he was.

Your consultant for writer's block doesn't have to be The Late Sir Terry Pratchett to be worthwhile. A friend who knows you and enjoys a good story will still help you infinitely more than an algorithm whose only chance of knowing anything about you is if it was fed one of your stories.

#and randomthunk is one of my go-tos for writer's block also#the swan and the flame is largely down to her#again a few words of suggestion that worked because she knows me and my nonsense

66 notes

·

View notes

Text

I have been seeing a bunch of buzz recently online about a possible "decline in value" of the ivy league+ degree - Nate Silver didn't start it but he certainly accelerated it. And while there is nothing robust you do see things like surveys of hiring manager opinions out there to suggest its possible, its not a crazy idea even if its far from proven. So assuming its real, why would it be happening?

1: This discourse is obviously happening because of the recent protests at top US schools - essentially its the idea that elite students are hyperpolitical, coddled, and out of touch with reality. This causal path should be very, very silly. The vast, vast majority of students at Columbia are not protesting. They don't really care about this topic! Sure, if asked, they agree Israel Bad Right Now, but otherwise they are busy with finals and job apps. This is of course equally true at most other schools, its just not a mass movement in that way (protesting to be clear rarely is). This is a specific instance of the general trap of selection bias - the visible students aren't the median ones.

Stacked on top of that is the second level of selection bias - the median protestor is not a business major or engineer! They are exactly the kind of students for whom being a politically engaged activist is *good* for their career, not bad, or at least neutral. Schools produce a large diversity of career outcomes, and those students self-select on how they spend their time, there is no "median" student to observe really.

And ofc all of this has to rest on the foundational reality that people are products of their context - jobless 20 year old's surrounded by young peers protest a bunch, that is what that context produces. The large majority of them will become mortgage-paying white collar workers by the time they are 30, this identity will not stick with them. If they become political activists it will, sure! But if you are the hiring manager for Palantir this isn't going to be the trend for your hires. There are "politically liable" hires out there but you aren't going to predict them via the sorting algorithm of "was at Columbia in 2024", that is for sure.

Now, as much as this is a silly idea, humanity are zeitgeist creatures - I can't actually reject the idea that, despite it being silly, hiring managers might use this moment to feel like they are "over" the Ivy League and start dismantling the privileged place their applications currently get. Cultural tipping points are vibes-based, and amoung elites (unlike the masses, who don't care much) Israel/Palestine has an awful lot of tense vibes.

2: Still, I don't think this is explaining those survey results people are throwing around, and I don't think its explained (very much at least) by the general "woke uni" trends of the past half decade. It is instead downstream of wider trends.

There was a time where companies really did want "the smart guy". You could major in English at Harvard, write a good thesis on Yeats, and be off to the trading desk in Chambers St two weeks after graduation. Those days are over - for complex reasons we won't get into - and nowadays people expect their new hires to be as close to experts in the field as they can manage. Students have internships, consulting clubs, capstone projects with real clients, specialized sub majors, the works. These are all ways of saying "signaling quality" has gotten more legible and more specific over time. Why would I choose a Harvard English major over a University of Illinois finance major who did a research internship with our specific Chicago firm on midwest agricultural derivates markets? Students like that exist by the bucketful now, and the Ivys cannot monopolize them. Partially because they choose not to; Columbia could actually say fuck it and make its school 90% finance majors, but they don't want that, they specifically recruit intellectually diverse students. Which means State School finance types will fill the remaining slots slots.

The other reason they can't monopolize is much simpler - numbers. The US has way more "elite" jobs today than it did in the past. Programmers and their adjacencies are the biggest growth sector, but everything from doctors to analysts to lawyers is all up up up. And do you know what isn't up? Undergraduate enrollment at elite schools! Columbia's has grown by like 10% over the past 20 years; Harvard's is essentially unchanged. For, again, reasons, these schools have found the idea of doubling or tripling their undergraduate enrollment, despite ballooning applications, impossible. Which means of course Microsoft can't hire from Stanford alone. So they don't, and they have learned what other schools deliver talent, and no longer need Stanford alone. The decline of Ivy Power is in this sense mathematical - if a signal of quality refuses to grow to meet demand, of course other signals will emerge.

I therefore personally think, while minor, the Ivy+ schools are experiencing declining status, have been for a while, and will continue to do so (though there are offsetting trends not mentioned here btw). But its structural way more than cultural.

51 notes

·

View notes

Text

youtube

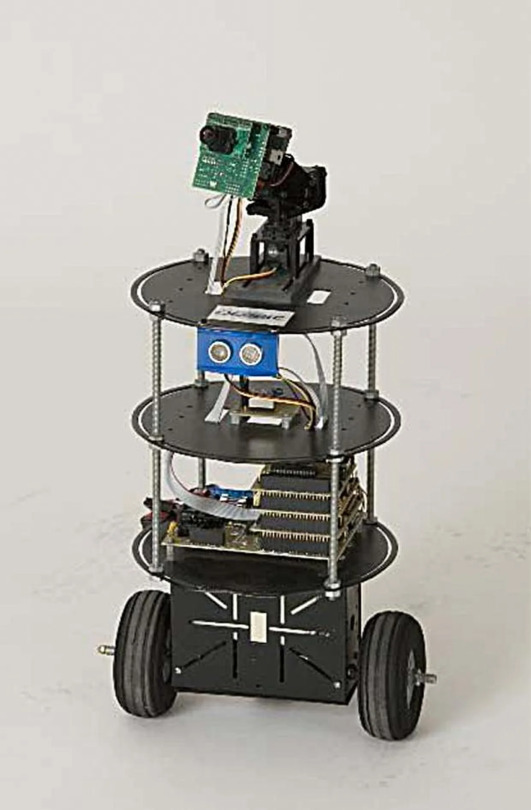

Flexo (2003) by Ted Larson and Bob Allen, CA, USA. Flexo is an early forerunner of the AMPbot.

"It was finally time to make a smaller, improved version of Bender that could do more things. One thing I learned from all my work was that bigger balancing robots are usually easier—since they move slower, the control system doesn’t need to be as exacting in making minor corrections. But making a really tiny balancing robot becomes harder and harder the smaller you go. In the TV show Futurama, Bender has a brother named Flexo. So it made sense to name the new robot after him.

Since I now had a PID algorithm good enough to do things like balance a robot with an offset load on top of it and drive up and down ramps, I could easily mount a moving, pan-tilt-camera rig to the top without any fear of the motion of the camera knocking the robot over. I used a color tracking camera tuned to track the color red, so that if you put a red object in front of the robot, it would try to move toward you. Once it got close enough, it would just stand there and stare at you. We took Flexo to the HomeBrew Robotics Club once he was working, and there was a kid there wearing a red sweatshirt the robot really took a liking to!

Bob thought we might be able to find some companies that might be interested in paying for our expertise in developing these kinds of balancing robots. We bought a booth at the first RoboNexus trade show held in San Jose in 2004. On the first day, we were standing in our booth with Flexo showing off his balancing act, and who should come down the aisle riding a Segway but Dean Kamen himself. He rode up, stopped for a moment, and said jokingly, “Wow! Look at that! I have never seen anything like that!”

On the second day, we met a bunch of enthusiastic engineers from Hasbro. They were looking for more interesting robotic toys they could add to their line, as well as some help with more advanced sensors in toy development. We were invited out to Hasbro corporate headquarters in Rhode Island to give a presentation to the engineering team about what we could do. Bob asked if we needed to prepare a formal presentation, but Hasbro told us to just show up and bring some robots. When we arrived, we were shuttled into an enormous conference room that looked like it could seat 100 people, and there were 20 people sitting in there waiting to hear the presentation that we didn’t have! We thought we’d completely blown it, but we just turned on the robots and Bob started talking. Soon, the crowd warmed up, got out of their seats, and started coming to look at the robots up close, and it all worked out after that. Bob and I started a robotics consultancy called OLogic in 2005 with Hasbro as our first customer." – Ted Larson, From HomeBrew to Hasbro How two friends hacked a balancing robot and wrote a toy story of their own.

18 notes

·

View notes

Text

The Federal Trade Commission is sending more than $5.6 million in refunds to consumers as part of a settlement with Amazon-owned Ring, which was charged with failing to protect private video footage from outside access. In a 2023 complaint, the FTC accused the doorbell camera and home security provider of allowing its employees and contractors to access customers’ private videos. Ring allegedly used such footage to train algorithms without consent, among other purposes. Ring was also charged with failing to implement key security protections, which enabled hackers to take control of customers’ accounts, cameras and videos. This led to “egregious violations of users’ privacy,” the FTC noted. The resulting settlement required Ring to delete content that was found to be unlawfully obtained, establish stronger security protections and pay a hefty fine. The FTC says that it’s now using much of that money to refund eligible Ring customers. According to a Tuesday notice, the FTC is sending 117,044 PayPal payments to impacted consumers who had certain types of Ring devices — including indoor cameras — during the timeframes that the regulators allege unauthorized access took place. Eligible customers will need to redeem these payments within 30 days, according to the FTC — which added that consumers can contact this case’s refund administrator, Rust Consulting, or visit the FTC’s FAQ page on refunds for more information about the process.

6 notes

·

View notes

Text

ALMOST THREE DECADES OF INSTITUTIONAL EXPERIENCE

We have been in business since 1995 and we own the Guinness World Record for the most consecutive winning trades in a row (1,426 consecutive wins).

Our backgrounds include algorithmic, quantitative, macro and high-frequency trading. And we specialize in strategy development, consulting and premium trading services.

6 notes

·

View notes

Text

ALMOST THREE DECADES OF INSTITUTIONAL EXPERIENCE

We have been in business since 1995 and we own the Guinness World Record for the most consecutive winning trades in a row (1,426 consecutive wins).

Our backgrounds include algorithmic, quantitative, macro and high-frequency trading. And we specialize in strategy development, consulting and premium trading services.

6 notes

·

View notes

Text

ALMOST THREE DECADES OF INSTITUTIONAL EXPERIENCE

We have been in business since 1995 and we own the Guinness World Record for the most consecutive winning trades in a row (1,426 consecutive wins).

Our backgrounds include algorithmic, quantitative, macro and high-frequency trading. And we specialize in strategy development, consulting and premium trading services.

6 notes

·

View notes

Text

ALMOST THREE DECADES OF INSTITUTIONAL EXPERIENCE

We have been in business since 1995 and we own the Guinness World Record for the most consecutive winning trades in a row (1,426 consecutive wins).

Our backgrounds include algorithmic, quantitative, macro and high-frequency trading. And we specialize in strategy development, consulting and premium trading services.

6 notes

·

View notes

Text

How a Tech Lawyer Can Help You Navigate Global Expansion

Strategic Legal Guidance from Strategy Law

Expanding your technology business into international markets is an exciting step—but it's one that comes with significant legal complexity. From data privacy to IP protection and cross-border contracts, global expansion introduces a new layer of regulatory and operational challenges. That’s where a knowledgeable tech lawyer becomes indispensable.

At Strategy Law, our experienced tech attorneys provide forward-thinking legal solutions to help technology companies grow across borders with confidence and compliance.

Why Global Expansion Requires Legal Expertise

Tech companies are uniquely positioned to scale rapidly into new markets, but laws don’t scale with your software. Every country has its own legal frameworks around privacy, intellectual property, taxes, labor, and more. Without legal guidance, even a small misstep can result in fines, blocked access, or reputational damage.

That’s why working with a trusted tech lawyer is essential to protect your assets and ensure your operations remain compliant from the outset.

Key Ways a Tech Lawyer at Strategy Law Can Help

Here’s how Strategy Law’s tech lawyers assist technology companies with international growth:

1. Cross-Border Contracts and Licensing Agreements

Entering new markets often involves licensing products, hiring vendors, or entering into partnerships. We draft and negotiate enforceable cross-border agreements that align with both U.S. and local laws.

2. Data Privacy & Regulatory Compliance

Global operations require compliance with laws like the GDPR, UK DPA, Canadian PIPEDA, and more. Our tech lawyers help you build policies and practices that meet international data protection standards.

3. Intellectual Property Protection Across Jurisdictions

We help tech companies protect their IP—whether it's source code, trademarks, or proprietary algorithms—through global trademark filings, patents, and licensing strategies tailored to each market.

4. Entity Formation & Corporate Structuring

Expanding globally often means setting up subsidiaries or branches abroad. We assist in choosing the right corporate structure, filing the necessary paperwork, and coordinating with local counsel.

5. Employment & Contractor Compliance

From remote hires to overseas offices, we help you comply with international labor laws, draft employment agreements, and develop workplace policies that meet global standards.

6. Export Control & Sanctions Compliance

Tech products and services may be subject to export controls or restricted jurisdictions. Strategy Law ensures your business meets U.S. and international trade laws to avoid violations and penalties.

Why Choose Strategy Law as Your Tech Legal Partner?

As a leading legal firm in California, Strategy Law offers deep experience supporting tech companies—from agile startups to global SaaS platforms. Our tech lawyers combine Silicon Valley insight with practical international legal strategy to help clients:

Enter new markets confidently

Avoid compliance risks

Protect their IP and data

Build scalable, legally sound operations

Whether you're expanding to Europe, Asia, or South America, our team delivers the legal clarity and precision you need to succeed.

Ready to Expand Globally? Let’s Talk.

Expanding your technology business globally is a bold move—and the right legal support can make all the difference. At Strategy Law, our seasoned tech lawyers are here to guide you through every stage of international growth.

Contact us today to schedule a consultation.

0 notes

Text

Algorithm Trading Market Growth Analysis 2025

The global Algorithm Trading market was valued at US$ 13,523.37 million in 2023 and is anticipated to reach US$ 26,730.34 million by 2030, witnessing a CAGR of 10.58% during the forecast period 2024-2030.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/270/algorithm-trading

North American market for Algorithm Trading is estimated to increase from $ 6,319.47 million in 2023 to reach $ 12,357.44 million by 2030, at a CAGR of 10.46% during the forecast period of 2024 through 2030.

Asia-Pacific market for Algorithm Trading is estimated to increase from $ 3,179.34 million in 2023 to reach $ 6,353.80 million by 2030, at a CAGR of 10.73% during the forecast period of 2024 through 2030.

The global market for Algorithm Trading in Investment Bank is estimated to increase from $ 6,852.29 million in 2023 to $ 13,381.21 million by 2030, at a CAGR of 10.39% during the forecast period of 2024 through 2030.

The major global companies of Algorithm Trading include QuantConnect, 63 moons, InfoReach, Argo SE, MetaQuotes Software, Automated Trading SoftTech, Tethys Technology, Trading Technologies, and Tata Consultancy Services, etc. In 2023, the world's top three vendors accounted for approximately 22.52 % of the revenue.

This report aims to provide a comprehensive presentation of the global market for Algorithm Trading, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Algorithm Trading.

The Algorithm Trading market size, estimations, and forecasts are provided in terms of and revenue ($ millions), considering 2023 as the base year, with history and forecast data for the period from 2019 to 2030. This report segments the global Algorithm Trading market comprehensively. Regional market sizes, concerning products by Type, by Application, and by players, are also provided.

For a more in-depth understanding of the market, the report provides profiles of the competitive landscape, key competitors, and their respective market ranks. The report also discusses technological trends and new product developments.

The report will help the Algorithm Trading companies, new entrants, and industry chain related companies in this market with information on the revenues for the overall market and the sub-segments across the different segments, by company, by Type, by Application, and by regions.

Market Segmentation

By Company

QuantConnect

63 moons

InfoReach

Argo SE

MetaQuotes Software

Automated Trading SoftTech

Tethys Technology

Trading Technologies

Tata Consultancy Services

Exegy

Virtu Financial

Symphony Fintech

Kuberre Systems

Itexus

QuantCore Capital Management

Segment by Type

Forex Algorithm Trading

Stock Algorithm Trading

Fund Algorithm Trading

Bond Algorithm Trading

Cryptographic Algorithm Trading

Other Algorithmic Trading

Segment by Application

Investment Bank

Fund Company

By Region

North America

United States

Canada

Others

Asia-Pacific

China

Japan

South Korea

Southeast Asia

India

Rest of Asia

Europe

Germany

France

U.K.

Rest of Europe

South America

Mexico

Brazil

Argentina

Rest of South America

Middle East & Africa

Middle East

Africa

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/270/algorithm-trading

0 notes

Text

🎯 Smart Contracts Need Smart IP: Protecting Blockchain Protocols

🧠 What Most Blockchain Developers Miss

Smart contracts are transparent, open-source, and self-executing — but they can be cloned, forked, and reused without your permission. Your protocol, your consensus mechanism, your tokenomics — all of it may be your intellectual property.

And if you don’t protect it... someone else can.

🔍 Key IP Risks in Blockchain Projects:

✅ Unprotected Codebases – Open-source licenses don’t equal ownership.

✅ Protocol Forking Without Legal Recourse – No patent = no enforcement.

✅ Loss of Trade Secrets – Deployed contracts are visible to everyone.

✅ No Licensing Model – No strategy = no royalties, no control.

✅ Investor Red Flags – Weak IP = reduced valuation in Web3 funding.

💡 Can You Protect Blockchain Protocols?

Yes — partially or fully. 🔹 Smart contract logic: Can be patented or copyrighted 🔹 Token systems & methods: Often patent-eligible 🔹 Consensus algorithms: May qualify for utility patent protection 🔹 Names, logos, symbols: Protected under trademark law 🔹 User interfaces & flows: Covered by design rights or copyright

🚨 Why It Matters in 2025

With rising Web3 investment, DeFi adoption, and AI-powered forks, having a smart IP framework is not optional — it’s essential.

The future of blockchain belongs to those who protect it.

🔐 Let IP Consulting Group Help You:

📁 Draft & File Patents for Blockchain Protocols 🧠 Review Smart Contract Ownership & IP Clauses 📜 Structure Licensing for DAOs and NFT Platforms ⚖️ Enforce IP Rights in Web3 Disputes

📞 Contact Us:

📧 [email protected] 🌐 www.ipconsultinggroups.com 📍 DC: +1 (202) 666-8377 | MD: +1 (240) 477-6361 | FL: +1 (239)

#SmartContracts#BlockchainIP#CryptoInnovation#Web3Protection#IPConsultingGroup#DeFiLaw#NFTIP#CryptoPatents#DAOstrategy#InnovationDefense#IntellectualProperty2025

0 notes

Text

Why AVENIR Tech is a Reliable Name in Artificial Intelligence & Machine Learning Solutions

In today’s fast-moving digital age, Artificial Intelligence (AI) and Machine Learning (ML) are not just buzzwords — they are practical tools helping businesses work smarter and make better decisions. If you’re looking for a dependable partner to implement these technologies, AVENIR Tech stands out as a top choice for Artificial Intelligence & Machine Learning solutions.

What Does AVENIR Tech Offer?

AVENIR Tech provides customized AI and ML solutions that help organizations automate operations, analyze data, predict trends, and improve overall efficiency. The company focuses on solving real-world problems through practical, tested AI models and machine learning algorithms.

Their solutions are applicable in a wide range of industries:

Healthcare — AI-driven diagnostics and predictive analytics

Finance — Fraud detection, risk scoring, and algorithmic trading

Retail — Customer behavior analysis and inventory forecasting

Manufacturing — Process automation and predictive maintenance

Marketing — Campaign optimization and sentiment analysis

Instead of offering pre-packaged services, AVENIR Tech understands the specific needs of each client and delivers tailored solutions that actually work.

Why Choose AVENIR Tech for AI & ML?

Here are a few reasons why AVENIR Tech has become a trusted provider for AI and ML projects:

1. Strong Technical Foundation

AVENIR Tech builds intelligent systems backed by years of experience in data science, software development, and cloud architecture. The team stays updated with the latest AI frameworks and machine learning techniques to ensure performance and scalability.

2. Problem-Solving Approach

They focus on solving specific business problems, not just applying technology for the sake of it. Their projects begin with understanding the challenge and identifying how AI/ML can bring value.

3. End-to-End Services

From initial consultation and model design to integration and maintenance, AVENIR Tech provides complete support. Clients don’t have to manage multiple vendors — everything is done in one place.

4. Transparent Process

Whether it’s data handling, algorithm selection, or performance evaluation, AVENIR Tech follows a transparent and ethical approach in all project stages.

5. Scalable Solutions

As your business grows, your AI needs change. The systems built by AVENIR Tech are designed to scale smoothly without requiring a complete overhaul.

What Makes AVENIR Tech Different?

Unlike many companies that treat AI as a generic solution, AVENIR Tech takes the time to understand what each client actually needs. Their AI and ML tools are not just functional — they are applicable, adaptive, and easy to maintain.

Here’s a closer look at how they work:

They use clean and reliable data sets for training.

Their models are continuously tested and improved.

They consider long-term usability and cost-efficiency.

This approach has helped AVENIR Tech successfully deliver AI/ML services to both startups and large enterprises alike.

Final Thoughts

Artificial Intelligence and Machine Learning are transforming how businesses operate. But the success of these technologies depends heavily on how they are implemented. AVENIR Tech offers dependable Artificial Intelligence & Machine Learning solutions that prioritize function, reliability, and simplicity.

If you’re looking for a practical partner who knows how to turn AI potential into real-world impact, AVENIR Tech is worth your attention.

Frequently Asked Questions (FAQ)

Q1. What industries does AVENIR Tech serve with AI/ML solutions? AVENIR Tech works with clients across healthcare, finance, retail, manufacturing, marketing, and more.

Q2. Does AVENIR Tech offer custom AI solutions or only ready-made tools? They focus on building tailored AI/ML models based on the specific needs and challenges of each client.

Q3. Can a small business afford AI services from AVENIR Tech? Yes, they offer scalable solutions suitable for both small businesses and large enterprises, ensuring the technology fits the budget and goals.

Q4. What makes AVENIR Tech different from other AI solution providers? They focus on solving real-world problems with a transparent, structured, and results-driven approach rather than simply implementing trendy tech.

Q5. How do I get started with AVENIR Tech? You can visit their official website avenirtechcorp.com and connect with their team for a consultation.

0 notes