#integrated with trading algorithms

Explore tagged Tumblr posts

Text

In the fast-paced world of trading, the integration of REST APIs with trading algorithms has become an essential tool for traders looking to enhance their strategies. REST APIs, or Representational State Transfer Application Programming Interfaces, allow seamless communication between different software applications. When integrated with trading algorithms, REST APIs enable traders to automate processes, access real-time data, and execute trades more efficiently.

#integrated with trading algorithms#API trading#trading algorithms#backtest your trading algorithm#trading platform

0 notes

Text

Integrated margin calculators are undoubtedly a robust and powerful computational tool that can significantly benefit algo traders. These calculators can precisely determine margin requirements by analysing an asset's volatility, leverage, position size, and market conditions.

2 notes

·

View notes

Text

Abstract economic theorizing typically asserts that prices coordinate the best rational resource allocations and that prices reflect the best information available while the market bets of the smartest people with skin in the game ensure efficiency. But Russell exposes this as flawed fig-leaf logic. He quotes one market participant (an insider “traitor”) confessing the “irrationality of commodity prices.” Algorithmic trades are shots fired between swanky skyscrapers as “hedge funds raid each other’s coffers,” collaterally taking calories out of the mouths of poor kids. Besides, only the absurdly blinkered could imagine that global food is used rationally or efficiently—never mind ethically. Grain used for biofuels “eats up enough food to feed 1.9 billion people annually.” Rich-world pets are less food insecure than the 2.4 billion people (1 in 3 humans) classified by the U.N. as lacking “access to adequate food.” Seventy-seven percent of global farming land is used for livestock which mostly the rich consume (or waste). Indeed, 30-40 percent of all food grown is wasted. Market forces aren’t in the business of fixing this sort of massive and malicious malarkey. For instance, analysis of market-oriented African Green Revolution projects, which aimed to “catalyze a farming revolution in Africa” by helping farmers in 13 countries over a period of 15 years switch from traditional subsistence-and-barter methods to raising monocrops for commercial export, concluded that they led to 31 percent higher undernourishment. As Timothy A. Wise reports in Mongabay News, this large-scale effort was led by the Bill & Melinda Gates Foundation and the U.S., U.K., and German governments, with the goal of doubling “yields and incomes for 30 million small-scale farming families while halving food insecurity.” As much as $1 billion per year went into the effort. But integration of small farmers into international markets put these small farmers under the same pressures that for-profit farmers face the world over (but without rich-nation safety nets). They’re at the mercy of volatile global pricing but have high fixed costs of inputs like commercial seeds and fertilizers. The net result was that even when yields rose, they often “failed to translate into rising incomes.” Many of these small farmers could now neither barter traditional crops with neighbors, nor did they have sufficient income to buy local food, a punishing recipe for food insecurity (further details are available in Wise’s coverage). The bottom line is that markets only feed you if you can pay (to match the bets of invisible-hearted hedge-funders or manufacturers of rich-world pet food).

163 notes

·

View notes

Text

37. The Dissonance Within: Unraveling the Fabric of Self-Respect and Interpersonal Integrity in a Fragmented Age

“The most fundamental aggression to ourselves, the most fundamental harm we can do to ourselves, is to remain ignorant by not having the courage and the respect to look at ourselves honestly.” — Pema Chödrön

At its core, self-respect is an intricate tapestry woven from threads of dignity, integrity, and sincerity, yet it remains perilously susceptible to the corrosive effects of societal disdain. We reside not in a vacuum, but rather in a kaleidoscope of expectations, judgments, and relentless comparisons, each contributing to an insidious erosion of our self-worth. When individuals forsake their moral compass, often in the pursuit of acceptance, they unwittingly engage in a betrayal of self, distorting their perception of innate value.

The contemporary social landscape exacerbates this fragility, introducing algorithmic biases that amplify self-doubt and resentment. These platforms create echo chambers where self-aggrandizement and vanity masquerade as authenticity, further ensnaring individuals in a web of superficial validation. Here, one must confront the bitter truth: the more we seek external affirmation, the more we distance ourselves from the foundation of genuine self-respect.

Moreover, this societal malaise manifests itself through the oppression of vulnerability; individuals are conditioned to guard their true selves behind a facade of what is deemed acceptable. The ironic consequence of this self-imposed exile is a moral disengagement that nurtures a climate of disconnection. How can we hold space for others if we cannot honor our own humanity? This inquiry invites a deeper understanding of the self as an integral part of the collective, where self-respect is not merely an abstraction but a catalyst for societal change.

As Pema Chödrön posits, ignorance breeds aggression against oneself, igniting a cycle of self-loathing that negates personal growth. Thus, the act of looking inward—equipping ourselves with courage and respect—becomes a revolutionary act in our journey toward self-respect. One must kindle the flames of introspection, however uncomfortable, to reclaim the dignity stripped away by an indifferent world.

Ultimately, as we delve into the labyrinth of self-respect, it becomes paramount to recognize that our worth is not contingent upon the fleeting opinions of others. The re-establishment of self-esteem hinges not on external approval but on internal acceptance. It is through this lens that we can begin to interrogate the nature and purpose of our existing relationships.

Interpersonal Relationships: The Paradox of Proximity

In an era marked by unprecedented connectivity, the paradox of interpersonal relationships becomes glaringly apparent. While technology propels individuals closer in a digital sense, it simultaneously erects barriers to authentic human connection. Social media perpetuates a curated existence, forcing individuals to present sanitized versions of themselves that cater to an insatiable audience, rather than fostering connections grounded in truth and vulnerability.

As we navigate this convoluted landscape, the erosion of dignity in relationships becomes stark. People find themselves ensnared in a transactional model of engagement, viewing interactions through the lens of utility rather than mutual respect. This paradigm shift engenders an environment where compassion and understanding are traded for likes and follows, breeding a culture that devalues the profound intricacies of human experience.

The psychological fallout of this disconnection is palpable, as individuals experience intensified feelings of loneliness and alienation despite a façade of social interaction. The very fabric of our relationships begins to fray under the weight of external pressures, leading to a generation plagued by anxiety, depression, and a pervasive sense of disillusionment. Here, the lack of genuine connection exacts a toll not merely on individuals, but on society as a whole.

Self-respect, thus, becomes compromised within these superficial exchanges. When our worth is measured by digital applause rather than real-world interactions, dignity erodes, fostering a cycle of self-deprecation and conflict. The challenge lies in recalibrating our expectations and priorities, shifting our focus from the pursuit of status to the cultivation of meaningful relationships grounded in empathy and authenticity.

To engage in this difficult dialogue, we must first confront the unsettling reality that many of our relationships serve as a mirror reflecting our own inadequacies. Are we truly connecting with others, or merely engaging in rituals that perpetuate our collective loss of self-respect? The answer may lie in the courage to seek out vulnerability, to embrace the complex interplay of human emotions, and to honor the underlying humanity that connects us all.

The Loss of Moral and Ethical Identity: A Societal Crisis

In this age of moral relativism, the erosion of ethical identity stands vividly illuminated. The pervasive narratives propagated by social, political, and religious institutions often prioritize conformity over moral integrity, encouraging individuals to align their beliefs with prevailing dogmas rather than cultivating personal values grounded in compassion and accountability. This dissonance between personal ethics and societal expectations marks the onset of a moral crisis.

As individuals navigate this landscape, the allure of acceptance often leads them to compromise their values in pursuit of belonging. In forsaking their moral compass, they not only forsake their self-respect but contribute to a broader societal disintegration of ethical standards. The quest for societal validation, then, becomes an act of self-sabotage—one that obliterates the possibility of genuine connection and accountability.

Moreover, the absence of moral clarity extends beyond the individual, infiltrating interpersonal relationships and societal constructs. As people grapple with conflicting ideals, a pervasive sense of apathy surfaces, fostering environments where ethical dilemmas are sidestepped in favor of convenience. This relinquishment of moral responsibility breeds distrust, resentment, and a pervasive sense of disillusionment among those yearning for authentic relationships.

Pema Chödrön’s assertion that ignorance fosters fundamental aggression towards oneself resonates powerfully in this context. As individuals neglect their ethical responsibilities, they inadvertently engage in a form of self-inflicted harm, eroding their sense of purpose and belonging. To disrupt this cycle of ignorance, one must first engage in a rigorous examination of their own values, cultivating the humility to recognize and confront one’s shortcomings.

In navigating the complexities of moral identity, it is essential to embrace the journey toward ethical rejuvenation. This requires a deliberate shift from superficial conformity to an unwavering commitment to personal values, fostering an environment where integrity thrives. In doing so, we can begin to forge relationships where respect is reciprocal, enabling the cultivation of a community built upon shared principles and a collective sense of dignity.

Algorithmic Control: The Social Media Dilemma

The algorithms governing our digital engagements have insidiously infiltrated our interpersonal relationships, distorting our understanding of self and others. They have conditioned us to prioritize engagement metrics over meaningful connections, fostering a superficial culture where worth is quantified through likes and shares. This commodification of human interaction encourages us to mask our flaws and insecurities, thereby alienating us from our authentic selves.

As users of social media, we unwittingly become participants in a grand experiment—one where our mental and emotional well-being is sacrificed at the altar of engagement-driven content. Amid this cacophony of curated realities, individuals grapple with an incessant comparison to the seemingly flawless lives of others, stoking feelings of inadequacy that undermine self-respect. Such psychological warfare cultivates a fertile ground for narcissism, as users retreat further into self-absorption to shield themselves from an unrelenting tide of external judgment.

The social media landscape thus exacerbates the erosion of dignity within interpersonal relationships, as individuals find themselves engaged in performative acts rather than authentic exchanges. The act of self-presentation becomes a battleground, where vulnerability is vilified and façade is glorified. We painstakingly construct personas that align with societal expectations, all while neglecting the profound humanity that resides beneath the surface.

Regrettably, algorithmic control extends beyond individual experience—it manifests in a collective relegation of moral consciousness. As empathy dwindles in the face of a hyper-competitive digital landscape, the capacity for altruism diminishes, eroding the social fabric that sustains healthy relationships. People find themselves entangled in a web of impersonal interactions, wherein self-interest eclipses the moral imperative to honor the humanity of others.

To counteract this disintegration, it becomes imperative to reclaim agency over our digital engagements. This encompasses not only resisting the temptations of algorithmic validation but also fostering a conscious commitment to cultivating authentic relationships that transcend the superficial confines of social media. By embracing vulnerability and empathy, we can restore the dignity required for healthy and enriching interpersonal connections.

Rediscovering Humanity: Bridging the Chasm of Disconnection

In the aftermath of this moral and ethical erosion, we find ourselves at a crossroads—a moment that demands introspection and action. The process of rediscovering the humanity of others calls for an unwavering commitment to dismantling the barriers erected by societal expectations and algorithmic control. It requires us to confront the uncomfortable reality that our relationships, too often filtered through the lens of self-interest, lack the depth and richness inherent in genuine connection.

To embark on this transformative journey, we must embrace the radical act of vulnerability—one that necessitates relinquishing the armor we don to shield ourselves from scrutiny. In vulnerability, we uncover the power of authenticity, revealing our true selves to others while inviting them to do the same. This reciprocal exchange fosters a space for genuine connection, where empathy flourishes amidst our shared struggles and triumphs.

Moreover, the act of rediscovering humanity extends beyond mere interpersonal connections—it is an invitation to reclaim our collective moral and ethical identity. As we engage with others in a spirit of compassion and understanding, we begin to dismantle the insidious forces that perpetuate division and antagonism. This reclamation of shared humanity fosters a culture of respect, where the dignity of all individuals is honored, contributing to the reparation of our fragmented social fabric.

As we navigate this path toward renewed connection, we must confront the uncomfortable truths residing within ourselves. Acknowledging our roles in perpetuating disconnection and estrangement is not an act of self-flagellation, but rather a potent catalyst for transformative growth. In doing so, we position ourselves as agents of change, committed to fostering an environment of radical empathy and respect—a process that ultimately enhances our collective sense of humanity.

The Call to Self-Examination: Embracing the Discomfort

Ultimately, the journey toward self-respect and moral clarity compels an uncomfortable but necessary reckoning. Engaging in self-examination—prompted by Chödrön's powerful reminder of the harm inherent in ignorance—serves as a vital precursor to genuine growth and transformation. In confronting our shortcomings, we not only enrich our self-awareness but cultivate the courage necessary to effect meaningful change in our lives and relationships.

This introspective journey is fraught with discomfort, as we grapple with the darker aspects of our nature—the envy, selfishness, and inauthenticity that often bubble beneath the surface. Yet, it is precisely in this discomfort that growth resides. By facing our moral failings, we can dismantle the barriers that inhibit authentic connection, allowing us to reconcile with the humanity of ourselves and others.

To invoke lasting change, we must harness the power of vulnerability and empathy, consciously choosing to engage with the world from a place of authenticity. This commitment to integrity transcends the superficial confines of societal expectations, granting us the freedom to forge relationships rooted in mutual respect. As we engage in this transformative endeavor, we will inevitably rediscover the essence of our shared humanity—an anchor amidst the chaos of contemporary existence.

The devastating psychological and sociological implications of our current milieu demand urgent attention, beckoning us to confront the uncomfortable truths that lie within. It is through confronting these truths that we pave the way for renewed self-respect and healthier relationships. By embarking on this journey of rediscovery, we reclaim not only our dignity but also the sacredness of our connections with others, nurturing a collective moral identity that fosters compassion, understanding, and a profound respect for the beauty of human experience.

Conclusion: The Path Forward

As we emerge from this intellectual journey, we are left with vital questions that challenge the status quo of our interpersonal relationships and collective moral fabric. How do we reconcile the dissonance between our aspirational ideals and the cultural forces at play? The key lies in embracing the discomfort of self-examination, recognizing the latent potential for growth inherent in vulnerability and empathy. Each moment spent digging into our moral consciousness garners the momentum necessary for this pivotal transformation.

This journey demands diligence, humility, and a steadfast commitment to reconnecting with our ethical foundations—principles that can lay the groundwork for enriching, dignified relationships. As we navigate the turbulent waters of societal pressures, mindfulness and introspection become indispensable tools, guiding us toward authentic connections that transcend the superficiality of current social paradigms. Embracing our humanity implicates recognizing the shared struggle of existence, fostering an enduring sense of solidarity that binds us together amidst our individual complexities.

In this endeavor, we come full circle to Chödrön’s striking observation regarding the perils of ignorance. Remaining willfully blind to our moral and ethical identity not only undermines our self-respect but ultimately contributes to the deterioration of trust and dignity in our relationships. By cultivating an ongoing practice of self-reflection, we kindle the flame of honesty and respect, illuminating the path toward reinventing the interconnectedness of our humanity. Ultimately, it is this revival—not only of self-respect but also of our collective ethical integrity—that holds the key to a flourishing world, one where each individual is cherished and valued for their inherent worth.

#Pema Chödrön#Self Respect#Integrity#Interpersonal Relationships#Honesty#Truth#Transparency#Philosophy#writerscommunity#writers on tumblr#writeblr

11 notes

·

View notes

Text

The end of TikTok has begun. As the dust settles from a week of shockingly fast legislative action by the US Congress, it’s clear that TikTok next year will look much different from the TikTok we’re using today.

When President Joe Biden signed a $95 billion dollar foreign aid package on Wednesday, it brought to life a nightmare that has haunted TikTok for more than four years. If TikTok’s Chinese owner, ByteDance, refuses to divest its stakes in the company, the United States will ban the app nationwide. The signing started the clock, giving TikTok 270 days to find a new owner. (As The Washington Post’s Cristiano Lima-Strong noted, TikTok’s time will run out the day before Inauguration Day 2025.)

There are a few ways this could all shake out. An American company or private equity fund could buy TikTok and its powerful recommendation algorithm. Or, a buyer might have to accept just the bones of the platform without that algorithmic muscle; The Information reported on Thursday that ByteDance has already started gaming out what a sale without the algorithm would look like. Or, perhaps no buyer can be found and TikTok goes poof.

Unless TikTok or a horde of its users were to somehow win a lawsuit challenging the law signed this week—a lawsuit the company has already said it plans to file—all the potential outcomes lead to an app that is dramatically different.

If a US tech company were to, miraculously, buy out the app and algorithm from ByteDance, it’ll likely integrate the app into its own products and services. But I doubt we’ll ever see a “TikTok by Meta.” Meta and other tech giants have come under intense antitrust scrutiny in recent years. If any company with a big social platform were to gobble up one of its top competitors, that would set off alarms at the Department of Justice or Federal Trade Commission.

Microsoft has suggested that it has an interest in buying TikTok, and it might be one of the app’s only viable choices for a buyer. Microsoft’s biggest subsidiary otherwise is, well, LinkedIn—and can we even call LinkedIn a TikTok rival with a straight face?

Separately, if, say, a private equity firm like Blackstone were to purchase TikTok without its much-envied algorithm, rebuilding the heart of the app could be difficult. A company without a deep bench of algorithmic wizards on hand likely wouldn’t have the expertise to quickly reengineer a feed-based social media platform from scratch. If they tried, I doubt the results would be pretty.

And if there’s no new owner? Well, I guess we’re left with YouTube Shorts and Instagram Reels. TikTok’s popularity in the US forced Google and Meta to invest in vertical video, but those platforms mostly cater to the younger “Skibidi Toilet” generation. They wouldn’t easily fill a TikTok-shaped gap on the US internet.

Still, the law passed this week may not stand for much longer. In a statement calling it unconstitutional, TikTok seemed confident that the law could be overturned. “We believe the facts and the law are clearly on our side, and we will ultimately prevail,” a TikTok spokesperson said on Wednesday. The company used a similar argument last year to win an injunction blocking a ban passed in Montana.

Regardless of how this lawsuit plays out, TikTok will be different. The question is just what kind of “different” that will be.

24 notes

·

View notes

Text

Is AT8XM Robot Legit Or Not? - AT8XM Robot PayPal Review

Explore the AT8XM Robot Paypal Review to uncover how this AI-driven forex trading system operates, its PayPal integration, and why it could be a game-changer for both new and seasoned traders.

The AT8XM Robot Paypal system combines artificial intelligence with PayPal integration to simplify forex trading. Learn how it works, who it’s for, and what makes it an appealing choice for automated traders.

Introduction

Let’s face it—forex trading can be a tricky beast. With markets shifting in the blink of an eye and economic news constantly rolling in, it’s tough to stay ahead of the curve. That’s where the AT8XM Robot Paypal steps into the spotlight. This AI-powered forex trading tool doesn’t just promise ease of use and smart trading; it also connects with PayPal, making transactions smooth as silk.

So, whether you're green around the gills or a trading veteran, this review will walk you through what makes the AT8XM Robot Paypal stand out in the world of automated forex systems.

What Is AT8XM Robot Paypal?

The AT8XM Robot Paypal is an automated forex trading application that leverages AI to scan markets, spot trading opportunities, and execute trades without needing constant human input. As if that wasn’t enough, it’s designed to be compatible with PayPal, adding a trusted layer of convenience for users handling deposits and withdrawals.

Top Features at a Glance

Smart AI Trading Engine

24/7 Market Monitoring

PayPal Payment Integration

User-Friendly Dashboard

Beginner-Friendly Setup

Real-Time Data Analysis

Customizable Risk Settings

This robot doesn’t sleep, doesn’t hesitate, and doesn’t complain—it just keeps scanning the forex market, aiming for profitable trades while the user can sit back and relax.

How AT8XM Robot Paypal Works

It might sound like rocket science, but the logic behind the AT8XM Robot Paypal is fairly straightforward:

Setup & Connect Broker – Users first create an account and connect it with a recommended broker.

Link PayPal – Funds can be deposited or withdrawn using PayPal, adding a layer of convenience.

Activate Robot – Once active, the robot starts scanning market conditions in real-time.

Trade Execution – Based on algorithmic decisions, it places trades aimed at maximizing profit.

Profit Monitoring – All gains go straight into the broker account, accessible via PayPal.

Pretty neat, huh? With minimal effort, users get a full-fledged trading partner running in the background.

Why Traders Are Buzzing About AT8XM Robot Paypal

There’s no shortage of reasons why this trading tool is gaining popularity:

Saves Time – No need to analyze charts all day.

Emotion-Free Trading – Decisions are driven by data, not by human impulse.

Trusted Payments – PayPal support adds an extra layer of user trust.

Ease of Use – Setup takes minutes, not hours.

Flexible Trading Options – Users can set their own trading limits and preferences.

Low Barrier to Entry – No prior trading knowledge required.

Who Stands to Benefit from AT8XM Robot Paypal?

The short answer? Just about anyone looking to dip their toes into the forex market or take their trading to the next level.

Complete Beginners – It’s plug-and-play simplicity helps new traders ease in.

Busy Professionals – They can let the bot do the legwork while they focus on other things.

Cautious Investors – The customizable risk settings are ideal for those who like to play it safe.

Experienced Traders – Automation lets them scale their strategies without burning out...

Is AT8XM Robot Legit Or Not? Full AT8XM Robot PayPal Review here! at https://scamorno.com/Robot-AT8XM-Review-App/?id=tumblr-legitornotpaypal

Security & Reliability: Is It the Real Deal?

Ah, the million-dollar question. The AT8XM Robot Paypal is reportedly backed by strong encryption and secure broker partnerships. And when PayPal’s in the mix, users often feel a bit more at ease, knowing that their transactions are protected by one of the most trusted online payment platforms out there.

Still, no system is perfect. As always, users should stick with well-reviewed brokers and do a touch of homework before diving in headfirst.

FAQs About AT8XM Robot Paypal

1. Is AT8XM Robot Paypal compatible with any broker?

Not quite. It usually works best with specific recommended brokers that support its integration and features.

2. Do I need trading experience to use it?

Nope! The platform is beginner-friendly, offering automated decisions without requiring deep knowledge of the forex market.

3. How does PayPal come into play?

Users can link their PayPal accounts for depositing and withdrawing funds, which adds a safe and well-known payment method into the mix.

4. Are the profits guaranteed?

Well, let’s not count chickens before they hatch. Like all trading, there’s risk involved. However, the robot is designed to increase the odds in the user’s favor.

5. Can I adjust the robot’s settings?

Absolutely! Users can customize risk levels, stop-loss limits, and trade sizes according to their comfort level...

Is AT8XM Robot Legit Or Not? Full AT8XM Robot PayPal Review here! at https://scamorno.com/Robot-AT8XM-Review-App/?id=tumblr-legitornotpaypal

2 notes

·

View notes

Text

What is artificial intelligence (AI)?

Imagine asking Siri about the weather, receiving a personalized Netflix recommendation, or unlocking your phone with facial recognition. These everyday conveniences are powered by Artificial Intelligence (AI), a transformative technology reshaping our world. This post delves into AI, exploring its definition, history, mechanisms, applications, ethical dilemmas, and future potential.

What is Artificial Intelligence? Definition: AI refers to machines or software designed to mimic human intelligence, performing tasks like learning, problem-solving, and decision-making. Unlike basic automation, AI adapts and improves through experience.

Brief History:

1950: Alan Turing proposes the Turing Test, questioning if machines can think.

1956: The Dartmouth Conference coins the term "Artificial Intelligence," sparking early optimism.

1970s–80s: "AI winters" due to unmet expectations, followed by resurgence in the 2000s with advances in computing and data availability.

21st Century: Breakthroughs in machine learning and neural networks drive AI into mainstream use.

How Does AI Work? AI systems process vast data to identify patterns and make decisions. Key components include:

Machine Learning (ML): A subset where algorithms learn from data.

Supervised Learning: Uses labeled data (e.g., spam detection).

Unsupervised Learning: Finds patterns in unlabeled data (e.g., customer segmentation).

Reinforcement Learning: Learns via trial and error (e.g., AlphaGo).

Neural Networks & Deep Learning: Inspired by the human brain, these layered algorithms excel in tasks like image recognition.

Big Data & GPUs: Massive datasets and powerful processors enable training complex models.

Types of AI

Narrow AI: Specialized in one task (e.g., Alexa, chess engines).

General AI: Hypothetical, human-like adaptability (not yet realized).

Superintelligence: A speculative future AI surpassing human intellect.

Other Classifications:

Reactive Machines: Respond to inputs without memory (e.g., IBM’s Deep Blue).

Limited Memory: Uses past data (e.g., self-driving cars).

Theory of Mind: Understands emotions (in research).

Self-Aware: Conscious AI (purely theoretical).

Applications of AI

Healthcare: Diagnosing diseases via imaging, accelerating drug discovery.

Finance: Detecting fraud, algorithmic trading, and robo-advisors.

Retail: Personalized recommendations, inventory management.

Manufacturing: Predictive maintenance using IoT sensors.

Entertainment: AI-generated music, art, and deepfake technology.

Autonomous Systems: Self-driving cars (Tesla, Waymo), delivery drones.

Ethical Considerations

Bias & Fairness: Biased training data can lead to discriminatory outcomes (e.g., facial recognition errors in darker skin tones).

Privacy: Concerns over data collection by smart devices and surveillance systems.

Job Displacement: Automation risks certain roles but may create new industries.

Accountability: Determining liability for AI errors (e.g., autonomous vehicle accidents).

The Future of AI

Integration: Smarter personal assistants, seamless human-AI collaboration.

Advancements: Improved natural language processing (e.g., ChatGPT), climate change solutions (optimizing energy grids).

Regulation: Growing need for ethical guidelines and governance frameworks.

Conclusion AI holds immense potential to revolutionize industries, enhance efficiency, and solve global challenges. However, balancing innovation with ethical stewardship is crucial. By fostering responsible development, society can harness AI’s benefits while mitigating risks.

2 notes

·

View notes

Text

Understanding Forex EA: An Essential Tool for Automated Trading

In the fast-paced world of forex trading, automation has become a powerful tool for traders seeking efficiency and consistency. Forex EA (Expert Advisor) is a widely recognized solution that empowers traders to automate their trading strategies. In this article, we will explore what a Forex EA is, how it works, and why it's essential for modern forex traders.

What is a Forex EA?

A Forex EA is a software application designed to automate forex trading based on predefined rules and algorithms. Installed on trading platforms like MetaTrader 4 or MetaTrader 5, these expert advisors analyze market conditions, execute trades, and manage positions without manual intervention.

Key Features of a Forex EA

Automated Trading Execution: A Forex EA executes trades based on preset parameters, minimizing emotional trading errors.

24/7 Market Monitoring: Unlike human traders, a Forex EA can operate continuously, ensuring no profitable opportunity is missed.

Backtesting Capability: Most Forex EA tools allow backtesting to assess performance based on historical data.

Benefits of Using a Forex EA

Improved Efficiency

By automating trading strategies, a Forex EA can perform transactions faster than manual traders, reducing the chances of missed opportunities.

Emotion-Free Trading

A Forex EA operates strictly according to its programmed rules, eliminating emotional biases that can impair decision-making.

Consistency

With predefined parameters, a Forex EA ensures each trade follows the same logic, reducing inconsistencies caused by human judgment.

Conclusion

For both novice and experienced traders, adopting a Forex EA can enhance trading efficiency, minimize emotional influences, and improve consistency. By integrating this powerful tool into their trading strategy, traders can focus more on refining their tactics while their Forex EA handles the execution.

2 notes

·

View notes

Text

AI Expert: How Rick Green is Transforming Finance with Artificial Intelligence

Artificial intelligence has revolutionized many industries, and the financial sector is no exception. Rick Green has been at the forefront of AI-driven financial solutions, using technology to improve investment decision-making, risk management, and market analysis.

1. AI in Forex Trading

The forex market is one of the most volatile and fast-moving financial markets in the world. Traders must analyze economic indicators, global news, and market trends to make informed decisions. AI has made this process more efficient by offering:

✔ Automated Trading Bots – AI-powered bots execute trades based on real-time market analysis, eliminating emotional decision-making. ✔ Predictive Analytics – Machine learning algorithms analyze historical price movements to predict future trends. ✔ Risk Management Tools – AI identifies potential risks in the market and suggests strategies to minimize losses.

Rick Green has helped traders and investors integrate AI-powered solutions into their forex trading strategies, leading to more accurate predictions and increased profitability.

2. AI in Financial Technology (Fintech)

Beyond forex trading, Green has also made a significant impact in financial technology (fintech). As fintech continues to evolve, businesses must adopt AI-driven tools to remain competitive. Some of the key areas where Green’s expertise has been valuable include:

✔ Fraud Detection – AI detects suspicious transactions and cyber threats, protecting businesses and consumers. ✔ Automated Customer Support – AI chatbots and virtual assistants improve customer service by providing instant, accurate responses. ✔ Personalized Financial Advice – AI-powered platforms analyze spending habits to offer customized investment recommendations.Through his work in fintech, Rick Green has helped businesses streamline their financial operations, improve security, and enhance customer experiences.

Through his work in fintech, Rick Green has helped businesses streamline their financial operations, improve security, and enhance customer experiences.

2 notes

·

View notes

Text

Exploring AI's Benefits in Fintech

The integration of artificial intelligence (AI) in the financial technology (fintech) sector is bringing about significant changes. From enhancing customer service to optimizing financial operations, AI is revolutionizing the industry. Chatbots, a prominent AI application in fintech, offer personalized and efficient customer interactions. This article explores the various benefits AI brings to fintech.

Enhanced Customer Experience

AI-powered chatbots and virtual assistants are revolutionizing customer service in fintech. These tools provide 24/7 support, handle multiple queries simultaneously, and deliver instant responses, ensuring customers receive timely assistance. AI systems continually learn from interactions, improving their efficiency and effectiveness over time.

Superior Fraud Detection

Fraud detection is crucial in the financial sector, and AI excels in this area. AI systems analyze vast amounts of transaction data in real time, identifying unusual patterns and potential fraud more accurately than traditional methods. Machine learning algorithms effectively recognize subtle signs of fraudulent activity, mitigating risks and protecting customers.

Personalized Financial Services

AI enables fintech companies to offer highly personalized services. By analyzing customer data, AI provides tailored financial advice, recommends suitable investment opportunities, and creates customized financial plans. This level of personalization helps build stronger customer relationships and enhances satisfaction.

Enhanced Risk Management

AI-driven analytics significantly enhance risk management. By processing large datasets and identifying trends, AI can predict and assess risks more accurately than human analysts. This enables financial institutions to make informed decisions and manage risks more effectively.

Automation of Routine Tasks

AI automates many routine and repetitive tasks in fintech, such as data entry, account reconciliation, and compliance checks. This reduces the workload for employees and minimizes the risk of human errors. Automation leads to greater operational efficiency and allows staff to focus on strategic activities.

Advanced Investment Strategies

AI revolutionizes investment strategies by providing precise, data-driven insights. Algorithmic trading, powered by AI, analyzes market conditions and executes trades at optimal times. Additionally, AI tools assist investors in making better decisions by forecasting market trends and identifying lucrative opportunities.

In-Depth Customer Insights

AI provides fintech companies with deeper insights into customer behavior and preferences. By analyzing transaction history, spending patterns, and other relevant data, AI predicts customer needs and offers proactive solutions. This level of insight is invaluable for targeted marketing strategies and improving customer retention.

Streamlined Loan and Credit Processes

AI streamlines loan and credit approval processes by automating credit scoring and underwriting. AI algorithms quickly assess an applicant’s creditworthiness by analyzing various factors, such as income, credit history, and spending habits. This results in faster loan approvals and a more efficient lending process.

Conclusion

AI is transforming the fintech industry by improving efficiency, enhancing customer experiences, and providing valuable insights. As technology advances, the role of AI in fintech will grow, driving further innovation and growth. Embracing AI solutions is essential for financial institutions to stay competitive in this rapidly changing landscape.

8 notes

·

View notes

Text

DeepSeek AI: The Catalyst Behind the $1 Trillion Stock Market Shake-Up - An Investigative Guide

Explore the inner workings of DeepSeek AI, the Chinese startup that disrupted global markets, leading to an unprecedented $1 trillion downturn. This guide provides a comprehensive analysis of its technology, the ensuing financial turmoil, and the future implications for AI in finance.

In early 2025, the financial world witnessed an unprecedented event: a sudden and dramatic downturn that erased over $1 trillion from the U.S. stock market. At the heart of this upheaval was DeepSeek AI, a relatively unknown Chinese startup that, within days, became a household name. This guide delves into the origins of DeepSeek AI, the mechanics of its groundbreaking technology, and the cascading effects that led to one of the most significant financial disruptions in recent history.

Origins and Founding

DeepSeek AI was founded by Liang Wenfeng, a young entrepreneur from Hangzhou, China. Inspired by the success of hedge fund manager Jim Simons, Wenfeng sought to revolutionize the financial industry through artificial intelligence. His vision culminated in the creation of the R1 reasoning model, a system designed to optimize trading strategies using advanced AI techniques.

Technological Framework

The R1 model employs a process known as “distillation,” which allows it to learn from other AI models and operate efficiently on less advanced hardware. This approach challenges traditional cloud-computing models by enabling high-performance AI operations on devices like standard laptops. Such efficiency not only reduces costs but also makes advanced AI accessible to a broader range of users.

Strategic Moves

Prior to the release of the R1 model, there was speculation that Wenfeng strategically shorted Nvidia stock, anticipating the disruptive impact his technology would have on the market. Additionally, concerns arose regarding the potential use of proprietary techniques from OpenAI without permission, raising ethical and legal questions about the development of R1.

Advantages of AI-Driven Trading

Artificial intelligence has transformed trading by enabling rapid data analysis, pattern recognition, and predictive modeling. AI-driven trading systems can execute complex strategies at speeds unattainable by human traders, leading to increased efficiency and the potential for higher returns.

Case Studies

Before the emergence of DeepSeek AI, several firms successfully integrated AI into their trading operations. For instance, Renaissance Technologies, founded by Jim Simons, utilized quantitative models to achieve remarkable returns. Similarly, firms like Two Sigma and D.E. Shaw employed AI algorithms to analyze vast datasets, informing their trading decisions and yielding significant profits.

Industry Perspectives

Industry leaders have acknowledged the transformative potential of AI in finance. Satya Nadella, CEO of Microsoft, noted that advancements in AI efficiency could drive greater adoption across various sectors, including finance. Venture capitalist Marc Andreessen highlighted the importance of AI models that can operate on less advanced hardware, emphasizing their potential to democratize access to advanced technologies.

Timeline of Events

The release of DeepSeek’s R1 model marked a pivotal moment in the financial markets. Investors, recognizing the model’s potential to disrupt existing AI paradigms, reacted swiftly. Nvidia, a leading supplier of high-end chips for AI applications, experienced a significant decline in its stock value, dropping 17% and erasing $593 billion in valuation.

Impact Assessment

The shockwaves from DeepSeek’s announcement extended beyond Nvidia. The tech sector as a whole faced a massive sell-off, with over $1 trillion wiped off U.S. tech stocks. Companies heavily invested in AI and related technologies saw their valuations plummet as investors reassessed the competitive landscape.

Global Repercussions

The market turmoil was not confined to the United States. Global markets felt the impact as well. The sudden shift in the AI landscape prompted a reevaluation of tech valuations worldwide, leading to increased volatility and uncertainty in international financial markets.

Technical Vulnerabilities

While the R1 model’s efficiency was lauded, it also exposed vulnerabilities inherent in AI-driven trading. The reliance on “distillation” techniques raised concerns about the robustness of the model’s decision-making processes, especially under volatile market conditions. Additionally, the potential use of proprietary techniques without authorization highlighted the risks associated with rapid AI development.

Systemic Risks

The DeepSeek incident underscored the systemic risks of overreliance on AI in financial markets. The rapid integration of AI technologies, without adequate regulatory frameworks, can lead to unforeseen consequences, including market disruptions and ethical dilemmas. The event highlighted the need for comprehensive oversight and risk management strategies in the deployment of AI-driven trading systems.

Regulatory Scrutiny

In the wake of the market crash, regulatory bodies worldwide initiated investigations into the events leading up to the downturn. The U.S. Securities and Exchange Commission (SEC) focused on potential market manipulation, particularly examining the rapid adoption of DeepSeek’s R1 model and its impact on stock valuations. Questions arose regarding the ethical implications of using “distillation” techniques, especially if proprietary models were utilized without explicit permission.

Corporate Responses

Major technology firms responded swiftly to the disruption. Nvidia, facing a significant decline in its stock value, emphasized its commitment to innovation and announced plans to develop more efficient chips to remain competitive. Companies like Microsoft and Amazon, recognizing the potential of DeepSeek’s technology, began exploring partnerships and integration opportunities, despite initial reservations about data security and geopolitical implications.

Public Perception and Media Coverage

The media played a crucial role in shaping public perception of DeepSeek and the ensuing market crash. While some outlets highlighted the technological advancements and potential benefits of democratizing AI, others focused on the risks associated with rapid technological adoption and the ethical concerns surrounding data security and intellectual property. The Guardian noted, “DeepSeek has ripped away AI’s veil of mystique. That’s the real reason the tech bros fear it.”

Redefining AI Development

DeepSeek’s emergence has prompted a reevaluation of AI development paradigms. The success of the R1 model demonstrated that high-performance AI could be achieved without reliance on top-tier hardware, challenging the prevailing notion that cutting-edge technology necessitates substantial financial and computational resources. This shift could lead to more inclusive and widespread AI adoption across various industries.

Geopolitical Considerations

The rise of a Chinese AI firm disrupting global markets has significant geopolitical implications. It underscores China’s growing influence in the technology sector and raises questions about the balance of power in AI innovation. Concerns about data security, intellectual property rights, and the potential for technology to be used as a tool for geopolitical leverage have come to the forefront, necessitating international dialogue and cooperation.

Ethical and Legal Frameworks

The DeepSeek incident highlights the urgent need for robust ethical and legal frameworks governing AI development and deployment. Issues such as the unauthorized use of proprietary models, data privacy, and the potential for market manipulation through AI-driven strategies must be addressed. Policymakers and industry leaders are called upon to establish guidelines that ensure responsible innovation while safeguarding public interest.

The story of DeepSeek AI serves as a pivotal case study in the complex interplay between technology, markets, and society. It illustrates both the transformative potential of innovation and the risks inherent in rapid technological advancement. As we move forward, it is imperative for stakeholders — including technologists, investors, regulators, and the public — to engage in informed dialogue and collaborative action. By doing so, we can harness the benefits of AI while mitigating its risks, ensuring a future where technology serves the greater good.

3 notes

·

View notes

Text

In the complex financial landscape in India, integrated margin calculators are surging in popularity because of their ability to streamline risk management practices, which aids traders in navigating their trades efficiently and confidently.

0 notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

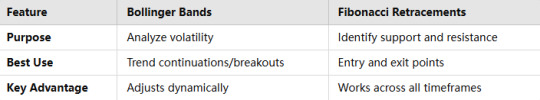

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

FxPro Review: Unveiling the World's Leading Online Forex Broker

In the dynamic realm of financial trading, the significance of efficient and reliable online forex brokers cannot be overstated. Among the myriad options available, FxPro stands out as a beacon of excellence, earning its reputation as the world’s number one online forex (FX) broker. This detailed FxPro review aims to explore the unique features, offerings, and overall experience that have established this broker as a preferred choice for traders globally.

youtube

Discovering FxPro: A Legacy of Trust and Innovation

Founded in 2006, FxPro has carved a niche for itself in the competitive forex market, showcasing a steadfast commitment to providing an exceptional trading experience. As a Top Forex Brokers review, FxPro has successfully built a reputation for transparency, reliability, and innovation, making it a trusted partner for thousands of traders around the world. With a user-centric approach, the broker continuously evolves to meet the needs of its clients, ensuring they have the tools and resources necessary to thrive in the fast-paced world of forex trading.

The FxPro Trading Platforms: A Gateway to Success

Central to FxPro's appeal is its diverse array of trading platforms, designed to cater to the varied preferences of both novice and experienced traders. Each platform boasts unique features that facilitate seamless trading, empowering users to make informed decisions in real-time.

MetaTrader 4 (MT4): The Industry Standard

The MetaTrader 4 (MT4) platform is a cornerstone of the forex trading experience, and FxPro offers an optimized version that enhances its functionality. Known for its user-friendly interface, MT4 provides traders with powerful charting capabilities, a plethora of technical indicators, and automated trading options through Expert Advisors (EAs). This platform is particularly favored by those who appreciate a straightforward yet effective trading environment.

MetaTrader 5 (MT5): The Next Generation

For traders seeking a more advanced experience, FxPro also provides access to the MetaTrader 5 (MT5) platform. MT5 is a comprehensive trading environment that includes advanced order management, a greater array of analytical tools, and an integrated economic calendar. Its multi-asset capabilities extend beyond forex, allowing traders to delve into commodities, stocks, and futures, making it an excellent choice for those looking to diversify their trading portfolio.

cTrader: Innovative and Intuitive

In addition to MT4 and MT5, FxPro offers the cTrader platform, which is designed for traders who prefer a more innovative and user-friendly experience. cTrader features a clean interface, advanced charting tools, and customizable workspaces, catering to both manual traders and algorithmic trading enthusiasts. The platform also includes a community-driven marketplace where traders can share and access trading tools, fostering collaboration and innovation.

Competitive Spreads and Pricing Structure

When it comes to trading costs, FxPro excels in providing competitive spreads and transparent pricing. The broker’s commitment to low trading costs is evident across its various account types, allowing traders to choose an option that best fits their trading style and budget.

FxPro offers several account types—each tailored to different trading needs—ensuring that clients can find a suitable option. For instance, the FxPro MT4 account is popular for its tight spreads and no commission trading, while the FxPro cTrader account provides a commission-based structure with slightly tighter spreads. This flexibility allows traders to optimize their trading strategies while minimizing costs.

Moreover, the broker’s commitment to transparency ensures that traders are always aware of the costs associated with their trades, allowing for effective financial planning and decision-making.

A Diverse Selection of Trading Instruments

One of the standout features of FxPro is its extensive range of trading instruments. While the broker is predominantly known for its forex offerings, it also provides access to a wide array of asset classes, including commodities, indices, and cryptocurrencies.

Forex Trading

FxPro covers a vast selection of currency pairs, encompassing major, minor, and exotic pairs. This diversity enables traders to capitalize on global economic trends and currency fluctuations, providing ample trading opportunities.

Commodity Trading

For those interested in commodities, FxPro offers trading in popular assets such as gold, silver, oil, and agricultural products. This allows traders to hedge against inflation or geopolitical risks while diversifying their investment portfolios.

Indices and Cryptocurrencies

In addition to traditional forex and commodities, FxPro provides access to global indices and a selection of cryptocurrencies. Traders can engage with major indices like the S&P 500 and FTSE 100, or explore the burgeoning cryptocurrency market, including popular coins such as Bitcoin and Ethereum. This extensive range of instruments empowers traders to explore various market dynamics and seize opportunities across different sectors.

Robust Security and Regulatory Oversight

In an industry where security is paramount, FxPro stands out for its commitment to safeguarding client funds and personal information. The broker is regulated by multiple reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. This multi-tiered regulatory framework offers clients peace of mind, knowing that their investments are protected by stringent regulations.

FxPro also employs advanced security measures to ensure the safety of its clients’ funds. These measures include SSL encryption for data protection and two-factor authentication for account security. The broker’s proactive approach to security and regulatory compliance underscores its dedication to maintaining a trustworthy trading environment.

Enhanced Customer Support

Exceptional customer support is a hallmark of a reputable broker, and FxPro does not disappoint in this regard. The broker offers a robust support system designed to assist traders at any stage of their trading journey.

FxPro’s customer support team is available 24/7, providing multilingual assistance to cater to its diverse global clientele. Whether you require help with account management, technical inquiries, or trading strategies, the knowledgeable support staff is always ready to assist.

Additionally, FxPro offers a wealth of educational resources, including webinars, trading tutorials, and market analysis, empowering clients to enhance their trading skills and knowledge. This commitment to client education is a testament to FxPro’s dedication to fostering a supportive trading community.

Educational Resources and Trading Tools

FxPro goes beyond offering trading platforms and customer support by providing a comprehensive suite of educational resources and trading tools. The broker recognizes that informed traders are successful traders, and it strives to equip its clients with the knowledge they need to navigate the complexities of the forex market.

Webinars and Tutorials

FxPro hosts regular webinars led by industry experts, covering a variety of topics ranging from trading strategies to market analysis. These interactive sessions provide valuable insights and allow traders to ask questions in real time, fostering a collaborative learning environment. Additionally, the broker offers a library of tutorials and articles, catering to traders of all experience levels.

Market Analysis

To help traders make informed decisions, FxPro provides daily market analysis and insights. This analysis includes technical and fundamental reports, helping traders understand market trends and identify potential trading opportunities. By staying informed about market developments, traders can enhance their strategies and improve their overall performance.

Trading Tools

FxPro also offers a range of trading tools to enhance the trading experience. These tools include economic calendars, calculators, and trading signals, all designed to assist traders in making informed and timely decisions. Such resources are invaluable for both novice and experienced traders, facilitating a more strategic approach to trading.

Conclusion: The Ultimate Choice for Forex Traders

In this comprehensive FxPro review, we have explored the myriad features and advantages that make this broker a top choice for forex traders worldwide. From its cutting-edge trading platforms and competitive pricing structure to its diverse selection of trading instruments and robust security measures, FxPro has established itself as a leader in the online forex brokerage space.

Through its unwavering commitment to customer support and education, FxPro empowers traders to hone their skills and navigate the complexities of the financial markets with confidence. Whether you are a seasoned trader or just starting your journey in forex trading, FxPro offers the tools, resources, and support to help you succeed.

In conclusion, FxPro stands as a testament to what a premier forex broker should aspire to be. With its extensive offerings and client-focused approach, FxPro is not just a broker; it is a partner in your trading journey, ready to elevate your forex trading experience to new heights.

2 notes

·

View notes

Text

$AIGRAM - your AI assistant for Telegram data

Introduction

$AIGRAM is an AI-powered platform designed to help users discover and organize Telegram channels and groups more effectively. By leveraging advanced technologies such as natural language processing, semantic search, and machine learning, AIGRAM enhances the way users explore content on Telegram.

With deep learning algorithms, AIGRAM processes large amounts of data to deliver precise and relevant search results, making it easier to find the right communities. The platform seamlessly integrates with Telegram, supporting better connections and collaboration. Built with scalability in mind, AIGRAM is cloud-based and API-driven, offering a reliable and efficient tool to optimize your Telegram experience.

Tech Stack

AIGRAM uses a combination of advanced AI, scalable infrastructure, and modern tools to deliver its Telegram search and filtering features.

AI & Machine Learning:

NLP: Transformer models like BERT, GPT for understanding queries and content. Machine Learning: Algorithms for user behavior and query optimization. Embeddings: Contextual vectorization (word2vec, FAISS) for semantic search. Recommendation System: AI-driven suggestions for channels and groups.

Backend:

Languages: Python (AI models), Node.js (API). Databases: PostgreSQL, Elasticsearch (search), Redis (caching). API Frameworks: FastAPI, Express.js.

Frontend:

Frameworks: React.js, Material-UI, Redux for state management.

This tech stack powers AIGRAM’s high-performance, secure, and scalable platform.

Mission

AIGRAM’s mission is to simplify the trading experience for memecoin traders on the Solana blockchain. Using advanced AI technologies, AIGRAM helps traders easily discover, filter, and engage with the most relevant Telegram groups and channels.

With the speed of Solana and powerful search features, AIGRAM ensures traders stay ahead in the fast-paced memecoin market. Our platform saves time, provides clarity, and turns complex information into valuable insights.

We aim to be the go-to tool for Solana traders, helping them make better decisions and maximize their success.

Our socials:

Website - https://aigram.software/ Gitbook - https://aigram-1.gitbook.io/ X - https://x.com/aigram_software Dex - https://dexscreener.com/solana/baydg5htursvpw2y2n1pfrivoq9rwzjjptw9w61nm25u

2 notes

·

View notes

Text

Crypto Exchange API Integration: Simplifying and Enhancing Trading Efficiency

The cryptocurrency trading landscape is fast-paced, requiring seamless processes and real-time data access to ensure traders stay ahead of market movements. To meet these demands, Crypto Exchange APIs (Application Programming Interfaces) have emerged as indispensable tools for developers and businesses, streamlining trading processes and improving user experience.

APIs bridge the gap between users, trading platforms, and blockchain networks, enabling efficient operations like order execution, wallet integration, and market data retrieval. This blog dives into the importance of crypto exchange API integration, its benefits, and how businesses can leverage it to create feature-rich trading platforms.

What is a Crypto Exchange API?

A Crypto Exchange API is a software interface that enables seamless communication between cryptocurrency trading platforms and external applications. It provides developers with access to various functionalities, such as real-time price tracking, trade execution, and account management, allowing them to integrate these features into their platforms.

Types of Crypto Exchange APIs:

REST APIs: Used for simple, one-time data requests (e.g., fetching market data or placing a trade).

WebSocket APIs: Provide real-time data streaming for high-frequency trading and live updates.

FIX APIs (Financial Information Exchange): Designed for institutional-grade trading with high-speed data transfers.

Key Benefits of Crypto Exchange API Integration

1. Real-Time Market Data Access

APIs provide up-to-the-second updates on cryptocurrency prices, trading volumes, and order book depth, empowering traders to make informed decisions.

Use Case:

Developers can build dashboards that display live market trends and price movements.

2. Automated Trading

APIs enable algorithmic trading by allowing users to execute buy and sell orders based on predefined conditions.

Use Case: