#baroda iphone store

Photo

Raksha badhan Offer! Buy Apple Watch 7 from Apple Authorized Reseller

Raksha badhan Offer! at iMagic Baroda & Get your Favorite Apple Product and get Instant Discount/Cash back.

Free Home Delivery Available.

Hurry! Visit the store now.

Stores:- Akota: 9228358888 | Karelibaug: 8347408888

#rakshabandhan2022#Watchseries7#Apple Watch 7#Apple Watch#vadodara iphone store#apple store baroda#baroda apple store#apple showroom vadodara#apple showroom in vadodara#apple reseller vadodara#iphone seller vadodara#baroda iphone store#apple iphone store in baroda#apple premium reseller

0 notes

Text

Grab the Amazon box opened! Biggest discount ever on iphone 12, hurry up the offer will end

If you are an Apple customer and looking to buy iPhone 12 for yourself at a cheap price, then you have a golden opportunity. The iPhone 12 64GB storage is presently available at a discount of Rs 12,000 on Amazon, bringing the price down to Rs 53,900. The iPhone 12 64GB storage model is available in Purple and White color options with flat discounts of Rs.5,000 and Rs.10,000 respectively. As mentioned on Apple’s online store, the launching price of the iPhone 12 is Rs 65,900.

iPhone 12 offers and discounts

Amazon is also offering discounts of up to Rs 11,000 on the iPhone 12 128GB storage model, taking the price of the phone to Rs 59,900. The iPhone 12 with 128GB of storage was originally priced at Rs 70,900. Apart from this, the e-commerce giant Bank of Baroda is offering exchange discounts of up to Rs 11,650 and discounts of up to Rs 2,000 on credit cards. But the entire exchange offer depends on the condition of your old phone. However, it should be noted that the maximum price will be given only if you exchange iPhone 12 for iPhone 11.

So, if you have been waiting to buy iPhone 12 for a long time, then don’t miss this chance. Keep in mind that the discount is only available on the iPhone 12 with 64GB and 128GB storage and not the 256GB storage.

Read More: Grab the Amazon box opened! Biggest discount ever on iphone 12, hurry up the offer will end

#gadget#gadgets news#hindi news#latest news#iphone 12 deals#iphone 12#trending news#viral news#viral posts

0 notes

Text

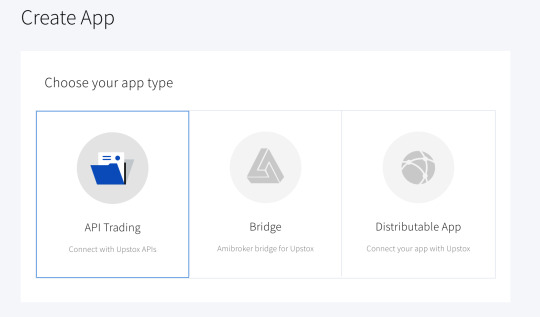

Upstox App

Upstox Pro App has a user rating of 4.1 stars on the Google Play Store. Upstox Pro Mobile App screenshot. The Nest Trader. The Nest Trader is a top-class trading platform, developed by Omnesys Technologies dedicatedly for the customers of RKSV broking. The nest is for the investors who want it on their computers or laptops. Go to your Playstore or Apple app store if you are using an iPhone, you can search for Upstox and install the app on your phone. It is a lightweight app that doesn't take up much space on your phone but at the same time gives you access to primary features such as watchlists, charting tools, and indicators. The Upstox app is used by 100k+ traders until now and still used by many traders. Apart from this, it provides advanced charts and various technical indicators. It is customer-friendly, understandable, and easy to use. Not only on mobile, but the Upstox Pro is available on the web. As per compliance guidelines, in-app NetBanking will only be applicable for those banks that support Third-Party Verification. Banks that support in-app NetBanking: llahabad Bank Andhra Bank Axis Bank Bank Of Baroda Bank Of India Bank o. Gold digital alarm clock.

When you open an Upstox account, the Equities segment and BSE Mutual Funds are activated by default. So, you can start investing and trading in them instantly. However other segments such as Futures & Options (F&O), Currencies (CUR), and Commodities segments (MCX), are optional. And in order to activate them, you need to submit sufficient income proof because each of these segments has its own trading rules, timings, and products.

Note: Watch this video to get a step by step tutorial on how to activate various segments from the Upstox Mobile App

1) Login to the Upstox app: https://upstox.com/upstox-pro-mobile/

2) Once you have logged in, click on the menu on the top left corner (on the Upstox app).

3) Click on 'Activate F&O, MCX'.

On the Upstox Android App, it will look like this -

4) Click on the ‘Activate segment’ for the segment you want to activate.

5) Based on the value of your holdings, you will be asked to upload your income proof.

If the value of your Holdings > ₹5k: income proof will not be required.

If the value of your Holdings < ₹5k: income proof will be required. You can upload your bank statement, ITR, or salary slip. Kindly follow the clear instructions mentioned based on the income proof type selected.

6) For MCX, you will also be asked to upload a live photo and geolocation, as shown below-

7) You can eSign your application with the following steps.

- Click on the ‘eSign’ button.

- Enter your Aadhaar number.

- Enter the OTP received on your Aadhaar-linked mobile number.

8) Once your request is placed successfully, it will take about 48 hours for your segments to get activated. We will be informing you over email / SMS about the status of your request.

Note: Your mobile number registered with Aadhar should be active while you are proceeding with the above steps.

Below is the detailed list of documents you can upload as income proof:

Note: Request you to please check the document before uploading to avoid rejection of the request.

Bank Statement: The bank statement must have the bank's logo or stamp on it and also your name, bank name, bank account number, and the IFSC Code

A mini statement or m-banking statement will not be accepted.

The bank statement should be of the latest 6 months.

Upstox App Download

The bank statement should have a minimum closing balance of ₹10,000

Please Note: We don't accept Payments bank (such as Paytm) and NRI banks on Individual Resident account as bank proof

Upstox Application

Upstox App Is Safe Or Not

Most recent Income Tax Returns (Form 16 - Part A & B)

Most recent (latest month’s) Salary slip.

Latest 1-month payslip if the salary is more than ₹10,000 with company logo and stamp/signature

Latest 6 months payslip if the salary is less than ₹10,000 with company logo and stamp/signature

0 notes

Text

How To Get Your Free Equifax Credit Score & Annual Credit Report Online?

Big dream expects Big steps, and these steps often require creditors on the way to achieve them. But the lenders also want evidence if you could handle the repayment of the loan once provided. Credit Score works as a sign for the lenders to evaluate the borrower based on history. Therefore, in this article, you will find detailed information on How to get your Free Equifax Credit Score & Annual Equifax Credit Report online?

Why Should You Consider Equifax Credit Report And Scores As The Right One For You?

It is one of its kind where you can get your first credit report for free. You would be wondering why you should consider Equifax for Credit Report as helpful. Equifax India is one of the 4 leading companies providing Credit Information of an individual in India. Equifax Credit Information Services Private Limited and Equifax Analytics Pvt Ltd. in India are the companies that are handling Equifax Credit Report and various other services provided by them. This bureau is a USA based company having its Indian headquarters located in Mumbai. It is a joint venture between Equifax Inc., USA, and seven major Indian financial institutions of India, which are Religare Finvest Limited, State Bank of India, Bank of Baroda, Kotak Mahindra Prime Limited, Sundaram Finance Limit, Bank of India, and Union Bank of India. Since major these institutions have a stake in this bureau, it is a great company for the credit reports.

What Does Equifax Credit Score Means And What Is Its Importance?

So, the Equifax credit score is a 3 digit number derived from the individual’s past financial data. It ranges from 300 and goes up to 850, where 300 is the worst and 850 is the best score. These scores are derived using an algorithm that performs analysis and drafts out a credit report. This report contains your credit score in the mentioned range. It holds value for them, which helps lenders evaluate the prospective borrower’s credit worthiness and the risk involved in lending money to the applicant.

Therefore by knowing your score, you can improve or maintain the same to make you a more eligible borrower. So if you want to improve, you might be wondering how these scores work? Is there any range to be safe? What scores should be avoided such that I am not in a danger zone?

Therefore, let’s discuss the ranges within the mentioned range to have quantitative information on the range scores.

Zone 1 – It ranges between 300- 579 within Equifax Score timeline

An Equifax score in this range is considered a poor score. It suggests you have been either late/ defaulted in paying your past credit card bills or EMIs that you were liable to pay on time. With an Equifax score in this range, it is unimaginable for anyone to obtain any credit from a verified lender as you are prone to be a defaulter.

Zone 2 -This zone ranges from 580 to 669 in the Equifax score sheet

A score in this range is regarded as a fair one. A very few institutions could lend you credit, but this would come with strings connected to it. The interest rate would be much higher than the market rate. The credit amount provided would be less, force you to take various insurance from them, and many more. A score in this zone illustrates that you might face difficulties in paying credit bills, not having a disproportionate mix credit, or many more factors listed below. You need to get these scores up by taking serious actions to enhance your Equifax score to have reasonable deals on loans.

Zone 3 – It lies in the range starting from 670 to 739

A score in this range displays that you have good credit behavior. A good amount of organizations would consider you for your credit request. But with this, you are required to have the good negotiating power to have loans granted without bounding conditions. But for a hassle-free process, you might look to advance to the next zone bypassing some small hurdles.

Zone 4 – This is the zone in the credit score timeline varying from 740 till 799

This zone is considered to be a perfect zone. You might think of it as a zone wherein lenders will be willing to grant you loans. It demonstrates your impressive payment history and smart work done by you in handling credits. Banks will give you credit at the lowest possible rates that you look for as there are the least chances that you might become a defaulter.

Zone 5 – This is the topmost zone of the credit score tower ranging from 800 – 850

This zone is considered to be an excellent one. You might find the highest score to be 900, but these are physically impossible to have them. So, you can assume that this zone is anything above 800 marks. This zone is exceptional for a borrower to have banks would be more than happy to have you with the conditions you said. An individual in this zone can assume an interest rate to be even a bit lower than the market rate. This the ideal zone you want to be in.

However, there is another zone, which is NA/NH. If you have no past credit history, your Equifax score will show NA/NH, signifying that it is either “not applicable” or has ” no history.” If you have never obtained a credit card or a loan, then you will have no credit history in the database.

So, by far, we know that the credit score is a part of the credit report, so the additional information is accounted for.

Basic Credit Information Report

A Basic Credit Information Report or CIR is the exact view of the borrower’s credit history and rating. Their readability is quite good and can be easily interpreted by a customer. This report contains 5 sections having both personal and credit information of the customer, which are as follows :

Section 1: Identification And Contact Section

This section contains your personal details, which include :

Name of the customer

Age and D.O.B of the individual

Permanent Address, and many more

Section 2: Credit History And Scores

This section contains all the crucial credit characteristics of the consumer based on past credit bills. It will quote the borrower’s credit type and the amount in the mentioned period. This section will also demonstrate how the consumer organized and utilized his/her credit.

Section 3: Latest Actions And Activities

The borrower highly values this section. The client will have information about the consumer’s recent activity, and actions are taken. It will reflect the credit that has been attained by the consumer. The report will also quote if the consumer has applied for a new account or loan in other banks related to it. If the account has been used for any offense, this section will emphasize it.

Section 4: All Type Of Account Details

This part of the report will show the client’s accounts that he/she possess. It gives account-wise details of the consumer’s repayment history to the client and monetary transactions involving a considerable amount of money. The account details will show the lender how a consumer has handled his credit and whether he/she has made the repayments on time.

Furthermore, this section will also highlight if the consumer has missed any payments and whether he has settled any accounts. The lender will avoid lending money to someone who has settled accounts or missed the repayments as it is a huge risk.

Section 5: Inquiry Section

This section delivers details of the number and the type of inquiries that are performed on the consumer. A high number of inquiries suggest that the consumer is desperately looking for credit. With several inquiries, if the consumer is yet unable to obtain a credit, it marks that the consumer cannot organize and use his/her credit efficiently.

How Can I Get My Equifax Credit Report Online? Can I Get It For Free?

Due to some amendments in 2017, it has been made mandatory for your country’s credit bureaus to provide a credit report for free. Keep in mind that it can only be availed once in a financial year. So, to get it from Equifax, download the Equifax mobile app from the play store. It is available both on android and iPhone, so don’t get disheartened. After installing the same, follow the steps mentioned below:

i. Sign in to the Equifax App on Android or iPhone

After downloading and installing the app on your smartphone, you will be asked to provide your email address to receive a temporary verification PIN. You will be required to login to this app using your email-id and the temporary pin received in the mail to create a personal 6-digit login PIN.

ii. Entering the KYC details and Validating yourself/KYC

You will be required to enter your enter personal details such as name, age, etc. along with Aadhaar and PAN card number to verify your identity. Once your authentication is done, you will receive an OTP on your Aadhaar registered mobile number. Upon entering the one-time password and validating it, you will be taken to the Equifax App homepage.

iii. Getting a soft copy of your Credit Report

Provide additional information which includes your gender, date of birth, address, etc. You would also be required to give in your identification (ID) like Passport, PAN, or Voter ID. The authentication will be conducted further based on your credit history. Here, you will need to respond to the questionnaire based on your history. You will have to answer three questions based on your credit history to authenticate yourself, and then you will attain your credit report on your registered email address within 24 hours.

Your credit report will be password protected. Equifax will provide you with a unique password for your report, which will be delivered to your mobile app on your phone. You will have to sign in to your Equifax app to get the password. Entering the same in the file that will provide you access to your Equifax credit report.

If you want to avail of this feature through offline mode, whatsoever may be the reason.

You can send the above mentioned scanned documents via email to [email protected]. You can also post the filled out credit report application form and documents through the postal services to their headquarters in Mumbai. If you want to have these reports from time to time for yourself, you will need to choose a subscription plan and make payments according to their portal.

Factors That Help In The Credit Card Scores Calculation

You might be wondering how these scores are calculated, and factors are taken into account while doing these same. So let’s dive deep into it:

Credit Score is evaluated using the credit history establish during the drafting of the Credit Report. Credit Report comprises data that analyses consumers’ credit behavior, including their credit payment and borrowing patterns, credit utilization ratio, etc. Therefore the key factors that are used and their importance, solutions are displayed below :

1. Repayment History Of Past Credits

Your credit repayment history accounts for a significant impact on your credit score, which is about 30% of the total. Have a credible track record regarding timely payment of credit bills and EMIs dramatically impacting your credit score and contemplating responsible credit behavior. This will boost your Equifax score. Whereas frequently defaults on EMIs and credit card payments affect your credit score negatively. It demonstrates poor financial planning and management, which decreases your score.

2. Credit Utilization Ratio

The credit availed to the credit limit for all the credits, such as credit card, loan, and overdraft accounts. A high credit utilization ratio reflects a higher dependence on credit and a rise in the repayment burden. It portraits the hunger of the individual for credit to get his/her things done. This affects your credit score in a hard way. However, a low credit utilization ratio (around a mark of 35% ) indicates higher credit credibility and enhances your Equifax credit score.

3. A mix Of Credit Types Used

The category of credit classified into secured and unsecured credit that you use also affects your credit score. Having a high number of unsecured loans like personal loans, credit cards, etc. are unfavorable for your credit score because it is frequently deduced as a sign of inefficiency in managing personal finances. It is nice to have a proper mix of credit, i.e., a balanced of secured loans like Home, Auto loans, and unsecured credit. It has a favorable influence on your credit score computed by Equifax.

4. The Number Of Recent Credit Applications

The number of new credit accounts and the credit inquiries that have been carried out recently also affect your credit score. Applying for multiple numbers of new credits portraits you to be credit hungry. Moreover, the increase in the number of hard inquiries performed by banks affects scores adversely.

5. Length Of Credit History

The length of your credit history, i.e., the period from when you first applied for a credit till now, affects your credit score. Periods over which credit accounts have been active are duly noted. The longer the track record of responsible credit, the better is the effect on your credit score.

FAQs

1. How long does it take to get EquifaxCredit Report?

If you have applied through the offline mode, when all the relevant documents are submitted, Equifax posts your Credit Report and Credit Score through post or courier within a week as soon as the verification and authentication of all the provided documents are done successfully.

However, using an online mode through your mobile app, you can get a soft copy mailed to your registered email address within 24 hours.

2. Why is there a difference between my Equifax Score and my CIBIL Score?

Though both the CIBIL and Equifax have a similar score range of 300-900, each bureau is inclined to provide a different credit score for the same individual conditions being the same. This is because each bureau has its own scoring algorithm and minor different factors used to calculate an individual’s credit score.

3. How can I get in touch with Equifax if there are discrepancies/ a query related to my Equifax Credit Report/Credit Score generated?

You can get in touch with then on working days from Monday to Friday from 10:00 to 7:00 pm through their :

Toll-free customer care number 1800-209-3247

Emailing your queries at [email protected]

Write an application and post it to Equifax Credit Information Services Private Limited.

Unit No. 931, 3rd floor, Building no. 9,

Solitaire Corporate Park, Andheri Ghatkopar Link Road,

Andheri East, Mumbai – 400 093

4. How much does it cost to have an Equifax report?

You can get 1 free credit report from Equifax in a financial year. To get more than that, you will have to spend Rs.400 (excluding GST ) for each report.

5. Can anyone accesses my Equifax credit report?

No. Only you and legal, financial organizations that are members of the Equifax credit bureau have a permit to your credit report. These authorized members are specified by the Credit Information Companies (Regulation) Act, 2005 by the government. Only those you have permitted to check your report when you apply for a loan or a credit card have a permit to your credit report.

Bottom Line

To cope with the necessities and luxuries of life, we try our level best to provide them to our loved ones. To procure them, we might require credit that might be high about our current income. So we apply for credits from the lenders. But to convince them to provide us with the asked credit, the lenders require a concrete piece of evidence that you would be able to pay them up with interest.

So, the Credit Score serves as a medium to convince them to provide us with the credit. So it is on us to provide them with that reason by which they should willingly provide us with the credits. Following the above cheat sheet and rectifying errors, if any, in the annual report will help you to maintain or improve your score to get the loans on your desired conditions and market rates.

source http://invested.in/get-free-equifax-credit-score-annual-report-online/

0 notes

Text

Apple Store Online goes live with trade-in option for iPhones, bank offers

Apple Store Online is currently live in India. The advanced store is a one-stop entrance where you can buy Apple items and profit of administrations. Said to convey a similar encounter that is accessible at Apple Store areas around the globe, the online store offers the shopping help include through Apple Online Specialists, exchange for iPhone, uniquely manufactured Mac, AppleCare+ and free no-contact conveyance. Additionally, the online store offers numerous financing alternatives on items — likened regularly scheduled payments through Mastercards. How about we investigate the offers as of now accessible on Apple Store Online:

Cashback offer from HDFC Bank

The Apple Store Online is running a restricted time cashback offer in organization with HDFC Bank wherein clients can benefit a six percent cashback on the price tag of select Apple items. The cashback sum is topped at Rs 10,000 and it would be attributed in financial balance in five to seven days. To benefit the cashback, the request truck esteem should be more than Rs 20,900.

As per the terms and states of the cashback offer, it is accessible just on HDFC Bank Visas and Mastercards EMI exchanges. The cashback is restricted to one request for every truck. The offer is substantial until October 16.

Additionally READ: Apple Store Online offers administrations past shopping

EMI and no-cost EMI choice

Apple is offering EMI and no-cost EMI financing choice on its items. The EMI financing alternative is accessible through Visas given by banks, including American Express, Axis Bank, Bank of Baroda, CitiBank, HDFC Bank, HSBC, ICICI Bank, IndusInd Bank, J&K Bank, Kotak Mahindra Bank, RBL Bank, Standard Chartered Bank, State Bank of India, and Yes Bank. There is a restricted time no-cost EMI financing alternative accessible for HDFC Bank Mastercards clients. Through no-cost EMI financing choice, clients can benefit no intrigue EMI for a half year.

0 notes

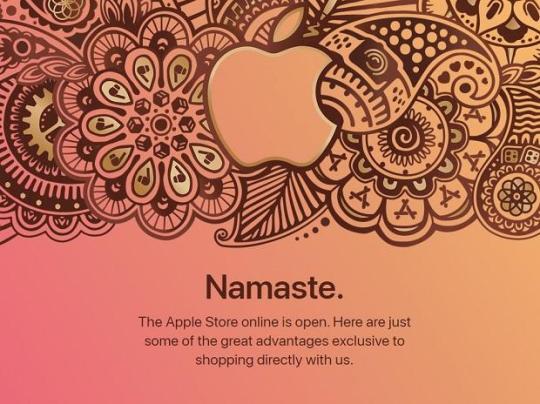

Photo

Raksha badhan Offer! Buy Ipad Air & Pro | iMagic Baroda

Buy Ipad Air & Pro from apple store in Vadodara

Get your Favorite Apple Product and get Instant Discount/Cash back.

Hurry! Visit the store now.

Free Home Delivery Available.

Stores:- Akota: 9228358888 | Karelibaug: 8347408888

#Apple iPad Pro#Apple iPad Air 5th Gen#Apple iPad Air#Apple iPad#vadodara iphone store#apple store baroda#baroda apple store#apple showroom vadodara#apple showroom in vadodara#apple reseller vadodara#iphone seller vadodara#baroda iphone store#apple iphone store in baroda#apple premium reseller

0 notes

Photo

Rakhi Special Offer Buy Airpods Pro from Vadodara iPhone Store

This Raksh bandhan, give a Gift that bring you Closer.

Rakshbandh Special Offer, Buy Airpods Pro Only In Effective Price ₹20,644*.

Raksha badhan Offer! Get your Favorite Apple Product and get Instant Discount/Cash back.

Hurry! Visit the store now.

Stores:- Akota: 9228358888 | Karelibaug: 8347408888

Shop Now: https://imagicbaroda.com/products/airpods-pro

#vadodara iphone store#apple store baroda#baroda apple store#apple showroom vadodara#apple showroom in vadodara#apple reseller vadodara#iphone seller vadodara#baroda iphone store#apple iphone store in baroda#apple premium reseller

0 notes

Photo

Buy iPad Air 4th Generation at Baroda iPhone Store

iMaGic Brings You Magical Monday with exciting offers on your favourite apple products like never before.

This Magical Monday Buy ipad Air 4th Generation and Get Free Apple Pencil 2nd Gen Wroth ₹10,900*.

Every Monday, get Exclusive offers on your Favourite apple products & Accessoires.

Stores - 9228358888 • 8347408888

#baroda iphone store#apple iphone store in baroda#i magic apple store vadodara#apple showroom vadodara#apple store baroda#vadodara iphone store#apple store in vadodara

0 notes

Photo

Buy Air Pods Pro Magsafe from Baroda Apple Store at iMaGic Baroda

Purchase Air Pods Pro Magsafe effective prices so buy now online at imagicbaroda.com. Best Deals, Free & Fast Shipping, Cash on Delivery. for more details Call Us +919228358888 or visit our store G/F, Sneh Plaza, Shree Nagar Society, Akota, beside Jain Temple, Vadodara, Gujarat 390020

#Apple Air Pods Pro#Buy Air Pods Pro Magsafe#Buy Apple Air Pods Pro#apple authorized store near me#vadodara iphone store#apple store baroda#apple showroom in vadodara#baroda iphone store#imagic apple store vadodara

0 notes

Photo

Buy Air Pods (3rd Gen) from Apple Authorised Reseller Vadodara at iMaGic Baroda

buy Air Pods (3rd Gen) effective prices so buy now online at imagicbaroda.com. Best Deals, Free & Fast Shipping, Cash on Delivery. for more details Call Us +919228358888 or visit our store G/F, Sneh Plaza, Shree Nagar Society, Akota, beside Jain Temple, Vadodara, Gujarat 390020

#Apple Air Pods#Buy Air Pods#Buy Apple Air Pods#Buy Air Pods 3rd Gen#apple authorized store near me#vadodara iphone store#apple store baroda#apple showroom in vadodara#baroda iphone store#imagic apple store vadodara

0 notes

Photo

Buy Air Pods (2nd Gen) from Apple Store Baroda at iMaGic Baroda

buy Air Pods (2nd Gen) effective prices so buy now online at imagicbaroda.com. Best Deals, Free & Fast Shipping, Cash on Delivery. for more details Call Us +919228358888 or visit our store G/F, Sneh Plaza, Shree Nagar Society, Akota, beside Jain Temple, Vadodara, Gujarat 390020

#Apple Air Pods#Buy Air Pods#Buy Apple Air Pods#Buy Air Pods 2nd Gen#apple authorized store near me#vadodara iphone store#apple store baroda#apple showroom in vadodara#baroda iphone store#imagic apple store vadodara

0 notes

Photo

Buy iPhone 13 from Apple Showroom in Vadodara at iMaGic Baroda

Apple iphone 13 Purchase effective prices & you will get free Accessories so buy now online at imagicbaroda.com. Best Deals, Free & Fast Shipping, Cash on Delivery. for more details Call Us +919228358888 or visit our store G/F, Sneh Plaza, Shree Nagar Society, Akota, beside Jain Temple, Vadodara, Gujarat 390020

#iphone 13#buy iphone 13#vadodara iphone store#apple store baroda#apple showroom in vadodara#baroda iphone store#imagic apple store vadodara

0 notes

Photo

Buy Apple iPhone 12 in Vadodara iPhone Store at iMaGic Baroda

Apple iphone 12 Purchase effective prices & you will get free Accessories so buy now online at imagicbaroda.com. Best Deals, Free & Fast Shipping, Cash on Delivery. for more details Call Us +919228358888 or visit our store G/F, Sneh Plaza, Shree Nagar Society, Akota, beside Jain Temple, Vadodara, Gujarat 390020

#iphone 12#buy iphone 12#vadodara iphone store#apple store baroda#apple showroom in vadodara#baroda iphone store#imagic apple store vadodara

0 notes

Photo

Buy MacBook Air from Apple Iphone Store in Baroda at iMaGic Baroda

Pre-book now Apple MacBook Air at best price Available next month online at imagicbaroda.com. Best Deals, Free & Fast Shipping, Cash on Delivery. for more details Call Us +919228358888 or visit our store G/F, Sneh Plaza, Shree Nagar Society, Akota, beside Jain Temple, Vadodara, Gujarat 390020

#apple iphone store in baroda#macbook air#apple showroom vadodara#iphone seller vadodara#apple store in vadodara#vadodara iphone store#baroda iphone store#apple showroom in vadodara

0 notes

Photo

Live Apple Event 2022 at iMaGic Baroda

Join us at Imagicabaroda for a special Apple Event 2022.

Live streaming of the special Apple event brodcasting at iMagic.

Stores - 9228358888 • 8347408888

#Apple Event 2022#iphone store in vadodara#apple showroom#apple india stores#apple store in baroda india

0 notes

Photo

Buy Lowest Price Macbook in Vadodara | iMaGic Baroda

Save on new mac with imagic Education Discount, Students Get up to ₹ 7000 off*

Hurry! Visit the store now.

You can also avail: ✔️No cost EMI available on Bajaj Finserv, HDFC Bank, IDFC First, and Zest

Stores:- Akota: 9228358888 | Karelibaug: 8347408888

#Macbook in vadodara#iphone store in vadodara#apple showroom#apple india stores#macbook pro#apple macbook#apple store in baroda india

0 notes