#beer market

Text

Discover the Refreshing New Taste of Rodenbach Fruitage in Australia

The world-renowned Belgian brewery, Rodenbach, has introduced a new beer to the Australian market: Fruitage, a cherry-flavoured delight that offers a unique and refreshing experience for beer enthusiasts. This latest addition to Rodenbach’s lineup combines the depth of traditional brewing techniques with a fresh twist, creating a beverage that is sure to captivate Aussie palates.

A Belgian…

#3.9% ABV#affordable beer#aged ale#Alcohol#Australia#Australian market#beer cans#beer collection#beer enthusiast#beer lovers#beer market#beer packaging#beer pairing#Beer Tasting#Belgian beer#Belgian brewery#brewing techniques#BWS#cheesecake#cherry beer#cherry notes#cocktail#Craft Beer#Dan Murphy&039;s#dark chocolate#dessert pairing#Drink#Fruitage#fruity beer#ice-cold

0 notes

Text

Non-Alcoholic Beer Market Share: Trends, Players, and Growth Opportunities

The non-alcoholic beer market has experienced significant growth over the past few years, driven by increasing consumer demand for healthier and more responsible beverage options. In this blog, we will explore the current state of the non-alcoholic beer market, including its size, share, and growth prospects, as well as the key players and trends shaping the industry.

Non-Alcoholic Beer Market Size and Share

The global non-alcoholic beer market size is expected to reach USD 28.7 billion by 2031, growing at a CAGR of 5.5% from 2022 to 2031. The market is driven by the increasing demand for healthier beverage options, growing awareness about the negative effects of excessive alcohol consumption, and the expansion of the global beer market.

Market Players

The non-alcoholic beer market is dominated by a few large players, including:

Anheuser-Busch InBev: Anheuser-Busch InBev is the largest player in the non-alcoholic beer market, controlling around 25% of the market share. The company operates a range of brands, including Budweiser, Stella Artois, and Corona.

Heineken: Heineken is the second-largest player in the non-alcoholic beer market, controlling around 20% of the market share. The company operates a range of brands, including Heineken, Desperados, and Amstel.

Carlsberg: Carlsberg is another major player in the non-alcoholic beer market, controlling around 15% of the market share. The company operates a range of brands, including Carlsberg, Tuborg, and Baltika.

Suntory Beer: Suntory Beer is a Japanese brewing company that controls around 10% of the non-alcoholic beer market share. The company operates a range of brands, including Suntory, Asahi, and Kirin.

Asahi Breweries: Asahi Breweries is a Japanese brewing company that controls around 5% of the non-alcoholic beer market share. The company operates a range of brands, including Asahi, Suntory, and Kirin.

Non-Alcoholic Beer Market Trends

Several trends are shaping the non-alcoholic beer market, including:

Health and Wellness: Consumers are increasingly seeking healthier beverage options, driving demand for non-alcoholic beers.

Responsible Drinking: Growing awareness about the negative effects of excessive alcohol consumption is driving demand for non-alcoholic beers.

Expansion of the Global Beer Market: The global beer market is expanding, driving demand for non-alcoholic beers.

Product Innovation: Companies are innovating their products to cater to changing consumer preferences, such as the launch of zero-alcohol beers.

Market Growth

The non-alcoholic beer market is expected to grow at a CAGR of 5.5% from 2022 to 2031, driven by increasing consumer demand for healthier and more responsible beverage options. The market is expected to reach USD 28.7 billion by 2031, up from USD 20.2 billion in 2022.

Conclusion

The non-alcoholic beer market is a growing and dynamic industry, driven by increasing consumer demand for healthier and more responsible beverage options. The market is dominated by a few large players, including Anheuser-Busch InBev, Heineken, and Carlsberg, but is also home to a growing number of smaller players. By understanding these trends and players, companies can develop effective strategies to capitalize on the growth opportunities in the non-alcoholic beer market.

0 notes

Text

Beer Market Size Worth $1.25 Trillion By 2030 | CAGR: 7.0%

The global beer market size is expected to reach USD 1.25 trillion by 2030, registering a CAGR of 7% during the forecast period, according to a new report published by Grand View Research, Inc. The market is expected to be driven by the elevated demand for craft beers. The wide availability and emergence of new brands in this competitive industry are also expected to drive growth.

Despite the overall category's immense size, sales have risen further in recent years, mostly as a result of people trading up, also known as premiumization in the industry, rather than increased consumption. The large-scale availability of budget drinking options has made premium beverages all the more appealing to consumers. These must offer added value and an exciting experience.

Due to the obvious immense popularity of the drink, as well as the vast varieties offered, marketers spend a substantial amount of money on advertising to promote their brands, and this spending has been escalating. According iSpot.tv, the ten largest beer brands in the U.S. spent nearly USD 525.8 million on TV ads in 2021. This has attracted a younger demographic to become consumers of beer and thereby propelled the market growth.

The lager segment held the largest share in 2021 and is expected to sustain its dominance during the forecast period. Due to their low prices and widespread acceptability, lagers are anticipated to dominate the global market. Lagers are produced by most players because they provide a good return on investment. During the forecast period, the others segment, which includes pilsners and non-alcoholic beer, is expected to showcase rapid growth.

The emergence of COVID-19 has led to an increase in off-trade consumption. However, on-trade consumption is expected to showcase faster growth during the forecast period. The growing trend of at-home consumption has boosted the significance of aluminum cans in the packaging segment. Aluminum cans are portable, light-weight, and easy to carry; hence, these are preferred by consumers.

The macro brewery segment dominated the market, commanding more than half the sales value in 2021. The large-scale operations of macro breweries give them a major edge over other segments. Furthermore, the availability of huge capital also increases production volumes, sales, and expenditure on marketing. The market is consolidated in nature, with the major players commanding more than 70% of the overall market in 2021.

Request a free sample copy or view the report summary: Beer Market Report

Beer Market Report Highlights

Asia Pacific held the largest share of the global revenue in 2021, with China accounting for more than 30% share of the regional market. Emerging economies of Vietnam, India, and the Philippines are expected to drive demand during the forecast period

Craft breweries are expected to drive growth during the forecast period due to the emergence of regional independent breweries offering strong beers, and the resultant shift in consumer preferences

The cans segment is expected to be the fastest-growing packaging segment due to the prevalent at-home consumption patterns, brought about by the outbreak of the pandemic

Beer Market Segmentation

Grand View Research has segmented the beer market based on product, packaging, production, distribution channel, and region.

Beer Product Outlook (Revenue, USD Billion, 2017 - 2030)

Lager

Ale

Stout

Others

Beer Packaging Outlook (Revenue, USD Billion, 2017 - 2030)

Bottles

Cans

Others

Beer Production Outlook (Revenue, USD Billion, 2017 - 2030)

Macro brewery

Micro brewery

Craft brewery

Beer Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

On-trade

Off-trade

Beer Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

U.S.

Europe

Germany

U.K.

France

Asia Pacific

China

India

Japan

Central & South America

Brazil

Middle East & Africa

South Africa

List of Key Players in the Beer Market

Anheuser-Busch InBev

Heineken

Carlsberg Breweries A/S

Molson Coors Beverage Company

Asahi Group Holdings, Ltd.

Diageo

Sierra Nevada Brewing Co.

United Breweries Ltd.

Oettinger Brauerei

China Resources Beer (Holdings) Company Limited

0 notes

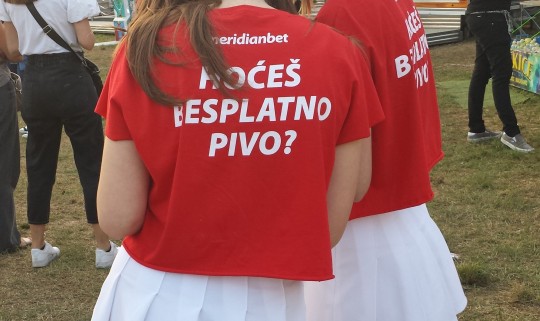

Photo

U toku je Belgrade Beer Fest

Uprkos kiši koja je odložila početak festivala za dva dana, publika, učesnici i organizatori su sačekali lepo vreme i manifestacija teče kao da nikakvih problema nije ni bilo. I u subotu i u nedelju veče na Ušće se okupilo po nekoliko desetina hiljada posetilaca koji su uživali u nastupima domaćih, regionalnih i svetskih zvezda, ali i u drugim pripremljenim sadržajima. Luna park je obe večeri bio prepun ljudi koji su imali priliku da uživaju u bogatoj ponudi zabavnog festivalskog programa te da posete ringišpile i najveći rolerkoster na ovim prostorima. Craft Beer Land i Beer Market ovogodišnjeg Belgrade Beer Fest-a su u svakom trenutku prosto okupirani od posetilaca, posebno onih koji obožavaju zanatska piva, ali i da uz njega nešto i da prezalogaje. Slede još dve večeri, i pošto su u pitanju radni dani videće se da li će se to odraziti na posetu.

Fotografije: M. Karan

#belgradebeerfest#beerfest#beer festival#zabava#pivo#muzika#kraftpivo#rokenrol#zoster#ana rucner#elvis bajramovic#craft beer land#beer market#beogradskifestivalpiva#beograd#ušće#ugostiteljstvo#hrana#skymusic#skymusic group

0 notes

Photo

Beer Market Share, Emerging Strong Growth Category Top Leading Players Industry Trends and Forecast to 2030

Beer Market Analysis

Market Research Future (MRFR) assessed the beer market 2022 through the review period between 2022 and 2030. Continuous innovations to satiate the changing demands of consumers for beverages is observed to underpin the expansion of the beer industry in the review period. As per MRFR assessment, the beer industry can expand at high CAGR to generate a substantial revenue in the analysis period. Covid-19 analysis on the beer market is offered along with the report. Insights that are explained in Covid-19 beer market analysis promises to offer valuable insights to investors to assist them in rational decision making. The introduction of modern equipment and technologies for the management of raw material and in the production of flavoured beer to meet the rising demand can support the beer industry expansion. Organizations are shifting their focus on creating work culture that can support rapid launch of new products to maintain pace with contenders. Transformation in the competitive landscape can work in favour the beer industry. However, less volume and the presence of many products can consume the market expansion in the years ahead.

Key Players

Bison Brewing Co. (U.S.), Asher Brewing Co. (U.S.), Eel River Brewing Co. (U.S.), Butte Creek Brewing Co. (U.S.), Laurelwood Public House and Brewery (U.S.), Hopworks Urban Brewery (U.S.), and Pisgah Brewing Co. (U.S.) are some reputed names in the global beer market that are listed by MRFR.

Beer Market Segment

The segment assessment of the global beer industry is done by ingredients, type, and packaging.

The type-based segments of the global beer industry are lager, ale, and stouts & porters among others. The lager beer segment can secure the largest global beer market share across the assessment period. The increase in consumer base for innovative beer, such as ale beer, can support the beer market rise.

The ingredient-based segments of the global beer industry are yeast, malt, hops, and enzymes among others. The hops segment can dominate the market, following the malt segment as the ingredients used for their manufacturing are obtained easily.

The packaging-based segments of the global beer market are bottle, can, and draught. The bottle segment of the beer market can thrive through the analysis period. The ease of transporting metal cans to and from stores that promote convenience of product handling can allow the can segment to win high revenue in the analysis period. The draught segment can is expected to thrive as consumer preference for draught beer is increasing.

Beer Regional Analysis

Trends and factors that can impact the global beer market are elaborated in the report. Europe, North America, APAC, and the Rest of the World (RoW) are regions that are studied for the market progress. In North America, the beer market can retain its hegemony through the analysis period, reveals MRFR regional evaluation. The rich culture for beer consumption in North America, likely to be led by the US, can support the market expansion. In the Asia Pacific region, the beer market can expand with high CAGR through the emerging economies, such as; India, Japan and ASEAN countries. The availability of feed and machinery for large amount of production of beer to meet the surge in its demand can favor the regional market through the assessment period. In Latin America, the existence of notable players can favor the market. The increase in consumption of alcoholic beverages across expanding regions of Latin America and Asia Pacific can support the beer market through the review period.

NOTE: Our Team of Researchers are Studying Covid19 and its Impact on Various Industry Verticals and wherever required we will be considering Covid19 Footprints for Better Analysis of Market and Industries. Cordially get in Touch for More Details.

0 notes

Text

Beer Market - Forecast (2022 - 2027)

The beer market size is estimated to reach $962 billion by 2027, growing at a CAGR of 2.9% during the forecast period 2022-2027. Beer is delineated as a drink that falls under the category of alcoholic beverages. It is prepared through brewing where cereal grains consisting of starch are marinated in water. Barley is the most common and extensively used cereal grain in the production of beer. Following the steeping fermentation process comes into the picture to confer beer its intoxicating content where yeast is added to alter glucose in ethanol and carbon dioxide. The beer market outlook is exceedingly captivating as the demand for beverages with lower alcoholic content is proliferating. To curve this precipitous rise in demand market players are focusing on wide-scale production which is resulting in the heightened number of breweries. Moreover, the innovative flavor options are proving to be the best thing since sliced bread for firms in their respective market. Elevating purchasing power, and western influence in developing countries like India, China are factors set to drive the growth of the Beer Market for the period 2022-2027.

Report Coverage

The report: “Beer Market Forecast (2022-2027)”, by Industry ARC, covers an in-depth analysis of the following segments of the Beer Market.

By Category: Malt, Ale, Lager, and Others.

By Source: Barley, Wheat, Rice, Corn, and Oats.

By Production: Craft Brewery, Micro and Macro-Brewery.

By Packaging: Glass bottles, and Cans.

By Geography: North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, Russia, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia & New Zealand, and Rest of Asia-Pacific), South America (Brazil, Argentina, and Rest of South America) and Rest of World (the Middle East and Africa).

Request Sample

Key Takeaways

Geographically, the Europe Beer Market accounted for the highest revenue share in 2021. However, Asia-Pacific is poised to dominate the market over the period 2022-2027.

The broadening number of breweries, pubs, and clubs worldwide is said to be the preeminent driver driving the growth of the Beer Market. Addictive nature and their overuse can erupt many health complications which are said to reduce the market growth.

Detailed analysis on the Strength, Weaknesses, and Opportunities of the prominent players operating in the market will be provided in the Beer Market report.

Beer Market Segment Analysis - By Source

The Beer Market based on the source type can be further segmented into Barley, Wheat, Rice, Corn, and Oats. The barley segment held the largest share in 2021. The growth is owing to its enzyme-rich nature. With the broadening trend of craft beer ascribing to its taste and flavor richness the demand for these cereal grains is plunging upward. Barley extents high effectiveness during fermentation of craft beer which gives more alcoholic content to the beverage. Furthermore, the presence of alpha-amylase and beta-amylase helps in the instantaneous breakdown of amylum polymeric carbohydrates into sugars which gives barley an edge over other grains. Furthermore, the barley segment is estimated to be the fastest-growing segment with a CAGR of 3.4% over the forecast period 2022-2027. This growth is owing to health benefits accompanied by such cereal grains as they provide vitamins, minerals, and fibers. Health benefits extended by barley are better metabolism, balanced cholesterol levels, and lower risk of a heart attack.

Inquiry Before Buying

Beer Market Segment Analysis - By Packaging

The Beer Market based on quality type can be further segmented into Glass bottles, Cans. The glass bottle segment held the largest share in 2021. The growth is owing to several benefits of glass as compared to cans. Glass bottles are hard-wearing, impervious to oxygen, impenetrable. Moreover, they can withstand high temperatures due to their heat-tolerant nature. Ascribing to all these characteristics glass bottles conserve the actual flavor of the beer. Moreover, glass is the most common medium to serve beers in clubs, restaurants, and hotels as beer in an open glass gives confer access to its fragrance and augment the sensory experience. However, the can segment is estimated to be the fastest-growing with a CAGR of 3.6% over the forecast period 2022-2027. This growth is owing to being portable and convenient to use. One of the best advantages of cans over bottles is lower chilling time. Moreover, the eventful lives of people are making cans a better alternative to bottled beers. Furthermore, cans are made of aluminum which is 95% recyclable, thereby helping the companies to place sustainable growth and ecological thinking as the base parameter.

Beer Market Segment Analysis - By Geography

The Beer Market based on Geography can be further segmented into North America, Europe, Asia-Pacific, South America, and the Rest of the World. Europe held the largest share with 41% of the overall market in 2021. The growth in this segment is owing to the factors such as the presence of alcohol loving population in European countries. The Czech Republic is the biggest consumer of beers with 188.6 liters per capita consumption Similarly, many other nations like Spain, Ireland, Romania, Austria, and others have their per capita consumption rates near to 100 liters. Besides, due to developed economies people in these nations enjoys a high standard of living and increased demand for alcoholic beverages. However, Asia-Pacific is expected to be the fastest-growing segment over the forecast period 2022-2027. This growth is owing to growing disposable income in developing nations. Additionally, youngster favors beer more than other beverages and the Asian nations hold a vast percentage of the young age population which is stimulating the overall demand in the beer market.

Schedule a Call

Beer Market Drivers

Elevation in the number of breweries, per capita income, is Anticipated to Boost Product Demand

With swift modernization and industrialization purchasing capacity of consumers worldwide is swelling. If we talk about the developed world then the majority of European nations have more than $60,000 GDP per capita. Nevertheless, developing nations are also witnessing a surge in purchasing powers too. For instance, India’s per capita income is anticipated to reach $1850 by the year 2023. Therefore, with rising purchasing capacity, and growing western influences worldwide people especially youngsters are making more demand. Therefore, market players are setting more breweries to curve this soaring demand. According to a report, with a slight increase than the previous year number of breweries in the US has reached over 9000 in 2021.

Blooming trends of nightlife, Speedy modernization augmenting the number of wine shops, pubs, and discos are Anticipated to Boost Product Demand

With swift modernization number of wine shops and clubs is on the rise to tap the proliferating demand for alcoholic beverages. With a 1.3% expansion, the number of wine shops in the US has reached over 43000 in 2021. Moreover, the exuberant nightlife of countries like the US, UK, Spain is a sight to hold. A report claimed that there are more than 60,000 bars and nightclubs in the US as of 2021. The number is expected to rise further in foreseeable future.

Buy Now

Beer Market Challenges

Health complications and restricted advertisement is Anticipated to Hamper Market Growth

There are innumerable health hitches related to beer and spirit intake which are anticipated to strangle the growth of the aforementioned market. Even though beer contains lower alcohol content but still its overuse and mixture with other spirits can be problematic. Over usage of such beverages can result in deterioration of liver tissue. Once liver tissue is damaged it affects the functioning of the liver, and after a certain period of time patient can face liver failure. On another hand, restrictions on open advertisement can play a role in hindering the growth of the aforementioned market.

Beer Market Competitive Landscape:

Product launches, mergers and acquisitions, joint ventures, and geographical expansions are key strategies adopted by players in the Beer Market. The top-10 Beer Market companies of this market are-

The Boston Beer Company

Heineken N.V

Carlsberg Group

Constellation Brands

Anheuser-Bush InBev

Diageo

Beijing Enterprises Holdings

Dogfish Head Craft Brewery

Nited Brewery

Sierra Nevada Brewing Co.

Recent Developments

June 23, 2021, Netherlands-based famous beer company “Heineken” has raised its shareholding by 14.9% in “UBL”, which is the beer division of India-based leading brewing company “UB Group.” In the process, Heineken bought an extra 39.6 million and now the company has control over a 61.5% stake in UBL. Owing to the following strategy, Heineken would now hold the Indian market by market capitalization and product control as separate parameter, which would allow effective synergies.

April 14, 2021, England-based multinational firm Diageo that manufactures alcohol beverages successfully acquired “Loyal 9 Cocktails”, a US-based company that manufactures ready-to-drink spirits. The step is anticipated to be a complete banger as demand for ready-to-drink cocktails is soaring in the US. The ready-to-drink cocktails sales witnessed a 79% increase and reached $664 million in 2020.

May 2, 2019, Heineken, a leading Dutch beer company based in Amsterdam, Netherland announced the acquisition of “Biela y Bebidas del Ecuador S.A” commonly known as “Beila Ecuador.” With this move, Heineken has set its foot in the profitable 6 million hectolitres beer market of Ecuador. HEINEKEN also plans to brew Heineken® beer locally in due course.

0 notes

Text

is this a marvel sci-fi tv show, or a fucking ROMANTIC COMEDY

#the tension was INSANEEEEE#on the verge of being on a date#i can't believe them actually#loki fixing himself up before going to mobius#and then mobius offering him a beer#then he asked loki 'are you still on the market?' and reiterated that his wife is loooong gooone KAHSKDHKSHD#tag talk#loki tv show#loki tv series#loki x mobius#loki season 2#loki series#lokius#mobius x loki#mobius m mobius#mobius#tom hiddleston#owen wilson#loki#marvel tv#mcu tv#sci fi#marvel mcu#mcu show#marvel show#disney#but also boycott disney fuck disney PIRATE!!!!! RAH!!!!!

2K notes

·

View notes

Text

Chicago Beer Pass: Oh! Oktoberfest!

youtube

Welcome to the Chicago Beer Pass: Your ticket to all the great beer events happening in and around Chicago.

On this episode of Chicago Beer Pass, Brad Chmielewski and Nik White continue their way across the glorious section of Oktoberfest beers in the Illinois beer market. Brad and Nik are doing their best to cover as many as possible this season but they are only gonna scratch the surface it seems. For this episode the guys have an Oktoberfest from Buckledown hitting their steins. As they knock back a few cans they talk about getting after the boot at Phase Three as well as some stops at Metropolitan Brewing and Burning Bush. The guys also have a preview of Revolution Brewing’s latest collaboration with Garrett’s popcorn.

Having issues listening to the audio? Try the MP3 (52.9MB) or subscribe to the podcast on iTunes!

#audio#podcast#audio podcast#beer podcast#chicago#oktoberfest#Brad Chmielewski#Nik White#Metropolitan Brewing#Chicago Beer Pass#garrett’s popcorn#WEEKLY#weekly podcast#guys drinking#revolution brewing#Burning bush#Illinois#beer market#buckledown#Buckledown Brewing

0 notes

Text

ctub and ctommy r so redneck hillbilly southerners to me <3

#vry different kinds of south tho tubbos appalachian hillbilly full ghillie suit dogtags sitting on the porch drinking a beer shotgun in hand#and tommys more texas redneck big belt buckles and cowboy boots bible quotes on a big truck selling tomatoes at the farmers market southern#this is my deep understanding of these two british kids LMAO#my art#tommyinnit#tommyinnit fanart#tubbo#<- tiny but hes still there ^^#dsmp#dsmp fanart

319 notes

·

View notes

Text

#marketing class is... fascinating /negative so far#gender is too Not A Big Deal to me for this#it puts so much weight on how traditional gender roles influence shopping habits#which like. it's just weird to have to throw myself into that mindset of 'men vs women' for a grade#because in my mind‚ the lines between the two lean pretty insignificant#like i get it. i'm not here to cancel this random ass course skjskdsd it's just a weird feeling to have to consciously lean INTO that#like there are objective demographic differences and patterns but it feels WEIRD to be reading my textbook about how#you should market cleaning supplies to women and beer to men#like i know it's all just about numbers and it's literally not that deep but it feels offputting to me personally sdksdks

93 notes

·

View notes

Photo

Sutra počinje Belgrade Beer Fest – detaljan vodič kroz festival

Jubilarno 20. izdanje najpopularnijeg i najmasovnijeg festivala muzike i piva u regionu, Belgrade Beer Fest-a, počinje sutra, 15. juna, u organizaciji Skymusic-a i pod pokroviteljstvom Grada Beograda i trajaće do 18. juna.

Na doboro poznatoj lokaciji – beogradskom Ušću, tokom četiri festivalska dana očekuje nas savršen zvuk i najsavremenija produkcija za koju je zadužen Skymusic, i više od 60 izvođača na čak tri bine.

Kao headlineri na glavnoj bini najavljena su velika imena svetske i domaće muzike, među kojima su Morcheeba, The Brand New Heavies, Incognito, Van Gogh, Partibrejkers, Ana Popović, Brkovi, Toni Cetinski, Joker Out, Kerber, Atomsko sklonište, Bombaj štampa, Bojana Vunturišević, Ana Rucner i Elvis Bajramović, Kralj Čačka, Repetitor, Obojeni program, Koikoi, Zoster i Neverne bebe.

Posetioci će moći da uživaju i u alternativnim zvukovima najperspektivnijih domaćih bendova na Riff stage-u, a kao glavni headliner Riff stage-a najavljen je bend Eyesburn, koji nastupa prve festivalske večeri.

Na Electro stage-u powered by Sakura posetioce očekuju najpoznatija imena domaće elektro scene.

Na ovogodišnjem Belgrade Beer Festu biće prisutno 300 različitih etiketa piva - pored velikih pivarskih brendova, u ponudi su i različite vrste kraft piva. Obožavaoci piva imaće dve posebno dizajnirane zone na festivalu posvećene upravo njima - Beer market i Craft Beer Land.

Kapije festivala otvaraju se od 18 časova, a zvanično se zatvaraju u 3 časa nakon ponoći.

Ulaz na festival biće slobodan svakog dana između 18 i 19 časova, nakon čega će se ulazak u festivalski prostor naplaćivati. Ulaz je slobodan za osobe ispod 15 godina svakog festivalskog dana, uz pratnju punoletne osobe. Ulaznice za Belgrade Beer Fest po ceni već od 300 dinara dostupne su putem sajta belgradebeerfest.com, sajta efinity.rs, besplatne aplikacije eFinity, u TC Rajićeva (I sprat) i na blagajni Štark Arene, a kupovina ulaznica omogućena je i na licu mesta.

#beer fest#belgrade beer fest#beograd#belgrade#ušće#koncerti#muzika#pivo#zabava#morcheeba#incognito#anja rucner#kerber#neverne bebe#zoster#beer festival#electro stage#riff stage#sky music#beer market#sky music group#sky music corporation#craft beer land#craft beer

0 notes

Text

James Brown for Falstaff, 1969

Theme Week: Black Celebrities 👑

#theme week#celebrity ads#james brown#beer#beverage#multicultural market#falstaff#1960s#1969#vintage advertising

43 notes

·

View notes