#best aeps admin portal

Explore tagged Tumblr posts

Text

Best Travel Admin Portal to Start your own Travel Brand | PayPrime

Introduction

Traveling is one of life's greatest joys, allowing us to explore new destinations, experience diverse cultures, and create cherished memories. However, the logistics of planning and organizing a trip can often be overwhelming and time-consuming. Thankfully, in this digital age, technology comes to the rescue with innovative solutions. One such tool that has revolutionized the travel industry is the Travel Admin Portal.

What is a Travel Admin Portal?

The Travel White label Software is an all-in-one digital platform designed to simplify and enhance every aspect of travel planning and management. It acts as a central hub that consolidates various travel- related services and tools, empowering travelers, travel agencies, and other stakeholders to collaborate efficiently and make informed decisions.

Key Features and Functionalities

Trip Planning Made Easy:

The best travel admin portal allows travelers to create personalized itineraries for their journeys. Users can browse through a comprehensive database of destinations, attractions, and activities, selecting the ones that align with their interests and preferences. Additionally, it offers real-time access to travel information like flight schedules, accommodation options, and local events, ensuring travelers stay informed and can optimize their plans accordingly.

Booking and Reservations:

Gone are the days of searching multiple websites to book flights, hotels, and other services. With the Travel Admin Portal, travelers can make all their reservations in one place. The platform collaborates with various airlines, hotels, car rental companies, and tour operators to provide users with a wide array of options at competitive prices.

Budget Management:

One of the most critical aspects of travel planning is budgeting. The portal offers budget management tools that help users estimate the cost of their trips based on their preferences and duration. It allows travelers to set spending limits for different categories, such as accommodation, transportation, and activities, ensuring they stay within their planned budget.

Group Travel Coordination:

Planning a trip with family or friends can be challenging, with multiple opinions and preferences to consider. The Travel Admin Portal facilitates group travel coordination by enabling members to collaborate in real-time, vote on activities, and synchronize their itineraries. This feature ensures a smooth and enjoyable group travel experience for everyone involved.

Travel Document Organization:

Keeping track of essential travel documents, such as passports, visas, and insurance papers, is vital to a stress-free journey. The portal provides a secure digital vault where users can upload and store their documents, ensuring easy access and peace of mind during their travels.

Benefits of Using a Travel Admin Portal

Time-Saving Efficiency:

With all travel-related services consolidated in one place, travelers save valuable time by avoiding the need to browse multiple websites and compare different options.

Personalized Experiences:

The platform tailors recommendations and suggestions based on user preferences, creating more personalized travel experiences.

Cost-Effective Solutions:

The ability to compare prices and find the best deals on flights, accommodations, and activities helps travelers stay within their budget.

Enhanced Collaboration:

For travel agencies and group travelers, the portal fosters seamless collaboration, promoting effective communication and decision-making.

Conclusion

The Travel Admin Portal is a game-changer in the world of travel planning. By harnessing the power of technology, it transforms the often-stressful process of organizing a trip into an enjoyable and efficient experience. Whether you're an avid solo traveler, a family planning a vacation, or a travel agency assisting clients, this all-in-one platform has something to offer to everyone. Embrace the convenience and benefits of the Travel Admin Portal, and embark on your adventures with confidence and excitement! Also we Provide Recharge Software, Best UPI Gateway.

0 notes

Text

This is goldmine information for those who are planning to start their own AEPS business as an admin. Here I have explained the top 10 steps to set a successful AEPS b2b business. please check out India's only company that offers AI smart AEPS portal.

#aeps service provider company#how to start aeps business#aeps service provider#aeps software provider#aeps admin software#aeps admin portal#best aeps portal for admin

2 notes

·

View notes

Text

online mobile recharge software | cyrusrecharge.com

Cyrus Recharge Solutions is top Software Company in Jaipur, India, working since 2010. We provide the best recharge software, recharge API, recharge admin software,b2b recharge,white label recharge software, all mobile recharge app with commission,bbps api,aeps api,b2b recharge software, etc.

0 notes

Text

With AePS API Provider Fast Forward Your FinTech Business

Do you want to enhance your business? Then switch to RBP which is one of the finest AePS API provider, it will give wings to your business with its scalable services

#aeps api#aeps api provider#aeps api provider company#aeps api service#aeps api service provider#aeps white labelportal#aeps admin portal#cash withdrawal api#banking api#digital payments api#aadhaar enabled payment system api#fintech api#best aeps api company#aeps company

0 notes

Link

#aeps software#aeps software provider#aeps software development company#aeps portal#best aeps portal#aeps api#aeps payment#aeps app#aeps business

2 notes

·

View notes

Text

Why is AEPS Considered a UPI for Rural India?

Aadhaar Enabled Payment System (AEPS) is a payment service that lets a bank customer use Aadhaar as his or her identity to access his or her Aadhaar enabled bank account. The goal of the AEPS system is to give people more power, especially in rural areas, by giving everyone access for financial and banking services through Aadhaar.

AEPS infrastructure is a great move toward solving the basic banking problems caused by the lack of Digitalization in rural India by allowing basic banking transactions, increasing the use of digital financial services in rural India, and filling them into the formal financial system. As India is now a developing Nation and so a rural area should be, making the rural areas more digitalized, more cashless, and more educated about digitalization, AEPS has been a key role for rural people and thus it has been a modern UPI for the rural people of India.

How to use AEPS as UPI?

It’s easy to use AEPS; all you have to do is give the correct Aadhaar number, and the payment will be sent to the right merchant.

• Download the app on the Android or iOS platform

• Register for the service by giving details about your bank account.

• Set up a VPA and get an MPIN

Benefits of AEPS Payments

As part of “Paperless, Cashless, and Faceless” services across the country, especially in rural and remote areas, different ways to make digital payments are being offered. These include Banking Cards, Mobile Wallets, Internet Banking, Mobile Banking, Bank Pre-paid Cards, Micro ATMs, and Aadhaar Enabled Payment System (AEPS) Also, with the move to digital, banking services will be available to customers on a 24/7 basis and on all days of the year, including bank holidays.

• Cost-effective and less transaction fee: There are a lot of payment apps and mobile wallets that don’t charge any kind of service fee or processing fee for the service they provide. The UPI interface is one example of a service that the customer can use for free. Costs are going down because of the many digital ways to pay.

• Discounts and cashback: Customers who use digital payment apps and mobile wallets can get a lot of rewards and discounts. Many digital payment banks offer cash-back deals that are pretty good. This is great for customers and makes them more likely to stop using cash.

• One-stop solution for paying bills: Many digital wallets and payment apps can be used to pay bills all in one place. This makes it easy to pay for things like utilities. All of these utility bills, like cell phone bills, internet bills, and electricity bills, can be paid through a single app without any hassle.

Which are the best AEPS services provider in Rajasthan?

Paydeer Company is one of the best AEPS service provider companies in Rajasthan. You can start your own AEPS banking service with us as an admin and can offer cashless banking and financial services to your members.

Many fintech companies also support financial inclusion by setting up their own banking correspondent agent networks that offer AEPS services to their communities. These networks can also help people who don’t have bank accounts but have an Aadhar card join the formal financial system without having to go to a bank branch.

Conclusion

Since the cashless economy, the Indian government has been working on a number of projects to meet the financial needs of the last mile consumer. In a country like India, where digital literacy is still low, one important part of promoting digital payments among rural populations is how easy it is for them to use these methods in their daily lives.

Tags: aeps pe rajasthan, rajasthan aeps portal services, aeps cash withdrawal rajasthan, rajasthan aeps department, rajasthan aeps transaction limit, rajasthan aeps machine, rajasthan aeps service provider, rajasthan aeps agent registration, rajasthan aeps near me, rajathan aeps registration online

Originally Published at :- https://paydeer.medium.com/why-is-aeps-considered-a-upi-for-rural-india-5617dcc2e4ba

0 notes

Photo

iServeU- The Best AEPS Service Provider in India

Aadhaar enabled payment system (AEPS) is a bank-led model that permits money transactions through your Aadhaar card. It needs Aadhaar based verification and a unique identification number to initiate and complete the fund transaction with ease. The main motto to introduce AEPS gateway is to promote a cashless economy and provide financial services to all the segments of the society through Aadhaar. Through this payment system, one doesn’t have to carry the documents like bank details or ATM cards. AEPS SDK is a simple and secure cash withdrawal system created by NPCI.

AEPS gateway is created by the National payment corporation of India (NPCI) with an aim to make the life of people simple and easy so, they can make financial transactions without sharing their confidential data with anyone. It is a way to promote a cashless economy and empower all sections of society. Many AEPS Portal is offering AEPS Gateway in rural areas. Through this system, one can make interbank and intra bank fund transfer. Do hassle-free purchasing from any shops through your Aadhaar card. The transaction can be done easily through Admin Portal and using a biometric scanner system. These transactions are safe & easy to use. Because it needs biometric authentication through your fingers/iris.

You don’t have to show other documents apart from the Aadhaar card. Only a finger impression will be required. Aeps is a big step towards a cashless society.

How to avail AEPS service?

If anyone wants to do an AEPS SDK transaction then, they can contact the nearby local retailers or banking correspondent to make Aadhaar based payments. Many iServeU retailers and agents are offering AEPS SDK to their customers through AEPS Portal.

How to use AEPS

Aeps registration process at iServeU AEPS Portal

Step1: Visit the banking correspondent in your zone or any retailer using AEPS Admin Portal providing the services.

Step2: Provide your 12-digit Aadhaar number to the retailer using AEPS Admin Portals o they can enter it at the POS (Point of sale) machine.

Step3: Choose the type of transaction i.e. cash withdrawal, balance inquiry, or mini statement.

Step4: Choose the name of your bank

Step5: Tell the retailer using the iServeU AEPS Portal or agent to enter the amount you want to withdraw.

Cash transaction limit of AEPS

The cash transaction limit of AEPS per day is Rs.10,000 that you can get from any iServeU AEPS Portal. RBI has not set any limit for cash transactions via AEPS SDK but different banks have different cash transaction limit per day.

What are the charges for AEPS?

There are no charges for using AEPS. The banking or business correspondent may charge UIDAI a very minimal fee. According to NPCI, the charges are between 15paise to 25paise for the instant settlement.

The Key features of AEPS Transaction:

In AEPS Transaction, no OTP or PIN is required to make any transactions, all you need to do is link your Aadhaar number with your bank account and provide a 12-digit Aadhaar number to the agent. The total number of transactions is 10 times per month.

Do you want to avail Aadhaar enabled payment services? iServeU is the right place to contact for all types of financial solutions. iServeU is a leading AEPS Service Provider and a business correspondent that offers AEPS Gateway to perform safe and easy financial transactions. iServeU has its own AEPS Admin Portal to provide Aadhaar payment and has 25,000 agents, providing AEPS services in rural areas.

Avail Aadhaar payments through iServeU AEPS Portal. You can also make your shop a micro ATM booth and get a good amount as commission. If you are unable to go to the banks or want to contact the nearby retailers, then many agents are using iServeU AEPS software for cash withdrawal. You can avail iServeU services round the clock and 365 days. For more info, call on +91 8338088000 or mail your query to [email protected].

0 notes

Photo

Start Earning with Mini-ATM Device at Your Shop

Business बढ़ाओ , पैसा कमाओ !!

इसके लिए आपको बहुत बड़े Investment यानि ज़्यादा पैसा देने की जरूरत नही है, केवल आपके पास Computer/Laptop/Mobile+Internet होना एवं इनको चलाने की Basic Knowledge होनी चाहिए, इस Business को चलाने की हमारी तरफ से Online Training बिल्कुल मुफ़्त दी जायेगी !

AEPS, पैन कार्ड पोर्टल, मनी ट्रांसफर सर्विस, बिजली बिल, रिचार्ज, EMI पेमेंट, कार/ बाइक इंश्योरेंस के साथ एक ही पोर्टल में 100 से आधिक IT Services JOIN NOW !

Best Opportunity to Start Your Own B2B Portal with Best AEPS White Lable Services Provider Company in India | You Will Get Admin Panel, Where You Can Create Unlimited Master Distributor, Distributor, Retailer Under You and Earn Extra Income

#AEPS#miniATM#AEPSServiceProvider#MiniATMMachine#FranchiseBusiness#Shop#StartYourOwnBusiness#WhiteLableServiceProvider#Enterpreneur#NewBusinessIdeas#FranchiseIdeas#ItService#FintechServiceProvider#DomesticMoneyTransfer#India#Rajasthan#TicketBooking#Insurance#DigitalSeva#Franchise#DMT#Taxation#DogmaSoft

0 notes

Text

What exactly is AEPS service? How can it help you?

Aadhaar Enabled Payment System which is also called as (AEPS) is a modern payment service which is provided by the National Payment Corporation of India for the banks and other financial institutions using 'Aadhaar.' Aadhaar is a unique id number which is issued by the Indian Unique Identification Authority (UIDAI).

This service can be accessed at Consumer Access Points (CSPs) operated by Business Correspondents (BCs) via Point of Sale (POS) devices. Oxigen, being that financial institution, which is providing the AEPS services across whole India through the appointed BCs which use the Oxigen Micro ATM PoS machines. Money Transfer Api is becoming much popular nowadays. Aeps White Label is also a good option.

A company correspondent who is also an agent designated by a bank to expand financial services in places where they would not have a branch may own the Oxigen Micro ATM to provide AEPS services to bank clients. You can find many aeps white label portal in the market. The range of the business Correspondents' operations covers, inter alia, the processing of small value transactions, withdrawing money and the small value interbank remittances. Different domestic money transfer portal will help you a lot with the services. Please note that if something is within the scope of the AEPS, a BC of a particular bank is then treated as the integral part of that Bank and the Correspondent Bank is then responsible for all of the acts of commissions and also the omissions. There is also a lot of Domestic Money Transfer Software available in the market, from which you can choose one of the best.

This facility encourages a bank client to use aadhar card as his / her identification to enter his / her Aadhaar allowed bank account and conduct simple interbank or inter - bank transactions, such as-Balance Enquiry, Cash Deposit, fund transfer and payments. For all payments, whether intrabank or interbank, the Transaction Receipt is written and turned over to the customer as a finality transaction record by the BC from which the transaction was initiated. Money Transfer White Label is the best thing to get extra features.

Across all the Aadhaar-enabled business transactions, including intrabank or inter - bank, BC utilizes its Oxigen Micro ATM, asks for Aadhaar customer numbers and checks the fingerprint of its customer using the MicroATM-enabled biometric scanner. The payment would only be successful if the Aadhaar encryption is successful.

AEPS India provides simple cash withdrawal facilities with AEPS services, now transferring cash to your bank account is simple, you don't need to go for a long walk towards your bank, all you really need is your own aadhar number, bank identity and thumb / finger impressions not just that this facility is not confined to our bank simply, you could do transactions online. You can also become a good White Label Aeps Service Provider and earn some good money.

Deposit money by calling any AEPS service provider and you can conveniently deposit cash in minutes without having to struggle with lengthy bank deposit queues or waiting for lunch.With AEPS India app, you can easily enable users to verify their balances with their Aadhar card numbers & fingerprint recognition ID, so people can easily verify the balances on the admin screen.

0 notes

Link

If you are willing to start your own fintech AEPS business as an admin and looking for the best AEPS service provider who can help you to set up a successful AEPS business by providing the best AEPS software at the lowest price and innovative features then you must you through this blog and start making a handsome income.

#aeps service provider#aeps service provider company#no 1 aeps company#best aeps service provider#best aeps service#aeps software#aeps business#best aeps portal#best aeps portal for admin

1 note

·

View note

Text

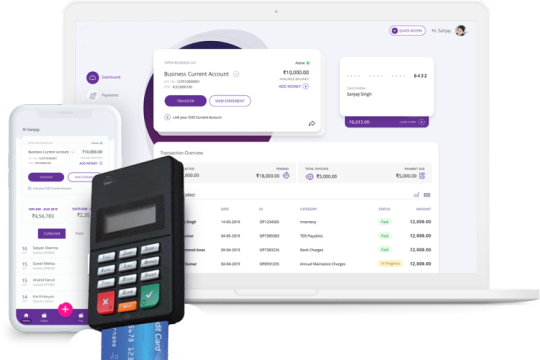

Do you want to start your own b2b fintech business and looking for best solution then this is for you?

Ezulix software is a leading b2b fintech software development company in India. We offer multipls software solutions in a singel b2b admin portal. Here we have mulitple packages with multiple features.

By choosing our b2b software silver package, you can get all multi recharge, aeps, bbps, pancard and money transfer services into your admin panel with integrated mobile app and your brand website.

You can offer all services to your agents and can earn highest commission in the market.

For more details visit our website now or request a free live demo. www.ezulix.com or call at (+91)7230001612

#b2b fintech software#b2b software silver package#mobile recharge software#aeps software#bill payment software#money transfer software#pancard software#b2b fintech business#fintech startup

3 notes

·

View notes

Text

Best Fintech Software Development Company

Ezulix software is a leading b2b fintech software development company in India. We have a huge team of skilled and experienced professionals who are expert in developing fully customized and advanced fintech solutions for businesses.

Our b2b fintech admin portal is a one-stop solution for multiple services like aeps, multi recharge, bbps, pancard, money transfer, and travel. As a business owner you can offer all services to your b2b agents using our b2b fintech admin software and can earn highest commission.

Along with this, we facilitate fintech software & app development services for various businesses as per their need.

If you are planning to start your own fintech business and looking for solution then this can be a great place for you.

For more details you can visit our website https://ezulix.com/ or request for a free live demo. (+91)7230086664

#fintech software#b2b fintech software#fintech software development#fintech software provider#fintech software development company#fintech app development company

2 notes

·

View notes

Text

Get EzulixB2b Software - Recharge, Aeps, BBPS

Are you planning to start your own b2b fintech admin portal and looking for best opportunity then this is for you?

Ezulix Software's, Year End Sale is live now.

You can start b2b fintech business with your own brand name and logo and can make it a handsome source of Income.

For more details, Click on below Image.

#aeps software#aeps software provider#aeps software developer#mobile recharge software#multi recharge software#money transfer software#bharat bill payment system#pancard software#b2b fintech admin portal#ezulix software

2 notes

·

View notes

Text

Are you planning to start your own b2b fintech admin portal and looking for the best opportunity then this is for you?

On this Ganesh Chaturthi, Ezulix Software is launching India's first-ever AI smart fintech admin portal. It includes mobile recharge software, AEPS software, bbps software, pancard software, money transfer software, and travel booking software.

As an admin, you can create unlimited members all over India and can earn the highest commission on all services. For more details visit our website or request a free live demo. (+91)7230086664

#aeps software#mobile recharge software#money transfer software#bharat bill payment system#nsdl uti pancard software#travel booking software

2 notes

·

View notes

Text

multi recharge software | cyrusrecharge.com

Cyrus Recharge Solutions is top Software Company in Jaipur, India, working since 2010. We provide the best recharge software, recharge API, recharge admin software,b2b recharge,white label recharge software, all mobile recharge app with commission,bbps api,aeps api,b2b recharge software, etc.

0 notes

Text

Best AEPS Admin Portal | PayPrime

AEPS changed into the first-rate alternative for banking withinside the Covid-19 section wherein all banks and ATMs are closed. After Covid-19, AEPS transactions ruin all facts and supported a cashless society in India.Payprime provides Best AEPS Admin Portal.

0 notes