#banking api

Text

Get Fintech API, Banking API, Travel API & Verification API

Are you looking for API solution to integrate into your software system to get addon services then this is for you?

Ezulix software is a leading fintech & banking API provider company in India. We provider you end-to-end fintech & banking API solution for your business.

Along with this, we facilitate you travel and verification APIs to support your business,

For more details visit our website or request a free live demo.

#fintech api#banking api#travel api#verification api#aeps api#bbps api#dmt api#pan verification api#aadhaar verification api#payout api#bus booking api#flight booking api#hotel booking api

3 notes

·

View notes

Text

The Best Banking API Software Solutions with WeGoFin

In the dynamic world of digital finance, the integration of robust and reliable banking API software has become crucial for businesses seeking to innovate and enhance their financial services. WeGoFin is proud to be at the forefront of this revolution, offering cutting-edge API solutions that empower businesses to create seamless, efficient, and secure financial experiences for their customers. In this blog, we’ll explore some of the best banking API software solutions available today, and how WeGoFin can help you leverage these tools to drive your business forward.

#wegofin#best payment gateway#best secure payment#api#banking api#banking#digital payment services#digital payments

0 notes

Text

UPI API Provider

Looking to revolutionize your banking services? Look no further! We, at PaySprint, are your leading UPI API Provider, offering innovative solutions for seamless integration and enhanced functionality. With our UPI Cash Withdrawal API, say goodbye to traditional banking methods and hello to the future of banking! Experience the ease of cardless withdrawals, secure transactions, and unparalleled convenience. Embrace the future with PaySprint, your trusted UPI API Provider!

#UPI API#UPI Cash Withdrawal#Cardless Withdrawals#Banking API#Secure Transactions#Real-time Transactions#Seamless Integration#Enhanced Functionality#Future of Banking#Convenience#Innovation#paysprint#upi api provider

0 notes

Text

Banks API: Simplifying IBAN to Bank Conversions

Banks API has revolutionized the way we interact with financial institutions. One of the key features of these APIs is their ability to process IBAN-to-bank conversions seamlessly. IBAN, or International Bank Account Number, is a standardized format used to identify bank accounts across different countries.

With Banks API, users can easily retrieve detailed information about a particular IBAN, such as the associated bank's name, address, and even contact details. This functionality streamlines various processes, such as verifying bank account details during transactions or conducting background checks for financial services.

The simplicity and speed offered by Banks' APIs have transformed the banking landscape. Gone are the days of manually searching through extensive databases or making time-consuming phone calls to determine the corresponding bank for a given IBAN. Now, a simple API call can provide accurate and up-to-date information within seconds.

Furthermore, Banks' APIs have enhanced security measures by incorporating stringent authentication protocols and encryption techniques. This ensures that sensitive data, such as customer account details, remains confidential and protected.

In conclusion, Banks' APIs have become a game-changer in the financial industry. They have simplified the process of converting IBAN to bank information, making transactions more efficient and secure. With the continued advancement of technology, we can expect Banks' APIs to further revolutionize banking services, offering new possibilities and improving customer experiences.

0 notes

Text

KYC Provider UK

KYC Verification is essential to onboard a new client in UK businesses to authenticate the identity of a person associated with the business and even to check involvement in money laundering. We are one of the leading KYC providers in the UK and assist with KYC API for financial and non-financial businesses.

#KYC UK#KYC Provider UK#KYC Solutions UK#KYC Solutions Provider UK#banking#finance#fintech#gaming#kyc api#kyc software#kyc companies#banks

4 notes

·

View notes

Text

#bed banks#bedbank#bed banks api#hotel bed bank#travel technology#travel software#travel tech#travel agency software#hoteliers#hotels#hotel channel manager integration#hotel channel manager

0 notes

Text

Enterprise LLM APIs: Top Choices for Powering LLM Applications in 2024

New Post has been published on https://thedigitalinsider.com/enterprise-llm-apis-top-choices-for-powering-llm-applications-in-2024/

Enterprise LLM APIs: Top Choices for Powering LLM Applications in 2024

The race to dominate the enterprise AI space is accelerating with some major news recently.

OpenAI’s ChatGPT now boasts over 200 million weekly active users, a increase from 100 million just a year ago. This incredible growth shows the increasing reliance on AI tools in enterprise settings for tasks such as customer support, content generation, and business insights.

At the same time, Anthropic has launched Claude Enterprise, designed to directly compete with ChatGPT Enterprise. With a remarkable 500,000-token context window—more than 15 times larger than most competitors—Claude Enterprise is now capable of processing extensive datasets in one go, making it ideal for complex document analysis and technical workflows. This move places Anthropic in the crosshairs of Fortune 500 companies looking for advanced AI capabilities with robust security and privacy features.

In this evolving market, companies now have more options than ever for integrating large language models into their infrastructure. Whether you’re leveraging OpenAI’s powerful GPT-4 or with Claude’s ethical design, the choice of LLM API could reshape the future of your business. Let’s dive into the top options and their impact on enterprise AI.

Why LLM APIs Matter for Enterprises

LLM APIs enable enterprises to access state-of-the-art AI capabilities without building and maintaining complex infrastructure. These APIs allow companies to integrate natural language understanding, generation, and other AI-driven features into their applications, improving efficiency, enhancing customer experiences, and unlocking new possibilities in automation.

Key Benefits of LLM APIs

Scalability: Easily scale usage to meet the demand for enterprise-level workloads.

Cost-Efficiency: Avoid the cost of training and maintaining proprietary models by leveraging ready-to-use APIs.

Customization: Fine-tune models for specific needs while using out-of-the-box features.

Ease of Integration: Fast integration with existing applications through RESTful APIs, SDKs, and cloud infrastructure support.

1. OpenAI API

OpenAI’s API continues to lead the enterprise AI space, especially with the recent release of GPT-4o, a more advanced and cost-efficient version of GPT-4. OpenAI’s models are now widely used by over 200 million active users weekly, and 92% of Fortune 500 companies leverage its tools for various enterprise use cases.

Key Features

Advanced Models: With access to GPT-4 and GPT-3.5-turbo, the models are capable of handling complex tasks such as data summarization, conversational AI, and advanced problem-solving.

Multimodal Capabilities: GPT-4o introduces vision capabilities, allowing enterprises to process images and text simultaneously.

Token Pricing Flexibility: OpenAI’s pricing is based on token usage, offering options for real-time requests or the Batch API, which allows up to a 50% discount for tasks processed within 24 hours.

Recent Updates

GPT-4o: Faster and more efficient than its predecessor, it supports a 128K token context window—ideal for enterprises handling large datasets.

GPT-4o Mini: A lower-cost version of GPT-4o with vision capabilities and smaller scale, providing a balance between performance and cost

Code Interpreter: This feature, now a part of GPT-4, allows for executing Python code in real-time, making it perfect for enterprise needs such as data analysis, visualization, and automation.

Pricing (as of 2024)

Model Input Token Price Output Token Price Batch API Discount GPT-4o $5.00 / 1M tokens $15.00 / 1M tokens 50% discount for Batch API GPT-4o Mini $0.15 / 1M tokens $0.60 / 1M tokens 50% discount for Batch API GPT-3.5 Turbo $3.00 / 1M tokens $6.00 / 1M tokens None

Batch API prices provide a cost-effective solution for high-volume enterprises, reducing token costs substantially when tasks can be processed asynchronously.

Use Cases

Content Creation: Automating content production for marketing, technical documentation, or social media management.

Conversational AI: Developing intelligent chatbots that can handle both customer service queries and more complex, domain-specific tasks.

Data Extraction & Analysis: Summarizing large reports or extracting key insights from datasets using GPT-4’s advanced reasoning abilities.

Security & Privacy

Enterprise-Grade Compliance: ChatGPT Enterprise offers SOC 2 Type 2 compliance, ensuring data privacy and security at scale

Custom GPTs: Enterprises can build custom workflows and integrate proprietary data into the models, with assurances that no customer data is used for model training.

2. Google Cloud Vertex AI

Google Cloud Vertex AI provides a comprehensive platform for both building and deploying machine learning models, featuring Google’s PaLM 2 and the newly released Gemini series. With strong integration into Google’s cloud infrastructure, it allows for seamless data operations and enterprise-level scalability.

Key Features

Gemini Models: Offering multimodal capabilities, Gemini can process text, images, and even video, making it highly versatile for enterprise applications.

Model Explainability: Features like built-in model evaluation tools ensure transparency and traceability, crucial for regulated industries.

Integration with Google Ecosystem: Vertex AI works natively with other Google Cloud services, such as BigQuery, for seamless data analysis and deployment pipelines.

Recent Updates

Gemini 1.5: The latest update in the Gemini series, with enhanced context understanding and RAG (Retrieval-Augmented Generation) capabilities, allowing enterprises to ground model outputs in their own structured or unstructured data.

Model Garden: A feature that allows enterprises to select from over 150 models, including Google’s own models, third-party models, and open-source solutions such as LLaMA 3.1

Pricing (as of 2024)

Model Input Token Price (<= 128K context window) Output Token Price (<= 128K context window) Input/Output Price (128K+ context window) Gemini 1.5 Flash $0.00001875 / 1K characters $0.000075 / 1K characters $0.0000375 / 1K characters Gemini 1.5 Pro $0.00125 / 1K characters $0.00375 / 1K characters $0.0025 / 1K characters

Vertex AI offers detailed control over pricing with per-character billing, making it flexible for enterprises of all sizes.

Use Cases

Document AI: Automating document processing workflows across industries like banking and healthcare.

E-Commerce: Using Discovery AI for personalized search, browse, and recommendation features, improving customer experience.

Contact Center AI: Enabling natural language interactions between virtual agents and customers to enhance service efficiency(

Security & Privacy

Data Sovereignty: Google guarantees that customer data is not used to train models, and provides robust governance and privacy tools to ensure compliance across regions.

Built-in Safety Filters: Vertex AI includes tools for content moderation and filtering, ensuring enterprise-level safety and appropriateness of model outputs.

3. Cohere

Cohere specializes in natural language processing (NLP) and provides scalable solutions for enterprises, enabling secure and private data handling. It’s a strong contender in the LLM space, known for models that excel in both retrieval tasks and text generation.

Key Features

Command R and Command R+ Models: These models are optimized for retrieval-augmented generation (RAG) and long-context tasks. They allow enterprises to work with large documents and datasets, making them suitable for extensive research, report generation, or customer interaction management.

Multilingual Support: Cohere models are trained in multiple languages including English, French, Spanish, and more, offering strong performance across diverse language tasks.

Private Deployment: Cohere emphasizes data security and privacy, offering both cloud and private deployment options, which is ideal for enterprises concerned with data sovereignty.

Pricing

Command R: $0.15 per 1M input tokens, $0.60 per 1M output tokens

Command R+: $2.50 per 1M input tokens, $10.00 per 1M output tokens

Rerank: $2.00 per 1K searches, optimized for improving search and retrieval systems

Embed: $0.10 per 1M tokens for embedding tasks

Recent Updates

Integration with Amazon Bedrock: Cohere’s models, including Command R and Command R+, are now available on Amazon Bedrock, making it easier for organizations to deploy these models at scale through AWS infrastructure

Amazon Bedrock

Amazon Bedrock provides a fully managed platform to access multiple foundation models, including those from Anthropic, Cohere, AI21 Labs, and Meta. This allows users to experiment with and deploy models seamlessly, leveraging AWS’s robust infrastructure.

Key Features

Multi-Model API: Bedrock supports multiple foundation models such as Claude, Cohere, and Jurassic-2, making it a versatile platform for a range of use cases.

Serverless Deployment: Users can deploy AI models without managing the underlying infrastructure, with Bedrock handling scaling and provisioning.

Custom Fine-Tuning: Bedrock allows enterprises to fine-tune models on proprietary datasets, making them tailored for specific business tasks.

Pricing

Claude: Starts at $0.00163 per 1,000 input tokens and $0.00551 per 1,000 output tokens

Cohere Command Light: $0.30 per 1M input tokens, $0.60 per 1M output tokens

Amazon Titan: $0.0003 per 1,000 tokens for input, with higher rates for output

Recent Updates

Claude 3 Integration: The latest Claude 3 models from Anthropic have been added to Bedrock, offering improved accuracy, reduced hallucination rates, and longer context windows (up to 200,000 tokens). These updates make Claude suitable for legal analysis, contract drafting, and other tasks requiring high contextual understanding

Anthropic Claude API

Anthropic’s Claude is widely regarded for its ethical AI development, providing high contextual understanding and reasoning abilities, with a focus on reducing bias and harmful outputs. The Claude series has become a popular choice for industries requiring reliable and safe AI solutions.

Key Features

Massive Context Window: Claude 3.0 supports up to 200,000 tokens, making it one of the top choices for enterprises dealing with long-form content such as contracts, legal documents, and research papers

System Prompts and Function Calling: Claude 3 introduces new system prompt features and supports function calling, enabling integration with external APIs for workflow automation

Pricing

Claude Instant: $0.00163 per 1,000 input tokens, $0.00551 per 1,000 output tokens.

Claude 3: Prices range higher based on model complexity and use cases, but specific enterprise pricing is available on request.

Recent Updates

Claude 3.0: Enhanced with longer context windows and improved reasoning capabilities, Claude 3 has reduced hallucination rates by 50% and is being increasingly adopted across industries for legal, financial, and customer service applications

How to Choose the Right Enterprise LLM API

Choosing the right API for your enterprise involves assessing several factors:

Performance: How does the API perform in tasks critical to your business (e.g., translation, summarization)?

Cost: Evaluate token-based pricing models to understand cost implications.

Security and Compliance: Is the API provider compliant with relevant regulations (GDPR, HIPAA, SOC2)?

Ecosystem Fit: How well does the API integrate with your existing cloud infrastructure (AWS, Google Cloud, Azure)?

Customization Options: Does the API offer fine-tuning for specific enterprise needs?

Implementing LLM APIs in Enterprise Applications

Best Practices

Prompt Engineering: Craft precise prompts to guide model output effectively.

Output Validation: Implement validation layers to ensure content aligns with business goals.

API Optimization: Use techniques like caching to reduce costs and improve response times.

Security Considerations

Data Privacy: Ensure that sensitive information is handled securely during API interactions.

Governance: Establish clear governance policies for AI output review and deployment.

Monitoring and Continuous Evaluation

Regular updates: Continuously monitor API performance and adopt the latest updates.

Human-in-the-loop: For critical decisions, involve human oversight to review AI-generated content.

Conclusion

The future of enterprise applications is increasingly intertwined with large language models. By carefully choosing and implementing LLM APIs such as those from OpenAI, Google, Microsoft, Amazon, and Anthropic, businesses can unlock unprecedented opportunities for innovation, automation, and efficiency.

Regularly evaluating the API landscape and staying informed of emerging technologies will ensure your enterprise remains competitive in an AI-driven world. Follow the latest best practices, focus on security, and continuously optimize your applications to derive the maximum value from LLMs.

#000#2024#agents#ai#AI development#AI models#ai tools#ai-generated content#AI21#Amazon#amp#Analysis#anthropic#API#APIs#applications#Art#Artificial Intelligence#automation#AWS#azure#banking#Bias#bigquery#box#Building#Business#business goals#chatbots#chatGPT

0 notes

Text

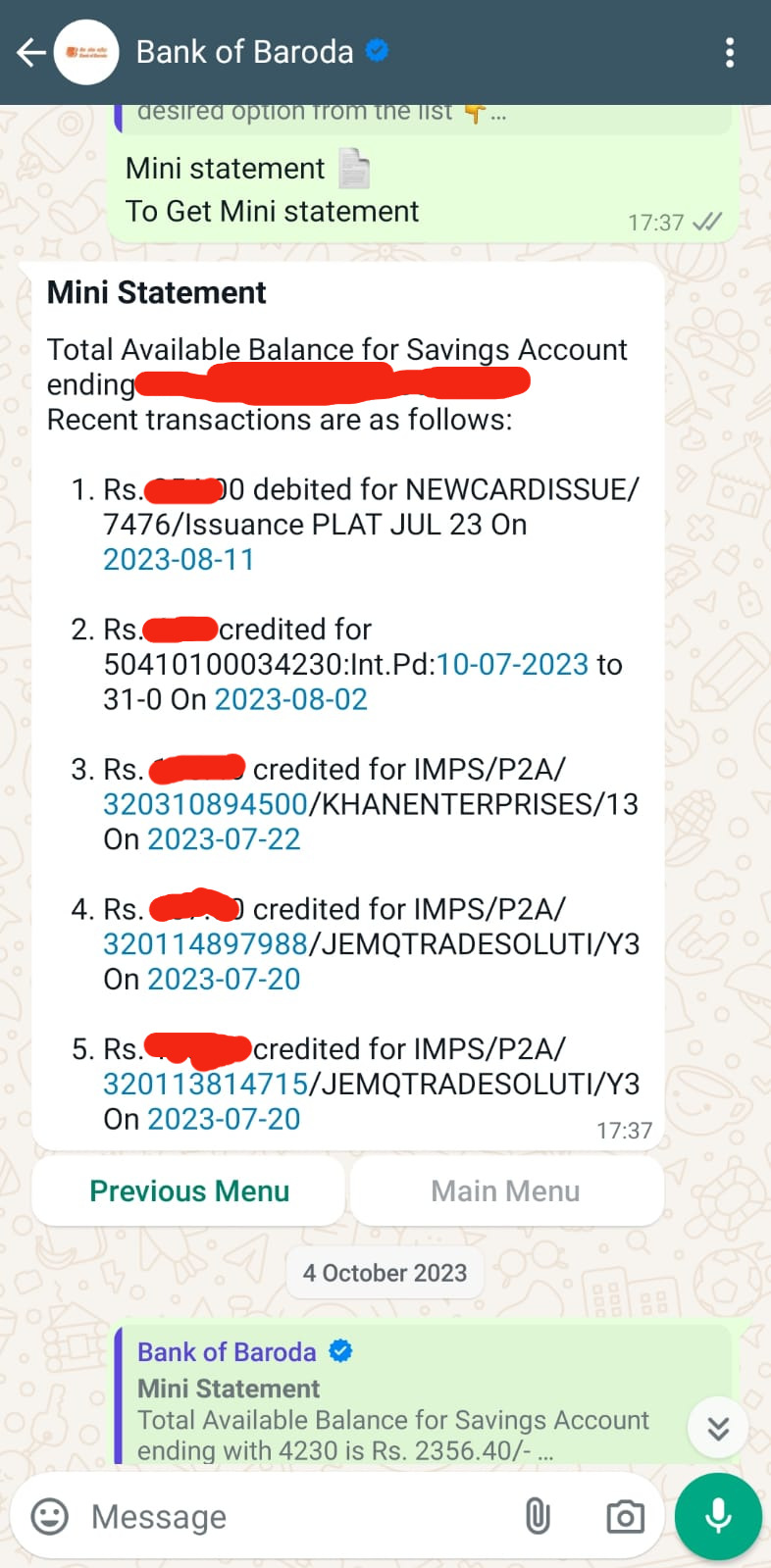

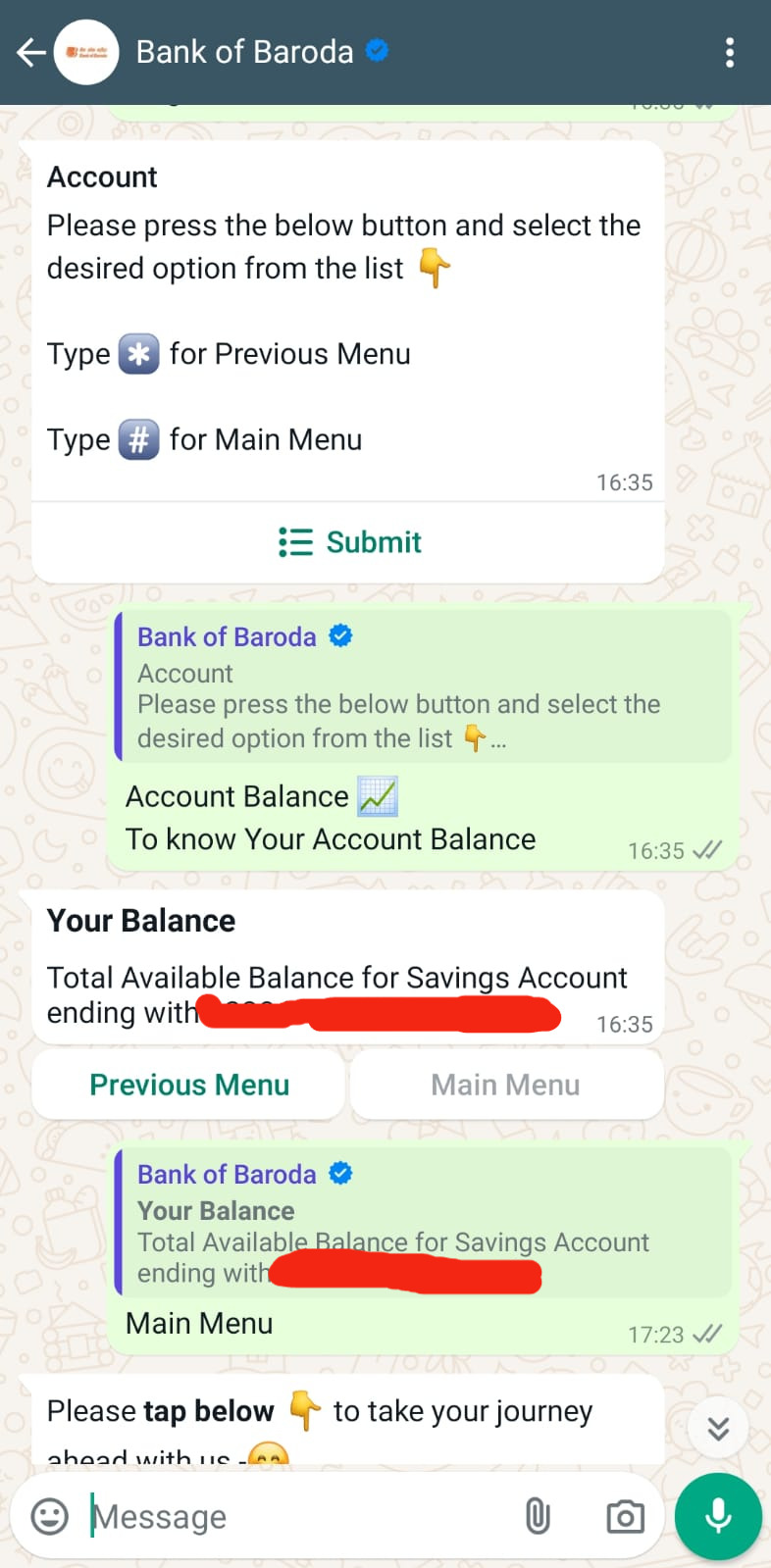

I recently opened an account at Bank of Baroda. After manually filling out the form and submitting it, I got a message stating that my account was opened. For more important information, you can use our verified WhatsApp number to see account details, scheme, balance, statement, etc. Let's try to save their number and send it on WhatsApp itself. In a few steps, I received my bank balance and account statement. In addition to this, all their services, such as fixed deposits and credit cards, are included in it. It was truly a better experience for me and saves time for bank customers as well as providing information about other schemes.

0 notes

Text

Open Banking API: A Step-By-Step Guide With Examples

Open Banking APIs represent a transformative approach in the financial services sector, centered around data democratization. This concept empowers customers by allowing them to securely share their financial information with authorized third-party providers of their choice. At its core, APIs (application programming interfaces) are the technical framework facilitating this secure data exchange.

Visit us:

#Open Banking API#app development#blockchain application development#ios app development#best iphone app development#ui and ux design service#snapseed qr codes

0 notes

Text

Take a look at this post… 'JSON to XML and XML to JSON converter in second . Use it for API integrations and Web development projects'.

0 notes

Text

Explore the best developer friendly API platforms designed to streamline integration, foster innovation, and accelerate development for seamless user experiences.

Developer Friendly Api Platform

#Developer Friendly Api Platform#Consumer Driven Banking#Competitive Market Advantage Through Data#Banking Data Aggregation Services#Advanced Security Architecture#Adr Open Banking#Accredited Data Recipient

0 notes

Text

#KYC in Banking#KYC Solutions in Canada#KYC Solutions Provider in Canada#KYC Canada#KYC solutions#KYC company#KYC providers#kyc solution#kyc software#kyc api#banks#business

1 note

·

View note

Text

Unleashing the Power of Fraud Detection with SprintVerify’s API

Fraud is an ever-present threat in today's digital landscape, affecting businesses across industries. At SprintVerify, we understand the critical need for robust and reliable fraud detection mechanisms. That's why we've developed our state-of-the-art Fraud Detection API, designed to safeguard your business and provide peace of mind.

Why Choose SprintVerify’s Fraud Detection API?

Advanced Algorithms: Our API uses cutting-edge algorithms and machine learning techniques to detect and prevent fraudulent activities. With real-time analysis, you can stay one step ahead of potential threats.

Comprehensive Coverage: Whether you’re in e-commerce, banking, insurance, or logistics, our API adapts to the unique needs of your industry, offering tailored solutions for effective fraud prevention.

Seamless Integration: Integrating our Fraud Detection API into your existing systems is straightforward and hassle-free. Our user-friendly documentation and dedicated support team ensure a smooth transition.

Real-Time Alerts: Get instant notifications of suspicious activities, allowing you to take immediate action and minimize potential damage. Our real-time alerts keep you informed and prepared at all times.

Customizable Settings: Every business is different, and so are its security needs. Our API allows you to customize settings and parameters to match your specific requirements, ensuring optimal protection.

How It Works

SprintVerify’s Fraud Detection API analyzes transaction patterns, user behaviors, and other critical data points to identify anomalies that may indicate fraudulent activity. By leveraging machine learning, our system continually evolves and improves, providing you with the most up-to-date fraud detection capabilities.

Benefits of Using SprintVerify’s API

Enhanced Security: Protect your business and customers with the most advanced fraud detection technology available.

Increased Trust: Build trust with your customers by demonstrating your commitment to their security and privacy.

Cost Savings: Preventing fraud saves your business from the financial and reputational costs associated with fraudulent activities.

Join the growing number of businesses that trust SprintVerify for their fraud detection needs. With our powerful API, you can focus on what you do best while we handle the complexities of fraud prevention.

Ready to Get Started?

Contact us today to learn more about how SprintVerify’s Fraud Detection API can protect your business and enhance your security infrastructure. Visit our website or reach out to our support team for more information.

Stay safe, stay secure with SprintVerify. 💼🔒✨

#FraudDetection#API#SprintVerify#BusinessSecurity#Ecommerce#Banking#Insurance#Logistics#CyberSecurity

0 notes

Text

Guide to ACH Payments

Automated Clearing House (ACH) payments are a popular and efficient way for businesses and individuals to transfer funds electronically. They are used for a variety of transactions, including direct deposit of payroll, automatic bill payments and online marketplace transactions. This guide provides an overview of ACH payments, how they work and their benefits.

Understanding ACH Payments

ACH payments are electronic payments made through the Automated Clearing House network, a secure system for financial transactions in the United States. They are a form of electronic fund transfer (EFT) that moves money between bank accounts across different financial institutions. ACH payments are known for their cost-effectiveness and efficiency, making them a preferred method for regular, recurring transactions.

One of the key uses of ACH payments is in facilitating ACH marketplace payouts. Online marketplaces and platforms often use ACH payments to distribute funds to sellers or service providers. This method is especially beneficial for handling bulk payouts while ensuring security and reducing transaction costs.

Advantages

ACH marketplace payouts offer several advantages for both the payer and the payee. For businesses, using ACH payments for marketplace payouts streamlines the payment process, reduces administrative overhead and minimizes errors associated with manual processing. It also offers a more cost-effective solution compared to traditional payment methods like paper checks or wire transfers.

For recipients, these payouts ensure timely and predictable receipt of funds. Since ACH payments are processed in batches, recipients typically receive their payments within one to two business days, which is quicker than traditional methods. Moreover, the direct deposit nature of ACH payments eliminates the need for physical checks, thereby reducing the risk of lost or stolen payments.

In conclusion, ACH payments play a crucial role in modern financial transactions, particularly in the context of online marketplaces. ACH marketplace payouts offer an efficient, secure and cost-effective way of handling transactions, benefiting both businesses and individuals involved. As electronic payments continue to evolve, ACH payments remain a reliable and preferred method for managing financial transactions.

Read a similar article about payout automation here at this page.

0 notes

Text

#KYC UK#Identity Verification Provider UK#kyc api#banking#finance#fintech#banks#kyc solution#Identity Verification solutions#AML Verification#identity theft#business

2 notes

·

View notes

Text

0 notes