#fintech api

Text

Get Fintech API, Banking API, Travel API & Verification API

Are you looking for API solution to integrate into your software system to get addon services then this is for you?

Ezulix software is a leading fintech & banking API provider company in India. We provider you end-to-end fintech & banking API solution for your business.

Along with this, we facilitate you travel and verification APIs to support your business,

For more details visit our website or request a free live demo.

#fintech api#banking api#travel api#verification api#aeps api#bbps api#dmt api#pan verification api#aadhaar verification api#payout api#bus booking api#flight booking api#hotel booking api

3 notes

·

View notes

Text

Fixed Deposit APIs in fintech enhance customer experience, automate processes, provide real-time data, increase accessibility, offer customizable solutions, and ensure secure transactions, making financial management seamless and efficient.

#mutual fund api#how to launch mutual funds#fintech api#api for mutual funds#deposit api#quick way to become fintech#mutual funds api solution#launching mutual fund api#mutual fund api solutions#mutual fund api provider

0 notes

Text

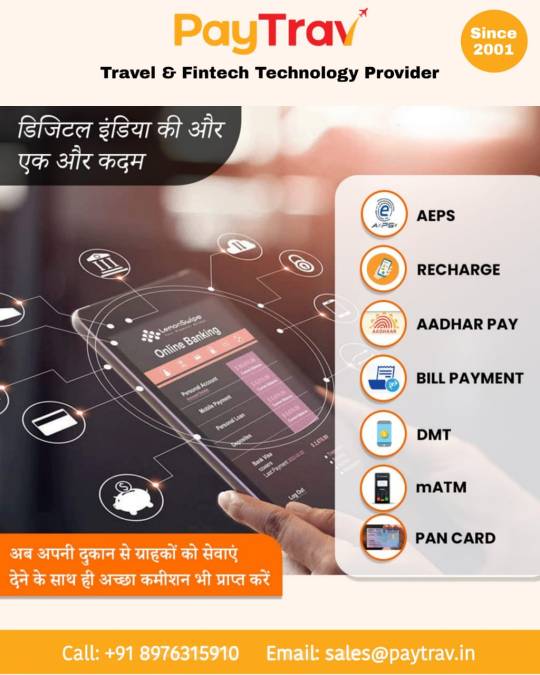

Edupoint Solution (Paytrav) is leading AEPS ,mATM API provider,recharge API provider company in mumbai,India over the last few years.Get the perfect solution to start an mATM and AEPS business as an Admin with Paytrav (Edupoint).Paytrav APIs Provider Company Paytrav is one of the best API Provider companies in India.

0 notes

Text

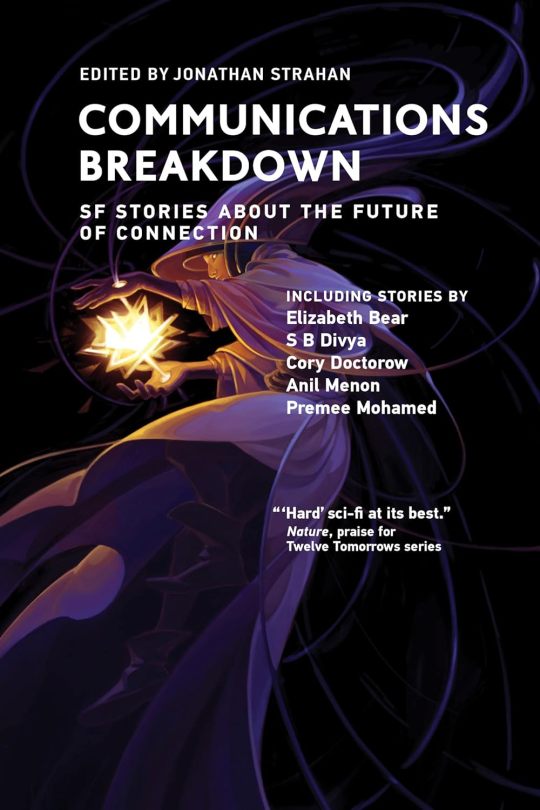

Moral Hazard

Today on my podcast, I read my short story "Moral Hazard," a madcap tale of fintech, inequality, finance bros, Wyoming, homelessness and bailouts. It's from "Communications Breakdown," a new anthology from MIT Press, edited by Jonathan Strahan, with stories from Elizabeth Bear, S.B. Divya, Chris Gilliard, Lavanya Lakshminarayan, Ken Macleod, Tim Maughan, Ian McDonald, Anil Menon, Premee Mohamed, and Shiv Ramdas.

Episode:

https://craphound.com/stories/2023/11/12/moral-hazard-from-communications-breakdown/

MP3:

https://archive.org/download/Cory_Doctorow_Podcast_455/Cory_Doctorow_Podcast_455_-_Moral_Hazard.mp3

Anthology:

https://mitpress.mit.edu/9780262546461/communications-breakdown/

I know exactly where I was the day I decided to give every homeless person in America their own LLC. I was in the southeast corner of the sprawling homeless camp that had once been Seattle’s Discovery Park on a rare, dry February afternoon. The sun was weak but so welcome. After weeks of sheltering in our tents and squelching through the mud and getting drenched waiting for the portas, we were finally able to break out the folding chairs and enjoy each other’s company. Mike the Bike had coffee. He always did. Mike knew more ways to make coffee than any fancy barista. He had a master’s in chemical engineering and a bachelor’s in mechanical engineering and when he was high he spent every second of the buzz thinking of new ways to combine heat and water and solids to produce a perfect brew. I brought trail mix, which I mixed up myself with food-bank supplies and spices I bought from the bulk place for pennies. My secret is cardamom and a little chili powder. I learned that from my Mom. “Trish,” Mike the Bike said, “I wish I was a corporation.”

17 notes

·

View notes

Text

KYC Provider UK

KYC Verification is essential to onboard a new client in UK businesses to authenticate the identity of a person associated with the business and even to check involvement in money laundering. We are one of the leading KYC providers in the UK and assist with KYC API for financial and non-financial businesses.

#KYC UK#KYC Provider UK#KYC Solutions UK#KYC Solutions Provider UK#banking#finance#fintech#gaming#kyc api#kyc software#kyc companies#banks

4 notes

·

View notes

Text

KYC Provider Canada

KYC is a mandatory process that financial institutions and other businesses follow to authenticate the identities of their customers. KYC Providers help and provide KYC API to verify users' and business identities. KYC Providers in the Canada also use various methods to verify identities, like id, document, and address verification.

#KYC Canada#KYC Providers#KYC API#KYC Services provider#KYC Solutions Provider#KYC Software#kyc verification#KYC verification Solutions#KYC Platform#KYC Solution#fiance#crypto#blockchain#bitcoin#insurance#finance#fintech#healthcare#business

3 notes

·

View notes

Text

Power up your apps with seamless crypto integration! https://tradermade.com/crypto. Our Crypto API delivers accurate tick, minute, hourly, and daily prices for popular cryptocurrencies since 2018, customized to bring reliable data straight into your apps. Empower your innovation today!

0 notes

Text

Banking’s API Evolution: Shifting from Cost Savings to Strategic Monetisation

Have you ever wondered how your banking apps seamlessly fetch real-time data and make transactions with just a tap? That’s this blog is about!

Firstly, let’s understand the definition of API. API stands for Application Programming Interface, act as messengers that enable different software systems to communicate and share information. It has become an indispensable part of banks. Want to know how? Read this full blog here.

Some of the ways an API can be used in baking are:

Banking, Simplified: When you check your account balance on a finance app, APIs are already at play. They request data from the bank's server and deliver it to your app in a language both understand. This keeps your app updated without manual input.

Making Transactions Swift: APIs streamline transactions too! When you transfer money or pay bills, APIs facilitate the communication between your app and the bank. It's like a digital connection ensuring your money moves securely and swiftly.

Security First: Worried about security? APIs always cover you! They use encrypted protocols, adding layers of protection to your data. It's like sending your information in an indecipherable secret code.

Innovation Happens Because Of API: Thanks to APIs, banks can collaborate with third-party developers to create new features and services. Think budgeting tools, investment apps, or even personalized financial advice – all made possible by APIs.

What are the Types of API in Banking?

While there are many different types of API, some of the most common ones are:

Payment APIs:

Functionality: Enable secure and swift money transfers between accounts.

Use Case: Power online payments, fund transfers, and payment gateways.

Account Information APIs:

Functionality: Retrieve account details, balances, and transaction histories.

Use Case: Integrates with personal finance apps for real-time financial updates.

Authentication APIs:

Functionality: Verify and authenticate users for secure access to banking services.

Use Case: Validates user identity during login or transaction authorisation.

Credit Scoring APIs:

Functionality: Assess creditworthiness of individuals or businesses.

Use Case: Supports loan approvals, credit card applications, and risk assessment.

FX (Foreign Exchange) APIs:

Functionality: Provide real-time exchange rates and facilitate currency conversion.

Use Case: Essential for international transactions and forex services.

Conclusion:

Banking APIs have transformed from saving costs to fuelling business growth and innovation. Initially used for expense reduction, they now serve as gateways, improving services, offering insights, and improving security. APIs open up global expansion and personalised customer experiences.

Yet, integrating APIs in banking faces challenges like data privacy, integration issues, and regulatory compliance. Overcoming these hurdles is important for banks, which is why banks needs a strong API app development service to help you fully leverage API potential in the changing financial landscape. Ficode can help in this. We provide API integration services that adheres to the finteh’s needs. Lean more about us!

0 notes

Text

instagram

#OmegaSoftwares#Fintech#CustomSoftware#UPI#MobileAppDevelopment#APIs#IntegrationServices#SoftwareSolutions#Innovation#BusinessSolution#Dombivli#dombivlikar#SoftwareDevelopment#TechnologyInnovation#AppDevelopment#B2BTransactions#SecureSolutions#B2B#b2bsales#softwaredevelopment#websitedevelopment#finance#Instagram

0 notes

Text

Revamp Your Hiring Process with SprintVerify - BGV Check API

Harness the power of our BGV Check API: Ensure you hire trusted candidates with confidence. We provide extensive services to help businesses secure the right talent. With SprintVerify, simplify your hiring process using reliable data and cutting-edge technology.

In today's highly competitive market, hiring errors can be expensive. Our API allows you to manage your hiring process efficiently, offering peace of mind and well-informed decisions. Enhance your hiring with SprintVerify solutions, deliver accuracy, speed, and security to empower your HR team for thorough pre-employment screenings. Rely on SprintVerify to elevate your HR operations and build a dependable workforce.

Key Features

Comprehensive Data Verification: Our BGV Check API performs extensive background checks, including criminal records, education, and employment history.

Real-Time Updates: Receive real-time data updates to ensure the information you have is always current and accurate.

User-Friendly Dashboard: Our intuitive dashboard allows your HR team to efficiently manage and review verification results.

Scalability: Whether you're a small business or a large corporation, our API scales seamlessly to meet your verification needs.

Secure Data Handling: We prioritize data security with robust encryption and compliance with data protection regulations.

Benefits

Enhanced Hiring Efficiency: Automate the verification process to speed up hiring, reducing the time and effort required for manual checks.

Improved Candidate Trust: Verify the credentials and history of potential hires to build a trustworthy and reliable workforce.

Risk Mitigation: Minimize the risk of hiring unqualified or fraudulent candidates with comprehensive background checks.

Regulatory Compliance: Ensure your hiring practices comply with industry standards and legal requirements through thorough verification.

Cost Efficiency: Streamline background checks to reduce the costs and time associated with lengthy hiring processes.

Conclusion Our API is revolutionizing the hiring industry with faster processes, greater trust, and reduced risk. Businesses can ensure compliance, reduce costs, save time, and confidently build a reliable workforce using our API. Improve your hiring process today with SprintVerify’s BGV Check API.

0 notes

Text

Virtual Card APIs for E-commerce: Enhancing Customer Experience

Organizations always seek innovative ways to simplify payment procedures. Virtual Card APIs are gaining popularity. Businesses and customers benefit from these APIs, transforming online transactions. Virtual card API help organizations control expenses and avoid fraud by providing a safe and flexible payment solution. They also let organizations set spending restrictions and track transactions in real time, improving financial control.

Enhanced Security

Virtual Card APIs prioritize security by encrypting transactions and preventing fraud. Each virtual card issued with unique credentials reduces the risk of illegal access or fraud. Customers feel secure knowing their financial information is protected by modern methods. Furthermore, the encrypted nature of these transactions protects sensitive information throughout the payment process, from beginning to end. This protects clients and boosts the virtual card system's credibility. Virtual Card APIs enable secure and effortless payment experiences, reaffirming businesses' commitment to customer security and satisfaction.

Customizable Features

Virtual Card APIs allow businesses to customize the payment process with many options. Businesses can specify precise spending limits, expiration dates, and usage limitations to give them complete control over virtual card use. Flexibility improves operational efficiency and security by reducing unauthorized transaction risks. These customization possibilities also make payment management easier and more flexible for customers. They can customize their virtual card settings to match their spending and financial patterns, improving their payment experience. Businesses and customers work together to simplify and customize digital payments, improving efficiency and satisfaction.

Improved Payment Flexibility

Virtual Card APIs allow clients to use virtual cards for single and recurring payments. This flexibility enhances the purchasing experience by accommodating a variety of client choices and payment methods. Users may easily manage their virtual cards, monitor transaction histories, and make payments, resulting in a smooth and effective payment management procedure. Customers are empowered to modify virtual card settings for a secure and personalized payment experience.

Real-time Transaction Updates

Virtual Card APIs give businesses and customers quick transaction alerts. Businesses may track transaction statuses and reconcile payments in real time using this functionality. Customers receive rapid transaction updates, which promotes transparency and payment trust. Real-time engagement improves both parties' financial transactions and ensures security.

Cost-effectiveness

Virtual Card APIs offer a cost-effective payment option for businesses, eliminating the need for actual cards and their associated overhead costs. Companies can save money by avoiding card issuance fees, printing, and shipping fees. These savings can be passed on to clients through competitive pricing, increasing value. Virtual cards further reduce fraud risk with unique card numbers for each transaction. They improve expenditure control with customized transaction limits and restrictions. Virtual cards improve payment efficiency by allowing quick issuance and use. Businesses can simply integrate these APIs into their existing systems for a smooth transition and operational continuity.

E-commerce is being transformed by Virtual Card APIs, which improve consumer experience and simplify payment processes. These API offer a comprehensive solution for businesses looking to improve their online payment systems with advanced security, easy integration, customizable choices, and cost-effectiveness. In digital e-commerce, Virtual Card APIs can improve customer satisfaction, security, and payment procedures. Additionally, the ability to generate virtual cards for one-time or recurrent use increases security and management. Businesses must use Virtual Card APIs to stay competitive and meet customer expectations as e-commerce grows.

0 notes

Text

Create Your Own Liquidity Pool API

Tap into the power of decentralized finance (DeFi) with our innovative Create Your Own Liquidity Pool API. This outstanding feature helps developers and platform owners provide users with an ultra-convenient way to set up their private liquidity pool. Through using our API, your users can have the liberty to customize the liquidity pools according to their specific choices and needs.

A wide portfolio of parameters and user-friendly options allow users to customize their pools to reach the highest liquidity potential, better trading conditions, and more efficient asset exchange. We make parameters like token pairs, fees, or allocation weights adjustable and customizable through our API while at the same time offering unsurpassed flexibility and convenience.

The Liquidity Pool API will help you to create a community of liquidity providers that will enhance liquidity across various asset types thus improving the resilience of your platform. Give your users the power to join the DeFi thrill by letting them create and maintain their liquidity pools without hassle.

Explore More - https://www.addustechnologies.com/blog/create-your-own-liquidity-pool

Get Free Demo - https://www.addustechnologies.com/get-free-demo

#LiquidityPool#API#DecentralizedFinance#CryptoTrading#TokenPairs#FinancialInnovation#Blockchain#LiquidityProvider#AssetExchange#Tokenomics#CryptoAPI#Fintech#Tokenization#Ethereum#SmartContracts

0 notes

Text

#mutual fund api#how to launch mutual funds#fintech api#mutual funds api solution#deposit api#api for mutual funds#mutual fund api solutions

0 notes

Text

Features To Look For While Choosing Your Crypto Tax Software - Technology Org

New Post has been published on https://thedigitalinsider.com/features-to-look-for-while-choosing-your-crypto-tax-software-technology-org/

Features To Look For While Choosing Your Crypto Tax Software - Technology Org

The world of cryptocurrency has seen explosive growth in the last few years, presenting a massive potential for investment and application across a variety of domains. But with this growth also comes the added responsibility of reporting your crypto activity accurately for tax purposes. Manually tracking and calculating your crypto taxes can be a daunting task, especially for those with frequent trades or complex transactions.

Cryptocurrencies. Image credit: WorldSpectrum via Pixabay, CC0 Public Domain

This is where crypto tax software comes in, offering a streamlined and efficient solution for enthusiasts. However, with numerous options available, choosing the right crypto tool can often be overwhelming. So, let’s delve into the essential features you should prioritize when selecting crypto tax software.

Automatic Transaction Import

Manually entering every crypto transaction is tedious and prone to errors. Look for software that seamlessly imports your transaction history from various exchanges and wallets via API connections or CSV file uploads. This saves you significant time and effort, minimizing the risk of inaccuracies.

Comprehensive Exchange And Wallet Support

Ensure the software supports all the exchanges and wallets you use. This is crucial for ensuring complete data capture and accurate tax calculations. Look for software that constantly expands its supported platforms to stay up to date with the evolving crypto landscape.

Accurate Cost Basis Tracking

The cost basis is the price you paid for your cryptocurrency when you initially acquired it. This is crucial for calculating capital gains and losses on your trades. Choose software that accurately tracks your cost basis for all your transactions, taking into account factors like fees and dust amounts.

Support For Various Transaction Types

Crypto trading involves more than just buying and selling. Look for software that handles diverse transaction types, including:

Stacking And Lending Rewards: These are treated as income and should be reported accordingly.

Margin Trading: This involves borrowing funds to amplify your gains (or losses), and the software should handle the complex calculations associated with it.

Hard Forks And Airdrops: These can create new tax implications, and the software should be able to identify and categorize them accurately.

NFT Transactions: Non-fungible tokens have unique tax implications, and the software should support their proper tracking and reporting.

Tax Optimization Tools

While reporting your crypto activity accurately is essential, maximizing your tax benefits is also crucial. Look for software that offers features like tax-loss harvesting. This involves strategically selling crypto assets at a loss to offset capital gains and potentially reduce your tax liability.

User-Friendly Interface And Reporting Features

Navigating complex tax calculations can be challenging. Choose software with a user-friendly interface that allows for easy data input, transaction categorization, and clear visualization of your tax position. The software should also generate tax reports that are compatible with your tax filing software or tax professional.

Security And Privacy

When dealing with sensitive financial data, security is paramount. Choose software with robust security measures like multi-factor authentication and secure data encryption. Additionally, ensure the software respects your privacy by clearly detailing their data collection and usage practices.

Customer Support

Even with user-friendly software, unforeseen issues or questions can arise at times. Opt for software that offers reliable customer support through email, chat, or phone, ensuring you have access to help when needed.

Pricing And Free Trial

Crypto tax software pricing models vary depending on the features offered and the volume of transactions you handle. Some software offers free basic plans with limited features, while others operate on a tiered subscription model based on transaction volume. Look for software that fits your needs and budget, and consider taking advantage of free trials to test the features before committing to a paid plan.

Integration With Other Tools

If you already use specific tax filing software or portfolio tracking tools, look for crypto tax software that integrates seamlessly with them. This can significantly streamline your workflow and reduce the need for manual data entry across various platforms.

Final Thoughts

By carefully considering these essential features, you can choose the best crypto tax software to simplify your crypto tax filing process, save time, and ensure accurate reporting. If you get stuck anywhere, consulting with a tax professional familiar with cryptocurrency is always recommended to navigate the complexities of crypto tax regulations.

#API#assets#authentication#Capture#comprehensive#consulting#crypto#cryptocurrencies#cryptocurrency#data#Data Capture#data collection#domains#dust#easy#email#encryption#factor#Features#financial#Fintech news#growth#History#integration#investment#issues#it#Landscape#margin#model

0 notes

Text

Our API Integrations

Discover our growing API Integrations list. Seamlessly integrate with leading financial institutions and services including Cargills Bank, Clear Bank, Currency Cloud, Pipit Global, Terra pay, Axcess, and more for enhanced efficiency and innovation financial journey.

0 notes