#bigsharer

Text

IPO helped Creative Graphics increase brand visibility, infuse capital – Pulkit Agrawal

The initial public offering (IPO) of Creative Graphics Solutions, one of India’s leading organized flexography ecosystem players, has received positive feedback from both foreign as well as reputed Indian investors. It has also helped the company increase its brand visibility and much-needed funds to upgrade its operations.

The retail portion of the Creative Graphics Solutions IPO opened for subscription from 28 March to 4 April 2024. The price band for the issue was fixed at Rs 80 to Rs 85 per share, and the lot size was 1,600 equity shares. Corporate Capital Ventures was the book-running lead manager, and Bigshare Services Private Limited was the registrar for the issue. Opening at the higher end of the price band at Rs 85, the share price was quoted above Rs 200 when last seen on 27 May 2024.

Talking to Packaging South Asia, Pulkit Agrawal, chief financial officer, Creative Graphics, said, “The IPO was basically for two reasons – firstly, to get more visibility and secondly, to give us capital infusion to continue to invest in new technology and upgrade our operations.”

The IPO gave the company greater visibility and credibility in the market. "We were already a known player in the printing and packaging segments but now many more know about us. A lot of businesses want to work with us as they think of us as a credible player,” he said, adding the IPO has brought the printing and packaging industry into the public eye.

A lot of people not directly associated with the industry now know about the value addition that the industry brings, he said, adding Creative Graphics has been in the flexography business for the past two decades and wants to continue participating in the growth path.

Before the IPO, Creative Graphics was a family-owned business when the promoters had almost all its shares, he said, adding the company listed the shares in the Rs 80-85 price band. The issue opened at the higher end at Rs 85 and right now (27 May 2024), the share price is above Rs 200.

The list of investors includes foreign as well as reputed Indian players, he said. “We have received a lot of positive feedback from investors. They have been very kind to us and have shown a lot of faith in the business, partly because of the industry that we are in and partly because of our vintage in the industry and the growth we have shown,” he said.

The funding will be used to fuel future growth. It is a technology-oriented industry and new technology keeps coming in now and then, he said. It is, thus, very important to continue investing in and exploring new technologies to stay ahead. “We also want to expand our operations and our customer base,” he added.

“The IPO is a wonderful route as it gives us a lot of power. However, it also brings a lot of responsibility because you are participating in a market where a lot of players are looking at you constantly. An ethical player who wants to run the business in the right way, who is transparent, and who has the right corporate governance, will always be appreciated by the market. For these players, I think, it will make a lot of sense to go for this route,” Agrawal said.

“A lot of SMEs in India are now growing thanks to government initiatives and the growing Indian economy. It is attracting a lot of talent, capital, and interest from global players. I think there is a bright future for India as a country.”

Agrawal said the printing and packaging segment will continue to grow as Indians rise in economic stature and their purchasing power increases. “We are confident and bullish about the Indian growth story. We expect that a lot more brands will be launched. For foreign players, the Indian market is becoming much more attractive compared to how it was 20 years ago or even a decade ago,” he added.

Creative Graphics specializes in manufacturing flexographic printing plates, including digital flexo plates, conventional flexo printing plates, letterpress plates, metal back plates, and coating plates. The company's customer base is spread out across India, Thailand, Qatar, Kuwait, Nepal, and Africa. It operates seven manufacturing facilities – Noida (Uttar Pradesh), Vasai, Pune (Maharashtra), Chennai (Tamil Nadu), Baddi (Himachal Pradesh), Hyderabad (Telangana), and Ahmedabad (Gujarat).

Founded by Deepanshu Goel, a first-generation entrepreneur and incorporated in 2014, Creative Graphics has expanded its business through its wholly owned subsidiaries – Creative Graphics Premedia Private Limited (CG Premedia) and Wahren India Private Limited.

While CG Premedia offers end-to-end premedia services, from design adaptation to print production, Wahren India supplies high-quality packaging solutions for the pharmaceutical industry. It produces alu-alu foil, blister foil, tropical alu-alu foil, CR foil, and pharmaceutical sachets.

The company clocked a revenue of Rs 131.5 crore and earned a profit (PAT) of Rs 10.8 crore in FY 2023-24. It registered revenue of Rs 90.14 crore and a profit (PAT) of Rs 8.64 crore in FY2022-23.

0 notes

Text

Creative Graphics Solutions India Limited IPO opens for retail investors today – 28 March 2024

Today, 28 March, the retail portion of the Creative Graphics Solutions IPO opens for subscription. The anchor portion of the public issue that opened yesterday has apparently received a good response from investors, including financial institutions.

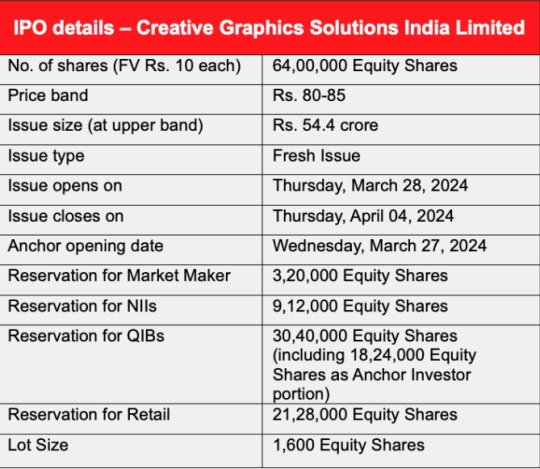

On 22 March 2024, Noida-headquartered Creative Graphics Solutions India Limited, one of India’s leading organized and integrated packaging ecosystem players, announced that its initial public offering (IPO) will open on Thursday, 28 March 2024. The anchor portion opened on Wednesday, 27 March 2024, and the issue will conclude on Thursday, 4 April 2024. The company intends to raise approximately Rs 54.4 crore (at the upper band) from the offering and aims to be listed on the NSE Emerge platform. The price band for the issue has been fixed at Rs 80 to Rs. 85 per share, and the lot size will be 1,600 equity shares.

Corporate Capital Ventures is the Book Running Lead Manager, and Bigshare Services Private Limited is the Registrar for the issue. According to the press release from Creative Graphics, Corporate Capital Ventures Private Limited has completed a string of successful SME IPOs in recent months, including Alpex Solar, Esconet Technologies, Rockingdeals, Accent Microcell, Oriana Power, Droneacharya and Crayons Advertising.

Creative Graphics is a product of the MSMEx SME IPO Cohort program, mentored by Amit Kumar, founder and CEO at MSMEx.

The Noida-based company’s IPO comprises a fresh issue of 64,00,000 Equity Shares with a face value of Rs 10 through the book-building route. As many as 3.2 lakh equity shares are reserved for the Market Maker, 9.12 lakh equity shares allocated for NIIs, 30.4 lakh equity shares for QIBs (including 18.24 lakh equity shares as the Anchor investor portion), and the Retail (RII) portion accounts for 21.28 lakh equity shares.

According to the Red Herring Prospectus document, the company intends to utilise the net proceeds from the IPO to meet the working capital requirements of the company, repay/prepay, in part or full of certain of the company’s borrowings, meet the capital expenditure of the company, fund inorganic growth through unidentified acquisition for the company, and general corporate expenses.

Creative Graphics specializes in manufacturing flexographic printing plates, including digital flexo plates, conventional flexo printing plates, letter press plates, metal back plates, and coating plates. The company serves its customer base in India, Thailand, Qatar, Kuwait, Nepal, and Africa. It operates seven manufacturing facilities in various states – Noida (Uttar Pradesh), Vasai, Pune (Maharashtra), Chennai (Tamil Nadu), Baddi (Himachal Pradesh), Hyderabad (Telangana), and Ahmedabad (Gujarat).

Founded by Deepanshu Goel, a first-generation entrepreneur and incorporated in 2014, Creative Graphics has expanded its business through its wholly owned subsidiaries – Creative Graphics Premedia Private Limited (CG Premedia) and Wahren India Private Limited. While CG Premedia offers end-to-end premedia services, from design adaptation to print production, Wahren India supplies high-quality packaging solutions for the pharmaceutical industry. It produces Alu-Alu Foil, Blister Foil, Tropical Alu-Alu Foil, CR Foil, and Pharmaceutical Sachets.

The company clocked a revenue of Rs 48.07 crore and earned a profit (PAT) of Rs. 7.24 crore during the first half (H1) of the current FY 2023-24 financial year, which ended 30 September 2023. It registered revenue of Rs. 90.14 crore and a profit (PAT) of Rs. 8.64 crore in FY2022-23.

Our take

We have known Creative Graphics for the past decade and have also admired its fast growth in establishing new plants across the country. We appreciate the need for companies in the printing and packaging industry to expand and raise capital for scaling up their operations. Creative Graphics' team has always been enthusiastic about vertical integration and diversification to new areas of packaging. The company’s IPO will hopefully open a path for other companies in the industry needing to raise capital for scaling up.

For more information, please visit: https://creativegraphics.group/

Disclaimer: CREATIVE GRAPHICS SOLUTIONS LIMITED is proposing, subject to applicable statutory and regulatory requirements, receipt of requisite approvals, market conditions and other considerations, to make an initial public offer of its Equity Shares and has filed the RHP with the NSE Emerge. The RHP is available on the website of BRLM and the website of NSE. Any potential investors should note that investment in equity shares involves a high degree of risk, and for details relating to the same, please refer to the RHP, including the section titled “Risk Factors”, beginning on page 28.

The Equity Shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the "Securities Act) or any state securities laws in the United States, and unless so registered, and may not be issued or sold within the United States, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in accordance with any applicable U.S. state securities laws. The Equity Shares are being issued and sold outside the United States in 'offshore transactions in reliance on Regulation "S* under the Securities Act and the applicable laws of each jurisdiction where such issues and sales are made. There will be no public offering in the United States.

First published on 23 March 2024, this article has been updated on the morning of 28 March 2024 – editor.

0 notes

Text

GP Eco Solutions India files DRHP for IPO with NSE Emerge

GP Eco Solutions India Ltd, the Noida-headquartered integrated solar energy solutions provider, has filed its Draft Red Herring Prospectus (DRHP) with NSE Emerge to launch its initial public offering (IPO). GP Eco Solutions IPO is an SME IPO and comprises a fresh issuance of 32.76 lakh equity shares, with a face value of ₹10 each. According to the DRHP, GP Eco proposes to utilize ₹12.45 crore of the IPO proceeds to meet the working capital requirements of the company and plans to invest ₹7.6 crore in its subsidiary, Invergy India Private Limited (IIPL), to procure plant and machinery and for setting up a new facility.

GP Eco Solutions IPO Lead ManagersCorporate Capital Ventures Pvt Ltd is the Book Running Lead Manager for the GP Eco Solutions IPO, while Bigshare Services Pvt Ltd is the IPO registrar.

About GP Eco Solutions. GP Eco Solutions was founded in 2010 by Deepak Pandey. It distributes a wide range of solar inverters and solar panels. It also provides comprehensive EPC services to commercial and residential customers and O&M of solar plants. The company is also an authorized distributor of Sungrow India Pvt Ltd, Saatvik Green Energy Private Limited and LONGi Solar Technology Co. Ltd for solar panels in North India.

www.optionperks.com

0 notes

Text

BIG LAW - DSMP RPVERSE DEFENSE ATTORNEY

Contact Info: please send all legal and business correspondence to my inbox.

...

Practice Areas:

Impromptu/Short Notice Legal Defense

Tumblr Drama Escalation

Witch Trials

Dreamon Exorcism (temporarily retired)

Birthday Parties

Custody Battle Representation

Qualifications:

Law School at HPXL Proper

Dreamonology Undergraduate Degree and Masters at the HPXL Youth Correctional Facility

Business Hours:

office is closed bc i dont give a shit n e more

but if your case is interesting enough i will consider it.

not longer legally dead!!!!!!!!

80 notes

·

View notes

Text

Cospower Engineering Ltd IPO Details

Cospower Engineering Limited incorporated in 2010. The organization associated with the assembling of electrical boards, hardware mounting structure, symphonious channels, and substation. The plans dispatch another IPO, Cospower Engineering Ltd IPO. The IPO membership will begin on seventeenth March and it will end on nineteenth March 2020.

Cospower Engineering Limited IPO Details:

Offer Period: March 17 to March 19, 2020.

Initial public offering Type: Fixed Price Issue IPO.

Initial public offering Size: 400,000 Eq Shares of Rs 10 (collecting up to Rs 2.04 cr).

Face Value: Rs 10 Per Eq Share.

Initial public offering Price: Rs 51 Per Eq Share.

Market Lot: 2000 Shares.

Min Order Quantity: 2000 Shares.

Posting At: BSE SME.

It is a 'Fixed Price Issue' IPO with the presumptive worth of Rs 10 for every value share. The size of the issue is 400.000 value imparts to an amassing up to Rs 2.04 crore. Besides, the cost of the IPO is Rs 51 for every value share.

The base measure of venture ought to be Rs 102,000 for a solitary parcel (1 lot= 2000 offers). The Cospower IPO will be recorded in BSE SME.

Advertiser Holdings:

The advertiser of this first sale of stock is Mr. Oswald Rosario Dsouza and Mr. Felix Shridhar Kadam.

Pre Issue Share Holding: 100%.

The object of the organization, it intends to use the raised sum for existing capital necessities, general corporate reason and for the IPO expenses.

Initial public offering Registrar:

Bigshare Services Pvt Ltd,

first Floor, Bharat Tin Works Building,

Opp. Vasant Oasis, Makwana Road,

Marol, Andheri (E), Mumbai – 400 059.

Phone: +91-22-6263 8200

Email: [email protected]

Website: Http://www.bigshareonline.com

Disclaimer: This post is only data about the IPO. It doesn't offer any guidance or suggestion. It would be ideal if you read the offer archive cautiously and counsel your counselor before contributing.

0 notes

Photo

Joe Armon-Jones – Starting Today #BrownswoodRecordings 2018 UK Bass – #DavidMrakpor (tracks: A2, A3, B2, B3), #MutaleChashi (tracks: A1, B1) Design – #ReubenBastienneLewis Drums – #KwakeBass (tracks: A1, B1), #MosesBoyd (tracks: A1 to B3) Effects [FX] – #MaxwellOwin (tracks: B1, B3) Electric Piano [Wurlitzer] – #JoeArmonJones (tracks: A1 to B2) Guitar – #OscarJerome (tracks: A2 to B3) Painting – #DivyaSrinivasan Piano – #JoeArmonJones (tracks: B3) Producer – Joe Armon-Jones Recorded By – Oliver Palfreyman Recorded By [Additional Field Recordings] – Oliver Palfreyman Tenor Saxophone – #JamesMollison (tracks: A3, B1, B2), #NubyaGarcia (tracks: A1, A3, B1, B2) Trumpet – #DylanJones (tracks: A1, A3, B1, B2) Vocals – #Asheber (tracks: A1), #BigSharer (tracks: B2, B3), #EgoEllaMay (tracks: A2, B2, B3), #OscarJerome (tracks: A2, B1)

#kwakebass#joearmonjones#oscarjerome#jamesmollison#dylanjones#brownswoodrecordings#egoellamay#reubenbastiennelewis#davidmrakpor#mutalechashi#maxwellowin#asheber#nubyagarcia#bigsharer#divyasrinivasan#mosesboyd

0 notes

Text

How to Check via BSE, Bigshare Service, GMP

How to Check via BSE, Bigshare Service, GMP

HP Adhesives will finalise its initial public offering (IPO) allotment status on Wednesday. The maiden offer received muted response when it had opened for subscription earlier this month. HP Adhesives IPO received bids for 5.29 crore equity shares against an issue size of 25.28 lakh shares. The portion set aside for retail investors was subscribed 81 times. The shares allocated to the…

View On WordPress

0 notes

Text

Creative Graphics Solutions India Limited IPO opens for retail investors today – 28 March 2024

Today, 28 March, the retail portion of the Creative Graphics Solutions IPO opens for subscription. The anchor portion of the public issue that opened yesterday has apparently received a good response from investors including financial institutions.

On 22 March 2024, the Noida-headquartered Creative Graphics Solutions India Limited, one of India’s leading organized and integrated packaging ecosystem players, announced that its initial public offering (IPO) will open on Thursday, 28 March 2024. The anchor portion will be opened on Wednesday, 27 March 2024, and the issue will conclude on Thursday, 4 April 2024. The company intends to raise approximately Rs 54.4 crore (at the upper band) from the offering and aims to be listed on the NSE Emerge platform. The price band for the issue has been fixed at Rs 80 to Rs. 85 per share, and the lot size will be 1,600 equity shares.

Corporate Capital Ventures is the Book Running Lead Manager, and Bigshare Services Private Limited is the Registrar for the issue. According to the press release from Creative Graphics, Corporate Capital Ventures Private Limited has completed a string of successful SME IPOs in recent months, including Alpex Solar, Esconet Technologies, Rockingdeals, Accent Microcell, Oriana Power, Droneacharya and Crayons Advertising.

Creative Graphics is a product of the MSMEx SME IPO Cohort program, mentored by Amit Kumar, founder and CEO at MSMEx.

The Noida-based company’s IPO comprises a fresh issue of 64,00,000 Equity Shares with a face value of Rs 10 through the book-building route. As many as 3.2 lakh equity shares are reserved for the Market Maker, 9.12 lakh equity shares allocated for NIIs, 30.4 lakh equity shares for QIBs (including 18.24 lakh equity shares as the Anchor investor portion), and the Retail (RII) portion accounts for 21.28 lakh equity shares.

According to the Red Herring Prospectus document, the company intends to utilise the net proceeds from the IPO to meet the working capital requirements of the company, repay/prepay, in part or full of certain of the company’s borrowings, meet the capital expenditure of the company, fund inorganic growth through unidentified acquisition for the company, and general corporate expenses.

Creative Graphics specializes in manufacturing flexographic printing plates, including digital flexo plates, conventional flexo printing plates, letter press plates, metal back plates, and coating plates. The company serves its customer base in India, Thailand, Qatar, Kuwait, Nepal, and Africa. It operates seven manufacturing facilities in various states – Noida (Uttar Pradesh), Vasai, Pune (Maharashtra), Chennai (Tamil Nadu), Baddi (Himachal Pradesh), Hyderabad (Telangana), and Ahmedabad (Gujarat).

Founded by Deepanshu Goel, a first-generation entrepreneur and incorporated in 2014, Creative Graphics has expanded its business through its wholly owned subsidiaries – Creative Graphics Premedia Private Limited (CG Premedia) and Wahren India Private Limited. While CG Premedia offers end-to-end premedia services, from design adaptation to print production, Wahren India supplies high-quality packaging solutions for the pharmaceutical industry. It produces Alu-Alu Foil, Blister Foil, Tropical Alu-Alu Foil, CR Foil, and Pharmaceutical Sachets.

The company clocked a revenue of Rs 48.07 crore and earned a profit (PAT) of Rs. 7.24 crore during the first half (H1) of the current FY 2023-24 financial year, which ended 30 September 2023. It registered revenue of Rs. 90.14 crore and a profit (PAT) of Rs. 8.64 crore in FY2022-23.

Our take

We have known Creative Graphics for the past decade and have also admired its fast growth in establishing new plants across the country. We appreciate the need for companies in the printing and packaging industry to expand and raise capital for scaling up their operations. Creative Graphics' team has always been enthusiastic about vertical integration and diversification to new areas of packaging. The company’s IPO will hopefully open a path for other companies in the industry needing to raise capital for scaling up.

For more information, please visit: https://creativegraphics.group/

Disclaimer: CREATIVE GRAPHICS SOLUTIONS LIMITED is proposing, subject to applicable statutory and regulatory requirements, receipt of requisite approvals, market conditions and other considerations, to make an initial public offer of its Equity Shares and has filed the RHP with the NSE Emerge. The RHP is available on the website of BRLM and the website of NSE. Any potential investors should note that investment in equity shares involves a high degree of risk, and for details relating to the same, please refer to the RHP, including the section titled “Risk Factors”, beginning on page 28.

The Equity Shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the "Securities Act) or any state securities laws in the United States, and unless so registered, and may not be issued or sold within the United States, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in accordance with any applicable U.S. state securities laws. The Equity Shares are being issued and sold outside the United States in 'offshore transactions in reliance on Regulation "S* under the Securities Act and the applicable laws of each jurisdiction where such issues and sales are made. There will be no public offering in the United States.

First published on 23 March 2024, this article has been updated on the morning of 28 March 2024 – editor.

0 notes

Text

Finding the unknown treasure trove

How can you find the unknown treasure trove left behind by the deceased parents or spouse or by someone for whom you are the legal heir?

Bank: The RBI has mandated banks to publish a list of inactive or inoperative accounts for 10 years or more on the bank’s website. It is possible for the depositor or legal heir to claim such amounts by searching first on these criterions ; name and date of birth/ name and PAN/ name and passport number / name and pin code / name and telephone number. In case of claim by a legal heir, he needs to visit the nearest branch and submit the unclaimed deposits claim form. The form needs to be accompanied with valid identity and address proof of the claimant, copy of death certificate of deceased account holder.

Shares: Listed companies have to identify and upload details of unclaimed dividend on their website. You shall have to visit the listed companies' website and search for your parents’ details under unclaimed / unpaid dividend section. Detailed information is provided for the benefit of shareholders or legal heirs on this link. Alternatively you may write letters and emails to registrars like Karvy, Link Intime, Bigshare etc. Mention name, PAN No., bank account number, email ID & correspondence address.

Mutual Funds: There are only three registrars, Karvy, CAMS and Templeton. You have to just write to these three with details of deceased member and ask for help to find out, if there are any investments done by the deceased earning member. If the results are positive you will have to get in touch with the relevant fund house with details for transmission of funds. The process to get the claim is not so complex.

CDSL/NSDL are the two main depositories in India and now a days they send consolidated account statement of all demat shares, mutual funds & insurance and offline mutual funds. Writing to these might also help to find out where all the deceased earning members were having investments.

Small Savings: For EPF it is very easy to approach the employers of deceased earning member and ask for the details. For PPF, RDs and other post office investments, you can visit the nearest post offices where ever your parents stayed or had office.

Life Insurance: There is no central depository to get information on life insurance policies yet. There are 35 life insurance companies in India. You may draft a letter format and simply change the name and addresses of these companies and submit in respective branches locally in your city and follow up.

Last but not the least; check each and every paper and document received by post. Also check some posts received at your old correspondent address. We seldom forget to change our addresses with old investments.

Documents to retain/Documents to discard…

Pay for the right investment advice

Sabyasachi Paul has been associated with equity research and advisory on equity markets in India for over 9 years & currently heads the equity research desk of Eastern Financiers Ltd, Kolkata. He also manages a portfolio on the online platform Kristal. Find link to the strategy named ‘The Tortoise’

Read the full article

1 note

·

View note

Text

Nirmitee Robotics IPO Review

Nirmitee Robotics IPO Review

Nirmitee Robotics makes robots

Nirmtee Robotics IPO review is just a suggestion on IPO, readers are requested to use their own mind while taking Decisions.

The company is engaged in providing HVAC Duct Cleaning and Ozone sterilization services with these robots. The company makes custom- made robots– operated by machines that clean the inside of HVAC Air Ducts – by scrubbing, polishing, sucking, scraping and removal of the accumulated contaminants like dust, debris, bacteria, mold, and even dead pests and rodents and provides the Ozone treatment to the ducts from the inside and thus sanitizes it for many more months to come. The company has its own fleet of patented, duct cleaning robots, which are employed in its service to do the inspection, cleaning, and post-cleaning operations. All these robots are fitted with an advanced controller mechanism and a high-resolution camera.

The company serves a broad range of clients including offices, convention centers, hospitals, trains and buildings that house sensitive equipment like data centers.

Promoters of Nirmitee Robotics

Mr Jay Prakash Motghare,

Mr Kartik Eknath Shende and

Mr Rajesh Narendra Admane

Nirmitee Robotics IPO Review

IPO WATCH

Nirmitee Robotics IPO details

Subscription Dates

31 March – 9 April 2020

Price Band

INR 185 per share

Fresh issue

175,200 shares (INR 3.24 crore)

Offer For Sale

Nil

Total IPO size

175,200 shares (INR 3.24 crore)

Minimum bid (lot size)

600 shares

Face Value

INR 10 per share

Retail Allocation

50%

Listing On

BSE SME platform

Nirmitee Robotics IPO Review

Nirmitee Robotics’ financial Management (in INR lakh)

FY2017

FY2018

FY2019

6M FY2020

Revenue

5.9

70.2

203.6

99.8

Expenses

5.2

65.1

177.7

96.5

Net income

0.5

2.2

20.7

2.6

Nirmitee Robotics IPO Review

Registrar of Nirmitee Robotics IPO

Bigshare Services Private Limited

1st Floor, Bharat Tin Works Building,

Opp. Vasant Oasis Makwana Road

Marol, Andheri (East), Mumbai – 400059

Phone: +91 22 6263 8200

Email: [email protected]

Website: www.bigshareonline.com

****************************************

Valuation of Nirmitee Robotics IPO (FY 2019)

Earnings Per Share (EPS): INR 8.58

Price/Earnings (PE ratio): 21.56

Return on Net Worth (RONW): 10.45%

Net Asset Value (NAV): INR 156.54 per share

Nirmitee Robotics IPO Subscription Details

Day

Subscription (no. of times)

Day 1

Day 2

Day 3

Day 4

Day 5

Day 6

Nirmitee Robotics Communication Information

Nirmitee Robotics India Limited

C/o Manisha Sales,

D 3/2, Hingna MIDC,

Nagpur – 440028

Phone: 91 9422881677

Email: [email protected]

Website: www.nirmiteerobotics.com

Nirmitee Robotics IPO Allotment Status

Nirmitee Robotics IPO allotment status will be available on Bigshare Services’ website. Visit this link to get allotment status.

Listing Performance of Nirmitee Robotics

IPO DATE

Description

Important Dates

IPO Opening Date:

31 March 2020

IPO Closing Date:

9 April 2020

Finalisation of Basis of Allotment:

16 April 2020

Initiation of refunds:

17 April 2020

Transfer of shares to Demat accounts:

20 April 2020

Listing Date:

21 April 2020

Opening Price on BSE SME:

Will be updated

Closing Price on BSE SME:

To be updated

Laxmi Goldorna IPO

https://www.upcomingipo.org/dj-media-print-and-logistics-ltd-ipo/

Pioneer HVAC Duct Cleaning and Maintenance by Nirmitee Robotics, to look after high - quality conditions and air quality control in homes and workplaces around the world.

Nirmitee Robotics is a pioneer HVAC Duct Cleaning and Ozone treatment Company built up in 2016 by a committed, persuaded gathering of youthful experts – Nirmitee Robotics has the one of a kind differentiation of having a patent of its HVAC cleaning and adjusting Robots.

On the present occasions HVAC Air Duct is the most widely recognized type of air supply, cooling, cooling as additionally air quality upkeep. It is nevertheless regular information that over some stretch of time thinking about the air quality – dust, minute life forms, even vermin including little feathered creatures, rodents and in uncommon cases huge creatures end up held up in these conduits, accordingly enduring the air nature of the workplace, medical clinic, home premises that it serves.

Nirmitee Robotics makes specially designed robots – worked by machines that spotless within these pipes – by cleaning, cleaning, sucking, scratching and expulsion of the above said contaminants and gives the Ozone treatment to the channels from within and consequently disinfects it for some more months to come.

https://sarkarinaukri.ws/admissions-2/

Read the full article

0 notes

Video

youtube

GALAXY SURFACTANTS IPO

0 notes

Text

Tweet - @printbigja

#BIGSHARE: According to the Syntactic Theory of Visual Communication by Paul Mar https://t.co/Pjmh37QLjm

— Print Big (@printbigja) June 14, 2020

0 notes

Text

Đọc báo kiếm tiền với Bigshare của tờ báo uy tín tintuc.vn

Lướt google tình cờ đọc được bài viết đọc báo kiếm tiền với Bigshare. Lại thấy nội dung đến từ web tintuc.vn một tờ báo uy tín có thứ hạng cao tại Việt Nam.

Trạng thái: Đang thử nghiệm

Lướt google tình cờ đọc được bài viết đọc báo kiếm tiền với Bigshare. Lại thấy nội dung đến từ web tintuc.vn một tờ báo uy tín có thứ hạng cao tại Việt Nam.

Nên mình xin phép được thử nghiệm sản phẩm này và muốn chia sẻ với mọi người.

Giới thiệu về tintuc.vn

Đây là một tờ báo online viết về các chủ để nóng hiện tại của xã hội. Có lượng truy cập khá cao và…

View On WordPress

0 notes

Text

Accounts Internship in Mumbai at Bigshare Services Private Limited

Accounts Internship in Mumbai at Bigshare Services Private Limited

[ad_1]

Gob title: Accounts Internship in Mumbai at Bigshare Services Private Limited

Company: Bigshare Services Private Limited

Gob description: : 1. Prepare asset, liability, and capital account entries by compiling and analyzing account information 2. Document… financial transactions by entering account information 3. Recommend financial actions by analyzing accounting options 4…

Expected…

View On WordPress

0 notes

Text

Nirmitee Robotics IPO Review

Nirmitee Robotics IPO Review

Nirmitee Robotics makes robots

Nirmtee Robotics IPO review is just a suggestion on IPO, readers are requested to use their own mind while taking Decisions.

The company is engaged in providing HVAC Duct Cleaning and Ozone sterilization services with these robots. The company makes custom- made robots– operated by machines that clean the inside of HVAC Air Ducts – by scrubbing, polishing, sucking, scraping and removal of the accumulated contaminants like dust, debris, bacteria, mold, and even dead pests and rodents and provides the Ozone treatment to the ducts from the inside and thus sanitizes it for many more months to come. The company has its own fleet of patented, duct cleaning robots, which are employed in its service to do the inspection, cleaning, and post-cleaning operations. All these robots are fitted with an advanced controller mechanism and a high-resolution camera.

The company serves a broad range of clients including offices, convention centers, hospitals, trains and buildings that house sensitive equipment like data centers.

Promoters of Nirmitee Robotics

Mr Jay Prakash Motghare,

Mr Kartik Eknath Shende and

Mr Rajesh Narendra Admane

Nirmitee Robotics IPO Review

IPO WATCH

Nirmitee Robotics IPO details

Subscription Dates

31 March – 9 April 2020

Price Band

INR 185 per share

Fresh issue

175,200 shares (INR 3.24 crore)

Offer For Sale

Nil

Total IPO size

175,200 shares (INR 3.24 crore)

Minimum bid (lot size)

600 shares

Face Value

INR 10 per share

Retail Allocation

50%

Listing On

BSE SME platform

Nirmitee Robotics IPO Review

Nirmitee Robotics’ financial Management (in INR lakh)

FY2017

FY2018

FY2019

6M FY2020

Revenue

5.9

70.2

203.6

99.8

Expenses

5.2

65.1

177.7

96.5

Net income

0.5

2.2

20.7

2.6

Nirmitee Robotics IPO Review

Registrar of Nirmitee Robotics IPO

Bigshare Services Private Limited

1st Floor, Bharat Tin Works Building,

Opp. Vasant Oasis Makwana Road

Marol, Andheri (East), Mumbai – 400059

Phone: +91 22 6263 8200

Email: [email protected]

Website: www.bigshareonline.com

****************************************

Valuation of Nirmitee Robotics IPO (FY 2019)

Earnings Per Share (EPS): INR 8.58

Price/Earnings (PE ratio): 21.56

Return on Net Worth (RONW): 10.45%

Net Asset Value (NAV): INR 156.54 per share

Nirmitee Robotics IPO Subscription Details

Day

Subscription (no. of times)

Day 1

Day 2

Day 3

Day 4

Day 5

Day 6

Nirmitee Robotics Communication Information

Nirmitee Robotics India Limited

C/o Manisha Sales,

D 3/2, Hingna MIDC,

Nagpur – 440028

Phone: 91 9422881677

Email: [email protected]

Website: www.nirmiteerobotics.com

Nirmitee Robotics IPO Allotment Status

Nirmitee Robotics IPO allotment status will be available on Bigshare Services’ website. Visit this link to get allotment status.

Listing Performance of Nirmitee Robotics

IPO DATE

Description

Important Dates

IPO Opening Date:

31 March 2020

IPO Closing Date:

9 April 2020

Finalisation of Basis of Allotment:

16 April 2020

Initiation of refunds:

17 April 2020

Transfer of shares to Demat accounts:

20 April 2020

Listing Date:

21 April 2020

Opening Price on BSE SME:

Will be updated

Closing Price on BSE SME:

To be updated

Laxmi Goldorna IPO

https://www.upcomingipo.org/dj-media-print-and-logistics-ltd-ipo/

Pioneer HVAC Duct Cleaning and Maintenance by Nirmitee Robotics, to look after high - quality conditions and air quality control in homes and workplaces around the world.

Nirmitee Robotics is a pioneer HVAC Duct Cleaning and Ozone treatment Company built up in 2016 by a committed, persuaded gathering of youthful experts – Nirmitee Robotics has the one of a kind differentiation of having a patent of its HVAC cleaning and adjusting Robots.

On the present occasions HVAC Air Duct is the most widely recognized type of air supply, cooling, cooling as additionally air quality upkeep. It is nevertheless regular information that over some stretch of time thinking about the air quality – dust, minute life forms, even vermin including little feathered creatures, rodents and in uncommon cases huge creatures end up held up in these conduits, accordingly enduring the air nature of the workplace, medical clinic, home premises that it serves.

Nirmitee Robotics makes specially designed robots – worked by machines that spotless within these pipes – by cleaning, cleaning, sucking, scratching and expulsion of the above said contaminants and gives the Ozone treatment to the channels from within and consequently disinfects it for some more months to come.

https://sarkarinaukri.ws/admissions-2/

Read the full article

0 notes

Text

Цитата #449129

<Bigshare> парни, помогите отыскать, что ещё входило в ЗИП-комплект ИЛ-2? А то тока моделистские форумы по поиску…

<Angelofnet> Bigshare: Покупаешь штурмовик, но не уверен, что ЗИП укомплектован полностью? ИЛ-2 брать лучше 45-го года выпуска, у них пробег только по Германии!

View On WordPress

0 notes