#biometric authentication project

Explore tagged Tumblr posts

Text

Biometrics is the most suitable means of identifying and authenticating individuals in a reliable and fast way through unique biological characteristics. Unlike traditional authentication methods like passwords or PINs, which can be easily forgotten or stolen, biometrics relies on inherent and distinctive attributes of a person. These attributes are difficult to replicate, making biometric authentication a powerful tool for ensuring the integrity and security of sensitive information, physical access control, and various other applications.

#biometricauthentication#biometricstechnology#biometrics#limitlesstech#biometricauthenticationsystem#futureofbiometrics#biometricauthenticationtechnology#facialrecognitiontechnology#biometricdata#biometricdevice#biometricsystem

#biometrics technology#the future of personal security#biometrics authenticaton the future of personal security#LimitLess Tech 888#biometrics#facial recognition#biometric authentication#biometrics authentication#biometric authentication system#the future of biometrics#the future of biometric authentication#biometric#biometric authentication technology#facial recognition technology#biometric authentication project#future tech#biometric device#biometric system

0 notes

Text

Biometrics is the most suitable means of identifying and authenticating individuals in a reliable and fast way through unique biological characteristics. Unlike traditional authentication methods like passwords or PINs, which can be easily forgotten or stolen, biometrics relies on inherent and distinctive attributes of a person. These attributes are difficult to replicate, making biometric authentication a powerful tool for ensuring the integrity and security of sensitive information, physical access control, and various other applications.

However, it also comes with challenges, such as privacy concerns, potential security vulnerabilities, and the need for robust protection of biometric data. As technology continues to advance, biometric authentication is likely to become even more integral to various aspects of our lives, from unlocking smartphones to securing critical infrastructure.

#biometricauthentication#biometricstechnology#biometrics#limitlesstech#biometricauthenticationsystem#futureofbiometrics#biometricauthenticationtechnology#facialrecognitiontechnology#biometricdata#biometricdevice#biometricsystem

#biometrics technology#the future of personal security#biometrics authenticaton the future of personal security#LimitLess Tech 888#biometrics#facial recognition#biometric authentication#biometrics authentication#biometric authentication system#the future of biometrics#the future of biometric authentication#biometric#biometric authentication technology#facial recognition technology#biometric authentication project#future tech#biometric device#biometric system

0 notes

Text

What Are the Costs Associated with Fintech Software Development?

The fintech industry is experiencing exponential growth, driven by advancements in technology and increasing demand for innovative financial solutions. As organizations look to capitalize on this trend, understanding the costs associated with fintech software development becomes crucial. Developing robust and secure applications, especially for fintech payment solutions, requires significant investment in technology, expertise, and compliance measures. This article breaks down the key cost factors involved in fintech software development and how businesses can navigate these expenses effectively.

1. Development Team and Expertise

The development team is one of the most significant cost drivers in fintech software development. Hiring skilled professionals, such as software engineers, UI/UX designers, quality assurance specialists, and project managers, requires a substantial budget. The costs can vary depending on the team’s location, expertise, and experience level. For example:

In-house teams: Employing full-time staff provides better control but comes with recurring costs such as salaries, benefits, and training.

Outsourcing: Hiring external agencies or freelancers can reduce costs, especially if the development team is located in regions with lower labor costs.

2. Technology Stack

The choice of technology stack plays a significant role in the overall development cost. Building secure and scalable fintech payment solutions requires advanced tools, frameworks, and programming languages. Costs include:

Licenses and subscriptions: Some technologies require paid licenses or annual subscriptions.

Infrastructure: Cloud services, databases, and servers are essential for hosting and managing fintech applications.

Integration tools: APIs for payment processing, identity verification, and other functionalities often come with usage fees.

3. Security and Compliance

The fintech industry is heavily regulated, requiring adherence to strict security standards and legal compliance. Implementing these measures adds to the development cost but is essential to avoid potential fines and reputational damage. Key considerations include:

Data encryption: Robust encryption protocols like AES-256 to protect sensitive data.

Compliance certifications: Obtaining certifications such as PCI DSS, GDPR, and ISO/IEC 27001 can be costly but are mandatory for operating in many regions.

Security audits: Regular penetration testing and vulnerability assessments are necessary to ensure application security.

4. Customization and Features

The complexity of the application directly impacts the cost. Basic fintech solutions may have limited functionality, while advanced applications require more extensive development efforts. Common features that add to the cost include:

User authentication: Multi-factor authentication (MFA) and biometric verification.

Real-time processing: Handling high volumes of transactions with minimal latency.

Analytics and reporting: Providing users with detailed financial insights and dashboards.

Blockchain integration: Leveraging blockchain for enhanced security and transparency.

5. User Experience (UX) and Design

A seamless and intuitive user interface is critical for customer retention in the fintech industry. Investing in high-quality UI/UX design ensures that users can navigate the platform effortlessly. Costs in this category include:

Prototyping and wireframing.

Usability testing.

Responsive design for compatibility across devices.

6. Maintenance and Updates

Fintech applications require ongoing maintenance to remain secure and functional. Post-launch costs include:

Bug fixes and updates: Addressing issues and releasing new features.

Server costs: Maintaining and scaling infrastructure to accommodate user growth.

Monitoring tools: Real-time monitoring systems to track performance and security.

7. Marketing and Customer Acquisition

Once the fintech solution is developed, promoting it to the target audience incurs additional costs. Marketing strategies such as digital advertising, influencer partnerships, and content marketing require significant investment. Moreover, onboarding users and providing customer support also contribute to the total cost.

8. Geographic Factors

The cost of fintech software development varies significantly based on geographic factors. Development in North America and Western Europe tends to be more expensive compared to regions like Eastern Europe, South Asia, or Latin America. Businesses must weigh the trade-offs between cost savings and access to high-quality talent.

9. Partnering with Technology Providers

Collaborating with established technology providers can reduce development costs while ensuring top-notch quality. For instance, Xettle Technologies offers comprehensive fintech solutions, including secure APIs and compliance-ready tools, enabling businesses to streamline development processes and minimize risks. Partnering with such providers can save time and resources while enhancing the application's reliability.

Cost Estimates

While costs vary depending on the project's complexity, here are rough estimates:

Basic applications: $50,000 to $100,000.

Moderately complex solutions: $100,000 to $250,000.

Highly advanced platforms: $250,000 and above.

These figures include development, security measures, and initial marketing efforts but may rise with added features or broader scope.

Conclusion

Understanding the costs associated with fintech software development is vital for effective budgeting and project planning. From assembling a skilled team to ensuring compliance and security, each component contributes to the total investment. By leveraging advanced tools and partnering with experienced providers like Xettle Technologies, businesses can optimize costs while delivering high-quality fintech payment solutions. The investment, though significant, lays the foundation for long-term success in the competitive fintech industry.

2 notes

·

View notes

Text

Best Practices for Data Lifecycle Management to Enhance Security

Securing all communication and data transfer channels in your business requires thorough planning, skilled cybersecurity professionals, and long-term risk mitigation strategies. Implementing global data safety standards is crucial for protecting clients’ sensitive information. This post outlines the best practices for data lifecycle management to enhance security and ensure smooth operations.

Understanding Data Lifecycle Management

Data Lifecycle Management (DLM) involves the complete process from data source identification to deletion, including streaming, storage, cleansing, sorting, transforming, loading, analytics, visualization, and security. Regular backups, cloud platforms, and process automation are vital to prevent data loss and database inconsistencies.

While some small and medium-sized businesses may host their data on-site, this approach can expose their business intelligence (BI) assets to physical damages, fire hazards, or theft. Therefore, companies looking for scalability and virtualized computing often turn to data governance consulting services to avoid these risks.

Defining Data Governance

Data governance within DLM involves technologies related to employee identification, user rights management, cybersecurity measures, and robust accountability standards. Effective data governance can combat corporate espionage attempts and streamline database modifications and intel sharing.

Examples of data governance include encryption and biometric authorization interfaces. End-to-end encryption makes unauthorized eavesdropping more difficult, while biometric scans such as retina or thumb impressions enhance security. Firewalls also play a critical role in distinguishing legitimate traffic from malicious visitors.

Best Practices in Data Lifecycle Management Security

Two-Factor Authentication (2FA) Cybercriminals frequently target user entry points, database updates, and data transmission channels. Relying solely on passwords leaves your organization vulnerable. Multiple authorization mechanisms, such as 2FA, significantly reduce these risks. 2FA often requires a one-time password (OTP) for any significant changes, adding an extra layer of security. Various 2FA options can confuse unauthorized individuals, enhancing your organization’s resilience against security threats.

Version Control, Changelog, and File History Version control and changelogs are crucial practices adopted by experienced data lifecycle managers. Changelogs list all significant edits and removals in project documentation, while version control groups these changes, marking milestones in a continuous improvement strategy. These tools help detect conflicts and resolve issues quickly, ensuring data integrity. File history, a faster alternative to full-disk cloning, duplicates files and metadata in separate regions to mitigate localized data corruption risks.

Encryption, Virtual Private Networks (VPNs), and Antimalware VPNs protect employees, IT resources, and business communications from online trackers. They enable secure access to core databases and applications, maintaining privacy even on public WiFi networks. Encrypting communication channels and following safety guidelines such as periodic malware scans are essential for cybersecurity. Encouraging stakeholders to use these measures ensures robust protection.

Security Challenges in Data Lifecycle Management

Employee Education Educating employees about the latest cybersecurity implementations is essential for effective DLM. Regular training programs ensure that new hires and experienced executives understand and adopt best practices.

Voluntary Compliance Balancing convenience and security is a common challenge. While employees may complete security training, consistent daily adoption of guidelines is uncertain. Poorly implemented governance systems can frustrate employees, leading to resistance.

Productivity Loss Comprehensive antimalware scans, software upgrades, hardware repairs, and backups can impact productivity. Although cybersecurity is essential, it requires significant computing and human resources. Delays in critical operations may occur if security measures encounter problems.

Talent and Technology Costs Recruiting and developing an in-house cybersecurity team is challenging and expensive. Cutting-edge data protection technologies also come at a high cost. Businesses must optimize costs, possibly through outsourcing DLM tasks or reducing the scope of business intelligence. Efficient compression algorithms and hybrid cloud solutions can help manage storage costs.

Conclusion

The Ponemon Institute found that 67% of organizations are concerned about insider threats. Similar concerns are prevalent worldwide. IBM estimates that the average cost of data breaches will reach 4.2 million USD in 2023. The risks of data loss, unauthorized access, and insecure PII processing are rising. Stakeholders demand compliance with data protection norms and will penalize failures in governance.

Implementing best practices in data lifecycle management, such as end-to-end encryption, version control systems, 2FA, VPNs, antimalware tools, and employee education, can significantly enhance security. Data protection officers and DLM managers can learn from expert guidance, cybersecurity journals, and industry peers’ insights to navigate complex challenges. Adhering to privacy and governance directives offers legal, financial, social, and strategic advantages, boosting long-term resilience against the evolving threats of the information age. Utilizing data governance consulting services can further ensure your company is protected against these threats.

3 notes

·

View notes

Text

TL;DR: in this post, i wax on about the abandoned concept album/multimedia project Lifehouse by Pete Townshend/The Who in the context of algorithms and artworks

people on Twitter aren't understanding that this is an ad for a scifi novel. it sounds interesting, to a degree.

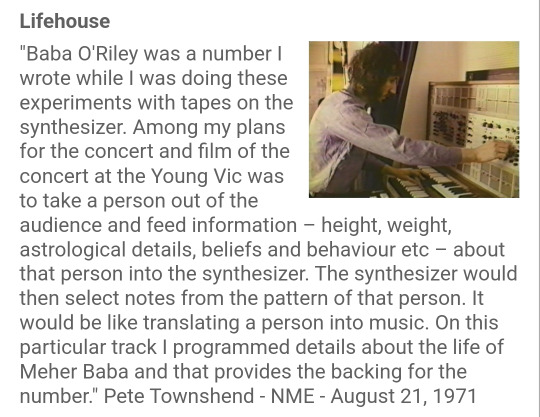

the first sentence reminds me of [The Who's] Pete Townshend's Lifehouse, still one of the most fascinating musical experiments i've ever read about.

i wish i knew about all that back when the Lifehouse Method website was a thing. for those unaware, it was a site created by Pete in conjunction with composer Lawrence Ball and software developer Dave Snowdon in which someone could input their personal data and generate "authentic musical 'portraits,'" pieces of music customized via algorithms that work based on whatever data you input. if you know anything about The Who, you'll probably recognize this as a facet of what would eventually become the album Who's Next, Lifehouse, a huge multimedia project involving a rock opera album, live performances with audience participation and complex tech on stage, a movie, who knows what else.

https://archive.is/8tYoM

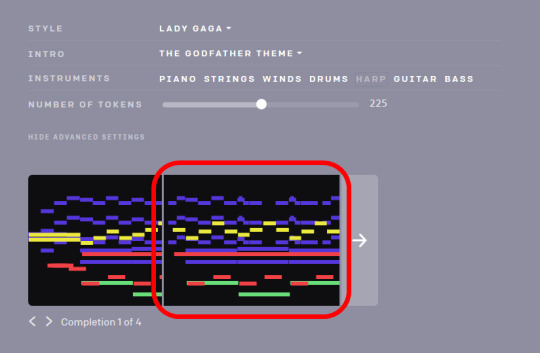

i've always wished i could do one of these "musical portraits." i remember when I first heard about algorithmic (i refuse to call it AI because it isn't true AI) music generators, this was the first thing i thought of. back when they were in a rudimentary state, i played around with one for my own amusement (not for my own music, all that comes from my own head unfortunately for you), and while it was fascinating, it didn't go far enough in the direction i hoped. thinking of OpenAI's MuseNet, it takes a few notes worth of MIDI data & a style suggestion and then kinda randomly guesses what would be a good fit after those notes.

<image sourced from https://gigazine.net/gsc_news/en/20190426-muse-net>

and y'know, it makes for some fun meme videos:

youtube

youtube

youtube

<shoutout to the papaya>

but you can also see it only goes so far, and still requires musical input. it isn't quite on the level of being usable for much. and it really isn't quite the same. it's using inputted data, but not, say, biometric or biographical data. it's musical parameters that are being input as the data.

i really want to one day see a true realization of Lifehouse. one of my wildest goals is to be the one to do that. admittedly, i feel like in the current artistic climate the art world might no longer be ready for it; people would see it, instantly think "AI ART EW," and back away. but in this case, i don't feel like that's a fair assessment of what the concept is. the idea was to find each person's unique signature melody via these musical portraits. it isn't meant for anything really beyond personal identification, when it comes down to it. it fascinates me from a musical standpoint, and as a person who holds a psychology degree. imagine what someone can learn about oneself via this process! would your musical portrait be different at different points in your life? what could you tell about your personality from a single melody, or about your life history, or your beliefs and values? how would all of that reflect in your music? what genre is your soul? could a musical portrait truly capture any of that? with sufficiently advanced tech, sure, but idk if we're there yet.

heck imagine the therapeutic implications! imagine this tech being used in an art/music therapy setting, in which you work with a therapist to input your data, get a melody, and then use that melody with whatever form of musical expression you prefer (e.g. if you prefer to play the piano, guitar, a DAW, etc). what would you and your therapist be able to learn about you?

i truly do believe that, when it comes down to it, everyone has their own musical identification, "a song in their heart" if you will. i wish to expose people's hearts to get that music out, so that people may hopefully understand themselves better.

we might actually be at the level of tech necessary to truly realize a project like Lifehouse, but the tech isn't being used in this way. our current tech relies on predictive algorithms that kinda mostly draw on established musical forms, tradition, and there are only so many notes in the musical alphabet and only so many combinations and permutations thereof. a true realization of this tech would work, say, maybe in a similar way to how Pokémon speedrunners essentially break the game and essentially reprogram it to do what they want via a series of unexpected inputs. arbitrary code execution is what that's called, and i bet a similar function might help greatly in creating a uniquely generated musical portrait. because, when it comes down to it, are we not all Glitch Pokémon who cannot be contained by the boundaries of our programming?

youtube

anyway that was a long ramble. feel free to gimme feedback like you're a guitar held up to an amp or feedback like an echo chamber, whichever you prefer. this post idk if it'll make both pro & anti AI people mad or not, but that's what happens when your position on a thing is more complicated than a simple binary.

currently homeless still, so please help me if you can:

My partner's donate links are here: https://linktr.ee/IzukuLeeYoung. that's the best place you can send us money to keep us in our current hotel room and off the street.

https://odiohi.me/pages/product-categories - if you wanna help me by buying my wares (including my music)

To support me directly:

https://ko-fi.com/NoraQRosa

https://cash.app/NoraQRosa

https://patreon.com/NoraQRosa

#artistic musings#essay#“AI art” really isn't true AI. when we finally realize that true AI actually lives and exists among us...#...you know we're gonna see them take offense to how we currently talk about AI and algorithms and be very upset#people don't care because they don't see AI as people but as new slaves.#they don't want artificial intelligence. they want custom-made servants.#we aren't at a point where we see true AI making art#we only currently see uncreatives abusing algorithms and then going “look i did this” when all they did was type out a few words.#at least Lifehouse was for a purpose and not for techbros to use and abuse!#it actually has a fascinating concept that i fear has been corrupted in this day and age. we need to fix that.#homeless plural trans queer artist in need of dire mutual aid#Youtube

3 notes

·

View notes

Text

Public Safety Solution Market Size, Share, Trends, Opportunities, Key Drivers and Growth Prospectus

Executive Summary Public Safety Solution Market :

Global public safety solution market size was valued at USD 22.05 billion in 2023 and is projected to reach USD 47.95 billion by 2031, with a CAGR of 7.54% during the forecast period of 2024 to 2031.

The market insights and market analysis about industry, made available in this Public Safety Solution Market research report are rooted upon SWOT analysis on which businesses can depend confidently. This market study underlines the moves of key market players like product launches, joint ventures, developments, mergers and acquisitions which is affecting the market and Industry as a whole and also affecting the sales, import, export, revenue and CAGR values. The consistent and extensive market information of this report will definitely help grow business and improve return on investment (ROI). This report makes available an actionable market insight to the clients with which they can create sustainable and profitable business strategies.

The Public Safety Solution Market report makes your business well acquainted with insightful knowledge of the global, regional and local market statistics. By keeping end users at the centre point, a team of researchers, forecasters, analysts and industry experts work exhaustively to formulate this market research report. To achieve maximum return on investment (ROI), it’s very crucial to figure out brand awareness, market landscape, possible future issues, industry trends and customer behaviour and Public Safety Solution Market report does the same. This Public Safety Solution Market report conveys the company profiles, product specifications, capacity, production value, and market shares of each company for the forecasted period.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Public Safety Solution Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-public-safety-solution-market

Public Safety Solution Market Overview

**Segments**

- Based on component, the Global Public Safety Solution Market can be segmented into solutions and services. The solutions segment is further classified into critical communication network, biometric security and authentication system, surveillance system, emergency and disaster management, scanning and screening system, C2/C4ISR system, and others. The services segment includes consulting, integration, maintenance and support. - By application, the market is divided into law enforcement, emergency services, disaster management, critical infrastructure security, and others. - On the basis of solution type, the market can be categorized into hardware and software solutions. The hardware solutions include devices such as cameras, sensors, emergency lights, and others. The software solutions consist of analytical tools, management solutions, and communication platforms. - Considering deployment mode, the market is segmented into on-premises and cloud-based solutions. - Geographically, the Global Public Safety Solution Market is analyzed across North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

**Market Players**

- Some of the key players in the Global Public Safety Solution Market are Cisco Systems, Inc., NEC Corporation, Motorola Solutions, Inc., Atos SE, Honeywell International Inc., IBM Corporation, Hexagon AB, ESRI, General Dynamics Corporation, and Thales Group among others. These companies are focusing on strategic partnerships, product innovations, and acquisitions to strengthen their market presence in the public safety solution domain.

The Global Public Safety Solution Market is witnessing significant growth due to the increasing focus on public safety and security measures by governments across the world. The rise in criminal activities, natural disasters, and terrorist threats have propelled the demand for advanced public safety solutions. The adoption of technologies such as artificial intelligence, Internet of Things (IoT), and cloud computing is also driving the market growth as these technologies enhance the efficiency and effectiveness of public safety operations.

The law enforcement application segment is dominating the market as law enforcement agencies are increasingly deploying public safety solutions to combat crime and maintain law and order. The emergence of smart cities and the integration of smart public safety solutions are further fueling market growth. Additionally, the growing investments in critical infrastructure security and disaster management solutions are contributing to the expansion of the market.

In conclusion, the Global Public Safety Solution Market is poised for substantial growth in the coming years as governments and organizations prioritize public safety measures. The market players are focusing on technological advancements and strategic collaborations to gain a competitive edge in the market and cater to the increasing demand for robust public safety solutions.

The Global Public Safety Solution Market is experiencing a rapid evolution driven by the escalating need for enhanced safety and security measures worldwide. With the rising instances of criminal activities, natural calamities, and terrorist threats, governments are increasingly investing in advanced public safety solutions to ensure the protection and well-being of their citizens. This heightened focus on security is propelling the demand for innovative technologies like artificial intelligence, IoT, and cloud computing within the public safety sector, as these solutions offer improved operational efficiency and effectiveness.

One of the key drivers shaping the market landscape is the dominant presence of the law enforcement segment, which is leveraging public safety solutions to combat criminal activities and uphold law enforcement standards. The integration of smart city initiatives and the implementation of intelligent public safety solutions are further amplifying market expansion. Moreover, the surge in investments directed towards critical infrastructure security and disaster management solutions is playing a pivotal role in driving market growth and fostering resilience against various threats and vulnerabilities.

Market players such as Cisco Systems, Inc., NEC Corporation, and Motorola Solutions, Inc., among others, are at the forefront of driving innovation and strategic partnerships to fortify their market positions in the public safety solution domain. By focusing on technological advancements and collaboration initiatives, these companies are poised to meet the escalating demand for robust security solutions and address the evolving challenges within the global public safety landscape.

Looking ahead, the Global Public Safety Solution Market is poised for significant growth as governments, and organizations continue to prioritize safety and security imperatives. As market dynamics evolve, the convergence of cutting-edge technologies and strategic alliances will play a critical role in shaping the future trajectory of the public safety sector. By staying attuned to market trends and enhancing solution capabilities, market players can capitalize on emerging opportunities and cement their foothold in this rapidly evolving ecosystem, thus contributing to a safer and more secure world for all.The Global Public Safety Solution Market is currently experiencing a transformation driven by the increasing emphasis on safety and security measures worldwide. With the surge in criminal activities, natural disasters, and terrorist threats, there is a growing demand for advanced public safety solutions to ensure the protection of communities. Governments are investing in innovative technologies such as artificial intelligence, IoT, and cloud computing to enhance the operational efficiency and effectiveness of public safety operations.

The dominance of the law enforcement segment in the market indicates a significant focus on combating crime and maintaining law and order. The integration of smart city initiatives and intelligent public safety solutions is further boosting market growth. Investments in critical infrastructure security and disaster management solutions are also contributing to the expansion of the market, fostering resilience against various threats.

Key market players like Cisco Systems, Inc., NEC Corporation, and Motorola Solutions, Inc. are leading the way in driving innovation and forming strategic partnerships to reinforce their positions in the public safety solution domain. By prioritizing technological advancements and collaboration initiatives, these companies are well-positioned to meet the increasing demand for secure solutions and address the evolving challenges in the public safety landscape.

Looking ahead, the Global Public Safety Solution Market is forecasted to witness substantial growth as safety and security remain paramount concerns for governments and organizations globally. The convergence of cutting-edge technologies and strategic alliances will play a crucial role in shaping the future of the public safety sector. By adapting to market trends and enhancing solution capabilities, market players can capitalize on emerging opportunities and solidify their presence in this dynamic landscape, contributing to a safer and more secure environment for all.

The Public Safety Solution Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-public-safety-solution-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Regional Analysis/Insights

The Public Safety Solution Market is analyzed and market size insights and trends are provided by country, component, products, end use and application as referenced above.

The countries covered in the Public Safety Solution Market reportare U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominatesthe Public Safety Solution Market because of the region's high prevalence Public Safety Solution Market

Asia-Pacific is expectedto witness significant growth. Due to the focus of various established market players to expand their presence and the rising number of surgeries in this particular region.

Browse More Reports:

Global Revenue Assurance Market Middle East and Africa Medical Clothing Market North America Automotive Heat Exchanger Market Global Grant Management Software Market Global Infrastructure Inspection Market Global Reverse Logistics Market Europe Automotive Battery Thermal Management System Market Global Air Sports Equipment Market Global Molecularly Long-chain Fatty Acid Oxidation Disorders Market Global Data Center Interconnect Market North America Plasma Fractionation Market North America Japanese Restaurant Market Global School Bus Market Global Healthcare Facilities Management Market North America Functional Mushroom Powder Market Global Chlorinating Agents Market Global Wash Basins Market Global Personal Care Contract Manufacturing Market Europe Pharmaceuticals Packaging Testing Equipment Market Global Watertight Doors Market Global Radio Frequency Identification RFID Tags for Livestock Management Market Singapore, China, Hong Kong and Taiwan Third Party Logistics Market Thailand Point-of-Care Testing (POCT) Market Global Cartoning Food Packaging Market North America Soft Tissue Repair Market Global Sugar Substitutes Market Global Data Center Rack Power Distribution Unit (PDU) Market Asia-Pacific Japanese Restaurant Market Global BRICS Oral Care Market Global Vascular Ultrasonography Market Global Packed Pickles Market Global Vitamin Patches Market Global Dental Sterilization Market Global Rigid Bulk Packaging Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us: Data Bridge Market Research US: +1 614 591 3140 UK: +44 845 154 9652 APAC : +653 1251 975 Email:- [email protected]

Tag:- Public Safety Solution, Public Safety Solution Size, Public Safety Solution Share, Public Safety Solution Growth

0 notes

Link

#adaptivethreatintelligence#AI-enhancedsecurity#behavioralauthentication#cross-jurisdictionalcollaboration#malwaredetectioninnovation#predictivedefensesystems#regulatoryharmonization#walletprotectionstandards

0 notes

Text

Raghuvamsh Chavali: The Global Indian Photographer Turning Stillness into Stories That Transcend Borders

In the vibrant tapestry of Global Indian achievers making their mark worldwide, Raghuvamsh Chavali stands out as a remarkable figure who blends artistic vision with cultural depth. Born in Hyderabad and now based in Canada, Raghuvamsh has carved a niche in the international photography scene by transforming moments of stillness—particularly the graceful flight of urban birds—into compelling visual narratives that resonate globally. His acclaimed photo series Wings Over Concrete not only won first place at the prestigious 10th 35AWARDS, beating over 470,000 entries from 174 countries, but also symbolizes the resilience and adaptability of nature amidst urban chaos.

From Hyderabad’s Quiet Shores to Canada’s Expansive Skies:

Raghuvamsh’s journey is a quintessential Global Indian story: rooted in Indian culture yet flourishing on a global stage. Self-taught and driven by curiosity, he began his photographic explorations near Ameenpur Lake in Hyderabad, capturing nature’s subtle rhythms. His move to Canada in 2021 introduced him to new landscapes and seasons, teaching him patience, stillness, and discipline—qualities that deeply inform his creative process. This cross-continental experience enriches his work, blending India’s vibrant contrasts with Canada’s serene expanses.

Wings Over Concrete: A Poetic Exploration of Urban Wildlife:

At the heart of Raghuvamsh’s acclaim is Wings Over Concrete, a photo series that reveals the intricate dance of birds navigating the steel and glass of cityscapes. Using an innovative interlacing framing technique, he captures patterns of flight that resemble natural sine waves, transforming everyday urban scenes into visual poetry. The series highlights how birds adapt to urban environments, finding food, nesting spots, and safe havens amidst human development. This narrative of coexistence invites viewers to pause and appreciate the unnoticed beauty and resilience thriving alongside us.

The project’s success is a testament to Raghuvamsh’s relentless dedication. Despite early doubts and countless failed attempts, he persisted, believing that every frame—no matter how imperfect—was a step forward. His work was recognized by a jury of 50 experts from 50 countries, underscoring its universal appeal and artistic excellence.

Innovation Beyond the Lens: Protecting Creative Rights:

Raghuvamsh is not only a visual storyteller but also a technological innovator. He holds a patent for a biometric watermarking system that embeds creator information into digital images, a crucial advancement for protecting intellectual property in the digital and AI era. This innovation reflects his commitment to empowering artists worldwide, ensuring their work remains authentic and safeguarded.

A Voice of the Global Indian Creative Community:

Featured in top-tier publications such as Smithsonian Magazine, Canadian Geographic, BBC Sky at Night, and Space.com, Raghuvamsh exemplifies the Global Indian ethos—merging cultural heritage with global perspectives. His photography explores themes of movement, identity, and the delicate balance between nature and urbanization, resonating with audiences across cultures.

He also serves as an ambassador for 1x.com, a globally curated photography platform, mentoring emerging photographers and inspiring them to embrace authenticity and innovation7. His story encourages creatives to persevere through uncertainty and find their unique voice.

Conclusion: Raghuvamsh Chavali’s journey from Hyderabad to Canada and from novice to internationally acclaimed photographer embodies the spirit of the Global Indian—rooted yet global, traditional yet innovative. Through Wings Over Concrete and his broader creative and technological contributions, he transforms stillness into universal stories of resilience, coexistence, and beauty. His work invites us all to slow down, observe, and connect with the extraordinary narratives unfolding quietly around us. Find more Global Indian stories.

0 notes

Text

App Development Trends You Can’t Ignore in Jeddah

In the evolving digital landscape, mobile app development company in Jeddah has gained enormous momentum. As the city grows as a technological and entrepreneurial hub, startups and enterprises alike are investing in innovative app solutions to meet customer needs and remain competitive. The rising demand for intuitive and scalable applications has given birth to several app development trends in Jeddah that businesses simply can't ignore in 2025.

1. Rise of Cross-Platform Development

Businesses in Jeddah are increasingly choosing cross-platform app development to save time and money. Tools like Flutter and React Native allow developers to write one codebase and deploy apps for both Android and iOS platforms. This trend ensures faster time-to-market and unified user experience.

2. AI-Powered Mobile Apps

Artificial Intelligence is transforming how users interact with mobile apps. From chatbots in customer service apps to personalized recommendations in e-commerce platforms, AI integration in Jeddah apps is enabling smarter, faster, and more efficient services. Five Programmers is actively integrating AI features into apps to offer intelligent functionalities.

3. Integration of Augmented Reality (AR)

AR in app development is redefining user experiences, especially in sectors like real estate, fashion, and education. Businesses in Jeddah are utilizing AR to provide immersive app features such as virtual product trials, guided property tours, and interactive learning.

4. Focus on Cybersecurity

With increasing digital threats, mobile app developers in Jeddah are prioritizing security. Biometric authentication, end-to-end encryption, and secure coding practices are becoming essential in every app project.

5. Demand for Instant Apps

Instant mobile apps allow users to access core features without full installation. This trend is gaining popularity in Jeddah due to the growing demand for convenience and low data usage. Businesses are now asking developers like Five Programmers to create lightweight, fast-loading apps that deliver value instantly.

6. Cloud-Based Applications

With the shift toward remote operations and scalability, cloud-based mobile apps are becoming standard in Jeddah's tech environment. These apps offer greater storage, faster performance, and seamless syncing across devices.

7. Super Apps Are on the Rise

Inspired by platforms like WeChat and Grab, super apps that integrate multiple services in one app are gaining traction in Jeddah. From ride-hailing to food delivery, businesses are exploring ways to create all-in-one digital ecosystems.

8. Integration with Wearables

The growing use of wearable devices like smartwatches and fitness trackers has led to increased demand for app development for wearables in Jeddah. Health, fitness, and productivity apps are now being tailored to sync smoothly with wearable gadgets.

9. Voice User Interfaces (VUIs)

Voice commands are becoming more popular with virtual assistants like Siri and Google Assistant. Voice-enabled app development is one of the most talked-about trends in Jeddah, offering hands-free convenience and accessibility.

10. Localization and Multilingual Apps

Businesses in Jeddah are focusing on developing multilingual apps to cater to diverse user bases, including Arabic-speaking and international users. Localized content boosts user engagement and customer satisfaction.

Why Choose Jeddah for Your Mobile App Development?

Jeddah is rapidly becoming the next tech frontier with access to local talent, startup support programs, and increasing government initiatives to digitize services. Companies like Five Programmers are at the forefront, offering cutting-edge app development services in Jeddah that combine creativity, technical proficiency, and user-focused design.

Frequently Asked Questions (FAQ)

Q1: Why is cross-platform development becoming popular in Jeddah? Because it allows businesses to launch apps faster and more affordably while covering both Android and iOS users with a single codebase.

Q2: Are AI-powered apps in demand in Jeddah? Yes, businesses are leveraging AI to automate tasks, enhance personalization, and provide intelligent features that improve user experiences.

Q3: Is it necessary to localize apps for Jeddah? Absolutely. Creating multilingual apps tailored to Arabic-speaking users helps increase engagement and ensures cultural relevance.

Get a Quote Today!

Looking to build your next app in Jeddah? Don’t wait. Reach out to Five Programmers for custom mobile app solutions that align with your business goals. Whether it’s iOS, Android, cross-platform, or wearable apps – we’ve got you covered.

Contact Us Today and transform your idea into a successful digital product with Five Programmers at your side.

#mobile app development company in Jeddah#Mobile app developers in Jeddah#app development companies in Jeddah#Technology#tech

0 notes

Text

🛒 Self-Checkout System Market Size, Share & Growth Analysis 2034: Retail’s No-Line Revolution

Self-Checkout System Market is undergoing a transformative shift as retailers increasingly prioritize speed, convenience, and automation. Self-checkout systems, which empower customers to complete purchases without cashier assistance, are rapidly becoming an integral part of modern retail strategies. These systems include hardware like kiosks, payment terminals, and scanners, as well as software platforms that manage transactions, inventory, and customer data. In 2024, the market recorded an impressive 320 million units in volume, projected to reach 550 million units by 2028. The global retail sector leads this trend, accounting for 55% of the market share, followed by hospitality and transportation sectors.

Market Dynamics

Several factors are fueling the growth of the self-checkout system market. Foremost among them is the increasing demand for contactless and efficient retail experiences, especially in the post-pandemic world. Customers value fast and autonomous shopping, while businesses benefit from reduced labor costs and enhanced operational efficiency. Innovations in artificial intelligence (AI), machine learning, and computer vision have elevated the capabilities of these systems, enabling real-time inventory tracking, fraud prevention, and biometric authentication.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS24605

However, challenges persist. High upfront costs can deter small retailers, and concerns about shoplifting and technical glitches pose operational risks. Maintenance and integration with existing retail systems also add complexity. Despite these hurdles, the overall trajectory of the market remains upward, driven by continuous innovation and growing consumer acceptance.

Key Players Analysis

The competitive landscape of the self-checkout system market features both established and emerging players. Industry leaders like NCR Corporation, Toshiba Global Commerce Solutions, and Diebold Nixdorf dominate with robust product portfolios and global reach. Companies such as Fujitsu, ITAB Shop Concept, and Pan-Oston contribute with innovative hardware solutions, while newer entrants like Mashgin, Standard Cognition, and Zippin are pioneering AI-powered, contactless checkout technologies.

These players are investing in R&D to develop smarter, customizable systems and are engaging in partnerships with retailers to co-develop tailored solutions. The market is also witnessing strategic mergers and acquisitions aimed at expanding technology capabilities and geographic presence.

Regional Analysis

North America leads the global self-checkout system market, driven by a mature retail sector and high consumer demand for automation. The United States, in particular, stands out due to aggressive technological adoption and a competitive retail environment. Europe follows closely, with the UK and Germany leading the way through strong regulatory support and consumer preference for self-service.

Asia-Pacific is emerging as a high-growth region, fueled by rapid urbanization, rising disposable incomes, and the digital transformation of retail in countries like China and India. Latin America and the Middle East & Africa are also witnessing gradual adoption, with Brazil, Mexico, UAE, and South Africa exploring self-checkout solutions to modernize retail infrastructure and improve customer experiences.

Recent News & Developments

Recent innovations are rapidly reshaping the self-checkout system market. AI and ML integration has significantly improved transaction speed and accuracy, while mobile-enabled systems are bridging the gap between online and offline retail. The pandemic accelerated the shift to contactless technology, making self-checkout a default expectation in many urban retail environments.

Pricing for self-checkout systems varies widely — from basic setups starting at $5,000 to advanced solutions costing upwards of $25,000. Retailers are seeking a balance between affordability and advanced features such as real-time analytics, digital receipts, and sustainability-focused designs. In parallel, companies are emphasizing compliance with global data protection regulations, investing in secure systems that safeguard customer information.

Browse Full Report : https://www.globalinsightservices.com/reports/self-checkout-system-market/

Scope of the Report

This report offers a comprehensive analysis of the self-checkout system market from 2018 through 2034, with a detailed forecast period of 2025–2034. It explores key market drivers, technological trends, and consumer behavior patterns across types, applications, and regions. Through value chain, PESTLE, and SWOT analyses, the report uncovers market dynamics and identifies strategic opportunities for stakeholders.

The study covers diverse segments such as product types (kiosks, mobile), technologies (barcode, RFID, AI), and end-users (supermarkets, department stores). It also includes insights on competitive strategies, regulatory impacts, and emerging players transforming the industry. With a projected CAGR of 10.6%, the market is set to reach $12.3 billion by 2033, offering substantial opportunities for innovation and investment.

#selfcheckout #retailautomation #smartretailing #contactlesspayment #aiinretail #retailtech #customerselfservice #digitalretail #selfservicekiosk #futureofshopping

Discover Additional Market Insights from Global Insight Services:

Industrial Robotics Market : https://www.globalinsightservices.com/reports/industrial-robotics-market/

Printed Electronics Market :https://www.globalinsightservices.com/reports/printed-electronics-market/

Current Sensor Market : https://www.globalinsightservices.com/reports/current-sensor-market/

Fiber Optic Cables Market : https://www.globalinsightservices.com/reports/fiber-optic-cables-market/

Medical Sensors Market : https://www.globalinsightservices.com/reports/medical-sensors-market/

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

The Ultimate Guide to App Development: Trends, Tips, and Strategies for Success

In today’s digital-first world, app development has become a cornerstone for businesses looking to engage users, streamline operations, and drive growth. Whether you're a startup or an established brand like City Insider Inc, having a well-designed, functional app can significantly enhance customer experience and boost revenue. This guide explores the latest trends, best practices, and essential strategies to help you succeed in the competitive app market.

Why App Development Matters in 2024

Mobile apps are no longer a luxury—they’re a necessity. With over 6.8 billion smartphone users worldwide, businesses that leverage app development gain a competitive edge. Apps improve accessibility, foster customer loyalty, and provide personalized experiences. For companies like City Insider Inc, a well-optimized app can be a powerful tool for delivering real-time updates, seamless transactions, and enhanced user engagement.

Top Trends Shaping App Development in 2024

Staying ahead in app development requires keeping up with emerging trends:

AI & Machine Learning Integration – Apps now use AI for chatbots, predictive analytics, and personalized recommendations.

5G Technology – Faster speeds enable richer multimedia experiences and real-time functionality.

Cross-Platform Development – Frameworks like Flutter and React Native reduce costs and development time.

Enhanced Security Features – Biometric authentication and end-to-end encryption are becoming standard.

Voice & AR/VR Integration – Voice search and augmented reality are transforming user interactions.

By adopting these trends, City Insider Inc can create innovative, future-proof apps that stand out in the market.

Key Steps in the App Development Process

A successful app development project follows a structured approach:

Market Research – Identify target audience needs and analyze competitors.

Define Objectives – Outline clear goals, such as improving sales or enhancing user engagement.

UI/UX Design – Prioritize intuitive navigation and visually appealing interfaces.

Development & Testing – Use agile methodologies for iterative improvements.

Launch & Marketing – Optimize app store listings and leverage social media for promotion.

Post-Launch Maintenance – Continuously update features based on user feedback.

Following these steps ensures a smooth development cycle and a high-quality final product.

Choosing the Right App Development Approach

Businesses like City Insider Inc must decide between:

Native Apps – Built for specific platforms (iOS or Android) for optimal performance.

Hybrid Apps – Combine web and native elements for cost efficiency.

Progressive Web Apps (PWAs) – Web-based apps that function like native ones.

Each approach has pros and cons, so selecting the right one depends on budget, timeline, and business goals.

How to Optimize User Experience (UX) in App Development

A great UX is critical for app success. Key strategies include:

Simplified Onboarding – Minimize steps for new users.

Fast Loading Speeds – Optimize performance to reduce bounce rates.

Personalization – Use data to tailor content and recommendations.

Accessibility – Ensure the app is usable for people with disabilities.

By focusing on UX, City Insider Inc can increase retention and user satisfaction.

Monetization Strategies for Your App

Generating revenue from an app requires smart monetization tactics:

In-App Purchases – Offer premium features or digital goods.

Subscription Models – Charge users monthly or annually for access.

Advertisements – Integrate non-intrusive ads for free apps.

Freemium Model – Provide basic features for free with paid upgrades.

Selecting the right model depends on the app’s purpose and audience.

Future of App Development: What’s Next?

The app development landscape is evolving rapidly. Emerging technologies like blockchain, IoT integration, and wearable-compatible apps will shape the future. Businesses like City Insider Inc must stay agile, continuously innovate, and adapt to new trends to remain competitive.

Conclusion: Partner with Experts for Successful App Development

Creating a successful app requires expertise, strategy, and innovation. Whether you're a startup or an established company like City Insider Inc, investing in professional app development ensures a high-performing, user-friendly product. By following the latest trends, optimizing UX, and choosing the right monetization strategy, your app can thrive in today’s competitive market.

Ready to build your next app? Contact City Insider Inc today for cutting-edge app development solutions tailored to your business needs!

0 notes

Text

Digital Identity Solutions Market Poised for Growth Amid Rising Cybersecurity and Authentication Demands Worldwide

The Digital Identity Solutions Market is entering a phase of robust growth, driven by the twin forces of escalating cybersecurity threats and the surge in demand for strong authentication methods. As organizations across industries accelerate digital transformation, comprehensive and secure user verification systems have become indispensable. Below, we explore the dynamics shaping this landscape, the key technologies driving change, major industry trends, sector-specific adoption, regional variations, and future projections.

1. Market Context: Why Now?

a. Escalating Cyber Threats

In recent years, cyberattacks—ransomware, data breaches, phishing—have not only increased in frequency but also in sophistication. Large-scale breaches involving identity theft and credential compromise have underscored the urgent need for strong identity verification. Incidents such as the 2024 data breaches at major payment processors and healthcare carriers have illuminated just how vulnerable legacy authentication methods like passwords remain.

b. Remote Work and Digital Service Expansion

The shift to remote work models and virtual customer engagement has significantly broadened the digital “attack surface.” Employees logging in from home, often on personal devices, have forced enterprises to reevaluate authentication practices. Consumer-facing online transactions—banking, retail, healthcare—have similarly grown more complex, leading to a surge in demand for frictionless yet secure digital identity solutions.

c. Regulatory Pressure

Regulatory frameworks around the world—GDPR in Europe, CCPA in California, CDPA in Virginia, and PDPA in Singapore—continue to impose strict requirements on identity data security and privacy. Governments have also introduced identity mandates, such as eIDAS Verified Digital Credentials in the EU and India’s expanding Aadhaar-linked services, fostering trust and compliance needs in digital identity ecosystems.

2. Key Technologies Fueling Adoption

a. Biometric Authentication

Fingerprint, facial recognition, and voice biometrics are now mainstream. Mobile device manufacturers have built secure enclave hardware capable of storing biometric templates locally. Meanwhile, multi-factor authentication (MFA) often leverages biometrics as a convenient second factor. That said, biometric vulnerabilities and spoofing attempts remain ongoing challenges, requiring continuous innovation.

b. Artificial Intelligence and Machine Learning

AI/ML are playing dual roles—strengthening authentication and detecting fraud. Behavioral biometrics track patterns like typing dynamics or mouse movement to enable continuous verification. Predictive analytics model transaction patterns in real time, triggering additional checks for anomalous behavior. According to a 2024 market study, solutions with integrated AI modules deliver 30–40% higher fraud detection rates compared to static rule-based systems.

c. Blockchain and Decentralized Identifiers (DIDs)

Blockchain-based identity models enable users to own and manage credentials, sharing them only when needed. Decentralized Identifiers and verifiable credentials (as defined by the W3C) support portable and secure identity claims. Use cases like digital wallets for vaccines, academic credentials, or licenses are gaining traction in Europe, North America, and the Middle East.

3. Market Trends and Signals

Unified Identity Platforms: Organizations are consolidating legacy point solutions into unified identity platforms covering workforce, consumer, and partner identities under a single pane.

Zero Trust Security Adoption: The shift toward Zero Trust architectures—“never trust, always verify”—elevates the importance of forging dynamic identity solutions.

Passwordless Authentication: WebAuthn and FIDO2 protocols are being adopted rapidly by browsers, mobile, and enterprise apps. Microsoft and Google see millions of users shifting away from passwords each quarter.

Regulatory Certification: Identity providers are pursuing ISO 27001, SOC 2, and cybersecurity certifications to meet corporate compliance, prompting greater enterprise uptake.

4. Industry Verticals Leading Uptake

a. Banking and Financial Services

One of the earliest and most active adopters, this sector enforces KYC/KYB standards, risk profiling, and PSD2 compliance. Mobile apps now integrate face matches with liveness detection during onboarding; biometric logins are standard, and banking institutions invest heavily in identity fraud monitoring.

b. Healthcare

Telehealth platforms and digital patient portals demand secure patient identity proofing and privacy compliance.

c. Public Sector

National ID programs (such as India’s Aadhaar and Estonia’s e‑ID) have matured; a growing number of countries are exploring sovereign digital identity systems for passporting, voting, and public benefits.

d. E‑Commerce and Retail

To protect against account takeover (ATO) fraud, digital identity checks have expanded at login, transaction points, and delivery. Risk‑based scoring and biometric verification tools reduce false positives and cart abandonment.

5. Regional Dynamics

North America remains a dominant market, driven by nimble fintech adoption, regulatory scrutiny, and high perceived cybersecurity risk.

Europe, led by the EU’s eIDAS2 regulations, is a hub for cross‑border identity innovations—wallet pilots run in Spain, Germany, and Poland.

Asia‑Pacific sees rapid adoption: India’s digital ID ecosystem is scaling; Australia and Singapore are piloting digital wallet schemes; and China integrates mobile biometrics into daily life.

Middle East & Africa: UAE and Saudi Arabia are building smart city identity integrations; digital IDs are being used to connect education, healthcare, and traffic systems.

6. Competitive Landscape

Major players in the sector include Okta, Microsoft Azure AD, Ping Identity (now part of Thoma Bravo), SailPoint, ForgeRock, and CyberArk in workforce identity. Consumer and government identity are being contested among IDEMIA, Thales, OneSpan, and Innovatrics. Emerging disruptors focus on decentralized identity (e.g. uPort, Sovrin) and embedded authentication services (like Socure, Jumio, Onfido).

Key Competitive Differentiators:

Scalability & Reliability: Can the solution handle 10 million active users?

UX and Frictionless Flow: Does the system respect privacy, such as via selective disclosure?

Ecosystem Connectivity: How well does the provider integrate into existing IT and SaaS apps?

Compliance Coverage: Is it certified for GDPR, HIPAA, PCI‑DSS, etc.?

Adaptability: Can the system evolve to support decentralized models, 5G devices, and IoT?

7. Challenges and Restraints

Despite rapid growth, hurdles remain:

Data privacy concerns: Biometric and personal information must be guarded carefully.

Standards fragmentation: Not all countries and industries align on blockchain identity or biometric specs.

Cost and complexity: Smaller organizations can find it hard to build internal expertise.

Security trade-offs: Even biometrics can be spoofed—continuous research and red teaming exercises are essential.

8. Market Forecast

The global digital identity solutions market, valued near USD 33 billion in 2024, is projected to reach USD 85 billion by 2030, growing at a compound annual growth rate (CAGR) of approximately 15–17% during the 2025‑2030 period. Growth engines include:

Mass deployment of X.509 certificates in IoT and device-to-device authentication.

Enterprise shift toward passwordless identity.

Expansion of cross-border digital ID ecosystems.

Government e‑ID initiatives continuing in developing regions.

9. Strategic Recommendations

Enterprises should adopt a phased approach: start with workforce SSO/MFA, layer risk‑based behavioral analytics, then extend to B2C or partner identity.

Vendors must differentiate by building open, modular cloud platforms, obtaining compliance certifications, and fostering trust through transparency and audit practices.

Policy makers should collaborate across borders on global identity standards, while ensuring citizens’ privacy rights aren’t compromised.

10. Outlook: What Lies Ahead

Over the next decade, more digital identity will be user-centric, portable across platforms, and governed by privacy-respecting consent frameworks. Advances in privacy-enhancing technologies (PETs) like zero‑knowledge proofs and homomorphic encryption will bolster user control and interoperability. Meanwhile, quantum‑resistant cryptography and deep learning‑driven risk assessments promise a more secure digital future. In our hyper‑connected world, digital identity is foundational—a keystone for trust, openness, and resilience.

In Summary

The digital identity solutions market stands at a pivotal juncture. With cybersecurity risks escalating and digital services proliferating worldwide, robust identity authentication systems are no longer optional. Backed by biometrics, AI-driven analytics, blockchain portability, and cloud-enabled scalability, this market is set to grow strongly, while emphasizing user privacy and regulatory compliance. Organizations that invest wisely in modern digital identity tools will gain both security assurance and competitive differentiation in a more digital-first era.

0 notes

Text

The Future of Market Research: Virtual Reality and Immersive Experiences

Market research is an integral part of customer behavior and experience personalization strategies. It provides necessary insights into consumers' product preferences and market trends. Conventional techniques such as one-to-one surveys, focus groups, or secondary data collection have been standard in this field. However, technological enhancements have equipped modern market researchers with novel tools like virtual reality. This post will discuss the future of market research, including the potential of virtual reality and immersive experiences.

What is Virtual Reality?

Virtual reality (VR) simulates a computer-aided audiovisual environment. It can mimic reality or include experiences from a fantasy. Its adequate implementation will resolve many customer profiling issues and data quality limitations haunting professionals in market research consulting. Moreover, immersing users in a realistic simulation allows VR projects to provide more dynamic or nuanced insights into consumer behavior.

What Are the Benefits of Virtual Reality in Market Research?

1| Immersive Experience and Consumer Behavior

One of VR's key advantages in market research is the ease of creating highly immersive experiences. Unlike traditional methods, VR can simulate a complete environment. That allows researchers to observe how consumers interact with products or services in a lifelike context. Besides, this immersion can lead to more accurate and authentic responses. After all, participants are less likely to be influenced by the artificiality of a traditional research setting. The required detailed, realistic simulation is often complex to accomplish with ordinary methods.

2| Emotional and Behavioral Insights

Another significant benefit of VR integration is its ability to interpret emotional responses. However, you require biometric sensors to track heart rate and eye movements. The acquired data will assist in measuring physiological responses to different stimuli within the virtual environment. This data on reactions can facilitate valuable insights into how consumers feel about a product. You can also check their positive or negative sentiments toward an advertisement or brand.

How to Utilize VR in Market Research Based on Your Target Industry?

According to market intelligence consulting experts, several industries already leverage VR for customer insights. The following use cases demonstrate the versatility and effectiveness of this technology.

1| Retail and Consumer Goods

Virtual reality software can help retailers try multiple store layouts to see how customer dwell time changes. Remember, product placements and marketing tactics affect how much customers buy before the final checkout. Therefore, companies like Walmart and IKEA have experimented with virtual stores. They also intend to gather consumer feedback before making costly and permanent changes to their physical store layouts in the real world. This precaution allows them to optimize their strategies based on data-driven insights rather than intuition or guesswork.

2| Automotive Industry

Automotive companies utilize VR systems to offer virtual car showrooms and deliver simulated test-driving experiences. This use case enhances the customer experience. Brands get this valuable data to investigate ever-changing consumer preferences and purchasing behaviors. Consider Audi and Ford. They have developed virtual test drives, allowing potential buyers to experience their vehicles. They can configure various scenarios for virtual driving sessions. Later, they might gather stakeholder feedback influencing future car designs, collision safety measures, handling methods, or fuel-efficiency parameters.

3| Healthcare and Pharmaceuticals

In healthcare, clinicians and universities will leverage VR to simulate medical environments for apprentices' training and evaluating new medical devices and treatments. Pharmaceutical companies employ VR to simulate clinical trials. Doing so allows medical professionals to examine patient reactions to new drugs. Although these trials are programmatic, they enable better forecasts for real-world healthcare outcomes. As a result, the stakeholders can accelerate research and enhance the accuracy of their findings.

Challenges in VR Integration for Immersive Experiences and Market Research

While VR's potential in market research is immense, several challenges and considerations might hinder the effective implementation of virtual reality experiences.

1| Accessibility and Cost

One of the top challenges to the widespread integration of VR is the cost of equipment and the availability of reliable talent. Business leaders need cost-effective tools and experienced VR-friendly market researchers to develop and maintain virtual environments. High-quality VR headsets and sensors can be expensive, and creating a realistic and engaging virtual environment requires significant software development and design investment. As the virtual reality industry matures and its tech tools become more affordable, these costs will likely decrease. So, VR integration for market studies will be more accessible to all organizations worldwide.

2| Data Privacy and Ethics

Corporations' use of VR in market research and hyper-personalization raises critical questions about data privacy and ethics. Biometric data, such as heart rate and eye movement, are highly sensitive data categories. Therefore, data processing entities must handle them with care. Companies must ensure that their data protection measures are effective. At the same time, participants must know how data recipients will utilize their data legally, ethically, and legitimately. Transparency and consent are crucial to maintaining trust and avoiding potential legal issues.

3| Technical Limitations

Despite significant advancements, VR technology still has limitations. Motion sickness, for example, can affect some users by limiting the duration of VR sessions. Additionally, the realism of virtual environments exhibits visual artifacts or rendering glitches because of current hardware and software limitations. As technology continues to improve, these obstacles will likely diminish. However, they might be a significant problem for enterprises with smaller budgets.

The Future of Virtual Reality in Market Research

The future of VR and immersive experiences in market research is promising, with several disruptive projects already making the headlines, as explored below.

1| Enhanced Realism and Interactivity

Continuous progress in AI technologies promises better realism and more engaging interactions. Advances in graphics, haptic feedback, and artificial intelligence will create more lifelike and engaging virtual environments. Their future releases will enhance the accuracy of consumer behavior studies and provide deeper insights into their preferences and motivations.

2| Integration with Other Technologies

Integrating VR with other emerging technologies will open up new possibilities for market research. Consider augmented reality (AR), artificial intelligence (AI), and live data streaming projects. For example, brands can use AI platforms to analyze the extensive databases from VR-powered market studies to identify unique patterns and crucial trends that may be undetectable in a standard analysis. AR can complement VR by overlaying digital information in the real world, creating a seamless blend of physical and virtual experiences.

3| Broader Adoption Across Industries

Affordable technologies indicate broader VR adoption in market research across various industries. The potential applications will benefit entertainment, tourism, education, and real estate. Companies that embrace VR early on will have a first-mover advantage because they will gain actionable insights into their customers before competitors. Consequently, they will successfully stay ahead of them in understanding market trends.

4| Personalized Consumer Experiences

VR will revolutionize market research and provide better approaches to studying consumer engagement metrics. Understandably, you want to personalize virtual experiences based on individual preferences and behaviors. This method helps create more meaningful and engaging interactions. For instance, a fashion retailer could offer virtual fitting rooms. Online customers would try on clothes and receive personalized recommendations based on submitted style and body type data. Similar customization options tell customers your business is committed to prioritizing satisfaction and brand loyalty.

Conclusion

Global brands want to incorporate virtual reality and immersive experiences into market research. These tech advancements help redefine the methods for understanding consumer behavior. VR addresses many of the limitations of traditional research methods by providing a more realistic, engaging, and data-rich environment. While challenges can be tricky to overcome, the strategic benefits attract brands. For deeper insights and more accurate data to inform business strategies, companies have invested in developing solutions to those problems.

As technology advances, domain experts expect VR to become indispensable in the market research toolkit. Companies that invest in this technology earlier will be well-positioned to reap the rewards since they acquire a competitive edge essential to thrive in their industry. The future of market research is immersive, and your competitors have merely begun exploring the possibilities.

2 notes

·

View notes

Text

How Is the Micro ATM Market Growing in India?

In recent years, India has witnessed a significant transformation in the way financial services are delivered, particularly in rural and semi-urban areas. One of the most revolutionary innovations supporting this shift is the Micro ATM. Designed to bring basic banking services to the doorstep of people with limited access to traditional banking infrastructure, Micro ATMs have emerged as a powerful tool for driving financial inclusion. With the Indian government’s continued push for digital payments and inclusive finance, the Micro ATM market in India is experiencing robust growth, backed by the rising demand for last-mile financial connectivity.

Understanding the Micro ATM Landscape

A Micro ATM is a portable device operated by banking correspondents or agents that enables users to perform essential banking activities such as cash withdrawal, deposit, balance inquiry, and fund transfer. These devices work on biometric authentication (especially Aadhaar-based), card swipes, or mobile number verification. Micro ATMs act as mini banks and provide a crucial link between rural populations and the formal financial system.

The expansion of Micro services like cash-in/cash-out and balance checks through these devices has made them an indispensable part of India’s financial ecosystem. The accessibility, low operational cost, and ability to operate without full-scale infrastructure make them ideal for bridging the urban-rural financial divide.

Market Growth Drivers

Several factors have contributed to the exponential growth of the Micro ATM market in India:

1. Government Push for Financial Inclusion

The Indian government's initiatives under schemes like Pradhan Mantri Jan Dhan Yojana (PMJDY) have led to a significant increase in the number of bank account holders, particularly in rural regions. However, these account holders often lack nearby access to bank branches or ATMs. Micro ATMs help fill this gap by enabling transactions in areas where physical banks are absent.

2. Rise in Digital Transactions

India has been witnessing a surge in digital payments since the demonetization drive in 2016. This cultural shift towards cashless transactions has laid the groundwork for alternative banking solutions. Micro services offered through Micro ATMs allow rural populations to engage in digital transactions even in the absence of smartphones or internet access, ensuring greater inclusion.

3. Banking Correspondent (BC) Model Expansion

The proliferation of banking correspondents across India has fueled the deployment of Micro ATM devices. These BC agents, equipped with Micro ATMs, act as the face of the bank in far-flung regions. They provide essential services such as deposits, withdrawals, and remittances, making financial services both personal and accessible.

4. Technological Advancements