#biotech investment advisors

Text

Earnings Catalysts Could Make These Stocks Rocket

🚀 Earnings Catalysts Could Make These Stocks Rocket 🚀

https://www.youtube.com/watch?v=b1jLKdCDW2A

Today I give you my top 3 stock setups going into earnings this week!

Some I have bought personally, others looks primed to explode!

Biotech's are super hot right now attracting a ton of hedge fund, smart money presence! Remember, when institutions see value and start buying, the street takes notes. Some tickers perform so well that they can be added to major index funds which will naturally cause more people to see value and buy the stock!

Any questions please ask!

TIMELINE:

0:00 Stock 1

2:01 Stock 2

3:37 Stock 3

✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1

✅ Stay Connected With Me:

👉 (X)Twitter: https://twitter.com/RealAvidTrader

👉 Stocktwits: https://ift.tt/a3no9He

👉 Instagram: https://ift.tt/lBLGJWq

==============================

✅ Other Videos You Might Be Interested In Watching:

👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader

https://youtu.be/pZAKJLk9o0I

👉 How My Subscribers Doubled Their Money Today!!!

https://youtu.be/s5M_OGv8AtM

👉 7 Great Value Stocks to Buy BEFORE They Explode!

https://youtu.be/0I451lsCjAc

👉 💥Super Cheap Penny Stock Can Run 3-5X FAST💥

https://youtu.be/4B3EK7lb38k

=============================

✅ About AvidTrader:

Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process!

Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services.

🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1

=====================

#stockstobuy #stockstobuynow #stockstowatch #stockstotradetomorrow #stockanalysis #stockmarketnews #stocknews #breakingnews #topstocks #topstockstobuynow #partnership #biotechstocks #millionaire #stockearnings #earningsreport #earningsweek #catalyst

Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock!

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use

© AvidTrader

via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA

May 07, 2024 at 05:55AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

2 notes

·

View notes

Text

Skyrocketing Stocks: Jaw-Dropping Predictions for the 2025 Share Market 🚀📈

Are you ready to take your investments to the next level? Buckle up, because we’re diving into the most anticipated stock market predictions for 2025. The financial landscape is set for some seismic shifts, and savvy investors need to stay ahead of the curve. Here's a deep dive into the trends and stocks that could make you a fortune in the next few years.

🌟 The Tech Titans: Dominating the Market

Technology stocks have been on a tear, and they show no signs of slowing down. By 2025, we predict that:

Artificial Intelligence (AI) companies will see unprecedented growth. Think beyond just the big names; emerging startups in AI and machine learning will offer incredible investment opportunities.

Blockchain Technology will revolutionize industries beyond cryptocurrency. Companies leveraging blockchain for supply chain management, security, and data integrity are set to soar.

Green Tech and Renewable Energy firms will be major players. With global shifts towards sustainability, stocks in solar, wind, and battery technology will be the ones to watch.

🏥 Health is Wealth: Biotech and Healthcare Surge

The pandemic has underscored the importance of healthcare innovation. Our 2025 predictions include:

Biotech Breakthroughs: Companies focusing on gene editing, personalized medicine, and biotech advancements are poised for massive growth.

Telehealth Expansion: The convenience and necessity of telehealth services will drive the growth of companies in this sector. Look for stocks that are innovating in virtual healthcare, remote diagnostics, and health monitoring.

💸 Financial Revolution: Fintech and Cryptocurrency

The financial world is undergoing a digital transformation. Key predictions for 2025 include:

Fintech Firms Flourish: Companies offering digital banking, payment solutions, and financial services will continue to disrupt traditional banking models. Stocks in this space are a must-watch.

Cryptocurrency Adoption: As cryptocurrencies gain mainstream acceptance, related stocks, including those in crypto exchanges, wallet providers, and blockchain infrastructure, will skyrocket.

🌐 Global Giants: International Market Leaders

Don't limit your portfolio to domestic stocks. Our 2025 predictions highlight the importance of international diversification:

Asian Markets: China and India will continue to be economic powerhouses. Companies in tech, manufacturing, and consumer goods from these regions will offer lucrative investment opportunities.

Emerging Markets: Countries in Southeast Asia, Africa, and Latin America are on the cusp of significant economic growth. Investing in diverse industries within these emerging markets could yield high returns.

📊 Strategy and Caution: How to Navigate 2025

While these predictions offer exciting prospects, it's crucial to approach 2025 with a strategic mindset:

Diversify Your Portfolio: Spread your investments across different sectors and regions to mitigate risk.

Stay Informed: Keep up with market trends, global news, and financial analyses to make informed decisions.

Consult Financial Advisors: Professional guidance can help tailor your investment strategy to your personal financial goals and risk tolerance.

🚀 Ready to Invest?

2025 promises to be a landmark year for the stock market. With the right strategies and a keen eye on emerging trends, you could be on the path to financial success. Don’t miss out on these investment opportunities – the time to start planning is now!

#StockMarket#MarketPredictions#2025Stocks#Investing#FinancialForecast#StockTips#MarketTrends#InvestmentStrategy#FutureStocks#BullMarket#ShareMarket#StockGrowth#MarketAnalysis#StockInvesting#FinancialGrowth#InvestmentPredictions#MarketOutlook#StockInsights#WealthBuilding#InvestSmart

0 notes

Text

What are some high return stocks?

Investing in individual stocks can potentially lead to high returns, but it's important to remember that it also comes with higher risk compared to diversified investments like index funds or ETFs. High return stocks often belong to companies with strong growth potential, innovative products or services, solid financials, and a competitive edge in their industry. However, these stocks can be volatile and may experience significant price fluctuations.

Here are some types of stocks that investors often consider for their potential for high returns:

Technology Stocks: Companies in the technology sector can offer high growth potential, especially those involved in areas like cloud computing, artificial intelligence, e-commerce, and software-as-a-service (SaaS). Examples include Apple Inc. (AAPL), Amazon.com Inc. (AMZN), Alphabet Inc. (GOOGL), and Microsoft Corporation (MSFT).

Biotech and Pharmaceutical Stocks: Biotechnology and pharmaceutical companies can see significant stock price movements based on the success of drug trials, FDA approvals, and breakthrough treatments. Examples include Moderna Inc. (MRNA), Pfizer Inc. (PFE), Biogen Inc. (BIIB), and Vertex Pharmaceuticals Incorporated (VRTX).

Consumer Discretionary Stocks: Companies that provide non-essential goods and services may experience strong growth during periods of economic expansion. This sector includes companies in retail, entertainment, travel, and luxury goods. Examples include Tesla Inc. (TSLA), Netflix Inc. (NFLX), Nike Inc. (NKE), and Starbucks Corporation (SBUX).

Renewable Energy Stocks: With increasing awareness of climate change and sustainability, companies involved in renewable energy, such as solar, wind, and electric vehicles, are gaining attention. Examples include Tesla Inc. (TSLA), NextEra Energy Inc. (NEE), Enphase Energy Inc. (ENPH), and Plug Power Inc. (PLUG).

Growth Stocks: These are companies that are expected to grow at an above-average rate compared to other companies in the market. Growth stocks may not always pay dividends but reinvest earnings to fuel further growth. Examples include Zoom Video Communications Inc. (ZM), Square Inc. (SQ), Shopify Inc. (SHOP), and Peloton Interactive Inc. (PTON).

While these stocks have the potential for high returns, it's crucial to conduct thorough research, consider your risk tolerance, and diversify your investments to mitigate risk. Additionally, past performance is not indicative of future results, so it's essential to invest with a long-term perspective. If you're uncertain, consider consulting a financial advisor before making investment decisions.

LTP Calculator Overview:

LTP Calculator is a comprehensive stock market trading tool that focuses on providing real-time data, particularly the last traded price of various stocks. Its functionality extends beyond a conventional calculator, offering insights and analytics crucial for traders navigating the complexities of the stock market.

Also Available on Play store - Get the App

Key Features:

Real-time Last Traded Price:

The core feature of LTP Calculator is its ability to provide users with the latest information on stock prices. This real-time data empowers traders to make timely decisions based on the most recent market movements.

User-Friendly Interface:

Designed with traders in mind, LTP Calculator boasts a user-friendly interface that simplifies complex market data. This accessibility ensures that both novice and experienced traders can leverage the tool effectively.

Analytical Tools:

Beyond basic price information, LTP Calculator incorporates analytical tools that help users assess market trends, volatility, and potential risks. This multifaceted approach enables traders to develop a comprehensive understanding of the stocks they are dealing with.

Customizable Alerts:

Recognizing the importance of staying informed, LTP Calculator allows users to set customizable alerts for specific stocks. This feature ensures that traders receive timely notifications about significant market movements affecting their portfolio.

Vinay Prakash Tiwari - The Visionary Founder:

At the helm of LTP Calculator is Vinay Prakash Tiwari, a renowned figure in the stock market training arena. With a moniker like "Investment Daddy," Tiwari has earned respect for his expertise and commitment to empowering individuals in the financial domain.

Professional Background:

Vinay Prakash Tiwari brings a wealth of experience to the table, having traversed the intricacies of the stock market for several decades. His journey as a stock market trainer has equipped him with insights into the challenges faced by traders, inspiring him to develop tools like LTP Calculator.

Philosophy and Approach:

Tiwari's approach to stock market training revolves around education, empowerment, and simplifying complexities. LTP Calculator reflects this philosophy, offering a tool that aligns with his vision of making stock market information accessible and understandable for all.

Educational Initiatives:

Apart from his contributions as a tool developer, Vinay Prakash Tiwari has actively engaged in educational initiatives. Through online courses, webinars, and seminars, he has shared his knowledge with aspiring traders, reinforcing his commitment to fostering financial literacy.

In conclusion, LTP Calculator stands as a testament to Vinay Prakash Tiwari's dedication to enhancing the trading experience. As the financial landscape continues to evolve, tools like LTP Calculator and visionaries like Tiwari sir play a pivotal role in shaping a more informed and empowered community of traders.

0 notes

Text

Unveiling the Most Anticipated IPOs of 2024: A Look into IPO Brains

IPO Brains: A Visionary Force in the Making

Founded on the principles of innovation and entrepreneurship, IPO Brains has rapidly emerged as a frontrunner in its respective industry. With a diverse portfolio of groundbreaking technologies and disruptive business models, IPO Brains epitomizes the spirit of forward-thinking enterprises. From cutting-edge biotech advancements to revolutionary fintech solutions, IPO Brains has positioned itself as a catalyst for transformative change.

Anticipated IPO Offerings: A Glimpse into the Future

As anticipation mounts for IPO Brains’ public debut, industry analysts and investors alike are eagerly speculating on the potential offerings that the company may unveil. With a track record of pioneering research and development, IPO Brains is poised to introduce a portfolio of innovative products and services that have the potential to reshape markets and drive sustainable growth.

Biotech Breakthroughs: Leveraging the latest advancements in biotechnology, IPO Brains aims to revolutionize healthcare with a diverse pipeline of novel therapies and treatments. From gene editing technologies to personalized medicine approaches, IPO Brains’ biotech offerings hold promise for addressing some of the most pressing medical challenges facing humanity.

Fintech Innovations: In the realm of financial technology, IPO Brains is poised to disrupt traditional banking and payment systems with its innovative fintech solutions. By harnessing the power of blockchain technology and artificial intelligence, IPO Brains aims to streamline financial transactions, enhance security, and promote financial inclusion on a global scale.

Sustainable Solutions: As the world grapples with environmental challenges, IPO Brains is committed to pioneering sustainable solutions that mitigate climate change and promote ecological stewardship. From renewable energy initiatives to eco-friendly manufacturing practices, IPO Brains’ sustainability offerings reflect its dedication to creating a better world for future generations.

Implications for Investors: Navigating the Opportunities and Risks

For investors seeking to capitalize on the potential of IPO Brains, careful consideration of both opportunities and risks is essential. While IPOs offer the opportunity to invest in early-stage companies with high growth potential, they also entail inherent risks such as market volatility and uncertainty. As such, investors should conduct thorough due diligence and consult with financial advisors to assess the suitability of IPO Brains’ offerings within their investment portfolios.

Conclusion: Embracing the Future with IPO Brains

As IPO Brains prepares to embark on its journey as a publicly traded company, the excitement and anticipation surrounding its debut are palpable. With a visionary approach to innovation and a commitment to driving positive change, IPO Brains is poised to captivate investors and redefine industries in the years to come. As we await the unveiling of IPO Brains’ offerings in 2024, one thing is certain — the future looks brighter with IPO Brains at the helm of innovation.

In conclusion, the upcoming IPO of IPO Brains in 2024 promises to be a watershed moment in the world of finance, ushering in a new era of growth, innovation, and opportunity. As investors eagerly await the debut of IPO Brains on the stock market, the potential for transformative change and substantial returns beckons those bold enough to seize the opportunity.

#IPOBrains2024#InvestingInnovation#FutureOfFinance#BiotechRevolution#FintechDisruption#SustainableSolutions#InvestmentOpportunity#MarketTransformation#IPOAnticipation#EconomicGrowth

0 notes

Text

How AI is Revolutionizing Investing and Asset Management

How AI is Changing the Way We Invest

I distinctly remember the first time I used an AI-powered investing tool. I had heard about these so-called "robo-advisors" and decided to give one a try to see if it could actually help manage my modest portfolio better than I could on my own. I linked my accounts, answered some questions about my risk tolerance and financial goals, and the robo-advisor got to work automatically balancing my investments and optimizing my returns. To say I was impressed would be an understatement! That experience got me fascinated with the incredible ways AI is transforming investing.

As an AI guru who’s been following these AI in investing developments closely over the past decade. I’ve seen first-hand how artificial intelligence and machine learning have revolutionized stock and portfolio management for everyone from retail investors like myself to big hedge fund titans on Wall Street. And we’re still just scratching the surface of what will be possible in the coming years!

Hyper-Accurate AI Market Analysis and Forecasting

One of the most remarkable capabilities AI tools offer investors is hyper-accurate market analysis and forecasting. By crunching huge troves of historical data and analyzing real-time news and financial statements, advanced machine learning algorithms can detect subtle patterns that allow them to make eerily accurate predictions about where the market and specific stocks are headed.

I remember one leading AI financial analysis tool, called Delta AI, correctly predicted the 2022 biotech crash and saved its users millions by recommending they shift assets away from healthcare weeks before the drop. This kind of prescience was unheard of before AI in investing!

AI Robo-Advisors Enhance Portfolio Management

Unlike my early experiments trying (and failing) to pick stocks myself, AI robo-advisors have the ability to look at the full picture and make expert decisions instantly. By considering your personal financial situation, risk attitudes, and dynamic market conditions, robo-advisors can automatically shift your portfolio holdings to balance risk versus reward and achieve your financial goals faster.

I tested out no fewer than 7 different robo-advisor platforms over the years. Though they took different approaches, all were able to generate higher net returns for me over a 5 year period than either index funds or professional human financial advisors. And the tax-loss harvesting algorithms some of them employed saved me thousands! Suffice to say, I’m now 100% sold on AI in portfolio management.

Democratizing Sophisticated Tools for All Investors

One of my favorite impacts of AI on investing has been seeing tools once restricted to hedge funds and other large institutions increasingly accessible to retail investors like myself. Things like quantitative analysis dashboards that alert me to short term arbitrage opportunities in undervalued securities. Or AI bots I can configure to trade currencies based on momentum signals used to be completely out of reach.

But thanks to user-friendly AI and automation, these sophisticated capabilities are being democratized! Last year, I collaborated with a fintech startup to build a simple algorithmic trading bot that runs on quant strategies typically restricted to Wall Street. Even with my limited coding skills, in just a weekend I made a bot that gives me a nice 5-8% return on asset trades automatically. The playing field is being leveled!

Of course, as optimistic as I am about the AI investing revolution, the ascendance of artificial intelligence does raise challenges and risks that have to be addressed...

Potential Risks and Downsides of AI-Powered Investing

One thing that worries me is the possibility of putting too much faith in AI predictions. The data underlying today’s trading algorithms doesn’t encompass historical crises and black swan events. This makes state-of-the-art machine learning models potentially susceptible to missing critical signals the next time an unprecedented crash occurs. We need to ensure a robust hybrid approach with human intuition still playing a key role.

There are also transparency issues around some AI systems making important financial recommendations or execution decisions without explanations humans can fully understand. And some jobs, like financial analysts, risk being displaced by AI. We must thoughtfully navigate these challenges and others as AI plays an increasing role allocating capital and driving growth.

The Outlook for an AI-Dominated Investing Future

Nonetheless, having lived through the initial phases of the AI investing transformation, I firmly believe we ain’t seen nothing yet! The most audacious forward-looking forecasts predict AI and automation supplanting as much as 90% of all human money managers worldwide by 2030. And I think they might be right!

Based on the accelerated capabilities I’m witnessing first-hand from today’s limited AI deployments in banking and asset management. It is entirely realistic to envision an investing landscape dominated by ultra-intelligent algorithms making markets, managing portfolios, and generating returns beyond what humans could achieve on our own. As AI matches and exceeds human intuition, it will claim an ever-increasing share of the pie.

Of course, this future raises deeper philosophical and economic questions around humans ceding such responsibility and power solely to artificial intelligences. It is critical we continue discussing and debating these issues even as AI drives incredible progress increasing access to financial tools and keeping markets efficient.

How you choose to utilize AI’s potential in your own investing is ultimately up to you. But however hands-on or hands-off an approach you decide to take, understanding both the current possibilities and future trajectory of AI in finance is essential. I hope this crash course has illuminated how these rapidly advancing technologies will shape investing and provided some guidance navigating the AI transformation ahead! The future is here...let the revolution begin!

How AI is Revolutionizing Workplaces and Liberating Employees

Read the full article

0 notes

Text

Upcoming IPOs of 2023: Promising Opportunities for Investors

The year 2023 holds exciting prospects for investors as a plethora of companies gear up for their Initial Public Offerings (IPOs). An IPO marks a pivotal moment in a company's journey, as it transitions from a private entity to a publicly-traded one. For investors, it presents a unique opportunity to own a piece of a potentially high-growth enterprise and participate in its success. Let's explore some of the highly anticipated upcoming IPOs of 2023 and the potential opportunities they offer.

Tech Unicorns:

The tech industry is set to dominate the IPO landscape in 2023, with several high-profile "unicorns" expected to go public. Unicorns are privately-held startups valued at over $1 billion. These IPOs garner significant attention as investors seek to invest in cutting-edge technologies and revolutionary business models.

Companies in sectors like artificial intelligence, cloud computing, fintech, and e-commerce are likely to lead the charge. Investors looking to capitalize on disruptive technologies and rapid market expansion may find these tech unicorns appealing.

Sustainable and Green Ventures:

The growing focus on sustainability and environmental consciousness has paved the way for an influx of green IPOs. Companies that emphasize environmentally-friendly practices and renewable energy solutions are attracting substantial interest from investors.

As climate change concerns drive policy shifts and consumer preferences, companies offering sustainable solutions could experience robust demand in the market. Investing in IPOs of eco-friendly ventures aligns not only with financial goals but also with a broader vision of creating a more sustainable future.

Healthcare and Biotech Innovations:

The healthcare and biotech sectors continue to witness groundbreaking innovations, with many companies actively working on cutting-edge treatments and therapies. The pandemic has highlighted the importance of healthcare research and development, accelerating the growth of this industry.

In 2023, we can expect IPOs from companies specializing in personalized medicine, gene editing, and novel drug development. Investors with an appetite for high-risk, high-reward opportunities may find potential gems in the healthcare and biotech sectors.

Electric Vehicles (EVs) and Autonomous Technology:

The automotive industry is undergoing a transformative phase, with electric vehicles and autonomous technology at the forefront of innovation. As governments worldwide promote clean energy and emission-reduction initiatives, EV companies are expected to thrive.

IPOs from electric vehicle manufacturers and autonomous technology developers may attract investors seeking exposure to the future of transportation. The race to revolutionize mobility presents significant opportunities for growth-minded investors.

Fintech and Digital Payments:

The rise of fintech and digital payments has reshaped the financial landscape, challenging traditional banking norms. As more consumers and businesses adopt digital payment solutions, fintech companies are gaining traction and garnering investor interest.

Upcoming IPOs in the fintech sector may include online payment platforms, blockchain-based financial services, and neobanks. Investing in this space provides exposure to the rapidly evolving financial technology ecosystem.

Opportunities and Considerations:

While upcoming IPOs of 2023 present exciting opportunities, investors must approach them with caution. Investing in IPOs involves inherent risks, such as price volatility, limited historical data, and uncertain market reception. Thorough research, analysis, and a clear understanding of the company's fundamentals are vital before committing funds to any IPO.

Diversification is key, and investors should spread their investments across various IPOs to mitigate risk. Additionally, seeking professional advice from financial advisors can offer valuable insights and guidance for constructing a well-balanced IPO investment strategy.

Conclusion:

The upcoming IPOs of 2023 promise an array of exciting opportunities for investors looking to participate in the growth stories of innovative and transformative companies. Tech unicorns, sustainable ventures, healthcare pioneers, EV disruptors, and fintech innovators are just some of the industries expected to make waves in the IPO market.

As investors, it is essential to approach IPOs with a discerning eye, considering factors such as the company's value proposition, market potential, and long-term growth prospects. While IPOs offer potential rewards, they also carry risks, and investors must make informed decisions based on their financial goals and risk tolerance.

By staying well-informed, conducting thorough research, and seeking professional advice, investors can navigate the world of upcoming IPOs and seize opportunities that align with their investment objectives. Embracing this dynamic market can set the stage for a rewarding and successful investment journey in 2023.

0 notes

Text

Emerging Job Opportunities in the Asia-Pacific Region: A Growing Workforce for Dynamic Industries

The Asia-Pacific region has experienced significant economic growth, fueled by its vibrant markets and technological advancements. As a result, numerous job opportunities have emerged across various industries, reflecting the region’s dynamism. Some of the promising job sectors in the Asia-Pacific region and highlights the key skills and trends driving employment growth.

Technology and IT: With the rapid digital transformation taking place in the Asia-Pacific region, the demand for technology and IT professionals has skyrocketed. Roles such as software developers, data analysts, cybersecurity specialists, and cloud computing experts are in high demand. Companies are seeking individuals skilled in programming languages, artificial intelligence, big data analytics, and cloud infrastructure to drive innovation and support digital initiatives.

E-commerce and Digital Marketing: The rise of e-commerce platforms and the growing online consumer base have led to a surge in job opportunities in the e-commerce and digital marketing sectors. Companies are actively hiring professionals with expertise in online sales, digital advertising, search engine optimization (SEO), social media marketing, and content creation. The ability to navigate various e-commerce platforms and understand consumer behavior in the region is highly valued.

Renewable Energy and Sustainability: The Asia-Pacific region is increasingly focusing on sustainable development and renewable energy sources. As a result, job opportunities in sectors such as renewable energy generation, energy efficiency, and environmental consulting have expanded. Engineers, project managers, policy analysts, and researchers with expertise in solar, wind, hydro, and other clean energy technologies are in demand to drive the transition to a greener future.

Financial Services and Fintech: As financial markets continue to evolve, the demand for skilled professionals in the financial services and fintech sectors has grown significantly. Roles such as financial analysts, investment advisors, risk managers, and fintech specialists are sought after. The ability to adapt to emerging technologies, such as blockchain and digital payment systems, is essential for professionals looking to thrive in this sector.

Healthcare and Biotechnology: The Asia-Pacific region’s rapidly aging population and increasing focus on healthcare have resulted in a growing demand for healthcare professionals and biotechnology experts. Job opportunities in healthcare management, medical research, pharmaceuticals, biotech development, and telemedicine are expanding. Professionals with expertise in genetics, bioinformatics, data analysis, and personalized medicine are particularly sought after.

Creative Industries: The creative industries, including design, advertising, media, and entertainment, are flourishing in the Asia-Pacific region. The demand for graphic designers, UX/UI designers, content creators, video editors, and digital marketers is on the rise. Companies are seeking professionals who can create compelling visual and digital experiences to engage diverse audiences in this rapidly growing market.

The Asia-Pacific region presents a wealth of job opportunities across diverse sectors, driven by economic growth, technological advancements, and evolving consumer demands. Professionals with skills in technology, digital marketing, renewable energy, finance, healthcare, and the creative industries are well-positioned to take advantage of these emerging job prospects. As the region continues to evolve, individuals who embrace lifelong learning, adapt to new technologies, and cultivate a global mindset will be at the forefront of the dynamic and rewarding job market in the Asia-Pacific region.

1 note

·

View note

Text

$1 Penny Stock is Anticipating MASSIVE News With $32 Billion Dollar Biotech THIS WEEK!

$1 Penny Stock is Anticipating MASSIVE News With $32 Billion Dollar Biotech THIS WEEK!

https://www.youtube.com/watch?v=yvGbl2KN1Ms

This week can be explosive for this small penny stock as they anticipate massive news with a thirty billion dollar biotech giant!

✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1

✅ Stay Connected With Me:

👉 (X)Twitter: https://twitter.com/RealAvidTrader

👉 Stocktwits: https://ift.tt/ykX3PYn

👉 Instagram: https://ift.tt/EdaFXMu

==============================

✅ Other Videos You Might Be Interested In Watching:

👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader

https://youtu.be/pZAKJLk9o0I

👉 🧨GameStop Short Squeeze 2.0 Incoming??🧨

https://youtu.be/XeFVaq4BHfU

👉 🙌💎 When Should You Diamond Hand a Stock? 💎🙌

https://youtu.be/ZO62i0cq0PQ

👉 This Penny Stock is a GUARANTEED Double!!

https://youtu.be/Yx6wZNz95dM

=============================

✅ About AvidTrader:

Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process!

Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services.

🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1

=====================

#smallcapstocks #microcapstocks #buyingstocks #stockanalysis #stocktobuy #stockstobuynow #stocksfortomorrow #stockstowatch #shortsqueeze #valuestocks #shortinterest #technicalanalysis #memestocks

Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock!

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use

© AvidTrader

via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA

May 20, 2024 at 04:12AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

0 notes

Text

The Best Financial Investments in Healthcare

Healthcare is one of the most profitable sectors in the world, and there are plenty of investment opportunities to be had too. When investing, you don’t need to start with thousands or even hundreds. You can look for smaller platforms that allow you to put less in, so you can slowly build up your investments over time.

Photo by Myriam Zilles on Unsplash

The healthcare business investment possibilities cover everything from medical supply manufacturers, technology companies, service providers, pharmaceuticals, and even assisted living business opportunities.

How can you invest in healthcare?

There are several ways that you can invest in healthcare; some of them you may have heard of, while others might be nice.

REITs are healthcare real estate and involve things like seniors living, medical offices and hospitals, or other medical facilities.

ETFs are healthcare exchange-traded funds, which means you can gain access to many companies but a single product.

Stocks are something that most people are comfortable with and understand, and there are a lot of options and sub-industries within the healthcare field that are open to investments.

Directly into a business is as possible and will give you a more hands-on role.

Should you always invest in the most expensive stocks?

There is a big difference between the most valuable stock and the most expensive. Expensive stock can be hundreds or thousands per single stock, and that gives you a relatively small position to start with.

Keep in mind that during the big gold rush, people made money in two ways, one was the shovels used to dig, and the other was the digging itself. In the care of healthcare, you can look at the supply chain and look for a lower-cost stock.

And not all expensive stocks are good stock.

What industries can I look at within the healthcare sector?

Healthcare is a broad term when it comes to just how many opportunities there are for investment.

Pharma, BioTech & Life Sciences

Life sciences and tools are clinical testing, research services, and analytical tools.

Biotechnology developed vaccinations and other products from live organisms.

Pharmaceuticals research and development, plus production of products like pills and vaccines from artificial sources

Healthcare Equipment and Services

Healthcare technology is companies that offer technological tools and services to the sector, platforms, programming and systems, and others.

Healthcare providers and services are things like wholesalers, insurers, healthcare products, those that provide healthcare services, and even distributors.

Equipment and supplies like bandages, needles, machines, beds, and stethoscopes.

The healthcare sector is always going to grow; people live longer than ever now, and with new technology, there are serious advancements in treatments and medication. We will likely see more breakthroughs, so investing in.

It would be best if you always kept in mind that when you make investments, it should never be more than you are prepared to lose, and seeking further financial information and advice from an advisor is a good idea.

There are a couple of things you can do to help yourself get investment ready, too; here are 3 Things You Need To Do Before Investing — corruption.

0 notes

Text

Petrichor Capital Management

Website: https://petrichorcap.com/

Address: 885 3rd Ave 24th floor, New York, NY 10022

Petrichor Capital Management is a life science venture capital firm that partners with healthcare managers and businesses to provide them with investment structures and support. This accomplished life science private equity team at Petrichor Capital Management makes structured equity and credit investments in the healthcare sector, focusing on the biotech space. They work with a wide range of companies, both private and public, helping them reach their goals of long-term growth through tailored investments. Petrichor acts as a strategic advisor by partnering with managers and boards or directors, as well as other investors, to provide capital solutions that enable healthcare innovators to reach their financial goals and grow their companies.

Finance #life science venture capital firms #life science private equity #life science angel investors

Linked In: https://www.linkedin.com/company/petrichor-capital/

1 note

·

View note

Text

Billionaire Ray Dalio Says Bitcoin Isn’t an Effective Money, Store of Value, or Medium of Exchange

Billionaire Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater Associates, says it’s “amazing” what bitcoin has accomplished but believes the cryptocurrency is not going to be an effective money, a store of value, or a medium of exchange. Nonetheless, he stressed that “we are in a world in which money as we know it is in jeopardy.”

Billionaire Ray Dalio on Bitcoin

Billionaire investor and hedge fund manager Ray Dalio, who founded the world’s largest hedge fund, Bridgewater Associates, and previously served as its co-chief investment officer, has offered his view on bitcoin in an interview with CNBC Thursday. Referring to the world’s largest cryptocurrency, he said:

I think it’s been quite amazing that for 12 years it’s accomplished … But I think it has no relation to anything … It’s a tiny thing that gets disproportionate attention.

Noting that bitcoin’s total market value is less than a third of Microsoft’s stock, whose market cap stood at $1.92 trillion on Friday, Dalio asserted: “Biotech and many other industries are more interesting than bitcoin.” The billionaire opined:

It’s not going to be an effective money. It’s not an effective storehold of wealth. It’s not an effective medium of exchange.

“But we are in a world in which money as we know it is in jeopardy … We are printing too much, and it’s not just the United States, all the reserve currencies,” he continued, mentioning problems with the euro and the Japanese yen in particular. “And so in that world, the question is, what is money and how’s that going to operate? So when we look at something like China’s renminbi, and then you take the digital renminbi, I think you’re going to see that become more and more a thing,” Dalio shared.

The Bridgewater Associates founder stressed, “if you want a digital currency, you have to do something different” from bitcoin. However, he noted: “I don’t think that the stablecoins are good because then you’re getting a fiat currency again.” He added:

What would be best is an inflation-linked coin. In other words, something where basically you would say, okay, this is going to give me buying power because every individual wants. What do they want? They want to secure their buying power.

“The closest thing to that is an inflation index bond and so on,” Dalio said. “But if you created a coin that says, okay, this is buying power that I know I could save in and put my money over a period of time, and then I can transact in anywhere, I think that that would be a good coin,” he continued. “So I think you’re going to see probably the development of coins that you haven’t seen that probably will end up being attractive, viable coins. I don’t think bitcoin is it.”

Many People Disagree With Ray Dalio

Following Dalio’s interview, many people took to Twitter to disagree with him. Some people noted that Dalio just described bitcoin while others pointed out that Bitcoin has been around for more than 14 years, not 12 like the Bridgewater founder said.

“An ‘inflation-linked currency’ is nonsense,” bitcoin proponent Robert Breedlove commented. “Lesson for Ray Dalio: Money’s buying power is preserved through the integrity of its supply. Bitcoin has a perfectly integral money supply of 21M. In the long run, bitcoin is the perfect money for preserving buying power over time.”

Gabor Gurbacs, strategy advisor at Vaneck/MVIS tweeted: “Ray Dalio is wrong about Bitcoin. I respect Ray’s work and like his books, but his comments on Bitcoin are under-researched and disappointing.” Gurbacs added:

Ray’s views particularly on bitcoin market sizing, reach and importance are concerning. Tens of millions of people use bitcoin around the world, particularly in emerging markets. Bitcoin’s censorship resistance is game-changing.

Dalio used to have a more bullish outlook on bitcoin. In January 2021, he said: “I believe bitcoin is one hell of an invention. To have invented a new type of money via a system that is programmed into a computer and that has worked for around 10 years and is rapidly gaining popularity as both a type of money and a storehold of wealth is an amazing accomplishment.” In February last year, he confirmed that he has “a tiny percentage” of his portfolio in cryptocurrency.

Nonetheless, he has repeatedly warned that governments can ban bitcoin if the cryptocurrency “becomes material,” predicting that crypto will be “outlawed, probably by different governments.”

What do you think about the statements by billionaire Ray Dalio? Let us know in the comments section below.

Read the full article

0 notes

Text

Petrichor Capital Management

Website: https://petrichorcap.com/

Address: 885 3rd Ave 24th floor, New York, NY 10022

Petrichor Capital Management is a biotech investors firm that partners with healthcare managers and businesses to provide them with investment structures and support. Petrichor has built a team of professionals who have worked for some of the biggest names in finance, completed over 80 investments totaling more than $5 billion in invested capital, and held over 30 board seats. This accomplished team at Petrichor Capital Management makes structured equity and credit investments in the healthcare sector, focusing on the biotech space. They work with a wide range of companies, both private and public, helping them reach their goals of long-term growth through tailored investments. Petrichor Capital Management acts as a strategic advisor by partnering with managers and boards or directors, as well as other investors, to provide capital solutions that enable healthcare innovators to reach their financial goals and grow their companies.

Finance #biotech venture capital firms

LinkedIn: https://www.linkedin.com/company/petrichor-capital/

1 note

·

View note

Note

My husband and me live in Glasgow. We would like to buy a house following sharia rule. We are both PhD holder ls working in biotech companies. Can we discuss? If I have understood you can offer a mortgage with a deposit of a minimum of 15%?

We cannot currently assist on properties in Scotland.

If you wish to buy a property in England or Wales (maybe for investment purposes or you plan to move), then e can assist. Please book an appointment to speak to one of our advisors.

0 notes

Photo

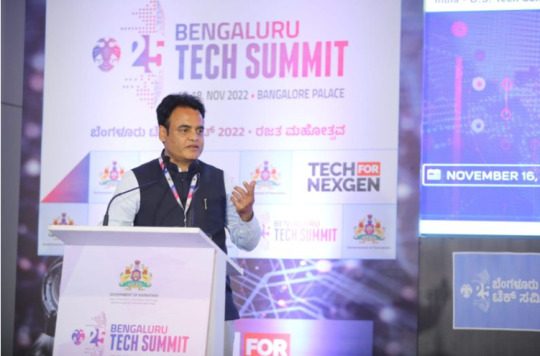

The 25th edition of India’s flagship event and Asia’s most prestigious tech summit, the Bengaluru Tech Summit, was held from the 16th-18th of November 2022 at Bangalore Place. Global Talent Exchange participated in the Startup Program of the event.

Here’s a recap of our exhilarating experience!

The theme of the 3-day event was #Tech4NextGen, a topic that has been gaining prominence and becoming increasingly relevant with India’s massive progress in the emerging tech domain.

BTS sought to bring together over 350 industry leaders from around the world, research think tanks, academics as well as policymakers to engage in discussion and explore the opportunities that lie before us and the vision as well as the path we must take to help the country achieve its goals at the earliest. Innovation is rampant and it’s essential to now put collaborative efforts on a pedestal.

Some of the important focus areas of the event included mRNA, Life sciences, MedTech, Vaccine Equity, Agriculture, Cellular immunotherapies, biotechnology, Biotech, and much more. This was also intended to serve as a platform to celebrate the different startups that are working on resolving problems that face humanity at large and are driving change with the use of technology.

In addition, the Bengaluru Tech Summit, with over 575 exhibitors, has often been regarded as a wonderful event for people to network, make strong connections, ignite partnerships and increase their awareness about the latest trends in this amazing industry.

The event was kicked off on a high note with a virtual inaugural address by Hon’ble Prime Minister Narendra Modi.

A key message of his speech was that India has been revolutionized in several ways- it is now no longer known for red tape, but the country has laid out a “red carpet” for investors. Bengaluru is now the 5th city in the world that garners and attracts the most venture capital investments, due to the large number of immersive tech firms that the area has given birth to.

“From reforming the foreign direct investment to offering the ease of doing business and increasing the production incentive schemes in various sectors, India’s excellent factors can bridge your investment and our innovation.”

PM Modi also extensively talked about using innovation for global good and mentioned that our country is using it as a weapon to defeat poverty. Technology is highly regarded as an exclusive domain- available only to the cream of the crop or the privileged few in society. However, India has attempted- and largely succeeded- to democratize tech in order to reach the furthest corners of our diverse society.

Hon’ble Chief Minister Of Karnataka, Shri Basavaraj Bommai, was also present at the event. During his address, he announced that Karnataka would be developing six new “high-tech” cities as well as a startup park. He declared that the state would now turn its focus toward setting up top-notch universities and research centers, as part of their contribution toward supporting and boosting India’s tech industry.

CM Bommai also highlighted the importance of sustainable innovation- resources are dwindling, and the brilliant minds of society must get together to formulate solutions to save the planet- “Global thinking” is what he called it.

A major highlight of the event was the insightful sessions and panel discussions.

Prof. Ajay K Sood, Principal Scientific Advisor, Government of India, talked about the Convergence of Technological Revolution for advancing India's growth trajectory. There was also an interesting dialogue on India’s power in the emerging tech, which covered key elements like the Indian opportunity to utilize AI for good, how the “make in India” program can benefit the world, as well as data science as a significant lever that is driving semiconductor innovation in the country for a better future.

BTS left no stone unturned to take up every new-gen technology and explore its potential to the fullest.

There were also a few sessions that took up the strategic relationship between India and the U.S. with regard to the critical and emerging tech domains- cyber, artificial intelligence, quantum, 5G, 6G, space hardware, biotech, and more. These two scientifically rich communities must collaborate to build up the global science and tech ecosystem, and strengthen national ties in the process.

Shri Rajeev Chandrasekhar- Hon'ble MoS for Ministry of Electronics and Information Technology

Dr. Ashwath Narayan C N- Hon’ble Minister for Electronics, IT, BT and S&T, Higher Education, Skill Development, Entrepreneurship & Livelihood

Circling back, Global Talent Exchange was represented at the event by our Bangalore team. We utilized the opportunity of this incredible platform to network and connect with several industry professionals, igniting fascinating conversations and broadening our understanding of the realm.

GTX is a next-gen tech platform that is working toward enhancing the global brain circulation phenomenon. In the fast-evolving technology ecosystem, India has a huge opportunity to become the digital talent hub of the world

However, there is one challenge that remains- the ginormous talent gap!

Global Talent Exchange eliminates this obstacle by ensuring Indian organizations have access to highly skilled tech talent from around the world, enabling them to scale and compete internationally. We use our network to map and source people from skill-rich global talent hubs and provide our clients access to this pool to find the perfect fit for their team.

Human capital is an incredibly valuable asset for companies, especially in such a stage of constant growth and development as India is in right now. This asset is becoming incredibly mobile, and the diaspora is garnering knowledge, skills, and experience and returning back to their homeland to contribute meaningfully to society.

Our flagship ‘Return To India’ program provides a platform for NRIs across the world to connect with organizations back home and find suitable opportunities, wherein their global exposure is celebrated and utilized for growth.

Download a free eBook:

The NRI Guide For A Seamless Return To India

On the whole, we are grateful to have attended an event of such grandeur and significance.

Empowered, motivated, and re-energized, we’re geared up to drive change and make a difference in this space.

Join us on our mission to bridge the global talent gap by following us on our social media channels:

LinkedIn: https://www.linkedin.com/company/globaltalex/

Instagram: https://www.instagram.com/globaltalex/

Twitter: https://twitter.com/globaltalex

0 notes

Text

Transitioning from SPECT to PET Technology: Positron $POSC

Transitioning from SPECT to PET Technology: Positron $POSC

https://www.youtube.com/watch?v=Nb98XF4at6g

https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA?sub_confirmation=1

Full Video & Breakdown of Positron: Ticker $POSC

https://youtu.be/42AI9djkN0s

✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1

✅ Stay Connected With Me:

👉 (X)Twitter: https://twitter.com/RealAvidTrader

👉 Stocktwits: https://ift.tt/6QyiXDw

👉 Instagram: https://ift.tt/3EY09hN

==============================

✅ Other Videos You Might Be Interested In Watching:

👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader

https://youtu.be/pZAKJLk9o0I

👉 How My Subscribers Doubled Their Money Today!!!

https://youtu.be/s5M_OGv8AtM

👉 7 Great Value Stocks to Buy BEFORE They Explode!

https://youtu.be/0I451lsCjAc

👉 💥Super Cheap Penny Stock Can Run 3-5X FAST💥

https://youtu.be/4B3EK7lb38k

=============================

✅ About AvidTrader:

Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process!

Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services.

🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1

=====================

#pennystocks #fdaapproval #healthcareinnovation #biotech #investmenttips #marketgrowth #positronpet #financialgrowth #spectrum #cardiovascular #positron #bigpharma #biotechstocks

Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock!

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use

© AvidTrader

via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA

May 12, 2024 at 01:57AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

0 notes

Text

Stocks to buy now

#Stocks to buy now for free#

This site does not include all companies or products available within the market. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources.

#Stocks to buy now for free#

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective. The author(s) held no positions in the securities discussed in the post at the original time of publication. That’s why financial advisors recommend them for most people. These are less swayed by the individual ups and downs of any one company but provide solid, steady long-term growth. Instead, consider purchasing exchange-traded funds ( ETFs) or index funds that track diversified indexes focused on the healthcare sector. While the large-cap stocks listed above can be very safe bets, more volatile small-cap biotech stocks can be incredibly risky investments.īut really, buying any individual stock is a risky game. When you’re considering a new investment, in healthcare stocks or any other market sector, doing your due diligence is always the first step. But if you have a 401(k), you’ll likely instead have to look into mutual funds that focus on the healthcare industry, rather than individual stocks. Retirement investors can buy healthcare stocks in tax-advantaged retirement plans, like individual retirement accounts ( IRAs). If you don’t already, check out our listing of the best online brokerage accounts to get started. If you have a regular brokerage account, you can easily add healthcare stocks to your taxable investment portfolio.

0 notes