#StockTips

Explore tagged Tumblr posts

Text

Stay Updated with the Latest News! 🚨

Want the latest on Ford Employee Discounts, Tesla Stock Price, Vanguard, and more? Visit our blog for quick, fresh updates on the hottest trends and breaking news in the USA!

💥 Why Visit?

Exclusive Insights on Tesla, Ford, and Vanguard.

Engaging Articles with the news that matters most to YOU.

👉 Don't miss out—check out our blog now! Link here

#StayInformed #HotTrends #USA

#TrendingNow#BreakingNews#USA#StockMarket#Tesla#Ford#Vanguard#TechNews#Finance#Investment#Crypto#StockTips#BusinessNews#NewsAlert#MarketUpdate#Innovative#Entrepreneur#Motivation#Economy#GlobalTrends#FinancialFreedom#TechSavvy#Lifestyle#CurrentEvents#FutureOfBusiness#SocialMedia#TechnologyUpdates#BuzzWorthy

4 notes

·

View notes

Text

How to Pass a Prop Firm Challenge: Tips from Funded Traders

If you’re dreaming of becoming a professional trader but don’t have a large account to start with, a funded prop firm like 49 Funded might be your best opportunity. These firms provide traders with access to significant capital once they prove their skills through a challenge. Passing a prop firm challenge isn’t easy—but it’s very achievable with the right mindset and strategy. In this guide, we’ll break down how to pass a prop firm challenge, featuring tips from traders who have already secured a funded account.

Whether you’re just starting or have failed challenges before, this article will give you real, actionable advice to help you succeed with a prop firm with a funded account.

1. Understand the Rules and Stick to Them

Every funded prop firm has a set of trading rules you must follow. These usually include:

Maximum daily drawdown

Overall drawdown limits

Minimum trading days

Profit targets

Trading during news restrictions

Traders often fail challenges not because of bad strategies but due to rule violations. At 49 Funded, traders are encouraged to fully understand all evaluation metrics before placing a single trade.

Tip from a funded trader: “I printed out the rules and taped them to my wall. It saved me from making emotional decisions.”

2. Treat the Challenge Like a Real Account

One of the most common mistakes traders make is treating the challenge as a video game. It’s not. If you want to get funded, trade like you’re managing real capital from day one.

Keep your risk per trade low (typically 0.5% to 1%). Overleveraging or revenge trading might get you a short-term win, but it won’t help you pass the challenge in the long run.

49 Funded Insight: Many successful traders at 49 Funded say this mindset shift was a turning point. They stopped chasing profits and started managing risk like professionals.

3. Stick to High-Probability Setups Only

You don’t need to take 10 trades a day to hit the profit target. You just need consistent, high-quality setups. Passing a prop firm challenge is about proving consistency, not hitting home runs.

Tip from a funded trader: “I passed my challenge with just 15 trades over 20 days. Each setup met all my criteria.”

Develop a trading plan that includes:

Your ideal trade setups

Entry and exit rules

Risk/reward ratios

How to handle different market conditions

When you stick to your edge, your results become more predictable and sustainable.

4. Use a Trading Journal

Tracking your trades isn’t optional—it’s essential. A trading journal helps you identify patterns, strengths, and weaknesses.

Record every trade, including:

Why you took the trade

Entry and exit points

Risk-to-reward ratio

Emotional state before and after the trade

49 Funded Suggestion: Many funded traders with 49 Funded use journaling to improve performance and build emotional discipline.

5. Control Your Emotions

Prop firm challenges are a test of mental endurance as much as they are of trading skill. Emotional discipline separates consistent winners from those who fail repeatedly.

Avoid:

Revenge trading after a loss

Overtrading when you’re close to the profit target

FOMO (fear of missing out) during volatile markets

Tip from a funded trader: “My worst day came when I tried to ‘make back’ losses. I nearly failed. Now I walk away after a loss and reassess.”

Learn to walk away when your emotions are heightened. The best traders know when not to trade.

6. Use the Full Duration

Don’t rush the process. Many prop firms give you 30 days or more to complete the challenge. Use that time wisely.

At 49 Funded, traders often succeed by trading slowly and waiting for only the best setups. Trying to pass in a few days increases your risk of hitting drawdown limits.

Strategy Tip: Spread your trades over multiple days. Trade small. Focus on longevity and consistency.

7. Practice First with a Trial or Demo

Before taking on a real evaluation, practice under similar conditions on a demo account. Simulate the rules of the challenge so you get comfortable with the parameters.

49 Funded offers trial challenges, which many traders use to fine-tune their strategies before committing real money.

8. Know When to Take a Break

If the market is choppy, your edge isn’t showing up, or you’re emotionally drained, the best move may be to do nothing.

Tip from a funded trader: “On bad days, I walk away. No trade is better than a forced trade.”

Give yourself the mental space to reset. Some of your best trading days will come after a well-timed break.

9. Learn from Others Who’ve Been Funded

One of the best ways to pass a challenge is to study those who already have. 49 Funded often shares case studies and interviews with funded traders. Learn from their successes and mistakes.

Common traits of successful funded traders:

Strong risk management

Patience and discipline

A well-tested strategy

Consistent journaling

These aren’t superpowers—they’re habits you can build.

10. Stay Consistent Post-Challenge

Passing the challenge is just the beginning. To keep your funded account, you need to trade with the same consistency and discipline. 49 Funded supports traders with performance monitoring tools and community coaching to help maintain long-term success.

Final Thoughts: Your Funded Account Awaits

A prop firm with a funded account gives you the capital you need to trade like a professional���without risking your own money. But to get there, you need to pass the challenge. With the right plan, emotional discipline, and a clear understanding of the rules, success is within your reach.

At 49 Funded, we believe in empowering skilled traders to reach their potential. If you’re ready to take the next step and earn a funded account, our structured evaluations and trader support tools are designed to help you win.

Start your journey with a funded prop firm today. Learn more at 49 Funded.

#prop trading app#prop trading firms#stock market#stock trading#stock#stocktips#trusted prop firms#prop firms#best funded prop firms#instant funding prop firm#best prop trading firm

0 notes

Text

youtube

Are you looking for the best AI stock platforms and stock market apps for beginners? Discover how AI-driven investing is changing the game! This video breaks down how AI trading bots help buy and sell stocks, the role of AI in stock market investing, and how you can invest in a rising fintech company through StartEngine crowdfunding.

💡 What You'll Learn: ✅ How to invest in stocks with AI bots for smarter trading ✅ The best AI stock platforms for beginners and experienced traders ✅ How AI-powered stock apps analyze the market and execute trades ✅ The role of AI in buying and selling stocks automatically ✅ AI companies on the stock market and emerging fintech opportunities ✅ How StartEngine enables investors to own a stake in innovative startups

🔍 Whether you're an investor exploring good trading apps or someone interested in alternative investing opportunities, this video provides valuable insights into AI-driven stock investing.

📢 Subscribe for more AI investing insights & fintech updates!

Best AI Stock Market Apps for Beginners & Pro Traders

#AIStockTrading#InvestWithAI#StockMarketApp#AITradingBot#BestInvestingApps#Crowdfunding#AIFinance#SmartInvesting#StockMarketNews#TradingApp#AIMarket#StockInvesting#Fintech#AIStocks#PassiveIncome#InvestingWithAI#FinancialFreedom#AlgoTrading#TradingBots#StockTips#StartEngine#InvestNow#Youtube

0 notes

Text

SEBI Registered RA’s False Promises: How We Helped Recover 50% Loss!

A SEBI Registered Research Analyst (RA) is authorized to provide and publish stock tips and recommendations. However, unlike Investment Advisors, an RA cannot offer customized or personalized advice to individual clients.

In simple terms, the key skill of an RA is research—whether it’s fundamental or technical. This research is published and made available to clients who pay for the service.

Seems straightforward, right?

Unfortunately, many beginners are unaware of these distinctions and get trapped by misleading schemes or advice from RAs.

This is exactly what happened to Arif (name changed), a beginner stock market learner. One day, he received a call from a Research Analyst and was trapped in a profit-sharing scheme, resulting in a loss of nearly ₹1,00,000.

Here’s the complete story of how it all unfolded and how our team helped Arif recover 50% of the lost amount from the Research Analyst.

How Arif Got Trapped in the Wrong Advisory Services

Arif had developed an interest in learning about the stock market and had registered for a webinar after seeing an ad on Instagram. Soon after, he received a call from Mumbai.

The call was from the office of a SEBI-registered Research Analyst. The caller, Irshad (name changed), offered Arif their services, assuring him that he wouldn’t need to pay any fees upfront. Instead, they would share any profits made from stock tips on a 60:40 basis.

But any registered or unregistered advisory working on profit profit-sharing model is itself a big red flag. But again Arif was not aware of the same.

Initially, Arif wasn’t interested, as he wanted to focus on learning and only had a limited capital of ₹40,000. But Irshad convinced him by calling him regularly and asking him to start small. He promised that, after making some profits, Arif could invest more and assured him that losses would be recovered in future trades.

To lure him further, Irshad shared the PnLs of other clients. Impressed by the profit value and the promises, Arif eventually agreed to take the service.

In the beginning, Arif made some profits and, as agreed, shared 40% of them with the RA. But soon after he increased his capital, things took a turn.

One day, he faced a loss of ₹7,000, and the next, ₹20,000. Even when Arif wanted to square off his positions, Irshad convinced him to hold them without any stop-loss.

In total, Arif ended up losing ₹90,000 in capital and an additional ₹15,000 in profit-sharing payments. When he called Irshad for help, he was advised to add more capital to recover the losses.

By then, Arif had lost all his savings and no longer trusted the RA’s tips.

How We Helped Arif Recover ₹50,000

Arif reached out to our team for assistance in recovering his lost money.

We examined his case and verified the details of the SEBI-registered RA from the bank account information and SEBI registration number Arif had received. The RA was based in Kolkata, but all calls to Arif had come from Mumbai.

Our team drafted a detailed account of the incident and attached the available proof, although Arif had no call recordings since most conversations took place over WhatsApp. However, some chat messages between Arif and Irshad proved useful.

When we emailed the RA, they initially agreed to settle the matter by repaying ₹30,000. But Arif insisted on recovering a larger portion of his lost savings.

Soon after, the RA denied all allegations and sent an email stating that neither he nor his team had promised guaranteed returns or engaged in profit sharing.

This led us to escalate the case to SEBI. We lodged a complaint in SCORES platform. After a few days, SEBI requested additional evidence. Fortunately, Arif had some of the necessary documents, and we were able to strengthen our case.

Upon submitting the missing proofs to SEBI, the RA called back and offered to settle for 50% of the amount lost. Finally, Arif agreed on this amount.

What Arif Learned From This?

Although Arif didn’t recover his entire loss, the experience taught him a valuable lesson: never blindly trust any registered entity, no matter how official they seem.

Instead, focus on learning and gaining knowledge before entering the stock market.

#StockMarket#InvestmentTips#SEBI#ResearchAnalyst#StockMarketScams#InvestorAwareness#TradingTips#FinancialFraud#ProfitSharingScam#StockAdvisory#SEBIRegulations#MarketEducation#InvestmentAwareness#ScamAlert#StockTips

0 notes

Text

How to Invest in Stocks: A Beginner’s Guide for Getting Started

The first thing to consider is how to start investing in stocks the right way for you. Some investors choose to buy individual stocks, while others take a less active approach. read more

#StockMarket#InvestingForBeginners#StockInvesting#FinancialLiteracy#InvestSmart#WealthBuilding#PersonalFinance#StockTips#BeginnerInvestor#Investing101

0 notes

Text

PM Modi Inaugurates Bharat Mobility Global Expo 2025: A Boost to India's Mobility Ecosystem

Prime Minister Narendra Modi inaugurated the Bharat Mobility Global Expo 2025 on January 17, 2025, at Bharat Mandapam, New Delhi. Touted as India's largest mobility event, the expo spans three prominent venues—Bharat Mandapam, Yashobhoomi, and the India Expo Center in Greater Noida—and runs from January 17 to January 22.

Themed "Beyond Boundaries: Co-creating Future Automotive Value Chain," the event focuses on fostering innovation and sustainability in the automotive sector. With over 100 new launches, the expo showcases vehicles, components, and technologies, offering a glimpse into the future of global mobility.

Sectors to Watch in the Stock Market

The Bharat Mobility Global Expo is set to influence various sectors in the Indian stock market. Here are key sectors and their leading companies to monitor:

1. Automobile Manufacturers

Maruti Suzuki India Ltd. (MARUTI): With the launch of its first electric SUV, e VITARA, Maruti Suzuki is poised to capture market share in the growing EV segment.

Tata Motors Ltd. (TATAMOTORS): A pioneer in India's EV space, Tata Motors continues to expand its portfolio, making it a key player to watch.

2. Auto Components and Suppliers

Motherson Sumi Systems Ltd. (MOTHERSUMI): A global supplier of automotive components, benefiting from the EV revolution.

Bharat Forge Ltd. (BHARATFORG): Renowned for its innovation in metal forming, Bharat Forge remains integral to automotive advancements.

3. Energy Storage and Battery Producers

Exide Industries Ltd. (EXIDEIND): As a leader in energy storage solutions, Exide is scaling production to meet EV demand.

Amara Raja Batteries Ltd. (AMARAJABAT): Its entry into lithium-ion battery manufacturing through strategic partnerships strengthens its growth potential.

4. Technology and Software Providers

Tata Elxsi Ltd. (TATAELXSI): Specializes in connected vehicle technologies and autonomous driving solutions.

KPIT Technologies Ltd. (KPITTECH): Focuses on software and engineering solutions for electric and autonomous vehicles.

Technical Levels: Pivot Points, Resistance, and Support

For investors, tracking pivot points, support, and resistance levels is crucial for identifying trading opportunities. Here are the key technical levels for major stocks in the highlighted sectors:

1. Tata Motors Ltd. (TATAMOTORS)

Pivot Point (P): ₹801.33

Resistance Levels:

R1: ₹828.02 – A strong breakout above this can push the stock to higher levels.

R2: ₹846.03 – Significant resistance, indicating a potential profit-booking zone.

R3: ₹873.72 – Marks a bullish trend continuation.

Support Levels:

S1: ₹783.32 – A critical support level; if breached, it may signal a bearish trend.

S2: ₹756.63 – Indicates deeper correction potential.

2. Tata Elxsi Ltd. (TATAELXSI)

Pivot Point (P): ₹6,242.97

Resistance Levels:

R1: ₹6,301.68 – A close above this can lead to a rally.

R2: ₹6,358.17 – Mid-term resistance; significant investor activity expected.

R3: ₹6,416.88 – Represents strong bullish momentum.

Support Levels:

S1: ₹6,186.48 – If breached, it signals potential downside.

S2: ₹6,127.77 – Indicates a critical correction phase.

3. Amara Raja Batteries Ltd. (AMARAJABAT)

Pivot Point (P): ₹635.20

Resistance Levels:

R1: ₹650.50 – Indicates bullish sentiment in the near term.

R2: ₹672.80 – Major resistance; sustained buying could break this level.

Support Levels:

S1: ₹622.10 – A breach could trigger further selling pressure.

S2: ₹605.50 – A long-term support zone for investors.

Market Outlook

The Bharat Mobility Global Expo 2025 represents a transformative phase for India's mobility sector, driving innovation, sustainability, and growth. From EVs to autonomous technologies, companies are positioning themselves for future opportunities.

Investors should watch:

Companies introducing EVs and related technologies.

Stocks with strong technical setups around pivot points and resistance/support levels.

Monitoring these metrics will help investors capitalize on growth trends and market momentum triggered by the expo.

Sources:

Reuters - Suzuki Motor President Says India to Be Global Production Hub for EVs

Top Stock Research - Tata Motors Pivot Point

#BharatMobilityExpo#PMModi#IndianStockMarket#ElectricVehicles#EVs#AutomotiveIndustry#StockMarketAnalysis#InvestingInIndia#IndianStocks#IndianEconomy#MobilityInnovation#SustainableTransport#GreenTech#IndianAutomobileStocks#TataElxsi#AmaraRajaBatteries#StockTips#InvestmentOpportunities#MobilityFuture

0 notes

Text

💡 Thinking about starting to invest in stocks?

Here's a simple guide to help you get started with your investment journey! 📈 Whether you're new to investing or looking to refine your strategy, it’s crucial to understand the basics, identify your goals, and take steps to make informed decisions. This article breaks it down step by step, from setting a budget to choosing the right platform! 💼

#Investing#StockMarket#InvestmentJourney#WealthBuilding#FinanceTips#InvestSmart#StockTips#FinancialFreedom#BeginnerInvestor

0 notes

Text

CW Stock: A Promising Investment Opportunity in 2024

(NYSE:CW) stock has gained attention for its growth potential. Investors are keen on its strong fundamentals and strategic positioning in the market. With consistent performance, it's becoming a top pick for value and growth investors.

Read more :

https://kalkinemedia.com/us/stocks/industrial

0 notes

Text

Prop Firm vs Personal Account: Which Trading Path Suits You Best?

Brought to you by 49 Funded – Where traders get the capital, tools, and structure they need to grow fast.

Introduction

The trading world isn’t one-size-fits-all. You’ve got choices—and they’re big ones. One of the most talked-about dilemmas in modern trading is this: should you grow your trading career through a prop firm like 49 Funded, or should you go it alone with a personal trading account?

Each path has its own rhythm, rules, and reward system. It’s not about which one is better overall—it’s about which one is better for you.

Why This Debate Matters: Prop Firm or Personal Account?

This decision impacts more than your strategy—it shapes your risk exposure, your growth speed, your financial freedom, and even your trading psychology. Whether you’re trading part-time or dreaming of full-time freedom, understanding the trade-offs between a prop firm and a personal account is critical.

Who This Blog Is For: New Traders, Aspiring Pros, and Curious Investors

This is for the curious minds and hungry traders. If you’re just dipping your toes into the markets, looking to upgrade from demo accounts, or you’ve been trading for a while but want to scale, this guide lays out the full picture.

49 Funded exists for exactly this purpose—to give traders an accessible, realistic way to trade big without needing a big bankroll.

What Is a Prop Firm?

Breaking It Down: The Basics of Proprietary Trading

A proprietary trading firm (like 49 Funded) gives you access to company capital to trade in financial markets. You’re not using your savings—you’re using the firm’s money under specific guidelines. Your job? Perform consistently, manage risk, and stay within the firm’s parameters. In return, you keep a large chunk of the profits.

How Prop Firms Make Money (And Share It With You)

At 49 Funded, traders can earn 50% of profits. That’s because prop firms thrive when you thrive. The firm keeps a share to cover risk and operations, but the lion’s share of the profit belongs to the trader. It’s a true partnership model, not a commission grind.

The Capital Advantage: Trading with the Firm’s Funds

This is the game-changer. Imagine trading $100K, $200K, or more—without ever risking your own money. That’s what prop firms like 49 Funded make possible. You get the buying power to trade like a pro, even if you’re just starting out with limited capital.

What Is a Personal Trading Account?

Total Control: You Call the Shots

With a personal account, you’re in the driver’s seat. There are no firm-imposed rules—just your own strategy, risk limits, and discipline. For some traders, that level of control is empowering. For others, it can be overwhelming.

Funding Your Own Growth: The Ups and Downs of Going Solo

Everything in a personal account comes out of your pocket. Growth is slow and capital constraints are real. But if you’ve got the patience and the funds, you’ll reap 100% of the rewards—eventually.

Risk, Reward, and Responsibility: It’s All on You

There’s no buffer here. Every dollar you trade is your own. Every loss stings—and every gain is fully yours. It’s a brutal but honest environment. For some, that’s exactly what makes it worth it.

Getting Started: Barriers to Entry

The Cost of Joining a Prop Firm: Fees, Challenges & Rules

At 49 Funded, getting funded means passing an evaluation. The process is designed to prove you can trade responsibly. Yes, there’s a fee—but it’s a fraction of what you’d need to fund a $50K or $75K personal account. And once you’re funded, there’s no hidden subscription or recurring cost. Just you and the market.

Opening a Personal Account: Requirements and Realities

Personal accounts are easy to open, but don’t confuse that with easy success. Many brokers will let you start with $100 or less, but real growth is slow without significant capital. And unlike a prop firm, no one’s there to guide you or help you level up.

What’s Easier to Start With—and Why?

If you’re looking to scale fast without risking your savings, a prop firm like 49 Funded is the more accessible route. Personal accounts give you freedom, but also more responsibility and slower progression—especially if your starting capital is small.

Risk and Reward: Who Carries the Weight?

Risk Management in Prop Firms: Safety Nets and Strict Limits

Prop firms like 49 Funded put rules in place to protect both the firm’s capital and the trader’s future. These rules—like daily drawdown limits and consistency checks—aren’t there to punish you. They’re designed to make sure you don’t blow up your account in one bad trade.

Solo Trading Risk: Freedom Comes at a Price

Without rules or oversight, it’s easy to spiral. One emotional trade can wipe out weeks—or months—of progress. Solo traders need ironclad discipline and an unshakable mindset. And even then, it’s a lonely path.

Profit Potential Compared: Can You Really Make More on Your Own?

With personal accounts, you keep 100% of your profit—but you’re often working with limited capital. At 49 Funded, you might split profits, but you can also access up to $75,000 in funding. That kind of capital can unlock earning potential that’s simply not feasible solo.

Access to Capital: How Big Can You Go?

Scaling Up with Prop Firms: Capital Access and Growth Potential

At 49 Funded, consistent performance means higher stakes. Many traders start with a $10K or $25K account and scale up as they prove themselves. You grow your account by mastering the process—not by adding more of your own money.

Trading with Your Own Funds: Slower Scaling but Full Ownership

Personal account growth depends on either adding more capital or compounding profits. It’s a slow grind that requires extreme patience and long-term vision. Worth it for some—but not for everyone.

Which Route Gets You to Bigger Trades Faster?

Prop firms like 49 Funded offer a shortcut to scale. If your strategy works, you can trade big from day one. With a personal account, it might take years to get to that level.

Support and Resources

Prop Firm Perks: Mentorship, Community, and Tools

At 49 Funded, you’re not just trading in isolation. You get access to a community of traders, performance dashboards, and expert support. It’s more than capital—it’s a learning environment built for progress.

Trading Alone: The DIY Learning Curve

Going it alone means building your own strategy, finding your own community, and troubleshooting every mistake solo. It’s a rewarding journey, but it’s also time-consuming and often frustrating.

Which Option Offers the Best Learning Environment?

If you want to accelerate your growth, learn from others, and get real-time feedback, a prop firm wins hands-down. Personal trading requires a longer learning curve—but it can develop deeper self-reliance over time.

Rules, Rules, Rules: The Limits You’ll Face

Prop Firm Restrictions: Daily Drawdowns, Targets, and Payout Caps

Prop firms, including 49 Funded, use rules to keep traders in check. These include drawdown limits, minimum trading days, and sometimes profit targets. They exist to promote consistency and reduce reckless trading.

No One’s Watching: The Freedom (and Danger) of Personal Accounts

Without rules, you’re free—but also exposed. Traders often struggle to self-regulate. Many blow accounts simply because there’s nothing stopping them from over-leveraging or revenge trading.

Do Rules Help or Hurt Your Trading Style?

For some, structure breeds success. For others, it feels like a leash. Know your personality—then choose your playground.

Psychological Impact: Mind Games and Money

Trading with Someone Else’s Money: Less Pressure or More?

Some traders perform better with firm capital. They feel detached from the fear of loss, which leads to clearer decisions. Others feel pressure to “prove themselves” and crack under the weight. 49 Funded’s rules are designed to balance this tension.

Emotional Rollercoaster of Personal Accounts: Every Loss Hits Harder

When it’s your money, every loss feels personal. That emotional load can either build resilience or break your resolve. It’s a test of mental stamina, every single day.

Which Setup Builds Better Trading Discipline?

Prop firms instill external discipline through rules. Personal accounts demand internal discipline through self-control. Both build muscle—just in different ways.

Payouts and Profit Sharing

How Prop Firms Split the Profits: What You Really Take Home

49 Funded offers up to a 90% profit share. That means if you earn $10,000 trading a funded account, you keep $9,000. It’s a high-reward model—if you can trade smart.

Personal Account Earnings: Keep 100%, But With a Catch

There’s no split—but there’s also no capital boost. That $500 profit on a $5,000 account might be satisfying, but it won’t move the needle fast. You’re limited by what you can afford to risk.

Short-Term Wins vs Long-Term Wealth Building

Use prop firms for acceleration. Use personal accounts for legacy. Many traders use both—earning with prop firms while building their own long-term portfolio on the side.

Long-Term Career Goals: What’s the Endgame?

Climbing the Ladder in a Prop Firm

At 49 Funded, scaling up can turn a side hustle into a serious career. Some traders start small and end up managing six-figure accounts. There’s room to grow—without risking your own savings.

Building Your Own Trading Empire from a Personal Account

Personal trading offers the allure of total independence. Over time, consistent compounding can lead to financial freedom. But the road is long and lined with risk.

Which Path Aligns with Your Bigger Vision?

If you’re chasing immediate scale and structured growth, 49 Funded is a powerful ally. If you want total independence and legacy control, a personal account may be the right fit. Many traders blend both.

The Hybrid Approach: Can You Do Both?

Starting with a Prop Firm, Then Going Solo

Plenty of traders start with 49 Funded to sharpen their skills and earn capital—then shift to personal accounts once they’ve built confidence and a nest egg. It’s a smart evolution.

Diversifying Your Strategy with Multiple Streams

You can run multiple funded accounts and grow a personal portfolio simultaneously. It’s not just smart—it’s modern trading.

Smart Ways to Combine the Best of Both Worlds

Use funded accounts for aggressive income and personal accounts for conservative growth. Balance risk. Play both games.

Conclusion

No One-Size-Fits-All Answer—And That’s Okay

The beauty of trading today is that you get to choose. There’s no right or wrong—just what aligns with your style, capital, and goals.

Choosing the Path That Fits You Best

If you need structure, scale, and support—49 Funded is here for you. If you crave independence and full control, start building your personal empire. Either way, own your decision.

Your Next Step: Try, Learn, and Adapt

Ready to trade with real capital? Take the next step with 49 Funded. Prove your edge. Access bigger accounts. Grow faster. Trade smarter.

Your journey starts now.

Explore Funding Programs at 49 Funded

#prop trading app#prop trading firms#stock market#stock trading#stock#stocktips#prop firm for indian markets#indian market#stocks

0 notes

Text

Video: Stock Investing Strategy Tips

I discuss Dollar cost averaging #DCA, #DogsoftheDOW, #TaxLossSelling, #LimitOrders, #ValueTraps, #Diversification, #hotstocks, and the #EconomicMoat of a company. I review these #stocktips. The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada. Visit: http://www.canadianmoneytalk.caThe Investing & Personal Finance Basics course is at…

#DCA#diversification#DogsoftheDOW#economicmoat#hotstocks#LimitOrders#stocktips#TaxLossSelling#ValueTraps

0 notes

Text

Skyrocketing Stocks: Jaw-Dropping Predictions for the 2025 Share Market 🚀📈

Are you ready to take your investments to the next level? Buckle up, because we’re diving into the most anticipated stock market predictions for 2025. The financial landscape is set for some seismic shifts, and savvy investors need to stay ahead of the curve. Here's a deep dive into the trends and stocks that could make you a fortune in the next few years.

🌟 The Tech Titans: Dominating the Market

Technology stocks have been on a tear, and they show no signs of slowing down. By 2025, we predict that:

Artificial Intelligence (AI) companies will see unprecedented growth. Think beyond just the big names; emerging startups in AI and machine learning will offer incredible investment opportunities.

Blockchain Technology will revolutionize industries beyond cryptocurrency. Companies leveraging blockchain for supply chain management, security, and data integrity are set to soar.

Green Tech and Renewable Energy firms will be major players. With global shifts towards sustainability, stocks in solar, wind, and battery technology will be the ones to watch.

🏥 Health is Wealth: Biotech and Healthcare Surge

The pandemic has underscored the importance of healthcare innovation. Our 2025 predictions include:

Biotech Breakthroughs: Companies focusing on gene editing, personalized medicine, and biotech advancements are poised for massive growth.

Telehealth Expansion: The convenience and necessity of telehealth services will drive the growth of companies in this sector. Look for stocks that are innovating in virtual healthcare, remote diagnostics, and health monitoring.

💸 Financial Revolution: Fintech and Cryptocurrency

The financial world is undergoing a digital transformation. Key predictions for 2025 include:

Fintech Firms Flourish: Companies offering digital banking, payment solutions, and financial services will continue to disrupt traditional banking models. Stocks in this space are a must-watch.

Cryptocurrency Adoption: As cryptocurrencies gain mainstream acceptance, related stocks, including those in crypto exchanges, wallet providers, and blockchain infrastructure, will skyrocket.

🌐 Global Giants: International Market Leaders

Don't limit your portfolio to domestic stocks. Our 2025 predictions highlight the importance of international diversification:

Asian Markets: China and India will continue to be economic powerhouses. Companies in tech, manufacturing, and consumer goods from these regions will offer lucrative investment opportunities.

Emerging Markets: Countries in Southeast Asia, Africa, and Latin America are on the cusp of significant economic growth. Investing in diverse industries within these emerging markets could yield high returns.

📊 Strategy and Caution: How to Navigate 2025

While these predictions offer exciting prospects, it's crucial to approach 2025 with a strategic mindset:

Diversify Your Portfolio: Spread your investments across different sectors and regions to mitigate risk.

Stay Informed: Keep up with market trends, global news, and financial analyses to make informed decisions.

Consult Financial Advisors: Professional guidance can help tailor your investment strategy to your personal financial goals and risk tolerance.

🚀 Ready to Invest?

2025 promises to be a landmark year for the stock market. With the right strategies and a keen eye on emerging trends, you could be on the path to financial success. Don’t miss out on these investment opportunities – the time to start planning is now!

#StockMarket#MarketPredictions#2025Stocks#Investing#FinancialForecast#StockTips#MarketTrends#InvestmentStrategy#FutureStocks#BullMarket#ShareMarket#StockGrowth#MarketAnalysis#StockInvesting#FinancialGrowth#InvestmentPredictions#MarketOutlook#StockInsights#WealthBuilding#InvestSmart

0 notes

Text

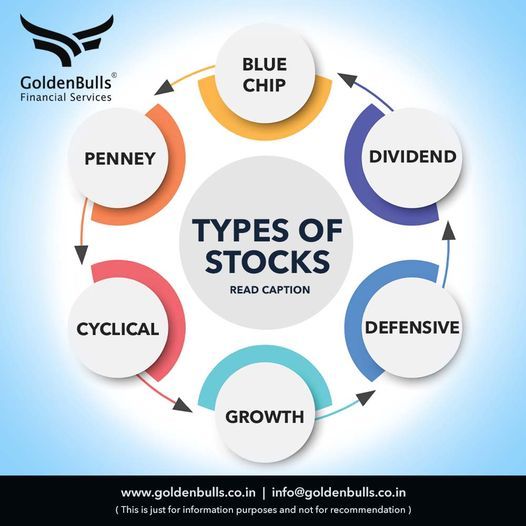

Blue Chip Stocks: These are shares of well-established, financially stable, and reputable companies with a history of consistent performance. Blue chip stocks are generally considered safe and reliable investments.

Dividend Stocks: Companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks are often favored by investors seeking regular income.

Defensive Stocks: Companies that tend to remain stable even during economic downturns. They are less sensitive to economic cycles, and their products or services are considered essential.

Growth Stocks: These are shares of companies expected to grow at an above-average rate compared to other companies. Investors in growth stocks are typically focused on capital appreciation rather than dividends.

Cyclical Stocks: Companies whose performance is closely tied to the economic cycle. These stocks often do well when the economy is booming but may suffer during economic downturns.

Penny Stocks: Stocks with a low market price, usually trading at less than $5 per share. Penny stocks are often associated with smaller, riskier companies and can be more volatile than stocks of larger, more established companies

Call us at : +91 8411002452 OR Visit: www.goldenbulls.co.in

#BlueChipStocks#DividendInvesting#DefensiveStocks#GrowthInvesting#CyclicalStocks#PennyStocks#InvestmentStrategies#DiversifyYourPortfolio#StockTips#MarketTrends#EconomicCycles#RiskManagement#Financialservices#FinancialWellness#Goldenbulls

0 notes

Text

#StockMarket#Diwali2023#ShareBazaar#TopStocks#InvestingTips#FinancialFreedom#MarketAnalysis#StockPicks#MarketTrends#InvestmentStrategies#DiwaliStocks#BullMarket#MarketWatch#StockTips#TradingIdeas#EquityInvesting#ProfitableInvestments#DiwaliInvestments#StockRecommendations#MarketInsights#WealthBuilding#StocksToWatch#EconomicOutlook#FinancialPlanning#InvestmentPortfolio#MarketUpdates#DiwaliFestivities#SmartInvesting#CapitalGrowth#MoneyMatters

0 notes

Text

Value Investing Strategies for Long-Term Growth

Implement effective value investing strategies to find undervalued stocks with strong growth potential. Focus on identifying companies with solid fundamentals and low price-to-earnings ratios for long-term success in the stock market.

For more information visit at: https://cse.google.com.au/url?q=https://kalkinemedia.com/us/stocks/value

#ValueInvesting#UndervaluedStocks#StockMarket#InvestingStrategies#LongTermGrowth#StockTips#ValueStocks

0 notes

Text

💥 Embarking on An Exciting Journey Through The World of Share Market Trading, 📈🌐

📊 Where Every Stock is a Potential Opportunity.🤝 Join Me as We Navigate the Market's 📈✅

🛢️ Twists and Turns in Pursuit of Financial Success! 📈📊💰

💷 Working in Mcx ,, Nse ,, Comex ,, Forex ,, Index ,, Future.💲

💱 Start In Just 4999/- 💸

#MarketTrends#ProfitPotential#RiskManagement#MarketResearch#StockCharts#TradingCommunity#StockTips#StockWatchlist#FinancialFreedom#StockMarketNews#TradeSmart#TradingEducation

0 notes

Text

Stock Market Tips for Beginners - Essential Wisdom for New Investors

📈 Unlock the secrets of stock market success with essential tips for beginners. Learn what every investor should know to make informed decisions in the market. 💡 Check out these valuable insights and start your investing journey today!

Link: Stock Market Tips for Beginners

0 notes