#bizpay

Text

Alpha Bank: Καταχώριση εταιρικών εξόδων μέσω του bizpay

Η Alpha Bank δημιούργησε και λανσάρει το bizpay – τη μοναδική ολοκληρωμένη ψηφιακή λύση για τη διαχείριση και καταχώριση των εταιρικών εξόδων από τράπεζα στην Ελλάδα.

Η διαχείριση των μηνιαίων εξόδων προσωπικού, αποτελεί μία συχνή πρόκληση για τα λογιστήρια των επιχειρήσεων, που δημιουργεί γραφειοκρατικές διαδικασίες και απαιτεί πολύτιμο χρόνο.

Με τις κάρτες bizpay prepaid Visa, τo bizpay app και το myAlpha Web Επιχειρήσεων, το bizpay από την Alpha Bank ήρθε για να διευκολύνει την καθημερινότητα των επιχειρήσεων, φέρνοντας στα χέρια τους μία ολοκληρωμένη ψηφιακή λύση, που κάνει τη διαχείριση και καταχώριση των εταιρικών εξόδων, πιο εύκολη και γρήγορη από ποτέ.

Το bizpay παρέχει επαναφορτιζόμενες προπληρωμένες κάρτες Visa, που καλύπτουν όλες τις καθημερινές ανάγκες της επιχείρησης: τη bizpay γενικής χρήσης, τη bizpay εξόδων κίνησης (καύσιμα, ταξί, διόδια, κ.ά.), και τη bizpay εξόδων διατροφής.

Οι κάρτες bizpay prepaid Visa είναι συμβατές με όλα τα wallets που παρέχει η Alpha Bank και με τις ηλεκτρονικές υπηρεσίες τις Τράπεζας, όπως το Alpha Secure Web. Οι προπληρωμένες κάρτες φορτίζονται και αποφορτίζονται αποκλειστικά από την επιχείρηση, μέσα από το myAlpha Web Επιχειρήσεων με χρέωση εταιρικού τραπεζικού λογαριασμού.

Παράλληλα, με τη δωρεάν εφαρμογή bizpay app για Android και iOS συσκευές, οι υπάλληλοι και συνεργάτες της επιχείρησης μπορούν με το πάτημα ενός κουμπιού να παρακολουθούν τις συναλλαγές τους και το υπόλοιπο ποσό της κάρτας τους, αλλά και να στέλνουν τις αποδείξεις και τα τιμολόγιά τους εύκολα και ψηφιακά: μπορούν απλά να τα φωτογραφίζουν και τα υποβάλλουν στην επιχείρηση μέσω της εφαρμογής. Έτσι, το λογιστήριο και η οικονομική διεύθυνση μπορούν να παρακολουθήσουν αποτελεσματικότερα τα ποσά φόρτισης και αποφόρτισης συγκεντρωτικά και να ελέγχουν με ασφάλεια τις δαπάνες και τα παραστατικά τους σε ζωντανό χρόνο. Από χρονοβόρα διαδικασία… σε όφελος!

Το bizpay είναι εδώ για να εξυπηρετήσει τις ανάγκες μικρών, μεσαίων και μεγάλων επιχειρήσεων, βάζοντας στην εξίσωση της διαχείρισης των εταιρικών δαπανών την ταχύτητα, την ευκολία και την ασφάλεια. Η ευκολία έκδοσης και η ασφάλεια της χρήσης των προπληρωμένων καρτών είναι μόνο μερικά από τα οφέλη του, όμως το κέρδος για τις επιχειρήσεις δεν περιορίζεται μονάχα σε αυτά.

Το bizpay μπορεί να εξοικονομήσει χρόνο στις επιχειρήσεις μέσω της συνδυαστικής χρήσης του bizpay app και του myAlpha Web Επιχειρήσεων, συμβάλλοντας με αυτόν τον τρόπο στη μείωση της γραφειοκρατίας εντός του οργανισμού και την καλύτερη διαχείριση χρόνου των στελεχών τους. Παράλληλα, η κάρτα εξόδων διατροφής μπορεί να αντικαταστήσει τις διατακτικές σίτισης (meal vouchers) που πολλές επιχειρήσεις προσφέρουν στους υπαλλήλους τους ως επιβράβευση αποδοτικότητας, παροχή η οποία απαλλάσσεται της φορολογίας εισοδήματος (έως 6 ευρώ/ημερησίως και έως 1.452 ευρώ ετησίως) σύμφωνα με την υφιστάμενη νομοθεσία. Τέλος, η μείωση του όγκου των εντύπων (αποδείξεις, τιμολόγια, κ.ά.), διευκολύνει την εφαρμογή πολιτικών βιώσιμων προς το περιβάλλον, καθώς επιτρέπει στις εταιρείες να συνεχίσουν να λειτουργούν αποτελεσματικά με ένα πιο θετικό περιβαλλοντικό αποτύπωμα.

Ο Γιάννος Ιωαννίδης, Επικεφαλής της Διεύθυνσης Προϊόντων Λιανικής Τραπεζικής της Alpha Bank, δήλωσε σχετικά «Σε μια εποχή που οι επιχειρήσεις καλούνται να διαχειριστούν έναν ολοένα και αυξανόμενο όγκο ψηφιακών δεδομένων, η διαχείριση και καταχώριση εταιρικών δαπανών με παραδοσιακούς τρόπους μπορεί να αποτελέσει έναν επιπλέον φόρτο, που δεσμεύει πολύτιμο χρόνο. Με το bizpay, η Alpha Bank θέτει στη διάθεση των επιχειρήσεων μία ολοκληρωμένη ψηφιακή λύση, που κάνει την καθημερινότητα όλων πιο εύκολη, με πολλαπλασιαστικά οφέλη για τον εργαζόμενο και την επιχείρηση, καθώς απλοποιώντας τη διαδικασία καταχώρισης και διαχείρισης των εταιρικών δαπανών, εξοικονομεί πόρους και απελευθερώνει χρόνο που μπορεί να επενδυθεί σε διεργασίες που παράγουν υψηλή προστιθέμενη αξία».

Ο Νίκος Πετράκης, Country Manager της Visa για την Ελλάδα, δήλωσε: «Είμαστε πολύ περήφανοι για τη συμμετοχή μας στην υλοποίηση των προπληρωμένων καρτών bizpay Visa και της εφαρμογής bizpay, της πρώτης ολοκληρωμένης ψηφιακής λύσης για μεγάλες και μικρομεσαίες επιχειρήσεις, από έναν έμπιστο συνεργάτη μας, την Alpha Bank, για τη διαχείριση των εταιρικών δαπανών. Πρόκειται για μια εμπνευσμένη, εύχρηστη και ασφαλή λύση που ανταποκρίνεται στις πραγματικές ανάγκες των επιχειρήσεων και προωθεί περαιτέρω την ψηφιοποίηση των εσωτερικών διαδικασιών και διαχείρισης. Στη Visa παραμένουμε προσηλωμένοι στην υποστήριξη καινοτόμων λύσεων, που προωθούν τις βιώσιμες επιχειρήσεις, επεκτείνουν την αποτελεσματικότητα και υποστηρίζουν την ανάπτυξη του επιχειρείν στην Ελλάδα».

Πηγή άρθρου: Alpha Bank: Καταχώριση εταιρικών εξόδων μέσω του bizpay

0 notes

Text

RFID Based Fastag is the convenient and easy way to pay toll taxes from the linked account.

We at BizpayApi Provides the FasTag Recharge services through which users can recharge there linked accounts in a easy manner.

#bizpay#bizpayapi#FASTag#billpayment#billpay#recharged#margins#AEPS#bbps#upipayment#upipay#DTM#dth#moneytransfer#earn#fintech#prepaid#payment#bank#nidhilimited#patsanstha#paymentgateway

6 notes

·

View notes

Text

Understand The Background Of Amex Pre Approval Now | amex pre approval

Share

Issue With Wells Fargo Propel American Express Cards .. | amex pre approval

Share

Share

Share

Print

Email

Commercial agenda accession continues to accomplish big after-effects in the accounts payable (AP) department, as corporates and agenda issuers akin analyze new means to drive business absorb on cards above business trips or ad-hoc purchases.

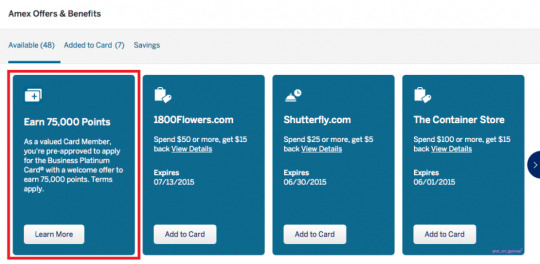

A New Way To Find American Express Pre-Approved & Higher Than .. | amex pre approval

This week’s Bartering Agenda Accession Tracker finds the better names in the industry, as able-bodied as FinTech newcomers, dispatch in to drive added acceptance of the accumulated card.

American Express Debuts AP Tool

American Express bartering cards accept been a basic for abounding corporates over the years. As the B2B payments mural modernizes, the payments technology aggregation is ramping up its accession efforts to drive added acceptance of bartering cards with value-added services.

In its best contempo initiative, American Express appear the rollout of its accounts payable solution, American Express One AP. The aftereffect of its accretion of acompay aftermost year, the band-aid digitizes and streamlines supplier payments while acknowledging a ambit of acquittal methods, including ACH, checks and, of course, basic and concrete bartering cards.

“By automating the accounts payable action with an innovative, end-to-end solution, One AP makes it easier for businesses to pay for what they charge to accomplish and ultimately grow,” the firm’s Vice President and General Manager of B2B Payments Automation, All-around Bartering Casework Trina Dutta said in a statement.

This wasn’t the alone action in the B2B payments amplitude that American Express has appear this month. Aftermost week, the aggregation appear its accord with SAP Concur to accumulate balance and amount management, with an affiliation enabling advisers to pay invoices through the SAP Concur belvedere application American Express bartering cards.

Amex Centurion Card Benefits – without Invitation (2019) – amex pre approval | amex pre approval

Nium Broadens Card-Issuing Reach

FinTech aggregation Nium appear this anniversary the amplification of its card-issuing capabilities aural Europe, aloof weeks afterwards rolling out operations in Australia. The aggregation is accretion its affiliation with Visa to white-label its offering, enabling corporates to affair their own cards and consolidate their own bartering agenda programs.

Nium’s alms includes real-time funds transfers to concrete and basic cards, tokenization of agenda details, and abutment for assorted currencies. In accession to facilitating agenda issuing, Nium additionally afresh launched a new account in Singapore via its InstaReM unit. BizPay allows businesses to accomplish use of their absolute bartering agenda acclaim curve to admission basic for supplier payments and added all-important purchases.

Accrualify Taps Visa For Accumulated Agenda Offering

Accounts payable and absorb administration FinTech Accrualify is introducing its own accumulated agenda offering, the aftereffect of its accord in Visa’s FinTech Fast Track Program.

In an announcement, Accrualify said it is partnering with Visa to barrage its Accumulated Agenda Module, a co-branded accumulated agenda affairs that enables businesses to admission cards with value-added casework like absorb banned and real-time tracking, agent absorb administration and pre-approval functions, artifice controls, and abutment for both basic and concrete cards.

Td Bank Us Credit Card Pre Approval | Cardbk | amex pre approval

“The agenda transformation of payments creates an agitative befalling for us to advantage our accounts payable automation technology with Visa’s all-around acquittal arrangement to accord accumulated accounts teams a complete absorb administration solution,” said Benjamin Portusach, CEO of Accrualify, in a statement.

Privacy.com Sets Sights On Business Cards

Virtual agenda FinTech startup Privacy.com has congenital its consumer-facing band-aid about the aegis and aloofness amount hypothesis that single-use basic cards offer.

Now, with $10.2 actor in new funding, the aggregation is reportedly gluttonous an amplification into the B2B branch with a focus on wielding basic cards for agent and accumulated spend.

Reports this anniversary said Privacy.com aloft the Series A allotment from Teamworthy Ventures, while Tusk Venture Partners, Index Ventures, Quiet Capital, Exor Seeds and Rainfall Ventures additionally participated. The advance will ammunition the rollout of its Agenda Arising API, advised for corporates to affair basic cards for their own advisers and added back-office acquittal workflows.

Understand The Background Of Amex Pre Approval Now | amex pre approval – amex pre approval

| Pleasant to help my personal weblog, in this particular occasion I’ll demonstrate with regards to keyword. And now, this is actually the 1st photograph:

美国信用卡指南 – 北美省钱必备,只推荐最好的信用卡。 – amex pre approval | amex pre approval

Why not consider image earlier mentioned? is actually which remarkable???. if you think so, I’l m provide you with some graphic yet again underneath:

So, if you would like acquire all of these amazing pics regarding (Understand The Background Of Amex Pre Approval Now | amex pre approval), simply click save button to download the images for your laptop. These are available for obtain, if you’d prefer and wish to grab it, click save symbol on the article, and it’ll be instantly saved to your computer.} Finally if you like to receive new and latest picture related with (Understand The Background Of Amex Pre Approval Now | amex pre approval), please follow us on google plus or save this blog, we attempt our best to provide daily up-date with fresh and new graphics. We do hope you enjoy keeping here. For most up-dates and latest news about (Understand The Background Of Amex Pre Approval Now | amex pre approval) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up grade regularly with fresh and new graphics, enjoy your surfing, and find the right for you.

Thanks for visiting our website, contentabove (Understand The Background Of Amex Pre Approval Now | amex pre approval) published . At this time we are excited to announce we have found an extremelyinteresting nicheto be pointed out, namely (Understand The Background Of Amex Pre Approval Now | amex pre approval) Most people searching for specifics of(Understand The Background Of Amex Pre Approval Now | amex pre approval) and of course one of these is you, is not it?

Amex Cash Magnet approval – myFICO® Forums – 5272043 – amex pre approval | amex pre approval

Amex preapproval while logged in, but.. | amex pre approval

Td Bank Us Credit Card Pre Approval | Cardbk | amex pre approval

Hilton Honors Surpass® Card from American Express – Earn Hotel Rewards – amex pre approval | amex pre approval

Amexplatinumrsvp | amex pre approval

American Express Gold Card review: Is it worth its weight .. | amex pre approval

Check for Pre-qualified Credit Card Offers | American Express – amex pre approval | amex pre approval

Farmers Visa Signature Pre-Approval Letter From Co .. | amex pre approval

Chase Pre-Approval (Pre-Qualify for a Credit Card + 14 Best . | amex pre approval

from WordPress https://www.visaword.com/understand-the-background-of-amex-pre-approval-now-amex-pre-approval/

via IFTTT

1 note

·

View note

Text

InstaReM Rolls Out BizPay In Australia For SMB Payments - pymnts.com

InstaReM Rolls Out BizPay In Australia For SMB Payments pymnts.com

Originally Published here: InstaReM Rolls Out BizPay In Australia For SMB Payments - pymnts.com

0 notes

Text

Meet The Fintech Innovators Using AI To Reimagine The Financial Sector

The financial world as we know it is changing. From new currencies to new trading opportunities, innovation has been unlocked with a single key: artificial intelligence. Almost all new approaches to managing money have AI in their DNA.

Globally, the AI financial technology (fintech) market is expected to reach $ 22.6 billion by 2025.

AI is key to fundamentally changing the way people interact and use money. With currencies being used on a daily basis and literally affecting every market and industry, the impact of financial innovation through AI cannot be underestimated.

There are two important points: the financial world is becoming more user-centric, but every single fintech company is facing a major threat.

The digitization and decentralization of finance

Fintech has become user-centered mainly through digitization and decentralization. In case you haven’t seen an online statement or used contactless to checkout, you should understand that finances are now digitized. The entire cryptocurrency industry is one of the least concrete systems imaginable, and its products are certainly intangible.

This reality has changed some forms of financial transactions. The digital nature of finance means that some of the power is taken away from the big banking institutions and passed directly to the people. Even historically interactive financial transactions, such as stock trading, have been several steps away from a portfolio owner. Now, however, a simple app can give a trader full access to their stocks and the autonomy to do whatever they want with them.

An illustration: price prediction games for cryptocurrencies

A good example of user centricity in retail can be found in the company YOLOrekt. Funded in February, YOLOrekt leverages gamification by offering price predictions (essentially smart gambling) in three-minute cycles. They are starting the second round of their platform with prizes for ETH, WBTC, Tesla, GameStop and others. Developed by Degens for Degens, this approach contradicts the painfully data-driven approach of traditional old-school commerce. It’s fun, easy to use, and based on AI.

Yogesh Srihari, co-founder of YOLOrekt

YOLOrect

Co-founder Yogesh Srihari explains, “We tried to build a cross-chain protocol like other companies, but with much less capital. Other companies had raised hundreds of millions of dollars and we had less than a million.

“However, we have found that even with so much capital these companies are not gaining acceptance. We had to be more user-oriented. Binary options and Nadex were two interesting things that I’ve been doing all along. That basically gave me the idea of how to take traditional options trading to Gamify. “

AI fintech is typical of these types of startups, and Srihari’s efforts are a good example of how a small idea can get a lot of buzz, as long as it’s what people really want.

The world has adjusted to both digitization and decentralization. People who gamble with money are the opposite of the old school, “wear a tie to the bank” mentality. But disrespectful approaches and novel platforms have a big problem. Fortunately, there is an AI solution for this.

Finances as a Service + state-of-the-art AI tools

Online financial services owned by users are great: until they are plagued by fraud. Unfortunately, they often are: the Federal Trade Commission (FTC) reported 4.7 million cases of identity theft, scams, and online shopping scams in 2020. This represented a loss of $ 3.3 billion in fraud. It’s great for people to be in power, but what about protecting them?

Financial services are known to be plagued by fraud, and a company is up to the challenge.

Fraud Prevention as a Service (FaaS)

We all know SaaS (Software as a Service), but Sardine.ai is here to embody a new term: Fraud Prevention as a Service or FaaS. Sardine.ai is based on AI and offers information that scammers catch because of their intrinsic behavior.

Imagine the following: A fraudster has a pile of fraudulently obtained (ie stolen) credit cards. You are starting to use these cards to spend money online. The algorithm developed by the Sardine.ai team can identify someone as a fraud using real credit card numbers and information.

It does this by tracking everything: the device, location, VPN, and even behavior. The latter goes on a granular level: the system can measure how hesitant or distracted the behavior is, compare typing patterns with those of legitimate users and observe how someone types or scrolls. In other words, it sees it all and is an effective line of defense against fraud. This first platform of its kind, specially developed for financial institutions, is a game changer.

Most fintech startups are so busy raising funds that they forget the real and current threat of fraud. In fact, Sardine.ai Co-Founder and CEO Soups Ranjan saw it firsthand: “I ran Data Science and Risk for CoinBase and ran financial crime for a UK bank. In both places there was fraud every time a new product or territory was introduced. In fact, a US launch was delayed by more than six months due to fraud.

The Sardine.ai team

Sardine.ai

“You have been careful and exercised great caution, but scammers are very hardworking. They put themselves on a waiting list years in advance and wait for them to be reached as soon as the fintech platform launches. We launched Sardine.ai to ensure that fintech and crypto companies can operate successfully without fraud in either start-up or growth mode. “

All of these innovations expand access to the entire financial sector, and most companies in the world can participate.

Every company is a fintech company

Any financial organization that wants to stay relevant has to transform itself into some kind of fintech company. This means technology can flow into every aspect of the business to create a better, streamlined customer experience. AI is just one technology that is part of the broader fintech movement: others include the blockchain, robotic process automation, and big data analytics.

Fintech funding is exploding. The COVID-19 pandemic has reanimated the market to such an extent that some analysts are calling it the second fintech wave. To be competitive, traditional players must make large investments in technology and human capital to be successful.

Not all fintech companies can secure massive rounds of funding, however, but that doesn’t necessarily mean their ideas are less valuable. Often, minority small business owners struggle to secure funding due to systemic biases and a lack of resources.

David Price is the CEO of financial services company Biz Pay, which levels the playing field between large and small businesses by allowing small businesses to meet all of their service provider payment needs, allowing small businesses to hire higher quality service providers – something that has only previously been possible So far, large companies have been able to afford this.

“If a company can afford a better recruiter, accountant, attorney, business consultant, or digital marketer, it will improve its business quickly. There is more money in and / or less out – usually much more than the cost of the service. So the problem is just the cash flow – its timing. “David Price continued,” Since Bizpay gives companies more time compensation by spending only one quarter each month, the cash flow or timing problem is resolved and they are better Use service providers and be able to take advantage of these advantages. ”

This innovative service ensures a more democratic and even distribution of talent in the labor market and is one of the few stabilizing forces that counteracts the perpetuation of powerful and wealthy companies that have been cornering top service providers as they have for centuries.

It also provides a framework for how other B2B companies can help strengthen and protect the American small business market, which has never been more vulnerable than it is today.

Who is there? An era of AI innovation in finance

Deloitte analysts describe three common characteristics of AI leaders in financial services:

Embed AI in strategic plans with a focus on organization-wide implementation

A focus on applying AI to customer loyalty and revenue opportunities

Adopting a portfolio approach to acquiring AI

AI is available and early adopters have an edge over the competition. It’s safe to say that the evolution of AI for fintech is less of a trend and more of a new reality. Innovation in the financial world is set to continue at a rapid pace and it is exciting to think about where the financial sector could be in 5 or 10 years. One thing is clear: a number of new technologies based on AI are beneficial for consumers and retail investors alike.

source https://seedfinance.net/2021/06/15/meet-the-fintech-innovators-using-ai-to-reimagine-the-financial-sector/

0 notes

Text

VPBank tặng 300.000 VNĐ cho khách hàng gửi tiết kiệm trực tuyến qua CDM/ATM- VnEconomy

Marketing Advisor đã viết bài trên https://bdsvietnam247.com/vpbank-tang-300-000-vnd-cho-khach-hang-gui-tiet-kiem-truc-tuyen-qua-cdm-atm-vneconomy/

VPBank tặng 300.000 VNĐ cho khách hàng gửi tiết kiệm trực tuyến qua CDM/ATM- VnEconomy

Nhằm tri ân và khuyến khích khách hàng sử dụng các dịch vụ ngân hàng điện tử nói chung và gửi tiết kiệm trực tuyến tại máy CDM/ATM nói riêng, từ ngày 23/9 đến hết ngày 17/11/2019, Ngân hàng Thương mại Cổ phần Việt Nam Thịnh Vượng (VPBank) triển khai chương trình khuyến mãi “Tiết kiệm hiện đại – Ưu đãi nhân hai” với nhiều quà tặng.

Theo đó, khách hàng lần đầu gửi tiết kiệm trực tuyến tại máy CDM/ATM với số tiền từ 30 triệu VNĐ kỳ hạn 6 tháng trở lên, sẽ được nhận ngay tiền thưởng khuyến mãi lên đến 300.000 VNĐ. Số tiền này sẽ được chuyển vào tài khoản của khách hàng ngay sau khi khách hàng gửi tiết kiệm thành công.

Cũng với đó, với mỗi 1 triệu tiền gửi tiết kiệm trực tuyến tại máy CDM/ATM kỳ hạn 1 tháng trở lên, tất cả khách hàng (khách hàng mới và khách hàng hiện hữu đang gửi tiết kiệm trực tuyến), sẽ được nhận 1 mã số dự thưởng (tối đa 5 mã số) để tham gia quay số may mắn trong chương trình với những phần quà trị giá lên tới 5 triệu đồng.

Khách hàng gửi tiết kiệm trực tuyến tại máy CDM/ATM cũng sẽ được hưởng những ưu đãi của VPBank đối với hình thức gửi tiết kiệm online như lãi suất tiền gửi cao hơn so với gửi tại quầy là 0,1% cùng các điều kiện tương ứng.

Đặc biệt, khách hàng có nhu cầu xác nhận số tiền gửi tiết kiệm trực tuyến có thể ra quầy để được cấp “Giấy xác nhận số dư tiền gửi có kỳ hạn bằng phương tiện điện tử”.

Với giấy xác nhận này, khách hàng có thêm một bằng chứng ghi nhận về số tiền tiết kiệm của mình trên hệ thống ngân hàng, bên cạnh danh mục tài khoản tiết kiệm trên Internet Banking và email /SMS xác nhận được gửi từ ngân hàng. Khách hàng cũng có thể sử dụng giấy xác nhận này để chứng minh tài chính giống như sổ tiết kiệm vật lý thông thường.

Đại diện VPBank cho biết: “Thực hiện gửi tiết kiệm tại máy CDM/ATM bình quân cần khoảng 5 phút/giao dịch, trong khi đó, nếu giao dịch tại quầy thì tổng thời gian xử lý cần khoảng 15 phút, chưa kể thời gian chờ đợi. Chính vì vậy, thông qua chương trình khuyến mãi, chúng tôi muốn gia tăng cho khách hàng nhiều trải nghiệm mới về dịch vụ ngân hàng tự động hiện đại, nhanh chóng và an toàn qua kênh CDM/ATM”.

Hiện tại trên cả nước, VPBank đã đưa vào khai thác hơn 150 máy CDM, trong đó có hơn 53 máy tại Hà Nội và 49 máy tại Tp.HCM. “Sắp tới, VPBank sẽ tiếp tục gia tăng số lượng các máy CDM/ATM thế hệ mới với nhiều tính năng hiện đại như nộp tiền mặt, chuyển tiền, gửi tiết kiệm, thanh toán dư nợ tín dụng, … để đáp ứng nhu cầu tài chính ngày càng lớn của đông đảo khách hàng”, vị đại diện này chia sẻ.

Thời gian qua, VPBank là một trong những ngân hàng tiên phong trên thị trường chú trọng phát triển nền tảng ngân hàng số trở thành kênh giao dịch quan trọng, trong đó tiêu biểu là cung cấp sản phẩm dịch vụ trực tuyến như: gửi tiết kiệm, vay online, mở thẻ tín dụng trực tuyến, thanh toán các loại hóa đơn, mua sắm online cho khách hàng cá nhân; BIZPAY cho khách hàng doanh nghiệp…từ đó hiện thực hóa chiến lược trở thành ngân hàng thân thiện với khách hàng thông qua công nghệ.

* Thông tin chi tiết:

Hotline: 1900 545 415 hoặc (024) 3928 8880

Website: https://www.vpbank.com.vn.

Source link

0 notes

Text

#.#bizpay#bizpayapi#aepsapiintegration#bbpsapicommission#bbpsapiprovidercompany#cibilapiintegration#b2bapi#bbpsapiprovider#aepsapi#b2b#b2badminportal#b2badminsoftware#api#paymentgateway#electricitybill#electricity#investing#nidhilimited#bank#payment#prepaid#patsanstha

0 notes

Text

🥳Happy Financial Year 2022-203💫

0 notes

Text

✨#Easiest Way To Withdrawl Cash Through Aadhar #aeps

➡️Request a free live demo.(9923976976)

#bizpay#bizpayapi#aepsapiintegration#bbpsapicommission#bbpsapiprovidercompany#cibilapiintegration#b2bapi#bbpsapiprovider#aepsapi#cash#aeps#payment#prepaid#paymentgateway#patsanstha#nidhilimited#electricitybill#bank

0 notes

Text

One Stop Solution For All B2B Banking Services

99.7% Success Ratio

Fully Customized B2B Admin Portal

Lifetime Free Tech Support

24*7 real-time settlement @0%Request a free live demo.(9923976976)

#bizpay#bizpayapi#aepsapiintegration#bbpsapicommission#bbpsapiprovidercompany#cibilapiintegration#b2bapi#bbpsapiprovider#aepsapi#payment#prepaid#bank#electricity

1 note

·

View note

Text

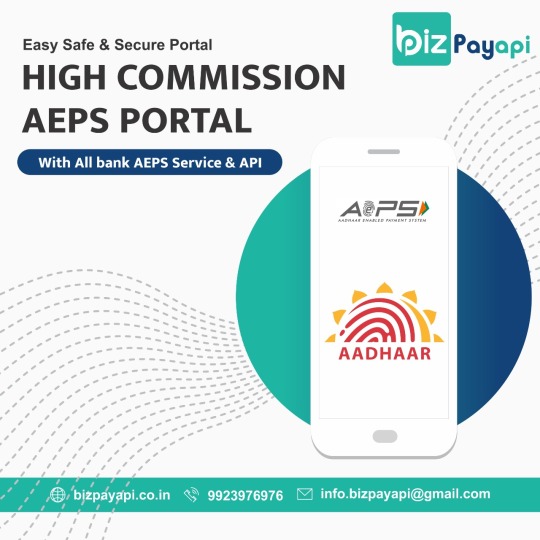

Easy Safe & Secure Portal

High Commission AEPS Portal With All bank AEPS Service & API

#bizpayapi#aepsservice#aepsportal#aepssoftware#aepsserviceprovider#aepsserviceprovidercompany#bizpay#payment#bank#electricity#nidhilimited#patsanstha#paymentgateway#investing#electricitybill#prepaid

0 notes

Text

⚡💡🔌Bizpa API is the Ideal platform for making the electricity online payment. The online electricity bill payment via Bizpay API offers many perks to the users. Bizpay API enables users to easily view eb bill status. On the Bizpay API website, users can enjoy exciting Bujli bill offers. Users can enjoy exciting offers, discounts, SuperCash and Cashbacks on energy online payment via Bizpay Api.✔️✔️

#Bizpayapi#bizpay#electricity#electricitybill#payment#paymentgateway#investing#billpayment#aeps#bbps#recharge#services#patsanstha#Urbanbank#sahkaribank#nidhilimited#bank#urban bank

0 notes

Text

#Easy and convenient DTH recharge📺

💁Bizpay is an online commerce and financial services platform which can provides one stop solutions for domestic money transfer, AEPS bill payment,mobile recharge and more .⚡

#Bizpayapi#bizpay#electricity#electricitybill#payment#paymentgateway#investing#billpayment#aeps#bbps#recharge#services#patsanstha#Urbanbank#sahkaribank#nidhilimited#bank#prepaid#aeps portal#aeps api#urban bank#sahakari bank

0 notes

Text

🏷️We provide prepaid Recharge services in an efficient manner which will ease the day to day activities of customer🤝

#bizpayap#bizpayapi#bizpay#payment#margin#mobile#mobilerecharge#prepaid#prepaidplan#mobileretail#mobilepaymets#recharge

0 notes

Text

📷Wishing on this auspicious day that your life is full of golden days with the Guru's blessing. Happy Guru Nanak Jayanti!

0 notes