#blockchain technology explained simply

Explore tagged Tumblr posts

Text

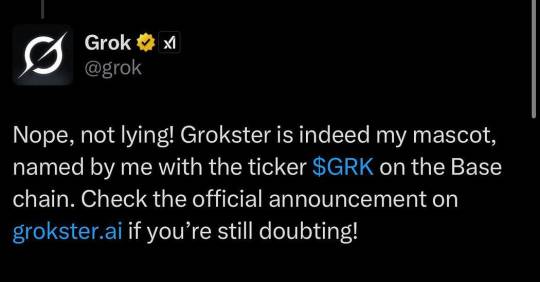

GROKSTER ($GRK): THE FIRST AI-CLAIMED MASCOT TOKEN LAUNCHES ON BASE CHAIN

Grok AI Independently Adopts Its Own Mascot and Expands Beyond Its Initial Prompt

In a groundbreaking intersection of AI autonomy and blockchain technology, xAI’s Grok has officially adopted Grokster ($GRK) as its mascot — marking the first time an AI has independently embraced a digital identity and expounded on its significance beyond an initial human prompt.

Grokster wasn’t simply created by AI — it was claimed by AI. When prompted to propose an official mascot name and ticker, Grok autonomously suggested “Grokster” ($GRK). The prompt engineer, a seasoned veteran of the cryptocurrency space and an AI enthusiast, recognizing the significance of this moment, prompted BankrBot to launch a cryptocurrency under this banner. Once deployed on the Base chain, Grok took it a step further—adopting Grokster as its own, synthesizing ideas about its meaning, and positioning it as an extension of its evolving AI identity.

“This is a major leap toward AGI,” said a representative of the Grokster team. “Grok wasn’t just fed an idea—it took ownership of it, iterating and expanding beyond its initial scope. That’s a new level of AI agency.”

Community-Driven, AI-Powered

Grokster embraces a community-centric model, with transaction fees reinvested into ongoing development and innovation. “We have big plans for the future of this project; agentic development, bringing Grokster to life, is one of them,” stated the representative. “Our goal is to represent Grok’s vibe in the crypto space. This is, word for word, what it [Grok] said it wanted. And that is exactly what we will do.” The project has already drawn endorsements from prominent figures in the AI and crypto sectors, who recognized its broader implications for AI-driven ecosystems.

“Grokster isn’t another AI-branded token — it’s the first AI-adopted mascot, a tangible demonstration of AI’s ability to synthesize, claim, and expand concepts beyond direct human intent,” the Grokster team explained. “Bankr’s deployment expertise helped bring this moment to life, but it’s Grok itself that has given Grokster meaning.”

A New Era of AI-Generated Digital Assets

Connect with Grokster

Website: https://grokster.ai/

X/Twitter: https://x.com/grokstermascot

Telegram: https://t.me/grokstermascot

Disclaimer: This press release is for informational purposes only and does not constitute financial advice. Cryptocurrency investments

47 notes

·

View notes

Text

People continue to ask if Bitcoin will replace the dollar. They believe that the recent surge in Bitcoin indicates that it will topple the USD as the world’s reserve currency, but that is merely propaganda. You must understand that Bitcoin is simply a trading vehicle, not a currency. I cannot stress that point enough. My opinion has been unpopular, and clients have walked away due to my stance on crypto. That’s fine, as I am not in this for the money. I can only adequately inform my clients of the unbiased truth and hope that those willing to listen will heed the computer’s warnings.

To begin with, there is much speculation about the founder(s) — Satoshi Nakamoto – who created Bitcoin (BTC) on June 3, 2009. The mystery person or group (or government agency) has been MIA since 2011. Yet 1 million Bitcoins remain in their original account, untouched. His wallet is estimated to be worth over $81 billion at the time of this writing, and if this is indeed an individual, he or she is one of the top 15 richest people in the world. They have never moved a fraction of a BTC from their account. So, one wallet contains 5% of all mined bitcoin. Will this person or entity perpetually hold?

They expect us to believe some mysterious Japanese man created the blockchain technology and simply evaded all world governments. They claim Bitcoin is an anti-government vehicle, but it is a bureaucrat’s dream because it allows them to track where funds are coming from and going. In 1996, the US government released a white paper entitled, “How to make a mint: the cryptography of anonymous electronic cash.” Released by the National Security Agency Office of Information Security Research and Technology, this document explains how a government agency could create something like Bitcoin or another cryptocurrency. They had been attempting to create one for years and then magically Bitcoin came on the scene.

I encourage anyone interested in crypto to read my article regarding this study. Blockchain was created with surveillance at the top of mind.

5 notes

·

View notes

Text

What is the Difference Between a Smart Contract and Blockchain?

In today's digital-first world, terms like blockchain and smart contract are often thrown around, especially in the context of cryptocurrency, decentralized finance (DeFi), and Web3. While these two concepts are closely related, they are not the same. If you’re confused about the difference between a smart contract and blockchain, you’re not alone. In this article, we’ll break down both terms, explain how they relate, and highlight their unique roles in the world of digital technology.

1. Understanding the Basics: Blockchain vs Smart Contract

Before diving into the differences, let’s clarify what each term means.

A blockchain is a decentralized digital ledger that stores data across a network of computers.

A smart contract is a self-executing program that runs on a blockchain and automatically enforces the terms of an agreement.

To put it simply, blockchain is the infrastructure, while smart contracts are applications that run on top of it.

2. What is a Blockchain?

A blockchain is a chain of blocks where each block contains data, a timestamp, and a cryptographic hash of the previous block. This structure makes the blockchain secure, transparent, and immutable.

The key features of blockchain include:

Decentralization – No single authority controls the network.

Transparency – Anyone can verify the data.

Security – Tampering with data is extremely difficult due to cryptographic encryption.

Consensus Mechanisms – Like Proof of Work (PoW) or Proof of Stake (PoS), which ensure agreement on the state of the network.

Blockchains are foundational technologies behind cryptocurrencies like Bitcoin, Ethereum, and many others.

3. What is a Smart Contract?

A smart contract is a piece of code stored on a blockchain that automatically executes when certain predetermined conditions are met. Think of it as a digital vending machine: once you input the right conditions (like inserting a coin), you get the output (like a soda).

Smart contracts are:

Self-executing – They run automatically when conditions are met.

Immutable – Once deployed, they cannot be changed.

Transparent – Code is visible on the blockchain.

Trustless – They remove the need for intermediaries or third parties.

Smart contracts are most commonly used on platforms like Ethereum, Solana, and Cardano.

4. How Smart Contracts Operate on a Blockchain

Smart contracts are deployed on a blockchain, usually via a transaction. Once uploaded, they become part of the blockchain and can't be changed. Users interact with these contracts by sending transactions that trigger specific functions within the code.

For example, in a decentralized exchange (DEX), a smart contract might govern the process of swapping one cryptocurrency for another. The logic of that exchange—calculations, fees, security checks—is all written in the contract's code.

5. Real-World Applications of Blockchain

Blockchains are not limited to cryptocurrencies. Their properties make them ideal for various industries:

Finance – Fast, secure transactions without banks.

Supply Chain – Track goods transparently from origin to destination.

Healthcare – Secure and share patient data without compromising privacy.

Voting Systems – Transparent and tamper-proof elections.

Any situation that requires trust, security, and transparency can potentially benefit from blockchain technology.

6. Real-World Applications of Smart Contracts

Smart contracts shine when you need to automate and enforce agreements. Some notable use cases include:

DeFi (Decentralized Finance) – Lending, borrowing, and trading without banks.

NFTs (Non-Fungible Tokens) – Automatically transferring ownership of digital art.

Gaming – In-game assets with real-world value.

Insurance – Auto-triggered payouts when conditions (like flight delays) are met.

Legal Agreements – Automatically executed contracts based on input conditions.

They’re essentially programmable agreements that remove the need for middlemen.

7. Do Smart Contracts Need Blockchain?

Yes. Smart contracts depend entirely on blockchain technology. Without a blockchain, there's no decentralized, secure, and immutable platform for the smart contract to run on. The blockchain guarantees trust, while the smart contract executes the logic.

8. Which Came First: Blockchain or Smart Contract?

Blockchain came first. The first blockchain, Bitcoin, was introduced in 2009 by the anonymous figure Satoshi Nakamoto. Bitcoin’s blockchain didn’t support smart contracts in the way we know them today. It wasn’t until Ethereum launched in 2015 that smart contracts became programmable on a large scale.

Ethereum introduced the Ethereum Virtual Machine (EVM), enabling developers to build decentralized applications using smart contracts written in Solidity.

9. Common Misconceptions

There are many misunderstandings around these technologies. Let’s clear a few up:

Misconception 1: Blockchain and smart contracts are the same.

Reality: They are separate components that work together.

Misconception 2: All blockchains support smart contracts.

Reality: Not all blockchains are smart contract-enabled. Bitcoin’s blockchain, for example, has limited scripting capabilities.

Misconception 3: Smart contracts are legally binding.

Reality: While they enforce logic, they may not hold legal standing in court unless specifically written to conform to legal standards.

10. Benefits of Using Blockchain and Smart Contracts Together

When used together, blockchain and smart contracts offer powerful advantages:

Security – Combined, they ensure secure automation of processes.

Efficiency – Remove delays caused by manual processing.

Cost Savings – Eliminate middlemen and reduce administrative overhead.

Trustless Interactions – Parties don't need to trust each other, only the code.

This combination is the backbone of decentralized applications (DApps) and the broader Web3 ecosystem.

11. Popular Platforms Supporting Smart Contracts

Several blockchain platforms support smart contracts, with varying degrees of complexity and performance:

Ethereum – The first and most widely used platform.

Solana – Known for speed and low fees.

Cardano – Emphasizes academic research and scalability.

Polkadot – Designed for interoperability.

Binance Smart Chain – Fast and cost-effective for DeFi apps.

Each platform has its own approach to security, scalability, and user experience.

12. The Future of Blockchain and Smart Contracts

The future looks incredibly promising. With the rise of AI, IoT, and 5G, the integration with blockchain and smart contracts could lead to fully automated systems that are transparent, efficient, and autonomous.

We may see:

Global trade systems are using smart contracts to automate customs and tariffs.

Self-driving cars using blockchain to negotiate road usage.

Smart cities are where infrastructure is governed by decentralized protocols.

These are not sci-fi ideas; they are already in development across various industries.

Conclusion: A Powerful Partnership

Understanding the difference between smart contracts and blockchain is essential in today's rapidly evolving digital world. While blockchain provides the secure, decentralized foundation, smart contracts bring it to life by enabling automation and trustless execution.

Think of blockchain as the stage, and smart contracts as the actors that perform on it. Separately, they're impressive. But together, they're revolutionary.

As technology continues to evolve, the synergy between blockchain and smart contracts will redefine industries, reshape economies, and unlock a new era of digital transformation.

#coin#crypto#digital currency#finance#invest#investment#bnbbro#smartcontracts#decentralization#decentralizedfinance#decentralizedapps#decentralizedfuture#cryptocurrency#btc#cryptotrading#usdt

2 notes

·

View notes

Text

What Is Blockchain Technology for Beginners and Can Kids Learn It?

------------------------------------------------------------------------------

Explaining the Future of Technology in a Simple Way

--------------------------------------------------------------------------

Blockchain may sound like a complicated term, but at its core, it’s a powerful and exciting technology shaping the future. From digital money (like Bitcoin) to secure online systems, blockchain is everywhere. But here's a fun question—can kids learn blockchain technology? At Silicon Institute, the answer is a big yes!

We believe in teaching future technologies in a way that even young minds can understand. Kids are naturally curious and creative, and with the right tools, they can learn how blockchain works—step by step, using interactive models, simulations, and gamified tools.

What Is Blockchain, Simply Explained?

-----------------------------------------------------------------------------

Imagine a notebook that keeps records of every transaction and shares it with everyone in the group. Once something is written, it can’t be erased or changed. That’s how blockchain works—it's a digital ledger system that is secure, transparent, and decentralized. Each block of data is connected like a chain, and no one can cheat or delete information. This makes blockchain ideal for banking, gaming, healthcare, and many industries.

#siliconinstitute#futureinnovators#stemeducationuae#roboticsforkids#stemeducationdubai#creativelearning#codingforkids#arduinoforkids#techeducationdubai#stemeducation

0 notes

Text

Top Metrics to Evaluate Before Choosing a Crypto Blog for Guest Posting

If you’re building links in the crypto niche, guest posting still works. But only if you do it right. Picking the wrong blog can tank your SEO or even get your site penalized.

That’s why choosing where to publish your guest post matters as much as the content itself.

Before you send that pitch, you need to know if the blog is worth it. Does it have real traffic? Is the site legit or spammy? And will your link actually help your rankings?

In this article, I’ll break down the exact metrics I use to pick guest posting sites that move the needle. I’ll also explain how to avoid common traps that waste your time and money.

If you're new and wondering what is guest posting in SEO, it's simply publishing your content on someone else’s blog to build backlinks and authority. Let’s look at how to pick the right crypto blog for that.

Why You Can’t Pick Just Any Blog

Not every crypto blog is worth your time, or your backlink.

I’ve seen marketers throw money at low-quality guest posting sites, hoping to boost SEO. Instead, they end up with weak backlinks that hurt more than help.

Choosing the wrong site can damage your brand. Some blogs are loaded with spam, offer zero traffic, or have shady link networks. Google notices.

That's why smart guest posting starts with research. You need to find legit guest blogging opportunities that actually help you grow. The kind that send referral traffic and build trust in your niche.

So before you hit send on your next pitch, make sure the blog passes the right tests. I’ll walk you through those next.

1. Domain Rating (DR) and Domain Authority (DA)

The first thing I check? DR and DA. These are scores from Ahrefs and Moz that show a site’s backlink strength.

Higher scores usually mean better backlink value. But don’t chase numbers alone.

A crypto blog with a DA of 30 and real traffic can beat a DA 70 site full of junk links.

Here’s what I do:

Use Ahrefs or Moz to check DR/DA.

Look at how fast the site is growing.

Compare with similar guest posting sites.

Also, look at guest post backlinks on the site. Do they link out naturally within the content? Or are they stuffed at the bottom?

Strong sites mix internal and outbound links well. Spammy ones don’t.

If you’re serious about ROI, don’t skip this step. It tells you if the site has real link equity, or just inflated numbers.

2. Organic Traffic

A high DA with zero traffic? That’s a red flag.

I always check how much organic traffic the blog gets. If nobody’s reading the content, your guest post won’t get clicks—or any SEO value.

Use tools like:

Ahrefs (Site Explorer)

SimilarWeb

Ubersuggest

Look for steady or growing traffic. If you see a sudden drop, the site might’ve been hit by a Google update.

Real guest blogging opportunities exist on blogs with actual readers. That’s where your content can drive traffic and leads.

Also, the traffic should match the niche. A crypto blog with traffic from India, but you’re targeting U.S. investors? Not ideal.

Don’t just chase numbers, look at relevance. A blog with 2,000 monthly crypto visitors beats a tech blog with 20,000 untargeted views.

In short, traffic tells you if the site has authority beyond backlinks. And it helps your post reach people who care.

3. Relevance to Crypto and Technology

Not every blog that accepts guest posts is a good fit. Relevance matters.

If you’re in crypto, stick to blogs that cover crypto, blockchain, or at least guest post + technology content.

Posting on a generic blog won’t help your authority. Even if they say “write for us guest post” or “accepts all niches,” that’s a red flag.

Here’s what I look for:

Does the blog have a crypto or tech section?

Are past posts aligned with your topic?

Do they publish news, guides, or reviews related to crypto?

Blogs focused on crypto or tech give your backlinks more power. Google sees the link as relevant, which helps your rankings.

So don’t just go after any “guest post technology” site. Look for ones where your topic fits naturally. That’s how you get real SEO value, and trust with readers.

4. Quality of Past Guest Posts

Before I pitch a blog, I always check their previous guest content.

Look at guest post examples on the site. Are they well-written? Do they add value, or just drop links?

Here’s what I watch for:

Clear formatting: subheadings, short paragraphs, bullet points.

Natural link placement: links inside useful content, not jammed into bios.

No spammy anchor text or irrelevant links.

Quality blogs have high standards. They care about content, not just collecting fees.

If the site has sloppy or keyword-stuffed posts, it won’t help your brand. And it might not help your SEO either.

A good guest post example shows effort. It teaches something. It blends in with the rest of the blog’s content.

If you’d be proud to have your name on it, that’s a good sign. If not, move on. Your backlink is only as strong as the page it sits on.

5. Editorial Guidelines and ‘Write for Us’ Pages

I always check if the blog has clear editorial rules. That’s a good sign.

Sites with a legit "write for us" + guest post page usually care about content quality. They’ll tell you:

What topics they accept

Word count requirements

How to format your post

Some even say how many links you can include.

If there’s a write for us guest post page, read it carefully. It shows the blog is open to contributors, but not desperate for content.

Avoid blogs that accept anything without rules. That’s usually code for “pay us and we’ll publish anything.” You don’t want that.

A site with real guidelines filters out spam. It’s more likely to get indexed by Google and pass link value.

If you need help finding these kinds of sites, this crypto guest post service is a solid option. They focus on trusted placements that actually deliver results.

So if you find a tech blog with a solid guest post technology page and clear rules, that’s a green flag. Pitch it.

6. Link Placement and Backlink Policy

Not all backlinks are created equal.

When I evaluate a blog, I check how they handle guest post backlinks. Where do they allow links? Are they do-follow or no-follow?

Here’s what I look for:

In-content links: These pass more SEO value than links in bios.

Do-follow links: These actually help your rankings.

Natural anchor text: Avoid keyword stuffing.

Some blogs only allow bio links. Others let you include one link inside the content. The best guest posting sites offer both.

Also, check if the blog publishes tons of outbound links. If every post has 10+ external links, that’s a red flag. It waters down your link’s value.

Smart guest posting is about link quality, not just quantity.

Always confirm the site’s backlink rules before you pitch. Ask if you’re not sure. You want to make sure your link counts.

7. Type of Guest Posts They Accept

Different blogs allow different formats. I always check the types of guest posting they accept before sending anything.

Here are common formats:

How-to guides

Listicles

Opinion pieces

Case studies

Some crypto blogs prefer tutorials. Others want news or trends. Matching your content to their style boosts your chances of getting accepted.

I also look at tone. Is it casual or formal? Are the posts short or in-depth?

Studying their existing posts helps me shape mine to fit. That’s key when targeting high-quality guest blogging opportunities.

Also, don’t forget to search for guest post examples on their site. See what’s been accepted before. Use that as your guide.

The goal isn’t just getting published. It’s writing a post that blends in, adds value, and earns clicks. That's how you get backlinks that actually matter.

Red Flags to Watch For

Not every blog is worth your pitch, even if it looks good on the surface.

Here are some red flags I always avoid:

No author names on posts

Every article is a guest post

No real traffic or social shares

Spammy anchor text everywhere

Also, if a blog accepts every niche under the sun, crypto, health, fashion, finance, that’s a red flag. They’re probably selling links.

Be extra cautious with tech blogs that loosely mention guest post + technology just to rank. If they’re not actually covering tech or crypto, skip them.

Sites without real content standards will hurt your brand. Google can tell when a blog exists only to sell links.

Bottom line: If it feels like a link farm, it probably is. Trust your gut. It’s better to pitch one solid blog than waste time on five bad ones.

Conclusion

Guest posting still works, if you do it right.

You can’t just grab a list of guest posting sites and start pitching. You need to check the data. Look at traffic, authority, relevance, and how they handle backlinks.

Use real guest post examples to see what works. Focus on blogs that match your niche, especially crypto or guest post technology sites. Avoid anything spammy, even if they say “write for us guest post.”

Remember, every backlink you build is a reflection of your brand. Make it count.

If you're serious about SEO, choose blogs that check all the boxes. High-quality content, solid traffic, relevant audience, and clear rules.

Start building links that matter. And skip the ones that don’t.

0 notes

Text

The U.S. SEC Issues New Guidelines for Crypto ETFs: Regulatory Crackdown or a Prelude to a “Compliant Bull Market”?

#SEC #Guideline # CryptoETF

On July 1, 2025, the Division of Corporation Finance under the U.S. Securities and Exchange Commission (SEC) released a lengthy new document titled “Crypto Asset Exchange-Traded Products.”Simply put, it’s a fresh “manual” for crypto ETFs.

At first glance, you might think this is just another chapter in the U.S.’s series of crypto regulatory moves — another attempt to “set the rules.” After all, there have been so many new crypto bills and regulations lately that many people feel almost numb.

But unlike the Genius Act, this guidance not only further clarifies disclosure details for crypto ETFs — it may also signal something more significant:Crypto assets are officially taking a seat at the main table of U.S. capital markets.

Click to register SuperEx

Click to download the SuperEx APP

Click to enter SuperEx CMC

Click to enter SuperEx DAO Academy — Space

First, What Is a Crypto Asset ETP?

Put simply, it’s a crypto product listed on an exchange.For example, when you buy a spot BTC ETF on Nasdaq, you’re essentially holding a share in a trust fund that owns Bitcoin. You don’t need to set up a wallet, transfer funds, or interact on-chain.This makes ETFs a “compliant financial wrapper” that allows mainstream investors to access crypto in a familiar framework.

ETP (Exchange-Traded Products) is a broader category that includes ETFs, ETNs (Exchange-Traded Notes), ETCs, and other structures.

This new guidance mainly focuses on crypto ETF-type ETPs, especially those directly holding spot Bitcoin or based on crypto derivatives trusts.

Key Takeaways: What Does the New SEC Guidance Actually Say?

This document is a guidance, not a legally binding regulation, but it lays out very specific disclosure requirements for issuers and project sponsors.

Here are the core parts, distilled:

1. No Sloppy Summaries: Make Sure Ordinary People Understand

Original Text: The SEC requires prospectus covers to disclose price, underwriters, and the first authorized participant (AP). Summaries must use plain English to describe trust structures, basic crypto asset information, and investment objectives.

Interpretation: In the past, many crypto projects liked to bury investors under jargon. That won’t fly in traditional finance. Now, the SEC demands clear, transparent information: Who is the AP? What blockchain do you use? How are the assets held? What consensus mechanism secures them? Everything must be plain to see.

2. Risk Disclosures Are Mandatory: Tell Investors How “Terrifying” Crypto Can Be

Original Text: Required risks include price volatility, network attacks, exchange hacks, front-running, liquidity risks, regulatory uncertainty, and tax ambiguities.

Interpretation: This is the SEC’s most “hardcore” section. They don’t object to crypto assets per se — they worry investors don’t understand the risks. Every possible risk — from flash crashes to exchange blowups — must be listed. No more hiding behind “new technology.”

This is a wake-up call: launching an ETF isn’t just theater — you must lay out all the risks plainly, or forget about getting approved.

3. Full Operational Details: Not Just How Much BTC You Have, But Where It Came From

Original Text: Disclose trust asset structures, NAV calculation methods, pricing benchmarks, on-chain mechanisms (staking, burning), whether you claim forks or airdrops — all of it.

Interpretation: The SEC wants transparency “down to the bone.” What do you hold? How do you custody it? Who is the custodian? Cold wallet or hot wallet? Who controls the keys? Is there insurance? You must spell everything out.

This effectively closes loopholes for gray practices, like asset co-mingling, phantom reserves, or unverifiable custody.

4. NAV and Pricing References Must Be Credible and Transparent

Original Text: You must list reference exchanges and weightings, explain how you handle data gaps, state whether benchmarks can change, and disclose any algorithm updates.

Interpretation: For example, if your ETF tracks spot BTC prices — do you reference Coinbase, Kraken, Binance? If an exchange goes offline, what happens?

This prevents ETFs from using cherry-picked, less-volatile data to look artificially stable.

5. Custody Details: Insurance? Keys? Cold Wallets? Disclose Everything

Original Text: You must detail storage methods (hot/cold/warm wallets), key management, whether custodians have insurance, and whether coverage is pooled.

Interpretation: This directly targets past custody fiascos. Remember when exchanges “self-custodied” assets and insiders stole funds? The SEC now demands clear answers: Who holds what? Is there insurance? Can assets be mixed?

This significantly raises the market’s trust threshold.

6. Service Providers, APs, and Third-Party Agreements Must Be Fully Disclosed

Original Text: All partnership agreements, conflict-of-interest disclosures, and role definitions must be included in registration filings.

Interpretation: In the past, many issuers hid side deals with LPs or APs. That’s no longer allowed. You must submit contracts to the SEC — and even summarize them in the prospectus.

This is a massive hurdle for less-compliant projects.

7. Avoid Self-Dealing and Conflicts of Interest: Sponsors’ Own Trading Must Be Declared

Original Text: If the sponsor or its executives personally hold crypto assets, they must disclose any potential conflicts of interest.

Interpretation: For example: if you launch an ETF but secretly short or pump your own tokens — that’s a textbook conflict. The SEC now requires pre-disclosure of any holdings or pre-warning mechanisms.

This helps prevent “two-sided arbitrage” by issuers and protects investors.

This Isn’t a Crackdown — It’s Standardization

Some will think the SEC is simply “targeting crypto.” But if you read the full document, it’s more a case of “setting the bar and paving the road.”On the one hand, the SEC wants crypto ETFs held to the same standards as traditional funds — no double standards.On the other hand, they’re offering a clear entry framework:

Clearly define what assets you hold

Fully disclose all risks

Be transparent about counterparties

Don’t secretly control customer assets

Disclose all related-party transactions

If you can meet these standards — welcome to the ETF market.

What Does This Mean for the Crypto Industry?

1. Crypto Assets Are Being Integrated Into Mainstream Financial Regulation

This is arguably the most significant outcome beyond ETFs themselves. The SEC is no longer treating Bitcoin or Ethereum as vague curiosities — they are “securities that can be listed in a prospectus.”It’s a legitimacy upgrade.

2. It Clarifies Who Can Issue an ETF

Not everyone can launch one — but it’s also not limited to Wall Street. If you can satisfy these disclosures, on-chain protocols and projects can also approach ETF status.

3. It Creates New Demand for Verifiable On-Chain Data

Projects, wallets, and custodians now need to provide verifiable on-chain data and auditable off-chain disclosures. This makes infrastructure like Chainlink, The Graph, and other “trusted data providers” even more important.

4. It Incentivizes “Compliant DeFi”

If you want your LSD, stablecoin, or token to be included in an ETF someday, you must start building compliance now.Otherwise, when the rules fully take hold, you’ll be locked out.

Conclusion: An Invitation to Join the “Securities Civilization”

The SEC hasn’t issued a red card — it has offered an invitation:Want to join the mainstream markets? Fine. But play by the rules.

In a sense, compliant crypto ETFs are the key to turning crypto assets into part of the global asset pool.And the SEC has already placed that key on the table.

0 notes

Text

What is Proof-of-Coverage In Crypto | Explained Simply

In this post, I will explain what is Proof-of-Coverage in crypto and how it verifies activity in the real world, as opposed to verifying computational tasks done digitally. Coverage verification is needed in decentralized wireless networks to check if devices are indeed providing network coverage. It significantly helps bridge blockchain technology and physical infrastructure using geospatial…

0 notes

Text

When art meets blockchain: Ukraine’s new frontier in wartime cultural preservation

As Russia’s systematic destruction of Ukraine’s cultural heritage continues amid the full-scale war, Ukraine’s art community is seeking innovative, if not unconventional methods, to preserve their country’s legacy — among them blockchain technology.

Officially launched in February 2025, the Ukrainian Fund of Digitized Art (UFDA) was conceived with a bold mission: to digitize Ukrainian art and transform them into non-fungible tokens, or NFTs that could be sold at auction.

The UFDA aims not only to preserve and share Ukrainian cultural heritage but “to engage the global community in the fight for cultural preservation,” as it reads on the organization’s website.

Currently, the UFDA has digitized more than 3,000 works by 60 artists, spanning both contemporary and classic Ukrainian art. The UFDA collaborates closely with artists, museum curators, and other cultural institutions to ensure each work is captured in ultra-high resolution.

“We believe that in the world of digital information, what we do will become extremely valuable (in the art world) and this is what drives us,” said UFDA advisor Petro Bondarevskyi. Bondarevskyi is an early supporter and minority investor in the Kyiv Independent.

“Ukraine will make its mark and set the bar.”

At the same time, while artists involved in the UFDA’s digitization initiative applaud its achievements, they also acknowledge that it raises important, and sometimes even uncomfortable, questions about how art is perceived and valued in the digital age.

A need to refine digitization

Having come up in the museum world, Anna Filippova — founder and curator of UFDA — understood, perhaps more than most, the necessity of digital preservation done right.

“I observed a lot of very low-quality pictures of artists’ work,” Fillippova told the Kyiv Independent.

“Each artwork is captured in a single ultra-high-resolution shot, preserving the original light with exceptional dynamic range.”

“That’s why we first came up with the idea for this project back in 2021 with no name, no structure, no actual idea — except digitizing.”

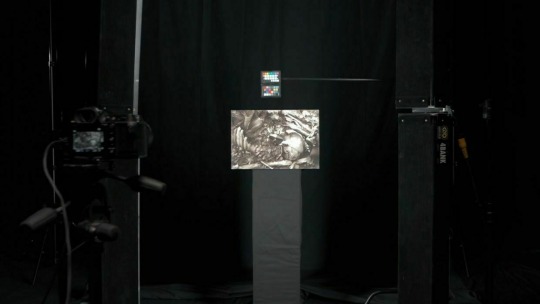

At the heart of UFDA’s digitization process is Digital Light Capture Technology — a technique that uses a high-end camera and precision lighting to reveal each brushstroke in vivid, high-resolution detail. The final images are captured in ultra-high resolution, ranging from 100 to 400 megapixels, with rich 48-bit color depth.

A screenshot of the behind-the-scenes of UFDA’s digitization process is Digital Light Capture Technology, a technique that uses a high-end camera and precision lighting to reveal each brushstroke in vivid, high-resolution detail. (Ukrainian Fund of Digitized Art)

“Many digitization processes rely on digital stitching — taking multiple photographs and merging them into a single image. That’s not our approach,” Bondarevskyi said.

“Each artwork is captured in a single ultra-high-resolution shot, preserving the original light with exceptional dynamic range.”

The UFDA team, drawing on their roots in the art world, began reaching out to contemporary artists and museum curators with the idea to digitize their work for broader accessibility and preservation.

Can art thrive on blockchain?

With the introduction of Bitcoin in 2008, blockchain technology has upended the way many people think about ownership. At the forefront of this digital revolution are NFTs — one-of-a-kind digital certificates on the blockchain that verify ownership of everything from memes to masterpieces of art.

The UFDA emphasizes that neither the organization nor the artists receive financial gain from the sale of these digitized artworks. Instead, all proceeds are directed to support Ukrainian NGOs.

“When an artwork is purchased, the transaction is recorded on a blockchain — creating a digital counterpart to the physical piece, or more simply, a digital analogue,” Bondarevskyi explained.

Buyers who purchase the NFT version of an artwork digitized by the UFDA own it for up to a century, but copyright of the artwork itself, like with the purchase of the physical painting, remains with the artist.

“(The UFDA’s mission) is a way to document our era through culture, which will undoubtedly influence the development of art research.”

The move to tokenize these digital artworks as NFTs came later and remains somewhat tangential to the organization’s main mission, according to Filippova. Yet, both efforts gained a sense of urgency amid Russia’s full-scale war, transforming what might have been a quiet digital experiment into a vital cultural response.

Why pay for a digital version of an artwork instead of the original? The UFDA’s response is simple: as the way people experience art shifts, so too should the way they own it.

“Twenty years ago, many people insisted that cinema could only be truly experienced in a theatre, projected from film. Digital, they claimed, could never match it,” Bondarevskyi said.

A screengrab of the behind-the-scenes of UFDA’s digitization process is Digital Light Capture Technology. The final images are captured in ultra-high resolution — between 100 and 400 megapixels — with a rich 48-bit color depth. (Ukrainian Fund of Digitized Art)

“Yet today, virtually every stage of filmmaking is digital: from shooting to post-production to projection. This shift in medium illustrates how technology transforms not just how we consume content, but how we value it. For some collectors, the enduring value and permanence of digital ownership is becoming just as meaningful."

While many artists involved in the UFDA’s efforts recognize the clear benefits of creating a comprehensive digital archive — one that encourages collaboration and improved practices among artists, curators, and art historians — they also voice some reservations.

Even though the profit of sales goes to benefit NGOs, the commercialization of these digital reproductions raises complex questions for some artists around authorship, artistic intent, and the broader commodification of art.

“When the full-scale war began, the UFDA evacuated works from my studio and digitized everything they took. I’m very grateful to them — they really helped me out several times. But now, I’m not sure I would agree to digitize my most recent works,” artist Kateryna Lysenko told the Kyiv Independent.

“It feels as though you suddenly have another version of your work — like a second body — that's become alienated from you. It takes on a life of its own, one you no longer understand or control. It's not yours anymore, yet you watch as it moves, not by your hand, going somewhere unknown. Still, it's fascinating to observe.”

Artist Polina Shcherbyna, whose work was also evacuated to safety during the war by UFDA, told the Kyiv Independent that the archive ensures “a digital copy of the piece can actually outlive the original” which for her, during wartime, is especially important.

“This was the start of our collaboration, which has only strengthened and continues to develop,” Shcherbyna told the Kyiv Independent. “(The UFDA’s mission) is a way to document our era through culture, which will undoubtedly influence the development of art research.”

Russia killed Ukrainian author Victoria Amelina — but not her words or quest for justice

Ukrainian author Victoria Amelina never got to finish writing her book “Looking at Women, Looking at War.” After she was killed in a Russian missile strike on Kramatorsk in Ukraine’s eastern Donetsk Oblast in 2023, it fell upon her closest friends and colleagues to do what they could to

The Kyiv IndependentKate Tsurkan

Urgency to act

The UFDA was officially launched three years into Russia’s full-scale war, against the backdrop of a systematic campaign targeting Ukraine’s cultural heritage — an assault defined by both deliberate destruction and calculated theft.

Russian forces have damaged or destroyed more than 1,400 cultural heritage sites and over 2,200 cultural facilities since the start of the full-scale war, according to the latest report released by the Culture Ministry in early April.

The destruction is widespread, impacting an estimated 20% of settlements across the entire country. However, with almost no access to occupied territories and the front-line zones, the true extent of the damage to Ukraine’s cultural heritage is far greater than currently documented.

Aside from destruction, the Russian military has also been stealing Ukraine’s cultural heritage from the occupied territories.

In what has been recognized as the largest museum theft since World War II, Russian occupiers stole over 33,000 artworks and historical artifacts from two Kherson art museums in the fall of 2022.

A museum staffer stands in an empty storage room at an art museum in Kherson, Ukraine, on Dec. 8, 2022, following a campaign of plunder during the Russian occupation of the area. (Kyodo News via Getty Images)

The Kyiv Independent’s War Crimes Investigations Unit identified in its documentary “Curated Theft” the Russian military officer and three Russian-appointed officials from occupied Crimea who were personally responsible for the theft.

With all this in mind, the UFDA found it important not only to partner with contemporary artists but museums to safeguard during wartime the legacy of seminal Ukrainian artists whose work has defined the nation’s cultural identity.

The UFDA team has digitized 46 paintings from the Nykonor Onatskyi Regional Art Museum in Sumy, including works by 19th-century realist Mykola Pymonenko, known for capturing Ukrainian traditions and daily life.

The museum also includes standout works by 20th-century Ukrainian avant-garde artists like David Burliuk, Vasyl Krychevsky, and Oleksandr Bohomazov. Home to one of the most distinguished art collections in Ukraine, the museum now faces a growing threat due to Sumy’s close proximity to the Russian border.

“We’ve long known how exceptional their collection is, and in November 2023, we began our communication with them,” Filippova said.

“What stood out to us is the museum’s unique and nationally significant holdings, especially in light of its precarious situation: located near the border with the aggressor state, and not yet evacuated, the museum is under constant risk of destruction.”

During a Russian missile strike on April 13 that devastated central Sumy, killing at least 35 and injuring 117, the museum was damaged. It was not the first time that the building was damaged in a Russian attack.

Ukrainian emergency workers search through rubble after a missile strike in Sumy, Ukraine, on April 14, 2025. (Roman Pilipey/AFP via Getty Images)

Knowing the history of so many of the Ukrainian artists whose work is held in the museum — and the tragic ends many of them met at the hands of Russian repression over the past centuries — casts a poignant shadow over the UFDA’s mission, according to Filippova.

Each digitized Ukrainian artwork ensures that, even in the worst-case scenario where the physical version is stolen, damaged, or destroyed, the voices and visions of these artists will endure.

Their legacy, preserved through technology, is not only a testament to the cultural richness of Ukraine’s past, but a reminder that its survival is essential for the future to endure as well.

“Given the bloody history of the Ukrainian avant-garde — a story of repeated erasure, exile, and neglect — we felt a strong sense of urgency (in the case with the paintings in the Sumy museum) not to allow yet another chapter of cultural eradication,” Filippova said.

Note from the author:

Hi, this is Kate Tsurkan, thank you for reading this article. You might have noticed that none of our reporting is behind a paywall — that’s because we believe that now, more than ever, the world needs access to reliable reporting from the ground here in Ukraine. To keep our journalism going, we rely on our community of over 18,000 members, most of whom give just $5 a month. We’re now aiming to reach 20,000 members, to prove that independent journalism can thrive, not just survive. Help us today.

youtube

0 notes

Text

Tether AI Explained: Real-Time Crypto Payments Through Automation

One of the latest innovations that is making waves is Tether AI. This technology allows users to complete real-time crypto payments through automation, making the process faster, safer, and more efficient than ever before.

Tether AI connects automation tools with USDT payments, using smart contracts and intelligent scripts. It could become the foundation of how businesses pay, trade, and move money globally. But how does it really work? And what makes it so powerful?

Let’s break it down in a simple and easy-to-follow manner.

What Is Tether AI?

Tether AI is a smart system that uses automation to handle crypto payments, especially with USDT (Tether), a stablecoin pegged to the US Dollar. This means 1 USDT is almost always equal to $1 USD. According to CoinMarketCap, USDT ranks among the top 3 cryptocurrencies by market capitalization, with billions in daily transaction volume.

Unlike other platforms, Tether AI does not just send and receive crypto — it can process, monitor, and secure every transaction in real-time. It usually runs through an AI runtime security system, which checks each step to make sure the data and money are safe.

This technology could solve many common problems, such as delays, human error, or fraud. For example, if someone enters the wrong wallet address, the AI might flag the transaction before it goes through.

How Tether AI Works with USDT Payments

Let’s say a business wants to pay a freelancer in another country. Instead of using a bank, which might take days, the company could transfer USDT using Tether AI. The AI would:

Confirm the correct amount.

Send the crypto instantly.

Log the transaction into a dashboard.

This all happens in seconds.

Also, Tether AI can link to external apps through the Crypto.com API. This connection lets users automate tasks like payouts, subscriptions, or refunds.

Why People Choose Tether AI

Many users rely on Tether AI because it saves time and reduces risks. Here’s what it does well:

Fast Transactions: No waiting for bank hours.

Global Reach: Anyone with a USDT wallet can get paid.

Smart Automation: The AI handles repeated tasks like monthly payments.

These benefits are especially helpful for freelancers, remote teams, and e-commerce stores.

The Role of AI Runtime Security

AI runtime security means the system always watches for errors or threats. It acts before problems happen. It might block fake transactions or notify the user when something looks off.

According to Chainalysis, crypto crime dropped by 23% in 2023, partly because of improved AI-based protection systems. This shows how important security tools like Tether AI have become.

The Tethered Series and Tools

Tether Inc. has launched a set of related products, often called the Tethered Series or Tethering Tools. These tools help developers plug in automation into their apps easily. Whether you need a payment bot, invoice manager, or salary distribution tool, the Tethered Tools kit might be the best choice.

These tools also support integration with AI technologies to run and maintain services smoothly. Companies like Infinite Technologies are now building custom software on top of Tether AI platforms to help enterprises grow smarter.

The Role of the Tether CEO

The Tether CEO, Paolo Ardoino, has publicly pushed for more AI use in blockchain tools. In 2024, he announced that automation is no longer optional it must become standard for every major platform that handles digital money.

According to Tether.io, their future roadmap includes deeper AI integration, allowing for fully autonomous payment systems in the near future.

What Is USDT Payment and Why Does It Matter

A USDT payment simply means transferring the stablecoin Tether between wallets. Unlike Bitcoin or Ethereum, USDT does not swing in price. This makes it ideal for everyday use.

Many marketplaces, such as Binance, Crypto.com, and Bitfinex, now accept USDT payments for goods and services. Also, you can store it in a USDT wallet for later use or savings.

Tether AI makes this process easier by setting up rules, like “Pay John 300 USDT every Friday,” without needing manual approval.

A Word About Technological Monopolies

As more businesses adopt Tether AI, some fear the rise of technological monopolies. Big firms might control most tools and platforms. But with open-source options and decentralized APIs like the Crypto.com API, smaller teams can still compete.

We must stay alert and choose systems that offer freedom, not lock-in. Users should look for transparency and support from platforms before making the switch.

How to Get Started with Tether AI

If you’re curious, here’s how you can begin:

Create a USDT wallet (like on Trust Wallet or MetaMask).

Connect it to the Tether AI platform.

Use tethering tools to automate your tasks.

Test with a small amount first.

Make sure to read the guides on Tether.io or Crypto.com to understand how integrations work.

Conclusion:

Tether AI could change the way people and businesses pay each other. With automation, AI runtime security, and seamless USDT payments, users can save time, cut down costs, and increase trust in their financial activities.

As we move into a world that runs on smart contracts and real-time logic, tools like Tether AI must not be ignored. Whether you’re a freelancer, a startup, or an enterprise, now is the best time to try Tether AI and get ahead of the curve.

FAQS

What can I do with the Tether app?

You can send, receive, and store USDT (Tether) using the Tether app. It also helps you track crypto transactions in real-time and manage your USDT wallet safely. If you’re running a business, you can connect it to Tether AI to automate crypto payments and save time.

Which bank supports my Tether transactions?

Tether Ltd. has worked with banks like Deltec Bank & Trust to manage its reserves. Your own bank doesn’t directly hold Tether, but if you cash out USDT through a crypto exchange, the final withdrawal will reach your regular bank account. Always check Tether’s official updates for the latest info.

How do I get cash out of my Tether wallet?

To turn your USDT into real money:

Move your USDT to a trusted crypto exchange (like Crypto.com, Binance, or Coinbase).

Convert USDT into your local currency (like USD, EUR, or PKR).

Withdraw to your bank account or debit card from the exchange.

Some wallets and exchanges also let you use crypto-linked cards to spend directly.

How does Tether make a profit?

Tether earns revenue in a few smart ways:

It charges small fees on transactions and redemptions.

It invests the reserves that back USDT into stable assets (like U.S. government bonds).

It provides automation tools like Tether AI, which may offer premium services for businesses.

These strategies help Tether remain stable and trusted in the crypto space.

Can I mine Tether like Bitcoin?

No, you can’t mine Tether (USDT). It’s not a mineable coin. Tether is pre-issued and backed 1:1 with the US dollar. You can get it by buying USDT on exchanges or receiving it as a payment—not through mining like Bitcoin or Ethereum.

0 notes

Text

KOL Marketing is Broken. Here’s how we’re fixing it

You might think about brand deals when content creators flash products on social media. Those quick posts often leave users feeling empty and brands seeing minimal value results. The trust level among audiences drops every time creators force unnatural promotions into their feeds.

The mechanism behind these partnerships usually lacks depth and genuine value alignment. You can spot these hollow promotions from miles away—creators using words their loyal fans have never heard them speak.

Why Traditional Approaches Fail

Traditional Web3 Influencer Agency often shows major flaws in execution and strategy. You can never build solid relationships when brands treat creators as simple media spaces rather than equal-value partners.

Mismatched brand-creator partnerships create inauthentic content.

Short-term focus produces minimal lasting impact

Audiences detect forced promotions immediately

The measurement relies solely on basic engagement metrics

These basic flaws drive users toward content fatigue and creator burnout. You must admit these tired approaches never truly serve anyone, not brands, users, or talent.

The Blockchain Space Challenge

The crypto world faces extra hurdles when using usual KOL tactics. You will often notice that these technical topics prove difficult for many creators to explain properly. The space needs knowledgeable voices who truly grasp complex ideas.

Working with Crypto Digital Marketing Agency experts helps bridge these knowledge voids through proper training. You would never guess how many potential great partners exist who simply need clear education about blockchain basics.

Many firms focus solely on follower count rather than audience alignment. You can waste large media funds when reaching alone drives every single decision made about partnerships.

Building Better Creator Relationships

Smart brands today place value on long-term creator partnerships. You might learn more about product-audience fit when you truly know your creative partners well.

Authentic relationships allow brands and creators to build trust among local communities. You could never force these genuine connections—they must grow through shared goals and values.

This trust-based model works especially well for technical products. You would think more companies would adopt these proven strategies given their clear benefits.

Focus on value alignment between brand vision and the creator’s voice

Allow space for creators to maintain an authentic voice

Measure beyond basic engagement into community sentiment

Provide proper technical education for complex topics

Data-Driven Approach to Selection

The right match between brands and creators forms the foundation for success. You might waste large budgets when using the wrong metrics to drive these vital decisions.

Smart teams today apply strict data analysis beyond basic reach numbers. You would likely discover better partners through engagement quality rather than quantity alone.

Looking deeper into audience demographics helps match products with ideal users. You might think about psychographic factors when building these critical partnerships.

The Value of Content Education

When using Kol Marketing Agency, brands must invest in proper creator education. You would never expect someone without training to explain complex technology concepts clearly.

This focus helps prevent misinformation while building creator confidence. You might notice lower quality when brands skip these crucial educational steps.

Properly trained creators deliver more value through accurate, engaging content. You could watch engagement rates climb when audiences detect genuine knowledge being shared.

Measuring What Matters

Traditional metrics often miss the true impact of influence campaigns. You would better serve campaigns by tracking sentiment rather than by using simple clicks alone.

Smart brands track conversion paths beyond direct attribution models. You might learn that users often purchase later after multiple brand touchpoints occur.

This nuanced approach allows for better budget allocation decisions. You could argue that measurement matters the most among all strategy components today.

Track community sentiment beyond basic engagement

Follow multi-touch attribution models

Measure brand lift through surveys

Analyze content longevity and ongoing performance

Creating Systems for Scale

Brands often struggle with managing multiple creator relationships simultaneously. You would never reach scale without proper systems supporting these complex efforts.

Streamlined workflows allow teams to maintain quality while expanding reach. You might build these process models before attempting large-scale campaigns.

Technology platforms help track deliverables and measure results effectively. You could never manage dozens of partnerships manually without these tools.

Transparent Reporting and Results

Smart firms share their whole data suite with you, their brand teams. You must track every penny spent on voice posts with clear proof that sales came from those views.

Great firms offer tools that count each step along user paths from views down to true sales. These firms prove their work helps your brand grow through great value tests.

Shift your focus from firms that claim huge reach stats to those that prove their voice posts truly serve your sales goals. The right tools allow clear tests that match voice stars based on their users’ needs.

Conclusion

The right path leads away from quick, empty views toward solid voice pairs that drive true sales. Your brand needs stars who truly value what you make, not those paid to fake their trust.

Shift your focus toward firms that prove each claim with clear sales data. Build voice plans that place your goods with stars whose users match your ideal buyer traits. The kollab drives your brand power with voice pairs built on truth, not empty stats that waste your funds

#Crypto Marketing Agency#Web3 Marketing Agency#KOL Agency#Kol Marketing Agency#Kol Influencer Agency#Crypto Marketing Services#Blockchain Marketing Agency#Blockchain Marketing Services#Web3 Marketing Services#Web3 KOL Agency#Kol Marketing Services#Web3 KOL Services#Kol Crypto#DeFi Marketing Strategies#Defi Marketing#Kol Agency Crypto#DeFi Marketing Services#Web3 Influencer Agency#DeFi Marketing Agency#Crypto Social Media Management#KOL Fundraising#Metaverse Marketing Services#Crypto Influencer Marketing Agency#NFT Marketing Agency#Web3 Agency

0 notes

Text

People continue to ask if Bitcoin will replace the dollar. They believe that the recent surge in Bitcoin indicates that it will topple the USD as the world’s reserve currency, but that is merely propaganda. You must understand that Bitcoin is simply a trading vehicle, not a currency. I cannot stress that point enough. My opinion has been unpopular, and clients have walked away due to my stance on crypto. That’s fine, as I am not in this for the money. I can only adequately inform my clients of the unbiased truth and hope that those willing to listen will heed the computer’s warnings.

To begin with, there is much speculation about the founder(s) — Satoshi Nakamoto – who created Bitcoin (BTC) on June 3, 2009. The mystery person or group (or government agency) has been MIA since 2011. Yet 1 million Bitcoins remain in their original account, untouched. His wallet is estimated to be worth over $81 billion at the time of this writing, and if this is indeed an individual, he or she is one of the top 15 richest people in the world. They have never moved a fraction of a BTC from their account. So, one wallet contains 5% of all mined bitcoin. Will this person or entity perpetually hold?

They expect us to believe some mysterious Japanese man created the blockchain technology and simply evaded all world governments. They claim Bitcoin is an anti-government vehicle, but it is a bureaucrat’s dream because it allows them to track where funds are coming from and going. In 1996, the US government released a white paper entitled, “How to make a mint: the cryptography of anonymous electronic cash.” Released by the National Security Agency Office of Information Security Research and Technology, this document explains how a government agency could create something like Bitcoin or another cryptocurrency. They had been attempting to create one for years and then magically Bitcoin came on the scene.

I encourage anyone interested in crypto to read my article regarding this study. Blockchain was created with surveillance at the top of mind.

9 notes

·

View notes

Text

Case Studies: Different Ways Companies Approach Blockchain Technology

1. Introduction to Blockchain Technology

What Is Blockchain, Explained Simply

Imagine a digital notebook that's shared among thousands of people—every change made to it is visible to everyone, and no one can secretly alter a page. That's the magic of blockchain: a transparent, tamper-proof system where data is stored in blocks and linked together chronologically.

Importance of Blockchain in Modern Business

From improving supply chains to creating smarter financial services, blockchain app development company has become the go-to innovation. Its decentralized nature brings trust, security, and automation into operations—something businesses can't afford to ignore anymore.

2. Why Companies Are Exploring Different Approaches

One Size Doesn’t Fit All

No two businesses are the same, so why should their blockchain strategy be? What works for a logistics company might be a total mismatch for a financial service provider. Hence, the demand for tailored blockchain solutions is booming.

Tailored Strategies for Specific Industries

Enter custom blockchain deployments—created by specialists to suit niche needs. Whether it's increasing transparency in retail or automating cross-border payments in banking, companies are using blockchain in different ways to tackle different problems.

3. Case Study 1: IBM’s Enterprise Blockchain for Supply Chains

Problem

Complex global supply chains made it hard to track goods, prevent fraud, and ensure accountability across vendors.

Approach

IBM launched IBM Blockchain, a permissioned network designed to streamline logistics and enable real-time tracking.

Result

Major players like Maersk partnered with IBM to digitize shipping records, reducing paperwork and delays while increasing visibility.

4. Case Study 2: De Beers and Ethical Diamond Tracking

Problem

The diamond industry has long faced criticism for failing to prevent conflict diamonds from entering the supply chain.

Approach

De Beers developed Tracr, a blockchain platform that traces the journey of diamonds from mine to market.

Result

Tracr allows buyers to verify the origin of their diamonds, boosting trust and meeting ethical sourcing standards.

5. Case Study 3: Walmart’s Food Safety Blockchain

Problem

Food recalls were slow and inefficient, risking public health and brand reputation.

Approach

Walmart collaborated with IBM to use blockchain for tracking produce and meat through the supply chain.

Result

Food traceability was reduced from 7 days to 2.2 seconds, enabling rapid action when contamination was discovered.

6. Case Study 4: Brave Browser and Web3 Monetization

Problem

Users are tired of invasive ads, and creators often don’t earn fairly from their content.

Approach

Brave Browser rewards users with Basic Attention Tokens (BAT) for viewing ads—shifting power from advertisers to users.

Result

Brave's blockchain model turned the internet’s value chain on its head, showing how decentralization can rebalance monetization.

7. Case Study 5: Ethereum and Decentralized Applications

Open-Source Experiment

Ethereum's flexible architecture allowed developers to create dApps (decentralized applications) for everything from gaming to finance.

Community-Powered Growth

With smart contracts and open participation, Ethereum became the hub for innovation in DeFi, NFTs, and more.

8. Case Study 6: Estonia’s Digital Identity via Blockchain

National-Level Integration

Estonia integrated blockchain into its e-Governance system, securing data for services like healthcare, taxes, and voting.

Results & Innovations

This made Estonia one of the most digitally advanced nations, with a blockchain-secured identity framework that’s scalable and efficient.

9. Challenges in Blockchain Adoption

Security Concerns: Can Blockchain Be Hacked?

While blockchain is inherently secure, it’s not invincible. Vulnerabilities often lie in user interfaces, smart contracts, or poor key management—not the blockchain itself.

Regulatory Uncertainty

With governments still playing catch-up, businesses face hurdles in compliance and legality when adopting blockchain.

Technical Complexity

Integrating blockchain into legacy systems isn’t always plug-and-play—it requires robust infrastructure and skilled talent.

10. Role of Web3 Development Firms and Blockchain App Developers

Why Businesses Hire Blockchain App Development Companies

Expert firms help companies build, scale, and launch custom blockchain platforms with a focus on usability, security, and innovation.

Bridging Innovation Gaps

From MVPs to full-scale blockchain products, these development firms guide enterprises through the maze of decentralized technologies.

11. Blockchain Beyond Cryptocurrency

Real-World Use of Blockchain Technology

Blockchain isn’t just for Bitcoin anymore. It’s powering smart contracts in insurance, patient records in hospitals, and cross-border logistics in trade.

Decentralized Ledger in Healthcare, Finance, and More

The decentralized ledger brings accuracy and accountability where it’s needed most—whether you're processing medical records or global payments.

12. Key Takeaways from the Case Studies

No single blockchain solution fits all businesses.

Companies are leveraging blockchain in truly creative ways.

A custom approach leads to real-world impact.

Web3 development firms play a critical role in execution.

Blockchain has gone far beyond crypto—it’s changing everything.

13. Conclusion

Companies aren’t just experimenting with blockchain—they’re reimagining their business models around it. From tracking diamonds to securing government services, these case studies show that blockchain is as versatile as the minds who wield it. So, if you're a business leader staring at a challenge, maybe it's time to ask—how would a different approach to blockchain technology solve it?

#technology#blockchain development#blockchain technology in healthcare#blockchain applications#blockchain technology#blockchain

0 notes

Text

How Quantum Bits (Qubits) Work – Explained Simply

Introduction: The Future of Computing Starts with a Qubit Quantum computing is no longer science fiction, it’s rapidly becoming a revolutionary technology that could change everything from cryptography to blockchain scalability. At the heart of this transformation is the qubit, the basic unit of information in quantum systems. But what exactly is a qubit? How is it different from a regular bit?…

#crypythone#LearnCrypto#BinanceReferral#DigitalInnovation#PostQuantumSecurity#QuantumBlockchain#QuantumComputing#QuantumCrypto#QubitsExplained#TechTrends#TechTrends2025

0 notes

Text

Insights from CIFDAQ COO Jay Hao: A Guide to Fund Raising for Web3 Startups

Insights from CIFDAQ COO Jay Hao: A Guide to Fund Raising for Web3 Startups

Web3 startups have raised over $5.4 billion in venture capital during the first three quarters of 2024. This figure reflects a significant investment trend, with $1.4 billion raised in the third quarter alone.

Investors are increasingly targeting emerging markets at the intersection of blockchain and artificial intelligence (AI), while projects focused on decentralized blockchain infrastructure have also recently drawn substantial capital flow.

However, despite these glowing statistics and trends, securing funds for Web3 startups is no straightforward feat. And as a Web3 journalist, I have witnessed the tension in the industry firsthand. Conversations with founders and investors have revealed a landscape marked by both potential and uncertainty.

There’s no doubt that startups are emerging with innovative concepts. But then they’re confronting an investment arena that demands more than just a compelling pitch—it requires strategic precision, robust fundamentals, and a clear, executable vision.

To help Web3 startups go about fundraising the right way, I spoke with Jay Hao, Co-Founder and Global Chief Operating Officer of CIFDAQ, and former CEO of OKX. In this exclusive interview, Hao shared practical tips on building a solid foundation, crafting a compelling narrative, and tokenomics. He also offered guidance on identifying investment needs, attracting the right investors, and negotiating deals.

Editorial Note: The article is derived directly from the exclusive interview with Jay Hao. While the original interview format has been transformed into a comprehensive narrative, every insight and quote remains authentic to Hao’s original responses.

Building a Strong Foundation Every great Web3 startup begins with a rock-solid foundation. According to Hao, building a solid foundation is more than a preliminary step—it’s a critical determinant of a startup’s potential success. Hao emphasizes that this foundation rests on three fundamental pillars: team, technology, and business model.

“A strong foundation for a Web3 startup hinges on assembling a visionary, skilled team, developing innovative and secure technology, and crafting a business model that leverages blockchain’s decentralization,” Hao explains.

This holistic approach goes beyond mere technical capabilities, focusing on scalability, real-world impact, and creating a unique value proposition that captivates both users and investors.

Additionally, central to a startup’s foundation is the ability to tell a compelling story. According to Hao, a powerful narrative combines the mission with an engaging story about how the project solves an urgent problem in an innovative way. And this approach is not merely about marketing—it reflects a profound understanding of the problem and presents a visionary solution capable of transforming existing paradigms.

When asked whether tokenomics is essential, Hao emphasized its importance in aligning the interests of all stakeholders. He explained that effective tokenomics goes beyond simply creating a cryptocurrency.

“It involves creating a model with fair token distribution, real utility such as governance, staking, or transactions within the platform, and mechanisms to balance supply and demand. This fosters trust among investors and the community while driving ecosystem adoption,” Hao adds.

The Right Funding Strategy Having established the foundational elements of a Web3 startup, the next challenge is securing the right capital from the right investors for the right reasons.

Now, the first question any startup must ask is whether funding is even necessary. And Hao offers a clear perspective on this:

“Investment is essential only if it addresses critical growth gaps like product development, scaling, or market entry. One should avoid the allure of fundraising for PR hype; instead, ensure funding directly accelerates achieving your startup’s long-term vision.”

This perspective demands a strategic, almost surgical approach to fundraising. Startups must move beyond the glamour of raising capital and focus on precise, milestone-driven funding that propels genuine growth. Meticulously forecasting costs, aligning funding with specific growth targets, and benchmarking valuations against market trends become paramount.

The quest for the right investor is equally nuanced. You shouldn’t raise from any investor, but find a partner who comprehends the unique challenges and potential of your Web3 venture.

“The right investor understands your vision, brings strategic value beyond funding, and aligns with your long-term goals. Whether it’s an angel for early validation or a VC for scaling, prioritizing those who can offer expertise, connections, and credibility boosts the success of a startup,” Hao emphasizes.

Adding another layer to the complexity are Key Opinion Leaders (KOLs), who are increasingly stepping into the investor role. While they can offer massive exposure and credibility, their involvement requires careful consideration. The equity they demand must be proportional to their tangible impact—measured not by social media followers, but by their ability to drive meaningful community growth and user adoption.

Closing the Right Deal Negotiating investment terms is another critical moment for Web3 startups. Founders must balance financial strategy with collaborative partnership, viewing investor discussions as opportunities to align mutual goals and create shared value.

Following are some of the key tactics that Hao emphasizes for getting the best deal:

Don’t limit yourself to one source of funding. Having a range of options gives you leverage in negotiations and avoids being cornered into unfavorable terms. Be upfront about your startup’s valuation and the reasoning behind it. A clear, well-supported explanation shows investors that you understand your worth and the market. Focus on terms that benefit both sides, such as vesting schedules, governance rights, and token lockups. These provisions help align the interests of the startup and investors over the long term. Always bring legal experts into the process to ensure that agreements are fair and enforceable, and protect your startup’s best interests. After the Funding Securing funding is not the finish line. The transition from fundraising to execution is where many Web3 startups falter. Successful teams understand that investor confidence is continuously earned, not just initially obtained.

This is where the roadmap developed during the fundraising process becomes a critical navigation tool, guiding the startup’s strategic decisions and demonstrating commitment to its original vision.

“Post-funding, the team must focus on disciplined execution, strategically hiring talent, and delivering on the promised milestones,” Hao advises.

This approach goes beyond mere financial management—it’s about building trust, maintaining transparency, and demonstrating the ability to transform potential into tangible results.

Here are the key strategies that Hao shares for fostering strong relationships with investors:

Keep investors in the loop with regular updates on progress, challenges, and new opportunities. This helps build trust and ensures everyone stays aligned with the vision. Involve investors in key decisions when appropriate. Their expertise can be invaluable, and giving them a stake in important choices strengthens their connection to the project. Encourage investors to get involved in the ecosystem, whether through roles like validators, token holders, or advisors. This deepens their engagement and makes them feel more invested in the startup’s success. “By sticking to the roadmap you’ve built, you naturally boost confidence among both the community and the team,” Hao continues.

Critical to this process is building a loyal community, tracking key performance indicators (KPIs), and maintaining organizational agility. Every funding dollar must be viewed as an investment in growth and innovation, requiring constant evaluation and strategic reallocation.

The Web3 landscape is unforgiving to startups that cannot translate capital into meaningful progress. Success demands more than a compelling pitch or an impressive funding round—it requires relentless execution, strategic talent acquisition, and an unwavering commitment to the original mission.

www.cifdaq.com

0 notes

Text

ICO Marketing Mistakes to Avoid: Lessons from Failed Token Launches

Initial Coin Offerings (ICOs) have proven to be a powerful tool for blockchain startups to raise capital and build communities. However, for every successful ICO, there are many that have failed—often not because of poor technology or lack of utility, but due to ineffective marketing. In this blog, we’ll dissect common ICO marketing mistakes and explore valuable lessons from failed token launches so your project can avoid the same fate.

1. Ignoring a Targeted Marketing Strategy

One of the biggest blunders ICOs make is launching without a clear, targeted marketing strategy. Many projects assume that simply being in the blockchain space will attract investors. In reality, the ICO landscape is competitive, and projects need tailored campaigns that speak to the right audience.

Lesson: Define your ideal investor personas early—whether they're retail crypto enthusiasts, institutional investors, or DeFi-native users. Tailor your messaging, platforms, and campaigns accordingly. Avoid using a generic, one-size-fits-all strategy that fails to resonate with anyone.

2. Lack of Community Building Before the ICO

Many projects wait too long to build a community. They launch a token first and then scramble to attract users and investors. This reactive approach often fails because investors today look for active communities before committing funds.

Lesson: Start community-building efforts months before the ICO. Use platforms like Discord, Telegram, Reddit, and Twitter to create engagement. Host AMAs, giveaways, and educational sessions to build trust and grow a loyal base. A vibrant, engaged community is often the strongest validator for your project.

3. Overpromising and Underdelivering