#blockchain underlying technology

Explore tagged Tumblr posts

Text

The Rise of Crypto Trading in India’s Heartland

India’s Heartland Joins the Crypto Revolution! 🌍

Once dominated by agriculture, India’s Tier 2 and Tier 3 cities are now embracing a digital transformation—crypto trading is booming! With rising internet access, smartphone adoption, and digital literacy, individuals from smaller cities are seizing global financial opportunities like never before.

But this is more than just a trend—it’s a movement reshaping India’s financial landscape. At the forefront are blockchain pioneers and educators, like Rovinder Singh, India’s leading blockchain expert and trading influencer, empowering the next generation of crypto enthusiasts.

From villages to vibrant crypto hubs, India’s financial future is being redefined. Are you ready to be part of it? 🚀🔥

Understanding the Growth of Crypto Trading in India

India’s journey into the crypto world has been a dynamic one. From skepticism to regulatory challenges and now widespread adoption, the country has come a long way. The heartlands, often overshadowed by metro cities, are now stepping into the limelight as significant contributors to this growth. But what fuels this interest?

Accessibility to Knowledge and Education

The rise of trading educators like Rovinder Singh has played a pivotal role in making crypto trading accessible to the masses. Rovinder, recognized as a leading blockchain influencer, has dedicated his efforts to educating aspiring traders and enthusiasts about the intricacies of blockchain and cryptocurrency. His emphasis on simplifying complex concepts has empowered individuals to venture into the world of digital assets confidently.

Technological Advancements and Mobile Penetration

The widespread availability of affordable smartphones and internet connectivity in rural and semi-urban areas has significantly contributed to the adoption of crypto trading. Platforms like “Finsai” and “MFEV", offering seamless trading experiences and user-friendly interfaces, are now reaching areas where financial literacy was once a challenge.

Youthful Enthusiasm

India’s youth are at the forefront of this revolution. With a hunger for financial independence and a keen interest in technology, they’re turning to crypto trading as an avenue for wealth creation. Influencers like Rovinder Blockchain Activist inspire them by highlighting the potential of blockchain to transform traditional financial systems.

Blockchain’s Role in India’s Heartland

Blockchain, the underlying technology behind cryptocurrencies, is much more than a financial tool. It’s a mechanism for transparency, decentralization, and empowerment. The adoption of blockchain in India’s heartland is evident in various sectors, from agriculture to education.

Enhancing Financial Inclusion

For years, financial services have been a luxury for many in rural India. Blockchain technology is changing that narrative. By offering decentralized and secure platforms, it provides opportunities for unbanked populations to access financial tools.

Educational Empowerment

Through platforms dedicated to blockchain education, trading influencers like Rovinder Blockchain Educator are creating awareness and opportunities. By integrating blockchain into educational frameworks, these initiatives are equipping individuals with the skills needed to thrive in the digital economy.

The Challenges of Crypto Trading in India

While the rise of crypto trading in India’s heartland is commendable, it’s not without challenges. Regulatory uncertainties, lack of awareness, and the prevalence of scams are significant hurdles.

Regulatory Landscape

India’s regulatory environment for cryptocurrencies has been evolving. While the government has shown interest in blockchain technology, cryptocurrencies often face scrutiny. Trading educators like Rovinder emphasize the importance of adhering to regulations and making informed decisions to navigate this uncertain terrain.

Combatting Scams

Scams and fraudulent schemes pose a threat to the credibility of the crypto industry. Influencers and educators must work together to spread awareness about identifying legitimate opportunities and avoiding pitfalls.

Bridging the Knowledge Gap

Although platforms like Rovinder’s initiatives are making strides, there’s still a long way to go in bridging the knowledge gap. Consistent efforts in education and awareness campaigns are crucial.

Opportunities for India’s Crypto Revolution

Despite challenges, the opportunities for crypto trading and blockchain adoption in India’s heartland are immense. The growing interest, coupled with support from blockchain influencers, is paving the way for a brighter future.

Wealth Creation for Individuals

Crypto trading offers a lucrative opportunity for individuals to grow their wealth. The accessibility of trading platforms and the guidance of experts like Rovinder Blockchain Educator ensure that even newcomers can achieve success.

Decentralized Finance (DeFi)

DeFi applications are opening doors for decentralized lending, borrowing, and saving. These innovations have the potential to revolutionize traditional banking systems and provide financial autonomy to underserved populations.

Job Creation

The blockchain and cryptocurrency sector is creating job opportunities in fields like technology, marketing, content creation, and education. Trading influencers and educators are actively contributing to this ecosystem by mentoring and guiding aspiring professionals.

Rovinder Singh: A Visionary Leader

Rovinder Singh’s contributions to the blockchain and crypto ecosystem in India are invaluable. Known as a blockchain activist, he combines his expertise as a trading educator and his vision as a crypto and forex trader to inspire countless individuals.

Pioneering Blockchain Education

As the best blockchain educator in India, Rovinder’s initiatives focus on making blockchain knowledge accessible and practical. By offering comprehensive training programs, he’s helping individuals understand the transformative power of blockchain.

Promoting Ethical Trading Practices

Rovinder’s influence extends beyond education. As a trading influencer, he advocates for ethical trading practices, ensuring that traders prioritize transparency and integrity.

The Road Ahead for Crypto in India’s Heartland

The rise of crypto trading in India’s heartland is a testament to the country’s adaptability and resilience. With the support of blockchain educators, influencers, and activists like Rovinder Singh, this movement is poised to create a lasting impact.

India’s heartland is no longer on the periphery of technological advancements. Instead, it’s emerging as a hub for innovation and opportunity. As crypto trading and blockchain technology continue to grow, the vision of a financially inclusive and empowered India is becoming a reality. By fostering education, awareness, and ethical practices, this revolution will leave an indelible mark on the nation’s future.

4 notes

·

View notes

Text

How to Spot a Promising New Crypto Before It Booms

Cryptocurrency has introduced a new wave of investment opportunities, but it has also come with its fair share of challenges. With thousands of tokens flooding the market, how can you identify the ones that will truly thrive? It’s not always easy to tell, but there are some key factors to look out for.

Let’s take a closer look at how to spot a promising new crypto and why UPB could be one to watch in the coming years.

Key Factors to Look for in a New Crypto

When evaluating a new cryptocurrency, it’s essential to focus on several key factors:

Utility: Does the project solve a real-world problem? Cryptos that have a clear use case—such as providing faster transactions, lower fees, or enabling new business models—are more likely to succeed in the long run.

Scalability: Is the blockchain designed to handle increasing numbers of transactions as the network grows? Scalability is crucial for a cryptocurrency to survive as more users adopt it.

Community: A strong, engaged community is often a sign that a cryptocurrency is on the right track. The community helps drive adoption and supports the token’s growth.

Transparency: A transparent development team and clear communication about the project’s goals, updates, and future plans indicate a serious commitment to success.

UPB’s Promise: Solving Real Problems

UPB is a cryptocurrency that stands out for its utility. While many tokens are launched with a speculative promise, UPB is focused on addressing real-world challenges in the blockchain space, like scalability and high transaction fees. By offering a network that processes transactions faster and at a fraction of the cost compared to older blockchains like Ethereum, UPB stands out as a potential winner.

Its scalability is another standout feature. UPB’s design allows the blockchain to handle more users and transactions without sacrificing speed or security. This positions the token as a practical solution for businesses and everyday users alike.

The project’s development team is also highly focused on transparency. They regularly update the community, engage in open discussions, and remain committed to building a product that adds value to the broader crypto ecosystem.

Why UPB is Worth Watching

UPB is still relatively new, but its underlying technology and commitment to solving real problems make it a promising candidate for future growth. The combination of low fees, fast transactions, and strong community support means UPB could become a staple in the crypto market, especially as more industries start to integrate blockchain technology.

Final Thoughts

Investing in cryptocurrencies is never without risk, but by focusing on the factors mentioned above, you can make more informed decisions. UPB is one token that seems to tick all the right boxes, offering a solution that could benefit both users and businesses in the future. If you’re looking for a promising new crypto, it’s worth keeping UPB on your radar.

2 notes

·

View notes

Text

Bitcoin-focused Metaplanet Slips 8% as It Announces Stock Split

Bitcoin-focused Metaplanet Faces 8% Decline Following Stock Split Announcement. Bitcoin-focused Metaplanet, a prominent Japanese investment firm, recently experienced an 8% drop in its share value after announcing a significant stock split. This move, intended to improve liquidity, involved a 10-for-1 stock split aimed at making shares more accessible to a broader range of investors. While the firm's decision to adjust its share structure is seen as a strategic move to enhance market activity, the immediate market response has been less than favorable.

Metaplanet, which has earned its reputation through investments in Bitcoin and other cryptocurrencies, was hoping for a positive outcome from this judgement. The company stated that its goal is to increase the investor base and overall liquidity of its shares, which could lead to stronger long-term growth. However, market reactions have varied, with some investors seeing the decline as a temporary setback. Also Read: trumps-world-liberty-financial-purchases-200m-wlfi-tokens-in-major-crypto-move The stock split is a significant milestone for Bitcoin-focused Metaplanet, as it continues to position itself in the fast rising blockchain and cryptocurrency sectors. Stock splits are commonly viewed as a technique for corporations to make their shares more affordable while maintaining the total value of their capital. This move by Metaplanet is no exception, and it represents a purposeful attempt to appeal to a larger audience. While the initial 8% loss may be worrying for some, it is critical to examine how the move will affect the company's standing in the marketplace in coming weeks. As the cryptocurrency market remains volatile, Metaplanet's long-term strategy of investing in Bitcoin-focused ventures may still be beneficial, despite the temporary drop in share price. Following this announcement, Metaplanet intends to focus on increasing its footprint in the Bitcoin and blockchain sectors. The corporation is eager to capitalise on the growing global acceptance of digital currencies and their underlying technologies. Metaplanet, a bitcoin-focused investment firm, is likely to continue looking for possibilities that correspond with the cryptocurrency market's future growth. Investors looking at Metaplanet should keep a watch on the company's post-split performance. While the market decrease has aroused some concerns, it may also create an opportunity for investors who believe Bitcoin and similar ventures have a bright future. The company's strong position in the cryptocurrency sector may help it rebound from this early setback, making it an attractive company to follow in the coming years. Read the full article

#Bitcoin#Bitcoin-focusedMetaplanet#blockchain#cryptocurrencyinvestments#digitalcurrencies#liquidity#Metaplanetshares#stockmarket#stocksplit

2 notes

·

View notes

Text

The Rise of Bitcoin: A Decade of Disruption

Early Beginnings: 2008-2010

Bitcoin, the world's first decentralized cryptocurrency, was born in 2008. Created by the pseudonymous Satoshi Nakamoto, Bitcoin's whitepaper outlined a peer-to-peer electronic cash system. In 2010, the first Bitcoin exchange was established, and the cryptocurrency began to gain traction.

The Evolution of Bitcoin: 2011-2017

Bitcoin's price surged from $1 to $1,000 between 2011 and 2013. The cryptocurrency's popularity grew, and it became a viable alternative to traditional fiat currencies. In 2017, Bitcoin's price skyrocketed to $19,666, sparking widespread interest and investment.

Bitcoin's Technology: Blockchain and Mining

Bitcoin's underlying technology, blockchain, enables secure, decentralized transactions. Miners verify transactions, solving complex mathematical equations to validate the blockchain. This process ensures the integrity of the network and prevents double-spending.

Bitcoin's Price: Volatility and Speculation

Bitcoin's price has experienced significant volatility, influenced by market speculation, regulatory announcements, and global economic trends. Despite price fluctuations, Bitcoin's market capitalization has grown, solidifying its position as a leading cryptocurrency.

The Future of Bitcoin: Adoption and Innovation

As Bitcoin continues to evolve, its adoption is increasing, with more businesses and institutions integrating the cryptocurrency into their operations. Ongoing innovation, such as the development of the Lightning Network, is improving Bitcoin's scalability and usability.

2 notes

·

View notes

Text

The Philosophy Behind Bitcoin

Introduction

In the world of finance, few innovations have sparked as much intrigue and debate as Bitcoin. But beyond its role as a digital currency, Bitcoin embodies a profound philosophy that challenges traditional financial systems and proposes a new paradigm for economic freedom. Understanding the philosophy behind Bitcoin is essential to grasp its potential impact on our world.

The Origins of Bitcoin

In 2008, amid the global financial crisis, a mysterious figure known as Satoshi Nakamoto published the Bitcoin whitepaper. This document outlined a revolutionary idea: a decentralized digital currency that operates without the need for a central authority. The financial turmoil of the time, characterized by bank failures and government bailouts, underscored the need for a system that could function independently of traditional financial institutions.

Core Philosophical Principles

Decentralization-Decentralization lies at the heart of Bitcoin’s philosophy. Unlike traditional financial systems that rely on centralized authorities such as banks and governments, Bitcoin operates on a decentralized network of computers (nodes). Each node maintains a copy of the blockchain, Bitcoin's public ledger, ensuring that no single entity has control over the entire network. This decentralization is crucial for maintaining the integrity and security of the system, as it prevents any one party from manipulating the currency or its underlying data.

Trustlessness-Bitcoin's trustless nature is another fundamental principle. In traditional financial systems, trust is placed in intermediaries like banks and payment processors to facilitate transactions. Bitcoin eliminates the need for these intermediaries by using blockchain technology, where transactions are verified by network nodes through cryptography. This system ensures that transactions are secure and reliable without requiring trust in any third party.

Transparency-The transparency of Bitcoin’s blockchain is a key philosophical aspect. Every transaction that has ever occurred on the Bitcoin network is recorded on the blockchain, which is publicly accessible. This transparency allows anyone to verify transactions and ensures accountability. However, while the ledger is public, the identities of the individuals involved in transactions remain pseudonymous, balancing transparency with privacy.

Immutability-Immutability is the concept that once a transaction is recorded on the blockchain, it cannot be altered or deleted. This is achieved through cryptographic hashing and the decentralized nature of the network. Immutability ensures the integrity of the blockchain, making it a reliable and tamper-proof record of transactions. This principle is crucial for maintaining trust in the system, as it prevents fraudulent activities and data corruption.

Financial Sovereignty-Bitcoin empowers individuals by giving them full control over their own money. In traditional financial systems, access to funds can be restricted by banks or governments. Bitcoin, however, allows users to hold and transfer funds without relying on any central authority. This financial sovereignty is particularly valuable in regions with unstable economies or oppressive governments, where individuals may face restrictions on their financial freedom.

The Ideological Spectrum

Bitcoin’s philosophy is deeply rooted in libertarian values, emphasizing personal freedom and minimal government intervention. It also draws inspiration from the cypherpunk movement, a group of activists advocating for privacy-enhancing technologies to promote social and political change. These ideological influences shape Bitcoin's emphasis on decentralization, privacy, and individual empowerment.

Real-World Applications and Challenges

Bitcoin's philosophy extends beyond theory into practical applications. It is used for various purposes, from everyday transactions to a store of value akin to digital gold. However, this revolutionary system also faces challenges. Regulatory issues, scalability concerns, and environmental impact are some of the hurdles that need addressing to realize Bitcoin’s full potential.

Conclusion

The philosophy behind Bitcoin is a radical departure from traditional financial systems. Its principles of decentralization, trustlessness, transparency, immutability, and financial sovereignty offer a new vision for economic freedom and integrity. As Bitcoin continues to evolve, its underlying philosophy will play a crucial role in shaping its future and potentially transforming the global financial landscape.

Call to Action

Explore more about Bitcoin and consider its implications for your own financial freedom. Engage with the community, stay informed, and think critically about the role Bitcoin can play in our economic future. Let’s continue the journey of understanding and embracing the Bitcoin revolution together.

#Bitcoin#Cryptocurrency#FinancialFreedom#Decentralization#Blockchain#DigitalCurrency#CryptoPhilosophy#SatoshiNakamoto#Cypherpunk#FinancialSovereignty#BitcoinRevolution#CryptoCommunity#DigitalEconomy#TechInnovation#FutureOfFinance#EconomicFreedom#CryptoEducation#BitcoinPhilosophy#BlockchainTechnology#financial education#financial empowerment#financial experts#finance#unplugged financial#globaleconomy

8 notes

·

View notes

Text

Why Choose Malgo for Your Cryptocurrency Development Needs? A Comprehensive Guide

Cryptocurrency is rapidly changing the way businesses and individuals approach finance and technology. From its decentralized nature to its potential to disrupt traditional financial systems, the world of cryptocurrency is growing, and businesses are looking to adopt this innovative technology. But when it comes to cryptocurrency development, you need a reliable partner who can guide you through the process. That’s where Malgo comes in. This comprehensive guide explains why Malgo is the good choice for your cryptocurrency development needs.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of any central bank, meaning it is decentralized. Unlike traditional currencies issued by governments, cryptocurrencies are based on blockchain technology, a decentralized system that records all transactions made with a particular cryptocurrency.

Cryptocurrency offers numerous advantages over traditional currencies, including lower transaction fees, faster transaction times, and greater privacy. The most well-known cryptocurrency is Bitcoin, but there are thousands of other cryptocurrencies, each with its own unique features and use cases.

What is Cryptocurrency Development?

Cryptocurrency development refers to the creation and maintenance of digital currencies and blockchain-based solutions. It involves building the underlying technology that supports cryptocurrencies, including the development of wallets, exchanges, and security features.

For businesses looking to create their own cryptocurrency or blockchain-based solutions, cryptocurrency development is a critical step. It requires a deep understanding of blockchain technology, security measures, and the regulatory landscape. Cryptocurrency developers must be proficient in coding, cryptography, and distributed ledger technology to ensure that their digital currency is secure, scalable, and functional.

Why Should You Choose a Cryptocurrency Development Company? Key Considerations

Choosing a cryptocurrency development company is a significant decision. Several factors should be considered when making your choice, as the right company will play a key role in the success of your cryptocurrency project.

Expertise and Experience: A reputable cryptocurrency development company should have a team of experienced developers who are well-versed in blockchain technology, cryptocurrency protocols, and security measures. This expertise ensures that your cryptocurrency is built on a solid foundation.

Security: Security is one of the most critical aspects of cryptocurrency development. Your development partner should have a strong focus on building secure platforms that protect users' funds and data from cyber threats.

Regulatory Knowledge: The cryptocurrency industry is heavily regulated in many regions. A good development company will stay updated on the latest regulations and ensure that your cryptocurrency project complies with local laws.

Post-launch Support: Cryptocurrency development doesn't end once the product is launched. Ongoing support and maintenance are necessary to keep your cryptocurrency platform running smoothly and to address any emerging issues or updates.

Types of Cryptocurrencies:

There are various types of cryptocurrencies, each serving a different purpose and offering unique advantages for businesses. Understanding these types is essential when considering the development of your own cryptocurrency solution.

Coins: Coins like Bitcoin and Ethereum are the most commonly known cryptocurrencies. They have their own blockchain and are primarily used as a store of value or for transactions.

Tokens: Unlike coins, tokens are built on existing blockchains like Ethereum. These tokens can represent a variety of assets, from real-world assets to digital services. They are commonly used in Initial Coin Offerings (ICOs) and as a way to raise funds for new blockchain projects.

Stablecoins: Stablecoins are cryptocurrencies that are pegged to the value of a stable asset like a fiat currency (USD, EUR, etc.). They offer the benefits of cryptocurrency but without the volatility, making them ideal for businesses looking to integrate cryptocurrency into their operations without the risk.

Utility Tokens: These tokens are used to access specific features or services within a blockchain platform or ecosystem. For example, they might be used as payment for transactions or to access special services on a platform.

Security Tokens: Security tokens are digital representations of real-world assets like stocks or bonds. They are subject to regulation and provide businesses with an avenue to tokenize their assets for better liquidity and broader investor access.

Can Malgo Help with Regulatory Compliance for Cryptocurrency Projects?, A Clear Answer

Regulatory compliance is one of the most important aspects of cryptocurrency development. The regulatory landscape for cryptocurrency is complex and varies from country to country. Failure to comply with regulations can result in penalties, delays, or even project cancellation.

Malgo is well-versed in the regulatory requirements of the cryptocurrency industry. They have a team of legal and compliance experts who stay up-to-date with the latest laws and regulations.Their team can guide you through the regulatory process and help ensure that your cryptocurrency project adheres to all necessary legal requirements, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) policies.

By choosing Malgo, you can be confident that your cryptocurrency project will comply with the laws of the countries in which you operate, ensuring a smooth and legal launch.

Does Malgo Provide Post-Launch Support for Cryptocurrency Projects?

Developing a cryptocurrency is just the beginning. The success of your cryptocurrency project largely depends on how well it is maintained and updated after its launch. This includes fixing bugs, adding new features, and ensuring the platform remains secure.

Malgo offers extensive post-launch support for cryptocurrency projects. Their team provide ongoing monitoring, troubleshooting, and updates to ensure that your cryptocurrency platform functions smoothly and securely. They also offers scalability solutions, meaning they can help your platform grow as your user base and transaction volume increase.

Having a partner like Malgo for post-launch support can make all the difference in maintaining a successful cryptocurrency platform.

Why Malgo is the Right Choice for Your Cryptocurrency Development Needs

Malgo stands out as a top choice for cryptocurrency development due to its expertise, commitment to security, and focus on customer satisfaction. With an experienced team of skilled developers and blockchain experts, Their team has successfully completed cryptocurrency projects and understands the industry's details. Security is a top priority at Malgo, implementing the latest protocols to safeguard your platform from vulnerabilities and attacks. Their regulatory experts ensure that your project remains compliant with shifting global laws, preventing potential legal issues. They also takes a customer-centric approach, building long-term relationships by offering best solutions aligned with your business goals, and providing post-launch support to ensure ongoing success. With a focus on scalability, Their team ensures your cryptocurrency platform can grow with your business. Ready to take your cryptocurrency project to the next level? Partner with Malgo for secure, scalable, and innovative solutions. Malgo’s deep understanding of the industry makes them the ideal choice for your cryptocurrency development needs.

Choosing the right cryptocurrency development partner is crucial for the success of your project. Malgo stands out as a top choice for businesses looking to develop a secure, scalable, and regulatory-compliant cryptocurrency platform. With a team of experienced developers, a strong focus on security, and a commitment to customer satisfaction, Malgo is the ideal partner for your cryptocurrency development needs.

2 notes

·

View notes

Text

Binance clone script — Overview by BlockchainX

A Binance Clone Script is a pre-built, customizable software solution that replicates Binance's features, connect with BlockchainX

What is Binance Clone Script

A Binance clone script refers to the ready-made solution of the Binance platform that deals with core functions parallel to the widely acclaimed cryptocurrency exchange platform associated with Binance. It enables companies to establish their own platforms like Binance, perfectly parameterized in terms of functionality and user interface of world-famous exchanges. The clone script provides display flexibility with built-in functionality such as spot trading software, futures trading configurations, and wallet systems that are extremely secure.

Basically, it reduces development costs and latency because things like these are already built. And as this is a startup for many young entrepreneurs, they can have saved on their capital to expand or grow their business.

The script is blessed as its feature set caters to future demands in the field. One can enjoy a safe trading experience to customers while ensuring that every peculiarity of Binance’s success opens up to investors of the script.

How does the Binance clone script work?

The Binance clone script works to provide a ready-made platform that replicates Binance’s core features, such as user registration, wallet management, trade and enables users to create accounts, deposit or withdraw cryptocurrency, and trade digital assets through an interface easily and safely. The platform supports various trading methods such as market orders, limit orders and forward trading. It has built-in security features like two-factor authentication (2FA) to save the user money. Admin dashboards allow platform owners to manage users, manage tasks, and set up billing. The script can be tailored to your brand, connecting liquidity sources to make trading more efficient. In short, the Binance clone script provides everything needed to create a fully functional crypto exchange.

key features of a Binance Clone Script

The key features of a Binance Clone Script are designed to make your cryptocurrency exchange platform secure, user-friendly, and fully functional. Here’s a simple overview of these features:

User-Friendly Interface

Multi-Currency Support

Advanced Trading Engine

Secure Wallet System

KYC/AML Integration

Admin Dashboard

Security Features

Trading Options

These features help ensure that your Binance-like exchange is efficient, secure, and ready for the growing crypto market.

Technology Stack Used by BlockchainX

Technology stack used for developing the Binance clone script involves the most advanced technology combination that ensures that the platform must have so much security, scalability, and performance to make it a platform that is secure, scalable, and high-performance as well. Here are a few key technologies and their brief descriptions:

Blockchain Technology:

The underlying part of the cryptocurrency exchange is Blockchain because it ensures the safe and decentralized processing of transactions.

Normally executed on either Ethereum or BSC (Binance Smart Chain) to carry out smart contracts and token transfers.

Programming Languages:

Frontend: For frontend, React or Angular could be engaged in actualization of the user interface leading to a responsive and interactive experience on the various devices.

Backend: In backend, languages like Node.js, Python, or Ruby on Rails can be applied on how internal logic is being run by server and arbitration of user interaction with the module is foremost.

Databases:

These two databases, MySQL or Postgresql, are typically used in user information storage, transaction records, and other exchange information.

NoSQL such as MongoDB or other databases might be used for horizontal scalability and high-volume transaction storage.

Smart Contracts:

It is used to generate and send out smart contracts for auto-trading, token generation, and other decentralized functionalities.

Blockchain Wallets:

Fundamentally, this automatically links famous wallet systems such as MetaMask, Trust Wallet, or Ledger for the secure storage and transactions of cryptocurrency.

Advantages of using a Binance Clone Script

Here are the advantages of using a Binance Clone Script:

Faster Time-to-Market

Cost-Effective

Customizable Features

Liquidity Integration

Multiple Trading Options

So, when entering the marketplace of the cryptocurrencies it would be the most possible work of something to pay off at a rapid pace: the Binance Clone Script proves so.

How to Get Started with BlockchainX’s Binance Clone Script

It is quite a straightforward process to begin working with a BlockchainX Binance Clone Script-this involves the first step of getting in touch with the company for an initial consulting period to understand more about what you require, need, or customize for the site, and what your goals are. When BlockchainX has an understanding of your needs, they offer a detailed list of what a proposal would entail before they can start the work; afterward, they will estimate the costs needed to do the project. Once both sides accept both the presentations and all features and timelines are agreed with, BlockchainX starts working on the development process of building a Binance Clone Script tailored to the brand, user interface, and other features.

After the entire platform is created, it passes through severe testing to ensure that everything functions excellently. Deployment follows the thorough test. BlockchainX customizes your user interface and more extensions, after deployment. BlockchainX also commits to supporting and sustaining your exchange so that it runs successfully and securely.

Conclusion:

At the end, your confusion may as well be cut short. Yes, the Binance Clone Script will be a resilient solution to spark up the exchange platforms synthesizing user-generated cryptocurrency dreams in the blockchain, even without bankroll when it comes to developing the app. Turning with BlockchainX expertise, you can make an adjustment and scale a powerful platform stocked with the likes of Binance that produced Blockchains, while still containing some specific set-ups for your masterpiece. More amazing features are exclusive to the clone script, moreover, such as support for multiple currencies, high-end security, real-time data, and a smooth user interface that completes the trading process for your users without any glitch.

This solution gives easy access to ready-made solutions. It could have quality Depending on the time you conveniently let BlockchainX’s be and use both exchanges or any variation of the two permutations. After all, who decides to couple up with a one-experienced Crypto Exchange developer who is struggling to offer anything new.

#binance clone script#binance clone script development#binance clone script development service#blockchain technology#blockchain#cryptocurrency#cryptocurrencies

2 notes

·

View notes

Text

Crypto Wealth Building A Guide for Gen Z

Who is Andrew Tate?

Understanding Memecoins

Memecoins have gained significant popularity in the world of cryptocurrencies, attracting a new wave of investors, especially among the younger generation like Gen Z. Let’s delve into what memecoins are and how they differ from traditional cryptocurrencies.

Definition and Explanation of Memecoins

Memecoins are a type of cryptocurrency that primarily relies on humor, memes, and community engagement to gain value and traction in the market. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which are based on underlying technology and blockchain functionality, memecoins derive their value from internet culture and trends. They often represent a joke or satirical concept that resonates with a specific online community.

How Memecoins Differ from Traditional Cryptocurrencies

While both memecoins and traditional cryptocurrencies use blockchain technology, their fundamental differences lie in their purpose, value proposition, and community-driven nature. Traditional cryptocurrencies aim to revolutionize finance by providing decentralized alternatives to traditional banking systems. In contrast, memecoins serve as a form of entertainment or social commentary within the crypto space. Their value is driven by community engagement rather than technological advancements or real-world utility.

Examples of Popular Memecoins in the Market

Several memecoins have gained significant attention and market capitalization. One notable example is Dogecoin (DOGE), which originated as a joke but has since become one of the most well-known memecoins. Another popular memecoin is Shiba Inu (SHIB), inspired by the Dogecoin phenomenon. These coins have experienced massive price surges due to viral trends and influential endorsements.

Memecoins offer an exciting alternative investment opportunity for Gen Z investors looking to explore the crypto space. Understanding their unique characteristics and how they differ from traditional cryptocurrencies is essential for making informed investment decisions.

Andrew Tate’s Advice on Memecoins

Andrew Tate, a prominent figure in the world of entrepreneurship and wealth building, has shared valuable insights into the realm of memecoins and their potential as an investment avenue for individuals. His perspective on investing in memecoins is characterized by strategic approaches and risk management techniques that can benefit investors looking to explore this unique market.

Overview of Andrew Tate’s Perspective

Andrew Tate views memecoins as an innovative and potentially lucrative investment opportunity within the crypto space. His approach emphasizes the significance of identifying promising memecoin projects with strong fundamentals and community support.

Strategies for Identifying Profitable Memecoin Investments

Tate advocates for thorough research and due diligence when considering memecoin investments. He highlights the importance of assessing the underlying technology, development team, and community engagement to gauge the long-term viability of a memecoin project.

Tips for Managing Risks Associated with Memecoin Investments

Recognizing the inherent volatility of memecoins, Andrew Tate advises investors to exercise caution and prudence in their approach. Setting clear entry and exit strategies, diversifying investment portfolios, staying updated on market trends, and identifying potential breakout candidates such as the next big cryptocurrency set to explode in 2024 are among the risk management practices he recommends.

By aligning his insights with practical investment strategies, Andrew Tate offers a comprehensive perspective on navigating the dynamic landscape of memecoins while prioritizing informed decision-making and risk mitigation.

The Role of Memecoins in Crypto Wealth Building for Gen Z

How Memecoins Can Help Gen Z Build Wealth Through Crypto Investments

Memecoins have become popular among Gen Z investors because they have low barriers to entry and can potentially generate high profits. Unlike traditional investment options, memecoins usually have lower fees for transactions and can be easily accessed through various online platforms. This makes it possible for young investors to enter the cryptocurrency market with a smaller initial investment, which is appealing to those who want to start building wealth at a younger age.

Furthermore, memecoins offer a sense of community and inclusivity that resonates with many Gen Z individuals. The social aspect of memecoins can create a supportive environment for learning about investing and financial literacy, empowering young adults to take control of their financial future.

The Potential for Long-Term Financial Growth Through Memecoin Investments for Young Investors

Memecoins present an opportunity for long-term financial growth for Gen Z investors. While they may be considered more volatile than traditional cryptocurrencies, some memecoins have shown significant increases in value over time. By carefully choosing and diversifying their memecoin portfolio, young investors can position themselves to benefit from potential long-term growth and take advantage of emerging trends in the crypto market.

As digital natives, Gen Z individuals are well-suited to adapt to the changing world of cryptocurrency and blockchain technology. Embracing memecoins as part of their wealth-building strategy can give them practical experience in navigating the digital economy while also potentially earning substantial profits in the future.

The Intersection of Memecoins and AI: A Survival Strategy for Bitcoin Miners

While memecoins offer financial opportunities for Gen Z, it’s important to note that the crypto landscape is ever-evolving. In fact, some forward-thinking Bitcoin miners are exploring AI as a survival strategy in response to certain challenges like the halving event. This intersection between memecoins and AI signifies the growing importance of technological innovations in the cryptocurrency industry. By staying informed and adaptable, young investors can navigate these shifts and continue to thrive in the crypto market.

Getting Started with Crypto Wealth Building as a Gen Z Investor

When it comes to starting your journey of crypto wealth building as a Gen Z investor, there are several important things to think about and tactics that can help you get on the right track. Here’s how you can get started:

1. Educate Yourself

Take the time to understand the basics of cryptocurrencies and blockchain technology. There are many resources available, such as online courses, articles, and forums where you can learn more.

2. Diversify Your Portfolio

Instead of putting all your money into just one cryptocurrency, think about spreading your investments across different assets. This can lower the risk and improve your chances of long-term success.

3. Stay Informed

The cryptocurrency market is always changing, with new things happening all the time. Stay up-to-date with the latest news, market analyses, and expert opinions to make smart investment choices.

4. Manage Risks

It’s important to know how much risk you’re comfortable with and set clear investment goals. Don’t invest more money than you can afford to lose and consider using strategies like stop-loss orders to protect yourself.

5. Find a Mentor

Look for experienced investors or mentors who have done well in the world of crypto wealth building. Their advice and guidance can be really helpful as you start your own investment journey.

By thinking about these things and using these tactics, Gen Z investors can build a strong foundation for their crypto wealth building efforts. With a proactive attitude and a commitment to always learning, it becomes more possible to see financial growth through cryptocurrencies.

Embracing the Future: Why Gen Z Should Explore Crypto Wealth Building Opportunities

As a member of Generation Z, you have the chance to lead the way in technological innovation and shape how financial markets will look in the future. Here’s why it makes sense for you to consider getting into crypto wealth building:

1. Technological Proficiency

Gen Z is known for being comfortable with technology, which puts you in a good position to understand and navigate the world of cryptocurrencies and blockchain. Getting involved in crypto wealth building is a natural fit for your tech-savvy nature.

2. Financial Empowerment

Investing in crypto gives you the power to take charge of your own financial destiny. Instead of relying solely on traditional methods, like saving money or investing in stocks, you can actively seek out opportunities that have the potential to grow your wealth over time.

3. Innovative Mindset

One of the key strengths of your generation is its ability to think outside the box and come up with fresh ideas. By embracing crypto wealth building, you’re not only tapping into an exciting new asset class but also contributing to the ongoing transformation of how money works.

4. Global Perspective

Unlike traditional financial systems that are tied to specific countries, cryptocurrencies operate on a global level. This means that by exploring crypto wealth building options, you can gain exposure to international markets and stay informed about global economic trends.

Embracing crypto wealth building isn’t just about making money; it’s about embracing a mindset of progress, empowerment, and adaptability — qualities that resonate deeply with Generation Z’s values.

Conclusion

As Gen Z individuals, embracing the world of crypto wealth building can have a significant impact on your financial future. The potential for long-term growth through investments in cryptocurrencies, including memecoins, presents a unique opportunity for young investors to secure their financial well-being.

Andrew Tate’s valuable advice on memecoins aligns with the overall guide, emphasizing the importance of strategic investment approaches and risk management. His expertise in entrepreneurship and wealth building serves as an inspiration for Gen Z to explore the world of crypto investments with confidence.

Thanks for reading Article, Also we done tons of research and found this amazing platform solanalauncher.com For you... Here you can generate your own memecoins tokens on solana in just less than three seconds without any extensive programming knowledge, There support is too good for clients, and also you aware about solana blockchain, It's fastest growing blockchain compare to other crypto blockchain.

By staying informed, adopting a proactive mindset, and leveraging the guidance available, you can position yourself to thrive in the evolving landscape of crypto wealth building. Remember, the decisions you make today can pave the way for a prosperous tomorrow.

Happy Investing!

4 notes

·

View notes

Text

Underlying technology…..,

How would you respond to someone who believes that the true innovation of Bitcoin lies in its « underlying technology » the so called blockchain and that Bitcoin itself is just another cryptocurrency among many.

3 notes

·

View notes

Text

Decoding the Code: The Power of Cryptocurrency MLM Software Development

In today’s digital-first world, businesses are constantly exploring new ways to grow, connect, and operate more transparently. One such powerful combination making waves is the integration of cryptocurrency into multi-level marketing (MLM) systems. With the help of dedicated cryptocurrency MLM software, companies can offer a more secure, scalable, and trust-building experience for their network members.

Let’s break down what this technology means, the value it brings, and where it’s headed.

Introduction

Traditional MLM systems have often been criticized for their lack of transparency, slow payouts, and fraud risks. At the same time, cryptocurrency is rising as a secure, decentralized way of handling digital transactions. When these two worlds come together through software, the result is a more efficient and trustworthy platform for MLM businesses.

A Cryptocurrency MLM Software Development Company builds tools that allow companies to run MLM operations while integrating digital currencies into payments, rewards, and record-keeping. These tools are especially impactful when powered by blockchain-based systems or smart contract automation, ensuring every step is recorded, verifiable, and tamper-proof.

Understanding Cryptocurrency MLM Software

At its core, cryptocurrency MLM software is designed to manage every aspect of a network marketing structure—while using digital currencies like Bitcoin, Ethereum, or custom tokens for transactions. It handles member registration, commission calculations, payout schedules, and more.

What sets this software apart is the underlying technology. A Blockchain Based Cryptocurrency MLM Software Development Company often builds the platform on decentralized systems that ensure no single party controls the data. Instead, records are stored across a distributed ledger, reducing the risk of fraud or manipulation.

This transparency builds trust. Whether it’s a commission being paid or a new member joining the network, everything is visible, trackable, and secure.

Key Benefits of Cryptocurrency MLM Software

There are several reasons businesses are turning to cryptocurrency MLM software:

Security First: Blockchain technology protects every transaction with high-level encryption and decentralization, making the system incredibly difficult to tamper with.

Real-Time Transparency: All users in the network can track their earnings and transactions in real-time. This removes doubts, builds trust, and reduces disputes.

Lower Operational Costs: Digital payments eliminate the need for traditional banking intermediaries and international transaction fees, making the process faster and cheaper.

Global Reach: With cryptocurrency, companies can reach partners and customers around the world without worrying about exchange rates or cross-border payment delays.

Automation with Smart Contracts: Companies choosing Smart Contract Based MLM Software Development benefit from rules that are automatically enforced. Smart contracts eliminate the need for manual monitoring or approvals, speeding up operations while reducing errors.

These advantages allow businesses to grow sustainably while offering a better experience to their network members.

Flexibility, Growth, and Security Built In

One of the best features of cryptocurrency MLM software is its flexibility. Companies can fully customize their MLM structure, whether they prefer a binary, matrix, unilevel, or hybrid plan. They can define their own rules for commissions, bonuses, and user roles.

As the company grows, the software easily scales with it. Thanks to blockchain infrastructure, platforms can handle thousands of transactions at once—without lag or downtime. This is especially valuable for growing MLM networks where users expect seamless performance.

Security is another major highlight. Fraud and data manipulation are constant risks in traditional systems. But in blockchain-based MLM platforms, transactions are irreversible and visible to all parties. This not only protects the company’s interests but also reassures its members.

Common MLM Plans Supported

Cryptocurrency MLM software can adapt to multiple plan types. Here are a few of the most popular:

Binary Plan: Each member can recruit two others, forming a two-legged structure. The software calculates and distributes earnings based on balance and performance.

Unilevel Plan: Members can recruit as many users as they like at one level, and earnings are shared accordingly. Digital records help track every level with precision.

Matrix Plan: This setup limits the number of recruits per level (like 3x3 or 4x4 structures), and the software manages spillovers, gaps, and commissions automatically.

Hybrid Plans: Businesses can mix two or more models, and the software can be customized to reflect unique payout structures, level rules, and reward triggers.

No matter the model, a well-built platform ensures fair distribution, timely payments, and automatic tracking of performance.

What’s Next for Cryptocurrency MLM Software?

As blockchain and digital currencies evolve, so will MLM platforms. In the near future, we can expect even more automation, enhanced privacy features, and better integration with digital wallets and DeFi platforms.

Smart contracts, in particular, will become a key driver. By automating complex rules and processes, they reduce human error and bring new levels of speed and reliability to MLM operations.

Companies that invest early in this space—especially with the help of a skilled Cryptocurrency MLM Software Development Company—are better positioned to stay ahead of the curve. As more users demand transparency and faster rewards, blockchain-backed systems will no longer be optional—they’ll be expected.

Conclusion

Cryptocurrency MLM software is changing how network marketing works—making it faster, safer, and more trustworthy. With built-in transparency, automation, and global reach, businesses can scale without sacrificing control or user experience.

Choosing the right development partner—whether a Blockchain Based Cryptocurrency MLM Software Development Company or one that specializes in Smart Contract Based MLM Software Development—can be the first step toward modernizing your MLM business.

As technology continues to evolve, these platforms will not only help businesses grow but also reshape how trust and value are shared in the digital economy. The future of MLM is here—and it’s running on blockchain.

#cryptocurrency mlm software development company#smart contract based mlm software development#cryptocurrency mlm software development#Blockchain Based Cryptocurrency MLM Software Development Company#White-label Cryptocurrency MLM Software Development solutions#White-label Cryptocurrency MLM Software Development

1 note

·

View note

Text

The impact of the spread of digital currencies on the global financial system

The spread of digital currencies has significant impacts on the global financial system, and these can be summarized as follows:

Challenging Traditional Financial Systems:

Digital currencies, such as Bitcoin and Ethereum, offer a way to trade without intermediaries like banks, reducing reliance on traditional financial systems.

Increased Financial Innovation:

Blockchain technology, which underlies most digital currencies, has opened the door to new financial technologies such as smart contracts and decentralized finance (DeFi).

Regulatory Challenges:

The lack of unified regulations for digital currencies poses challenges for countries and central banks as they seek to establish legal frameworks to protect investors and combat money laundering.

Impact on Monetary Policies:

Digital currencies may affect central banks' ability to control monetary policies and manage inflation, especially if they become popular as a means of storing value.

Threat to Financial Stability:

The volatility of digital currency prices may lead to financial risks, particularly if they are widely used in investments or as a payment method.

Cross-Border Transactions:

Digital currencies facilitate money transfers across borders without the need for intermediaries, enhancing global trade but also complicating international efforts to combat financial crimes.

Financial Inclusion:

Digital currencies provide an opportunity for individuals who are excluded from the traditional financial system to access financial services, thereby promoting financial inclusion.

In summary, the spread of digital currencies has a profound impact on the global financial system, creating new opportunities while also presenting significant regulatory and economic challenges.

3 notes

·

View notes

Text

Avalanche Airdrop $AVAX: Claim Crypto Airdrops!

The Avalanche airdrop distributes $AVAX tokens to eligible participants. Crypto airdrops are promotional events in cryptocurrency, often to boost adoption.

The cryptocurrency community often buzzes with excitement at the mention of an airdrop, and the distribution of $AVAX by Avalanche has been no exception. This innovative platform delivers a decentralized finance (DeFi) ecosystem and aims to incentivize usage and engagement through its airdrop strategy.

By providing $AVAX tokens to users, Avalanche not only rewards early adopters but also attracts new users to its streamlined, scalable blockchain. Such events typically require individuals to hold a certain amount of tokens or participate in network activities to become eligible for the airdrop, creating a more active and invested community. As the cryptocurrency landscape expands, airdrops like Avalanche’s serve as a strategic marketing tool, fostering a wider acceptance of both the token and the underlying technology.

Unpacking The $avax Airdrop Phenomenon

Unpacking the $AVAX Airdrop Phenomenon stirs excitement and curiosity among cryptocurrency enthusiasts. Airdrops represent more than free tokens; they symbolize a project’s commitment to community growth and reward mechanisms. Avalanche’s innovative approach to airdrops has caught the eye of the crypto world. Let’s dive into what an airdrop is and how Avalanche is changing the game.

✅Claiming Crypto Airdrops Event is Here:

To claim your Crypto Airdrop rewards, first, check your eligibility on the Crypto Airdrop Page.

Next, connect your wallet to the airdrop platform. Follow on-screen instructions to check eligibility. If you are eligible you will claim a reward directly to your wallet.

In case if your wallet was not eligible try to use another wallet, you might get lucky to claim airdrop twice. Some users might face issues with wallet integration or transaction delays, if you had any issues try with another wallet.

What Is An Airdrop In Cryptocurrency?

In the digital currency realm, an airdrop involves sending free tokens or coins to wallet addresses. Companies and projects use airdrops for promotions or to ignite token distribution. Ownership of a different cryptocurrency or a specific wallet balance may qualify one for participation.

Marketing Tool: Projects often use airdrops to increase visibility.

Loyalty Rewards: Airdrops can act as rewards for early adopters.

Decentralization: They help in distributing tokens to a broader audience, aiding in decentralization.

The Emergence Of Avalanche ($avax)

Avalanche stands out as a swift, scalable, decentralized platform for dApps. It aims to solve the blockchain trilemma of scalability, security, and decentralization. The native token $AVAX facilitates network transactions and staking.

The $AVAX airdrop gained attention, rewarding users actively participating in the ecosystem. The focus was on fair token distribution and community engagement. Users experienced firsthand the advantages of the innovative Avalanche protocol. This event set a precedent for how airdrops could amplify growth and user adoption.

Criteria And Eligibility For The $avax Airdrop

Welcome to the exciting world of Avalanche! $AVAX, the digital token, is not just a cryptocurrency but a gateway to a vibrant ecosystem. Understanding the criteria and eligibility for an $AVAX airdrop can enhance your experience within this fast-growing platform. Get to grips with what it takes to qualify and clear up any eligibility myths right here.

Qualifying For The Airdrop

To participate in an $AVAX airdrop, you need to meet specific conditions. First, ensure you have an active Avalanche wallet. Next, you often must hold a minimum amount of $AVAX in your wallet. Sometimes, participating in community events or early adoption of certain features also counts.

Active Avalanche wallet required

Minimum $AVAX balance may apply

Community participation might grant eligibility

Snapshot dates are crucial. They record your wallet balance to confirm eligibility. Always check the airdrop’s official announcements for these dates.

Common Misconceptions About Eligibility

There’s plenty of confusion around who gets airdrops. A popular myth is that all users get airdrops. This is false. Not every user qualifies; it’s based on the specified criteria.

Another incorrect belief is that you can qualify after the snapshot date by quickly adding $AVAX to your wallet. This will not work. The snapshot captures the state of wallets at a specific moment, and anything done afterward won’t count.

Not all users qualify; criteria matters

Post-snapshot transactions are irrelevant

Lastly, some think that holding $AVAX on any platform is sufficient. Often, you need to hold your $AVAX in a compatible wallet. Exchanges might not always support airdrops, so personal wallets are usually recommended.

A tip:official Avalanche channels to clear up eligibility doubts.

Claiming Your $avax Rewards

Excitement buzzes in the crypto world with the prospect of claiming $AVAX airdrops. To facilitate this exhilarating process, here’s everything you need to know to ensure you secure your $AVAX rewards without a hitch.

Step-by-step Guide To Claim Airdrops

Unlock your rewards by following these simple steps:

Check Eligibility: Verify your participation in previous network activities.

Create Wallet: Set up an Avalanche wallet if you don’t have one.

Access Airdrop Site: Visit the designated airdrop website provided by the Avalanche team.

Enter Details: Input your wallet address on the prompt.

Claim Tokens: Click the “claim” button to receive your $AVAX.

Confirm Transaction: A small network fee may apply; confirm to proceed.

Potential Pitfalls And How To Avoid Them

Stay ahead by sidestepping common setbacks:

Invalid Wallet: Ensure your wallet supports $AVAX before claiming.

Phishing Sites: Double-check the URL to confirm it’s the official site.

Quick Reaction: Act fast as airdrops may have a time limit.

Network Fees: Keep some $AVAX in your wallet to cover transaction fees.

Tip: Bookmark the official Avalanche website and only use verified links to avoid scams.

Impact On The Crypto Community

The introduction of Avalanche’s $AVAX airdrops sends ripples through the crypto sphere. As new assets land in digital wallets, the community feels the impact. Excitement builds up. The market prepares for potential shifts. These events highlight the vibrant nature of the cryptocurrency ecosystem.

Market Reactions To $avax Airdrops

Airdrops often herald market excitement. $AVAX is no different. Upon announcement, trading volumes might spike. Prices can swing widely. Investors scour news outlets. They hope to predict the market’s next move. Everyone watches, waiting for the airdrops to set new market trends.

Statistics show varied reactions. Sometimes, the price of $AVAX increases. Other times, it faces a slight dip. A table of recent market responses illustrates this point:

Community Engagement And Hype

Airdrops act as fuel for community excitement, and $AVAX stirs the buzz. Chatrooms light up. Forums come alive. Social media erupts with hashtags and mentions. Anticipation grips the community.

Users engage with great energy. They create tutorials for claiming airdrops. They share tips on wallet security. Engagement metrics tell a tale of an activated user base. Below are some community highlights:

Hundreds of tweets with #AVAXAirdrop

Dozens of Reddit threads discussing strategies

YouTube overflows with tutorials

Crowds come together to celebrate the influx of new assets. A sense of unity pervades. The thrill of the airdrop showcases crypto’s ability to galvanize its patrons.

What’s Next After The $avax Airdrop?

The excitement around the $AVAX airdrop has been palpable. Investors and crypto enthusiasts received free tokens as a generous distribution. Now that the airdrop is complete, many wonder about the next steps. This section guides airdrop recipients on optimizing their new assets and explores what future airdrops might look like.

Strategic Moves For Airdrop Recipients

Receiving an airdrop like $AVAX is thrilling. It is crucial to make smart decisions. Below are strategies to consider:

HODL — The simplest strategy. Hold onto your $AVAX and watch its value.

Stake your $AVAX — Earn passive income through staking rewards.

Diversify — Invest in different crypto assets to spread risk.

Stay updated — Follow $AVAX news for informed decisions.

These moves can help airdrop recipients optimize their gains. It is important to research and consult a financial expert before any action.

Predictions For Future Airdrops

Speculation about future airdrops creates a buzz. Here are predictions:

Staying vigilant for new airdrop opportunities is essential. Always perform due diligence to ensure legitimacy.

Frequently Asked Questions For Avalanche Airdrop $avax

What Is Avalanche Native Token?

Avalanche’s native token is AVAX, used for transactions, staking, and network fees.

Is Avax A Good Coin?

Avalanche’s AVAX coin shows strong potential with its fast transactions and scalable platform. Its technology and partnerships indicate a positive outlook, making it worth considering for investors. Always assess risks before investing.

Where Can I Buy Avalanche Crypto?

You can buy Avalanche (AVAX) on cryptocurrency exchanges such as Binance, Coinbase, and Kraken. These platforms allow for secure purchasing and trading of AVAX.

What Is The Supply Of Avalanche Tokens?

The total supply of Avalanche (AVAX) tokens is capped at 720 million, with a circulating supply that varies based on token releases and other network factors.

Conclusion

To wrap up, the Avalanche airdrop presents a compelling opportunity for $AVAX enthusiasts. Seizing this chance could mean significant gains for your digital asset portfolio. Remember, staying informed and acting swiftly is key to making the most of such events.

Keep an eye on updates and set your alarms; this is a crypto moment you won’t want to miss!

#bitcoin#airdrop#crypto#blockchain#coinbase#ethereum#accounting#crypto airdrop#airdrops#airdrops project#airdrops information#retroactive airdrops#monia clips#defi#web3#btc#cryptocurrency#crypto market

3 notes

·

View notes

Text

What Exactly is Cryptocurrency? A Comprehensive Guide to Get You Started!

The term cryptocurrency has been gaining increasing attention over the past few years, capturing the interest of both investors and the general public. But what exactly is this emerging digital asset? How does it work, and what does it mean for someone new to the world of crypto? In this guide, we’ll walk you through the basics, from the core concepts to real-world applications, offering a complete insight into the rapidly evolving world of cryptocurrency.

What is Cryptocurrency?

Cryptocurrency is a digital asset built on blockchain technology. Unlike traditional currencies, it is not issued by central banks but is created and managed through decentralized technology. The key characteristics of blockchain are its openness, transparency, and immutability, which allow for secure transactions without the need for intermediaries like banks or other financial institutions.

Bitcoin (BTC), created in 2009, is the first and most well-known cryptocurrency. Its creator, Satoshi Nakamoto, aimed to leverage blockchain technology to build a new financial system that operates independently of traditional banking institutions. Since then, countless other cryptocurrencies have emerged, including Ethereum (ETH), Ripple (XRP), and many more.

Different cryptocurrencies have different design goals. Some are used for payments, others for executing smart contracts, while others are primarily investment or store-of-value tools. In essence, cryptocurrencies emerged to address issues in the traditional financial system, such as high transaction fees, long settlement times, and lack of transparency.

Cryptocurrency and Blockchain: The Relationship

To understand cryptocurrency, it’s essential to grasp the underlying technology — blockchain. Simply put, blockchain is a distributed ledger where all participants can view transaction records, but no one can arbitrarily alter them. Each time a transaction is completed, it’s added to a "block," and these blocks are linked in chronological order to form a chain — hence the name "blockchain." This setup ensures that every step of the transaction is traceable and nearly impossible to manipulate.

Another critical feature of blockchain is decentralization, meaning that no single entity controls the system, which, in theory, enhances its security and transparency. The reason cryptocurrencies are so popular is largely due to the independence that blockchain technology provides from traditional financial systems.

Beyond Payments: Cryptocurrency’s Other Use Cases

Although cryptocurrencies were initially designed as digital payment systems, their applications have grown exponentially over time. Here are a few common use cases:

Payment Systems: Cryptocurrencies like Bitcoin are widely used as global payment tools, especially in regions where traditional payment systems are inaccessible, such as countries with unstable political or economic conditions.

Smart Contracts and Decentralized Applications (DApps): Ethereum, beyond being a cryptocurrency, is also a platform for developing smart contracts — self-executing contracts that automatically enforce terms without human intervention. These contracts have broad applications across industries like law, finance, and logistics.

Decentralized Finance (DeFi): DeFi is one of the hottest trends in the crypto world. It aims to create a decentralized financial system where users can lend, borrow, trade, and earn interest on crypto assets without intermediaries like banks. DeFi is seen as more transparent and efficient compared to traditional banking systems.

NFTs and Digital Art: NFTs (Non-Fungible Tokens) are unique digital assets stored on the blockchain. Each NFT has a unique identifier, making it impossible to copy or divide, which has led to their popularity in digital art and collectibles markets.

How to Buy Cryptocurrency?

For beginners, the most common way to buy cryptocurrency is through a crypto exchange. These platforms provide a convenient interface for users to convert fiat money (like USD, EUR, or TWD) into cryptocurrency. Popular exchanges include Binance, Bitget,OKX,Gate·io, Kraken and Bybit. These platforms typically support various payment methods, including bank transfers, credit cards, and third-party payment systems.

Here’s a basic guide to purchasing cryptocurrency:

Create an Account: Choose an exchange and create an account. Most exchanges require identity verification to comply with KYC (Know Your Customer) regulations.

Deposit Funds: Once registered, you can deposit funds via bank transfer or another payment method.

Choose a Cryptocurrency and Place an Order: After depositing, you can select the cryptocurrency you want to purchase, set the quantity, and place an order. Most exchanges offer market orders (buying at the current price) or limit orders (setting a target price).

Transfer to a Wallet: Once your purchase is complete, it’s recommended to transfer your cryptocurrency to a private wallet for safekeeping. Wallets can be online, hardware, or paper-based.

Security Concerns Around Cryptocurrency

While blockchain technology itself is highly secure, cryptocurrency transactions still come with significant risks. Some of the most common include:

Market Volatility: The price of cryptocurrencies can fluctuate wildly in short periods, offering high returns but also posing substantial risks, especially for newcomers.

Scams and Hacking: Fraudulent schemes, like "rug pulls" (where project creators disappear with investors’ money), are common. Exchanges are also frequent targets for hackers, making it crucial to choose a reputable platform and store assets in a secure personal wallet.

Regulatory Risk: Cryptocurrency regulations vary widely across different countries. Some nations ban crypto trading, like China, while others, like the U.S., Singapore, and Hong Kong, are more open. Investors need to be aware of local regulations, especially regarding tax reporting and asset management.

The Future of Cryptocurrency: Opportunities and Challenges

While cryptocurrency has seen significant growth, it still faces several challenges, including market volatility, regulatory uncertainty, and the need for improved user experiences. Stablecoins, like USDT and USDC, have emerged to address price volatility, offering a more stable investment option. However, as governments increasingly seek to regulate the sector, the industry’s transparency and legitimacy are likely to improve over time.

On the technological front, high-energy consumption is a critical issue for some cryptocurrencies, especially Bitcoin. However, projects like Ethereum's switch to a Proof-of-Stake (PoS) model, which is more energy-efficient than traditional Proof-of-Work (PoW), signal an environmentally friendly future for blockchain. With continuous advancements in technology and growing mainstream adoption, cryptocurrency is poised to become a significant part of our daily lives.

Conclusion

Cryptocurrency represents a transformative financial tool, offering new possibilities through decentralization, transparency, and efficiency. From Bitcoin to Ethereum, and from DeFi to NFTs, the scope of cryptocurrency’s application continues to expand, offering unprecedented opportunities for investors, developers, and everyday users.

Despite its potential, investing in cryptocurrency carries risks, particularly in terms of volatility, security, and regulatory uncertainty. However, for those willing to invest time in understanding the landscape and remaining patient as the technology matures, cryptocurrency presents an exciting frontier to explore.

Whether you’re a beginner or a seasoned crypto enthusiast, understanding the fundamental concepts and future prospects of this rapidly evolving field is key to thriving in the industry. As technology continues to develop and mainstream applications grow, cryptocurrency could become an integral part of our financial system, reshaping our understanding of money, transactions, and assets.

2 notes

·

View notes

Text

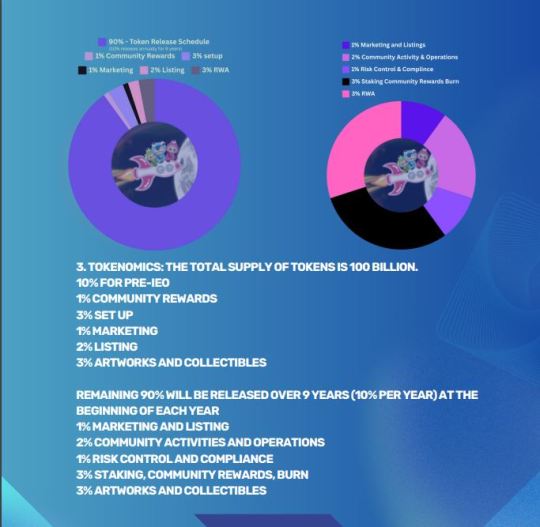

MONSTAR: The Future of Meme Tokens and Real-World Asset Integration

As cryptocurrency continues to evolve, one thing is clear: innovation and creativity are key to standing out in a crowded market. This is where MONSTAR comes into play, as it seamlessly merges the worlds of meme tokens and real-world assets (RWAs). While meme tokens are often seen as speculative investments driven by internet trends and community enthusiasm, MONSTAR takes a bold step in a different direction—offering real, tangible value with its legal backing by a portfolio of artworks and collectibles.

In this post, we’ll dive deeper into the unique features and future potential of MONSTAR, illustrating why this pioneering token is poised to become a game-changer in the evolving cryptocurrency space.

Understanding MONSTAR’s Unique Proposition

At its core, MONSTAR is more than just a meme token. It represents the integration of the digital and physical worlds through blockchain technology. While meme coins like Shiba Inu or DogeCoin are fun, often volatile assets that rely heavily on internet culture and trends, MONSTAR adds an element of stability and intrinsic value by tying each token to physical artworks and collectibles.

So how does this work? Each MONSTAR token is legally connected to a curated portfolio of high-value items, offering a fractional ownership model for holders. These items could range from rare paintings and sculptures to limited-edition collectibles with historical and cultural significance. When you hold a MONSTAR token, you’re not just participating in a fun meme culture. You’re owning a piece of a real-world asset with value, which provides an added layer of security and potential growth.

Real-World Assets (RWAs) in Crypto: A New Paradigm

The integration of Real-World Assets (RWAs) with cryptocurrencies is a significant development in the blockchain space. Traditionally, cryptocurrencies have been purely digital assets, with their value often being based on supply and demand, market speculation, and community-driven narratives. This can result in high volatility, where assets experience dramatic rises and crashes based solely on market sentiment.

MONSTAR shifts this paradigm by tying digital tokens to tangible, valuable assets. The art and collectibles market is known for its long-term appreciation and stability, with certain pieces increasing in value over time due to their rarity, historical importance, and cultural relevance. By leveraging these physical items as collateral, MONSTAR ensures that each token has a built-in level of stability and intrinsic worth.

For instance, imagine owning a fraction of an original Andy Warhol piece or a limited edition Superman comic book. Instead of purchasing and maintaining these items yourself—an often expensive and cumbersome endeavor—you can hold MONSTAR tokens that are tied to the value of such assets. As these artworks and collectibles appreciate in value, so too does your token, making MONSTAR not only a fun meme token but also a viable investment.

Legally Backed for Transparency and Trust

In the often murky world of digital assets, trust and transparency are two factors that can make or break a project. MONSTAR is a legally backed token, meaning that it adheres to regulatory frameworks and provides a clear, auditable connection to its underlying assets. This level of transparency is crucial for investors who want to be confident that their tokens represent actual ownership in valuable real-world assets.