#bookkeeping for corporations

Text

day 1522

#amphibian#frog#frogsona#tip: dont become self employed you have to do so much taxes related stuff all. the. time#(in my country. who knows about america based on what ive heard about your taxes its probably worse)#i dont neeed help btw im just complaning because i had to look at The Spreadsheets#didnt do my bookkeeping correctly for 2 months but i fixed it👍#its not even THAT bad i just needed to draw like. corporate vent art i guess

443 notes

·

View notes

Text

my mom's first and only job was part time at a supermarket in like the 80s and she literally worked for that chain until the chain folded in her 50s and she retired. it was a union job so btwn that and the length of her employment she was making like a full salary w insurance and paid vacation and shit. from moving up the ladder in a supermarket. imagine a world such as this.

#she didnt even work in corporate or anything#she like started as a cashier and became a bookkeeper in the store's customer service desk

9 notes

·

View notes

Text

Here is Bookkeeper! What a nervous fella...he looks a little distressed.

.

.

.

Here is my COG oc! I do quite adore him <3

I'm very happy how turned out, truly wonderful!

20 notes

·

View notes

Text

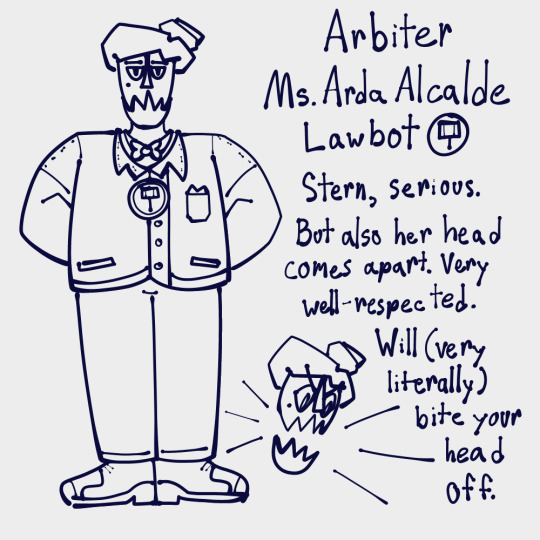

oh god toontown oc time. ref at the bottom is old! cool boots' outfit has changed a bit but im posting it bc i probably should and the sketch refs for the other guys arent final ill probably be updating their designs soon lolll

#toontown corporate clash#fanart#original character#cog oc#toon oc#cool boots#dr. pumpkinsnout#bookkeeper#paper shuffler#arbiter#hatchet man#toastmaster#tagging by job title rather than name bc its easier#technically misty and graham and chip are here but like. i this isnt rly a post About them so i wouldnt wanna clog the tag

16 notes

·

View notes

Text

Corporate Tax Outsourcing Services

Every UK business – regardless of its type, size, and domain – must file corporate tax returns within 12 months after the accounting period it covers. For any UK accountant, preparing and filing corporate tax returns can be a very stressful task! Take the help of Affinity Outsourcing, an experienced corporate tax preparation outsourcing company. We will calculate your clients’ tax liabilities and assist with calculating any quarterly instalment payments. You can rely entirely on us for our accurate corporate tax advice.

2 notes

·

View notes

Text

The ideal accountant will assist you in expanding your company. The best accountant in Kelowna, Talwar & Associates Inc., has the knowledge, expertise, and resources to support your company's expansion and advancement. Our qualified accountants, who have more than a decade of company expertise, have aided in the growth of businesses across BC.

2 notes

·

View notes

Text

The Role of Accounting Firms in Abu Dhabi in Supporting Startups and SMEs

Abu Dhabi, the capital of the UAE, has become a vibrant hub for startups and small to medium-sized enterprises (SMEs). With its strategic location, supportive government policies, and growing investment landscape, the city offers numerous opportunities for new businesses. However, navigating the complexities of finance, compliance, and taxation can be daunting for entrepreneurs. This is where Accounting firms in Abu Dhabi play a crucial role. Let’s explore how these firms support startups and SMEs in their journey to success.

1. Providing Financial Guidance

One of the primary roles of accounting firms is to provide financial guidance to startups and SMEs. These firms help entrepreneurs understand their financial health by offering insights into cash flow management, budgeting, and financial forecasting. With accurate financial data, businesses can make informed decisions and plan for future growth.

2. Tax Compliance and Planning

Navigating tax regulations in the UAE can be complex, especially for new businesses. Accounting firms in Abu Dhabi assist startups and SMEs with tax compliance, ensuring they meet all local regulations. They also provide strategic tax planning advice, helping businesses minimize their tax liabilities while remaining compliant with the law. This is particularly important with the introduction of VAT and other tax measures in the UAE.

3. Bookkeeping Services

Maintaining accurate financial records is vital for any business, but startups and SMEs often lack the resources to manage this effectively. Accounting firms offer comprehensive bookkeeping services, which allow business owners to focus on their core operations. Regular bookkeeping helps in tracking expenses, managing invoices, and preparing for audits.

4. Assisting with Business Setup

For startups, the process of setting up a business can be overwhelming. Accounting firms provide valuable assistance in this area, guiding entrepreneurs through the legal and financial requirements of establishing a company in Abu Dhabi. This includes obtaining the necessary licenses, understanding local regulations, and setting up accounting systems.

5. Financial Audits and Reviews

Regular financial audits are essential for businesses seeking investment or loans. Accounting firms conduct audits to ensure the financial statements are accurate and comply with regulations. For startups looking to attract investors, a clean audit can significantly enhance credibility and increase the chances of securing funding.

6. Advisory Services for Growth

As startups and SMEs grow, they face new challenges and opportunities. Accounting firms in Abu Dhabi provide advisory services that help businesses strategize for growth. This includes mergers and acquisitions, market entry strategies, and financial restructuring. Their expertise can be invaluable in navigating these complex decisions.

7. Facilitating Access to Funding

Access to capital is often a challenge for startups and SMEs. Accounting firms can assist in preparing financial projections and business plans that are crucial for securing funding from banks, venture capitalists, or angel investors. Their expertise in financial modeling can make a significant difference in how potential investors perceive a business.

8. Supporting Technology Integration

The rise of financial technology (fintech) has transformed the accounting landscape. Accounting firms in Abu Dhabi are increasingly incorporating technology into their services, helping startups and SMEs implement accounting software and automated solutions. This not only improves efficiency but also enhances the accuracy of financial reporting.

9. Networking and Connections

Many accounting firms have extensive networks that can benefit startups and SMEs. They can connect businesses with other professionals, potential clients, and investors, fostering valuable relationships that can drive growth. These connections are particularly beneficial in a city like Abu Dhabi, where networking can lead to new opportunities.

Conclusion

In a rapidly evolving business environment, the support of accounting firms in Abu Dhabi is invaluable for startups and SMEs. From financial guidance and tax compliance to business setup and growth strategies, these firms play a multifaceted role in helping businesses thrive. By leveraging their expertise, entrepreneurs can focus on what they do best — innovating and growing their businesses — while leaving the complexities of finance and compliance to the professionals. As Abu Dhabi continues to grow as a business hub, the partnership between startups, SMEs, and accounting firms will be essential for sustainable success.

#accounting firms#Abu Dhabi accountants#financial services#bookkeeping#tax services#audit services#payroll management#financial consulting#tax planning#business advisory#corporate finance#VAT services#accounting solutions#financial reporting#compliance services#CFO services#accounting software#SME accounting#forensic accounting#accounting outsourcing

0 notes

Text

Efficient Tax Solutions with a Tax Accountant Hornsby

When managing your business finances, a reliable tax accountant in Hornsby can be your greatest ally. A professional tax accountant Hornsby service ensures compliance with the latest tax regulations, making tax season a breeze. They specialize in tailored tax accounting for small businesses, helping you maximize your deductions and reduce liabilities. Their comprehensive tax accounting services cover everything from individual tax returns to business tax planning. By choosing an experienced tax accountant Hornsby-based, you secure peace of mind knowing that your finances are in good hands. Let a tax accountant Hornsby handle your taxes efficiently, giving you more time to focus on growing your business.

#tax accountant hornsby#tax accounting for small business#tax accounting services#corporate bookkeeping#taxation services#taxation advisor

0 notes

Text

Manage your financi

#Manage your financial#taxcompliance#taxation#taxfiling#taxaudit#law#tax#corporations#finance#compliance#business#bookkeeping#accounting#accountants#DigiTax

0 notes

Text

7 Accounting Steps to Start a Small Business

Discover the 7 Accounting Steps to Start a Small Business with Apex Accounting! From setting up financial records to managing cash flow, our guide provides essential tips to help you launch and grow your business with confidence. For personalized support, explore our expert accounting services in Toronto and let us help you succeed from day one!

0 notes

Text

https://decidim.calafell.cat/profiles/yegtaxmasters/timeline

#Tax Services#Edmonton Accounting#Corporate Tax#Personal Tax#Payroll Services#Bookkeeping#CRA Essentials#Financial Reporting#Tax Consulting#Small Business Tax#Edmonton Tax Experts#Tax Preparation#Affordable Accounting#Business Finances#Tax Advice#Edmonton Finance#Tax Planning#CRA Compliance#Expert Accounting#YEG Tax Masters

0 notes

Text

Thailand Expands Visa-Free Access to 93 Countries

Thailand has expanded its visa-free entry program, now allowing travelers from 93 countries and territories to visit for up to 60 days without needing a visa. This update, which started on Monday, increases the number of countries eligible for visa-free travel from 57.

Tourism is crucial to Thailand’s economy, which is still bouncing back from the pandemic. In the first half of 2024, the country…

#Accounting Software Thailand#Bookkeeping Services Thailand#Corporate Services Thailand#Expat Tax Services Thailand#Financial Planning Services Thailand#Payroll Services Thailand#Tax Consultant Thailand#Thai Business Visa

0 notes

Text

Oh ho ho ! More Bookkeeper doodles 🌼✨

I’m having such a delight drawing this fella 💕

18 notes

·

View notes

Text

Comprehensive Guide to Accounting Services in the UAE

The United Arab Emirates (UAE) has established itself as a global business hub, attracting companies from around the world. A critical factor in the success and sustainability of businesses in the UAE is the availability of robust accounting services. These services ensure financial transparency, compliance with local regulations, and effective financial planning. In this article, we will explore the various accounting services available in the UAE and their significance for businesses.

The Importance of Accounting Services

Accounting services are essential for any business as they provide a clear picture of financial health, helping in strategic decision-making. In the UAE, where economic activities are diverse and regulations are stringent, professional accounting services play a vital role in maintaining accurate financial records, ensuring compliance, and enhancing business efficiency.

Key Accounting Services Offered in the UAE

Bookkeeping Services Bookkeeping involves recording daily financial transactions accurately. This service is foundational for all other accounting activities. In the UAE, bookkeeping must adhere to local laws and international accounting standards, making professional bookkeeping services indispensable.

Financial Reporting Financial reporting includes the preparation of financial statements such as balance sheets, income statements, and cash flow statements. These reports are crucial for stakeholders to understand the financial performance of a business. In the UAE, timely and accurate financial reporting is mandatory for compliance and helps in attracting investors.

Tax Compliance and Advisory With the introduction of VAT and corporate tax in the UAE, businesses must comply with tax regulations. Accounting firms provide tax compliance services to ensure that businesses meet their tax obligations accurately and on time. Additionally, tax advisory services help businesses plan and optimize their tax strategies effectively.

Auditing Services Auditing is a critical service that provides an independent assessment of a company’s financial statements. In the UAE, businesses are often required to undergo external audits to ensure compliance with local regulations and to build trust with stakeholders. Professional auditors help in identifying discrepancies and suggesting improvements.

Payroll Services Managing payroll can be complex, especially with varying employment laws and regulations. Accounting firms offer payroll services that include salary processing, tax deductions, and compliance with labor laws. Efficient payroll services help in maintaining employee satisfaction and ensuring regulatory compliance.

Financial Consulting Financial consulting services involve providing expert advice on financial management, investment strategies, and business growth. In the dynamic UAE market, businesses benefit from consulting services to navigate financial challenges, optimize resources, and achieve their goals.

Forensic Accounting Forensic accounting involves investigating financial discrepancies and fraud. In a region with significant financial activities, forensic accountants play a vital role in ensuring financial integrity and addressing any suspicious activities.

Choosing the Right Accounting Firm

Selecting the right accounting firm is crucial for leveraging these services effectively. Here are some factors to consider:

Reputation and Experience: Look for firms with a solid reputation and extensive experience in the UAE market.

Range of Services: Ensure the firm offers comprehensive services that meet your business needs.

Regulatory Knowledge: The firm should have in-depth knowledge of UAE laws and regulations.

Technological Capabilities: Opt for firms that use advanced accounting software and technologies for efficient service delivery.

Client Reviews: Check client reviews and testimonials to gauge the firm's reliability and quality of service.

Conclusion

Accounting services in the UAE are integral to the success and compliance of businesses. From bookkeeping and financial reporting to tax compliance and auditing, professional accounting firms offer a wide range of services that support business growth and financial stability. By choosing the right accounting partner, businesses can navigate the complexities of the UAE market with confidence and achieve long-term success.

Whether you are a startup or an established enterprise, investing in professional accounting services will not only ensure compliance but also provide valuable insights for strategic decision-making, ultimately contributing to your business's growth and sustainability in the competitive UAE market

#Accounting services in UAE#Bookkeeping services in UAE#Accounting services#Bookkeeping services#Tax in UAE#Corporate Tax in UAE#Corporate Tax#Business in UAE#UAE#UAE Accounting services#Accounting firms in UAE#Accounting firms in Abu Dhabi

0 notes

Text

0 notes

Text

Why are Professional PRO Services vital in today's market? Get Answers Here!

Today's fast global economy makes PRO services more important than ever. These services are critical. They manage the red tape and legal aspects of business. This is especially true in regions with complex regulations. For instance, pro services Abu Dhabi handles regulatory paperwork well. They also act as strategic advisors, helping businesses navigate local laws and regulations. They are proactive. They ensure that businesses meet current laws and expect future changes. This foresight is invaluable. It keeps business running smoothly and makes the environment suitable for business. Following rules not only keeps everything legal but also earns trust from the people involved and boosts how others see the company. In this article, you will learn why Professional PROP Services are vital for modern businesses.

Exploring The Importance of Regulatory Compliance

PRO services are essential for navigating the dense maze of government regulations. They help businesses manage everything from visa applications to renewing business licenses. Corporate PRO Services in Dubai and other cities offer tailored solutions. They fit the unique needs of each business. This lets businesses focus on their main operations and avoid administrative distractions. This expertise is especially valuable. It helps maintain operational flow and strategic growth. This is true amidst strict regulations.

Facilitating Business Operations

The modern tech market is competitive. Businesses must remain proactive in compliance to keep their market standing. For instance, PRO Services in the UAE are indispensable. They act as an intermediary between companies and government bodies.They ensure all business documents are current and follow local laws. Staying compliant protects companies from legal troubles that could interrupt their business and harm their reputation. It helps them avoid fines, penalties, and disruptions, keeping their operations stable and secure.

Helping In Cost and Resource Efficiency

Beyond compliance, professional PRO services offer significant cost and time savings. Outsourcing these tasks to experts reduces the need for an extensive in-house team. This cuts down on overhead costs. This allocation of resources allows companies to invest more in their core activities. Investing in compliance helps the business grow and come up with new ideas and improves its ability to adjust to market changes and take advantage of new opportunities.

Enhancing Strategic Business Growth

The benefits of using professional PRO services include boosting business growth. They also help with market adaptability. By reducing administrative distractions, companies can focus more on planning and expanding. This strategic focus is crucial in markets where economic dynamics can shift rapidly. Pro services UAE and other places help businesses adapt quickly to these changes. They ensure firms can use new opportunities and cut risks from regulatory shifts. Their expertise keeps the business legal. It also gives crucial insights. These insights can be pivotal for long-term growth and sustainability.

Overview

As rules change and business gets more complicated, there's a growing need for skilled PRO services. Companies depend on these services not just to handle legal issues but also to stay updated with new regulations. Skilled PRO services provide proactive solutions that reduce risks and ensure companies follow the rules. Businesses expanding or establishing in dynamic markets can partner with firms such as House of Business City. Their team of experienced PRO service experts helps you understand all legal regulations. They also navigate you through the complexities of the market, making sure your business follows the rules and thrives in a competitive environment.

#Corporate Pro Services Dubai#Pro Services Abu Dhabi#UAE Residence Visa Issue#Chief Financial Officer Services#Bookkeeping Services Dubai#Bookkeeping Services UAE#Accounting and Bookkeeping Services Dubai

0 notes