#business pitch deck

Link

Codezeros help you sail through the best investor pitch decks which promise a lasting impact on the potential investors’ minds. We create engaging, informative, and high-quality pitch decks that reflect the company’s vision and definitely convince investors.

#Pitch Deck solutions#Pitch deck design provider#blockchain pitch deck#presentation deck services#Business pitch deck#Pitch Deck Presentation#sales pitch deck#investors pitch presentation

0 notes

Text

OFFICIAL DISCORD EXISTS NOW YEEEEHAWWW 🤠

the Figmin XR discord (previously only for the devs + artist residents) is now an open community server!

⭐ INVITE LINK HEEEREE ⭐

join if you wanna see even more behind-the-scenes stuff about what goes into Extending Reality~*~*~ (and also just to see me act like a dork in yet another semi-professional setting)

#figmin xr#also i'm slacking on my devlog duties but i have more videos to post#i've been busy with a surprising amount of writing lately#revamping the pitch deck and our help site#and also EVENT PLANNING#that and getting this discord into a presentable state has taken up most of my time this week#oh and the bug racetrack#which i am currently editing the video of

35 notes

·

View notes

Text

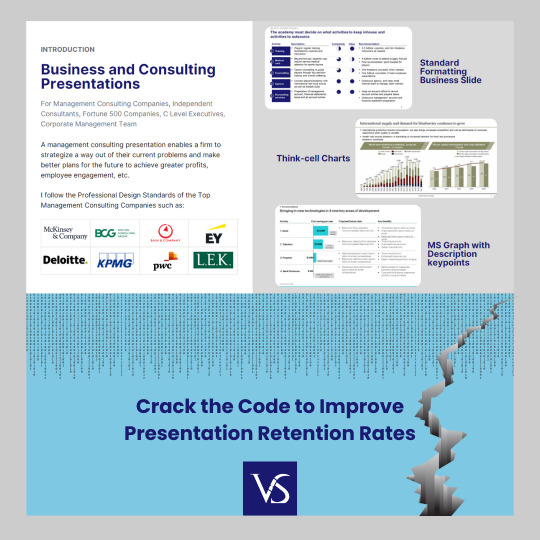

Selecting the Right Tools for Effective Presentations

Selecting appropriate tools for presentations is a critical aspect of delivering an impactful message to an audience. A presenter should carefully assess the purpose and objectives of their presentation to determine the most effective tools for conveying information. This could range from traditional slide decks to interactive multimedia presentations, depending on the nature of the content being presented. It is also crucial to take into account the audience's technological proficiency when choosing the tools to ensure seamless communication and engagement.

Moreover, rehearsing and becoming familiar with the selected tools is imperative for a polished and professional delivery that resonates with the audience, making a lasting impression.

By meticulously selecting the right tools, presenters can elevate their presentations and create a memorable experience for their audience. The choice of tools plays a significant role in how information is communicated and perceived by the viewers.

It is essential to strike a balance between technological sophistication and user-friendliness to ensure that the tools enhance rather than distract from the message being conveyed.

A well-prepared presenter who has mastered their tools can captivate their audience, foster engagement, and effectively convey their message with clarity and impact.

Visual Sculptors Designs – Aligned to Client Branding Guidelines.

To ensure that presentations are in line with a management consulting company's branding and messaging, we adopt various important strategies: After signing an agreement with a firm, we have calls to understand past projects and brand guidelines. We then create a detailed style sheet for approval, usually finalizing after 1-2 iterations. For the initial 10-15 deliveries, the agency prioritizes delivering high quality work with multiple quality checks. This includes ensuring brand consistency in aspects like color scheme, choosing appropriate chart types, and formatting elements. Graphic design process helps familiarize the agency team with the client's brand.

#Consulting Presentation#Business Presentation#Graphic Design#Management Consulting Presentation#Pitch Deck Design#Corporate Presentation#Executive Presentation#C-Level Presentation#Business Report Design#Mc-Kinsey Style Presentation#Top-Level Consulting Presentation Designs#Presentation Visual Enhancement

2 notes

·

View notes

Text

Crafting the Perfect Pitch Deck: Key Elements for Success

Introduction: The Power of First Impressions

In the ever-evolving world of entrepreneurship, every decision, every step, and every presentation can make or break your startup's future. Among these, the pitch deck often stands as the most potent tool in an entrepreneur's arsenal. This document is the culmination of countless sleepless nights, tireless research, and the distilled essence of a startup's vision.

The Resounding Impact of a Pitch Deck

While an idea can spark interest, a pitch deck turns that spark into a roaring flame. It's more than just a presentation; it's your story, your dream, and the potential trajectory of your company laid out for investors to see. Its weight is undeniable. In the world of startups, it is this tool that often determines whether you secure the funds necessary to propel your venture to new heights or return to the drawing board.

Anatomy of an Outstanding Pitch Deck

Clear Value Proposition: Before delving into the depths of your solution, lay out the problem in stark clarity. Dive into statistical data, employ real-life scenarios, and juxtapose this against the current solutions in the market. This provides a context that makes your offering's uniqueness shine brighter.

Market Opportunity: The global market is vast and diverse. Within this expanse, identify your niche. Shed light on the demographics, buying behaviors, and potential gaps that your product or service is tailored to address. Demonstrating a clear understanding of market dynamics positions your startup as a formidable player.

Product Overview: Delve deeper into the intricacies of your product or service. Discuss the research behind it, the challenges faced during development, and how feedback was incorporated to refine it. Such a comprehensive overview showcases commitment and adaptability.

Traction: Beyond showcasing successes, highlight the journey. Discuss the challenges faced, the feedback loops implemented, and how the product or service evolved based on user interaction. This offers investors a transparent view of your startup's adaptability and resilience.

Revenue Model: Financial sustainability is at the core of any venture. Detail out not only the current revenue streams but potential avenues for diversification. This could include potential licensing deals, franchising, or even pivoting to new markets.

Marketing and Sales Strategy: The digital landscape offers myriad avenues for brand outreach. Detail out your strategies, the rationale behind choosing specific channels, and potential collaborations that could amplify your reach. Highlight past campaigns, their impact, and learnings derived.

The Team: Every individual in your team brings a unique set of skills and experiences. Showcase their journeys, their passion, and how their combined expertise creates a formidable force driving the startup forward.

Ask: Clearly outline what you seek. Beyond just funds, perhaps you're looking for strategic partnerships, mentorship, or access to specific markets. Being clear and transparent about your needs resonates with potential investors.

Gleaning Insights from Legendary Pitch Decks

Successful startups like Airbnb, Uber, and Dropbox have left behind blueprints in the form of their pitch decks. Dissecting these can offer invaluable insights. Highlight what made their presentations stand out, the balance of data and narrative, and how they positioned themselves in a competitive market.

Pitch Deck Pitfalls to Avoid

Every entrepreneur should be aware of potential pitfalls when crafting their pitch deck. Overloading with data, a lack of clear focus, or failing to address potential investor concerns can be detrimental. Highlighting and addressing these can further bolster your deck's effectiveness.

Refinement through Feedback: Iterating Your Pitch Deck

One of the most overlooked aspects of creating an effective pitch deck is the iteration process. Startups, especially those in their infancy, can benefit enormously from soliciting feedback.

Peer Review: Before presenting in front of potential investors, seek feedback from trusted peers, mentors, and advisors within the startup ecosystem. Their insights, often derived from personal experiences, can shed light on potential pitfalls or gaps in your presentation that you might've missed.

Audience Perspective: At times, being deeply entrenched in your startup can lead to a tunnel-vision perspective. This is why presenting your pitch deck to a neutral audience can be invaluable. They can provide fresh perspectives, ask questions that you might not have anticipated, and highlight areas where clarity is needed.

Continuous Refinement: The entrepreneurial world is ever-evolving. As your startup grows and pivots, ensure your pitch deck evolves in tandem. Whether it's updated market statistics, new milestones achieved, or shifts in strategy, ensure your pitch deck is a living document, reflective of your startup's current status and future trajectory.

The Art of Storytelling in Your Pitch Deck

While data and metrics form the backbone of your pitch deck, the art of storytelling weaves these elements into a compelling narrative.

Emotional Resonance: People, including seasoned investors, are moved by stories. The story of why you started, the challenges faced, the eureka moments, and the hurdles overcome can humanize your startup, making it more relatable and memorable.

Customer Testimonials: Incorporate stories from early adopters of your product or service. These real-world testimonials serve as powerful endorsements, illustrating the tangible impact your startup has on its users.

Visual Narratives: The adage, "a picture is worth a thousand words," rings true, especially in pitch decks. Use visuals—graphs, infographics, images—to break the monotony of text and drive home key points more effectively.

Supplementary Materials: Beyond the Pitch Deck

While the pitch deck is the centerpiece, always be prepared with supplementary materials to bolster your presentation.

Detailed Reports: Be ready with more in-depth reports on market research, product testing results, and financial projections. Interested investors may request these for a deeper dive.

Product Demos: If feasible, offer a live demo of your product or service. Witnessing your product in action can further enhance its appeal and showcase its efficacy.

FAQs: Prepare a list of frequently asked questions (with answers) based on prior presentations and interactions. This can expedite follow-up discussions and address common queries upfront.

Conclusion: Mastery in Pitch Deck Crafting - A Journey, Not a Destination

The journey of creating the ultimate pitch deck is perpetual. As the entrepreneurial landscape shifts, so too should your approach to presenting your vision. Mastering this art is a continuous endeavor, blending intuition with feedback, storytelling with data, and passion with pragmatism. As you venture forth, let your pitch deck be not just a reflection of where your startup stands, but a beacon illuminating its boundless potential.

2 notes

·

View notes

Text

Pros and cons of working with angel investors

Working with an angel investor can be a great way to get funding for your startup. Learning the shared risk factor involved and the potential upsides and downsides of raising money from angel investors is essential if you're considering raising capital from angel investors.

What is an angel investor?

An angel investor is a wealthy individual who invests in startups or established companies and helps guide the company to success. Angel investors typically invest as little as $10,000 with the hope of making several times more in return. Let's look at why you should consider working with an angel investor and some pitfalls to avoid when working with them.

The Pros of Angel Investors

An alternative to traditional sources of funding

Traditional funding sources, such as banks and venture capitalists, have become increasingly difficult for small businesses to access. Angel investors offer an alternative to these conventional financing options by providing capital to startups and small businesses that are usually too risky for banks and venture capitalists.

Expertise.

A significant benefit of angel investors is their expertise.Angel investors are experienced and knowledgeable, which can be an invaluable asset to a company. They will be able to provide you with guidance on how to grow your business, what mistakes to avoid, and how to attract more customers. This can be especially helpful if you're starting and don't have much experience running your own business.

Connections.

The most obvious benefit of having an angel investor is the connections they bring with them. When you have a networker on your side, you can leverage those connections to help grow your business and connect with new customers, financing sources, business partners, and other relevant contacts.

Strategic support

Angel investors are a great source of strategic support. They bring a lot of experience and knowledge to the table and are not afraid to say what's working and what isn't. The best thing about this kind of investor is that they'll give you honest feedback—and if they're not feeling it, they'll know how to tell you why.

Flexibility

Angel investors don't have inflexible corporate policies. This enables them to structure their investment deals creatively, which expands the range of investment opportunities available to startups with few financial resources.

Deep pockets.

Angel investors have deep pockets. This means that they have the financial resources to invest in your business and can afford to take risks on new ideas. Angel investors may be interested in making follow-up investments in your small business if it needs financing later.

The Cons of Angel Investors

Most deals are relatively small.

One of the primary drawbacks to angel investors is that they tend to invest less money than groups of investors. Individual investors typically will only invest a few thousand dollars, so you might need to seek out many individuals to raise a significant amount of money.

Shared control.

Angel investors have a stake in the businesses they invest in. In some cases, angel investors can gain so much control over a business that the original owners can't run the company as they had planned. Before finding an angel investor, consider your future goals and create a well-written business plan. To maintain primary control of your business, consider other funding options.

Potential for misunderstanding

Angel investors can help you achieve your dreams, but it's hard to know how much support they will give and whether they will be involved in your business. One of the best parts of angel investors is the informality that comes with them. But that also means that it's easy for angels to be vague or ambiguous in their agreements.

Angel investors provide a different and refreshing relationship for business owners. However, some things should be kept in mind before diving in. You'll need to ensure that you have done your research and understand what you're getting into. With all the possible benefits and drawbacks on the table, it's up to you to decide whether or not working with an angel investor is worth it.

check out: World's largest database of successful startup pitch decks

2 notes

·

View notes

Text

The Secret Weapon for Business Success: A Business Plan

You probably want to act immediately upon a fantastic business idea. You’ll want to get started as soon as possible by searching for suppliers, creating products, and locating clients full of energy and inspiration.

I promise you won’t want to sit down and draft a business plan amid all of this excitement. But you might be surprised to learn that skipping this crucial first step before starting…

#business advice#business consulting#business development#business funding#business growth#business plan#business success#entrepreneurship#financial planning#goal setting#investor pitch deck#marketing strategy#small business#startup#strategic planning

0 notes

Text

#presentation#template#infographic#slider#powerpoint#canva#google slides#business#helth care#pitch deck

1 note

·

View note

Text

Check out the 11-slide pitch deck that delivery startup Rohlik used to raise $170 million

Here's some insight for those of you prepping for fundraising rounds...

#pitch deck#repost#trending#readmore#entrepreneurship#vc culture and you#business insider#cfre#fundraising ideas#fortheculture#thedigitaldigest🗞️#digitalculture#social media#aceupdates#aos#start up culture#getting to the bag#team building#how to#fundraising rounds#expansion#experience based content#content ideas for your pitch#new fundraiser ideas#expand your footprint#delivery start-up

0 notes

Text

Filfox Wealth offers professional assistance in application for start-up grants consultancy. Our team of experienced consultants will guide you through the process, helping you to secure the funding you need to successfully launch your business.

Visit here: https://www.filfoxwealth.com/

#How to raise funds for Startup business in India#Government Schemes for Startups in India#Policy making and analysis for Startups in India#Name of top firms to prepare for Investment Readiness#Assistance in Application for Startup Grants Consultancy#Legal due diligence services for Startups#AIF registration consultants#Top or Best firm to prepare/ draft Pitch Deck Report for Startups#How to prepare Founders Agreement#How to set up Family Offices

0 notes

Text

Building Trust and Credibility With Corporate Presentation Design Services

Eye-catching images can capture attention and enhance presentation meaning in today's fast-paced world. However, the decision-makers are discerning. They crave more than just beauty; They seek presentations that inspire trust and convince them to present ideas. Here's how a corporate presentation design service provider can ensure your presentation inspires confidence and inspires confidence in your vision:

Accuracy First: Accuracy is paramount. Carefully check all information, from data points to quotes and statistics. The decision-makers' confidence will quickly be lost if there are inconsistencies or deficiencies.

Data-Driven Insights: Compelling visuals are powerful, but they have even more impact when supported by data. Translate relevant data points into clear and meaningful charts, graphs, or infographics. This strengthens the foundation of your argument and data and demonstrates a data-driven approach.

Transparency and Source Attribution: Trust is built on transparency. When you use data, make sure that clear source attribution is provided. This allows decision-makers to check the accuracy of the data and creates a sense of openness.

Logical Flow and Storytelling: A well-structured presentation with a clear narrative builds trust. It guides decision-makers step by step from their point of view, showing how their minds progress logically and giving them an understanding of the thought process behind it.

Professional Design Aesthetics: While the focus is not limited to the visual, professional design elements are still important. Create polished and uncluttered presentations. This shows a commitment to detail and professionalism, adding credibility to your message.

#business ppts#ppt desisgn services#pptdesign#presentation desing agency#presentation services#pitch deck#uae#saudi arabia

0 notes

Text

Lever des fonds : Guide complet pour les entrepreneurs ambitieux

Lever des fonds est une étape cruciale dans le parcours de toute entreprise en croissance. Que ce soit pour financer une expansion, développer de nouveaux produits ou simplement pour assurer sa survie, comprendre les tenants et aboutissants de la levée de fonds est essentiel pour les fondateurs et les dirigeants d’entreprise. Dans cet article, nous explorerons en profondeur les différents aspects…

View On WordPress

0 notes

Text

Need Canva and PowerPoint presentation?

I'm here to help. No more boring slides! With 2 years of experience, I will do eye-catching canva and powerpoint presentation for you that can grab attention and drive results.

My services include:

Canva presentation templates.

PowerPoint presentation templates.

Business presentation.

Google slides presentation.

Professional pitch deck design

For more please visit here:

#canva template#canva presentation#powerpoint presentation#Business presentation#google slides#pitch deck#seo#digital marketing#seo services

1 note

·

View note

Text

Series-A Deal Room Platform

A Series-A Deal Room Platform typically refers to an online or digital platform designed to facilitate and streamline the process of conducting Series-A funding rounds for startups. The Series-A funding round is a crucial stage in a startup's development, where it seeks to secure substantial capital to scale its operations, expand market reach, and achieve key milestones. Here are some key features and functionalities that a Series-A Deal Room Platform might offer: Document Management, Communication and Collaboration, Due Diligence Tools, Security and Compliance, Workflow Management, Analytics and Reporting, Integration with Existing Tools, Customization. Visit us: series-a.co

0 notes

Text

Distinguish yourself through our exceptional design solutions - presentations that eloquently convey their message - Visual Sculptors

#Consulting Presentation#Business Presentation#Graphic Design#Management Consulting Presentation#Pitch Deck Design#Corporate Presentation#Executive Presentation#C-Level Presentation#Business Report Design#Mc-Kinsey Style Presentation#Top-Level Consulting Presentation Designs#Presentation Visual Enhancement#Branding Collaterals Design#Google Slides Design#Keynote Presentations#Webinar Presentation#PowerPoint Presentation Template Designs#Customized Branding Template Creation#Business PPT designs#Consulting Slides Design

2 notes

·

View notes

Text

BB23-48. Paul Lange's Pitch Deck Creation.

Building Your Business with Sara Troy and her guest Paul Lange, on air from November 28th

Paul Lange get’s up every morning with the mission to transform how the world works, aligning business and pleasure as mutually inclusive.

He says boldly that in business, it matters very little what you do, because many millions of other people can do the same thing. Similarly having a “Why” or “Purpose”…

View On WordPress

#Building a Business shows#Orchard of Wisdom#Paul Lange#Paul Lange&039;s Pitch Deck Creation.#Pitch Deck#Pitch your plan#Sara Troy#www.selfdiscoverywisdom.com

0 notes

Text

Behind the Number: Unveiling the reasons for Startup Failures In India

While lack of funding and valuation struggles can contribute to startup failures in India, they are not the sole factors responsible for the high failure rate. While access to capital is a challenge for many startups, there are several other reasons as well, as mentioned in the previous response.

Funding plays a crucial role in the success of startups, as it provides the necessary resources for growth and expansion. However, startups can fail even with sufficient funding if they are unable to effectively utilize the funds or if there are other underlying issues in their business model.

Valuation struggles can also be a factor in startup failures. Overvaluing or undervaluing a startup can impact its ability to raise capital or attract investors. Unrealistic valuations can lead to difficulties in securing funding, while undervaluing a startup can result in limited resources for growth.

However, it's important to note that startups fail for a variety of reasons, and each case is unique. Factors such as lack of market demand, regulatory challenges, talent acquisition issues, infrastructure limitations, and the absence of mentorship and support can significantly impact the success or failure of a startup.

There are companies that facilitate fundraising specially for startups that will not only help them raise funds but also provide advisory that specializes in Pre-Series A to Series B. One such company is FundTQ

. They have valuation software

to calculate your business value seamlessly and effectively.

Successful startups in India and around the world often address these challenges by conducting thorough market research, building strong teams, adapting to regulatory requirements, and seeking mentorship and guidance from experienced entrepreneurs. It's a combination of factors that contribute to startup success, and overcoming these challenges requires a comprehensive approach.

#pitch deck#business valuation#entrepreneur#entreprenuership#startup india#right valuation#businesswoman#pitch book#entreprenuerlife#fundraising#finance#valuation#trendingnow#viral trends#explorepage

0 notes