#c corporation

Text

What You Should Know About C Corporation Advantages And Disadvantages

C corporations are one of the most frequent types of business structures in the United States, and are widely used by large corporations such as Microsoft and Walmart for tax advantages and liability protection. A C corporation has a variety of advantages for business owners, but it also has some disadvantages that should be considered. In this post, we'll analyze the advantages and disadvantages of C corporations so you can make an informed decision for your company.

What exactly is a C corporation?

A C corporation, also known as a regular company in the United States, is a type of for-profit corporate organization. It is the most frequent type of corporation and provides the most security to its shareholders.

Furthermore, this form is particularly suited for large firms with a complex ownership structure. A C corporation may be the best option for you if you intend to sell equity in your firm or raise funds from investors.

https://bbcincorpltd.wixsite.com/home/post/what-you-should-know-about-the-pros-and-cons-of-c-corporations

2 notes

·

View notes

Text

A complete guide on Company registration in Florida

Company registration in Florida: Process for business registration in Florida & Benefits of registering a company in Florida

Introduction

One’s initial thought when deciding to do company registration in USA from India is likely to be "expansion." And whenever we discuss expansion, we tend to drift toward Florida. Florida can significantly contribute to the international expansion of your firm because of its pro-business climate, world-class infrastructure, and skilled workforce. In this article information on company registration in Florida, Benefits of registering a company in Florida, and process for business registration in Florida is mentioned.

About Company registration in Florida

There are two primary benefits to registering your Florida firm as a legitimate business entity, such as an LLC, corporation, or non-profit:

Higher credibility

Defence against personal liability in the event that your company is sued

It is critical to remember that all corporations, whether for profit or non-profit purposes, must be registered with the Division of Corporations of the Florida Department of State.

Additionally, in order to conduct business in Florida, Limited Liability Companies and Sole Proprietorships must register with the Florida Department of State.

It is crucial to note that one must finish the registration process in Florida even if they already have a corporation or an LLC outside of Florida but intend to use their corporate name there.

Process for business registration in Florida

Register a unique business name

You must make a crucial decision on the name of your new company before you register it. Although choosing a name for your new business might appear simple at first, it is actually one of the most important and difficult stages you will have to go through during the business launch process.

The name of your company should be unique and draw customers attention, but it should also stand for much more than that. It ought to make it very obvious what goods and/or services you are selling. The name of your firm introduces your brand to the public and may convey a message about your business and what it stands for. That is why it is most important to register a unique business name for your business.

Select an appropriate Business Structure

The following are the most typical legal forms for businesses:

Corporation

Partnership

Limited Liability Company (LLC)

Sole Proprietorship

Corporation

A corporation is a type of company created for people who already have or want to have shareholders. So, if you intend to go public in the future, this might be your best course of action.

Corporations, like LLCs, are required to appoint a registered agent to receive communication from the government, compliance documentation, and paperwork in the event of legal problems. Similar to an LLC, a professional service, a legal person, or an individual might serve as your registered agent.

Partnership

A general partnership is a non-formal business structure similar to a sole proprietorship created for business owners forming a partnership with at least one other person. The company can be run under the last names of you and your partners, or you can get a DBA (Doing Business As) name.

There is no personal asset protection; the gains and losses would be reported on your (and your partners’) individual tax return. All partnerships in the state of Florida are required to submit formal papers to the state along with a filing fee.

Limited Liability Company (LLC)

A Limited Liability Company (LLC) could be the ideal option for you if going public is not something you intend to do in the near future. It provides additional flexibility and safeguards your private assets against a lawsuit.

All Florida LLCs must appoint a registered agent to receive legal documents on their behalf. This is a requirement of the state. Your registered agent must be a Florida resident who meets the requirements or a company that is permitted to do business there. In Florida, you must also adhere to specific naming guidelines and file the Articles of Incorporation, which contain important information about your business.

Sole Proprietorship

All business arrangements differ slightly, but sole proprietorship is the clearest. This unofficial organization was created for business owners who do not intend to have any partners. It has no personal asset protection and does not need to be filed with the state.

Your company will be a sole proprietorship and run under your name. If you decide to register for a DBA in Florida, you must publish a notice of your DBA at least once a week in a publication that is distributed in the county where your firm will operate. You can only register your DBA after the notice has been made public. The fictitious name in Florida needs to be renewed every 5 years.

Register your business in Florida

Once you have chosen your formal organizational structure and registered your new company name, you should contact your state to find out the criteria for business registration. There are specific regulations for each state, and you must adhere to them.

Additionally, some companies (such as sole proprietorships and single-member LLCs without employees) are exempt from having to register and submit paperwork to the IRS in order to obtain a Tax ID Number, commonly known as an Employer Identification Number (EIN). You should think about registering even if it is not necessary for your business, because there are various legal and tax advantages.

Obtain permits and license

Certain firms must get the necessary professional or occupational licenses in Florida. For instance, in order to provide certain services for hair and nails, cosmetology shops must get permission.

Additionally, certain businesses are subject to federal government regulation and demand federal licenses and/or permits. For instance, the FDA’s standards and regulations would apply to a maker of alcoholic beverages. By visiting the Small Business Administration (SBA) website, you may find out more information about the requirements and costs for federal permits.

Benefits of registering a company in Florida

Flexible Business Laws: Business Laws in Florida are more flexible compared to any other state, and hence, it becomes easy for the Corporations and LLCs to exist in the state.

Low Tax Burden: The business owners in Florida have to bear a minimum of tax burden. Meaning thereby that In Florida one does not have to pay Personal Income Tax.

Access to Funds and Capitals: Florida is always on its toes to provide entrepreneurs willing to launch their business in Florida, with Investment Capitalists and Angel Investors.

Conclusion

The majority of business owners who want to expand their operations may discover that forming a Florida corporation is the best option. Because it is simple and easy to establish a corporation or an LLC in Florida, there are numerous opportunities for entrepreneurs to expand their businesses.

0 notes

Text

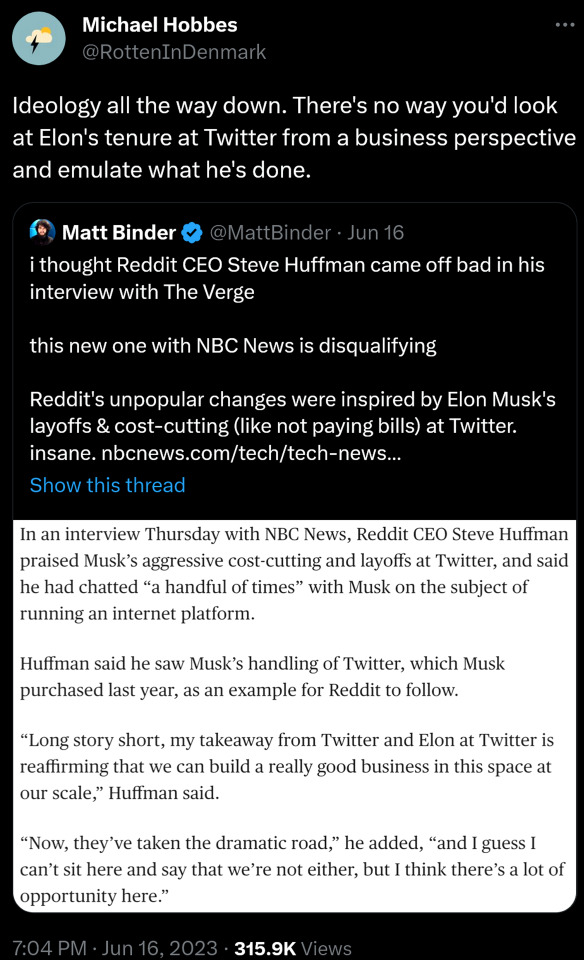

(source)

8K notes

·

View notes

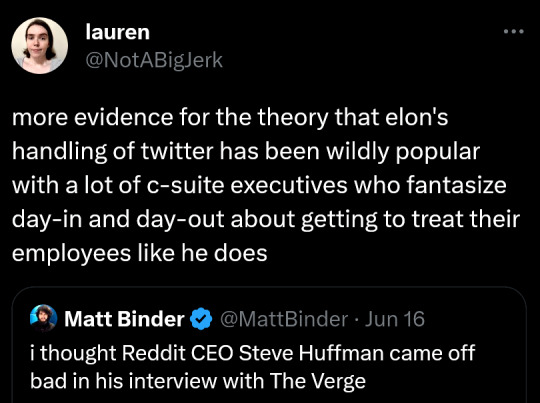

Text

Hey Corporations!

And more corporate stuff.

2K notes

·

View notes

Text

Takeaways from my mentor

I meet with my mentor as and when he’s available. He manages my family’s money and he’s very good at what he does - his firm manages about $5 billion, and I have great conversations with him.

I don’t want to talk too much about him, but he came from a lower middle class background and today is wealthy beyond comprehension. He could buy a plane or two in the middle of the night if he wanted.

Today we focused a lot of personal growth in my career.

He gave me two books - The Inheritors by Sonu Bhasin and Fortune’s Children by Arthur Vanderbilt.

Here are some brief takeaways:

Work backwards from the outcome you want.

Define the outcome of where you want to be and plan it backwards to your current position.

2. Eliminate, eliminate, eliminate.

Life is all about elimination. Don’t focus on your weaknesses, focus on your strengths. Eliminate all the things you know you’re not good at, you have no interest in and that make you depressed.

3. Intellectual honesty.

Be honest with yourself about things you are good at and are not. The easiest person to fool is yourself.

4. Read one business biography a week.

Everything you’re going in life, there’s a 99% chance someone else has gone through it and come out of it victorious. He also mentioned this article.

5. Outline 3 strengths and 3 weaknesses.

6. (In business/ corporate careers) You’re either primarily an investor (you’d rather fund companies and start ups than start them), an operator (you’d rather build something hands on), or a manager (you’d rather periodically manage something hands off. Like for instance you could have your own franchise bakery chain where you don’t need to exercise minute control over every franchise but you still ensure that there’s some managing done from your part).

7. Do not have extreme ideologies at this age.

Not when it comes to religion, politics, etc.

8. Emotions, money and your time are something you need to be ruthless about. Absolutely ruthless.

Be careful about the friends you have and the influence they have on you.

#ceo aesthetic#that girl#personal growth#strong women#powerful woman#balance#getting your life together#c suite#q/a#productivity#Business#Mentor#mentoring#takeaways#business advice#Corporate#success

1K notes

·

View notes

Text

sometimes I think about how much body spray graham is probably drenched in (and also how flammable that would make him)

#toontown#corporate clash#graham ness payser#pacesetter#flint bonpyre#firestarter#tawney c. esta#featherbedder#ttcc#toonblr#toon tag#fanart#art tag

456 notes

·

View notes

Text

It's been one of those days.

Unblurred under the cut :)

#my art#toontown corporate clash#chip revvington#chainsaw consultant#ttcc oc#Mrs. Beatrix#ttcc#they were fine after this I promise#she helps him with maintenance afterwards c:

186 notes

·

View notes

Text

Their designs go hard fr

#toontown#toontown corporate clash#advocate#duck shuffler#buck ruffler#featherbedder#tawney c. esta#high roller#magnate#legal eagle#litigator#mundie mudsnapper#loan shark#scapegoat#kilo kidd#shark watcher

320 notes

·

View notes

Text

Part 2 of the redesigned manager redesigns!!!

Finally i am done thank cog

#toontown#toontown corporate clash#ttcc#mouthpiece#major player#firestarter#plutocrat#treekiller#chainsaw consultant#featherbedder#pacesetter#belle dama#dave brubot#flint bonpyre#cosmo kuiper#spruce campbell#chip revvington#tawney c. esta#graham ness payser

104 notes

·

View notes

Text

the managers dont have profile pictures on cogs ink, and i wanted to make renders of what i think they would look like

also yes ben isnt using his updated model i was LAZY! and did not want to get it

#ttcc#toontown corporate clash#I may remake Flint's#im also going to make the rest of them#graham ness payser#flint bonpyre#chip revvington#mary anna#misty monsoon#benjamin biggs#holly grayelle#belle dama#dave brubot#tawney c. esta#buck ruffler#mine

388 notes

·

View notes

Text

ouwle

104 notes

·

View notes

Text

Registering a Company in the US as a Non-Resident: A complete guide

Registering a Company in the US as a Non-Resident

Introduction

Can non-residents establish a business in the United States? The answer to this question is Yes. For a long time, the United States has welcomed foreign businesses and will most likely continue to do so in the future. Everyday, foreign nationals establish or expand their business operations in the United States. Here in this article major focuses on the company registration in the US as a Non-resident, Business structure for Registering a Company in the US as a Non-Resident, and benefits of Company registration in the USA. The price for company registration in USA from India starts at INR 39,999 only with Ebizfiling.

Starting a new business or expanding an existing one to a new country can be an exciting but difficult endeavor. The complexities of establishing a business in a foreign country can be overwhelming, especially given today’s political and economic uncertainties. Non-citizens should take the necessary steps and utilize all available resources in order to succeed in their ventures.

Benefits of the Company registration in the USA

Low Corporate Tax

Many states and some cities in the USA offer financial incentives to foreign investors who will establish their business in a specific location. Some incentives are in the form of tax credits and the country has recently lowered commercial real estate taxes for foreign investors. Also, corporate tax rates are much lower.

Techno Friendly

Access to advanced technology, which the U.S. is known for, increases the desirability of the U.S. as a place to do business. Many foreign investors are starting companies in the U.S. just to have access to advanced technological innovations which will enhance their business production and world -wide communication.

Law and Regulations

Businesses in the USA are treated the same, whether foreign or domestically owned. This gives you the benefit of all the laws relevant to acquiring a business or transferring capital. It puts you on an equal standing with your opponent if there is ever a business dispute. The laws & regulations are the same for all businesses.

Business structure for Registering a Company in the US as a Non-Resident

Before you even start the formation process, you should research the various company structures available in the United States. In the United States, the two most common corporate structures are Limited Liability Company (LLC) and C Corporation. The structure you choose will influence how you conduct business and pay taxes in the United States.

LLC (Limited Liability Corporation)

An LLC, or Limited Liability Company, is likely the best business structure to use when starting a business in the United States. Members are shielded from personal liability for corporate decisions or actions, and their assets are protected if the company incurs debt or has problems. LLCs are also exempt from the stringent bookkeeping regulations that apply to C and S corporations.

C Corporation

A corporation, also known as a C-Corp, provides the best protection against personal liability for its owners; however, forming a corporation is more expensive than other business structures. The ability to grow by offering unlimited shares is the most significant advantage of forming a corporation; this is frequently very appealing to investors.

Similarities and Differences between LLCs and C Corporation

Similarities of LLCs and C Corporation

Difference between C Corporation and LLC (Limited Liability Company)

Which US state is ideal for registering your business?

The physical location is one of the crucial factors in US company registration for non-residents. The laws in each state vary, which has an impact on your revenues, taxes, and general business operations.

Taxes, anonymity, and executive decisions are the most crucial aspects to consider when choosing which US state to establish a business in for non-citizens.

Due to the numerous benefits they provide businesses over other states, Delaware, Florida and Wyoming are the most attractive states for both domestically and internationally owned enterprises.

Documents required for company registration in the USA by Non-residents

State-to-state variations in documentation requirements are possible. Below are the general documents that are needed at the time of establishing a company in the US.

For C Corporation in the USA

Certificate of Incorporation or Articles of Organization.

Share certificate for every shareholders.

IRS Form SS4 – Employer Identification Number Application.

For LLC in the USA

Articles of Organization or Articles of Formation.

Operating Agreement.

IRS Form SS4 – Application for Employer Identification Number.

LLC Membership Certificate.

Process for Registering a Company in the US as a Non-Resident

Whether you’re founding an LLC or a corporation will largely determine how the registration process differs from state to state. You must take the following actions once you have chosen a business structure and a location to launch your business:

Select a unique business name for your LLC or C Corporation

Filing of company incorporation with the state

Get an EIN (Employer Identification Number)

Get a physical US mailing address

Open US bank account

Conclusion

Many businesses worldwide rely on access to the US market to succeed. The most cost-effective way to enter this market is through a US company, which can benefit from the world’s largest and most integrated national market while paying the lowest tax rate.

0 notes

Text

C corporations offer tax benefits to owners and provide limited liability protection. C-corporations have a larger variety of expenses and IRS-allowed deductions. We have a straightforward online application process if you're wanting to Apply For C Corporation. On the same day that we finish the procedure, we will email your email with the EIN number.

0 notes

Text

insanity based ttcc doodles from the past few days

#doodles#ttcc#fanart#overwhelming authority#3rd image is based on the vocaloid song choose me by hyadain because i was unhealthily obsessed with it when i was 8#and i would loop it on moviestarplanet youtube because i was too scared to use normal youtube on the family computer#why have i drawn directors vocaloids at least 3 separate times. who knows#toontown corporate clash#buck wilde#director of land development#dold#director of public affairs#dopa#dana s charme#derrick hand#desmond kerosene#pacesetter#firestarter#featherbedder#graham ness payser#flint bonpyre#tawney c. esta

212 notes

·

View notes

Text

hehe

#ttcc#toontown corporate clash#buck ruffler#duck shuffler#someone i was in a battle with called him pondboy and i cant stop thinking about it#release him into the wild#tawney c esta#featherbedder#chip revvington#chainsaw consultant#flint bonpyre#firestarter#im sooooooo eepy

153 notes

·

View notes