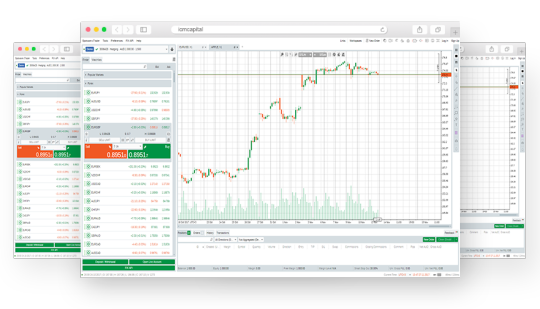

#cTrader web platform

Text

Why cTrader is So Popular among Brokers?

White label online trading platforms have gained high popularity in recent years. If you want to become a broker in the trading world, you can take advantage of such platforms. cTrader is also a platform created by Software Systems Ltd to provide several benefits to brokers.

The Forex business is complicated and costly, and a high-quality trading platform is one of the essentials for small brokerages. If you want to be a cTrader broker, you can leverage benefits from the White Label solution. Depending on your preferences, you must pay the volume and infrastructure rental fees.

Why Do Many Brokers Prefer cTrader for Their Business?

cTrader is a multi-asset trading platform designed to provide the best trading experience. Developers of this platform have chosen a traders-first approach and worked with a mission to offer a robust solution that ensures client loyalty. Brokers will have a reliable environment with the cTrader platform.

Another reason for choosing cTrader is that it encourages client retention and active trading activities. Very often, brokers face challenges with live trading accounts that currently have no trading activity. Sometimes, clients put in only a couple of trades and quit the broker’s platform. Brokers can solve the problem by providing better and improved tools to traders.

cTrader is a revamped platform, which enables traders to involve in manual trading, algo trading, and copy trading using a single interface.

There is a Trade button to let traders choose the manual trading option. It provides comprehensive information, types of charts, market sentiment details, technical analysis signals, and multiple timeframes. Traders can place their orders or modify them with the drag-and-drop functionality.

The cTrader desktop platform also allows copiers to follow top-rated traders. Again, the Automate button enables traders to choose cBots for scripting algorithmic systems.

Grow Your Brokerage Business With cTrader

cTrader has addressed the brokers’ needs, as it provides unique solutions that ensure faster deployment, ultra-scalability, and easy integration. Low latency and high performance are major advantages of using cTrader.

The comprehensive cTrader Suite helps you make your business cycle successful. As a broker, you will find several management tools and sophisticated technology to deal with their operations. If you choose the cTrader web platform, you will get both cBroker and cServer without additional cost.

cBroker is a feature-rich management platform that provides tools for risk management, reporting, and marketing. Besides, you will find custom settings, unlimited managers, and 100% transparency.

cServer is another advantageous aspect because of the easy availability of servers. It involves an international infrastructure with proxies in major locations all over the world. Moreover, as there are third-party integration options, you can find better opportunities. You can quickly establish a connection to liquidity providers through the FIX API.

cTrader is the best brokerage solution that gives technical assistance to users. The developer frequently releases innovative features and makes updates to maintain the highest standards in the trading industry. So, you can use cTrader Suite and establish yourself as a broker.

0 notes

Text

Compare Forex Brokers — Best Forex Brokers for Beginners

Your ideal choice for a forex broker should be well-regulated in its local jurisdiction, accept clients from your country, and have tight dealing spreads and a sufficient variety of currency pairs and other assets to suit your trading needs.

Published By | SmartFX | Sep 10, 2024

best forex brokers in dubai

Best for Overall for Beginners: Smartfx.com

Top forex, gold, oil Trading Company & Brokers in Dubai | SmartFX ranks №1 as our choice for the best forex broker for beginners in the U.S. The broker is strictly regulated by the NFA and CFTC, while its subsidiaries are overseen by 6 other major regulators around the world.

Why We Picked It: Top forex, gold, oil Trading Company & Brokers in Dubai | SmartFX is widely regarded as the top forex broker for beginners due to its user-friendly platform, comprehensive educational resources, and 24/7 customer support. They offer a variety of tools and tutorials to help newcomers grasp the complexities of forex trading along with a 5% cashback deal for new account openings by U.S. residents. The round-the-clock customer service is especially valuable for beginners who might feel overwhelmed by the forex market.

Best for Simplified Trading Platform: | SmartFX

Top forex, gold, oil Trading Company & Brokers in Dubai | SmartFX is becoming the go-to choice for forex traders seeking a straightforward yet effective trading platform. Tailored for modern traders, it has a user-friendly interface that streamlines trade executions, especially for those who prioritize simplicity over complex features.

How to Choose a Forex Broker as a Beginner

Choosing a forex broker as a beginner can be a daunting task given the amount of options available. However, focusing on a few key factors can simplify the process and help you select a broker that suits your needs. Here’s a some guidelines to help you make an informed decision:

Regulation and Security

Check broker regulation: Ensure the broker is regulated by a reputable financial authority such as the U.S. Commodity Futures Trading Commission (CFTC), the UK’s Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC). Regulation provides a level of security and oversight, protecting you from fraudulent practices.

Verify credentials: Cross-check the broker’s regulatory credentials on the regulator’s official website that corresponds to the country you are trading from to confirm their authenticity.

Account Types and Minimum Deposits

Account options: Look for brokers that offer a variety of account types to accommodate different trading styles and budgets, including demo accounts for practice and learning.

Minimum deposit requirements: Choose a broker with a minimum deposit requirement that aligns with your budget. Many brokers offer accounts with low or no minimum deposit requirements, which is ideal for beginners.

Trading Platform and Tools

Platform usability: The trading platform should be user-friendly, intuitive, and compatible with your preferred device (desktop, web, or mobile). Popular platforms like MetaTrader 4/5 or cTrader are widely recommended.

Technical tools and features: Ensure the platform provides essential tools for technical analysis, charting capabilities, and automated trading options.

Spreads and commissions: Compare the spreads (difference between bid and ask prices) and commission structures. Lower costs mean higher profitability, especially for beginners with smaller capital.

Additional fees: Be aware of other potential fees such as withdrawal charges, inactivity fees, and overnight financing rates (swap rates).

Leverage and Margin Requirements

Leverage options: Understand the leverage options offered by the broker and how they align with your risk tolerance. Higher leverage allows for larger trades with a smaller capital but increases the risk for loss.

Margin requirements: Check the margin requirements to ensure you understand how much capital is needed to maintain your positions.

Customer Service and Support

Availability and accessibility: Look for brokers that offer great customer support available through various channels (phone, chat, email) and during trading hours.

Language and response time: Ensure customer support is available in your preferred language and check reviews for their response time and helpfulness.

Educational Resources

Learning materials: A good forex broker for beginners should offer educational resources such as webinars, tutorials, articles, and demo accounts to help you learn and practice trading.

Market analysis: Access to daily market analysis and insights can be beneficial for understanding market trends and making informed trading decisions.

Deposit and Withdrawal Options

Convenience and flexibility: Check the deposit and withdrawal methods to ensure they are convenient and flexible for you. Look for options that are secure, low-cost, and easy to use.

Processing time: Consider the processing time for deposits and withdrawals to avoid delays in funding your account or accessing your money.

Reputation and Reviews

Broker reputation: Research the broker’s reputation through online reviews, forums, and trader communities. Look for consistent positive feedback and check for any major complaints or issues.

Time in the market: Brokers with a longer track record in the market often have more reliability and stability.

Trading Instruments and Market Access

Range of instruments: Ensure the broker offers a wide range of trading instruments, including major, minor, and exotic currency pairs, as well as other assets like commodities, indices, and cryptocurrencies if you plan to diversify.

Market access: Confirm that the broker provides access to the markets you are interested in trading.

Additional Resources

Demo trading: Before committing real money, use a forex demo account to practice trading and understand how the broker operates.

Seek recommendations: Talk with experienced traders or financial advisors to get recommendations based on your needs and goals.

Join forex communities: Engage with online forex communities and forums to learn from other traders’ experiences and insights.

With these guidelines in mind, you’ll be well-equipped to choose a forex broker that aligns with your trading goals and provides a solid foundation for your trading strategy.

Best Forex Brokers for September 2024

Foreign exchange (forex) traders have access to the largest and most liquid market in the world, 24 hours a day, five days a week. The best forex brokers operate under strict regulatory supervision, offer robust research and analytical tools, provide access to a wide range of assets, deliver strong customer support, and more — all while maintaining competitive, transparent pricing.

Top forex,gold,oil Trading Company & Brokers in Dubai | SmartFX provides a streamlined trading experience across its collection of 3rd-party and proprietary platforms. Speedy order execution, access to automated trading algorithms, and the company’s proprietary Performance Analytics feature, which helps traders understand their personal trading, are among the many features that make the platform stand with the industry’s top companies. But where Top forex,gold,oil Trading Company & Brokers in Dubai | SmartFX really shines is in its proprietary mobile apps. The platform offers superb customizability, robust portfolio analysis, deep research, easy-to-digest education, innovative tools, and more — all in a well-designed, intuitive mobile experience that prioritizes what matters most to traders.

Top forex,gold,oil Trading Company & Brokers in Dubai | SmartFX requires high account balances to start earning interest on uninvested cash, however, and a very high volume of trades is needed to benefit from active trader discounts. Lastly, product offerings for U.S. clients are limited to spot forex trades.

Frequently Asked Questions What Is Forex Trading?

Forex (or FX) trading entails trading currencies, contracts for differences (CFDs), indexes, commodities, spread betting, cryptocurrencies, and more on the global foreign exchange market, the largest and most liquid asset market in the world. In the forex markets, currencies trade against each other as exchange rate pairs. The EUR/USD would be a currency pair for trading the euro against the U.S. dollar, for example.

The forex markets exist as spot markets, as well as derivatives markets, offering forwards, futures, options, and currency swaps. Investors trade in the forex markets as a hedge against international currency and interest rate risk, as a means to speculate on geopolitical events, and to diversify their portfolios, among other reasons.

Is Forex Trading Legit?

Forex trading is legitimate. The trading of currencies is a massive global market that sees trillions of dollars of transactions every day. It also serves a crucial function in the global economy by helping to settle transactions across borders. Foreign exchange trading is also a very active market, where world events, country-specific releases, and general news have a 24/7 impact on the values of one country’s currency against another. Forex traders establish positions with the hopes of benefiting from this price action, often using leverage to increase potential profits.

In principle, forex trading isn’t very different from stock trading. Due to the size and global reach of the market, however, forex trading is attractive to scammers at the broker level. If a company is promising you guaranteed returns or raising other red flags, that firm is probably not legitimate, even though the broader forex market is. One of the key things we look at in our forex broker reviews — and, in fact, the data we put the highest scoring weight on — is whether a forex broker is regulated by a trusted regulator like the Commodity Futures Trading Commission (CFTC).

Is Forex Trading Profitable?

Forex trading can be profitable, and the same could be said for every type of investing. There is no one way to be profitable in investing, but forex traders tend to do well when they have a defined trading strategy, control their overall trading exposure and are mindful when using leverage.

This does not mean there aren’t investors who can make money in the forex market in other ways. George Soros made over a billion dollars in a deep short against the British Pound in the 1990s. That trade probably wouldn’t have been as massive if he was running a risk-controlled trading strategy, but it was made possible by his already significant capital reserves and a strong conviction. For the average forex trader, however, it is better to find your ideal trading timeframe, adopt a style that fits, avoid over-leveraging, and cut your losses while they are small.

Which Forex Brokers Accept U.S. Traders?

Forex trading is popular worldwide, with more traders outside of the United States than within it. Nonetheless, the U.S. remains one of the largest financial hubs and the U.S. dollar makes up half of the most popular currency pairs. Brokers catering to U.S. traders must be regulated by the CFTC and hold membership in the National Futures Association (NFA). The rules and enforcement regime these brokers face is much more stringent than firms operating out of less well-regulated jurisdictions.

It is also worth noting that some large stock brokers offer access to limited forex trading. Interactive Brokers stands out as a rare trading platform that does forex and a wide range of asset classes equally well.

What Does a Forex Broker Do?

Forex brokers are like other brokerages — they match a buyer with a seller. They maintain a trading platform that monitors price data for currency pairs across the network of institutional forex participants and exchanges and allows users to trade these pairs. FX brokers make money off the spread on trades as well as any platform related fees.

Beyond simply facilitating trading, forex brokers set the rules around a trader’s use of leverage and determine how much will be available under what specific terms. A best forex broker will also include some additional resources to support traders. These may be in the form of educational resources or unique tools to support trading. That said, the core job of a forex broker is to allow you to buy and sell currency pairs. It can be hard to measure how well a forex broker does when you don’t know what they do. That is why we evaluate how well these forex brokers perform for you, including how trustworthy they are, what support they provide, and how the value they provide balances against the costs.

Is Forex Good for Beginning Investors?

Forex trading can be complicated, but it’s certainly possible for beginning investors to diversify their portfolios by trading currencies and other forex assets. It would be wise to exercise caution and take the time to educate yourself on the assets in which you wish to trade. There’s a wealth of education and research resources available through a number of forex trading platforms, so take the time to avail yourself of this information.

How Do I Start Trading Forex?

First and foremost, do your research. Beginning investors should educate themselves on the wealth of research and educational resources available through trading platforms and sites such as Investopedia.

Next, compare forex brokers, choose one that suits your trading needs, and open an account.

Then you’ll want to build out your strategy for trading in the forex markets.

Finally, open, monitor, and close your first position. And you’ve successfully become a forex trader.

How Much Money Do I Need to Begin Forex Trading?

You can start with as little as $100 in most cases, but it’s important to note that forex trades are made in standard lots of 100,000 units of currency. This may require you to invest more than $100.

We researched and reviewed 18 forex brokers to find the best forex trading companies you see in the list above. Below is the full list of companies we researched along with links to individual company reviews to help you learn more before making a decision:

How We Chose the Best Brokers for Forex Trading

Our commitment to providing unbiased, comprehensive reviews of forex brokers is rooted in extensive research and expert analysis. We evaluated 18 forex brokers based on rigorous criteria, focusing on key aspects such as regulatory oversight, costs, trading experience, and available offerings. Our methodology ensures that our recommendations are based on reliable data and a thorough understanding of the industry.

To gather data, we sent a questionnaire to each of the 18 brokers, covering multiple areas critical to a forex trader’s experience. Our researchers and editors verified the responses and supplemented the data with additional online research and direct communication with each broker. This research was conducted between May 13 and July 30, 2024, ensuring that our evaluations reflect current information.

Our proprietary scoring model evaluated each broker across 11 major categories and 73 weighted criteria, plus an additional 15 non-weighted criteria. The overall ratings are a weighted average of the weighted criteria, ensuring a balanced and fair assessment.

Some brokers also demonstrated their platforms live via videoconferencing, and our experts conducted hands-on testing with live accounts to further validate the platforms’ functionality and user experience. This comprehensive approach allows us to present an unbiased, detailed review of today’s best forex brokers.

For more information, read our full methodology explanation.

Forex Trading online:Best Platforms,Brokers 2024 | SmartFX

smartfx brokers offer forex and CFD trading with the best online forex trading platforms and 24 hour live support.

Learn more about forex trading and the forex market:

Take the Next Step to Invest

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

#forex factory#forex trading#gold forex#forex market#forex news#forex expo#forex calendar#forex rate#forex factory calendar#khaleej times forex#forex expo dubai#forex factory news#usd to aed#gold news forex#trading view#xauusd#best forex broker in uae#forex expo dubai 2024#khaleejtimes forex#gold rate today

0 notes

Text

Forex Broker Ratings 2024: Who Stands Out in the Market?

Forex Broker Ratings 2024: Who Stands Out in the Market?

As the forex market continues to grow and evolve, choosing the right broker becomes increasingly important for traders. With numerous brokers vying for attention, it can be challenging to determine which ones truly stand out. This article aims to provide an in-depth analysis of the top-rated forex brokers in 2024, highlighting their unique features and what sets them apart in the competitive market.To get more news about forex broker, you can visit our official website.

Key Criteria for Rating Forex Brokers

When evaluating forex brokers, several key criteria are considered to ensure traders receive the best possible service:

Regulation and Security: A top-rated broker must be regulated by reputable financial authorities, ensuring a high level of security and trust for traders.

Trading Platforms: The quality and reliability of trading platforms are crucial. Brokers offering advanced charting tools, real-time data, and a seamless trading experience are highly rated.

Fees and Spreads: Competitive fees and tight spreads are essential for traders to maximize their profits. Brokers with low fees and tight spreads are more attractive to traders.

Customer Support: Efficient and responsive customer support is vital, especially for new traders. Brokers offering 24/7 support and multiple contact options are preferred.

Educational Resources: Comprehensive educational resources, including webinars, tutorials, and market analysis, are invaluable for traders looking to improve their skills and knowledge.

Top-Rated Forex Brokers in 2024

Based on the above criteria, here are some of the top-rated forex brokers in 2024:

HFM (HotForex): HFM is renowned for its comprehensive trading solutions, competitive trading conditions, and strong regulatory framework. It offers a wide range of trading instruments, including forex pairs, commodities, indices, stocks, bonds, and cryptocurrencies. HFM’s advanced trading platforms, exceptional customer support, and educational resources make it a top choice for traders.

XTB: XTB stands out with its robust and transparent trading environment. It offers advanced trading platforms, competitive spreads, and a wide range of trading instruments. XTB’s commitment to research and education makes it a preferred broker for both novice and experienced traders.

Pepperstone: Known for its fast execution speeds and low average spreads, Pepperstone is a trusted broker regulated by multiple tier-1 authorities. It offers a variety of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, catering to different trading styles.

IC Markets: IC Markets is praised for its low forex fees, tight spreads, and wide range of trading instruments. It offers advanced trading platforms and is regulated by several reputable financial authorities, ensuring a high level of security for traders.

Fusion Markets: Fusion Markets is known for its low commissions and wide range of currencies. It offers a user-friendly trading platform and is regulated by multiple financial authorities, making it a reliable choice for cost-conscious traders.

IG Group: IG Group offers a first-class web trading platform, superb educational tools, and a wide range of trading products. Its strong regulatory framework and commitment to customer support make it a top-rated broker in 2024.

eToro: eToro is famous for its social trading feature, allowing traders to follow and copy the trades of successful investors. It offers a seamless account opening process and is regulated by multiple financial authorities, ensuring a secure trading environment.

OANDA: OANDA is known for its great trading platforms, outstanding research tools, and fast, user-friendly account opening process. It is regulated by several reputable financial authorities, providing a high level of security for traders.

0 notes

Text

Forex Trading Platforms

Forex trading, popularly known as foreign exchange trading, has grown exponentially in these few years. It attracts millions of traders from various parts of the world. However, one does not achieve success in the forex market by merely understanding the economic trends and currency pairs; one can succeed based on choosing the right trading platform. In this blog, we at Profithills Education will try to assist you in understanding some key points related to forex trading platforms so that you can decide accordingly.

What is a Forex Trading Platform?

The forex trading platform is a software interface, which the brokerage firm offers to the trader for access to the currency markets. These platforms may be web-based, desktop, or mobile applications and enable traders to execute a range of functions, including the following:

Trade online currency pairs

Have live price charts

Use analytical tools for technical analysis

Create automated trading bots

Get news feeds and economic calendars

A good trading platform will make the difference between profitable trading and lost opportunities. Let's see what types of platforms are available and how to choose the best for your trading style.

Types of Forex Trading Platforms

Proprietary Platforms

Sometimes, the brokers develop their own trading platforms. This is to please their clients with the features they want or need. Most of these proprietary platforms are user-friendly and very neat to interface; the newbies or professional traders will be pleased with what they are seeing on the screen. However, it lacks the ability for customization compared to the other developed platforms.

MetaTrader 4

By far and away, MT4 is the most used platform in the forex trading world. It is known to be very versatile; for it allows a good amount of technical analysis tool, to conduct automated trading through so-called Expert Advisors, commonly known as EAs, and a huge community. The MT4 is especially favored by both novice and professional traders alike.

MetaTrader 5 (MT5)

MT5 is an update from MT4, containing a greater amount of timeframes, types of orders, and DOM features. It will be satisfactory to those traders who need more versatility, more extensive access to markets, including CFDs, stocks, and commodities besides forex.

cTrader

As for another competitive platform, cTrader enjoyed the reputation of being intuitive-looking and performing. Advanced charting, super-fast order execution, and the enormous amount of indicators make it a darling among technical traders.

TradingView

It works online, mainly known for its great charting tools. Many traders do their analysis of the market on this and execute the trade with another broker's trading terminal. Additionally, it offers a social trading environment where members share ideas regarding trading.

Key Features to Look for in a Forex Trading Platform

The selection of the proper trading platform depends on your own trading style and experience level. Following are some of the basic features to consider:

User Interface & Ease of Use

Regardless of your experience-a novice or professional trader-an easy-to-use and intuitive platform is what you need. A clean interface means you will be able to act quickly when performing trading, without being overloaded by a bunch of features you do not need.

Technical Analysis Tools & Indicators

A platform filled with technical analysis tools is more important for traders reliant on charts and patterns. Multiple indicators, different drawing tools, and chart types are crucial to have a decent trading platform.

Every second counts in Forex, and the selected platform should be able to deliver instant order execution, especially in those instances of high volatility. Slippage and lag mean missed opportunities and loss of money.

Security

The nature of Forex trading involves handling personal and financial information. Always settle for a secure platform-outfitted with SSL encryption, two-factor authentication, and reputable regulatory oversight.

Mobile Compatibility

A mobile-friendly platform allows trading on the move-anywhere and anytime, thus giving flexibility, which is all the more essential for day traders and scalpers who need to keep constant tabs on the market.

Automation & Algorithmic Trading

Those traders who wish to employ automated strategies will need to make sure the platform they select will allow for algorithmic trading. MT4 and MT5 have this capability through EAs, while cTrader provides support for cAlgo, which allows for more advanced programming.

How to Choose the Right Platform for You

We at Profithills Education recommend the following while choosing a forex trading platform:

Know your trading style: Position trader, day trader, or scalper? Each website has a relative strength that fits better with one trading approach over another.

Know your budget: Some sites charge extra for services or spread wider. Understand how much use of each site will cost you in commission and hidden fees.

Get a Feel for the Platform: Most brokers will let you try demo accounts. Use that to the fullest to learn how the features of the platform work before you put in some real money.

Seek Customer Support: Fast customer service when you are up against problems can save you. Make sure the broker offering the platform has suitable and available support.

Conclusion

The Forex market is a hub of endless opportunities, and your success completely depends on informed decisions-right from selecting a proper trading platform. At Profithills Education, we try to arm you with the necessary knowledge to instill confidence in the Forex world. MT4, cTrader, or a proprietary platform-whatever suits your trading goal and provides the necessary tools for success.

0 notes

Text

Best Free Forex Trading Platforms

Are you on the lookout for the best free forex trading platforms to kickstart your trading journey? With a plethora of options available, it can be challenging to find the right platform that suits your needs. In this guide, we'll explore some of the top free forex trading platforms in 2024, including those that tie in with valuable promotions like JRFX's "Golden March" offer.

What Makes a Forex Trading Platform Great?

User-Friendly Interface:

A good forex trading platform should have an intuitive and user-friendly interface.

This makes it easy for traders of all levels to navigate the platform and execute trades efficiently.

Robust Trading Tools:

Look for platforms that offer a wide range of trading tools and indicators.

These tools help traders analyze the market and make informed trading decisions.

Reliability and Security:

The platform should be reliable with minimal downtime.

Security features such as encryption and two-factor authentication are essential to protect your funds.

Top Free Forex Trading Platforms

MetaTrader 4 (MT4):

MetaTrader 4 is one of the most popular forex trading platforms in the world.

It offers a wide range of technical analysis tools, customizable charts, and automated trading capabilities.

JRFX, the platform behind the "Golden March" promotion, also offers MT4 as its trading platform.

JRFX's "Golden March" Promotion and Trading Platforms

Now, let's tie in JRFX's "Golden March" promotion with these top forex trading platforms. JRFX's promotion offers new customers a $35 welcome bonus without requiring any initial deposit. For those ready to invest, bonuses of up to 100% are available on deposits, with a maximum bonus cap of $5,000.

By choosing one of the platforms offered by JRFX, such as MetaTrader 4 or MetaTrader 5, traders can not only benefit from the platform's robust features but also take advantage of the "Golden March" promotion. These platforms are well-known for their reliability, security, and comprehensive trading tools, making them ideal choices for traders looking to maximize their trading experience.

How to Choose the Right Forex Trading Platform

Consider Your Trading Style:

Different platforms cater to different trading styles.

If you prefer automated trading, look for platforms with robust algorithmic trading capabilities.

Check for Compatibility:

Ensure that the platform is compatible with your device, whether it's a desktop, web-based, or mobile platform.

Having access to your trading platform on-the-go can be crucial for active traders.

Look for Educational Resources:

Some platforms offer educational resources such as tutorials and webinars to help traders improve their skills.

These resources can be invaluable, especially for beginners.

Conclusion: Elevate Your Trading Experience with the Best Free Platforms

In conclusion, the best free forex trading platforms offer a combination of user-friendliness, robust trading tools, and reliability. Platforms like MetaTrader 4, MetaTrader 5, and cTrader are among the top choices for traders worldwide, providing access to a wide range of markets and tools.

By choosing a platform offered by JRFX ( https://www.jrfx.com/?804 ) , such as MT4 or MT5, traders can not only benefit from the platform's features but also take advantage of the "Golden March" promotion. This promotion offers new customers a welcome bonus of $35 and bonuses of up to 100% on deposits, making it an attractive offer for traders looking to maximize their trading potential.

So why wait? Explore these top free forex trading platforms today and elevate your trading experience to new heights.

0 notes

Text

Check out the List of Meta Trader 5 Brokers Offering Different Trading Options and Capabilities

MetaTrader 5, a multi-functional trading platform, is used by brokers to trade more than just forex. This forex trading platform is most popular amongst advanced and day traders using the platform over the web, on desktops, or as a mobile app. Check out the list of MetaTrader 5 brokers on ForexUK to choose the best.

#forex trading course#trading forex for beginners#trading forex beginners#metatrader#metatreader 5 brokers#spread betting brokers

1 note

·

View note

Text

Empower Your Trades Mastering Trading and Brokerage Platforms

For traders and investors, there are undoubtedly a variety of trading platforms and brokerage services available.

Market-making Tools:

MT4 (MetaTrader 4) and MT5 (MetaTrader 5): These platforms, which are frequently used for trading forex and CFDs, provide a number of tools, technical indicators, and automated trading options.

Another platform for trading forex and CFDs is cTrader, which is renowned for its user-friendly design and sophisticated charting tools.

Thinkorswim: Provided by TD Ameritrade, this platform is well-liked by stock, options, and futures traders and is renowned for its cutting-edge analysis capabilities.

Ninja Trader: Ninja Trader provides cutting-edge charting, analysis tools, and automated trading capabilities and is mostly used for futures and currency trading.

Technical analysts and traders like Trading View, a web-based platform with sophisticated charting and social networking features.

The Interactive Brokers (IBKR) Trader Workstation is a potent platform with access to a variety of marketplaces that is ideal for institutional investors and active traders.

Services for Brokers:

The company Interactive Brokers is renowned for its wide market access, minimal costs, and global presence. Both individual traders and institutional clients are served by it.

Stocks, options, ETFs, and other investment alternatives are available through E*TRADE on a user-friendly website.

Fidelity: Offers both novice and seasoned investors a complete platform with research tools and a range of investment alternatives.

Charles Schwab: Provides a vast selection of financial options, research resources, and learning materials.

Robinhood: Popular with younger and less experienced traders because to its commission-free trading of stocks, options, and cryptocurrency.

Thinkorswim platform, extensive research, and learning materials are all available from TD Ameritrade. Additionally, it offers a variety of investing possibilities.

Webull: Much like Robinhood, Webull provides extended trading hours along with commission-free trading in stocks, options, and ETFs.

Overtrade: Offers a user-friendly platform, a variety of educational materials, and specializes in forex and CFD trading.

For traders and investors, Ally Invest provides a range of investing alternatives on a user-friendly website.

Keep in mind that since my previous update, the functionality and accessibility of trading platforms and brokerage services may have changed. Before selecting a platform or brokerage service, it's crucial to undertake extensive research, take your trading demands and preferences into account, and read reviews. When picking your choice, keep in mind costs, commissions, customer service, and legal compliance.

#best trading platforms#best trading online platform#trading online#best trading website#trading techniques#online trade marketing#best online trading#online trading company

0 notes

Text

FiatVisions Review 2023

Where Is FiatVisions Trading Broker Active?

According to our research, FiatVisions is mainly active in the following countries:

Thailand,

Australia,

Canada,

Germany,

UK.

About FiatVisions’ Trading Platform

We tried reviewing FiatVisions’ trading platform but weren’t able to access it. The company offers a proprietary WebTrader with a dedicated mobile app.

According to the web presentation, the software contains raw pricing, quick execution, in-depth analytical tools, and multiple execution models. However, we could not register an account as it was pending approval from the broker employees. Therefore, we are unable to confirm anything said here.

It’s always good to have third-party software on offer, MT4, MT5, or cTrader. According to numerous retail traders, these are more reliable, less susceptible to different manipulations, and overall provide a great user experience.

What Can You Trade With a Broker?

You can choose between four asset classes, those being:

Currency pairs – EUR/USD, GBP/AUD, SEK/NOK

Indices – FTSE100, DJIA, NASDAQ

Shares – Amazon, Apple, Microsoft

Commodities – gold, crude oil, natural gas

Crypto trading is not on offer, which is another drawback.

Fees and Spreads Overview

Besides the leverage, this broker doesn’t reveal other trading terms. We know that the spread is floating on each account, and that’s about it. Nothing about fees, commissions, or other related costs.

FiatVisions Trading Account Review

Depending on your trading skills, you can choose from two groups of FiatVisions account types:

Just Starting

Beginners – $5,000

Basic – $25,000

Silver – $100,000

Next Level

Gold – $250,000

VIP – $1,000,000

You can get a personal account manager, daily signals, and a trading academy in the first group. With higher sums, the second group brings in the event room, webinars, and video courses.

The minimum deposit is exceptionally high, standing at $5,000. Usually, regulated firms have Micro accounts, starting with as low as $10.

FiatVisions Demo Account – Can I Trade For Free?

Since we were unable to register an account, we were also unable to find the FiatVisions Demo account. Additionally, we didn’t see it mentioned on the broker’s site.

All this leads us to believe you have no choice but to deposit $5,000 to review the software. It’s too big an amount for a loosely regulated trading intermediary with fake reviews on Trustpilot.

1 note

·

View note

Text

FiatVisions Review 2023 – Can You Trust An Offshore Broker?

For example, FCA-regulated companies must meet specific criteria, such as maintaining minimum capital at 730,000 GBP, participating in the compensation fund with up to 85,000 GBP per client, and limiting leverage at 1:30 per ESMA.

FSC, on the other hand, has no such criteria. The required capital is 1,000,000 MUR, which is roughly $21,500. Additionally, companies are not obligated to participate in the compensation fund, and there are no leverage restrictions.

All this makes trading with offshore brokers less safe. Please notify our team if you have any details about FiatVisions broker and their operations.

FiatVisions is an offshore trading brokerage registered in Mauritius. However, the broker has earned several bans, most notably in the UK and Canada.

About FiatVisions’ Trading Platform

We tried reviewing FiatVisions’ trading platform but weren’t able to access it. The company offers a proprietary WebTrader with a dedicated mobile app.

According to the web presentation, the software contains raw pricing, quick execution, in-depth analytical tools, and multiple execution models. However, we could not register an account as it was pending approval from the broker employees. Therefore, we are unable to confirm anything said here.

It’s always good to have third-party software on offer, MT4, MT5, or cTrader. According to numerous retail traders, these are more reliable, less susceptible to different manipulations, and overall provide a great user experience.

1 note

·

View note

Text

How to trade Forex Online: A Guide

As a financial market that operates 24 hours a day, five days a week, Forex trading has become increasingly popular among investors looking to diversify their portfolios. Forex trading involves the buying and selling of currencies from around the world, with the goal of making a profit from the fluctuating foreign exchange rates.

How to Trade Forex Online – Choosing the Right Trading Platform

To trade Forex online, investors must first choose a trading platform. There are a variety of online Forex trading platforms available, each with its own features and benefits. When choosing a trading platform, investors should consider factors such as ease of use, reliability, security, and customer support.

Popular Online Forex Trading Platforms

Some of the most popular online Forex trading platforms include MetaTrader 4 and 5, cTrader, and TradingView. MetaTrader is a widely used trading platform that offers a range of features, including advanced charting tools and the ability to automate trades. cTrader is known for its user-friendly interface and advanced order management tools. TradingView is a web-based platform that offers real-time market data and a wide range of technical analysis tools.

Tips for Successful Forex Trading

To be successful in Forex trading, investors should follow a few key tips. First, it is important to have a solid understanding of the market and the factors that impact currency pair performance. Additionally, investors should have a well-defined trading strategy and risk management plan in place. Finally, investors should always stay up to date on market news and events to make informed trading decisions.

Understanding Currency Pairs

In Forex trading, currencies are always traded in pairs. Each currency pair represents the exchange rate between two currencies. For example, the EUR/USD currency pair represents the exchange rate between the Euro and the US Dollar. When trading Forex, investors will always buy one currency and sell another based on their belief in the future performance of the respective currencies.

What are the Most Traded Currency Pairs?

The most traded currency pairs in the Forex market are known as the major currency pairs. These currency pairs are the most widely traded due to their high liquidity and the stability of the respective economies. The top 10 most traded currency pairs in the Forex market are:

EUR/USD – Euro/US Dollar

USD/JPY – US Dollar/Japanese Yen

GBP/USD – British Pound/US Dollar

USD/CHF – US Dollar/Swiss Franc

AUD/USD – Australian Dollar/US Dollar

USD/CAD – US Dollar/Canadian Dollar

NZD/USD – New Zealand Dollar/US Dollar

EUR/GBP – Euro/British Pound

EUR/JPY – Euro/Japanese Yen

GBP/JPY – British Pound/Japanese Yen

Factors that Affect Currency Pair Performance

The performance of currency pairs in the Forex market is affected by a variety of factors, including economic data releases, central bank policy decisions, geopolitical events, and market sentiment. Economic data releases, such as GDP and inflation figures, can have a significant impact on the exchange rate between two currencies.

Central bank policy decisions, such as interest rate changes, can also impact currency pair performance. When a central bank raises interest rates, it can attract foreign investment and increase demand for the currency, leading to a rise in the exchange rate. Conversely, when a central bank lowers interest rates, it can lead to a decrease in demand for the currency and a decline in the exchange rate.

Geopolitical events can also have a significant impact on currency pair performance. Political instability, such as a change in government or a major conflict, can lead to a decline in the value of a currency. Finally, market sentiment, or the overall mood of investors, can also impact currency pair performance.

Analyzing Currency Pairs

To make informed trading decisions in the Forex market, it is important to analyze currency pairs using a variety of technical and fundamental analysis tools. Technical analysis involves the use of charts and technical indicators to identify trends and patterns in the market. Fundamental analysis, on the other hand, involves the analysis of economic data releases, central bank policy decisions, and other factors that can impact the performance of currency pairs.

[ Suggested read: forex vs stocks ]

Benefits of Trading Forex Online

1.Flexibility

One of the major benefits of trading Forex online is the flexibility it offers. Online Forex trading enables investors to take advantage of market opportunities from any location in the world, at any time of the day.

2. High Liquidity

Forex trading offers high liquidity, making it easier to buy and sell currencies quickly. This is due to the fact that there is always someone on the other side of the trade.

3. Low Transaction Costs

Another advantage of Forex trading online is the low transaction costs. Forex trading does not involve any middlemen, making it an efficient and cost-effective way to trade. This results in significantly lower transaction costs compared to other financial markets such as the stock market.

Conclusion – Mastering the Art of Forex Trading

Forex trading can be a lucrative investment opportunity for those who are willing to put in the time and effort to understand the market and develop a solid trading strategy. By keeping an eye on the most traded currency pairs, analyzing market trends and events, and choosing the right trading platform, investors can increase their chances of success in the Forex market. With the right approach, anyone can master the art of Forex trading.

Originally Published on Shortkro

Source: https://shortkro.com/how-to-trade-forex-online-a-guide/

0 notes

Text

Why You Need A Forex Trading System To Succeed - A Story Of Two Forex Traders Just Starting Out

With anything field or venture you might want to take on, there are dependably apparatuses and assets accessible to help you. Also, this is particularly evident with regards to Forex trading platform. The money market can be very overpowering, and turning into an effective Forex merchant doesn't come from blind karma. There are essentially such a large number of variables that can influence the heading that money costs will push toward.

The following are two significant real factors to consider:

1. Most beginners attempt to take on Forex utilizing no help or instruments. (Most novices lose the entirety of their cash).

2. Best dealers utilize a Forex exchanging framework to help them (Fruitful merchants earn substantial sums of money in Forex).

Yet, even with these real factors ordinarily known, amateurs actually attempt to go after Forex blind, basing their trading choices on restricted information and experience. It isn't until they have lost all of their exchanging supports that they consider that it presumably would have been more brilliant to put resources into a Forex exchanging framework and programming all along. Try not to misstep the same way. If you have any desire to find lasting success with money exchanging (ie. making reliable productive exchanges) then it is enthusiastically suggested that you research the numerous Forex exchanging frameworks and programming available.

Allow me to show further with an account of around two Forex dealers:

Tom and Jim have been finding out about Forex a ton as of late. Both have been going through hours internet attempting to comprehend what money exchanging is and how (and if) they can create a few speedy gains. All of the advertising promotions that they read say that you can build your cash extremely, rapidly. Certainly, there's some gamble included, however the potential prizes are simply too great to even consider missing. So the two of them choose to evaluate Forex and check whether they can find success with it.

The two people are profoundly energetic and need to allow Forex their best opportunity. So every one of them will put $1000 of their reserve funds into money exchanging. In the event that they lose the $1000, they will stop Forex and reconsider the choice about whether to attempt once more from now on. By effective financial planning 1,000 bucks, both have shown that they are completely dedicated to making Forex work for them.

Beginning:

Tom takes his whole $1000 and moves it into a retail online Forex dealer. Tom will go with all of his exchanging choices all alone. He will do his own exploration and will sneaking on Forex discussions and web journals to check whether he can get a few truly necessary tips.

Jim goes an alternate course. In spite of the fact that he is similarly basically as roused as Tom, he is likewise mindful of the intricacy of the Forex market and understands that he simply doesn't have a lot of involvement with this point. So he takes $900 and moves it to a similar retail Forex specialist as Tom. He saves the excess $100 to gain admittance to devices and assets (ie. Forex exchanging frameworks and programming) to assist him with improving exchanges. He used to day exchange stocks and knows direct the edge that these instruments and assets can have (particularly assuming you are simply getting acquainted with everything).

For more details, visit us :

Fbs broker reviews

Best ctrader broker

Islamic fx broker

Proprietary trading firms uk

#Forex broker reviews#Forex brokers reviews#Forex trading company#Forex trading platform#Forex broker reviews usa

1 note

·

View note

Text

Top Forex Broker Reviews of 2024: Navigating the Best in the Market

Top Forex Broker Reviews of 2024: Navigating the Best in the Market

The forex market, known for its vast liquidity and 24-hour trading opportunities, continues to attract traders worldwide. As we step into 2024, the landscape of forex brokers has evolved, offering a plethora of options tailored to diverse trading needs. This article delves into the top forex brokers of 2024, highlighting their unique features and what sets them apart.To get more news about forex broker, you can visit our official website.

1. IG - Best Overall Broker, Most Trusted

IG stands out as the most trusted and comprehensive broker in 2024. With a trust score of 99, IG offers an extensive range of tradeable instruments, competitive pricing, and outstanding platforms and tools1. Their industry-leading education and research tools make them a top choice for both novice and experienced traders.

2. Interactive Brokers - Great Overall, Best for Professionals

Interactive Brokers is renowned for its professional-grade trading tools and platforms. Catering to seasoned traders, it offers a wide array of investment options and competitive fees1. Their robust infrastructure ensures fast execution speeds and reliability.

3. Saxo - Best Web-Based Trading Platform

Saxo Bank excels with its web-based trading platform, providing a seamless and intuitive trading experience. Known for its excellent platform technology, Saxo offers a broad spectrum of financial instruments and top-notch research tools.

4. CMC Markets - Excellent Overall, Best Platform Technology

CMC Markets is celebrated for its platform technology, offering a user-friendly interface and advanced trading tools. Their comprehensive offering includes competitive spreads, a wide range of instruments, and excellent customer support.

5. FOREX - Excellent All-Round Offering

FOREX provides an all-round excellent trading experience with a focus on education and research. Their platform is designed to cater to traders of all levels, offering competitive pricing and a variety of trading tools.

6. Charles Schwab - Award-Winning Thinkorswim Platform

Charles Schwab’s Thinkorswim platform is a favorite among traders for its advanced features and user-friendly interface. It offers a wide range of tradeable instruments and comprehensive research tools, making it a top choice for serious traders.

7. Exness - Best Overall for International Traders

Exness is a standout broker for international traders, offering multiple account types and competitive trading fees. Their platforms, including MT4 and MT5, are equipped with extensive research tools and educational resources.

8. FXTM - Best for Professional Traders

FXTM caters to professional traders with its ECN trading accounts and advanced trading platforms. Their copy trading feature, FXTM Invest, allows traders to follow and replicate the strategies of successful traders2.

9. Eightcap - Best for Cryptocurrency Trading

Eightcap is the go-to broker for cryptocurrency enthusiasts, offering over 100 cryptocurrencies with low spreads and zero commissions. Their Crypto Crusher dashboard provides traders with valuable insights and trading signals.

10. IC Markets - Best Low Spreads

IC Markets is known for its low spreads and low commissions, making it an attractive option for cost-conscious traders. Their platforms, including MT4, MT5, and cTrader, offer advanced trading tools and fast execution speeds.

Conclusion

Choosing the right forex broker is crucial for success in the forex market. The brokers listed above have been meticulously evaluated based on their features, fees, and overall performance. Whether you are a beginner or a seasoned trader, these brokers offer a range of options to suit your trading needs in 2024.

0 notes

Text

Making Sure You Choose the Right Forex Broker

Technology is becoming smarter every day. If you have talked about forex trading or googled some stuff related to it, we’re sure you must’ve come across plenty of ads of forex brokers. Each claim to be the best and profitable for you.

It becomes overwhelming to decide which broker is the right for you. Your mind constantly buzzes with endless questions like:

· Is eToro the right forex broker?

· Is FxPro a safe choice?

· Does IG charges high fees?

· Is XM a good broker for a beginner like me? And the list goes on…

The following tips will help you choose the right broker amongst the many brokers in the market.

5 Tips for Selecting the Right Forex Trading Broker

1. Check the Licenses and Registration Details

The first tip for choosing the right forex broker is to check the regulatory bodies that oversee it. The about page of the broker’s website has the list of licenses from the regulatory bodies.

The more licenses the broker has, the merrier. Suppose there is a trade dispute between you and the broker. In that case, you can turn to regulatory bodies to resolve your issue.

However, if there are no licenses on the broker’s website, it is a red flag for you. Beware of dealing with such types of brokers.

Moving on, we have…

2. Study the Broker’s Account Types and Initial Deposit

Brokers offer different types of trading account to cater to traders’ need. The details of these accounts are mentioned on their website. Check the account types provided by the broker, along with the minimum deposit required to open the account.

The amount of the initial deposit varies from broker to broker. Some brokers charge as low as

$100; whereas, some brokers can require as much as $1,000.

Similarly, the spreads, leverage, and commission charged by brokers also vary. Some brokers provide low spreads and higher power to enable traders to get more value from their trade.

Choose the broker that perfectly fits your need. Up next, we have…

3. Quality of Customer Care Service

Forex trading is a global market and is open 24/7. The trader might need some help from his broker to resolve a trading query or ask about deposits and withdrawals details.

Hence, the customer service of a broker should be top-notch. His team should be available around the clock to answer traders’ questions and solve his needs. The good forex brokers in the market are available 24/7 and respond to their clients via email, call, and live chat.

The 4th tip for choosing the right broker is understanding the trading platform they offer.

4. Trading Platforms Offered

Currency trading platforms give access to the forex market. The broker can offer you different types of platforms, either in the form of downloadable apps or online web-trading portals. The majority of brokers in the market provide MetaTrader4, MetaTrader5, or cTrader to their clients.

Study the pros and cons of trading platforms provided by the broker. You can also try your hands at the demo account to experience the broker’s trading platform.

The last tip on the list is to check the availability of educational material on the broker’s website. Let’s talk more about it…

5. Educational Material Available on its Website

New traders need a proper understanding of forex terms, market updates, and open profitable trades. A few brokers in the market have rich educational material on their websites, including glossaries, video tutorials, webinars, eBooks, and courses.

The quality of educational material available on the broker’s website shows its proficiency and knowledge about the forex. An abundant and good quality educational material signifies that the broker is not an amateur in the market. He is experienced and knows the forex trading arena really well.

Conclusion

The first step towards profitable forex trading is finding the best forex broker. You have to make sure that you are opening and funding your account with a broker who is experienced, reputable, and competent in the market.

The internet has hundreds of forex brokers. Unfortunately, not all of them are trustworthy. Many fraudulent entities portray themselves as brokers but shut down overnight and run away with traders’ funds. Hence, beware of such scammers and always conduct thorough research before signing up with the forex broker.

2 notes

·

View notes

Text

Honest Forex Broker Review - Fx Pro

Fx Pro Trading Brokerage Fully Reviewed

In this summary we are going to make a fully reviewed explanation of Fx Pro trading brokerage in some detail.

About FxPro

Founded in 2006, FxPro has executed more than 500 million orders since its inception and has serviced more than 1.8 million clients in over 173 countries. As of 2021, FxPro lists over $100m in Tier 1 Capital and has more than 200 employees across its 4 offices.

The FxPro brand holds regulatory licenses in the United Kingdom (UK) under FxPro UK Limited, Cyprus under FxPro Financial Services Limited, South Africa, and the Bahamas. Making Fx Pro a highly trusted broker by many retail & institutional traders.

FxPro competes among the top MetaTrader brokers, offering the full suite of MT4 and MT5 platforms with multiple accounts and execution methods. The only drawback to an otherwise balanced forex broker is pricing that is slightly higher than the industry average.

In the below table please take your time to view some of Fx Pro's features & benefits:

Start Trading Like A Pro With Fx Pro

Is FxPro Safe?

FxPro is considered very low-risk, with an overall Trust Score of 93 out of 99. FxPro is not publicly traded and does not operate a bank. FxPro is authorized by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). FxPro is fully authorized & regulated by the following tier-1 regulators: Financial Conduct Authority (FCA). Fx Pro is extremely unlikely to be a scam broker. and has been tried & tested by Fx Brokers Empire.

Commissions and Fees

FxPro's pricing is slightly higher than the industry average, putting it at a small disadvantage compared to its peers, such as Etoro or HF Markets, who both also offer the full MetaTrader and cTrader suites just like FxPro does. However what they lose in price is far outweighed with better options & service. Execution method: On FxPro MT4, you can choose either variable or fixed spreads. For the variable spread pricing, there are two types of execution-based pricing: instant and market. Instant execution is subject to requotes but no slippage, while market execution has the potential for slippage but without requotes. Commissions: FxPro offers its most competitive spreads on its cTrader platform, which uses commission-based pricing. FxPro's effective spread to trade EUR/USD is roughly 1.27 pips, based on 0.37 average spread + 0.9 pip commission equivalent on cTrader, using August 2020 data. Spreads: FxPro's floating rate model (variable spread) is available on both MT4 and MT5, with EUR/USD spreads of 1.57 pips for accounts on market execution (1.51 pips on MT5) and 1.71 for accounts with instant execution, as per August 2020 data from FxPro. Fixed pricing: On MT5, there is no fixed spread offering, and only market execution is available. Other platforms such as MT4 and web traders offer fixed pricing models. Active traders: FxPro offers an Active Trader program, & provides loyalty rewards for its longstanding traders. Executing large orders: Without question, FxPro's best feature is its ability to execute large trading orders, which can be placed with no minimum distance away from the current market price. A high liquidity broker which is important for high frequency & big money traders

Platforms and Tools

Thanks to offering MetaTrader, cTrader, and its own in built proprietary FxPro Edge web platform, traders at FxPro have a diverse selection of platform options depending on their trading style. Both beginners & experts can enjoy trading and perform with there respective platforms. MetaTrader suite: FxPro offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platform for web and desktop. A notable add-on is available for MT4 which is the suite of trading tools from Trading Central that can be rather helpful. cTrader: The FxPro cTrader platform is available for web and desktop. The cAlgo platform can also be used to enable algorithmic trading when using cTrader at FxPro. Proprietary platform: FxPro Edge is a light web-based platform that has robust charts and a responsive design. There are a few default layouts, and users can drag and drop the modules to rearrange them and add new widgets. Overall, there is a good foundation established for the future, especially for such a new in built platform. There will definitely be more updated features to this platform to enhance traders performance. Research

FxPro provides great daily market updates and analysis on its blog, along with content from third-party providers. Overall, we found the written articles from FxPro's in-house staff to be of a good quality. More Video content would help fill the gap in research, as FxPro's YouTube channel is mostly webinars, platform tutorials, and promotional videos. FxPro News blog: There are multiple articles per day available on FxPro's dedicated blog, including its 'Market Snapshots' series. These articles provide a daily outlook and are nicely organized, making it easy to consume, understand & apply in volatile market conditions. Traders dashboard: FxPro has a client portal where users can access sentiment data for various symbols and forex pairs, along with the trading session times and a summary of gainers and losers. There is also an integrated economic calendar. Adding trading capabilities to the client portal, or merging these features with the Edge platform, would help to centralize these resources in one place.Fx Pro Education

FxPro has a general education section where it provides written materials, along with some educational videos on its website. Overall, FxPro has a good foundation of educational content. Expanding its coverage and adding other videos on some more advanced trading elements would balance out the FxPro educational offering.Written content: FxPro's educational section features mini cards with key information and short paragraphs explaining things like "what is a stop out" in less than six sentences. There are 36 cards in the Psychology section and four other areas, each with a collection of learning cards. There is even progress tracking, so you know which modules or chapters you have finished, which is a nice touch.

Mobile Trading

Alongside providing its proprietary FxPro Direct app for trading, account management, and basic market news, FxPro's mobile lineup is powered by the same third-party providers as its desktop and web-based platforms: MetaTrader (Meta Quotes) and cTrader (Spotware).

cTrader: FxPro's white-labeled version of cTrader is consistent with the web-based platform, offering traders a really friendly & easy to use trading experience with a variety of trading tools. As far as third-party mobile apps go, cTrader is very versatile.

MetaTrader: The mobile versions of the MT4 and MT5 platforms are presented as standard from the developer with default features. In 2021, FxPro is a Best in Class MetaTrader Broker due to a range on smart trading indicators & strong liquidity.

FxPro Direct: The FxPro Direct app is the broker's proprietary mobile app which supports trading for users that have a CFD account, but is mainly optimized for account management. With just a quotes, trades, and history tab, we found that the FxPro Direct app was not very ideal for trading, compared to FxPro's other available mobile platforms. Meanwhile, the FxPro Edge platform is not yet available for mobile.

While FxPro does not stand out for its pricing, FxPro is a well-capitalized, trustworthy broker that offers multiple platform options, multiple execution methods, and, for professionals, can cleanly execute large orders. Fx Pro Trust

FxPro scores quite well when it comes to reputation and trustworthiness. Most importantly, they are regulated in the United Kingdom, which is reputedly safer than some regulators in the EU. FxPro also advertises that they have one of the highest counterparty credit ratings in the industry, scoring a whopping 95 on a hundred point scale, where a high score indicates a lower risk of default or bankruptcy. They also participate in the Financial Services Compensation Scheme (FSCS) that allows clients to claim compensation in the event FxPro were to become insolvent up to £80,000. They also offer clients negative balance protection under new EU guidelines that prevent clients from losing more money than they have deposited. So they are clearly not worried about liquidity issues as they have good insurances in place. One negative for FxPro is the absence of guaranteed stop‑loss orders. Some brokers offer this feature for a fee, but this is not offered by FxPro at all. Fx Pro Special Features

FxPro offers traders algorithmic trading through cTrader, which is an advanced algo and technical indicator coding application that allows traders to create and build algorithmic trading strategies and custom indicators. This is a smart technological feature that is not offered by many brokers and definitely worth checking out. FxPro also offers a Virtual Private Server (VPS) that enables clients to upload and run MT4 Expert Advisors and algo bots, 24 hours a day, without needing to keep the trading terminal running. These applications also allow for back testing of trading strategies.

Fx Pro Customer Support

FxPro prides itself on its "five‑star customer service," specifically its multilingual, 24‑hour Monday‑through‑Friday (24/5) customer service team. Their live phone support operates in several locations with a toll‑free number in the U.K., France, Germany, UAE, and Russia. Live chat is offered for both live trading clients and prospective clients. Unlike other brokers, they have a physical office in London with a reception desk that is open from 7:30 a.m. to 4:30 p.m. Some social media support is available on Twitter, but this is mainly news related rather than specifically for customer support.

Please Note: The FCA has a ban in place for the sale of crypto-derivatives to UK retail consumers as from 6th January 2021.

Fx Brokers Empire's Conclusion For Fx Pro

We recommend trading with this broker and find it to be a very trustworthy broker. Due to its popularity and multi tiered regulations, Fx Pro is extremely unlikely to be a scam. Fx Brokers Empire recommends using Fx Pro for its high liquidity & execution service. Along with outstanding customer support based on our own experiences & our client feedback. Using there run on line 'Trade Like A Pro' they definitely have weight in there words and offer some decent trading features. We further recommend not to start a investment account with Fx Pro in excess of £25,000 initially until you get used to the platform offered and all its features. Fx Pro is a highly popular trading choice & has a well branded name that delivers results for its traders, across Europe, Asia & most definitely in the UK as a trusted broker.

Fx Brokers Empire rates Fx Pro as a 4.5/5 star broker

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Start Trading Like A Pro With Fx Pro

#fx pro review#detailed fx pro review#fxpro#fxproreview#fxproreviewed#fx pro reviewed#fx pro best fca broker review

3 notes

·

View notes

Text

Forex: The best online trading Platform and Tools provider

On account of offering MetaTrader, cTrader, and its exclusive FxPro Edge web platform, traders at FxPro have a different choice of platform options relying upon their trading style.

MetaTrader suite: FxPro offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for web and work areas. One eminent extra accessible for MT4 is the set-up of trading apparatuses from Trading Central.

cTrader: The FxPro cTrader platform is accessible for the web and work area. The cAlgo platform can likewise be utilized to empower algorithmic trading when utilizing cTrader at FxPro.

Exclusive platform: FxPro Edge is a light online platform that has strong outlines and a responsive plan. There are a couple of default designs, and clients can relocate the modules to revise them and add new gadgets. Generally speaking, while FxPro Edge unmistakably trails platform pioneers like Saxo Bank, CMC Markets, and IG, there is a decent establishment set up for the future, particularly for another platform.

Examination

FxPro gives day-by-day market updates and investigation on its blog, alongside content from outside suppliers. Generally, I tracked down the composed articles from FxPro's in-house staff to be of acceptable quality. Adding video substance would help fill the hole in research, as FxPro's YouTube channel is generally online courses, platform instructional exercises, and special recordings. For examination, XM Group and Tickmill produce various exploration recordings every day.

FxPro News blog: There are various articles each day accessible on FxPro's devoted blog, including its Market Snapshots arrangement. These articles give a day-by-day standpoint and are pleasantly coordinated, making it simple to burn-through.

Traders dashboard: FxPro has a customer entrance where clients can get to supposition information for different images and forex sets, alongside the trading meeting times and synopsis of gainers and failures. There is additionally an incorporated monetary schedule. Adding Trading Platforms for Forex capacities to the customer entryway, or blending these highlights with the Edge platform, would help unified these assets in a single spot.

Instruction

FxPro has an instruction segment where it gives composed materials, alongside some instructive recordings on its site. Generally speaking, FxPro has a decent establishment of instructive substance, yet still path schooling pioneers, for example, IG, Saxo Bank, and FXCM regarding the amount and extent of materials it offers. Extending its inclusion and adding different recordings would adjust the FxPro instructive contribution.

Composed substance: FxPro's instructive segment highlights small cards with bits of data and short sections clarifying things like "what is a stop out" in under six sentences. There are a day and a half in the Psychology segment and four different territories, each with an assortment of learning cards. There is even advancement following, so you know which modules or sections you have completed, which is a pleasant touch. Visit marketcapitalnews.com for more details.

1 note

·

View note

Text

Best Forex Trading Platforms

Picking the privilege Forex trading stage is basic in case you will exchange on each and every day. You need an adaptable exchanging stage that fits all your own exchanging requires. Exchanging the market is a troublesome cycle, you need to ensure you cause your life as simple as could reasonably be expected so you to can zero in available activity.

Going ahead, you will get familiar with the main highlights that you have to look for while picking a Forex exchanging stage. To begin with, you need a handily worked and available Forex exchanging stage that offers you all the apparatuses required for your central and specialized examination.

You need a solid and stable exchanging stage that doesn't go disconnected the second you open an exchange. Besides, it's significant to have a safe exchanging stage that can offer you a straightforward exchanging climate. At last, as a broker, you need to explore the best stages before you exchange with your well deserved cash.

We live in a quick moving reality where new mechanical developments have empowered a blast of super serious Forex exchanging stages. We have composed a functional guide that covers the most mainstream and believed Forex exchanging stages and the most serious stages.

MetaTrader 4 – Fx Trading Platform

The MetaTrader 4 exchanging stage is unmistakably the most well known Forex trading stage. A large number of dealers with various degrees of involvement and distinctive exchanging needs have picked MetaTrader 4 as their fundamental exchanging stage. The MT 4 stage was first delivered in 2005 and it was created by MetaQuotes Software. Since it's broadly acknowledged and utilized by numerous merchants, MetaTrader 4 is given by most of the Forex retail expedites. Likewise, read Everything you have to think about intermediaries.

The MetaTrader 4 isn't only a graphing stage, it's additionally a stage that you can synchronize with your dealer. You can interface it with different records, and not at all like with the normal graphs, the MetaTrader 4 furnishes you with full usefulness where you can set mechanized exchanges likewise called Expert Advisors or EAs.

The MT 4 stage is wealthy in specialized pointers as it accompanies in excess of +50 free markers that you can alter and you can change. For a beginner dealer, the MetaTrader 4 is the best specialized investigation arrangement and graphing programming as it's instinctive to utilize.

With the MT4 stage, you can likewise have the One-tick exchanging choice which is the quickest method to exchange through an outline.

TradingView – Fx Trading Platform

TradingView is an electronic Forex exchanging stage. In reality, it's likewise a multi-resource web based exchanging stage since it offers outlining answers for stocks, items, files and numerous different instruments. It's anything but difficult to utilize and you can get to the TradingView stage through any internet browser. What truly separates this product from other exchanging stages is the social part of exchanging.

TradingView is something beyond a basic exchanging stage. It's an informal community that permits merchants to cooperate with one another and share thoughts. With TradingView, you can utilize specialized examination, and furthermore distribute and share thoughts for criticism. Along these lines, Tradingview was planned starting from the earliest stage as an extraordinary network for merchants.

TradingView offers an expansive scope of graphing instruments that can assist you with improving your Forex examination. You can likewise buy in for a month to month expense to their Pro record where you can approach considerably more highlights.

cTader – Forex Trading Platform