#car loan interest rate for new car

Text

#Best Car Loan Interest Rate#Car Par Loan#Interest Rates For Car Loans#Loan Against Car#New Car Loan Interest Rate#Used Car Loan

1 note

·

View note

Text

Key Factors To Keep In Mind While Applying For A Used Car Loan

When applying for a used car loan, several key factors can essentially affect your financial experience and in general fulfilment with the advanced process. To ensure a smooth and favourable result, consider the following components

Credit Score:

Your credit score plays an essential part in determining the interest rate you will be advertised. A higher credit score generally leads to lower interest rates, sparing you cash over the life of the credit. Some time recently applying, check and, on the off chance that conceivable, move forward your credit score.

#Best Cars loan in India#Best car loan in Noida#New Car Loan Low Interest Rates#Vehicle Loan Interest Rate in India#Car Loan lowest Interest Rate#Vehicle Loan Online in India#cars loans

0 notes

Text

Car Loan Apply Full Process Details

Thinking to buy a car loan? Well, buying a car loan is a quite big milestone for the people out there but don’t worry financenu is here with a guide on the full process of car loan to give you ease. Understanding the process will help you to get the best price for your car loan and you will also have a smooth process.Get your basics clear first.

That what car loan basically is. Go through the criteria which has been set up by the loan provider. Do you set up in the criteria or not. Always determine the amount which you need to borrow for your car loan.

#Car Loan Apply#Best Cars loan in India#Best car loan in Noida#New Car Loan Low Interest Rates#Car Loan lowest Interest Rate#Applying for car loan#cars loans

0 notes

Text

Car Loan Apply Full Process Details

Thinking to buy a car loan? Well, buying a car loan is a quite big milestone for the people out there but don’t worry financenu is here with a guide on the full process of car loan to give you ease. Understanding the process will help you to get the best price for your car loan and you will also have a smooth process.Get your basics clear first.

#Car Loan Apply#Best Cars loan in India#Best car loan in Noida#New Car Loan Low Interest Rates#Car Loan lowest Interest Rate#Applying for car loan#cars loans

0 notes

Text

New Car Loan Low Interest Rates

New car loan low interest rates are a hot topic for many prospective car buyers looking to finance their vehicle purchase affordably. As of recent trends, interest rates on new car loans have been relatively favorable, with many lenders offering competitive rates to attract borrowers.

The specific interest rates available for new car loans can vary depending on several factors. These factors include the borrower's creditworthiness, the loan term, the amount financed, and prevailing market conditions. Generally, borrowers with excellent credit scores and stable financial backgrounds are more likely to qualify for the lowest interest rates.

In recent years, new car loan interest rates have been on a downward trend due to factors such as economic conditions, changes in monetary policy, and competition among lenders. As a result, many borrowers have been able to secure loans with rates ranging from around 2% to 5% APR (Annual Percentage Rate).

However, it's essential for borrowers to shop around and compare rates from multiple lenders to find the best deal available to them. Different lenders may offer different rates based on their individual lending criteria and risk assessment processes.

Additionally, borrowers can take steps to improve their chances of qualifying for low-interest rates on new car loans. These steps may include maintaining a strong credit score, reducing existing debt, saving for a larger down payment, and negotiating with lenders for better terms.

Ultimately, securing a low-interest rate on a new car loan can lead to significant savings over the life of the loan. By carefully researching options, comparing rates, and taking proactive steps to improve creditworthiness, borrowers can make informed decisions and ensure they get the most favorable terms possible for their new car purchase.

#Vehicle Loan#Canara vehicle#Vehicle loan calculator#Vehicle loan interest rate#Vehicle loan meaning#Vehicle loan agreement#Commercial vehicle loan#Two wheeler vehicle loan#New Car Loan Low Interest Rates#Car Loan EMI Calculator

0 notes

Text

tags. fem!reader, boss/employee relationship, stupidly domestic, little wife kink in there somewhere, nanny reader, single dad gojo, breeding kink [18+ only]

You sometimes find yourself wistfully imagining having a family of your own—a soft and sweet little bundle to cuddle and someone strong and capable (competent) at your side. But you can’t think of the last time you’ve been on a date where that person had the same interest in something more serious than casually sleeping around.

Nannying seemed like the natural conclusion, especially when you’re still settling in a new city and barely scraping by for rent and student loans for a degree you don’t use.

You pick up a few jobs just to get a feel for it: parents going away for a honeymoon, a last-minute call-in, a weekend business trip. Then a friend of a friend says she makes enough to afford one of those picturesque apartments that overlook tall high-rises and iridescent lights, the very ones you’ve dog-eared in real-estate magazines.

All it takes are a few phone calls and an interview until you’re packing up your apartment and taking the freeway outside of the city to somewhere remote and expensive, your car looking almost out of place parked beside the shiny new one in the long driveway.

You rap on the front door before you lose your nerve, and a few moments later, it opens, and you’re unsure who looks more out of place: this man with a smile too big, dressed for work, immaculate suit dampened by the baby rag slung over his shoulder and what looks like drool on his crisp collar, or you in your scuffed shoes and second-hand store clothes, standing in front of the nicest house you’ve ever seen.

“The nanny?”

“Yes,” you mutter, licking your lips. “That’s me.”

“Good, Ren just woke up from his nap,” he says, opening the door a little wider with a creak. The darkness behind him is almost comforting.

You take a deep breath and pass over the threshold into his home.

The entire time, his hand stays on the small of your back to steer you toward the nursery, and a shiver threatens up the length of your spine.

Three months. That’s how long it takes before your employer poses a problem.

It’s not that he’s a terrible boss; in fact, he’s quite the opposite. He lets you take over one of the many spare rooms in his massive house, pays you double the regular rate, and gives you time off when you ask for it.

It also helps that Ren is cute, only a year old, and still so sweet and tiny.

Perfect.

The problem lies in that you know what he sounds like first thing in the morning, that he knows how you like your coffee, that he helps you fold laundry in the living room while the baby naps, how you catch him staring anytime you hold his son—his expression shuttered, a foreign thing that you can’t read. It’s all so terribly domestic.

Terrible in that you think it’s a horrible idea to develop a crush on your boss, that you can’t help but get flustered anytime he so much as looks your way, even if it’s fleeting. How a sleepy smile before he retires to his room for the night can turn your thoughts into a scattered, ill-defined mess of what they used to be until all that’s left are words like spun sugar melting on your tongue.

But also, it’s not normal, at least not from your experience.

You were lucky in the past if your employer even wanted to know about their kid’s day. Barely saying hello once they walk through the front door before sending money to your bank account.

Satoru—because that’s what he asked you to call him one afternoon while you were in the middle of feeding Ren mashed banana, a lazy smile curling the edges of his lips after you say it for the first time—wants to know everything: what Ren ate, if he laughed, how your day was, if you finally got your hands on that book you’ve been meaning to buy.

“You don’t have to ask about my day,” you tell him shyly, accepting the glass of wine he proffers you after spending the past hour trying to put a teething baby to bed. “To make me feel better, that is.”

“Would it be so bad if I said I want to? You live here, too.”

You try to separate the two: that he cares as your employer and not for any other reason, and how you sometimes catch the soft look in his eye whenever he looks at you could make you believe otherwise.

Cool fingers cup your chin gently, thumb caressing the top of your cheek, now close enough that you catch a few of the warm notes of his cologne, a move that’s probably very inappropriate between a boss and an employee.

“I never say anything I don’t mean.”

You swallow, nodding, slightly shaky, breath caught in your chest. “Okay.”

“Good girl.” He retreats to his office before witnessing how those two words knock the wind out of you.

He starts saying things like our shopping list, our car—because he gave you the keys to the SUV parked beside his car and hasn’t touched it since; for you and the baby, he said, plus it’s terrible on gas when I drive it to work—our house, our baby. You don’t think he means to do it; it's more of an easy slip in conversation.

But then, one morning, he’s rushing around the kitchen, hair still damp and smelling like his shampoo, as he grabs his coffee and briefcase from the counter, kissing Ren’s forehead first…and then yours.

You’re half convinced that you imagined it—that his lips hadn’t stayed there for a second longer than necessary—until he straightens his tie and heads out for the day with a ‘be good’ tossed over his shoulder, and you’re left wondering if he meant to say that to you or Ren.

It sets off a chain reaction of thoughts whirling away in your head, leaves you wanting and wondering—only ever allowing yourself to fantasize a little when the house is quiet and dark, the baby monitor humming on your nightstand, and images of your boss flit behind closed eyelids as you fit your hand underneath your soft sleep shorts.

In the morning, you worry he can tell what you did, his smile almost too sharp, too something—more teasing than what you’re used to—his hand resting on your lower back as he leans down to kiss Ren’s chubby cheek while you make breakfast.

“I have a meeting this afternoon, so I’ll be late. Want me to pick up some food on the way home?”

No, you think, there’s no way he knows.

You spend most of the morning cleaning and folding the array of graphic onesies Satoru has a penchant for dressing Ren in, and the later half walking around the pool because it’s warm and Ren enjoys splashing around in the water. It’s enough to tucker him out for bed early, unable to keep his eyes open while eating a plate of mashed potatoes.

It’s also the first time in weeks that you have the night to yourself, no baby keeping you busy, no Satoru to—well.

After a long shower, you step out of the bathroom, moving into the hallway. And there are many reasons why you felt confident walking the few steps it took to reach your bedroom. Most revolve around what Satoru told you that morning, so you don’t expect him to be standing there, shirtsleeves rolled up, piercing gaze sliding down the length of you wrapped in a towel and little else.

“I brought home those drunken noodles you like,” he says when his eyes focus back on your face, his whole expression softening into a smile.

A beat. “Thank you,” you whisper, unable to look away.

He tucks the wet strands of hair clinging to your cheek behind your ear. “Why don’t you get dressed, and I’ll join you downstairs?”

The noise in your brain goes static.

You’re unsure what causes it, but everything changes when he comes home early one afternoon and finds you and the baby napping in the nursery. He has this soft look on his face and something else you can’t decipher with his piercing blue eyes settled firmly on you.

Ren coos softly into your shoulder.

When Satoru picks him up and settles him in the crib, then walks you to your room—here, let me help you—and when he hovers in your doorway, you let him in without question.

He doesn’t waste any time peeling off your clothes, eager to have you naked and splayed out underneath him. You cum on his tongue more times than you can count until you’re silently begging him to fuck you.

He laughs, large hands spread over your tummy.

“Use your words, baby. I’m not a mind reader.”

You feel like you’re someone else watching you from somewhere else, another body rocking against the length of your boss’s cock, back arching every time you manage to find the friction you need. He’s hard against your back, thick in a way that makes you wonder if he did enough to stretch you out.

“I-I want—”

All other thoughts are obliterated by the stretch and press of him against your cunt.

“Think I’m going to keep you,” he rasps, lips dragging over your throat. “Keep this drippy little cunt spread open on my desk whenever I want while the baby naps. Would you like that? For me to fuck you full until you give me a baby.”

You clench, nerves shot.

“Gonna get all round with my baby, stay here forever,” he mumbles when he draws away, and you can’t tell if the words are meant for you to hear or slip out without him realizing. “Fuck—breed my little wife until it takes—”

Your eyes roll up, lost in the little promises he paints across your skin, body shivering over and over until you’re sobbing from it until he has to clamp a hand down over your mouth—shh, you’re going to wake the baby—going limp when he finally cums, pressing as deep as your body will allow, as if he can somehow imprint himself there.

Wonders if maybe he’s been building up to this moment all along.

It’s so easy to lay there after, blissed out while he litters kisses across your face and collarbones, letting him lift your hips up to slide a pillow underneath, even though the position is awkward when he tries to cuddle you afterward.

His fingers draw shapes on your stomach, giving you a wistful look, like he can’t believe he’s laying here with his cum still dripping between your thighs—no matter how many times he scoops it up and pushes it back inside you. “Do you think it’ll take?”

And you don’t have the heart to tell him about the little foil packet of pills tucked away in your nightstand.

#gojo x reader#gojo smut#gojo satoru smut#gojo satoru x reader#gojo x you#jjk x you#jjk x reader#jjk smut#jujutsu kaisen x you#jujutsu kaisen smut#jujutsu kaisen x reader#.things i write

5K notes

·

View notes

Text

5 Questions to Ask When Financing a Vehicle

Financing a vehicle is no small feat. It requires careful consideration and research.

Asking the right questions before signing on the dotted line can save you from making an expensive mistake.

Read on for five key questions that you should ask when financing a vehicle.

What’s the Interest Rate?

When taking out any loan, it’s important to know the interest rate—the amount you’ll have to pay in…

View On WordPress

0 notes

Text

Which Best Describes a Way People Can Use Personal Loans?

Wedding Expenses (Which Best Describes a Way People Can Use Personal Loans?)

Which Best Describes a Way People Can Use Personal Loans?:- Personal loans have become a popular way for people to address their financial needs. Those who need it can make personal loans a flexible financing option because they can decide how to spend the money. In this article, we will explore the different ways people can use personal loans.

Debt Consolidation (Which Best Describes a Way…

View On WordPress

#"which best describes a way people can use personal loans?"#a credit score is based in part on#a way to build good credit is#an example of secured credit is a#bad credit new job loans#can i get a car loan if i just started a new job#can i get a home loan if i just started a new job#can i get a loan with a job offer letter#can you get a loan when you just started a job#can you get a payday loan before your first paycheck#car loan with job offer letter#how long do you have to have a job to get a car loan#how long do you have to work to get a personal loan#the type of credit people are most likely to use for small purchases during their lifetime is#what best determines whether a borrower’s interest rate on an adjustable rate loan goes up or down?#what best determines whether a borrowers interest rate on an adjustable rate loan goes up or down#what is a benefit of obtaining a personal loan#what is a benefit of obtaining a personal loan?#Which Best Describes a Way People Can Use Personal Loans?#which best describes a way people can use personal loans? quizlet#which describes an example of using unsecured credit#which describes the difference between secured and unsecured credit#which describes the difference between secured and unsecured credit?#which describes the difference between simple and compound interest#which statement is true of both mortgages and auto loans?

0 notes

Text

When you hear "fintech," think "unlicensed bank"

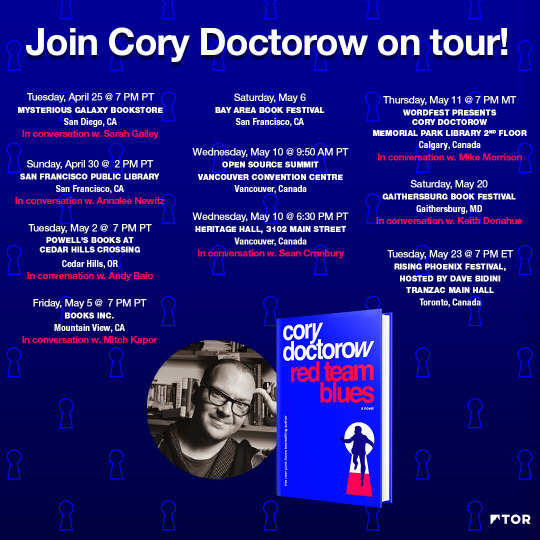

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.

These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set. They’re grifters, but they’re celebrated grifters. There’s a whole bottom-feeding sludge of tech exceptionalists that don’t get the same kind of attention, like patent trolls.

Oh, and the fintech industry.

As Riley Quinn says, “when you hear ‘fintech,’ think: ‘unlicensed bank.’” The majority of fintech “innovation” consists of adding “with a computer” to highly regulated activities and declaring them to be unregulated (and, in the case of crypto, unregulatable).

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is definitely doing and claims it isn’t). Most people don’t buy or sell securities regularly — indeed, most Americans own little or no stocks.

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars’ worth of debt. Many of us are privileged to borrow money by walking into a bank and asking for a loan, but millions of Americans are denied that genteel experience.

Instead, working Americans increasingly rely on payday lenders and other usurers who charge sky-high interest rates, on top of penalties and fees, trapping borrowers in an endless cycle of indebtedness. This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out — the crop comes in, say — and the debt is repaid.

But eventually, you’ll get a bad beat. The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you’re in an even worse situation, and the next time you catch a bad break, you go further into debt. Over time, all production comes under the control of creditors.

The historical answer to this is jubilee: a regular wiping-away of all debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it. Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors’ tables. Then, as starvation sets in, civilization collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

As the debt historian Michael Hudson says, “Debts that can’t be paid, won’t be paid.” Without jubilee, indebtedness becomes a chronic and inescapable condition. As more and more creditors attach their claims to debtors’ assets, they have to compete with one another to terrorize the debtor into paying them off, first. One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm. Debts that can’t be paid, won’t be paid — but when you have a choice between a broken arm and stealing from your kid’s college fund or the cash-register, maybe the debt can be paid…a little. Of course, digital tools offer all kinds of exciting new tools for arm-breakers — immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Under Trump, payday lenders romped through America. A lobbyist for the payday lenders became a top Trump lawyer:

https://theintercept.com/2017/11/27/white-house-memo-justifying-cfpb-takeover-was-written-by-payday-lender-attorney/

This lobbyist then oversaw Trump’s appointment of a Consumer Finance Protection Bureau boss who deregulated payday lenders, opening the door to triple digit interest rates:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as “inclusive.” These papers were secretly co-authored by payday loan industry lobbyists:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

Of course, Trump doesn’t read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved Rohit Chopra from the FTC to the CFPB, where, as director, he has overseen a determined effort to rein in the sector. As the CFPB re-establishes regulation, the fintech industry has moved in to add “with a computer” to many regulated activities and so declare them beyond regulation.

One fintech “innovation” is the creation of a “direct to consumer Earned Wage Access” product. Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they’ve already worked. The direct-to-consumer EWA offers loans without verifying that the borrower has money coming in. Companies like Earnin claim that their faux EWA services are free, but in practice, everyone who uses the service pays for the “Lightning Speed” upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers’ arms into leaving a “tip” for the service (yes, they expect you to tip your loan-shark!). Anyone desperate enough to pay triple-digit interest rates and tip the service for originating their loan is desperate and needs to the money now:

https://prospect.org/power/05-01-2023-fintech-ewa-payday-loan-scam/

EWA annual interest rates sit around 300%. The average EWA borrower uses the service two or three times every month. EWA CEOs and lobbyists claim that they’re banking the unbanked — but the reality is that they’re acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

This fact is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state’s 18% interest rate cap — remember, the true APR for EWA loans is about 300%.

In Texas, payday lenders are classed as loan brokers, not loan originators and are thus able to avoid the state’s usury caps. EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the “it’s different: we do it with a computer” logic.

But as Jarod Facundo writes for The American Prospect, quoting Monica Burks from the Center for Responsible Lending, a loan is a loan even if it’s with a computer: “The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws… When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that’s what a loan is.”

Catch me on tour with Red Team Blues in Mountain View, Berkeley, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A stately, columnated bank building, bedecked in garish payday lender signs.]

Image:

Andre Carrotflower (modified)

https://commons.wikimedia.org/wiki/File:30_North_%28former_Pontiac_Commercial_%26_Savings_Bank_Building%29,_Pontiac,_Michigan_-_entrance_and_Chief_Pontiac_relief_sculpture_-_20201213.jpg

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cfpb#earned wage access#digital armbreakers#loansharks#payday lenders#tech exceptionalism#jubilee#debt#fintech#usury#michael hudson#graeber#debts that can't be paid wont be paid

669 notes

·

View notes

Note

Am I the asshole for refusing to lend a friend money? 🐱🐱🐱🐱<- (for finding later)

I (28nb) have a friend (28m) who has recently had some problems with employment. He lost his job but has since found another. He is in a living situation with his fianceé where he pays half the rent.

Today he sent me a message asking, very politely, if he could have $59 dollars to cover his half of their rent. He made it clear in his request that he had not discussed this with his fianceé yet.

I said no - one reason being we recently totalled our car and depleted our savings putting money down on a new one (and those interest rates....still ouch), the other being that we've lent almost 1000k to a different friend of ours over the last two years, and haven't been paid back despite multiple verbal agreements.

We are a two income household making a combined 100k a year, but the majority of our income is spent on rent and our student loans. I feel bad because it seems surface level, $59 dollars isn't really that much of an ask. But looking at our broad finances, we're more in-debt to the institutions our loans are paid to than our actual income. We do, however, live comfortably and are privlidged enough to save some money most months. We do donate to causes, and have in the past given our friends places to stay for months at a time when they have no where to go / are in bad financial situations.

When this friend lost his job, I did help him by brainstorming with him on jobs he could do that would suit his sensory needs, and didn't involve customer service. I did research on multiple places close to him that would also suit his transportation limitations and pay him well while accentuating his skillset, and compiled links to the job listings. He has since been hired and onboarded at one of those jobs; he's a very sweet, genuine individual and I'm truly happy because I was also supporting him emotionally during this time and could see how hard this situation was on his mental and physical health.

The other reason I said no was this - he is getting married in one week from the time I'm sending this in. He made it clear in his message he had not talked yet about how he was short for rent with his fianceé. They live together, and go half on rent. I felt very concerned that he was bringing this to me first, and not to his soon-to-be-wife, who deserves financial transparency from her partner (as do we all). I don't think he ever intended to not tell her, but in my opinion money-matters should always be discussed with your significant other first in a healthy relationship.

I discussed this with my wife and she agreed. I told him we couldn't lend him the money and he said he understood. I also encouraged him to talk to his fianceé because she's his best friend and support. I didn't include my p-o-v that he should discuss money matters with her first and foremost because of their relationship and housing arrangement, because I'm hoping that's a conversation they can have in the immediacy?

But I still feel like an asshole and I'm not sure if it's because I said "No," because I have provided financial / housing assistance in the past to others and didn't this time, or because I actually am an asshole.

So - what do you think?

TL;DR - A soon-to-be-married, recently unemployed and then re-employed friend asked for $59 to cover rent. I have helped other friends in the past with rent and housing but said no because we can't afford it right now (which is true, despite being dual income) and also he hasn't discussed being short on rent with his finaceé / housemate yet.

63 notes

·

View notes

Text

#Best Car Loan Interest Rate#Car Par Loan#Interest Rates For Car Loans#Loan Against Car#New Car Loan Interest Rate#Used Car Loan

1 note

·

View note

Text

#Best Cars loan in India#Best car loan in Noida#New Car Loan Low Interest Rates#Vehicle Loan Interest Rate in India#Car Loan lowest Interest Rate#Vehicle Loan Online in India#cars loans

0 notes

Text

Can You Get a 100% Car Loan?

While deciding on a car to purchase, potential automobile owners are always attracted to the possibility of financing the purchase 100 percent. They are also known as 100% car loans or auto loans where the lender finances the full purchase price of the vehicle.

Let’s understand what this implies and if there is a way to obtain one.In the Best Cars loan in India definition, there is a disclosure that it is a loan where the lender funds the entire amount that is necessary to purchase the car. There is no initial cash outlay that you need to make In d when obtaining a mortgage loan.

#Best car loan in Noida#Vehicle Loan Interest Rate in India#Vehicle Loan Online in India#cars loans#New Car Loan Low Interest Rates#Best Cars loan in India#Car Loan lowest Interest Rate

0 notes

Text

by Dov Fischer

Yes, like that hapless car dealer, many university directors and trustees have no grasp of the entirety of responsibilities they have accepted and assumed when they became directors and trustees, but they bear those fiduciary duties nonetheless.

What fiduciary duties do they have to the federal (and state) government? The Feds allocate millions of dollars to the universities for research. They allocate millions in Pell Grants and other federal financial grants to students so that the kids get a full unhindered education. They extend loans at advantaged interest rates and often end up writing off those loans, at the expense of the national budget and American taxpayer, when it becomes clear that the students cannot or will not pay the loans back. They grant the universities tax exemptions that waive millions in federal tax revenue so that donors will give more to the colleges and universities. Any single federal expenditure for a college entitles the federal government to subject matter jurisdiction and standing in any lawsuit brought over Director or Trustee malfeasance, misfeasance, or non-feasance in the conduct of fiduciary duties. (READ MORE: Catching Up on More Infuriating Things in the Past Month’s News)

Most students’ parents also would have legal standing to sue. If their kids pay all the tuition and dorm rent, or borrow it all, then such parents may not have standing. But if a parent has paid even one dollar, not to mention tens of thousands, or borrowed tens of thousands in Parent PLUS loans, toward paying tuition or dorm fees, then they have paid for their child to receive a full, unhindered education on a safe and peaceful campus. Any extended rioting or other insurrection on campus distorts the very purpose for which that money has been spent. It comprises, at the very least, a breach of contract. The failure of the directors or trustees to impose solutions, fire ineffective university presidents, demand the removal of toxic professors, and implement all steps necessary to secure the campus for reasoned and calm learning legally exposes them to great individual liability. And what a fabulous class action that lawsuit would be! One thousand parents suing Columbia University for $60,000 apiece, a winning class action for $60 million. I am almost tempted to return to practicing law.

All that is needed is a federal law like FIRREA and similar state laws, since states also finance educational institutions within their borders. Overnight, you will see one Claudine Gay after another, like that evil woman now at the helm of Columbia University, fired; students expelled and a great many deported back to the dirt holes whence they came, and a return to proper, reasoned, and respectful learning.

47 notes

·

View notes

Video

youtube

The Biggest Economic Lies We’re Told

In America, it’s expensive just to be alive.

And with inflation being driven by price gouging corporations, it’s only getting more expensive for regular Americans who don’t have any more money to spend.

Just look at how Big Oil is raking it in while you pay through the nose at the pump.

That’s on top of the average price of a new non-luxury car — which is now over $44,000. Even accounting for inflation, this is way higher than the average cost when I bought my first car — it’s probably in a museum by now.

Even worse, the median price for a house is now over $440,000. Compare that to 1972, when it was under $200,000.

Work a full-time minimum wage job? You won’t be able to afford rent on a one-bedroom apartment just about anywhere in the U.S.

And when you get back after a long day of work, you’ll likely be met with bills up the wazoo for doctor visits, student loans, and utilities.

So what’s left of a paycheck after basic living expenses? Not much.

You can only reduce spending on food, housing, and other basic necessities so much. Want to try covering the rest of your monthly costs with a credit card? Well now that’s more expensive too, with the Fed continuing to hike interest rates.

All of this comes back to how we measure a successful economy.

What good are more jobs if those jobs barely pay enough to live on?

Over one-third of full time jobs don’t pay enough to cover a basic family budget.

And what good are lots of jobs if they cause so much stress and take up so much time that our lives are miserable?

And don’t tell me a good economy is measured by a roaring stock market if the richest 10 percent of Americans own more than 80 percent of it.

And what good is a large Gross Domestic Product if more and more of the total economy is going to the richest one-tenth of one percent?

What good is economic growth if the way we grow depends on fossil fuels that cause a climate crisis?

These standard measures – jobs, the stock market, the GDP – don’t show how our economy is really doing, who is doing well, or the quality of our lives.

People who sit at their kitchen tables at night wondering how they’re going to pay the bills don’t say to themselves

“Well, at least corporate profits are at record levels.”

In fact, corporations have record profits and CEOs are paid so much because they’re squeezing more output from workers but paying lower wages. Over the past 40 years, productivity has grown 3.5x as fast as hourly pay.

At the same time, corporations are driving up the costs of everyday items people need.

Because corporations are monopolizing their markets, they don’t have to worry about competitors. A few giant corporations can easily coordinate price hikes and enjoy bigger profits.

Just four firms control 85% of all beef, 66% of all pork, and 54% of all poultry production.

Firms like Tyson have seen their profit margins skyrocket as they jack up prices higher than their costs — forcing consumers who are already stretched thin to pay even more.

It’s not just meat. Weak antitrust enforcement has allowed companies to become powerful enough to raise their prices across the entire food industry.

It’s the same story with household goods. Giant companies like Procter & Gamble blame their price hikes on increased costs – but their profit margins have soared to 25%. Hello?

They care more about their bottom line than your bottom, that’s for sure.

Meanwhile, parents – and even grandparents like me – are STILL struggling to feed their babies because of a national formula shortage. Why? Largely because the three companies who control the entire formula industry would rather pump money into stock buybacks than quality control at their factories.

Traditionally, our economy’s health is measured by the unemployment rate. Job growth. The stock market. Overall economic growth. But these don’t reflect the everyday, “kitchen table economics” that affect our lives the most.

These measures don’t show the real economy.

Instead of looking just at the number of jobs, we need to look at the income earned from those jobs. And not the average income.

People at the top always bring up the average.

If Jeff Bezos walked into a bar with 140 other people, the average wealth of each person would be over a billion dollars.

No, look at the median income – half above, half below.

And make sure it accounts for inflation – real purchasing power.

Over the last few decades, the real median income has barely budged. This isn’t economic success.

It's economic failure, with a capital F.

And instead of looking at the stock market or the GDP we need to look at who owns what – where the wealth really is.

Over the last forty years, wealth has concentrated more and more at the very top. Look at this;

This is a problem, folks. Because with wealth comes political power.

Forget trickle-down economics. It’s trickle on.

And instead of looking just at economic growth, we also need to look at what that growth is costing us – subtract the costs of the climate crisis, the costs of bad health, the costs of no paid leave, and all the stresses on our lives that economic growth is demanding.

We need to look at the quality of our lives – all our lives. How many of us are adequately housed and clothed and fed. How many of our kids are getting a good education. How many of us live in safety – or in fear.

You want to measure economic success? Go to the kitchen tables of America.

405 notes

·

View notes

Text

New cars are insanely expensive. Perhaps you’re not aware of this. I certainly was not, having been raised from birth on a succession of rust-weeping, barely operable automobiles. So you can imagine my surprise when I walked into a dealership recently (the city shut off my water, so I had to use their bathroom) and got an eyeful of the price stickers on these suckers. For the same amount of money that your ancestors would spend on Louisiana, you too could have a depressing luxury crossover.

You can argue about the motivation behind this ridiculous state of affairs. Is it financialization writing obscene loans at unsustainably low interest rates? Maybe it’s wage deflation, driving the average suburbanite to buy luxury goods in order to feel like they are important, despite being paid significantly less than they would have in 1976.

Or, and this is the one the car companies like to tell you, it’s because of all those safety features. Ah yes, the government forces us to include airbags, seatbelts, backup cameras, and collision mitigation. It’s their fault. If only we had no regulation at all, we could all drive around in $400 Power Wheels with lead-acid batteries like our business partners in China. And if we got rid of drivers’ licenses, imagine how many more people could buy them!

This line of argument does make a little bit of sense. For instance, my cars are hilariously unsafe, and they were very inexpensive. However, this is coming from the same folks that told you adding a $30 6-CD changer to a car costs $5000 and requires you to get a different colour of paint. And despite this state of affairs, they are racking up mega profits. Maybe – just maybe – we shouldn’t be listening to them about this particular fact, especially if the backup camera kept you from driving over an errant toddler this morning. (That would never happen to me: I would notice immediately as the child tears through the paper-thin rusty steel of my trunk, and ends up embedded in my glovebox, where they could later be safely removed and trained in welding and bodywork.)

233 notes

·

View notes