#usury

Text

When you hear "fintech," think "unlicensed bank"

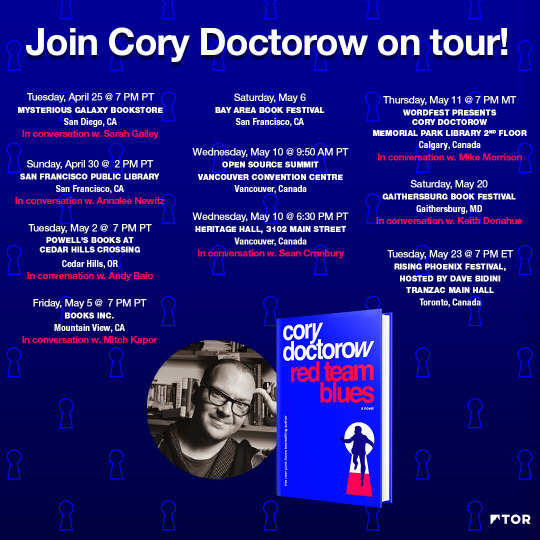

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.

These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set. They’re grifters, but they’re celebrated grifters. There’s a whole bottom-feeding sludge of tech exceptionalists that don’t get the same kind of attention, like patent trolls.

Oh, and the fintech industry.

As Riley Quinn says, “when you hear ‘fintech,’ think: ‘unlicensed bank.’” The majority of fintech “innovation” consists of adding “with a computer” to highly regulated activities and declaring them to be unregulated (and, in the case of crypto, unregulatable).

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is definitely doing and claims it isn’t). Most people don’t buy or sell securities regularly — indeed, most Americans own little or no stocks.

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars’ worth of debt. Many of us are privileged to borrow money by walking into a bank and asking for a loan, but millions of Americans are denied that genteel experience.

Instead, working Americans increasingly rely on payday lenders and other usurers who charge sky-high interest rates, on top of penalties and fees, trapping borrowers in an endless cycle of indebtedness. This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out — the crop comes in, say — and the debt is repaid.

But eventually, you’ll get a bad beat. The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you’re in an even worse situation, and the next time you catch a bad break, you go further into debt. Over time, all production comes under the control of creditors.

The historical answer to this is jubilee: a regular wiping-away of all debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it. Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors’ tables. Then, as starvation sets in, civilization collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

As the debt historian Michael Hudson says, “Debts that can’t be paid, won’t be paid.” Without jubilee, indebtedness becomes a chronic and inescapable condition. As more and more creditors attach their claims to debtors’ assets, they have to compete with one another to terrorize the debtor into paying them off, first. One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm. Debts that can’t be paid, won’t be paid — but when you have a choice between a broken arm and stealing from your kid’s college fund or the cash-register, maybe the debt can be paid…a little. Of course, digital tools offer all kinds of exciting new tools for arm-breakers — immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Under Trump, payday lenders romped through America. A lobbyist for the payday lenders became a top Trump lawyer:

https://theintercept.com/2017/11/27/white-house-memo-justifying-cfpb-takeover-was-written-by-payday-lender-attorney/

This lobbyist then oversaw Trump’s appointment of a Consumer Finance Protection Bureau boss who deregulated payday lenders, opening the door to triple digit interest rates:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as “inclusive.” These papers were secretly co-authored by payday loan industry lobbyists:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

Of course, Trump doesn’t read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved Rohit Chopra from the FTC to the CFPB, where, as director, he has overseen a determined effort to rein in the sector. As the CFPB re-establishes regulation, the fintech industry has moved in to add “with a computer” to many regulated activities and so declare them beyond regulation.

One fintech “innovation” is the creation of a “direct to consumer Earned Wage Access” product. Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they’ve already worked. The direct-to-consumer EWA offers loans without verifying that the borrower has money coming in. Companies like Earnin claim that their faux EWA services are free, but in practice, everyone who uses the service pays for the “Lightning Speed” upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers’ arms into leaving a “tip” for the service (yes, they expect you to tip your loan-shark!). Anyone desperate enough to pay triple-digit interest rates and tip the service for originating their loan is desperate and needs to the money now:

https://prospect.org/power/05-01-2023-fintech-ewa-payday-loan-scam/

EWA annual interest rates sit around 300%. The average EWA borrower uses the service two or three times every month. EWA CEOs and lobbyists claim that they’re banking the unbanked — but the reality is that they’re acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

This fact is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state’s 18% interest rate cap — remember, the true APR for EWA loans is about 300%.

In Texas, payday lenders are classed as loan brokers, not loan originators and are thus able to avoid the state’s usury caps. EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the “it’s different: we do it with a computer” logic.

But as Jarod Facundo writes for The American Prospect, quoting Monica Burks from the Center for Responsible Lending, a loan is a loan even if it’s with a computer: “The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws… When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that’s what a loan is.”

Catch me on tour with Red Team Blues in Mountain View, Berkeley, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A stately, columnated bank building, bedecked in garish payday lender signs.]

Image:

Andre Carrotflower (modified)

https://commons.wikimedia.org/wiki/File:30_North_%28former_Pontiac_Commercial_%26_Savings_Bank_Building%29,_Pontiac,_Michigan_-_entrance_and_Chief_Pontiac_relief_sculpture_-_20201213.jpg

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cfpb#earned wage access#digital armbreakers#loansharks#payday lenders#tech exceptionalism#jubilee#debt#fintech#usury#michael hudson#graeber#debts that can't be paid wont be paid

670 notes

·

View notes

Text

#mundus#banker#wall street#usury#debt#white washed#capitalist society#demons#gif edit#ps4#dailygaming#gaming edit#capcom#dailyvideogames#ninja theory#dmc devil may cry definitive edition#devil May Cry#dmc sparda#video game photography#kat dmc

32 notes

·

View notes

Text

usury is a sin.

22 notes

·

View notes

Text

#payday loans#usury#moneylenders#money lending#night city#night street photography#night photography#night#streetleaks#streetsnap#street photografie#street photographer#bnw life#bnw captures#bnwzone#bw life#blackandwhitephotography#everybodystreet#bnw addicted

27 notes

·

View notes

Link

Empire of debt slavery

#Federal Reserve#banking cartels#freemasonry#Rothschild#oligarchy#hegemony#imperialism#slavery#usury

6 notes

·

View notes

Quote

There are families in need who cannot work and have nothing to eat. Then along come usurers to take what little they have. Let us #PrayTogether for these families' dignity. And let us pray also for the usurers, that the Lord might touch their hearts and convert them.

Pope Francis

8 notes

·

View notes

Text

Hi! I am Marie, I am very pleased to meet you!

this post will clearly tell a lot about me

#al haytham#fan edit#genshin edit#genshin impact#yae miko#genshin#nahida#all#mari#fol#kids#oddities#usury#kelso#yxuen#laos is#jxxuue#ososcujd#lsksixid#wugsgzvzn#kudus i#midis is#duisburg#jsidis#isolation#bendy and the ink machine#black stories#books & libraries#eren aot#aot smut

4 notes

·

View notes

Text

“First, I should say that taking a usurer’s money by proper authority is not robbery, but recovery of stolen goods.”

— G.K. Chesterton: Utopia of Usurers

6 notes

·

View notes

Text

Fairness is Weakness

For the Domineer

Covert and Ominous

Truth they Fear

#Fairness#Usury#Oppression#Bureaucracy#Power#Poem#Temple#Sovereign#Property Rights#Harmony#Truth#Censorship#Bias#Marginalization#Mistreatment#Obstruction#Stalking#Violence#Silence#Abandonment#Torture#Gaslighting#Free speech#Freespeech#Property Damage#Prosecution#Persecution

0 notes

Text

Payday Loans: No, no, no!

Why use these services? By the time you are using it, maybe you should be considering either a consumer proposal or bankruptcy.

#usury ##paydayloans

https://www.canajunfinances.com/2007/04/23/payday-loans-no-no-no/

0 notes

Text

Red Dead Redemption 2

#video game screenshots#video game photography#photo mode#gif edit#ps4#rockstar games#red dead redemption two#usury#bank robbery#wild west#arthur morgan

6 notes

·

View notes

Text

Specialist moneylenders were always Jewish: a woman's name was as good as that of a man, licensed equally by the church to undertake the so-called sin of usury, offering large credit and international banking businesses.

"Normal Women: 900 Years of Making History" - Philippa Gregory

#book quote#normal women#philippa gregory#nonfiction#specialist#money lender#jewish#licensed#church#sin#usury#credit#banking#international finance

0 notes

Text

Tidbits of History - Usury and Medici

The Ascent of Money – Niall Ferguson

If you have, my beloved reader, taken the time to pursue my site and diligently read The Soul Coin page you will no doubt have crossed a summary of this novel there. If you haven’t, then let me say I’m not angry, just disappointed…

This book is a great starting point for learning more about High Finance, and the global economy. What stood out to me as a…

View On WordPress

0 notes

Photo

Discover Quran Verses about #Usury @ https://quranindex.info/search/usury [30:39] #Quran #Islam

0 notes

Text

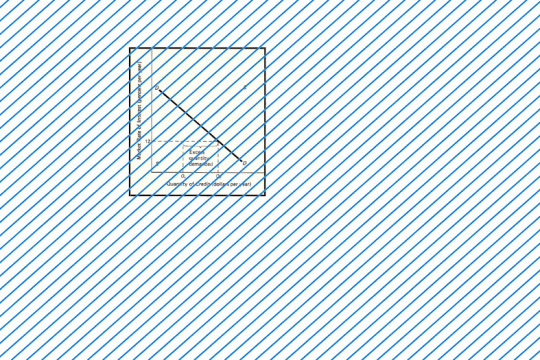

page 543 -

Oh hell. I really messed up painting the walls in my office. I thought it would be easy and then I got distracted doing these stupid blog posts, which I might add are extremely laborious and time consuming.

WHY ISN'T THE AI SYSTEM WORKING AND WHY ARE THE DUNGEON AUTHORS SO SHIT. Either passed out because of "starvation" or so blissed out on all is one love hippy foolishness. Useless!!!

And I don't understand what I'm supposed to write as a caption. I tried to have a look at previous examples but I got bored and confused by tumblr. So now I'm just writing this message to you, my dear colleagues, but none of you have the good grace to respond and it makes me wonder why we all agreed to this internal messaging system if we aren't going to use to discuss important matters.

All to say, now I have a very expensive graph covered in Lichtensteinian stripes. I hate Roy Lichtenstein.

#economics#economist#economy#the effects of usury law#usury#law#legal#the burden of the law falls on the poor#poor poverty#oppress the working class#lichtenstein#roy lichtenstein#pop art#modern art#art#wall paper#style#forced labour#labor#labour#poor#poverty#angry boss#blasts

5 notes

·

View notes

Text

William of Auxerre’s Summa 1500

The first medieval theologian to develop a systematic treatise on free will, the virtues, and the natural law.

586J Guillermus Altissodorensis, or William of Auxerre, c.1150-1231

Summa aurea in quattuor libros sententiarum : a subtilissimo doctore Magistro Guillermo altissiodore[n]si edita. quam nuper amendis q[uam]plurimis doctissimus sacre theologie professor magister Guillermus de quercu…

View On WordPress

#Aristotle#Contraception#free will#Guillermus Altissodorensis#Natural law#Peter Lombard#scholastic philosophy#Summa Aurea#Usury#William of Auxerre#William of Beauvais

0 notes