#cash app institution name

Text

thank you for the tag @oscarpiastriwdc <3

who is your favourite driver? oscar, charles, alex. i'm indecisive.

do you have any other favourite drivers? lando and max. i'm always rooting for yuki as well.

who is your least favourite driver? daniel always. i don't really like checo either and due to recent events, carlos until someone else pisses me off more. i used to say nico h, but he's been funny lately and called nico r "rosi" in china.

do you pull for drivers or do you like teams as well? drivers all the way. as ro said: all teams/institutions are evil.

if you like teams, what team do you pull for? sigh. forza ferrari.

how long have you been into f1? a bit less than a year.

how did you get into f1? in short, thanks to algorithms. charles leclerc thirst edits started popping up everywhere and i had to investigate lmao.

do you enjoy fanfic/rpf? i wouldn't be on tumblr otherwise.

how do you view new fans? hi, hello, welcome! please leave your mental wellbeing at the door for the sake of watching this sport.

if you could take over as team principal for any team, who would it be and why?: i think i would be a horrible tp which makes me a great fit for the job description. i'd make the visa cash app rb formula one team the scuderia toro rosso again, send daniel into retirement, bring in liam lawson for the second seat, start loads of rumours and conspiracies against marko and horner, lie to the press constantly, name one of the sainz family's crusty dogs as my successor and then fuck off.

are your friends and family into f1 as well? not really. i have an uncle who does watch, but i highly doubt he has a tumblr blog and an ao3 account to complete the experience. if i explained shipping to him, i'd probably send him to the grave. one of my irl friends sends my every f1 reel she comes across, which is very sweet and i feel like i could indoctrinate her if i play my cards right.

are you open to talking to other fans/making friends?: yes, of course!

tagging @wanderingblindly @itsgoingdutchin2021 @fueledbyremembering if you guys want <3

19 notes

·

View notes

Text

Tips for Increasing Your ATM Withdrawal Limit on Cash App

Cash App ATM withdrawal limits are essential part of its mobile payment services. Cash App limits are imposed for both the platform and for the protection of its users. These limits impact how much one can withdraw each day or per week from Cash App. Cash App Card limits withdrawals to $1,000 per day and within a seven-day period. Moreover, there are also Bitcoin withdrawal limits on Cash App.

However, there are ways to increase these Cash App limits if needed. The first step to increasing your Cash App withdrawal limit is verifying your identity in the app. This involves providing information like your full legal name and date of birth, as well as your last four digits Social Security number. Verified accounts have higher withdrawal limitations. Apart from this Cash App withdrawal limits can also increase by sending and receiving payments frequently using the app. This shows responsible usage. This may result in a higher limit. So, let’s begin and learn more about it.

Understanding the Cash App ATM Withdrawal Limit

The Cash App ATM limit is the amount you can withdraw from an ATM with your Cash App card in each time. ATM limits are an important aspect of money transfers and prepaid debit cards including Cash App. They are set to protect customers while reducing fraud risks and complying with regulatory requirements.

There are several factors which decide your Cash App ATM withdrawal limits such as account verification status and your total transaction. For a basic Cash App account Cash App ATM withdrawal limit is $1,000 for each day. And this limit can be upgraded through identity verification.

Why Does Cash App Have Withdrawal Limits?

The main reason Cash App have limits for users account is for security and protection. There are several other reasons due to which Cash App have withdrawal limits which are mentioned below:

Cash App ATM withdrawal limit will prevent scammers from draining your account in one go if they gain access to it.

Cash App must comply with regulatory institutions and laws against money laundering.

Limiting Cash App withdrawals protects your account against excessive cash outflows, especially if the account is linked to a compromised card or bank.

What are Cash App ATM Withdrawal Limits?

Cash App ATM withdrawal limits are $1,000 per seven-day period. This limit only applies to ATM withdrawals, and does not affect any other Cash App functions, like sending money to others or making purchases using your Cash App Card.

The limits are calculated in a rolling manner, which means that the system does not track your withdrawals by calendar week, but rather over the last seven days. If you withdraw $200 from your account on Monday, then you can withdraw up to $850 within the following seven days. The Cash App limit will reset as soon as you reach the $200 withdrawal.

What are the Cash App BTC Withdrawal Limits?

Cash App has limits for both cash withdrawals and Bitcoin (BTC). Cash App BTC withdrawal limit is important for users who want to trade or store Bitcoin on the platform. The BTC withdrawal limit on Cash App is $2,000 per day and $5,000 per week. However, there are options available to increase these Bitcoin limits on Cash App by verifying your account and following other security measures.

How to Increase Your Cash App ATM Withdrawal Limit?

You do not need to panic or worry when you reach the standard limits for withdrawals on Cash App and need more money. You have the option to increase Cash App ATM withdrawal limits by verifying identity, or reaching out the customer support team. Verifying your Cash App account is the easiest way to increase your ATM withdrawal limits. This involves submitting personal information such as your name, date of birthday, and Social Security Number. Here is how to increase Cash App withdrawal limit:

Go the profile section by opening the Cash App on your mobile phone.

Then Verify Identity by entering details such as your name, address, date of birth and social security number.

Send the information to be reviewed.

Once Cash App account is verified successfully, you expect to see your ATM withdrawal limit gradually increase.

FAQ

What is the standard Cash App withdrawal limit?

The Cash App withdrawal limits for a basic unverified account are $310 per transaction and $1,000 per day.

How can I increase the Cash App ATM withdrawal limits?

You can increase your ATM withdrawal limits by verifying identity on Cash App. Moreover, you can contact the Cash App customer support team and request to increase these limits.

What is the maximum Cash App BTC withdrawal?

The maximum Cash App BTC withdrawal limit is $2000 for each day.

Can I switch to a Cash App for Business account for higher limits?

Yes, you can switch Cash App for Business account and get higher withdrawal and transaction limits.

2 notes

·

View notes

Text

— it seems that [ hasan keskin ] has entered the scene ! he looks exactly like [ can yaman ]. this [ 35-year-old ] is the [ major shareholder ] of [ app-h inc. ]. it’s a small wonder since he is known for being [ ambitious & confident ] and [ arrogant & greedy ]. he has been involved with the company for [ 6 ] years.

𝙗𝙖𝙨𝙞𝙘𝙨

name : hasan keskin

age : thirty-five years old

height : 188 cm / 6'2"

gender : cis man, he/him

sexual orientation : straight

status : single

children : two

— 10 years old

— 3 years old

𝙧𝙚𝙨𝙪𝙢𝙚

schooling: massachusetts institute of technology

born and raised in istanbul. older brother to feyza and their two younger siblings. during his childhood and teen years, his life revolved around football. his dream just like every young boy his age was to be a football player until one christmas he was gifted a psp. he became obsessed with video games and no longer as infatuated with football.

later his interest grew to fascination. how were these games created? what goes into making a gaming console? how long does it take to create something like this?

once finding out what it required to become a game developer, he started taking school more seriously. it was a great surprise to his parents to find him excelling in his studies even though it was due to his obsession with video games. they couldn't tell him to reduce his playing time solely due to the fact he was getting amazing grades.

after university, his career was flourishing, working under companies like ubisoft, and EA who have all created his favourite games. — but just as thing were getting good, in 2014 he gets his situationship pregnant and he had just blown most of his money on contributing to the ethereum crowdfund and bitcoin, which had horrible returns for the rest of the year. he kept his situation hidden from his family. they didn't need to know.

two years later when feyza had approached him to invest into app-h inc., he was reluctant. now that he's responsible for a child, he's convinced he needed to take less risks. it wasn't responsible living a lifestyle of big rewards or big losses. although photograpp-h is doing amazing, it didn't guarantee app-h inc., would do well.

he came clean about the child and how he would have immediately agreed if it wasn't for the child. he didn't express his other concerns since it didn't seem relevant and he didn't want to pessimistic considering he wasn't in the position to lecture or give advice to his sister who was doing better than him.

with bitcoin crashing even more significantly in 2018, he was desperate for fast cash. he was doing well for himself, but not enough to maintain the lifestyle he created for himself and the lifestyle he's grown accustomed to. he reached out to his sister and asked if the offer was still on the table. feyza suggested he buy shares now that they were more established and she would trust him in that position rather than some fancy investor in a suffocating suit.

without much of a thought, he agreed. if this went to shit, he would put everything into a high interest savings account and never invest anything until he earned the amount he desires.

in the next two years everything moved so fast. app-h inc., was turning over a high profit, catching up to comoedia and the bulletin — and bitcoin reached an all time high ending the year at around 20k per bitcoin. with the amount of money he had, he didn't need to work anymore.

he left america and moved to london to be closer with his siblings. his involvement with app-h inc. increased. his position is merely an advisory role and helps with day to day production while coming and going as he pleases.

2 notes

·

View notes

Text

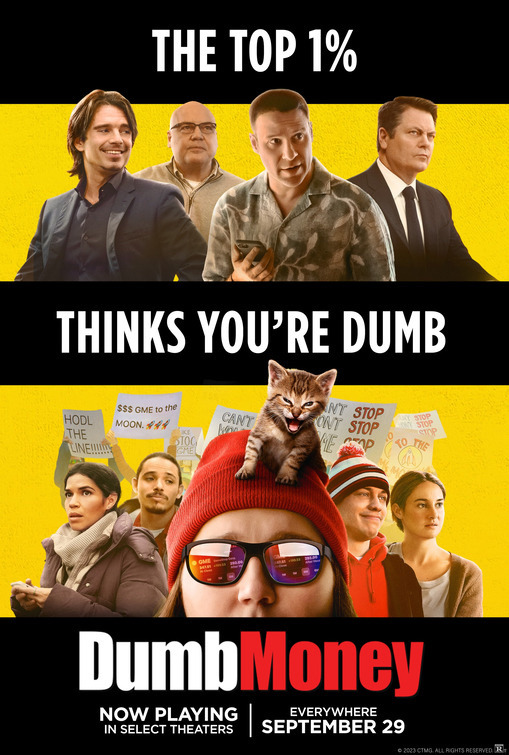

“DUMB MONEY”

“Dumb Money” is based on a true story, but unless you regularly watch CNN or dabble on the stock market with a smart phone app you’ve probably never heard of it.

The events of the story are fairly recent (2019 to mid 2021). Keith Gill (Paul Dano) shared his theories about the stock market on Reddit. He thought the GameStop stock (retail video game stores) was undervalued because deep pocket investors and investment companies were betting against it. Gill’s enthusiasm about GameStop motivated a legion of fans to buy shares in the company. This caused “yadda yadda yadda”. (I can already see your eyes glaze over as you read this.)

And that’s the problem with “Dumb Money” - lots of talk about the stock market and lots of characters; it’s gets boring. Despite this Paul Dano, with his round face and soft marshmallow body, is likable in his Everyman role. Dano is good in everything I’ve seen him in, from “Little Miss Sunshine” to his turn as a serial killer villain in “The Batman”.

The “Dumb Money” has lots of villains as well - institutional investors played by Seth Rogan, Vincent D'Onofrio, and an especially slimy Sebastian Stan. Plus Dane Dehaan as an officious store manager. It’s fun seeing them shit their pants and lose hundreds of millions of dollars in a single day. (But in reality they were already so rich, it probably didn’t really impact them.)

But truthfully, my biggest complaint about the movie is a song played repeatedly throughout the film - “Pussy, Money, Weed” by Lil Wayne. Keith Dill’s user name on YouTube (and the app formerly know as Twitter) was Roaring Kitty. Someone thought it was be a good idea to use Lil Wayne’s tune as Gill’s theme song. I have never heard the word “pussy” said so many time in less that 2 hours. I never want to hear the word “pussy” again in my life!

Rather than invest $12 of your hard earn cash on a ticket for “Dumb Money”, I recommend skipping it and rewatching your favorite Paul Dano from your streaming library.

#movie review#dumb money#GameStop#Paul Dano#Keith Gill#slimy Sebastian Stan#Seth Rogan#stock market#short squeeze#millions and billions

7 notes

·

View notes

Text

So a little inside baseball ... but let's assume you are excited about starting a female empowerment narrative pro sports league for a niche sport that's never been done before where athletes get to tell their own story and make cash so they can continue their sport after college.

Narrator: It's not the first time, it's only new in concept in that it's structure is more ambitious and less obviously feasible.

So you are wanting to start a pro league for, let's say for the sake of argument, oh I don't know, women's gymnastics. You have all this attractive market research data available based on the popularity of NCAA gymnastics. But one of the very basic things when you launch a new product is you see if someone has launched a similar product before or if there is a similar product else where in the world.

Narrator: Yeah that step? These people don't appear to have done that.

So talking to some people who have heard the pitches for this league both to sponsors and athletes here is the first major mistake they made (aside from you know, not doing research). Imagine that you are some well meaning gymnastics coaches and a marketing executive that has tried to start several (apparently folded) sports leagues in the past. You've lived through the dumpster fire of the USAG sexual abuse scandal. You think... oh I'm going to tell all these potential sponsors that we have nothing to do with USA Gymnastics. That will give them confidence.

And maybe at the height of the dumpster fire in 2018 in the wake of the victim impact statements that might have been the call. But it's a terrible reading of the room now. And really it was a terrible reading of the room a year ago when they apparently started pitching this to sponsors. Corporate sponsors have been returning to USAG. Whatever you think of Li Li, this was her job, to right the ship and her job experience (unlike the women running this enterprise) is dealing with major sponsors. So what the pro league people thought was going to be reassuring to sponsors in fact was a red flag to them.

See, no one loves a sports national governing body (or an international one), but what they have is institutional knowledge, access to equipment manufacturers, to athletes, to venues, they know how to run meets and in general they provide a certain amount of safety net on basic organizational issues. Every sports league founded in the last few decades that is successful has some support from the governing body even when there is tension between the players and that organization. The national women's soccer league has ties to USA Soccer because you need those ties to function as a league and I promise you there is no more love between women's soccer player/fans and USA Soccer than there ever was between USAG and women's gymnastic fans.

This stance probably seemed even more out of touch in 2023 than it was in 2022 as USAG emerged from the sponsorship wilderness and started seeing much bigger names having confidence in putting their names next to them.

Who in this group decided that "we have nothing to do with USAG" was a good move I don't know.

They also apparently spent a lot of time being concerned that the potential sponsors fit their leagues ethos. Which is not inherently bad, you don't want a case like US Figure Skating being sponsored by the It's not a Diet It's an Eating Disorder App - Noom. But that becomes less something I trust them with when one of the big name founders has previously shilled a weight loss MLM.

But anyway apparently the sponsors also looked at the reaction among the fandom to the launch of the website in June and were put off by the fact that there was less enthusiasm and more skepticism than the league founders had expected.

I know I was active in those few discussions and if I was a sponsor I'd probably be concerned about one of the things that @darthmelyanna raised: the nature of gymnastics means injuries will happen and the league didn't seem to be providing insurance meaning that we were likely to see a lot of medical expense Go Fund Me's n the future.

But all of these missteps with sponsors also has a side issue. Apparently they finally did realize they need to get insurance for their league (I can't imagine a venue was willing to host one of their events without it and I would hope that athletes wouldn't be signing up to this without it). Supposedly they then went to USAG... the organization who they were badmouthing to sponsors (who themselves were trying to recover sponsors so was very much aware of that)... and they inquired about getting USAG to add them to their insurance pool for gyms.

I'll just let you think about what the answer might be to that. Because that would be a profoundly bad financial stewardship decision for USAG to do for their overall membership/insurance pool. Even if they wanted to help these people.

6 notes

·

View notes

Text

What is the maximum money that can be sent via Zelle?

What is the maximum money that can be sent via Zelle?

Zelle has managed to become one of the new alternatives to sending and receiving money in the United States. It has gained users as an easy-to-use application that helps customers facilitate transfers regardless of the bank to which users belong.

One of the characteristics of Zelle is the immediacy that characterizes this new service because, in a matter of minutes, transfers are made regardless of where they are.

One of the most common questions from Zelle customers in the United States is about the maximum limit that can be sent in a transfer daily, weekly or even monthly.

We will clarify the general aspects of the limits established by Zelle for the money transfers depending on the financial institution to which you belong and the limits established by the banks themselves.

What is the limit of money that can be sent by Zelle in the United States?

If your bank does not yet offer the Zelle service, the weekly allowable limit is $500, which cannot be increased or decreased regardless of conditions.

However, if your bank offers the Zelle service, the sending limits are established specifically by each financial institution, which we detail below.

Wells Fargo, Bank of America

These two institutions tell us that the daily limit to send money through Zelle is $3,500, although if you usually send money monthly, the maximum you can transfer will be $20,000.

Capital One, CitiBank, and US Bank

In these three banks, the figures vary, and their daily limit is lower than that offered by other institutions, although higher than that offered by Zelle to customers who do not yet have the service. The daily maximum varies between $1,500 to $2,500, depending on the client’s account type.

Finally, other banks like TD Bank have daily minimums of $1,000 and monthly maximums of $10,000.

Zelle Limits at Top Banks: Daily and Monthly

Mobile payment tools make it faster and more convenient for you to send and receive money for personal, professional or small business purposes. Along with PayPal, Cash App and Venmo, Zelle is a platform that allows you to send money from your bank account to an intended recipient with no fees attached.

Here’s a closer look at how Zelle works, its limits at many of the country’s top banks and what you can do if you reach these monthly and daily limits.

More From Your Money: Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today.

What Are Zelle Limits at National Banks?

Banks often have different limits on how much users can receive or send. The following table lists the daily and monthly Zelle limits at some of the country’s largest banks.

What Are Some Alternative Options if You Hit Your Zelle Limit?

There are other ways to send money if you hit the Zelle limits. Here are some alternatives to consider.

Try another payment platform: Some popular payment platforms include Venmo, PayPal and Square. Many of these services charge a small fee to send money, and users need an account to receive the money.

Write a personal check: While personal checks may seem outdated, they are an excellent alternative to peer-to-peer transfer apps if you need to send a large sum of money.

Withdraw cash: People typically do not have a lot of cash on hand because of the popularity of debit cards, but you can always make a trip to the ATM to withdraw some money.

Use a payment retailer: Western Union and MoneyGram allow you to send money by visiting an authorized retailer and funding the transaction with cash or a debit card. Your recipients can pick up the money by visiting a retailer and providing their name and the transaction number.

Wait a few days: Waiting 24 hours or 30 days until you are back under Zelle’s payment limits is the slowest strategy, but it may be necessary if you want to send a large payment.

How Does Zelle Work?

Here are the steps for sending or receiving money through Zelle.

Step 1: Choose your recipient. Due to increasing Zelle fraud, you should only send money to people you know and trust, like repaying a family member or friend or paying a service provider.

Step 2: Obtain the recipient’s phone number or email address. Anyone with an account at a U.S. financial institution can receive money through Zelle with their phone number or email.

Step 3: Decide your payment amount. Your Zelle limit depends on your bank or credit union. If you want to send a large amount consistently, you may need to find an alternative payment option.

Step 4: Send the money. Your recipient will typically receive the money in minutes if they are already a member of Zelle. They’ll receive instructions on obtaining the funds via email or text if they are not enrolled.

Step 5: Verify the payment. You should always follow up, contacting the recipient to make sure they received the money. You should also check your bank account to ensure it deducted the proper amount from your account.

What Are the Benefits of Using Zelle?

One of the biggest benefits of using Zelle is that it is free and there are no fees to send or receive money. Most competitors charge a small fee if you use a Visa, Mastercard, debit card or credit card to send money, while others charge to transfer funds received to a bank account. Zelle can offer the service at no cost to customers because money is sent directly between bank accounts with no middleman.

While there’s no cost to use Zelle, you can only use your checking, savings or debit card to send or receive money, and you can’t make credit card payments. To be sure, you should check with your bank or credit union to make sure it doesn’t charge extra fees for using the Zelle feature.

An additional benefit of using Zelle over another payment application is the instant nature of the service. The money is immediately transferred to your recipient’s bank account because there’s no intermediary. It takes a few days to transfer funds from the app to a bank account with other services. Other platforms that do offer instant transfers charge a fee for the service.

Final Take To GO

Your bank must have a partnership with Zelle for you to access its features. More than 1,000 financial institutions in the U.S. offer Zelle to their customers. Financial institutions typically incorporate Zelle’s capabilities into their mobile banking apps.

If your financial institution offers Zelle, you should contact it directly to inquire about its daily and monthly sending limits. If your bank or credit union does not provide the service, you must download the Zelle app to send and receive payments.

FAQ

Can I get paid with Zelle?

While Zelle is a popular way to send money, it's also an easy way to receive money from individuals, companies, government agencies and even academic institutions. For instance, it may be possible to request payment via Zelle if you are owed a refund from a university or government agency. Sending money through Zelle is free for both parties and quickly ensures you get the funds.

Can businesses use Zelle?

Just like PayPal, any individual or business with an account at an institution that uses Zelle can use the feature to send or receive money. Many business owners use the service to send and receive money because there are no fees involved. You may want to encourage your customers to send payments via Zelle if the amount is within their daily Zelle transfer limits. It may be necessary to accept other methods for large payments.

What is the maximum you can send with Zelle?

The maximum amount you can send through Zelle depends on what bank you use as the cap will vary both daily and monthly by each financial institution. For example, Bank of America and Wells Fargo have a maximum daily limit of $3,500 whereas TD Bank has a daily limit of $2,500.

Can you send $5,000 through Zelle?

Yes, you can send $5,000 through Zelle if you have a private client or business checking account with Chase.

Can you send $10,000 through Zelle?

The amount you are able to send through Zelle depends on your bank's set limits. Many banks allow you to send $10,000 in a month, but not in one day. Check with your financial institution to find out your daily and monthly sending limits.

How do I increase my Zelle limit?

There is no way to increase your Zelle limit. If you find their limits to be too confining for your needs, you can try another payment platform such as Venmo or PayPal.

#limit zelle#zelle transfer limit#zelle limits#zelle daily limit#zelle limit per day#bank of america zelle limit#zelle maximum transfer#chase zelle limits#zelle weekly limit#zelle transfer limit bank of america#zelle sending limit#zelle transaction limit#zelle limits bank of america#zelle transfer limit 2023#maximum zelle transfer#zelle daily transfer limit#zelle daily limit bank of america#usaa zelle limit#zelle account limit email#zelle monthly limit#zelle payment limits#zelle business account limits#zelle limits chase#zelle maximum amount

2 notes

·

View notes

Text

Cash App Limits: How Much Can You Withdraw, Send and Receive Daily?

Cash App is a payment app available for iOS and Android that is used to send and receive money, as well as make purchases and invest. Cash App, like similar payment apps, has limits for all of its transactions.

Cash App limits vary based on the transaction type and identity verification status. For example, unverified accounts have a 30-day sending and receiving limit of $1,000. However, that limit can be increased by meeting Cash App identity verification requirements.

Keep reading to learn more about Cash App’s sending and spending limits, and find out how you can increase yours.

What Is Cash App?

Cash App is a platform that allows you to send and receive money, make purchases, invest in stocks, buy and sell bitcoin, and complete other financial transactions. Cash App also partners with other financial institutions and banks to provide debit cards and brokerage services. You can even use Cash App to file your taxes and have your refund sent directly to your Cash App account.

Cash App Limits

Cash App limits apply to all accounts, and generally depend on whether the account is verified.

Cash App Sending and Receiving Limits

Unverified Cash App accounts can send and receive up to $1,000 within 30 days. When you reach these limits, Cash App will ask you to verify your identity right in the app. You will need to provide your full name, date of birth, and your Social Security number to increase your limits. Verifying your account may significantly increase your limits, potentially allowing transactions up to $7,500 weekly.

Cash App Withdrawal Limits and Spending

If you use the Cash App Cash Card a debit card that is connected to your Cash App balance — you may be subject to spending limits, similar to other debit cards. The Cash App limit per day and transaction for Cash Card users is $7,000. Daily limits reset at 6 p.m. Central Standard Time each day.

The Cash Card also has weekly and monthly limits. You can spend up to $10,000 per week and $15,000 per month. Weekly limits reset at 6 p.m. CST on Saturdays, while monthly limits reset at 6 p.m. on the last day of the month.

The Cash Card daily limitations cover all types of transactions. This includes purchases made in-store or online, ATM withdrawals, and even transactions that are declined. Essentially, any activity with your Cash Card counts towards this daily limit.

Cash App Limits for Users Under 18

With a Cash App family account, users under 18 will automatically have access to borrow money, make deposits via check, and contact phone support. With consent from a parent or guardian, these younger users can also send and receive money — up to $1,000 within 30 days — as well as have a personal debit card and transfer funds between Cash App and a linked bank account.

They can also transfer up to $7,500 per 30 days into their Cash App account and move up to $25,000 per seven days out of their Cash App account. In addition, users under 18 can make paper money deposits of up to $250 within seven days and $1,000 within 30 days.

Users under 18 who have a Cash Card are subject to the same spending and withdrawal limits as users over 18.

How To Increase Your Cash App Daily and Weekly Limits

Increasing your Cash App limits is relatively simple. After setting up your Cash App account, you just need to verify the following information to confirm your identity:

Your full name

Your date of birth

Your Social Security number

If you’re under 18, a parent or guardian must give consent to access certain features and increase your limits. In some cases, Cash App may need to request additional information if they are unable to verify your identity with just the information listed above.

How To Send Cash App Payments?

The Cash App platform is designed with ease in mind, so sending money to another Cash App user just takes a handful of simple steps:

Open the app and enter the amount you want to send.

Tap “Pay.”

Search for the recipient using an email address, phone number, or Cashtag.

Add a note describing the purpose of the payment.

Tap “Pay” again to complete the transaction.

Is Cash App Safe To Send and Receive Money?

Cash App has many security features to keep your money safe. In addition to using top-tier data encryption, Cash App accounts can be locked using a PIN, Touch ID, or Face ID, and users can enable account notifications to monitor activity. Cash Card users can disable their cards at any time, and Cash App also has security features specific to Bitcoin storage and fraud protection.

It’s important to note that Cash App sending limits are relatively low, especially compared to traditional bank accounts and some other money apps. If you send or receive money regularly, you should compare your options to make sure your transaction limits are high enough to meet your needs.

0 notes

Text

All PalmPay USSD Codes for Account Opening, Balance, and Transfer

PalmPay, a financial service provided by PalmPay Limited, is regulated by the Central Bank of Nigeria (CBN). Operating out of Lagos, Nigeria, and also with offices in Ghana, PalmPay allows users to perform financial transactions seamlessly without internet access through its USSD codes.

PalmPay USSD Code Overview

PalmPay’s main USSD code is *652#, which allows users to transfer funds, check balances, buy airtime, and pay bills. This feature is especially useful in areas with poor internet connectivity or for users without smartphones.

How to Use PalmPay USSD Code

Dial *652# on your phone.

A menu will appear, allowing you to choose services such as balance checks, transfers, airtime purchases, or bill payments.

Select the service by typing the corresponding number.

Input relevant details such as recipient number, amount, or biller details.

Confirm the transaction with your PIN.

A confirmation message will be sent upon successful completion.

Ecobank USSD code for transfer, buy airtime, check balance, BVN, right now

Moniepoint Microfinance Bank Unveils USSD Code for Enhanced Banking Experience

FG *969# Conditional Cash Transfer (CCT) USSD Codes For All State

Activating PalmPay USSD Code

To activate the USSD code:

Dial *652#.

If new, register by providing your PalmPay account number and date of birth.

Create a 4-digit PIN.

Confirm the PIN to activate the USSD code.

List of PalmPay USSD Codes

Here is a summary of key USSD codes for different services:

Service

Code

General USSD Code

*652#

Transfer Money

*652#, choose ‘Transfer’

Buy Airtime

*652#, select 'Buy Airtime'

Check Account Balance

*652#, select 'Check Balance'

Access Bank Transfer to PalmPay

901Amount*Account Number#

GTBank Transfer to PalmPay

73722#

How to Transfer Money to PalmPay from Other Banks

GTBank: Dial 73722#, select “Trsf – Mobile Money/PSB,” enter the amount and PalmPay account number, and complete the transaction with your PIN.

Access Bank: Dial 901Amount*Account Number#, choose “Other Financial Institutions,” select PalmPay, and confirm with your PIN.

Opening a PalmPay Account

To open an account, download the PalmPay app from the Apple App Store or Google Play Store and follow the prompts. Required information includes your name, email, phone number, password, and BVN (Bank Verification Number).

PalmPay Customer Care

For assistance, you can contact PalmPay through:

Phone: +234 2018886888

Email: [email protected]

Address: 20 Opebi Rd, Opebi, Lagos, Nigeria.

Benefits of PalmPay USSD Codes

Convenience: Perform transactions without internet access.

Ease of Use: Quick access via simple codes.

Secure: Transactions are PIN-protected.

24/7 Availability: Accessible anytime, anywhere.

Using PalmPay’s USSD codes provides a fast, secure, and cost-effective way to manage your finances without needing internet access, making it ideal for both the banked and unbanked population in Nigeria.

0 notes

Text

Faster Transactions: The Impact of EFT on IT Companies

IT companies need an efficient payment system to maintain smooth operations. Electronic Fund Transfer is crucial for these companies, allowing fast, safe, and adaptable payments for items like software licenses and developer fees.

What is an Electronic Fund Transfer?

An electronic fund transfer involves moving money from one financial institution to another through electronic means. Some of the widely used electronic payment options include credit card payments, ACH, wire transfers, etc.

The demand for digital payment methods is increasing as more and more people are embracing cashless payments. The swiftness and convenience of electronic fund transfers make it a viable alternative to conventional payment methods.

Advantages of Electronic Funds Transfer

Speed: The transactions are processed instantly compared to traditional methods.

Convenience: These transfers can be initiated anytime and from anywhere, regardless of location. This eliminates the need to visit any financial institution or carry physical cash.

Quick Access to Funds

EFT transactions are typically deposited into the account of the recipient within a 24-hour period. It ensures that funds are readily available when needed.

Digital Records

Manual record maintenance for every transaction is a difficult process. This issue is resolved by EFT by providing an electronic record of transactions.

EFT Payment Types

ACH Payments

ACH transfer is a type of electronic transfer processed through an automated clearing house network. ACH payments are overseen by NACHA (National Automated Clearing House Network).

There are two main types of ACH transfer: ACH credits and ACH debits. The main difference between these two lies in how money moves between accounts. In the case of ACH credits, the money is added to the account, and with ACH debits, the money is deducted from the account.

Wire Transfers

Wire transfer is one of the fastest ways to transfer funds between financial institutions. There are two types of wire transfers: domestic and international wire transfers.

When should you use wire transfer?

To complete an urgent transfer: Most domestic transfers are processed within the same day, and international transfers take a few days depending on the destination country.

To transfer large amounts of money: wire transfers are the best choice for high value transactions.

When sending a domestic bank wire, you have to provide the following details: recipient’s name, address, bank account number, and ABA number (routing number).

When sending an international bank wire, you will need to provide the recipient’s name, address, bank SWIFT/BIC code, and bank account number.

Incoming wires usually cost about $15, while outgoing domestic wires range from $20 to $30, and outgoing international wires can be more expensive, costing between $30 and $50.

eChecks

eChecks function the same as a conventional paper check. It contains all the information a paper check contains, like checking account number, bank routing number, and payment amount. eChecks can also be used to make recurring payments.

It is estimated that printing and issuing a paper check will cost your business anywhere between $4 and $20. However, the average fee per eCheck transaction ranges from $0.30 to $1.50.

Credit Card Transactions

A credit card allows you to make purchases on credit. You can borrow money up to a set credit limit. When you use a credit card, your card issuer typically covers the payment to merchants and issues a statement to you at a later date. Transactions made through credit cards also help to earn various rewards, which can be in the form of cashback, travel miles, etc.

How IT companies benefit from EFT

IT companies create different software products like apps, system software, and cloud services. They usually have to pay developers, buy software licenses, and handle ongoing subscriptions. OnlineCheckWriter.com – Powered by Zil Money, helps with these payments using EFTs. The platform supports various payment options, including ACH, wire transfer, credit card payments, and eChecks.

Using the platform, IT companies can efficiently create and send eChecks to vendors or contractors through email or SMS. Recipients can print the checks on plain white paper or blank check paper and deposit them into their accounts.

Additionally, ACH transfers allow IT firms to directly transfer funds to the bank accounts of their employees, suppliers, or service providers. There is also an option for both one-time and recurring ACH payments.

Wire transfer services are quick and efficient for urgent and large transactions. IT companies often need to pay for emergency software licenses or settle bills with international partners, making wire transfers essential. IT companies can choose between international and domestic wire transfers, depending on their needs.

Another distinct feature of OnlineCheckWriter.com—Powered by Zil Money is the ability to pay clients quickly via the platform’s "Pay by Credit Card" feature. This capability allows you to settle payments to recipients even if they don’t accept credit cards. The payee will receive the payment as wire, ACH, or another preferred method.

Electronic Fund Transfers (EFTs) shine as an essential instrument for overseeing money movements. As the world of digital payments progresses, adopting EFTs will be vital for companies aiming to stay relevant in the challenging market.

0 notes

Text

ATM Services Procurement Intelligence, 2030: Key Factors to Consider

The ATM Services category is anticipated to grow at a CAGR of 5.6% from 2023 to 2030. Asia Pacific region accounts for the highest ATM usage. According to Asian Banking & Finance, the Asia Pacific region accounted for more than 40% of the number of automated teller machines globally in 2021. Owing to technological advancement, the category has seen a drastic transformation and has changed the cash systems. Banks are aiming to enhance the speed, security, and user-friendliness of their ATMs. Some of the key trends in the industry include cash recycler, contactless transactions, cash withdrawals, more appealing user interfaces, mobile integration, biometric identification, and remote teller assistance to name a few. Cash recycling would help the machines to accept, sort, validate, and store banknotes. This can enable customers to use machines to withdraw and deposit cash eventually reducing labor costs. According to UK’s RBR 2023 report, from 2020 to 2021, the number of cash-recycling ATMs installed globally grew from 973,000 to more than a million.

Cardless ATMs technology, an emerging feature, allows users to withdraw money through apps installed on their mobiles without the necessity to physically operate the machines. In June 2023, the Bank of Baroda, a nationalized bank in India, announced the launch of a cardless cash withdrawal facility, where users can withdraw cash using the UPI system at the bank’s ATM. Additionally, face biometrics at cardless machines is enabling face-based authentication in order to avoid fraud through the use of stolen cards or fake cards. According to biometric update.com’s June 2023 report, around 13,000 of Japan’s seven bank ATMs possess face biometric technology.

Full-service machines can act as a customer's initial point of contact with the bank. Rather than solely performing transactions, ATMs have the potential to become instruments for fostering relationships between banks and customers by offering services such as opening accounts, issuing cards instantly, printing checkbooks, and utilizing other versatile technologies. Through Remote Teller Technology, video banking allows customers to engage with the bank and carry out a majority of branch activities using real-time communication and video.

Order your copy of the ATM Services Procurement Intelligence Report, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Manufacturing and installation of the machines may cost around USD 50,000 to 55,000. Cash services such as transporting cash between points, which is the major cost component, account for around 35 to 50% of the total cost. In-house service may cost up to 35% of the entire annual operational cost for the financial institutions whereas outsourcing the entire operations can save them up to 25%. ATM installation, maintenance, security, cash management, and compliance are some of the major cost components. Maintenance charges may vary on the basis of where the machine is located, and how much traffic it generates. Installation of ATMs may range from USD 200 to 300 per machine. ATM machine prices can range from USD 2,000 to 8,000. Carefully evaluating the nature of the service provider and the expenses associated can help the vendor to save on overall costs.

The threat of substitutes is moderate. Although advancements in digital banking and online payment systems have reduced the dependence on physical cash, ATMs still play a crucial role in providing convenient access to cash withdrawals, balance inquiries, and other services. However, the emergence of alternative payment methods like mobile payment apps and digital wallets could potentially pose a substitute threat in the long run.

The category saw a slight reduction during the COVID-19 pandemic owing to lockdowns, travel restrictions, and social distancing measures that resulted in reduced foot traffic at ATMs. According to the Payments Industry Intelligence 2022 report, it is observed that there was a reduction in the number of ATMs by 2% in 2021 worldwide. Post-pandemic, as everything normalized, ATM usage saw an increase but precautions such as contactless transactions gained momentum which has resulted in the implementation of cardless services.

Outsourcing of ATM software development, testing, and distribution is the most preferred type of sourcing by banks. Banks, financial institutions, and other users are continuously seeking to outsource their category operations to third-party operators who can handle maintenance, cash management, and other responsibilities.

This enables the banks, and financial institutions staff to deal with other priorities along with significantly saving on cost. Shifting the managing task to a third party can also boost customer satisfaction. Maintaining long-term relationships with the service provider is also considered to be beneficial as it helps the vendor such as banks, and financial institutions to know the service provider better and save on searching and evaluating new service providers. The use of such practices in sourcing the services can ensure customer satisfaction, and quality services over the long run.

ATM Services Procurement Intelligence Report Scope

• ATM Services Category Growth Rate: CAGR of 5.6% from 2023 to 2030

• Pricing growth Outlook: 5 - 10% (annual)

• Pricing Models: Full Service Outsource Pricing, Price for services offered, Competition based pricing

• Supplier Selection Scope: End-to-end service, cost and pricing, compliance, security and data protection, service reliability and scalability

• Supplier selection criteria: Machine quality, services offered, post-sale services, end to end services, track record and reputation, cash management, traffic handling capacity, technical support, upgrade timeline and options, multifunctional machine

• Report Coverage: Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Browse through Grand View Research’s collection of procurement intelligence studies:

• Debt Collection Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Accounting Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Key companies profiled

• Diebold Nixdorf

• AGS Transact Technologies Ltd.

• Brink’s Incorporated

• AEPS India

• NCR Corporation

• Loomis Armored US, LLC

• Prineta LLC

• NationalLink Inc.

• ATM USA, LLC

• Hyosung Global

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

#ATM Services Procurement Intelligence#ATM Services Procurement#Procurement Intelligence#ATM Services Market#ATM Services Industry

0 notes

Text

From Pocket Change to Powerhouse: The Evolution of Mobile Wallets into Financial Ecosystems

Introduction

In the past decade, mobile wallets have undergone a dramatic transformation. Once seen as a simple and convenient way to store and spend digital cash, they have now evolved into comprehensive financial ecosystems. These platforms are no longer just about making payments; they are about offering a full suite of financial services that cater to various aspects of our daily lives. This evolution reflects the broader changes in the financial technology landscape, where convenience, security, and innovation intersect to create powerful tools that are reshaping how we manage money.

The Humble Beginnings: Convenience in Your Pocket

Mobile wallets first gained traction as a convenient alternative to carrying physical cash and cards. Early adopters were drawn to the idea of making quick, contactless payments using just their smartphones. This convenience was particularly appealing in the era of online shopping, where digital wallets simplified the checkout process. Apps like Apple Pay, Google Wallet, and PayPal became household names, offering users the ability to store multiple cards, transfer money, and pay for goods and services with a few taps.

The initial success of mobile wallets was driven by their ease of use and the growing acceptance of digital payments. They provided a seamless way to manage money on the go, eliminating the need for bulky wallets and reducing the risk of losing physical cards. However, while convenience was the initial draw, mobile wallets were still limited in functionality, primarily focused on payment transactions.

The Expansion Phase: Beyond Payments

As the popularity of mobile wallets grew, so did the demand for more features. Users wanted more than just a digital version of their physical wallets—they wanted tools that could help them manage their finances in a more holistic way. This shift in consumer expectations led to the expansion of mobile wallets beyond simple payment solutions.

Today, mobile wallets offer a wide range of financial services, including budgeting tools, investment options, bill payments, and even access to loans and credit. Platforms like Paytm, Venmo, and Alipay have integrated features that allow users to track spending, save money, and invest in stocks—all within the same app. This convergence of services has turned mobile wallets into mini financial hubs, where users can manage all aspects of their financial lives.

The integration of loyalty programs and rewards has further enhanced the appeal of mobile wallets. Users can now earn points, cashback, and discounts directly through their wallets, making them a central part of their shopping experience. These features have transformed mobile wallets from mere payment tools into comprehensive financial ecosystems that offer real value to users.

The Ecosystem Era: A New Financial Frontier

The evolution of mobile wallets into financial ecosystems is a testament to the power of fintech innovation. As these platforms continue to expand their offerings, they are increasingly becoming one-stop solutions for all financial needs. The most advanced mobile wallets now provide a seamless experience that integrates payments, savings, investments, insurance, and even financial education.

This ecosystem approach is not only convenient for users but also highly beneficial for businesses. By offering a broad range of services within a single platform, mobile wallets can gather valuable data on user behavior, preferences, and spending habits. This data can then be used to offer personalized financial products and services, creating a more tailored experience for users.

Moreover, the rise of open banking has further accelerated the growth of mobile wallet ecosystems. By connecting different financial institutions through APIs, mobile wallets can offer users access to a wide range of third-party services, such as robo-advisors, insurance products, and more. This interconnectedness is creating a new financial frontier, where users have unprecedented control over their financial lives.

The Future of Mobile Wallets: What Lies Ahead

As we look to the future, it’s clear that mobile wallets will continue to evolve. With advancements in artificial intelligence and machine learning, these platforms will become even more intelligent, offering predictive financial insights and personalized advice. The integration of blockchain technology could also enhance the security and transparency of mobile wallets, making them even more trustworthy.

In the coming years, we can expect mobile wallets to become even more embedded in our daily lives, blurring the lines between different financial services and creating a truly interconnected financial ecosystem. As they do, they will continue to revolutionize how we manage our money, making financial services more accessible, convenient, and personalized than ever before.

Outcome

The journey of mobile wallets from simple payment tools to comprehensive financial ecosystems is a reflection of the broader evolution in fintech. What started as a convenient way to pay has transformed into a powerful platform that offers a full range of financial services. As mobile wallets continue to evolve, they are not just making our lives easier—they are fundamentally changing the way we interact with money. The future of mobile wallets is bright, and as they continue to grow, they will play an increasingly important role in the global financial landscape.

0 notes

Text

Fintech Startups: Transforming the Financial Landscape

In the fast-paced world of finance, fintech startup companies are playing a crucial role in reshaping how we manage money and access financial services. So, what is a fintech startup company? These are innovative businesses that leverage technology to enhance or automate financial services and processes. By utilizing cutting-edge tools such as artificial intelligence, blockchain, and data analytics, fintech startups are creating solutions that offer greater convenience, accessibility, and efficiency compared to traditional financial institutions.

Fintech Startup Companies are driving a revolution in the financial sector, enabling both consumers and businesses to manage their finances more effectively. Whether it's through mobile banking apps, digital payment platforms, or investment management tools, these startups are making financial services more user-friendly and tailored to the needs of modern consumers.

The Forces Fueling Fintech Growth

The explosive growth of fintech startups can be attributed to a combination of technological advancements, changing consumer expectations, and a supportive regulatory environment. Today's consumers demand seamless digital experiences, and fintech companies are responding by delivering innovative solutions that simplify financial transactions. This shift towards digital-first financial services has opened up new opportunities for startups to challenge established players and capture market share.

What Are the Top Fintech Companies?

When considering what are the top fintech companies, several names stand out for their impact and innovation. Companies like PayPal, Square, and Stripe have revolutionized payment processing and set the standard for excellence in the fintech industry. Their success demonstrates the potential for fintech startups to disrupt traditional financial services and create new paradigms in the market.

Highlighting the Fintech Startup Companies List

A fintech startup companies list showcases the diversity and creativity within the sector. Here are a few noteworthy startups making significant contributions:

Revolut: A financial super app offering a range of services from currency exchange to stock trading.

Chime: A digital bank that provides fee-free banking services with features designed to help users save money and manage their finances better.

Plaid: A technology platform that connects consumer bank accounts to financial apps, facilitating seamless data sharing and integration.

Brex: A fintech company providing corporate credit cards and cash management solutions tailored for startups and small businesses.

These companies exemplify the innovative spirit of fintech, each addressing specific financial needs with unique solutions.

Top Fintech Startup Companies to Watch

The top fintech startup companies are those that have successfully harnessed technology to deliver exceptional value and customer experiences. These companies are not only transforming financial services but also setting new benchmarks for efficiency and customer satisfaction. Their innovative approaches continue to inspire and drive the fintech industry forward.

Fintech Startup Companies in the USA

The United States is a hotbed for fintech startup companies in the USA, with a thriving ecosystem that supports innovation and growth. Companies like Robinhood, Affirm, and SoFi are at the forefront, offering a wide range of services from investment management to personal loans. The supportive regulatory environment and access to venture capital have made the U.S. an ideal location for fintech startups to flourish and expand their offerings.

Conclusion

Fintech startups are leading the charge in redefining the financial landscape, providing innovative solutions that enhance convenience, accessibility, and security in financial services. As these companies continue to grow and evolve, they are set to play an increasingly important role in shaping the future of finance. By focusing on customer-centric innovations, fintech startups are not only changing how we think about financial services but are also redefining the industry as a whole.

0 notes

Text

What Are the Cash App Transaction Limits for 2024?

In 2024, Cash App transaction limits are structured around two key factors: whether the user has verified their account and the type of transaction being conducted. Verification typically involves providing identifying information such as your full name, date of birth, and the last four digits of your Social Security Number (SSN).

Limits for Unverified Cash App Accounts

Unverified accounts are subject to stricter limits. If you have not verified your identity on Cash App, you will face more limited transaction capabilities. Here are the limits for unverified accounts:

Cash App Sending Limits: Unverified accounts can send up to $250 within a 7-day period.

Cash App Receiving Limits: You can receive up to $1,000 within a 30-day period.

Cash App Withdrawal Limits: Unverified users may have limited access to withdrawal options, particularly in terms of transferring money to a bank account or withdrawing funds from an ATM.

To fully unlock Cash App's features, including higher transaction limits, you need to verify your account.

Limits for Verified Cash App Accounts

Once you verify your account, you’ll gain access to much more flexible and higher limits. Verified users enjoy the following limits:

Cash App Sending Limits: Verified users can send up to $7,500 per week.

Cash App Receiving Limits: There is no limit on the amount you can receive once your account is verified.

Cash App ATM Withdrawal Limits: Cash App allows you to withdraw up to $1,000 per transaction, $1,000 per day, and $1,000 per week from an ATM.

Cash App Cash Card Purchases: If you use a Cash App Card, you can spend up to $7,000 per transaction, $10,000 per day, $15,000 per month, and make up to 20 transactions per day.

How to Increase Your Cash App Limits

Raising your Cash App limits is straightforward and can be done by verifying your account. Here’s a quick guide on how to do that:

Open Cash App: Launch the Cash App on your mobile device.

Enter Personal Information: Navigate to the profile section and enter your full name, date of birth, and the last four digits of your SSN when prompted.

Submit Information: Follow the instructions and submit the necessary information for verification.

Verification Completion: Once your identity is verified, you’ll receive a confirmation, and your transaction limits will automatically increase.

ATM and Withdrawal Limits on Cash App

For users who regularly use the Cash App Card, ATM and withdrawal limits are another important factor to consider. Here’s what you need to know for 2024:

ATM Withdrawals: The maximum amount you can withdraw from an ATM is $1,000 per day, $1,000 per transaction, and $1,000 per week.

Over-the-Counter Withdrawals: If you visit a bank or other financial institution to withdraw funds using your Cash App Card, the same limits apply.

Cash App Limits on Instant Transfers: Cash App’s Instant Transfer feature lets you send money to your bank instantly for a fee. Verified users can transfer up to $25,000 per week through instant transfers.

Cash App Bitcoin Transaction Limits

One of the standout features of Cash App is its ability to facilitate Bitcoin transactions. In 2024, Bitcoin enthusiasts will find the following transaction limits on the platform:

Bitcoin Purchases: Verified users can buy up to $100,000 worth of Bitcoin per week.

Bitcoin Sales/Withdrawal: You can withdraw up to $2,000 worth of Bitcoin per day and $5,000 within any 7-day period.

These limits apply whether you are buying Bitcoin through the app or withdrawing it to an external wallet. To raise your Cash App Bitcoin transaction limits, you may need to complete additional verification steps, including providing information about your income sources.

Cash App Direct Deposit Limits

If you use Cash App to receive direct deposits, you’ll find the following limits:

Maximum Direct Deposit Amount: Cash App allows users to receive up to $50,000 in a single day through direct deposit.

No Monthly Limits: there is a cap on the total amount of money you can receive via direct deposit each month.

Many users appreciate this feature as it allows for seamless integration of their payroll or government benefits into their Cash App balance.

Managing Transaction Limits

Cash App offers flexible limits, but understanding and managing them is crucial for efficient use. Here are some tips on how to manage your limits:

Keep Your Account Verified: Verifying your account unlocks higher limits for transactions and withdrawals.

Check Your Limits Regularly: It’s important to keep track of your transaction limits by visiting the profile section of the Cash App.

Utilize Direct Deposit: Direct deposits on Cash App provide higher incoming transaction limits, making it a great option for receiving salaries or large sums of money.

Bitcoin Transactions: Make sure to complete any additional verification steps if you plan to deal with high-value Bitcoin transactions.

Conclusion

In 2024, Cash App transaction limits are designed to offer flexibility for both verified and unverified users. While unverified users face tighter restrictions, verified users can enjoy significantly higher sending, receiving, and withdrawal limits. Additionally, features like Bitcoin transactions, direct deposits, and ATM withdrawals add versatility to Cash App’s growing list of functionalities. To make the most of Cash App, ensure your account is verified, and always stay informed about the platform’s transaction limits.

4 notes

·

View notes

Text

Your Guide to Check Cashing with an Expired ID

Need to cash a check but have an expired ID? Here’s what you need to know to navigate this situation successfully! 💵🆔

Can You Cash a Check with an Expired ID? Cashing a check with an expired ID can be challenging, as most financial institutions and check cashing services require a valid, unexpired form of identification. However, there are some steps you can take and options to consider.

Steps to Cash a Check with an Expired ID:

1. Renew Your ID: 🆕 Best Option: The most straightforward solution is to renew your ID. Visit your local DMV or relevant authority to renew your driver’s license or state ID.

2. Use an Alternative Form of ID: 🔄 Other IDs: If you have another form of valid ID, such as a passport, military ID, or another government-issued ID, you may be able to use it to cash your check.

3. Bank Account Deposit: 🏦 Deposit Instead: If you have a bank account, deposit the check using a mobile app, ATM, or through a bank teller. Banks are more likely to accept deposits even with an expired ID, especially if you are an existing customer.

4. Visit Your Bank: 🤝 Talk to Your Bank: If you are an existing customer, visit your bank and explain the situation. Some banks may cash your check if they recognize you and you have a history with them.

5. Endorse the Check to Someone You Trust: 🔄 Third-Party Endorsement: You can endorse the check to someone you trust who has a valid ID. They can then cash or deposit the check on your behalf. Make sure to write "Pay to the order of [Person’s Name]" and sign underneath.

6. Contact Check Cashing Services: 📞 Call Ahead: Some check cashing services may have specific policies regarding expired IDs. Call ahead to see if they can work with you or offer any alternative solutions.

Additional Tips:

Prepare Documentation: Bring any additional documentation that can help verify your identity, such as a birth certificate, Social Security card, or utility bill.

Plan Ahead: Start the process of renewing your ID as soon as possible to avoid similar issues in the future.

Conclusion: While cashing a check with an expired ID can be difficult, there are several steps and alternatives to explore. Renewing your ID is the best long-term solution, but using alternative IDs, depositing checks, or seeking help from your bank can also be effective.

For more detailed information and additional tips, visit: Your Guide to Check Cashing with an Expired ID

0 notes

Link

#howtotransfermoneybetweenbankaccounts#howtousezelletotransfermoneybetweenbanks#moneytransfer#transfermoney#transfermoneybetweenbanks#transferringmoneybetweenbanksonline#usezelletotransfermoneybetweenbanks#zellemoneytransfer

0 notes

Text

How Much Money Can You Send On Cash App?

Cash App, a popular mobile payment service, allows users to send and receive money effortlessly. However, it's important to understand the various limits imposed by Cash App to make the most of its features. In this comprehensive guide, we will explore the different limits associated with Cash App, including daily and ATM withdrawal limits, Cash App sending limits after verification, and how to increase these limits.

Understanding Cash App Limits

Cash App is designed with certain limits to ensure security and compliance with financial regulations. Cash App limits can vary depending on whether your account is verified or unverified.

What Are the Cash App Limits Per Day?

Cash App Daily Limits for Unverified Accounts: For users with unverified accounts, the daily limits on Cash App are relatively lower. You can send up to $250 within any seven-day period and receive up to $1,000 within any 30-day period. These limits are sufficient for basic transactions but may not meet the needs of users who engage in more frequent or larger transactions.

Cash App Daily Limits for Verified Accounts: Upon verifying your account, which involves providing your full name, date of birth, and the last four digits of your Social Security number, the Cash App daily limits are significantly increased. Verified users can send up to $7,500 per week and receive an unlimited amount of money. Verification not only increases your Cash App transaction limits but also adds an extra layer of security to your account.

Understanding Cash App ATM Withdrawal Limits

For users who utilize the Cash App card to withdraw money from ATMs, there are specific limits to be aware of:

Cash App ATM Withdrawal Limit:

The standard Cash App ATM withdrawal limit is $310 per transaction.

The Cash App daily ATM withdrawal limit is $1,000.

The Cash App weekly ATM withdrawal limit is $1,250.

These limits apply regardless of whether your account is verified or unverified. Additionally, Cash App charges a fee of $2-$2.50 per ATM withdrawal, although this fee can be reimbursed if you receive direct deposits of at least $300 per month.

What Are the Cash App Sending Limits After Verification?

Verification on Cash App not only increases the amount you can send but also enhances your account's security features. Here’s a detailed look at the sending limits for verified accounts:

Cash App Sending Limits:

After verification, you can send up to $7,500 per week.

This Cash App limit is reset every week, providing substantial flexibility for users who need to send larger sums of money.

Verification is a straightforward process that requires you to provide additional personal information. Once verified, you not only enjoy higher limits but also benefit from enhanced security features such as two-factor authentication.

How to Increase Cash App Limits

If the default limits do not meet your needs, there are steps you can take to increase your Cash App limits further:

Verify Your Account: As mentioned, the first step is to verify your account. This involves providing your full name, date of birth, and the last four digits of your Social Security number. Verification typically results in significantly higher limits for sending and receiving money.

Link Your Bank Account: Linking your bank account to Cash App can also help increase your Cash App transaction limits. This link establishes a direct connection between your Cash App and your financial institution, allowing for larger and more frequent transactions.

Enable Direct Deposit: Setting up direct deposit for your paycheck can help you qualify for higher limits. Users who receive direct deposits of at least $300 per month may benefit from increased ATM withdrawal limits and fee reimbursements.

Maintain a Positive Transaction History: Regular use of Cash App and maintaining a positive transaction history can also contribute to increasing your limits over time. Consistently using the app without any issues demonstrates your reliability as a user.

Conclusion

Understanding and managing Cash App limits is crucial for making the most of this versatile payment platform. By verifying your account, linking your bank account, and enabling direct deposit, you can maximize your transaction capabilities and enjoy greater financial flexibility. Whether you're a casual user or someone who relies heavily on Cash App for financial transactions, knowing these limits and how to increase them ensures you can use the app efficiently and effectively.

0 notes