#cashout api

Explore tagged Tumblr posts

Text

Monetizing Your Sports Betting Software: APIs, Affiliate Programs, and Revenue Streams

The sports betting industry is experiencing rapid growth, with more entrepreneurs looking to develop profitable platforms. However, building a betting platform is only part of the equation—ensuring sustainable revenue is the key to long-term success. Whether you’re a startup or an established operator, understanding the best monetization strategies will help you maximize your profits.

In this guide, we’ll explore various ways to monetize your sports betting software, including leveraging Sports Betting API providers, affiliate marketing, and multiple revenue streams.

1. The Role of APIs in Monetization

When developing a betting platform, using Sports Betting API providers is essential for real-time data integration, odds calculation, and seamless betting experiences. These APIs not only enhance user engagement but also open multiple revenue-generating opportunities.

Ways to Monetize Using APIs:

Subscription-Based Access: If you're developing a Sports Betting app development solution for other businesses, offering premium API access on a subscription model can generate recurring revenue.

White-Label Solutions: Many API providers allow businesses to create custom platforms and resell them under their brand. This is a great way to generate income without building everything from scratch.

Pay-Per-Use Model: Charging customers based on the number of API calls or specific features can be a profitable approach.

2. Affiliate Programs and Commission-Based Revenue

Affiliate marketing is a powerful way to earn passive income in the sports betting industry. If your platform integrates an affiliate program, users can refer new bettors and earn commissions on their wagers.

How to Implement Affiliate Programs:

Partner with Major Bookmakers: Many sportsbooks offer attractive affiliate programs, allowing you to earn commissions on referred players.

Create a Referral System: Integrate a referral feature where users can invite friends and get a percentage of their bets.

Leverage Influencers & Streamers: Partnering with influencers in the sports betting niche can drive traffic and boost affiliate sign-ups.

3. In-App Advertising & Sponsorships

If you’re involved in best Sports Betting app development, integrating advertising solutions can be a steady income source. Many betting platforms display targeted ads based on user behavior.

Monetization Through Ads & Sponsorships:

Programmatic Ads: Use platforms like Google AdSense or sports-specific ad networks to display relevant ads to users.

Sponsored Content: Partner with betting brands to promote their odds, special offers, or tournaments.

Premium Ad-Free Experience: Offer users an option to remove ads through a paid subscription model.

4. Betting Fees & Commission Models

Many successful platforms generate revenue by taking a small percentage of each wager. This model ensures continuous earnings, regardless of the outcome of bets.

Examples of Commission-Based Revenue:

Transaction Fees: Charge a small fee per bet or deposit made by users.

Cashout Commissions: Implement a small commission on early cashouts for live bets.

Exchange Betting Model: Act as a mediator between users betting against each other and take a small cut from winning bets.

5. Premium Membership & VIP Programs

A great way to boost profits is by offering premium features through a membership program. Many bettors are willing to pay for enhanced services such as exclusive odds, early access to bets, and VIP support.

Ideas for Premium Features:

Advanced Analytics & Insights: Provide AI-driven betting predictions for paying members.

Exclusive Live Streaming: Offer live sports streaming for premium users.

Personalized Betting Limits: Allow high-rollers to place larger bets through a VIP membership.

6. Fantasy Sports & Gamification Elements

Fantasy sports betting is a growing market that can generate significant revenue. Integrating fantasy leagues, leaderboards, and interactive contests can drive engagement and increase monetization.

How Fantasy Sports Can Increase Revenue:

Entry Fees for Contests: Charge users a small fee to enter tournaments with cash prizes.

In-Game Purchases: Sell virtual currency, power-ups, or premium analytics for fantasy leagues.

Sponsored Fantasy Leagues: Partner with sports brands to create custom leagues and sponsorships.

Conclusion

Monetizing your sports betting software requires a strategic approach that combines various revenue streams. Whether through Sports Betting API providers, affiliate marketing, or premium memberships, the key is to maximize user engagement while ensuring profitability.

If you're involved in Sports Betting app development, integrating these monetization strategies from the start will help create a sustainable and scalable platform. With the right approach, your betting business can thrive in this competitive ind

#sports betting app developers#best sports betting app development company#sports betting app development

0 notes

Text

Get more cash in your pocket

About me

Hello, I'm Destin Jones—a husband, homeowner, car owner, and reseller. I manage a small local company and handle my finances using tools like Money Market, APY Savings Accounts, and various money-making apps, both free and paid. Additionally, I venture into Stock Market Investing Forex, & other methods for financial growth.

Follow me on social media! My goal is to share years of experience and value to help shape a more positive future for those that are interested.

Now Let's

Get more cash in your pocket

1.) Get more money using money market Google: highest savings APYs this is simple just get on Google and search money market and find the best saving APYs on market today. 👉 I'll do this on your behalf click here for auto Google search! 👈 Browse and open your eyes to the drowning offers out there. Follow me on TikTok so you can see my next upcoming APY deals. They are ALWAYS changing because of the market. I highly urge you to at least get to know what APY savings is all about and to view offers on the market right now as I complete a value packed post about what I am using right now!

2.) POGO APP is so easy to use. Pogo, the free app that gives you rewards on every purchase - without receipt scanning. Just click a button to redeem points on your purchases in APP. Millions of people use it. You connect your bank and it's safe I use it daily and click claim points on each purchase you make. You get cashouts through PayPal and other Payment options 🎁👉 Claim Free 250 points on your Pogo account now by signing up using me! 👈 How does Pogo make money if it sends me money by seeing what I buy? It collects DATA and sells it to big corporations. Using Pogo is a way to capitalize off your own data which is a win win given that you give free data to Google, Meta, Instagram, Facebook, Tiktok, and Google Maps without earning a cent!

👉 Claim Free 250 points on your Pogo account now by signing up using me! 👈

3.) Robinhood: I survive on the waves in the stock market. Bear or Bull I can still maintain a positive margin even though things can seem rough. Easy to use for beginners there's Robinhood a free to use stock broker app. Stay connected to me and I will point out some potential stocks and ones I have already grabbed. Why do I need to use the stock market when it's a bear market? This is when most players in the stock world build a planned long term portfolio which turns around ones things pick up. I've had poor performing stocks turn around when summer came back and then I would sell them off for a small gain. 🎁 👉 Get a free $5 stock now 👈 Connect your bank to this well known app and get a free stock worth from $5 up to $200.

🎁🎁👉 Get a free $5 stock now 👈🎁🎁

Thanks for reading my post! More to come soon.

#make money online#make money from home#make money fast#make money tips#resources#marketing tools#seo tools#business tips#start a business#small business#entrepreneurship#entrepreneur#startup#start up#business#marketing#ecommerce#branding#digitalmarketing#business growth#how to make money online#passiveincome#self made#billionairequotes#business mindset#dropshipping#quotes#success#amazon#entreprenuership

0 notes

Text

No Need to Travel long, When Micro ATM Has Come Along

Micro ATM is the solution for the areas where large or traditional ATMs and bank branches are hard to reach. So, to solve the cash crunch in remote areas, RBP Finivis Pvt. Ltd. has come forward as an API Provider in India with an extremely useful product. It offers Micro ATM API & SDK for the businesses to emerge and occupy space in the rapidly evolving FinTech industry. It is available 24/7 and 365 days to deliver various banking services such as cash withdrawal, balance inquiry, mini statement, and more.

What is Micro ATM and how it works?

Micro ATM is basically a card swipe machine that works on a point of sale terminal with minimal power consumption. It is a handheld portable device that contains a card reader to verify debit cards from any bank, makes it interoperable, and offers desired financial transaction services to individuals. Some Micro ATMs are also available with a fingerprint scanner. It is connected to the central banking servers through GPRS technology. Hence, Micro ATMs are a safe, secure, and instant solution to get banking transactions done.

Is That Amazing for Rural India? Let Us Discuss Benefits of Micro ATM for Them-

Micro ATM is really an amazing thing launched by the government of India under the guidelines of the National Payment Corporation of India (NPCI). As it is a mini version of traditional ATMs, it doesn’t require much space for its setup and it is also very cost-effective. Hence, Micro ATMs can be set up anywhere without much effort.

These are some reasons; Micro ATM is a boon for rural India. People don’t need to travel long distances and waste time in long queues to get facilities of banking services. People can easily withdrawal cash up to Rs. 10,000 using their debit card just by visiting their nearest business correspondent. Also, they get access to some other basic banking services too. So, to co-operate government in the motive of bringing financial inclusion in the country, RBP Finivis Pvt. Ltd. emerged as an API Provider Company. It offers an opportunity for businesses, become a part of the FinTech industry and help rural people & weaker sections of society to come under the banking framework and enjoy financial services at their doorsteps.

Objectives Of RBP Towards Developing Micro ATM API

Objectives of this specification are as follows-

To bring down transaction cost

To guarantee interoperability

Ensure security and transparency of transaction

Provide a uniform customer experience

As the API is customized, it is user friendly that reduces agent training needs

To bring down the cost of being compatible with an existing banking system

Conclusion

RBP Finivis is a Micro ATM API Provider company in India located in Haryana that contributes to making Digital Bharat as it provides reliable services for easy transactions. It is an integrated programming facility that guarantees secured payments. Along with Micro ATM API, RBP offers a few more APIs for businesses to grow to earn and offer the best financial/e-commerce transactions on fingertips to everyone. Such APIs are –

AePS API

Micro ATM API

DMT API

BBPS API

Fastag Recharge API

AePS Cash Withdrawal

#micro atm api#micro atm api provider#matm api provider#mini atm api provider#white label api provider#micro atm software#aeps api#aeps admin portal#high commission aeps api#aeps api provider#aadhaar pay api#aeps software#aeps business#cashout api#payout api#cash withdrawal api

1 note

·

View note

Text

Best AePS API Service Provider Company in India

RBP Finivis Pvt Ltd is among the leading aeps api service provider. All the principles could be implemented if the businesses were self-same two years ago but guess what? The businesses are not the same. Banks are still ravaged by days-consuming tasks.

Aadhaar enabled payment system aeps plays a significant role in banks and Fintech companies in India over a few years.

What is AePS Cash Withdrawal API?

AePSstands for Aadhaar Enabled Payment System. API (Application Programming Interface) refers to company service providers through API and SDK solutions.

In addition, on smartphones with aadhaar pay customers can carry out digital payments. With the help of your thumb impression, you can pay and secure cash from anywhere at any hour. The fund relocation payment system is supported by the aeps api payment system every point you send the funds, you take biometric verification. With aeps payout api our vision is to safe and secure banking with the help of globalization and digitalization.

How Does Our Aeps API support you?

· Pin less cash withdrawal

· Mini statements

· Balance in the credit system

· Multiple bank usage facility

· Real-time payment solutions with 24*7 guidance

· Biometric Authentication

· Instant and flexible payment system

Best AePS API Service Provider Companies:

• RBP FINIVIS Pvt.Ltd.

• ICICI Bank

• KOTAK MAHINDRA Bank

• Yes Bank.

• Airtel Payments Bank

• SBM Bank

AePS cash withdrawal api services for the growth of our customers. The services are designed and developed accordingly. We believe in connecting companies with the latest technology for a faster and more accessible user base. AePS API service provider helps to empower a bank customer to use Aadhaar as his/her identity to access his/ her respective Aadhaar enabled bank account.

As aadhaar enabled payment system aeps api provider, we are encouraging you to enlarge and transform your business boundary. AePS API can be integrated with business correspondent payment portals. Giving guaranteed convenience to their financial services to Fintech platforms, supporting corporations by building products around banking services.

Conclusion

RBP Finivis Pvt Ltd is the finest aeps cash withdrawal api provider that connects industries simultaneously with an extensive significance on financial inclusion. Basic banking facilities are often overlooked by institutions with the help of NPCI and RBI aadhaar enable payment system and the solution can be resolved with aeps cash out api are developed. Along with API, our vision is to enhance our customer’s business potential. With aeps api we believe in modernization for the advancement of your business.

Aadhaar se paisa nikalne ka app

#aeps#aeps api#aeps service#aeps api provider#aeps service provider#best aeps api service provider#aadhaar enabled payment system aeps#aeps cash withdrwal api#aeps cashout api#aeps payout api#aeps api provider company in indai#aeps portal#best aeps service provider company

0 notes

Text

Flutterwave- A Potential Unicorn Payment Company in Africa.

Flutterwave was co-founded in year 2016 by Iyinoluwa Aboyeji and Olugbenga Agboola to solve the financial frictions of online payment process systems in Africa by making payment easy, fast, inclusive and secure with technology. They seem to be the 21st- century middle man type of the old trade by barter era where merchants trade what they have with something they need. Flutterwave serves as an online catalyst and gateway for users to achieve boundless payment needs either to make successful payments or cashouts, anywhere even in preferred local currency, creating a win-win butterfly moments for businesses and individuals in Africa.

Flutterwave have its headquarter in San Francisco Bay Area, West Coast Western US. Iyinoluwa Aboyeji one of the co-founders who is a 2016 Quartz African Innovator and also the Co-founder of Andela announced his exit as the CEO of Flutterwave after 2 years he co-founded the payment startup, similar to his exit from Andela a company he also co-founded, that trains developers locally and expose them to global opportunities. They have raised over $20.4m in 9 funding rounds funded by a total of 25 investors to include 4DX Ventures, FinTech Collective CRE Venture Capital, Plug and Play, Green Visor Capital, GreyCroft, Glynn Capital management, and HOF Capital and recently attracted investment from Raba Capital and Mastercard as an early-stage venture. They currently have a staff strength of over 50 direct employees, In the course of running their business, according to a report by Crunchbase, "Flutterwave actively use about 22 technology products and services such as Wordpress, Google Tag Manager and google analytics. The company's website actively uses over 82 technologies which include SSL by default, Android and iPhone mobile-enabled, they are ranked globally as 110,233 among active websites in the world with a traffic of over 447,023 monthly website visitors".

The fintech company is currently led by a team of 5 change agents comprising of 2 females and 3 males to include Olugbenga Agboola who is the CEO and Co-founder of the company, Bode Abifarin who serves as the Chief Operation Officer, Opeyemi Fowler- Head of Growth Nigeria, Usman Abiola-User Experience Designer and Ernest Terry Obi- Head of Global Sales. They also have board members and observers comprising of 4 foreign nationals namely; Will Szczerbiak, Ian Sigalow, Micheal Walsh and Joe Saunders. Flutterwave from inception to date has processed over $1.3 billion in over 10 million transactions helping big brands such as Uber, Facebook, Booking.com and Hotels.ng with payments to generate an estimated revenue of over $1 million annually and according to PrivCo “Flutterwave has a post-money valuation in the range of $10million to $50 million as July 31, 2017”. They compete with other companies in the fintech space such as PayPal, Interswitch, and VoguePay with presence in about 40 African countries.

Developer communities of young talents in Africa is growing as the internet and mobile penetration increases in a continent with the youngest workforce population in the world. Flutterwave is a big believer of African talents in the tech industry as they provide a global pedestal for local developers to put their skills to use to better their own lives and millions of other individuals in the global community through leading payment solutions.

They have 3 major categories of service which include developer APIs, Payment, and Software and also have 2 major products already in the market this includes Rave and Barter.

Rave is an easy way to make or receive payments from customers and merchants anywhere in the world through a simple payment link or integrated payout system to hundreds of individuals using mobile money, credit and debit cards, cash tokens. Unstructured Supplementary Service Data (USSD) and Automated Clearing House (ACH).

Barter helps individuals, businesses to manage finances with total control from peer to peer payment, data subscriptions, to send money, borrow money and other spending on bills and utilities to enable customers to focus on other pressing needs of life.

Pros-Some of the advantages of Flutterwave includes open market opportunities, growing developer community, easy and secured payment across borders, improving payment performance metrics, inspiring more profitable businesses in the 21st-century, saves time, hassle and unnecessary cost for individuals.

Cons- Poor password retrieval web interface system, poor work-life balance culture and focus on elite market segment only.

Conclusion

Flutterwave is a rave of change that has happened to the payment system majorly across Africa and the rest of the world as it is simplifying and securing ways payments are made or received by businesses and individuals around the world to promote digital economy. Looking ahead into the 21st-century Flutterwave seems to be the next Unicorn company rising from Africa to the world in the payment industry as the company in the past 3 years have shown growth potential in volume of transactions, engaged developer community and organic revenue boom.

1 note

·

View note

Text

Cashout in 6 seconds: ORCA solution for instant crypto to euro withdrawals will cure headaches for crypto users

Want to cash out Ethereum or other cryptocurrencies from an exchange instantly without paying ridiculous fees? ORCA can help you. The passage linking cryptocurrencies together regular finance is being laid. Yesterday ORCA Alliance has presented their technological case for the community during a live event streamed online. Mere 6 seconds. That’s how long it took ORCA to complete a transfer from a cryptocurrency exchange straight to user’s bank. The demonstration was opened by Laurent Bourquin, Chief Operating Officer of ORCA and former investment bank analyst who presented the changing landscape of global finance. “The whole banking sector is being disrupted <…>. A couple of years ago it had been inconceivable to think that a start-up can enter the closed market of retail and investment banking and take over a part of its market share” – claimed L. Bourquin. According to him, new IT-based market players are challenging banks and providing cheaper, more efficient services. To intensify the changes further, Open Banking is already making it’s way to Europe while other countries are watching closely to jump onboard. Most importantly, cryptocurrencies are capturing people’s attention and have become the most recent trend widely discussed in the world of finance, especially due to the fact it is including and making regular people interested in finance. Natan Avidan, the co-founder, and CEO of ORCA Alliance gave a broader presentation about ORCA and what problems does it aim to solve. ORCA is a financial management tool oriented for cryptocurrency users which connects various financial accounts through their APIs. N. Avidan said that mass cryptocurrency adoption would be reached only if the market becomes more user-friendly, facilitating ease of access to technologically uneducated users. The technological case itself was presented by Dmitrij Radin, Chief Technological Officer of ORCA, with the help of a vending machine which helped to verify that funds were received. The transfer took only 6 seconds, ten times shorter than was initially expected. ORCA’s solution is set to relieve loads of issues tormenting cryptocurrency adopters. ORCA is building an Open Banking platform that will make everyone’s banking experience convenient and simple. Users will be able to connect, track and manage their financial accounts from European banks, e-money institutions, cryptocurrency exchanges, and wallets. ORCA is providing an all-in-one banking solution. “At the core, ORCA is a consumer application, and we are well aware that mass adoption can be reached only through practical use cases and convenience benefits. Instant crypto withdrawals are just a stepping stone towards our goal albeit an essential one.” – commented Natan Avidan, CEO of ORCA Alliance. ORCA started making waves in the crypto community. Fintech start-up recently announced a partnership with an e-money institution MisterTango which is operating under the supervision of European authorities. Soon enough they presented the technological solution for momentous crypto withdrawals and plans to release introductory version of the platform before the end of June. The timing of ORCA to create a consumer-oriented application for personal banking including cryptocurrencies is impeccable. More information about ORCA: https://orcaalliance.eu

This is a sponsored press release and does not necessarily reflect the opinions or views held by any employees of NullTX. This is not investment, trading, or gambling advice. Always conduct your own independent research.

Cashout in 6 seconds: ORCA solution for instant crypto to euro withdrawals will cure headaches for crypto users published first on https://medium.com/@smartoptions

0 notes

Text

AePS API Provider Company with High-Tech API

AePS API provider company delivers innovative API banking services in a real-time and secure manner that seamlessly offers services like cash withdrawal, balance inquiry & more.

Micro ATM API provider company brings unique banking services to the customers. Without going bank branch or ATM people can perform banking transactions instantly.

As a DMT API provider company, we offer a money transfer API that is entirely safe and secure. We assure you that the money will safely reach the designated account only

#aep api#aeps api povider#aeps api company#high commission aeps api#aeps service provider#aeps admin portal#aeps business#aeps cash withdrawal api#cashout aeps api#aadhaar pay api#dmt api#domestic money transfer api#money transfer api#fintech api#open banking api#matm api#micro atm api#mini atm api

0 notes

Text

Как настроить Hodlbot

https://crypto-hunter.info/kak-nastroit-hodlbot/

Как настроить Hodlbot

Если вы предпочитаете автоматизировать свой криптографический портфель, одним из лучших инструментов для этого является Hodlbot . Он работает с биржами Binance и Kraken и позволяет вам использовать подход «установи и забудь об этом» в своих инвестициях.

Но как настроить Hodlbot? Какие есть разные стратегии? Продолжайте читать, чтобы узнать.

Создайте ключи API на Binance или Kraken

Прежде чем вы сможете начать использовать Hodlbot , вам сначала нужно создать ключ API в Binance или Kraken. Ключ API позволяет приложению Hodlbot взаимодействовать с вашим биржевым счетом и совершать сделки от вашего имени.

Имейте в виду, что Hodlbot не может использовать только процент от ваших активов на бирже — это все или ничего. Если вы предпочитаете держать часть своего портфеля под своим собственным контролем, вам нужно создать дополнительную учетную запись на предпочитаемой платформе. Ни Binance, ни Kraken не запрещают иметь более одной учетной записи в своих Условиях; не о чем беспокоиться, если вы предпочитаете такой подход.

Чтобы создать новый API в Binance, войдите в свою учетную запись и выберите «Настройки»> «Упр��вление API» . В разделе «Создать новый API» укажите API и имя и нажмите « Создать» . Вы будете новые, чтобы подтвердить создание, используя ссылку электронной почты. После принятия подтверждения убедитесь, что в настройках API установлен флажок « Включить торговлю» .

Если вы пользователь Kraken, перейдите в [Имя пользователя]> Настройки> API и нажмите Создать новый ключ . Опять же, убедитесь, что вы включили торговые разрешения, прежде чем подтвердить создание.

Зарегистрироваться в Hodlbot

Теперь пришло время сделать вашу учетную запись Hodlbot. Нажмите на ссылку регистрации на домашней странице Hodlbot и выберите имя пользователя и пароль.

Вам будет предложено ввести ключ API, который вы только что создали для Binance или Kraken, нажмите «Подтвердить», и вы увидите страницу обзора учетной записи приложения.

Создание вашего портфолио

Прежде чем приступить к настройке учетной записи Hodlbot, вам необходимо решить, как настроить свой портфель. Нажмите на вкладку « Портфолио » в левой части экрана, чтобы начать.

Вы можете выбрать один из четырех готовых портфелей или сделать свой собственный. Четыре нативных портфеля:

Индекс Coinbase: отслеживает 12 активов, доступных на Coinbase. Он взвешен по рыночной капитализации.

Индекс Hodlbot 10: 10 лучших монет по рыночной капитализации, взвешенной по корневой.

Индекс Hodlbot 20: 20 лучших монет по рыночной капитализации, взвешенной по корневой.

Индекс Hodlbot 30: верхние 30 монет по рыночной капитализации, взвешенные по корневой.

Чтобы использовать любой из четырех, нажмите « Выбрать портфолио» .

Как создать собственное портфолио на Hodlbot

Кроме того, вы можете создать свой собственный портфель. Нажмите кнопку + , чтобы начать процесс. Вам сразу же будут представлены два варианта: создать собственный индекс и создать собственный портфель .

Создайте свой собственный индекс на Hodlbot

Индекс рыночной капитализации идеально подходит для того, чтобы дать себе широкое знакомство с криптовалютами.

Если вы создаете свой собственный индекс, основанный на рейтинге рыночной капитализации, вам необходимо решить, какой диапазон монет включить. Введите свой выбор в разделе [X] — [X] . Вы также можете добавить минимальный и максимальный процент вашего портфеля для каждой монеты.

Затем выберите свою стратегию взвешивания. Доступны три варианта:

Четный : ваше портфолио делится поровну между каждой монетой в вашем портфеле.

Рыночная капитализация : процентное содержание каждой монеты в вашем портфеле взвешивается в соответствии с ее рыночной капитализацией. На монеты с более высокой рыночной капитализацией будет выделено больше средств.

Ко��невая шапка : монеты сбалансированы в соответствии с квадратным корнем их рыночной капитализации.

Создайте свой собственный портфолио на Hodlbot

Если вы предпочитаете ограничить свои инвестиции, чтобы выбрать группу монет, выберите « Создать собственное портфолио» .

В левой части экрана вы можете выбрать, какие монеты вы хотите включить. Количество добавляемых номеров не ограничено. Однако имейте в виду, что чем больше монет вы выберете, тем больше должен быть ваш валютный баланс, чтобы покрыть торговые комиссии и соответствовать минимальным торговым суммам, которые накладывают Binance и Kraken.

Еще раз, вы можете выбрать для взвешивания вашего портфеля равномерно, рыночной капитализации или root-cap.

Оба инструмента также имеют кнопку Backtest . Вы можете использовать его, чтобы увидеть, как ваш новый портфель работал бы исторически, хотя помните, что прошлые результаты не являются показателем будущей доходности.

Установите период перебалансировки

Hodlbot позволяет вам выбирать, как часто вы хотите сбалансировать свой портфель; по умолчанию установлено 28 дней. Вы можете получить доступ к настройке на вкладке Утилиты в левой панели.

Хотя может возникнуть соблазн перебалансировать чаще, помните, что многочисленные исследования показали, что нет никакой корреляции между более регулярной перебалансировкой и лучшей отдачей. Для небольших портфелей это может быть даже недостатком — комиссионные, связанные с более частой торговлей, будут лишь постоянно грызть ваши доходы.

Создайте свой черный список

Hodlbot позволяет вам создать черный список монет. Приложение никогда не будет покупать монеты, которые вы добавляете в список, независимо от того, какое портфолио вы выбрали.

По крайней мере, было бы разумно добавить топ стабильных монет в список. Они не обеспечивают возврат и займут место в вашем портфеле, которое может использовать другой актив.

Вы также можете использовать черный список, чтобы исключить монеты, которые вам принципиально не нравятся, или удалить монеты с огромными рыночными капитализациями, с которыми вы уже сталкивались в других местах.

Используйте инструмент Cashout

Если вам нужно спешно продать все свои монеты, было бы нецелесообразно торговать ими по отдельности на бирже, особенно если в вашем портфеле 40 или 50 активов.

Опция вывода средств позволяет вам консолидировать процент вашего портфеля в одну монету по вашему выбору одним щелчком мыши.

0 notes

Text

Original Post from Security Affairs Author: Pierluigi Paganini

Experts spotted a Java ATM malware that was relying on the XFS (EXtension for Financial Service) API to “jackpot” the infected machine

Introduction

Recently our attention was caught by a really particular malware sample most probably linked toarecent cybercriminal operation against the banking sector.

This piece of malicious code is a so-called ‘ATM malware‘: a malicious tool that is part of a criminal arsenal able to interact with Automatic Teller Machine. ATM malware are used in modern bank robberies due to their ability to access the cash dispenser hardware, such as ATMitch malware we analyzed on last May. In that case, the malware was relying on the XFS (EXtension for Financial Service) API to “jackpot” the infected machine.

Instead, this particular ATM malware does not rely on standard communication interfaces. It is using other more specific techniques, suggesting an increased level of customization, maybe achieved by leveraging knowledge from the inside of the target organizations.

For this reason, Yoroi-Cybaze ZLAB team decided to dig into this malicious tool.

Technical Report

Hash 0149667c0f8cbfc216ef9d1f3154643cbbf6940e6f24a09c92a82dd7370a5027 Threat Java ATM Dispenser Brief Description Java ATM Malware Ssdeep 6144:gm/yO7AN3q8QjcAcZ7qFx6Jo7tpYRC3ivnZj+Y5H:2O7AN35QYJZ2TlSkivZjR

Table 1. Info about the sample

The malware makes extensive use of Java Instrumentation techniques in order to manipulate the control flow of a legit Java-based ATM management software. The first action it performs is to identify the proper running Java Virtual Machine (JVM) used by the ATM software. The malware has the capability to:

display the list of all the JVM registered on the system

attach to a specific JVM defined in the arguments list

choose an arbitrary JVM which attaches to

This is done using the Java Attach API, a Sun Microsystems extension that provides a mechanism to attach to a Java virtual machine.

Figure1. Code to identify the JVM

Once identified the target JVM, the malware forces the loading of a Java agent in it using the “vm.loadAgent(path_to_jar, options)” method.

Figure 2. Code to load the Java Agent from Jar file

The loader identifies the agent class in the specified JAR file using the “MANIFEST.MF” file embedded into it, then it loads the class into the target JVM’s context.

Figure 3. Jar’s manifest file containing the agent class name

At this point, the main class terminates printing the banner “Freedom and glory” in different languages, as shown in Figure 2. Now, the control flow moves to the “agentmain” method belonging to Agent class. Its only goal is to invoke the “startagent” method through the following code line:

getDeclaredMethod(“startagent“, String.class, Instrumentation.class).invoke((Object)null, agentArgs, ints);

The malicious intents of the malware are exhibited starting from this method. It deploys an HTTP server which acts as an interface between the attacker and the ATM under attack.

Figure 4. Code to start the HTTP server

Exploring the HTTP handler class, in fact, some suspicious information immediately emerges. In the following figure it is possible to see a hardcoded IP address “150.100.248[.]18” which will be used later. Moreover, this class embeds three static variables containing Javascript code (one of this is Base64 encoded).

Figure 5. Static strings embedded into HTTP server code

Continuing the code analysis, we encounter the server logic, which provides several functionalities that can be triggered by the attacker using simple HTTP requests.

Figure 6. Part of server logic

It is possible to summarise all the malware capabilities, exposed through the HTTP server instance, in the following table:

HTTP Method Path Query string Body Description POST / – Base64-encoded command Execute the specified command through cmdline POST /d – i={id}&d={amount} Dispense the specified {amount} from the Dispenser cash unit identified by {id} POST /d – q=1 Return the current amount of each cash unit POST /eva JS script – Execute the script using Java ScriptEngine GET /mgr className1&className2 – Return info about the specified running Java classes POST /mgr className method Invoke the method belonging to the specified Java class GET /core – – Display an HTML form to insert info about a JAR to load POST /core – 0={Base64EncodedJAR}&1={mainClass}&2={method}&3={args}&4={type} Load a new JAR file and execute the specified method

Table 2. Malware capabilities

In the following screen, we report part of the server logic in which are highlighted the functions used by the malware to retrieve information about the ATM cash dispenser.

Figure 7. Evaluation of HTTP request

Most malicious actions are executed using Javascript code running on top of a JavaScript engine instance (included into the “runjs” method). For example, to retrieve the amount of cash stored in the dispenser the following code is invoked:

Figure 8. Javascript code to extract information about dispenser cash units

First of all, the malware retrieves the Java class associated with the Dispenser from the list of all the running classes. Then, for each dispenser’s cash unit, it invokes the “getValue” and “getActual”methods to obtain the right information from the dispenser interface.

A similar thing is done for money dispensing: after retrieving the associated object, the malware removes the “AnomalyHandler” using the “removeAnomalyHandler” method in order to stealthily achieve its objectives.

Figure 9. Javascript code used to remove the anomaly handler from dispenser

After that, it iterates the cash units dispensing the number of bills specified by the criminals through the following function calls sequence:

setDispense(amount);

dispense();

present();

waitForBillsTaken(30);

At the end of the theft, the malware restores the “AnomalyHandler”. The complete Javascript code is shown in the following figure.

Figure 10. Javascript code used to dispense money from all the cash units

On return, the malware communicates the success of the dispense operation connecting to the abovementioned IP (“150.100.248[.]18”) stored in the “urlreport” variable.

Figure 11. The malware contacts the embedded IP address after dispensing

This ATM malware has also additional capabilities increasing its flexibility and dangerousness. It is able to execute arbitrary batch commands, to invoke methods directly into the memory of the running Java classes and also to run new JAR applications. The “jscmd” variable, shown in Figure 5, contains the Base64-encoded Javascript snippet useful to load the commands in the Windows cmdline:

Figure 12. Javascript code to execute batch commands

Before launching the JS script, the malware replaces the following patterns:

%%shell%% with cmd.exe

%%arg%%with /c

%%cmdb64%% with the Base64-encoded command coming from the HTTP request

Then, it invokes the “java.lang.Runtime.getRuntime().exec()” function.

Figure 13. HTML form to specify the Jar to upload and run

Instead, in the JAR loading case the attacker preconfigured an HTML form to make the upload easier. In it, the criminal can specify which JAR to load, which is the main class and which method they want to execute first. A set of tools to ensure the criminals will be able to overcome eventual technical faults in their ATM cashouts.

Conclusion

Cyber criminals are threatening financial and banking sector for a long time. During the years, criminal groups evolved their operation and developed more sophisticated arsenals, achieving customization capabilities making them able to target specific organizations, even if they are not leveraging known Industry Standards.

As recently pointed by Kaspersky, these criminals reached such sophistication and customization levels by leveraging deep knowledge of the target systems, making the malware work just on a small fraction of the AMTs. How the crooks accessed this knowledge is the Question.

At the moment it’s not clear how the technical information required to develop ad hoc malware have been accessed. A wide range of scenario are possible, such as the involvement of an insider, the long term compromise of the whole target network or just a small subset of mailboxes, or maybe a compromise of the Software Development Supply Chain. A set of scenarios that need to be seriously taken into account by the financial and banking organizations aiming to tackle modern bank thieves.

Technical details, including Indicator of compromise and Yara rules are reported in the analysis published on the Yoroi blog:

https://blog.yoroi.company/research/java-amt-malware-the-insider-threat-phantom/

window._mNHandle = window._mNHandle || {}; window._mNHandle.queue = window._mNHandle.queue || []; medianet_versionId = "3121199";

try { window._mNHandle.queue.push(function () { window._mNDetails.loadTag("762221962", "300x250", "762221962"); }); } catch (error) {}

Pierluigi Paganini

(Security Affairs – Java ATM malware, hacking)

window._mNHandle = window._mNHandle || {}; window._mNHandle.queue = window._mNHandle.queue || []; medianet_versionId = "3121199";

try { window._mNHandle.queue.push(function () { window._mNDetails.loadTag("762221962", "300x250", "762221962"); }); } catch (error) {}

Pierluigi Paganini

(SecurityAffairs – Java ATMmalware, malware)

The post Malware researchers analyzed an intriguing Java ATM Malware appeared first on Security Affairs.

#gallery-0-6 { margin: auto; } #gallery-0-6 .gallery-item { float: left; margin-top: 10px; text-align: center; width: 33%; } #gallery-0-6 img { border: 2px solid #cfcfcf; } #gallery-0-6 .gallery-caption { margin-left: 0; } /* see gallery_shortcode() in wp-includes/media.php */

Go to Source Author: Pierluigi Paganini Malware researchers analyzed an intriguing Java ATM Malware Original Post from Security Affairs Author: Pierluigi Paganini Experts spotted a Java ATM malware that was relying on the XFS (EXtension for Financial Service) API to “

0 notes

Text

New Post has been published on Payment-Providers.com

New Post has been published on https://payment-providers.com/ecommerce-product-releases-april-3-2019/

Ecommerce Product Releases: April 3, 2019

Here is a list of product releases and updates for late March from companies that offer services to online merchants. There are updates on social commerce, furniture shipping, chargeback management, Amazon summits, and Facebook ad transparency.

Got an ecommerce product release? Email [email protected].

Ecommerce Product Releases

Instagram launches Checkout for shopping. Checkout on Instagram will be available within posts and stories with shopping stickers and tags, enabling Instagram users to buy, track, and manage their purchases directly within Instagram and allowing businesses to sell directly on Instagram. After discovering a Checkout-enabled product, shoppers will see “Checkout on Instagram” when they tap to view additional details. Shoppers will be able to pay with Visa, Mastercard, American Express, Discover, and PayPal. Shoppers can also use the Instagram app to view their order status, delivery date, and tracking number, as well as cancel orders, initiate a return, and request additional support.

youtube

Twitter offers Snapchat-like camera features. Twitter is launching a Snapchat-like camera feature that lets users post videos or photos in a swipe. The update allows users to more easily access the service’s existing camera, encouraging them to show nearby events in real-time. Twitter has opened access to its prototype app, called ��twttr,” which the company is using to test new ideas and obtain feedback, marking the first time Twitter has provided early explorations of product features to the public. Users must apply for access to the app.

Instacart launches Instant Cashout for instant payment. Instacart has partnered with Stripe to build a solution that will let shoppers — Instacart workers who shop in stores on behalf of consumers — to receive the cash they’ve earned through Instacart whenever they want. All U.S. shoppers can expect to have access to Instant Cashout by June 2019.

Adobe announces Commerce Cloud. Adobe has announced the availability of Adobe Commerce Cloud, a core part of Adobe Experience Cloud. Built on the Magento platform, Adobe Commerce Cloud focuses on brands looking to deliver a differentiated commerce experience on an aggressive timeline. Adobe Commerce Cloud integrates with Adobe Analytics Cloud, Adobe Marketing Cloud, and Adobe Advertising Cloud.

Adobe Commerce Cloud

uShip’s In-home delivery enhanced for online furniture sellers. uShip, a logistics technology platform for large-item transport, has announced the expansion of “In-Home Delivery,” a suite of technology tools for online furniture sellers. uShip’s In-Home Delivery, which saw a 260 percent increase in furniture shipments in 2018, now includes instant shipping rates that integrate directly into sellers’ checkout process via an API, as well as curated carrier networks.

eBay rolls out Google Pay. eBay is introducing Google Pay to its suite of payment options to further increase customer choice in its new managed payments experience. Google Pay users will be able to complete purchases on eBay via the app, mobile web, and on desktop — from sellers participating in managed payments. Customers who have the Google Pay digital wallet will also be able to complete purchases on desktop, regardless of operating system or device.

Verifi launches self-service chargeback dispute management. Verifi, a provider of end-to-end payment protection and risk management solutions, has launched “Self-Service Chargeback Representment,” a new service for merchants to fight chargebacks with in-house dispute management. The web-based solution empowers merchants with instant access to the critical information needed to represent a chargeback.

Verifi

Facebook introduces Ad Library to help users learn more about ads. Facebook has launched Ad Library, previously called Ad Archive in the U.S., to help users learn more about ads on Facebook or Instagram related to politics. Ad Library offers information about who saw the ad, as well as its spend and impressions. Ad Library houses ads for seven years. Facebook is updating Ad Library to make it easier to learn about all ads and the pages that run them. It’s also making improvements to the Ad Library report. Starting in mid-May, it will update the Ad Library report daily, rather than weekly. It will also offer weekly, monthly, and quarterly reports that are downloadable for anyone.

Amazon’s new Selling Partner Summits have sold out. Amazon announced that its new Selling Partner Summits, a series of six conferences for small and medium-sized business, have sold out in six weeks. More than 1,800 SMBs are set to attend the nationwide events between March and October. Each summit will feature an Amazon-led educational track, experts’ lounge, and product labs to help small businesses build and grow their sales in Amazon’s stores. Participants will learn directly from Amazon’s experts and meet like-minded Amazon sellers to network, learn, and share success stories.

Amazon Pay to integrate Worldpay. Worldpay, a payments technology company, became the first ever acquirer to integrate Amazon Pay into its payment options. Now Worldpay merchants can provide a familiar way for shoppers to complete their purchases, by enabling them to use the information already stored in their Amazon account.

Worldpay

Source link

0 notes

Text

12 Helpful Tips For Doing linux vps hosting

For those who have begun a website or you're considering beginning 1, Then you definitely most likely ought to contemplate your entire web hosting possibilities, together with Linux VPS hosting. When you acquire VPS servers, you are going to have number of assets to operate with. these days you recognize the factors for Linux VPS hosting receiving so widespread.

there are several issues that you will have to remember once you opt for Linux VPS out of your shared internet hosting.

Employing a digital server or VPS web hosting is just not correct for everybody, but it'd be ideal for you. as a substitute, there are a variety of benefits of dealing with a Linux VPS. low-cost Home windows VPS provider makes it attainable for yourself an extensive server customization.

inform us about what you have to have, and what precisely you're trying to do. you will find those that will show you an enormous distinction between Linux and Home windows is usually that Windows is inferior when it should do with safety. Although it may look laborous to setup an online store, you commonly simply need to choose over a plugin or insert-on to start.

If you operate a firm using a higher quantity of data, you should shun away all of the next Tips and pick the Linux VPS web hosting mainly because it offers productive disaster Restoration solutions. protection of the site is built incredible through the use of Linux. Linux Shared web hosting prepare is amongst the effectively-regarded hosting forms all over the country.

Linux techniques are more simple in contrast to other options. in case you are by now educated about Linux, then you will likely uncover it a complete lot simpler to make use of a Linux based web hosting organization than 1 that isn't quite as familiar for you. Linux happens to be the preferred platform of Net developers For the reason that early ages of the net.

Website hosting services have seen a dynamic change both of those in regard to providers and expandability they provide. Website hosting by itself involves a lot of terms aggregated jointly that's very vital to your smaller small business and lacking any one of them may well not serve your Business very well. VPS internet hosting is arguably the best Online company That could be introduced into any company's business enterprise Procedure to amass the most beneficial of provider and cost.

youtube

Besides obtaining an experienced, fair web site designer, securing an internet host is an additional severe move in the web internet site structure course of action. You will have the option to make certain that the site is up and functioning. your internet site is ready to go to the following amount.

Digital personal Server is good in case you are planning to initiate an internet site internet hosting enterprise with minimum hard work. Shared internet hosting isn't a better choice for e-commerce Web sites, meanwhile dedicated servers can be a ton costlier the beginners won't be able to pay for with. So, VPS hosting is nearly always a valuable solution when you are certain your site cannot mature with the means from shared web hosting options.

VPS contains a restricted ability to take care of high targeted visitors spikes for your web site and functionality may still be fairly influenced by other Internet sites around the server. Managed VPS internet hosting is the proper choice for users which You should not possess administrative skills or time for server administration. So with a VPS you're actually using a shared server, nonetheless It isn't as pricey then a devoted server and you will personalize your shared Section of the server that is unique from Other folks.

Any good hosting firm may have a number http://saphiria.net/osmanat/post-linux-vps-hosting-79628.html of various decisions so that you can choose from so you will have the opportunity to obtain managed Together with unmanaged server packages. Additionally, while in the party the server House furnished by your shared web hosting provider isn't adequate for your website, you are able to change above to Digital private servers. So it is very important to decide the suitable Webhosting server in Netherlands which means you don't need to face any situation in upcoming.

Some host does not give the choice to pay by using bitcoin at the correct time of cashout. Also, you can expect to also get yourself a customized program for your web site relying on your specifications and everything is at a small price. just one other significant factor to take into account When picking more cost-effective options is the sum of RAM you'll get out of your company.

On top of that, Linux features entry to programming shells that enable the consumer to generate the two scripts and courses that might increase protection or practical capabilities. At consider you are going to be requested to enter your API critical. generally, he takes advantage of virtual factors mainly because it presents them a sense that they're making use of their own server.

0 notes

Text

ORCA - the next ICO to look forward to!

ORCA Open Banking platform launching its ICO on August 6th!!!

What is ORCA?

ORCA (Open & Regulated Cryptocurrency Adoption) is an open banking platform that will make crypto life much easier to broader audiences. It puts all your assets, both crypto and fiat, into a single dashboard! This includes:

Crypto Wallets

Exchange Accounts

Fiat bank accounts

Other financial services

We are the start-up that achieved the crypto-to-fiat withdrawal in merely 6 SECONDS! See for yourself

ORCA places cryptocurrency wallets and exchanges next to traditional bank accounts for a convenient all-in-one display. Connecting user accounts via APIs gives real-time access to a whole range of financial services without compromising security. Every transaction on the platform has to be validated by ORCA tokens granting them a distinct token use-case. Moreover, Artificial Intelligence-backed analytics provide personalized tips on the most optimal fund management strategies for everyone.

Our team is very strong: from crypto giants to major bank CEOs to GetJar developers – we have them all!

We are pioneers of filling the crucial open crypto-banking niche, with the European Commission launching the PSD2 initiative and with API technology becoming widely available. ORCA truly is on the front lines of bringing banking and crypto to another level. This is why the World waits for AUGUST 6TH!!

Tech:

ORCA Alliance technology allows instant crypto withdrawals. Conversions and deposits from crypto assets to fiat payment accounts and debit cards – all happening in seconds.

See instant cashout presentation (live recording)

Platform:

ORCA platform will be implemented through 5-version development process. It starts with PYGMY, an auto-updating next generation asset tracker suited for multiple platforms and ending with a fully operational digital banking assistant that offers tailored solutions based on financial goals. Track-Trade-Save-Gain!

Presubscribe for early access to PYGMY (free-of charge)

ORCA Alliance team encompasses experienced financial managers, full-stack developers, marketing professionals and blockchain experts. The integration of diverse competences and fields of expertise makes ORCA a dynamic problem-solving unit.

Sigitas, ex-GetJar developer, joins as System Architecht

NEM Co-founder & CEO of Tomochain joins ORCA as advisor

Business development:

Partnership with licensed e-money institution

Recognized as utulity token by Central bank of Lithuania

20% bonus seats available. Only whitelisted people who finished KYC will be eligible for bonus. Bonus duration: first 48 hours of the sale.

Add event to calendar

//mods: https://imgur.com/F0tKWWp

submitted by /u/Dann512 [link] [comments] ORCA - the next ICO to look forward to! published first on https://icoholder.tumblr.com/

0 notes

Text

Cashout in 6 seconds: ORCA Solution for Instant Crypto to Euro Withdrawals Will Cure Headaches for Crypto Users

Cashout in 6 seconds: ORCA Solution for Instant Crypto to Euro Withdrawals Will Cure Headaches for Crypto Users

Want to cash out Ethereum or other cryptocurrencies from an exchange instantly without paying ridiculous fees? ORCA can help you. The passage linking cryptocurrencies together regular finance is being laid. Yesterday ORCA Alliance has presented their technological case for the community during a live event streamed online. Mere 6 seconds. That’s how long it took ORCA to complete a transfer from a cryptocurrency exchange straight to user’s bank. The demonstration was opened by Laurent Bourquin, Chief Operating Officer of ORCA and former investment bank analyst who presented the changing landscape of global finance. “The whole banking sector is being disrupted . A couple of years ago it had been inconceivable to think that a start-up can enter the closed market of retail and investment banking and take over a part of its market share” – claimed L. Bourquin. According to him, new IT-based market players are challenging banks and providing cheaper, more efficient services. To intensify the changes further, Open Banking is already making it’s way to Europe while other countries are watching closely to jump onboard. Most importantly, cryptocurrencies are capturing people’s attention and have become the most recent trend widely discussed in the world of finance, especially due to the fact it is including and making regular people interested in finance. Natan Avidan, the co-founder, and CEO of ORCA Alliance gave a broader presentation about ORCA and what problems does it aim to solve. ORCA is a financial management tool oriented for cryptocurrency users which connects various financial accounts through their APIs. N. Avidan said that mass cryptocurrency adoption would be reached only if the market becomes more user-friendly, facilitating ease of access to technologically uneducated users. The technological case itself was presented by Dmitrij Radin, Chief Technological Officer of ORCA, with the help of a vending machine which helped to verify that funds were received. The transfer took only 6 seconds, ten times shorter than was initially expected. ORCA’s solution is set to relieve loads of issues tormenting cryptocurrency adopters. ORCA is building an Open Banking platform that will make everyone’s banking experience convenient and simple. Users will be able to connect, track and manage their financial accounts from European banks, e-money institutions, cryptocurrency exchanges, and wallets. ORCA is providing an all-in-one banking solution. “At the core, ORCA is a consumer application, and we are well aware that mass adoption can be reached only through practical use cases and convenience benefits. Instant crypto withdrawals are just a stepping stone towards our goal albeit an essential one.” – commented Natan Avidan, CEO of ORCA Alliance. ORCA started making waves in the crypto community. Fintech start-up recently announced a partnership with an e-money institution MisterTango which is operating under the supervision of European authorities. Soon enough they presented the technological solution for momentous crypto withdrawals and plans to release introductory version of the platform before the end of June. The timing of ORCA to create a consumer-oriented application for personal banking including cryptocurrencies is impeccable. More information about ORCA: https://orcaalliance.eu

https://ift.tt/2y9d8NI

0 notes

Text

Cashout in 6 Seconds: ORCA Solution for Instant Crypto to Euro Withdrawals Will Cure Head-Aches for Crypto Users - VipCryptoSignals.com

New Post has been published on https://vipcryptosignals.com/bitcoin-news/cashout-in-6-seconds-orca-solution-for-instant-crypto-to-euro-withdrawals-will-cure-head-aches-for-crypto-users-vipcryptosignals-com/

Cashout in 6 Seconds: ORCA Solution for Instant Crypto to Euro Withdrawals Will Cure Head-Aches for Crypto Users - VipCryptoSignals.com

Want to cash out Ethereum or other cryptocurrencies from an exchange instantly without paying ridiculous fees? ORCA can help you. The passage linking cryptocurrencies together regular finance is being laid. Yesterday ORCA Alliance has presented their technological case for the community during a live event streamed online. Mere 6 seconds. That’s how long it took ORCA to complete a transfer from a cryptocurrency exchange straight to user’s bank.

The demonstration was opened by Laurent Bourquin, Chief Operating Officer of ORCA and former investment bank analyst who presented the changing landscape of global finance.

L. Bourquin claimed:

The whole banking sector is being disrupted <…>. A couple of years ago it had been inconceivable to think that a start-up can enter the closed market of retail and investment banking and take over a part of its market share.

According to him, new IT-based market players are challenging banks and providing cheaper, more efficient services. To intensify the changes further, Open Banking is already making it’s way to Europe while other countries are watching closely to jump onboard. Most importantly, cryptocurrencies are capturing people’s attention and have become the most recent trend widely discussed in the world of finance, especially due to the fact it is including and making regular people interested in finance.

Natan Avidan, the co-founder, and CEO of ORCA Alliance gave a broader presentation about ORCA and what problems does it aim to solve. ORCA is a financial management tool oriented for cryptocurrency users which connects various financial accounts through their APIs. N. Avidan said that mass cryptocurrency adoption would be reached only if the market becomes more user-friendly, facilitating ease of access to technologically uneducated users.

The technological case itself was presented by Dmitrij Radin, Chief Technological Officer of ORCA, with the help of a vending machine which helped to verify that funds were received. The transfer took only 6 seconds, ten times shorter than was initially expected.

ORCA’s solution is set to relieve loads of issues tormenting cryptocurrency adopters. ORCA is building an Open Banking platform that will make everyone’s banking experience convenient and simple. Users will be able to connect, track and manage their financial accounts from European banks, e-money institutions, cryptocurrency exchanges, and wallets. ORCA is providing an all-in-one banking solution.

Natan Avidan, CEO of ORCA Alliance, commented:

At the core, ORCA is a consumer application, and we are well aware that mass adoption can be reached only through practical use cases and convenience benefits. Instant crypto withdrawals are just a stepping stone towards our goal albeit an essential one.

ORCA started making waves in the crypto community. Fintech start-up recently announced a partnership with an e-money institution MisterTango which is operating under the supervision of European authorities. Soon enough they presented the technological solution for momentous crypto withdrawals and plans to release introductory version of the platform before the end of June. The timing of ORCA to create a consumer-oriented application for personal banking including cryptocurrencies is impeccable.

More information about ORCA: https://orcaalliance.eu

Images courtesy of ORCA Alliance

The post Cashout in 6 Seconds: ORCA Solution for Instant Crypto to Euro Withdrawals Will Cure Head-Aches for Crypto Users appeared first on VipCryptoSignals.com.

Telegram: Vip Crypto Signals

#bitcoin #cryptocurrency #ripple #xrp #tradebot #ethereum #news #tron #litecoin

0 notes

Text

7 Million Heroes in 70 years

The spring locks of my grandma's attache case stretched like a cat, when I ordered them to open. Toiled by years of hard work, they had lost their recoil and sounded a warning for opening a treasure chest which did not belong to me. Neatly, stacked in there were separate stacks of letters from her six sons of whom my dad's were the most distinguishable. They were the blue aerogram letters that I had grown up seeing at my dad's desk. I immediately recognized them. It is difficult to understand how could one fill those leaves of paper without with an autocorrect featured software and printer, but with only a pen and ink of emotions.

Dad moved to Saudi Arabia in 1966 as a young pediatrician from his government job in a remote town in South Punjab. Those were the days when the King's Landing (overwhelmed by the GOT Season 7) was being built by hundreds of my fellow country men in the fields of medicine, engineering and education. Another of my uncle went to build the Queen's Landing in UK and another one to the Green's Landing posted as an army captain in the East Pakistan (fills me with grief on the 70th Independence day for what we lost only after 24 years of independence). The stories of my uncles are for another day when I unpack their letters.

Grandma had a lot reading to do. The boys treasured a great bond with their mother. The letters were old and many. Schooled by a great mom, almost all the letters were written in beautiful handwriting with cut nib pens. They were stocked neatly with grace into packs covered in a plastic envelop binded with a rubber band. The rubber band lay there now melted on the envelope, like a dutiful soldier with a sprawled hands protecting an unaffectionate intrusion into his motherland.

With teary eyes when I opened the first of my dad's scriptures, a tale of how my Rome was built unravelled infront of me. The struggle of defending Pakistani identity in a foreign land was bigger than the struggle of winning economic freedom. Month over month the hard earned money helped my aunts get married and the younger uncles complete their education. Like my father, there are more than 7 million expatriate heroes of Pakistan who go through this struggle everyday.

Our heroes keep our green lights blinking. Every year they send almost $19Bln home to their families home through banking channels

Even with the quick options of account/wallet credits using IBFT from 1Link powered by TPSWorldWide, the cash over counter is still the most in-demand transfer option for cross border remittances. As per industry insights, atleast 50% of the home remittances in the country are collected in cash from the bank branches or from the exchange company locations. The Agent banking/mobile money network though reaching 300,000+ locations in the country have not been able to contribute as a cashout access point for the home remittances. The reason is the average transaction size of ~USD300 per transaction.

The liquidity availability at the agent of PKR 25,000 - 30,000 is a challenge considering the only way to source the agent till is the funds from selling the merchandise. Also the 0.7-1% commission expectation of the agent (possible in a domestic remittance of average transaction size of ~Pkr 4300) against the disbursement is not viable for the MFS service provider.

The human centric operations for remittance payouts have not been productive. ATMs can prove to be a simpler and cost effective answer. Considering the impact of ATMs in financial inclusion and increasing the reach of financial service points, regulator is in a process of introducing regulations to license White Label ATM Operators.

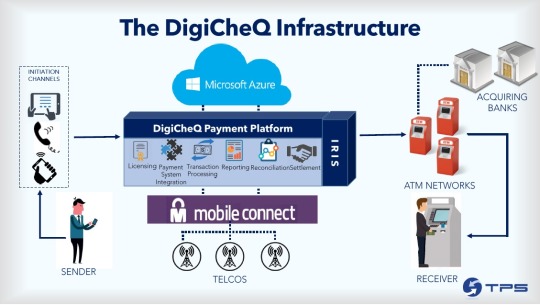

For remittance payouts through ATMs, the challenge is the KYC diligence of the beneficiary at the payout location. How can the beneficiary will be authenticated in the absence of a human agent. We have taken an attempt to crack the code with our #DigiCheQ service. (Read Just In Time remittances blog post ).

With our verified money transfer service built on GSMA's personal identity initiative Mobile Connect the beneficiary is able to withdraw funds from the ATM even without a formal bank account/wallet by authenticating herself from Teleco data (Read first blog in this series).

Using the Azure cloud hosted service the connected financial institution/exchange house can validate the beneficiary identity with a mobile number. The beneficiary is flashed with a USSD/SMS permission message to share her name and Citizen ID from the telco data. The One time Passcode is issued by the overseas correspondent to the sender for onward transmission to beneficiary.

The DigiCheQ is created from the in-coutry correspondent in the beneficiary name sent on her mobile number. With the two factor of authentication, the beneficiary can withdraw funds from the ATM of the acquirer institution connected to the DigiCheQ network. This is done with the help of Mobile Connect APIs of the connected telecom operator.

Mobile Connect is live with 52 mobile operators in 29 countries reaching East & South Asia, APAC, Europe, MENA and Latam. With our early deployments live with China Mobile, other operators including Mobilink, Telenor adoption is in progress. DigiCheQ is now expanding to integrate the Mobile Connect APIs of global operators to enable Just In Time Remittances.

About Mohsin Termezy:

Mohsin has rich experience across full cycle digital payments ecosystem with banks (retail, corporate, microfinance, agent banking), regulatory consulting and fintechs. He is a futurist with a belief in the power of two currencies: Data & Trust.

#tps worldwide#tps#tps pakistan#mobile connect#digicheq#two factor authentication#ibft#1link#payments#digital payments#mobile banking#agent banking#remittances#remittance processing solution#remittances in pakistan#financial inclusion

0 notes