#mini atm api provider

Text

WhatsApp Business Solution | WhatsApp Business API

Across several industries, you can use WhatsApp to notify, converse and engage with customers through their most preferred messaging app. WhatsApp can act as a dynamic platform to drive two-way conversations and improve customer satisfaction. Also, the fact that customers do not have to download an additional app poses a major motivational factor for them to engage with businesses via an app they already use and trust.

WhatsApp presents two possibilities.

Brands can use the platform to send out communications to notify consumers. If the consumer reaches out with a query or a response, two-way communication between users and the brand is possible, provided the brand responds within the 24-hour window.

Additionally, users need to first opt in via the brand’s website or any other such channel to be able to receive messages on WhatsApp.

Let us break this down via each industry for you.

· Banking, Insurance & Financial Services (BFSI)

· Travel & Hospitality

· Automobiles

· Retail

· E-commerce

· Medical and Healthcare

· Consumer electronics, Appliances & Durables

Banking, Insurance & Financial Services (BFSI):

Customers today would rather carry out most transactions digitally rather than talk to an agent or visit the branch.

Banking, Insurance, and Financial Services can carry out most of their processes that require agent interactions and high wait times for customers with ease on WhatsApp.

Whether it is updating KYC or a mutual fund risk preference, helping a customer understand the account opening process or something as critical as reporting fraud/loss/block of a card, banks, and financial institutions can use the WhatsApp Business solution to simplify processes and make them convenient for their customers and employees alike.

Enterprises can also use the medium to notify and keep their customers informed for processes such as transaction alerts, OTP authentication, trade summary and confirmations, portfolio updates, policy renewal reminders and so much more.

Alternatively, customers can chat with a customer care agent to request the program to retrieve information for mini statements, and even update important information such as adding on an insurance nominee for example.

The platform can also be used to address customer grievances and locate ATM and insurance branches and calculate insurance premiums and loans.

Additionally, with Karix, the WhatsApp Business solution can easily be integrated into existing APIs.

Travel & Hospitality:

Adding WhatsApp to your communication suite will make you a more reachable and better-connected host and travel partner.

You can carry out an entire buyer’s journey end-to-end in WhatsApp.

For example, the interested customer can initiate a ticket booking inquiry with a WhatsApp message which can be responded to with seat availability and prices.

After the customer shares his preferences, you can next help the customer with the booking by sharing a URL where the customer can make the payment.

You can close the transaction by sending out a confirmation message after the payment has been made and next share the ticket, invoice, and PNR number.

Before the flight, the customer can enquire about the flight status and complete his web check, all via the same platform.

The platform can also be used to keep customers informed about important reminders and updates.

Additionally, if the company opts to integrate Karix’s Natural Language Processing (NLP) engine into its ecosystem, customers can reach out to retrieve airline miles or even with an unstructured query and retrieve instant responses from the brand.

Automobiles:

Use WhatsApp to provide a better overall customer experience.

Before a sale, you can let potential customers locate a showroom, schedule an appointment or a test drive and manage dealers within the same application.

After the sale, for existing customers, you can share insurance processing alerts, smart car functions, updates, and roadside assistance.

Customers can also directly reach out to you if they want to check on their invoice, insurance status, warranty information, and feedback on the entire process.

If you opt for Karix’s Conversational solutions, WhatsApp can also double up as a round-the-clock customer care service to address customer grievances, unstructured queries, and FAQs.

Retail:

With the rise of e-commerce, retail enterprises need to put in more effort to retain their customers. An investment in WhatsApp will result in higher customer retention numbers and eventually a higher annual ROI (return on investment).

Use WhatsApp as part of your retention strategy to inform customers about holidays and maintenance activities. You can share gamification messages and offer them to look for product information when you are expecting long wait times outside trial rooms during sales. After a purchase, share transaction details and collect feedback.

Retailers that decide to add Karix’s Natural Language Processing Manager (NLP) can use the platform to support two-way communication with their customers and help them with several services.

Existing customers can seek information on the purchase or want to update their profiles, while customers interested in making a purchase might want store locations – and all this information can be shared via WhatsApp with rich text content supported by images.

E-commerce:

E-commerce is a digital medium that attracts people because of its convenience must factor in the need for upgrading their customer experience consistently.

It is important to develop key touch points with customers since the whole process for an e-commerce player is virtual.

To supplement the sales process, information such as transaction success, order processing, and shipping status can easily be shared via WhatsApp.

E-commerce players can also easily avoid any negative feedback or losing out on their customer base if they

Share information on delays, order cancellations, refund status, and delivery rescheduling with their customers ahead of time.

In case things escalate, and you need to manage customer grievances, you can use WhatsApp for live customer care and FAQ channel and take up unstructured queries via the medium, provided you opt for Karix’s chat interface.

Medical and Healthcare:

With platforms now available to review and recommend doctors, the perspective on healthcare as an industry has changed drastically over the years. Customers now expect more value, best-in-class facilities, and a higher level of expertise from a healthcare service/institution.

WhatsApp can act as a mediator and facilitate several urgent requests from sharing test reports to updates on insurance processing and outstanding balance.

Leverage WhatsApp to share reminders and updates for appointments to avoid long queues outside waiting rooms and disgruntled patients.

You can also share available appointment schedules and allow them to reschedule appointments in case of delays or changes of schedules on either you’re or the customer’s end.

The platform can also be used for a host of other services by customers like browsing services, package selection, and FAQs.

Consumer electronics, Appliances & Durables:

There is no dearth of new products and appliances in the market today. With innovative technologies and so many new products available across channels, how does a brand develop and maintain brand loyalty with its customers?

The answer is simply by valuing customers, taking note of their grievances and queries, and providing better customer support. And all of this can be easily executed via WhatsApp.

Whether a new software version or update is available or if the warranty is about to expire, Karix can help you send out automated WhatsApp messages to your customers.

Information like product verification, warranty details, and service center location can easily be available at their fingertips with the WhatsApp Business API with an add-on to Karix’s Knowledge Repository service. You can make it easier and more convenient for customers to now book service appointments, and request warranty extensions, all via the same platform.

For more info:

https://www.karix.com/products/whatsapp-business-api/

Reference Article:

https://www.karix.com/blogs/do-more-with-whatsapp-business-api/

#WhatsApp Business API India#WhatsApp API messaging platform#WhatsApp business message platform#WhatsApp business platform#WhatsApp API platform

0 notes

Text

Get Micro ATM API Solution to Start Your FinTech Business

RBP Finivis Pvt Ltd is India’s largest B2B fintech platform delivering various banking API & SDK solutions to individuals and businesses of all sizes. One such API solution is micro atm api that has made us one of the finest micro atm api provider company in India. This simple functionality of api offers ordinary citizens easy access to secure financial services like cash withdrawal, etc. while businesses can make a good commission and better-earning opportunities without much investment and effort.

What Role does API Play for the Growth of Digital Banking?

An API plays an important role in making the banking system interoperable. Application Programming Interface is a software application that empowers and allows to connect various banking networks to interchange products and services needed to offer customers. This enables banks to offer even more features and feasible services that have made banking services available to each and every corner of the country. However, the time has now come to digitally transform India with the invention of APIs.

A Mini Version of ATM is an Outcome of API Solution

Micro atm is a mini version of an atm that does not occupy much space for its set-up. It is a portable device that can be carried anywhere. It can carry out basic banking transactions within a few seconds at a click. This amazing device came into existence only because of the arrival of advancements in the technology with the introduction of API (Application Programming Interface)

We with our experienced and pro-active technical team of developers developed & designed fully customized and highly scalable API solutions for businesses. With this advanced payment gateway, entrepreneurs can use their business ideas and strategies in the fintech industry without having much technical knowledge. In other words, we will be available 24*7 for their technical quarries and will solve them as early as possible.

Benefits of Micro ATM With Its Features:

· One can extend banking services anywhere in remote locations using a micro atm machine

· Cheap – It is a low-cost option for the existing traditional ATMs

· Portable – It is a portable device, easy to carry, easy to set up anywhere.

· Interoperable – It can work for any bank using debit cards.

· Secure – Connects banking network through GPRS technology for carrying banking transactions, making it safe and secure

Working of Micro ATM is Similar to Usual ATMs

First of all, you need to undergo a verification process of your debit card. For verification card swipe option is available. Once the verification is completed micro atm screen will display various transaction options. You need to select the option and the device will process the transaction. On a successful transaction, a message will be displayed on the screen and a receipt will be generated. You will also receive an SMS alert from your bank about the transaction.

Conclusion

To offer customers a powerful payment solution, RBP as a micro atm api provider company become a force in supplying the best banking platform. With our fully automated banking api solutions, businesses will enjoy unlimited flexibility and fly at great heights with success all around.

aadhaar se cash withdrawal krnye ka app

#micro atm api#micro atm#micro atm api provider#micro atm api provider company#matm api#matm api proivder#mini atm api provider#mini atm api provider company#micro atm sdk#micro atm device#cash withdrawal api#digital payments api#fintech api#banking api

1 note

·

View note

Text

Looking for Micro ATM API & SDK? Switch to RBP Finivis

Do you want to start your fintech business without much investment? Then switch to RBP where you will get micro atm api & sdk to get the best outcomes with 100% success.

#micro atm#micro atm device#micro atm device cost#micro atm api#micro atm api provider company#white label portal#micro atm api provider#mini atm#mini atm api#matm api#matm api provider#mini atm api provider#white label micro atm portal

1 note

·

View note

Text

Domestic Money Transfer Company in India

#recharge api service provider#atm machine apply#mini atm#micro atm machine#aeps service provider#aadhaar based payment system app

0 notes

Video

undefined

tumblr

Roundpay Merchant App is highly secure gives an ease of access to the merchants to work effectively & efficiently.

Roundpay App Features:

★ Easy Merchant Registration: Simple process to become Roundpay Money Merchant / Agent all you need is mobile number & basic KYC documents

★ Mobile and DTH Recharge: Recharge your Customer's prepaid mobile and DTH for all telecom operators like Jio, Airtel, Vodafone, Idea, Reliance,BSNL,Dish TV, Sun Direct,Videocon D2H & others.

★ Cash Withdrawal (Micro-ATM): Merchants can help customers to withdraw cash from ANY bank account (SBI, PNB, Allahabad Bank, Bank of Baroda, ICICI + 180 more banks) with Aadhaar number & fingerprint only

★ Easy movement of money to Bank : Roundpay Merchant can transfer earned money in bank account in few taps.

★ Money Transfer (DMT): Merchants/Agents can take cash from customers and transfer money to any bank accounts across India.

★ MPOS – Merchants can accept payments through credit cards/ debit cards with the help of their mobile phone and MPOS machine.

★ Bharat Bill Payment (BBPS): Merchant can fetch & pay utility bills of their customers which includes: Gas, Electricity, Water,Education Fees,Insurance Premium)

★ Railway Ticket:Become IRCTC authorized agent and use Roundpay wallet as payment method at booking check out

★ Travel: Roundpay Merchant can book Domestic and Internation Flights Ticket Air, Domestic and Internation Hotels Oyo Rooms for their customers.

★ Pancard Services: Merchant can create new PAN card for their customers online From UTI With Help of Our Expert.

★ Wallet Upload: On the go wallet upload feature using digital payments like UPI, NetBanking, Credit Card, Debit Card.

★ App Notifications: Stay updated with various attractive offers.

★ Transaction History: Roundpay provides you with a detailed Account Statement of your online shop. See all your transaction and how much have you earned on them. Control your online business with relevant reports at your disposal.

★ 24*7 Availability: Provide hassle free services to customer available 24*7

★ User Friendly Interface: Fast, simple & easy interface

★ Secure & Robust: Secure mobile app with multiple layers of authentication to ensure security and Most advanced Level (RD service) AEPS integration from four biometric companies - Morpho, Mantra

visit here for information: https://www.roundpay.in/

Source Link: https://youtu.be/YoQIorj6C-Q

#Mobile Recharge API Provider India#mini atm machine#aadhar micro atm#Aadhaar Enabled Payment System#Recharge API Provider In India

0 notes

Photo

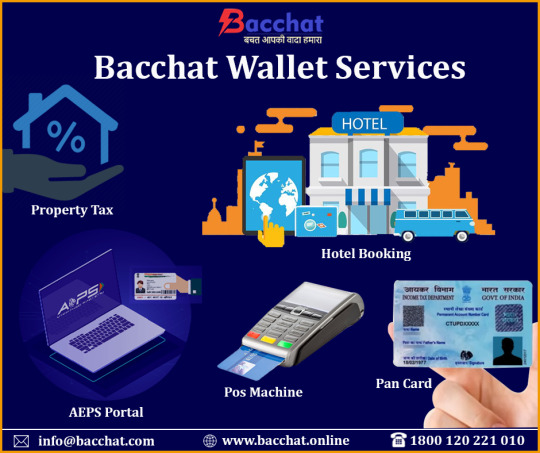

#BacchatWallet is Professional In Mobile Recharge, Money Transfer Services & POS Machine Provider in India. Bacchat Services is a unit of TelecomServices India Limited - India's leading Recharge & money transfer services since 2013. We have been serving India through our business of recharge API, Payment API, Utility Bill Payment, and, Mini ATM Machines at over 3,50,000+ retail outlets. & 1000+ distributors.

Visit👉: https://www.bacchat.online/

Phone☎️: 1800 120 221 010

Email📧:[email protected]

#online money transfer#Money Transfer Services#Mobile Recharge Services#utility services provider#Utility Payment Services#Card Swipe Machine#POS Machine#Domestic Money Transfer Services#PAN Card Service#aadhaar enabled payment system#aeps portal#mini atm machine#toll payments#Pay Toll Online#school fees payment online#online hotel booking#bulk sms service provider in india#ticket booking service#property tax online payment#credit card payment services#loan payment services#FastTag API

1 note

·

View note

Text

Micro ATM API and Software Provider Company

Micro ATM is helpful if you are running a business. It helps your customer with cash withdrawal, mini statements, and instant settlement and has long durability. Buy the Micro ATM device or API to boost your business. Check our website for more details or call us for a quick response: 9667928122

#micro atm api provider#micro atm api provider in india#micro atm api#micro atm software#best micro atm service provider in india

0 notes

Link

#api service provider#Recharge and BBPS#domestic money transfer white label#biometric micro atm machines#white label atm companies in india#Money Transfer Portal#white label atm#best aeps service provider#aeps service provider#Micro ATM Machine Business#Mini ATM

0 notes

Text

Why Your Retail Store Should Embrace Kiosk Banking?

Believe it or not, there’s a plethora of rural places around India that still don’t have access to banking services. In order to put an end to this gruelling problem, the Reserve Bank of India has been implementing measures to ensure financial inclusion. This is where Customer Service Point or Kiosk Banking comes to play. This is an initiative wherein retail shops opt for CSP registration to deliver minimalistic banking services to the rural communities.

How Customer Service Point Makes Banking Accessible?

Customer Service Points (CSP) or Kiosk banking facilities serves the following two categories:

• Villages or rural areas where bank branches are pretty much non-existent.

• Low income individuals – such as migrant or factory workers – who don’t have an ID proof/address proof to open a bank account.

Lack of access to banking facilities makes financial security and management nearly impossible. This is when CSPs or kiosk banking services are a godsend. Post successful CSP registration, retailers can offer the following facilities to their customers:

• Open a no-frills account that doesn’t have a minimum balance requirement.

• Maximum balance will be Rs 50,000.

• Rupay ATM card will be issued.

• Customers can send and receive funds.

• Fixed deposit and Recurring deposit are available.

• Maximum limit of transactions will be Rs. 10,000 per day.

• Availability of social security schemes including PMJJBY, PMSBY & APY

Benefits for Retailers Offering CSP:

CSP offered by State Bank of India is one of the best options worth considering. Pay Point India, a reliable Business Correspondent for SBI since 2011, has been providing kiosk banking services for participating retailers. Once you do the CSP registration online, your business can enjoy the following benefits:

• Generate Additional Income:

Opening up a mini banking facility for customers arriving at your store is basically a new revenue stream for you. As you work hand-in-hand with a CSP provider, you will be earning a good commission for the banking transactions performed.

• Easy to Use:

The facility offered by Pay Point India is quite intuitive and easy to setup. After training, you will get easily familiarised with its functionality. All you need is a decent PC and a reliable internet connection. The transactions are biometrically secured as well.

• Brand Equity:

Working with reputable banks like SBI definitely benefits your business by improving your goodwill and brand name in the market. This way, you will earn more loyal customers too.

• Increased Sales:

People will most likely make purchases at your store once they fulfil their banking needs at your kiosk facility, simply because it is convenient to do it all in one place. Not to mention kiosk banking also increases your store’s visibility.

Now that you realise the benefits of kiosk banking or CSP for your business, why not discuss with Pay Point India to get started? If you’d like to know the CSP registration fee or anything else, talk to the experts today.

0 notes

Text

CSP Bank Mitra: Documents Needed and Registration Procedure

Making financial products and services low-cost, accessible and affordable for low-income groups and businesses is known as financial inclusion. Banks use CSP banking points which, after getting CSP Registration, provides such services.

The majority of poor Indians live in the village area. These poor people are unable to connect to banking services. These poor people give up on these opportunities. This is where Bank CSP Provider can help them provide access to the banking system by providing associated services.

Services provided by Bank CSP Provider:-

• Send money to your bank account

• Inquiries regarding IMPS transactions/balances

• Fixed Deposit / E-KYC

• Pay cash

• Mini ATM

• Aadhaar Payment System (AEPS Facility)

• Withdrawal card / ID card

• Loan deposit / Fixed deposit

• Social Security System (PMJJY, PMSBY, APY)

• Insurance Service

• Online payment transfer

• Bank Loan

What kind of documents do you need for CSP registration?

• Police confirmation (within six months of age)

• Application form

• Two passport-sized personal photos

• PAN card (required)

• Identity card (voter ID / driver's license / passport, etc.)

• Proof of store address

• Address proof (electricity bill, power distribution card, etc.)

• NPD account

• Innovative digital banking service with e-MITRA

Who can start the kiosk banking system?

Store owners, retailers, small business owners, and even individuals can apply to set up a standing kiosk. The eligibility criteria for Bank CSP Provider are:

• Minimum age: 18 years old

• Qualifications: The person must have passed the secondary exam

• Minimum space required to install a kiosk: 100-200 square meters. leg

• Applicants need to make sure that their computers and internet are available.

Store owners or small business owners can incorporate to get CSP Registration that requires the small business to have an MSME registration. Banks must provide the equipment needed to set up a kiosk using this, such as kiosks, fingerprint scanners, and computer-compatible software.

Kiosk banking registration procedure:

• First, the customer needs to open an account without luxury.

• Next, they need to proceed to Know Your Customer Verification (KYC).

• The corresponding bank performs the KYC verification process and validates the submitted documents.

• Once the KYC process is complete, individuals are free to use their accounts to trade.

Article Source: https://applyforcspbank.finance.blog/2022/01/17/csp-bank-mitra-documents-needed-and-registration-procedure/

0 notes

Text

Advanced White Label AePS | Micro ATM | DMT Admin Portal

RBP Finivis introduced aeps, micro atm, dmt, recharges, bbps admin portal for startups to start their FinTech business and achieve success with better earning opportunities.

Aadhaar se paisye nikalne ka app

#aeps api#aeps api provider#white label aeps portal#aadhaar pay api#aeps api provider company#dmt api#dmt api provider#dmt api provider company#white label portal#recharges software#recharges api#aeps service provider#micro atm#micro atm api#matm api#mini atm api#mini atm api provider#fintech api#open banking api

1 note

·

View note

Text

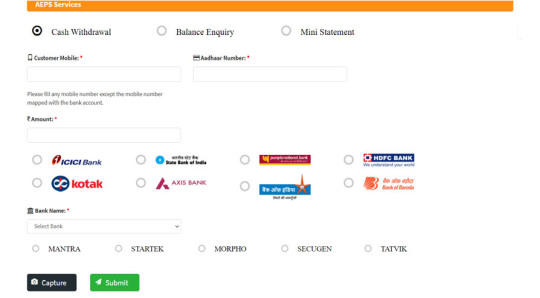

AEPS Agent Portal

Aadhaar Enabled Payment System (AEPS) is a system is one of the several FINTECH product launched by National Payments Corporation of India (NPCI) that allows people to carry out financial transactions on a Web portal, Application platform, Micro-ATM by furnishing just their AADHAAR number and verifying it with the help of their fingerprint/iris scan. After Verifying Unique Identification no given by UDAI and interacting platform customer can either withdraw cash, check balance in their account or download mini statement.

AEPS Channel Partners: Indezon is reseller for AEPS service .We appoints AEPSagent partner, distributors, white label and API Partners. Our channel partner needs to keep laptop; Mobile APP or our Micro ATM Device and Biometric device after registration process is done.

BENEFITS OF AEPS TO CUSTOMERS

Enjoy card less cash withdrawal transaction via keeping Unique no

Option to even check balance and download mini Statement

Option to select bank where Unique no is registered without remembering bank account

Safe and secure digital transaction without compromising security of data loss

No minimum amount capping and selection of multiple banks.

BENEFITS OF AEPS TO AGENTS

By becoming Indezon Agents, a has new business opportunity

Increase product line to agents and thus increase income.

Instant Commission

Instant settlement to Wallet and 24*7 Move to bank option available

Option to work in PC/Laptop

Option to work in Mobile App.

Option to work in Micro ATM based withdrawal.

HOW TO DO AEPS TRANSACTION?

A0EPS transaction is simple; you need to follow below step to complete transaction:-

Visit our registered Indezon agent’s outlet and ask for services required.

Give our agents 12 Digit Aadharno and select bank and give mobile no.

Select transaction type-Cash Withdrawal /Balance Inquiry

Select Amount and authenticate your finger print or Iris Scan as per device

Once Finger print or Iris scan is authenticated transaction is complete.

Get payment from agent along with receipt.

Get SMS confirmation from your bank.

Note: Agents need to follow agents registration process and we provide agent Services at very low price. You can find our service charges from Service plans and costing options.

0 notes

Link

0 notes

Text

Know exactly what AEPS is and its particular uses.

Aeps is a particular system which is developed by the National Payments Company of India which enables people to actually carry out the financial transactions mostly on a Micro-White Label Atm by supplying only their particular Aadhaar number and checking it with the aid of their fingerprint/iris scan.

People may not have to actually mention the particulars of their particular bank account in order to carry out these transfers. With the assistance of this kind of payment system, people will simply send money from one bank account to somehow another via their Aadhaar numbers. Just try to contact the Best Recharge API Provider.

As the particular system runs on a single server, people may transfer money from mostly their own account to any of the account, irrespective of that bank under which the particular receiver's account is run. You can easily get the Mobile Recharge Api.

This scheme would provide another layer of authentication to financial transfers, as bank records will no longer be needed to be shown when these financial transactions are being carried out, and signatures from the account holder would be used to authorize the transaction. You can also become a Mobile Recharge API Provider.

Aeps Payment Benefits

There are a host of advantages to Aeps. Some of these are listed below:

Banking and non-banking operations may be carried out by a bank correspondent. Recharge Api is also present.

Banking correspondents of particularly one bank may also conduct transactions of some other banks.

Individuals don't have to provide a debit/credit card in order to allow transfers by Aeps. Usually Recharge API Free is good.

Fingerprinting is necessary for account verification through Aeps.

Micro PoS devices may be brought to distant areas, allowing people in the remote villages to make immediate purchases. Find the best Recharge API Provider in India.

What services should be used by Aeps?

Particular 6 services are given to the citizens through Aeps. There are the following:

Funds Withdrawal

Cash Deposition

Balance Survey

Aadhaar to Aadhaar Fund Conversion

Mini Declaration

EKYC – Strongest Finger Tracking/IRIS Detection

Shift of the Aeps Fund Cap

RBI has indeed set no restrictions for transactions which are made by Aeps. However, perhaps the various particular banks have limited the transactions made through Aeps to minimize, if any, the abuse of the payment mechanism. Recharge API Providers usually make a lot of money.

Why did the Indian government introduce the Aeps program?

The government has actually set the goal of getting all people into the banking system. It is not possible, however, to fully open the particular bank branches in all of the remote villages. As a result, the government has indeed come up mostly with AePS, where people from distant areas can conveniently be able to actually send or receive money and uses other kind of financial and otherwise non-financial banking facilities with now the help of further Micro ATMs and otherwise bank correspondents. You should always try to get Recharge API with High Margin.

Transactions made via this channel include biometric verification through the best detection of the index finger or iris. Signatures can be further forged, but once again fingerprints/iris cannot be forged. This made transfers safer. Api Recharge is actually very beneficial.

0 notes

Text

Bias Tees Market

The “Global Bias Tees Market” provides up-to-date information on current and future industry trends, enabling readers to identify products and services to increase revenue growth and profitability. This research report provides in-depth study of all key factors affecting global and regional markets, including drivers, imprisonment, threats, challenges, opportunities and industry-specific trends. This report cites worldwide trust and specimens with leading player’s downstream and upstream analysis.

Request Sample Copy of this Report@: https://www.theresearchinsights.com/request_sample.php?id=302918

This market research reports on analyzes the growth prospects for the key vendors operating in this market space including Analog Microwave Design, API Technologies - Inmet, AtlanTecRF, Centric RF, Clear Microwave, Inc, Crystek Corporation, ETL Systems, Fairview Microwave, HYPERLABS Inc, JFW Industries, Jyebao, L-3 Narda-ATM, Marki Microwave, Maury Microwave, MC2-Technologies, MECA, Metropole Products Inc, Mini Circuits, MP Device, Pasternack Enterprises Inc

The Bias Tees Market has witnessed continuous growth in the past few years and is projected to grow even further during the forecast period. In addition to the complete assessment of the market, the report presents Future trend, Current Growth Factors, attentive opinions, facts, historical data, and statistically supported and industry validated market data.

This report segments the Bias Tees market on the basis of Types are

DC to 3 GHz

DC to 6 GHz

5 to 10 GHz

On the basis of Application, the Bias Tees market is segmented into

Commercial

Military

Space

Others

Asia Pacific is the most advanced market for Bias Tees. This growth is largely driven by factors such as population perspective improvement and increased awareness. In addition, Latin America’s value-based healthcare services market will expand to a significant CAGR. Brazil and Mexico are leading the value-based health care services market in the region because of the favorable businesses that governments are promoting. Moreover, as research and development develops, market growth in Latin America will accelerate.

Get Reasonable Discount on this Premium Report @: https://www.theresearchinsights.com/ask_for_discount.php?id=302918

Key questions answered in the report include:

What will the market size and the growth rate be in 2025?

What are the key factors driving the Global Bias Tees Market?

What are the key market trends impacting the growth of the Global Bias Tees Market?

What are the challenges to market growth?

Who are the key vendors in the Global Bias Tees Market?

What are the market opportunities and threats faced by the vendors in the Global Bias Tees Market?

Trending factors influencing the market shares of the Americas, APAC, Europe, and MEA.

This report provides an effective business outlook, different case studies from various top-level industry experts, business owners, and policymakers have been included to get a clear vision about business methodologies to the readers. SWOT and Porter’s Five model have been used for analyzing the Global Bias Tees Market on the basis of strengths, challenges and Global opportunities in front of the businesses.

Enquiry before Buying@ https://www.theresearchinsights.com/enquiry_before_buying.php?id=302918

*If you need anything more than these then let us know and we will prepare the report according to your requirement.

About us:

The Research Insights – A global leader in analytics, research and advisory that can assist you to renovate your business and modify your approach. With us, you will learn to take decisions intrepidly. We make sense of drawbacks, opportunities, circumstances, estimations and information using our experienced skills and verified methodologies. Our research reports will give you an exceptional experience of innovative solutions and outcomes. We have effectively steered businesses all over the world with our market research reports and are outstandingly positioned to lead digital transformations. Thus, we craft greater value for clients by presenting advanced opportunities in the global market.

Contact us:

Robin

Sales manager

Contact number: +91-996-067-0000

https://www.theresearchinsights.com

0 notes