#community-based P2P model

Explore tagged Tumblr posts

Text

Powering the Future: A Comprehensive Look at the Peer-to-Peer Energy Trading Platforms Market Through 2035

Key Market Drivers & Trends

The peer-to-peer (P2P) energy trading platforms market is rapidly evolving, fueled by significant global shifts in energy production, consumption, and management. One of the primary forces behind this transformation is the growing adoption of distributed energy resources (DERs), which include small-scale power generation sources like rooftop solar panels, home battery systems, and small wind turbines. This decentralized approach is empowering consumers to become "prosumers," both producing and consuming electricity.

This transformation aligns with the broader push toward energy democratization, where individuals and communities have greater control over energy generation and consumption. As this model gains popularity, peer-to-peer energy trading platforms are providing the infrastructure to support localized energy exchanges, allowing users to buy and sell electricity directly.

Technological advancements, particularly in blockchain and smart grid systems, are further accelerating the development of these platforms. Blockchain, with its ability to create secure and transparent transactions, is a natural fit for the energy trading ecosystem. Smart grids, which integrate digital technology into the electricity network, enable real-time data collection and intelligent energy distribution.

Supportive regulatory frameworks are also playing a critical role, particularly in markets that prioritize energy independence and sustainability. As nations aim to reduce carbon footprints and transition to cleaner energy systems, the decentralized nature of P2P trading fits neatly into long-term policy goals.

The integration of peer-to-peer platforms with virtual power plants (VPPs)—which aggregate energy from multiple sources to operate as a unified entity—has become another key trend. These integrations are enhancing grid resilience and improving energy management, especially during peak demand periods. Moreover, energy tokenization (turning energy assets into tradable tokens) and the growth of community-based energy trading initiatives are gaining popularity among consumers seeking to localize energy control and economic benefits.

The rise of microgrid-as-a-service (MaaS) business models and the growing adoption of Internet of Things (IoT) and smart home ecosystems are further enhancing the appeal of P2P trading systems. These digital environments provide the data and connectivity needed to streamline energy transactions, especially in developed markets with advanced infrastructure.

Get Sample Copy @ https://www.meticulousresearch.com/download-sample-report/cp_id=6183?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=23-05-2025

Key Challenges

Despite strong momentum, the peer-to-peer energy trading platforms market faces several barriers that could hinder growth if not adequately addressed. Regulatory uncertainty is one of the most prominent issues. In many countries, energy markets remain heavily regulated, and the lack of clear policies around decentralized energy trading can slow innovation and investment.

Grid integration is another complex challenge. Distributed trading systems must coexist with existing centralized grid infrastructures, which can require significant technical adjustments and cooperation from traditional utilities. High initial costs for implementing these systems—especially in terms of software, hardware, and installation—can also deter adoption.

Cybersecurity and data privacy concerns are increasingly relevant, particularly given the reliance on connected systems and personal energy data. Ensuring that platforms are secure and compliant with evolving privacy regulations is essential to building trust among users.

Technology scalability remains a hurdle, particularly for startups and smaller providers aiming to expand their solutions. Additionally, the behavioral shift required among consumers—many of whom are unfamiliar with energy trading or hesitant to engage in real-time market interactions—can be a barrier to widespread adoption.

Another challenge is maintaining liquidity and trading volume in local markets. For P2P trading to be viable, there must be a critical mass of participants, which isn’t always achievable in rural or underdeveloped regions.

Growth Opportunities

Despite these challenges, the peer-to-peer energy trading platforms market presents several strong growth opportunities. One of the most promising is integration with virtual power plants (VPPs). By aggregating multiple decentralized energy sources, P2P platforms can support grid balancing and open up new business models.

Emerging markets, particularly in regions with growing renewable energy deployment, also present untapped potential. These markets are often characterized by unreliable energy access and are looking for innovative solutions to improve energy security. P2P platforms can offer flexible and localized alternatives to large-scale infrastructure projects.

Electric vehicle (EV) charging infrastructure is another key area of synergy. EVs are essentially mobile energy storage units, and integrating them with P2P platforms enables users to buy, sell, and store energy on demand. As EV adoption grows, this integration will likely become an essential feature of modern energy systems.

Artificial intelligence (AI) and machine learning (ML) are also starting to play a role in optimizing energy trading. These technologies can analyze consumption patterns, predict energy prices, and automate trading decisions, making the platforms more efficient and user-friendly.

Market Segmentation Highlights

By Component

In 2025, the Software Platforms segment is projected to hold the largest market share. These platforms are the backbone of the entire trading process, enabling real-time transactions, smart contract execution, and user interface functionalities. As digital energy trading becomes more mainstream, the demand for robust, user-centric software will continue to rise.

Meanwhile, Hardware Infrastructure is gaining traction in areas with strong smart grid foundations. These components—such as meters, sensors, and gateways—are essential for data acquisition and automation.

The Services segment is expected to grow at the fastest rate, driven by rising demand for consulting, deployment, and maintenance. As the complexity of systems increases, service providers will play a crucial role in enabling smooth implementation and optimization.

Get Full Report @ https://www.meticulousresearch.com/product/peer-to-peer-energy-trading-platforms-market-6183?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=23-05-2025

By Platform Type

Blockchain-Based Platforms are forecast to dominate the market in 2025 due to their superior transparency, data security, and decentralized architecture. These platforms are particularly effective in facilitating trustless transactions, a necessity in peer-based exchanges.

However, Hybrid Solutions, which combine blockchain with traditional or cloud-based systems, are set to expand rapidly. These platforms offer enhanced flexibility and performance while addressing scalability concerns and integrating with legacy systems.

By Energy Type

The Solar segment is expected to maintain the largest share of the market. Rooftop solar installations continue to rise globally, particularly in residential settings where individual homeowners are producing excess energy.

That said, Storage-Based Trading will experience the fastest growth. With battery technologies becoming more affordable and efficient, energy storage is enabling users to trade stored electricity based on real-time market conditions, significantly enhancing grid flexibility.

By End User

Residential users are currently the largest contributors to the peer-to-peer energy trading platforms market. Rooftop solar adoption, home energy management systems, and growing awareness of energy independence are encouraging residential prosumers to engage in localized energy trading.

Microgrid Communities, however, are poised for the fastest growth. These community-driven initiatives promote resilience and self-sufficiency, particularly in remote or disaster-prone areas where centralized grid access is limited or unreliable.

By Geography

North America is expected to lead the global market in 2025. The region’s well-developed smart grid infrastructure, high penetration of DERs, and favorable regulatory environment for innovation have made it a hub for peer-to-peer energy solutions.

Europe is the second-largest market, bolstered by strong sustainability policies, clean energy mandates, and consumer-centric energy models.

Asia-Pacific, on the other hand, is expected to register the fastest growth rate. Countries in this region are experiencing rapid urbanization, increased energy consumption, and government-led smart grid programs. These factors are making Asia-Pacific a hotbed for decentralized energy experimentation and investment.

Competitive Landscape

The global peer-to-peer energy trading platforms market is shaped by a highly diverse competitive ecosystem. It includes major energy technology companies, blockchain specialists, grid technology providers, and forward-thinking startups. These players are categorized into industry leaders, market differentiators, innovators, and emerging players, each employing unique strategies.

Leading companies are developing integrated solutions that combine blockchain, AI, and smart grid functionalities. These offerings not only improve trading efficiency but also ensure compatibility with diverse regulatory and infrastructure conditions worldwide.

Prominent players in this space include Power Ledger Ltd, LO3 Energy Inc., ConsenSys AG, Energy Web Foundation, Electron Ltd, Next Kraftwerke GmbH, Enel X Global Retail S.r.l., Piclo Ltd, Tibber AS, SunContract d.o.o., Ponton GmbH, Grid Singularity GmbH, Powerpeers B.V., Voltus Inc., and Lition Energy GmbH, among others.Get Sample Copy @https://www.meticulousresearch.com/download-sample-report/cp_id=6183?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=23-05-2025

0 notes

Text

SMS Firewall Market Landscape: Opportunities and Competitive Insights 2032

The SMS Firewall Market Size was valued at USD 2.7 Billion in 2023. It is expected to grow to USD 5.9 Billion by 2032 and grow at a CAGR of 9.2% over the forecast period of 2024-2032

The SMS Firewall market is witnessing rapid expansion as organizations and telecom providers strengthen their defenses against messaging fraud and cyber threats. With increasing incidents of SMS-based phishing, grey routes, and spam, the need for robust firewall solutions has never been greater. As global SMS traffic rises, businesses are investing in advanced security systems to ensure compliance and prevent revenue leakage.

The SMS Firewall market continues to grow as mobile network operators (MNOs) and enterprises recognize the importance of filtering and monitoring SMS traffic. Fraudulent messaging, including SMS pumping, smishing, and SIM box fraud, has led to financial losses and damaged customer trust. To counter these threats, companies are deploying AI-powered SMS firewalls, real-time analytics, and threat intelligence solutions, driving market expansion.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3535

Market Keyplayers:

AdaptiveMobile Security (A2P SMS Firewall)

BICS (SMS Firewall Solution)

Cellusys (Cellusys SMS Firewall)

Comviva (Mobility Services Platform)

Infobip Ltd. (Infobip SMS Firewall)

Mobileum (Mobileum SMS Firewall)

Monty Mobile (Monty SMS Firewall)

Proofpoint (Proofpoint SMS Security)

Sinch (Sinch A2P Messaging)

TATA Communications (TATA SMS Firewall)

Twilio (Twilio Programmable Messaging)

Nexmo (Vonage) (Nexmo SMS API)

CloudMark (CloudMark Messaging Security)

Fortinet (FortiGate SMS Firewall)

Symantec (Symantec Messaging Gateway)

OpenMarket (OpenMarket SMS Messaging)

Viber (Viber Business Messages)

Amdocs (Amdocs Messaging Solutions)

Zenvia (Zenvia SMS Messaging)

MessageBird (MessageBird SMS API)

Market Trends Driving Growth

1. Rising SMS Fraud and Security Threats

The increase in smishing (SMS phishing) and grey route messaging has forced telecom providers to implement robust SMS firewall solutions. These security threats not only affect end-users but also lead to significant revenue losses for network operators.

2. Growth of A2P Messaging and Monetization Efforts

Application-to-Person (A2P) messaging is experiencing high demand, especially in industries such as banking, e-commerce, and healthcare. To protect revenue streams, operators are turning to SMS firewalls that ensure only authorized traffic is delivered.

3. AI-Powered SMS Filtering and Analytics

Artificial Intelligence (AI) and machine learning are transforming SMS firewall technology. AI-driven firewalls can detect patterns of fraudulent messages in real time, reducing false positives and improving the accuracy of message filtering.

4. Regulatory Compliance and Data Protection

Governments and regulatory bodies are enforcing stricter policies around SMS security, such as GDPR, HIPAA, and telecom-specific guidelines. This has accelerated the adoption of SMS firewalls that offer compliance-focused solutions.

5. Cloud-Based and SaaS SMS Firewalls

Cloud-based firewall solutions are gaining traction due to their scalability and cost-effectiveness. Businesses are increasingly adopting firewall-as-a-service (FaaS) models to secure their SMS traffic without investing in expensive hardware infrastructure.

Enquiry of This Report: https://www.snsinsider.com/enquiry/3535

Market Segmentation:

By Component

SMS Firewall Platform

Services

By SMS Type

A2P Messaging

P2P Messaging

Others

By SMS Traffic

National SMS traffic

International SMS traffic

By Deployment

On-premise

Cloud

Market Analysis and Current Landscape

Key drivers of this growth include:

Surge in SMS fraud incidents: Mobile fraud cases are increasing, making security solutions essential for telecom providers.

Expansion of enterprise messaging: Businesses are using SMS for authentication, notifications, and marketing, requiring secure message filtering.

Advancements in AI and automation: AI-powered fraud detection tools are improving the efficiency of SMS firewalls.

Telecom operators’ focus on revenue assurance: MNOs are monetizing A2P traffic by blocking fraudulent and grey-route SMS messages.

While the market presents significant opportunities, challenges such as high implementation costs, interoperability issues, and evolving fraud tactics remain concerns. However, continued technological advancements are expected to mitigate these challenges.

Regional Analysis: Market Growth Across Key Geographies

North America

North America leads the SMS Firewall market due to the high adoption of mobile security solutions and stringent regulatory policies. Major players in the telecom sector are heavily investing in firewall technologies to combat SMS fraud.

Europe

Europe follows closely, with increased demand for SMS security solutions driven by GDPR compliance and a growing enterprise messaging market. Businesses are prioritizing data protection and fraud prevention, fueling SMS firewall adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, thanks to the rapid expansion of mobile networks and A2P messaging. Countries such as India and China are witnessing a surge in SMS-based financial transactions, making security a top priority for telecom providers.

Middle East & Africa

The Middle East & Africa region is also seeing significant growth, with mobile operators investing in firewall solutions to prevent revenue leakage and enhance SMS traffic security. The rise in digital banking and mobile payments is further driving demand for secure messaging.

Latin America

Latin America is experiencing gradual growth in the SMS Firewall market as businesses and telecom providers recognize the importance of securing SMS communications. The adoption of mobile-based services and online transactions is expected to boost demand.

Key Factors Shaping the Market

Several factors are influencing the growth and adoption of SMS firewall solutions:

Regulatory Compliance Requirements – Stricter telecom regulations are pushing operators to invest in SMS security solutions.

Increase in A2P Messaging Volume – Businesses rely heavily on A2P messaging for customer engagement, requiring better security.

Advanced Fraud Tactics – Fraudsters are constantly developing new ways to exploit SMS vulnerabilities, necessitating advanced protection measures.

Network Operator Monetization Strategies – MNOs are increasingly using firewalls to block grey-route traffic and maximize revenue.

Technological Innovations – AI-driven filtering, real-time threat intelligence, and automated SMS security solutions are enhancing firewall efficiency.

Future Prospects: What Lies Ahead?

The future of the SMS Firewall market looks promising, with several key developments expected to shape its growth:

1. AI-Driven Threat Detection

AI will play an even greater role in identifying fraudulent SMS patterns in real time, reducing response times and improving firewall accuracy.

2. Blockchain-Based SMS Security

Blockchain technology is being explored to enhance the transparency and authenticity of SMS transactions, providing an added layer of security.

3. Expansion of Firewall-as-a-Service (FaaS)

More businesses and telecom providers will adopt cloud-based firewall solutions, allowing for flexible and cost-effective SMS security.

4. Strengthening of Global Regulatory Policies

Governments will continue to enforce stricter regulations, compelling businesses to prioritize SMS security compliance.

5. Rise of 5G and Its Impact on Messaging Security

With the widespread adoption of 5G, the SMS Firewall market will need to adapt to new security challenges and opportunities arising from increased network speeds and IoT connectivity.

Access Complete Report: https://www.snsinsider.com/reports/sms-firewall-market-3535

Conclusion

The SMS Firewall market is evolving rapidly as organizations and telecom providers prioritize SMS security in response to growing fraud threats. As technology advances and regulatory frameworks strengthen, the demand for intelligent, AI-powered, and cloud-based firewall solutions will continue to rise. With businesses increasingly relying on SMS for communication, the market is set to play a crucial role in securing global messaging networks and ensuring safe and reliable communication for consumers and enterprises alike.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#SMS Firewall market#SMS Firewall market Analysis#SMS Firewall market Scope#SMS Firewall market Growth#SMS Firewall market Trends

0 notes

Text

How Web3 Can Enable Peer-to-Peer Energy Trading Using Blockchain

Web3 has begun to change many industries, and its entry into the energy domain is most effective. This decentralized peer-to-peer trading eliminates the role of intermediaries, enabling individuals and companies to trade energy through Web3 development services. The transparency, security, and efficiency provided by blockchain technology create a healthy environment for peer-to-peer (P2P) energy trading. Through Web3 Development Services, these technologies become seamlessly integrated, allowing businesses to set up scalable and more efficient energy trading platforms. This innovation opens new avenues for direct transactions between energy consumers and producers, hence cutting costs and promoting sustainability. It makes the energy exchange democratized by bringing it close to users through Web3 control over consumption and optimization of energy usage, contributing to a greener future. Further, smart grids integrated with blockchain technology can enhance an efficient distribution of electricity through surplus power sharing and utilization. Finally, with an ever-increasing demand for energy around the world, the decentralized approach will certainly create a better, scalable, and more resilient approach toward traditional power grids for urban and rural communities alike.

The Need for Decentralized Energy Trading

Traditional energy markets generally rely on centralized grids and utility companies for the delivery of electric energy. Such systems usually experience challenges such as high transmission costs, regulatory constraints, and mismatches in supply and demand. Moreover, the centralized nature of such authorities brings increased vulnerability to power outages and monopolistic pricing. Increasing adoption of renewable energy sources such as solar and wind would benefit from a decentralized scenario whereby the prosumers (producers and consumers) sell excess energy directly to users in need, thereby paving the way for a more resilient and cost-effective system. Not only does this model give financial benefits to energy producers, but it also reduces their dependence on fossil fuels and promotes a cleaner energy future in a sustainable manner. In addition, decentralization avoids a central point of failure to increase the dependability of energy distribution, especially in regions vulnerable to disasters or underserved areas where traditional grids are unlikely to work efficiently. By allowing direct trade among users, decentralized networks of energy promote local energy independence and thus diminish the reliance on exogenous suppliers in favor of creating community-based energy programs.

How Blockchain Facilitates P2P Energy Trading

A mode for perfect peer-to-peer exchange of energy trading for security, transparency, and tamper-proof transactions is attained via blockchain technology. The following are some of the greatly esteemed benefits:

Smart Contracts: Automatically govern energy transactions, using specified conditions that maintain trust while minimizing human intervention. Smart contracts manage disputes and enforce agreements without a need for third-party intervention. Contracting can take a further step and allow dynamic pricing systems, whereby energy prices vary with real-time supply and demand. They can also trigger automated billing and instant payment settlement, therefore further reducing delay and loss in efficiency.

Transparency: A decentralized ledger tracks every transaction, allowing real-time visibility and the ability to deter fraud. Each player in the network can verify the transactions, therefore, enhancing their credibility while also diminishing the risk of manipulation. This type of transparency guarantees fairness; hence, trust is developed between buyers and sellers in the energy market. The immutable records of energy transactions can also serve as a tool for regulators and policymakers needing to monitor market activities without interfering directly in transactions.

Security: Data integrity is guaranteed by cryptographic techniques, which also protect users from any kind of cyberattack. In contrast to traditional energy networks, blockchain systems are heavy-proofed against illegitimate access or hacking. Furthermore, decentralized identity solutions strengthen authentication for users thereby preventing fraudulent energy claims. Use of blockchain also lessens risks on double-spend and guarantees energy transactions to be accurate and verifiable at any point in time.

Reduced Costs: Transaction costs are lowered by eliminating intermediaries, thus making energy trading more affordable. With the elimination of intermediaries, consumers and producers can negotiate better prices with more financial rewards. The elimination of bureaucracy also accelerates the process of energy getting to its destination, making transactions almost immediate. Lowering transaction costs can encourage increased participation that will bring many households and businesses into the decentralized energy market.

Improved Grid Efficiency: With distributed trading, energy supply-demand balance will be achieved and less pressure applied to traditional grids; this will also help save energy. Smart contracts will enable dynamic energy dispatch to divert surplus energy where it is needed most. Thereby enabling utilization of energy resources in real time to stabilize the grid where energy supply fluctuates.

Web3-Based Energy Marketplaces

Web3-powered platforms allow users to easily find an energy marketplace and trade their own energy with each other, using dApps that link both energy producers and consumers as well as transaction facilitation through blockchain technology. Users will be able to set their tariffs, understand how the energy is used, and even automate payments for energy using digital tokens or cryptocurrencies. Further, AI and IoT will further optimize the energy distribution systems and improve the efficiency of grids. These efforts would support energy democratization and improve grid stability, allowing a smarter and more flexible energy ecosystem. Decentralized energy markets, on the other hand, would empower communities and allow the use of microgrids in an independent manner, encouraging economic development in distant areas. Advancing these web marketplaces will also come up with such features like real-time pricing among site consumers and AI-powered demand forecasts for further improving energy trading efficiency and affordability. Finally, these new types of energy marketplaces offer opportunities for enterprises and start-ups focused on creating solutions that replicate the principles of sustainability and decentralization, ushering in a new era of energy entrepreneurship.

Challenges and Future Prospects

Though Web3-based energy trading has lots of real-world potential, we still face issues such as regulatory uncertainty, technological adoption issues, and scalability. Governments and energy regulators should put frameworks into place that permit blockchain-based trading of energy while maintaining the reliability of grids. Awareness and education on blockchain for energy trading would be important in supporting the movement toward adoption. Many consumers and businesses alike are not very aware of blockchain technology and the advantages that it may contribute to the energy sector. High scalability solutions and interoperability will, as the Web3 evolves, engender smooth adoption into the energy sector. Technologies like Layer 2 solutions and cross-chain interoperability will work on tackling the existing bottlenecks in making blockchain-based energy trading more efficient and viable for public participation. Also, a close collaboration between blockchain innovators and energy providers will boost adoption by integrating decentralised solutions into the existing infrastructure, creating a hybridization of both traditional and modern systems for energy distribution. To enable states to act as agents of change, an active partnership among regulatory authorities, blockchain developers, and energy distributors should be there to underpin innovative policies that secure energy safety. With the eventual elimination of these barriers, the vision of a decentralized energy economy powered by peer-to-peer trading will begin to find realization.

Conclusion

The incumbent Web3 and blockchain technology on energy are applicable for forging an energy market that is more efficient, decentralized, and sustainable. With the help of a Web3 development company, businesses and individuals can use blockchain-powered energy trades through private networks and peer-to-peer applications, thus reducing their dependence on traditional energy grids. Increasing acceptance of such technology would make peer-to-peer energy trading a vital component of the future energy ecosystem with economic and environmental gains, making energy distribution more equitable and fast-tracking progress toward renewables around the world. This is not merely a better approach towards energy distribution; it will also hasten global changes to cleaner energy sources and improve wellness in the world as a whole. As the infrastructure of Web3 continues to grow, blockchain technology coupled with AI and IoT will open up an entirely new sphere of possibilities for even greater accessibility and efficiency in using decentralized energy trading. To achieve this vision, governments, technology enterprises, and energy providers will have to work hand in hand so that these decentralized energy solutions will be practically feasible and beneficial to everyone. Energy of the Future will be Decentralized and Web3 will lead the way in making this transformation into reality.

0 notes

Text

How to Create a Custom Blockchain for Your Cryptocurrency

Blockchain technology has revolutionized industries by enabling decentralized and secure transactions. If you're planning to create a cryptocurrency, developing a custom blockchain is a crucial step that offers complete control over functionalities, security, and governance. This guide will walk you through the key steps to creating a blockchain from scratch for your cryptocurrency.

1. Understanding the Need for a Custom Blockchain

Before diving into development, consider why you need a custom blockchain instead of using existing ones like Ethereum, Binance Smart Chain, or Solana. Here are some reasons:

Full Control: A custom blockchain allows complete customization of consensus mechanisms, transaction speeds, security measures, and governance models.

Scalability: Public blockchains can face congestion. A custom blockchain can be optimized for specific use cases.

Security: Control over cryptographic standards and node management improves security.

Unique Features: You can integrate smart contracts, privacy settings, and tokenomics tailored to your project’s needs.

2. Choose the Blockchain Architecture

There are different blockchain architectures to consider:

Public Blockchain: Open to anyone (e.g., Bitcoin, Ethereum). Suitable for decentralized cryptocurrencies.

Private Blockchain: Restricted access, ideal for enterprises and private transactions.

Consortium Blockchain: Partially decentralized, controlled by a group of entities. Useful for inter-organizational networks.

For a cryptocurrency, a public blockchain is the most common choice to ensure decentralization.

3. Select a Consensus Mechanism

The consensus mechanism determines how transactions are validated. Popular options include:

Proof of Work (PoW): Used by Bitcoin, requires computational power for mining, making it secure but energy-intensive.

Proof of Stake (PoS): Used by Ethereum 2.0, validators stake tokens instead of mining, reducing energy consumption.

Delegated Proof of Stake (DPoS): A variant of PoS where users vote for validators. Faster and more scalable.

Proof of Authority (PoA): Suitable for private blockchains, where only authorized nodes validate transactions.

For a cryptocurrency development, PoS or DPoS is preferred due to lower energy consumption and faster transaction speeds.

4. Define Tokenomics and Governance

Your blockchain must have a well-defined tokenomics model, which includes:

Total Supply: Fixed (like Bitcoin’s 21M supply) or inflationary (like Ethereum’s unlimited issuance).

Mining/Staking Rewards: How validators earn rewards.

Transaction Fees: Flat or dynamic fees based on network demand.

Token Utility: Usage within the ecosystem (payments, governance, staking, etc.).

Governance Model: Decision-making mechanisms (centralized, decentralized, DAO-based).

5. Develop the Blockchain Core

To create your blockchain, you need programming knowledge in C++, Python, Rust, or Go. Key steps include:

1. Set Up a P2P Network

Define how nodes communicate and sync transactions.

Implement node discovery and connection protocols.

2. Implement Cryptographic Security

Use cryptographic hashing (SHA-256, Keccak) for transaction security.

Implement digital signatures and key management for wallets.

3. Develop Smart Contracts (If Needed)

If your blockchain supports dApps, create a smart contract execution layer (like Ethereum’s EVM).

Use Solidity, Rust, or Vyper for smart contract coding.

4. Create a Block Structure

Each block should contain:

Block header (timestamp, previous block hash, nonce)

List of transactions

Merkle root (for transaction verification)

5. Implement Consensus Mechanism

Code the rules for PoS, PoW, or other mechanisms.

Design validator selection and slashing conditions (for PoS-based chains).

6. Build a Wallet and Explorer

1. Cryptocurrency Wallet

A user-friendly interface for sending, receiving, and storing tokens.

Can be web-based, mobile, or hardware-based.

Use cryptographic libraries (like OpenSSL, Bouncy Castle) for security.

2. Blockchain Explorer

A tool for tracking transactions and network activity.

Develop using web frameworks like React, Angular, or Vue.

Connect with blockchain nodes via API to fetch real-time data.

7. Deploy Nodes and Secure the Network

1. Launch Full Nodes

Deploy nodes globally to increase network decentralization.

Use cloud services (AWS, Google Cloud, Digital Ocean) or self-hosted servers.

2. Implement Security Measures

51% Attack Protection: Implement hybrid consensus or checkpointing.

DDoS Protection: Use rate limiting, node whitelisting, and traffic monitoring.

Private Key Security: Secure wallets with multi-signature authentication.

8. Test the Blockchain

Before launching publicly, conduct thorough testing:

Unit Testing: Test individual blockchain components.

Testnet Deployment: Deploy a testnet for real-world simulations.

Bug Bounties: Offer incentives to developers for finding vulnerabilities.

9. Mainnet Launch and Community Building

Once testing is complete:

Launch the Mainnet: Transition from testnet to a fully operational blockchain.

List on Exchanges: Partner with crypto exchanges for liquidity.

Build a Community: Promote adoption through social media, forums, and partnerships.

Continuous Updates: Improve scalability, security, and user experience over time.

Conclusion

Creating a custom blockchain for your cryptocurrency is a complex but rewarding process. By defining your architecture, choosing the right consensus mechanism, implementing security measures, and engaging the community, you can build a scalable and secure blockchain ecosystem. Whether you aim for financial transactions, decentralized applications, or enterprise solutions, a well-designed blockchain can drive long-term success.

0 notes

Text

The Future of Crowdfunding: Exploring Blockchain-Based Funding Platforms

Crowdfunding has revolutionized the way individuals and businesses raise funds for projects, enabling entrepreneurs to bypass traditional funding channels and connect directly with supporters. However, as the landscape of crowdfunding continues to evolve, blockchain technology is emerging as a transformative force. Blockchain-based funding platforms offer a new level of transparency, efficiency, and inclusivity, promising to reshape the crowdfunding industry. In this blog, we'll explore how blockchain is revolutionizing crowdfunding clone script and what the future holds for this innovative funding model.

What is Blockchain Crowdfunding?

Blockchain crowdfunding leverages decentralized ledger technology to facilitate fundraising. Unlike traditional platforms, blockchain-based systems operate on smart contracts, which are self-executing agreements with the terms directly written into code. These platforms use cryptocurrencies or tokens instead of fiat money, enabling borderless transactions and enhanced security.

Benefits of Blockchain-Based Crowdfunding Platforms

1. Enhanced Transparency

Blockchain’s immutable ledger ensures that all transactions are recorded and accessible to everyone involved. This transparency helps build trust between project creators and backers, reducing the risk of fraud.

2. Lower Fees

Traditional crowdfunding platforms often charge significant fees for their services. Blockchain platforms, by removing intermediaries, can drastically reduce transaction costs, allowing more funds to go directly to the project.

3. Global Accessibility

Blockchain eliminates geographical barriers, enabling anyone with an internet connection to participate in crowdfunding campaigns. This inclusivity broadens the pool of potential backers and increases the chances of funding success.

4. Decentralized Governance

With blockchain, decision-making can be decentralized, allowing backers to have a say in the project’s direction. This feature fosters a stronger sense of community and engagement.

5. Tokenization and Rewards

Blockchain enables project creators to issue tokens that can represent ownership, rewards, or future value. These tokens can be traded on cryptocurrency exchanges, providing liquidity and additional incentives for backers.

6. P2P Lending Software Platforms

An individual or business organization who’s looking into setting up lending fintech should consider using a crowdfunding fundraising script for effective growth and development. It is very easy to integrate into crowdfunding websites for campaign management.

1. Loan Rates & EMI Calculator

2. Loan Origination

3. Email Notification

4. Credit Scores

5. Loan Terms

6. Loan Feedback

7. Social Media

These are a few amazing features P2P Lending Software has got to offer. It offers many more features to control the crowdfunding lending process.

Challenges in Blockchain Crowdfunding

Despite its potential, blockchain-based crowdfunding faces several challenges:

Regulatory Uncertainty: The legal status of cryptocurrencies and tokens varies by country, posing challenges for global campaigns.

Technical Barriers: Understanding blockchain technology and cryptocurrencies can be daunting for non-technical users.

Market Volatility: Cryptocurrency prices are highly volatile, which can affect the value of funds raised.

Security Concerns: While blockchain itself is secure, associated platforms and wallets can be vulnerable to hacks.

Successful Examples of Blockchain Crowdfunding

Several platforms and projects have successfully utilized blockchain for crowdfunding:

KickICO: A blockchain-based crowdfunding platform that allows users to launch ICOs (Initial Coin Offerings) and blockchain projects.

Ethereum: Many blockchain projects have raised funds through token sales or ICOs on the Ethereum network.

DAO Maker: Focused on retail-oriented crowdfunding, this platform offers token-based community participation.

The Future of Blockchain Crowdfunding

The integration of blockchain into crowdfunding is still in its early stages, but its potential is undeniable. As technology matures and regulatory frameworks become clearer, we can expect:

Increased Adoption: More startups and established companies will turn to blockchain-based crowdfunding as a viable alternative to traditional methods.

Interoperability: Cross-platform compatibility will allow seamless collaboration and token exchange across different blockchains.

Enhanced User Experience: Simplified interfaces and educational resources will make blockchain crowdfunding accessible to a broader audience.

Regulatory Evolution: Governments and regulatory bodies are likely to develop clearer guidelines, fostering trust and reducing risks for participants.

Conclusion

Blockchain-based crowdfunding platforms represent a significant leap forward in the world of fundraising. By combining transparency, security, and inclusivity, these platforms have the potential to democratize funding and empower innovators worldwide. While challenges remain, the future of crowdfunding software solution is undeniably intertwined with the continued advancement of blockchain technology. Entrepreneurs, investors, and backers alike should keep an eye on this exciting evolution as it unfolds.

0 notes

Text

Indonesia Digital Lending Market- Empowering Financial Access Through Technology

The Indonesia Digital Lending Market is undergoing a transformative evolution, reshaping the financial ecosystem with innovative solutions tailored to the country’s unique needs. Fueled by rapid digitalization, government initiatives, and an increasingly tech-savvy population, digital lending is revolutionizing access to credit in Southeast Asia’s largest economy. But how profound is this transformation, and what does the future hold for this burgeoning industry?

The Indonesia Digital Lending Market reached an estimated value of USD 14.8 billion in 2023 and is projected to grow at a CAGR of 25% through 2028. This surge is driven by rising smartphone adoption, expanding internet penetration, and growing demand for inclusive financial services.

Key Market Insights

Fintech Dominance: Over 46% of Indonesians have used fintech lending apps like Akulaku, with platforms such as Kredivo close behind at 43%.

Rural Financial Inclusion: Digital lending has enabled underserved communities in rural Indonesia to access credit, previously hindered by traditional banking barriers.

Government Support: Initiatives like National Digital Economy Blueprint 2025 aim to drive financial inclusion and promote cashless transactions.

Trends Shaping the Indonesia Digital Lending Market

1. Rise of Peer-to-Peer (P2P) Lending Platforms: P2P lending is one of the fastest-growing segments in the digital lending market. These platforms connect borrowers directly with lenders, eliminating intermediaries and offering competitive interest rates.The P2P lending sector is expected to grow at a CAGR of 27%, fueled by increasing trust in fintech solutions.

2. Buy Now, Pay Later (BNPL) Adoption: BNPL services are rapidly gaining traction among Indonesia’s younger population, particularly for e-commerce transactions. BNPL accounted for 18% of digital lending transactions in 2023, with platforms like Akulaku and Kredivo leading the market.

3. Focus on Artificial Intelligence for Credit Scoring

AI and machine learning are redefining credit scoring models, enabling lenders to assess risk accurately and expand credit access to previously excluded groups. By 2025, over 60% of digital lenders in Indonesia are expected to integrate AI-driven credit scoring systems.

4. Expansion into Microloans: Digital lending platforms are increasingly targeting micro-entrepreneurs with tailored loan products to support small businesses.Microloans contributed 35% of digital lending revenue in 2023, highlighting their critical role in economic empowerment.

Major Players in the Indonesia Digital Lending Market

1. Akulaku: Dominates the market with a robust ecosystem of P2P lending, BNPL, and microfinancing services.Focuses on underserved markets and offers tailored products for both consumers and small businesses.Leverages AI to enhance credit scoring and customer onboarding processes.

2. Kredivo: A leader in the BNPL space, known for its seamless integration with e-commerce platforms.Targets millennial and Gen Z users with instant credit approvals and flexible payment terms.Utilizes data analytics to offer personalized credit limits and repayment plans.

3. Investree: A major player in the P2P lending segment, focusing on SME financing.Partners with banks and government agencies to expand its reach and improve risk management.Implements blockchain for secure and transparent transactions.

4. Modalku (Funding Societies): Known for providing microloans to small and medium enterprises (SMEs).Emphasizes collaborative financing, allowing multiple lenders to fund a single borrower.Uses cloud-based platforms for seamless borrower-lender interaction.

Opportunities in the Digital Lending Market

1. Expanding Financial Inclusion: With 66% of Indonesia’s population still unbanked or underbanked, digital lending presents a significant opportunity to close the financial inclusion gap.

2. Integration with E-Commerce: E-commerce growth is a major driver of digital lending adoption, particularly through BNPL services.Indonesia’s e-commerce sector is projected to reach USD 53 billion by 2025, creating new opportunities for digital lenders.

3. Government Initiatives and Regulation: Policies supporting fintech innovation and financial literacy programs are creating a favorable environment for digital lending growth.

4. Advanced Analytics and AI: The adoption of AI and big data analytics is enabling digital lenders to better understand consumer behavior and tailor their offerings accordingly.

Challenges in the Market

Cybersecurity Risks: As digital lending grows, so does the risk of data breaches and fraud. Robust security measures are essential.

Regulatory Compliance: Ensuring compliance with evolving regulations remains a challenge for fintech platforms.

Consumer Awareness: Educating consumers about responsible borrowing and lending practices is crucial for market sustainability.

Future Outlook: The Next Phase of Growth

The Indonesia Digital Lending Market is on track to become a cornerstone of the country’s financial ecosystem. Key growth drivers include increasing smartphone penetration, rising adoption of AI, and supportive government initiatives. The market is expected to reach USD 45 billion by 2028, creating immense opportunities for investors, fintech startups, and consumers alike.

Conclusion: Indonesia’s digital lending market is not just growing—it’s transforming lives by providing financial access to millions who were previously underserved. With innovative solutions, robust investments, and a tech-driven approach, this market holds immense potential to redefine the financial landscape of the country.

#Indonesia Digital Lending Market size#Indonesia Digital Lending Market trends#Indonesia Digital Lending Market share#Indonesia Digital Lending Market revenue#Indonesia Digital Lending Future Market

0 notes

Text

WinZO: Elevating the Skill-Based Gaming Experience with Security and Trust

WinZO is a popular skill-based gaming platform that offers players a diverse selection of engaging games. Available on both Android and iOS, WinZO delivers a tailored multiplayer gaming experience, making it accessible to a broad audience.

With a user base of over 150 million registered players, WinZO has made a significant impact in the world of online skill-based gaming. One of the key features driving its success is the facilitation of over five billion micro-transactions every month across its varied games. This achievement speaks to the platform’s broad appeal and efficient financial model. The primary goal of WinZO is to build and nurture an active gaming community, often collaborating with gamers to improve and refine the user experience.

WinZO prides itself on providing culturally relevant and enjoyable gaming experiences for all its users. Its innovative micro-transaction model allows players to make seamless in-game purchases, which has been a key factor in maintaining user engagement and loyalty.

Withdrawing Money from WinZO: A Simple and Secure Process

WinZO makes it easy for users to withdraw their earnings quickly and securely. After logging into your WinZO account, navigating to the wallet or earnings section allows you to choose a preferred withdrawal option. Although the platform supports multiple payment methods, all transactions are seamless and designed for ease of use.

Here’s what some users have said about the withdrawal process:

"Using WinZO to withdraw my winnings has been incredibly easy! I just log in, go to my wallet, and pick my preferred withdrawal method. The best part is that my funds are credited almost immediately. It’s quick and stress-free!"

WinZO Review: Safe, Secure, and Reputable

WinZO has earned a strong reputation as a trustworthy gaming platform, complying with all legal regulations in the countries where it operates. The platform is transparent with its fees, charging only minimal costs without hidden charges, ensuring a fair and honest user experience.

Security is a top priority for WinZO. The platform implements advanced security protocols to safeguard users' personal and financial data, collaborating with trusted payment service providers to ensure the highest level of protection. In addition, cutting-edge fraud detection systems are in place to provide users with confidence in the platform’s ability to protect their information.

Certifications and Fair Play: WinZO’s Commitment to a Safe Gaming Experience

WinZO holds multiple certifications that reflect its commitment to maintaining a fair, secure, and enjoyable gaming environment for all players:

RNG Certification: WinZO has been certified for its Random Number Generator (RNG) system, ensuring fair and unbiased gameplay. The platform employs robust security measures and fraud detection technology to maintain the integrity of its games, assuring players that their gaming experience is genuine.

NO BOT Certification: iTech Labs, a globally recognized authority in gaming security, has certified WinZO for its peer-to-peer (P2P) gameplay, confirming that no bots are used to manipulate the gaming process. This certification guarantees that all gameplay is driven by real players, ensuring fairness and transparency for users. WinZO’s commitment to authenticity makes it a trusted platform for gaming enthusiasts.

Conclusion: WinZO’s User-Centric Approach

This review highlights WinZO’s ongoing commitment to delivering a secure, enjoyable, and user-focused gaming experience. From its user-friendly withdrawal process to its strong security measures, WinZO offers a platform that prioritizes safety and transparency. With its dedication to providing fair gameplay, coupled with a wide array of skill-based games, WinZO has earned the trust and loyalty of millions of players.

For those seeking a gaming platform that combines entertainment, security, and ease of use, WinZO remains a top choice in the world of skill-based gaming.

1 note

·

View note

Text

Decentralized Storage Network In Web3

In 2006, British mathematician Clive Humby famously said, "data is the new oil." This idea is even more relevant today, as our personal data is closely linked to our online experiences.

Our digital identities are currently typically kept in centralized systems. These systems are simple to use, but because users do not have complete control over their data, it is more dangerous for loss, privacy violations, and cyberattacks.

However, the emergence of Web3 is altering how we communicate online, and blockchain technology is a major factor in this change. Applications powered by Blockchain function independently of others, eliminating the need for dependable third parties and promoting a decentralized Internet where users have greater control over their personal information and online activities. Furthermore, rather than depending on a single centralized server, users can store and retrieve their data throughout a distributed network with Decentralized storage alternatives.

Understanding Decentralized Storage Networks

Decentralized storage networks distribute data across multiple nodes, often spread globally, rather than storing it in a single, centralized location. These networks use blockchain technology and P2P (peer-to-peer) protocols to ensure data integrity, security and accessibility.. Each node in the network contributes storage space, and in return, earns rewards, typically in the form of cryptocurrency.

How Does Decentralized Storage Work?

Decentralized storage works by spreading data across many different computers or nodes in a peer-to-peer (P2P) network, such as BitTorrent or the InterPlanetary File System (IPFS).

When you upload data to a decentralized storage system, it’s broken down into small pieces and distributed across multiple nodes in the network. When you need to retrieve your data, the network gathers these pieces from the various nodes and puts them back together for you to download.

Moreover, the data stored in a decentralized system is secure because it’s automatically encrypted using cryptographic hashing. This means the nodes storing the data can’t see or change it. Only users with the right private keys can access their data, ensuring that unauthorized people can’t get to it.

Types of DSN

1. Peer-to-Peer Networks-

Directly share files or make calls without central servers, like BitTorrent for downloads and Skype for calls.

2. Blockchain and Cryptocurrencies-

Public Blockchains- Open to everyone, like Bitcoin and Ethereum.

Private Blockchains- Restricted access for specific groups, like Hyperledger Fabric.

3. Decentralized Finance (DeFi)-

Exchanges- Trade cryptocurrencies directly with others, like Uniswap.

Lending/Borrowing- Borrow or lend without banks, using platforms like Aave.

4. Decentralized Autonomous Organizations (DAOs)-

Organizations run by code, where members vote on decisions, like MakerDAO.

5. Decentralized Apps and Identity-

dApps- Apps running on a blockchain, like the game CryptoKitties.

Decentralized Identity- Control your own digital ID, with projects like Sovrin.

6. Decentralized Storage and Marketplaces-

File Storage- Spread files across many computers for security, like IPFS.

Marketplaces- Buy and sell directly without middlemen, using platforms like OpenBazaar.

Centralized Vs Decentralized Storage

Centralized Storage-

Centralized storage refers to storing data in a single, central location, often managed by a single organization or entity. This is the traditional model used by most businesses and cloud storage providers.

Decentralized Storage-

Decentralized storage distributes data across multiple nodes or locations, often leveraging peer-to-peer networks and blockchain technology. Examples include IPFS (InterPlanetary File System) and blockchain-based storage solutions like Filecoin and Stor.

Challenges In Decentralized Storage Network

Security-

Ensuring strong encryption to protect data.

Trusting nodes not to tamper with or steal data.

Reliability-

Maintaining network uptime and data availability.

Ensuring sufficient data replication to prevent loss.

Performance-

Speeding up data retrieval, which can be slower than centralized systems.

Reducing network latency.

Economic Incentives-

Creating fair compensation models for storage providers.

Managing the volatility of cryptocurrency-based payments.

Legal Issues-

Complying with varying data storage laws across countries.

Determining responsibility for illegal content.

Usability-

Making the network user-friendly and easy to integrate.

Building trust and awareness among users.

Technical Problems-

Ensuring interoperability with other systems.

Developing secure and efficient consensus mechanisms.

Maintenance-

Coordinating decentralized upgrades and improvements.

Rapidly addressing security vulnerabilities and bugs.

Future Developments and Innovations

Smarter Consensus Mechanisms-

Researchers are creating new ways for systems to agree on data integrity that are more efficient and environmentally friendly, such as Proof of Stake (PoS) and Proof of Burn (PoB). These innovations aim to secure data without wasting resources.

AI Integration-

Artificial intelligence is being woven into decentralized storage networks, making data storage and retrieval smarter and faster.They improve security and privacy by giving consumers more control over their personal information.

Ongoing Blockchain Innovations-

New blockchain technologies with improved scalability, quicker transaction speeds, and more security are always being created. The usage of distributed storage is now more solidly supported by these developments.

Rise of Decentralized Identity-

As privacy concerns increase, more individuals and organizations are looking to Decentralized Identifiers (DIDs) and other decentralized identification solutions. They improve security and privacy by giving consumers more control over their personal information.

How does Nadcab Labs use decentralized storage networks to boost client profitability?

Nadcab Labs uses decentralized storage networks to improve its blockchain services. By distributing data across multiple nodes, they make it difficult for hackers to secure information. This arrangement also allows businesses to grow without expensive infrastructure upgrades. It also reduces costs by reducing the need for central data centers. Overall, this approach helps Nadcab Labs customers become more efficient and profitable by providing a combination of security, scalability and savings that benefit multiple industries.

Author Profile:

Siddharth Kanojia work at Nadcab Labs, helping businesses succeed online. He uses SEO strategies to make sure companies show up easily when people search the internet. He uses new technology like blockchain to help businesses grow. At Nadcab Labs, our goal is to help businesses get noticed and do well in the digital world with smart digital marketing and innovative solutions.

0 notes

Text

Peer-to-Peer Lending Market Surges to US$ 517.2 Billion by 2024, Driven by Growing Demand and Reduced Operating Costs

The peer-to-peer lending market value is expected to rise from US$ 517.2 billion in 2024 to US$ 1,709.60 billion by 2034. This market is analyzed to surge ahead at a CAGR of 12.70% over the next decade.

The surging popularity of P2P lending has propelled players to collaborate and contribute to market growth. For instance, Traveloka, an Indonesia-based travel tech platform publicly announced its partnership with Gojek-supported Bank Jago to disburse loans via Traveloka PayLater.

The initiative is raising opportunities for the underbanked community in Indonesia. Thanks to these initiatives, the growth of peer-to-peer lending is expected to flourish over the forecast period.

Unlocking the Knowledge: Requesting a Sample Copy for In-Depth Understanding.https://www.futuremarketinsights.com/reports/sample/rep-gb-14675

The adoption of peer-to-peer lending platforms by several end users like student loan organizations and real estate is projected to provide growth prospects to vendors. Additionally, increasing partnerships among market players are projected to yield market growth.

“Key players are investing in product innovation and strategic partnerships to gain a larger hold in the market. Going forward, AI capabilities are also expected to be exploited to develop customized financing solutions,” says an analyst of Future Market Insights.

Key Takeaways from the Peer-to-peer Lending Market Report

The peer-to-peer lending market attained a valuation of US$ 295.34 billion in 2019. By 2023, the valuation topped US$ 458.91 billion, recording a CAGR of 6%.

Based on end user, the consumer credit segment is expected to accumulate 40% in 2024.

By business model, the traditional segment is predicted to acquire 80% in 2024.

The China market is projected to showcase a significant growth rate of 80% over the forecast period.

The United States market is anticipated to pace at a CAGR of 70% during the next ten years.

The Australia and New Zealand market is expected to witness a 20% CAGR over the assessment period.

Competitive Strategies

The market is observing intense competition, propelled by global presence of many small as well as medium vendors providing diverse solutions. The players in the global market are concentrating on adopting alternative distribution channels like online sales to increase their presence across the world.

Market players are focusing on investments in strategic partnerships and product innovation to enhance their market share. These initiatives are expected to elevate the competitiveness of their offerings and increase collaborative efforts within the industry.

Request for Methodology:https://www.futuremarketinsights.com/request-report-methodology/rep-gb-14675

Latest Developments in the Peer-to-peer Lending Market

In March 2024, a grouping of peer-to-peer (P2P) lending platforms in India asked their members Faircent, Lendbox, and Liquiloans to put instant withdrawal products on halt after March 2024. Other P2P startups providing this service have also been asked the same.

Fable Fintech, which is a banking infrastructure firm, made public its strategic partnership with XeOPAR in May 2022. The company is set in its ways to gain maximum from the Fable Growth Suite (Retail) by founding its first P2P remittances corridor to reach India from the United Kingdom.

LendingClub, recognized for peer-to-peer lending, obtained Radius Bancorp, Inc., as well as its digital bank subsidiary in January 2021. The acquisition is made to increase the company’s revenue.

CRED, a well-known contender in the peer-to-peer market, rolled out CRED Mint, a peer-to-peer lending platform, in August 2021. The platform can be used for cred-card repayment and it permits members to gain interest on money by lending to high-earning consumers.

Enlisted Below are Some Top Market Players

Prosper Marketplace, Inc.

LendingClub Corporation

CommonBond Inc.

Funding Circle Limited

Upstart Network Inc.

Others

Market Segmentation of Peer-to-peer Lending

By End User:

Consumer Credit

Small Business

Student Loans

Real Estate

Based on the Business Model:

Traditional

Marketplace

Different Regional Markets are as follows:

North America

Europe

Asia Pacific

Middle East and Africa

1 note

·

View note

Text

The Definitive Guide to P2P Cryptocurrency Exchange

Introduction

In the realm of digital finance, peer-to-peer (P2P) cryptocurrency exchanges have emerged as a revolutionary alternative to traditional centralized platforms. This comprehensive guide explores the intricacies of P2P cryptocurrency exchanges, offering insights into their workings, benefits, and the steps involved in setting up and using these platforms.

Understanding P2P Cryptocurrency Exchange

What is a P2P Cryptocurrency Exchange?

A P2P cryptocurrency exchange facilitates direct transactions between buyers and sellers without the need for intermediaries. It operates on a decentralized model, enabling users to trade cryptocurrencies directly with one another, bypassing traditional financial institutions.

How Does a P2P Cryptocurrency Exchange Work?

P2P cryptocurrency exchanges operate through online platforms that connect buyers and sellers. Users create listings indicating the cryptocurrencies they want to buy or sell, along with the desired price and payment method. The exchange matches buyers with sellers based on their preferences, allowing for secure and efficient peer-to-peer transactions.

Benefits of P2P Cryptocurrency Exchange

Decentralization

P2P cryptocurrency exchanges operate on decentralized networks, providing users with greater control over their funds and transactions. There is no central authority governing the exchange, reducing the risk of censorship or interference.

Security

By eliminating the need for intermediaries, P2P cryptocurrency exchanges reduce the risk of hacking or security breaches associated with centralized platforms. Users retain control of their private keys, enhancing security and mitigating the risk of unauthorized access to funds.

Privacy

P2P cryptocurrency exchanges offer enhanced privacy compared to centralized platforms, as users can trade directly with one another without disclosing sensitive personal information. This anonymity appeals to users seeking greater privacy and confidentiality in their transactions.

Lower Fees

P2P cryptocurrency exchanges typically charge lower fees compared to centralized platforms, as there are no intermediary fees or transaction costs associated with third-party services. This cost-effectiveness makes P2P exchanges an attractive option for traders looking to minimize expenses.

Setting Up and Using a P2P Cryptocurrency Exchange

Registration

To use a P2P cryptocurrency exchange, users typically need to register an account on the platform. Registration may require providing basic personal information and verifying identity through Know Your Customer (KYC) procedures.

Creating Listings

Once registered, users can create listings indicating the cryptocurrencies they want to buy or sell, along with the desired price and payment method. Listings are visible to other users on the platform, who can then initiate trades based on their preferences.

Initiating Trades

To initiate a trade on a P2P cryptocurrency exchange, users can browse existing listings and select the ones that match their criteria. Once a suitable listing is found, users can initiate a trade request and communicate with the counterparty to finalize the transaction details.

Escrow and Dispute Resolution

P2P cryptocurrency exchanges often incorporate escrow services to facilitate secure transactions. Funds are held in escrow until both parties confirm the completion of the transaction. In the event of disputes or discrepancies, the exchange may provide mediation or arbitration services to resolve conflicts.

Conclusion

P2P cryptocurrency exchanges offer a decentralized, secure, and cost-effective alternative to traditional centralized platforms. By facilitating direct transactions between buyers and sellers, these platforms empower users with greater control, privacy, and flexibility in their cryptocurrency trading activities. Whether you're a seasoned trader or a novice investor, P2P cryptocurrency exchanges provide a user-friendly and efficient way to buy, sell, and trade digital assets.

0 notes

Text

Unlocking Growth: Why P2P Financing Could Be Your SME's Ticket to Success

In the dynamic landscape of small and medium-sized enterprises (SMEs) in Malaysia, securing financing is often the key to unlocking growth opportunities. Traditional lending avenues can be slow, cumbersome, and sometimes inaccessible, particularly for newer or smaller businesses. However, in recent years, Peer-to-Peer (P2P) financing has emerged as a viable alternative, offering SMEs a faster and more flexible way to access the capital they need. In this blog post, we'll explore why P2P financing might just be the game-changer your SME has been searching for.

Speed and Accessibility:

P2P financing platforms leverage technology to streamline the lending process, offering SMEs quick access to funding without the prolonged wait times associated with traditional bank loans. Unlike banks, which may require extensive paperwork and credit checks, P2P platforms often have simpler application processes, allowing businesses to secure financing in a matter of days rather than weeks or months. This speed and accessibility can be invaluable for SMEs looking to seize time-sensitive opportunities or address urgent financial needs.

Diverse Funding Options:

P2P financing opens doors to a diverse range of funding sources beyond traditional banking institutions. Instead of relying solely on banks or venture capitalists, SMEs in Malaysia can connect directly with individual investors or institutional lenders through P2P platforms. This diversity not only increases the chances of securing financing but also offers greater flexibility in terms of loan terms, interest rates, and repayment schedules. SMEs can choose the option that best aligns with their unique financial circumstances and growth objectives.

Cutting-Edge Risk Assessment:

P2P financing platforms utilize advanced algorithms and data analytics to assess creditworthiness, allowing them to evaluate SMEs in Malaysia based on a broader range of criteria than traditional lenders. By analysing factors such as cash flow patterns, transaction histories, and even social media presence, P2P platforms can provide more accurate risk assessments, enabling them to extend financing to businesses that may have been overlooked by banks. This data-driven approach not only benefits SMEs by expanding their access to capital but also enhances transparency and fairness in the lending process.

Community Engagement and Support:

Unlike impersonal banking institutions, P2P financing platforms foster a sense of community among borrowers and investors. SMEs have the opportunity to connect directly with potential lenders, building relationships based on trust and mutual benefit. This sense of engagement goes beyond financial transactions, as SMEs can tap into the expertise and support of their P2P network, accessing valuable insights and guidance to help navigate challenges and capitalize on opportunities. In essence, P2P financing transforms the lending experience into a collaborative journey toward SME success.

Conclusion

In the competitive landscape of SME financing in Malaysia, agility and innovation are paramount. P2P financing represents a paradigm shift in how businesses access capital, offering speed, flexibility, and community support that traditional banking models struggle to match. By embracing P2P financing, SMEs can unlock new pathways to growth, harnessing the power of technology and community to realize their full potential. If you're ready to take your SME to the next level, consider exploring the possibilities of P2P financing—it could be the catalyst for your business's success story.

0 notes

Text

Global Top 28 Companies Accounted for 18% of total A2P Sms & Cpaas market (QYResearch, 2021)

A2P SMS messaging is also called enterprise or professional SMS. Businesses can use it in several technical modes to communicate with consumers, authenticate users of online services, or deliver time-sensitive alerts. In all the cases, communication is initiated from a business application, and not an individual’s mobile phone, as is the case with P2P SMS.

PaaS is an abbreviation for Customer-Platform-as-a-Service. A CPaaS offers application leaders a cloud-based, multi-layered middleware on which they can develop, run and distribute communications software. The platform offers APIs and integrated development environments that simplify the integration of communications capabilities (for example, voice, messaging and video) into applications, services or business processes.

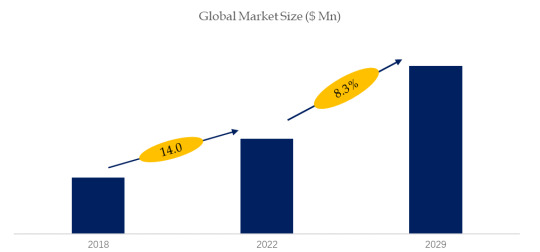

According to the new market research report “Global A2P Sms & Cpaas Market Report 2023-2029”, published by QYResearch, the global A2P Sms & Cpaas market size is projected to reach USD 58.97 billion by 2029, at a CAGR of 8.3% during the forecast period.

Figure. Global A2P Sms & Cpaas Market Size (US$ Million), 2018-2029

Based on or includes research from QYResearch: Global A2P Sms & Cpaas Market Report 2023-2029.

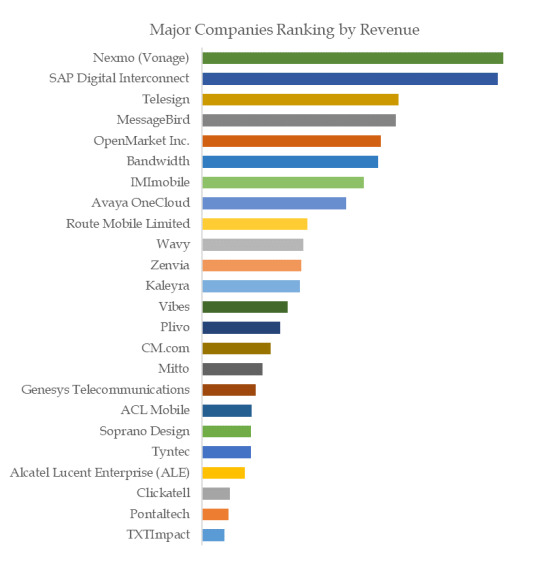

Figure. Global A2P Sms & Cpaas Top 28 Players Ranking and Market Share(Based on data of 2021, Continually updated)

Based on or includes research from QYResearch: 2021 data information of Global A2P Sms & Cpaas Market Report 2023-2029.

The global key manufacturers of A2P Sms & Cpaas include Twilio, RingCentral, Infobip, Sinch, Nexmo (Vonage), SAP Digital Interconnect, OpenMarket Inc., Telesign, MessageBird, Bandwidth, etc. In 2021, the global top 10 players had a share approximately 18.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

does stacksocial vpn support p2p

🔒🌍✨ Get 3 Months FREE VPN - Secure & Private Internet Access Worldwide! Click Here ✨🌍🔒

does stacksocial vpn support p2p

StackSocial VPN P2P Compatibility

StackSocial offers a wide range of VPN services that cater to different needs, including P2P compatibility. Peer-to-peer (P2P) file sharing is a popular way to distribute large files among users directly, without relying on a centralized server. Many VPN users often engage in P2P activities for sharing files, and having P2P compatibility is crucial for a VPN service.

With StackSocial VPN's P2P compatibility, users can securely and anonymously engage in file sharing activities without worrying about their data being exposed or compromised. This feature allows users to connect to P2P networks and share files with peace of mind, knowing that their online activities are protected by the VPN's encryption and security protocols.

StackSocial VPN's P2P compatibility also ensures that users have access to high-speed connections for seamless file sharing experiences. By allowing P2P connections, StackSocial VPN enables users to enjoy fast and reliable downloads and uploads, making it an ideal choice for those who regularly engage in P2P activities.

Moreover, StackSocial VPN's P2P compatibility extends to various devices and platforms, allowing users to connect and share files securely from their computers, smartphones, and other devices. This flexibility ensures that users can enjoy P2P file sharing across all their devices without compromising on security or performance.

In conclusion, StackSocial VPN's P2P compatibility is a valuable feature that enhances the overall user experience by providing secure, fast, and reliable connections for P2P file sharing activities.

Peer-to-Peer Support in StackSocial VPN

Title: Harnessing Peer-to-Peer Support for Enhanced Privacy: A Look into StackSocial VPN

In the realm of virtual private networks (VPNs), StackSocial VPN stands out not only for its robust encryption and privacy features but also for its unique approach to peer-to-peer support. Peer-to-peer support, a model where users assist each other with technical issues and inquiries, has become increasingly popular across various online platforms. StackSocial VPN has embraced this trend, integrating peer-to-peer support into its service to provide users with a more dynamic and interactive experience.

One of the primary benefits of peer-to-peer support in StackSocial VPN is the sense of community it fosters among users. By allowing individuals to connect and assist each other in troubleshooting VPN-related issues, StackSocial VPN creates a collaborative environment where users can share knowledge and learn from one another. This community-driven approach not only enhances the overall user experience but also empowers individuals to take control of their online privacy and security.

Moreover, peer-to-peer support in StackSocial VPN offers users real-time assistance and feedback. Instead of relying solely on customer support agents, users can seek help from their peers who may have encountered similar challenges or have unique insights to share. This immediate access to support ensures that users receive timely assistance and can resolve issues efficiently, without the need to wait for a response from traditional customer support channels.