#cpa nyc

Text

Our Managing Partner, Paul Miller, CPA shares some common business mistakes that lead to #bankruptcy in business.com

To stay financially healthy and avoid bankruptcy, Miller advised building a strong cash reserve, regularly updating your business plan and diversifying your revenue streams. Let’s take a closer look at five tips to get your debt and cash flow management on track.

0 notes

Text

The Ultimate Guide to Financial Planning: Secure Your Future with Confidence

In today’s fast-paced world, Financial planning is more crucial than ever. Whether you're starting your career, nearing retirement, or somewhere in between, a well-thought-out financial plan can help you achieve your goals, mitigate risks, and secure your financial future. This guide will walk you through the essentials of financial planning, offering practical steps and strategies to build a solid foundation for your financial well-being.

1. Understanding Financial Planning

Financial planning is the process of creating a strategy to manage your financial situation to achieve your long-term and short-term goals. It involves evaluating your current financial status, setting financial goals, and creating a roadmap to achieve those goals. Effective financial planning covers various aspects, including budgeting, saving, investing, insurance, and retirement planning.

2. Setting Financial Goals

The first step in financial planning is to define your financial goals. These can be categorized into short-term goals (e.g., saving for a vacation), medium-term goals (e.g., buying a house), and long-term goals (e.g., retirement savings). Setting clear, specific, measurable, achievable, relevant, and time-bound (SMART) goals is essential for creating a focused and actionable financial plan.

3. Creating a Budget

A budget is a fundamental tool in Financial planning. It helps you track your income and expenses, ensuring you live within your means and allocate funds towards your financial goals. Start by listing all sources of income and categorizing your expenses into fixed (e.g., rent, utilities) and variable (e.g., entertainment, dining out) costs. Regularly reviewing and adjusting your budget will help you stay on track.

4. Building an Emergency Fund

An emergency fund is a savings reserve designed to cover unexpected expenses or financial setbacks, such as medical emergencies or job loss. Financial experts recommend setting aside three to six months' worth of living expenses in an easily accessible account. An emergency fund provides a financial safety net and helps prevent debt accumulation during challenging times.

5. Managing Debt

Debt management is a critical component of financial planning. High levels of debt can hinder your ability to save and invest. Start by assessing your debt situation, including credit card debt, student loans, and personal loans. Prioritize paying off high-interest debt first and explore strategies such as debt consolidation or refinancing if necessary. Aim to avoid accumulating new debt and use credit responsibly.

6. Saving and Investing

Saving and investing are key to building wealth and achieving financial goals. Consider the following strategies:

Savings Accounts: Use high-yield savings accounts for short-term goals and emergency funds. These accounts offer liquidity and low risk.

Retirement Accounts: Contribute to retirement accounts such as 401(k)s or IRAs. Take advantage of employer matching contributions and tax benefits.

Investing: Invest in stocks, bonds, mutual funds, or exchange-traded funds (ETFs) based on your risk tolerance and time horizon. Diversify your investments to reduce risk and increase potential returns.

Automated Investments: Consider using robo-advisors or automated investment platforms to manage your investments with minimal effort.

7. Insurance Planning

Insurance plays a crucial role in protecting your financial well-being. Evaluate and obtain the following types of insurance:

Health Insurance: Ensure you have adequate health coverage to manage medical expenses and prevent financial strain.

Life Insurance: Life insurance provides financial protection for your dependents in case of your untimely death. Choose between term life and whole life insurance based on your needs.

Disability Insurance: Disability insurance offers income replacement if you become unable to work due to illness or injury.

Home and Auto Insurance: Protect your assets with appropriate home and auto insurance coverage.

8. Retirement Planning

Retirement planning involves preparing financially for your post-working years. Key steps include:

Estimating Retirement Needs: Calculate how much you’ll need to retire comfortably based on your lifestyle, expenses, and life expectancy.

Contributing to Retirement Accounts: Regularly contribute to retirement accounts and take advantage of tax benefits.

Planning for Healthcare: Consider potential healthcare costs in retirement and explore options such as Medicare or supplemental insurance.

9. Tax Planning

Effective tax planning can help you minimize your tax liability and maximize your savings. Strategies include:

Utilizing Tax-Advantaged Accounts: Contribute to accounts such as 401(k)s, IRAs, and Health Savings Accounts (HSAs) to benefit from tax deductions or tax-free growth.

Tax Deductions and Credits: Take advantage of available tax deductions and credits to reduce your taxable income.

Tax-Efficient Investments: Invest in tax-efficient assets to minimize capital gains taxes.

10. Estate Planning

Estate planning involves preparing for the distribution of your assets after your death. Key elements include:

Creating a Will: A will outlines how your assets will be distributed and appoints guardians for minor children.

Establishing Trusts: Trusts can help manage and protect your assets, minimize estate taxes, and ensure your wishes are carried out.

Designating Beneficiaries: Update beneficiary designations on retirement accounts, insurance policies, and other financial accounts.

11. Regular Review and Adjustment

Financial planning is not a one-time event but an ongoing process. Regularly review your financial plan to ensure it aligns with your goals and adjust as needed. Life changes, such as marriage, career changes, or having children, may require updates to your plan.

Conclusion

Financial planning is a powerful tool for achieving financial security and peace of mind. By setting clear goals, creating a budget, managing debt, saving and investing wisely, obtaining appropriate insurance, planning for retirement, and addressing tax and estate planning, you can build a strong financial foundation for your future. Start today, and take control of your financial destiny with confidence.

#Financial planning#decor#home#interiors#kitchen#nyc#plants#sunset#clouds#finance#investing#gst#cpa#stock market#city#architecture

0 notes

Text

How do business people choose the right tax accountant NYC?

One doesn't basically have to claim a business or must be well off for profiting advantages of employing an expense bookkeeper. Many people who would like to prepare their own tax returns balk at the idea and wonder how to select a tax accountant NYC. If you are likewise one of the people who find it convoluted to set up their expenses or face issues while taking care of a duty obligation, recording back charges, and so on, you should track down the right assessment bookkeeper. You should be explicit about the administrations you want. Numerous private ventures simply need a bookkeeper to set up their duties.

Check experience

A tax accountant with several years of expertise is always preferable because they will have a deeper comprehension of the tax rules and codes than a newly certified professional. Additionally, find out if the tax professional has any expertise in filing taxes online.

Provides invaluable advice

Some portion of a bookkeeper's schooling involves exploring complex duty issues and making a business pay for them less. The time and money a business owner will save as a result of an accountant's well-informed advice will be priceless.

Fees

It's critical to be transparent about fees and take the competition into account. Many accountants bill by the hour or by the task, like finishing your company's tax returns. It's reasonable to inquire about costs in advance and be aware of the breakdown of hours and prices. It's also customary to provide your financial and tax details to several applicants and get their upfront advice on how to reduce taxes or improve things overall.

0 notes

Text

Small Business Accountant Brooklyn

ISCPA offers tax solutions to small businesses. Including tax planning, outsourced CFO and accounting services, tax preparation & financial coaching.

For more information, visit our website: https://stepanchukcpa.com/

1 note

·

View note

Text

What are Medicare Taxes?

Medicare tax is something that most people know about, but few are familiar with what it does. It's one of those charges on your W-2 alongside Social Security Tax. You may see it when working with an NYC tax preparation professional. But what is it, and why do you pay for it?

Funding Medicare Part A

The sole purpose of Medicare tax is to fund the Medicare system. More specifically, it pays for Medicare Part A.

Medicare is a federal health insurance program for people over the age of 65. It also covers those with disabilities and certain medical conditions. Part A refers to hospital insurance. It covers hospital stays, hospice care, nursing home stays and more.

Medicare tax and Social Security tax go into trust funds held by the United States Treasury. Medicare Tax goes into the Hospital Insurance Trust Fund, which funds Medicare Part A.

This tax helps current and future Medicare beneficiaries. The idea is that you pay the tax throughout your life to utilize it yourself when you reach 65.

How Do You Pay Medicare Tax?

For most people, Medicare tax comes out of their paycheck directly. The current tax rate is 2.9 percent. Employers and employees split that percentage evenly.

Under the Federal Insurance Contributions Act (FICA), your employer must withhold both Medicare and Social Security taxes from your paycheck. You don't pay for it at the end of the year like some taxes. It comes out of each paycheck, making it easier for most people to manage.

If you're self-employed, things are different. Because you have no employer, you must pay the full 2.9 percent and employer contributions for Social Security tax. In those cases, the taxes are part of self-employment taxes.

It's a good idea to visit an NYC tax preparation professional if you are self-employed. It doesn't matter if you pay quarterly taxes or wait until tax season to pay everything in one lump sum. Tax preparers will help you calculate your Medicare tax responsibilities and help you find ways to reduce your taxable income.

Read a similar article about Brooklyn tax planning here at this page.

0 notes

Text

Scenes from the Void AU Ages and Timelines Masterpost

Note, this is my AU. Ages and years are different. Also they're Americans. Why? Rule of cool, bro🤘

Primo

b. 1953 New York City d. 2001 Ministry HQ

Irving Robert Olson Parents: Nance and Nihil

Left the Church in 1960 with Nance, returned after her death in 1972.

Bodyguard for Mater Emeritus Jocasta 1972-1979, Groundskeeper/Super for Ministry HQ until elevation

Papa Emeritus: 1994-2000, died from exhaustion caused from the Papa Emeritus Curse

Secondo

b. 1961 Ministry HQ

Michael Aulenbach changed to Michael Leider in 2008 Parents: Rebecca and Nihil

Rebecca passed over for a promotion to Mother Imperator due to her surprise pregnancy (the magic ritual would kill the fetus)

Child prodigy pianist. Tours eastern United States as "Modern Mozart" from the ages of 6 to 10. Piano teacher to this day.

Magician of the Church 1977-2008. Head of the Conclave of Magicians 1990-1999. Papa Emeritus II 2001-2008.

Married Sandra Leider in 2006. Three children Paul (2004), Eden (2010) and Samuel (2013). Left the church in 2008 to help Sandra's family run the Leider Memorial Home. Funeral Director.

Terzo

b. 1965 Milan Ministry location d. March 2018 Ministry HQ

Arsenio Moretti Parents: Nihil and a Catholic novitiate only known as "Maria"

Fathered during Nihil's first major tour of Italy. Mother died and so he was returned to Nihil in the US in 1969.

1984 Last seen at Bishop Camino's funeral in NYC. Missing for two years, returned to Ministry in 1986 and never speaks about it to anyone (except Omega eventually) Now has photography and filmmaking skills.

Director of promotional materials, films Primo's tours 1994-2000. Elevated to Cardinal in 1998. Choir Director until his elevation to Papa Elect in 2004.

Summons Omega in 2005.

Papa Emeritus III 2008-2017. Forcibly removed from office 2017 for [REASONS REDACTED].

First Papa Emeritus formally executed by the Church in 300 years for the crimes of [REDACTED]. (you will have to read hehehe)

Copia

b. 1976???? Unknown

Copia is his real name. Unknown origin. Unknown parents, although raised as prev characters' youngest brother.

Found by Primo in mysterious circumstances in 1979. Parental figure found murdered. (My fic Violence and Gentleness focuses on this mystery)

Raised primarily by Primo. Homeschooled by Rebecca until 13. Secondo is his piano teacher.

He had a very strong bond with both Primo and Secundo and considers them father figures. Primo taught him how to be a moral person and Secondo taught him how to be an intelligent person. Secondo started teaching him piano at the age of five and by fifteen he was learning on the organ.He had an interest in math and science and pursued that at the academic level. He was the first of the family to actually go to a college outside of the Ministry. He graduated top of his class as a CPA in 1997, and immediately began working under the Head Treasurer. He was head treasurer for the Ministry from 2005-2017.

Met Cardinal Marian in 2006 was in a relationship with her until 2017, then back again in 2019.

Elevation to Cardinal 2010. Elevation to Papa Elect 2012. Finally Papa Emeritus upon Nihil's death in 2019.

Nihil

b. 1930 Milwaukee, WI d. 2019 onstage Mexico City

Robert Irving Olson Parents: Betty and Irving

Father gambler and alcoholic. Mother church organist. Church choir and guitarist. Older brother Archie lost at sea in 1946 (WWII Navy). Forced to drop out of school and work to support family in machine shop. Ran away from home in 1947. Rode the rails with the nickname "Zero". Picked up by the Satanic Church of the Void in NYC 1950. Multi-instrumentalist in Bishop Camino's house band until 1958. Odd jobs all throughout his life from taxicab driver, singing telegram, model, busker, roadie, trucker, etc.

Transferred to Ministry HQ thru Bishop Camino's recommendation. Brought Nance and Primo with him. Affair with Rebecca led to Secondo's birth and Nance leaving the church altogether. Elevated to Papa Emeritus 1963. First American Papa since Papa Camino in 1940s. Sister Imperator 's first Construct (after she underwent her magical rite she bestowed on him the Curse to make him Papa). Toured Italy and Europe 1964-1965. Secret bastard child Terzo discovered in 1969.

Got his ghouls terminally addicted to slot machines in 1972, foisted from position for that mistake. Protegee Jocasta took over until 1979.

Personal Assistant to Sister Imperator 1972-1984. Leader of the College of Cardinals 1986-2017. Return to Papa Emeritus 2017-2019.

#ghost band headcanons#Papa Emeritus I#Papa Emeritus II#Papa Emeritus III#Papa Emeritus IV#Papa Nihil#Ghost band Headcanons#Oh my god I'm so embarrassed at how huge this post is but hey someone asked lmao#ghost scenes from the void

18 notes

·

View notes

Note

Today, I picked up my Master's regalia for graduation 🎓 and got my results back from my first attempt at a CPA exam (failed it but, I was very close to the pass rate).

Suffice to say, I finally have a little time to catch up on your writing before getting back to studying! I know that your current au is Hart of Dixie (?) - Should I be expecting maximum strength angst or light hearted fluff with a hint of angst? I've never seen the show so, I can't really imagine the angst levels in advance

Hi! First off, congrats at graduating!!! That is SO exciting and a major accomplishment! It sounds like you're not too down about the CPA exam, I know a few people who have taken it and it's a beast so I'm sure you will pass next time!!

So I currently have 2 series that I'm working on. The first is a Hart of Dixie AU with both Bob and Bradley. I would say it's more light hearted than a lot of my fics! Lots of small town charm and flirting. Essentially, Olive is the new shiny doctor in town, moves from NYC to a tiny town in Georgia where Bob Floyd is the town doctor and he takes a distinct dislike to her. He's surly and broody but obviously he ultimately falls for Olive. Meanwhile, she also meats Bradley, the town lawyer, who is flirty and also spent some time in New York so they instantly have common ground. Who will she choose?

My second series that I'm working on is a Bob marriage pact fic. Haley and Bob grew up together before she moved away in high school, but before she left they made a promise: let's get married if we're both 30 and single. She tracks him down in San Diego and revives the pact. But what Bob doesn't know is that Haley's bakery is failing and she needs an inheritance from her grandmother to keep it going — an inheritance that she can only get if she gets married. The two fall back into a relationship seamlessly, and she begins to have real feelings for him, but of course Bob is going to find out at the worst time her real motives for returning. Will he be able to forgive her? This one will be more angsty!

2 notes

·

View notes

Text

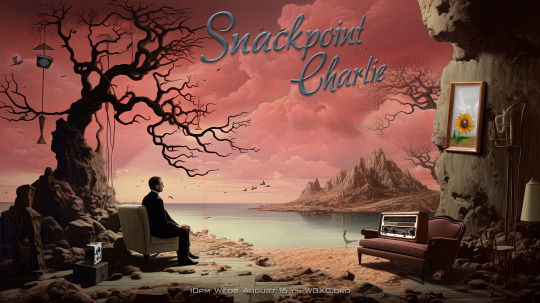

Snackpoint Charlie, for that nagging feeling that there’s gotta be more out there, there just has to be. Spoiler alert: there is, and it’s more alluring and mysterious music from elsewhere and beyond. 10pm to midnight Wednesday August 16 on WGXC 90.7-FM / WGXC.org / the Wave Farm smartphone app / and podcast NOW at https://wavefarm.org/wf/archive/fhwfsn

Snackpoint Charlie - Transmission 121 - 2023.08.16

https://wavefarm.org/wf/archive/fhwfsn

[ ^ click for download ^ ]

PLAYLIST

1) Altai music - T. Chinjin (Throat Singing and Topshur lute) - “Karkira” from VOYAGE EN URSS – N° 10 SIBÉRIE/EXTRÊME ORIENT/EXTRÊME NORD – ANTHOLOGIE DE LA MUSIQUE INSTRUMENTALE ET VOCALE DES PEUPLES DE L'URSS

https://www.discogs.com/release/1253115-Various-Siberie-Extreme-Orient-Extreme-Nord

https://music-republic-world-traditional.blogspot.com/2018/12/siberia-siberie-voyage-en-urss-n-10.html

2) Ustad Noor Bakhsh - “Des” from JINGUL

https://hivemindrecords.bandcamp.com/artists

https://honiunhoni.bandcamp.com/

3) Ferka Jilaliya & Zine Mohamed / الفرقة الجيلالية : الزين محمد - “Sidi Mbarek” from TANGEPHONE TAN 480

https://music-republic-world-traditional.blogspot.com/2023/03/morocco-ferka-jilaliya-zine-mohamed.html

4) Faizal Mostrixx - “Loosely (ft. Morena Leraba)” from MUTATIONS

https://faizalmostrixx.bandcamp.com/album/mutations

(underbed throught:)

Tuluum Shimmering - “Tamalpais (at about 6)” from TAMALPAIS (AT ABOUT 6)

https://tuluumshimmering.bandcamp.com/album/tamalpais-at-about-6

plus -

Pinchas Gurevich - “Klaus Barbie and Q”

5) ELECTRONICOS FANTASTICOS! - “Dian Ci Long (feat. Namichie & Submarine)” from ELECTROMAGNETIC MATSURI BAYASHI IN NEO TOKYO

https://www.electronicosfantasticos.com/news/230620/

https://www.instagram.com/electronicosfantasticos/

6) VAGABOND cpa - “Manhattan Minuet” from RAYMOND SCOTT SONGBOOK

http://raymondscott.jp/

https://www.discogs.com/release/5554447-Various-Raymond-Scott-Songbook

7) Son Thoeung - “Damrey Cheung Buon (The Four Feet of the Elephant)” from CAMBODIAN CASSETTE ARCHIVES: KHMER FOLK & POP MUSIC VOL. 1

https://sublime-frequencies.bandcamp.com/album/cambodian-cassette-archives-khmer-folk-pop-music-vol-1

8) Ryuichi Sakamoto - “Replica” from ONGAKU ZUKAN

https://www.wewantsounds.com/?lightbox=dataItem-ljdbjhi2

9) ESP Summer - “Land of 102°” from MARS IS A TEN

https://hisnameisalive.bandcamp.com/album/mars-is-a-ten

10) Steven Ruppenthal & Gary R. Weisberg - “Post-Apocalyptic Biscuit” from STRANGE TIMES

https://importantrecords.com/

https://meterpool.bandcamp.com/

11) Diah Iskandar Dan Jopie's Band - “In My Room” from DIJATI KEKASIH

https://www.discogs.com/release/12068152-Diah-Iskandar-Dan-Jopies-Band-Dihati-Kekasih

https://madrotter-treasure-hunt.blogspot.com/2020/01/diah-iskandar-jopies-band-dihati-kekasih.html

12) John Cale - “Terry's Cha-Cha” from NEW YORK IN THE 1960S

https://www.discogs.com/master/175544-John-Cale-New-York-In-The-1960s

https://www.tableoftheelements.org/all-releases

https://www.withinthings.com/

13) Alan Courtis & David Grubbs - “Song of a Fence Grown through a Tree” from BRAINTRUST OF FIENDS AND WEREWOLVES

https://huskypantsrecords.bandcamp.com/album/braintrust-of-fiends-and-werewolves

14) Hali Palombo - “Voice Scrambler” from RADIO & MY VOICE

https://halipalombo.bandcamp.com/album/radio-my-voice

15) Graeme Jefferies - “Brand New Start” from CANARY IN A COALMINE

https://allyrecords.bandcamp.com/album/canary-in-a-coalmine

16) Don Van Vliet - “Pork Chop Blue Around the Rind” from GARY LUCAS' SOUNDCLOUD

https://soundcloud.com/garylucas/pork-chop-blue-around-the-rind-don-van-vliet-nyc-7-83

https://www.discogs.com/release/2042457-Don-Van-Vliet-Riding-Some-Kind-Of-Unusual-Skull-Sleigh

17) Robert Wilson & Christopher Knowles - “Excerpt from ‘A Letter To Queen Victoria: The Sundance Kid Is Beautiful’” from BIG EGO

https://ubu.com/sound/big_ego.html

https://store.giornofoundation.org/products/the-dial-a-poem-poets-big-ego

18) Orkes Aneka Warna - “Lontong Balap” from ORKES ANEKA WARNA

https://madrotter-treasure-hunt.blogspot.com/2020/04/orkes-aneka-warna.html

https://www.discogs.com/artist/6759840-Orkes-Krontjong-Aneka-Warna

#snackpointcharlieradio#wgxc#wgxcradio#hellsdonuthouse#communityradio#freeformradio#snackpointcharliewgxc#hudsonny#globalmusic#worldmusic#radioforopenears#freeform radio#radioeverywhere#globalbeat#outernational#community radio

2 notes

·

View notes

Text

William Timlen CPA

Website: https://seaislenews.com/william-timlen-cpa-nyc-real-estate-market-trends-significant-developments-local-impact/

Address: New York, NY

William Timlen CPA specializes in tax aspects for real estate clients and high-net-worth individuals. After graduating from Providence College in 1993, William Timlen CPA embarked on his career as a staff accountant at Lear & Pannepacker, CPAs. Subsequently, he founded his own firm, Timlen & Company, CPAs, where he excelled in tax planning for real estate companies. Later, as a tax principal at Friedman, LLP, William Timlen CPA managed a team and delivered exceptional services. Since joining EisnerAmper LLP in 2016 as a tax partner, William Timlen CPA has led a successful trajectory, serving major real estate companies in New York City, while expanding the expertise of the real estate group.

#Accounting#Finance#William Timlen CPA

LinkedIn: https://www.linkedin.com/in/william-timlen-98986b17

2 notes

·

View notes

Photo

Absolutely loving this small exhibit which captures the work and world of Berenice Abbott. "When I saw New York again, and stood in the dirty slush, I felt that here was the thing I had been wanting to do all my life." - Showcasing hundreds of NYC photographs from early 1900s - "Berenice Abbott's New York Album, 1929," sheds new light on the creative process of one of the great photographic artists of the 20th century. .... #UnderGlassCollection #ShoeDaydreams #CuratedCloset #TheClosedDoorCollection #SophisticatedPrecious #art #photography #photographer #newyork #newyorkcity #metmuseum #AbbottNYC #WomensHistoryMonth @metmuseum @metphotographs @metmembers https://www.instagram.com/p/Cpa-4HGOoNf/?igshid=NGJjMDIxMWI=

#underglasscollection#shoedaydreams#curatedcloset#thecloseddoorcollection#sophisticatedprecious#art#photography#photographer#newyork#newyorkcity#metmuseum#abbottnyc#womenshistorymonth

3 notes

·

View notes

Text

MEET ELLIOTT

Full Name → Elliot Michael Gilbert

Age → 35

Birthday → January 29th, 1989

Order & Type → first, solo

Gender & Pronouns → cis man, he/they

Sexuality → homosexual

Occupation → recording artist under the stage name “Starchild”

THEIR STORY

Elliott was born and raised in Paramus, NJ – just close enough to NYC to grow up in the shadow of its reputation, and to be exposed to a huge array of cultural experiences. His parents were firmly middle class: his mother Marianne was a middle school art teacher and gave private art lessons on the side, and his father Ray was a CPA. His mother’s strong artistic influence led to Elliott developing his own methods of self-expression from a young age, including learning to alter and sew his own clothes when he wanted something with a little more flair.

The performance bug first bit when Elliott was cast as Schroeder in his 5th grade production of You’re a Good Man, Charlie Brown. He started with voice lessons, and added piano and guitar as he got older. By the time he reached high school, Elliott had branched out to explore different genres of music, and he convinced his parents to let him take periodic trips into the city for shows and concerts.

Despite his dad’s career, Ray had an attic full of old vinyl records that Elliott discovered one summer. As his own personal style continued to take shape, he took refuge in the creation of a much more daring alter ego – an homage of sorts to the music his father’s collection introduced him to, heavily influenced by David Bowie’s Ziggy Stardust period. His ‘Starchild’ persona continued to evolve as he grew older, but it gave him a creative outlet as well as a means of self-expression.

As a high school senior, all of Elliott’s college applications went towards schools in New York. AMDA offered him a place (for Vocal Performance) with enough of a scholarship to make it worth his while, so he made the move to the city while starting to play local clubs on the side whenever possible. After college, Elliott found himself working in a local recording studio running tech while he focused on his music. He contributed background vocals whenever needed, and was eventually scouted during an amateur cabaret night at a local gay club, mostly because of his unique vocal range and theatrical stage presence. He suddenly found himself on the other side of the booth, and soon enough Starchild started playing larger and larger venues around New York.

His first album dropped the following year and garnered significant airplay, creating enough buzz for him to make a name for himself and start to build a surprisingly dedicated (albeit eclectic) fan base. His second album was released in the summer of 2022, and charted 4 singles by the end of the year. At his label’s urging, he went on tour the following year, and while he hasn’t exactly reached household name status, he’s moderately recognizable in his stage persona and it’s started to become an issue. Fortunately, when he’s not in full ‘Starchild’ mode, Elliott Gilbert is much harder to pick out in a crowd, so he still maintains a measure of privacy.

Once his tour wound down, Elliott started looking for a quieter base of operations, away from the chaos and toxic party culture of New York. He keeps an apartment in the city, but a smaller, more secluded home base seemed like a good investment for when he needed downtime to relax, as well as someplace he could work on new music in relative peace. He isn’t exactly hiding his day job, but he’s not drawing attention to it either. As long as he can find a space to just be plain Elliott without the pressures and trappings of Starchild, he doesn’t mind occasionally getting recognized without the costume.

1 note

·

View note

Text

Client appreciation post for Gerald, our client who will be 102 years young in December! Gerald stopped by with his daughter to visit Paul (accountant NYC) and our team in Whitestone, NY before heading back to his home in St. Croix. We are so lucky to have serviced Gerald over the years and are so grateful for clients like him.

#clientappreciation#accountingservices#cpafirm#accountant#cpa firms in nyc#cpa firm nyc#cpa nyc#accountant nyc#cpa#tax#accountant NYC

0 notes

Text

Top Accounting Firms in New York

Explore the top accounting firms in New York City. This guide highlights the leading firms for tax, audit, and advisory services to help you find the right CPA firm for your business needs in the NYC metro area.

1 note

·

View note

Text

Accountants in nyc

At present, many businesses are looking for the skilled tax Accountants in nyc. During that time, checking out Custom Accounting CPA can be the best choice to find the leading accountants.

0 notes

Text

youtube

Makilala TV Ep 133 | Philippine Independence Day Across NYC Boroughs

Guest Panelists

Leonora "Nora" Galleros-Tinio, CPA. MBA

Executive Director, Philippine Independence Day Council Inc (PIDCI)

Ederlinda Paraiso-Miranda

President, Philippine Independence Committee of Staten Island, Inc. (PICOSI)

Hosts

Cristina Pastor

Community Journalist

Rachelle Ocampo , EdM (lead)

Public Health Professional

Produced by Manhattan Neighborhood Network (MNN)

Zenaida Mendez, Director

Fredy Pinto, Production & Studio Manager

Carla Robles, Production Facilitator

MakilalaTV Ep133 Yr11 Ep11

#makilalatv#filam#filipinoamerican#tvtalkshow#television#newyork#philippines#PhilippineIndependenceDayParade#PIDCI#PICOSI#Youtube

0 notes

Text

The Ultimate Guide to SEM Analysis for Business Law Firms

Businesses that provide legal representation should prioritize Search Engine Marketing (SEM) if they want to increase their visibility online and get more clients. By utilizing search engine optimization (SEO) strategies like pay-per-click (PPC) advertising and keyword research, legal companies can boost their visibility in search engine results and potentially interact with more people who are looking for legal help. Search engine optimization (SEO) is a potent tool that business law firms may use to increase their online presence, draw in more qualified leads, and expand their clientele.

If legal companies want to know how effective their SEM ads are and how to improve them, they need to implement performance tracking. Investigating KPIs like cost-per-acquisition, click-through rates, and conversion rates helps legal firms understand how well their SEM tactics are working and where they can make improvements. Businesses' legal firms can improve their search engine optimization (SEO), increase their return on investment (ROI), and accomplish their marketing goals more precisely and efficiently if they can monitor and evaluate performance metrics.

Critical Performance Measures for SEM

Return on investment (ROI), cost per click (CPC), cost per acquisition (CPA), click-through rate (CTR), and conversion rate are some of the key performance indicators (KPIs) for search engine optimization (SEO). You can learn a lot about an ad's effectiveness and relevancy by looking at its click-through rate, which is the proportion of people who actually click on it after seeing it. Conversely, conversion rate shows what proportion of people who click on an ad really do something useful, such as filling out a contact form or calling the number provided. Metrics like cost per click and cost per acquisition provide light on the monetary side of SEM campaigns, allowing companies to evaluate the efficacy of their advertising budget.

Law firms can assess the efficacy of their ads by keeping a close eye on metrics like CTR, conversion rate, and ROI. This data-driven approach allows them to make adjustments that boost performance. Firms may need to reevaluate their targeting and messaging strategies if they see a high CTR but a low conversion rate, which could be an indication of problems with the content of their landing pages or advertisements. Law firms can better manage their advertising expenditures and allocate money to channels and campaigns that produce the best results by utilizing CPC and CPA analytics. The best business attorney on Long Island can improve their SEM strategy, increase their marketing ROI, and reach their target audience with confidence thanks to a thorough understanding of important performance metrics.

Establishing Concrete Aims and Targets

Aligning SEM efforts with overall business objectives is made easier with these goals serving as guiding principles that define the intended outcomes. By establishing clear objectives, companies can direct their efforts towards attaining quantifiable outcomes and efficiently monitor campaign advancement. The efficient allocation of resources and the directing of efforts towards meaningful outcomes are both guaranteed by well-defined objectives, which in turn provide direction and clarity to SEM strategies.

Both specific and measurable goals help organizations achieve their objectives because they spell out exactly what has to be done and how to measure accomplishment. In light of things like available resources and current market trends, attainable goals are those that are both reasonable and doable. To make sure that SEM works towards the bigger picture, company goals should also be relevant. Finally, creating deadlines for yourself makes you feel more accountable and gets things done faster. An NYC social media marketing agency can help companies achieve their SEM campaign goals by providing expert advice on how to create and implement SMART objectives.

Monitoring SEM Efficiency using These Tools

Google Ads (formerly AdWords), Google Analytics, and SEMrush are priceless tools that offer thorough information about SEM efficiency. By providing a plethora of data such as impressions, clicks, conversions, and more, these solutions enable organizations to track the efficacy of their SEM campaigns in real-time. Long Island business attorneys can take use of these tools to learn more about the efficacy of their SEM efforts and where they can make improvements.

Businesses may improve their SEM tactics and campaigns to better suit the demands of their target audience with the help of these tools, which also provide vital insights into user behavior. Businesses can optimize their SEM campaigns based on data-driven decisions made possible by tools like Google Analytics, which provides precise information on website traffic, user demographics, and engagement metrics. Long Island business attorneys can use these tools to monitor SEM performance data, spot trends, and fine-tune their campaigns for maximum outcomes and achieving business objectives.

Assessing Information and Reaching Well-Informed Conclusions

To guarantee the success of a Search Engine Marketing (SEM) strategy, data analysis is crucial. In order to gain significant insights from SEM data, business law firms must implement tactics. Search engine optimization (SEO) indicators like cost-per-acquisition, click-through rates, and conversion rates help businesses spot patterns, trends, and opportunities for growth.

Optimizing search engine marketing campaigns for business law firms relies heavily on data-driven decision-making. For better SEM strategy decisions, businesses should depend on data rather than gut feelings. By utilizing data analysis insights, companies can improve resource allocation, fine-tune targeting criteria, and optimize bidding methods to get maximum return on investment. In addition, by embracing a data-driven strategy, business law firms may enhance their SEM efforts, provide superior outcomes, and accomplish their marketing goals with more accuracy and efficiency.

Methods Modified in Response to New Information

Achieving success requires the capacity to adjust and improve tactics using insights obtained from performance data. In order to make educated decisions regarding their SEM initiatives, business attorneys on Long Island can utilize performance statistics. By analyzing indicators like cost-per-click, click-through rates, and conversion rates, attorneys may pinpoint where they can make improvements and modify their strategy appropriately. In order to achieve this goal, it may be necessary to optimize keywords so that they more closely match user intent, test several versions of ad text to find the most effective messaging, and manage bids so that ROI is maximized.

To find out what works best in their SEM marketing, lawyers might run controlled trials to try out various components. Using this iterative strategy, they can improve the efficacy of their SEM efforts over time by refining their techniques. The business attorney on Long Island may ultimately improve the effectiveness and efficiency of their SEM campaigns by making adjustments based on insights gained from performance data and experimentation. This will lead to better outcomes and a more precise achievement of their marketing objectives.

Highlights from the Ultimate Guide on SEM Analysis for Business Law Firms

If business law firms want to attract more customers online and enhance their visibility, they must track and analyze SEM performance data. To determine how effective their SEM ads are, law firms should keep a close eye on important metrics like conversion rates, return on investment, and click-through rates. These enable businesses to optimize their strategy, distribute resources more efficiently, and make decisions based on data. Organizations may adjust to shifting market dynamics and maintain a competitive edge in the cutthroat online environment by constant monitoring and optimization.

Keeping SEM in line with the firm's overall aims is possible with the help of strong tracking systems and well-defined targets. Business law firms can improve the efficacy of their SEM strategy across time by conducting frequent evaluations of performance and making improvements based on data-driven insights. Business law firms can improve their online presence, acquire qualified leads, and build their client base in a sustainable and impactful way by prioritizing the recording and analysis of performance metrics in SEM.

0 notes