#credit guarantee scheme for msmes

Explore tagged Tumblr posts

Text

How to Utilize a CGTMSE Loan: A Step-by-Step Guide

Starting or expanding a business in India typically involves substantial funding, which is a challenge to MSMEs. and start-ups, especially where they lack assets to employ as collateral. The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) offers relief through its CGTMSE scheme, under which entrepreneurs can take collateral-free loans to propel their business growth. Here is this exhaustive guide that will guide you through the procedure for getting a CGTMSE loan, eligibility, benefits, and application, so that you can access this robust government scheme for MSMEs for pursuing your entrepreneurial dreams.

What is the CGTMSE Scheme?

CGTMSE scheme, or the Credit Guarantee Fund Trust for Micro and Small Enterprises, is a flagship programme launched in 2000 by the Government of India jointly with the Ministry of Micro, Small and Medium Enterprises (MoMSME) and the Small Industries Development Bank of India (SIDBI). The primary objective of this credit guarantee programme is to facilitate business lending by providing MSME loan guarantees to lending institutions and encouraging them to extend collateral-free loans in India to micro and small businesses (MSEs).

Under the CGTMSE scheme, eligible businesses can avail loans up to ₹5 crore without collateral security or third-party guarantee. In the event of default, the scheme gives 75-85% guarantee of the loan, reducing lenders' risk and making finance accessible for MSMEs and startups. This has been revolutionary in small business loans in India, and first-time entrepreneurs and companies have been able to innovate and grow.

Benefits of the CGTMSE Loan

The CGTMSE loan has several advantages that make it attractive for MSME loans for startup enterprises and startup business loans. It provides collateral-free loans, meaning no collateral security is necessary, a significant roadblock for small businesses with limited assets. This is ideal for MSMEs and startups that wish to expand without mortgaging property or other assets. MSME credit guarantee scheme covers 75-85% of the loan amount for loans of up to ₹50 lakh, and a maximum of 50% for retail trade or loans of over ₹50 lakh and up to ₹5 crore. For women entrepreneurs and businesses in the Northeast Region (NER), the coverage can be raised to 80-90%. With a higher loan limit of ₹5 crore (from ₹2 crore in April 2023), MSMEs can avail large working capital funds, machinery acquisition, business expansion, or technology upgradation. The scheme charges minimal CGTMSE fees, ranging from an annual guarantee fee of 0.37% to 1.35% of the loan amount, depending on the loan size and borrower category. Small-ticket financing up to ₹10 lakh has a nominal fee, being economical. MSMEs engaged in manufacturing, services, and retail trade (50% coverage) are covered under the CGTMSE scheme except for agriculture, self-help groups, and educational and training institutions. As it reduces lenders' risk, the guarantee scheme encourages entrepreneurship, enabling startup financing in India and funding MSME support programs by the Indian government.

Eligibility for CGTMSE Loans

To take advantage of a CGTMSE loan, businesses need to satisfy specific eligibility criteria as specified under the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006. Those who can borrow such loans include new and existing micro and small enterprises (MSEs) engaged in manufacturing, services, or retail trade. Startups which have been identified by Department for Promotion of Industry and Internal Trade (DPIIT) are also eligible under the Credit Guarantee Scheme for Startups (CGSS) with a maximum limit of ₹20 crore. Business entities that may be eligible are proprietary companies, partnerships, limited liability partnerships (LLPs), private companies, or public companies. Farms, self-help groups (SHGs), schools, and training institutions are not eligible. They must be registered as MSMEs under the Udyam Portal with a valid Udyam registration number. The borrowers must have an Income Tax Permanent Account Number (IT-PAN) except in case of loans up to ₹5 lakh. The loans may be taken for working capital, growth of the business, acquisition of machinery, or technology upgradation but not for personal expenditure.

The RTI full form (Right to Information) has no relationship with the CGTMSE scheme but can be applied in the case of asking for transparency on the process of the scheme or approvals under the RTI Act, 2005.

CGTMSE Loan Process: How to Apply for CGTMSE

Applying for a CGTMSE loan is an easy but comprehensive procedure. Go through the following steps to avail CGTMSE for startups or MSMEs. First, prepare a solid business plan outlining the project's financial viability, objectives, and funding requirements. This is instrumental in convincing lenders of your business potential. Secondly, visit one of the participating banks, non-banking financial company (NBFC), or financial institution registered with CGTMSE. Key Member Lending Institutions (MLIs) include State Bank of India (SBI), HDFC Bank, ICICI Bank, Bank of Baroda, and Ujjivan Small Finance Bank. A complete list may be accessed on the CGTMSE website (www.cgtmse.in). Attach loan application with required documents like duly filled CGTMSE loan application form, recent passport size photographs, Udyam registration certificate, GST registration certificate (if any), business incorporation or company registration certificate, detailed business project report, financial statements for the last 2-3 years (profit and loss, balance sheet) in case of an existing business, bank statements for the last six months, KYC documents (PAN card, Aadhaar card, passport, or driving license), proof of address (utility bills, rental agreement, or passport), and letter requesting CGTMSE loan cover. The lender will further analyze the loan application by evaluating the business viability, creditworthiness, and CGTMSE guideline adherence. On sanctioning the loan, MLI applies for guarantee cover through the use of the CGTMSE login portal. The borrower must pay the CGTMSE fee (guarantee and service fee) to initiate coverage. The guarantee then begins with payment by crediting the fee into CGTMSE's account. After approval by CGTMSE, the MLI discharges the loan to the account of the borrower. In case of term loans, guarantee is for the term; for working capital, it is for five years or a certain period. Pay the annual CGTMSE charges (if any) and follow the repayment schedule of the lender. In default, MLI can trigger the guarantee after 18 months lock-in period, if the account is NPA.

CGTMSE Fee and Fee Structure

CGTMSE fee is a combination of an annual guarantee fee (AGF) and a service fee paid in advance in the initial year and subsequently every year. The fee structure is based on the loan amount and classification of the borrower. For up to ₹5 lakh loans, the charge is 0.37% per annum for micro-enterprises (85% coverage). Up to ₹10 lakh loans incur a nominal charge, generally 0.75% per annum. For ₹10 lakh to ₹5 crore loans, the charge is 1.35% per annum (75-85% coverage, 50% for retail trade). Concessional rates and up to 90% coverage are provided for women entrepreneurs and Northeast Region (NER) units. The fee can be waived off for Zero Defect Zero Effect (ZED) certified units or for units in specified locations. Fee particulars are mentioned in the CGTMSE Scheme Document on the web.

Recommendations to Improve Your Chances of Getting a CGTMSE Loan

Ensure your project report is detailed, highlighting the growth opportunities of the business as well as repayability. Have a good credit score because lenders review creditworthiness during appraisal. Enroll your firm on the Udyam Portal beforehand to avoid delays in eligibility verification. Choose an MLI who has experience of handling CGTMSE loans in the past to make the application process easier. Seek the help of a financial advisor or chartered accountant to ensure all documents are accurate and complete. By following these steps and taking the advantage of the CGTMSE scheme, MSMEs and startups are able to get the financing they need in order to thrive in India's competitive marketplace. Click on the official CGTMSE website or consult with a participating lender in order to start your process for obtaining a collateral-free loan.

#cgtmse loan process#cgtmse scheme#credit guarantee scheme for msmes#msme loan guarantee#government schemes for msmes#msme subsidy programs#small business loans india#startup funding india#collateral-free loans india#finance

0 notes

Text

Mumbai News: महाराष्ट्र की औद्योगिक भूमिका को कभी नजरअंदाज नहीं किया - सीतारमण

केंद्रीय वित्त मंत्री सीतारमण ने शुरू की एमएसएमई का ‘म्यूचुअल क्रेडिट गारंटी योजना’। योजना के तहत मिलेगा 100 करोड़ रुपए तक का ‘कोलैटरल-फ्री लोन’। सीतारमण ने मुम्बई एक कार्यक्रम में कहा कि देश के बजट सेशन में महाराष्ट्र की औद्योगिक भूमिका को कभी नजरअंदाज नहीं किया। (Mumbai News, Never ignored the industrial role of Maharashtra) Mumbai News: माइक्रो स्मॉल और मीडियम एंटरप्राइजेज (MSME) को…

#Big news#Bombay#Bombay news#Breaking news#CollateralFree Loan#Fasttrack#fasttrack news#Hindi news#Indian budget#Indian Fasttrack#Indian Fasttrack News#Latest hindi news#Latest News#latest news update#Maharashtra big news#Maharashtra News#MSME#Mumbai News#Mutual Credit Guarantee Scheme#Never ignored the industrial role of Maharashtra#News#News in Hindi#News updates#Self reliance#self reliant india#Sitharaman#TODAY&039;S BIG NEWS#Union Finance Minister Sitharaman#what is Collateral Free Loan#आज की बड़ी खबर

1 note

·

View note

Text

Eastern India's Growth Takes Center Stage in Budget: Ranjot Singh

Purvodaya Scheme promises regional development boost CII Jharkhand chief applauds government’s focus on empowering MSMEs and fostering industrial growth in the East. JAMSHEDPUR – The initiatives in the Union Budget are designed to accelerate economic progress in the eastern region of India. The Union Budget, which was recently announced, has highlighted the importance of developing India’s…

#बिजनेस#business#CII Jharkhand budget response#Credit Guarantee Scheme MSMEs#Eastern India Development#Gaya industrial node#Jharkhand Industrial Policy#MSME support initiatives#Mudra loan limit increase#Purvodaya Scheme eastern India#regional economic growth#Union Budget 2024 highlights

0 notes

Text

Micro-Business Empowerment: Unveiling 5 Key Insights into CGTMSE Loan Schemes for Sustainable Growth

Micro-Business Empowerment: Unveiling the Pros and Cons of CGTMSE Loan Schemes for Sustainable Growth: Key Insights into CGTMSE Loan Schemes for Sustainable Growth India’s vast network of Micro, Small, and Medium Enterprises (MSMEs) forms the backbone of the nation’s economy. However, securing funding for these small businesses often proves challenging due to their perceived higher risk profile.…

View On WordPress

#Business Development#CGTMSE Loans#CMA Data#Credit Guarantee Fund Scheme#Empowerment#Entrepreneurship#Financial Consulting#Financial Empowerment#Loan Schemes#Micro-business#MSMEs#Project Reports#Pros and Cons#Small Business Financing#Sustainable Growth

0 notes

Text

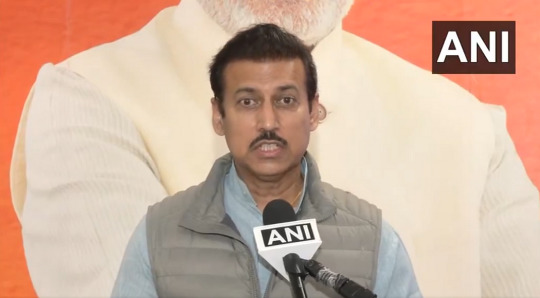

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

A guide to enhance your business growth

Running a business is akin to navigating a complex maze, and every entrepreneur dreams of not just surviving but thriving. In the Indian business landscape, the government has laid out a golden path for micro, small, and medium enterprises (MSMEs) through a simple yet powerful tool – MSME registration. In this guide, let's explore how this seemingly mundane registration process can be your ticket to unparalleled business growth.

Understanding the MSME Advantage

The Heartbeat of the Economy:

Micro, Small, and Medium Enterprises collectively form the heartbeat of the Indian economy. From local grocery stores to innovative startups, these businesses contribute not only to economic development but also to job creation, fostering a robust and inclusive growth environment.

Unlocking Financial Avenues:

One of the immediate perks of MSME registration is the access to financial assistance and credit facilities. Financial institutions offer tailored loans at favorable terms, recognizing the importance of these enterprises in driving economic progress.

The MSME Registration Journey

A Simpler Path Than You Think:

Contrary to popular belief, the MSME registration process is not a bureaucratic labyrinth. It's a straightforward journey that involves providing essential details about your business, such as PAN, Aadhaar, and other relevant information. Whether you choose the online portal or opt for the traditional route at District Industries Centres, the process is designed to be accessible.

Documents: Your Passport to Opportunities:

The importance of documentation in the registration process cannot be overstated. Your Aadhaar card, PAN card, business address proof, and details of your plant and machinery are the keys that unlock the door to a myriad of government schemes and subsidies.

The MSME Advantage Unveiled

Market Access and Procurement Preferences:

Once you've acquired your MSME registration, you find yourself in a prime position in government procurement. MSMEs are often given preference in government tenders, providing a golden opportunity to secure contracts and expand your market reach.

Technology Upgradation and Subsidies:

In the rapidly evolving business landscape, technology is the differentiator. MSME registration brings with it the chance to upgrade your technology with subsidies for adopting new and advanced processes. This not only boosts efficiency but also enhances your competitiveness.

Navigating the Schemes and Subsidies Landscape

Credit Linked Capital Subsidy Scheme (CLCSS):

At the forefront of government schemes is CLCSS, a game-changer for technology upgradation. It provides capital subsidies to MSMEs, facilitating access to credit for purchasing new machinery and equipment.

Pradhan Mantri Employment Generation Programme (PMEGP):

For those looking to embark on the entrepreneurial journey, PMEGP is the beacon. This credit-linked subsidy program promotes self-employment, creating not just businesses but livelihoods.

Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGMSE):

The fear of collateral is a common hurdle for many small businesses. CGMSE eliminates this barrier by offering collateral-free credit facilities, making it easier for MSMEs to access the capital needed for growth.

Tailoring Your Approach

District Industries Centres (DIC) and National Small Industries Corporation (NSIC):

Think of DIC and NSIC as your business allies. DIC, as a local agency, offers guidance and support, while NSIC provides a range of services from marketing assistance to credit facilitation. Engaging with these institutions can significantly enhance your MSME journey.

Tech and Quality Upgradation Support:

The government's emphasis on quality is evident through schemes like Lean Manufacturing Competitiveness Scheme (LMCS) and Quality Management Standards & Quality Technology Tools (QMS/QTT). These initiatives not only boost competitiveness but also position your business as a paragon of quality in the market.

Export Promotion and Market Development:

Venturing into global markets can seem daunting, but the Market Development Assistance Scheme for MSMEs is a trustworthy companion. It provides financial support for participating in international trade fairs, opening doors to new business horizons.

Overcoming Challenges for Seamless Growth

Lack of Awareness:

One of the challenges MSMEs often face is the lack of awareness about available schemes. Entrepreneurs can overcome this by actively seeking information through government portals, industry associations, and local MSME support cells.

Complex Application Processes:

Cumbersome application procedures can be discouraging, but persistence pays off. Simplifying the application process and seeking assistance from dedicated facilitation services or MSME support agencies can make the journey smoother.

Continuous Evaluation and Adaptation

Performance and Credit Rating Scheme:

Enhancing your creditworthiness is an ongoing process. The Performance and Credit Rating Scheme allows MSMEs to undergo assessments, showcasing financial stability to potential investors and lenders.

Embracing Continuous Improvement:

The business landscape is dynamic, and your approach should be too. Regularly assess the impact of government schemes on your operations, adapt to changes, and stay informed about updates to maximize benefits continually.

Conclusion: Your Journey to Unprecedented Growth

In conclusion, MSME registration in India is not just a formality; it's your gateway to a realm of opportunities. By understanding the classifications, embracing government schemes, and overcoming challenges, you position your business for sustainable growth. The government's commitment to fostering MSMEs is a testament to the integral role these enterprises play in shaping the nation's economic future. So, don't just register – embark on a journey of growth, innovation, and success. The path is laid; it's time to walk it.

Learn more at : https://msme-registration.in/

#udyog aadhar free registration#msme free registration#msme registration free#print udyam certificate#free udyog aadhar registration#udyog aadhar update#msme registration online#msme loan#online business#msme

2 notes

·

View notes

Text

How Private Limited Companies Can Secure Business Credit Lines Without Collateral

Access to capital is a critical factor in the growth journey of any business. For private limited companies in India, securing business credit lines can unlock essential working capital, fuel expansion, and build creditworthiness. However, one of the biggest hurdles entrepreneurs face is getting a credit line without collateral.

Fortunately, with the right strategy and structure, it is possible for Private Limited Companies to secure unsecured business credit. This blog explains how, and why your company’s legal setup—including Private Limited Company Registration in India—plays a vital role in accessing such credit.

Why Choose a Private Limited Company Structure?

Before diving into credit strategies, let’s understand why the Pvt Ltd Company Registration in India matters. Lenders assess a business’s structure to evaluate risk. A Private Limited Company, as opposed to a sole proprietorship or partnership, is a legally distinct entity. It is considered more credible by banks, NBFCs, and fintech lenders.

If you're still operating as an unregistered business, learning how to register a company in India is your first step toward building financial credibility.

How to Register a Company in India to Improve Credit Access

To secure credit lines, you must first ensure your business is legally registered. Here’s a simplified process to register a company in India:

Choose a business name and get it approved via the Ministry of Corporate Affairs (MCA).

Apply for Digital Signature Certificates (DSC) and Director Identification Numbers (DIN).

Draft incorporation documents, including the Memorandum and Articles of Association.

File for registration with the Registrar of Companies (RoC) through the SPICe+ portal.

Once approved, you’ll receive a Certificate of Incorporation, PAN, and TAN.

With increasing digitization, many entrepreneurs now prefer company registration online in India, which allows the entire process to be completed from anywhere with minimal paperwork.

Still unsure how to register a startup company in India? Expert services are available to guide you through compliance, documentation, and legal formalities.

Strategies to Get Business Credit Without Collateral

Once your Private Limited Company is properly registered, here’s how you can improve your chances of securing unsecured business credit:

1. Build a Strong Business Credit Profile

Open a current account under your company name, pay vendors and employees through traceable means, and ensure all regulatory filings (GST, income tax, ROC) are done on time. This builds your creditworthiness.

2. Maintain Clean Financial Records

Audited financials, income tax returns, and bank statements are key documents lenders review. Having transparent, professionally managed books increases your chances of approval.

3. Use Fintech Lending Platforms

Many modern lenders use alternate data (like cash flow, digital payments, and e-commerce history) to assess risk, allowing Private Limited Companies to borrow without pledging assets.

4. Apply for Government-Supported Schemes

Schemes like Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) offer loans without collateral to eligible businesses, especially for startups and MSMEs.

5. Leverage Vendor and Customer Relationships

Some credit lines are extended based on your contractual revenue or supply chain relationships. If you have predictable invoices or clients with strong credit histories, lenders may use this to justify extending unsecured credit.

Why Company Registration Online in India Matters

A formally registered company holds greater trust in the eyes of financial institutions. That’s why Company Registration in India—especially using online company registration portals—is a critical foundation step. Whether you’re an early-stage startup or scaling SME, registering a Private Limited Company opens up access to:

Institutional lending

Government schemes

Invoice financing

Trade credit

Venture capital and angel investment

Final Thoughts

If you're serious about scaling your business, registering a Private Limited Company in India is more than a compliance step—it’s a strategic move to unlock credit and growth. Understanding how to register a company in India and building a strong business credit profile go hand in hand.

And with options for Company registration online in India, there's no reason to delay. Whether you're figuring out how to register a startup company in India or ready to scale a growing venture, start by getting your business structure right—and the capital will follow.

#Private limited company registration in India#Pvt Ltd Company Registration in India#Company Registration in India#how to register a company in India#register a company in India#how to register a startup company in India#Company registration online in India#company registration online in India

0 notes

Text

Udyam Registration Online: Your Business’s Key to Growth

In the ever-expanding world of entrepreneurship, every business—big or small—needs a competitive edge to grow, sustain, and thrive. For Micro, Small, and Medium Enterprises (MSMEs) in India, that edge comes in the form of Udyam Registration. Introduced by the Ministry of Micro, Small, and Medium Enterprises in 2020, Udyam Registration is a simplified, paperless process designed to formalize small businesses and give them access to numerous government benefits. Whether you’re a startup, a home-based entrepreneur, or an established SME looking to scale up, Udyam Registration could be your gateway to growth. Let’s explore what it is, why it matters, and how to register online quickly and easily.

What is Udyam Registration?

Udyam Registration is a government-issued certificate that officially recognizes your business as an MSME (Micro, Small, or Medium Enterprise) under the MSME Development Act, 2006. It replaces the earlier system of Udyog Aadhaar registration and aims to provide a hassle-free platform to promote the ease of doing business.

The entire process is digital, self-declared, and linked with your Aadhaar number—no physical documents or fees are required.

Benefits of Udyam Registration

Access to Government Schemes

Registered MSMEs can avail benefits under various schemes such as:

Credit Guarantee Scheme

Prime Minister’s Employment Generation Programme (PMEGP)

Micro and Small Enterprises Cluster Development Programme

Zero Defect Zero Effect (ZED) certification

Easier Bank Loans and Subsidies

Banks and NBFCs often prefer lending to registered MSMEs. Udyam registration makes your business eligible for:

Priority sector lending

Lower interest rates on loans

Collateral-free credit

Tax and Compliance Benefits

MSMEs enjoy exemptions from certain tax filings, registration under specific laws, and concessions in electricity bills, trademark fees, and patent registration.

Government Tenders and Procurement

Udyam-registered enterprises get preference in government procurement policies and are eligible to participate in e-tenders issued on the GeM (Government e-Marketplace) portal.

Protection Against Delayed Payments

According to the MSME Act, registered businesses can claim interest on delayed payments from buyers and resolve disputes quickly through specialized courts.

Ease of Business Expansion

Recognition as a registered MSME adds credibility to your business, making it easier to partner with corporates, apply for licenses, and expand operations.

Who Can Register Under Udyam?

Any business involved in manufacturing, production, processing, or service delivery can apply. This includes:

Proprietorships

Partnership firms

Limited liability partnerships (LLPs)

Private limited or public limited companies

Self-help groups (SHGs)

Co-operative societies

Trusts and societies involved in business activities

Businesses must meet the following investment and turnover criteria:

Micro Enterprises: Enterprises with investments not exceeding ₹2.5 crore and annual turnover capped at ₹10 crore.

Small Enterprises: Businesses investing up to ₹25 crore with a maximum turnover of ₹100 crore per year.

Medium Enterprises: Firms with investments up to ₹125 crore and annual turnover not exceeding ₹500 crore.

Step-by-Step: Udyam Registration Online Process

Registering your business on the Udyam portal is simple and takes less than 10 minutes. Here’s how you can do it:

Go to the Official Website

Launch your browser and navigate to the official Udyam Registration portal.

Fill Out Business Information

Input all required business details, including name, type, location, and banking information. Ensure all entries are accurate.

Double-Check Your Form

Review your application to make sure there are no mistakes before moving forward.

Proceed with Payment (If Required)

Select your payment option and complete the fee payment if you're using a paid service for registration.

Verify with OTP

A One-Time Password will be sent to the mobile number linked to your Aadhaar. Enter it to confirm your identity.

Submit the Application

Once verified, submit your registration form for processing.

Receive Your Certificate

After approval, your official Udyam Registration Certificate will be emailed to you.

Documents Required for Udyam Registration

Udyam registration is document-free. You only need:

Aadhaar Number of the applicant (mandatory)

PAN and GSTIN (for partnerships, LLPs, and companies)

Bank details (account number and IFSC code)

Basic business information (address, activity, etc.)

Everything is verified automatically via government databases (Income Tax, GST, and Aadhaar systems), making it seamless.

Udyam Registration for Existing Enterprises

Already registered under Udyog Aadhaar, EM-I, or EM-II? You must re-register under the Udyam system to continue receiving MSME benefits. The process is the same, but requires linking your old registration number during the application.

Common Mistakes to Avoid

Entering incorrect Aadhaar or PAN details

Not updating turnover or investment figures annually

Using personal accounts instead of business accounts

Failing to link the GSTIN if applicable

Correct and updated information ensures you remain eligible for all schemes and benefits.

Note: Now easily Print Udyam Certificate through the udyam portal

Conclusion

In a fast-changing business environment, Udyam Registration is not just a compliance formality—it’s a smart strategy. It offers credibility, simplifies access to capital, and unlocks a suite of government incentives that can accelerate your business journey. Whether you’re a home-based business or a growing SME, don’t miss out on the opportunities that come with Udyam. Register online today, formalize your operations, and take your business to the next level.

0 notes

Text

Small business accountants near me Hyderabad

The Benefits of the MSME Scheme: Empowering Small Businesses for Growth and Success

Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in driving economic growth, fostering innovation, and generating employment. Recognizing their significance, governments around the world, including India, have introduced specialized schemes to support this sector. The MSME scheme is designed to offer financial and operational assistance to small businesses, empowering them to thrive in competitive markets. In this article, we will explore the key benefits of the MSME scheme and the transformative impact it has on businesses. Income Tax Filing Madhapur Hyderabad

1. Easy Access to Capital

One of the most significant challenges faced by MSMEs is securing adequate funding. The MSME scheme addresses this issue by providing businesses with easier access to loans, credit facilities, and other financial aid. Under this scheme, small enterprises can benefit from lower interest rates, reduced collateral conditions, and extended repayment periods. Compliance Services Madhapur

Key Financial Benefits:

- Collateral-free loans to reduce financial burdens.

- Subsidies on interest rates for timely repayments.

- Specialized financial programs for startups and first-time entrepreneurs.

This financial support ensures that small businesses have the resources needed to invest in infrastructure, purchase equipment, and scale their operations. Small business accountants near me Hyderabad

2. Tax Exemptions and Incentives

To ease the operational cost burden, the MSME scheme offers a range of tax benefits and incentives. These tax policies allow businesses to retain more of their earnings, which can be reinvested in growth initiatives.

Tax Relief Features:

- Direct tax exemptions under certain conditions.

- Credit guarantee schemes to reduce taxation pressure.

- Subsidies for energy efficiency and technology adoption.

These incentives make it easier for MSMEs to focus on expansion and innovation without being weighed down by excessive taxation.

3. Technology Adoption and Skill Development

A vital component of the MSME scheme is encouraging businesses to embrace modern technologies. Technological advancements enhance efficiency, improve product quality, and elevate competitiveness in global markets.

Highlights:

- Funding for acquiring modern machinery and tools.

- Training programs and workshops for employee skill development.

- Assistance in integrating digital marketing strategies.

By promoting skill enhancement and tech adoption, MSMEs can stay ahead in rapidly evolving industries and boost their productivity.

4. Market Expansion Opportunities

Breaking into larger markets can be daunting for small businesses. The MSME scheme bridges this gap by enabling enterprises to expand their market reach, both domestically and internationally.

Support Mechanisms for Market Growth:

- Participation in trade fairs and international exhibitions at subsidized costs.

- Access to a national database for vendor registrations and public contracts.

- Business matchmaking opportunities to connect MSMEs with larger corporations.

This targeted support allows businesses to tap into new customer bases and explore global opportunities without incurring excessive costs.

5. Protection Against Delayed Payments

One of the most common hurdles faced by small businesses is the issue of delayed payments from buyers, particularly in business-to-business transactions. The MSME scheme provides a legal framework to protect these enterprises from such bottlenecks.

Payment-Related Benefits:

- Mandated timelines for buyers to settle dues with MSMEs.

- Penalty provisions for delayed payments to safeguard business liquidity.

- Digital platforms for dispute resolution and payment tracking.

These measures enable businesses to maintain a steady cash flow, ensuring continuity of operations and reducing financial stress.

6. Encouragement of Women Entrepreneurs

The MSME scheme places special emphasis on empowering women entrepreneurs by offering tailored programs and exclusive benefits.

Benefits for Women-Run MSMEs:

- Special subsidies for women-led businesses.

- Priority lending programs to support women entrepreneurs.

- Mentorship and training initiatives specifically designed for women in business.

This support not only promotes inclusivity but also helps women entrepreneurs make a significant contribution to the economy.

7. Export Promotion and Assistance

Expanding into global markets is a critical step for MSMEs looking to grow. The MSME scheme facilitates international trade by providing access to resources and financial assistance for export activities.

Export Promotion Benefits:

- Subsidies for freight and shipment costs.

- Export credit facilities and insurance coverage.

- Guidance in meeting international product standards and certifications.

With these measures in place, MSMEs can confidently venture into international markets, boosting their revenue and establishing a global footprint.

8. Sustainability and Green Initiatives

The MSME scheme encourages enterprises to adopt sustainable practices, contributing to environmental conservation and long-term profitability.

Sustainable Business Support:

- Subsidies for adopting eco-friendly production techniques.

- Assistance in gaining green certifications.

- Financial aid for waste reduction and energy conservation.

By integrating sustainability into their operations, MSMEs can reduce costs, comply with regulatory norms, and appeal to environmentally conscious customers.

9. Improved Infrastructure and Business Ecosystem

The MSME scheme is instrumental in creating a supportive ecosystem for small businesses. This includes the development of industrial parks, business hubs, and technological infrastructure tailored specifically for MSMEs.

Infrastructure Benefits:

- Access to dedicated industrial clusters for cost-efficient operations.

- Improved connectivity and logistics support.

- Technology-based solutions like e-marketplaces and digital platforms for procurement.

These initiatives contribute to creating a cohesive and efficient business environment, ensuring that MSMEs can operate without major logistical or infrastructural challenges.

10. Enhanced Employment Opportunities

By empowering MSMEs, the scheme indirectly contributes to national employment generation. With improved access to financial resources, infrastructure, and markets, these businesses can expand, leading to the creation of new jobs.

Employment Benefits:

- Skill development for local workers.

- Opportunities for self-employment, particularly in rural industries.

- Expansion of manufacturing and service-based industries.

An increase in employment opportunities strengthens the workforce and drives economic development at the grassroots level.

Conclusion: Transforming India’s MSME Sector

The MSME scheme is a game-changer for small businesses, offering financial, technical, and infrastructural support to fuel their growth. By addressing key challenges such as funding, market access, and skill development, the scheme lays the foundation for a robust MSME ecosystem. For businesses aiming to scale and thrive in competitive markets, leveraging the benefits of this scheme can be the key to long-term success.

As MSMEs continue to grow and innovate, they not only contribute to individual economic success but also drive national progress by creating jobs, promoting sustainability, and boosting exports. For entrepreneurs seeking to tap into this opportunity, enrolling in the MSME scheme is a step toward unlocking untapped potential and achieving broader business ambitions.

Tirumalesh & Co | Chartered Accountants offers expert Best CA Firms In Madhapur Get accurate, timely solutions from trusted professionals near you.

Call/What’s App – +91 84998 05550.

Location: https://bit.ly/42ljdS4

Visit link: https://www.catirumalesh.in/

#Income Tax Filing Madhapur Hyderabad#Best Ca Firms In Madhapur#TDS Return Filing Madhapur#Company Registration Madhapur#ROC Compliance Services Hyderabad#Professional Tax Filing Madhapur#Company Audit Services Near Me

1 note

·

View note

Text

MSME Loans Made Simple: Fast & Trusted Solutions by Vibho Associates

In today's competitive economy, Micro, Small, and Medium Enterprises (MSMEs) form the backbone of India's economic growth. They generate employment, foster innovation, and contribute significantly to GDP. However, one of the biggest hurdles MSMEs face is access to timely and sufficient financing. That’s where Vibho Associates comes into play with its fast, reliable, and customer-centric MSME loan solutions.

Understanding MSME Loans

MSME loans are specialized financial products aimed at supporting the unique needs of small and medium-sized businesses. These loans can be used for a variety of purposes, including:

Business expansion

Purchasing equipment and machinery

Working capital requirements

Inventory management

Technology upgrades

With the right financial support, MSMEs can boost their operations and compete effectively in both domestic and international markets.

Challenges MSMEs Face in Securing Loans

Many small businesses struggle with loan approval due to:

Lack of collateral

Limited credit history

Complex documentation

Delayed processing

Unfavorable interest rates

Vibho Associates addresses these challenges with a customer-first approach, ensuring that every entrepreneur gets a fair chance to grow.

Why Choose Vibho Associates for MSME Loans?

1. Speedy Processing:

Time is money, especially in business. Vibho Associates is known for its quick turnaround time, from loan application to disbursal. Most loans are approved within 48-72 hours, subject to documentation.

2. Minimal Documentation:

Forget the endless paperwork. Vibho Associates simplifies the process with a minimal documentation requirement, allowing you to focus on running your business.

3. Personalized Support:

Each MSME is unique. The experts at Vibho Associates offer personalized financial consultation to understand your needs and suggest the best loan product.

4. Competitive Interest Rates:

With partnerships across leading banks and NBFCs, Vibho Associates ensures competitive interest rates that fit your budget and repayment capacity.

5. Trusted by Thousands:

With a strong track record and numerous happy clients, Vibho Associates has built a reputation as a trusted MSME loan facilitator in India.

Types of MSME Loans Offered

Vibho Associates offers a variety of loan products to cater to different MSME needs:

Working Capital Loans: To meet day-to-day operational costs.

Term Loans: For purchasing machinery, property, or infrastructure expansion.

Line of Credit: Flexible credit facility for recurring business needs.

Equipment Finance: For buying new or upgrading existing machinery.

Invoice Financing: Get loans against unpaid invoices to maintain cash flow.

Eligibility Criteria

Though eligibility may vary slightly based on the lender, the general criteria include:

Business should be registered as an MSME

Operational history of at least 1 year (for some products)

Valid business PAN card and GST registration

Minimum annual turnover as specified by the lender

Required Documents

Identity & address proof

Business registration documents

Bank statements (last 6-12 months)

ITR and financial statements

GST returns

How to Apply with Vibho Associates?

The application process is simple and can be initiated both online and offline:

Consultation: Speak with a loan advisor from Vibho Associates.

Document Submission: Share the necessary documents.

Loan Assessment: Your application is assessed for eligibility.

Approval & Disbursal: Once approved, funds are disbursed quickly to your bank account.

Real Success Stories

Many businesses have benefited from Vibho Associates’ MSME loans. From local manufacturers in tier-2 cities to small tech startups, Vibho has empowered entrepreneurs to expand, invest in innovation, and create jobs.

Government Schemes for MSMEs

Vibho Associates also assists clients in availing government-backed MSME loan schemes such as:

CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises)

PMEGP (Prime Minister’s Employment Generation Programme)

MUDRA Loans under the Pradhan Mantri Mudra Yojana

These schemes offer benefits like collateral-free loans, interest subsidies, and flexible repayment terms.

Why MSME Loans Are More Important Than Ever

Post-pandemic recovery, rising digitization, and global economic opportunities make it crucial for MSMEs to invest in technology, talent, and infrastructure. MSME loans act as the fuel to power this growth engine.

With rising demand and growing competition, access to quick and affordable financing can mean the difference between stagnation and growth.

Final Thoughts

Vibho Associates is committed to supporting the dreams and ambitions of India's MSME sector. Whether you're a manufacturer, retailer, trader, or service provider, Vibho has a loan solution tailored just for you.

MSME Loans are no longer complex. With Vibho Associates, they are fast, trusted, and hassle-free.

#MSMELoan#BusinessLoan#SmallBusinessSupport#LoanForBusiness#MSMEIndia#StartupFinance#EntrepreneurSupport#FinancialGrowth#BusinessFunding#SMELoan

0 notes

Text

How to Obtain a CGTMSE Loan: An In-Depth Guide

Beginning or expanding a small business is often a matter of one solitary factor: access to financing. For numerous entrepreneurs in India, conventional loans are still beyond reach because of collateral demands and stringent eligibility standards. That is where the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) comes into play. This government flagship programme provides collateral-free financing to micro, small, and medium enterprises (MSMEs), facilitating businesses in accessing finance and expanding activities.

The CGTMSE programme, initiated jointly by the Ministry of Micro, Small and Medium Enterprises and SIDBI (Small Industries Development Bank of India), aims to provide new and existing MSMEs with loans. It offers a credit guarantee to banks and financial institutions, thus lowering the risk of lending to enterprises that are unable to provide collateral. The scheme allows MSMEs to access loans of up to ₹5 crore without having to mortgage personal or enterprise assets. It is therefore one of the most impactful credit guarantee schemes for MSMEs in India.

There are a number of advantages in taking a CGTMSE loan. The most significant is access to collateral-free loans in India, which is especially useful for small businesses and startups with fewer assets. Because the loans are guaranteed by the government, banks are more willing to lend, and this usually results in easier approvals and more favorable loan conditions. The plan is also very inclusive and supports a large number of business enterprises and covers a very extensive network of banks and non-banking finance companies (NBFCs) enrolled under the program.

For this state-funded financing, the business enterprise must qualify as Micro, Small, or Medium Enterprise according to the MSME Development Act. It should engage in manufacturing, services (not retail trade), or allied agricultural activities. It should not be a defaulter of any bank or financial institution and should also have a sustainable business model or project proposal that can indicate its possibility of succeeding.

Knowledge of the CGTMSE loan process is imperative for an effective application. It starts with the preparation of a comprehensive business plan, financial projections, market analysis, and a definite strategy to utilize the funds. After preparing the plan, the entrepreneur has to visit a participating bank or NBFC and apply for a small business loan against the CGTMSE scheme. The proposal will be examined by the lender as per its internal credit policy and will test the financial sustainability of the company. In case of approval for the loan, then the bank approaches CGTMSE for the guarantee cover. After getting the approval from CGTMSE, the loan is credited to the account of the borrower.

Now if you are thinking about how to apply for CGTMSE, the process is quite simple. First, choose an participating lender from the list of CGTMSE-registered banks and NBFCs. Make all the documentation ready like business registration, KYC details, GST registration, financial projections, and a detailed business plan. Next, apply for the loan at the chosen financial institution, making sure you specify clearly that you desire to apply under the CGTMSE scheme. Once submitted, remain in contact with the lender to find out about the status of your application and any additional requirements.

Apart from the CGTMSE loan, companies need to consider other subsidy schemes for MSMEs provided by the Indian government. Some of them are the Credit Linked Capital Subsidy Scheme (CLCSS), Technology and Quality Upgradation Support, MUDRA loans, and Stand-Up India Scheme. These schemes provide additional assistance in the form of interest subsidies, capital support, and technological upgradation, keeping businesses competitive and financially healthy.

In summary, the CGTMSE scheme is an essential lifeline for Indian small enterprises and startups seeking affordable finance. Being a strong credit guarantee mechanism for MSMEs, it eliminates one of the largest impediments—collateral—and presents fresh avenues for entrepreneurial development. By knowing the process of taking a CGTMSE loan and utilizing the different government schemes for MSMEs, entrepreneurs can avail of the necessary financial support to innovate, grow, and excel in the Indian market.

Whether you're an emerging entrepreneur requiring startup capital in India or an existing small business owner wanting to expand, a CGTMSE loan can be the key to success. Contact a participating financial institution today and begin your journey to securing your future.

#cgtmse scheme#msme loan guarantee#msme subsidy programs#startup funding india#small business loans india#collateral-free loans india#credit guarantee scheme for msmes#cgtmse loan process#government schemes for msmes

0 notes

Text

Emergency Credit Line Scheme for MSME Borrowers

The Emergency Credit Line Guarantee Scheme (ECLGS) offers 100% guaranteed additional loans up to 20% of outstanding credit to eligible MSMEs and business entities. Loans have a 4-year term, 1-year moratorium, and no fees. Only existing borrowers are eligible under set criteria.

0 notes

Text

Government Initiatives Supporting Collateral-Free Business Loans

The Indian government has launched several initiatives to promote financial inclusion and support the growth of micro, small, and medium enterprises (MSMEs) through collateral-free financing options.

One notable scheme is the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), which provides credit guarantees to financial institutions offering loans to MSMEs without requiring collateral. Under this scheme, businesses can avail loans up to ₹2 crore, provided they meet the eligibility criteria, including a viable business plan and satisfactory credit history.

Another significant initiative is the Pradhan Mantri MUDRA Yojana (PMMY), which aims to provide financial support to micro-enterprises. MUDRA loans are categorized into three segments: Shishu (up to ₹50,000), Kishore (₹50,000 to ₹5 lakh), and Tarun (₹5 lakh to ₹10 lakh), catering to businesses at different stages of development. These loans are collateral-free and are disbursed through various financial institutions, including banks and non-banking financial companies (NBFCs).

The Stand-Up India scheme is designed to facilitate bank loans between ₹10 lakh and ₹1 crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch for setting up greenfield enterprises. These loans are also collateral-free and aim to promote entrepreneurship among underrepresented groups.

Additionally, the PM Vishwakarma Scheme offers collateral-free loans with an interest rate of 5% to traditional artisans and craftsmen, supporting their business development and financial inclusion.

These government-backed schemes play a crucial role in enabling MSMEs to access credit without the burden of collateral, thereby fostering entrepreneurship and economic growth.

0 notes

Text

Introduction to Economic Current Affairs

Introduction to India’s Economic Landscape

India’s economy is buzzing from tech start-ups to green energy, from rural schemes to global diplomacy. And with the world watching closely, current economic trends are more relevant than ever to citizens, entrepreneurs, students, and policymakers alike.

Why Keeping Track of Economic Affairs is Crucial

Whether you’re investing in stocks, running a business, or planning your future career, being aware of what’s happening in the economy helps you make smarter decisions. Especially in a dynamic economy like India’s, where every policy or budget tweak impacts millions.

Key Drivers of the Indian Economy Today

India’s growth is currently driven by tech innovation, infrastructure development, digitisation, and a young, aspirational workforce. Government reforms, global partnerships, and educational advancements like those by Khan Global Studies are helping build a future-ready economy.

Post-Pandemic Recovery

Growth in GDP Post-COVID

India’s GDP rebounded sharply post-COVID, making it the world’s fastest-growing major economy. Sectors like manufacturing, construction, and services saw a significant uptick, with the IMF projecting robust growth through 2025.

Employment and MSME Revamp

The Micro, Small, and Medium Enterprises (MSME) sector, the backbone of India’s economy, is getting back on its feet thanks to financial stimulus, digital tools, and credit guarantees.

Inflation and RBI’s Monetary Policies

Rising Prices and Consumer Sentiment

Prices of essentials like food and fuel have been volatile. The Reserve Bank of India (RBI) is walking a tightrope between controlling inflation and sustaining growth.

Interest Rate Hikes and Their Impact

To manage inflation, the RBI has raised repo rates multiple times. While it curbs rising prices, it also makes loans and EMIs more expensive, affecting consumers and businesses alike.

Digital India and Tech Growth

Digital Payments and UPI Expansion

India is leading the world in digital payments. UPI transactions have skyrocketed, even in rural areas, transforming how people buy, sell, and save.

Start-up Ecosystem and Unicorn Boom

India is now home to over 100 unicorns. From fintech to healthtech, innovation is thriving, drawing global investors and creating new jobs.

Role of Khan Global Studies in Digital Education

Khan Global Studies is playing a key role in educating students and professionals on the digital economy. Their online platforms offer courses that simplify complex economic concepts, preparing learners for the real world with relevant, timely knowledge.

Budget 2025 and Fiscal Policies

Highlights of the Union Budget

The Union Budget 2025 focused on capital expenditure, rural development, and digital skilling. A significant chunk was allocated to green energy, transportation, and youth employment programmes.

Push for Infrastructure and Manufacturing

Initiatives like PM Gati Shakti and National Infrastructure Pipeline aim to build modern roads, ports, and railways, enhancing logistics and attracting investments.

Agriculture and Rural Economy

Government Schemes for Farmers

PM-KISAN, Fasal Bima Yojana, and Minimum Support Price (MSP) reforms are helping farmers stabilise incomes and reduce risk.

Digital Agriculture and Market Linkages

Agri-tech is booming with mobile apps and digital platforms connecting farmers directly with markets, boosting their profits and efficiency.

Energy Sector and Sustainability

Green Hydrogen Mission

India’s National Green Hydrogen Mission aims to make the country a hub for clean fuel production, reducing the carbon footprint and energy imports.

Investments in Solar and Wind Energy

Massive solar parks and wind farms are being set up across the country, backed by public-private partnerships and international funding.

Employment and Labour Market Trends

Rise in the Gig Economy

More Indians are freelancing or working part-time gigs via apps, creating new flexibility but also raising questions about job security and benefits.

Government Skill Development Initiatives

Schemes like Skill India and Digital India are training millions in new-age skills, coding, data analysis, AI, and entrepreneurship.

Make in India and Manufacturing Push

PLI Schemes

Production-linked incentive (PLI) schemes are giving a big boost to domestic production in electronics, pharmaceuticals, and textiles.

Boost in Electronics and Defence Manufacturing

India is becoming a preferred destination for electronics manufacturing. Defence exports are also rising, showcasing India's strategic manufacturing capabilities.

EdTech’s Contribution to the Economy

Growing Online Education Market

Post-pandemic, digital education has gone mainstream. Platforms are expanding into regional languages, bridging gaps in access and quality.

Khan Global Studies Empowering Youth

Khan Global Studies is leading by example, offering practical, engaging economic education tailored to Indian students. Their mission? To make every learner economically literate and future-ready.

Trade Relations and Global Influence

India’s Trade with Neighbours and Beyond

India is diversifying trade ties with countries in the Indo-Pacific, Africa, and Latin America. Free Trade Agreements (FTAs) with the UK and EU are also in the pipeline.

Role in BRICS, G20, and Global Supply Chains

India is taking centre stage in global forums, influencing trade, tech, and climate discussions. Its presidency of the G20 spotlighted key economic agendas.

Stock Market and Investor Trends

Retail Investor Participation Surge

More Indians are investing in the stock market than ever before, thanks to easy-to-use apps and financial awareness campaigns.

Trends in Mutual Funds and SIPs

Systematic Investment Plans (SIPs) are growing rapidly, showing rising trust in long-term investment instruments.

Urbanisation and Real Estate Trends

Affordable Housing Push

Pradhan Mantri Awas Yojana is driving mass housing projects in tier-2 and tier-3 cities, making homeownership more achievable.

Smart Cities and Urban Planning

The Smart Cities Mission is modernising urban infrastructure with technology-led governance, better transit systems, and sustainable development.

Challenges Ahead

Inflation, Global Tensions, and Policy Delays

Geopolitical unrest, inflation, and slow policy execution could threaten the current growth momentum.

Bridging Economic Inequality

Access to quality education, employment, and healthcare remains unequal. Policies and platforms like Khan Global Studies are vital in bridging this gap.

Future Outlook for the Indian Economy

India's economy is expected to stay resilient, with strong domestic demand, a thriving digital ecosystem, and strategic global alliances. But success will depend on inclusive growth, tech adoption, and agile governance.

Conclusion

India’s economic journey in 2025 is vibrant, complex, and full of potential. With sectors like EdTech, renewable energy, and manufacturing leading the charge, and with educational platforms like Khan Global Studies building awareness and skillsets, the country is on track to become a global economic powerhouse. Staying informed and engaged is the first step towards making the most of these exciting times.

FAQs

What are the key highlights of India’s economy in 2025?

India is experiencing strong GDP growth, digital innovation, increased manufacturing, and a boom in start-ups, with a sharp focus on sustainability and youth empowerment.

How is Khan Global Studies contributing to India’s education sector?

Khan Global Studies offers interactive, real-world economics and financial education courses, helping learners understand and participate in India’s evolving economy.

What is India doing to tackle inflation?

The Reserve Bank of India is adjusting interest rates, while the government is implementing price controls, subsidies, and promoting local production to stabilise prices.

Which sectors are leading India’s economic growth?

Key sectors include EdTech, green energy, manufacturing (especially electronics and defence), digital finance, and infrastructure.

How are Indian start-ups impacting the economy?

They’re generating jobs, attracting global investment, and offering innovative solutions across sectors like fintech, healthtech, agri-tech, and education.

Originally published at http://kgsupsc.wordpress.com on May 17, 2025.

0 notes

Text

Fueling Growth: Understanding MSME Loans in India

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the Indian economy, contributing significantly to employment generation, manufacturing output, and exports. However, one of the biggest challenges MSMEs face is access to timely and affordable credit. This is where MSME loans step in—tailored financial products that provide small businesses with the working capital and long-term funds they need to grow and compete.

What is an MSME Loan?

An MSME loan is a form of business financing provided to micro, small, and medium enterprises for various purposes, such as business expansion, purchasing machinery, working capital, or managing cash flow. These loans are offered by banks, Non-Banking Financial Companies (NBFCs), and fintech lenders, often under schemes supported by the Government of India, like CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) and PMEGP (Prime Minister’s Employment Generation Programme).

Key Features of MSME Loans

Loan Amount: MSME loans can range from ₹50,000 to ₹2 crore or more, depending on the lender and the borrower’s profile.

Tenure: Usually between 12 months to 5 years, with flexible repayment schedules.

Collateral-Free: Many MSME loans are unsecured, especially those covered under government guarantee schemes.

Quick Disbursal: Some NBFCs and digital lenders offer instant approval and fund disbursal within 24–72 hours.

Competitive Interest Rates: Interest rates vary from 9% to 25%, depending on the lender, business health, and credit score.

Types of MSME Loans

Working Capital Loans: For day-to-day operational expenses like inventory, wages, and rent.

Term Loans: For long-term business investments like equipment purchase or infrastructure expansion.

Line of Credit (Overdraft): A revolving credit facility to manage irregular cash flow.

Equipment Financing: Specifically for purchasing new machinery or upgrading existing tools.

Government-Backed Loans: Under schemes like MUDRA, Stand-Up India, and PMEGP.

Eligibility Criteria

Though criteria vary slightly across lenders, the general requirements include:

Business should be classified as an MSME under the Udyam Registration.

Minimum 1 year of business vintage (some lenders require 3 years).

Valid business documents like GST registration, trade license, and bank statements.

Good credit history (CIBIL score of 650+ preferred).

MSME Loan Application Process

1. Assessment & Documentation

Start by evaluating your business needs and gathering documents such as:

Aadhaar, PAN card

Business registration proof

GST returns

Last 6–12 months of bank statements

2. Apply Online or Offline

You can apply through a bank, NBFC, or fintech platform. Many lenders offer a digital application process with minimal paperwork.

3. Verification and Approval

The lender assesses your creditworthiness and business performance. If approved, you receive a sanction letter.

4. Loan Disbursal

Funds are typically credited directly to your business bank account.

Final Thoughts

Access to finance is the lifeline for any growing enterprise. MSME loans empower small businesses to scale operations, embrace innovation, and compete globally. Whether you're a budding entrepreneur or an established small manufacturer, the right loan at the right time can transform your business journey.

With increasing digitalization and government support, securing an MSME loan today is simpler than ever—fueling not just businesses, but the future of India's economy.

0 notes

Text

New Government Schemes for Manufacturing Startups

In 2025, the Indian government reaffirmed its commitment to developing the manufacturing sector by proposing many new incentives designed exclusively for startups. Through the "Make in India" philosophy, these projects seek to promote self-reliance, increase employment, and encourage innovation. Manufacturing startups, particularly micro, small, and medium-sized firms (MSMEs), can profit greatly from these schemes if they have the necessary documents, such as a feasibility report, TEV report, bankable project report, pitch deck for a startup, and so on.

Key Government Schemes for Manufacturing Startups in 2025

Production Linked Incentive (PLI) 2.0 Scheme The revised PLI Scheme in 2025 now includes broader categories such as green technologies, EV components, and advanced electronics. It provides 4%–6% incentives on incremental sales for five years. Manufacturing startups with a solid DPR for a bank loan and a Feasibility Report can apply to avail themselves of this benefit.

Startup India Seed Fund Scheme (SISFS) Extended in Budget 2025-26 with an increased corpus, this scheme helps early-stage startups with financial support of up to ₹50 lakh. To qualify, the startup must be recognized under Startup India Registration and have a compelling Pitch Deck for the Startup and a Project Report for Business.

Credit Guarantee Scheme for Startups (CGSS) Launched by SIDBI, this scheme offers collateral-free loans up to ₹10 crore. Banks and NBFCs prefer a professionally crafted Bankable Project Report and DPR for a bank loan to assess applications under this scheme.

NLM Support for Manufacturing in Agri-Based Sectors The National Livestock Mission (NLM) has expanded support to rural manufacturing startups producing fodder, poultry, and animal feed. Here, an NLM Project Report and Feasibility Report are crucial for availing subsidies and credit.

Pradhan Mantri Mudra Yojana (PMMY) A classic yet still relevant scheme, PMMY offers loans up to ₹10 lakh under Shishu, Kishor, and Tarun categories. Startups applying for these loans must submit a specific Project Report for Mudra Loan, along with a TEV Report to assess the technical and economic viability of the business.

Crucial Documentation Required for Startups

Securing funding or support from any government scheme requires startups to be thoroughly prepared with essential documents. Below are the key project reports and why they are critical:

1. Feasibility Report

A feasibility report assesses the viability of the planned manufacturing venture. It addresses market demand, operational issues, infrastructural availability, and legal needs. This report is sometimes requested in conjunction with a Project Report for Land Allotment when startups apply for land allotment.

2. Techno-Economic Viability (TEV) Report

TEV Reports evaluate both technical soundness and financial feasibility. It covers CAPEX and OPEX estimates, product lifecycle projections, and break-even analysis. Banks and investors rely on this document to make loan and equity investment decisions.

3. Bankable Project Report

Bankable Project Reports are designed exclusively for financial institutions. It focuses on income estimates, repayment capability, business risks, and mitigation techniques. Repeating this report structure across many programmes, such as Mudra Loan, CGSS, and land allotment, saves time and improves consistency.

4. NLM Project Report

The NLM Project Report is vital for startups in the livestock or rural agri-manufacturing sectors. It provides information on feed production capacity, supply chain, local demand, and predicted job creation.

5. DPR for Bank Loan

The Detailed Project Report (DPR) for Bank Loan is a more exhaustive version of the Bankable Project Report. It includes architectural layouts, machinery specifications, regulatory approvals, environmental clearances, and more. This is often mandatory for loans above ₹1 crore.

6. Startup India Registration

To access most startup-specific schemes, it is mandatory to complete the Startup India Registration on startupindia.gov.in. Once registered, startups can apply for tax exemptions under sections 80-IAC and 56(2)(viib) of the Income Tax Act, 1961.

7. Pitch Deck for Startup

The Pitch Deck for a Startup serves as a visual summary for angel investors and venture capitalists. It typically includes the problem statement, solution, USP, target market, business model, financials, and ask. While not legally required, it greatly enhances the success of fundraising.

Land Allotment and State Industrial Policies

Several states, including Gujarat, Uttar Pradesh, and Tamil Nadu, have announced new industrial plans for 2025, including subsidised land, capital subsidies, and power tax exemptions. Startups must submit a Project Report for Land Allotment to industrial development firms, which includes a site appraisal, environmental impact, and layout plan.

Conclusion

2025 is a promising year for manufacturing startups in India. Budding entrepreneurs today have unprecedented access to capital, infrastructure, and policy support thanks to a variety of federal and state-level initiatives. However, the key to realising these benefits is to prepare a solid Feasibility Report, TEV Report, Bankable Project Report, NLM Project Report, DPR for bank loan, and other critical documents such as the Startup Pitch Deck and Project Report for Mudra Loan.

To get started, complete your Startup India registration and meet with professionals to create a comprehensive Project Report for your business. With proper planning and documentation, your manufacturing firm can reach new heights by 2025 and beyond. For additional information or assistance, please contact us at +91-8989977769.

0 notes