#credit line app

Text

Mobile loan | Stashfin

StashFin's mobile loan application offers a fast and convenient way to secure funds on the go. Users can apply easily through their smartphones, eliminating the need for physical visits or extensive paperwork. This mobile platform streamlines the borrowing process, making it accessible and user-friendly. StashFin's online application ensures quick approval and rapid disbursal, making it suitable for addressing urgent financial needs. However, borrowers should exercise prudence in managing their loans to maintain financial stability while enjoying the convenience of StashFin's mobile loan application.

#mobile loan#loan app#personal loan app#loan apps#loans app#mobile loan app#credit line app#small loan#small loann app#loan application

2 notes

·

View notes

Text

Credit Line App By Stashfin

Discover Stashfin, the premier credit line app revolutionizing your borrowing journey. Bid farewell to the intricacies of traditional banking as you embrace a flexible credit line tailored to your needs. Whether it's for unexpected expenses, home improvements, or leisure pursuits, Stashfin has you covered. Navigate seamlessly with our intuitive app and experience swift approvals, empowering you to take charge of your financial decisions. Benefit from competitive interest rates and personalized support at every turn. Download the Stashfin app today and unleash the ease of borrowing with a touch of humanity.

0 notes

Text

Loans App | Stashfin

The Stashfin Loans App epitomizes digital lending excellence, providing users with a comprehensive platform tailored for diverse financial requirements. Designed for convenience and efficiency, the app streamlines the loan application process, ensuring prompt approvals, competitive interest rates, and transparent terms. By integrating advanced technology with user-centric features, Stashfin emphasizes accessibility and reliability. Whether addressing immediate expenses or planned investments, the Stashfin Loans App stands as a trusted resource, reflecting a commitment to innovation, customer satisfaction, and financial empowerment in today's dynamic landscape.

#loan app#loans app#loan apps#loans#loan#personal loan#personal loan app#instant loan#instant loan app#small loan#small loan app#cash loan#cash loan app#credit line app#all loan app#stashfin

1 note

·

View note

Text

Instant Personal Loan App | Stashfin

An instant personal loan app offers swift access to funds with minimal documentation and quick approval processes. Leveraging technology, these apps streamline lending, enabling borrowers to secure funds promptly for various needs. However, users must exercise caution, understanding terms, interest rates, and repayment conditions to ensure responsible borrowing and avoid potential financial pitfalls.

#loan#instant loan app#credit line app#best loan app#loan app#all loan app#best instant loan app#personal loan#instant personal loan app#loans app#loan apps

1 note

·

View note

Text

Get credit line - Fast-Track Your Finances with Privo App!

Looking for instant financial support? Look no further! Get an Instant Credit Line Loan of up to ₹ 5 Lakh within minutes using the Privo Credit Line app. It's your go-to solution for both personal and business needs. Explore hassle-free financing now at Privo- Instant Credit Line. Your financial freedom awaits!

#credit line app#credit line#loan app#line of credit#personal line of credit#Privo - Instant credit line app

0 notes

Text

New Loan App

A personal loan app in India called Stashfin new loan offers quick and simple access to money for a variety of uses. The loan amount is between 5,000 and 5 lakhs rupees, and there are adjustable payback terms up to 36 months. The software makes sure that instant loan offers by analysing the borrower's creditworthiness using sophisticated algorithms. The entire loan application procedure is done online, and after the loan is approved, the money is transferred right to the borrower's bank account. The new loan app from Stashfin is simple to use and makes borrowing easy.

0 notes

Text

Claim Your $1,000 Credit Line: A Guide to Getting Started

If you're looking to take control of your finances and start building credit, claiming a $1,000 credit line can be a great first step. Here's everything you need to know to get started:

Understand What a Credit Line Is

A credit line is a type of loan that allows you to borrow money up to a certain limit. Unlike a traditional loan, you can borrow and repay money as often as you'd like as long as you stay within your credit limit. Interest is charged on the amount you borrow, and you'll need to make minimum payments each month to avoid fees and penalties.

Check Your Credit Score

Before you apply for a credit line, it's important to know where you stand. Your credit score is a number that represents your creditworthiness, and lenders use it to decide whether or not to approve your application. You can check your score for free once a year at annualcreditreport.com or sign up for a credit monitoring service to keep track of your score on an ongoing basis.

Shop Around for the Best Deal

Not all credit lines are created equal, so it pays to shop around. Look for a credit line with a low interest rate, no annual fee, and flexible repayment terms. Consider applying with a bank or credit union where you already have a relationship, as they may be more likely to offer you a better deal.

Apply for Your Credit Line

Once you've found the right credit line for you, it's time to apply. You'll need to provide personal information like your name, address, and Social Security number, as well as information about your income and expenses. The lender will use this information to decide whether or not to approve your application.

Use Your Credit Line Responsibly

If you're approved for a credit line, it's important to use it responsibly. Only borrow what you need and can afford to pay back, and make sure to make your minimum payments on time each month. Using your credit line responsibly can help you build a positive credit history and improve your credit score over time.

In conclusion, claiming a $1,000 credit line can be a great way to start building credit and taking control of your finances. By understanding what a credit line is, checking your credit score, shopping around for the best deal, and using your credit line responsibly, you can set yourself up for financial success.

Claim Your $1,000 Credit Line!

0 notes

Text

Quick and easy application process for Stashfin small credit loan offers a completely online application process, which means you can apply for a loan from the comfort of your home or office. The application process is quick and easy, and you can receive an approval decision within minutes.

#loan apps in india#instant personal loan app#new loan app#small credit loan#credit line app#all loan app

1 note

·

View note

Text

death to services that ask for ur payment info even tho they are free >:( then why in the good goddamn hell would u need that info then hhUH ???

#trying to use fly.io to get this stupid app to the internet and dude I do not want to put my credit card info there#it’s for one (1) course I don’t want to suddenly wake up some day and see that I have a big ass bill for something I thought was free#bc i don’t trust anything to actually stay free#and fly.io ’’ we don’t offer free-tier. instead we offer some free resource allowances that include enough usage per month to run a small#app for free’’ but like that seems sketchy?? like are they going to inform me like hey so if u don’t take this down we are going to start#billing you?? seems like it’ll be ’’hey so ur app is actually not what we consider ’’small’’ so we took the liberty to rob ur entire#apartment for payment thanxx <3’’#stupid heroku deciding that u now how to pay for it like literally what can u do in this world without putting ur bank account on the line??#literally nothing#september 2023#2023

51 notes

·

View notes

Text

the guy who helped us seemed just as frantic and confused as i am

#apparently the person i saw before just#fuckin lied? by omission#like i have no credit we all know that so i applied for a secured credit card but it seems like she filed an application for a Normal One#and just didnt say anything#like i have the secure credit line open but idk why the FUCK she wouldnt say anything#so i got a notice that my credit application was denied in the mail#yet i obviously have the credit line in my banking app#also its been determined that my check didnt cash bc the machine couldnt read it#who the FUCK makes out a check in light blue ink

2 notes

·

View notes

Text

you can give seven days of internet connection to someone in gaza for just 6 USD

gazaesims.com is a website dedicated to helping people donate esims for people in gaza. (for the ultimate guide to donating an esim, see http://tinyurl.com/gaza-esims) there are multiple options for where to purchase an esim to donate, for the price i listed you want to use nomad esims. you can get a $3 discount by using someone's referral code from the notes of this post. it also will give the referrer credit to buy more esims! (you can only use a referral code on your first purchase) @/fairuzfan also a tag for esim referral codes here, some of which are nomad. BACKPACKNOMAD is another code to get $3 off your first purchase, it's been working for some people but not others so try out a referral code instead if you can't get it to work. also it took over an hour for the email with my information to come through so don't panic if it doesn't show up right away. (logging back into your nomad account seems to have helped some people get their emails to send!) NOMADCNG is a code for 5% off any middle east region nomad esims from connecting gaza. it can be used on any purchase, not just your first but is generally going to give less off than the first-purchase only codes, so use those first. it can be used in combination with nomad points. AWESOME NEW CODE: nomad esim discount code for 75% off any plan, NOMADCS25 do not know how long it lasts but this is an amazing deal esp. since they are really low on esims right now! (nomad promo codes do not work on plans that are already on sale, unlimited plans, and plans under $5)

weekly tuesdays only code on nomad web, PST timezone! it gives 10% off plans 10gb and above. NOMADTUE

for the month of may, first time referrals give 25% off for a person's first purchase and 25% off the referrer's next purchase! it's a great time to use someone's referral code from the notes if you are a first time buyer.

troubleshooting hint 1: if you are trying to pay through paypal, make sure you have pop-ups enabled! otherwise the payment window won't be able to appear.

troubleshooting hint 2: if you are trying to purchase an esim using the provider's app, it may block you from purchasing if your phone does not fit the requirements to install and use their esims. use their website in your browser instead and this problem should go away.

edit as of 5/21/24: holafly (israel and egypt), nomad (regional middle east), simly (palestine and middle east), mogo (israel), and airalo (discover) are currently in the highest in demand. here is a purchase guide i made that covers all of the esim platforms, including these three platforms. if it has been more than 3 weeks since you initially sent your esim and your esim has not been activated, you can reforward your original email with the expiration date in the subject line. you can see gothhabiba’s guide for how to tell if your esims have been activated. if your esim has expired without use, you can contact customer service to renew or replace it.

78K notes

·

View notes

Text

Personal Loan | Stashfin

Stashfin Personal Loan is a quick way for people to borrow money for personal needs. Through a straightforward mobile app process, users can apply easily and receive funds swiftly. It offers convenience for those looking for immediate financial support, making borrowing hassle-free with flexible repayment options.

#personal loan#loan app#loan#all loan app#credit line app#personal loan app#loan apps#loans app#loans#cash loan

1 note

·

View note

Text

Personal Loan App | Stashfin

The Stashfin Personal Loan App revolutionizes borrowing by offering a streamlined, digital platform for quick financial solutions. Designed for convenience, the app simplifies the application process, requiring minimal documentation and ensuring prompt approvals. Users can access personalized loan options tailored to their needs, complete with competitive interest rates and transparent terms. With user-friendly features and intuitive navigation, Stashfin's app empowers individuals to manage loans effortlessly, from application to repayment. Prioritizing customer ease and efficiency, it has become a go-to resource for instant, reliable personal financing.

#personal loan#personal loan app#loan app#loan app in india#instant loan#small loan#small loan app#instant loan app#credit line app#all loan app#best loan app#cash loan

1 note

·

View note

Text

🌟 Quick Credit Line Loan on Tumblr | Secure a Line of Credit up to ₹5 Lakh! 🌟

Tired of financial worries? Look no further! Discover the Privo Instant Credit Line Loan – your path to obtaining a flexible line of credit worth up to ₹5 lakh in a matter of minutes. No matter if it's for personal or business requirements, Privo App has got your back.

What Makes Privo's Credit Line Stand Out:

🚀 Instant Approvals: Say farewell to those prolonged approval procedures. With Privo, you can grab a credit line of up to ₹5 lakh almost instantly, ensuring you can tackle your financial needs without any holdup.

💰 Adaptable Usage: Whether you're handling unexpected expenses, making investments, or boosting your business endeavors, the Privo Credit Line is designed to cater to your diverse range of needs.

🌐 Effortless Application: Applying for a credit line has never been more convenient. You can complete your application directly through the Privo App, saving you the trouble of physically visiting a location.

⏱️ Speedy Disbursal: Once given the green light, your credit line amount will be swiftly transferred to your account, enabling you to take prompt action and accomplish your financial objectives.

🔒 Safe Transactions: Privo places the utmost importance on the security of your transactions and personal data. Rest assured, advanced security measures are in place to safeguard your information.

Don't allow financial limitations to hold you back! Empower yourself with the Privo Instant Credit Line Loan and access up to ₹5 lakh whenever the need arises.

Ready to take charge of your financial journey? Find out more on the official Privo Credit Line website:

🔗Download Privo app and Explore Privo Credit Line: https://privo.in/credit-line

Experience the convenience and flexibility of Privo's Credit Line. Your dreams, your way! 💪🌐

#credit line#instant creditline loan app#credit line loan app#credit line app#personal line of credit

0 notes

Text

Small Credit | Stashfin

Borrowers can take advantage of a number of benefits from Stashfin's small credit loan, including quick and simple loan approvals, flexible loan amounts ranging from INR 500 to INR 5,00,000, competitive interest rates, customizable loan tenures, instant fund disbursement, no need for collateral, convenient EMI repayment options, a straightforward and user-friendly application process, strong security measures to protect user data, and round-the-clock customer support. Borrowers can quickly and conveniently get the money they need to cover their short-term financial needs with Stashfin modest credit loan.

#small credit#credit line app#instant loan app#small loan app#instant personal loan app#new loan app

0 notes

Text

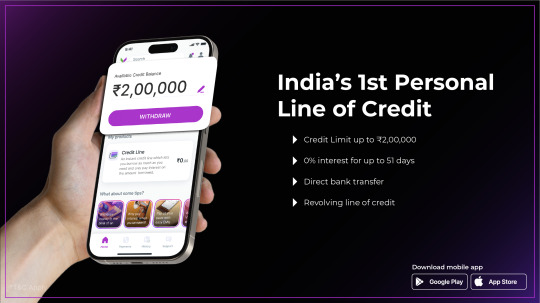

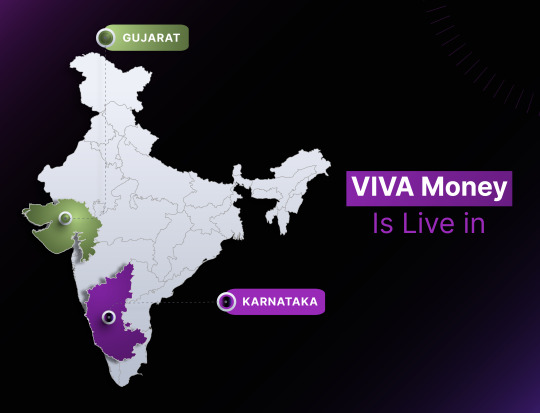

VIVA Money App Hits 100K+ Downloads in Lightning Speed!

VIVA Money, the revolutionary fintech startup from Bengaluru, has stormed into the digital finance scene with a bang! In just four months since its launch in Gujarat and Karnataka, the VIVA Money app has surpassed a staggering 100,000 downloads, setting a new benchmark for rapid growth and user engagement.

But what's fueling this meteoric rise? Let's dive into the heart of VIVA Money's offerings:

Freedom to Borrow, No Strings Attached: VIVA Money offers an exclusive grace period of up to 51 days, allowing users to borrow without worrying about hefty interest charges.

Revolutionary Revolving Credit: Unlike traditional loans, VIVA Money offers a revolving credit limit, giving you the power to borrow, repay, and borrow again, all with unparalleled ease.

Flexible EMI Plans: Choose from three flexible EMI plans ranging from 5 to 20 months, tailored to fit your unique financial needs and goals.

Digitally Driven Convenience: Embrace the future of finance with VIVA Money's 100% digital process, eliminating paperwork and streamlining your borrowing experience.

Seamless Bank Transfers: Say goodbye to traditional credit card limitations! With VIVA Money, your credit line can be seamlessly transferred to your bank account, putting financial freedom at your fingertips.

Lightning-Fast Approval: With VIVA Money, there's no waiting game. Experience lightning-fast approval and disbursal within a mere 15 minutes, ensuring you get the funds you need when you need them.

VIVA Money goes beyond just offering a Credit Line; it's dedicated to transforming how Indians handle their financial matters and boasts extensive experience in the lending sector. As the fintech landscape continues to evolve, VIVA Money remains committed to innovation, customer satisfaction, and financial inclusion.

Looking ahead, VIVA Money has its sights set on Rajasthan and Maharashtra, gearing up to extend its innovative financial solutions to even more eager users across India. With a personalized loan product in the pipeline, offering higher loan amounts and extended repayment periods, VIVA Money is poised to make a lasting impact on the Indian fintech ecosystem.

So, what's next for VIVA Money? With an estimated 40,000 credit lines and a projected loan book value of ₹1400 million by year's end, the journey is just beginning. Join the VIVA Money revolution today and experience the future of finance, redefined.

About VIVA Money:

VIVA Money stands at the forefront of digital financial lending, offering India's premier Line of Credit. Powered by cutting-edge technology and a customer-centric approach, VIVA Money provides seamless access to financial solutions through its mobile application and website.

As a subsidiary of the holding company Tirona Limited, with its headquarters in Cyprus, Viva Money benefits from a global perspective. Tirona Ltd operates across Europe, Asia, and South America, investing in fintech opportunities and established companies in banking and IT. Notable investments within Tirona's portfolio include 4 finance, the world's leading digital consumer finance company, and TBI Bank, a next-generation digital bank operating in multiple countries.

With assets spanning more than 20 projects in 22 countries, Tirona's financial prowess is evident. The group's total assets saw a 30% increase in 2022, reaching 1.44 billion euros, while revenue surpassed 490 million euros. This growth trajectory underscores Tirona's commitment to innovation and excellence in the financial sector, driving progress and prosperity across diverse markets.

0 notes