#creditmonitoring

Text

LifeLock Family Plan: Comprehensive Protection for Your Loved Ones

Why Your Family Needs Identity Protection in 2024

In today’s digital world, protecting your personal information has become more critical than ever. But it’s not just your identity at risk—your entire family could be vulnerable to cyber threats and identity theft. Are you doing enough to protect your loved ones? The LifeLock Family Plan offers a comprehensive solution designed to secure the identities of every member of your household. And with the availability of LifeLock discount codes & vouchers, you can access this essential protection at an affordable price.

What Makes the LifeLock Family Plan Stand Out?

1. All-in-One Family Protection

What if you could secure your entire family’s personal information with just one plan? The LifeLock Family Plan makes this possible by covering up to two adults and five children under a single subscription. This all-in-one protection ensures that every family member, regardless of age, is safeguarded against identity theft.

By utilizing a LifeLock promo code & rewards, you can get the most comprehensive coverage for your family without overspending. Isn’t it reassuring to know that everyone’s identity is protected under one reliable plan?

2. Real-Time Alerts for Every Family Member

How quickly would you respond if you knew your child’s Social Security number was being used fraudulently? LifeLock’s real-time alerts notify you immediately if any suspicious activity occurs, whether it’s on your accounts or your children’s. These alerts allow you to act swiftly, reducing the risk of long-term damage.

With a LifeLock discount code, you can access these critical alerts at a reduced rate, making it easier to keep your entire family’s identities safe. Real-time protection for everyone has never been more accessible.

3. Dark Web Monitoring: Beyond the Basics

Did you know that children’s identities are prime targets for cybercriminals? They often go undetected for years, making them a valuable asset on the dark web. LifeLock’s dark web monitoring goes beyond basic protection by scanning the dark web for any signs that your family’s personal information is being traded or sold. If a threat is detected, you’ll be alerted immediately.

By applying LifeLock promo codes, you can secure this advanced monitoring service for your entire family, ensuring that even the youngest members are protected from identity theft.

4. Credit Monitoring and Identity Restoration

How would you handle it if a family member’s identity was stolen? The LifeLock Family Plan includes comprehensive credit monitoring for adults, ensuring that any changes to your credit report are flagged immediately. In the unfortunate event of identity theft, LifeLock’s identity restoration services step in to help restore your family’s identities as quickly and smoothly as possible.

With the use of LifeLock coupons 2024, you can add these essential services to your plan at a fraction of the cost. Why not invest in the security of your family’s financial future?

Why Choose the LifeLock Family Plan?

When it comes to protecting your family’s identities, the LifeLock Family Plan offers a level of security that’s hard to match. But why should you choose LifeLock over other identity protection services? The answer lies in the comprehensive nature of their family plan.

LifeLock doesn’t just offer basic identity protection; it provides a full suite of services designed to safeguard every aspect of your family’s digital lives. From real-time alerts to dark web monitoring and identity restoration, LifeLock ensures that every member of your family is protected.

Moreover, LifeLock understands that affordability is key, especially when it comes to family expenses. With LifeLock discount codes & vouchers, you can secure top-tier protection for your loved ones without breaking the bank. Dealszo, one of the best online platforms, consistently offers the best LifeLock discount codes and LifeLock promo codes—especially during major sales events like Black Friday sales.

Latest Lifelock Offers & Discount

50% Off Norton 360 with Ultimate Plus for Family Plan

Shield your family online! Get a 50% discount on Norton 360 with LifeLock Ultimate Plus for the Family Plan. Limited time, maximum security!

52% Off LifeLock Ultimate Plus 2 Adults Plan

Save big on security! Enjoy a 52% discount on the LifeLock Ultimate Plus 2 Adults Plan. Shield your identity with confidence!

Up to 33% off your first year plan

Unlock savings! Enjoy up to 33% off your first-year plan. Don’t miss this limited-time offer for affordable protection and peace of mind.

Protect Your Identity: LifeLock to the Rescue

#IdentityProtection#StaySecure#LifeLockSafety#ProtectYourIdentity#CyberSecurity#FraudPrevention#CreditMonitoring#DigitalSecurity#SafeOnline#IdentityTheftProtection#PeaceOfMind#StayVigilant#DarkWebSurveillance#DataSecurity#SecureYourself

0 notes

Text

The Purpose of Credit Monitoring Arrangement

In today's fast-paced financial world, keeping an eye on one's credit health has become more important than ever. Credit monitoring, a tool that helps individuals and businesses manage their credit scores and reports, plays a crucial role in maintaining good financial health. It allows for the early detection of potential credit issues and provides a line of defense against identity theft and fraud. This blog explores the purpose of a Credit Monitoring Arrangement (CMA) and delves into its numerous benefits.

What is Credit Monitoring Arrangement?

A Credit Monitoring Arrangement is a systematic approach to tracking and reviewing credit reports and scores. It involves regular checks of credit information to identify any discrepancies, unusual activities, or changes that might affect an individual’s or organization’s creditworthiness. The key components of a CMA include:

Regular Monitoring: Constant surveillance of credit reports from major credit bureaus.

Alerts and Notifications: Immediate notifications of any significant changes or suspicious activities.

Error Resolution Support: Assistance in identifying and correcting inaccuracies in credit reports.

Identity Theft Protection: Measures to safeguard against identity theft and fraud.

The Purpose of Credit Monitoring Arrangement

Ensuring Financial Stability

One of the primary purposes of a CMA is to ensure financial stability. By keeping a close watch on credit activities, individuals and businesses can promptly address any issues that could potentially harm their credit scores. This proactive approach helps in maintaining a healthy credit profile, which is essential for securing loans, mortgages, and favorable interest rates.

Early Detection of Credit Issues

Credit monitoring allows for the early detection of credit issues, such as unauthorized accounts or unexpected changes in credit limits. By catching these problems early, individuals and businesses can take immediate action to mitigate any negative impacts on their credit scores.

Protecting Against Identity Theft and Fraud

With the rise in identity theft and fraudulent activities, credit monitoring serves as a critical line of defense. It provides real-time alerts for any suspicious activities, enabling quick response to potential threats. This not only protects financial assets but also minimizes the stress and complications that come with identity theft.

Maintaining a Good Credit Score

A good credit score is vital for financial flexibility and opportunities. Credit monitoring helps maintain a good credit score by ensuring that any negative marks, such as late payments or defaults, are promptly addressed. It also aids in identifying and disputing errors that could unfairly impact credit scores.

Benefits of Credit Monitoring Arrangement

Continuous Tracking of Credit Reports

CMA provides continuous tracking of credit reports, ensuring that any changes are immediately noted. This helps in maintaining an accurate and up-to-date credit profile.

Alerts for Suspicious Activities

One of the standout features of credit monitoring is the alerts for suspicious activities. These alerts can prevent significant financial damage by enabling swift action against potential fraud.

Assistance in Correcting Errors on Credit Reports

Credit reports can sometimes contain errors that negatively affect credit scores. CMA offers assistance in identifying and correcting these errors, thereby improving overall credit health.

Peace of Mind for Consumers and Businesses

Knowing that one’s credit information is being continuously monitored brings peace of mind. Both consumers and businesses can focus on their financial goals without the constant worry of unexpected credit issues.

How Credit Monitoring Arrangement Works

Steps Involved in Setting Up Credit Monitoring

Setting up credit monitoring typically involves enrolling in a credit monitoring service, which then begins to track credit reports from major credit bureaus. Users receive regular updates and alerts about any significant changes.

Tools and Services Used in Credit Monitoring

Credit monitoring services utilize various tools and technologies, such as secure databases, encryption, and real-time monitoring systems, to keep track of credit activities and ensure data security.

Role of Credit Bureaus and Financial Institutions

Credit bureaus and financial institutions play a crucial role in credit monitoring. They provide the necessary credit information and collaborate with credit monitoring services to detect and address any issues promptly.

Real-World Applications

Case Studies or Examples of Successful Credit Monitoring

Several individuals and businesses have successfully used credit monitoring to improve their credit scores and protect against fraud. For example, a small business owner who discovered unauthorized loans in their name was able to resolve the issue quickly thanks to timely alerts from their credit monitoring service.

Impact on Personal Finance Management

Credit monitoring significantly impacts personal finance management by providing a clear picture of one’s credit health. This helps individuals make informed financial decisions, such as applying for loans or managing debt.

Role in Business Credit Management

For businesses, credit monitoring is essential for managing credit risks and maintaining financial stability. It ensures that the business’s credit profile remains robust, which is vital for securing funding and building partnerships.

Choosing the Right Credit Monitoring Service

Factors to Consider

When selecting a credit monitoring service, consider factors such as the comprehensiveness of monitoring, alert systems, customer support, and additional features like identity theft protection.

Comparison of Popular Credit Monitoring Services

Comparing popular credit monitoring services based on their features, pricing, and customer reviews can help in choosing the right service that meets specific needs.

Tips for Maximizing the Benefits of Credit Monitoring

To maximize the benefits of credit monitoring, users should regularly review their credit reports, promptly respond to alerts, and utilize the tools and resources provided by the monitoring service.

Conclusion

Credit monitoring arrangements offer a robust solution for maintaining financial health. By ensuring financial stability, detecting credit issues early, protecting against fraud, and maintaining a good credit score, CMA provides numerous benefits. Adopting credit monitoring is a proactive step towards securing one’s financial future and achieving peace of mind.

0 notes

Text

How to Detect and Respond to Identity Theft - My ID Armor

Learn how to detect and respond to identity theft with our expert tips. Safeguard your personal information and action to protect yourself from fraud.

Identity theft is a growing concern in our increasingly digital world. This detailed guide from MyIDArmor provides crucial information on how to detect identity theft early, before it can cause significant damage. It outlines the common signs that may indicate your identity has been compromised, such as unexpected bank statements, unfamiliar credit card charges, or new accounts in your name. The article also offers a step-by-step response plan to mitigate the impact, including contacting financial institutions, alerting credit bureaus, and filing reports with the Federal Trade Commission (FTC). Additionally, it shares proactive measures to prevent future occurrences, like regularly monitoring your credit report and using strong, unique passwords. Equip yourself with the knowledge and tools to protect your identity and navigate the aftermath if you fall victim to this pervasive crime.

#IdentityTheft#CyberSecurity#PersonalSecurity#FraudPrevention#IDProtection#CreditMonitoring#FTC#DigitalSecurity#PersonalInformation

1 note

·

View note

Video

youtube

Another Credit Monitoring EXCLUSIVE DEAL! Credit Monitoring for just $1#...

Finance and Prosperity #passiveincome #makepassiveincomeonline #cryptoaribitrage #cryptoforex @moneyprosperitych{Another Credit Monitoring EXCLUSIVE DEAL! Credit Monitoring for just $1 Credit Monitoring for just $1 #creditmonitoring Must Watch! Don't miss out on this incredible deal! Mr. Kimble is offering his NEW platinum patreon members an exclusive credit monitoring package that includes monitoring from all three credit bureaus, daily alerts, and up to 1 Million dollars in identity theft insurance for just $1! Join today to access this amazing offer and enjoy other discounts and benefits. Become a PLATINUM MEMBER TODAY: {https://patreon.com/wordonthestminmlk...} 🌟💳 #CreditMonitoring #IdentityTheftInsurance #ExclusiveOffer #PlatinumPatreon #JoinNow

https://www.youtube.com/live/xcd7DvaeJkY?si=h9ee1Mfi442TEnUk

0 notes

Text

🔍 Understanding Your Credit Score 🔍

Ever wonder what that mysterious number means? 🤔 Your credit score is a key factor in your financial health and can impact everything from getting approved for a loan to securing a rental apartment. Here's the lowdown:

1️⃣ What is a credit score? It's a numerical representation of your creditworthiness, based on your credit history. Scores typically range from 300 to 850.

2️⃣ How is it calculated? Factors like payment history, credit utilization, length of credit history, types of credit accounts, and recent inquiries all play a role.

3️⃣ Why does it matter? Lenders, landlords, and even employers may use your credit score to assess your reliability. The higher your score, the more likely you are to be approved for favorable terms.

4️⃣ How can you improve it? Pay bills on time, keep credit card balances low, maintain a mix of credit accounts, and avoid opening too many new accounts at once.

Understanding your credit score is the first step toward financial empowerment! 💪 Stay tuned for more tips on mastering your finances. 💳📈

#CreditScore #CreditRating #FinancialHealth #CreditHistory #CreditWorthiness #PersonalFinance

#thearaizas#realestate#arizona#instagramaz#phoenixarizona#az#phoenix#realtorsofinstagram#EmpowerYourFinances#Finance101#CreditScoreGoals#CreditReport#CreditMonitoring#CreditEducationMonth#FinancialFreedom#MoneyTalks#FinancialGoals#CreditGoals#MoneyManagement#BudgetingTips#DebtFreeJourney#SmartSpending#FinancialWellness#MoneyMatters#CreditRepair#CreditBuilding#FinancialLiteracy#CreditAwareness#CreditManagement#CreditTips

0 notes

Text

A COMPREHENSIVE GUIDE TO THE BEST MONEY LOAN APPS

With the increasing popularity of mobile technology, loan applications have become a ubiquitous part of our daily lives. With just a few taps on your smartphone, you can get a loan without ever leaving your house. This is not only convenient but also an effective way of accessing quick cash. However, with so many loan apps to choose from, it can be challenging to know which one is the best for…

View On WordPress

#budgetintools#cashadvance#creditmonitoring#financialmanagement#financialwellness#investmentadvice#moneyloanapps#overdraftprotection#paydayloans#personalfinance

0 notes

Photo

Informasi Training Banking Series 2023. Seminar Perbankan online dan offline. Training Banking dibawakan oleh trainer yang ahli di bidang perbankan. Topik pelatihan perbankan antara lain: 1. Verification For Credit Consumer 2. Penilaian Transaksi Jaminan Kredit 3. Credit Monitoring and Control 4. Strategi Menghadapi Kredit Bermasalah 5. Remedial Loan Management 6. Loan Syndication 7. Consumer Loan Portofolio Management 8. Supervisi Kredit Mikro 9. Revitalisasi Kredit Kecil dan Mikro 10. Restrukturisasi Non Performing Loan (NPL) 11. Strategi Efektif Menghadapi Risiko NPL dengan Analisa Kredit Komprehensif 12. Managing Credit Risk In Treasury Products And Derivative Info seminar training lengkap: WA: 0851-0197-2488 Jadwal training lengkap: https://www.informasi-seminar.com #credit #creditconsumer #jaminankredit #creditmonitoring #creditcontrol #remedialloan #loanmanagement #loansyndication #loanportofolio #kreditkecil #revitalisasikredit #restrukturisasikredit #treasury #trainerbanking #trainerperbankan #kredit #infopelatihan #pelatihan #seminar #training #publictrainig #inhousetraining (di Smesco Convention Centre) https://www.instagram.com/p/Cm_JA6fpYDW/?igshid=NGJjMDIxMWI=

#credit#creditconsumer#jaminankredit#creditmonitoring#creditcontrol#remedialloan#loanmanagement#loansyndication#loanportofolio#kreditkecil#revitalisasikredit#restrukturisasikredit#treasury#trainerbanking#trainerperbankan#kredit#infopelatihan#pelatihan#seminar#training#publictrainig#inhousetraining

0 notes

Text

Elevate Your Score with Our Advanced Credit Repair Software Experience newfound financial independence with Credit Revive. Effortlessly mend your credit, challenge inaccuracies, and track improvement, all through our comprehensive software solution. Seize command of your financial destiny today! #CreditRepair #FinancialFreedom #CreditRevive #CreditScore #DebtFree #FinancialEmpowerment #CreditMonitoring #CreditRestoration #FinancialWellness #TakeControl

2 notes

·

View notes

Text

🌟 Mastering CMA Preparation and Vetting: Your Path to Financial Confidence 🌟

Navigating the world of Credit Monitoring Arrangements (CMA) can feel overwhelming, but with the right approach, you can turn it into a powerful tool for managing your financial health. Whether you’re a business owner or an individual aiming to stay on top of your credit, mastering CMA preparation and vetting is essential. Here’s how you can get started:

📊 1. Understand the Basics of CMA

First things first: get familiar with what a Credit Monitoring Arrangement (CMA) entails. At its core, CMA involves setting up a system to regularly monitor and review your credit reports and scores. This helps you detect any anomalies, track your credit health, and ensure that everything is in order.

🛠️ 2. Choose the Right Monitoring Service

Not all credit monitoring services are created equal. Look for a service that offers:

Comprehensive Coverage: Monitors reports from all major credit bureaus—Equifax, Experian, and TransUnion.

Real-Time Alerts: Get notified immediately of any significant changes or suspicious activities.

Detailed Reporting: Access to detailed credit reports and score updates to help you stay informed.

🔍 3. Prepare for Effective CMA

Preparation is key to making the most out of your CMA:

Gather Necessary Documents: Have your financial documents and recent credit reports ready.

Set Clear Goals: Determine what you want to achieve with CMA—whether it’s detecting fraud early, maintaining a healthy credit score, or improving credit management.

Review Regularly: Schedule regular reviews of your credit reports and scores to stay on top of any changes.

✅ 4. Vetting the Right Service

Vetting is all about ensuring you choose the best service for your needs:

Check Reviews and Ratings: Look at customer feedback and ratings to gauge the reliability of the service.

Evaluate Customer Support: Ensure they offer robust customer support to assist you with any issues.

Assess Costs vs. Features: Compare the costs and features of different services to find the best fit for your budget and needs.

🔒 5. Implement Best Practices

Once you’ve set up your CMA, follow these best practices:

Use Secure Access: Protect your account with strong passwords and two-factor authentication.

Monitor Alerts: Pay attention to real-time alerts and act swiftly to address any issues.

Integrate with Financial Tools: Sync your CMA with budgeting and financial management tools for a comprehensive view of your financial health.

📈 6. Review and Adjust

Finally, CMA isn’t a set-it-and-forget-it tool. Regularly review your strategy and adjust as needed:

Evaluate Performance: Check how well your CMA is meeting your goals.

Update Tools: Make sure you’re using the latest features and updates from your monitoring service.

Adjust Goals: As your financial situation evolves, adjust your CMA goals to stay aligned with your objectives.

By following these steps, you can take control of your credit health and make CMA a powerful part of your financial strategy. Stay vigilant, stay informed, and make your credit monitoring work for you! 💪💼

looking for cma prepration and vetting then visit here.

#CreditMonitoring #CMA #FinancialHealth #CreditScore #FinancialManagement #FraudPrevention #CreditMonitoringTip

0 notes

Text

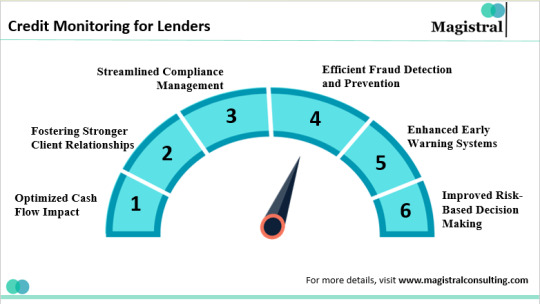

Enhancing Financial Security: Credit Monitoring Services for Lenders

#magistralconsulting #keyriskindicators #creditmonitoring #financialsecurity #lendingservices #operationsoutsourcing #creditscore

0 notes

Text

Computer and Gadgets Addiction For these years, many students depend on the computers and gadgets. Our group aims to prevent/lessen computer and gadgets addiction. Were expecting that the students can lessen/prevent there addiction on gadgets so they can focus on there studies. Our purpose in this project is to find out the bad effects of gadgets and computer addiction to the life of student. For example: • lack of face to face social interaction •Feeling irritable and out of control or depressed when not using it •Health problems(eye strain, back pain, and obesity •Neglecting work, school, or family obligations Computer and Gadgets Addiction This activity is the excessive or compulsive use of the computer and gadgets addiction. Addiction under learners anonymous computer addiction ,internet addiction disorder homophobia video, game, overuse, mobile phones. How Does Technology Affect Family Communication? Technology in today’s world offers a plethora of ways to communicate effectively so that every member of a family can keep in touch. From text messaging, Skype, webcams, Facebook, Twitter and emails, the facilitation of communication has never been more available. However, there are times when the one-on-one communication between human beings falls through the cracks and technology can take control over a family. TV Parents can monitor how much time their child watches television Photo CreditRemote control image by pavel siamionov from Fotolia.com Television is one mode of technology that can prevent a family from communicating. With the advent of Tv and myriad 24-hours-a-day program availability, the family can literally sit for hours without speaking a word to each other. According to the University of Maine’s Cooperative Extension Publications, parents can be proactive in reining in television watching. They can limit the amount of time a child watches television and, to encourage language skills, parents can participate by discussing the program the children have just watched and analyzing the advertisements . Trending Articles on Think you’re hardcore -- or that you have a hard core? Prove it! These 41… Online Networks Parents have differing opinions on the effects of interactive technologies Photo CreditMonitor image by Kavita from Fotolia.com Social interactive online networking such as Facebook and MySpace has changed the way families communicate. A study done at Indiana University asked parents for their opinions on these technologies. Some parents stated that a socially isolated child may become more socially isolated because all of her networks are through the computer. However, other parents believed the Internet could help a potentially depressive child. Sponsored Links Free DownloadZip, Unzip or Open Any File. unzipper.com Online and Offline Interaction Researchers found that most of a child's conversations were still face-to-face. Photo Credit girls talk image by Galina Barskaya from Fotolia.com Parents can take control of this situation by joining Facebook with their child so that they can monitor who their child is talking to. Researchers have found that even though IMing and text messaging and Facebooking are fun, fast-paced tools that young people love, most of their serious conversations still take place offline. Concerns Proliferation of technology and its effects on interpersonal relationships Photo CreditPortrait of a young people. Shot in studio.. image by Andrey Kiselev from Fotolia.com Dr. Jeffrey S. McQuillen, assistant professor of speech communication at Texas A&M University, warns that the influence of technology can be a hindrance to interpersonal relationships.disastrous for family life.

0 notes

Text

Resolve Your Credit Score with Comprehensive Credit Counseling Solutions

Did you ever take a mortgage loan and now you're struggling to repay it back? Then you definitely need to be aware from the fact that this can have a detrimental influence in your credit score. You may even find it tough to get a loan or any kind of monetary help inside the future. If such circumstances, the very best point for you to accomplish will be to get credit counseling services that can help you to get your credit score back on track. For additional information about Credit Monitoring Service Charlotte NC just click here.

What's credit counseling?

Credit counseling is actually a procedure by which a credit counseling Charlotte NC business can look into your present credit records and economic situations to provide you valuable suggestions via which you are able to repair your credit score. It really is essential that you simply implement effective techniques to repair your credit with out which you are going to be experiencing major monetary hurdles at a later stage of one's life. Efficient credit repair solutions Charlotte NC can not only assist to resolve your credit problems but in addition make it possible for you personally possess the reassurance you have to manage your economic position.

Consulting a credit repair business

If you are thinking about where you can get credit repair services near me, then you definitely will be pleased to know that you will find many reputed organizations that offer Charlotte NC credit counseling options to clients. Wise finish credit counseling services Charlotte NC will help you a lot when you are trying to have greater manage more than your finances.

youtube

1 note

·

View note

Text

ADVERTISEMENT - Please support our supporters http://www.gaycalgary.com/ad3480

0 notes

Photo

Real strong password 🤔💪🏾😂 #cybersecurity #strongpassword #damien_at_legalshield #damien_at_idshied #idshield #cyberrisk #socialmediamarketing ##antivirus #randsomware #firewall #cybercrimes #reputationhijacking #creditmonitoring #passwordmanagement #businessprotection #vulnerabilityscan #protectyourbottomline #creditcounseling #creditrepair https://www.instagram.com/p/CbF8t3kJi93/?utm_medium=tumblr

#cybersecurity#strongpassword#damien_at_legalshield#damien_at_idshied#idshield#cyberrisk#socialmediamarketing#antivirus#randsomware#firewall#cybercrimes#reputationhijacking#creditmonitoring#passwordmanagement#businessprotection#vulnerabilityscan#protectyourbottomline#creditcounseling#creditrepair

0 notes