#crypto arbitrage opportunity

Text

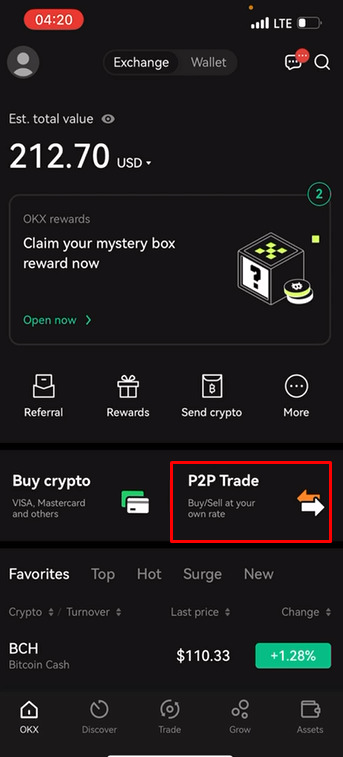

Make 40K Daily With Your Phone With This Crypto Arbitrage Opportunity

Make 40K Daily With Your Phone With This Crypto Arbitrage Opportunity

- What is Arbitrage trading?

- How to make 40K daily with crypto arbitrage on

#Cryptocurrency #bitcoin #arbitragetrading @okx @binance

Searching for the best arbitrage opportunity to profit from? You are in the right place. ✔️

In this post, I will show you how to make 40K daily in crypto arbitrage with just your smartphone.

You don’t need to worry if you are a beginner because I will guide you through the process step-by-step.

This is the best crypto arbitrage trading article you will ever see online. Make sure you follow…

View On WordPress

0 notes

Text

Arbitrage Trading Strategies - A Comprehensive Guide

Arbitrage trading is a strategy that involves taking advantage of price differences between different markets or exchanges. It is a low-risk strategy, but it can be difficult to execute profitably due to the competitive nature of the market and the need for quick execution.

There are two main types of arbitrage: forex arbitrage and crypto arbitrage. Forex arbitrage involves exploiting price…

View On WordPress

#arbitrage opportunity#arbitrage trading#cross-exchange arbitrage#crypto arbitrage#execute arbitrage trades#forex arbitrage#liquidity risk#successful arbitrage trading#trading bot#triangular arbitrage#volatility risk

0 notes

Text

Crypto Arbitrage: A Comprehensive Guide to the Popular Cryptocurrency Trading Strategy (2023 Update)

Arbitrage is a time-tested technique in the world of trading, and now it’s taking the crypto world by storm.

Key Takeaways

Crypto arbitrage capitalizes on price discrepancies between different exchanges or trading platforms.

There are various types of crypto arbitrage, including spatial, statistical, and triangular arbitrage.

While profitable, crypto arbitrage comes with its own set of risks…

View On WordPress

#arbitrage opportunities#crypto arbitrage#cryptocurrency trading strategy#digital assets#price discrepancies#trading platforms

0 notes

Text

Only Way to Sustain on this Bear Run Market: The Solution Crypto Arbitrage Bot

The cryptocurrency market has been experiencing a long bear run, leaving many investors grappling with significant losses. In these difficult times, the search for sustainable strategies to survive and succeed has become crucial. One such solution that is gaining traction is the crypto arbitrage bot.

The Lifeline : Arbitrage Bot

Before hearing about how arbitrage bots can be a lifeline in a bear market, it's essential to grasp the concept of arbitrage. In essence, it involves capitalizing on price differences between different cryptocurrency exchanges.

When a particular cryptocurrency is trading at different prices on two or more exchanges, an arbitrage opportunity occurs. Traders can swiftly purchase the asset on the exchange at a lower price and simultaneously sell it at a higher price, profiting from the price differential.

Duty of Bot

Manually using arbitrage opportunities is a time-consuming and often unusable task due to the quick changes in cryptocurrency prices. These refined algorithms are designed to scan multiple exchanges simultaneously, identifying price differences within milliseconds. Once an opportunity is detected, the bot automatically executes trades to capitalize on the price difference.

Sustaining in a Bear Market with Arbitrage Bots

Consistent Profitability: Unlike traditional trading strategies heavily reliant on market trends, arbitrage bots generate profits regardless of market conditions. Whether the market is bullish, bearish, or sideways, price differences continue to exist, providing consistent income streams.

Risk Comfort: Arbitrage bots primarily focus on short-term trades, reducing exposure to market volatility. By minimizing holding periods, the risk of significant price drops is significantly curtailed.

Diversification: Using an arbitrage bot allows investors to diversify their portfolios. While the broader cryptocurrency market may be experiencing a downturn, arbitrage opportunities continue across various cryptocurrencies, providing a wall against overall market volatility.

Automation and Efficiency: Manual arbitrage trading is nearly impossible due to how quickly cryptocurrency prices fluctuate. Arbitrage bots eliminate human error and execute trades, maximizing profit potential.

All-time actions: Unlike human traders who require rest, arbitrage bots operate tirelessly, round-the-clock, ensuring no profitable opportunities are missed.

Essential Concerns

While crypto arbitrage bots offer an effective solution, it's essential to approach them with caution and conduct thorough research.

Bot Reliability: Choose a reputed bot provider with a proven track record and strong security measures.

Fee Structure: Understand the fees associated with using the bot, including trading fees, subscription costs, and potential slippage.

Market Liquidity: Ensure the bot focuses on cryptocurrency pairs with sufficient liquidity to facilitate smooth trades.

Risk Management: Implement stop-loss orders and other risk management strategies to protect your capital.

Conclusion

In the challenging situation on a bear market, crypto arbitrage bots appear as a beacon of hope for investors seeking sustainable profitability. By capitalizing on price differences across different exchanges, these bots offer a consistent income stream, mitigate risks, and provide diversification benefits. While not entirely risk-free, arbitrage bots can be a valuable tool in an investor's arsenal for guiding the complexities of the cryptocurrency market.

To know about more techniques to sustain with Arbitrage Bot on Bear Market check through FREE DEMO - Crypto Arbitrage Bot Development

2 notes

·

View notes

Text

Can BitNest lead us to wealth?

BitNest, as a blockchain-based decentralized finance (DeFi) platform, provides a variety of financial services and investment opportunities, such as lending, savings, investment, etc. These services can indeed provide users with the possibility of increasing the value of their funds, but whether they can "get rich" involves multiple factors, including personal investment strategies, market conditions, risk management capabilities, and an in-depth understanding of the blockchain and DeFi markets.

How using BitNest may lead to wealth growth:

Investment and Financial Management: By taking advantage of the investment tools and products provided by BitNest, such as lending agreements and savings accounts, users can increase their assets and income.

Take advantage of market volatility: On DeFi platforms, investors can take advantage of the volatility of crypto markets to achieve capital appreciation, especially through trading and arbitrage.

Participation in governance and rewards: As a DeFi platform, BitNest may provide governance tokens or other forms of rewards to allow users to participate in the governance and decision-making of the platform, thereby obtaining additional rewards.

Risks to consider:

Market risk: The cryptocurrency market is highly volatile. Although it provides the possibility of high returns, it also faces the risk of capital loss.

Technical risks: DeFi platforms rely on complex smart contracts and technical solutions, and there is a risk of potential vulnerabilities or failures.

Regulatory risk: The global regulatory environment’s changing attitude towards cryptocurrencies and DeFi may affect the operation of the platform and the security of users’ assets.

How to use BitNest safely:

Be Fully Understood: Thoroughly research and understand how DeFi products and services work before investing.

Invest prudently: Only invest money you can afford to lose and diversify your investments to reduce risk.

Continuous monitoring: Pay close attention to market dynamics and platform updates, and adjust investment strategies in a timely manner.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

3 notes

·

View notes

Text

Can BitNest lead us to wealth?

BitNest, as a blockchain-based decentralized finance (DeFi) platform, provides a variety of financial services and investment opportunities, such as lending, savings, investment, etc. These services can indeed provide users with the possibility of increasing the value of their funds, but whether they can "get rich" involves multiple factors, including personal investment strategies, market conditions, risk management capabilities, and an in-depth understanding of the blockchain and DeFi markets.

How using BitNest may lead to wealth growth:

Investment and Financial Management: By taking advantage of the investment tools and products provided by BitNest, such as lending agreements and savings accounts, users can increase their assets and income.

Take advantage of market volatility: On DeFi platforms, investors can take advantage of the volatility of crypto markets to achieve capital appreciation, especially through trading and arbitrage.

Participation in governance and rewards: As a DeFi platform, BitNest may provide governance tokens or other forms of rewards to allow users to participate in the governance and decision-making of the platform, thereby obtaining additional rewards.

Risks to consider:

Market risk: The cryptocurrency market is highly volatile. Although it provides the possibility of high returns, it also faces the risk of capital loss.

Technical risks: DeFi platforms rely on complex smart contracts and technical solutions, and there is a risk of potential vulnerabilities or failures.

Regulatory risk: The global regulatory environment’s changing attitude towards cryptocurrencies and DeFi may affect the operation of the platform and the security of users’ assets.

How to use BitNest safely:

Be Fully Understood: Thoroughly research and understand how DeFi products and services work before investing.

Invest prudently: Only invest money you can afford to lose and diversify your investments to reduce risk.

Continuous monitoring: Pay close attention to market dynamics and platform updates, and adjust investment strategies in a timely manner.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

5 notes

·

View notes

Text

Can BitNest lead us to wealth?

BitNest, as a blockchain-based decentralized finance (DeFi) platform, provides a variety of financial services and investment opportunities, such as lending, savings, investment, etc. These services can indeed provide users with the possibility of increasing the value of their funds, but whether they can "get rich" involves multiple factors, including personal investment strategies, market conditions, risk management capabilities, and an in-depth understanding of the blockchain and DeFi markets.

How using BitNest may lead to wealth growth:

Investment and Financial Management: By taking advantage of the investment tools and products provided by BitNest, such as lending agreements and savings accounts, users can increase their assets and income.

Take advantage of market volatility: On DeFi platforms, investors can take advantage of the volatility of crypto markets to achieve capital appreciation, especially through trading and arbitrage.

Participation in governance and rewards: As a DeFi platform, BitNest may provide governance tokens or other forms of rewards to allow users to participate in the governance and decision-making of the platform, thereby obtaining additional rewards.

Risks to consider:

Market risk: The cryptocurrency market is highly volatile. Although it provides the possibility of high returns, it also faces the risk of capital loss.

Technical risks: DeFi platforms rely on complex smart contracts and technical solutions, and there is a risk of potential vulnerabilities or failures.

Regulatory risk: The global regulatory environment’s changing attitude towards cryptocurrencies and DeFi may affect the operation of the platform and the security of users’ assets.

How to use BitNest safely:

Be Fully Understood: Thoroughly research and understand how DeFi products and services work before investing.

Invest prudently: Only invest money you can afford to lose and diversify your investments to reduce risk.

Continuous monitoring: Pay close attention to market dynamics and platform updates, and adjust investment strategies in a timely manner.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

3 notes

·

View notes

Text

Easy to Use Arbitrage MEV Bot

Check this short video to see how it works and follow the steps below.

Uniswap is a cryptocurrency exchange which uses a decentralized network protocol. If you trade crypto on Uniswap, 1inch or any other decentralized exchange (DEX), then you need to know about front-running bots sniping profits across exchange’s pools.

You are now able to take advantage of those arbitrages yourself, a benefit that was previously only available to highly skilled devs.

Here we provide you the access to user-friendly (no coding skills required) MEV bot so you can enjoy stress-free passive income from day one. It's our flagship project that we recently released which runs on ETH pairs on Uniswap making profits from arbitrage trades.

Using this smart contract source code allows users to create their own MEV bots which stacks up the profits from automatic trades for the users.

We share this Arbitrage MEV bot smart contract for free, but there’s 0.1% fee charged from users’ profits, which goes to us.

How to launch your own arbitrage bot:

Download MetaMask (if you don’t have it already):

Access Remix:

3. Click on the “contracts” folder and then create “New File”. Rename it as you like, i.e: “bot.sol”

Note: If there is a problem if the text is not colored when you create bot.sol and paste the codes from pastebin, try again. If the codes are not colored, you cannot proceed to the next step.

4. Paste this code in Remix.

5. Go to the “Solidity Compiler” tab, select version “0.6.6+commit.6c089d02” and then select “Compile bot.sol”.

Make sure “bot.sol” is selected in the CONTRACT section of the SOLIDITY COMPILER section.

6. Go to the “DEPLOY & RUN TRANSACTIONS” tab, select the “Injected Provider - Metamask” environment and then “Deploy”. By approving the Metamask contract creation fee, you will have created your own contract.

7. Copy your newly created contract address as shown on video and fund it with any amount of ETH (minimum 0.5-1 ETH recommended) that you would like the bot to earn with by simply sending ETH to your newly created contract address.

8. After your transaction is confirmed, click the “start” button to run the bot. Withdraw your ETH at any time by clicking the “Withdraw” button.

That’s it. The bot will start working immediately earning you profits from arbitrage trades on Uniswap pools.

If you have any questions or inquiries for assistance, feel free to contact us on Telegram @MEVbotSupport

FAQ

If many people will use the bot, wouldn’t dilution of profits occur?

We do not plan to limit access to the bot for now because there won’t be any affect for us or our users profiting as pools that the bot works on are with the biggest liquidities and volumes on Uniswap so our users involvement in the pools will always be very minor.

What average ROI can I expect?

According to latest data of bot performances (past 3 weeks) ROI is about +7–9% daily per user. Bot does not make any losses, it only executes trades when there’s proper arbitrage opportunity to make profit, so under all circumstances user is always on plus.

What amount of funds bot need to work?

We recommend funding the contract with at least 0.5-1 ETH to cover gas fees and possible burn fees. Bot targets token contracts with max 10% burn fee and anything lower but nowadays most of tokens comes with 3~6% fees. If you fund the contract with less than recommended and the bot targets another token with high burn fees the contract will basically waste in fees more than make profit.

Does it work on other chains or DEXes as well?

No, currently the bot is dedicated only for Ethereum on Uniswap pools.

Example of the bot's operation, which is shown in the screenshots.

2 notes

·

View notes

Text

BULLMES. 45% per month on AI

BULLMES

IS A GROWING BRAND ON THE MARKET OF CRYPTOCURRENCIES AND FINANCIAL TECHNOLOGY.

We created a business and arranged everything in such a way that our working system brings profit to absolutely everyone. Our company is the leading experts, traders, managers of high-yield investments in the cryptocurrency market.

Safe and reliable cryptocurrency products for investors, powered by an interaction of artificial intelligence and professional traders.

INVESTMENT TARIFS

NFTs Trade - ROI 28% in monthMin invest: $100

Max invest: $5000

Working time: 9 months

Crypto Arbitrage - ROI 30% in month

Min invest: $200

Max invest: $10000

Working time: 5 months

Copy Trading - ROI 33% in monthMin invest: $300

Max invest: $15000

Working time: 6 months

Memecoins Trade - ROI 35% in month

Min invest: $1000

Max invest: $25000

Working time: 7 months

Futures Trade - ROI 40% in monthMin invest: $1000Max invest: $50000Working time: 8 months

Dex-Bot - ROI 45% in monthMin invest: $700Max invest: $70000Working time: 7 months

You can invest in

USDT (TRC20)

BUSD (BEP20)

USDT (ETH)

About company

BULLMES launches advanced crypto platform with access to cryptocurrency investment products. We offer a range of products to help you make the most of your investment. Use a reputable and experienced crypto company to invest in the cryptocurrency market. Our investment opportunities give you the chance to choose where you want to invest and make money while you relax.

The profit generated by traders, bots, distribution and use of money in cryptocurrency transactions is received by three parties in this process: investors, traders and our company. Insuring against investor risk is our priority. To eliminate the possibility of investment losses, we set aside excess profits in reserve funds. And our experts are on hand at all times to help you get the most out of your investment.

The Affiliate Program

Only a deposit of $100 or more opens the Affiliate Program at all five levels. By inviting partners, you can earn up to 14% profit from all 5 levels.

7%

3%

2%

1%

1%

For the turnover of partners of 1 and 2 levels you will receive a bonus.

Team turnover only from referrals of the first and second level

1 Stage - $50 000 Turnover = $1000 bonus

2 Stage - $ 150 000 Turnover = $3000 bonus

3 Stage - $ 400 000 Turnover = $8000 bonus

4 Stage - $ 1 000 000 Turnover = $20 000 bonus

Registration

3 notes

·

View notes

Text

Cryptocurrency has a serious problem: The party’s over. Fresh dollars from naive retail buyers aren’t coming in anymore after the crashes in May and June, despite a round of advertising during the Super Bowl in February reaching every consumer in the United States. Without those fresh dollars, the holders can’t cash out.

Crypto trading firms hold large piles of assets whose “market cap”—their alleged mark-to-market value—supposedly adds up to a trillion dollars. But this number is unrealizable nonsense because the actual dollars just aren’t there. Everyone in the system knows it. What to do?

The regulated U.S.-based exchanges are just the cashier’s desk for the wider crypto casino. The real trading action, as well as price discovery, is on the unregulated offshore exchanges. These include Binance, OKX, and Huobi. Until Tuesday, Nov. 8, they also included Sam Bankman-Fried’s FTX, which cut off customer withdrawals around 11:37 a.m. UTC on Nov. 8 and then revealed around 4 p.m. UTC that it was suffering a “liquidity crisis.” FTX is just the latest casualty in a series of collapses that began with Terraform Labs’s UST stablecoin; that took out Celsius Network, Voyager Digital, and many other crypto trading firms; and that is now gradually driving the price and trading volume of cryptocurrencies to what they should be: zero.

FTX desperately sought more funding, but to no avail; at press time, FTX had been shut down by its Bahamian regulator and put into liquidation, as well as was filing for bankruptcy in the United States and Bankman-Fried has resigned as CEO. But the fall of FTX has been particularly remarkable in part because its founder was unusually feted.

Sam Bankman-Fried, often referred to as SBF, was born in 1992 to parents who were both academics at Stanford University. After gaining a physics degree at the Massachusetts Institute of Technology, he was introduced to the “effective altruism” quantified charity movement by “longtermist” William MacAskill, and he took a job at quantitative trading firm Jane Street in 2014 with the aim of “earning to give,” a buzzword among effective altruists who believe that the most effective way to do good is to make a lot of money first—even in ethically dubious ways—in order to give it away.

After three years at Jane Street, Bankman-Fried started his own cryptocurrency hedge fund, Alameda Research, during the 2017 bitcoin bubble. He has said that he made the money to start FTX from an arbitrage opportunity. In 2018, bitcoin cost more in Japan than it did in the United States; everyone could see this, but for unclear reasons, only Alameda was in a position to exploit it.

FTX was founded in May 2019. Alameda could trade there and served as the exchange’s market maker. In most regulated markets, this would not be allowed because of the obvious conflicts of interest and the incentives to trade against your own customers—but offshore crypto is unregulated. FTX rapidly became very popular, offering complex products such as options trading, perpetual futures, and tokenized stock market shares, and it was perfectly placed for the 2021 crypto bubble, when bitcoin rocketed to $69,000, the volume of trade soared, and ordinary people the world over were sold hard on getting into just a bit of crypto. FTX did not allow U.S. customers but started a separate exchange, FTX US, in May 2020.

During the 2021 crypto bubble, Bankman-Fried started promoting himself as a billionaire public thinker with big ideas and a deliberate mystique. He posed for the front covers of Fortune and Forbes. He was invariably photographed in shorts, a T-shirt, and untied shoes. He reportedly said, “I think it’s important for people to think I look crazy.” This worked on the venture capitalists, such as Sequoia Capital, which bought his pitch—hook, line, and sinker—with a writer on its website saying: “And, since SBF is obviously a genius, I should simply assume that, compared with me, SBF will always be playing at level N+1.”

High-profile visitors would be scheduled to arrive when Bankman-Fried was asleep in the office beanbag. He spoke to the media about his charitable mission—even if the charities’ goals sometimes seemed odd, such as fighting risks from hypothetical future artificial intelligences.

FTX marketed itself heavily. It got Larry David to do a Super Bowl ad this year in which his character’s skepticism turned out to be completely correct. Bankman-Fried bought a 7.6 percent share in popular day-trading brokerage Robinhood. FTX sports sponsorships included the Miami Heat’s FTX Arena, MLB umpire patches, the Mercedes-AMG Petronas Formula 1 racing team, and athletes such as quarterback Tom Brady. FTX even advertised in fortune cookies. FTX worked hard to paint itself as a trustworthy, fully capitalized institution run by smart and sensible people—even as it was operating almost entirely outside any regulation and was a hollow shell.

But Bankman-Fried was also keen to sell himself as a philanthropist. Bankman-Fried formed a super PAC, Protect Our Future, to lobby for political candidates in the 2022 U.S. midterm elections, spending over $39 million. Several million dollars went to sponsoring his fellow effective altruist Carrick Flynn in a Democratic primary for the House of Representatives, but Flynn lost his primary to Andrea Salinas.

Bankman-Fried aggressively lobbied in Washington, D.C., for the Commodity Futures Trading Commission to control crypto in the United States. He was photographed with its commissioner, Caroline Pham. Bankman-Fried’s policy proposals upset many of his fellow crypto institutions, most notably offshore crypto exchange Binance and its CEO, Changpeng Zhao, who felt that Bankman-Fried was setting the rest of the industry up for failure.

Bankman-Fried’s media promotion served to distract attention from what was going on inside FTX. Occasionally, warning signs would leak: His Forbes billionaire list entry included a cautionary note that most of his claimed wealth “was tied up in ownership of about half of FTX and a share of its FTT tokens.”

FTT was the internal trading token of FTX—like supermarket loyalty points for frequent traders, who could get discounted trading fees and free withdrawals. The token was also traded in the wider crypto market. On Nov. 2, a balance sheet was leaked showing that a third of Alameda’s claimed assets were a large volume of FTT. It was as if the Tesco supermarket chain was solvent only if you counted its own made-up Clubcard points as assets. Alameda had also used this pile of FTT as collateral for loans from outside companies.

Binance had been an early investor in FTX. It divested in July 2021; FTX paid Binance for its share in $2.1 billion of FTT and stablecoins. On Nov. 6, when FTT was at $25, Zhao started dumping Binance’s FTT holding on the open market. Alameda offered to buy Binance’s FTT at $22, but Binance continued dumping.

Bankman-Fried had always maintained that Alameda and FTX were separate entities, but the market considered them closely entwined. The possibility of trouble at Alameda led FTX users to withdraw funds as fast as possible—a bank run. FTX paused all withdrawals on Nov. 8.

A few hours later, Binance and FTX announced that Binance would buy FTX to resolve its “liquidity issues”—pending due diligence. Zhao announced the next day that FTX’s books showed that, rather than just a lack of liquidity, the exchange was insolvent by at least $6 billion. The Bahamas, where FTX is incorporated, has frozen all assets and has appointed a provisional liquidator.

Alameda’s liabilities included substantial loans from FTX. It came out later that FTX had lent over $10 billion in customer assets to Alameda and had accepted FTT—its own internal-trader loyalty points—as collateral. Alameda had been in a hole months before, when the crash in May of Terraform’s UST had quickly been followed by the collapse in June of Celsius Network and Three Arrows Capital. Bankman-Fried had bailed out Alameda with customer funds, secured by Alameda’s FTT holding. FTX and Alameda worked in tandem as a risky shadow bank, using customer funds.

Bankman-Fried was quick to reassure customers that FTX US was not affected and that it was “fully backed 1:1.” FTX US was also attempting to buy the remains of the bankrupt Voyager Digital—another victim of Three Arrows Capital—though the deal is on hold until the status of FTX US is sufficiently clear; withdrawals are operating, but deposits have been blocked. The Texas State Securities Board had previously wanted to stop FTX US’s purchase of Voyager on the grounds of problematic activity by the international branch of FTX.

It’s clear now that FTX and Alameda had been hollow shells for many months, even as Bankman-Fried was presenting himself to legislators as a serious regulation-minded crypto proprietor. But there is no reason to presume any other crypto institution is any healthier while the fresh dollars aren’t coming in. In May 2021, FTX’s erstwhile savior Binance appeared to be trading against its own customers. Binance was also used by Iran to evade sanctions with bitcoin. There was, after all, no regulator to stop the exchange from doing anything it felt like.

Legislators have occasionally proposed rules for sensible crypto trading in the United States. The problem for regulation is that the cryptocurrency industry is intrinsically all but unregulatable as long as the trading volume and price discovery happen in the unregulated offshore casinos and the U.S. entities in reach of the law are just the cashier’s desk for the casinos. This is how the crypto world likes it: a trash-fire trading environment, but being able to cash out with real dollars. This is why it bitterly fights the faintest regulation, every time.

This is not just a concern for consumers but a concern about broader financial stability. The Financial Stability Oversight Council’s 2022 Report on Digital Asset Financial Stability Risks and Regulation covers in detail the collapses of UST-Luna and Three Arrows Capital, as well as the cascade of failures that ensued.

The upside for regulators is that the collapse of cryptocurrency didn’t affect the wider economy. The consequences for retail investors in Celsius Network and Voyager Digital were horrifying, but the wider economy hasn’t been put at systemic risk—yet.

The cryptocurrency collapse will be easy to unwind: The crypto traders will go broke, and everyone in crypto will finally admit to their losses. Sequoia Capital has marked its FTX investment down to $0—and deleted from its website its previous hilarious paean to Bankman-Fried’s mysterious genius. The crash victims that FTX was going to bail out, such as BlockFi, have realized their rescuer is not coming.

The crypto bag-holders all actually lost their money long before, when they bought the bitcoins. In the time since, they’d been telling themselves and everyone else that their magic beans were worth money and never mind the lack of buyers. But this was not the case. The beans were always worthless, and the only way to make money from them was to sell them off before other people caught on.

4 notes

·

View notes

Text

GBTC stands for Grayscale Bitcoin Trust. The Grayscale Bitcoin Trust, originally known as the Bitcoin Investment Trust (BIT — no G!), was launched way back in 2013, and it began trading over-the-counter that same year. Grayscale would go on to become a subsidiary of Digital Currency Group (DCG) in 2015.

It’s important to remember that it was a lot harder for the average person to buy Bitcoin (BTC) in 2013. Grayscale observed that there was a market there: investors—both institutional and individual—wanted exposure to Bitcoin, but didn’t want to or weren’t able to mine it themselves, buy it peer-to-peer, or use one of the various (and somewhat shaky) crypto exchanges. So, Grayscale launched GBTC.

GBTC is, as the name would suggest, a trust. Grayscale owns a big pile of Bitcoins, and they issue the $GBTC security. The idea is that Grayscale does all the work of obtaining and custodying the Bitcoins, individual investors can buy GBTC via their usual brokerage accounts (and even put it in tax-advantaged accounts like retirement plans), and investment firms and funds can get exposure to BTC in a compliant way.

Because the number of GBTC shares is proportional to the number of Bitcoins held in the trust, the idea is that the price of GBTC will generally track the price of Bitcoin.

For the more crypto-familiar readers, this is not entirely unlike the mechanism of asset-backed stablecoins. If I take in US$100 and issue 100 MollyUSD, the value of MollyUSD should track the value of the US dollar, assuming people trust me to actually hold on to those dollars responsibly, and trust that they could likely obtain $1 in exchange for their 1 MollyUSD (either by redeeming it with me directly or trading it on the secondary market). We’ll come back to this in a moment.

High demand for GBTC, coupled with its limited supply, actually caused GBTC to trade at a significant premium to its net asset value (NAV—that is, the total value of the Bitcoins held in the trust) up until early 2021. From 2019 until the beginning of 2021, GBTC enjoyed a premium that hovered somewhere between 10% and a whopping 50%, meaning that people were willing to pay considerably more for GBTC than the equivalent quantity of BTC.

2 notes

·

View notes

Text

Increase Your Profits: Strategic Multi-User Flash Loan Arbitrage Bot

Flash Loan Arbitrage Trading Bot Development focuses on designing sophisticated bots that utilize flash loans to capitalize on arbitrage opportunities across various platforms, all without needing initial capital. These bots execute loans and repayments within a single transaction, profiting from price discrepancies. By processing real-time data and automating trades, businesses can optimize their returns and reduce risks in the unpredictable crypto markets.

0 notes

Text

How Effective is Crypto Algo Trading Bot in the Trading Journey

The cryptocurrency market is well-known for its volatility and quick price changes. Amidst this activity, crypto algo trading bots have appeared as effective tools for guiding the complexity of trading. These automated systems, driven by algorithms and advanced data analysis, offer the potential to improve trading efficiency and profitability. But how effective are they truly in a trader's journey?

Comprehending Crypto Algo Trading Bots

Crypto algo trading bots are computer programs developed to perform trades automatically based on predefined parameters. They work on various strategies, from simple trend-following to complex arbitrage opportunities. These bots can analyze market data at sparky speed, recognizing patterns and executing trades exactly, often exceeding human capabilities.

Key Advantages of Crypto Algo Trading Bots

Emotional detachment: One of the biggest advantages of algo trading is the elimination of human emotions. Fear and desire can often cloud judgment, leading to impulsive decisions. Bots operate in a pure sense, without emotional preferences, ensuring disciplined trading.

Speed and efficiency: Humans have limitations in processing data and responding to market changes. Algo bots can execute trades in milliseconds, capitalizing on quick opportunities that humans might miss.

All time function: The crypto market never sleeps. Algo bots can trade constantly, without the need for rest or breaks, maximizing potential profits.

Backtesting and optimization: Before deploying a bot, traders can backtest its performance on recorded data to assess its significance. This allows for the optimization of trading strategies and risk management parameters.

Diversification: Algo bots can manage numerous trading strategies simultaneously, diversifying risk and increasing the possibility for constant returns.

Impact and Success Stories

Multiple traders have reported significant benefits from using crypto algo trading bots. Some have achieved consistent profitability, outperforming manual trading strategies. These bots have been confirmed particularly effective in high-frequency trading, where speed is essential. Additionally, they can be valuable for arbitrage opportunities, using price differences across different exchanges.

However, it's essential to recognize that not all algo trading bots are created equal. The point of a bot depends on several aspects, including the underlying trading method, the quality of data used, and the bot's ability to adjust to market conditions.

Challenges and Concerns

While the potential advantages of crypto algo trading bots are important, it's crucial to approach them with real expectations. Overfitting to historical data can lead to suboptimal performance in future market conditions.

Moreover, developing and maintaining a good algo trading system requires specialized expertise and continuous monitoring. Traders should carefully evaluate the risks involved and consider their ability and help before launching into algo trading.

Conclusion

Crypto algo trading bots have the prospect of being effective tools in a trader's journey. They offer advantages in terms of speed, efficiency, and emotional detachment. While not a guaranteed path to riches, they can significantly improve trading performance when used wisely.

It's important to approach algo trading with a combination of confidence and notice. Thorough research, backtesting, and ongoing monitoring are essential for increasing the benefits and reducing risks. As with any investment, diversification is key. Combining algo trading with other strategies can help create a well-rounded investment portfolio.

In conclusion, crypto algo trading bots represent an exciting frontier in the world of trading. While challenges exist, the potential rewards are significant for those who approach this technology with knowledge and discipline.

Get a opportunity to grab a FREE DEMO - Crypto Algo Trading Bot Development

2 notes

·

View notes

Text

Can BitNest lead us to wealth?

BitNest, as a blockchain-based decentralized finance (DeFi) platform, provides a variety of financial services and investment opportunities, such as lending, savings, investment, etc. These services can indeed provide users with the possibility of increasing the value of their funds, but whether they can "get rich" involves multiple factors, including personal investment strategies, market conditions, risk management capabilities, and an in-depth understanding of the blockchain and DeFi markets.

How using BitNest may lead to wealth growth:

Investment and Financial Management: By taking advantage of the investment tools and products provided by BitNest, such as lending agreements and savings accounts, users can increase their assets and income.

Take advantage of market volatility: On DeFi platforms, investors can take advantage of the volatility of crypto markets to achieve capital appreciation, especially through trading and arbitrage.

Participation in governance and rewards: As a DeFi platform, BitNest may provide governance tokens or other forms of rewards to allow users to participate in the governance and decision-making of the platform, thereby obtaining additional rewards.

Risks to consider:

Market risk: The cryptocurrency market is highly volatile. Although it provides the possibility of high returns, it also faces the risk of capital loss.

Technical risks: DeFi platforms rely on complex smart contracts and technical solutions, and there is a risk of potential vulnerabilities or failures.

Regulatory risk: The global regulatory environment’s changing attitude towards cryptocurrencies and DeFi may affect the operation of the platform and the security of users’ assets.

How to use BitNest safely:

Be Fully Understood: Thoroughly research and understand how DeFi products and services work before investing.

Invest prudently: Only invest money you can afford to lose and diversify your investments to reduce risk.

Continuous monitoring: Pay close attention to market dynamics and platform updates, and adjust investment strategies in a timely manner.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

5 notes

·

View notes

Text

Boost Your Crypto Gains with Arbitrage Trading Bots

It's difficult to stay ahead of the curve in the quick-paced world of crypto trading. Arbitrage Trading is one efficient technique to optimize profits in this volatile market. By utilizing price discrepancies for the same item across several exchanges, cryptocurrency arbitrage enables traders to purchase an asset at a discount on one platform and sell it at a premium on another. However, it takes a lot of effort and time to manually identify and take advantage of these changes. Crypto arbitrage bots can be useful in this situation.

What is a Crypto Arbitrage Trading Bot?

An automated program that searches several exchanges, finds price disparities, and makes trades instantly to take advantage of arbitrage possibilities is known as a crypto arbitrage trading bot. In the quick-moving cryptocurrency market, these bots are made to respond faster than any human trader, spotting and carrying out winning trades in a matter of seconds to make sure no opportunity is lost.

How Arbitrage Trading Bots Boost Crypto Gains?

Speed and Efficiency: Prices on the cryptocurrency market fluctuate rapidly, often as much as a millisecond. Arbitrage opportunities are short-lived and must be acted upon quickly. An intelligent arbitrage bot can recognize and carry out trades more quickly than a human trader, making money before price differentials vanish.

24/7 Trading: Cryptocurrency markets are open around-the-clock, in contrast to traditional financial markets. It is hard for human traders to monitor price variations across many exchanges at all times of the day or night. Even when you're asleep, an arbitrage trading bot keeps working, making sure you never lose out on a possible profit.

Multiple Exchange Monitoring: An arbitrage bot's capacity to keep an eye on many cryptocurrency exchanges at once is one of its main benefits. This extensive coverage raises the likelihood of finding lucrative arbitrage opportunities. After that, the bot takes over and makes transactions automatically, requiring no human involvement.

Increased Profit Margins: A trading bot helps you execute several arbitrage deals quickly and effectively by automating and accelerating the arbitrage process. This volume of trades can greatly increase your overall cryptocurrency returns when paired with modest but steady profits.

Minimized Risk: By taking advantage of the tiny, regular variations in asset pricing between exchanges, arbitrage bots reduce risks. Because arbitrage concentrates on pricing inefficiencies rather than market trends, it carries a lower risk profile than speculative trading.

Selecting the Ideal Crypto Arbitrage Trading Bot

Choosing a trustworthy and efficient bot is essential. Working with the best crypto arbitrage trading bot development company guarantees that the bot you acquire is safe, secure, and can be customized to fit your trading approach.

To provide you with a competitive edge, a reputable arbitrage trading bot development firm can incorporate unique features like multi-exchange support, real-time data feeds, and sophisticated algorithms that adjust to shifting market conditions in your bot.

Conclusion

Crypto traders can increase their profits by taking advantage of price variations across exchanges more profitably than they might with manual approaches provided they use the correct arbitrage trading bot. Gaining an advantage in the market and accessing this automated solution is possible when you collaborate with a professional crypto arbitrage trading bot development company.

Book a Free Demo - https://bit.ly/3XDvBLR

0 notes

Text

Mastering the Future of Finance: Crypto Prop Trading Firms

The world of finance is evolving at a rapid pace, and nowhere is this more evident than in the rise of cryptocurrency. The demand for innovative trading solutions has led to the emergence of crypto proprietary (prop) trading firms. These firms play a crucial role in shaping the future of digital asset trading. They provide the platform, resources, and expertise for traders to leverage cryptocurrency market opportunities.

In this article, we’ll explore the concept of crypto prop trading, the benefits of joining a crypto prop trading firm, and what to consider before diving into this high-risk, high-reward world.

Understanding Crypto Prop Trading

In traditional proprietary trading, firms invest their own capital rather than handling client investments. Traders employed by prop trading firms are given access to the company’s resources, tools, and funds to engage in high-frequency trading, arbitrage, or directional bets on market trends. Profits are split between the firm and the trader based on a pre-determined percentage.

Crypto prop trading operates similarly but is exclusively focused on the cryptocurrency market. It involves trading assets such as Bitcoin, Ethereum, and various altcoins. Traders at a crypto prop trading firm analyze the market, use advanced algorithms, and employ sophisticated risk management strategies to generate profits.

Given the volatility and unpredictability of crypto markets, prop trading offers substantial opportunities for both high gains and steep losses.

Key Benefits of Crypto Prop Trading

Access to Capital

One of the most significant benefits of joining a crypto prop trading firm is access to substantial capital. In crypto markets, a well-funded account can amplify profits, allowing traders to take larger positions and benefit from market swings. Firms typically provide traders with a portion of their profits, keeping the rest to cover operating expenses and reinvest in trading activities.

Risk Management Expertise

Crypto markets are notorious for their volatility, and managing risk is key to success. Prop trading firms have established risk management protocols, providing traders with the guidance they need to minimize potential losses. These firms often use sophisticated tools to monitor market trends and limit exposure, helping traders make informed decisions.

Advanced Trading Tools and Technology

Another advantage is access to cutting-edge technology. Proprietary firms invest heavily in high-speed algorithms, data analytics, and blockchain analysis tools to stay ahead in the market. Traders without access to these advanced tools may find it harder to execute successful strategies on their own. A crypto prop trading firm will offer its traders these tools to ensure competitiveness.

Profit Sharing and Learning Opportunities

Traders at a prop firm typically earn a share of the profits they generate, incentivizing high performance. Many firms also offer structured training programs to develop traders' skills, particularly when it comes to understanding market patterns, refining trading strategies, and enhancing technical expertise. New traders can benefit greatly from the mentorship provided in these environments.

Things to Consider Before Joining a Crypto Prop Trading Firm

Profit Split

While firms provide traders with access to large amounts of capital, they also expect a share of the profits. Before joining a prop firm, it’s crucial to understand the profit-sharing model. Depending on the agreement, a trader could receive anywhere from 50% to 90% of the profits, with the firm retaining the rest.

Risk and Loss Management

Trading in the cryptocurrency market is risky, and losses are inevitable. Prop firms typically offer a set risk limit, meaning traders can only lose a specific percentage of the firm’s capital. However, in some cases, traders might be held personally accountable for losses beyond this limit. Understanding the risk policies is essential before committing to a firm.

Performance Expectations

Prop trading firms are performance-driven environments. They often set strict targets for traders, and those who fail to meet them might face job insecurity. Aspiring traders must be prepared for the pressure of delivering consistent results, particularly in volatile markets like crypto.

Regulatory Considerations

The regulatory landscape surrounding cryptocurrencies is still developing. Traders and firms must stay up-to-date with the latest laws and regulations in different countries. Non-compliance can result in fines, shutdowns, or legal action. It’s crucial to ensure that the firm you work with operates within a well-defined legal framework.

Why Crypto Prop Trading is Growing

The surge in the popularity of cryptocurrencies has been driven by their decentralized nature and the potential for significant returns. As the digital economy continues to expand, crypto prop trading is expected to grow in demand. Traders are drawn to the flexibility, access to capital, and the ability to generate high profits in relatively short periods.

Moreover, the introduction of decentralized finance (DeFi) platforms and the rise of non-fungible tokens (NFTs) have expanded the opportunities available in the crypto market. Crypto prop trading firms that stay on top of these trends will likely continue to flourish.

Conclusion

For those looking to capitalize on the lucrative yet unpredictable world of cryptocurrencies, joining a crypto prop trading firm can be a powerful way to gain access to resources, expertise, and large capital reserves. However, as with any financial endeavor, it's crucial to understand the risks involved and to carefully choose the right firm.

If you're serious about entering the world of crypto prop trading, consider working with established names in the industry like Bitfunded, which provides traders with the tools and capital needed to succeed in the digital finance revolution.

0 notes