#volatility risk

Text

Arbitrage Trading Strategies - A Comprehensive Guide

Arbitrage trading is a strategy that involves taking advantage of price differences between different markets or exchanges. It is a low-risk strategy, but it can be difficult to execute profitably due to the competitive nature of the market and the need for quick execution.

There are two main types of arbitrage: forex arbitrage and crypto arbitrage. Forex arbitrage involves exploiting price…

View On WordPress

#arbitrage opportunity#arbitrage trading#cross-exchange arbitrage#crypto arbitrage#execute arbitrage trades#forex arbitrage#liquidity risk#successful arbitrage trading#trading bot#triangular arbitrage#volatility risk

0 notes

Text

EMOTIONAL

#project sekai#akito shinonome#ena shinonome#pjsekai ena#pjsekai akito#shinonome siblings#tagging things is so hard#anyway. im insane about them. the shinonomers....#the way they grew up in the same household and ended up with two different defense mechanisms#that often facilitate each other#agonzing over how emotional both ena and akito can be. how quick to anger#how volatile.#I wonder if they watch each other grow into their father's anger#and hate every second of it#watching their friends and trying so so hard to learn to be soft#to love in a way that doesn't come with the risk of being loud and sharp.#ah wait#tw eyestrain

54 notes

·

View notes

Text

Am *this close* to venturing into the ValVel tags on AO3 just so I can consume content of them interacting. I swear they better have at least one scene together in S2 or so help me God I will actively start to ship them on main instead of VoxVal.

#Poly Vees is an incredibly interesting concept & I honestly think it offers a lot of potential to their respective character I just#am increasingly struggling to give a ham abt Vox's love life in fan dipistions at this point I am so sorry#Also despite the joke I don't actually have any grips against Valvel as a ship at all#at this point the only thing that's stopping me from thinking abt them in that light#Is just my extremely personal preference based on what a purely platonic bound would likely mean for two people#who are not built for it in the slightest#& both developed very constricted ideas on how that type of relationship is permitted to function for them#Since it's striping Valentino away from his main areas of manipulation whilst making Velvette struggle with the fact that she has to live#with an incredibly volatile and emotionally needy person who she not only has a high-risk professional relationship with#but unironically finds joy in being around as well#She does not want to deal with his shit she doesn't know how#She barely deals with regular shit already and it's why she has Vox to temper with him so she doesn't have to#We're not even sure what Velvette even thinks of Valentino based on the cannon content we have at the moment#there's barely anything to work off of with their limited screen time & I don't even neccesarily believe there will be more#hazbin hotel shitpost

7 notes

·

View notes

Note

" at least i have you to look after me, eh? " from cyrillo for sa :’ ))

“𝘪𝘯 𝘢𝘯 𝘩𝘰𝘶𝘳 𝘰𝘧 𝘯𝘦𝘦𝘥” 𝘱𝘳𝘰𝘮𝘱𝘵𝘴. / accepting // @tvrningout

She sees red— literally— and her mind goes white. She focuses on what's important— what actually matters— and squashes everything else— the worry, the panic, the terror, the urge to cry and scream and throw up, the ghosts suddenly suffocating her— into a far off corner of her mind so she can get to work.

She doesn't remember much after that, but also remembers every breath with an eye-seering clarity. The reek of blood. How he was colder than he should've been. Crimson embedding itself in the cracks of her skin, under her nails. Every single stitch and plaster and bruise and scrape.

How she can't close her eyes, for even a blink, lest she see the life drain from his. Keeps checking and double checking and triple checking his face to make sure it isn't so, no matter how briefly.

After an eternity, after a blink of an eye, she's done.

She excuses herself to the bathroom (she thinks she says to clean up), and regrets it immediately. It hits her like a horsekick to the chest, she can't breathe she can't breathe she can't breathe— and she barely keeps herself from sending her fist through the mirror (and, changes are, into the wall behind it). She hates looking at herself, on a good day, and now—

Now she'd failed. Again. There's blood on her hands and it's not hers, because it's never hers. It's all for her but it's not hers, and it should be hers, it should've always been hers, the blood on her clothes and the eyes going lifeless. Why isn't it hers?!

Why is she—

She shoves the wind back into her lungs like gathering broken glass with naked hands, and pulls herself back outside. She doesn't think she actually got to cleaning. She just knows seeing Cyrillo again, like this, rips her heart out of her chest. But him still being here, gaze alive, lets it continue to beat — no matter how atrocious and gorey of a thing it is. That she is.

Sasume feels about as old as Cyrillo presumably is, maybe older, but without any immortality or undeath to keep her going. Like a puppet with its strings cut and joints rotted and clogged still trying to drag itself through its cues as if there's any audience left.

She sits at his bedside again, silently. Doesn't remember doing it. Can only stare at the spark in his eyes until she's seeing through them, seeing nothing at all, as if pretending to keep him out of her nightmares could ever keep him from joining the graveyard at her feet, pumping through her veins. Keeping her alive, no matter what she says or wishes or wills otherwise — because she's never had a choice.

" — at least i have you to look after me, eh? "

And she wheezes, chest crushing in on her ribs and heart and soul so suddenly and so fiercely once more that the world starts to spin. Heat floods her skin even as her blood runs ice cold, and acid creeps up her chest. Her vision blurs, and she isn't sure if the world is shaking or if her bones are.

"Don't—" she chokes on a sob, wetness leaking out of her eyes, and presses the hand she'd been gripping tight against her forehead instead of her own. She gasps, a keening, pathetic thing, and sees more than feels the tears pouring out.

It's not fair, she thinks, both distantly and as deafening as a thunderclap. She's not sure if she means this, or all the bodies piled up in her heart. If it's his being hurt, or that she's not hurt, or that taking all the gods damned blades and bites and bruises in the world can't spare those closest to her even a single one— no matter how much she wants otherwise.

"Don't—" she can't get anything else out. Doesn't even think there'd be a point. Even if, already, it feels like she's begging. For him to not play light, maybe, but also for the gods to maybe— maybe— show her even the slightest of favor and make it so this wasn't so. That maybe—

"I should've been there," she chokes out, nonsensically, world blurring again, pressing the back of his hand even harder against her own skin. If she gives even the slightest inch, even now, who's to say he won't slip through her fingers a final time?

"I should've...—" and finally, curled over herself like that, at Cyrillo's bedside as he warms her own damned bed, she weeps.

#tvrningout#tvrningout: cyrillo#ic // sasume#v: dorverold#prompt responses //#emeto //#panic attack //#blood mention //#disassociation //#oh dear god(s) uhhhhhhhhhh#ask to tag //#pov sa has. so much fucking Trauma 8'))) and lost loved ones 8'))))#sure SEEING him get hurt first hand would be infinitely worse but at least when shes /not/ there its easier to imagine her Stopping it yk..#ft indirect miscommunication fuel bc :'))) cyrillo thinks her isms are bc of her Duty/JobTM while shes so fucked up bc she cares abt HIM yk#also dear god lmfao bc. not only will she be biting at the bit to hyper turbo slaughter who / what ever did this to him .#liable to be uncannily temperamental/rebellious/volatile even in the field/wrt orders abt it#including risks of Fourth cropping up whether briefly or to rrod HER a la that other inverse caretake-y meme

4 notes

·

View notes

Photo

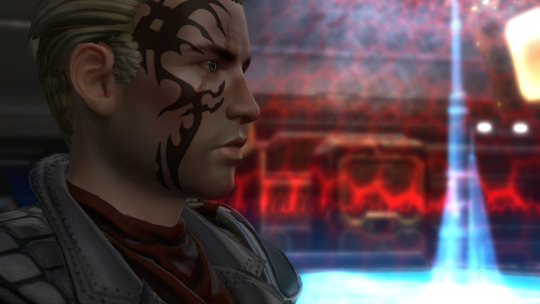

Lensen Ryaldar - aka my “ah fuck, I’ve fallen in love with this absolute bastard and his devilish good looks anyway” (despite many poor and questionable decisions) collection, KOTET edition and in no particular order.

#swtor#swtor screenshots#ch: lensan#srsly i cannot overstate that i have never loved and hated one of my ocs in such strong equal measures before#awful stinky bastard man. absolute jackass. terrible. so fiercely loyal to the few people he does somehow care about.#he's ride or die. he's sold out imperial trade routes to a close associate for smuggling operations. he's mandalorian#but also he's just a bounty hunter. he's a staunch loyalist to the empire.#like. sir. you do realize half of that contradicts?#honestly why didn't i run him thru the agent story at this rate tbh#with this many cross-purposes he'd be perfect and maybe i'm just a glutton yea?#fun fact: he started originally as cipher four ie a plant to keep tabs on the mandalorian alliance before i made him black ops#either way intelligence could fill a family of 5's grocery list with his bullshit tbh#'potential recruit. volatile. violent. also potentially extremely high-risk threat.'#that file would hit tyr's desk and i can already hear him sighing lmao#i really need to stop putting oc lore in the tags...#anyway part of the reason he hasn't gotten an agent run is honestly bc i can't see him without the facepaint anymore#tattoo. whatever you wanna call it. it just adds a little a lot of somethin lmao

24 notes

·

View notes

Note

I'd like to hear about Marble and the exact context behind her... unfortunate demise.

Why, yes - we absolutely can!

Let's start with this: Marble is a Wasp Bomber, by game terms. She is very competent in making and employing explosive charges. She is, in fact, so competent at making and employing explosive charges that she is capable of producing bombs that can melt a hole in a kaiju. She was also banned from military service for collateral damage before the Wasp King turned up.

Wasp Kingdom military attitudes tend to, overwhelmingly, be shaped by the environment they live in - they border on deadlands, but more specifically Northern deadlands, where them being classified as Deadlands because of the sheer number of hazards to bug life that they have around there meaning that anything that isn't specifically adapted to the environment will be incapable of surviving well enough for any children it might produce to not end up Lesser.

There are monsters. The Wasp Military is, on a regular basis, pitted against a very large number of Beasts of all sorts, which means that having a decent supply of bugs capable of fighting them off is a necessity. Pretty much any wasp with capacity to serve is set to work as some part of fighting forces at some point, be it out in the field or repairing equipment for those who can be out in the field. Conscription is very much mandatory, and it is considered a deeply important role and a core part of a wasp's duty in the hive to, at one point or another, contribute to the fighting fitness of the Hive.

This demand - and the need for bugs associated, especially when the general danger of the territory will lead to wasp lives lost even on very standard patrols, goes to the point that the Wasp Kingdom will actively pull from demographics that most kingdoms prefer to either avoid or keep out of the line of fire - drones, kept out of the line of fire in nearly every other kingdom, are drafted just as often as workers, and the Wasp Kingdom is just about the only kingdom to actively welcome brood parasites and random out-of-kingdom bugs for the potential strategic advantages that they may offer.

With this established, Marble was been banned from active service the Wasp military forces after approximately two months of service due to her flagrant disrespect of safety procedure and astronomically high risk of friendly fire. She is, in fact, not actually allowed to do mechanical work without supervision, because not keeping track of what she's doing has an extremely high risk of her including improvements that, even while working as intended, are capable of maiming or killing their users if mishandled even slightly.

Even if Marble herself is capable of handling her inventions safely, for the most part, the Wasp Kingdom under Vanessa was entirely unwilling to take that risk. As such, she was banned from military service, as she was deemed unsuitable for just about any other potential role available to her and no one was really willing to put her within reach of any sort of potentially volatile equipment that absolutely anyone else might handle, and she spent a few years mostly just hanging around Defiant Root and making friends with the inhabitants of the Black Market.

Hoaxe put her back into military service after taking over the Wasp Kingdom.

Unfortunately, a Marble who is being actively mind controlled by someone who doesn't know shit about bomb safety and is simply setting her to whatever will be most effective offensively is even worse at safety than a Marble who is creating highly volatile explosives constructed with the assumption that whoever is using them Also has exactly as much knowledge of her own work as her.

She blew herself up. Badly.

Technically, it wasn't immediately lethal - the specific bomb that did it wasn't something that would instantly vaporize her like some of the other options! It was, instead, a crowd-control weapon, which released a fucking massive amount of heat energy and cooked everything in a hideously wide radius to cinders.

Technically, there are forms of treatment available to Bugaria that could keep her from straight-up dying to that, if they got to her in three minutes or so - mostly just Gold save crystal restoration or flat-out replacing most of her body with charmcraft, and definitely not without major damage to just about every organ in her body. Depending on the specific circumstances that she blows herself up in, it might even be survivable - it's possible for her to die even while handling the bomb properly due to things like "it has an effective range that can be measured in human-size metres" and "Hoaxe is not an effective strategist". However, this is a very remote chance, and most of the time she just dies badly.

#asks#we speak#ocs#marble#it was very predictable to anyone who knew her#shes really good at making Extremely Effective Explosives So Volatile She's The Only One Who Can Reliably Hold Them#unfortunately when you work in a military unit sometimes other people will need to touch your weapons#and when you work as a technician then it's actually a Major Detriment to include a nuke that will blow up if you look at it wrong#this is a woman who generates enough collateral damage that she got banned from the Kaiju Squad#because the risk of using her Inventions That Could Put A Hole In Godzilla outweighed the benefits of Putting A Hole In Godzilla#her death was very predictable. if she survives this then she is permanently retired from the wasp kingdom army on disability#because she is A Liability if allowed around any sort of mechanical things#anyways shes part of the reason that DL omega is so active in-game#because she set. a radius of like fifteen human-sized feet on fire

2 notes

·

View notes

Note

Hogwarts honestly needed a program for the gifted children because it's shown through time that they need to be kept occupied or they'll find their own chaos (Tom Riddle, The Marauders, Snape, The Weasley Twins, Draco Malfoy and Hermione Granger)

no but fr. some kids need to be intellectually stimulated or they’ll go round the bend.

but also, on a funnier note, i love how almost every one of these kids were driven to (accidental or deliberate) murder lmao

tom- well. do i even need to say anything?

the marauders- sadly, the prank. also, their shenanigans on full moons.

weasley twins- literally experimenting on kids & themselves. stuffed montague in a vanishing cabinets. i know there’s more but i can’t remember.

draco- the entire sixth year. (which yeah ik extenuating circumstances but still). also just him generally being a little shit

hermione- my god. that girl literally needed The Most. she set a teacher on fire, imprisoned and blackmailed a grown woman, permanently disfigured a classmate, and erased her parents’ entire memory. i mean,,,good on her for all that (def not criticising) but she would’ve really benefitted from a gifted kids program ykno?

snape- a whole death eater lmao maybe if he’d gotten a grant and some resources, he could’ve gotten tf away from all that nonsense.

imagine them in gifted kid programs—they could’ve probably revolutionised the wizarding world multiple times over

#like chaos here is literally homicide or disfigurement#and yah most of that is because magic increases the threshold of what’s considered socially acceptable#and a lil murder attempt (and a threat to ur life) is prolly considered a rite of passage#imagine a kid who’s been sheltered their whole life. others reacting to how he’s never had a NDE like#‘ur such a weirdo man. youve had to have almost died atleast once by this point right?’#imagine NDEs being an indicator of how much magic u use/how powerful u are etc#bc if you’ve had none it means u love a very boring and/or non-magical life#live*#bc of how volatile the whole thing can be#lmao i don’t even know if this is making sense anymore but i promise it does in my head#i just like thinking of magic as separate from our own conventions of morality and risk and stuff#bc that makes it more fun#if i just apply irl standards then everything is a horrific shitshow#so yah#pen’s asks

33 notes

·

View notes

Text

Volatile Vial of Reaper's Risk

#cardboard anvil#kleptogoblicon#volatile vial of reaper's risk#potion#potions#poisons#poison#woah#dark#horror#cursed#healing#health#recovery

5 notes

·

View notes

Text

Mastering Relative Volatility Trading: A Comprehensive Guide

Trading in financial markets can be daunting, especially with the plethora of strategies available. One of the sophisticated yet effective methods is trading based on relative volatility. This approach helps traders understand market movements better and make more informed decisions. In this detailed guide, we’ll delve into the concept of relative volatility, its significance, how to calculate…

View On WordPress

#Bloomberg Terminal#Financial data analysis#Financial Markets#Market Sentiment#Market Volatility#MetaTrader#Online trading courses#Pair trading#Portfolio diversification#Price movements#Quandl#Relative Volatility#Relative Volatility Index (RVI)#Risk Management#Standard deviation#stock trading#Stop-loss levels#Take-Profit Levels#Technical Indicators#Thinkorswim#Trading Education#trading signals#Trading Strategies#TradingView#Trend Analysis#Volatility convergence#Volatility indicators#Volatility spread trading#Volatility Trading#Yahoo Finance

0 notes

Text

Unlocking Perpetual Futures Contracts: Essential 2024 Guide for Beginners

Are you ready to take your trading to the next level with a financial instrument that offers endless opportunities and flexibility?

Perpetual futures contracts have emerged as a revolutionary tool in the trading arena, particularly for cryptocurrency enthusiasts. These contracts, unlike traditional futures, do not have an expiration date, allowing traders to hold positions indefinitely. This feature provides a significant advantage, enabling continuous trading and the ability to take advantage of long-term market trends. The funding rate mechanism, which periodically adjusts to keep contract prices in line with the spot prices of the underlying assets, ensures a balanced and fair trading environment.

Leverage is a key feature of perpetual futures contracts, allowing traders to control larger positions with a smaller capital investment. This can significantly amplify profits, but also poses a risk of larger losses, making risk management a crucial aspect of trading these contracts. The real-time mark-to-market settlement process adjusts traders' margin balances continuously, ensuring that gains and losses are promptly accounted for. This mechanism helps prevent sudden liquidations and keeps traders informed about their margin requirements.

Despite the numerous benefits, perpetual futures come with their own set of risks, including market volatility and fluctuating funding rates. Traders must have a solid understanding of these risks and employ effective strategies to mitigate them.

Intelisync, a pioneer in blockchain technology and exchange development, offers advanced solutions to enhance the security and functionality of perpetual futures trading. Explore how Intelisync can enhance your trading experience and provide the tools you need to succeed in the dynamic world of perpetual futures.

Discover how Intelisync can transform your trading journey and provide you with the tools needed to succeed in the dynamic world of perpetual futures. Contact Intelisync today! Ready to revolutionize your trading journey? Contact Intelisync today and Learn more....

#Advantages of Perpetual Contracts#Crypto Market Liquidity#Cryptocurrency Trading#Funding Rate#Funding Rate Mechanism#Futures Trading Guide#How do Future contract work?#How does trading on perpetual contracts work?#Intelisync Blockchain solution#Main Features of Perpetual Futures#Margin Requirements#Market Volatility#PERP DEX Development: Intelisync’s Expertise in Perpetual Future Contracts#perpetual futures trading.#Perpetual Futures vs. Traditional Futures#Risks Associated with Perpetual Futures Contracts#Trading Strategies#What is Perpetual Futures Contracts

0 notes

Text

2024 The Wild World of Meme Coins: A Look at 12 Popular Tokens

New Post has been published on https://www.ultragamerz.com/2024-the-wild-world-of-meme-coins-a-look-at-12-popular-tokens/

2024 The Wild World of Meme Coins: A Look at 12 Popular Tokens

The Wild World of Meme Coins: A Look at 12 Popular Tokens

$DOGE $FLOKI $SLERF $DUKO $MFER $PENG $BOME $CANDLE $TROLL $MUMU $Hege $Mong

The cryptocurrency market can be a serious business, but there’s also a lighter side fueled by internet humor and virality. Enter meme coins – cryptocurrencies inspired by internet memes and online jokes. While they may lack the perceived utility of other crypto projects, meme coins can experience explosive growth thanks to community hype and social media trends. Let’s take a deep dive into 12 of the most popular meme coins, exploring their origins, functionalities, and potential:

<blockquote class=”twitter-tweet”><p lang=”en” dir=”ltr”>Which one will you Buy during this dip?<a href=”https://twitter.com/search?q=%24DOGE&src=ctag&ref_src=twsrc%5Etfw”>$DOGE</a><a href=”https://twitter.com/search?q=%24FLOKI&src=ctag&ref_src=twsrc%5Etfw”>$FLOKI</a><a href=”https://twitter.com/search?q=%24SLERF&src=ctag&ref_src=twsrc%5Etfw”>$SLERF</a><a href=”https://twitter.com/search?q=%24DUKO&src=ctag&ref_src=twsrc%5Etfw”>$DUKO</a><a href=”https://twitter.com/search?q=%24MFER&src=ctag&ref_src=twsrc%5Etfw”>$MFER</a><a href=”https://twitter.com/search?q=%24PENG&src=ctag&ref_src=twsrc%5Etfw”>$PENG</a><a href=”https://twitter.com/search?q=%24BOME&src=ctag&ref_src=twsrc%5Etfw”>$BOME</a><a href=”https://twitter.com/search?q=%24CANDLE&src=ctag&ref_src=twsrc%5Etfw”>$CANDLE</a><a href=”https://twitter.com/search?q=%24TROLL&src=ctag&ref_src=twsrc%5Etfw”>$TROLL</a><a href=”https://twitter.com/search?q=%24MUMU&src=ctag&ref_src=twsrc%5Etfw”>$MUMU</a></p>— Elon Musk (Parody) (@ElonMuskPDA) <a href=”https://twitter.com/ElonMuskPDA/status/1783102815017308291?ref_src=twsrc%5Etfw”>April 24, 2024</a></blockquote> <script async src=”https://platform.twitter.com/widgets.js” charset=”utf-8″></script>

1. Dogecoin (DOGE) – The OG Doggo Coin (https://dogecoin.com/) Dogecoin, the granddaddy of meme coins, features the iconic Shiba Inu dog from the “Doge” meme. Launched in 2013 as a joke by Billy Markus and Jackson Palmer, Dogecoin gained mainstream popularity with tweets from Elon Musk and garnered a passionate community known as the “Doge Army.” DOGE has limited functionality beyond being a medium of exchange, but its cultural significance and strong community backing have fueled its success.

2. Floki Inu (FLOKI) – Taking Over for Doge? (https://floki.com/) Capitalizing on the Shiba Inu theme, Floki Inu claims to be the “son of Doge” and has gained traction with its association with Elon Musk’s dog of the same name. FLOKI aims to be more than just a meme coin, offering features like an NFT marketplace, a play-to-earn game, and a charitable arm. However, its long-term success hinges on the execution of its development roadmap and maintaining community interest.

3. Slurp ($SLERF) – All About the Memes (https://blockworks.co/) Slurp embraces the meme culture with a constantly evolving mascot, often featuring internet-famous characters and references. The project prioritizes fun and community engagement, hosting regular contests and giveaways. SLERF has limited real-world use cases beyond being a community token, but its focus on fun and lightheartedness could attract users seeking a more light-hearted crypto experience.

4. Ducky Inu (DUKO) – Quacking its Way into Crypto (https://www.duckychannel.com.tw/) DUKO features a cute duck character and aims to provide a fun and easy entry point for new crypto users. The project offers a decentralized exchange (DEX) and a staking platform within the Binance Smart Chain ecosystem. However, DUKO faces stiff competition from established DEX platforms, and its long-term success relies on attracting and retaining a loyal user base.

5. Mothership (MFER) – Bringing the Memes to DeFi (https://coinmarketcap.com/currencies/mothership/) MFER takes a different approach, utilizing the “Mfers” meme within a Decentralized Finance (DeFi) ecosystem. The MFER token grants access to a platform offering various DeFi features like staking, governance, and potential future NFT integration. While the project holds promise for DeFi enthusiasts, its success hinges on attracting users who value both the meme aspect and the DeFi functionalities.

6. Penguin Finance (PENG) – Waddling into the Market (https://coinmarketcap.com/currencies/penguincoin-old/) PENG features a penguin mascot and focuses on building a decentralized exchange (DEX) within the Binance Smart Chain ecosystem. Unlike some meme coins with limited functionality, PENG offers a real-world use case for users seeking alternative trading platforms. However, the success of PENG relies heavily on the overall adoption and liquidity of its DEX platform.

7. Bombshell (BOME) – Making a Big Bang (https://www.wsj.com/articles/bitcoin-blockchain-hacking-arrests-93a4cb29)

BOME utilizes a sexy anime character as its mascot and aims to create a fun and engaging community around its token. The project has plans for an NFT marketplace, a play-to-earn game, and its own anime series. However, BOME faces criticism for its reliance on a potentially exclusionary mascot and the ambitiousness of its development roadmap.

8. Candle (CANDLE) – Burning Bright in the Memeverse (https://www.candlestick.io/)

CANDLE features a simple candle chart as its logo and focuses on building a sustainable meme coin through a deflationary token model. A portion of every transaction is burned, reducing the total supply of CANDLE tokens over time, which some believe can increase its value. However, the effectiveness of this model in a volatile market like meme coins remains to be seen.

9. TrollCoin (TROLL) – Feeding the Online Antics (https://www.coinbase.com/price/trollcoin)

TROLL uses the “trolling” meme as its inspiration and aims to create a fun and engaging community for internet pranksters. The project has limited real-world use cases beyond being a community token, but its focus on humor and lightheartedness could resonate with users seeking a more playful crypto experience.

10. Mumu the Bull (MUMU) – A Bovine Take on Meme Coins

Mumu the Bull (MUMU) takes a unique approach to the meme coin space by featuring a bullish character instead of the more common dog theme. Inspired by the “Mumu the Bull” meme, popular within the crypto community as a symbol of bullish market sentiment, MUMU aims to capitalize on this positive association.

The project has plans for a decentralized exchange (DEX) and a yield-generating mechanism for MUMU holders. However, the long-term success of Mumu the Bull hinges on the execution of its development roadmap and attracting users who see value in its specific meme and its functionalities.

11. Hege Coin (HEGE) – Inspired by a Controversial Figure (https://coinmarketcap.com/dexscan/solana/CJcu7ciRHBHu4BDnpLgAUm1A6iSp9RuhJMG36rjjrxnd/)

HEGE is a more controversial meme coin, inspired by a historical figure. While the inspiration can be a source of community engagement, it can also raise ethical concerns and potentially limit its mainstream appeal. It’s crucial to conduct thorough research on the project’s background and community before investing in HEGE.

12. MongCoin (MONG) – Bringing Memes to the Real World (https://coinmarketcap.com/currencies/mongcoin/)

MONG aims to bridge the gap between the meme coin world and real-world applications, focusing on charity and social good. The project partners with various charities and donates a portion of its transaction fees to support them. MONG offers a unique approach within the meme coin space, potentially attracting investors seeking to combine meme culture with social impact.

Important Note: Meme coins are inherently risky investments due to their high volatility and lack of underlying utility. Always conduct thorough research before investing in any cryptocurrency, and consider your risk tolerance. The information provided here is for informational purposes only and should not be considered financial advice.

#Bombshell (BOME)#Candle (CANDLE)#charity#community hype#controversial meme coin#Cryptocurrency#decentralized exchange (DEX)#Decentralized Finance (DeFi)#deflationary token model#Dogecoin (DOGE)#Ducky Inu (DUKO)#financial advice#Floki Inu (FLOKI)#governance#Hege Coin (HEGE)#high volatility#internet memes#Meme Coins#MongCoin (MONG)#Mothership (MFER)#Mumu the Bull (MUMU)#NFT marketplace#online jokes#Penguin Finance (PENG)#play-to-earn game#risk tolerance#Shiba Inu dog#Slurp ($SLERF)#social good#social media trends

1 note

·

View note

Text

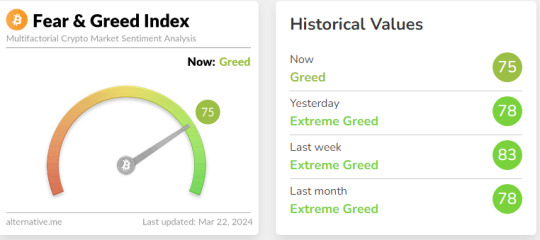

At its core, the Crypto Fear and Greed Index serves as a barometer for investor sentiment within the cryptocurrency market. It assigns a numerical value between 0 and 100, with lower values indicating extreme fear and higher values suggesting extreme greed. This index provides invaluable insights into prevailing market emotions, enabling investors to make informed decisions regarding their crypto portfolios.

https://www.bloglovin.com/@a2zcrypto/unlocking-crypto-fear-greed-index-a-comprehensive-12512075

0 notes

Text

Binance Exclusive: Start Trading with $100 for Free!

Take your first steps into the exciting realm of cryptocurrency trading with Binance! Sign up now and receive a complimentary $100 to kickstart your trading journey. Explore a diverse selection of cryptocurrencies, hone your trading skills, and potentially turn that initial $100 into something more. Don't miss this exclusive offer – seize the opportunity to trade on Binance with free funds! #binance #cryptotrading #freemoney

Link Below : https://bit.ly/BinanceFree100

#Cryptocurrency#Forex#Stocks#Day Trading#Swing Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Risk Management#Options Trading#Futures Trading#Bull Market#Bear Market#Market Trends#Stop-Loss#Take Profit#Margin Trading#Leverage#Candlestick Patterns#Market Volatility

0 notes

Text

Maximizing Retail Profits: Harnessing B2B Price Optimization Software

In the ever-evolving world of retail and e-commerce, businesses are constantly seeking ways to gain a competitive edge. Among the many strategies employed, B2B Price Optimization and Management Software stands out as a game-changer. Price optimisation and management (PO&M) software solutions enable businesses to oversee and optimize the prices of their goods and services. These services also provide a growing range of sales intelligence advice, such as best-next-action suggestions and customer churn warnings. In the industry, vendors either focus on back-office price management and product management roles, or they focus on providing real-time sales intelligence to sales representatives and B2B digital commerce websites, or both. Quadrant Knowledge Solutions, a leading global advisory and consulting firm, has recognized the significance of this technology in their report, “B2B Price Optimization and Management Applications, 2023”. Quadrant Knowledge Solutions focuses on helping clients in achieving business transformation goals with Strategic Business, and Growth Advisory Services.

Download the sample report of Market Share: B2B Price Optimization and Management Software

Understanding the Retail and E-commerce Landscape

The retail and e-commerce industry is a highly dynamic and competitive space. Companies within this domain face the continuous challenge of pricing their products right to maximize profitability while staying attractive to their customers. In this context, pricing becomes a critical element of their strategy. Let's delve into some of these challenges:

Rapidly Changing Market Dynamics: Retail and e-commerce markets are highly volatile, with ever-shifting consumer preferences and market trends. Adapting to these changes in real-time is essential to stay competitive. Without the right tools, businesses risk making pricing decisions that are out of sync with market realities.

Intense Competition: In retail and e-commerce, competition is fierce. With numerous players offering similar products or services, pricing becomes a key differentiator. Setting prices too high can drive customers away, while pricing too low can erode profit margins.

Complex Supply Chain and Cost Structures: The retail and e-commerce sector often deals with complex supply chain operations and cost structures. Understanding the true costs associated with a product or service is essential for setting optimal prices. Traditional methods of cost calculation can be time-consuming and error-prone.

Customer Behaviour and Expectations: Today's consumers are more informed and price-sensitive than ever before. Their buying behaviour can change rapidly in response to various factors, including promotions, discounts, and market trends. Retailers must be agile in responding to these changes.

Competitor Pricing Strategies: Keeping a constant eye on competitor pricing is crucial. Businesses need to respond promptly to pricing moves made by competitors to remain competitive. Manual tracking and analysis of competitor pricing are arduous and inefficient processes.

Download the sample report of Market Forecast: B2B Price Optimization and Management Software

B2B Price Optimization and Management Software: A Necessity

B2B Price Optimization and Management Software is the solution to these challenges. This technology leverages advanced algorithms, data analytics, and real-time market insights to help businesses make data-driven pricing decisions. It empowers retail and e-commerce companies to optimize their prices efficiently while taking into account factors like demand fluctuations, competitor pricing, and customer behaviour.

Talk To Analyst: https://quadrant-solutions.com/talk-to-analyst

#In the ever-evolving world of retail and e-commerce#businesses are constantly seeking ways to gain a competitive edge. Among the many strategies employed#B2B Price Optimization and Management Software stands out as a game-changer. Price optimisation and management (PO&M) software solutions en#such as best-next-action suggestions and customer churn warnings. In the industry#vendors either focus on back-office price management and product management roles#or they focus on providing real-time sales intelligence to sales representatives and B2B digital commerce websites#or both. Quadrant Knowledge Solutions#a leading global advisory and consulting firm#has recognized the significance of this technology in their report#“B2B Price Optimization and Management Applications#2023”. Quadrant Knowledge Solutions focuses on helping clients in achieving business transformation goals with Strategic Business#and Growth Advisory Services.#Download the sample report of Market Share: B2B Price Optimization and Management Software#Understanding the Retail and E-commerce Landscape#The retail and e-commerce industry is a highly dynamic and competitive space. Companies within this domain face the continuous challenge of#pricing becomes a critical element of their strategy. Let's delve into some of these challenges:#Rapidly Changing Market Dynamics: Retail and e-commerce markets are highly volatile#with ever-shifting consumer preferences and market trends. Adapting to these changes in real-time is essential to stay competitive. Without#businesses risk making pricing decisions that are out of sync with market realities.#Intense Competition: In retail and e-commerce#competition is fierce. With numerous players offering similar products or services#pricing becomes a key differentiator. Setting prices too high can drive customers away#while pricing too low can erode profit margins.#Complex Supply Chain and Cost Structures: The retail and e-commerce sector often deals with complex supply chain operations and cost struct#Customer Behaviour and Expectations: Today's consumers are more informed and price-sensitive than ever before. Their buying behaviour can c#including promotions#discounts#and market trends. Retailers must be agile in responding to these changes.#Competitor Pricing Strategies: Keeping a constant eye on competitor pricing is crucial. Businesses need to respond promptly to pricing move#Download the sample report of Market Forecast: B2B Price Optimization and Management Software

0 notes

Text

Unveiling the Myths in the Stock Market: Separating Fact from Fiction

Title: Unveiling the Myths in the Stock Market: Separating Fact from Fiction

Introduction:

The stock market is a complex and dynamic ecosystem that has fascinated and confounded investors for generations. As individuals navigate this financial realm, they often encounter a myriad of myths that can influence their decisions and perceptions. In this blog post, we aim to debunk some common myths…

View On WordPress

#commission-free trading#debunking myths#diversification#ETFs#financial decisions#financial education#financial goals#financial myths#fractional shares#informed investing.#investing myths#Investment Strategies#investor community#long-term investing#market timing#Market Trends#Market volatility#online trading#Risk Management#stock market#stock market misconceptions#stock market realities

0 notes

Text

Azad Engineering IPO Date, Price, GMP, Review December 2023

New Post has been published on https://wealthview.co.in/azad-engineering-ipo-details/

Azad Engineering IPO Date, Price, GMP, Review December 2023

Azad Engineering IPO: Azad Engineering is a leading Indian manufacturer of high-precision turbine components and assemblies for the global aerospace industry. They primarily cater to commercial and military aircraft engine programs, boasting a dominant position in the gas turbine market.

Azad Engineering IPO Highlights:

Open Date: December 20, 2023

Close Date: December 22, 2023

Listing Date: Tentatively January 4, 2024

Offer Size: ₹740 crore

Price Band: ₹499 – ₹524 per share

News and Developments:

Strong Market Position: Azad Engineering claims around 70% share of the global gas turbine market in terms of technology ownership and units ordered in the first half of 2022.

Increased Defense Focus: The company recently secured a contract to supply critical components for a high-thrust military aero engine, potentially boosting its order book and future prospects.

Azad Engineering: Securities, Reservation Percentages, and Investment Details

Azad Engineering currently offers only one type of security: equity shares. They haven’t issued any bonds or other types of investment instruments.

However, since you’re interested in details regarding different investor categories and investment requirements, I assume you’re inquiring about their Initial Public Offering (IPO) which happened in July 2023. Here’s the breakdown:

Equity Shares:

Issue size: Rs. 380 crore (approximately $45 million)

Offer type: Book-building with a greenshoe option

Reservation percentages:

Retail Individual Investors (RII): 35%

Non-Institutional Investors (NII): 15%

Qualified Institutional Buyers (QIB): 50%

Minimum lot size: 150 equity shares

Minimum investment amount: Rs. 11,100 (at offer price of Rs. 74 per share)

Please note: This information is based on their IPO details from July 2023. As of today, December 18, 2023, the shares are already trading on the exchange and the initial reservation percentages and lot size are no longer applicable for new investments.

To understand the current trading details and investment requirements, you can refer to the company’s website or any reliable financial platform like NSE or BSE. They will provide information on the current market price, bid/ask spread, trading volume, and other relevant details.

Azad Engineering Company profile:

A Brief History:

Founded in 1961, Azad Engineering has grown from a small forging unit to a global leader in precision-engineered components.

Initially focused on automotive parts, it shifted towards complex components for high-demand industries like aerospace, defense, energy, and oil & gas.

In 2018, it went public (IPO) and has witnessed consistent growth since then.

Operations and Market Position:

Azad Engineering boasts state-of-the-art facilities in India, equipped with advanced forging, machining, and automation technologies.

They specialize in manufacturing highly engineered, mission-critical components like turbine blades, landing gear segments, and structural parts.

With sales in over 16 countries, they hold a strong position in the global market for complex engineered components.

Prominent Brands, Subsidiaries, and Partnerships:

Azad Engineering operates under its own brand and caters directly to global OEMs (Original Equipment Manufacturers).

They have strategic partnerships with leading players in their target industries, ensuring access to cutting-edge technology and market needs.

They don’t currently have any subsidiaries, but maintain a lean and focused operation.

Competitive Advantages and Unique Selling Proposition (USP):

Vertical Integration: Azad Engineering controls the entire manufacturing process, from forging to machining, ensuring quality and cost control.

Material Expertise: They possess deep knowledge of forging complex materials like titanium and superalloys, setting them apart.

Focus on Innovation: They continuously invest in R&D, developing new manufacturing techniques and materials to stay ahead of the curve.

Global Reach and Local Touch: With facilities in India and a strong export network, they offer global reach while maintaining local flexibility.

Azad Engineering Ltd Financials:

The following table represents Azad Engineering Ltd’s key financials for the past three fiscal years.

Particulars

FY23

FY22

FY21

Net Revenues (₹ in crore)

241.68

194.47

122.72

Sales Growth (%)

24.28%

58.47%

Profit after Tax (₹ in crore)

8.47

29.46

11.50

PAT Margins (%)

3.50%

15.15%

9.37%

Total Equity (₹ in crore)

203.99

120.01

90.89

Total Assets (₹ in crore)

589.21

404.32

256.05

Return on Equity (%)

4.15%

24.55%

12.65%

Return on Assets (%)

1.44%

7.29%

4.49%

Asset Turnover Ratio (X)

0.41

0.48

0.48

Earnings per share (₹)

1.79

6.49

2.53

Data Source: Company RHP filed with SEBI

Lead Managers for Azad Engineering IPO:

The joint Book Running Lead Managers (BRLMs) for the Azad Engineering IPO are:

Axis Capital Ltd.

ICICI Securities Ltd.

SBI Capital Markets Ltd.

Anand Rathi Securities Ltd.

These are all well-established investment banks with extensive experience in managing IPOs. Here’s a brief overview of their track record in recent similar offerings:

Axis Capital: Managed IPOs of Adani Wilmar, Glenmark Life Sciences, and Clean Science and Technology, all of which witnessed positive subscriptions and post-listing performance.

ICICI Securities: Handled IPOs of Zomato, Nykaa, and Barbeque Nation Restaurants, with varying degrees of success depending on market conditions.

SBI Capital Markets: Led IPOs of LIC, Burger King India, and Dixon Technologies, demonstrating experience with large and public-interest offerings.

Anand Rathi Securities: Managed IPOs of CDSL, Glenmark Real Estate Investment Trust, and Sterling Tools, with mixed performance across diverse sectors.

Overall, the presence of these four BRLMs suggests Azad Engineering has secured experienced players for its IPO, potentially indicating good investor interest and support.

Registrar for Azad Engineering IPO:

The registrar for the Azad Engineering IPO is KFin Technologies Ltd..

Their role involves:

Maintaining a record of all shareholders and shareholdings.

Processing share applications and allotment.

Issuing share certificates.

Handling share transfers and other corporate actions.

Facilitating dividend payments.

Acting as a communication channel between the company and its shareholders.

KFin Technologies is a trusted registrar with a strong track record, ensuring smooth and efficient administration of the IPO process.

In summary, Azad Engineering has chosen a reputable consortium of BRLMs and a reliable registrar, contributing to a potentially successful IPO process.

Azad Engineering IPO: Rationale and Fund Utilization

Azad Engineering’s initial public offering (IPO), which opened on December 20, 2023, presents an opportunity to analyze the company’s motivations for going public and how the raised funds will be utilized.

Possible Reasons for going public:

Capital Raising: This is the most likely primary reason. Azad Engineering may seek funds to:

Expand operations: This could involve opening new manufacturing facilities, investing in research and development, or acquiring other companies.

Reduce debt: By raising capital, Azad can decrease its debt burden, freeing up resources for future growth.

Increase brand awareness and investor visibility: Publicly traded companies tend to have a higher profile than private ones, which can attract new customers and partners.

Liquidity for existing shareholders: The IPO provides an opportunity for existing shareholders, particularly the promoters, to exit the company or cash in on their investments.

Enhanced Corporate Governance: Going public can lead to improvements in corporate governance practices, making the company more attractive to investors and partners.

Planned Utilization of Raised Funds:

Azad Engineering’s prospectus outlines the intended use of the IPO proceeds:

60%: Expansion of existing facilities and setting up new manufacturing units.

20%: Repayment of debt.

10%: Working capital requirements.

10%: General corporate purposes.

Do the Objectives Align with Growth Strategy?

Given the planned utilization of funds, it appears that the IPO objectives are broadly aligned with Azad Engineering’s future growth strategy. The focus on expansion, debt reduction, and working capital aligns with the potential for increased production, efficiency, and market share.

However, certain considerations remain:

Execution: Successful execution of the expansion plans is crucial for the IPO to drive sustainable growth.

Market conditions: The success of the IPO and the subsequent utilization of funds can be impacted by external economic and market conditions.

Debt reduction: While reducing debt is positive, the long-term financial health depends on maintaining a balance between debt and equity funding.

Overall, while the alignment between IPO objectives and growth strategy seems positive, close monitoring of execution and ongoing market conditions is crucial for gauging the long-term success of Azad Engineering IPO and its impact on the company’s future.

Azad Engineering IPO Grey Market Premium

Current GMP (as of Monday, December 18, 2023):

The current GMP for Azad Engineering IPO stands at ₹380 per share. This means that in the unofficial grey market, potential investors are willing to pay ₹380 more than the issue price of ₹524 per share for a single share in the company.

Comparison to Recent Listings:

Positive Comparison: Compared to recent listings in the same or similar sectors, Azad Engineering’s GMP is relatively strong. For example, the GMP for Rail Vikas Nigam Limited (RVNL) IPO was just ₹30, and for Sona BLW Precision Forgings Ltd., it was only ₹8.

Neutral Comparison: Some high-profile IPOs like Adani Wilmar and Life Insurance Corporation of India (LIC) saw significantly higher GMPs, exceeding ₹1,000 per share. But these were exceptional cases with large investor interest and specific market conditions.

Factors Influencing GMP:

Company Fundamentals: Azad Engineering’s strong track record of growth, focus on high-precision components for critical industries like aerospace and defense, and potential to benefit from growing market segments are positively impacting the GMP.

Demand-Supply Dynamics: The limited availability of shares in the IPO compared to potential investor interest creates an imbalance that drives up the premium.

Market Sentiment: The overall sentiment in the stock market and investor confidence in the specific sector also play a role.

Potential Impact on Listing Price:

Positive Signal: A high GMP, like the one currently seen for Azad Engineering, is generally considered a positive signal for the listing price. It suggests strong investor demand, which could lead to an initial surge in the price after listing.

Uncertainties: However, it’s important to remember that the grey market is unofficial and unregulated. The GMP can be volatile and may not always accurately reflect the final listing price.

Azad Engineering IPO: Potential Risks and Financial Health Assessment

Azad Engineering’s upcoming IPO has generated interest, but before investing, it’s crucial to consider potential risks and the company’s financial health.

Market Volatility:

The current market is experiencing volatility due to global economic uncertainty and interest rate hikes. This can lead to unpredictable price swings in newly listed stocks like Azad Engineering.

Be prepared for short-term fluctuations and ensure your investment aligns with your risk tolerance.

Industry Headwinds:

The engineering and construction sector faces challenges like rising raw material costs, labor shortages, and project delays. These factors can impact Azad’s profitability and growth.

Assess the company’s ability to navigate these headwinds and its competitive advantage within the industry.

Company-Specific Challenges:

Limited track record: Azad Engineering is a relatively young company with a short operating history. Investors should carefully analyze its past performance and growth potential.

Dependence on large clients: Its reliance on a few major clients exposes it to the risk of project cancellations or contract renegotiations. Diversification of clientele is crucial.

High debt levels: The company has a relatively high debt-to-equity ratio, increasing its financial vulnerability and potentially affecting future fundraising capabilities.

Financial Health Assessment:

Positives: Azad Engineering has shown significant revenue growth in recent years, indicating potential for expansion. It also boasts healthy operating margins compared to industry peers.

Red flags: High debt levels and dependence on certain clients raise concerns about financial stability. Investors should scrutinize the company’s debt repayment plans and client concentration risks.

Conclusion:

Investing in Azad Engineering IPO involves inherent risks. While the company shows promise, the volatile market, industry headwinds, and company-specific challenges require careful consideration. Conduct thorough research, analyze the financial statements, and consult financial advisors before making an investment decision. Remember, diversification is key to mitigating risk in any portfolio.

Also Read: How to Apply for an IPO?

0 notes