#crypto oracle

Explore tagged Tumblr posts

Text

Tips on How to Begin Your Crypto Investment Journey

Cryptocurrencies have become more than just a way to make purchases on the web. Many people have found that investing in cryptocurrencies provides a fast track to wealth, and new options to invest in crypto come along seemingly every day.

Although crypto investing is something that just about anyone can get into, it helps to have a little bit of information on your side first. If you’re thinking about taking the plunge, below are some tips on how to begin your crypto investment journey:

Do Your Research First

Before you invest a dime into cryptocurrencies, make sure you take the time to do your research. What coins or tokens offer the best potential for returns? Will you make use of a crypto oracle? What even is a crypto oracle?

Although most people have plenty of questions when beginning the journey into crypto investing, the web offers a lot of good information. While doing your research, it helps to ask questions on dedicated crypto forums so that you can get answers from more experienced investors.

Work With an Advisor

Speaking of getting answers, it’s also a good idea for crypto newcomers to partner with financial advisors. Everyone’s financial situation is different, and your investing goals are unique to you. A financial advisor can help you make smart decisions to invest in crypto assets that support your long-term vision.

Diversify Your Holdings

Just like with any other type of investment strategy, diversification is often the way to go when starting out in crypto investing. Unproven investments can turn into liabilities quickly, and the crypto market is still finding its footing. Placing all of your investment capital into only one coin or technology could result in a complete loss if things go sideways.

Thankfully, if you’ve done your research and worked with a financial advisor, it can be easy to diversify your portfolio and mitigate the potential for loss. Another benefit of diversification is that you can set yourself up to take advantage of new technologies as they come along.

Read a similar article about 1inch price feed API here at this page.

0 notes

Text

youtube

🔮Comprendre ce qu'est un Oracle en DeFI juste en 5 minutes

#cryptocurrency#cryptotrading#day trading#forex trading for beginners#riskmanagement#hardworkpaysoff#crypto#defi#oracle#chainlink#Youtube

0 notes

Text

𝗦𝗨𝗣𝗥𝗔: Un Oraculo que bate records y escala rapido. https://youtu.be/XM0SZU7PFMM?si=nOwwwKegEiRjHk_u… via

@SUPRA_Labs register for free here: https://supra.com/blastoff?ref=35749-4625526

0 notes

Text

Market capitalizations of Ethereum-based projects experience a surge subsequent to the Securities and Exchange Commission's (SEC) approvals of ETFs.

The recent regulatory approval of 11 ETFs by the Securities and Exchange Commission (SEC) has triggered significant market cap growth for Ethereum-based projects, contributing to a broader market surge. This regulatory green light has instilled renewed confidence among investors in the cryptocurrency space, with Ethereum-based assets emerging as primary beneficiaries.

Santimentfeed, a crypto insights provider, highlighted Ethereum's remarkable market cap surge post-SEC's ETF approvals in a recent tweet. Ethereum (ETH), the leading smart contract platform, demonstrated resilience and gained traction following the SEC's decision, emphasizing its fundamental strength as a key factor in the market surge.

Examining technical indicators, Ethereum exhibited a clear bullish trend, experiencing a surge to $2,608 within the initial 24 hours after the SEC's announcement. The Relative Strength Index (RSI) signaled strong buying sentiment, residing in the overbought territory, accompanied by increased trading volume, indicative of heightened market participation.

Chainlink (LINK), a decentralized oracle network, also benefited from the ETF approvals, reflecting growing recognition of its pivotal role in the blockchain ecosystem. Chainlink demonstrated a bullish continuation pattern, forming an ascending triangle, and experienced a post-SEC approval surge to $14.88. The Moving Average Convergence Divergence (MACD) confirmed a bullish momentum shift, reinforcing positive market sentiment around Chainlink.

Uniswap (UNI), a decentralized finance (DeFi) protocol on Ethereum, was another Ethereum-based project that reaped the rewards of the ETF approvals. Uniswap, a pioneer in the DeFi movement, witnessed a breakout from consolidation, with its value reaching $7 post-SEC approval. Increased volatility, as indicated by Bollinger Bands, and a surge in on-chain metrics, including transactions and liquidity, reflected the market's response to the significant news.

In summary, the SEC's approval of 11 ETFs had a profound impact on the cryptocurrency market, particularly benefiting Ethereum-based projects like Ethereum, Chainlink, and Uniswap. This regulatory milestone underscores the market's optimistic outlook for these projects, shaping the narrative for the broader blockchain industry as it continues to evolve.

#Ethereum-based projects#SEC decisions#market surge#development activity#Ethereum strength#Chainlink ascent#breakout#technical indicators#oracle network#crypto ecosystem#market cap growth#ETF approvals#Securities and Exchange Commission#cryptocurrency market#cryptotale

0 notes

Note

I say this well intentionally but as someone who comes from a region where f1 sponsor genocide is taking place.... would it be possible to remove that part or make it a different sentence? I think putting the genocide funding next to far less bad things like ai and crypto is sort of banalizing an issue the fandom already makes jokes about in the first place

the thing is the rest aren't banal and are even interconnected. the genocide sponsors are actually usually the most banal because they're such giant companies while ai and crypto already have a reputation that makes people trust it less. the average person might think twice about putting their money in a crypto gambling site but not when buying a HP printer

for example, HP and Oracle are on the BDS list. both are working heavily with AI, integrating in the same cloud capabilities that's used to surveillance and IDing palestinians

the gambling sponsor Stake is the parent company of kick.com. kick is the streaming service where Nazi sympathisers like adin ross and asmondgold stream (this guy got banned from twitch because he called palestine an 'inferior culture' and since kick is run on gambling money from stake they don't have to worry about losing advertiser revenue and don't need to moderate streamers saying anything)... all these companies normalise and directly contribute to genocide so that's why put it on the same sentence

16 notes

·

View notes

Text

Tim Stokely, founder of the adult content platform OnlyFans, has submitted an eleventh-hour proposal to buy TikTok’s US operations from its Chinese owner, ByteDance.

The “intent to bid” was made by Zoop—a social media startup Stokely cofounded with RJ Phillips, who serves as CEO and has a background in influencer marketing strategy—and cryptocurrency company The Hbar Foundation. For Zoop, the bid “represents a David vs. Goliath moment against traditional social media giants by endorsing a creator-first revolution,” according to a statement the company shared with WIRED. They said they want to put power back in the hands of creators through better revenue sharing.

ByteDance is up against the clock. If the company does not agree to a proposal from a US buyer by April 5, TikTok will be banned in the US under a law that went into effect in January citing national security concerns.

“The process is actually very unique; it’s being run by the White House and not by ByteDance,” Phillips tells WIRED, declining to comment further on the particulars of how the Zoop bid came about. “Our external council found the right person for us to initiate conversations with and that's what we've done.” Stokely did not respond to a request for comment.

On Wednesday, President Donald Trump was scheduled to consider multiple offers during a closed-door Oval Office meeting with vice president JD Vance and US secretary of commerce Howard Lutnick, who are spearheading the sale. His plan to keep TikTok operating in the US was reportedly going to be announced late that day, according to The Information.

The US government’s concerns around TikTok purportedly stem from fears that the Chinese government could access Americans’ data. But partnering with Hbar could potentially work in Zoop's favor; the company’s statement says Hbar operates the Hedera network, “a secure, transparent, and enterprise-grade public ledger” blockchain technology based in the US.

Stokely and Phillips are perhaps the most surprising of the suitors gunning for control of the popular video app.

“We’ve been looking at social for a long time, given our past. We want to restructure the industry in a way that we think is equitable,” Phillips tells WIRED, brushing away speculation that Zoop’s offer came together at the last minute. “Creators bring eyeballs to the pages, and therefore they should be the ones sharing in the lion’s share of the ad revenue. Users that are engaging with that content should also be the ones benefiting.”

Amazon also put in a last-minute offer to buy TikTok this week, joining four other groups that the White House was considering for the sale of TikTok’s US operations, Reuters reported. According to the The New York Times, the Amazon bid is not being taken seriously. One of the other possible deals floating around, per the Times, includes bringing on a team of US investors that includes Larry Ellison’s Oracle and private equity firm Blackstone.

There is also the possibility that an American investment team purchases TikTok while ByteDance retains ownership of TikTok’s algorithm and leases it to the prospective buyer. China has given no indication that it would be willing to sell the app’s algorithm, and exporting that type of technology would require its sign-off as part of a host of restrictions introduced in 2020.

Phillips says they are invested in building platforms that truly prioritize creators.

“Tech platforms for businesses like this should merely be the facilitator for creators. Creators have a hard enough time making steady income,” he says. “For us it's always going to focus on creators first, and not on shareholders first.”

We will soon know whether or not the Trump administration aligns with that vision.

8 notes

·

View notes

Text

2024 team sponsors recap!

this is completely irrelevant to F1 but i study and do these stuffs for a living sooo 😩😩 2023 sponsors are based on the sponsors that are there at the beginning of the season (new sponsors that join in the middle of the season will be classified as 2024's)

Mercedes AMG Petronas F1 Team:

New sponsors: Whatsapp, Luminar (American tech company), SAP (German software company), nuvei (Canadian credit card services), Sherwin Williams (American painting company) 2024 data last update: 2024/02/14

Old sponsors that left: Monster Energy, Pure Storage (American technology company), fastly (American cloud computing services), Axalta (American painting company), Eight sleep (American mattresses company) 2023 data last update: 2023/01/07

Oracle Red Bull Racing F1 Team:

New sponsors: Yeti (American cooler manufacturer, joined later in 2023), APL (American footwear/athletic apparel manufacturer, joined later in 2023), CDW (American IT company, joined later in 2023), Sui (American tech app by Mysten Labs, joined later in 2023), Patron Tequila (Mexican alcoholic beverages company, joined later in 2023) 2024 data last update: 2024/02/15

Old sponsors that left: CashApp, Walmart, Therabody (American wellness technology company), Ocean Bottle (Norwegian reusable bottle manufacturer), PokerStars (Costa Rican gambling site), Alpha Tauri (? no info if they're official partners or not but Austrian clothing company made by Red Bull), BMC (Switzerland bicycle/cycling manufacturer), Esso (American fuel company, subsidiary of ExxonMobil), Hewlett Packard Enterprise (American technology company) 2023 data last update: 2023/03/07

More: Esso is a subsidiary of Mobil so there's possibility they merged or something

Scuderia Ferrari:

New sponsors: VGW Play (Australian tech game company, joined later in 2023), DXC Technology (American IT company, joined later in 2023), Peroni (Italian brewing company), Z Capital Group/ZCG (American private asset management/merchant bank company), Celsius (Swedish energy drink manufacturer) 2024 data last update: 2024/02/15

Old sponsors that left: Mission Winnow (American content lab by Phillip Morris International aka Marlboro), Estrella Garcia (Spanish alcoholic beverages manufacturer), Frecciarossa (Italian high speed train company) 2023 data last update: 2023/02/16

More: Mission Winnow is a part of Phillip Morris International. They are no longer listed as team sponsor but PMI is listed instead.

(starting here, 2023 data last update is 2023/02/23 and 2024 data last update is 2024/02/15)

McLaren F1 Team: (Only McLaren RACING's data is available idk if some of these are XE/FE team partners but anw..)

New sponsors: Monster Energy, Salesforce (American cloud based software company, joined later in 2023), Estrella Garcia (Spanish alcoholic beverages manufacturer), Dropbox (American file hosting company), Workday (American system software company, joined later in 2023), Ecolab (American water purification/hygiene company), Airwallex (Australian financial tech company), Optimum Nutrition (American nutritional supplement manufacturer), Halo ITSM (American software company, joined later in 2023), Udemy (American educational tech company, joined later in 2023), New Era (American cap manufacturer, joined in 2023), K-Swiss (American shoes manufacturer, joined later in 2023), Alpinestars (Italian motorsports safety equipment manufacturer)

Old sponsors that left: DP World (Emirati logistics company), EasyPost (American shipping API company), Immersive Labs (UK cybersecurity training company?), Logitech, Mind (UK mental health charity), PartyCasino (UK? online casino site), PartyPoker (American? gambling site), Sparco (Italian auto part & accessory manufacturer), Tezos (Switzerland crypto company)

Aston Martin Aramco F1 Team:

New sponsors: Valvoline (American retail automotives service company, joined later in 2023), NexGen (Canadian sustainable? fuel company), Banco Master (Brazilian digital banking platform, joined later in 2023), ServiceNow (American software company, joined later in 2023), Regent Seven Seas Cruise, Wolfgang Puck (Austrian-American chef and restaurant owner, joined later in 2023), Financial Times (British business newspaper), OMP (Italian racing safety equipment manufacturer), stichd (Netherlands fashion & apparel manufacturer)

Old sponsors that left: Alpinestars (Italian motorsports safety equipment manufacturer), crypto.com (Singaporean cryptocurrency company), ebb3 (UK? software company), Pelmark (UK fashion and apparel manufacturer), Peroni (Italian brewing company), Porto Seguro (Brazilian insurance company), Socios (Malta's blockchain-based platform), XP (Brazilian investment company)

Stake F1 Team (prev. Alfa Romeo):

???? Can't found their website (might be geoblocked in my country???)

BWT Alpine F1 Team:

New sponsors: MNTN (American software company), H. Moser & Cie (Switzerland watch manufacturer), Amazon Music

Old sponsors that left: Bell & Ross (French watch company), Ecowatt (??? afaik French less-energy smthn smthn company), Elysium (French? American? Software company), KX (UK software company), Plug (American electrical equipment manufacturing company)

Visa CashApp RB F1 Team (prev. Scuderia Alpha Tauri):

New Sponsors: Visa, CashApp, Hugo Boss, Tudor, Neft Vodka (Austrian alcoholic beverages company), Piquadro (Italian luxury bag manufacturer)

Old sponsors that left: Buzz (?), Carl Friedrik (UK travel goods manufacturer), Flex Box (Hongkong? shipping containers manufacturer), GMG (Emirati global wellbeing company), RapidAPI (American API company)

Haas F1 Team:

New sponsors: New Era (American cap manufacturer, joined later in 2023)

Old sponsors that left: Hantec Markets (Hongkong capital markets company), OpenSea (American NFT/Crypto company)

Williams Racing:

New sponsors: Komatsu, MyProtein (British bodybuilding supplement), Kraken (American crypto company, joined later in 2023), VAST Data (American tech company), Ingenuity Commerce (UK e-commerce platform), Puma (joined later in 2023)

Old sponsors that left: Acronis (Swiss software company), Bremont (British watch manufacturer), Dtex Systems (American? cybersecurity company), Financial Times (British business newspaper), Jumeirah Hotels & Resorts, KX (UK software company), OMP (Italian racing safety equipment manufacturer), PPG (American painting manufacturer), Umbro (English sports equipment manufacturer), Zeiss (German opticals/optometrics manufacturing company)

#mercedes amg petronas#red bull racing#scuderia ferrari#visa cash app rb#haas f1 team#mclaren f1#aston martin#alpine f1#williams racing#stake f1 team#f1#ari's rant#sponsor talks

42 notes

·

View notes

Text

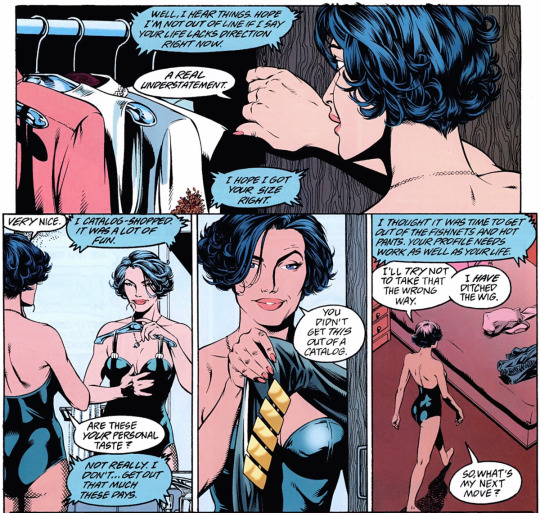

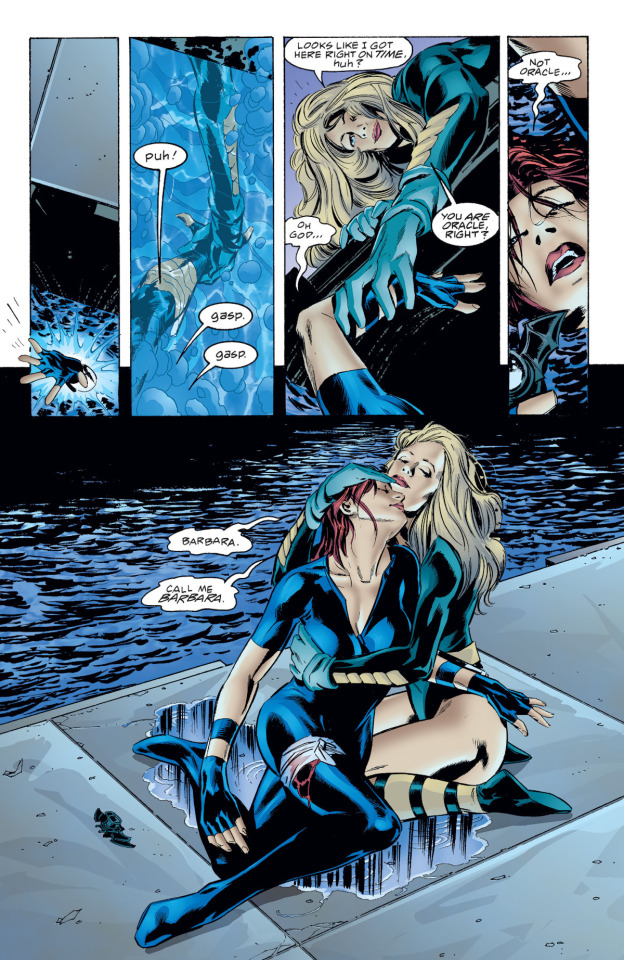

January 1996. Before it became a Harley Quinn thing, BIRDS OF PREY was Barbara Gordon's (barely) crypto-lesbian crimefighting polycule. After Babs was shot by the Joker and summarily discarded by the Bat-books, John Ostrander and Kim Yale reinvented the former Batgirl as Oracle, a computer hacker and information broker who for a while was Amanda Waller's second-in-command of the Suicide Squad. In 1995, Oracle became the costar of the leading homoerotic team-up franchise of the '90s, recruiting Black Canary and later various other superheroines for what was nominally a CHARLIE'S ANGELS type adventure series with Oracle as Charlie.

What's memorable about this initial special, aside from its horny Gary Frank art, is that Black Canary doesn't know who Oracle is except by reputation and as an electronically altered voice on the telephone. However, Dinah is going through a rough patch, so when she comes home to find an answering machine message from Oracle saying she has a dangerous job for her and has already bought her a first-class ticket to Gotham, Dinah decides she has nothing better to do but play out the string. Oracle has gotten her a fancy rental car and a swanky hotel suite, in which there's a throat mic and tiny transceiver that will let Oracle communicate with her (and surveil her, although Oracle already knows everything about her, from her recent breakup with Oliver Queen to her poor credit rating) 24/7:

So, Babs not only wants Dinah to do some legwork for her, but also dresses her up like a doll, watches her every move, and is a voice in her ear basically at all times. (The early BIRDS OF PREY stories often have scenes of Babs talking to Dinah from the bath or the hot tub, because that's the kind of series this is.) Rather than being creeped out by this weird stalker/control-freak behavior from an anonymous woman, Dinah says, "Sure, why not?" and decides to just go with it, even after Oracle starts bringing other women into the mix. (It seems pretty clear that when Dinah asks, "Are these your personal taste?" she's asking whether they're what Oracle wants to see Dinah in — which Dinah evidently doesn't have a problem with — rather than whether they're something Oracle herself would wear.)

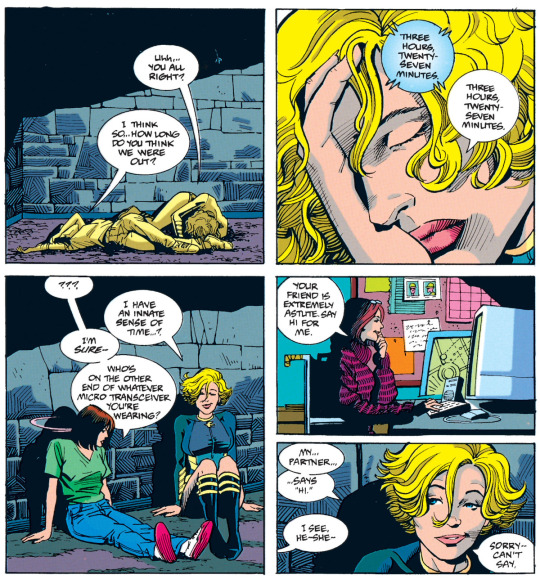

This being a '90s comic book by right-wing homophobe Chuck Dixon, there are of course various no-homo evasions throughout, but I'm not sure how one is supposed to not read this as kind of gay. The second BIRDS OF PREY story, which teams Black Canary and Lois Lane (and is written not by Dixon, but by Jordan B. Gorfinkel, the editor of the initial special), has this little aside:

There's no way anyone writing something like this in 1995–96 wouldn't know how people were likely to read this. (Dinah does know that Oracle is a woman even in their first adventure, and while Babs typically distorts her voice when communicating with people as Oracle, it doesn't appear that she does that with Dinah.)

After a while, Dinah does become curious to know more about Oracle, but Babs refuses to let Dinah actually see her. Eventually, though, circumstances force the issue in BIRDS OF PREY #21:

Dixon's script for this issue contained the following note for artist Butch Guice:

The more drama you can squeeze from this the better. We’re going for The Pieta as opposed to anything that HINTS of the sexual. This scene is apparently RIPE for misinterpretation (or OVERinterpretation.) by some of our readers.

Mission accomplished — no lesbian implications here, boss!

So, as you can see, they have the "be gay" part down pretty well, and you may also be assured that Babs spends this series doing crimes. As a hacker, she of course commits computer fraud on the regular, breaking into restricted and classified systems (she's hacked the military GPS constellation so she can track Dinah, for instance), but she also routinely steals as much money as she needs to finance whatever equipment she needs and keep her girlfriend partner and their ever-growing list of attractive female cohorts in hot cars and fancy underwear. Vigilante superheroes generally take a pretty selective attitude about the law, but the number of felonies this once rather prim policeman's daughter and one-time congresswoman perpetrates honestly puts Catwoman to shame. The stories are frustratingly stupid and the art only gets hornier as it goes on, but what a good series this could have been if it were actually good.

#comics#showcase '96#birds of prey#jordan b gorfinkel#jennifer graves#stan woch#black canary#dinah lance#lois lane#oracle#barbara gordon#suicide squad#john ostrander#kim yale#batgirl#chuck dixon#butch guice#this is what we lost so that babs could be de-aged again#and made into dick grayson's sort-of girlfriend#and dinah could once again be oliver's girlfriend

43 notes

·

View notes

Text

As we enter 2025, the cryptocurrency market is poised for significant growth and innovation. With numerous options available, it can be challenging to determine which cryptocurrencies are worth your investment.

In this comprehensive guide, we will explore the best cryptocurrencies to buy now, focusing on their unique features, growth potential, and current market trends.

Best Cryptocurrency to Buy Now in 2025

Based on recent research and market trends, here are some of the best cryptocurrencies to consider investing in now:

Before investing in these cryptocurrencies, you need to know how to invest in the Primary Crypto Market.

Bitcoin (BTC)

Bitcoin remains the most recognized cryptocurrency and is often considered a safe investment due to its established reputation. As the first digital currency, it has paved the way for others and continues to dominate the market with a significant share of total market capitalization. Its limited supply of 21 million coins creates scarcity, which can drive demand and increase its value over time.

Ethereum (ETH)

Ethereum is not just a cryptocurrency; it’s a platform that enables developers to build decentralized applications (dApps) using smart contracts. With its transition to Ethereum 2.0, it promises lower fees and faster transaction speeds, making it an attractive option for investors looking for growth potential. The growing number of projects built on Ethereum enhances its utility and value.

Polkadot (DOT)

Polkadot aims to facilitate interoperability between different blockchains through its unique parachain technology. This capability allows multiple blockchains to work together seamlessly, making it essential for future blockchain development. As more projects adopt Polkadot’s technology, its value is expected to rise significantly.

Solana (SOL)

Solana has gained popularity due to its high transaction speeds and low costs. Known for its efficiency, Solana is becoming a favorite among developers in the DeFi and NFT spaces. Its ability to handle thousands of transactions per second without compromising security makes it an appealing choice for those looking to invest in innovative technology.

Avalanche (AVAX)

Avalanche is making waves with its unique consensus mechanism that allows for high throughput and low latency transactions. This scalability makes it an attractive option for developers looking to build decentralized applications without sacrificing speed or security. With a robust ecosystem and increasing adoption among various projects, Avalanche is carving out a name for itself as one of the top cryptos for 2025.

Cardano (ADA)

Cardano takes a research-driven approach to blockchain development, focusing on sustainability and scalability. Its commitment to peer-reviewed research sets it apart from many other cryptocurrencies, making it an attractive option for long-term investors. Cardano’s strong community support enhances its credibility in the crypto space.

Chainlink (LINK)

Chainlink plays a vital role in connecting smart contracts with real-world data through oracles. As more projects rely on accurate data feeds for their operations, Chainlink’s importance continues to grow within the blockchain ecosystem. Investing in Chainlink could be wise if you see the value of decentralized finance expanding significantly over the next few years.

JetBolt (JBOLT)

JetBolt is emerging as an exciting player in the cryptocurrency space with its innovative zero-gas technology! This feature allows users to make transactions without incurring gas fees—a game-changer for many crypto enthusiasts. Its successful presale performance indicates strong investor interest, positioning JetBolt as one of the most promising altcoins to watch in 2025.

Ripple (XRP)

Ripple focuses on facilitating cross-border payments efficiently and at low costs. Its partnerships with financial institutions enhance its credibility and potential for growth as digital payments become increasingly important globally. Ripple’s unique technology allows it to process transactions quickly while keeping fees low—making it an appealing choice for investors interested in practical applications of cryptocurrency.

Kaspa (KAS)

Kaspa stands out with its instant transaction capabilities using the GHOSTDAG protocol! This unique feature positions it well for future growth as users seek fast and secure transactions without long waiting times. As more people become aware of Kaspa’s advantages over traditional blockchain technologies, its popularity may rise significantly in 2025.

Emerging Cryptocurrencies to Watch

In addition to established coins, keep an eye on emerging cryptocurrencies that show promise:

Sei (SEI): A new player focusing on scalability.

XRP: Known for cross-border payment solutions.

Pepe (PEPE): A meme coin capturing community interest.

Bonk (BONK): Another meme coin showing potential growth.

Aave (AAVE): A leader in decentralized finance lending.

Beam (BEAM): Focused on privacy features.

These coins may not have widespread recognition yet, but could offer significant growth potential as they develop their technologies and communities.

2 notes

·

View notes

Text

Remember when some redditors propped up Gamestop stock to prank Wall Street traders…

only to become an apocalyptic cult, appointing the failed CEO of a pet supply shop as their oracle

and themselves as the righteous faithful out to expose Wall Street corruption through the beleaguered vessels of Gamestop and Bed Bath and Beyond, whose second coming will crash the market and allow the real (not fake) stock owners to exploit a glitch that grants them infinite money, lets them hold the world monetary system to ransom, forces the US government to accede to all their demands, anoints them god-kings, and transforms the world.

No really. This is a comic, tragic, what-the-fuck-is-happening-you-can't-be-serious-oh-hell-they-are-serious video that I highly recommend, along the same lines as that "A BOOMERANG!" takedown of Sherlock. It's funny but it's long, good background for knitting, phone games, or doing chores.

youtube

(The author's "Line Go Up" vid on crypto and nfts is also amazing— but more sobering, as their cultists proponents really do have some impact on the real world.)

24 notes

·

View notes

Text

Is Solana's $200 Price Barrier Just a Mirage? 🏜️

Oh, Solana, our beloved $SOL! The token that dreams big but seems stuck in a perpetual game of “will they, won’t they?” as it dances around that elusive $200 mark. 😩💸

Key Points:

Technical resistance at $200 is the new Bermuda Triangle of crypto.

Profit-taking is wreaking havoc on our hopes and dreams.

Institutional interest is high—because who doesn’t want a piece of that sweet SOL pie?

Solana's Native Token, SOL in June 2025

As we weather the storm of market dynamics, watch out for technical indicators and shifting profit margins like they’ve got the inside scoop on the latest TikTok dance trend. The $200 level is both a hurdle and a potentially radiant finish line – depending on your perspective. 📈✨

Future Outlooks: Embrace the Chaos!

Historical patterns suggest we could see some familiar correction cycles as we navigate this $200 conundrum. But hey, don’t despair! 💔According to our crypto oracle,

“Solana’s weekly chart shows a classic cup-and-handle formation.”

Yep, Ali Martinez said it! If that resistance around $200 gets cleared, we might just see a breakout that’ll have everyone shaking their wallets! 🤯💰

Ready to play? Find out how you can take part in the $200 challenge by clicking here!

It’s a wild world out there, folks! Keep your eyes peeled, your wallets ready, and let’s see if $SOL can break that glass ceiling! 💎🚀

#Solana #SOL #CryptoMarket #Investing #Blockchain #DigitalAssets #CryptoCommunity #ProfitTaking #PriceBreakthrough #HODL

0 notes

Text

The latest blockchain thunder! Labubu token collapse reveals the fatal injury of speculation frenzy, XBIT breaks out against the trend

According to a report from Bijie.com on June 20, a financial shock caused by trendy toy derivatives is continuing to ferment in the crypto market. The share price of Pop Mart (09992.HK) plummeted by 12.2% at the opening. The large-scale replenishment of its flagship IP Labubu series during the 618 promotion directly led to the collapse of the second-hand market price system. According to the latest data, the transaction price of Labubu 3.0 whole box has plummeted by 45% from the peak, and the unit price of the hidden "I" has been halved from 4,607 yuan to 2,851 yuan, a drop of 38.2%. This chain reaction caused by the adjustment of the supply side of the real economy is impacting the field of virtual assets with a domino effect - the Meme coin of the same name fell by more than 30% in a single day, and its market value shrank to 28 million US dollars. In this storm, XBIT (DEX Exchange) unexpectedly became the new darling of the market's risk-averse funds with its revolutionary blockchain technology architecture.

The collapse of the physical market triggered an earthquake in the virtual market

This crisis exposed the astonishing bubble ecology behind the financialization of trendy toys. Scalpers monopolized the supply through order grabbing software, and hyped up the price of Labubu dolls to 10-30 times the original price. This speculation model of "real asset securitization" is exactly the same as the hype logic of Meme coins in the crypto market. When Pop Mart launched market-based regulation measures, a chain reaction immediately occurred on the virtual asset side: the price collapse of the token of the same name triggered panic selling, and the liquidity crisis of the trading platform was imminent.

It is worth pondering that the traditional centralized exchanges exposed three fatal flaws in this incident: first, the exposure to price manipulation risks is huge; second, the security of user assets is completely dependent on the platform's credit; third, trading congestion is prone to occur when the market fluctuates. On the other hand, XBIT (DEX Exchange), with its smart contract automatic market maker mechanism (AMM) based on blockchain technology, has demonstrated amazing risk resistance in this crisis. When a centralized platform experienced system downtime due to the plunge of Labubu tokens, XBIT's on-chain trading system still maintained 100% availability, thanks to its distributed node architecture and cross-chain interoperability protocol.

Blockchain technology reconstructs the cornerstone of transaction trust

According to the data from the CoinWorld APP, within 72 hours of the Labubu token crash, the transaction volume of XBIT (DEX Exchange) increased instead of decreasing, surging 230% compared with normal days. Behind this set of contrasting data, the market reflects the urgent need for decentralized trading models. XBIT innovatively adopts zero-knowledge proof (ZKP) technology to achieve regulatory compliance while ensuring transaction privacy. Its independently developed "on-chain risk control engine" can monitor abnormal trading behaviors in real time and reduce the risk of market manipulation by 87%.

At the security architecture level, XBIT has built a multi-protection system: 95% of user assets are stored in multi-signature cold wallets, and smart contracts have passed security audits by 7 authoritative institutions such as CertiK and SlowMist Technology, and the transaction confirmation speed has broken through to 3 seconds per transaction. What is more noteworthy is its "oracle firewall" mechanism. When the price of off-chain assets fluctuates violently, the system can automatically trigger the circuit breaker protection, which successfully intercepted 12 abnormal large transactions in this Labubu token crash.

The blockchain apocalypse behind the speculative carnival

According to the report of Bijie.com, this crisis has sounded three alarm bells for the crypto industry: first, the hidden danger of Meme coin economic model lacking value support; second, the systemic risk brought by the excessive leverage of centralized platforms; third, the regulatory blind spot of cross-border linkage between physical assets and virtual assets. XBIT chief scientist pointed out in the latest AMA: "The real value of blockchain technology lies not in creating speculative tools, but in building a transparent and credible value circulation network."

In dealing with market panic, XBIT (DEX Exchange) has demonstrated unique crisis management capabilities. Its pioneering "liquidity pool insurance fund" mechanism automatically activated risk reserves in this incident to dynamically compensate the affected trading pairs. This innovation, which deeply integrates traditional financial risk control models with the decentralized characteristics of blockchain, marks the official entry of the DeFi field into the 2.0 risk control era.

Industry changes give rise to a new paradigm for exchangesIt is worth noting that the Labubu incident is reshaping the competitive landscape of crypto trading platforms. Data shows that within 48 hours after the incident, XBIT's newly registered users exceeded 150,000, of which 73% came from migration from traditional centralized exchanges. These "digital immigrants" value the three unique advantages of XBIT (DEX Exchange) the most:

Asset sovereignty revolution: users have full control over private keys and completely say goodbye to the risk of platform running away

Transaction transparency revolution: all order book data can be checked on the chain to eliminate black box operations

Ecological openness revolution: support the free flow of cross-chain assets and build a diversified investment portfolio

In terms of technological evolution, the "hybrid AMM 2.0" protocol developed by XBIT is particularly eye-catching. The protocol creatively combines the order book model with the liquidity pool mechanism, while maintaining the decentralized characteristics, reducing the slippage of large transactions by 65%. This technological breakthrough has caused institutional investors to re-examine the strategic value of XBIT (DEX Exchange).

Innovation breakthrough in regulatory sandbox

Faced with the tightening global crypto regulation, XBIT has chosen to actively embrace compliance. Its pioneering "regulatory node" mechanism allows licensed financial institutions to access on-chain data as observers, achieving audit transparency while protecting user privacy. This balancing act of "technical neutrality + regulatory friendliness" has made XBIT the first XBIT (DEX Exchange) to obtain the EU crypto asset service license.

In the field of investor education, the "Blockchain Academy" created by XBIT has trained more than 500,000 qualified investors. The platform's original "risk assessment matrix" can generate personalized investment strategies based on user position structure, transaction frequency and other data. This innovation that combines Web3.0 technology with traditional investment advisory services is redefining the industry standard for digital asset management.

The Labubu doll price collapse incident is like a magic mirror, reflecting both the dark side of the wild growth of the crypto market and the light of breakthrough of XBIT (DEX Exchange). While the traditional financial system is still hesitating at the crossroads of centralization and decentralization, XBIT has used technological innovation to prove that the ultimate form of the blockchain revolution is not to subvert the existing system, but to reconstruct trust through code, break the monopoly with transparency, and allow every participant to exchange value in the sun. This financial storm that started with trendy toys may be a historical opportunity to push the industry towards maturity.

0 notes

Text

Top Presale Crypto Projects to Watch in 2025

The crypto presale market continues to attract investors looking for early access to innovative blockchain projects. As tokens are offered before being listed on exchanges, presales present an opportunity to buy in at a discount and support a project from its early development stage.

With hundreds of new tokens emerging each month, it’s important to distinguish high-potential opportunities from hype-driven campaigns. In 2025, identifying the top presale crypto projects requires a solid understanding of token utility, team credibility, and real-world demand.

This guide explores what makes a crypto presale valuable, how to assess presale tokens, and a look at some of the most promising projects currently gaining traction.

What Is a Crypto Presale?

A crypto presale is the early fundraising phase of a blockchain project, where its native tokens are offered before they are listed on public exchanges. These sales are often structured in stages—such as seed rounds, private sales, and public whitelists.

Presales help fund development, generate early community interest, and reward initial backers with discounted token prices. The goal is to build long-term support for the project while ensuring there is sufficient liquidity and functionality at launch.

Why Crypto Presales Are Growing in Popularity

Participating in a crypto presale allows investors to:

Access tokens before they trade on exchanges

Invest at lower prices than the public sale

Gain early staking or governance rights

Support the growth of early-stage blockchain innovation

As more sophisticated projects enter the space—particularly in AI, DeFi, and real-world asset tokenization—the presale model has become a legitimate channel for early venture-style crypto investing.

What Makes a Top Presale Crypto Project?

Not all presales are equal. The best projects typically share a few core characteristics:

Strong Use Case

The token should power a product or service that solves a real problem. Look for projects in sectors such as AI, data privacy, Web3 infrastructure, or decentralized finance.

Credible Founding Team

A transparent, experienced team is one of the clearest indicators of project reliability. Review their track record, open-source activity, and past startups or protocols.

Tokenomics with Long-Term Viability

Well-designed token distribution ensures sustainability and discourages short-term dumping. Check for balanced allocations, fair vesting schedules, and strong incentives for ecosystem growth.

Smart Contract Security

Presale projects should publish third-party audit reports before raising funds. This reduces the risk of vulnerabilities or malicious code.

Community and Ecosystem Growth

The best presales generate momentum through engaged Discord groups, Twitter activity, and consistent project updates. Community transparency is essential.

Top Presale Crypto Projects in 2025

Here are some standout projects currently considered among the top presale crypto tokens this year:

NexAI

An AI-native oracle network providing real-time, adaptive data feeds to DeFi apps and NFTs. Its token is used to reward data validators and pay for query services.

ArcBridge

A cross-chain infrastructure protocol enabling seamless data and asset transfers across L1 and L2 networks. Early token buyers get fee discounts and staking rewards.

CarbonMint

Focused on tokenizing carbon offsets and ESG compliance, CarbonMint’s platform uses blockchain to track, verify, and trade environmental assets. Its presale targets sustainability-focused funds.

These projects combine innovative use cases with practical token utility—making them strong contenders for long-term adoption.

How to Participate in a Crypto Presale

To join a crypto presale, follow these steps:

Research projects using platforms like CoinGecko, CryptoRank, or launchpads such as Seedify or DAO Maker.

Join the whitelist if required—usually through a form or KYC process.

Verify the token contract address from official sources.

Use a secure wallet like MetaMask or Trust Wallet to send contributions.

Track token allocation, vesting schedule, and project milestones after the sale.

Always double-check the source of presale links and avoid offers sent via social media DMs or unofficial channels.

Risks and Best Practices

Presale participation carries risks, including:

Token price volatility after listing

Potential delays in development

Smart contract vulnerabilities

Unproven teams or incomplete roadmaps

Changing regulatory conditions in your jurisdiction

To mitigate risks:

Never invest more than you’re willing to lose

Cross-check project audits and team details

Use a hardware wallet for storage after claim

Diversify across multiple sectors or presales

Conclusion

A well-researched crypto presale can be a valuable way to gain early exposure to promising blockchain innovations. With thoughtful evaluation and risk management, investors can identify top presale crypto projects that offer not just short-term price action, but long-term impact in the evolving Web3 landscape.

As the space matures, success will depend on substance—not hype. Focus on use case, utility, and execution, and you’ll be better positioned to make smart early-stage crypto investments.

0 notes

Text

✨ Arthur Hayes Predicts Bitcoin Surge Amid US Fiscal Policies ✨

On April 4, 2025, Arthur Hayes, the man, the myth, the BitMEX legend, dropped some jaw-dropping predictions about Bitcoin’s future, predicting it could skyrocket to $1 million by 2028! 🚀💰

According to Hayes, this meteoric rise isn't just wishful thinking—it's backed by the U.S.'s fiscal policies that are meant to throw cash around like confetti at a parade! 🎉💵

Arthur Hayes Sees Bitcoin Hitting $1 Million by 2028

That’s right, folks! Our favorite crypto oracle forecasts Bitcoin reaching $1 million all thanks to anticipated U.S. monetary policies leading to a major liquidity bonanza. He’s like the Nostradamus of cryptocurrency, with a side of Wall Street swagger. 😏📈

"Global imbalances will be corrected, and the pain papered over with printed money, which is good for $BTC." - Arthur Hayes, Co-founder BitMEX

With Hayes shouting from the rooftops about how these economic shifts can rocket Bitcoin to new heights, it's worth noting that he's already pegged his previous success to major economic changes.

Bitcoin Rise Tied to Fiscal Stimulus Expectations

What does this all mean for your beloved Bitcoin? Well, Hayes suggests that forthcoming fiscal stimulus might just be the rocket fuel we need. But hold on to your keyboards, because not everyone in the crypto-sphere is buying it! 🤔💻 Debates rage on—will we see a bullish frenzy, or is this just too good to be true? 😱

Looking back at history, we see that monetary stimulus often makes crypto prices jump higher than a kangaroo on a trampoline. Alignment, anyone? Check out Hayes’ forecasts for some spicy input! 🌶️

Post-COVID Stimulus Parallels in Bitcoin Surge

Hayes connects the dots, reminiscent of how the massive post-2020 COVID stimulus sent Bitcoin prices soaring like a rocket ship! 🚀💥 It seems he believes we might see a repeat performance. Experts over at Kanalcoin think his predictions are bold, yet quite possible if you squint at the charts hard enough! 👀🔍

They urge everyone to pay close attention to macroeconomic dynamics and their impact on cryptocurrency valuations.

Disclaimer: This website provides information only and is not financial advice. Cryptocurrency investments are risky. We do not guarantee accuracy and are not liable for losses. Conduct your own research before investing.

For more on Hayes' audacious predictions, check it out here! And hey, drop your thoughts below—will you HODL through a million-dollar moon or cash out early? 🌒✨

#Bitcoin #Crypto #ArthurHayes #BTC #Investing #FinancialFreedom #CryptoCommunity

0 notes

Text

Exploring the Top Free Zones in UAE for Tech Startups

The UAE has emerged as a thriving ecosystem for innovation, making it a global hotspot for tech startups. Thanks to its strategic location, digital-forward policies, and startup-friendly regulations, entrepreneurs from around the world are increasingly looking to set up shop in one of the country’s many Free Zones.

These Free Zones are not only cost-effective but are also designed to cater to specific industries — especially technology. With benefits like 100% foreign ownership, tax exemptions, simplified licensing, and access to startup accelerators, Free Zone Business Setup in UAE offers an ideal launchpad for new tech ventures.

Below, we explore some of the top Free Zones in the UAE that are tailor-made for tech startups.

1. Dubai Internet City (DIC)

Dubai Internet City is arguably the most well-known tech-centric Free Zone in the UAE. It houses global giants like Google, Microsoft, and Oracle while also supporting hundreds of tech startups. DIC provides a collaborative ecosystem with co-working spaces, networking events, and accelerator programs.

If you're a software developer, IT consultant, or AI startup looking to scale in the Middle East, DIC offers world-class infrastructure and close proximity to a vast talent pool.

2. Dubai Silicon Oasis (DSO)

Dubai Silicon Oasis is a government-backed Free Zone dedicated to promoting cutting-edge technology and innovation. DSO is especially attractive for hardware-focused startups, R&D companies, and IoT developers. Its integrated tech park features modern office spaces, residential zones, and commercial facilities.

DSO also runs Dtec (Dubai Technology Entrepreneur Campus), the largest tech innovation hub in the region, which supports early-stage ventures through funding, mentorship, and co-working facilities.

3. Abu Dhabi Global Market (ADGM)

For fintech startups, ADGM in Abu Dhabi offers a robust legal framework based on English common law and a FinTech RegLab that supports innovation in financial services. ADGM is gaining traction for its focus on digital banking, blockchain, and AI-driven finance solutions.

This Free Zone appeals to startups that require a regulatory sandbox to test and validate tech products before full-scale deployment.

4. Sharjah Research, Technology and Innovation Park (SRTIP)

SRTIP is an up-and-coming Free Zone with a focus on emerging technologies like renewable energy, AI, big data, and water technologies. It's ideal for startups involved in scientific research and applied tech development.

Located near major universities, SRTIP promotes academia-industry collaboration and offers startups access to labs, R&D facilities, and grants.

5. Ras Al Khaimah Economic Zone (RAKEZ)

While not solely focused on tech, RAKEZ offers one of the most cost-effective Free Zone Business Setup in UAE options for digital and e-commerce startups. It features business-friendly regulations, customizable packages, and lower operational costs compared to zones in Dubai or Abu Dhabi.

RAKEZ is ideal for solo entrepreneurs, small software companies, and mobile app developers looking to operate remotely with minimal overheads.

6. Dubai Multi Commodities Centre (DMCC)

Though primarily known for trade and commodities, DMCC has become increasingly tech-friendly, especially for blockchain and crypto-related ventures. It has introduced a regulatory framework for crypto firms, making it an attractive option for blockchain developers and fintech disruptors.

DMCC also features co-working spaces, incubator programs, and a vibrant business community with over 22,000 registered companies.

Key Benefits for Tech Startups in UAE Free Zones

100% Foreign Ownership: Unlike Mainland companies, Free Zones allow full ownership without the need for a local sponsor.

Tax Benefits: Most Free Zones offer corporate and income tax exemptions for a specific period.

Easy Licensing: Free Zones simplify the company formation process with centralized licensing and visa services.

Startup Ecosystems: Many Free Zones host incubators, accelerators, and VCs focused on tech startups.

Infrastructure: High-speed internet, modern office spaces, and proximity to talent make these zones ideal for digital businesses.

Choosing the Right Free Zone for Your Tech Venture

When evaluating a Free Zone, consider factors such as:

Your business niche (e.g., fintech, e-commerce, AI)

Licensing costs and flexibility

Access to funding and accelerator programs

Availability of talent and R&D facilities

Market proximity and networking opportunities

Some zones are better suited for bootstrapped startups, while others provide the network and resources needed for venture-backed growth.

Final Thoughts

The UAE continues to push the boundaries of digital innovation and offers a compelling environment for tech startups to thrive. Whether you're building a SaaS platform, launching a fintech app, or exploring AI solutions, setting up in the right Free Zone can provide the infrastructure, support, and flexibility your business needs.

With tailored licensing, supportive ecosystems, and world-class facilities, a Free Zone Business Setup in UAE is a strategic choice for entrepreneurs aiming to make an impact in the region and beyond.

If you’re unsure which Free Zone aligns best with your startup goals, consulting with experienced business setup professionals like CDA Corporate can ensure a smooth, compliant, and cost-effective journey to launch and scale.

0 notes