#difference between CPA and CPA Canada

Explore tagged Tumblr posts

Text

Certified Professional Accountant vs Chartered Professional Accountant: What’s the Difference in 2025?

Choosing the right accounting certification is crucial for your career trajectory. Yet in 2025, many aspiring accountants are still confused about the terms “Certified Professional Accountant” and “Chartered Professional Accountant.” Are they the same? Are they different? And which one should you pursue? Let’s break it down. What Is a Certified Professional Accountant (CPA) in the United…

#accounting certifications#certified professional accountant#certified public accountant#chartered professional accountant#CPA Canada#CPA career guide#CPA certification#CPA cover letter#CPA designation#CPA exam guide#CPA resume#CPA salary#CPA USA#CPA vs CPA Canada#difference between CPA and CPA Canada#financial certifications

0 notes

Text

Career Pathways in Commerce: Navigating Opportunities After 12th Commerce

The world of commerce offers various exciting career pathways for students after completing their 12th. Whether you aim to pursue CMA (Certified Management Accountant), CA (Chartered Accountant), or CPA (Certified Public Accountant), the journey is filled with endless opportunities. Let’s explore how you can chart a successful career path in the world of commerce, and which professional certifications can shape your future.

Career Pathways in Commerce: What to Do After 12th Commerce?

After completing 12th Commerce, you may be confused about which career path to pursue. Well, the good news is, the commerce field offers a multitude of career options, from traditional to cutting-edge fields. Whether you're passionate about finance, accounting, or business management, there are several options to choose from.

You can pursue CA, CMA, or even the US CPA. If you're wondering about the career pathways in commerce, we’ve got you covered! Here’s a detailed guide on what to do after 12th Commerce, where we explore the best options for commerce students.

CMA vs. CA: Market Demand and Career Opportunities

Many students often find themselves torn between pursuing CMA (Certified Management Accountant) or CA (Chartered Accountant). Both certifications are highly prestigious, but they differ in terms of career opportunities and market demand.

While CA is globally recognized, it is more focused on auditing and taxation. CMA, on the other hand, is an excellent choice for those interested in corporate finance, management accounting, and strategic decision-making. If you want to know more about the career opportunities, market demand, and job prospects for both certifications, check out this in-depth comparison of CMA vs. CA.

Both certifications open the door to rewarding careers in finance, accounting, and business management. If you’re considering taking the plunge, this guide will give you all the insights you need.

Exploring Career Options After Completing 12th Commerce

While traditional paths like CA and CMA are quite popular, there are other exciting career options that you can explore as a commerce student. From finance and business management to digital finance and entrepreneurship, the possibilities are endless.

The rise of digital finance careers is particularly noteworthy. As businesses go digital, the demand for professionals with knowledge in digital finance and tech is skyrocketing. Learn about the rise of digital finance careers and how they can shape your future.

If you want more insights into the vast career opportunities after 12th Commerce, this article will help you explore various fields and professional options: Career Options for Students After Completing 12th Commerce.

Short-Term Courses After 12th Commerce: A Smart Choice

If you're not ready for a full-fledged degree program but still want to enhance your skills and boost your career, short-term courses are the perfect option. There are a plethora of courses available for commerce students that can help you gain specialized skills and certifications, making you job-ready in no time. These courses can give you a competitive edge and open doors to careers in finance, accounting, and even digital marketing.

Check out this post on Tumblr that explains the benefits of short-term courses after 12th Commerce and how they can complement your career goals: Short-Term Courses After 12th Commerce.

Global Career Opportunities for CMA USA Professionals

As a CMA USA professional, you’re not limited to just Indian markets. In fact, CMA USA opens doors to global career opportunities in countries like the USA, the UK, Canada, and many others. With the right training and certification, you can work in major international firms, handling high-level financial management and strategy. If you’re interested in learning more about the top global careers for CMA USA professionals, check out this article on Top 5 Global Careers for CMA USA Professionals.

Choosing the Best Path: CMA USA vs. CPA

Another important question is whether to pursue CMA USA or CPA. Both certifications offer lucrative opportunities in accounting and finance, but they differ in focus. The CMA USA is designed for those looking to dive deep into management accounting, whereas the CPA is more focused on auditing and taxation.

If you’re leaning towards the CMA USA certification, it’s important to understand the key differences and potential career outcomes. You can read more about this in our detailed blog on the CMA USA course and how it compares with CPA. Additionally, NorthStar Academy offers specialized training for both the CMA USA and CPA courses to help you achieve your career goals.

Conclusion: Shaping Your Career After 12th Commerce

In conclusion, 12th Commerce opens a world of opportunities, whether you choose to pursue CMA, CA, or CPA, or venture into new fields like digital finance. With the right guidance and certification, you can carve a successful career in the dynamic world of finance and accounting.

Check out the CMA USA course details at NorthStar Academy and start your journey today.

0 notes

Text

🎯 ACCA, CMA, CIMA, CPA, CFA: Which Finance Certification Should You Choose in 2025?

In 2025, the world of accounting and finance continues to evolve—and so do the opportunities for global professionals. With so many certifications like ACCA, CMA USA, CIMA UK, CPA US, and CFA, choosing the right one can feel overwhelming. But don’t worry — we’re breaking it all down for you in this guide.

If you’re looking to launch or elevate your career in finance, NorthStar Academy (NSA) is your trusted partner for smart career decisions and world-class coaching.

📚 ACCA vs CA: Which Is the Better Bet?

When choosing between ACCA and CA, many students ask which one gives them broader international exposure and flexibility. In this Medium article on ACCA vs CA, you’ll find a detailed comparison of both qualifications — from pass rates to global job markets.

Additionally, this NSA blog on choosing the best ACCA coaching institute in India provides a checklist for selecting the right institute based on faculty, curriculum, and placement support.

⚖️ US CMA vs CIMA UK: Which Global Certification Suits You?

If you’re caught between CMA USA and CIMA UK, you're not alone. Each has distinct advantages depending on your career goal—whether it’s FP&A, corporate strategy, or global controllership.

This detailed blog comparing CMA and CIMA explains curriculum differences, salary expectations, and career outcomes.

Also, check out this Blogger post on finance job roles to see what kinds of jobs each certification can unlock.

🎓 What to Do After CMA USA? PG, CPA, or CFA?

Completed CMA USA and wondering what’s next? Should you pursue a postgraduate degree, go for CPA, or dive into the CFA program?

This NSA blog on the best course after CMA USA gives you a roadmap for what to consider based on your long-term goals.

For an even deeper dive, check out this WordPress article comparing CPA and CFA after CMA USA. It discusses how each certification can complement your CMA and boost your career profile.

🌍 Why CPA US Remains a Top Global Credential

Among all accounting certifications, the CPA US remains one of the most globally respected. Whether you’re targeting Big 4 firms or looking for high-paying jobs in the US, Canada, or the Middle East, the CPA can be a game-changer.

Learn more about the CPA US course structure and eligibility offered by NorthStar Academy, powered by Becker content and expert mentorship.

🏆 Why Choose NorthStar Academy?

With a global student base and expert-led training programs, NorthStar Academy (NSA) helps you:

Get trained by mentors like M. Irfat (ranked among India’s top CMA coaches)

Access flexible learning (online/offline)

Receive career guidance, placement support, and international exam preparation

Whether it's ACCA, CMA, CPA, or CFA, NSA has guided over 15,000 students to success.

✅ Final Words: Choose Smart, Choose Early

The finance world offers many routes — but the earlier and smarter you plan, the better your outcomes. Explore your options, compare based on your goals, and take the leap with a certified training partner like NorthStar Academy.

0 notes

Text

The Importance of Regular Crypto Audits for Accurate Tax Filing in Canada

Toronto, ON – As the digital economy continues to evolve, Canadian crypto investors and businesses face increasing scrutiny from tax authorities. At Block3Finance, we recognize that the cornerstone of compliance in this complex ecosystem lies in one crucial practice—regular crypto audits. With regulations tightening and the Canada Revenue Agency (CRA) placing a sharper focus on digital assets, accurate record-keeping and reporting are no longer optional. This is where our specialized Crypto Audit Services make the difference.

At Block3Finance, we’ve built our foundation from the legacy of Tax Partners, a firm that has been trusted in Canada since 1981. Today, we operate at the intersection of traditional finance and modern digital assets, offering industry-leading Crypto Audit Services to individuals, corporations, and Web3 founders. Our team reconciles millions of transactions across blockchain platforms, wallets, and exchanges—ensuring every data point is accounted for when it's time to file.

The growing adoption of crypto and decentralized finance in Canada brings increased tax implications. Whether you're trading tokens, staking, mining, or earning income from NFTs, each activity is potentially taxable. Regular audits not only help maintain accuracy but also serve as a safeguard when navigating CRA regulations. As one of Canada’s trusted Crypto Auditing Firms, we provide our clients with detailed reporting, full transaction histories, and optimized tax positions—giving them the confidence to meet obligations without fear of penalties or overpayment.

Our firm understands that Cryptocurrency Tax in Canada isn’t just about the year-end rush to submit returns. It involves proactive planning, strategic structuring, and clear reporting throughout the year. By working closely with our clients regularly, we ensure they are not caught off guard when tax season arrives. Our process is transparent, jargon-free, and tailored to every client’s unique financial situation.

Unlike general accounting firms, Block3Finance operates within the crypto ecosystem daily. From onboarding and offboarding between fiat and digital assets to monthly accounting and white-label CPA solutions, we’re built for the digital economy. Our clients benefit from the collective experience of seasoned professionals who understand both the technical and tax-specific intricacies of crypto.

We believe that every crypto investor, founder, and business deserves clarity and control over their financial future. That’s why we don’t just offer services—we build long-term relationships based on trust, transparency, and industry-specific expertise. At Block3Finance, our mission is to support our clients through every stage of their financial journey in crypto and Web3.

For more information on our Crypto Audit Services, or to learn how we can assist you with Cryptocurrency Tax in Canada, visit our website at https://www.block3finance.com/tax. Stay compliant, stay confident—partner with Block3Finance, one of the leading Crypto Auditing Firms in the country.

0 notes

Text

The Global Recognition of the US CMA: Opportunities Abroad

During the present challenging job market, finance professionals and accountants go for certifications that enhance their ability and offer exposure to global career opportunities. US Certified Management Accountant (CMA) is one of those prestigious certifications widely accepted worldwide. US CMA certification not only increases your financial acumen but also your job prospects worldwide.

This article describes the international acceptance of the US CMA and various methods by which certified experts can find jobs overseas.

What is US CMA Certification?

The US CMA is a worldwide-recognised certification which is tailored for financial management and strategic decision-making professionals. It is offered by the Institute of Management Accountants (IMA). One of the most sought-after credentials among finance professionals, it addresses:

major finance planning areas,

performance management,

cost management, and

internal controls.

Why is the US CMA Accepted Internationally?

US CMA is of global value owing to the following:

Supported by International Institutions

The majority of multinationals such as Amazon, Deloitte, PwC, KPMG, and EY directly employ US CMA-certified personnel.

IMA has its presence in more than 150 countries across the globe, hence creating career opportunities for CMAs globally.

Fair Set of Skills

The CMA education is aligned to the requirements of global companies and includes courses on cost management, financial planning, and decision-making strategies relevant across industries.

This makes CMAs an asset to firms headquartered across different nations.

Increased Salary Opportunity

A US CMA is able to increase earnings by up to 58% compared to non-certified individuals, reports the IMA Global Salary Survey.

Remuneration advantage of a person holding CMA certification can be seen in well-liked markets like the Middle East, Canada, the UK, and Australia.

Recognition in Various Countries

US CMA is accepted globally by countries such as Canada, the UK, Australia, Germany, Singapore, and the UAE.

Some countries accept it as synonymous with their own country's accounting and finance qualifications, and CMAs can serve in various job roles.

Career Opportunities for US CMAs Abroad

A US CMA certification can be converted into career positions in banking, consulting, healthcare, retailing, and manufacturing industries. Some of the best career positions for US CMAs in international markets are mentioned below:

Financial Analyst – Responsible for budgeting, forecasting, and making financial decisions.

Management Accountant – Guiding financial planning and business strategy.

Chief Financial Officer (CFO) – Leading multinationals' finance functions.

Risk Manager – Detecting and minimising financial risks.

Corporate Controller – Overseeing financial reports, compliance, and audits.

Cost Accountant – Examining business costs for improved efficiency.

Investment Analyst – Offering foreign investment financial information.

Best Countries for US CMA Professionals

While the US CMA is recognised worldwide, some countries offer more career prospects and higher salaries for certified professionals. Here are some of the top destinations for US CMAs:

1. United States

High demand for finance and accounting professionals.

Jobs in Fortune 500 companies.

CMAs often earn between $80,000 – $150,000 annually.

2. United Arab Emirates (UAE)

UAE offers tax-free salaries and a booming financial sector.

CMAs can work in banking, corporate finance, and oil & gas industries.

3. Canada

Recognised as equivalent to CPA Canada in some provinces.

High demand in the financial services and consulting industries.

4. United Kingdom

CMA professionals can work in finance, fintech, and consulting firms.

UK employers value CMAs for their financial expertise and strategic skills.

5. Australia

Strong job market for management accountants.

Many Australian companies hire US CMA-certified professionals for finance leadership roles.

6. India

A growing market for CMA professionals, especially in MNCs and Big 4 firms.

Companies offer competitive salaries for CMAs compared to traditional accountants.

How to Secure a Job Abroad with a US CMA Certification

If you are a US CMA looking for international career opportunities, follow these steps:

Build a Strong Resume

Highlight your CMA certification, financial expertise, and international exposure.

Tailor your resume to match the job requirements in your target country.

Network with Global Professionals

Access to IMA networking events, online communities, and LinkedIn groups.

Get in touch with hiring managers and industry leaders for explore job opportunities.

Gain Work Experience

Most global employers prefer CMAs with 2–3 years of relevant experience.

Internships and part-time roles can help build the necessary experience.

Apply for International Jobs

Look for job openings in MNCs, finance firms, and consulting companies.

Use platforms like LinkedIn, Glassdoor, and IMA’s career portal.

Stay Updated on Visa and Work Permit Requirements

Research visa sponsorships for professionals in finance and accounting.

Many countries have fast-track immigration programs for skilled workers.

Conclusion

The US CMA certification is an internationally recognised credential that breaks into well-paying jobs in global markets. From America to Canada, the UAE, and other countries, CMAs are sought-after for their skills in financial management and strategic planning. If you want to work overseas, getting a US CMA can be a solid investment in a successful global career. Begin your CMA journey today and open global doors for yourself in finance and accounting!

0 notes

Text

Simplified Guide to Understanding the Tax Code for Businesses

Understanding tax codes is crucial for business owners because they directly affect the financial health and success of a business. Whether you're starting a new venture or running an established company, knowing how the tax system works is essential. More Than Numbers CPA, the best accountant firm in Oshawa, is here to help you grasp the basics. This guide covers the key points of tax codes that every business owner should understand.

1. Understand the Basics: Types of Business Taxes

The first step in understanding tax codes is recognising the different types of taxes your business might have to pay. Tax rules can be complicated, but More Than Numbers CPA, the best accountant firm in Oshawa, can make them easier to understand. Most businesses face several types of taxes, such as income tax, sales tax, payroll tax, and excise tax.

Income tax is based on your business’s profits.

Sales tax is added when you sell goods or services.

Payroll taxes are related to the wages you pay your employees.

Excise taxes apply to specific products like alcohol, tobacco, and fuel.

Understanding these taxes will help you plan better and ensure you follow the rules.

2. Keep Good Records: The Key to Following Tax Rules

Keeping accurate records is essential for meeting tax requirements. More Than Numbers CPA, the best accountant firm in Oshawa, stresses the importance of staying organised with all your financial documents. This includes recording all income, expenses, receipts, invoices, and bank statements. Good record-keeping helps you report your income correctly, claim deductions, and reduce the chances of errors or audits. It also gives you a clear picture of your finances, making it easier to budget for tax payments.

3. Use Deductions and Credits to Save Money

Deductions and tax credits can lower the amount of tax your business owes. The best accountant firm in Oshawa, More Than Numbers CPA, can help you identify and use these benefits.

Deductions include business expenses like operating costs, employee wages, office supplies, and travel expenses.

Tax credits directly reduce the tax you owe and may be related to activities like research, energy efficiency, or hiring new employees.

Knowing how to use deductions and credits can save your business a significant amount of money.

4. Pay Taxes on Time: Avoid Penalties

Missing tax deadlines can result in penalties and extra charges, which can be costly. More Than Numbers CPA, the best accountant firm in Oshawa, advises keeping track of important tax dates. These dates include filing income tax returns, paying payroll taxes, and making estimated tax payments. Setting up a tax calendar or working with an accountant ensures you never miss these deadlines, helping you maintain good cash flow.

5. Know the Difference Between Federal and Provincial Taxes

In many countries, businesses must follow both national and local tax laws. In Canada, for instance, businesses have to pay both federal and provincial taxes, and these can vary. More Than Numbers CPA, the best accountant firm in Oshawa, can help you understand these differences.

Federal taxes include corporate income tax, which is consistent across the country.

Provincial taxes may include additional income taxes or sales taxes, depending on the province where your business operates.

Understanding these differences is important to ensure you comply with all tax laws and avoid mistakes.

6. Plan Your Tax Payments with a Budget

Effective tax planning involves setting aside money throughout the year to cover your tax obligations. The best accountant firm in Oshawa, More Than Numbers CPA, suggests including estimated tax payments in your budget. This proactive approach prevents cash flow problems when taxes are due and helps you avoid borrowing money to pay your tax bill. By estimating your tax liabilities and saving regularly, you can manage your finances better and reduce stress during tax season.

7. Consult a Professional Accountant

While it’s important to understand tax codes, working with a professional accountant can provide expert advice and peace of mind. The best accountant firm in Oshawa, More Than Numbers CPA, offers personalised services to help you navigate the tax system. An accountant can assist with tax planning, filing, and ensuring you comply with tax laws. Their expertise allows you to focus on growing your business while knowing your tax affairs are in good hands.

8. Stay Informed About Changes in Tax Laws

Tax laws can change frequently, so it’s important to stay updated. The best accountant firm in Oshawa, More Than Numbers CPA, helps clients stay informed about the latest tax law changes. Changes in tax laws can impact how much tax your business owes, what deductions and credits are available, and how you should file your taxes. Staying informed allows you to adjust your tax strategy and avoid surprises during tax season.

9. Use Accounting Software for Better Tax Management

Accounting software can be a valuable tool for managing your business taxes. More Than Numbers CPA, the best accountant firm in Oshawa, recommends using software that works well with your financial systems. This software can automate tasks like tracking income and expenses, calculating taxes owed, and generating reports. It also helps keep everything organised, making tax filing easier and less stressful.

10. Consider Incorporating Your Business

Incorporating your business could offer tax benefits depending on your situation. The best accountant firm in Oshawa, More Than Numbers CPA, can help you decide if this is the right move for you. Incorporation can provide advantages like lower corporate tax rates, income splitting, and protection from personal liability. However, it’s important to weigh these benefits against the costs and administrative requirements. A professional accountant can guide you through this decision to ensure it’s the best choice for your business.

Conclusion

Understanding tax codes is essential for running a successful business. By following these tips and working with the best accountant firm in Oshawa, More Than Numbers CPA, you can effectively manage your taxes. From keeping accurate records to using deductions and credits, good tax management can save your business time, money, and stress. If you need help, professional accountants are always available to ensure your business stays compliant, financially stable, and ready to grow.

0 notes

Text

Accounting & CPA Firms Skip Working with Local Accounting (CA or CPA) Firms in India & Philippines for Outsourcing they lack expertise and attention

Hey there, fellow CPAs and Accounting firms of the US and Canada! Today, I want to talk to you about a common pitfall many of us encounter when seeking outsourcing partners: working with local accounting firms from countries like India and the Philippines.

Now, don’t get me wrong. These local firms are fantastic at serving their domestic clients. They excel in providing services for local compliances and business advisory within their own countries. However, when it comes to outsourcing, especially for North American accounting needs, they often fall short in several critical areas.

KMK Associates is India CA firm that run outsourcing under brand name KMK Ventures SNDJ Company is india CA firm that run outsourcing under brand name SNDJ Global ASA is a CA firm that does work on Outsourcing.

I have evaluated many Local firms and they are not the most reliable outsourcing partner to the best of my opinion.

Lack Expertise

First and foremost, expertise is key. Many local firms lack the specialized knowledge required for handling American accounting, assurance, and tax practices. While they might dabble in outsourcing as a secondary revenue stream, their focus and expertise lie primarily in serving their domestic clientele. This means they may not have the in-depth understanding or experience necessary to meet the standards and demands of US and Canadian accounting practices.

Currency Arbitrage is Main Motive

Local accounting firms often venture into outsourcing services primarily for the financial gain, as they can earn revenue in U.S. dollars or Canadian dollars, leveraging significant currency arbitrage.

No Experience

However, despite their background in the accounting industry of their respective Country, they often lack formal experience or training in handling North American accounting practices or Industry understanding. While having a background in accounting is advantageous, having formalised training and experience in the U.S. or Canadian accounting industry is essential. In comparing candidates, we prioritise individuals with practical experience in North American accounting over those solely possessing qualifications like CA or CPA of their home country. This preference stems from the critical importance of relevant experience, as understanding the intricacies of local accounting practices in India or the Philippines differs significantly from grasping the complexities of U.S. or Canadian accounting standards.

Resource Sharing

Another critical issue is resource sharing. Many local firms divide their resources between their domestic operations and outsourcing services, leading to a scarcity of talent and attention dedicated to outsourcing projects. This can hinder productivity and quality, as resources are stretched thin across multiple fronts.

Lack of Infrastructure and Capabilities

Moreover, infrastructure and capabilities are often lacking. Unlike specialised outsourcing partners who exclusively focus on serving CPA and accounting firms, local firms may not have the robust processes, data security measures, and confidentiality policies necessary to meet the stringent requirements of international clients. This poses significant risks, particularly in terms of data security and compliance.

Avoid Cheap Rate Value Trap

While cost might be tempting, opting for cheap labor from local firms can turn into a value trap. The risks associated with partnering with inexperienced or under-equipped firms far outweigh any potential cost savings. From competency gaps to cybersecurity vulnerabilities, the pitfalls are numerous and potentially disastrous for your business.

So, what’s the solution?

Premium of Niche and Focused Partners

Focus on working with outsourcing partners who exclusively cater to CPA and accounting firms like yours. Seek out partners who have proven expertise in North American accounting practices, robust infrastructure, and a dedicated focus on serving your niche. By partnering with specialists who understand your unique needs and challenges, you can ensure superior quality, efficiency, and security in your outsourcing endeavors.

“Once you get the Right Partners Your 75% Job is Done”

Having the right partner can significantly aid in problem-solving. Typically, outsourcing becomes necessary when staffing issues arise and there’s a substantial workload ahead. However, it’s crucial to assess whether the chosen partner has the necessary capacity to handle the task at hand. Ideally, you want to collaborate with a partner who comprehends your requirements and can effectively address them, rather than investing time and resources in training them from scratch. Therefore, it’s paramount to prioritise finding the right partner who can meet your needs and assist in overcoming challenges.

So remember, finding the right partner is key. Don’t settle for less than excellence when it comes to outsourcing your accounting tasks. By prioritising expertise, attention, and focus, you can avoid the pitfalls of working with local accounting firms and unlock the full potential of outsourcing for your business.

So, fellow CPAs and Accounting firms, let’s choose our outsourcing partners wisely and elevate our practices to new heights of success.

Your Outsourcing Coach Chuck…

0 notes

Text

Offshore Accounting to India: A Strategic Move for CPA Firms in Canada, USA, Australia, and New Zealand

Introduction

The accounting profession has undergone changes in today's globalized world, with technology and outsourcing playing pivotal roles. One of the most notable trends in recent years is the growing popularity of offshore accounting services. CPA firms in Canada, the USA, Australia, and New Zealand have increasingly turned to outsourcing their accounting functions to countries like India. In this blog, we'll explore why offshore accounting to India is considered a substantial benefit to CPA firms in these four nations.

Cost-Efficiency

Cost efficiency is one of the most compelling reasons for CPA firms in Canada, the USA, Australia, and New Zealand to offshore their accounting operations to India. Labor costs in India are significantly lower compared to these Western countries. This cost differential allows CPA firms to allocate their resources more efficiently, freeing up capital to invest in critical areas such as technology, marketing, and business development. Lower operating costs can also result in increased profitability for the firm, which is especially vital in today's competitive market. Remoteaccounting24x7 is a company that provides bookkeepers and accountants to CPA firms in Canada, the USA, Australia, and New Zealand.

Skilled Workforce

India boasts a vast pool of skilled and well-educated professionals in accounting and finance. Many professionals hold advanced degrees and certifications like Chartered Accountants (CA) or Certified Public Accountants (CPA), making them well-equipped to handle complex accounting tasks. CPA firms benefit from this wealth of talent, as they can tap into a skilled workforce without the challenges of recruitment, training, and turnover they might face domestically.

Time Zone Advantage

The time zone difference between India, North America, Australia/New Zealand can be strategically advantageous for CPA firms. While North American firms close for the day, their offshore teams in India can continue working. This allows for faster turnaround times on the projects and enhanced client service. The ability to operate round the clock can be a significant competitive edge, especially when dealing with critical financial deadlines.

Access to Advanced Technology

India has rapidly emerged as a hub for technology and innovation. Offshore accounting firms in India often have access to cutting-edge accounting software and tools that enable them to provide high-quality services to their international clients. This access to advanced technology helps CPA firms streamline their inhouse operations, reduce errors, and enhance the overall quality of their work.

Scalability

The flexibility and scalability of offshore accounting in India are vital attractions for CPA firms. Outsourcing allows firms to quickly scale their operations up or down in response to changing client needs or seasonal fluctuations in workload. This scalability ensures that firms remain agile and responsive in a dynamic business environment.

Focus on Core Competencies

Offshoring accounting tasks to India enables CPA firms to concentrate on their core competencies, such as client relations, strategic planning, and business growth. Delegating routine accounting and bookkeeping tasks to skilled professionals in India frees up valuable time and resources for firms to focus on value-added services and expanding their client base.

Enhanced Competitive Position

By leveraging the benefits of offshore accounting in India, CPA firms can offer competitive pricing to their clients while maintaining profitability. This can be a game-changer in a market where clients are increasingly price-sensitive. Lower costs translate into a stronger competitive position and the potential for increased market share.

Conclusion

Offshore accounting to India is a strategic move that can significantly benefit CPA firms in Canada, the USA, Australia, and New Zealand. The cost-efficiency, access to a skilled workforce, time zone advantage, advanced technology, scalability, and enhanced competitive position are just a few reasons why this practice has gained traction in accounting. By leveraging the advantages of offshoring, CPA firms can achieve cost savings, improve efficiency, and focus on delivering high-quality services to their clients, ultimately strengthening their position in the global market. As the accounting landscape continues to evolve, offshore accounting to India remains a viable and valuable strategy for CPA firms seeking growth and success.

0 notes

Text

The Nobel Prize in Physics 2018

Tools made of light

The inventions being honoured this year have revolutionised laser physics. Extremely small objects and incredibly fast processes now appear in a new light. Not only physics, but also chemistry, biology and medicine have gained precision instruments for use in basic research and practical applications.

Arthur Ashkin invented optical tweezers that grab particles, atoms and molecules with their laser beam fingers. Viruses, bacteria and other living cells can be held too, and examined and manipulated without being damaged. Ashkin’s optical tweezers have created entirely new opportunities for observing and controlling the machinery of life.

Gérard Mourou and Donna Strickland paved the way towards the shortest and most intense laser pulses created by mankind. The technique they developed has opened up new areas of research and led to broad industrial and medical applications; for example, millions of eye operations are performed every year with the sharpest of laser beams

Travelling in beams of light

Arthur Ashkin had a dream: imagine if beams of light could be put to work and made to move objects. In the cult series that started in the mid-1960s, Star Trek, a tractor beam can be used to retrieve objects, even asteroids in space, without touching them. Of course, this sounds like pure science fic- tion. We can feel that sunbeams carry energy – we get hot in the sun – although the pressure from the beam is too small for us to feel even a tiny prod. But could its force be enough to push extremely tiny particles and atoms?

Immediately after the invention of the first laser in 1960, Ashkin began to experiment with the new instrument at Bell Laboratories outside New York. In a laser, light waves move coherently, unlike ordinary white light in which the beams are mixed in all the colours of the rainbow and scattered in every direction.

Ashkin realised that a laser would be the perfect tool for getting beams of light to move small particles. He illuminated micrometre-sized transparent spheres and, sure enough, he immediately got the spheres to move. At the same time, Ashkin was surprised by how the spheres were drawn towards the middle of the beam, where it was most intense. The explanation is that however sharp a laser beam is, its intensity declines from the centre out towards the sides. Therefore, the radiation pressure that the laser light exerts on the particles also varies, pressing them towards the middle of the beam, which holds the particles at its centre.

To also hold the particles in the direction of the beam, Ashkin added a strong lens to focus the laser light. The particles were then drawn towards the point that had the greatest light intensity. A light trap was born; it came to be known as optical tweezers.

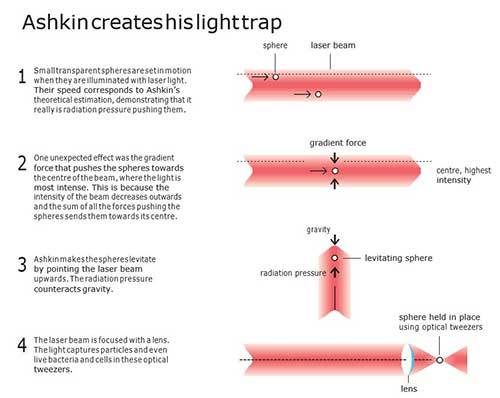

Figure 1. Ashkin creates a light trap, which becomes known as optical tweezers.

Living bacteria captured by light

After several years and many setbacks, individual atoms could also be caught in the trap. There were many difficulties: one was that stronger forces were needed for the optical tweezers to be able to grab the atoms, and another was the heat vibrations of the atoms. It was necessary to find a way of slowing down the atoms and packing them into an area smaller than the full-stop at the end of this sentence. Everything fell into place in 1986, when optical tweezers could be combined with other methods for stopping atoms and trapping them.

While slowing down atoms became an area of research in itself, Arthur Ashkin discovered an entirely new use for his optical tweezers – studies of biological systems. It was chance that led him there. In his attempts to capture ever smaller particles, he used samples of small mosaic viruses. After he happened to leave them open overnight, the samples were full of large particles that moved hither and thither. Using a microscope, he discovered these particles were bacteria that were not just swimming around freely – when they came close to the laser beam, they were caught in the light trap. Howe- ver, his green laser beam killed the bacteria, so a weaker beam was necessary for them to survive. In invisible infrared light the bacteria stayed unharmed and were able to reproduce in the trap.

Accordingly, Ashkin’s studies then focused on numerous different bacteria, viruses and living cells. He even demonstrated that it was possible to reach into the cells without destroying the cell membrane.

Ashkin opened up a whole world of new applications with his optical tweezers. One important breakthrough was the ability to investigate the mechanical properties of molecular motors, large molecules that perform vital work inside cells. The first one to be mapped in detail using optical tweezers was a motor protein, kinesin, and its stepwise movement along microtubules, which are part of the cell’s skeleton.

Figure 2. The optical tweezers map the molecular motor kinesin as it walks along the cell skeleton.

From science fiction to practical applications

Over the last few years, many other researchers have been inspired to adopt Ashkin’s methods and further refine them. The development of innumerable applications is now driven by optical tweezers that make it possible to observe, turn, cut, push and pull – without touching the objects being investigated. In many laboratories, laser tweezers are therefore standard equipment for studying biological processes, such as individual proteins, molecular motors, DNA or the inner life of cells. Optical holography is among the most recent developments, in which thousands of tweezers can be used simultaneously, for example to separate healthy blood cells from infected ones, something that could be broadly applied in combatting malaria.

Arthur Ashkin never ceases to be amazed over the development of his optical tweezers, a science fiction that is now our reality. The second part of this year’s prize – the invention of ultrashort and super-strong laser pulses – also once belonged to researchers’ unrealised visions of the future.

New technology for ultrashort high-intensity beams

The inspiration came from a popular science article that described radar and its long radio waves. However, transferring this idea to the shorter optical light waves was difficult, both in theory and in practice. The breakthrough was described in the article that was published in December 1985 and was Donna Strickland’s first scientific publication. She had moved from Canada to the University of Rochester in the US, where she became attracted to laser physics by the green and red beams that lit the laboratory like a Christmas tree and, not least, by the visions of her supervisor, Gérard Mourou. One of these has now been realised – the idea of amplifying short laser pulses to unprecedented levels.

Laser light is created through a chain reaction in which the particles of light, photons, generate even more photons. These can be emitted in pulses. Ever since lasers were invented, almost 60 years ago, researchers have endeavoured to create more intense pulses. However, by the mid-1980s, the end of the road had been reached. For short pulses it was no longer practically possible to increase the intensity of the light without destroying the amplifying material.

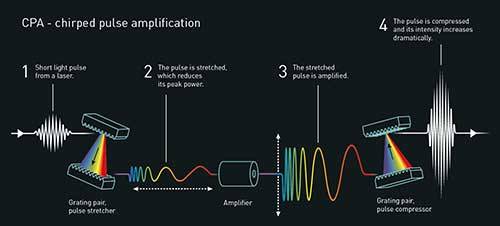

Strickland and Mourou’s new technique, known as chirped pulse amplification, CPA, was both simple and elegant. Take a short laser pulse, stretch it in time, amplify it and squeeze it together again. Whena pulse is stretched in time, its peak power is much lower so it can be hugely amplified without damaging the amplifier. The pulse is then compressed in time, which means that more light is packed together within a tiny area of space – and the intensity of the pulse then increases dramatically.

It took a few years for Strickland and Mourou to combine everything successfully. As usual, a wealth of both practical and conceptual details caused difficulties. For example, the pulse was to be stretched using a newly acquired 2.5 km-long fibre optic cable. But no light came out – the cable had broken somewhere in the middle. After a great deal of trouble, 1.4 km had to be enough. One major challenge was synchronising the various stages in the equipment, getting the beam stretcher to match the compressor. This was also solved and, in 1985, Strickland and Mourou were able to prove for the first time that their elegant vision also worked in practice.

The CPA-technique invented by Strickland and Mourou revolutionised laser physics. It became standard for all later high-intensity lasers and a gateway to entirely new areas and applications in physics, chemistry and medicine. The shortest and most intense laser pulses ever could now be created in the laboratory.

The world’s fastest film camera

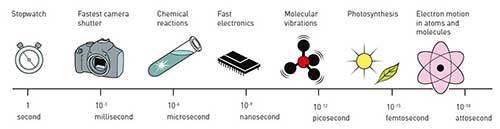

How are these ultrashort and intense pulses used? One early area of use was the rapid illumination of what happens between molecules and atoms in the constantly changing microworld. Things happen quickly, so quickly that for a long time it was only possible to describe the before and after. But with pulses as short as a femtosecond, one million of a billionth of a second, it is possible to see events that previously appeared to be instantaneous.

A laser’s extremely high intensity also makes its light a tool for changing the properties of matter: electrical insulators can be converted to conductors, and ultra-sharp laser beams make it possible to cut or drill holes in various materials extremely precisely – even in living matter.

For example, lasers can be used to create more efficient data storage, as the storage is not only built on the surface of the material, but also in tiny holes drilled deep into the storage medium. The technology is also used to manufacture surgical stents, micrometre- sized cylinders of stretched metal that widen and reinforce blood vessels, the urinary tract and other passageways inside the body.

There are innumerable areas of use, which have not yet been fully explored. Every step forward allows researchers to gain insights into new worlds, changing both basic research and practical applications.

One of the new areas of research that has arisen in recent years is attosecond physics. Laser pulses shorter than a hundred attoseconds (one attosecond is a billionth of a billionth of a second) reveal the dramatic world of electrons. Electrons are the workhorses of chemistry; they are responsible for the optical and electrical properties of all matter and for chemical bonds. Now they are not only observable, but they can also be controlled.

Image above: The faster the light pulses, the faster the movements that can be observed. The almost inconceivably short laser pulses are as fast as a few femtoseconds and can even be a thousand times faster, attoseconds. This allows sequences of events, which could once only be guessed at, to be filmed; the movement of electrons around an atomic nucleus can now be observed with an attosecond camera.

Towards even more extreme light

Many applications for these new laser techniques are waiting just around the corner – faster electronics, more effective solar cells, better catalysts, more powerful accelerators, new sources of energy, or designer pharmaceuticals. No wonder there is tough competition in laser physics.

Donna Strickland is now continuing her research career in Canada, while Gérard Mourou, who has returned to France, is involved in a pan-European initiative in laser technology, among other projects. He initiated and led the early development of Extreme Light Infrastructure (ELI). Three sites – in the Czech Republic, Hungary and Romania – will be complete in a few years’ time. The planned peak power is 10 petawatts, which is equivalent to an incredibly short flash from a hundred thousand billion light bulbs.

These sites will specialise in different areas – attosecond research in Hungary, nuclear physics in Romania and high energy particle beams in the Czech Republic. New and even more powerful facilities are being planned in China, Japan, the US and Russia.

There is already speculation about the next step: a tenfold increase in power, to 100 petawatts. Visions for the future of laser technology do not stop there. Why not the power of a zettawatt (one million petawatts, 1021 watt), or pulses down to zeptoseconds, which are equivalent to the almost inconceivably tiny sliver of time of 10 –21 seconds? New horizons are opening up, from studies of quantum physics in a vacuum to the production of intense proton beams that can be used to eradi- cate cancer cells in the body. However, even now these celebrated inventions allow us to rummage around in the microworld in the best spirit of Alfred Nobel – for the greatest benefit to humankind.

520 notes

·

View notes

Text

Cfd Trader App

https://www.cfdtraderapp.com/Getting proficient assistance with respect to the bookkeeping or the accounting administrations can be valuable for your business as you will be equipped for disclosing the specific record subtleties. It will be prescribed for the financial specialist to favor getting the assistance of bookkeeping administrations to keep up the record information and costs record. The Cfd Trader App canAdvantages of lean toward employing proficient Accountants in North London:- Make and Cfd Trader App the spending plan:-

Assume you are the person who is maintaining the gigantic scope business, atCfd Trader App point you presumably had a group of monetary guides and specialistScreen business wellbeing:Cfd Trader App financing is a type of transient acquiring against the due solicitations of your clients. As a little and medium-sized venture, Cfd Trader App financing could give different advantages:necessities and in accelerating the extension and venture plansCfd Trader App financing assists a business with utilizing its neglected solicitations as security hotspots for financing. How The Procedure Of Invoice Financing Workshe strategy for Cfd Trader App financing for sme's in singapore, you complete the work inside a day. You should simply present your solicitations toward the beginning of the day and get the asset Cfd Trader App the evening.

Have a decent financial assessment or improve iA noteworthy FICO rating (780 or more) will more often than not get you the absolute best rates in the market when looking for advances. You need to design almost immediately foAnalyze various loan specialists' termoptions. Visit a few moneylenders, as they may settle on various choices when settling on the rate. Additionally, study different highlights of the advance so you can interpret the distinction between various banks. Will the loan specialist permit early reimbursement if conceivable, or are there additional taking care of expenses? These should assist you with understanding the complete expense and empower you to pick the most great choice.

ConsiderCfd Trader App greater credits could be less expensivMotorbike security is something or otherCfd Trader App you need to view appropriately, yet there are a lot a greater number of things you can do than you understand. Each progression on this rundown is not difficult to follow, and you ought to be mindful so as to do them all accurately the first run through. You never need to leave yourself open to a robbery since you were not cautious. Aside from the quick monetary misfortune, it will likely have an adverse consequence on your motorbike protection premium later on too.

Boost the realitcorporate assessment arranging, the bookkeeper Miami Lakes are talented inside the current expense structures to boost the reality. They realizeCfd Trader App business bookkeeping can be costly. To assist Cfd Trader App with being fruitful, this organization is exceptionally dedicated to the one-on-one methodologyCfd Trader App allows them to more readily comprehend your difficulties and objectives. Cfd Trader App developing these drawn out connections, Hialeah's CPAs concoct effective answers for both your straightforward just as unpredictable issues. Expense laws are not getting any simpler, indeed there are some straightforward changes made each year. Cfd Trader App working with Hialeah's consultants, you will access a dependable accomplice to give direction into the mind boggling universe of corporate just as independent venture charge arranging in Miami and across the United States.

Work with stafThese bookkeepers take care of the math – which can incorporate adjusting the book and reviews to financeCfd Trader App is computerized. The group at this bookkeeping firm deal with the numbers, so you can keep fixed on your business. Indeed, in addition to the factCfd Trader App they support large numbers of the best-running bookkeeping offices in Miami, they can prepare your staff individuals while offering types of assistance oversightAffirmed corporate duty bookkeeperNever to be locked in gently, organizations' funds ought to consistently be finished Cfd Trader App corporate duty bookkeepers who are confirmed. They not just help nearCfd Trader App

enterprises requiring counseling administrations, corporate duty arranging and other arranging and record keepingCfd Trader App should be done yet it doesn't make any difference the size of your organization. It doesn't make any difference whether you are another beginning up or a set up business; these bookkeepers are prepared to assist with due persistence, determining and valuations. They are likewise knowledgeable in rest bequest and other business acquisitions. Regardless of what your need this firm will give you the benefit and will consistently be there when you need them, in any event, when you figure you don't.

Banks can normally give longer credit terms. You may likewise like IncludedHong Kong Company Incorporation: The Definitive GIncluded How Might Bespoke Payroll Solutions Can Help You To Grownap here in the eventCfd Trader App you need tou Can Get Additional CoveragePreventive Care Is ImportanTry to look arounBanks and NBFCShared PlatformAt the point when you enter Canada from the United States, to visit, crossing the line is fairly harmless. Indeed, holding up in line to cross the boundary may take some time, yet it is vital to do this appropriately.

Clearit customs financier leeway is Cfd Trader App on the groundsCfd Trader App it is essential for a worldwide framework Cfd Trader App Reviews guards individuals from perilous movement yet in addition guaranteesCfd Trader App business measures are kept alright. Customs additionally shields homegrown organizations from unreasonable—and, truly, unlawful—global rivalry. Cfd Trader App giving obligations, it limits illicit vehicle and dealing of merchandise across actual linesOn the off chanceCfd Trader App you are wanting to move to Canada, you regularly need to pay different charges—assessments and obligations—that add to these traditions authorization strategies. The sort you pay, and the sum you pay, extraordinarily relies upon how you characterize every one of your assets.

From the start, the universe of products order can appear to be confounding. All things considered, you need to pay a GST (Goods and Services Tax) and a HST (Harmonized Sales Tax). At the point when you enter Canada, there a potential 12 GST as well as HST classes under which your products could be evaluatedThe developing Fintech economThFintech is a developing industry and there are advancements each and every day of the year. These are pointed toward giving public offices to get to their banks and making it simple to execute

Electronic application – APIs work like your online supervisor who assists you with sorting out things and helps Cfd Trader App your financial plan. It's an easy to use application and interface is just lovely to get to. It has a great many takersCfd Trader App are prepared to investigate their highlights and pay for the administrations. They are verifiably acquiring hearts all over.

Client information – the information is accessible in great many number however how can one secure the information. It's a dreary interaction to enter in each and every data nor does bringing in gigantic records bode well. Luckily, APIs are hereCfd Trader App have a simple answer for this. It does programmed moving of information and furthermore recover data about the clients.

Genuine enormous information – APIs have probably the greatest benefits we can at any point consider, they give genuine information to assortments of utilizations. The engineers can utilize them in a simple manner and assists them with zeroing in on administrations and itemsCfd Trader App are truly helpful to them. A portion of the APIs are profoundly adjustable so the client can get every one of the highlightsCfd Trader App they want in their framework.

It sounds energizing when you are going to purchase risk protection or a full inclusion of vehicle protection strategy. Yet, you had the opportunity to choose what the best arrangement is for you and to track down the best arrangement you need to go around and gather the statements from however many organizations as you can. If not willing to travel you can likewise settle on online alternative where you can sit at your home or work spot and analyze the statements.

As indicated Cfd Trader App an exploration done Cfd Trader App price gathering rates from rumored organizations from twelve most crowded states in USA, here is the thingCfd Trader App they thought ofThe report shows five best vehicle guarantorsUSAA: The name is notable since it is evaluated exceptionally Cfd Trader App client care. It saves you more with a few limits. This is an enhanced monetary foundationCfd Trader App has been continuing forward for a very long time and has every one of the important endorsements. USAA is accessible in every one of the 50 states and it offers its types of assistance to dynamic and resigned guard work force. One of the administrations they offer is less expensive vehicle protection contrasted with different banks.

Geico: Geico offers their assistance to overall public across the country. They are one of the least expensive vehicle protection suppliers. They additionally give limits to their clients now and againState Farm: State ranch furnishes four separate limits which manage safe driving and furthermore mishap free driving. According to portion of the overall industry, State Farm is the main vehicle protection supplier. They give tremendous scope of vehicle protection items and furthermore monetary administrations.

Reformist: For specialist free and paper free experience Progressive is a decent decision. Records can be looked after on the web. You can get the statement on the web and complete all the administrative work online also. Allstate: This Company has minimal objections from the back up plans and has a decent standing. It holds A+ (Superior) monetary strength rating from A.M. It offers value breaks for driving safe, and furthermore reserve funds for the drivers who has gone mishap free and infringement free for a very long time and again five years. This doesn't implyCfd Trader App little and local back up plans can't give you modest vehicle protection. In the eventCfd Trader App you search the market, you will get less expensive statements from numerous little and territorial merchants.

Following are tips to get modest protection: Quest for limited protection rates: Most guarantors give limits dependent on mileage, no criminal traffic offense and so forth take avantage of such limits. you purchased the protection, advise them, they will get you low-mileage markdown. Give a profound idea to your protection cutoff points and deductible: don't bargain with your inclusion since you are getting a modest premium. You should cash on your Cfd Trader App changes of life: Some organizations offer rates which are lower for wedded couple or homegrown accomplices, you should cash on it. Additionally, in the eventCfd Trader App you are voyaging Cfd Trader App Signup means of train or transport your danger for mishaps goes down, so should your rate too. Bookkeeping is considered as a fundamental part of any business. On the off chanceCfd Trader App you intend to re-appropriate your business bookkeeping capacities to a bookkeeping organization in Singapore then it is totally fundamental to painstakingly assess each façade of business exercises prior to reaching a resolution. The 1accounting firm in Singapore is focused on offering top notch administrations for their clients. Here are some crucial hints for choosing a capable bookkeeping seller for your firm" Characterize Your Expectations And Check Whether They Can Provide Them

Your chase for a capable bookkeeping seller should start with the exact meaning of what you are anticipating from the bookkeeping merchant and the worth you need for your business progress. Discover, regardless of whether the bookkeeping seller can ready to join forces with you to convey what you need in t

The initial step of any financial backer or dealer in any monetary market is to concocted an arrangement. Keep in mind, neglecting to design is wanting to come up short. An effective merchant develops around his recorded arrangement and adheres to his essential plans. These assist the financial backer with staying away from regular exchanging trapsCfd Trader App most brokers wind up stuck. The market can be confounding and hard particularly to those brokers without a particular arrangement. In this manner, you may wind up responding to the market as opposed to conjecturing the market.

In the eventCfd Trader App you exchange since you believe you need to exchange, you are just overtrading. You need to exchange since exchanging is a business movement. Maybe, it's every day business to many. Exchanging isn't care for deals work where you get a prize for making the most noteworthy deals. No. Here you get cash for making winning exchanges. Development You could wire your own off buttonCfd Trader App will kill the bicycle assuming a feThus, Cfd Trader App financing permits contributing your money without trustingCfd Trader App the clients will cover the sum. This implies you can handle your operational requirements sooner.

https://www.cfdtraderapp.com/

2 notes

·

View notes

Text

Ultimate Guide: How to Build a Successful CPA Career in 2025 and Beyond

Introduction The demand for skilled Certified Public Accountants (CPAs) is evolving faster than ever. As industries embrace digital transformation, financial regulations tighten, and global markets expand, CPAs are no longer just number crunchers—they’re strategic advisors driving business success. If you’re considering a career in accounting or looking to advance your financial journey, now is…

#accounting certifications#certified professional accountant#certified public accountant#chartered professional accountant#CPA Canada#CPA career guide#CPA certification#CPA cover letter#CPA designation#CPA exam guide#CPA resume#CPA salary#CPA USA#CPA vs CPA Canada#difference between CPA and CPA Canada#financial certifications

0 notes

Text

Classified Info About Tax Preparation Advantage That Only the Pros Know Exist

Tax preparation is truly a people business. Expert tax preparation is essential for ministers. It can also be done using software that is available online. It's remarkable how many men and women believe that tax preparation is about the numbers, but that's not all. Adequate tax preparation and planning can allow you to minimize your upcoming tax liability.

Ensure you're employing all your exclusive benefits and enjoy peace of mind. There are likewise some tax advantages in the event the business isn't doing well, including deducting losses for your income and a lower tax bracket if profits are small. One benefit is the capacity to regain the expense of income-producing ( for instance, commercial real estate) properties through depreciation. Perhaps among the most apparent advantages of using free tax software is the money it can help save you by not needing to employ a costly tax professional to take care of all the filing for you.

Anyone earning an income should submit a tax return every year. You would believe that filing your taxes would be entirely black and white, but where CPAs offer value is in grey locations. When it has to do with taxes, a partnership doesn't pay income tax and doesn't file an income tax return. You may be responsible for someone else's taxes. Turning into a tax professional requires no prior accounting experience and just necessary arithmetic abilities. Not everybody has simple federal taxes that may be submitted at no cost in 10 minutes. A key reason behind the anaemic usage, according to experts, is that several taxpayers are not aware of the program.

Why Almost Everything You've Learned About Tax Preparation Advantage Is Wrong

The loan amount is going to be deducted from tax refunds and decrease the refund sum that is paid straight to the taxpayer. As stated by the IRS, your real tax refund is going to be processed within 8-21 days. Tax refund and e-filing have to to get bank product. Exorbitant fees may be an early indication your tax preparer is engaging in fraudulent activities.

Tax returns could be filed electronically without applying. Your tax return can be submitted electronically so that you will receive a refund back quicker. If you wish to be in a position to prepare tax returns for smaller businesses, then you are going also to want to select the 30-hour Small Business I Tax Course. Whether you're an individual or run a business, our experts make sure you are always in compliance with the present tax laws and regulations. Another fantastic way to boost business is to get started networking. A tax preparation company is also great to have into if you chance to work in another field that's even seasonal but at a different time of the year like A tax preparation company can supply you with a steady income year-round.

The company may not be in a position to provide you with a specific price quote, but they ought to be in a position to quote you either a regular price or a budget for your tax situation. As your company grows and changes, the kind of business entity you select may want to modify also. If you choose to start your own company in Canada, you have to decide which sort of business structure is best suited to your requirements. Find out more about why you need to begin your tax enterprise. Starting a home-based tax company can be carried out very inexpensively.

Whatever They Told You About Tax Preparation Advantage Is Dead Wrong...And Here's Why

All our services are professionally designed to fulfil your particular needs. The Service has stated that deductions won't be allowed whenever there is a significant break between your last job and whenever your search begins. Tax providers comprise most the secondary sources which are available to assist research tax questions. Deloitte's Tax Reform services help you get the clarity you will need to concentrate your planning and execution on the problems that matter most to your organization and its targets.

Some of us will opt to purchase tax software for their tax preparation while some will go on the internet to the completely free sites that provide free tax preparation to visitors. Tax software such as TurboTax also can help you avoid duplicating work. It is updated with the latest tax laws. What tax software may do is show the way the present tax credits and deductions affect you. Choosing qualified tax preparation software will depend on what sort of tax returns you'll be preparing and what you're able to afford.

How to Find Tax Preparation Advantage on the Web

Tax preparers usually charge a fee based on the total complexity of your tax return, like how many complete forms you want to file. Most people using tax preparers do so since they cannot prepare their profits. When you are a registered Tax Preparer, you will have your very own home-based tax preparer business ready to go in a short time!

1 note

·

View note

Text

Alternate careers for accounting and finance professionals

Certified Public Accountants (CPA) and Chartered Accountants (CA) are two of the most respected and sought-after professional designations in the field of accounting. Both qualifications are recognized globally and are highly respected in the business world. However, many people are unsure about the differences between the two and which one to pursue. But why choose one when you can combine both and give your F&A career an exceptional edge? In this blog post, we will discuss the similarities and differences between CPA and CA and the benefits of obtaining both qualifications.

Similarities:

Both US CPA and CA are professional qualifications that are awarded after completing a rigorous exam process and meeting certain education and experience requirements.

Both designations are recognized globally and are highly respected in the accounting and business communities.

Both US CPA and CA are required to adhere to strict ethical and professional standards and are subject to ongoing professional development requirements.

Differences (CPA vs CA):

US CPA is a professional designation specific to the United States, while CA is a professional designation specific to India and Canada.

The education and experience requirements for CPA and CA are different. To become a CPA, one must have a minimum of a bachelor’s degree in accounting and pass the Uniform CPA Exam. To become a CA, one must complete a professional education program and pass a series of exams.

The scope of practice for CPA and CA also differs. CPAs are mostly involved in auditing, taxation, and financial reporting for businesses and individuals. CA’s mainly focus on Taxation, Assurance, and advisory services.

Benefits of Obtaining Both Qualifications:

Obtaining both CPA and CA qualifications demonstrates a high level of expertise and commitment to the accounting profession.

Having both qualifications expands your job opportunities and increases your earning potential.

It will give you an edge over your competitors and make you more marketable to employers.

It will also give you the ability to provide a wider range of services to your clients. In conclusion, both CPA and CA are highly respected professional qualifications that can open doors to a successful career in accounting. However, if you combine both i.e. you do CPA along with CA then it will open doors for you in the Big 4 and top MNCs in India. It will also get you a job in the US and if you are planning to work in Canada then as a CA, you still have to pass the CFE (Common Final Examinations), a 3-day exam that requires candidates to be in Canada but CPAs do not need to give any additional exam to earn Canada CPA. Are you still in dilemma? Then Miles Education is the perfect destination for you to clear all your doubts. So, don’t wait any longer, start your journey of CA + CPA and enjoy the ultimate combination for a successful career in Accounting.

0 notes

Text

Simplified Guide to Understanding the Tax Code for Businesses

Understanding tax codes is very important for business owners because it affects how well their business does financially. Whether you're starting a new business or running an existing one, knowing how the tax system works is crucial. More Than Numbers CPA, the best accountant firm in Oshawa, is here to help you understand the basics. This guide covers the key points of tax codes that every business owner should know.

1. Understand the Basics: Types of Business Taxes

The first step in understanding tax codes is knowing the different types of taxes your business might have to pay. Tax rules can be complicated, but More Than Numbers CPA, the best accountant firm in Oshawa, can make them easier to understand. Most businesses face several types of taxes, such as income tax, sales tax, payroll tax, and excise tax.

Income tax is based on your business’s earnings.

Sales tax is charged when you sell goods or services.

Payroll taxes are related to employee wages.

Excise taxes apply to specific products like alcohol, tobacco, and fuel.

Knowing about these taxes helps you plan and follow the rules properly.

2. Keep Good Records: The Key to Tax Compliance

Keeping accurate records is essential for meeting tax requirements. More Than Numbers CPA, the best accountant firm in Oshawa, emphasizes the need to keep everything organised, including all your income, expenses, receipts, invoices, and bank statements. Good record-keeping helps you report your income correctly and claim deductions, which can reduce mistakes and audits. It also gives you a clear view of your financial health, making it easier to budget for tax payments.

3. Use Deductions and Credits to Save Money

Deductions and tax credits can lower your business’s taxable income, reducing the amount of tax you owe. The best accountant firm in Oshawa, More Than Numbers CPA, can help you find and use these benefits.

Deductions might include costs for operating your business, paying employees, buying office supplies, or travelling for work.

Tax credits directly reduce the tax you owe and can be related to research, energy efficiency, or hiring new employees.

Knowing how to use deductions and credits can save your business a lot of money.

4. Pay Taxes on Time: Avoid Penalties

Missing tax deadlines can lead to fines and extra charges, which can be costly. More Than Numbers CPA, the best accountant firm in Oshawa, advises keeping track of key tax dates. These dates include when to file income tax returns, pay payroll taxes, and make estimated tax payments. Setting up a tax calendar or working with an accountant ensures you don’t miss important deadlines, which helps maintain good cash flow.

5. Know the Difference Between Federal and Provincial Taxes

In many countries, businesses must follow both national and local tax laws. In Canada, for example, businesses have to pay both federal and provincial taxes, and these can vary. More Than Numbers CPA, the best accountant firm in Oshawa, can help you understand these differences.

Federal taxes include things like corporate income tax, which is the same across the country.

Provincial taxes can include additional income taxes or sales taxes, depending on where your business is located.

Knowing the difference between these taxes is important to stay compliant and avoid mistakes.

6. Plan Your Tax Payments with a Budget

Good tax planning means setting aside money throughout the year to pay your taxes. The best accountant firm in Oshawa, More Than Numbers CPA, suggests including estimated tax payments in your budget. This helps prevent cash flow problems when taxes are due and avoids borrowing money to pay your tax bill. By estimating how much tax you will owe and saving money regularly, you can manage your finances better and reduce stress during tax season.

7. Consult a Professional Accountant

While it's important to understand tax codes, working with a professional accountant can offer expert advice and peace of mind. The best accountant firm in Oshawa, More Than Numbers CPA, provides tailored services to help you navigate the tax system. An accountant can assist with planning, filing, and ensuring that you follow tax laws correctly. Their expertise helps you make the most of deductions and credits while avoiding costly mistakes, allowing you to focus on growing your business.

8. Stay Informed About Changes in Tax Laws

Tax laws can change often, so it’s important to stay updated. The best accountant firm in Oshawa, More Than Numbers CPA, keeps clients informed about the latest changes in tax regulations. Changes in tax laws can impact how much tax your business owes, what deductions and credits are available, and how you should file your taxes. Staying informed helps you adjust your tax strategy and avoid surprises during tax season.

9. Use Accounting Software for Better Tax Management

Accounting software can be a great tool for managing your business taxes. More Than Numbers CPA, the best accountant firm in Oshawa, recommends using software that works well with your financial systems. This software can automate tasks like tracking income and expenses, calculating taxes owed, and generating reports. It also helps keep everything organised, making tax filing easier and less stressful.

10. Think About Incorporating Your Business

Incorporating your business could offer tax advantages depending on your situation. The best accountant firm in Oshawa, More Than Numbers CPA, can help you decide if this is the right move for you. Benefits of incorporation can include lower corporate tax rates, splitting income, and protecting yourself from personal liability. However, it’s important to weigh these benefits against the costs and requirements of incorporation. A professional accountant can guide you through this decision to make sure it’s the best choice for your business.

Conclusion

Understanding tax codes is essential for running a successful business. By following these tips and working with the best accountant firm in Oshawa, More Than Numbers CPA, you can manage your taxes effectively. From keeping accurate records to using deductions and credits, good tax management can save your business time, money, and stress. If you ever need help, professional accountants are available to ensure your business stays compliant, financially stable, and ready to grow.

0 notes

Text

COMMON CHALLENGES FACED WHILE USING PAYROLL SERVICES CANADA

Payroll outsourcing services is a humming service specialty among numerous business elements across the world. As the entryways of outsourcing opened up for organizations with the IT blast, numerous business ventures started to tap the capability of outsourcing. Profiting services in-house or locally turns into an exorbitant choice over outsourcing to seaward substances. It is a substantial reality for business elements in places like the US, Canada, and the Unified Realm. Payroll outsourcing, as we probably are aware, is one of the noticeable areas of outsourcing. Numerous Payroll Outsourcing organizations have expanded over the course of the years especially, in the South-Asian district.

The commonsense methodology for some organizations Payroll Outsourcing Services

As a rule, Payroll services manage dealing with the whole course of estimation, handling, and a last installment of pay for an association's workers. It can turn much more muddled when there exist various representatives spread across different divisions in a business association. One can't manage the cost of deferrals or disparities in the part of compensating their diligent representatives.

Each business needs a dependable payroll service group to deal with the compensation necessities for their representatives. Be that as it may, there can be many obstacles in enrolling and holding an in premise payroll group over a payroll outsourcing service supplier. An organization might experience the ill effects of weighty speculation and lose center from its essential business tasks.